- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Chase’s Travel Portal

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use Chase's travel portal?

How to use chase's travel portal, other things you can do in chase's portal, chase travel contact options, chase's travel portal can be lucrative.

Chase Ultimate Rewards® points are among the most useful rewards you can earn. When it comes time to redeem them, you will be directed to Chase's travel portal. This is where you can book flights, hotels and rental cars with points, redeem them for merchandise and gift cards, or transfer points to other programs.

Should you redeem points to pay for a trip instead of using cash or transfer them to a loyalty program partner to get better value? You'll need to do a little homework to find the right answer as each situation is different.

Chase points are the currency you earn when using cards like Chase Sapphire Preferred® Card or Chase Sapphire Reserve® . They are superior in many ways to other point currencies because you earn more than one penny in value per point with these two cards. For example, when redeeming through Chase's travel portal, the Chase Sapphire Reserve® will net you 1.5 cents in value per point and the Chase Sapphire Preferred® Card will net you 1.25 cents in value per point. When you transfer to a partner, your per-point-value may be even greater.

With the travel portal, you can redeem points to pay for an entire trip or you can use a mix of points and cash to cover a travel booking. You can also pay all in cash, earning 5 to 10 points per $1 spent, depending on the card you have. Using points for travel is the most valuable way to extract value from Chase Ultimate Rewards® for most people.

It's an efficient website, but some irritants snag even savvy travelers. Let's dig into Chase's travel portal's good and bad. You'll find that it is mostly good, if not great.

Chase cards vary in earning and redemption benefits so you will want to pay attention to which one you use, especially if you have more than one card. The most valuable cards earn Ultimate Rewards® points, but some Chase cards, like the United℠ Explorer Card , earn miles or points in that co-branded program (in this example, United MileagePlus miles ).

Let’s review the cards that earn Chase Ultimate Rewards®, with the most rewarding cards first. Keep in mind that if you have more than one of these cards, you can move points between Chase Ultimate Rewards® accounts to redeem them from an account that delivers more cents per point in value.

These cards earn Chase Ultimate Rewards® and provide access to Chase's travel portal:

Chase Sapphire Reserve® .

Chase Sapphire Preferred® Card .

Ink Business Preferred® Credit Card .

Chase Freedom Unlimited® .

Chase Freedom Flex® .

Ink Business Cash® Credit Card .

Ink Business Unlimited® Credit Card .

Chase Freedom Rise Credit Card.

There is an important perk to remember if you have multiple cards. Since the Chase Sapphire Reserve® card offers 1.5 cents in value per point and the Ink Business Preferred® Credit Card and the Chase Sapphire Preferred® Card offer 1.25 cents in value, it is best to redeem points from these accounts rather than any other Chase card.

If you have one of those two premium cards and another Chase card (like Chase Freedom Unlimited® , for example), you can move your Ultimate Rewards® points from the Chase Freedom Unlimited® account to a premium card’s account (like the Chase Sapphire Reserve® card).

This strategy allows you to unlock half a cent more in value in seconds. It’s one of the best benefits of Ultimate Rewards® when you have a premium card and one of its no-fee cards.

Want to earn a bunch of points quickly to make a redemption? The sign-up bonuses on these cards can rake in extra points if you meet the terms and conditions.

on Chase's website

• 5 points per $1 on travel booked through Chase.

• 3 points per $1 on dining (including eligible delivery services and takeout), select streaming services and online grocery purchases (not including Target, Walmart and wholesale clubs).

• 2 points per $1 on other travel.

• 1 point per $1 on other purchases.

Point value in Chase's travel portal: 1.25 cents apiece.

• 10 points per $1 on Chase Dining, hotel stays and car rentals purchased through Chase.

• 5 points per $1 on air travel purchased through Chase.

• 3 points per $1 on other travel and dining not booked with Chase.

Point value in Chase's travel portal: 1.5 cents apiece.

• In the first year, 6.5% cash back on travel purchased through Chase, 4.5% cash back on drugstores and restaurants, and 3% on all other purchases on up to $20,000 in spending.

• After that, 5% cash back on travel purchased through Chase, 3% cash back at drugstores and restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Point value in Chase's travel portal: 1 cent apiece.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

» Learn more: The best travel credit cards right now

Here’s a primer on what you can and cannot do with Ultimate Rewards® points.

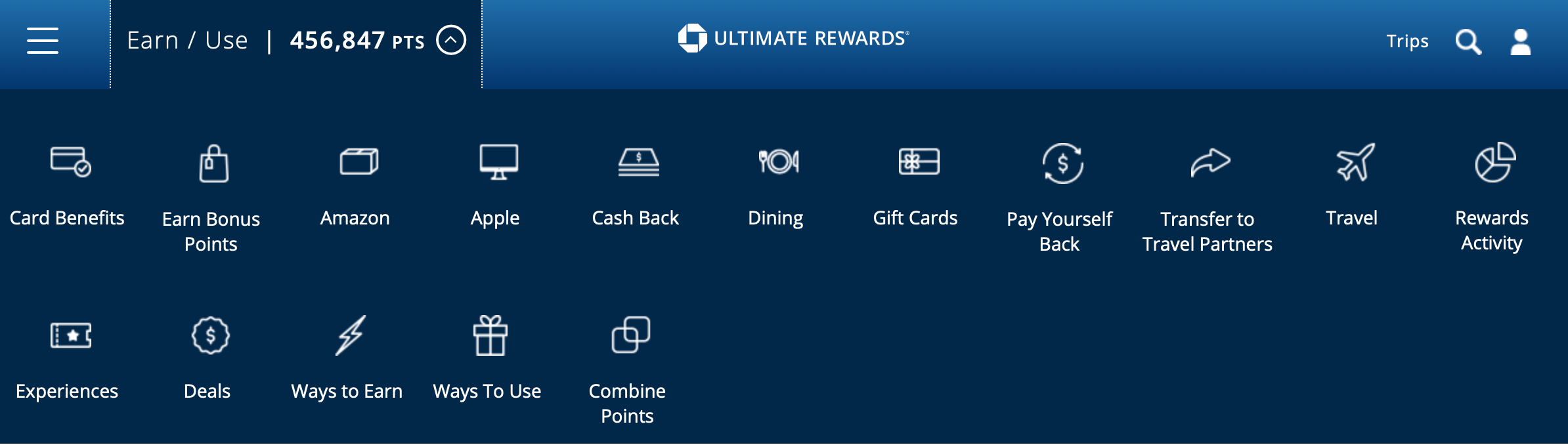

Log in to your account, then navigate to the Chase Ultimate Rewards® tab on the right of the screen. If you have more than one card that earns this currency, you can see each balance and select the account from which you want to redeem points.

Once you select the card, you’ll be taken to a homepage that shows the points you have earned and how you can redeem them. We recommend sticking to travel redemptions rather than using points for merchandise as the value diminishes significantly with the latter.

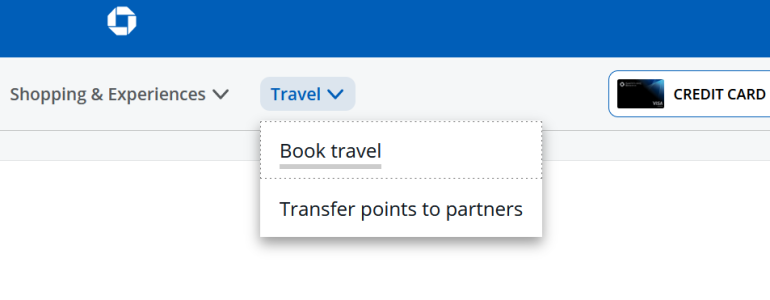

Select the "Travel" tab at the top of the screen. From here, you can decide whether to transfer points to a partner or redeem them as cash for a trip.

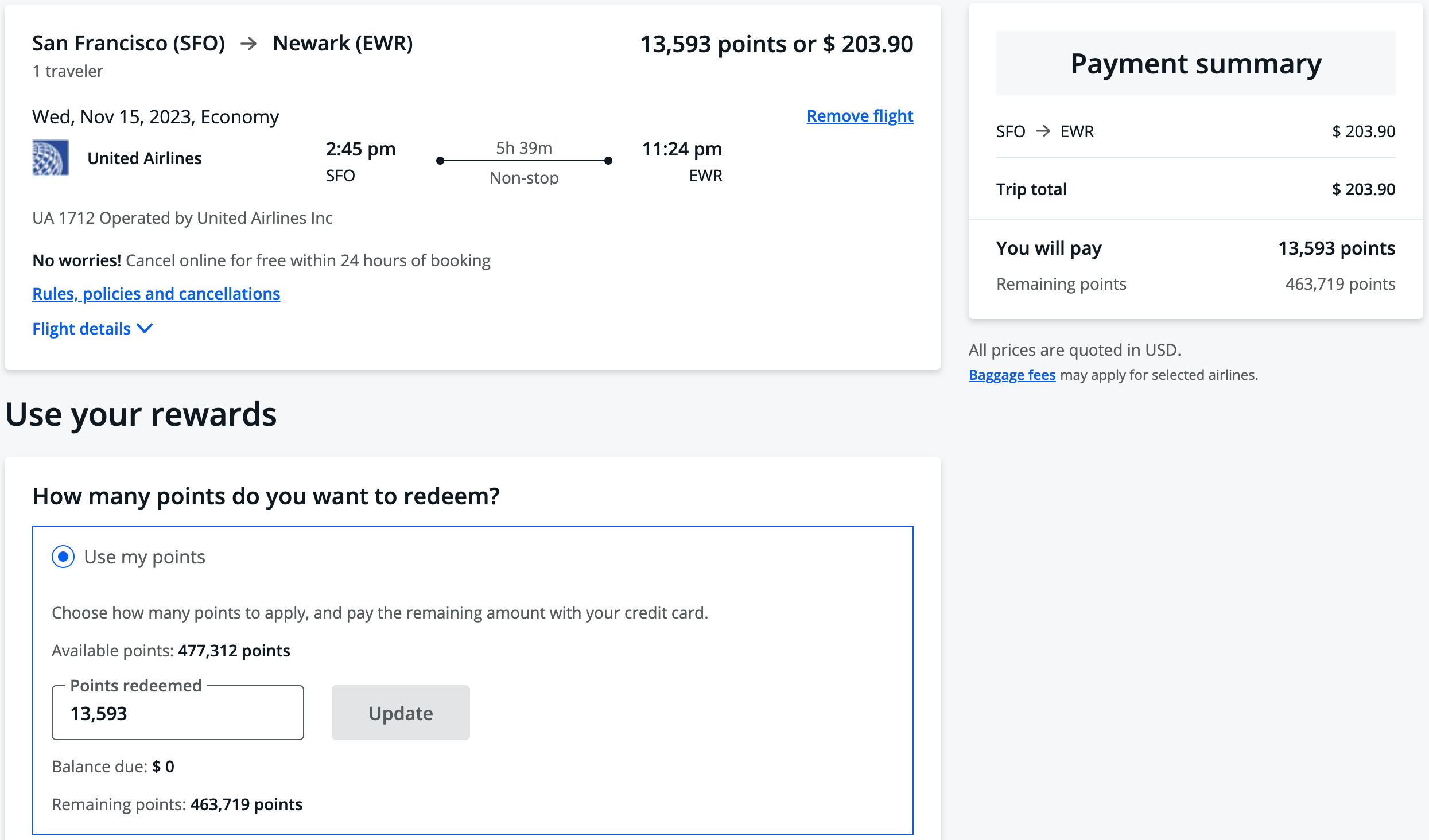

One of the best perks of using this travel portal to make a points redemption is that you still earn frequent flyer miles on most airline tickets since these are booked as a revenue ticket (not as an award redemption like when using airline miles to book a flight).

How to book award flights in Chase's travel portal

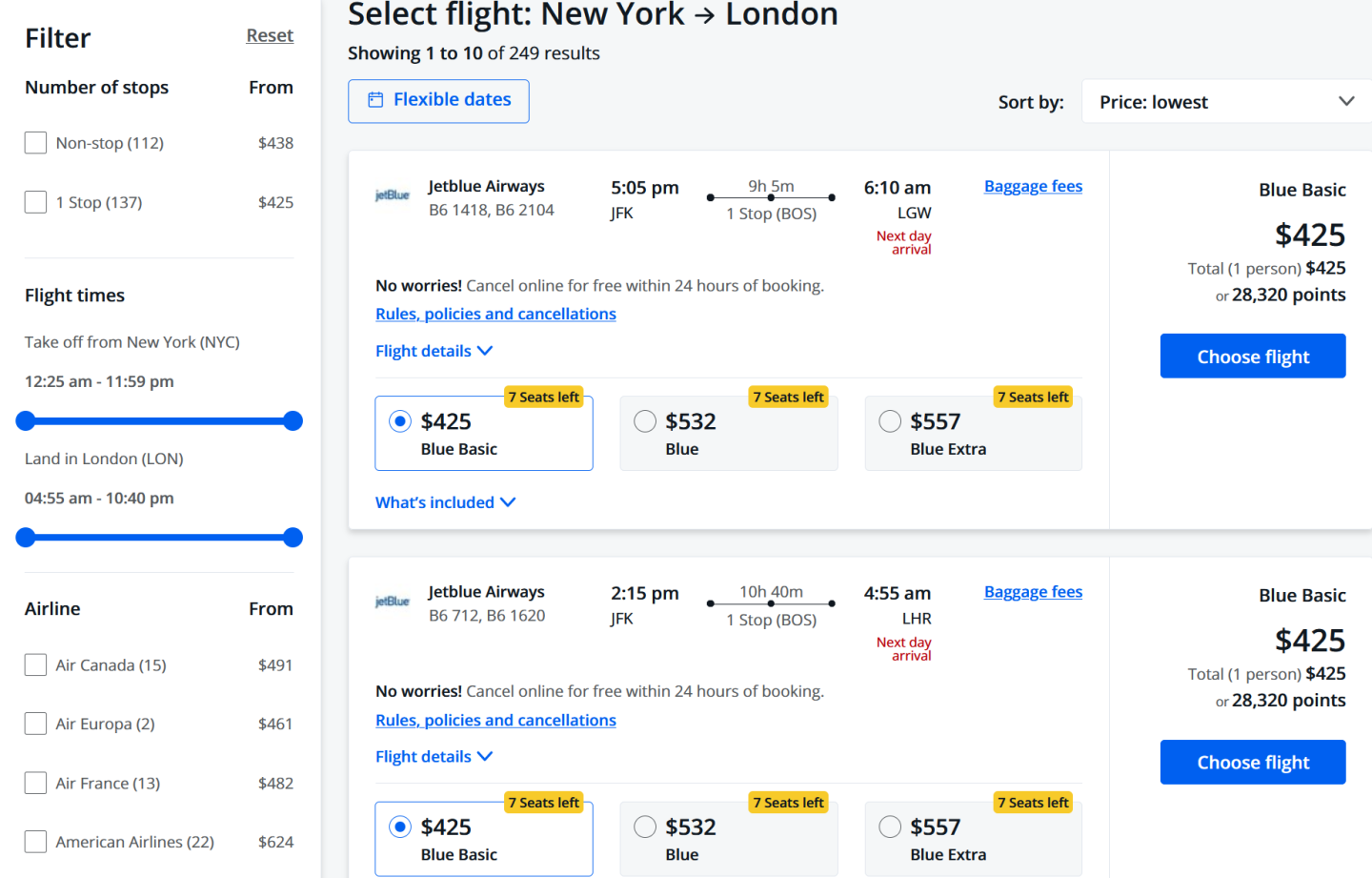

This is one of the more popular features of using points, but keep in mind it doesn't feature all airlines, which can be frustrating. Even if you find a flight on an airline's website or third-party booking site, it doesn't mean it will be available at Chase.

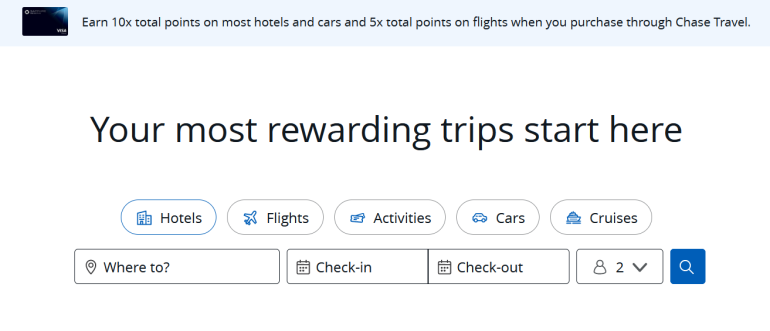

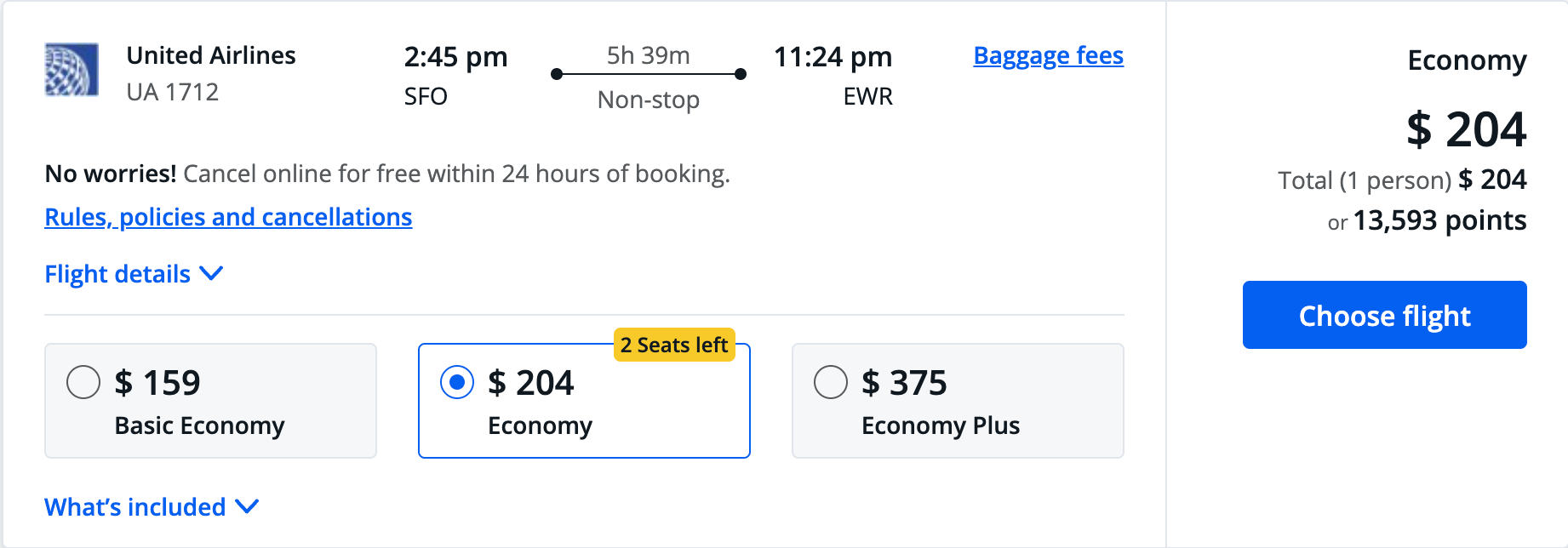

Enter the relevant details in the search bar to find a flight. Results can be filtered by stops, airline or price. Another benefit of this portal is that you aren't subject to award seat availability in the same way you might be when redeeming miles through an airline's program.

If there is a seat that could be bought with cash, you can usually redeem points for it. Plain and simple.

Compare how many miles you would need if booking directly with the airline with what Chase is charging.

If it would cost fewer points to book directly with the airline, you’ll want to use miles instead. For example, Delta co-branded American Express cardholders can often redeem their miles like cash on Delta’s website (at 1 cent per mile’s value). That’s just average, but if it is cheaper than what Chase is charging, consider that the better option. But don’t forget that airlines will add on taxes and fees when redeeming miles . Airfare booked with Chase Ultimate Rewards® points don't have additional costs tacked on — these are already bundled into the fare.

Another important note is that some low-cost airlines like Allegiant don't appear in search results. If you want to travel on a budget airline, then you'll need to visit those websites to compare fares.

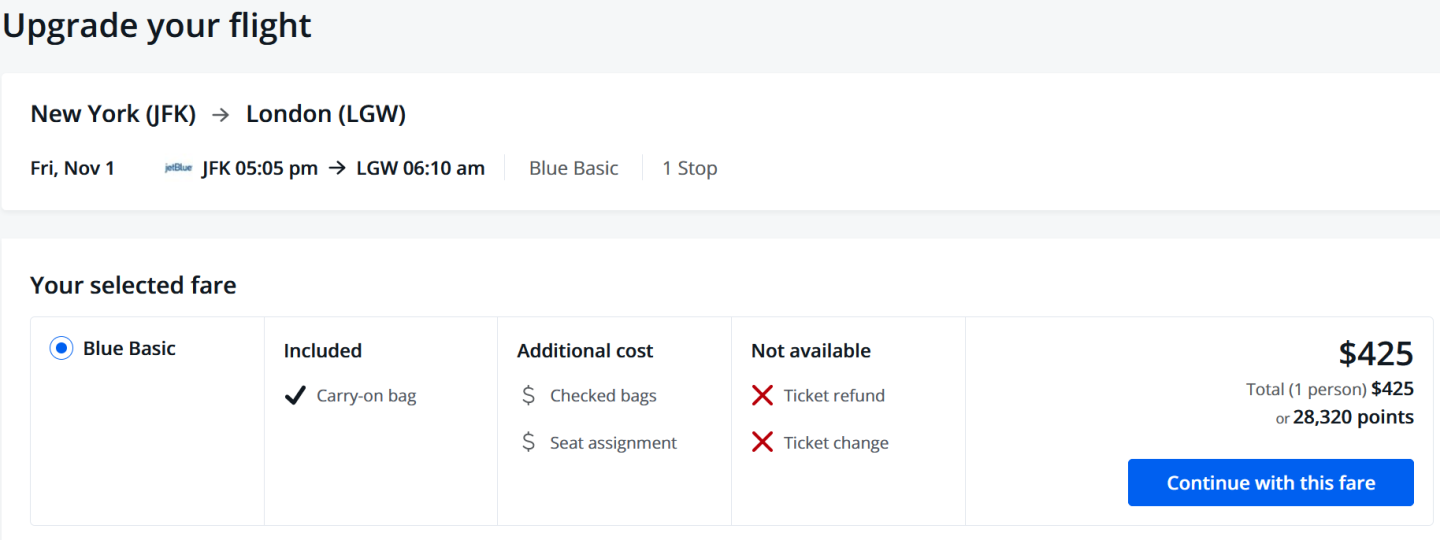

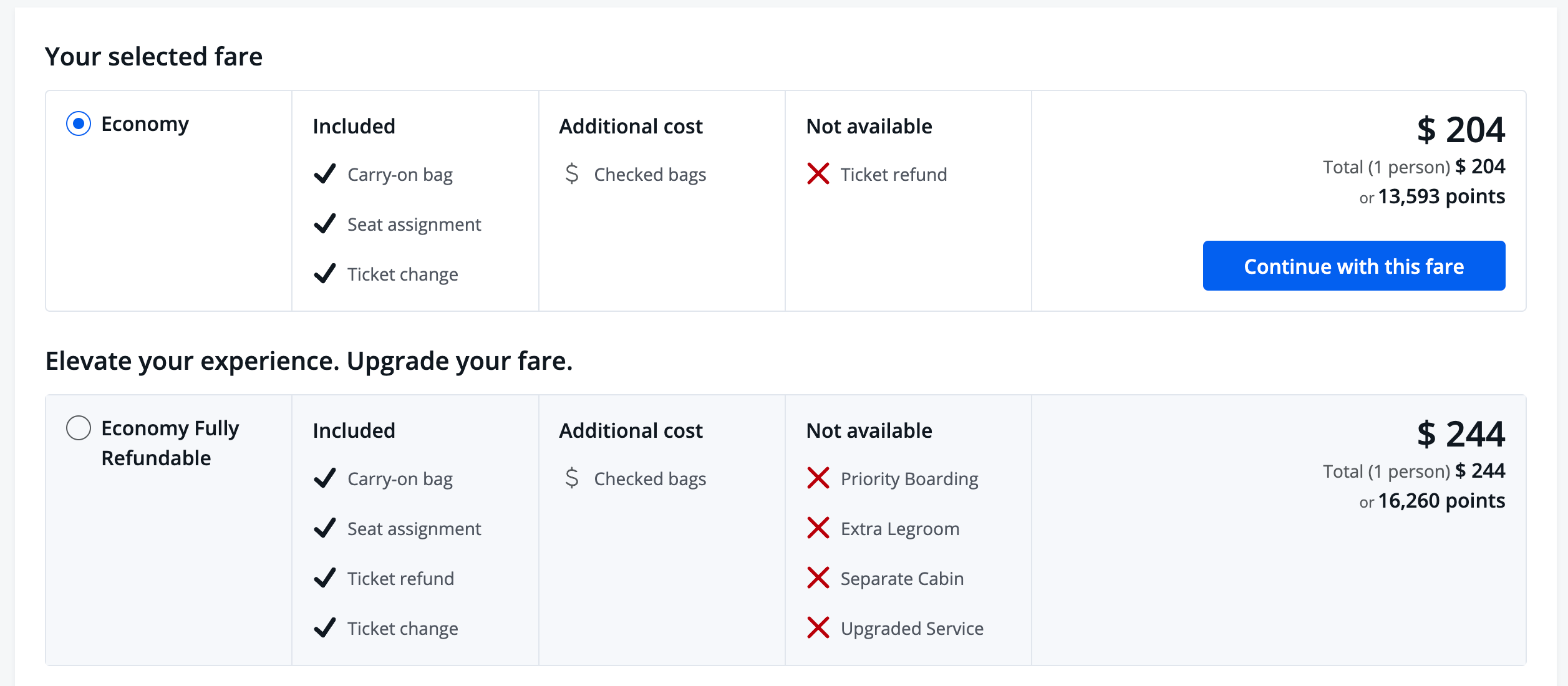

You can pay in cash, points or a combination. Chase will display particular details about your fare, like whether assigned seats or checked bags are included. This may not take into account any elite status perks you hold.

How to book hotels in Chase's travel portal

You can also redeem points for hotel stays using Ultimate Rewards® points. This is great news, especially when staying at hotels where you may not have elite status or don't care about elite perks or points earned.

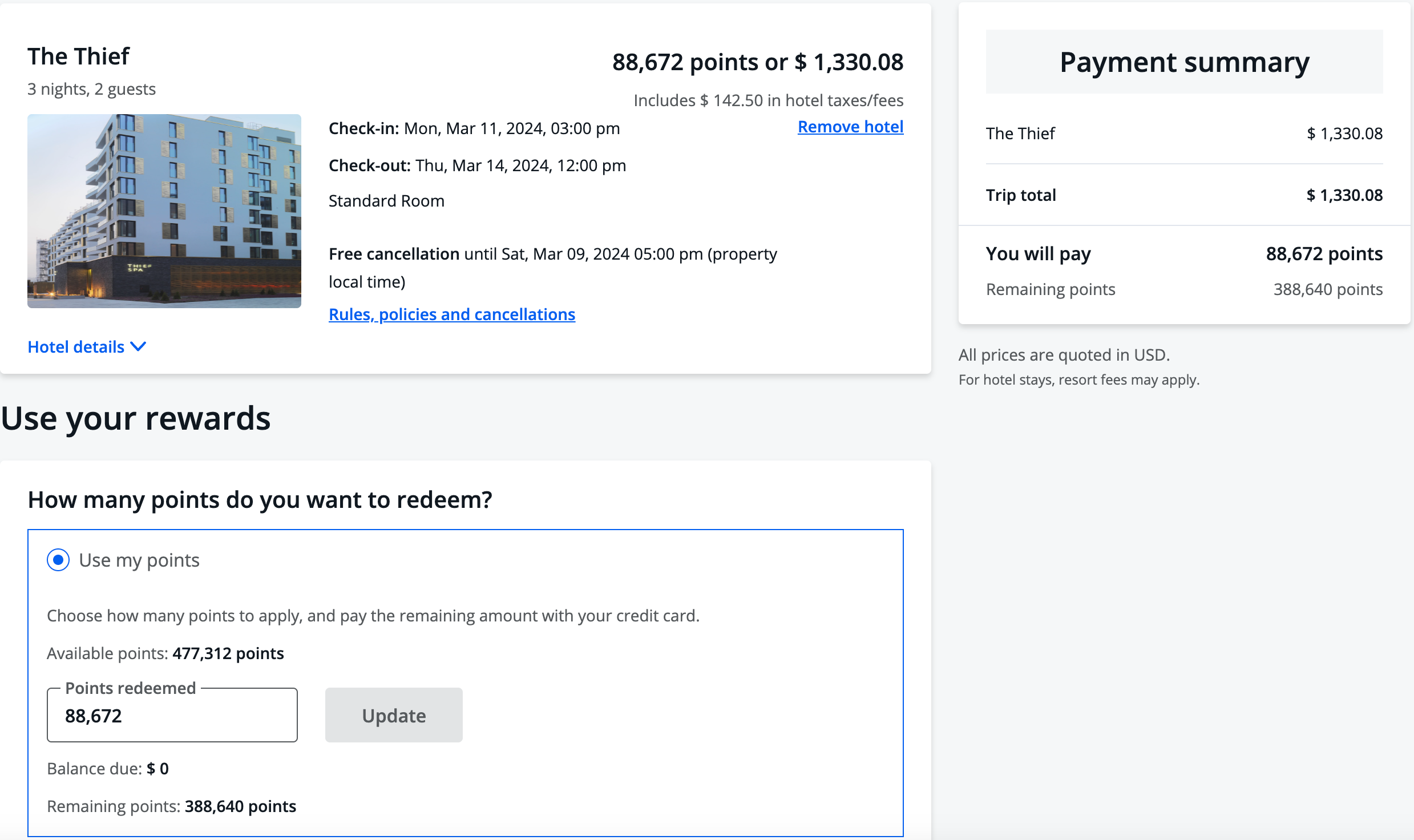

Keep in mind that when making a reservation outside a hotel’s official reservation channels, you won’t earn points in its program or be able to take advantage of elite status benefits. So if you have status with a hotel chain, this isn't the best value unless you are willing to forgo those benefits.

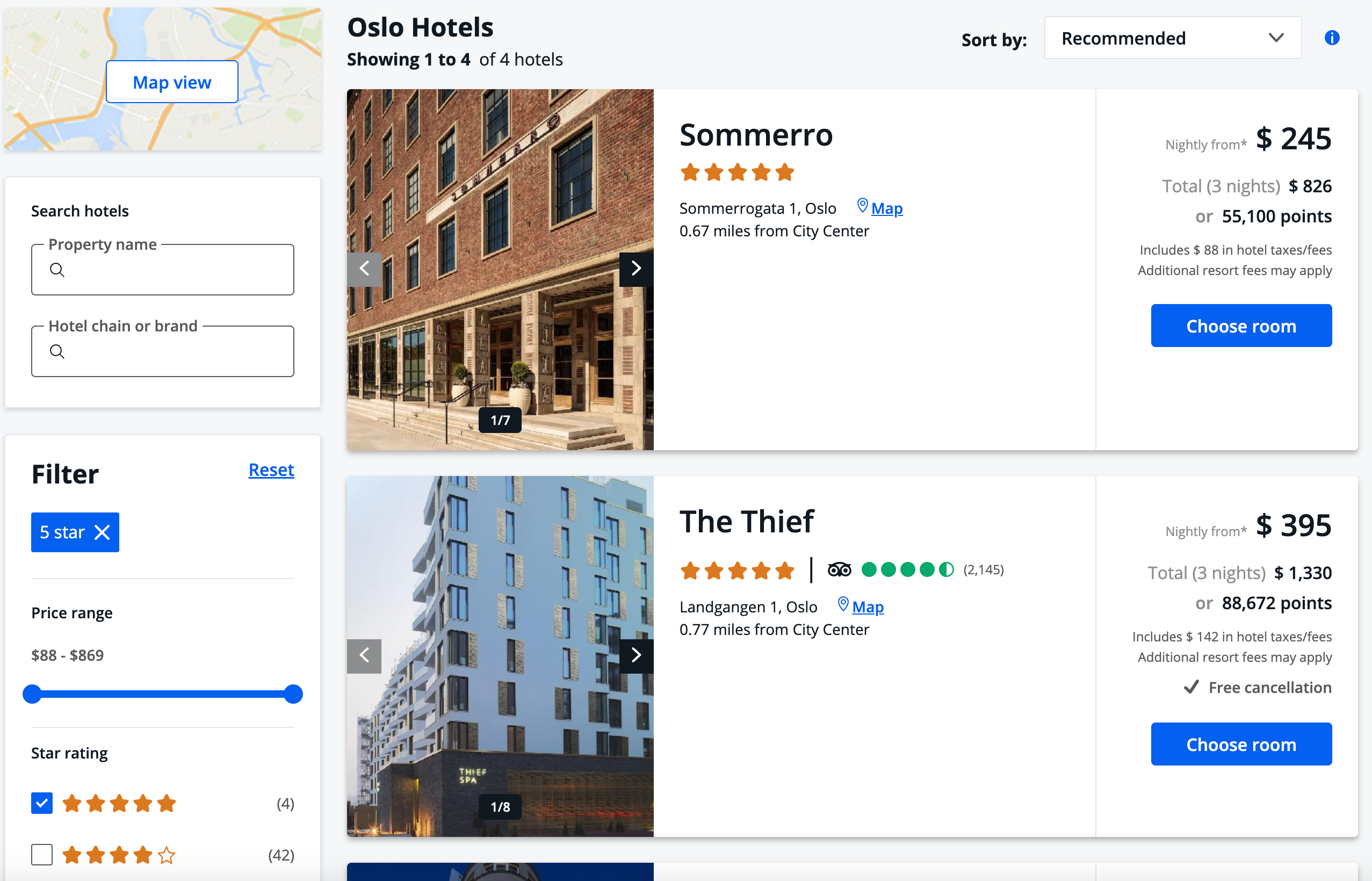

Making a reservation is straightforward. Enter the city and travel dates to see a list of hotels available for redemption. Then, you can redeem points or pay in cash for your trip.

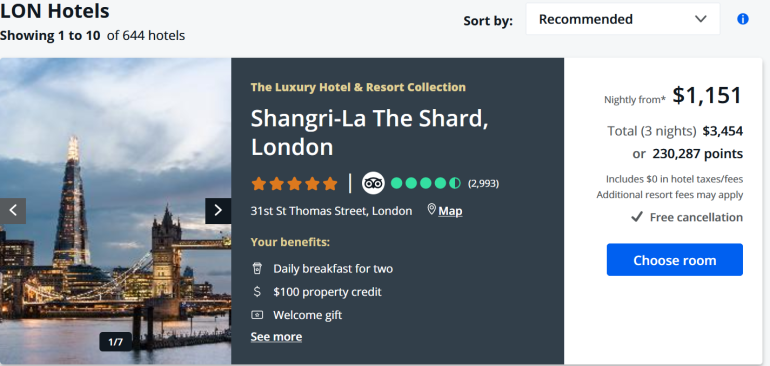

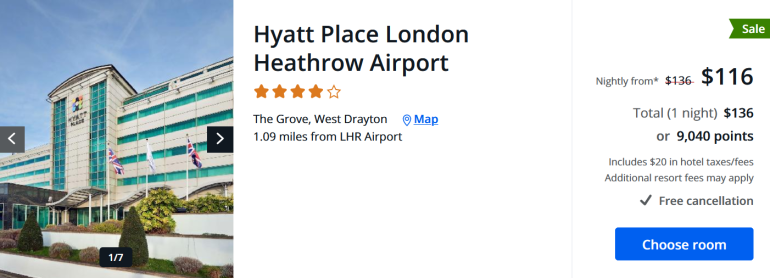

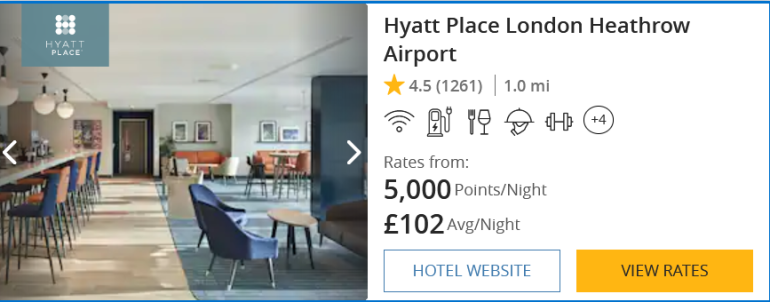

Like with flights, compare the cost of Chase Ultimate Rewards® points with the number of points a hotel’s program is charging. A particular favorite is World of Hyatt, which still uses an award chart and, as a transfer partner of Chase Ultimate Rewards®, can often deliver more favorable deals when using Hyatt’s points rather than Chase points.

For example, it would cost about 9,000 Chase Ultimate Rewards® points to redeem a night at Hyatt Place London Heathrow Airport. But, if you transfer points to World of Hyatt, you would need 5,000 points for the same night’s stay.

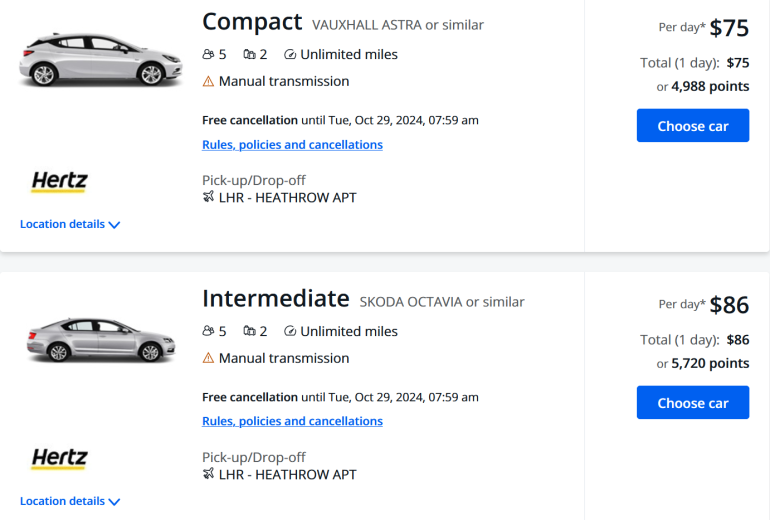

How to book car rentals in Chase's travel portal

This is a great place to reserve rental cars using points, and Chase rental car insurance benefits apply when using the card and paying with points. But, for that to be the case, you will want to pay for part of the rental in cash so the insurance benefits are activated. To do that, pay with a combination of cash and points, and decline the rental company's insurance first.

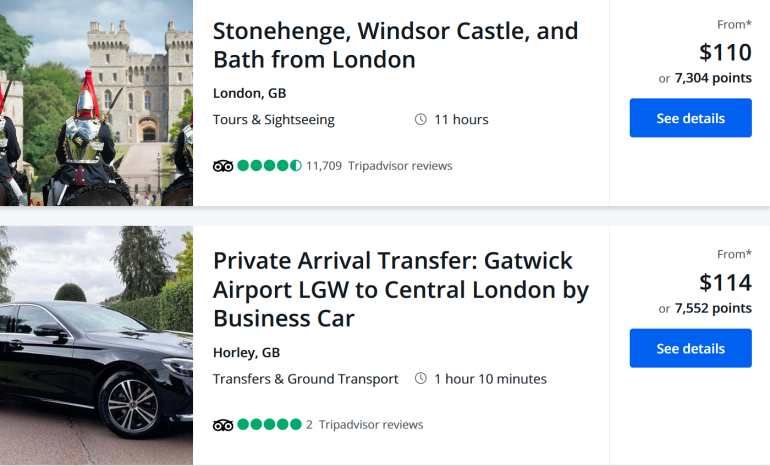

How to book activities in Chase's travel portal

Activities available for booking through Chase's travel portal include tours and experiences at home or when traveling and airport transfers. Price comparison plays a role here, too, since many hotel brands have their own platforms like Marriott Bonvoy Moments or FIND Experiences from World of Hyatt. These allow you to redeem points for experiences.

Check which program is cheaper before redeeming Chase points if you find similar options in either program.

How to book cruises in Chase's travel portal

Since cruise bookings can be more complex, you will need to call Chase Ultimate Rewards® at 855-234-2542 to make a reservation. There are many ways to earn multiple points when booking a cruise that may be better than using Chase, but when redeeming points for a cruise , there can be a lot of value.

Using Chase's portal to make a travel reservation is also strategic, as depending on your card, you can earn a healthy stash of points this way. Just be sure to compare the benefits you can earn with the opportunity cost of booking elsewhere.

Benefits of booking travel in Chase's portal

Let’s say you have a premium card like Chase Sapphire Reserve® . It earns 5x points per $1 when booking flights through the portal. The sweet spot is when using this card for hotel stays and rental cars booked via the portal for 10x points per dollar spent. Consider what’s in your wallet, and decide which card will net the most points.

Another benefit is that you will earn miles from flights booked through the portal, even when redeeming Chase Ultimate Rewards® points since these are viewed as a revenue ticket.

Remember, you will want to compare if it is cheaper to redeem airline miles directly through a carrier’s redemption program or if you can use fewer points by redeeming Chase points via the portal.

Sometimes it might make more sense to transfer points from Chase to an airline partner when redeeming a flight (or a hotel program when making a hotel stay). Be as vigilant with price comparison when redeeming miles and points as you would when using cash.

Does Chase's travel portal price match?

No. You cannot submit a lower fare elsewhere for a price guarantee here since this isn't a publicly available site. It is only available to those who have a Chase card.

What else you need to know

When booking through this reservation site, keep in mind that most airlines and hotels cannot assist directly with a reservation. They see this as a third-party booking through Expedia and will direct you to Chase's agents.

Many travelers report the experience can be frustrating when travel disruptions or cancellations occur. Agents are friendly but can sometimes be limited in their abilities, often reading prompts on their screens in international call centers.

It can be a hazard booking a reservation with a third party, but the trade-off in redeeming points is worth it for some travelers.

If you do need to contact a Chase portal agent for support on a reservation made through the site — whether for a flight, hotel booking, car rental or activity — you've got one option: a good, old-fashioned telephone call.

Dial 866-331-0773 for assistance regarding changes or cancellations to your bookings.

You might have better luck dialing the support line for your specific Chase card. You might opt to give one of these a try:

Chase Sapphire Reserve® : 855-234-2542.

Chase Sapphire Preferred® Card : 866-331-0773.

All other cards: 866-951-6592.

If you compare prices and consider the opportunity cost of using the portal instead of booking elsewhere, you can almost always come out ahead.

You can save money, earn bonus points and travel better with transferable loyalty points like Chase Ultimate Rewards®. They have the flexibility and versatility necessary to deliver excellent value on travel (rather than being locked into one airline or hotel loyalty program). With the right card (or suite of cards), you’ll be able to accumulate points and benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel℠, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Chase Travel®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Booking a Cruise with Chase Ultimate Rewards: A Quick Guide

If you’re like me and love earning rewards through credit card points, booking a cruise with Chase Ultimate Rewards might be an exciting option. Chase Ultimate Rewards points are known for their flexibility, allowing users to book various types of travel, such as flights, hotels, and rental cars, directly through the Chase portal. But what about cruises? After researching this topic, I’ve discovered that it’s entirely possible, and there are some essential details to keep in mind.

Before diving into the specifics, it’s essential to share that Chase Ultimate Rewards points can be used to book cruises, but the process is slightly different than booking flights or hotels. Instead of using the online travel portal, you need to call Chase to book your dream cruise. This may seem inconvenient, but calling a cruise advisor from Chase can come with some benefits, such as personalized assistance in selecting and booking your trip. It’s also important to note that cruise fares should be the same as booking directly with the cruise line, ensuring that you’re getting a fair deal.

Chase Ultimate Rewards Overview

I find the Chase Ultimate Rewards program to be one of the most versatile and valuable credit card rewards programs out there. When I use a Chase credit card, like the Chase Sapphire Preferred Card or the Chase Ink Business Preferred Card, I earn Ultimate Rewards points for each dollar spent. These points can be redeemed for travel expenses, statement credits, experiences, or even transferred to travel partners, such as airlines and hotel chains.

One of the key benefits of the Chase Ultimate Rewards program is the Chase Travel Portal , where I can redeem my points for travel directly through Chase. This can be especially useful when there are no award flights available, or if I find a cheap fare that requires fewer points to book than transferring to a travel partner.

While booking flights, hotels, and rental cars through the Chase Travel Portal is straightforward, booking a cruise with Chase Ultimate Rewards points requires a different approach. Unfortunately, I cannot book a cruise directly through the online portal, but instead, I’ll have to call the Ultimate Rewards booking hotline to make a reservation.

When booking a cruise with points, I must keep in mind that the redemption value might not be as high as when I redeem points for other types of travel. However, for those who love cruising, using Chase Ultimate Rewards points can still provide a valuable way to pay for a cruise vacation.

Booking a Cruise Options

In this section, I will discuss available options for booking a cruise using Chase Ultimate Rewards. There are two primary methods that I will detail: using the Chase Travel Portal and transferring points to partner programs.

Chase Travel Portal

The Chase Travel Portal is a convenient way to book cruises directly with your Chase Ultimate Rewards points. However, it may not list all possible cruise options, so it’s essential to do thorough research. To book a cruise through the portal, follow the booking process, similar to booking flights or hotels. If you can’t find the cruise you want, you can call Chase’s cruise advisors at 1-866-951-6592 to help you find and book your desired cruise. Cruise advisors are available Monday through Friday, 9 am to 9 pm, and Saturday 9 am to 5 pm.

Transfer to Partner Programs

Another option when booking a cruise is transferring your Chase Ultimate Rewards points to partner loyalty programs, such as airlines or hotels. This can be beneficial if award flights or hotel stays are not available, or if you find a cheap fare through the travel partner. Transferring points to partner programs can help you maximize the value of your points.

Note that not all cruise lines accept points transfers directly. Therefore, transferring points to airlines or hotels may help you save on flights or accommodation related to your cruise vacation. It’s essential to research which transfer partners have partnerships with your chosen cruise line and confirm that your points transfer will provide the best value for your trip.

In conclusion, booking a cruise using Chase Ultimate Rewards points can be done through the Chase Travel Portal or by transferring points to partner programs. It is vital to do thorough research and consult with Chase’s cruise advisors if needed to find the best option for your desired cruise vacation.

Maximizing Cruise Value

As a Chase Ultimate Rewards enthusiast, I’m always looking for ways to get the most value out of my points, especially when it comes to booking a cruise vacation. In this section, I will share my insights and tips on how to maximize the value of your Ultimate Rewards points when planning a cruise getaway.

Top Cruise Line Partners

One of the best ways to maximize cruise value is by booking with top cruise line partners that are affiliated with Chase’s travel partners. Some popular cruise line partners include Royal Caribbean, Princess Cruises, and Norwegian Cruise Line. By transferring Ultimate Rewards points to these partners, I often get better value for my points than by booking directly through the Chase Travel Portal .

Seasonal and Regional Tips

Another strategy I utilize to maximize value when booking a cruise is considering the season and region of my vacation. Off-peak times, such as the fall and winter months, tend to be cheaper for cruises. Additionally, certain regions might offer better value for your points. For example, Caribbean cruises are often more affordable compared to European cruises. By being flexible with my travel dates and destinations, I can get more value for my Chase Ultimate Rewards points.

Bonus Point Deals

Finally, I always keep an eye out for bonus point deals offered by Chase and their travel partners. These deals can include earning extra points on cruise bookings or redeemable discounts on cruise fares. Regularly checking The Points Guy and other points and miles websites, along with monitoring my Chase account, helps me stay up-to-date with the latest deals and promotions, ensuring I get the most value out of my Ultimate Rewards points when booking a cruise vacation.

Required Points and Costs

Determining points needed.

To book a cruise with Chase Ultimate Rewards, I first need to determine how many points are required. The value of the points depends on the specific Chase credit card used. For example, with the Chase Sapphire Preferred Card, points are worth 1.25 cents each when used for travel, while with the Chase Sapphire Reserve, they are worth 1.5 cents each (The Points Guy) .

Calculating the points needed for a specific cruise means converting the cruise fare (in dollars) to points, based on the card’s point value. To do this, I would divide the total cost of the cruise by the per-point value offered by my card.

Associated Fees and Taxes

When booking a cruise with Chase Ultimate Rewards, it’s important to remember that additional fees and taxes may apply. These can vary depending on the cruise, the destination, and the duration of the trip. Port fees, government taxes, and other miscellaneous fees may not be included in the cruise fare and would need to be paid separately.

Typically, the following costs are associated with a cruise:

- Government taxes

- Fuel surcharges

When using Chase Ultimate Rewards to book a cruise, I must also be aware that some non-cost factors can affect my booking. For example, reward bookings made over the phone may not offer extra onboard credits or other perks that are usually available when booking directly with the cruise line (Cruise Critic) .

Booking Process

It’s time to book a cruise with my Chase Ultimate Rewards. Here’s a step-by-step guide on how to do that along with some tips for a smooth booking process.

Step-by-Step Guide

To start the process, I need to call a Chase Travel Specialist at 1-866-951-6592 as the online portal may not have all the available cruise options. The specialists are available Monday-Friday 9 am to 9 pm and Saturday 9 am to 5 pm Eastern Time.

Once connected, I’ll provide the Cruise advisor with my desired cruise details, including the cruise line, ship, departure port, date, and itinerary. The specialist will then guide me through the options that meet my criteria.

After selecting a suitable cruise, I’ll provide my passenger details and choose my preferred cabin type. The Chase Travel Specialist will confirm the pricing and help me complete the booking process by redeeming the required number of Chase Ultimate Rewards points.

Tips for Smooth Booking

- Before calling, I should have a general idea of the cruise line, ship, departure date, and itinerary to help the specialist find suitable options more efficiently.

- It’s a good idea to research the cabin types available on the chosen ship. This way, I can provide the Cruise advisor with my preferences and make the booking process faster.

- Having my Chase Ultimate Rewards account details and the necessary passenger details ready before the call ensures a smoother booking experience.

- It’s important to note any cancellation and change policies associated with the chosen cruise, as these may affect my points redemption or any penalties in case of changes or cancellations.

By following these steps and tips, I can confidently book a fantastic cruise using my Chase Ultimate Rewards points.

Cancellation and Changes

As a frequent user of Chase Ultimate Rewards, I’ve found that it’s essential to understand the cancellation and changes policies when booking a cruise. In this section, I’ll provide details about the different aspects of these policies, including change and cancellation processes, as well as refunds and point reversals.

Change and Cancellation Policies

First and foremost, it’s important to keep in mind that the change and cancellation policies for a cruise booked with Chase Ultimate Rewards may vary depending on the cruise line and specific booking terms. Before making any changes or cancellations, I always recommend reviewing the travel provider’s website to find their most updated COVID-19 policy information, as some providers have waived cancellation fees during this time. Additionally, Chase’s Ultimate Rewards cancellation request form is available for trips at least eight days in the future. If your trip is departing sooner, it’s best to call the customer support.

Refunds and Point Reversals

Once you’ve determined the appropriate cancellation process, it’s essential to understand how refunds and point reversals will work. In most cases, when canceling a cruise booked with Chase Ultimate Rewards points, the points will be credited back to my account. The exact amount returned may depend on the specific cancellation terms and any applicable fees. Remember that the timeline for receiving these points back may vary and can range from a few days to several weeks.

For cash refunds, it’s important to note that they will typically be processed to the original form of payment, such as a credit card or debit card used at the time of booking. Just like with point reversals, the refund timeline can vary, so it’s essential to be patient and keep an eye on your account for any updates.

In conclusion, when booking a cruise using Chase Ultimate Rewards, it’s crucial to understand the change and cancellation policies, as well as the process for refunds and point reversals. By staying informed and acting accordingly, I can make the most out of my rewards and enjoy a hassle-free travel experience.

Frequently Asked Questions

As I’ve booked cruises with Chase Ultimate Rewards, I’ve come across some common questions that might also be on your mind. I’ve provided short and concise answers to help guide you through the process.

How do I use Chase Ultimate Rewards to book a cruise? To book a cruise with Chase Ultimate Rewards, visit the Chase Ultimate Rewards website and log in to your online account. Once logged in, click on the “Earn/Use” tab, followed by the “Travel” icon. From the travel menu, select the “Cruises” tab, and you will be able to either browse available cruise packages or search for a specific offer based on the destination or cruise line.

Are the cruise fares the same as booking directly? Yes, the cruise fares booked through Chase Ultimate Rewards should be the same as what you would see when booking directly with a cruise line or through other travel agencies. However, there might be some differences in extra offers like onboard credit ( Cruise Critic ).

Can I book other travel services with Chase Ultimate Rewards? Yes, in addition to cruises, you can use your Chase Ultimate Rewards points to book flights, hotel stays, rental cars, and various activities. It’s essential to compare your options and decide whether it’s better to book through the portal or transfer points to airline and hotel partners ( The Points Guy ).

Can I use a combination of points and cash to pay for my cruise? Yes, you can use a combination of your Chase Ultimate Rewards points and your credit card to pay for your cruise booking. This option provides more flexibility, allowing you to choose how many points you want to redeem and how much cash you want to pay ( Chase Ultimate Rewards ).

In my experience, booking a cruise with Chase Ultimate Rewards can be a great way to use my points and enjoy a memorable vacation. One of the key aspects I’ve learned is that cruise fares should be the same as what I’d see booking direct, but it can be different when it comes to the additional offers and onboard credits (Cruise Critic) .

I found that the Chase Ultimate Rewards travel portal allows me to book flights, hotels, rental cars, and more directly with my points (The Points Guy) . However, when booking a cruise, it is better to call a Chase travel specialist directly. The phone number I used was 1-866-951-6592, and they were available Monday through Friday 9 am to 9 pm, and Saturday 9 am to 5 pm (Richmond Savers) .

It’s worth noting that some types of cruises, like Disney Cruises, cannot be booked with Chase Ultimate Rewards (The Points Guy) . So, I recommend checking with the Chase travel specialist to confirm the availability of the desired cruise lines and options.

Utilizing Chase Ultimate Rewards to book a cruise has allowed me to make the most out of my points and create fantastic memories. By keeping these points in mind and communicating with a Chase travel specialist, booking a cruise journey can be a seamless and enjoyable process.

Help us grow by sharing!

About the author.

Ryan Kangail

You probably want to read these too....

How to Book a JetBlue Flight with Chase Ultimate Rewards: A Simple Guide

Best Chase Ultimate Rewards Redemptions: Top Picks

Chase Ultimate Rewards Calculator: Maximize Your Points with Our Interactive Tool

How to Book American Airlines Flights with Chase Ultimate Rewards: A Quick Guide

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

How to plan a cruise vacation.

Soon after you start, you'll likely find that the excitement of planning a cruise propels you through the voyage of careful research. Cruises are a unique type of vacation because of the places they can reach and the wonders that hospitable sea travel can offer.

A beginner's guide to cruise planning

We'll outline each step you need to take so that your cruise is a vacation to treasure. Along the way, you'll have to consider your options and make choices. We've kept the number of steps to a minimum so that you can refer back to them. There are many options, and it makes complete sense if you need time to reflect on them.

1. Determine your budget

A cruise ticket typically covers lodging for the duration of your trip. Your fare may also include food, entertainment, plus certain onboard amenities and activities, such as access to a pool and spa. Be sure to check the details up front and find out exactly what you're paying for, so there's no chance of buyer's remorse.

Usually, several parts of a cruise are not included with your ticket, and they can all cost money at the time of booking or when you're already aboard:

- Travel to and from the cruise port

- Alcoholic beverages

- Specialty dining

- Spa services

- Shore excursions

- Onboard entertainment

- Activities or shopping when ashore in ports of call

Therefore, determine your total budget at the outset of planning a cruise. It might be helpful to set a certain amount for spending rather than calculate the cost of everything you plan to do. As you follow the next steps, your decision-making will benefit from having your total budget on hand.

2. Select a cruise destination

Selecting a destination is an important step for many reasons. In fact, the destination might be the very inspiration for your trip. You might be looking to party with friends on the open seas or are you looking to broaden your horizons within a new environment. Maybe your need to relax has been growing uncontrollably. Overall, the destination you choose plays a big role in shaping the experience you'll have at sea.

Different types of ships from major cruise lines sail all around the world. That includes regions you might not expect, such as European coasts, the Mediterranean and Scandinavia. Some cruise destinations tend to be seasonal, however, like Canada, Alaska and much of Europe.

After you choose a destination, confirm travel requirements at all the ports the cruise will use. You could do this closer to your departure, but requirements like passports and vaccinations may be best handled well in advance of your trip.

3. Plan your itinerary

It's better to start planning your itinerary before you actually book a cruise because your preferences help most in narrowing your search. For instance, do you definitely want to take many excursions on land? Perhaps you're traveling with the whole family and want plenty of onboard activities for children to enjoy.

Here are some of the types of cruise you could plan:

- Ocean: You'll be hard-pressed to find an ocean cruise that doesn't take place on a massive ship with thousands of passengers. The programs, amenities and activities are usually expansive.

- River: Normally, a river cruise happens on a small or mid-size ship, and your route will be very scenic. This type also tends to have few passengers and amenities, but all those amenities—including food and drink—might be included in your fare.

- Adventure: When travel and unique excursions top your list of priorities, adventure cruises may be the best choice. They aim to give you rich experiences in all the destinations on your route, as opposed to the weeklong party environment of an ocean cruise.

- Family: Some ships are stocked with areas and activities tailored to children and fun for the whole family. Most cruises are great for kids of all ages.

To pick a cruise, you'll want to review all of its amenities and offerings .You can always refine your itinerary after you choose your cruise line. Knowing exactly what you want to do will make your research and, eventually, booking the cruise much simpler.

4. Pick a cruise line and ship

The number of options at your fingertips can be overwhelming, and the cruise line you choose may be your most important choice. Most sail to a wide variety of destinations and have a fleet of ships available to guests. One week is the most common length, but the size of the ship can vary wildly. For example, ocean cruises tend to fit thousands of people, while river cruises don't usually fit more than 25.

To recap, by this stage you should have considered your budget destination and itinerary. This can help you search cruise companies and locate which ones seem to best fit your goals.

As you search, here are some questions to ask yourself:

Are you traveling with family?

Many cruise lines have families in mind when designing ships and itineraries. That includes multi-generational groups, not just families with small children. It will be easy to find family-friendly cruises in your research, but determining if this is your preference can help narrow your search results.

Is this a couple's getaway?

The main way this may affect your choice of cruise is by eliminating cruises that allow children onboard. Maybe that won't bother you, but chances are, you'll find more romance on a cruise that's exclusive to adults.

Do you want an all-inclusive experience?

We talked a bit about budget, and it's worthwhile if you're considering an all-inclusive experience. In general, this means all of your food and drinks are included in your cruise fare. All-inclusive may also extend to other amenities and activities your ship has available. This package has a premium cost, but it's one that can greatly enhance your entire time aboard a cruise.

5. Choose any additional packages

We've explained how your cruise can cost more than just the price of admission. Cruise lines aren't usually bent on charging you for everything, but some amenities cost money once you're onboard. Many cruises offer packages that include the amenities and activities you're probably interested in, such as excursions, special dinners and drink packages.

A cruise package might be an add-on to your fare, or it might be included in the itinerary you choose when booking. Discounts may be available at this point, but you might also be able to sign up as you book and receive offers prior to your cruise.

Review the packages and any special deals that are available as you complete your booking. Another chance to bundle the price of common pay-as-you-go cruise expenses won't be guaranteed. This is also a good time to book any add-on, amenity, such as a massage or land excursion.

6. Book your air travel (if needed)

This may seem like common sense if you live in Wisconsin and depart from Florida. However, we have one significant piece of advice: Plan to fly one day early. Common problems with flights can happen—delays, cancellations, missed connections—and a cruise ship will depart without you. Flying early may not seem necessary, but it can be an invaluable precaution in unforeseen situations.

As with most vacation plans, flight prices tend to increase as the trip dates grow nearer. You may save money by booking air travel in advance, around the same time you book your cruise.

7. What to bring on a cruise

With all the planning out of the way, you'll eventually have to pack to make your trip more enjoyable. All the essentials you pack when traveling will also be useful on a cruise, but space may be limited in your cabin. That doesn't necessarily mean pack light, but your items may go in and out of your baggage more often.

Other essential items to bring include your travel and identification documents. Usually, a passport will cover all the bases, but check the cruise line's advice and local requirements for any port you might board and de-board the ship.

In addition, consider how you're going to spend each day of your cruise, and check the weather. You may be comfortable wearing less clothing in warm-weather destinations. Or, if you're going on an adventure cruise, you may need specific attire for variant weather and specific footwear for your land excursions.

One more thing: Some surge-protectors, steamers and clothes irons are not allowed on every cruise ship. For lists and information about allowable items, contact your cruise line's customer service or check its website.

How far in advance should you plan a cruise?

In general, you should begin planning for your cruise as early as possible. This helps with both pricing and cabin availability. Cabins in the middle of ships tend to book the earliest because the cabins at the ends of the ship may affect guests prone to seasickness. Booking between 6 and 12 months before a cruise may yield the best results in price and quality. However, last-minute bookings might be favorable, too. Exactly when you'll secure the best deal on a cruise can depend heavily on various sales and promotions, the trends of which are difficult to predict.

How much does an average cruise ship trip cost?

The cost of cruises can vary greatly based on several factors, but the total cost can range from hundreds to thousands of dollars. For the accommodations, expect a minimum of $100 per day. Cruise tickets themselves, which include your cabin at the very least, are about the same as hotel rates. But like hotels, the size, quality, availability and amenities contribute most to the daily rate you pay for a cruise.

Here are several other costs to expect:

- Port taxes: These are not included in cruise fare but will be due before you board. Most port taxes are not more than $200 per person. The more ports your cruise takes you to, however, the higher the fees.

- Personal spending: Some amenities, activities and excursions aren't included in the cruise fare or packages you pay for when booking. Depending on your interest level, this cost can range widely. Between all the onboard and off-board options available to you, you might spend at least an additional $100 a day.

- Miscellaneous: Expenses that vary depending on the passenger are difficult to estimate. For example, gratuities, pre/post-cruise transportation and parking. These may or may not apply to the cruise you're taking.

There you have it: 7 steps and some important considerations to help you plan a cruise. Although it might seem daunting, even if it's not your first time, organizing a cruise is like organizing most vacations. The destination, trip length and desired itinerary are best considered early, before you start research. Of course, you might also need to budget for expenses beyond your cruise fare, but that's true of most vacations, too. If you follow this guide, we're confident you'll have a wonderful time at sea.

- card travel tips

What to read next

Credit card basics priority pass houston iah: what you need to know.

Houston's George Bush Intercontinental Airport is home to two Priority Pass network lounges that travelers can access. Learn some ways you can gain access to these lounges and enjoy comfort before your next trip.

credit card basics Guide to accessing lounges in the Priority Pass network at Seattle-Tacoma Airport

Seattle-Tacoma Airport is home to multiple Priority Pass lounge options. Learn about the lounges for you to visit before your next trip.

credit card basics The guide to Priority Pass network lounges at Orlando MCO

If you find yourself going to Orlando International Airport soon, you can find relaxation before your flight at a lounge in the Priority Pass network. Learn how you can access MCO airport lounges before your next flight.

credit card basics Hyatt hotels to stay at in Louisville, Kentucky

Learn about the top Hyatt hotels to book in Louisville, Kentucky.

How to book travel (and save points) with Chase Travel

Editor's note : This is a recurring post, regularly updated with the latest information.

Chase Ultimate Rewards is one of the best flexible rewards currencies available, and you can get some incredible value from your Ultimate Rewards points .

Generally, we recommend transferring Chase points to the program's airline and hotel partners for award bookings. However, sometimes redeeming Ultimate Rewards points for paid travel through Chase Travel℠ is more advantageous. This option can save you money, particularly when traditional award space is unavailable, as you can book almost any available flight or hotel through Chase Travel.

Here's what you need to know about Chase Travel.

What is Chase Travel?

To maximize your Ultimate Rewards points, it's often best to transfer them to partner programs like United MileagePlus , World of Hyatt or British Airways Executive Club for award reservations. However, it's important to compare the points needed for a direct booking through Chase Travel to those required for an award booking. Sometimes, booking through the portal can be beneficial, as the points price is tied to the cash cost of the flight or hotel stay, potentially resulting in lower point requirements.

However, you need to have some Chase points before using Chase Travel. If you're unfamiliar with Chase's most popular cards and welcome offers, here are a few current ones to be aware of.

Ink Business Preferred® Credit Card

The Ink Business Preferred® Credit Card is a TPG favorite. It currently comes with one of the highest sign-up bonuses from Chase — 120,000 bonus points after spending $8,000 on purchases in the first three months from account opening.

Based on our valuations , the bonus points alone are worth $2,460. However, you can redeem these points through Chase Travel for a fixed value of 1.25 cents apiece.

Read more: Ink Business Preferred Credit Card review: A great all-around business card

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is another fantastic addition to your wallet. The Sapphire Preferred is currently offering 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. The bonus is worth $1,230 based on TPG valuations .

Like the Ink Business Preferred, you'll get a value of 1.25 cents per point when booking directly through Chase Travel with the Sapphire Preferred. You'll also earn 5 points per dollar on paid travel purchased through Chase (excluding the first $50 in hotel purchases that qualify for the card's annual hotel credit ).

Read more: Chase Sapphire Preferred credit card review: 60,000-point bonus for a top travel card

Chase Sapphire Reserve®

The Chase Sapphire Reserve® offers 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening, which is worth $1,230 based on TPG valuations.

This card includes additional perks, like a PreCheck or Global Entry credit , Priority Pass lounge access and a $300 annual travel credit . This card also boosts your portal redemption rate to 1.5 cents per point, giving you 0.25 cents per point in additional purchase power over the Sapphire Preferred. When you book travel through Chase with the Sapphire Reserve, you'll earn 10 points per dollar on hotels and car rentals and 5 points per dollar on flights (excluding purchases that qualify for the $300 travel credit).

Read more: Chase Sapphire Reserve credit card review: Luxury perks and valuable rewards, plus a 60,000-point bonus

Cash-back cards

Chase also issues a number of cash-back credit cards — including the Chase Freedom Unlimited® , Ink Business Cash® Credit Card and Ink Business Unlimited® Credit Card . The rewards you earn on these cards are worth 1 cent apiece toward travel in Chase Travel. However, Chase allows you to combine your earnings into a single account . This means that you can effectively convert these cash-back rewards into fully transferable Ultimate Rewards points if you also have the Sapphire Preferred, Sapphire Reserve or Ink Business Preferred.

How to use Chase Travel

You can book flights, hotels, car rentals, cruises and other travel through Chase Travel, and it's relatively simple to access. First, you'll need to log into your Chase account, then navigate to the right side of the page, where you'll see a little box with your total Ultimate Rewards balance.

Click the box and it will bring you to the Ultimate Rewards dashboard, which looks like this:

Click "Travel" to access the travel homepage and search for airfare, hotels or vacation rentals.

Remember that when you book hotels through the portal with Ultimate Rewards points, you typically will not earn hotel points and elite credits and may not receive elite status perks because it's considered a third-party booking.

However, flights booked through the portal will typically earn frequent flyer miles and qualify for elite status.

How to book flights using Chase Travel

Booking your flights is a straightforward process once you've navigated to the portal's travel page. Type in your arrival and departure airports and travel dates, then hit the search button. For this search, I looked for a one-way flight from San Francisco International Airport (SFO) to Newark Liberty International Airport (EWR).

You'll then see the available flight options. When you find a flight you like, select the fare type you want to book and click the blue "Choose flight" button.

Once you've selected your preferred flights, you'll be taken to the next page to review your flight information and look over any upgrades you'd like to make.

Then, you'll be directed to the checkout page, where you can pay with cash, points or a combination of the two. Again, points linked to a Chase Sapphire Reserve account are worth 1.5 cents each. If you have a Chase Sapphire Preferred Card or Ink Business Preferred Credit Card , points are worth 1.25 cents each.

Finally, you'll be directed to a page where you will enter the traveler's information and finalize your flights.

How to book hotels using Chase Travel

Booking hotels is similar to booking flights on the travel portal. This can be advantageous if you're looking at hotels outside of major chains that partner with Ultimate Rewards ( Hyatt , IHG and Marriott ). Regardless of how you book your hotel, compare the award rates required by these hotel loyalty programs to ensure you're getting the best deal.

Also, if you have an eligible card, you can access the Chase Luxury Hotel & Resort Collection , which gives you perks at around 1,000 luxury properties worldwide. Participating cards include the Chase Sapphire Reserve , United℠ Explorer Card , United Club℠ Infinite Card , United Quest℠ Card and United℠ Business Card .

Here's a sample search for hotels in Olso, Norway, which hosts mostly boutique hotels.

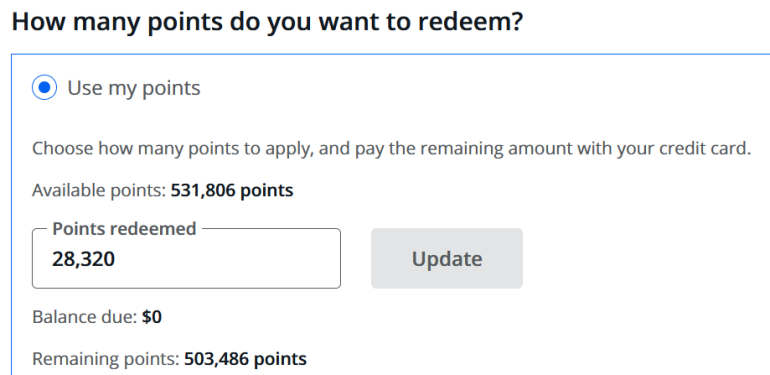

Once you've selected your desired property, room and rate, you can specify how many points you want to use on the checkout page.

Then, run through the on-screen prompts to finalize your booking, and you'll get an email confirmation.

Remember, you'll receive up to $50 in statement credits yearly for hotel reservations made through Chase Travel as a Sapphire Preferred cardholder.

Related: Book low-end or luxury hotels to get the best value from your points

How to book car rentals, cruises and other travel using Chase Travel

Using Chase Travel, you can rent cars, pay with points and still receive the excellent primary car rental insurance offered by the Chase Sapphire Reserve and Chase Sapphire Preferred Card .

The process of renting cars is similar to booking flights and hotels. Navigate to the "Cars" header from the main landing page and type in your itinerary, even if it's a one-way rental. Then, select "Search," and the results page will pop up. Once you choose your car, you'll be prompted to select add-ons.

When you've finished selecting, you'll head to the booking page, where you'll input your personal information and choose how many points you'd like to spend. Remember that to qualify for rental car insurance, you must decline the car rental company's collision damage waiver and ensure that anyone driving the car is on the rental agreement.

You can also book activities and cruises through Chase. Regarding activities, you can use your points to book fantastic tours like a Washington, D.C., night monument tour or Singapore heritage food tour at 1.25 or 1.5 cents each. This can be an excellent way to make a vacation free, instead of just your hotels and flights.

Cruises are also available, though you'll have to call to book those.

Related: The easiest ways to save on rental cars

More things to consider about Chase Travel

Below is some general guidance to maximize your experience with the portal.

We recommend comparing the points needed through Chase Travel with those required for partner transfers, factoring in taxes and fees. If you have or want hotel elite status, avoid booking hotels through the portal. These stays generally won't count toward status or qualify for hotel elite status benefits.

Booking through Chase Travel with cash can earn you extra points; Ink Business Preferred and Sapphire Preferred cardholders earn 5 points per dollar on all travel and Sapphire Reserve cardholders earn 5 points per dollar on flights and 10 points per dollar on hotels and rental cars. You might find better rates by booking directly with the travel provider; however, if your plans are firm and rates are comparable, booking through the portal can be worthwhile for earning extra points.

Remember that booking through third-party sites may result in issues if you change your plans, though. Travel providers are more likely to assist you if you've booked directly with them.

Bottom line

Chase Travel lets you use your points to book flights, hotels, rental cars, cruises and activities. If award flights aren't available or you find a cheap fare that requires fewer points, booking through the portal can be a good option.

Similarly, for hotels, it can be a good deal if you find a cheap rate or book a boutique property, but keep in mind that you may not earn hotel points or receive elite benefits. Whether booking rental cars, activities or cruises, always compare the options to see if using the portal or transferring to partners for an award is more advantageous.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Best Ways To Book a Cruise Using Points and Miles [2024]

Katie Seemann

Senior Content Contributor and News Editor

359 Published Articles 61 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Stella Shon

News Managing Editor

106 Published Articles 733 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

38 Published Articles 3331 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![chase travel cruises The Best Ways To Book a Cruise Using Points and Miles [2024]](https://upgradedpoints.com/wp-content/uploads/2019/10/Cruise-ships-in-port.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

American express membership rewards points, capital one credit cards, chase ultimate rewards points, cruise credit cards, marriott bonvoy points, united mileageplus miles, other cruise perks, discounts, and bonuses, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

You probably think of points and miles as a great way to book a flight or hotel room without spending a lot of money. While those are great ways to use your points, you can also book other types of travel, like a cruise, with points.

A cruise might not be something you think you can book with points or miles, but it can be done! In this post, we’ll walk you through all of the ways you can use your points and miles to book the cruise vacation of your dreams.

While there are no programs that offer a cruise line as a transfer partner, you can still use your points to book a cruise. The key is knowing which type of points you need and how to use them wisely.

As always, we’ve got you covered here at Upgraded Points — this guide will give you all the tools you need to book your next cruise with points.

American Express Membership Rewards is a popular transferrable currency because its points are easy to earn and it has lots of great Amex airline partners .

You can also use Membership Rewards points through AmexTravel.com , a travel portal that acts like an online travel agency. The downside is that you’ll get less value for your points when you use them this way . Booking through AmexTravel.com will give you 0.7 cents in value, while transferring your points to hotel or airline partners often gives you 2, 3, or more cents per point in value.

If you’re also interested in flights and hotels, your best bet will be to transfer your points. However, if a cruise is what you’re after, the lower value might be worth it if you’re getting to book the vacation of your dreams.

There are lots of great cards that earn Amex Membership Rewards points — here are some of our favorites:

Recommended American Express Cards (Personal)

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck ® application fee for a 5-year plan only (through a TSA PreCheck ® official enrollment provider), when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

This is the best card for food lovers who dine out at restaurants (worldwide), order take-out and want big rewards at U.S. supermarkets!

The American Express ® Gold Card is a game-changer.

With this card, you can earn 4x Membership Rewards points at restaurants and you’ll also earn 4x Membership Rewards points at U.S. supermarkets on up to $25,000 per calendar year in purchases, then 1x.

There isn’t another card on the market that offers a 1-2 punch like this. Of course, there are several other benefits of the Gold Card as well, including extra monthly dining rewards and more.

- 4x points per dollar at restaurants, plus takeout and delivery in the U.S.

- 4x points per dollar at U.S. supermarkets, up to $25,000 per calendar year in purchases; and 1x thereafter

- 3x points per dollar on flights purchased directly from airlines or at AmexTravel.com

- $250 annual fee (see rates and fees )

- No lounge access

- Earn 60,000 Membership Rewards ® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards ® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards ® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards ® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express ® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

If you’re a business owner, see our article on the best American Express business cards .

How To Book a Cruise With American Express Membership Rewards Points

- To book a cruise using your Membership Rewards Points, just search for your cruise on AmexTravel.com as you normally would.

- After you select the cruise you want to book, you’ll see the cruise summary page. Click on the small calculator underneath your fare summary.

- Next, you’ll see a pop-up where you can select how much of your cruise you want to pay for in points. You can pay for the entire cruise if you have enough points or just a portion of the cruise.

- You may notice that your total cost still shows in dollars. That’s because the full cost of the trip will be charged to the credit card that’s linked to your account. Then you’ll see a credit based on the amount of Membership Rewards points you chose to apply towards your cruise.

Bottom Line: You can book a cruise through AmexTravel.com online or by calling 866-669-4423. However, booking a cruise online through Amex can be glitchy, so you might have to end up calling. Unfortunately, many agents won’t know how to apply points to your booking, so you may have to call several times to get someone who can help you. You’ll get 0.7 cents per point in value when booking a cruise through AmexTravel.com.

Amex Cruise Privileges Program

As an American Express cardholder , you’re also eligible for some extra perks when you book a cruise.

When you search for a cruise, keep an eye out for the Special Offers tab that will be next to your search results. This tab will list the current deals offered to Amex credit cardholders. Perks can include things like onboard credit or prepaid gratuities.

Cruise Privileges for Amex Platinum Card Members

As a cardholder of Amex Platinum card or The Business Platinum Card ® from American Express , you’re eligible for exclusive benefits when you book a cruise through AmexTravel.com.

On eligible cruises of 5 nights or more, you’ll receive a shipboard credit of $100 to $300 per stateroom (based on cabin type and cruise line), plus an additional exclusive amenity based on your cruise line.

Here are the extra amenities you can expect to receive from each cruise line (please keep in mind these are subject to change at any time):

- AMA Waterways: $100 spa voucher per stateroom

- Azamara: Behind the scenes ship tour and a bottle of premium Champagne

- Celebrity Cruises : Bottle of Champagne or wine

- Crystal Cruises: $200 shore excursion credit per stateroom

- Cunard: Bottle of wine

- Holland America Line : Plate of chocolate-covered strawberries

- Norwegian Cruise Line: Complimentary dinner for 2 at Le Bistro Restaurant

- Oceania Cruises: Premium wine tasting event and a bottle of wine of your choice from the tasting menu

- Princess Cruises: Plate of canapés

- Regent Seven Seas Cruises: Exclusive private galley tour

- Royal Caribbean: Bottle of premium Champagne or wine

- Seabourn : Exclusive “suite dreams” turndown service plus a bottle of wine

- Silversea: Bottle of premium Champagne and a tour of the ship’s galley

- Uniworld Boutique River Cruises: Bottle of wine and fresh flowers

- Windstar Cruises: Canapés, a bottle of Champagne, and chocolate-covered strawberries

To redeem these benefits, book online with your Amex Platinum card or call the Platinum Card Travel Service at 800-525-3355.

Hot Tip: Disney Cruise Line sailings can’t be booked through AmexTravel.com, Chase Travel, or Citi Travel.

One of the easiest and best ways to use points to pay for your cruise is by using a credit card that earns points or miles that can then be redeemed as a statement credit. These types of cards tend to be easy to use and a great option when you want to book something other than a flight or hotel.

Capital One offers some great cards that may come in handy when booking a cruise, including the Capital One Venture Rewards Credit Card, Capital One Venture X Rewards Credit Card, and Capital One VentureOne Rewards Credit Card.

When you use this method, you can take advantage of any other sale or promotion since you don’t have to book through a specific portal, so it’s a great way to get additional discounts.

Recommended Capital One Cards

The Capital One Venture X card is an excellent option for travelers looking for an all-in-one premium credit card.

The Capital One Venture X Rewards Credit Card is the premium Capital One travel rewards card on the block.

Points and miles fans will be surprised to see that the Capital One Venture X card packs quite the punch when it comes to bookings made through Capital One, all while offering the lowest annual fee among premium credit cards.

Depending on your travel goals and preferences, the Capital One Venture X card could very well end up being your go-to card in your wallet.

- 10x miles per $1 on hotels and rental cars purchased through Capital One Travel

- 5x miles per $1 on flights purchased through Capital One Travel

- 2x miles per $1 on all other purchases

- $395 annual fee ( rates & fees )

- Does not offer bonus categories for flights or hotel purchases made directly with the airline or hotel group, the preferred booking method for those looking to earn elite status

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

- APR: 19.99% - 29.99% (Variable)

Capital One Miles

Get 2x miles plus some of the most flexible redemptions offered by a travel credit card!

The Capital One Venture Rewards Credit Card is one of the most popular rewards cards on the market. It’s perfect for anyone in search of a great welcome offer, high rewards rates, and flexible redemption options.

Frequent travelers with excellent credit may benefit from this credit card that offers a lot of bells and whistles. And it offers easy-to-understand rewards earning and redemption.

- 5x miles per $1 on hotels and rental cars booked through Capital One Travel

- Global Entry or TSA PreCheck application fee credit

- $95 annual fee ( rates & fees )

- Limited elite benefits

- Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening – that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

The card offers unlimited miles at 1.25x per $1 and no annual fee. When you consider the flexible rewards, frequent travelers come out on top.

Interested in a travel rewards credit card without one of those pesky annual fees? Then say hello to the Capital One VentureOne Rewards Credit Card.

In addition to no annual fee, the Capital One VentureOne card offers no foreign transaction fees.

But is this card worth its salt, or is it merely a shell of the more popular Capital One Venture card?

- No annual fee ( rates & fees )

- No foreign transaction fees ( rates & fees )

- Ability to use transfer partners

- Weak earn rate at 1.25x miles per $1 spent on all purchases

- No luxury travel or elite benefits

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

- APR: 19.99% - 29.99% (Variable),0% intro on purchases for 15 months

Bottom Line: With the Capital One Venture card, Capital One VentureOne card, or the Capital One Venture X card, you’ll be able to use your miles to redeem against your cruise purchase (within 90 days) at 1 cent per point in value.

The Chase Ultimate Rewards program gets a lot of hype because its points are easy to earn and use and there are great Chase transfer partners .

There are so many ways to earn Ultimate Rewards points and they can be redeemed in many ways . You can even book a cruise through the Chase travel portal and use points to pay for it.

The value you get for your points will depend on which credit card you have. Here’s a quick look:

As you can see, Chase credit cards (including Chase’s business credit cards ) have different rates of earning points, with the Chase Sapphire Reserve card yielding the most value for your Ultimate Rewards points.

Recommended Chase Cards

A fantastic travel card with a great welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

- APR: 21.49%-28.49% Variable

Chase Ultimate Rewards

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.