How to claim CRA medical travel expenses for 2023

The costs involved with traveling to receive medical attention can be significant when you factor in accommodation, meals, and related expenses.

Find out how to claim your CRA medical travel expenses.

IMPORTANT: All claims related to Medical Travel require documentation provided by the practitioner confirming your attendance (whether this be a receipt for services, or a letter signed by your service provider).

Claiming Mileage

There are two ways to claim transportation costs as a CRA travel medical expense but you have to travel at least 40 kilometers one way to obtain medical service that were not available locally.

Example: for trips to and from the hospital, clinic, or doctor’s office.

Record the distance of travel, calculate your mileage according to the province in which you reside. (2021 rates):

Example: 55¢ x 160km = $88.00; you may claim $88.00 as an eligible medical expense.

Vehicle expenses may be claimed as CRA medical travel expenses by submitting gas receipts for the date(s) of travel/service.

Claiming Meals, Accommodations and Parking

In addition to the transportation costs above, you may claim reasonable expenses during your trip for medical attention provided that you had to travel more than 80 kilometers to attend your appointment. The travel costs of one accompanying individual are also allowable, if it is deemed necessary to have a companion.

Meals can be claimed one of two ways: 1. Meal receipts can be submitted for reasonable costs for the patient and one attendant (alcoholic beverages will not be reimbursed) OR 2. A flat rate of $23 per meal may be claimed for the patient and one attendant up to a maximum of $69 per day per person.

Accommodations

Receipts must be enclosed for any reasonable accommodation fees that are being claimed (ie: hotel receipt). Coverage applies to the accommodations ONLY; telephone, movie charges and the like are not eligible for reimbursement.

Receipts must be enclosed for any parking lot fees incurred. Please refer to the CRA medical travel expenses website for further details

A farmer lives in rural Alberta. There is not much in the way of medical services, vision care, or therapeutic care, such as physiotherapy, available in this small town. Consequently, most treatment modalities require travelling to a center that has the appropriate medical facilities. The closest center is 44 kilometers from their home.

On a recent trip, they had chiropractic services performed and managed to visit the dentist for a check-up and teeth cleaning. They were eligible to be reimbursed for the cost of the travel between their home and where the services took place.

In Alberta, that amounts to 53 cents a kilometer – so they were also able to claim $46.64 for travel expenses (there and back). An alternative is to submit gas receipts for the dates of travel service.

On occasion, the same farmer requires a medical service that was only available on a timely basis in a major medical facility in the USA. This service was available in Canada but the wait time was over six months and the inconvenience to our customer as a result of their condition necessitated a faster remedy. They chose the US destination for the service.

As the travel distance now exceeded 80 Kilometers, in addition to the travel costs (economy class air fare), our customer can claim reimbursement for meals, accommodations, parking as well as the costs associated with a companion travelling with the patient if deemed necessary. An eligible travel expense claim of this magnitude represents a significant savings.

How to write off 100% your medical expenses

Are you an incorporated business owner with no arm's length employees? Learn how to use a Health Spending Account to pay for your medical expenses through your corporation:

Do you own a corporation with arm's length employees? Discover a tax deductible health and dental plan that has no premiums:

Write off 100% of your medical expenses

Are you an incorporated business owner with no employees? Learn how to use a Health Spending Account to pay for your medical expenses through your corporation:

Do you own a corporation with employees? Discover a tax deductible health and dental plan that has no premiums:

What's in this article

Subscribe to the blog

Discover more.

What is a health care spending account?

Health care spending accounts help business owners save on medical costs by turning after-tax...

By Alden Hui on December 8, 2020

What's covered in a Health Spending Account?

One of the great benefits of a Health Spending Account is the freedom it provides through an ...

By Alden Hui on October 15, 2019

7 Key Health Spending Account Rules that you should know

A Health Spending Account (HSA) is a tax-free benefit which allows small business owners and their...

By Alden Hui on April 25, 2019

This website stores cookies on your computer. To find out more about the cookies we use, see our Privacy Policy .

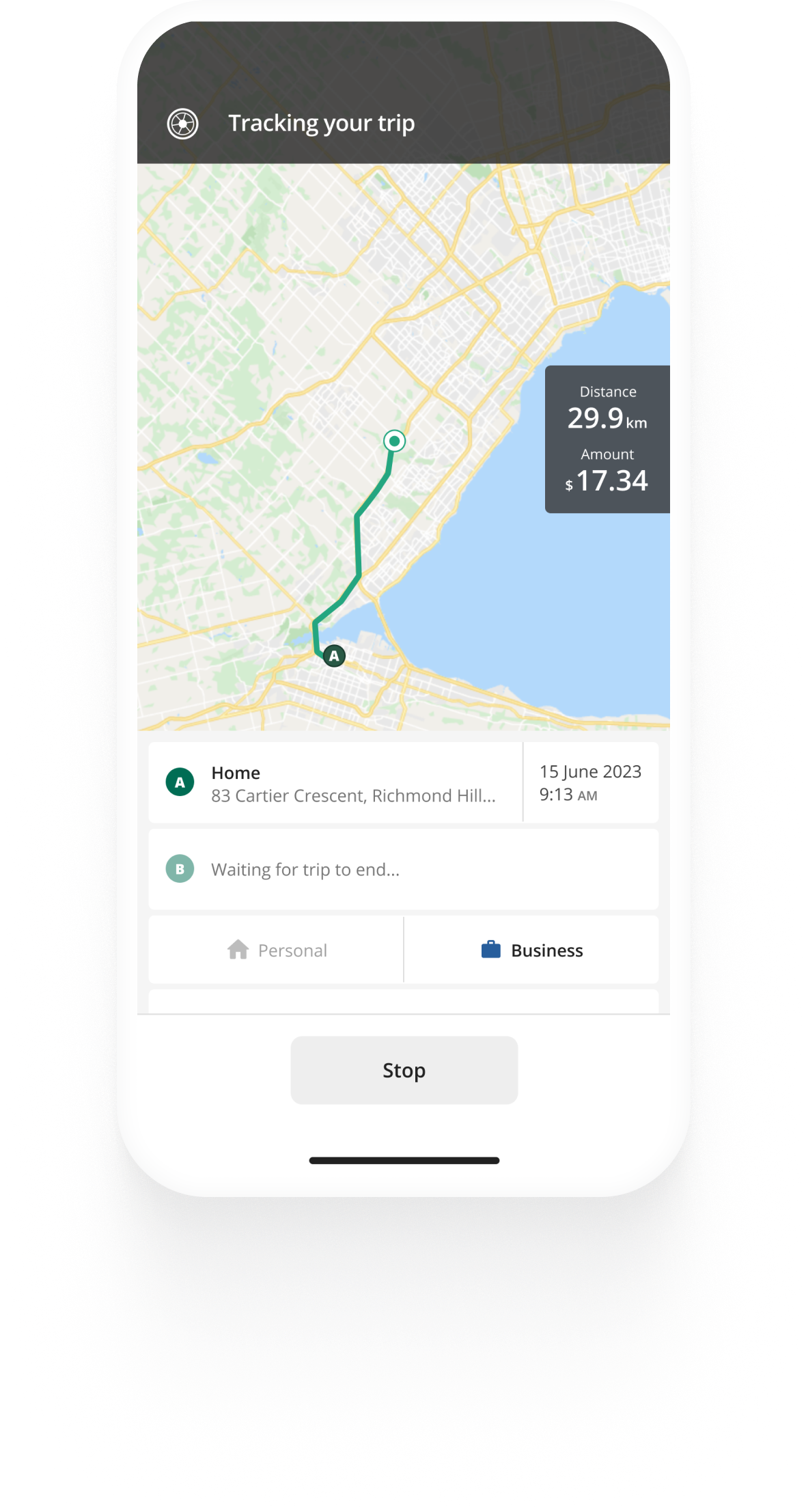

Track mileage automatically

Medical travel expenses, in this article, medical travel expenses you can claim, how to claim medical mileage from the cra.

You can claim a range of expenses for medical-related costs from the CRA. An important cost you can deduct on your tax return is medical travel expenses when you drive or use public transport to reach a medical centre that provides the medical care you need.

Track business driving with ease

Trusted by millions of drivers

Automatic mileage tracking and CRA-compliant reporting.

You can claim medical mileage from the CRA if you travel over 40 kilometres in one direction in order to receive medical attention. In order for your mileage to qualify, you must observe the following rules from the CRA:

- You weren’t able to receive the medical care you needed near your home

- You took a reasonably direct route to the medical facility

- It was reasonable for you to travel to the specific medical facility in order to receive the needed medical service

You can claim mileage with your own car or a rented one, as well as any public transport costs such as bus, taxi and train fares if that was your mode of transportation.

The CRA provides two methods with which you can claim medical travel expenses - the simplified and detailed methods.

With the simplified method , you can use a flat per-kilometre rate to claim medical travel expenses. Each province and territory has a different cents per kilometre rate. With the detailed method, you can claim your actual medical travel expenses.

You can only use one method during a tax year.

If you use the simplified method for claiming medical travel expenses, it is highly recommended that you keep track of your medical mileage, as the CRA may ask for proof of your claim.

If you decide to use the detailed method in order to claim medical travel expenses, you will need to keep all receipts related to your medical mileage. These can include gas, fuel, oil, tyres, insurance, maintenance and repairs receipts for your vehicle, and bus, taxi and train tickets. You also need to keep track of your mileage, including your total mileage and mileage related to medical purposes.

If you use your vehicle to travel for medical purposes, you can find the percentage of medical mileage by dividing your medical travel by the total travel for the year. You will be able to claim a percentage of your fixed and variable costs to maintain and drive your vehicle equal to the percentage of medical travel you had during the year. For example, if 3% of your total kilometres were for medical purposes, you will be able to claim 3% of your vehicle expenses during the year.

Learn more about medical travel and other medical expenses you can claim and see the flat per-kilometre rates for the simplified method.

Do you also use your vehicle for work-related travel? See our CRA guide on mileage allowance and deductions where you’ll learn how to claim work-related travel and what records you need to keep.

Tired of logging mileage by hand?

Effortless. CRA-compliant. Liberating.

Related posts

Capital cost allowance for vehicles.

June 3, 2024 - 10 min read

Calculate CCA for cars to reduce the taxes you or your business need to pay. Get an overview of the CCA classes and rates in this table

CRA Mileage Rate 2024

January 2, 2024 - 2 min read

The CRA announces 2024 rates for vehicle allowance: From January 1st, 2024, per kilometre rates will increase 2 cents over 2023.

Self-Employed Tax Deductions You Can Claim In Canada

July 11, 2024 - 2 min read

See common tax deductions for self-employed individuals in Canada and how to claim them at tax time. Maximize your earnings by deducting business-related expenses

Choose your Country or region

CRA Mileage Rate 2024: Guide to Tax-Free Vehicle Allowances For Business Travel

Cra mileage rate 2024.

Are you an employee, small business owner, or self-employed individual looking to understand the rules and regulations of CRA mileage rate this 2024 ? Canadian taxpayers need to be aware of what they can expense on their taxes as entertainment, such as meals or kilometres travelled in a car.

We will discuss all relevant to ensure you maximize your deductions for businesses travelling while remaining compliant.

Key Takeaways

- 70¢ per kilometre for the first 5,000km driven

- 64¢ per kilometre after that

- 74¢ per kilometre for the first 5,000km driven

- 68¢ per kilometre after that

Changes to the CRA mileage rate for 2024

When reimbursing employees for business travel, the Canada Revenue Agency (CRA) has set out a specific set of rules that employers must adhere to. Canadian taxpayers should be aware of these rules when managing their business expenses to avoid any penalties from the CRA.

The 2024 standard CRA mileage rate per kilometre is currently 70 cents with a 4-cent per kilometre reduction after the first 5,000 kilometres driven yearly.

Here’s the CRA’s Automobile Allowance Rates for the past five years:

You can report any tax-subjected automobile allowances paid to employees or officers on Form T2200 Declaration of Conditions of Employment .

Employers can claim input tax credits based on reimbursements made for these expense claims but must ensure they keep detailed records alongside invoices related to any incurred costs.

Businesses must recognize reimbursement requirements, as failure to comply could result in CRA-implemented fines and other financial penalties, which will financially affect both employers and their staff.

What is CRA mileage allowance and tax-free vehicle allowance in Canada?

The CRA mileage rates are a guide set by the Canada Revenue Agency to reimburse taxpayers for vehicle expenses incurred for business use. They calculate the deductible expenses related to operating a vehicle for business, medical, moving, or charitable purposes. Taxpayers can use these rates to calculate their deductible vehicle expenses when filing their income tax returns.

How to use the 2024 CRA mileage rate and automobile allowance: Salaried workers, Self-employed, and Employers

Mileage reimbursement rules for salaried workers.

Employees may be eligible to claim allowable motor vehicle expenses on their income tax return if they incurred these expenses under the terms of their employment contract. For instance, if an employer agrees to reimburse travel expenses for using one’s personal vehicle for work-related tasks.

However, it’s essential for employees to maintain accurate records and evidence to substantiate that the kilometers claimed were indeed for business purposes.

Mileage Reimbursement Rules for Self-employed

Self-employees can also deduct business-related vehicle expenses. This also applies to personal cars used for business purposes such as purchasing supplies for your businesses, meeting with clients, attending conferences, or visiting customers. Other expenses may also include:

- License and registration fees

- Fuel and oil expenses

- Insurance fees

- Maintenance and repairs expenses

- Leasing costs

- Capital cost allowance

The allowance will be deducted in the annual tax returns. But remember, self-employees must keep receipts and invoices in order to get deductions. Expenses incurred for personal use of their personal vehicle will not be eligible for coverage under the allowance.

Mileage Reimbursement Rules for Employers

There is no law mandating that employers must compensate employees for using their personal vehicles for business purposes – this depends on individual company policies or contracts.

Nevertheless, implementing a mileage allowance using Canada Revenue Agency (CRA) standards can make a job offer more attractive to potential employees, as it compensates for their personal vehicle usage.

With a CRA mileage allowance, employers are obliged to cover employees’ work-related vehicle expenses. This reimbursement also provides a tax benefit for the company. To qualify as legitimate and tax-deductible, the reimbursement should:

- Cover the yearly amount of kilometres driven solely for business purposes

- Be based on a reasonable per-kilometre rate or slightly lower than the official CRA vehicle allowance rates

- Be for the employee who hasn’t already been reimbursed for the same use of their vehicle.

If these conditions are met, the mileage reimbursement is considered a non-taxable benefit for employees.

Eligibility For CRA Mileage Rate 2024 And Tax-Free Vehicle Allowances

The CRA provides rules and regulations for claiming tax-free vehicle allowances and mileage rates when travelling for business purposes.

You are also eligible if you use your car to attend conventions, seminars or meetings, and other activities with work-related purposes away from home. But travelling from your home to your normal place of work is not considered business-related driving.

The type of transportation used is essential—employees using public transport, such as buses and subways, do not qualify for any reimbursements. At the same time, those who choose personal cars will receive a predetermined per-kilometre rate (according to the CRA standard mileage rate as shown above).

4 Types Of Business Travel Eligible For CRA Mileage Rates And Tax-Free Vehicle Allowances

- Regular Work Locations

- Temporary Work Locations

- Home Office as a Regular Work Location

- Commuting to Work

Whether travelling for regular work locations, temporary work locations, home office or commuting to work, you’ll find everything you need to know about the CRA mileage rates and tax-free vehicle allowances here.

Canada Revenue Agency (CRA) defines regular work location as any workplace that the employee visits at least once a week on a sustained basis for a purpose related to their employment.

It includes both long-term and short-term job positions or assignments. The employer must be able to provide sufficient proof of attendance; records such as timesheets should help demonstrate this.

In addition, travel expenses associated with these locations are only eligible for reimbursement if they are located more than 80 km (one way) from the primary place of business or residence of the employee.

For example, an accountant who works in Toronto but travels to Ottawa each weekend would likely qualify for CRA mileage rate reimbursements since it’s more than 160 km one way between cities—even if he has not been assigned there permanently yet.

Any work location other than an employee’s regular place of employment is considered a “temporary” work location and would be eligible for mileage rate and tax-free vehicle allowances.

According to CRA guidelines, temporary locations last up to four weeks or have been pre-approved by the employer in writing. Considering all surrounding circumstances, the employer must demonstrate why the travel was reasonable.

Any expenses related to this travel, such as lodging, meals, allowance and specific motor vehicle rates, can be deducted from income if proven to be necessary business or relocation expenses incurred during that journey.

- Home Office As A Regular Work Location

Home offices may qualify for either CRA mileage reimbursement or tax-free vehicle allowance when it is determined to be a regular work location.

To qualify as a regular work location, the home office must be used for working with clients or customers more than 50% of the time each month and must meet specific criteria, such as having private entrances, separate telephone lines and an exclusive portion of the residence dedicated solely for business activities.

- Commuting To Work

Commuting expenses incurred while travelling to and from work regularly are usually not eligible for mileage rate or tax-free vehicle allowance benefits under the CRA.

However, Canadian taxpayers can claim certain commuting expenses for business activities associated with their job or profession that require them to travel and attend industry events or other such engagements away from their workplace.

To be eligible, the primary purpose of this travel must be generating income by performing duties related to your job/profession rather than commuting between home and work.

LEARN MORE: How to Find the Best Tax Accountant Near Me

Mileage Reimbursement Implications

Tax implications.

In Canada, tax deductions are available to businesses for business travel expenses, including mileage and car allowances. Mileage allowance paid to employees or officers is treated as a taxable benefit subject to the employer’s income tax withholding at source.

If an employee is provided with the use of a company car, this will be presented as part of their salary, and taxes will be deducted accordingly. For employers, eligible expenditure on providing car allowances to employees may also qualify for input tax credits if applicable according to prevailing rules in each province or territory.

Accurate tracking and record-keeping are essential when claiming CRA mileage rates and tax-free vehicle allowances for business travel. Recent changes have been implemented regarding the supporting documentation that employers must keep to claim certain deductions from their business’s income taxes relating to these types of expenses (e.g., a detailed log that includes the date of travel, route taken, and distance travelled).

If you need clarification about the tax implications, you can always consult a tax accountant who can help you with personal and corporate tax matters.

External Influences

- Economic Conditions : Rates might be adjusted to align with prevailing economic conditions.

- Cost of Fuel: Fluctuations in fuel prices may cause the allowance rate to increase or decrease.

- Inflation Rates: General inflation can affect the cost of vehicle maintenance, repairs, insurance, and other related expenses. CRA might adjust the mileage allowance accordingly.

- Policy Changes: Any new regulations regarding business expenses and reimbursements might necessitate changes to the allowance.

- Technological Advancements: The increase in electric and hybrid vehicles can affect the per-kilometre cost calculation regarding vehicle expenses, which could potentially impact the CRA mileage allowance.

3 Tips For Managing Business Travel Expenses and Mileage Tracking

– Provide clear guidelines for employees to follow when tracking and recording business travel expenses, such as keeping detailed records and utilizing technology.

1. Keep Detailed Records

Keeping detailed records of business travel expenses is essential for Canadian taxpayers. It helps to accurately calculate CRA mileage rates and tax-free vehicle allowances and avoid potential issues during an audit from the Canada Revenue Agency (CRA). Taxpayers need to keep records such as:

• Gas receipts

• Oil changes

• Car maintenance & repair costs

• Insurance payments

• Any other related out-of-pocket expenses

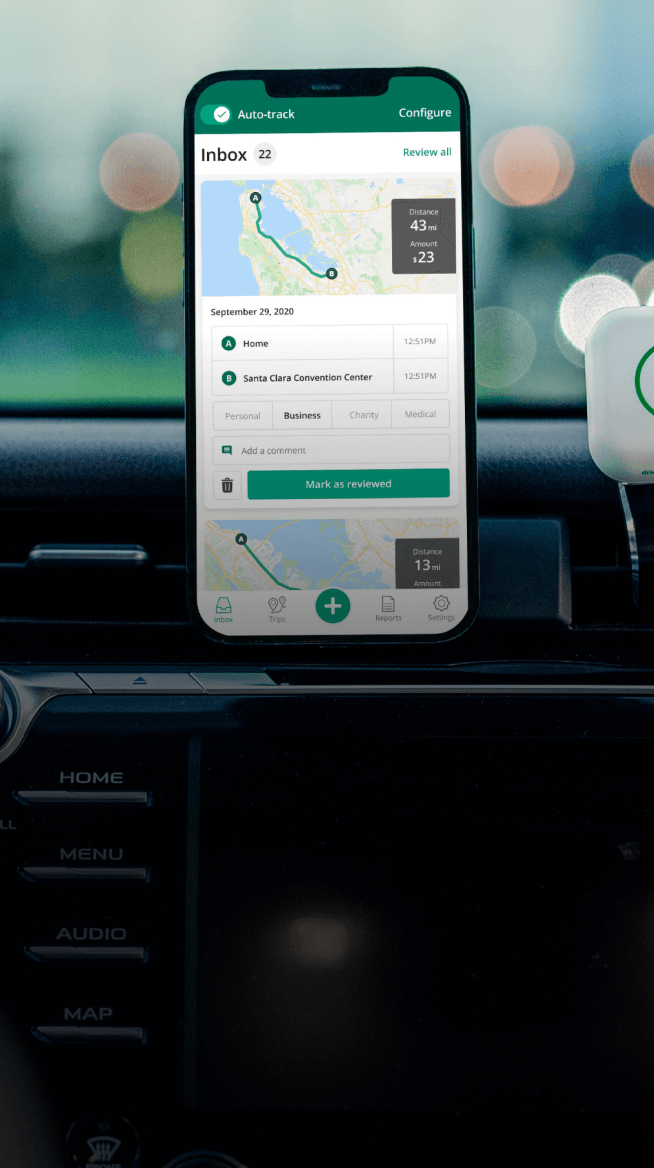

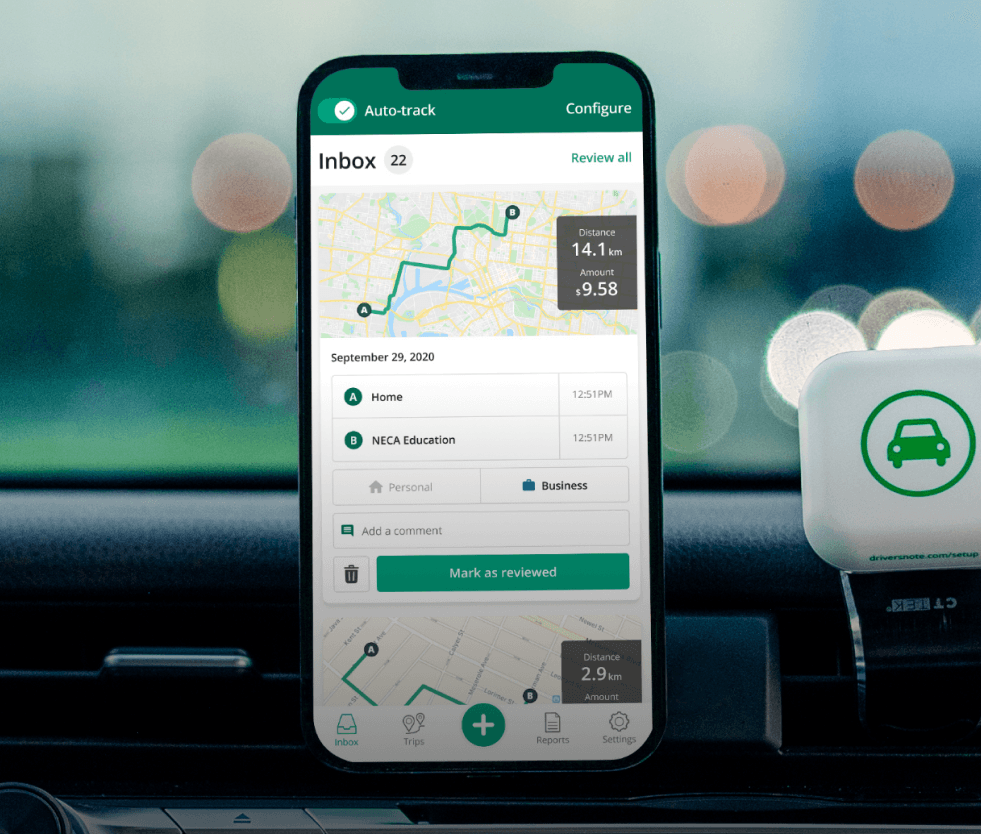

By keeping these mileage records, Canadian taxpayers can easily track their business travel expenses and ensure everything is accounted for correctly. Further, it provides evidence that any vehicle deductions are legitimate, so there are no problems or additional costs associated with CRA audits. Technology can also help Canadians monitor their spending by using various automatic mileage tracking tools, such as Driversnote’s expense reimbursement system and tracking tool – perfect for managing business trips abroad or just around town!

2. Use Technology To Track Vehicle Expenses

Technology can be a valuable tool for managing business travel expenses associated with CRA mileage rates and tax-free vehicle allowances. Mileage tracking apps and other tools can enable accurate record-keeping and precise calculations, which can help taxpayers claim total tax deductions. Keeping a detailed log of trips is still necessary, but using technology reduces the need for manual tracking of odometer readings while adding convenience.

Examples of mileage tracking apps include TripLog , MileIQ , QuickBooks Self Employed , etc. Additionally, businesses may install GPS units on employee vehicles to keep track of automobile-related expenses for various purposes, including deduction claims at year-end taxes or providing client billing information when required.

Using these apps or tools can make managing business travel expenses in different locations within Canada easier by automatically tracking all drives based on time spent driving as per kilometre rate set by the CRA standard mileage allowance (SMA). It saves time to manually enter odometer readings every time an individual travels between two points, ensuring that no detail remains unaccounted during tax filing or claiming expenditures from bosses/employers, respectively.

DISCOVER: Free Resources

3. Reimburse Employees Promptly

Employers must ensure that employees are reimbursed promptly and accurately for travel expenses on business trips to avoid any potential complications or legal ramifications.

Promptly reimbursing employees helps maintain employee morale and makes them feel empowered and valued, primarily if the employer guides them in navigating the expense system. Hence, they know exactly what to do when their reimbursements will be delivered and why it’s crucial.

According to Canadian tax laws, employers who provide an automobile allowance must maintain documents clearly outlining this arrangement and documenting all claims made by employees against it via an expense reimbursement form.

Furthermore, failure to automate the process in some way may lead to delays with repayment — another aspect that should be addressed in such arrangements.

- Understanding Provincial/Territorial Allowances and Mileage Rates in Canada

Canadian taxpayers are responsible for understanding the differences between federal and provincial/territorial allowances when claiming expenses related to business travel.

The CRA has a standard mileage rate of $0.70 per kilometre for the first 5,000 kilometres driven each year; however, some provinces or territories might have additional tax-free vehicle allowance amounts based on their accommodations, cost of living or other particular circumstances that could increase the amount an individual can claim up from CRA’s base rate.

CRA Mileage Rate 2024 Conclusion

As business travel can be complicated and expensive, understanding the CRA mileage rates and tax-free vehicle allowances is essential. Following the rules prescribed by the Canada Revenue Agency (CRA) can save time, money, and energy when preparing your taxes.

The key takeaway from this article is to keep records of all your travels—including destinations, distances travelled, and dates—and submit accurate expense reports for CRA mileage reimbursement or claim for a business vehicle allowance as per eligible criteria as soon as possible.

Common questions related to CRA Mileage Rates this 2024 And Tax-Free Vehicle Allowances For Business Travel relate to eligibility criteria for claiming deductions on taxes relating to business trips; applicability of different rates in various provinces/territories; use of technology tools for tracking expenses; etc., all of which have been addressed throughout this article.

It’s also essential to remember that expenses must adhere to guidelines set forth by the Canada Revenue Agency’s prescriptions for deductions to apply on personal income tax filings.

1. What are the CRA mileage rates for business travel?

The Canada Revenue Agency (CRA) sets a mileage rate for business travel for automobile and bicycle use. Currently, the kilometric rate is set at $0.70/km (2024)for taxis, cars or vans leased or owned by employees.

2. How do you calculate vehicle allowances provided by employers through CRA?

To calculate vehicle allowance amounts provided by employers using the CRA mileage rate, multiply an employee’s total business kilometres driven during a given tax year with the corresponding kilometric rate of ($0.70 per km 2024 for the first 5,000km and $0.64 thereafter). This amount should be included in Box 14 on their T4 slip from the employer to declare it as income when filing taxes every year unless the allowance meets certain criteria and is considered “reasonable.”

3 . Are car expenses covered under my prescribed mileage rates allowance?

Yes – once you met CRA’s conditions, reimbursed car expenses such as insurance costs and eligible lease payments are intended to be covered by your prescribed mileage rates allowance according to CRA guidelines.

Are you looking for assistance with your personal or corporate taxes? Look no further than CPA Guide. Our network of top accountants and accounting firms in Canada will help you find the best CPA to suit your needs. Get started today with CPA Guide .

Making a Claim for Medical Expense Travel Credits in Canada

by dellendo | Income Tax Return Preparation

Making a Claim for Medical Expense Travel Credits

Taxpayers can use the medical expense tax credit to offset taxes paid or owed. If you paid for healthcare, you may be allowed to deduct them from your taxes and benefits.

- Details of medical expenses

Medical Expense Tax Credit

- Eligible medical expenses

CRA Medical Expenses in Canada

Canada is the world second largest country. In addition to its immense size, some of the country’s most attractive places to reside are found in rural communities. Traveling long distances for medical care is a hassle, and it’s an issue if you live outside of a big city. If you have to travel for your treatment, you may be able to claim travel expenses on your tax return according to the Canadian government.

A range of costs incurred when traveling for medical treatment, as well as those incurred on behalf of your spouse or family, may be eligible for tax deductions. All reimbursements will cover travel, food, and housing costs for the patient and an escort, if needed. To help with tax season, let’s consider the allowable deductions and how to claim them.

How far must I travel to qualify for Medical Expense Travel Credits?

It is likely that you have spent a lot of money on parking at a hospital in the past, so be prepared for that expense. When traveling for medical treatment, parking charges are not deductible unless you travel more than 80 kilometers.

When submitting a claim to the CRA for transportation and travel expenses, it is necessary to meet the following requirements:

- In your neighborhood there were no comparable medical services.

- You avoided detours and followed the shortest route.

- It was appropriate for you to go to the place you did in order under the circumstances to acquire such medical care.

If you take public transportation to travel more than 40 kilometers (one way) for medical treatment, you may be entitled to claim the costs (eg. bus, train, or taxi fare). Even if you don’t use public transportation, you may be able to deduct the cost of your car.

If you traveled more than 80 kilometers (one way), you can deduct your automobile expenses, as well as your housing, meals, and parking fees, from your tax return.

If a medical professional has determined that you cannot travel without assistance, you may be able to claim reimbursement for expenses incurred by someone who traveled with you as a caretaker.

How does the CRA calculate vehicle costs?

If you need to drive to get medical attention, you can claim expenses such as gasoline, oil, license fees, insurance, maintenance and repair costs, and replacement parts on your tax return. Depreciation, provincial taxes, and loan charges are all considered tax-deductible expenses in the United States.

There are two techniques to determining automobile expenses: the complete methodology and the streamlined method. The comprehensive technique is the more thorough approach. If you select the detailed option, you will be required to keep track of the total amount of kilometers driven over a 12-month period. Assess the relationship between the overall cost of your vehicle and the number of kilometers travelled for medical treatment.

You can deduct half the cost of your car on your tax return, for example, if you drive 10,000 kilometers in a year, with 5,000 kilometers of those being for medical treatment (which was more than 40 kilometers away).

You may easily calculate how many miles you traveled throughout the 12-month period in which you choose to seek medical attention by following this straightforward procedure. Calculate the distance traveled by multiplying the distance traveled by the provincial rate that is in effect. Tariffs vary by province or territory and are subject to change on a yearly basis. The document is available on the website of the Canada Revenue Agency.

Keep all of your receipts for future Canada Revenue Agency inspection applications, regardless of whether you choose a detailed or a simple approach (CRA).

What are the Accommodations Policies?

- To be eligible for payment for housing and food you must have covered more than 80 km for medical care.

- Receipts are based on accommodation claims and only stay costs, including taxes, are reimbursable. No additional price is included for items like room service, movies and telephone calls.

What is the process for claiming meals?

- You must have gone more than 80 kilometers to be eligible for food refunds from CRA. You have the possibility, as well as with car costs, to choose the detailed manner or the simplified method.

- You must keep track of the actual cost of each meal with the detailed way.

- You can deduct up to $17 for each meal up to $51 a day including sales tax and up to a maximum of $17 per meal for people who choose for the simpler option.

- Keep in mind whether you employ the detailed technique or the simplified method always to save receipts.

Travel Partners / Companions

You may be entitled to deduct the expenses of your spouse or common-law partner, as well as any other person who travels with you, as part of the tax credit for medical expenses if they accompany you on your journey. To include these charges, your doctor or other authorized practitioner must present you with a certificate showing that you were unable to travel alone at the time the incident happened.

When you meet certain qualifications, you may be able to cover the costs of transportation, lodging, and meals for your travel companion, depending on how far you traveled for medical care.

Travel outside of Canada’s borders

In addition to being able to claim expenditures incurred while out of the country, qualified medical expenses for traveling within Canada may also be reimbursed. Every single one of the following requirements must be met:

- Practitioners must have the legal right to practice in the country where they work. When it comes to hospitalizations, the institution must be either public or privately licensed private.

- The program requires that the health-care services you receive be unavailable in your neighborhood and that you travel to seek them.

Related Projects

Service title.

- Community basics

- TurboTax™

Why sign in to the Community?

- Submit a question

- Check your notifications

- Community Basics

- Community home

- Discuss your taxes

Do you have a TurboTax Online account?

We'll help you get started or pick up where you left off.

- Discussions

- Navigating TurboTax

- Self-employed

Where do I put mileage for medical expenses

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Printer Friendly Page

- Mark as New

- Report Inappropriate Content

- TurboTax Online Standard

View solution in original post

Related Content

What's the difference between the medical expense tax benefit that i'm too low to qualify for, and the very next page asking for medical expense claims?

Turbotax said I'll get $1490.15 for tax return refund but I only received $269.28. I even paid for doing tax return with medical expenses. What could've happened?

Why aren't my dependant's medical expenses showing on my medical expense claim page in Turbo Tax?

dhiraj-mapleleaf

Can we claim medical expense after filing our returns? thank you.

As a self-employed contractor, I was reimbursed $0.51 for mileage, and it was included in my income. Can I claim vehicle expenses still?

You are leaving TurboTax.

You have clicked a link to a site outside of the TurboTax Community. By clicking "Continue", you will leave the Community and be taken to that site instead.

Form T2200, Declaration of Conditions of Employment , must be completed by the employer in order for the employee to claim these expenses.

The employee claims the expenses on Form T777 Statement of Employment Expenses .

In order to deduct vehicle expenses on Form T777, the employee must

This is the only method allowed for an employee to claim vehicle expenses - they cannot simply use a rate per kilometre x kilometres driven for work.

Line 22900 employment expenses can be entered in the "other deductions" line of the Canadian Tax and RRSP Savings Calculator .

This topic is discussed in the Life in the Tax Lane October 2019 video , referencing Tax Court case MacDonald v. The Queen, 2019 TCC 169 re vehicle expenses denied.

Travel To and From Work

Travel to and from the place of work is not considered use for employment. When the form is completed, the kilometres used for earning employment income is entered, as well as the total kilometres driven in the year .

GST/HST Refund

The motor vehicle expenses will include any GST/HST or provincial sales taxes incurred. You may be eligible for a refund of the GST/HST included in the costs. See Employee and Partner GST/HST rebate on the GST/HST page.

Working From Home Travel Expenses

If an employee normally works in their home office, does not have an office at the employer's place of business but occasionally must travel there, the travel to and from the employer's place of business may qualify for a vehicle expense deduction, or may receive a tax-free reasonable travel allowance from their employer for this travel.

Working from Home during COVID

Tax Court of Canada case Gardner v. The Queen 2020 TCC 108 decided the expenses claimed by the taxpayer for travel between her home office and her employer's office in 2015 were deductible as an employment expense as per s. 8(1)(h.1)(ii) of the Income Tax Act. The T2200 form completed by her employer stated that her employment contract required her to use a portion of her home from work, and that 90% of her duties of employment were performed in her home office. She did not have an office at the employer's place of business, and said that the travel was employment travel because it was between two places of her employment, one being her home office. The Court agreed.

In Tax Court case Campbell v. The Queen 2003 TCC 160 , a group of appellants who held office with a school board, and worked from home, were successful in arguing that the travel allowances they received for travel between their home offices and the school board offices were not taxable. The appellants' home offices were their regular places of work, and they did not maintain offices at the school board building. For these reasons, the Court was satisfied that the travel between the home offices and the school board building to attend meetings was not personal travel, and ruled that the expenses were exempt from taxation under the provisions of s. 6(1)(b)(vii.1) of the Income Tax Act.

Other Resources

Video Tax News Life in the Tax Lane August 2022 re required travel between home and work

TaxTips.ca Resources

Auto Taxable Benefits

Employee Tax Topics on our Personal Income Tax page

Employee Work-Space-in-Home Expenses

Capital Cost Allowance (CCA) - Zero-Emission Vehicles

Canada Revenue Agency (CRA) Resources

A reasonable per-kilometre allowance is tax-free, and is the easiest method for an employee to recover vehicle expenses.

Employees deducting vehicle expenses on their tax return must track vehicle kilometres and vehicle expenses for the entire year.

Revised: December 19, 2023

Canadian Income Tax

Travel costs claimed as medical expense tax credit, by edelkoort smethurst cpas llp.

In an effort to assist Canadian residents who have to travel for medical care the Government allows the costs of travel to be claimed as a medical expense tax credit on personal tax returns.

In order to claim travel CRA medical expenses the following three conditions must all be met:

- Equivalent medical service is not available near your home hence the requirement to travel to receive medical care

- A reasonable travel route was taken to receive medical support

- It is considered reasonable to travel to a place for the medical support received

If a doctor/medical practitioner confirms you are unable to travel alone to receive the necessary medical care, the travel costs of an attendant may also be claimed as per the conditions outlined.

Travel Radius

In order to claim travel costs as a medical expense, taxpayers must travel at least 40 kilometers for purposes of seeking medical support.

- When traveling 40 kilometers or more, public transportation expenses such as fare of taxis, buses, or trains can be claimed. If public transportation is not readily available, vehicle expenses can be claimed.

- When traveling 80 kilometers or more, because it is likely you need temporary accommodations while receiving the medical care, accommodation expenses can be claimed, along with any parking and meal expenses in addition to vehicle expenses.

Claiming Public Transportation (Travel Distance of 40 km or more)

Public Transportation can vary from the cost paid to travel by taxi, bus, train, or air travel to reach a destination where medical services are provided.

Claiming Meal and Vehicle Expenses

Meal and Vehicle Expenses can be claimed using the simplified or detailed method as described below. All expenditures claimed using the detailed method require supporting documentation in the event the CRA decides to review the claim.

Meals expenses claimed using the simplified method are calculated using at a flat rate of $17 per meal to a maximum of $51 per day (assumes three meals a day). The detailed method claims the actual amount spent on all meals during the time spent traveling for the medical care.

Vehicle Expenses similarly can be claimed using the simplified method which is to apply a per km rate to the number of kilometers travelled from home to the place of medical service. The per km rates are published by the CRA here and the applicable rate is based on the province in which a taxpayer departs from.

The detailed method is more complicated. First, a taxpayer must document not only their travel for medical purposes but also the total kilometers driven during the tax year. The taxpayer must also report the total of all vehicles related costs (fuel, license fees, insurance, repairs, etc.) in order to calculate the medical travel portion based on the kilometers tracked. Due to the level of record keeping required, we typically advise our clients to use the simplified method. While a log of kilometers driven for medical support must be maintained using the simplified method, it need only list the departure and destination along with the date of travel.

If you have any questions about claiming travel costs as a CRA medical expense please feel free to contact our firm for additional information to gain a better insight on your tax situation.

Blog post authored by Andrew Bidulka

- What I Do & My Credentials

- Articles/Seminars

- Useful Links

- News & Other

Medical Expenses and Taxes – What Can You Claim?

January 2024

You may claim a tax credit for medical expenses when preparing your income tax return. How much is it worth to you? What qualifies as a medical expense? In my 45 years of doing tax returns, I consider the medical expense credit as the most common tax credit under-claimed by taxpayers, especially the mileage claims, out-of-province travel insurance premiums and assisted living costs for infirm residents. Although this article is quite complex, we hope it is easier to read than the Canada Revenue Agency Income Tax Folio – S1-F1-C1 available to you free from the Canada Revenue Agency (CRA). I also recommend their publication RC4065, Medical Expenses . See the CRA Folio index for other medical and disability information. If you pay someone to do your tax return based on time, read this article on how to Organize your Medical Receipts to save them time in trying to figure out all of your receipts.

If you have missed claims in past years, you are allowed to amend prior year returns for up to 10 calendar years after the error or omission.

First of all, you can only claim medical expenses after they exceed a certain amount. This threshold amount for the federal part of your tax return (Schedule 1) is either 3% of your net income as reported on your tax return, or $2,635 in 2023 ($2,759 in 2024), whichever is lower. For example, if your net income on your tax return is $40,000, you can deduct expenses in excess of $1,200. If your income is over $87,833 in 2023, you can claim any amount over $2,635. Provincial thresholds vary. For example, for P.E.I. residents, the 3% formula is the same, but there is a different threshold. For many years, the threshold has been $1,678 for P.E.I., which means that if your income is over $55,933, you can claim any amount over $1,678. If you are preparing your tax return and you do not qualify to claim expenses on a federal basis because the amount is too low, remember to look at the provincial form also.

The medical expense is deductible based on when it was paid , not when the service was performed. If you pay a bill late, or by instalments (such as many parents do for large dental bills), your tax savings may be reduced. Your tax savings for medical expenses will be the amount of medical claim multiplied by the lowest federal rate of 15%, plus your provincial tax rate. This will be approximately 20% to 25% of your qualifying expenses. For example, in P.E.I., if you pay $2,000 of medical costs, but the first $1,200 are not deductible, then the $800 that you can claim will save you tax of about $200 (15% + 9.8% = 24.8% of $800). For certain low income taxpayers, the medical claim may result in a refundable tax credit, meaning that a tax refund is issued even if you have no taxes payable. You may claim medical costs for you, your spouse or common-law partner or a dependent relative, which may include a child, grandchild, parent, grandparent, brother, sister, uncle, aunt, niece or nephew. I discuss dependants further below.

Note that medical costs for cosmetic procedures will not qualify unless required for reconstructive purposes. These non-qualifying costs include teeth whitening, hair replacement, liposuction and botulinum injections. Other costs that do not qualify include over-the-counter medications, non-prescription birth control devices, vitamins and supplements, health foods, emergency personal response systems and blood pressure monitors. Common expenses that qualify as medical expenses are listed below. In some cases, you need a prescription, and in other cases, you do not. When in doubt, contact the Canada Revenue Agency for clarification, or visit the Canada Revenue Agency Web page discussing medical cost s. Also, to help you organize your receipts, see my article titled Organize your Medical Receipts – Reduce Your Tax Preparation Fee .

- Payments for prescriptions , minus any amounts refunded by a health insurance plan;

- Premiums paid to a health insurance plan – whether paid privately or deducted from your wages. Do not include life or disability premiums, only the medical, dental and vision;

- Premiums paid for travel health insurance , such as out of country coverage;

- Payments for vision care, such as checkups, eye glasses, contact lenses or eye surgery;

- Payments for hearing aids , as well as hearing aid batteries (no prescription required);

- Payments for dental work, including checkups, cleaning, surgery and other procedures;

- Payments to qualified medical professionals . A publication by the Canada Revenue Agency ( Income Tax Folio – S1-F1-C1 ) provides a sample list of professionals. Do not rely on this list because, as their publication states, the correct definition depends on “the laws of the jurisdiction”. Go to the CRA web site listing of authorized medical practitioner s by province or territory for a list of qualified medical professionals for each province. For example, in some provinces, fees paid to a podiatrist, a massage therapist or a naturopathic doctor will not qualify. However, these can change at anytime, so check annually.

- Payment for attendant care for a patient who has a severe and prolonged mental or physical impairment. Depending on your situation, you will need either a doctor’s letter or a Disability Tax Credit Certificate. See the CRA publication, RC4064, Disability-Related Information . Generally speaking, if a person qualifies for the disability credit, then you can claim either the disability credit or the attendant care fees for full-time care in the person’s home or for a nursing home , but not both. Note that the Income Tax Act, in paragraph 118.2(2)(b) and (c) says “remuneration for one full-time attendant”, but that phrase also includes multiple people providing care, not just one round-the-clock person. CRA folio S1-F1-C1 , starting at paragraph 1.31, provides more detail than I provide here. In addition, CRA states online in their description of tax return lines 33099 and 33199 for attendant care , “We consider care to be full-time when a person needs constant care and attendance.” A retirement residence, community care home or assisted living facility is not a nursing home. All costs for a nursing home can be claimed, if applicable, but for people living elsewhere, only salary and wages paid for attendant care will qualify. There are exceptions to this “either/or” rule. If you are living at home or in a retirement home, then ITA paragraph 118.2(2)(b.1) in combination with ITA subsection 118.3(c) comes into play. You can claim the disability credit and the attendant care fees where you claim only salaries and wages for the attendant, and claim no more than $10,000 of these salaries and wages ($20,000 in year of death). If you pay wages, for example, of $15,000, you can choose to claim only the attendant care, only the disability credit, or $10,000 of wages plus the disability credit. For care paid directly, such as in your own home, you would know these figures. Where you are claiming attendant care for an assisted living facility, that facility would need to provide you with a breakdown of their fees to allow you to determine the eligible amounts. I have a more extensive discussion of these rules an my article titled Caregivers of Parents and Tax Deductible Expenses . While that article relates to caregivers, the medical descriptions are applicable to you or other dependants. See the heading, “Attendant care and nursing home costs are medical expenses” in that article. Finally, patients being cared for in a group home or at a training school may claim both the disability credit and attendant care expenses, if they qualify for both. See RC4065, Medical Expenses for details and examples about this complex deduction.

- Payment for the cost of full-time care in a nursing home for a patient who has a severe and prolonged mental or physical impairment. To qualify as a nursing home, there must be appropriately qualified medical personnel in attendance in sufficient numbers on a 24-hour basis. Receipts from the nursing home and a certificate from a medical practitioner (a medical doctor or a nurse practitioner) are required to support a claim for an expenditure of this nature. A letter is sufficient from a medical practitioner when a patient’s mental capacity is the only issue. Otherwise, a Form T2201 , Disability Tax Credit Certificate is required, i.e. for mental or physical incapacity. See the CRA publication, RC4065, Disability-Related Information. Costs for a community care facility may qualify as a payment for a “full-time attendant” if the institution will not qualify as a nursing home. Also, see my article on Caregivers of Parents and Tax Deductible Expenses for more information.

- Travel to a location that is at least 40 kilometers away in order for the patient to receive medical services. This includes travel expenses for one individual to accompany the patient as long as the patient has been certified by a medical practitioner as being incapable of travelling without an attendant. See more details on qualifying travel expenses below.

- Cost of purchase or rental of medical appliances , such as crutches, hearing aids and hearing aid batteries, wheelchairs, artificial limbs, products required because of incontinence, ileostomy or colostomy pads including pouches and adhesives used for the same purpose, compression stockings, etc. Medical prescriptions may be required for some of these items, but not all of them. See the CRA Guide RC4065, Medical Expense to determine which items need prescriptions.

- Under certain circumstances, the cost of house renovations , chair lifts, moving costs, special vehicles, etc. for individuals with mental or physical disabilities. Again, I refer you to my article on Caregivers of Parents and Tax Deductible Expenses for a description.

A special “ disability supports deduction ” also exists for attendant care and long-term disabilities that differ from the medical expense credit, which should be investigated if the circumstances warrant it. This credit is available for personal attendant care and other disability supports expenses that allowed you to go to school or to earn certain income. See the CRA publication, RC4065, Disability-Related Information .

Travel Costs for Medical Purposes

Patients must often travel to obtain their required services, and special rules relate to travel expenses that can be claimed. First, the travel must be at least 40 kilometers. Then, in order to qualify, equivalent medical services must be unavailable within the patient’s locality. Travel costs must be paid to a person engaged in the business of providing transportation services if one is readily available; otherwise, reasonable expenses incurred for operating a vehicle are accepted. A “per kilometer” amount may be claimed for actual automobile expenses based on a prescribed rate set annually by the government. For PEI, in calendar year 2023, it is 56.0 cents per kilometer; such rates are announced in mid to late January of the following year. See the CRA web site for current prescribed rates .

For travel at least 80 kilometers away, other reasonable travel expenses may be claimed such as meals and accommodation for a patient and, where certified medically necessary by the doctor, for an accompanying individual. Receipts must be retained for accommodations, but a flat rate may be claimed for meals. This flat rate for 2023 is $23.00 per meal to a maximum of $69.00 per day. For many years prior to 2020, it was $17.00 per meal, to a maximum of $51.00 per day. This information is also available on the web site for current prescribed rates . Amounts paid for lodging must be necessary because of the distance travelled, or because of the condition of the patient, and not solely for the sake of convenience.

Claims for Dependants

Who is a dependant? Based on Canada Revenue Agency published interpretations:

Generally, a person will be dependent for support on an individual if the individual has actually supplied necessary maintenance or the necessities of life, to the person on a regular and consistent basis. For example, when an elderly parent who is not wholly self-supporting because of mental or physical infirmity lives with a married child, and the child provides the necessary food, lodging, clothing, medical care, etc., the parent may qualify as a dependant of that child. In general terms, support involves the provision of the basic necessities of life such as food, shelter, and clothing. A person may be confined to a hospital for all or substantially all of the year because of mental or physical infirmity and the cost of hospitalization is paid by a provincial government. The latter fact, in itself, does not necessarily mean that the person was not supported by an individual. If expenses such as clothing, comforts, and medical premiums were paid by the individual (e.g. child) on those occasions when the dependant (e.g. parent) was able to be out of hospital, then, ordinarily, it is recognized that the individual supported that person.

In Technical Interpretation 2010-0381211I7, CRA clarifies that support must deal with provision of the basic necessities of life such as food, shelter and clothing, and can be financial or non-financial. They state, “financial support” would involve money to acquire the basic necessities and the term “non-financial support” would refer to directly providing such things as shelter, clothing and food. The nature and degree of the actions or contributions in each case will determine whether they constitute “support” of another person. However, they state that support does not include “visiting the dependent each day, providing moral support, preparing a meal and doing the person’s laundry and/or shopping.”

What can be claimed? First, medical costs for minor children are combined with those of the parents. For other dependants, you must know that dependant’s net income. You may claim expenses that exceed 3% of that dependant’s income (or above the limits as set earlier) on your tax return. If your dependant qualifies for the disability tax credit and does not need that credit to eliminate their own income taxes, the unused portion of the credit can be transferred to you for use.

Claim Period

You may claim medical expenses on your tax return for any 12-month period ending in that year. Most people use the calendar year, but that is not necessary. For example, for 2023, if you wanted to do so, you could claim expenses paid from January 2, 2022 to January 1, 2023, which is 12 months. On the other hand, you could claim July 1, 2022 to June 30, 2023, or any other combination of 12 months. Look for the time frame with the biggest expenses, but also consider your expectations for the following year. If you claim only part of the expenses on a particular day because you have eliminated all of your taxes, you can include that particular day again next year, as long as you never exceed a 12-month period and do not claim the same expense twice. This sometimes happens when claiming nursing home costs, which are large expenses paid on a particular day. If you missed some expenses in a prior year, you have up to ten years to ask for a correction.

Of course, I wish you and your family the best of health so you never have a deduction. If this article was useful to you, or if you have suggestions, a brief email to me from my contact page would be helpful to know whether I should continue publishing it.

Return to Articles Listing

Blair Corkum, CPA, CA, R.F.P., CFP, CFDS, CLU, CHS holds his Chartered Professional Accountant, Chartered Accountant, Registered Financial Planner, Chartered Financial Divorce Specialist as well as several other financial planning related designations. Blair offers hourly based fee-only personal financial planning, holds no investment or insurance licenses, and receives no commissions or referral fees. This publication should not be construed as legal or investment advice. It is neither a definitive analysis of the law nor a substitute for professional advice which you should obtain before acting on information in this article. Information may change as a result of legislation or regulations issued after this article was written.©Blair Corkum

Need tech to impress? Time to DevUp !

© Copyright 2014 Blair Corkum Financial Planning Inc. All rights reserved.

Language selection

- Français fr

Motor vehicle provided by the employer

You may be looking for:

- Automobile or motor vehicle benefits – Allowances or reimbursements provided to an employee for the use of their own vehicle

- Automobile provided by the employer

Content has been updated for clarity, completeness and plain language. No changes were made to the current CRA administrative policy.

You may provide a motor vehicle to your employee to use in performing their duties of office or employment that is not an automobile. Generally, the benefit from personal driving of the employer provided motor vehicle is a taxable benefit.

This information may apply to the following, even though it is specific to an employee:

- a person who does not deal at arm’s length with the employee

- an individual who holds an office or a person who does not deal at arm’s length with that individual

- a partner or a person related to the partner

- a shareholder or a person related to the shareholder

On this page

Determine if the vehicle is a motor vehicle.

The Income Tax Act defines motor vehicles and automobiles differently for tax purposes.

Answer a few questions to determine if the vehicle is a motor vehicle or an automobile.

Launch vehicle validator

The difference between an automobile or a motor vehicle depends on:

- Seating capacity

- Type of vehicle

- Primary use of the vehicle

An automobile is a motor vehicle that is designed or adapted mainly to carry individuals on highways and streets, and has a seating capacity of not more than the driver and eight passengers. A zero-emission passenger vehicle (ZEPV) is also considered an automobile.

Learn more: ZEPV - What kind of vehicle do you own? .

Does not include

An automobile does not include :

- An ambulance

- Clearly marked police or fire emergency response vehicles

- Clearly marked emergency medical response vehicles that you use to carry emergency medical equipment and one or more emergency medical attendants or paramedics

- A motor vehicle you bought to use primarily (more than 50% of the distance driven) as a taxi, a bus used in a business of transporting passengers, or a hearse in a funeral business

- A motor vehicle you bought to sell, rent, or lease in a motor vehicle sales, rental, or leasing business, except for benefits arising from personal use of an automobile

- A motor vehicle (other than a hearse) you bought to use in a funeral business to transport passengers, except for benefits arising from personal use of an automobile

A van, pickup truck, or similar vehicle that meets either of the following criteria:

- Can seat no more than the driver and two passengers, and in the year it is acquired or leased is used (50% or more of the distance driven) to transport goods or equipment in the course of business

- In the year it is acquired or leased, it is used (90% or more of the distance driven) to transport goods, equipment, or passengers in the course of business

Pickup trucks that you bought or leased in the tax year that meet both of the following criteria:

- Are used (50% or more of the distance driven) to transport goods, equipment, or passengers in the course of earning or producing income

- Are used at a remote work location or at a special work site that is at least 30 kilometres away from any community having a population of at least 40,000

If the back part or trunk of a van, pickup truck, or similar vehicle has been permanently altered and can no longer be used as a passenger vehicle, it is no longer considered an automobile as long as it is used primarily for business.

A motor vehicle is an automotive vehicle designed or adapted for use on highways and streets. It does not include a trolley bus or a vehicle designed or adapted for use only on rails. Although an automobile is a kind of motor vehicle, the CRA treats them differently for income tax purposes.

Zero-emission vehicles are cars and trucks powered by rechargeable electric batteries or hydrogen fuel cells.

If the vehicle is an automobile and is not a motor vehicle based on the above definitions, do not continue to next step.

Refer to: Automobile provided by the employer .

- If the vehicle is a motor vehicle and is not an automobile, continue to: Step 2 - Determine if the motor vehicle was used for personal driving .

Determine if the motor vehicle was used for personal driving

Personal driving is any driving of a motor vehicle provided by the employer for purposes not related to their employment. This includes driving between home to a regular place of employment.

The CRA considers a regular place of employment to be any location where your employee regularly :

- Reports for work

- Performs their employment duties

"Regularly" means there is some degree of frequency or repetition in your employee’s reporting to that particular work location in a period (weekly, monthly or yearly). This does not need to be your establishment . An employee can have multiple regular places of employment.

Generally, any travel by your employee between home and a regular place of employment is considered personal driving.

A regular place of employment may include:

- The office where your employee reports daily

- Several store locations that a manager visits monthly

- A client’s premises when your employee reports daily for a 6 month project

- A client’s premises when your employee attends biweekly meetings

The benefit may not be taxable where you provide your employee with transportation to a regular place of employment in one of the following situations:

- You need to provide your employee with transportation from pickup points to an employment location where public and private vehicles are neither allowed nor practical at the location because of security or other reasons

- You need to provide transportation to your employee who works in remote locations

- You need to provide transportation to your employee who works at special work sites, including prescribed zones

Depending on the situation, your employee may have more than one location where they regularly report for work. The CRA considers that if your employee drives to multiple regular places of employment in a day, the following is considered personal driving :

- Between your employee’s home and their first work location

- Between the final work location and your employee’s home

Any other travel by your employee between regular places of employment is considered business (employment-related) driving.

The CRA considers a point of call any location other than a regular place of employment where your employee goes to perform their employment duties.

Generally, any travel by your employee between home and a point of call is considered business (employment-related) driving, if you need or allow your employee to travel directly from home to a point of call, or return home from that point. In order for the travel to be considered business (employment-related) driving, it must be reasonable that your employee’s travel to the point to call be made at that time and on the way to or from work.

If the travel is not reasonable, it is considered personal driving.

Personal driving examples

- Vacation trips

- Driving to conduct personal activities

- Travel between home and a regular place of employment other than a point of call

- Travel between home and a regular place of employment even if you insist your employee drives the vehicle home, such as when your employee is on call

Business (employment-related) driving examples

- Travel between your employee’s regular place of employment and a client’s workplace (a point of call)

- Travel for business purpose errands

- Salesperson visiting customers

- Going to a client’s premises for a meeting

- Making a repair call

If there is no personal driving, the use of the employer-provided motor vehicle is not a taxable benefit.

Do not continue to next step.

If there is personal driving , the use of the employer-provided motor vehicle is a taxable benefit.

Continue to: Step 3 - Determine if the motor vehicle benefit is taxable .

Determine if the motor vehicle benefit is taxable

Non-taxable situation.

If you provide a motor vehicle to your employee, the benefit is not taxable if your employee does not use the motor vehicle for any personal driving .

Taxable situation

If you provide a motor vehicle to your employee and they use the motor vehicle for personal driving, the benefit from the personal driving is taxable.

You need to calculate the value of the benefit from your employee’s personal driving of the motor vehicle.

If the benefit is not taxable, you do not need to do any calculations.

- If the benefit is taxable , continue to: Step 4 - Review the records (logbook) to determine the number of personal and business (employment-related) kilometers driven .

Review the records (logbook) to determine the number of personal and business (employment-related) kilometers driven

If you provide a motor vehicle to your employee, they must keep a logbook or daily record of the trips made with the motor vehicle.

The logbook or daily record will support your calculation of the vehicle benefit and any expenses your employee will claim. They must give you a copy.

Your employee should record the details of the use of the vehicle, such as the following information in a logbook or daily record:

- Total number of days that the vehicle was made available to them during the year

- Total number of kilometres travelled for business (employment-related) and personal driving (on a daily, weekly or monthly basis) during the number of days that the vehicle was made available

Learn more on what to include in a logbook: Motor vehicle records

If no record was kept or is no longer available, you must be able to reasonably account for the number of personal and business (employment-related) kilometers driven to use the fixed rate calculation.

If no record is kept or is no longer available, you cannot calculate using the fixed rate calculation.

Continue to: Step 6 - Calculate the value of the motor vehicle benefit to be included on the T4 slip , using other calculation methods.

If your employee kept the detailed records and you received a copy, you may be able to calculate using the fixed rate calculation .

Continue to: Step 5 - Determine if the motor vehicle home at night policy applies .

Determine if the motor vehicle home at night policy applies

Under the CRA's administrative policy, you can use the prescribed rate per kilometre of personal driving to calculate the value of the motor vehicle benefit using the fixed rate calculation if all of the following conditions of the motor vehicle home at night policy apply:

- The vehicle is not an automobile.

- You tell your employee in writing that they cannot make any personal driving of the vehicle, other than travelling between work and home. Your employee kept records of the vehicle’s use as proof that there was no other personal driving.

- It would not be safe to leave tools and equipment at your premises or at a worksite overnight.

- Your employee is on call to respond to emergencies (the CRA generally considers an emergency to relate to either health and safety of the general population or to a significant disruption to the employer's operations), and you provide the vehicle so the employee can respond more effectively to emergencies.

- The vehicle is designed, or significantly modified, to carry tools, equipment, or merchandise. Your employee has to have the vehicle to do their job.

- The vehicle, such as a pickup truck or a van, is suitable for and is consistently used to carry and store heavy, bulky, or numerous tools and equipment. It would be difficult to load and unload the contents. The vehicle is essential to your employee in performing their job.

- The vehicle is regularly used to carry harmful or foul-smelling material, such as veterinary samples or fish and game. The vehicle is essential to your employee in performing their job.

- A clearly marked emergency response vehicle.

- Specially equipped to respond rapidly.

- Designed to carry specialized equipment to the scene of an emergency.

The CRA generally considers an emergency to relate either to the health and safety of the general population or to a significant disruption to the employer’s operations.

Simply transporting your employee to a work location does not meet the condition of being "essential in the performance of your employee's duties".

Example - Does not meet all conditions

ABC Restaurant Inc. uses a van that has been specially modified so it can be used more efficiently to transport and deliver food orders. The employer has asked the manager, Leslie, to take the van home at night in case she needs to respond to an emergency at the restaurant, such as an after hour alarm or to fill in on busy nights. Leslie is not allowed to use the van for any other personal use. Since she is the manager, her employment duties do not include delivering food orders, even on a busy night.

ABC Restaurant cannot use the fixed rate (33 cents per kilometre) when calculating Leslie's taxable benefit. These circumstances do not meet all of the conditions of the administrative policy. Although the vehicle has been modified for business needs, Leslie does not need the van to perform her employment duties, so she does not have to bring it home for valid business reasons.

Example - Meets all conditions

Mary works for a gas utility company and has to be on-call two weekends out of every month. On these weekends, she has to be able to respond to emergencies directly from her home. The van, which the employer provides Mary for these weekends, displays the company's name, has a light on the roof and has been permanently modified to carry specialized equipment to the scene of the emergencies. The company has a written policy prohibiting any other personal use of these vehicles, other than driving between the worksite and home. Mary has not used the vehicle for any other personal driving other than driving from home to work and back.

Since this situation meets all of the conditions of the administrative policy, Mary's employer may calculate the personal use of the vehicle using the fixed rate of 33 cents per kilometre.

If your employee does not meet all conditions of the motor vehicle home at night policy , do not use the fixed rate calculation.

If your employee meets all conditions of the motor vehicle home at night policy , you can calculate using the fixed rate calculation.

Calculate the value of the motor vehicle benefit to be included on the T4 slip

You must calculate a reasonable estimate of the fair market value (FMV) of the benefit received by your employee from their personal driving of the motor vehicle you provided, including the GST/HST and PST.

A reasonable estimate is considered to be the amount an employee would have had to pay in an arm's length transaction for the use of comparable transportation. It includes items such as the cost of leasing a comparable vehicle and any other related operating costs.

In some cases, the benefit to the employee is not the fair market value of the particular vehicle the employee has the use of, but in the fact that by using an employer-provided motor vehicle, the employee does not have to invest in and operate their own vehicle. Depending on the situation, where the only personal use is driving between the employee’s home and place of work, the value of the benefit may be measured as the personal kilometres driven multiplied by the prescribed rates in Income Tax Regulation 7306 (reasonable rate).

Generally, the CRA accepts the following methods:

- Reasonable allowances rate calculation (prescribed rates per kilometre from section 7306 of the ITR)

- Fixed rate calculation, if all conditions in step 5 are met (prescribed rates per kilometre from section 7305.1 of the ITR)

It is also acceptable to use other methods to reasonably estimate the motor vehicle taxable benefit.

Methods to calculate

Use the prescribed rate (section 7306 of the ITR) per kilometre of personal driving to calculate the motor vehicle taxable benefit:

- Total number of kilometres travelled for personal driving

- multiply by Reasonable allowance rate - First 5,000 kilometres

- multiply by Reasonable allowance rate - Additional kilometres

- equals This is the amount for the motor vehicle benefit

- minus Any amounts your employee reimbursed you in the year for the motor vehicle benefit

- equals This is the total value of the motor vehicle benefit to be included on the T4 slip in code 34

In 2022, Matthew was required to use a motor vehicle provided and owned by his employer in connection with his employment in Ontario. In reviewing his travel logbook, his employer found that he drove 10,000 km for personal driving. Matthew reimbursed the employer $300 for the personal driving of the motor vehicle. His personal driving of the motor vehicle was not limited to driving between home and work. His employer chose to calculate using the reasonable allowances rates method to determine the taxable benefit for the personal driving of the motor vehicle.

- 10,000 km is the total number of kilometres Matthew travelled for personal driving

- multiply by $0.61 is the reasonable allowance rate for 2022 on the first 5,000 kilometres

- multiply by $0.55 is the reasonable allowance rate for 2022 on the additional kilometres

- equals $5,800 ($3,050 + $2,750) is the amount for the motor vehicle benefit

- minus $300 is the amount Matthew reimbursed for the motor vehicle benefit

- equals $5,500 is the total value of the motor vehicle benefit to be included on the T4 slip in code 34

Use the prescribed rate (section 7305.1 of the ITR) per kilometre of personal driving to calculate the motor vehicle benefit if all conditions in step 5 are met :

- multiply by Fixed rate

In 2022, Matthew was required to use a motor vehicle provided by his employer in connection with his employment in Ontario. In reviewing his travel logbook, his employer found that he drove 10,000 km for personal driving. This personal driving was exclusively between home and work. The benefit met all other conditions of the motor vehicle home at night administrative policy. Matthew reimbursed his employer $300 for the personal driving of the motor vehicle.

- multiply by $0.29 is the fixed rate for 2022

- equals $2,900 is the amount for the motor vehicle benefit

- equals $2,600 is the total value of the motor vehicle benefit to be included on the T4 slip in code 34

You need to reasonably estimate the taxable benefit from your employee’s personal use of your motor vehicle, including the GST/HST and PST.

What is fair market value (FMV) of the motor vehicle benefit

The value of the taxable benefit is generally its FMV. This is generally the amount an employee would have had to pay for the same benefit, in the same circumstances, if there was no employer-employee relationship. The cost to you for the particular property, good, or service may be used if it reflects the FMV of the item or service.

You must be able to justify your position regarding the amount of the motor vehicle benefit being reasonable.

What is considered a reasonable estimate

A reasonable estimate is considered to be the amount an employee would have had to pay in an arm’s length transaction for the use of comparable transportation. It includes items such as:

- Cost of leasing a comparable vehicle

- Any related operating costs (excluding the GST)

What may not be considered a reasonable estimate

If you calculate the benefit by prorating the operating costs and capital cost allowance, this does not necessarily represent the value of the benefit to your employee.

To be a reasonable estimate, the value must correspond to the amount an employee would have had to pay for the use of the motor vehicle when used for the purpose it was designed for.

Value of the motor vehicle benefit

- FMV of the motor vehicle benefit

Withhold payroll deductions and calculate the GST/HST to remit

The benefit for personal driving of a motor vehicle is a non-cash benefit.

If the benefit is taxable, you must withhold the following deductions:

Withhold : Option 1

- EI (do not withhold)