Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Protect Yourself Abroad: Best Medical Evacuation Insurance [2024]

Jessica Merritt

Editor & Content Contributor

89 Published Articles 499 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3209 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![travel evacuation insurance reviews Protect Yourself Abroad: Best Medical Evacuation Insurance [2024]](https://upgradedpoints.com/wp-content/uploads/2023/12/Medevac-helicopter-stretcher.jpeg?auto=webp&disable=upscale&width=1200)

Table of Contents

The 5 best medical evacuation travel insurance plans, what is medical evacuation travel insurance, is medical evacuation travel insurance worth it, what medical evacuation travel insurance costs, what medical evacuation travel insurance covers, types of medical evacuation travel insurance, what to look for in a medical evacuation travel insurance policy, how to get medical evacuation travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Leaving your destination in a medevac helicopter probably isn’t in your travel plans. But if you need emergency medical evacuation, it will be costly and may be difficult to coordinate without help. A medical evacuation travel insurance plan can cover some or all of the costs of emergency medical evacuation and help you get the medical care you need when it matters most.

If you’re considering a medical evacuation travel insurance policy, read this guide to learn how this type of travel insurance coverage can help you, when it’s worth it, what it costs, and how to choose the best plan for your needs.

Many travel insurance policies offer emergency medical evacuation benefits, so you have many options to compare. We considered travel insurance plans with at least $500,000 in emergency medical evacuation benefits and coverage for emergency medical care, trip cancellation, and trip interruption.

Consider these medical evacuation travel insurance plans with a good value for the coverage provided:

Best Medical Evacuation Travel Insurance for Europe: IMG

With IMG’s iTravelInsured Travel SE , your medical evacuation benefits are up to $500,000 if a local attending physician and IMG’s travel assistance services provider determine your condition is acute, severe, or life-threatening and medically necessary treatment isn’t available where you are. IMG will pay to return you to your point of origin, your primary residence, or a hospital or medical facility closest to your home.

If applicable, costs covered include air and land transportation, including an air ambulance and medical escort. IMG pays covered expenses directly to the service provider if payment is required upfront — so you don’t have to think about paying a huge bill before getting home safely.

In addition to medical evacuation coverage, you’ll get trip cancellation and interruption insurance. The $250,000 medical benefits offer primary coverage, so you don’t have to go through regular insurance first. For this plan, we got a $53.49 quote for a 35-year-old visiting Switzerland .

Best Medical Evacuation Travel Insurance for Antarctica: Aegis

The Aegis Go Ready Choice plan offers medical evacuation coverage even when traveling to far-flung Antarctica with limited services. This plan offers evacuation to the nearest adequate medical facility if you experience a medical emergency during your trip.

It covers medically appropriate transportation and medical care en route to the nearest suitable hospital if the on-site attending physician certifies that you’re medically able to travel and there is no suitable local care available. Aegis will also fly 1 person of your choice — subject to a maximum of $3,000 — to your place of hospitalization and provide lodging and meals up to $300 per day for 15 days.

On top of medical evacuation coverage, this plan covers 100% of your costs for trip cancellation and 150% for trip interruption. Emergency medical coverage is for up to $500,000, though it’s secondary coverage, so you’ll have to exhaust other available insurance options first. This plan was quoted to us for $100.57 for a 35-year-old visiting Antarctica.

Best Medical Evacuation Travel Insurance for Costa Rica: WorldTrips

Using the WorldTrips Atlas Journey Economy plan, you’ll get up to $500,000 in medical evacuation benefits if you need a physician-ordered medical evacuation. That includes medically appropriate transportation and necessary medical care en route to the nearest suitable hospital.

The coverage applies if you’re critically ill or injured and no suitable local care is available. It also covers non-emergency repatriation to get you to your home or hospital in the U.S. for proper care, plus transportation, hotel, meals, phone calls, and local transportation for 1 person of your choice if you’re hospitalized for 24 hours or more.

While the medical evacuation coverage is comprehensive, emergency medical coverage is limited to only $10,000 of secondary coverage. But you also will be covered for up to 100% of your total cost with trip cancellation and interruption benefits. Our quote for a 35-year-old visiting Costa Rica came to $114.

Best Medical Evacuation Travel Insurance for $1 Million Coverage: TravelSafe

If you need up to $1 million in medical evacuation coverage, you can get it from TravelSafe’s Classic plan. You can use this benefit to get to the nearest suitable medical facility if your condition is acute, severe, or life-threatening, and adequate medically necessary treatment isn’t available in your immediate area. It also covers medical evacuation expenses to return you to your point of origin or a medical facility closest to your primary residence.

This plan also includes up to $25,000 for non-medical evacuation, which applies if you need transportation due to natural disasters or civil or political unrest. And emergency medical coverage offers up to $100,000 per person.

Trip cancellation covers up to 100% of your trip cost and trip interruption up to 150%. For a 35-year-old visiting Costa Rica, this plan came out to $122.

Read our Travelsafe insurance review for more information on all of their plans.

Best Medical Evacuation Travel Insurance for Cruises: Seven Corners

On a Seven Corners Trip Protection Choice plan, you’ll get up to $1 million in medical evacuation coverage. It applies if you have a severe, acute, or life-threatening condition and can’t get medically necessary treatment in your immediate area. It can include a medical escort who can provide medical care during transportation. You can also get transportation back to your point of origin, primary residence, or a hospital or medical facility closest to your primary residence.

If you’re traveling alone and will be hospitalized for more than 7 consecutive days or unable to travel after your evacuation, Seven Corners will pay airfare for a person of your choice to support you. Or, you can get reimbursed for a traveling companion’s expenses if you’re hospitalized for at least 3 days.

Emergency medical coverage offers up to $500,000 in primary coverage benefits with no medical deductible. Trip cancellation benefits cover up to 100% of your trip cost, and trip interruption covers up to 150%. Our quote for this plan came to $139 for a 35-year-old cruising Mexico.

Medical evacuation travel insurance is a type of travel insurance that can cover the costs of medically necessary emergency evacuation . It applies if you become seriously injured or ill on your trip and there are no appropriate medical facilities where you are.

With medical evacuation coverage, your insurance generally pays for transportation costs to get to a medical facility with adequate care, which may include land and air ambulance . It also covers the price of a medical escort and may provide coverage for a companion to help you during a hospitalization. Medical evacuation policies frequently offer repatriation benefits, which can get you home after emergency medical treatment.

Medical evacuation travel insurance is crucial if you plan to visit a remote destination or an area with limited medical facilities. With this coverage, you can travel confidently, knowing you can be transported to appropriate medical care without overwhelming costs.

Medical evacuation travel insurance could save your life, and that’s priceless. Prompt medical care from a capable medical facility could be a matter of life and death, particularly if you’ve experienced trauma and need critical care as soon as possible .

Getting medical evacuation travel insurance is often worth it compared to the out-of-pocket cost of medical evacuation. Sure, you might travel your entire life and never need an emergency medical evacuation. But if you do need medical evacuation, the costs can be catastrophic.

Don’t overlook the value of the support offered by an insurance company’s assistance hotline. If you’re seriously injured or ill, you may struggle to coordinate care and may face language barriers or unfamiliarity with local and regional medical care. An assistance hotline to coordinate care could be crucial in getting the lifesaving medical care you need.

How much medical evacuation travel insurance is worth to you depends on your health conditions, where you plan to travel, and what you plan to do when you travel. If you travel domestically or to locations with robust healthcare facilities, medical evacuation travel insurance might not be beneficial to you.

On the other hand, if you plan to visit remote locations or destinations with limited access to medical care, medical evacuation travel insurance is probably worth getting. It’s also a good idea if you plan to engage in activities with a high risk of accidents or injuries, such as backcountry skiing or mountaineering.

Consider these factors as you determine whether medical evacuation travel insurance is worth it for you:

- Your destination and its medical infrastructure

- Planned travel activities

- Preexisting health conditions

- Your financial ability to pay for evacuation expenses

- How far you’re traveling from home

Medical Evacuation Is Costly

If you need medical evacuation, you should expect it to cost at least $20,000 just for transportation , according to Allianz Travel Insurance . That number can increase exponentially to $200,000 or more if evacuation is complicated, such as needing a medevac from a remote mountain.

Emergency transportation can also cover the cost of getting you home once you’re stable. That might be more complicated than you’d think. You may need to ride home on a stretcher with a medical escort who can monitor your condition and administer care. This type of flight generally costs about $25,000 to $30,000, and an air ambulance may cost up to $50,000.

These costs are only for transporting you to and from the hospital , as evacuation is just part of the cost of emergency medical treatment. It’s also best to get medical evacuation coverage as part of a comprehensive travel insurance plan with emergency medical coverage.

Don’t count on Medicare to cover medical evacuation on a cruise ship or while traveling abroad. Medicare medical evacuation coverage is limited to particular circumstances. For example, Medicare may pay when you have a medical emergency in the U.S., and a foreign hospital that can treat you is closer than any hospital in the U.S.

Credit Card Travel Insurance May Limit Medical Evacuation Coverage

Credit cards with travel insurance coverage may provide medical evacuation benefits, but not all do. Check the limits on your medical evacuation benefit and understand that actual medical evacuation costs could exceed your benefits.

For example, Chase Sapphire Reserve ® covers up to $100,000 in emergency evacuation and transportation costs . That might be enough if you’re not too far from adequate medical care, but it’s probably not enough coverage to get you out of a remote area with a severe injury.

Some credit cards offer medical evacuation coverage with no limit. The Platinum Card ® from American Express is one of the best travel cards and offers emergency evacuation with no specified limit under its Premium Global Assistance coverage.

If your credit card’s emergency medical evacuation coverage isn’t adequate for your needs, travel insurance with medical evacuation benefits may be worth it.

Medical evacuation travel insurance is often part of a comprehensive travel insurance policy. All of the quotes we got were about $50 to $140. You should expect comprehensive travel insurance with medical evacuation coverage costs of about 5% to 10% of your trip.

Your cost of medical evacuation travel insurance may vary depending on factors including:

- Age: Your age is a significant factor in medical evacuation travel insurance costs, as older travelers are considered more at high risk for travel insurance coverage.

- Health Conditions: You may pay more for your policy if you need coverage for preexisting conditions.

- Destination: Traveling to a location with limited medical facilities, high health care costs, or travel advisories may require paying a higher premium for medical evacuation travel insurance.

- Travel Duration: The longer you plan to travel, the greater the risk, so you’ll pay more to insure an extended travel period.

- Activities: The activities you plan on your trip, such as adventure sports, can increase the cost of your medical evacuation travel insurance premium.

- Policy Details: Your policy’s coverage limits, deductibles, copayments, and features, such as emergency assistance services, will influence how much you pay to carry a medical evacuation travel insurance policy.

Adventure travel insurance policies may cost more but deliver the coverage you need if risky activities are in your travel plans.

Your coverage with a medical evacuation travel insurance policy depends on the travel insurance company, plan, coverage selections, and other policy details. Still, you can generally expect a medical evacuation travel insurance policy to at least cover emergency medical evacuation along with medical treatment, monitoring, and coordination.

Let’s look at some of the coverages common among medical evacuation travel insurance policies:

- Emergency Medical Evacuation: This coverage covers the cost of transportation to the nearest suitable medical facility, which could require air, land, or sea emergency transportation with ambulance services.

- Medical Escort: Medical escort coverage provides medical care and monitoring while you’re en route to a medical facility. For example, you may be escorted and treated by doctors and nurses on a medevac helicopter to a hospital.

- Care Coordination: Travel insurance companies generally offer an emergency assistance line and coordination that can help you find and coordinate with local healthcare providers, monitor your situation, and communicate between you, the medical staff, and your family. They may facilitate admission to hospitals with financial guarantees.

- Support Travel: Whether you’re traveling alone and need a support person to meet you or you have a traveling companion who needs to come with you, medical evacuation travel insurance may pay for transportation and other costs for a support person so you don’t have to be hospitalized without a trusted friend or family member.

- Repatriation: Emergency medical evacuation travel insurance may pay to get you home or to a medical facility near your home after you’re stable.

Comprehensive travel insurance plans are the most common type with emergency medical evacuation coverage. However, you may have access to specialized plans that focus mainly on emergency medical treatment and evacuation. These plans may offer higher coverage limits and more specialized services.

You can also look for specialized travel insurance policies. For example, you’d want adventure travel insurance with medical evacuation if you plan to climb a remote mountain or cruise travel insurance with medical evacuation coverage if you’re concerned you may need medical evacuation from a cruise ship.

It’s also worth considering an annual travel insurance policy or multi-trip coverage, which can cover all your travel within a year.

Read our travel insurance introductory guide to learn more about travel insurance options, which frequently include emergency medical evacuation coverage.

As you compare emergency medical evacuation travel insurance policies, consider these factors:

- Cost: While the price of a medical evacuation travel insurance policy may pale compared to actual evacuation costs, you still want to be mindful of how much you pay for coverage. Consider adjusting coverage levels, deductibles, and copays to get the right coverage at a reasonable price.

- Coverage Limits: Compare how much coverage you get from one policy to another. A policy may be more expensive but offer greater coverage. You should also look at the emergency medical coverage limits of each policy.

- Covered Benefits: The features of medical evacuation travel insurance policies vary between companies and plans. Confirm that the plans you’re considering offer the benefits you want, such as transportation for a support person to join you in the hospital.

- Policy Limitations: Make sure your policy doesn’t place limitations that would restrict key coverage, such as not covering the region or country you’re visiting, your trip exceeding the allowed duration, or your age or preexisting conditions excluding you from receiving full benefits.

- Additional Coverage: Medical evacuation coverage may be a major consideration, but consider the complete package when choosing a travel insurance policy. Trip interruption and cancellation, emergency hotlines, and other coverage can be valuable features for protecting your trip.

- Customer Service and Claims: Read customer reviews to learn about the claims process, how well the company delivers on claims and services, and what you can expect if you buy a policy.

You can usually get medical evacuation travel insurance as part of a comprehensive travel insurance plan . Start by getting quotes from travel insurance companies directly, or use a travel insurance comparison website such as Squaremouth to get quotes for multiple policies simultaneously.

Another option is looking at the coverage offered when you book travel. For example, an airline or online travel agency may allow you to add travel insurance to your booking. Read the fine print to find out if it covers medical evacuation and learn about the coverage details. It makes sense to compare policies offered at booking to the quotes you can get independently from travel insurance companies.

You may have travel protection, including medical evacuation coverage, available with your credit card. Check your benefits guide to see what’s covered, how much coverage you get, and when it applies.

Emergency medical evacuation travel insurance can be critical coverage if you experience a medical emergency while traveling. Getting a travel insurance policy with medical evacuation coverage can offer a financial safety net and the assurance of lifesaving support in case of a medical crisis. While medical evacuation insurance can add to your travel costs, the savings can be exponential if you need to use your coverage.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Does insurance cover medical evacuation.

Regular health insurance and Medicare may cover medical evacuation under limited circumstances, but in most cases, your plan won’t cover it. Comprehensive travel insurance policies commonly offer medical evacuation coverage.

How much medical evacuation insurance should I get?

You should get at least $100,000 in medical evacuation insurance. If you’re traveling to a particularly remote or dangerous location, you may opt for medical evacuation insurance of up to $1 million.

How much does it cost to be medically evacuated?

Medical evacuation costs vary depending on the complexity of your evacuation but generally range from $20,000 to $200,000 just for transportation costs.

What is the difference between medical evacuation and repatriation?

Medical evacuation gets you to the closest medical facility that can treat you effectively, while repatriation brings you home. For example, you may get a medical evacuation to a regional hospital for critical care, then repatriation to a medical facility near your home once your condition is stable enough for travel.

Was this page helpful?

About Jessica Merritt

A long-time points and miles student, Jessica is the former Personal Finance Managing Editor at U.S. News and World Report and is passionate about helping consumers fund their travels for as little cash as possible.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

What is medical evacuation insurance?

Jennifer Simonson

Jennifer Lobb

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 9:22 a.m. UTC Nov. 13, 2023

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Getty Images

Editor’s Note: This article contains updated information from a previously published story .

- Medical evacuation insurance provides coverage for emergency medical transportation to the nearest adequate treatment center if you become seriously injured or ill while traveling.

- If your attending physician determines you should be transported home for care, the cost of emergency medical transportation could be hundreds of thousands of dollars.

- Medical evacuation insurance can pay to transport your children home if you require a lengthy hospital stay.

Imagine you are on your dream vacation skiing through the Swiss Alps and you take a serious tumble that shatters your femur. To make matters worse, the healthcare facility in the remote town you are visiting doesn’t have adequate doctors, equipment or supplies to treat you. What do you do?

To pay out of pocket to be transported to a proper medical facility could potentially cost you tens of thousands of dollars. That is where a comprehensive travel insurance plan with emergency medical evacuation benefits comes into play.

While every plan is different, buying enough medical evacuation insurance coverage can give you peace of mind that you will be taken care of no matter what happens when you are away from home. And that an outrageous medical bill isn’t one of the souvenirs you bring home.

Compare the best travel insurance offers

Travel insured.

Via TravelInsurance.com’s website

Top-scoring plan

Worldwide Trip Protector

Covers COVID?

Medical & evacuation limits per person

$100,000/$1 million

Atlas Journey Preferred

Seven Corners

RoundTrip Basic

$500,000/$1 million

What is medical evacuation insurance?

Medical evacuation insurance is often found in comprehensive travel insurance policies in the form of a benefit called emergency medical evacuation, medical evacuation or repatriation insurance. This benefit covers the cost of emergency medical transportation to the nearest adequate treatment center if you become seriously injured or ill while traveling. If a qualified facility is not available, it may even cover the cost of transporting you back home.

A physician generally certifies that the severity of the accidental injury or illness warrants the move. The ultimate objective is to save your life, arm, or leg by ensuring you receive the emergency treatment you require.

Do I need medical evacuation insurance?

If you’re traveling in a location not covered by your domestic health care plan and are not prepared to pay for medical bills out of pocket, travel insurance that includes emergency medical coverage is crucial, says Daniel Durazo, director of external communications at Allianz Partners.

Emergency medical treatment overseas can be challenging to navigate. Most providers do not accept U.S. health insurance plans, Medicare or Medicaid. Travel insurance companies can help by coordinating with doctors, providing translation services, arranging emergency transportation and handling billing, says Durazo.

How much does medical evacuation cost?

Medical evacuation charges are not cheap, especially in remote locations.

“The cost of emergency medical transportation can run into the tens of thousands of dollars or more, and varies based on the traveler’s health condition, care required and their location,” Durazo said.

Medical evacuations are logistically challenging to coordinate leading to the high cost of transportation. According to Durazo, if you need emergency medical transportation back to the U.S., it can cost the following.

How much medical evacuation insurance do I need?

Squaremouth, a travel insurance comparison site, recommends at least $100,000 in medical evacuation insurance if you are traveling internationally. If traveling to a remote location or going on a cruise, Squaremouth recommends $250,000 in coverage.

You can buy medical evacuation insurance coverage for up to $1 million, depending on the travel insurance plan you buy.

What does medical evacuation insurance cover?

Medical evacuation insurance typically covers emergency transportation, medical escorts, the cost of a companion to be by your side and the cost to send your children home if there is no one available to care for them.

Emergency transportation

If you become seriously ill or injured while traveling, medical evacuation insurance can cover the cost of transportation to the nearest adequate facility for treatment. If medically necessary, it may even cover the cost of your flight back home.

Should emergency medical transportation be deemed necessary, options may include air ambulance or commercial carrier, Durazo said.

While some might assume an air ambulance is the best mode of transportation, most patients report a better experience on a commercial carrier. Commercial airlines not only offer more options for direct flights, better overall flight quality and more room for medical staff and travel companions, but they also allow patients to travel in either first or business class where they can lay flat if medically necessary.

Medical escort

Medical evacuation insurance can pay for the cost of medical escort services should you need a medical professional to assist you on the trip home. In-flight medical teams could include nurses, paramedics or doctors that monitor vital signs, manage pain and assist with medication administration.

Transport to bedside

If you become seriously ill or injured or develop a medical condition while on your trip requiring hospitalization for more than a predetermined amount of time, the insurance might arrange and pay for round-trip transportation for a family member or friend to stay with you.

Some plans also provide compensation for food, hotel and other expenses your bedside companion incurs while remaining close to you is also available on certain plans.

Return of dependents

Insurance companies may also pay for the transportation of traveling companions who are under the age of 18 to their primary residence or a location of your choice if you do not have an adult family member traveling with you who can care for them.

You typically need to be told by the treating doctor that you will be in the hospital for a minimum number of days before you can claim this benefit.

What does medical evacuation not cover?

While medical evacuation insurance covers most illnesses and accidents, be aware that injuries resulting from extreme, high-risk sports and activities like bungee jumping, skiing in areas accessed by helicopter, free climbing and skydiving are often excluded from coverage.

If you are planning risky activities, look into a travel insurance plan that offers an adventure bundle. The Travel Guard Deluxe plan, for example, comes with up to $1 million in coverage for emergency evacuation and repatriation of remains and offers an Adventure Sports upgrade that removes the exclusions for adventure and extreme activities.

Other exclusions to medical evacuation coverage may include:

- Transportation not pre-approved by the travel insurance company.

- Transportation that goes against the advice of your physician.

- Pre-existing medical conditions.

- Mental or psychological disorder.

- Normal pregnancy or childbirth (complications are generally not excluded).

- Intentional injury, suicide or attempted suicide.

- Loss that occurs within 100 miles of your home.

Make sure you read and understand the exclusions listed in your travel insurance policy. Travel insurance companies typically offer 14 or 15 days to review your plan. During this “free look” period, you can request a refund if you’re not satisfied with the coverage.

When would I need medical evacuation insurance?

While it is always a good idea to travel with medical evacuation insurance, it is even more important to do so when you are traveling off the beaten path such as on safaris, Antarctic expeditions or car trips through remote countryside.

“Slips and falls that result in broken legs, broken hips and head injuries are some of the most frequent things we transport for,” said John Gobbels, chief operating officer of air medical transport company Medjet. “We also see a lot of cardiovascular episodes such as heart attacks and strokes as well as infections that have progressed to sepsis.”

Other medical transport options

Most medical evacuation insurance plans stipulate that you are flown to the nearest adequate facility for treatment. Once you reach that “acceptable facility,” you are often required to stay there until you’ve recovered to the fullest extent possible before being flown home via a commercial carrier. If you are unhappy with that facility because the most modern equipment is not available, the language barrier is frustrating or simply because you do not want to have corrective surgery so far from home, you are often out of luck.

“People need to understand what the ‘acceptable facility’ and ‘medically necessary’ terms in their coverage really mean. When you read about people with very good travel insurance ‘stuck’ in foreign hospitals, it’s usually because of those terms,” said Gobbels. “The insurance company gets to decide what’s acceptable and whether it’s medically necessary to move you.”

That’s where “medical transport memberships” like Medjet can help. They pick up where insurance leaves off. With a medical transport membership, you can choose the hospital where you are treated even if it is not the same one deemed the closest adequate hospital by the insurance company.

“We move you just because you want to be moved home. It doesn’t have to be “medically necessary” to move you,” he said about medical transport memberships. “You get to choose whether you want to go home or not. That’s the difference.”

What if I am traveling within the United States?

If you are traveling within the United States or to U.S. territories like Puerto Rico or the U.S. Virgin Islands, the need for medical evacuation insurance is less dire.

If you are traveling to a remote location like the Rocky Mountain backcountry or an adventure-oriented trip like hiking the Grand Canyon, purchasing a travel insurance plan that includes medical evacuation might still be the smart choice.

While your domestic health care plan likely covers transportation to a hospital within the U.S., it probably does not cover a flight home requiring medical equipment and a medical escort. In addition, you would still be responsible for copays and deductions.

How do I buy medical evacuation insurance?

Medical evacuation insurance is often included in comprehensive travel insurance plans, but you can also buy a stand-alone travel medical plan.

One such option is the OneTrip Emergency Medical plan from Allianz, which includes up to $250,000 in emergency medical transportation, $50,000 for medical and dental emergencies and $10,000 in travel accident coverage.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Jennifer Simonson covers everything from business to the wine industry to international travel. Outdoor adventure, water parks and all things Texas are by far her favorite beats. Her work has appeared in Forbes, Travel + Leisure, Texas Monthly, Smithsonian Magazine, Fodor's, Lonely Planet, Slate and more. You can follow her on Instagram at @storiestoldwell.

Jennifer Lobb is deputy editor at USA TODAY Blueprint and is an experienced insurance and personal finance writer. Jennifer served as an insurance staff writer and editor at U.S. News and World Report and deputy editor of insurance at Forbes Advisor. She also spent several years covering finance and insurance for various financial media sites, including LendingTree and Investopedia. For nearly a decade, she’s helped consumers make educated decisions about the products that protect their finances, families and homes.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

AXA Assistance USA travel insurance review 2024

Travel Insurance Jennifer Simonson

Cheapest travel insurance of May 2024

Travel Insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance companies of May 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Medical Evacuation Insurance – an Overview of Medevac Plans

Medical evacuation insurance plans, often called Medevac plans, are focused on emergency medical evacuations, international security evacuations and repatriation.

What is Medical Evacuation Coverage

Just because you get injured and require medical transportation doesn’t mean you will be sent all the way back to your home. When a well-planned trip goes awry and you, or someone you love, desperately needs immediate medical attention, this is where medical evacuation coverage comes through.

Most travel insurance policies cover transportation to the nearest facility and leave you there for treatment. They decide where you go, not you. They decide what is considered an acceptable medical facility for your care, not you. Once they get you to the hospital, their obligation is finished. You will then be liable to cover the cost of getting home or getting transported to a hospital at home that can complete your treatment.

Medical evacuation coverage gets you transported to the hospital of your choice and then, after you are well enough to be repatriated, it transports you to your hospital at home.

How does Medical Evacuation Insurance Work?

Most travel insurance plans include basic coverage for medical evacuation. According to the terms of your contract with them, they take you to the nearest facility that can handle your emergency.

This means you have:

- No choice in where you go

- No guarantee of going to the best medical facility

- No one to walk you through the process or translate the language for you

Medical evacuation insurance is important because each year over 10 million travelers are hospitalized abroad and over two million require emergency medical transportation. And medical transport is not cheap.

When you need a medical evacuation, you will contact your plan provider and they will coordinate your medical evacuation, handle family communications, provide translation services, and provide support every step of the way. When you’re well enough to travel home, they will arrange for medical transportation to your choice of hospital back home.

Different types of Evacuation Coverage

There are essentially two types of evacuation coverage:

- Medical evacuation coverage (also called medevac)

- Security/political evacuation coverage

Medical evacuation covers the coordination and cost of transportation to a medical facility. Depending on your need for treatment, it will also transport you either to your home or to a medical facility at home that can continue your care.

Security and political evacuation covers your transportation away from an unsafe place to a safe one. Depending on how the situation develops, you and your dependents can be returned to your trip destination or back home.

What makes Medical Evacuation unique?

A medical evacuation insurance plan provides coverage for evacuations and repatriation for individuals who travel either internationally and/or for business reasons on a regular basis.

Focuses on all types of evacuations

Medevac plans focus on emergency medical evacuations, international security evacuations, and repatriation. The travel insurance company must handle the coordination of these efforts and they usually take care of payments to the rescue team as well. Evacuations are covered up to the policy limits and only for covered reasons listed in the policy document.

Care for the important people in your life

Medevac plans often include emergency medical reunion benefits and return of minor children benefits, so you can care for the people who are important to you as well.

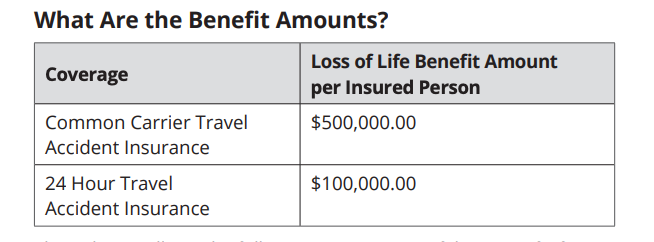

Often includes AD&D or term life benefits

Many medevac plans include AD&D and/or term life benefits as well. These are paid regardless of whether the insured has other AD&D or life insurance benefits to the beneficiary(ies) listed on the application form.

May include extra benefits

A few medical evacuation plans include some package-like benefits, including:

- Trip interruption

- Lost baggage

- Optional adventure sports coverage

Why do you need a Medical Evacuation Coverage Plan?

- You are working on a volunteer project in the middle of the jungle and have a heart attack.

- Your teenage son has an accident with a jet ski while on a family cruise and suffers a severe concussion at sea.

- On a hike to a waterfall in Costa Rica, your wife slips off the trail and breaks her leg.

- Your parents are traveling with you to Rome when your father experiences a stroke.

- Your daughter’s graduation trip ends in a horrific traffic accident miles from home.

What coverage is included?

The following coverage is typically found in a Medical Evacuation travel insurance plan.

- Coordination and payment for emergency medical transportation to get you to a medical facility or return you home where you can obtain medical care.

- Language translation services when you are traveling in a foreign country and don’t understand what the local medical team is saying.

- Communication to family members and business partners back home who are worried about you.

- Repatriation arrangements, including proper handling, negotiations and payments necessary to return your body to your home or a nearby funeral home if you are killed or die on your trip.

Who should buy Medical Evacuation travel insurance?

Travelers like these should purchase medical evacuation travel insurance:

- Individuals and families on a cruise. The medical facilities on a cruise ship are limited and if you experience a medical emergency, you’ll want coverage to coordinate and pay for your evacuation to obtain proper medical care.

- Travelers headed to remote destinations. If you are planning to travel to remote regions of the globe, where medical care may be non existent, you’ll want assistance if you are severely ill or injured.

- Missionaries and foreign aid workers. Often missionaries and foreign aid workers travel to politically dangerous areas or regions that are damaged by natural disasters. Be sure you can save yourself if something happens to you so you can continue doing important work.

- Business travelers working abroad. When you work in a foreign country, you may have access to your own health care or universal health care, but you won’t have coverage to be returned home if something truly terrible happens without medical evacuation insurance.

How much does Medical Evacuation cost?

The factors that affect the cost of a medical evacuation plan include:

- The age of the travelers

- Individual or family plan

- Annual or single-trip

- The length of the trip

- Optional coverage

An annual medical evacuation plan will cost a traveler around $200.00 and cover all the trips taken during the year. A single-trip medevac plan will cost a traveler between $45 and $68 (depending on the factors above).

- 4 Steps to 100% confidence in your travel insurance plan

Where should you buy your Medical Evacuation travel insurance?

You have two options for buying travel insurance – the best option is to compare plans from all companies, get quotes, and purchase your travel insurance plan online:

- Compare plans from all companies: Compare travel insurance plans from all companies, get quotes, and buy online.

- Quote and buy direct: Review the travel insurance companies and plans and purchase directly from the company.

All travel insurance companies include a free look period with a refund that lets you review the plan documentation. If you decide you need something a little different, you can make changes to your policy or cancel it for a refund (minus a small fee).

Which companies offer Medical Evacuation travel insurance plans?

- Medevac plans focus on all types of evacuations – emergency medical, security, etc.

- Often includes coverage for emergency medical reunion and return of minor children if you are hospitalized

- Sometimes includes coverage for medical expenses and package-like benefits

- Use a travel insurance comparison tool to find medevac plans and compare prices

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.

Travel with peace-of-mind... Compare quotes for free

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- Travel Insurance

Best Medical Evacuation Insurance Plans 2024

On This Page

- Key takeaways

What is emergency medical evacuation insurance?

Medical evacuation insurance vs. travel medical insurance, our top picks for the best medical evacuation insurance plans, do i need medical evacuation insurance, what does emergency medical evacuation insurance cover, how much does a medical evacuation cost without insurance, how much emergency evacuation insurance coverage should you have, when is medical evacuation coverage recommended, tips for choosing the best medevac insurance, how to use emergency medical evacuation insurance, air ambulance insurance and other alternatives, medical evacuation insurance faq.

- Recommended articles

Related topics

- The CDC recommends buying medical evacuation insurance if you are traveling to a remote area or to somewhere that has low-quality medical care that may not be up to U.S. standards.

- Based on our research, the best emergency medical evacuation insurance plans come from: AXA Assistance USA, Seven Corners, Tin Leg, & Cat 70. ( skip ahead to view these plans )

- Emergency medical evacuation insurance is built to cover the cost of transporting you to a high-quality hospital via air ambulance or other suitable arrangements and can cost as little as $2 per day.

- Many medevac plans also cover the repatriation of remains, which means if you or a travel companion pass away during a trip, you can be transported home for a proper burial.

- We recommend opting for medical evacuation limits between $250,000 - $1,000,000 because evacuation costs can easily exceed $100,000 in most parts of the world - as outlined here by the CDC .

- We recommend using a comparison tool to compare plans and prices from multiple providers at once.

Emergency medical evacuation insurance, also known as medevac insurance or air ambulance insurance, can save you hundreds of thousands of dollars in case of an emergency while traveling.

For this reason, we consider medevac insurance as one of our most basic coverages to look for when buying travel insurance .

In this guide, we’ll cover:

- What it covers

- How much it costs

- What to look for when you go to buy

- How to use it if you need it

Not all evacuation coverage is made equal, and many factors can influence whether the plan you purchase will cover you or not.

To help you make the best decision when buying medevac insurance, we have reviewed plans from some of America’s best providers and highlighted our top picks.

So without further delay, here is our selection of the best medical evacuation insurance.

Our top picks for the best medical evacuation insurance

- MedjetAssist: Best Medical Evacuation Membership

- Tin Leg: Best for Budget Friendly Travelers

- AXA Assistance USA: Best for Premium Comprehensive Coverage

- Seven Corners: Best Value

- Cat 70: Best for Affordable Comprehensive Coverage

Emergency medical evacuation insurance, or medevac insurance, is a type of travel insurance coverage that pays for emergency transportation home or to a suitable medical facility when you become sick or injured while traveling.

Medevac coverage is different from travel medical insurance in that it focuses on paying for the journey to a medical facility or transport home after an incident whereas travel health insurance is made to reimburse you for the costs of medical treatment you receive while traveling.

If you plan to take a trip that’s far from where you live, it’s best to have both travel evacuation insurance & travel medical coverage in place.

These insurances work in tandem to cover essential services and treatments while offering entirely separate types of benefits.

- Emergency travel medical insurance: pays for the emergency medical care you receive while you’re away – including doctor bills, lab tests, emergency surgery, etc.

- Emergency medical evacuation insurance: pays for you to be rescued or evacuated mid-travel and will ensure you are transported to a proper medical center for treatment. Also repatriates remains in the event of your death.

- Combining both coverages: The best travel insurance plans combine both of the above coverages into one comprehensive travel insurance package and can also include extras like baggage coverage.

Search for comprehensive plans with combined coverage

Best Medical Evacuation Membership

Medjetassist, why we like it.

Editor's take

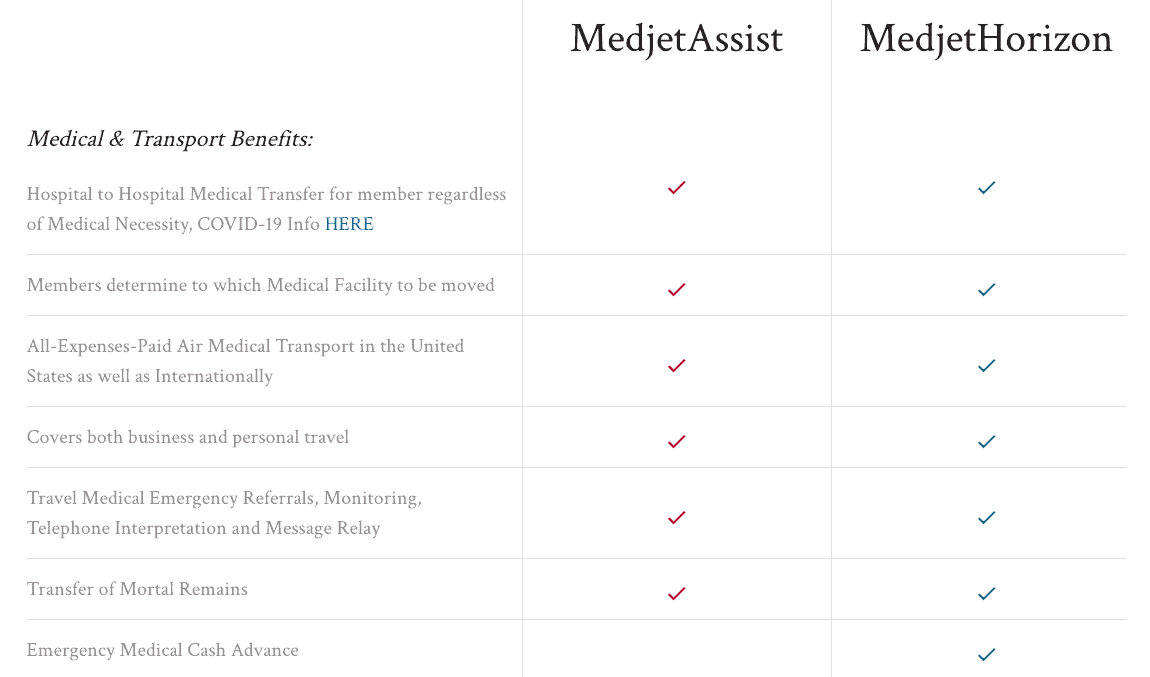

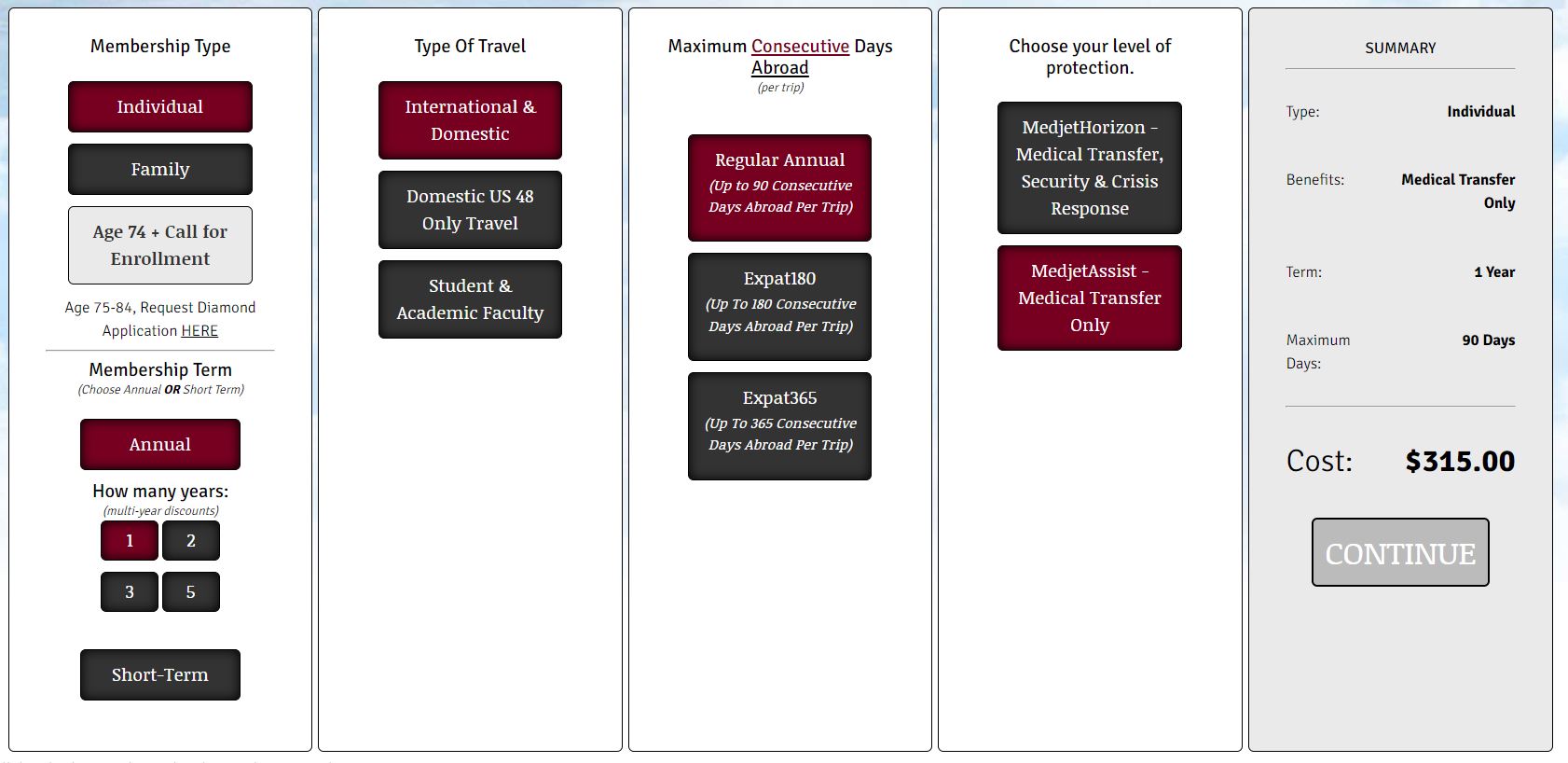

MedJet Assist is a membership plan that ensures individuals get the medical evacuation help they need when they need it. Paying for membership ensures travelers get help arranging medical transfers regardless of medical necessity, and it lets members determine which medical facility they want to be moved to. This plan works for medical evacuation within the United States and abroad, and it can be purchased for short-term travel or longer trips.

While the traditional MedJet Assist plan includes coverage for medical evacuation, the upgraded MedJetHorizon plan also adds in worldwide travel security, crisis response, and evacuation services powered by FocusPoint International. This add-on coverage can help pay for evacuation in the event of terrorism, natural disasters, and violent crime.

Read our full review

- Available for short-term or long-term travel

- Can cover pricey evacuation expenses when you need medical care

- Covers both personal and business travel

- Membership covers each trip you take during its term

- Short-term memberships start at just $99

- Does not include traditional travel insurance benefits

- Does not cover transportation from the site of an accident (medical facility transfers only)

- Covers up to two transport events per year

Best for Budget Friendly Travelers

The Tin Leg Gold plan is one of the top-selling plans offered by the acclaimed budget insurance provider Tin Leg. Despite being one of the most affordable insurance providers on the market, Tin Leg is renowned for its high-quality travel insurance coverage at competitive and reasonable prices. The gold plan is an ideal plan for medical evacuation thanks to its extremely high limits and the complementary medical coverage it offers for accidents and illnesses while traveling.

The Gold plan provides up to $500,000 in coverage for emergency medical evacuation & medically necessary repatriation, guaranteeing a safe return in case of emergencies.

Here’s a look at the coverage:

- Expenses for evacuation to a medical facility – including medically necessary transportation, related medical services, and supplies.

- Cost to send one person (chosen by you) to come and accompany you in the hospital if you are hospitalized for an extended time.

- Return transportation costs for dependent children, domestic partner, or spouse.

- Return transportation costs for you once you are healed and can leave the medical facility.

- Medical escort to accompany you back home if you are disabled during your trip.

- Escort to return your dependent children back home if you’re incapacitated or deceased.

- Repatriation of remains in case of death. This can include embalming or cremation before sending, temporary storage costs, shipping of the remains, necessary documentation, consular proceedings, transfer to final destination.

Apart from the extensive medical evacuation coverage, this plan offers up to $500,000 in primary emergency medical treatment coverage, ensuring you receive emergency medical care without deductibles or out-of-pocket expenses. The plan’s medical coverage includes COVID-19 sickness.

Tin Leg Gold also covers pre-existing conditions when purchased within 14 days of booking your trip and insuring the full trip cost. This feature is valuable for older travelers or those with pre-existing health concerns.

This plan also includes comprehensive travel protection in the form of trip cancellation and interruption coverage for various circumstances, including COVID-19.

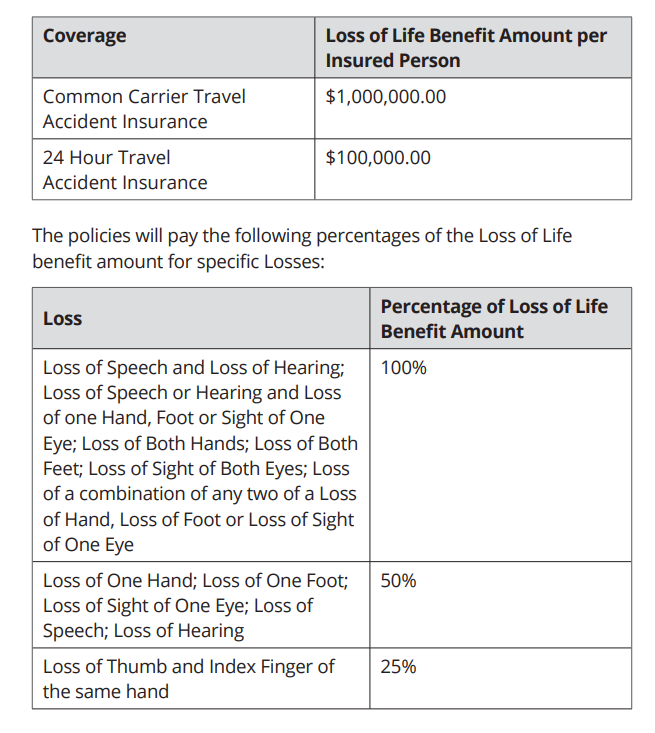

The plan includes other essential benefits such as coverage for accidental death and dismemberment, as well as sports and adventure activities (with some exclusions). Additionally, it offers coverage for travel delays, missed connections, baggage delays, damage, loss, and sports gear or equipment issues.

While this plan has slightly lower limits for travel delay and baggage coverage compared to other plans, its outstanding medical coverage at an affordable price makes it a compelling choice. With a 14-day money-back guarantee and 24-hour travel assistance service, Tin Leg Gold prioritizes customer satisfaction and support, making it a top pick for travelers who value their well-being and seek comprehensive coverage for their trips.

- Excellent primary coverage for medical expenses

- High limit for emergency evacuation coverage

- Optional cancel for any reason (CFAR) coverage available

- Comes with coverage for hurricanes and inclement weather

- Coverage for pre-existing conditions is available if purchased within 14 days of the trip deposit

- Baggage delay coverage requires a 24-hour waiting period

- Low coverage limits for baggage and personal effects

Best for Premium Comprehensive Coverage

Axa assistance usa.

AXA Assistance USA is a highly-rated travel insurance company that offers comprehensive travel insurance plans with a ton of benefits. This means the coverage you purchase from them includes medical evacuation protection as well as baggage insurance, trip cancellation insurance, trip interruption coverage, travel delay coverage, and more. The company also offers three tiers of coverage you can choose from based on your needs and your budget.

We recommend the Platinum plan from AXA Assistance USA due to its superior medical evacuation coverage and robust limits in other categories. This plan comes with up to $1 million in protection for emergency medical evacuation and repatriation of remains, up to $250,000 in coverage for emergency medical expenses, $300 per day (maximum of $1,250) in trip delay coverage, $3,000 in insurance for baggage and personal effects, and more. Optional cancel for any reason (CFAR) coverage is also available as an add-on with this plan.

- High coverage limits in every category. Extremely comprehensive

- Includes identity theft coverage & non-medical evacuation coverage

- CFAR coverage reimburses 75% of prepaid travel expenses

- Coverage cannot be extended unlike other plans

- Medical limit is lower than other cheaper plans, but still sufficient

Seven Corners

The Trip Protection Choice plan from Seven Corners is an excellent choice for a comprehensive plan and offers robust coverage at a great price. In fact, the Trip Protection Choice plan is our top-selling travel insurance policy thanks to its high coverage limits, customizable add-ons, excellent 24-hour customer service, and a 14-day money-back guarantee. This plan is neither the cheapest nor the most expensive, but it offers solid coverage for an affordable price.

Regarding medical coverage, Seven Corners’ Trip Protection Choice plan offers $500,000 for emergency medical coverage and $1m in medical evacuation and repatriation coverage per person. It also covers medical expenses related to Covid-19. The plan’s primary medical coverage also means there is no deductible, and you won’t have to pay out of pocket if any medical emergencies occur during your trip.

The Trip Protection Choice offers extensive medical evacuation and repatriation coverage. Here is what it includes at a glance:

- Emergency Medical Evacuation: Covers transportation expenses for evacuating you to the nearest suitable hospital or medical facility for necessary treatment.

- Medical Repatriation: Covers expenses for sending you back home or to a hospital or medical facility closest to your home for continued treatment.

- Medical Escort: Covers expenses for a medical professional to escort you back to the U.S. and provide medical care during the trip, if necessary.

- Repatriation of Remains: If you die while on the trip this will cover expenses for sending your body back home and can include embalming or local cremation before sending, temporary storage costs, transportation of the remains, and necessary documentation.

- Transportation of Children/Child: Covers the cost of returning your dependent children or minors left unattended due to your hospitalization for 7+ consecutive days or death during the trip. It also ensures they are accompanied and attended to until they arrive home.

- Transportation to Join You: Covers the cost of someone you know to visit your bedside if you are hospitalized for 7+ consecutive days. A daily benefit of up to $1,000 is available for bedside traveling companions.

Apart from this, the Trip Protection Choice plan can easily cover and reimburse you for things like:

- Overall trip cost

- Travel delays & stipends

- Baggage & equipment loss/damage

- Accidental death or dismemberment

You will also be covered for trip cancellations (up to 100%) and interruptions (up to 150%) including a wide range of valid reasons for claiming trip cancellation and interruption benefits. Optional add-ons include coverage for Cancel for Any Reason, Interruption for Any Reason, rental car damage, sports equipment rental, and event ticket protection.

- Offers coverage for pre-existing conditions

- Money-back guarantee

- Cancellation & Interruption coverage standard

- Covers action sports & equipment

- Cancel for any reason not included standard

- Must meet waiver for pre-existing conditions to be covered

Best for Affordable Comprehensive Coverage

Cat 70 offers affordable comprehensive travel coverage with high limits for emergency medical evacuation. This plan is exclusively available through platforms like LA Times Compare.

The Cat 70 Travel Plan is a solid and affordable option for comprehensive travel insurance that also includes ample coverage for medical evacuation. In fact, this plan comes with $500,000 in coverage for emergency medical expenses and up to $500,000 in insurance for emergency medical evacuation. Other benefits include trip cancellation coverage, baggage insurance, travel delay coverage, protection for missed connections, and more.

- High limits for emergency medical expenses

- Affordable travel insurance with high limits for medical evacuation

- Includes extras like trip cancellation coverage & baggage insurance

- Not available in all destinations

The US Government’s travel.state.gov website highlights that most traditional health insurance plans will not cover repatriation costs back to the U.S. making evacuation insurance all the more useful to travelers.

Travelex travel insurance reports that medical evacuation costs can average close to $25,000 in North America, or as much as $100,000 in Europe or $250,000 on a global level.

These two factors alone are enough to warrant travel insurance that includes medevac coverage. Without emergency medical evacuation insurance, you could be forced to bear the brunt of these costs by paying out-of-pocket if you needed to be transported by a medevac helicopter, plane, or ambulance for medical treatment.

You should consider opting for medical evacuation coverage if:

- You plan to travel to a remote area where medical facilities may be far away or inadequate

- You have pre-existing health conditions that could flare up and require hospitalization

- You have special healthcare needs that certain facilities may not be able to adequately treat

- There is a higher-than-average risk of you dying or falling seriously ill while away

- You cannot afford to pay the out-of-pocket costs associated with an unexpected medical evacuation

Medical evacuation travel insurance will pay for a range of non-medical and even non-emergency services that can help you overcome an injury or illness when you travel.

The following services are typically covered with emergency medevac coverage:

Emergency transportation to a hospital of your choice

All medical evacuation plans offer coverage to the nearest suitable medical facility equipped to handle your condition. However, most plans allow you to be sent to a hospital of your choice. Transport method depends on your condition but can include a specialized medical plane equipped with a mobile ICU, commercial airplane, helicopter, or ambulance.

COVID coverage & transport care

Most emergency evacuation plans include coverage for COVID-19. If you become severely ill with coronavirus and need to be hospitalized or intubated, you can receive emergency medical transportation in a specialized mobile COVID quarantine unit that will provide adequate care throughout transport to a proper medical facility.

A medical escort for returning home

Your coverage may pay for a medical escort, such as a doctor, to accompany you home safely if you need surgery or medical care as a result of your emergency. This means you won’t be stuck traveling home alone, which can be a major blessing when you’re sick or injured and require extra assistance.

Return travel costs for your children

If you pass away or become hospitalized and require care during your trip, evacuation coverage can pay for a return ticket for your dependent children who were traveling with you. Your plan can also provide them with a travel escort if one is required.

Bedside companion’s room and board

If you are ill or injured and require hospitalization, **some emergency medical evacuation plans cover non-medical expenses** like your bedside companion’s room and board so your travel companion can accompany you as you receive proper treatment. It’s important to read over your policy and check to make sure coverage extends to travel companions and not just the patient.

Travel expenses for a family member or friend to reach you

If you are alone and become hospitalized at your travel destination for a longer period of time (usually seven nights or longer) your emergency coverage may pay for a family member to travel to visit you . This non-emergency protection can pay for a plane ticket to where you are located, as well as meals, hotel stays, and incidental travel expenses incurred by your companion.

Repatriation of remains

Finally, you should know that your evacuation plan can pay to have your body returned home if you pass away during your vacation. In addition to covering the travel expenses for your remains, medical evacuation and repatriation insurance can also cover embalming, local cremation, and a basic casket for transportation.

The costs for medical evacuations can be astronomical and can add up to hundreds of thousands of dollars.

Travel insurance guidelines from the CDC state the following :

“The total cost of medevac varies by location, ranging from $25,000 for transport within North America to ≥$250,000 for more distant and remote locations. Costs increase when the patient being evacuated is critically ill or needs complex infection control measures.”

It’s best to anticipate that when traveling abroad you could end up paying $250,000 or more for an international transfer to a U.S. facility to receive medical attention.

Ultimately, this is why many travel insurance plans with emergency medical evacuation coverage have limits of up to $500,000 or even $1 million for emergency transport.

With emergency medical evacuation protection in place, there may be zero out-of-pocket expenses associated with this care. In other cases, your costs may be limited to the travel insurance deductible amount or a few hundred dollars.

How much coverage you should have for travel evacuation insurance depends heavily on the destination and traveler profile.