This platform and its APIs have reached their end of life and will be switched-off at the end of May 2024.

Data are not updated anymore. We invite you to use instead our new data dissemination platform OECD Data Explorer.

To find the corresponding OECD Data Explorer dataset, see this Excel file.

- Data by theme

- Popular queries

- Business Demography

- Birth rate of enterprises

- Death rate of enterprises

- Enterprise survival rates

- Employment creation and destruction

- High-Growth enterprises rate (employment definition)

- High-Growth enterprises rate (turnover definition)

- Business Demography Indicators ISIC4

- High-Growth enterprises

- Medium and High-Growth enterprises

- Number of active enterprises

- Share of employer start-ups

- Structural Business Statistics

- All Businesses (SSIS)

- Mining and quarrying (By Size Class)

- Manufacturing (By Size Class)

- Electricity, gas & water (By Size Class)

- Construction (By Size Class)

- Wholesale and retail trade (By Size Class)

- Hotels & restaurants (By Size Class)

- Transport, storage & communications (By Size Class)

- Real estate, renting and business activities (By Size Class)

- Structural Business Statistics - ISIC4

- Employment of SMEs and large firms

- Number of SMEs and large firms

- Production by sector (Total size)

- Productivity of SMEs and large firms

- Total number of enterprises, by sector

- Turnover of SMEs and large firms

- Value added of SMEs and large firms

- I: TEC by Size classes

- II: TEC by Top enterprises

- III: TEC by Partner zones and countries

- IV: TEC by number of partner countries

- V: TEC by commodity groups (CPC)

- I - TEC by sector and size class

- III - TEC by partner zones and countries

- IV - TEC by number of partner countries

- IX - TEC by activity sectors

- V - TEC by commodity groups (CPC)

- VI - TEC by type of trader

- VII - TEC by ownership

- VIII - TEC by exports intensity

- X - TEC by partner countries and size-class

- Employer enterprise demography, Large TL2 and small TL3 regions

- Enterprise Demography (all firms, incl. non employer)

- Establishment Regional Demography

- Indicators of female entrepreneurship

- Timely Indicators of Entrepreneurship (ISIC4)

- New enterprise creations

- Bankruptcies of enterprises

- Exits of enterprises

- Timely Indicators of Entrepreneurship by Enterprise Characteristics

- Number of enterprise entries

- Number of enterprise exits

- Number of enterprise bankruptcies

- Netherlands

- New Zealand

- United Kingdom

- United States

- Venture capital investments

- Future of Business Survey

- Businesses by sector

- Businesses by size

- Businesses by age

- Businesses by sex, single owner

- Businesses by sex, multiple ownership

- Businesses and international trading

- Share of exporters by export scope

- Sources of business funding

- Outlook on business

- Outlook on job creation

- Positive business status and outlook, by sex

- Production and Sales (MEI)

- Work started

- STAN: Database for Structural Analysis (ISIC4 SNA08)

- iSTAN: Indicators for structural analysis

- BTDIxE: Bilateral Trade by Industry and End-use

- TiM 2021: Trade in employment

- TiM 2023: Trade in employment

- TiM 2021: Trade in employment by characteristics

- IOTs 2021: Input-Output Tables

- IOTs 2018: Input-Output Tables

- IOTs 2015: Input-Output Tables

- TeCO2: CO2 emissions embodied in trade

- TeCO2: Principal indicators

- Embodied CO2 emissions in trade

- Embodied CO2 emissions in trade: Principal indicators

- TiM 2019: Trade in employment

- ANBERD (R&D by industry)

- 1. TiVA 2018: Principal indicators

- 2. TiVA 2018: Origin of value added in gross exports

- 3. TiVA 2018: Origin of value added in final demand

- 4. TiVA 2018: Gross exports by origin of value added and final destination

- 5. TiVA 2018: Origin of value added in gross imports

- 1. TiVA 2016: Main indicators

- 2. TiVA 2016: Origin of value added in gross exports

- 3. TiVA 2016: Origin of value added in final demand

- 4. TiVA 2016: Gross exports by final destination

- 5. TiVA 2016: Origin of value added in gross imports

- TiVA, October 2015

- Trade in Value Added (TiVA): Core Indicators

- TiVA 2015: Origin of Value Added in Gross Exports

- TiVA 2015: Origin of Value Added in Final Demand

- TeCO2 2015: CO2 emissions embodied in trade

- OECD Global Value Chains indicators – May 2013

- Indices of the number of production stages

- Participation indices

- TiVA Nowcast Estimates

- TiM 2015: Core Indicators

- BTDIxE 2016

- BTDIxE 2011

- BTDIxE 2012

- TeCO2 2013: CO2 emissions embodied in trade

- STAN 2016: Database for Structural Analysis

- STAN 2011: Database for Structural Analysis (ISIC Rev.3 SNA93)

- STAN 2012: Database for Structural Analysis (ISIC Rev.4 SNA93)

- STAN 2005: Database for Structural Analysis

- STAN Indicators 2012

- STAN Indicators 2011 (ISIC3 SNA93)

- Manufacturing share of employment 1970-2009

- Manufacturing share of value-added 1970-2009

- R&D intensity of manufacturing sectors 1995-2009

- STAN Indicators 2009

- STAN Indicators 2005

- STAN I-O Intermediate Import Ratio, March 2012

- STAN Input-Output Total, Domestic and Imports, March 2012

- STAN I-O Imports content of Exports, March 2012

- STAN I-O Inverse Matrix Coefficients (Domestic), March 2012

- STAN I-O Inverse Matrix (Total), March 2012

- ANBERD: business enterprise R&D by industry (ISIC Rev. 3)

- ANBERD: business enterprise R&D by industry (ISIC Rev. 2)

- Services Trade Restrictiveness Index by services sector

- STRI Heterogeneity Indices

- Digital Services Trade Restrictiveness Index

- Digital STRI Heterogeneity Indices

- Intra-EEA Services Trade Restrictiveness Index

- Intra-EEA STRI Heterogeneity Indices

- Steelmaking Capacity

- Receipts and expenditure

- Domestic tourism

- Inbound tourism

- Outbound tourism

Enterprises and employment in tourism

- Internal tourism consumption

- Key tourism indicators

- TiVA 2021: Principal Indicators

- Economic Outlook

- Gross domestic product (annual)

- Gross domestic product (quarterly)

- Composite Leading Indicators

- Consumer price indices - inflation

- Health Status

- Labour Market Statistics

- Monthly Monetary and Financial Statistics (MEI)

- Agricultural Outlook

- Bilateral Trade by Industry and End-use (ISIC4)

- Statistics from A to Z

This dataset preview is momentarily unavailable.

Please try again or select another dataset.

- Country [59 / 61]

- Tourism industry [18 / 18]

- Variable [2 / 2]

- Year [14]

- Table options

- Text file (CSV)

- Developer API

- Related files

Information

By Bastian Herre, Veronika Samborska and Max Roser

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000.

Tourism can be important for both the travelers and the people in the countries they visit.

For visitors, traveling can increase their understanding of and appreciation for people in other countries and their cultures.

And in many countries, many people rely on tourism for their income. In some, it is one of the largest industries.

But tourism also has externalities: it contributes to global carbon emissions and can encroach on local environments and cultures.

On this page, you can find data and visualizations on the history and current state of tourism across the world.

Interactive Charts on Tourism

Cite this work.

Our articles and data visualizations rely on work from many different people and organizations. When citing this topic page, please also cite the underlying data sources. This topic page can be cited as:

BibTeX citation

Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license . You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

- Press Releases

- Press Enquiries

- Travel Hub / Blog

- Brand Resources

- Newsletter Sign Up

- Global Summit

- Hosting a Summit

- Upcoming Events

- Previous Events

- Event Photography

- Event Enquiries

- Our Members

- Our Associates Community

- Membership Benefits

- Enquire About Membership

- Sponsors & Partners

- Insights & Publications

- WTTC Research Hub

- Economic Impact

- Knowledge Partners

- Data Enquiries

- Hotel Sustainability Basics

- Community Conscious Travel

- SafeTravels Stamp Application

- SafeTravels: Global Protocols & Stamp

- Security & Travel Facilitation

- Sustainable Growth

- Women Empowerment

- Destination Spotlight - SLO CAL

- Vision For Nature Positive Travel and Tourism

- Governments

- Consumer Travel Blog

- ONEin330Million Campaign

- Reunite Campaign

Economic Impact Research

- In 2023, the Travel & Tourism sector contributed 9.1% to the global GDP; an increase of 23.2% from 2022 and only 4.1% below the 2019 level.

- In 2023, there were 27 million new jobs, representing a 9.1% increase compared to 2022, and only 1.4% below the 2019 level.

- Domestic visitor spending rose by 18.1% in 2023, surpassing the 2019 level.

- International visitor spending registered a 33.1% jump in 2023 but remained 14.4% below the 2019 total.

Click here for links to the different economy/country and regional reports

Why conduct research?

From the outset, our Members realised that hard economic facts were needed to help governments and policymakers truly understand the potential of Travel & Tourism. Measuring the size and growth of Travel & Tourism and its contribution to society, therefore, plays a vital part in underpinning WTTC’s work.

What research does WTTC carry out?

Each year, WTTC and Oxford Economics produce reports covering the economic contribution of our sector in 185 countries, for 26 economic and geographic regions, and for more than 70 cities. We also benchmark Travel & Tourism against other economic sectors and analyse the impact of government policies affecting the sector such as jobs and visa facilitation.

Visit our Research Hub via the button below to find all our Economic Impact Reports, as well as other reports on Travel and Tourism.

UN Tourism | Bringing the world closer

Statistics of tourism, tourism statistics database, share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

UN Tourism systematically collects tourism statistics from countries and territories around the world in an extensive database that provides the most comprehensive repository of statistical information available on the tourism sector. This database consists mainly of more than 145 tourism indicators that are updated regularly. You can explore the data available through the UN Tourism database below:

145 Key Tourism Statistics

Data on inbound, outbound and domestic tourism, international tourism flows, tourism industries, employment and other indicators.

Economic Contribution and the SDGs

Data on the economic contribution of tourism and the implementation of relevant standards, such as the Tourism Satellite Account (TSA) and the System of Environmental-Economic Accounting (SEEA).

Statistics Explained will be under maintenance from 8pm to 11pm.Edition and login will not be available.

- Statistical themes

- Statistics 4 beginners

- Eurostat home

- Education corner

- Regional yearbook

- Sustainable development

- What links here

- Special pages

Tourism industries - employment

Data extracted in January 2022.

Planned article update: 29 May 2024.

Persons employed in total tourism industries as share of those employed in non-financial business economy, 2019 (%)

- (¹) Total tourism industries: NACE classes: H491, H4932, H4939, H501, H503, H511, I551, I552, I553, I561, I563, N771, N7721 and division N79.

- (³) Non-financial business economy: NACE sections: B-N_S95_X_K (Total business economy; repair of computers, personal and household goods; except financial and insurance activities).

- Note: No data available for EE, IE, FR, LU, NL, PT, SI. Full description of economic activities covered, see under "Data sources".

- Source: Eurostat (online data codes: sbs_na_sca_r2, sbs_na_1a_se_r2)

This article presents recent statistics on employment in the tourism industries in the European Union (EU). Tourism statistics focus on either the accommodation sector (data collected from hotels, campsites, etc.) or on tourism demand (data collected from households), and relate mainly to physical flows (arrivals or nights spent in tourist accommodation or trips made by a country’s residents). However, this analysis of employment in tourism is based on data from other areas of official statistics, in particular structural business statistics (SBS), the labour force survey (LFS), the structure of earnings survey (SES) and the labour cost survey (LCS).

This article analyses the tourism sector with a focus on its contribution to the labour market in the EU and its potential to create jobs for economically less advantaged socio-demographic groups or regions.

Full article

In 2019, the tourism industries employed over 12.5 million people in the eu.

Economic activities related to tourism (but not necessarily relying only on tourism — see the section "Data sources" for further details) employed over 12.5 million people in the European Union (see Table 1). Nearly 7.4 million of these people worked in the food and beverage industry, while 2 million were employed in transport. The accommodation sector (not including real estate) accounted for more than 2.5 million jobs in the EU; travel agencies and tour operators accounted for nearly half a million. The three industries that rely almost entirely on tourism (accommodation, travel agencies/tour operators, air transport) employed nearly 3.4 million people in the EU. These three industries will from now on be referred to as the "selected tourism industries".

In 2019 the tourism industries accounted for more than 22 % of people employed in the services sector. When looking at the total non-financial business economy, the tourism industries accounted for nearly 10 % of people employed. Among the Member States, Greece recorded the highest share (27.8 % or more than one in four people employed) followed by Cyprus and Malta with respectively one in five and more than one in seven people employed working in the tourism sector (see Figure 1).

In absolute terms, Germany had the highest employment in the tourism industries (2.6 million people, not including passenger rail transport interurban), followed by Italy (1.7 million) and Spain (1.6 million, not including taxi operation). These three Member States accounted for nearly half (48 %) of employment in the tourism industries across the EU.

In 2019, one out of four (25 %) people employed in the selected tourism industries, worked in micro-enterprises that employ fewer than 10 people. This share is by four percentage points lower than the 29 % observed for the total non-financial business economy (see Figure 2). Looking at the three selected tourism industries separately, 39 % of employment in travel agencies and tour operators was in micro-enterprises while for the accommodation sector this figure was 25 %. Not surprisingly, small and medium-sized enterprises (< 250 staff) are of minor importance in air transport, with 89 % of people employed in the sector working in companies employing 250 people or more.

The economic crisis of 2008 led to a fall in total employment which started recovering in 2014 and reached the before crisis levels in 2016 (see Figure 3). However, this was not the case for the services sector, including the selected core tourism industries, which during the period 2008-2016 has had an average annual growth rate of +2.4 %. More specifically, during this period, the selected tourism industries registered an average annual growth of +2.0 %, while the average growth for the tourist accommodation sector was +3.8 %. This shows the tourism industry’s potential as a growth sector, even in times of economic turmoil that significantly affect other sectors of the economy.

The positive trend in employment in the selected core tourism industries continued until 2019 when the number of people employed in the sector reached +17 % compared with 2008.

In 2020, COVID-19 pandemic has slowed economic activity and, as a result, the labour market. It clearly had a negative impact on employment but also pushed out people of unemployment by affecting their availability or their job search. Tourism was one of the most affected sectors due to the resulting travel restrictions, health protocols and the drop in demand among tourists. This was reflected to the employment in the selected tourism industries, with a sharp drop by -16 % in 2020 compared with 2019. This drop was significantly higher than the -3 % and -4 % observed for the non-financial business economy and the services sector respectively.

Characteristics of jobs in tourism industries

2020 was a special year due to the outbreak of the COVID-19 pandemic. The measures taken to contain the virus caused a severe economic recession. There was a hiring freeze in almost all the sectors with tourism being one of the most affected. People with less formal education, young people, people on temporary contracts or foreign workers were more likely to lose their job or have difficulties finding a job in tourism (see Table 3).

Tourism creates jobs for women

The tourism industry is a major employer of women (see Table 2, Figure 4 and Table 2A in the excel file ). In 2020, compared with the total non-financial business economy where 36 % of people employed were female, the labour force of the tourism industries included more female workers (58 %) than male workers. The highest proportions were seen in travel agencies and tour operators (64 %), followed by the accommodation sector (60 %). Even though nearly three out of ten women working in the tourism industries worked part-time (compared with just over one in ten men), women working full-time still represented the biggest share of employment (41 %, see Figure 4). Female employment accounted for less than half of tourism industry employment in only two Member States (Luxembourg and Malta); for the accommodation sector this was the case only for Malta. In Estonia, Latvia, Romania and Slovakia, more than two out of three people employed in tourism were women.

Part-time employment significantly higher in the tourism industries

In 2020, the proportion of part-time employment in the tourism industries (23 %) was significantly higher than in the total non-financial business economy (15 %) and was comparable to the figure for the services sector as a whole (20 %) (see Table 2, Figures 4 and 5, and Table 2B in the excel file ). Within the three selected tourism industries, the proportion of part-time employment in the accommodation sector and in travel agencies and tour operators was 23 %, while in air transport 22 % of staff worked on a part-time basis. In most Member States for which data is available, the tourism industries had a higher proportion of part-time employment than the rest of the economy. This was not the case for the popular tourism destinations of Greece, Spain and Cyprus where the proportion of part-time work in the tourism industries was equal or lower than in the rest of the economy. In Slovenia, the proportion of part-time workers in tourism was more than double compared to the economy as a whole.

Tourism attracts a young labour force

Traditionally, the tourism industries have a particularly young labour force, as these industries can make it easy to enter the job market. In 2020 however, the COVID-19 crisis has affected labour market of young people aged 15-24 more than the other age groups. With a drop of -25 % compared with 2019, the impact on youth employment in the selected tourism industries was even harder than the impact on this age group in the rest of the non-financial business economy where the drop was -8 % (see Table 3 and Figure 6).

The share of young workers in the selected tourism industries remained however high in 2020, with close to one in ten people (9.5 %) aged 15 to 24, while only 8.2 % of the labour force in the non-financial business economy were young workers. In the big majority of EU countries with available data, the share of young workers in tourism industries was above the proportion seen in the economy as a whole. The highest proportions of employed people aged 15 to 24 were registered in Denmark (21 %), Ireland and the Netherlands (both at 19 %) (see Table 2 and Table 2C in the excel file ). In the subsector of accommodation, 11 % of the people employed were between 15 and 24 years old (see Figure 6a), while in the three above mentioned countries, at least 23 % of persons employed in this sector were aged 15 to 24.

The tourist accommodation sector gives more opportunities to lower educated workers

The previous sections showed that tourism employs more female workers and young workers. In 2020, people with a lower educational level (those who have not finished upper secondary schooling) were more or less equally represented on the labour market as a whole and in the tourism sector (respectively 19 % and 18 %) — see Table 2, Figure 7 and Table 2D in the excel file . However, in the subsector of accommodation, 23 % of people employed had a lower educational level. In Malta and Portugal at least two out of five people employed in tourist accommodation belong to this group. However in these two countries lower educated people are more represented in the whole labour force compared with the rest of EU countries.

In 2020, however, as in the case of youth employment, people with a lower educational level were hit the hardest from the COVID-19 impact on employment. The drop in the employment in the selected tourism industries was -23 % for this group of workers, while it was -6 % in the non-financial business economy (see Table 3 and Figure 7a).

Nearly one in seven people employed in tourism are foreign citizens

Many foreign citizens work in tourism-related industries (see Table 2, Figure 8 and and Table 2E in the excel file ). In 2020, they accounted for 13 % of the labour force in tourism industries (of which 6 % were from other EU Member States and 7 % were from non-EU countries). In the services sector as a whole, the proportion of foreign citizens employed was 11 %, and in the total non-financial business economy it was 9 %. Looking at this in more detail, we see that foreign workers made up 9 % of the workforce in air transport and 10 % in travel agencies or tour operators, but 15% of the workforce in accommodation (i.e. more than one in seven people employed in this sub-sector was a foreign citizen).

In three EU Member States, more than one in three people employed in the selected tourism industries were foreign citizens: Cyprus (34 %), Luxembourg (58 %) and Malta (40 %).

In 2020 compared with 2019, the drop in the number of foreign workers was more significant in the selected tourism industries (-27 %, reaching -30 % in the segment of foreign citizens employed in the accommodation sector) than in the non-financial business economy (-4 %) (see Table 3).

Jobs are less stable in tourism than in the rest of the economy

Since tourism tends to attract a young labour force, often at the start of their professional life (see above, Table 2 and Figure 6), certain key characteristics of employment in this sector are slightly less advantageous than in other sectors of the economy.

The likelihood of occupying a temporary job was significantly higher in tourism than in the total non-financial business economy (18% versus 12 % of people employed) – see Table 2, Figure 9 and Table 2F in the excel file . There are big differences across the European Union (ranging from less than 3 % of temporary contracts in tourism in Estonia, Lithuania and Romania to more than 30 % in Greece, Italy, Cyprus and Poland). In all but five countries (Estonia, Spain, Lithuania, Hungary and Malta), fewer people have a permanent job in tourism than in the economy on average. In Bulgaria, Greece and Cyprus, the proportion of temporary workers was three to four times higher in tourism than in the non-financial business economy as a whole. In the accommodation sector, more than one in five people employed did not have a permanent contract.

In 2020 compared with 2019 however, the drop in the number of people working with a temporary contract was -36 % in the selected tourism industries, significantly higher than the drop in the total non-financial business economy where it was -16 % (see Table 3).

Similarly, the likelihood of an employee holding their current job for less than one year (see Table 2, Figure 10 and Table 2G in the excel file ) was also higher in tourism than in the non-financial business economy as a whole (15 % versus 13 %). In the economy on average, more than three out of four employees (77 %) had worked with the same employer for two years or more, while in tourism this is the case for 73 % of people employed. Air transport tends to offer more stable jobs, with only 6 % of employees having job seniority of less than one year, compared with 18 % in accommodation and 10 % for people employed by travel agencies or tour operators. More than one third of the workforce in the accommodation sector had held their job for less than one year in Greece and Cyprus.

However, as seen in the previous sections, employment in tourism was seriously affected by the outbreak of the COVID-19 pandemic. Compared with 2019, the drop in the number of people working with a temporary contract was -36 % in the selected tourism industries while in the non-financial business economy this was -16 % (see Table 3).

Regional issues in tourism activities

Regions with high tourist activity tend to have lower unemployment rates

Tourist activity can have a negative impact on the quality of life of the local population in popular tourist areas. However, the influx of tourists can also boost the local economy and labour market.

Comparing regional data on tourism intensity (e.g. the annual number of nights spent by tourists per capita of local population) with regional unemployment rates or their deviation from the national average unemployment rate, we see that in 2019, 22 of the 30 regions with the highest tourism intensity had an unemployment rate below the national average.

Table 4 lists the regions with a tourism intensity over 20 (tourism nights per local inhabitant). In all but three of these 20 regions, the unemployment rate lied below the national average. Two of the three regions where this did not hold true, the Canary Islands and Madeira, are island regions relatively remote from the mainland (and the mainland’s economy).

Earnings and labour costs in the tourism industries

Hourly earnings and labour costs in the accommodation sub-sector are below the average for the economy as a whole

Besides employment rates, another important feature of labour market analysis concerns labour costs for employers and earnings for employees. This section takes a look at hourly labour costs and hourly gross earnings, both in the economy as a whole and in the selected tourism industries.

In the EU as a whole, labour costs and earnings tend to be significantly lower in the tourism industries than they are in the total economy. In the economy, the average hourly labour cost was €25.6 in 2016 and average hourly earnings were €15.7 in 2018. In the three selected tourism industries (air transport, accommodation, travel agencies & tour operators) the average hourly labour cost was €23.6 in 2016 and the average gross hourly earnings amounted to €13.3 in 2018 (see Table 5 and Figure 11).

Given the characteristics of tourism jobs outlined above, this observation does not come as a surprise: a relatively young labour force (see Figure 6a) with a higher proportion of temporary contracts (see Figure 9) and lower job seniority (see Figure 10) has a comparative disadvantage on the labour market, which leads to lower labour costs and earnings. For the accommodation sector — which employs more people with a lower educational level and more part-timers — the differences are even higher. In 2018, for people employed in the accommodation sub-sector, gross hourly earnings were €11.0. For air transport, they were €26.5 (well above the average for the economy as a whole), and for travel agencies and tour operators they were €14.4.

Gross hourly earnings in tourism were highest in Denmark, Luxembourg, Norway and Switzerland, but these countries were also among the top ten countries with highest average hourly earnings in the total economy (see Table 5 and Figure 12).

In 2016 only seven EU Member States had higher hourly labour costs in tourism than the total economy: Bulgaria, Czechia, Estonia, Hungary, Portugal, Romania and Slovakia (see Table 5 and Figure 13); for gross hourly earnings, this was the case only for Latvia. Comparing the accommodation subsector with the economy as a whole, both hourly average labour costs and earnings were lower for those employed in accommodation, and this was true across the EU (see Figure 14).

Source data for tables and graphs

Data sources

This article includes data from four different sources:

- Structural business statistics (SBS) .

- EU labour force survey (EU-LFS) .

- Labour cost survey (LCS) .

- Structure of earnings survey (SES) .

This data is available at a detailed level of economic activity, which makes it possible to identify and select industries that are part of the tourism sector.

For Eurostat, tourism industries (total) include the following NACE Rev.2 classes:

- H4910 — Passenger rail transport, interurban

- H4932 — Taxi operation

- H4939 — Other passenger land transport n.e.c

- H5010 — Sea and coastal passenger water transport

- H5030 — Inland passenger water transport

- H5110 — Passenger air transport

- I5510 — Hotels and similar accommodation

- I5520 — Holiday and other short-stay accommodation

- I5530 — Camping grounds, recreational vehicle parks and trailer parks

- I5610 — Restaurants and mobile food service activities

- I5630 — Beverage serving activities

- N7710 — Renting and leasing of motor vehicles

- N7721 — Renting and leasing of recreational and sports goods

- NACE division N79 — Travel agency, tour operator reservation service and related activities.

However, many of these activities provide services to both tourists and non-tourists – typical examples include restaurants catering to tourists but also to locals and rail transport being used by tourists as well as by commuters. For this reason, this publication focuses on the following selected tourism industries which rely almost entirely on tourism:

- H51 — Air transport (including H512 ‘Freight air transport’ which accounts for 6.0 % of employment in H51).

- I55 — Accommodation (including I559 ‘Other accommodation’ which accounts for 1.7 % of employment in I55).

- N79 — Travel agency, tour operator reservation service and related activities (including N799 ‘Other reservation service and related activities’ which accounts for 12.9 % of employment in N79).

According to a United Nations World Tourism Organisation (UNWTO) publication titled " Tourism highlights ", the EU is a major tourist destination, with four of its Member States among the world’s top 10 destinations in 2019. Tourism has the potential to contribute towards employment and economic growth, as well as to development in rural, peripheral or less-developed areas. These characteristics drive the demand for reliable and harmonised statistics within this field, as well as within the wider context of regional policy and sustainable development policy areas.

Tourism can play a significant role in the development of European regions. Infrastructure created for tourism purposes contributes to local development, while jobs that are created or maintained can help counteract industrial or rural decline. Sustainable tourism involves the preservation and enhancement of cultural and natural heritage, ranging from the arts to local gastronomy or the preservation of biodiversity .

In 2006, the European Commission adopted a Communication titled " A renewed EU tourism policy: towards a stronger partnership for European tourism " (COM(2006) 134 final). It addressed a range of challenges that will shape tourism in the coming years, including Europe’s ageing population, growing external competition, consumer demand for more specialised tourism, and the need to develop more sustainable and environmentally-friendly tourism practices. It argued that more competitive tourism supply and sustainable destinations would help raise tourist satisfaction and secure Europe’s position as the world’s leading tourist destination. It was followed in October 2007 by another Communication, titled " Agenda for a sustainable and competitive European tourism " (COM(2007) 621 final), which proposed actions in relation to the sustainable management of destinations, the integration of sustainability concerns by businesses, and the awareness of sustainability issues among tourists.

The Lisbon Treaty acknowledged the importance of tourism — outlining a specific competence for the EU in this field and allowing for decisions to be taken by a qualified majority. An article within the Treaty specifies that the EU "shall complement the action of the Member States in the tourism sector, in particular by promoting the competitiveness of Union undertakings in that sector". " Europe, the world’s No 1 tourist destination — a new political framework for tourism in Europe " (COM(2010) 352 final) was adopted by the European Commission in June 2010. This Communication seeks to encourage a coordinated approach for initiatives linked to tourism and defined a new framework for actions to increase the competitiveness of tourism and its capacity for sustainable growth. It proposed a number of European or multinational initiatives — including a consolidation of the socioeconomic knowledge base for tourism — aimed at achieving these objectives.

Direct access to

- All articles on tourism statistics

- Tourism industries - economic analysis

- Employment and unemployment (Labour Force Survey) (t_employ) , see:

- Employment and unemployment (Labour Force Survey) (employ) , see:

- Structural business statistics (sbs) , see:

- Employment and unemployment (Labour force survey)

- Structural business statistics (SBS)

- Recent Eurostat publications on tourism

- Employment and unemployment (Labour Force Survey) (ESMS metadata file — employ_esms)

- LFS series - Detailed annual survey results (ESMS metadata file — lfsa_esms)

- LFS series - Detailed quarterly survey results (from 1998) (ESMS metadata file — lfsq_esms)

- Commission Implementing Regulation (EU) No 1051/2011 of 20 October 2011 implementing Regulation (EU) No 692/2011 concerning European statistics on tourism, as regards the structure of the quality reports and the transmission of the data.

- Regulation (EU) No 692/2011 of the European Parliament and of the Council of 6 July 2011 concerning European statistics on tourism and repealing Council Directive 95/57/EC.

- Summaries of EU Legislation: Tourism statistics

- Regional Statistics Illustrated - select statistical domain Tourism , Labour market .

- European Commission – Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs: Tourism

- Industry, trade, and services

- Tourism industries

- Statistical article

- Employment by sector

- ISSN 2443-8219

- This page was last edited on 17 May 2024, at 11:42.

- 2 watching users

- Privacy policy

- Accessibility

- About Statistics Explained

- Disclaimers

- Tourism employment

Related topics

- Innovation and Technology

Employment in tourism data refer to people or jobs. In the case of people, the data refer to employees only or to employees and self-employed people (employed people). Full-time equivalent employment is the number of full-time equivalent jobs, defined as total hours worked divided by average annual hours worked in full-time jobs.

Latest publication

- Industrial production

- Tourism GDP

- Tourism receipts and spending

- Tourism flows

Tourism employment Source: Key tourism indicators

- Selected data only (.csv)

- Full indicator data (.csv)

- Add this view

- Go to pinboard

©OECD · Terms & Conditions

Perspectives

Compare variables

Highlight countries

Find a country by name

Currently highlighted

Select background.

- European Union

latest data available

Definition of Tourism employment

Last published in.

Please cite this indicator as follows:

Related publications

Source database, further indicators related to industry, further publications related to industry.

Your selection for sharing:

- Snapshot of data for a fixed period (data will not change even if updated on the site)

- Latest available data for a fixed period,

- Latest available data,

Sharing options

Permanent url.

Copy the URL to open this chart with all your selections.

Use this code to embed the visualisation into your website.

Width: px Preview Embedding

US Travel Header Utility Menu

- Future of Travel Mobility

- Travel Action Network

- Commission on Seamless & Secure Travel

- Travel Works

- Journey to Clean

Header Utility Social Links

- Follow us on FOLLOW US

- Follow us on Twitter

- Follow us on LinkedIn

- Follow us on Instagram

- Follow us on Facebook

User account menu

Leisure and hospitality employment.

MONTHLY INSIGHTS November 10, 2022

While the overall U.S. jobs market has now surpassed pre-pandemic levels, the Leisure & Hospitality (L&H) industry still remains far behind in its recovery of lost, and desperately needed, jobs.

- At 6.5%, L&H has a higher share of jobs still lost than any industry except for mining

- With 1.1 million jobs still lost, L&H losses far exceed those of any other industry

This underscores how disproportionately the L&H sector was, and continues to be, impacted by the pandemic. The attached slides decks analyze the latest trends in the L&H industry.

Please note: Leisure & Hospitality (L&H) is an official industry category defined by the U.S. Bureau of Labor Statistics (BLS). L&H employment trends are often used as a proxy for travel industry employment since there is significant overlap between the two categories. The following document explains the similarities and differences between L&H and travel employment. L&H data is available monthly from BLS. Direct and Indirect travel employment is calculated annually by U.S. Travel and Tourism Economics.

An official website of the United States government

- Special Topics

Travel and Tourism

Travel and tourism satellite account for 2018-2022.

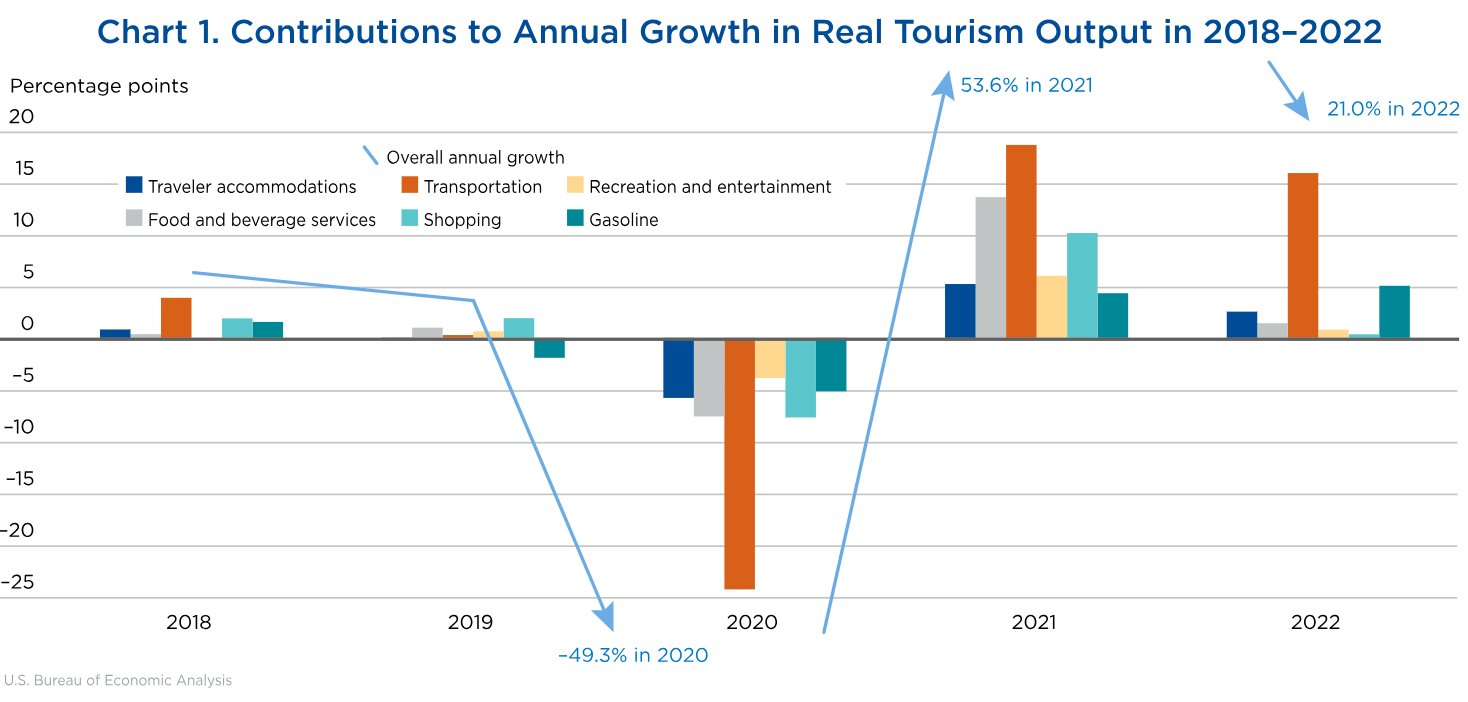

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2018–2022 By Hunter Arcand and Paul Kern - Survey of Current Business April 2024

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

Please note: Our website no longer fully supports IE11 , as such you may encounter issues using our website, please try an alternative browser such as Google Chrome, Mozilla Firefox, Microsoft Edge (Windows) or Safari (Mac).

Understanding the travel and tourism labour market

Tourism in the UK is a vital source of economic activity, contributing to GDP and supporting jobs across the UK’s regions and nations through a mix of inbound, outbound and domestic tourism. In seeking to understand more closely the scale and structure of employment within the UK’s travel and tourism industry, the Centre for Economics and Business Research (Cebr) was commissioned by ABTA to undertake a detailed study of employment associated with tourism activity.

- The travel and tourism industry employed around 1.7 million people in 2012, equivalent to around 5.8% of the UK’s workforce. This included 789,000 full-time employees (FTEs), 674,000 part-time employees and 236,000 self-employed workers.

- This scale of direct employment amounted to around 1.3 million FTEs in 2012. This included over 600,000 FTEs in the accommodation and food and beverages sectors; and a further 205,000 FTEs in the retail sector. In addition, 2012 saw the travel and tourism industry indirectly support the employment of an estimated 680,000 FTEs along its supply chain.

- Part-time working is more important in travel and tourism than it is in the wider economy. Over the five years from 2008 to 2012, part-time employees represented nearly two-fifths (39.0%) of total travel and tourism employment. This compares to just under a quarter (22.7%) in the UK as a whole.

- The travel and tourism industry provides more opportunities for female employment than is seen in the economy as a whole. Over the period 2008-12, women made up 51.4% of total employment in the travel and tourism industry. The equivalent proportion in the wider UK labour market was 46.3%.

- Almost a third (31.9%) of travel and tourism workers are under the age of 30, while over half (50.6%) are under the age of 40. Amid an ageing UK labour force and population, tourism provides an important source of work opportunities for young people.

- The employment provided by the travel and tourism industry supports many people who require more flexibility in their work patterns, who are pursuing their education, or seeking to improve their skills sets.

- This is reflected in job tenures – in 2012, employees within the travel and tourism industry had spent an average of 6.1 years with their current employer. This is lower than almost all other sectors, and reflects the prevalence of flexible, part-time and temporary working in the sector.

- Tourism workers during 2012 earned an average salary of £19,500, compared with £26,800 in the UK as a whole. However, average weekly hours are lower in tourism (31.0) than in the broader economy (33.0), while the prevalence of temporary and seasonal work is higher, supporting greater flexibility.

- Elementary occupations make up over a quarter (27.1%) of job roles in tourism, highlighting how tourism provides opportunities which can suit comparatively young, lower-skilled or part-time employees, including those just starting out in their careers.

Latest News

BestPrice travel to promote the image of Vietnam at New York’s times square

How private MCAT tutors address specific weaknesses or areas of improvement for medical school applicants

Marriott International celebrates the 2024 J. Willard Marriott Awards of Excellence honorees

Landal GreenParks UK sees big growth in inbound holiday market

Next generation leaders earn their seat at the table at IMEX Frankfurt

RDB Hospitality expands luxury services with addition of Lenox VIP Global

Ronald Leitch appointed Chief Operating Officer of AGS Airports

NH Collection’s debut in Finland continues a proud legacy of legendary hospitality

Deepak Chopra aboard SH Diana in New York as Swan Hellenic announces two new “Explore & Restore” cruises in Brazil

VisitEngland joins forces with AccessAble to promote new tourism accessibility guides

Oman’s Travel & Tourism sector predicted to reach new heights in 2024, says WTTC report

The 2024 Economic Impact Research by the WTTC highlights a promising outlook for Oman’s Travel & Tourism sector, with projected growth driven by strong government support and strategic investments. The sector’s contribution to GDP and employment is expected to break records, further positioning Oman as a leading destination in the Middle East.

DUBAI, UAE – The World Travel & Tourism Council ’s ( WTTC ) 2024 Economic Impact Research (EIR) unveiled a promising future for Oman ’s Travel & Tourism sector. With strong government support and strategic initiatives, the sector is poised to not only recover but to reach unprecedented heights this year.

According to the global tourism body’s latest research, in 2023 the Travel & Tourism sector’s GDP contribution surged by almost 35%, totalling OMR 2.8BN, and is on track to surpass previous records. The sector witnessed a robust job growth of 15%, now employing 191,500 individuals nationwide. Last year, international visitors injected OMR 1.1BN into the economy, a remarkable 69% increase from 2022, while spending by domestic travellers rebounded to OMR 1.4BN.

Oman as a Premier Destination

Oman’s status as a top tourist destination in the Middle East is clearer than ever, thanks to strategic government investment and support. These efforts are not only rejuvenating the economy but are also setting the stage for further increases in international travel spending and overall economic contribution from the sector.

Julia Simpson , WTTC President & CEO, said; “Oman’s Travel & Tourism sector is on the cusp of an historic revival in 2024. The Oman Government is a strong support of Travel & Tourism and is aiming to achieve unprecedented economic growth and job creation.”

Dr. Hashil Al Mahrouqi , CEO of OMRAN Group added; “The significant growth of Oman’s Travel & Tourism industry demonstrates the robust support of Ministry of Heritage and Tourism and Oman Investement Authority, and their commitment to realising the industry’s potential through strategic enablers and developments across the country.

“As Oman’s master developer for sustainable tourism destinations and innovative urban communities, we strive towards contributing to these promising prospects and remain committed to responsible tourism development and promoting Oman as a premier travel destination through our ‘Visit Oman’ brand and digital distribution solutions, with the ultimate goal of fostering Oman’s Socio-Economic growth.”

What Does This Year Look Like?

The global tourism body is forecasting thatthe sector will grow its GDP contribution to more than OMR 3.3BN in 2024, 7.6% of the country’s economy, and is projected to employ more than 206,000 people across the country, with one in fourteen people working in the sector.

Domestic visitor spending is predicted to continue growing, to reach OMR 1.5BN, beating the 2019 level by just over 8%. Although international visitor spending is forecast to still be behind 2019 levels by OMR 142.3MN, it is expected to continue growing through 2024.

What Does the Next Decade Look Like?

The global tourism body is forecasting that the sector will grow its annual GDP contribution to OMR 5.4BN by 2034, 9.8% of Oman’s economy, and is projected to employ more than 265,600 people across the country, with one in 13 residents working in the sector.

Across the Middle East

The Middle Eastern Travel & Tourism sector grew by more than 25% in 2023 to reach almost $460BN. Jobs reached nearly 7.75MN and international spending grew by 50% to reach $179.8BN. Domestic visitor spending grew by 16.5% to reach more than $205BN.

WTTC is forecasting that Travel & Tourism across the region will continue to grow throughout 2024 with the GDP contribution set to reach $507BN. Jobs are forecast to reach 8.3MN, international visitor spending is forecast to reach $198BN and domestic visitor spending is expected to reach more than $224BN.

Vicky Karantzavelou

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief . She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.

- Vicky Karantzavelou https://www.traveldailynews.com/author/vicky-karantzavelou/ Marriott International celebrates the 2024 J. Willard Marriott Awards of Excellence honorees

- Vicky Karantzavelou https://www.traveldailynews.com/author/vicky-karantzavelou/ Next generation leaders earn their seat at the table at IMEX Frankfurt

- Vicky Karantzavelou https://www.traveldailynews.com/author/vicky-karantzavelou/ NH Collection’s debut in Finland continues a proud legacy of legendary hospitality

- Vicky Karantzavelou https://www.traveldailynews.com/author/vicky-karantzavelou/ VisitEngland joins forces with AccessAble to promote new tourism accessibility guides

Related posts

First Club Med in the Middle East announced, $100 million development

WTTC and IC Bellagio partner for new consumer campaign

Qatar’s Travel & Tourism sector achieves record growth in 2024

Portugal’s Travel & Tourism poised for historic year, says WTTC

Previous post, air serbia launches contest for company mascot, asm global europe to open four new uk venues by 2027 .

eSIM Go launches global travel eSIM service in partnership with SWISS

Impress your Airbnb guest on their next vacation

McDreams becomes Europe’s first hotel group to roll out 100% AI-powered phone system integrated with Like Magic

Europeans defy costs and conflicts to embrace travel in Summer 2024

SAS expands connectivity to Scandibavian Winter destinations

airBaltic and Bulgaria Air start codeshare cooperation

Sofitel Al Hamra Beach Resort opens its doors on the shores of Ras Al Khaimah

Prague Airport and Korean Air celebrate two decades of Seoul connection

Understanding Nevada’s modified comparative negligence law

Exhibitions & Conferences Alliance welcomes ICCA as its newest Alliance partner

BEONx and JUYO Analytics partner to streamline data access for hoteliers

Good Travel Management announces strategic partnership with Trinity Event Solutions

Finnair resumes flights to Tartu

Afreximbank funds $30m. for Silversands Hotel expansion in Grenada

AMG survey reveals consensus on importance of training but not on how to develop new advisor talent

“Tauck On Tour” events coming to UK travel advisors this Fall

Global Travel Marketplace expands and rebrands as Connecting Travel Marketplace

Sporting events elevated Madrid hotel performance in April

easyJet to open 10th UK base at London Southend Airport next spring signalling continued UK growth

Middle East hotel construction pipeline rises to 612 projects/144,222 rooms at Q1 2024

The Vinoy Resort and Golf Club hires Chris Major as Golf and Club Operations GM

IEG: The Board of Directors approves the consolidated interim report as of March 31, 2024 – Revenues at 88.9m. euros

U.S. Travel applauds passage of Long-term FAA Renewal Bill

Travel and tourism sector deal activity down by 13.5% YoY in January-April 2024, finds GlobalData

THE WELL appoints Zeev Sharon as Chief Development Officer to lead integrated wellness brand’s global expansion

Icelandair transported more than one million passengers this year

Qatar hotel market sees significant performance boost during Eid al-Fitr

New research highlights toll of business travel on mental health and a need for more support from employers

Avianca will only transport passengers aged 14 or younger who travel with their parents or a responsible adult

CEIR releases Q1 2024 index results, growth of U.S. B2B exhibition industry continues

Luxury digital concierge company The Prelude to hit $20m in first year sales

Celebrity Cruises’ revolutionary ship Celebrity Apex homeports in Southampton for first-ever season from the UK

Oklahoma Tourism and Recreation Department launches new “Find Yourself in Oklahoma” campaign

Transportation methods from Alicante airport to Benidorm

Oceania Cruises launches innovative and free marketing solution for trade partners

TAAG assumes exclusive operation od the Luanda – Lisbon route with its international fleet

Hotel rewards programs are going greener, extending across brands, new report finds

Pegasus launches direct route from Istanbul to Bratislava

MIA starts 2024 with record growth and an A+ bond rating

Time Out Market to open in Budapest

JW Marriott and Flamingo Estate debut a global brand partnership to guide travelers on a sensorial journey rooted in well-being

Yuppi Group leverages Turkish destination specialism to launch B2B hotel platform Pax2Night

Reputable merchant advance companies for business owners

Best April in Katowice Airport’s history

Erna Solberg named Havila Pollux

Soaring passenger traffic, longer stays: Mastercard Economics Institute on travel in 2024

Consistency in differentiation: How GCC is building the future of their travel destinations

Carnival Corporation rolls out SpaceX’s innovative Starlink across entire global fleet

Dream Yacht Sales welcomes Jeremy Tutt as Global Yacht Sales Director

Tribute Portfolio debuts in the United Arab Emirates with The First Collection at Jumeirah Village Circle, a Tribute Portfolio Hotel

Wellness real estate market reached $438bn. in 2023 and is forecast to more than double to $913bn. by 2028

Sojern expands its guest experience solutions to Europe

Waymore’s Guest House & Casual Club announces new General Manager

Forty-five percent of the hotel projects in Europe’s total pipeline are under construction at the end of Q1 2024

New Grill Room General Manager and Sommelier at The Windsor Court Team

Corazón Cabo Resort & Spa appoints new Director of Sales and Catering

Travel demand remains resilient in Q2 2024: TUI achieves record revenue of 3.6bn euros

Higher Lake Mead water levels bolster business for marina, boating operator

Elevate your travel experience with essential tech on a budget

Google rolls out enhanced AI-driven travel planning features

Game changers: Trends shaping college sports today

VisitScotland Connect 2024 hailed a success

Fraport Group continues growth in First Quarter of 2024

Travelport and WestJet confirm new long-term Content agreement

Sights of Belek you must visit

How to make the most of your trip to Napa Valley

South Western Railway hosted the rail industry’s first national safeguarding conference

Sabre Corporation reinforces partnership with ACI blueteam Spa with new contract

Trip.com Group and Rezdy join forces to offer new travel experiences around the world

The Ritz-Carlton, San Francisco appoints new General Manager

Berlin celebrates five years of Sustainable Meetings Berlin at IMEX

Over 200,000 additional seats from Shannon Airport this summer to destinations across Europe and the USA

Destination DC highlights impactful role in hosting global meetings at IMEX Frankfurt

PCMA and The Strategic Alliance of the National Convention Bureaux of Europe announced Convene 4 Climate

Hotel Equities selected to manage first Hampton by Hilton-branded hotel in St. Thomas, U.S. Virgin Islands

Abra Group reaches agreement for strategic investment in Wamos Air

Chisinau International Airport will be the host of the International Aviation Conference

Mews acquires HS3 Hotelsoftware to bolster German expansion

Paradies Lagardère announces Q1 restaurant openings at Atlanta, Boston and Oklahoma City Airports

Generation Voyage monetizes content through affiliate sales powered by Stay22

Celestyal finalises agreement with Abu Dhabi and AD Ports Group

New dates for Essence of Africa, the continent’s premier buyer forum

LanzaJet announces Doreen Pryor as Chief Financial Officer

Neptune Luxury Resort announces culinary collaboration with acclaimed Italian chef Salvatore Andolina

Fontainebleau Miami Beach to unveil all-new coastal convention center in Q4 2024

Cvent announces Top Meeting Destinations and Top Meeting Hotels in Europe for 2024

Prague remains among world’s most sought-after meeting destinations

Over 260 applications from 60+ countries: Best Tourism Villages 2024 adventure kicks off

Seychelles and Mauritius Tourism met at the Arabian Travel Market (ATM) in Dubai

IRF and SITE, along with research partner Oxford Economics, launch 2024 edition of incentive travel survey

Explore Worldwide furthers expansion in North America with new team and Toronto office

Colletts Travel evolves with reservation module new technology from Dolphin Dynamics

Skyscanner launches Savvy Search – its new generative AI travel planning tool

BCD Meetings & Events launches three-year strategic plan following momentus growth

RiminiWellness 2024: Shaping the future of wellness and fitness industry

Traveloka becomes first Platinum Sponsor of GSTC to promote sustainable tourism

The Brunelleschi Hotel gets the prestigious Michelin Key

Minor Hotels appoints Lokesh Kumar as Vice President of Development for the Middle East

onefinestay unveils villas in Provence

Outdoorsy launches weather guarantees for RV rentals with “Roamly Weather by Sensible”

UK awards Alain St.Ange the “Nelson Mandela Leadership Award”

Resorts World Cruises to homeport in the Arabian Gulf

Dondra Ritzenthaler Takes the Helm as Chief Executive Officer of Azamara Cruises

Storrington Collective is appointed to handle the UK Public Relations for the entire Cotton Lifestyle Group

ATL Airport District appoints Rylee Govoreau as Sales Manager

Aeronology accepted into global luxury travel group Virtuoso

The world of travel and tourism: A journey through cultures and destinations

Grace La Margna St Moritz joins American Express Fine Hotels + Resorts

Digital Markets Act: European Commission designates Booking.com as gatekeeper

Al Ansari Exchange signs a strategic partnership with Etihad Airways

Royal Caribbean’s Utopia of the Seas begins tests at sea

Traveazy Group unveils the future of B2B travel solutions at ATM 2024

Aena’s airports in Spain registered more than 25.6 million passengers in April

Casablanca: A must-visit destination in 2024 according to TripAdvisor

Caribbean Week 2024 set to sparkle in New York City

BLS International secures visa outsourcing contract with Portuguese Embassy in Morocco

Caribbean tourism flourishes: Insights from CHTA at CHRIS 2024 Summit

OsaBus invested 1m. euros in new buses to expand services in Barcelona

Illinois Office of Tourism announces international visitor growth in 2023

Hyatt doubles down on Latin America growth with 30+ planned openings through 2027

The Emirates Group achieved record profits and revenue in 2023-24, driven by robust demand and strategic global expansion

Mondee Holdings announces record Q1 2024 financial results, highlighting AI-driven growth in the travel sector

The Vines Resort & Spa announce villa expansion

HyperPay showcased innovative hospitality service at Arabian Travel Market 2024

Ethiopian Airlines Group assumes management role for Ethiopia’s new Legacy Lodges through Ethiopian Skylight Hotel

ACI World welcomes new Vice Presidents to lead Events & Commercial Services, and Safety, Security, and Operations

Traveling with white snus: A guide to regulations and recommendations

Understanding wrongful deaths from a legal perspective: A guide

TravelgateX returns to CON-X 2024 with a new concept, “Enough, redefined”: Pushing the boundaries in the travel industry and technology

Why the USA is the perfect host for the World Cup

Six tips for becoming a travel influencer on Instagram

Iberostar announces re-opening of 5* Iberostar Selection Creta Marine following 3 year renovation

Three smart tech must-haves for a bleisure trip

Bud & Marilyn’s takes home title of “2024 Merchant of the Year”

Introducing DEOS: A new vision of luxury by the Myconian Collection

Delta Air Lines operates its Prague – New York route again

Emirates return to Edinburgh Airport, Pegasus starts twice weekly flights to Istanbul

British Airways announces the launch of its new Customer Access Advisory Panel

Air India strengthens presence in Europe with additional flights to Amsterdam, Milan and Copenhagen

Ryanair extends Trinity College Dublin partnership to 2030

Redefining luxury in the Middle East: Insights from Arabian Travel Market 2024

Sheen Falls Lodge partners with Seabody for enhanced wellness experience

UN Tourism puts spotlight on investments and empowerment at AIM Congress

IAG reports strong First Quarter, forecasts positive outlook for 2024

Amsa Hospitality and Radisson Hotel Group extend partnership with the signing of Radisson Hotel Madinah set to open this year

Alaska Airlines launches new way for guests to join the journey to help make air travel more sustainable

Copthorne Hotel Aberdeen unveils major renovations

Top-performing airlines set themselves apart with friendly staff, J.D. Power finds

Hilton announces Dale MacPhee as General Manager of Conrad Washington, DC

Bardessono Hotel & Spa in Napa Valley unveils $1.8m. guestroom renovations

Mews and YouLend partner to launch “Flexible Financing” for hospitality expansion

British Airways Holidays unveils 2024 travel trends influencing UK consumers

Daniel Alexander of Tanjung Kelayang Reserve in Indonesia and President of MTPA met Seychelles Consultant Alain St.Ange at ATM in Dubai

InterLnkd crowned winner of the ATM 2024 Start-up Pitch Battle, held in association with Intelak

airBaltic lunches direct flights from Riga to Skopje, Chisinau, and Pristina

El Cortez Hotel & Casino announces plans to enhance casino

JW Marriott Chicago unveils reimagined event space

Cloud5 appoints Frank Ziller as Chief Technology Officer

Vingcard enhances hotel security with MIFARE Ultralight AES compatibility

Authenticity and Innovation at the forefront of CityDNA’s “Reality Check!” Conference

Travel entrepreneur and startup funding is growing in the Middle East but more investment is needed, say industry experts at ATM 2024

The leading source of labour statistics

- Country profiles

- Standards & methods

Data by region

For data producers, publications, selected topics.

- © TopSphere Media / Unsplash

- November 7, 2023

- Occupation , Profiles , Sector , Women

Where women work: female-dominated occupations and sectors

Last month marked a significant stride towards gender equality. The Nobel Memorial Prize in Economic Sciences, an infamously male-dominated field, was awarded to Professor Claudia Goldin . This is not simply a nod towards women’s contribution in this field, but also an acknowledgment of the importance of her research which “advanced our understanding of women’s labour market outcomes”. While her research provides a profound understanding of women’s role and the underlying causes of gender inequalities in the U.S. labour market, it is important to recognize that different narratives may emerge in an international context, shaped by diverse social and cultural factors.

This blog provides current global trends in women’s employment across occupations and sectors, pointing to persistent gender-based horizontal and vertical segregation. The underlying data is derived from the ILO Harmonized Microdata Collection and is now available in the Worker and Sector Profiles database (see box for details ).

Gender imbalances across occupations and sectors

Unsurprisingly, women still occupy traditionally female roles in the workplace across many sectors and occupations. For instance, occupations related to nursing and childcare exhibit exceptionally high female shares, with figures reaching over 90 per cent. Positions in teaching and education also boast a significant female presence, especially in primary school and early childhood teaching. Similarly, elementary occupations related to cooking and cleaning have high shares of women, as do clerical and librarian positions.

Conversely, certain high-risk occupations, like locomotive engine driving, heavy machinery operations, and ship deck crews, are devoid of female representation. The same can be said of many other plant and machine operators, as well as trades workers and labourers. Meanwhile, the most gender-balanced occupations are often seen among sales workers and business and administration professionals.

There are no surprises either across sectors in terms of where women are the majority. Aside from dominating economic activities in social and health services, women are also over-represented in certain manufacturing industries, such as those related to apparel. In contrast, industries like mining, quarrying, and construction-centric activities continue to be male-dominated. Retail sectors, however, present a more balanced gender distribution.

Care work’s feminine footprint

Many of the occupations and sectors comprised of mostly women are care related. This female dominance is most pronounced in core care occupations, such as childcare, nursing and midwifery, and in sectors related to residential care (e.g., activities in nursing homes) and private households (where domestic workers are employed). Women make up 67 per cent of the global care workforce according to the most recent global estimate based on available data. Particularly, domestic workers employed directly by households have the most significant proportion of women. In countries such as Seychelles, Belarus, Slovakia, and Georgia, at least four in five individuals in care employment are women. Interestingly, care occupations outside the care sector (i.e., personal care workers in the hospitality sector,) as well as non-care occupations in the care sector (i.e., administrative staff in care homes, hospitals, or clinics) appear to have a more balanced gender distribution.

The stubborn gendered nature of care work has had severe implications for women’s labour market outcomes, economic independence, and broader gender equality. As the global demand for care increases due to factors like changing family structures, population ageing and climate change, there is an urgent need for adequate and gender-transformative care policies to address the growing care demands and to mitigate constraints on women’s labour force participation and equal representation in society and decision-making. Failure to address these evolving needs might further accentuate gender inequalities in the workforce and place an additional burden on the already strained care workers, especially in the aftermath of COVID-19 pandemic . Last month also marked the first celebration of the UN International Day for Care and Support , which highlights the importance of investing in care to achieve gender equality and social justice.

Breaking boundaries for women in STEM

The Science, Technology, Engineering and Mathematics (STEM) workforce has been male dominated for a long time, but there is evidence that this is changing. Two in five STEM workers are now women according to the most recent global estimate based on available data. Some countries including Mongolia, Belarus and Lesotho are now leading the charge with female representation in these occupations, with women comprising more than half of STEM employment. However, on the flip side, countries including Pakistan, the United Arab Emirates, Burkina Faso, and Iraq still have a considerable journey ahead, with women constituting less than a quarter of their STEM workforce.

The inclusion of women in STEM occupations is essential to nurture diverse perspectives from well-rounded workplaces, rectifying historical gender inequalities, spurring economic growth via innovation, inspiring future generations, addressing intricate global issues, and championing inclusiveness and fairness. So, while there has been some improvement, women remain significantly underrepresented in a number of STEM occupations, particularly those related to technology and engineering. For example, women represent only around 10 per cent of civil engineers and software developers. In fact, the information and communication technology (ICT) sector still has less than a quarter of women and the gender wage gap is often high in this sector .

Women's slow climb to management positions

While women have made some strides in STEM employment, challenges remain for their career advancement. Only 36 per cent of senior and middle management roles are held by women. Furthermore, women predominantly hold management roles in areas traditionally viewed as female centric. For example, 89 per cent of childcare service managers and 78 per cent of aged care service managers are women. Conversely, a mere 1 per cent of mining managers are women, unsurprisingly given the mining sector is male dominated. Meanwhile, there is a more balanced gender representation for managers in public relations, human resources, finance, and business services, where women hold almost half of these managerial positions. Notably, only about one-fifth of managing directors and chief executives are women. These findings reflect not just a gap in numbers but, more importantly, in opportunities, empowerment, and perceptions.

Tourism’s potential for women's empowerment in local economies

Tourism stands out as a vibrant sector, buzzing with opportunities for women and youth. Despite being recognized for its labour-intensive nature, tourism has become a beacon of hope for women – many of whom rise to become entrepreneurs – in various corners of the world. Moreover, it serves as an economic diversification catalyst, especially in secluded rural and remote areas. In particular, the food and beverages sector as well as the accommodation sector lead in female employment . However, jobs in these sectors often come with their own set of challenges. They are predominantly characterized by self-employment, smaller enterprises, higher rates of informality, and generally lower wages and productivity.

Navigating the global gender dynamics in the workforce reveals both progress and challenges. Professor Claudia Goldin’s Nobel recognition emphasized the importance of women’s roles in labour markets. From our exploration of occupational and sectoral trends, the narrative is clear: there are fields where women lead, areas where they’re just stepping in, and some where they’re still largely absent. Remarkably, traditional views and patterns persist, with limited signs of change – be it in STEM occupations or managerial positions. As we navigate towards a more equitable future, it’s vital to keep the dialogue alive, challenge norms, and most importantly, celebrate every stride towards gender parity. Every figure, every statistic, and every story holds the potential to inspire change and set new milestones in our collective pursuit of equality.

Announcing the Worker and Sector Profiles database

The analysis presented in this blog is based on data now available in the Worker and Sector Profiles (PROFILES) database . The database focuses on groups of workers for which there is high interest but no internationally agreed statistical definitions. The selected groups of workers are defined using the International Standard Industrial Classification of All Economic Activities (ISIC) and/or the International Standard Classification of Occupations (ISCO) and estimates are produced from household surveys in the ILO Harmonized Microdata Collection .

The PROFILES database currently covers the following groups of workers:

- Paid care workers

- Workers in STEM occupations

- Public sector workers

- Tourism sector workers

The data series cover a range of topics, including employment, informality, working time, and earnings. Country coverage and length of the time series vary depending on the availability of household survey microdata and whether the variables for occupation and/or economic activity are available and sufficiently detailed to derive estimates based on the chosen definition.

For information on the concepts and definitions, refer to the PROFILES database description .

Donika Limani

Donika works as a Statistician at the Data Production and Analysis Unit of the ILO Department of Statistics. An economist by training, her research focuses on labour economics, migration and child labour.

View all posts

Marie-Claire Sodergren

Marie-Claire is a Senior Economist in the Data Production and Analysis Unit of the ILO Department of Statistics.

Related stories

Current practices in measuring sexual orientation and gender identity in population censuses, women with young children have much lower labour force participation rates, women are more likely than men to want a job but not have one, making labour statistics work for women: recent developments and the way ahead, behind the mic: exploring employment patterns in radio broadcasting, sign up for our newsletter.

All the latest content from the ILO Department of Statistics delivered to your inbox once a quarter.

COMMENTS

Premium Statistic Tourism industry employment in Iceland 2010-2017 Basic Statistic Contribution of travel and tourism to employment in the U.S. 2013-2017, by type

The ongoing historic tightness in the labor market was embodies by the 10.4% rise in average hourly earnings in December relative to the same month in 2019. The L&H sector continued its rapid wage growth, with average hourly earnings rising to 16.6% above 2019 levels in December - the fastest growth of all major industries.

An establishment in the tourism sector is an enterprise, or part of an enterprise, that is situated in a single location and in which only a single productive activity is carried out or in which the principal productive activity accounts for most of the value added. Data on employment in tourism refer to people or jobs. Tourism can be regarded ...

Tourism Statistics. Get the latest and most up-to-date tourism statistics for all the countries and regions around the world. Data on inbound, domestic and outbound tourism is available, as well as on tourism industries, employment and complementary indicators. All statistical tables available are displayed and can be accessed individually ...

Industry and Services. Enterprise Statistics. Structural and Demographic Business Statistics (SDBS) ... Enterprises and employment in tourism Customise ... Tourism industry Total tourism..... Tourism industries.... 284 203: 282 990: 271 131: 274 255: 275 463 ...

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000. Tourism can be important for both the travelers and the people in the countries they visit. For visitors, traveling can increase their ...