Cookies policy

In order to provide you with the best online experience this website uses cookies. By using our website, you agree to our use of cookies. Learn more .

Air Canada's Future Travel Credits no longer expire in 24 months

Air Canada is now allowing travellers to use their Future Travel Credits whenever they want— with no expiration date in sight.

Under a revised goodwill policy, new bookings made up to June 30th, 2020 can be changed without fees for original travel between March 1st, 2020 and June 30th, 2021.

In cases where Air Canada cancels flights due to COVID-19, customers with refundable tickets will continue to have the option of refunds . Since January 1, 2020, Air Canada has refunded nearly $1 billion to customers. Both customers with refundable and non-refundable tickets will have two new options to choose from:

- An Air Canada Travel Voucher for the remaining value of their ticket that has no expiry date, is fully transferable and retains any residual value or;

- The ability to convert the remaining value of their ticket into Aeroplan Miles, with 65 per cent more value versus the normal rate for buying Miles.

"While the world is making great progress against COVID-19, we know we must remain vigilant, which includes being flexible. This is why we are introducing two new solutions for customers should their travel plans change ," said Lucie Guillemette, executive vice-president and chief commercial officer at Air Canada.

What's changed?

In addition to the company's regular goodwill policies, starting June 1st, 2020, Air Canada will offer customers the choice of a travel voucher with no expiry date that is fully transferable or to convert their booking into Aeroplan Miles and get an additional 65 per cent bonus miles .

Both options, retroactive to March 1st, give customers more flexibility with their future vacation plans.

Previously, travellers had 24 months to use any issued credits from Air Canada.

Don't miss a single travel story: subscribe to PAX today!

WestJet and AMFA agreement ratified

Etihad Airways Expands North American Presence with New Routes and Aircraft Upgrade

Delta Air Lines and Riyadh Air forge strategic partnership to expand global connectivity

Arajet achieves milestone with record passenger numbers in 2024

Air France-KLM and SAS sign codeshare and interline agreements

You may also like.

France & Portugal among top travel destinations, says TravelHub report

Heathrow border agents to go on strike

account, indicator....

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

How To Cancel an Air Canada Flight [Points or Cash Ticket]

Jarrod West

Senior Content Contributor

452 Published Articles 1 Edited Article

Countries Visited: 21 U.S. States Visited: 24

Keri Stooksbury

Editor-in-Chief

41 Published Articles 3360 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

Senior Editor & Content Contributor

149 Published Articles 763 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![credit for future travel air canada How To Cancel an Air Canada Flight [Points or Cash Ticket]](https://upgradedpoints.com/wp-content/uploads/2020/03/B787-9-Wingflex-1.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Air canada’s cancellation policy: flights paid with cash or points, air canada’s flight change policy, how to cancel a flight with air canada, how to use an air canada travel evoucher, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Key Takeaways

- Air Canada allows flight cancellations with policies varying by fare type. Refundable fares offer full refunds, while non-refundable tickets may offer travel credits.

- Cancellations within 24 hours of booking are eligible for a full refund, regardless of fare class.

- Cancelling an award ticket incurs a fee of up to $150, depending on fare type.

At times, things happen that are outside of our control that can force us to cancel our travel plans. Unfortunately, the process of canceling a flight can be both expensive and complicated if you don’t know all of your options.

If you happened to book your flight with Air Canada and need to cancel, you’re in the right place! Here’s all the information you need to navigate their cancellation policy and determine what policies apply to your situation.

All customers have 24 hours from the time of their original booking to cancel their reservation without being charged a cancellation fee , regardless of the fare selected.

Cancellation Policy for flights between Canada and the U.S.

For cancellation policies of domestic Canada flights or flights between Canada and International destinations, visit here .

Basic Economy Ticket

Air Canada will not allow you to cancel a basic economy ticket unless it is canceled within 24 hours from when it was purchased. However, there are some circumstances where you can cancel and request a refund if Air Canada changes your flight schedule by 2 hours or more, if you have military orders, or if you or your traveling companion dies.

Non-Refundable Tickets

Standard, Flex, and non-flexible business or premium economy fares are all categorized as non-refundable.

You will be charged a fee to cancel your ticket. The fee incurred will depend on the fare type you purchased. After you pay the fee, you can apply the unused value of your ticket toward a future trip as long as your new trip begins no later than 1 year from the ticket’s original issue date and you canceled the original ticket before the departure of the first flight.

Hot Tip: Non-refundable tickets can still be refunded in the event of the death of the passenger or passenger’s traveling companion or because of military orders. Supporting documentation is required.

Refundable Ticket

Comfort, Latitude, and flexible premium economy or business fares are categorized as fully refundable. If you’ve purchased one of these tickets, cancellations can be made anytime before the departure of your flight, and the refund will be issued to your original credit card within 7 days (it should appear on your statement in 1-2 billing cycles).

Award Ticket

If you’ve booked an award ticket with Air Canada and more than 24 hours have passed, the cancellation fee is $0 – $150 (depending on the fare type) for those who cancel via aeroplan.com and $0 – $175 (depending on the fare type) for those who cancel via an Aeroplan contact center.

Those with top-tier Altitude Super Elite 100k status with Air Canada will not be charged cancellation fees.

Hot Tip: Looking for even more information about canceling award tickets? Explore our guide on canceling award tickets , including information on over 30 carriers, to learn more.

As with cancellations, all customers will have 24 hours from their original booking to change their reservation without being charged a fee, regardless of the fare selected.

Air Canada does not allow flight changes for those with basic economy tickets after the initial 24-hour window.

Standard, Lowest Premium Economy, and Lowest Business Class Fares

For Standard, Lowest Premium Economy, and Lowest Business class fares, after the 24-hour window has passed, Air Canada charges a change fee of $100. You must pay the price difference if you’re changing to a more expensive option.

Flex, Comfort, Latitude, Flexible Premium Economy, and Flexible Business Class Tickets

If you purchased a Flex, Comfort, Latitude, flexible premium economy, or flexible business class ticket, you can change your ticket without being charged any additional fee. You must pay the price difference if you’re changing to a more expensive option. If you’re changing to a cheaper flight, the difference in fare will be refunded to your original payment method.

If you need to make a change to your award ticket, you can do so up to 2 hours before the flight departs — but you will be charged a fee depending on the fare class. The fee is $100 per direction for all ticket types. Those with Altitude Super Elite 100k will not be charged a fee.

Same-Day Change

The Air Canada fees for same-day changes are as follows:

- Basic Economy: not permitted

- Standard Fares: $150 ($100 for routes between Toronto and JFK, LaGuardia, or Newark airports)

- Flex and Lowest Premium Economy Fares: $75

- Comfort, Latitude, Flexible Premium Economy, and Business Class: $0

- Award Tickets: $100 per direction for all ticket types (those with Altitude Super Elite 100k will not be charged a fee)

Step 1: Log into your account on Air Canada’s homepage and select Manage Bookings .

Step 2: Select the booking you wish to cancel and click the Cancel Booking link.

Step 3: Once you have confirmed and finalized your cancellation, a confirmation email will be sent to the email you provided at the time of booking, and you’ll receive a voucher for any remaining funds after any potential cancellation fees.

Electronic travel vouchers are issued in the form of an email. Within the letter is your 13-digit electronic travel voucher number. Vouchers are transferable, and you can transfer the total or partial value of your electronic travel voucher to another person by calling Air Canada Reservations when you are ready to make a new reservation.

You can redeem your electronic travel voucher when you complete a booking on the Air Canada website by selecting a voucher as your payment method on the payment screen and then entering the voucher number.

If you’re worried that you may need to cancel your flight and want to make sure you can get a refund, a refundable ticket will be your best option, albeit more expensive.

Having to deal with canceling a flight can be difficult enough as it is, but knowledge is power (as are credit cards that provide compensation ). Be certain to review fare rules closely so that you know your options at the time of booking and if you need to cancel.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Our Bloggers

Select Page

Changes to the Air Canada Travel Voucher

Posted by Maple Miles | Jun 9, 2023 | Airlines , Commentary , Travel Tips | 0

Air Canada Travel Voucher (Prior to June 2023)

Since COVID-19, many airlines have imposed a flexible change and cancellation policy, despite most tickets being non-refundable. Most airlines offer the ability to cancel a reservation and receive a travel voucher for a future booking. This allowed many customers to re-book existing flights at a lower price if prices were to drop. Air Canada made it slightly difficult, by processing vouchers within six weeks of the cancellation. If you were looking to cancel and re-book because you found a lower fare, you could not use the same voucher for the new reservation. Instead, you had to spend more money and use the Air Canada travel voucher for another future reservation.

Despite the limitation, I personally leveraged this travel voucher on multiple occasions throughout the pandemic. I was able to book tentative flights knowing I could cancel for a voucher. In addition to that, I could book discounted fares with change fees, knowing that I would rather cancel for a full voucher than change my flight. However, I can imagine, a policy like this was detrimental to Air Canada. I’m sure Air Canada found their frequent flyers paying for tickets with change fees, knowing, that they will not pay a change fee if they cancel their reservation.

Fare Classes on Air Canada

When you typically book a flight within North America, you are often presented with the following fare classes :

- Basic (Economy)

- Standard (Economy)

- Flex (Economy)

- Comfort (Economy)

- Latitude (Economy)

- Lowest (Premium Economy)

- Flexible (Premium Economy)

- Lowest (Business Class)

- Flexible (Business Class)

Air Canada Fare Class

The most restrictive fare category has always been the Basic Economy Class fare. The Basic Economy Class fare did not allow any voluntary changes. If Air Canada made a voluntary change , that could often work in your favor. The changes to the Air Canada travel voucher have no impact to the Basic Economy Class fare hack. I will continue to book Basic Economy Class fares when my travel is in the future. I am very confident that Air Canada will make a schedule change that will allow me to refund the reservation if necessary.

The following fare classes have a change fee of $100, which impacts the travel voucher changes the most:

- Standard (Economy),

- Lowest (Premium Economy),

In the future, if you book those fare classes, and want to change your flight, you will have to pay the $100 change fee as shown below.

Air Canada Travel Voucher (Ongoing)

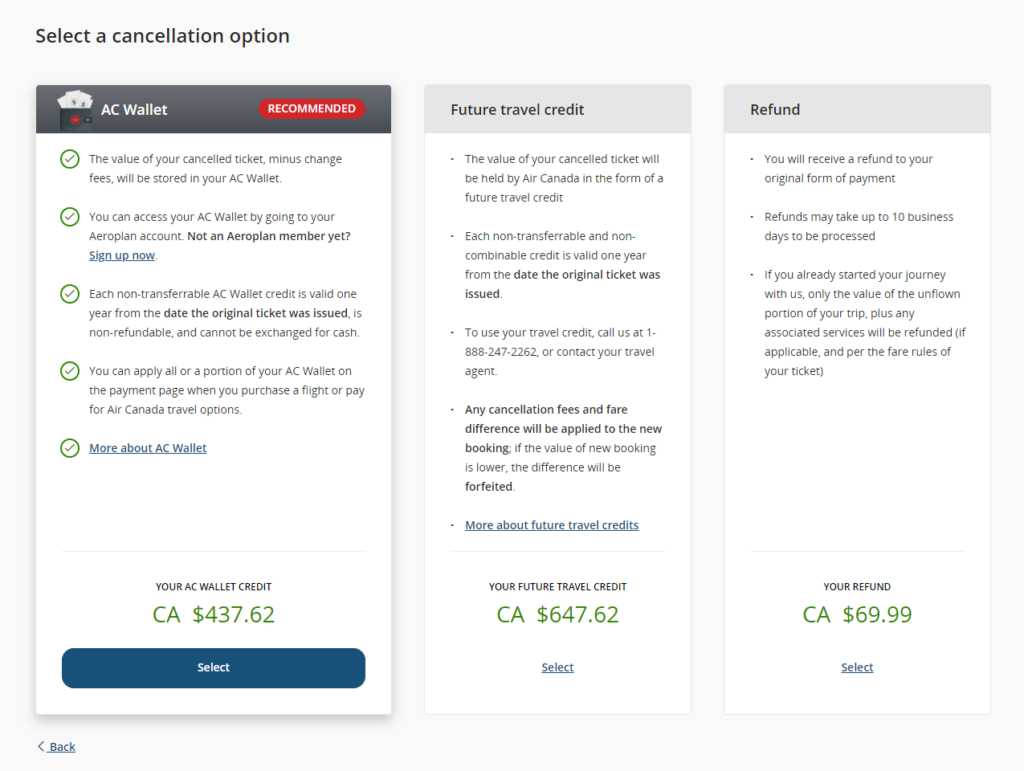

In the picture below, I had paid $647.62 for my flight reservation. I booked Standard (Economy) and Lowest (Business Class) thinking I could obtain a voucher if my travel plans were to change. When I go to cancel the ticket, I see the following options:

Air Canada Cancellation Options

You might be fooled into believing that you should take the future travel credit. After all, the future travel credit was for the full amount. However, the last bullet point explicitly states

Any cancellation fees and fare difference will be applied to the new booking : if the value of new booking is lower, the difference will be forfeited

Previously, you could use the future travel credit across multiple reservations. Now it has to be used in one single reservation and cannot be used by anyone else other than the originally ticketed passenger. That is a massive change that will influence how you purchase revenue tickets going forward.

To receive a full voucher in the event of a cancellation, you have to purchase Flex (Economy) or Flexible (Premium Economy, or Flexible (Business Class). Purchasing a flexible ticket in Premium Economy and Business Class is redundant; you can always do a full refund back to your credit card for flexible tickets.

Let’s be honest, this policy change helps Air Canada. Air Canada on the other hand are hoping for a behavior change. Personally, Air Canada has succeeded in a behavior change. Going forward, I will only be booking flex for myself or the basic fare if I am booking in advance for others.

What’s the worst part of these changes?

The changes are retro-active. This means even if you purchased tickets in the past, expecting a very generous Air Canada travel voucher, you will now have the same restrictive policies applied.

I think it is safe to say; this is the end of Air Canada’s COVID-19 flexible travel policy. Going forward, with rising demand of travel, we are back to pre-COVID policies.

Air Canada, thank you. It was great while it lasted.

Join our mailing list to receive the latest news and updates from our team.

You have successfully subscribed, maple miles.

Hello Hello, this is Moli! Welcome to Maple Miles. A tech professional on a weekday, and a global traveler outside of work. I manage my entire family's travel, connecting us across the globe, between Canada (Vancouver is home, for now), India and whatever country comes in between. I love water, so you might always find me either dreaming of a beach, or actually at a beach in my free time.

More Posts from Maple Miles

Oh, Hello from Maple Miles

March 8, 2023

Best Ways to Earn Free WestJet Flights

March 9, 2023

WestJet Companion Voucher: How to earn them?

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Most Popular Posts

Our Authors

The Unaccompanied Flyer

Travel Gadget Reviews

The Flight Detective

Takeoff To Travel

The Hotelion

Bucket List Traveler

MJ on Travel

The Points Pundit

Family Flys Free

Recent Reviews

- St Regis Cairo Review – A perfect stay Score: 100%

- Six Passengers in Two Business Class Seats in Gulf Air Score: 90%

- Review: Hyatt Place Waikiki Score: 83%

- Review: Hyatt Centric Waikiki Score: 81%

- Gulf Air Business Class from Mumbai to Bahrain Score: 65%

Where travel agents earn, learn and save!

No data found

News / air canada vacations updates guidelines for future travel credit.

ACV has updated policies in wake of coronavirus crisis

April 20 - Air Canada Vacations has made changes to its policies, including changes to guidelines for future travel credits, in the wake of the coronavirus pandemic.

ACV says it has extended the validity of its future travel credits, plus passengers have the option to transfer the credit to another person, and the ability to keep the leftover value of the credit resulting from a fare difference.

Nino Montagnese, ACV’s Managing Director, says: “ Our travel partners have always been a vital link with our mutual customers. While we’ve all had to adapt rapidly to our new realities, Air Canada Vacations’ goal remains to work in tandem with travel agents to meet the evolving needs of our customers. ”

Montagnese says that in order to better support its retail partners, and with agent feedback, “ we’ve increased the flexibility of our future travel credits and made our procedures easier. ”

He adds; “ I know these are uncertain times and I want to thank our travel partners for their support, commitment and expertise, all of which I witness personally everyday .”

Here’s a look at the changes:

Automatic extension of future travel credit validity

Transfer a future travel credit to another person, residual value on future travel credits, cruise and group bookings.

More detailed information on each of the changes as well as updates to all of ACV’s procedures can be accessed through an agent’s ACV&ME account.

Source: Travelweek

More Travel News:

Porter Airlines accessing Canada’s federal wage subsidy program How travel demand changed after weeks of lockdowns TIAC Tourism Advocacy Update Here’s a roundup of highlights from ACTA’s emergency financial assistance webinar

Latest News

Calling all the cigar aficionados

Live Havana from another dimension...

Less than two years after launch, ...

Grenada Tourism Authority welcomes...

Latest post.

- ACV’s 2024-25 Digital Sun Guide key to ‘Vacation Mood’ campaign

- Air Canada Vacations launches new Colombia program

- Air Canada Vacations brings back Travel Advisory Board

- Registration opens for ACV’s 2024/2025 #ACVDreamMakers roadshow

- ACV has 37 destinations, 100+ daily departures for winter 2024/2025

- Air Canada Vacations’ Chill Out Pride event is back

- Air Canada Vacations extends Aeroplan Points program

- Air Canada Vacations unveils new guided tours to Dubai

- Air Canada Vacations enhances self-service tools for travel advisors

- ACV launches first Travel Agent Toolkit for Asia & Australia

- Book ACV’s Europe tours and packages for chance to win a Portugal FAM

- Air Canada Vacations expands Europe offering for 2024

- Air Canada inaugurates newest Pacific route from Vancouver to Singapore

- ACV enhances cruise shopping experience for agents

- ACV showcases Air Canada’s upcoming Tulum service with FAM

- Air Canada Vacations welcomes new Sales team members

- ACV launches new tour packages to Australia

- Key takeaways from ACV’s 2024 Europe Breakfast Seminars

- Air Canada Vacations celebrates one year anniversary of ACV@Home Program

- Air Canada Vacations expands summer lineup with more sun options

- S Hotels Jamaica now part of ACV portfolio

- Air Canada Vacations launches Asia guided tours packages

- Air Canada Vacations adds Grenada and Saint Vincent & the Grenadines to summer lineup

- Air Canada Vacations’ 2024 Europe Travel Agent Toolkit is here

- ACV’s VP Nino Montagnese has an update for agents

- Group Quoting Tool now available with Air Canada Vacations

- Air Canada Vacations expands Aeroplan offering with new destinations

- Windjammer Landing Villa Beach Resort available through ACV

- ACV expands Aeroplan earning system, celebrates #ACVDreamMakers award winners

- ACV celebrates its winter 2023/24 launch with travel advisor partners

Subscribe to our newsletter

- Skip to main content

- Skip to "About this site"

Language selection

- Search and menus

Canada Jetlines Air passengers - Important information about cessation of air operations

If you are affected by Canada Jetlines' cessation of air operations, the Canadian Transportation Agency (CTA) suggests the following:

- Passengers who have purchased a ticket for future travel with Canada Jetlines should contact their travel agent or transportation provider as soon as possible to see if it is possible to make alternative arrangements. If not, they may need to secure their own alternative travel arrangements.

- Passengers who paid for their tickets by credit card should contact their credit card company to see what they are eligible for.

- If travel insurance was purchased, passengers should contact the insurance company to see if their coverage includes such circumstances.

- If passengers purchased their travel arrangements from a travel agent that is registered in Ontario, Quebec or British Columbia, they may be eligible for a refund from the provincial government authorities responsible for travel. Those authorities are the following:

Ontario Travel Industry Council of Ontario (TICO) Tel.: 1-888-451-8426 Email: [email protected] https://tico.ca/

Quebec Office de la protection du consommateur Tel.: 1-888-672-2556 https://www.opc.gouv.qc.ca/en/

British Columbia Consumer Protection BC Tel.: 1-888-564-9963 Start a complaint http://www.consumerprotectionbc.ca/

The top 11 credit cards with annual travel statement credits

Editor's Note

Travel rewards credit cards entice new cardholders with flashy welcome offers and waived annual fees during the first year. They can also help you beat rising travel costs due to inflation.

However, many premium rewards cards on the market also offer ongoing travel benefits. These perks include airport lounge access and Global Entry or TSA PreCheck application fee reimbursements, as well as annual statement credits toward travel purchases.

These can be especially useful for stays at boutique hotels that aren't part of a major loyalty program or even when using ride-hailing apps to get from your hotel back to the airport.

Credit card travel credits can vary from a flat $300 per year for a wide variety of travel purchases — as you get with the Chase Sapphire Reserve® — to up to $200 per calendar year as a statement credit specifically for non-ticket airline incidentals on your selected carrier with The Platinum Card® from American Express (enrollment is required; terms apply).

In this guide, we'll walk through which credit cards have annual travel credits and how flexible they are for hotels, flights and everything in between.

Overview of cards with annual travel credits

Multiple credit cards offer annual travel credits, which can help offset portions of a trip where cash is required.

However, the rules for using these credits can vary by card. Let's look at the amount of credit you can receive on each card and its welcome bonus before exploring the details of what you can and can't use these credits for each year.

The information for the Premium Rewards Elite, Citi Prestige, Hilton Amex Aspire, Ritz-Carlton and U.S. Bank Altitude Reserve cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

American Express Gold Card

The Amex Gold is generally recommended for foodies, but it provides some useful travel benefits as well.

Annual travel credit: Up to $120 in Uber Cash each calendar year — up to $10 monthly delivered in the form of Uber Cash that can be used on U.S. Uber rides and Uber Eats purchases, making the credits exceptionally versatile. Enrollment is required; terms apply.

Current welcome offer: Earn 60,000 bonus points after spending $6,000 on eligible purchases with your card within the first six months of card membership. Plus, receive 20% back in statement credits on eligible restaurant purchases (up to $100) within the first six months of card membership. Offer ends 11/6.

You might be eligible for a higher targeted offer via the CardMatch tool ; offers are subject to change anytime.

Annual fee: $325

Other benefits: Amex Gold cardmembers earn 4 points per dollar at restaurants (on the first $50,000 in purchases per calendar year; then 1 point per dollar) and at U.S. supermarkets (on up to $25,000 in purchases each calendar year, then 1 point per dollar), 3 points per dollar on flights booked directly with airlines or on amextravel.com, 2 points per dollar on prepaid hotels and other eligible purchases booked through amextravel.com and 1 point per dollar on other eligible purchases.

This card earns Membership Rewards points, which you can transfer to a total of 21 airline and hotel partners . As a cardmember, you can earn up to a total of $10 in statement credits monthly (up to $120 in annual dining statement credits each calendar year) when you pay with the Amex Gold at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com and Five Guys. Enrollment is required; terms apply.

You can also earn up to $84 per calendar year (up to $7 per month) in statement credits for Dunkin' Donuts purchases in the U.S. and up to $100 per calendar year (up to $50 biannually) for purchases made at Resy-affiliated restaurants in the U.S. and on other eligible Resy purchases. Enrollment is required; terms apply.

To learn more, read our full review of the American Express Gold .

Apply here: American Express Gold Card

Bank of America Premium Rewards Credit Card

With the opportunity to earn elevated rewards if you're a member of the Bank of America Preferred Rewards® program, the Bank of America Premium Rewards can be a strong addition to a traveler's wallet.

Annual travel credit: Up to $100 in statement credits for airline incidentals like checked bags, seat selection or upgrades each year.

Current welcome offer: Receive 60,000 bonus points after spending at least $4,000 in the first 90 days of account opening.

Annual fee: $95

Other benefits: The Bank of America Premium Rewards card has a solid rate of return. Cardholders earn 2 points per dollar on travel and dining and 1.5 points per dollar on everything else.

You can boost your earnings from 25% to 75%, depending on how much you have in deposits with Bank of America and Merrill through the Bank of America Preferred Rewards program .

Points can be redeemed for statement credits, gift cards and purchases through the Bank of America Travel Center or as a deposit to a Bank of America account at a rate of 1 cent apiece. The card waives foreign exchange fees and will reimburse cardholders for a Global Entry or TSA PreCheck application fee once every four years (up to $100).

To learn more, read our full review of the Bank of America Premium Rewards credit card .

Apply here: Bank of America Premium Rewards Credit Card

Bank of America Premium Rewards Elite Credit Card

Despite its hefty annual fee, the Bank of America Premium Rewards Elite can be worth considering for anyone heavily invested in the Bank of America ecosystem.

Annual travel credit: Up to $300 in statement credits for airline incidentals like checked bags, seat selection or upgrades each year.

Current welcome offer: Receive 75,000 bonus points after spending at least $5,000 in the first 90 days of account opening.

Annual fee: $550

Other benefits: The Bank of America Premium Rewards Elite card mirrors the earning rates on the Premium Rewards card: 2 points per dollar on travel and dining and 1.5 points per dollar on everything else.

If you're a Bank of America Preferred Rewards member, you can earn an additional 25% to 75% bonus points on purchases, depending on how much you have in deposits with Bank of America and Merrill. Points can be redeemed for statement credits , gift cards and purchases through the Bank of America Travel Center or as a deposit to a Bank of America account at a rate of 1 cent apiece.

Cardholders also receive a 20% discount when paying for airfare with points through the Travel Center and up to $100 in reimbursement for Global Entry or TSA PreCheck application fees once every four years.

Finally, cardholders can receive up to $150 in statement credits annually for eligible purchases, such as video streaming services, food delivery and ride-hailing services.

Related: The best premium credit cards: A side-by-side comparison

The Business Platinum Card from American Express

If you own a business with a high monthly expenditure, the Amex Business Platinum is a great card to consider.

Annual travel credit: Up to $200 in statement credits on airline incidental fees charged by the carrier on one select airline each calendar year.

Current welcome offer: Earn 150,000 bonus points after spending $20,000 on eligible purchases within the first three months of card membership.

Annual fee: $695

Other benefits: The Amex Business Platinum offers similar benefits as the personal version and some great additional ones.

The card offers annual statement credits to cardmembers for business and travel expenses with companies like Dell, Adobe and Clear Plus every calendar year.

Cardmembers can earn 5 Membership Rewards points per dollar on flights and prepaid hotels booked through Amex Travel, 1.5 points per dollar on eligible purchases in select business categories and eligible purchases of $5,000 or more on up to $2 million of these purchases per calendar year and 1 point per dollar on everything else.

Cardmembers also receive a 35% rebate when redeeming points for airfare booked through Amex Travel (up to 1 million points per calendar year) on their selected qualifying airline or for business- or first-class tickets on any airline.

Enrollment is required for select benefits; terms apply.

To learn more, read our full review of the Amex Business Platinum .

Apply here: The Business Platinum Card from American Express

Capital One Venture X Rewards Credit Card

The Capital One Venture X is one of the best premium travel cards on the market right now.

Annual travel credit: $300 in annual credits for bookings made through the Capital One Travel portal .

Current welcome offer: Earn 75,000 bonus miles after spending $4,000 on purchases in the first three months from account opening.

Annual fee: $395 (see rates and fees )

Other benefits: The Capital One Venture X is a premium credit card that has garnered attention in the points and miles world. Cardholders earn 10 miles per dollar on hotel and car rentals booked through Capital One Travel, 5 miles per dollar on flights booked through Capital One Travel and 2 miles per dollar on all other eligible purchases.

Capital One miles transfer to 15-plus airline and hotel loyalty programs, such as Air Canada Aeroplan , British Airways Executive Club and Turkish Airlines Miles&Smiles .

Other Venture X benefits include unlimited access to Capital One and Priority Pass lounges , a Global Entry or TSA PreCheck statement credit, the ability to add a number of authorized users for free (and share those lounge benefits; see rates and fees ), 10,000 bonus miles as an anniversary bonus every year and more.

To learn more, read our full review of the Capital One Venture X .

Apply here: Capital One Venture X Rewards Credit Card

Chase Sapphire Reserve

The Chase Sapphire Reserve is one of the most popular credit cards we recommend here at TPG, and for good reason.

Annual travel credit: $300 annual travel credit as reimbursement for a broad range of travel purchases charged to your card each account anniversary year.

This credit will apply automatically to the first $300 spent on travel, and purchases covered by this credit don't qualify for bonus points-earning rates.

Current welcome offer: Earn 60,000 bonus points after spending $4,000 on purchases in the first three months from account opening.

Other benefits: The Chase Sapphire Reserve is widely considered to be one of the best all-around travel rewards credit cards, thanks to its slate of chart-topping benefits.

In addition to that annual travel statement credit, cardholders earn 10 points per dollar on car rentals and hotels booked through Chase Travel℠, 10 points per dollar on Lyft rides (through March 2025), 5 points per dollar on flights booked through Chase Travel, 3 points per dollar on other travel and dining worldwide and 1 point per dollar on everything else.

Ultimate Rewards points transfer to 11 airline partners, including Southwest and Air Canada, and three hotel partners , including Hyatt, IHG and Marriott. Points may also be redeemed directly through Chase Travel for 1.5 cents apiece.

Cardholders can access Priority Pass lounges and be reimbursed up to $100 once every four years for a Nexus, Global Entry or TSA PreCheck application fee.

Other benefits include a complimentary two-year Lyft Pink membership (when activated by Dec. 31), a complimentary DashPass from DoorDash (when activated by Dec. 31, 2027) and a range of travel protections.

To learn more, read our full review of the Chase Sapphire Reserve .

Apply here: Chase Sapphire Reserve

Citi Prestige Card

Although the Citi Prestige is no longer open to new applicants, existing cardholders can take advantage of its travel benefits.

Annual travel credit: Up to $250 worth of annual travel statement credits each calendar year toward travel purchases, including airline tickets, hotel stays, car rentals, commuter transportation, subways, taxis, train tickets and more. This credit applies automatically.

Current welcome offer: The card is no longer available to new applicants.

Annual fee: $495

Other benefits: If you're a Citi Prestige cardholder, you earn an incredible 5 points per dollar at restaurants, on air travel and with travel agencies. Cardholders also earn 3 points per dollar at hotels and on cruise lines and 1 point per dollar on all other purchases.

Citi ThankYou points transfer to 20 airline and hotel partner programs , including Air France-KLM Flying Blue, Virgin Atlantic Flying Club and Wyndham Rewards.

As a cardholder, you can enter Priority Pass lounges and receive the fourth night free on up to two hotel stays per year when booking through Citi concierge or at ThankYou.com.

With this card, you won't pay foreign transaction fees, and you can receive Global Entry or TSA PreCheck application fee reimbursement once every five years.

Learn more: Citi Prestige

Hilton Honors American Express Aspire Card

The Hilton Amex Aspire is Hilton's top-of-the-line credit card. It offers a range of benefits for avid Hilton fans.

Annual travel credit: Up to $400 per calendar year (up to $200 semi-annually) on eligible purchases made with Hilton Resorts and up to $200 on flight purchases made directly with the airline or through Amex Travel per calendar year (up to $50 per quarter). Enrollment is required; terms apply.

Current welcome offer: Earn 150,000 bonus points after spending $6,000 in purchases on the card within the first three months of card membership.

Other benefits: The Hilton Honors Aspire earns a whopping 14 points per dollar on Hilton purchases , 7 points per dollar on flights booked through Amex Travel or directly with airlines, on car rentals and at U.S. restaurants and 3 points per dollar on everything else.

The Hilton Amex Aspire offers automatic top-tier Hilton Honors Diamond status and an annual free night reward . Cardmembers also get up to $100 in credits for qualifying charges at participating Waldorf Astoria Hotels & Resorts and Conrad Hotels & Resorts when booking two-night-minimum stays by phone. Enrollment is required for select benefits; terms apply.

Learn more: Hilton Honors American Express Aspire

The Platinum Card from American Express

Prospective cardmembers may raise their eyebrows at its annual fee, but the Amex Platinum comes with a wide range of benefits to justify its cost.

Annual travel credit: Up to a $200 statement credit on airline incidental fees with your preferred airline each calendar year. Unfortunately, airfare itself does not count per the terms. Cardmembers can also score up to $200 in annual Uber Cash every calendar year (for U.S. services, up to $15 per month Jan. - Nov. and up to $20 in Dec.) after adding their Card in the Uber app.

Current welcome offer: Earn 80,000 bonus points after spending $8,000 in the first six months. You may be eligible for a higher targeted offer via the CardMatch tool ; offers are subject to change at any time.

Other benefits: The Amex Platinum Card has plenty of perks to justify its high annual fee. Cardmembers earn 5 points per dollar on airfare booked directly with an airline or through American Express Travel (on up to $500,000 on these purchases per calendar year, then 1 point per dollar), 5 points per dollar on prepaid hotels booked through American Express Travel and 1 point per dollar on everything else.

This card earns Membership Rewards points, which you can transfer to a total of 21 airline and hotel partners. Cardmembers can also receive up to $200 in annual credits for certain hotel bookings every calendar year, an up to $199 reimbursement for their annual Clear Plus membership fee each calendar year and a statement credit for a Global Entry ($100, every 4 years) or TSA PreCheck (up to $85, every 4½ years) application fee . Enrollment is required for select benefits; terms apply.

The card gets you into Centurion Lounges and offers Priority Pass lounge access , plus Delta Sky Club access when you're on a same-day Delta flight (limited to 10 annual visits from Feb. 1, 2025). At hotels, enjoy value-added benefits when booking stays through Amex Fine Hotels + Resorts plus Gold status with Hilton Honors and Gold Elite status with Marriott . Enrollment required for select benefits.

To learn more, read our full review of the Amex Platinum .

Apply here: The Platinum Card from American Express

Ritz-Carlton Rewards Credit Card

Although the Ritz-Carlton card is no longer open to new applicants, it is possible to product-change to this card from one of Chase's Marriott Bonvoy cobranded cards.

Annual travel credit: Up to $300 in credits for airline lounge day passes or membership, airline seat upgrades, airline baggage fees, inflight Wi-Fi/entertainment or inflight meals. You will need to message Chase to manually request these credits.

Current welcome offer: No longer open to new applicants.

Annual fee: $450

Other benefits: The Ritz-Carlton Card offers more to travelers than just the $300 in annual travel credits. Additional benefits include an annual free night award worth up to 50,000 points, a Priority Pass Select membership and Gold Elite status with Marriott Bonvoy .

Cardholders also can be reimbursed for their application fees for Global Entry or TSA PreCheck every four years and receive a $100 hotel credit toward dining, spa treatments or other hotel recreational activities on paid stays of two nights or longer at Ritz-Carlton and St. Regis properties.

Related: Best Marriott credit cards

U.S. Bank Altitude Reserve Visa Infinite Card

The U.S. Bank Altitude Reserve is an underrated premium travel card and a great choice for those who want to keep their wallet simple.

Annual travel credit: Up to $325 in statement credits per cardmember year for purchases made directly with airlines, hotels, car rental companies, taxis, limousines, passenger trains and cruise lines. It can also be applied to restaurants (plus takeout and delivery) and fast-food and bar purchases.

Current welcome offer: Earn 50,000 bonus points after spending $4,500 within 90 days of account opening.

Annual fee: $400

Other benefits: U.S. Bank Altitude Reserve Visa cardholders earn 5 points per dollar on prepaid hotel bookings and car rentals made through the Altitude Rewards Center, 3 points per dollar on travel and eligible mobile wallet purchases and 1 point per dollar on everything else.

Cardholders can redeem points for 1.5 cents apiece on airfare, hotels and car rentals booked through the Altitude Rewards Center and for lower values for other purchases. If used mostly for travel, your rate of return is a considerable 4.5% on most purchases.

As a cardholder, you'll also enjoy eight Priority Pass passes for airport lounge access, reimbursement for a Global Entry or TSA PreCheck application fee every four years and waived foreign transaction fees .

Learn more: U.S. Bank Altitude Reserve Visa Infinite Card

Bottom line

Whether you prefer a travel rewards card that earns transferable points , a cobranded hotel card or a card that earns fixed-value points, some phenomenal options offer annual travel statement credits.

Picking one of them will ensure you continue to get value from your credit card long after you've earned its welcome bonus and paid its annual fee.

Related: 12 credit cards that can get you $1,000 or more in first-year value

For rates and fees of the Amex Platinum, click here . For rates and fees of the Amex Business Platinum, click here . For rates and fees of the Amex Gold, click here .

Canada Jetlines grounds all flights, plans to file for creditor protection

Airline says it could not raise the financing needed to keep flying.

Social Sharing

Canada Jetlines is grounding all flights and says it is temporarily ceasing airline operations effective immediately, making it the latest carrier to signal distress within Canada's troubled commercial airline industry.

The airline, which flew mainly to sun destinations out of Toronto, said Thursday it has been unable to find the capital needed to stay afloat and plans to file for creditor protection.

"The company ... pursued all available financing alternatives including strategic transactions and equity and debt financings," said spokeswoman Erica Dymond in a release.

"Unfortunately despite these efforts, the company has been unable to obtain the financing required to continue operations at this time."

Passengers with existing bookings should contact their credit card company to secure refunds, the company said. "Every effort is being made to assist passengers at this time."

The shutdown follows the resignation of four executives on Monday, including CEO Brigitte Goersch.

It marks yet another airline departure from Canadian skies after the closure of Lynx Air and budget carrier Swoop within the past year.

Canada Jetlines, which is headquartered in Mississauga, Ont., serves Canadians flying within the country or to destinations in the U.S., Caribbean and Mexico. It launched its first flight in September 2022.

The carrier provides charter flights to sports teams and companies and leases its fleet to other carriers in the summertime. Its former CEO Eddy Doyle characterized it as leisure airline, though it was originally conceived as an ultra low-cost carrier.

That business model was ultimately shelved, partly because the starting price for discount carriers in Canada "is composed of a lot of taxes," and partly due to the challenges of competing with Air Canada and WestJet, Doyle told CBC News in February.

Why is it so much more expensive to travel by air in Canada?

At the time, Doyle said he thought there was "enough supply there to meet demand for the Canadian travelling public," with Air Canada, WestJet and Air Transat back at full-strength following the disruptions prompted by the COVID-19 pandemic.

But he added that any new entrants would be fighting for the same portion of the market.

Canada Jetlines, which has struggled to get more than a handful of planes off the ground since its inaugural flight in September 2022, faced a series of hiccups even before this week's turbulence.

Even its initial launch, announced for December 2019, was postponed when company announced that fall it was laying off most employees after failing to secure the required financing and losing investment partners.

In January 2023, Canada Jetlines pressed pause on domestic routes as the carrier refocused on sun destinations and leasing its planes, but said at the time it aimed to resume in-country flights that fall.

That setback came after seven years of fundraising and despite Ottawa lifting the foreign ownership ceiling on Canadian airlines to 49 per cent from 25 per cent in 2018, allowing for a wider pool of investors.

Canada Jetlines lost $14.2 million over the 12 months between March 2023 and last March, despite eking out a profit in one of the quarters, according to financial filings. Quarterly revenues ranged between $8 million and $12 million.

In May, the company secured a $2-million loan from Square Financial Investment Corp., a Mississauga-based holding company owned by board member Reg Christian, who was named executive vice-president as a result. The loan is one of several taken out by Canada Jetlines over the past two years.

As recently as May 10, the company said in financial statements it planned to grow to seven planes by year's end and 15 aircraft by 2026.

And in June, Doyle announced his retirement three-and-a-half years after joining the company. Goersch then took over as chief executive.

'It's a sign of the times'

Aviation expert John Gradek told CBC News that the airline had "been on the edge for months."

"When you look at their pattern of operations and their pattern of funding ... to me it was a surprise that they didn't get their licence pulled by Transport Canada earlier," said Gradek.

"These guys had six airplanes and a couple hundred people, and they were just going month-to-month, trying to scramble and get as much cash as they possibly could to meet the payroll and the lease cost on the airplane[s]," Gradek said.

- As Lynx heads to the discount airline graveyard, what options do travellers have?

He said it was only a matter of hours after the executive exodus on Monday that the airline would collapse.

"It's a sign of the times. We have a problem in terms of commercial aviation in Canada," Gradek added.

"People were spending five, six, $700 to buy a ticket on an airline that, in my opinion, was on pretty shaky ground. That, to me, is a failing of our transportation policy [and] practices."

Trading of company shares on the NEO Exchange was halted late yesterday afternoon.

With files from CBC's Jenna Benchetrit, Reid Southwick and Nisha Patel

Related Stories

- Play makes Canadian debut with flights to Europe amid discount airline ups and downs

- WestJet shutting down discount airline Swoop

- Credit Cards

- Best Travel Credit Cards

15 Best Travel Credit Cards Of August 2024

Expert Reviewed

Updated: Aug 15, 2024, 10:32am

For anyone who travels enough to have a travel savings account, credit cards are a valuable resource toward booking and paying for your trip. The rewards can offset a huge portion of your out-of-pocket expenses, and the best travel credit cards often pay for themselves both in savings and avoided headaches.

Why you can trust Forbes Advisor

Our editors are committed to bringing you unbiased ratings and information. Our editorial content is not influenced by advertisers. We use data-driven methodologies to evaluate financial products and companies, so all are measured equally. You can read more about our editorial guidelines and the credit card methodology for the ratings below.

- 113 countries visited

- 5,500 hotel nights spent

- 93,000,000 miles and points redeemed

- 29 loyalty programs covered

Best Travel Rewards Credit Cards

- Chase Sapphire Preferred® Card : Best Travel Credit Card for Beginners

- Citi Strata Premier℠ Card : Best Everyday Earnings with Travel Redemptions

- Capital One Venture Rewards Credit Card : Best Flat-Rate Rewards Credit Card for Travel

- Wells Fargo Autograph Journey℠ Card : Best Travel Earnings Without a Portal

- American Express® Green Card * : Best Midrange Travel Card with Lounge Access

- Capital One Venture X Rewards Credit Card : Best Premium Travel Rewards Card

- Chase Sapphire Reserve® : Best Travel Credit Card for International Travel

- The Platinum Card® from American Express : Best Travel Rewards Card for Lounge Access

- American Express® Gold Card : Best Travel Rewards Earnings for Foodies

- U.S. Bank Altitude® Reserve Visa Infinite® Card * : Best Premium Perks with Simple Redemptions

- Chase Freedom Flex® : Best Intro APR Travel Card

- Bilt World Elite Mastercard® : Best Flexible Rewards Without an Annual Fee

- Capital One VentureOne Rewards Credit Card : Best No Annual Fee Card with Flat-Rate Rewards

- United Quest℠ Card : Best Airline Credit Card

- The World of Hyatt Credit Card : Best Hotel Credit Card

- Best Credit Cards Of 2024

- Credit Cards With Travel Insurance

- Best Hotel Credit Cards

- Best Credit Card For Lounge Access

- Best No-Annual-Fee Cards For Travel

- Best Airline Credit Cards

Best Travel Card Offers

Best travel credit card for beginners, chase sapphire preferred® card.

Up to 5x Reward Rate

Earn 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all Read More

Welcome Bonus

60,000 bonus points

Regular APR

21.49%-28.49% Variable

Credit Score

Excellent, Good (700 - 749)

I jumped at the chance to get the Chase Sapphire Preferred® Card when it was first launched. More than a decade later, I’m still a loyal cardholder. It’s the ideal starter card for someone dipping their toe into travel rewards and I’m living proof you may never need to upgrade. Cardholders earn valuable Chase Ultimate Rewards® points for access to transfer partners or for easy, no-strings-attached redemptions through Chase Travel℠. There’s no foreign transaction fee and a wide selection of travel insurances.

Why We Like It

For a modest annual fee of $95 (which can be partially offset with an annual $50 hotel credit for bookings through Chase Travel℠) you get a rare mix of high rewards rates and redemption flexibility.

What We Don’t Like

The highest earning rate requires making reservations through Chase Travel℠, which doesn’t include direct bookings or online travel agencies.

Who It’s Best For

This card is best for travelers who want to earn transferable points without a steep annual fee.

It’s the granddaddy of travel credit cards, but it still earns its reputation as one of the best around with solid bonus categories, strong travel protections, a great set of domestic and international transfer partners and a reasonable annual fee to boot. You can’t go wrong with it as your first travel credit card.

- Earn high rewards on several areas of spending

- Transfer points to travel partners at 1:1 rate

- Many travel and shopping protections

- No intro APR offer

- Best travel earning rates are only for bookings through the Chase Travel℠ portal

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027.

- Member FDIC

Best Everyday Earnings with Travel Redemptions

Citi strata premier℠ card.

Up to 10X Reward Rate

Earn 10 points per dollar spent on hotels, car rentals and attractions booked on CitiTravel.com, 3 points per dollar at Read More

70,000 bonus points

21.24% - 29.24% (Variable)

Excellent, Good

The Citi Strata Premier℠ Card slides right into everyday life, with earning categories that reflect typical expenses at home as well as rewarding you for your travel spending—then giving you the opportunity to redeem toward travel.

This card could be a supreme fit for someone looking for a one-card solution, thanks to a low annual fee, access to transferable points and a variety of accelerated earn categories. It also offers a $100 annual hotel benefit which can be applied toward eligible stays reserved through Citi Travel to save you even more money. Select travel protections are also included.

Citi makes you jump through some hoops to access card benefits. You’ll need to book through the card’s proprietary booking portal to maximize your travel earnings and to use your annual hotel benefit.

The Strata Premier makes the most sense for travelers seeking a modest annual fee and a card that rewards varied spend.

Several key travel benefits were recently reintroduced on the Citi Strata Premier℠ Card, including trip delay and cancellation protections and lost baggage and rental car damage coverage. But the card still retains all its original features and its relatively low $95 annual fee. The highlight of the Citi Strata Premier continues to be its ability to earn 3 points for every dollar you spend on gas, and now EV charging. Those points can be transferred to any of Citi’s over 15 airline and hotel partners, making your rewards potentially even more valuable than if you just earned straight cash back with another credit card

- High rewards rates for many popular categories

- Ability to transfer points to hotel and airline loyalty programs

- No foreign transaction fees

- Some built-in travel protections

- The $100 hotel benefit is difficult to redeem

- The highest earning rates are on Citi Travel bookings

- $95 annual fee

- Earn 70,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $700 in gift cards or travel rewards at thankyou.com

- Earn 10 points per $1 spent on Hotels, Car Rentals, and Attractions booked on CitiTravel.com.

- Earn 3 points per $1 on Air Travel and Other Hotel Purchases, at Restaurants, Supermarkets, Gas and EV Charging Stations.

- Earn 1 Point per $1 spent on all other purchases

- $100 Annual Hotel Benefit: Once per calendar year, enjoy $100 off a single hotel stay of $500 or more (excluding taxes and fees) when booked through CitiTravel.com. Benefit applied instantly at time of booking.

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

Best Flat-Rate Rewards Credit Card for Travel

Capital one venture rewards credit card.

Up to 5X Reward Rate

Earn 5X miles on hotels, vacation rentals, and rental cars booked through Capital One Travel. Earn 5X miles on Capital Read More

Earn 75,000 bonus miles + $250 credit

19.99% - 29.99% (Variable)

Casual travelers who don’t plan to carry a balance will find good value in the Capital One Venture Rewards Credit Card ’s earnings rates ( rates & fees ). And if you appreciate the skip-the-line perks of TSA PreCheck® and Global Entry as much as I do, you’ll be grateful for the up to $100 credit toward program fees.

You can earn double miles on every purchase and can access transfer partners without ponying up a triple-digit annual fee.

Expect dialed-back benefits compared to more premium travel cards. You’ll still enjoy select trip protections along with no foreign transaction fee. Keep in mind that you’ll want to redeem for travel bookings or transfers to partner programs (cash back redemptions are often not the best value).

This card is ideal for cardholders who want to earn travel rewards at a flat rate and want to keep their annual fee below $100.

The Capital One Venture Rewards card is extremely low maintenance as far as travel reward cards go. It provides consistent value and flexibility when it comes to earning and redeeming points for travel and is an excellent alternative for anyone a bit leery of the high Venture X annual fee ( rates & fees ).

- Solid rewards rate

- Global Entry or TSA PreCheck® statement credit (up to $100)

- Miles are easy to redeem either via partner transfers or by applying against travel purchases

- No introductory APR on purchases or transfers

- Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening – that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

Best Travel Earnings Without a Portal

Wells fargo autograph journey℠ card.

Earn unlimited 5X points on hotels, 4X points on airlines, 3X points on other travel and restaurants, and 1X points Read More

21.24%, 26.24%, or 29.99% Variable APR

We love that the Wells Fargo Autograph Journey℠ Card bestows you with strong earning rates on travel without requiring you to book through a card’s portal. Go ahead and book directly with your preferred airline and hotel: You’ll earn 5 points per dollar on hotels, 4 points per dollar on airlines, 3 points per dollar on other travel and restaurants and 1 point per dollar on other purchases.

This card has a minimal annual fee and offers the opportunity to earn a $50 statement credit each year when you spend $50 or more on airline purchases. That’s a bargain all travelers will love.

For now, there’s a limited number of transfer partners, which means you’ll have fewer redemption options than what some other issuers provide.

This card is a perfect fit for travelers who like to book trips directly, especially if they’re looking for cash-back rewards rather than travel transfers.

Wells Fargo has entered the premium card market with its highly anticipated Autograph Journey credit card which offers accelerated points earnings on airfare, hotels and restaurants. It’s also the newest card to offer the option to redeem points by transferring them to travel partners.

- Solid welcome bonus

- High rewards rates on travel and restaurants

- Annual statement credit for airfare

- Limited everyday bonus rewards

- Few transfer partners

- Charges an annual fee

- Select “Apply Now” to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn 60,000 bonus points when you spend $4,000 in purchases in the first 3 months – that’s $600 toward your next trip.

- Earn unlimited 5X points on hotels, 4X points on airlines, 3X points on other travel and restaurants, and 1X points on other purchases.

- $95 annual fee.

- Book your travel with the Autograph Journey Card and enjoy Travel Accident Insurance, Lost Baggage Reimbursement, Trip Cancellation and Interruption Protection and Auto Rental Collision Damage Waiver.

- Earn a $50 annual statement credit with $50 minimum airline purchase.

- Up to $1,000 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

Best Midrange Travel Card with Lounge Access

American express® green card *.

Up to 3X Reward Rate

Earn 3X Membership Rewards points on eligible travel, transit and restaurant purchases including takeout and delivery in the U.S. Earn Read More

Earn 40,000 points

See Pay Over Time APR

Excellent/Good (700 - 749)

When you don’t want to limit your earnings only to travel charges, check out the American Express® Green Card * . It offers elevated rewards on dining and local transit, too.

Cardholders have access to annual statement credits for CLEAR® Plus and LoungeBuddy charges, which can easily exceed the cost of the card’s annual fee and let you dip your toe into the world of premium perks.

Amex isn’t always accepted overseas, which could be a major issue for international travelers without a backup card.

This is a great midrange card that offers access to American Express Membership Rewards®, making it a good choice for those who don’t want the high cost of a Gold or Platinum card.

Occasional travelers who want to be treated like VIPs will find that the Amex Green card has an ideal set of perks. The $100 annual LoungeBuddy credit is just enough to cover airport lounge access a few times a year, and the CLEAR credit provides expedited access through TSA security at major airports across the country. Put them together and it’s a perfect balance of benefits for infrequent flyers at a relatively low annual fee.

- No foreign transaction fee

- Flexible redemption and points transfer options

- High rewards rate on dining, travel and transit

- Mediocre base rewards rate

- Limited features and perks

- No balance transfer option

- Earn 40,000 points after spending $3,000 on purchases in the first 6 months

- Earn 3 points per dollar spent on travel, transit purchases and eligible purchases at restaurants worldwide

- Earn 1 point per dollar on all other eligible purchases

- $199 CLEAR® Plus and $100 LoungeBuddy credits

- Trip delay insurance

Best Premium Travel Cards

Best premium travel rewards card, capital one venture x rewards credit card.

Earn 2 miles per dollar on all eligible purchases, 5 miles per dollar on flights and vacation rentals and 10 Read More

Earn 75,000 bonus miles

Excellent (750 - 850)

The Capital One Venture X Rewards Credit Card is packed with extras that put it firmly in competition with other upscale credit cards. Just as important, the easy earnings structure is ideal for anyone who doesn’t want to stress over details.

Its annual fee ( rates & fees ) is easily recouped through an annual $300 credit for bookings through Capital One Travel and 10,000 bonus miles after your anniversary, which makes the perks feel almost free. A Priority Pass membership also provides value, giving you access to 1,300+ lounges worldwide.

The flat-rate earnings mean that if you spend a lot in a single category, you might be better off with a different card.

The Venture X is a strong choice for travelers who want premium benefits and are willing to book through Capital One Travel at least once a year.

If you’re looking for lofty perks without a lofty annual fee ( rates & fees ), the Venture X fits the bill. While other cards with elite benefits run nearly $700 a year, you’ll only pay a little more than half that for the Venture X. And you’ll still get Capital One and Priority Pass airport lounge access for you and your guests, an annual travel credit and solid earnings on everyday purchases.

- Annual fee lower than others in its category

- Annual travel credit through Capital One Travel and anniversary miles alone could justify the annual fee

- Miles are easy to earn and easy to use

- Lack of domestic airline and upscale hotel travel partners

- Capital One lounge network in its infancy

- Lack of hotel status benefits

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights and vacation rentals booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy a $100 experience credit and other premium benefits with every hotel and vacation rental booked from the Premier Collection

Best Travel Credit Card for International Travel

Chase sapphire reserve®.

Up to 10x Reward Rate

Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Read More

22.49%-29.49% Variable

If you spend frequently on travel and dining out, you can accumulate rewards with the Chase Sapphire Reserve® . Its greatest selling point is its awesome list of 1:1 transfer partners. There are also best-in-market travel insurance benefits and no foreign transaction fees. Plus, as a Visa card, it’s widely accepted globally.

Cardholders can make up for a chunk of the annual fee with the $300 annual travel credit, a Priority Pass Select airport lounge membership and up to a $100 credit every four years to cover your Global Entry, TSA PreCheck® or NEXUS application fee, all of which make far-flung travel easier to bear. The travel protection benefits have personally reimbursed me more than $1,000.

There’s an extra fee to add an authorized user to your account.

This card is readymade for frequent travelers who want to take advantage of built-in travel insurance protections and airport perks.

The Chase Sapphire Reserve card is one of the most valuable flexible rewards credit cards thanks to its lucrative bonus categories and easy-to-use travel credit. Cardholders can offset the annual fee and get great value when redeeming Chase Ultimate Rewards points earned on the card, thanks to partnerships with numerous airlines and hotels and its convenient travel booking portal, Chase Travel℠.

- $300 annual travel credit is incredibly flexible

- Generous welcome bonus

- Get 50% more value when you redeem points for travel through Chase

- Points transfer to valuable airline and hotel partners

- High annual fee

- High variable APR on purchases

- Excellent credit recommended

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

Best Travel Rewards Card for Lounge Access

The platinum card® from american express.

5X Reward Rate

Earn 5 Membership Rewards Points per dollar on prepaid hotels booked with American Express Travel and on flights booked directly Read More

Earn 80,000 points

Good,Excellent (700 - 749)

The Platinum Card® from American Express (terms apply, see rates & fees ) is destined for frequent travelers who intend to fully leverage the rich set of travel benefits. Trust me when I say the perks can make you feel like a VIP. The staggering annual fee for this classic status card won’t be worth it for everyone, but in the right hands the expense can be well justified.

Lounge access with this card extends beyond the Priority Pass membership you see on other premium cards. Plus, if you’re looking for a giant welcome bonus to get things started, the Platinum Card certainly shakes things up.

Many of the perks are very specifically applied and may require enrollment. Examples include statement credits toward Uber, Saks Fifth Avenue, select digital entertainment, select hotel stays and airline incidental fees.

The Platinum Card® from American Express could be a valuable pick for cardholders who are willing to track and maximize its long list of member benefits.

Being an Amex Platinum cardholder grants access to the International Airline Program, which can save you money on first and business class seats on more than 20 airlines as well as premium economy tickets for you and up to seven traveling companions. Start your search on the Amex Travel website to find international flights departing or arriving in the U.S. on any of those premium cabins.

- High reward potential on flights and hotels booked through American Express Travel

- Multiple credits can help justify the fee

- Comprehensive airport lounge access

- Luxury travel benefits and elite status with Hilton and Marriott with enrollment

- Very high annual fee

- Maximizing the statement credits takes some work and could be impractical for many

- Reward rate outside of travel is sub-par for a premium card

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel using your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $199 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $199 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.¤

- Terms Apply.

Best Travel Rewards Earnings for Foodies

American express® gold card.

Up to 4X Reward Rate

Earn 4X Membership Rewards® points at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X; Earn Read More

Earn 60,000 points + earn up to $100 back

Foodies and travelers can leverage the American Express® Gold Card (terms apply, see rates & fees ) to the hilt, earning up to 4 points per dollar. The annual fee may seem intimidating—I get that. But my household comes out ahead by taking advantage of the card’s dining credits and rotating Amex Offers. It’s an appealing option for anyone who wants to redeem travel rewards but doesn’t spend enough on flights or hotels to require elevated earning categories on travel itself.

The grocery earnings on this card are impressive and rare for a travel card. For someone who wants to transform everyday expenses into a vacation, this card seamlessly blends the experience.

The American Express® Gold Card also offers a variety of ways to earn statement credits. This includes up to $120 ($10 per month) in annual dining credits for purchases at participating partners, up to $100 ($50 semi-annually) in annual statement credits for purchases at Resy restaurants and up to $84 ($7 per month) in statement credits for Dunkin purchases. Plus, cardholders get $10 in Uber Cash each month for a total of up to $120 per year. Enrollment is required for select benefits.

While the Amex Gold’s credits can be valuable, you’re required to enroll to take advantage of them and credits are dished out monthly or semi-annually rather than in an annual lump sum.

The Amex Gold might be the consummate choice for travelers with high spending on food expenses.

This card makes it easy to earn Membership Rewards points while doing regular grocery shopping since the card earns bonus points at supermarkets. And for the nights that cardholders don’t want to cook, they can make use of the monthly dining and Uber credits (which can be used on Uber Eats orders).

- High rewards earnings possibilities

- Points transfer option to many partners

- Add up to five authorized users for no additional annual fee

- Can choose from regular, rose gold or white gold versions

- Most credits are doled out monthly and can be cumbersome to redeem

- Limited options to carry a balance

- High APR for pay over time feature

- Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Plus, receive 20% back in statement credits on eligible purchases made at restaurants worldwide within the first 6 months of Card Membership, up to $100 back. Limited time offer. Offer ends 11/6/24.

- Get the American Express® Gold Card in either the Gold, Rose Gold or Limited-Edition White Gold metal design. White Gold design is only available while supplies last.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.