Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

Do You Need To Set Up a Travel Notice for Your Chase Credit Cards?

Katie Seemann

Senior Content Contributor and News Editor

344 Published Articles 53 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Director of Operations & Compliance

1 Published Article 1178 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

Why would you want to notify chase of your travels, how to avoid foreign transaction fees, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you aren’t a frequent traveler, you might be wondering about everything you need to do to prepare for a trip abroad. Of course, you’re considering what to pack and whether or not you should buy travel insurance , but what about your bank?

One of the things you might want to think about is adding a travel alert notification to your credit cards. While this isn’t required, it has historically been helpful to avoid the unnecessary hassle of credit card problems while traveling.

In this post, we’ll talk about setting up a travel notification on your Chase account , whether or not it’s even necessary, and how to avoid foreign transaction fees when using your Chase credit cards abroad.

So, why would you even want to add a travel notification to your accounts in the first place?

Previously, charges from outside the U.S. could trigger a fraud alert, which would temporarily shut down your credit card even if you were traveling abroad. That’s not a great way to start a vacation.

An easy way to avoid that risk was to place a simple travel notification on your Chase account. This allowed your Chase credit cards to be used outside the U.S. without problems.

Thankfully, it’s no longer necessary to set up a travel alert notification with Chase when you’re planning to travel outside the U.S.

Previously, you’d set up a travel alert on your Chase account online or through the Chase mobile app.

You would do this by going to your account, clicking on Profile & settings , navigating to Account Settings , and then clicking Travel .

Now, when you follow those same steps, you get a message from Chase saying that it’s not necessary to set up a travel alert notification anymore .

Setting up a travel alert notification on your Chase account is no longer necessary when you’re planning to travel outside the country.

While you no longer need to set up a travel alert for your Chase credit cards, choosing the right credit card is important to avoid foreign transaction fees.

Certain cards carry a 3% foreign transaction fee anytime you use them outside the U.S. The good news is plenty of cards waive this fee — just be sure to know which cards have no-additional fee and try to use only those on your trip.

Personal Chase Credit Cards With No Foreign Transaction Fees

Multiple Chase credit cards waive the standard 3% foreign transaction fee. Be sure to carry at least 1 of these while traveling abroad.

The following Chase credit cards do not have any foreign transaction fees :

- Aer Lingus Visa Signature ® Card

- Aeroplan ® Credit Card

- Amazon Rewards Visa Signature Card

- British Airways Visa Signature ® Card

- Chase Sapphire Preferred ® Card

- Chase Sapphire Reserve ®

- Iberia Visa Signature ® Card

- IHG One Rewards Premier Credit Card

- Instacart Mastercard ®

- Marriott Bonvoy Bold ® Credit Card

- Marriott Bonvoy Boundless ® Credit Card

- Marriott Bonvoy Bountiful™ Credit Card

- Prime Visa card

- Southwest Rapid Rewards ® Priority Credit Card

- Southwest Rapid Rewards ® Premier Credit Card

- The World of Hyatt Credit Card

- United Club℠ Infinite Card

- United℠ Explorer Card

- United Gateway℠ Card

- United Quest℠ Card

Business Chase Credit Cards With No Foreign Transaction Fees

- IHG One Rewards Premier Business Credit Card

- Ink Business Preferred ® Credit Card

- Ink Business Premier ® Credit Card

- Southwest Rapid Rewards ® Performance Business Credit Card

- United℠ Business Card

- United Club℠ Business Card

- World of Hyatt Business Credit Card

Adding an alert to your Chase account before you travel internationally is no longer needed. While this used to be a way to let Chase know you would be out of the country so international activity on your card wouldn’t trigger a fraud alert, today’s more sophisticated technology makes this step unnecessary.

The information regarding the Amazon Rewards Visa Signature Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Marriott Bonvoy Bold ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Marriott Bonvoy Boundless ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Marriott Bonvoy Bountiful™ Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding The World of Hyatt Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the United Club℠ Business Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

How do i set up a travel alert with chase.

You don’t. Setting up a travel alert with Chase is no longer necessary.

Do I have to let Chase know that I am traveling?

No, letting Chase know when you travel internationally is no longer required. It used to be common practice to set up a travel alert so international charges didn’t trigger a fraud alert on your credit cards, but today’s more sophisticated systems have made this step unnecessary.

Does Chase no longer require travel notice?

That’s correct. Chase doesn’t require a travel notice at all anymore. The ability to set up a travel notice on Chase’s website has been removed.

Do I need to notify Chase of International travel?

No, it’s no longer necessary to notify Chase of any upcoming travel, including international travel. The ability to add a travel alert notification has even been removed from Chase’s website.

Was this page helpful?

About Katie Seemann

Katie has been in the points and miles game since 2015 and started her own blog in 2016. She’s been freelance writing since then and her work has been featured in publications like Travel + Leisure, Forbes Advisor, and Fortune Recommends.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Top Credit Card Content

Buying Guides

- Best Credit Cards for High Limits

- Best Credit Cards for Young Adults

- Best Credit Card Combinations

- Best Credit Cards for Military

- Best Credit Card for Paying Monthly Bills

Credit Card Reviews

- American Express Platinum Card

- American Express Gold Card

- Chase Sapphire Preferred Card

- Chase Freedom Unlimited Card

- Capital One Venture X Card

Credit Card Comparisons

- Amex Gold vs Blue Cash Preferred

- Amex vs Chase Credit Cards

- Amex Platinum vs Capital one Venture X

- Amex Platinum vs Delta Platinum Card

- Chase Sapphire Reserve vs Amex Platinum Card

Recommended Reading

- How to Pay Your Credit Card Bill

- Credit Card Marketshare Statistics

- Debit Cards vs Credit Cards

- Hard vs Soft Credit Checks

- Credit Cards Minimum Spend Requirements

Related Posts

![chase bank international travel notification Chase Freedom® Credit Card — Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2019/11/Chase-Freedom-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

UponArriving

How to Set Up a Chase Travel Notice (And Why You Should Do It) [2021]

If you’re traveling outside of the country soon you probably want to consider putting travel notices on the Chase credit cards or debit cards that you want to use. If you don’t do that then you run the risk of your cards not working properly abroad and you’ll have to deal with that frustration, which is no fun when traveling.

So avoid the frustration and set your Chase travel notices following these easy steps broken down below.

Interested in finding out the hottest travel credit cards for this month? Click here to check them out!

Table of Contents

How to Set Up a Chase credit card travel notice

It’s very easy to set up a travel notice for your Chase credit card and bank account. You can set up a travel notice over the phone, via the Chase App, or simply do it online — whichever is more convenient. However, I would recommend doing it online because it is so easy.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Setting up the notification by phone

If you’re looking for the Chase travel notification number, just call the number on the back of your credit card or debit card.

I’ve made calls from the plane as I’m boarding and Chase handled pretty quickly so it usually doesn’t take the agents very long to put the notification on.

If you’re ever outside of the US you can call Chase collect number at: 1-302-594-8200

Setting up the Chase travel notification online

To set up a Chase credit card or debit card travel notice, it only take a few steps.

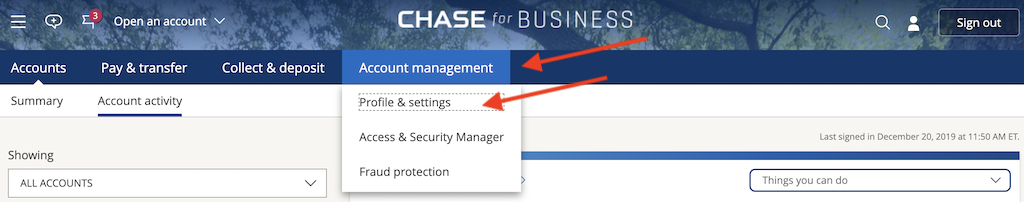

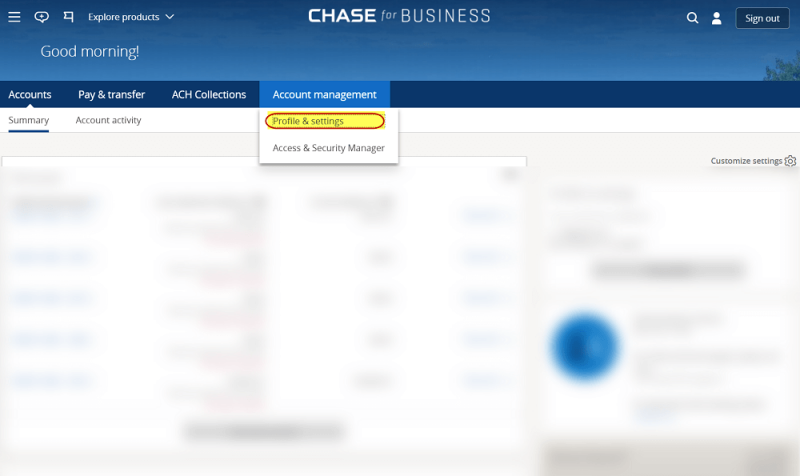

The first thing that you need to do is log-in to your Chase account. Once you are logged in, click on “Account management” and then click “Profile and settings.” This will all be found at the top of your screen as pictured below.

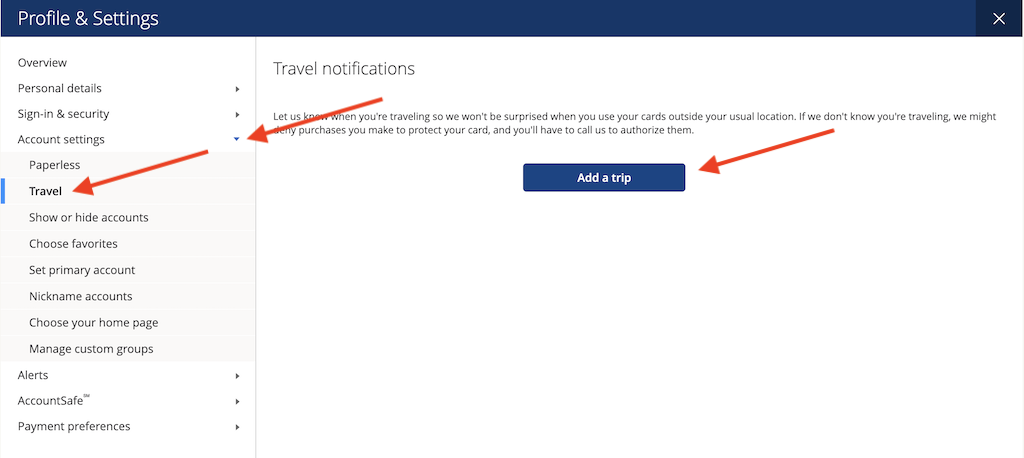

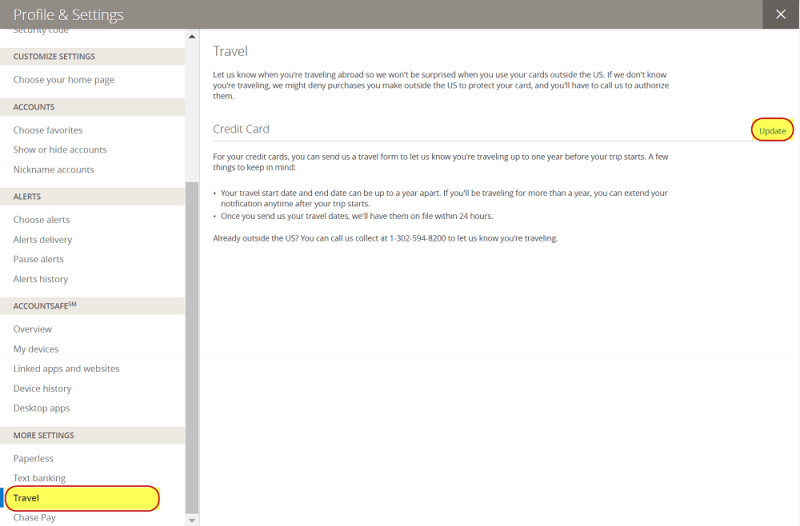

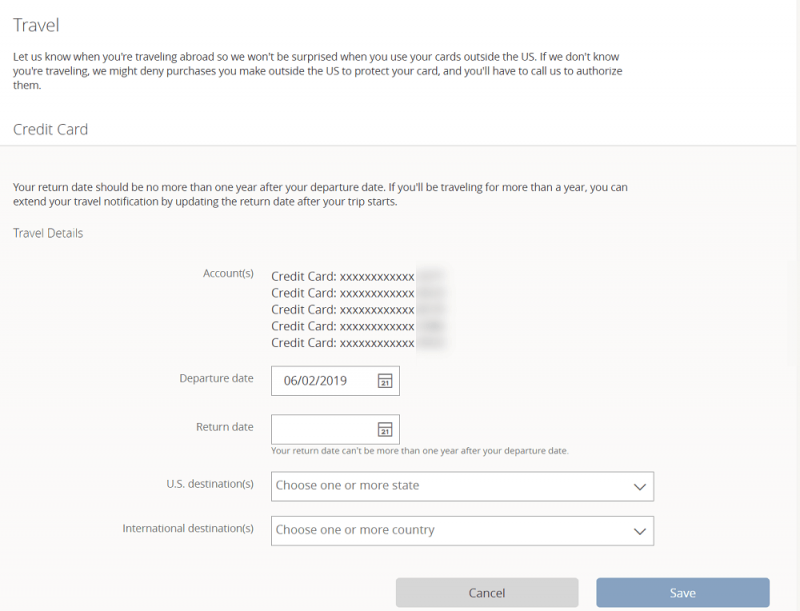

Once you are in profile and settings, now you want to click on “Account settings” and then click on “Travel.” To begin the process of adding a travel notification, simply click on “Add a trip.”

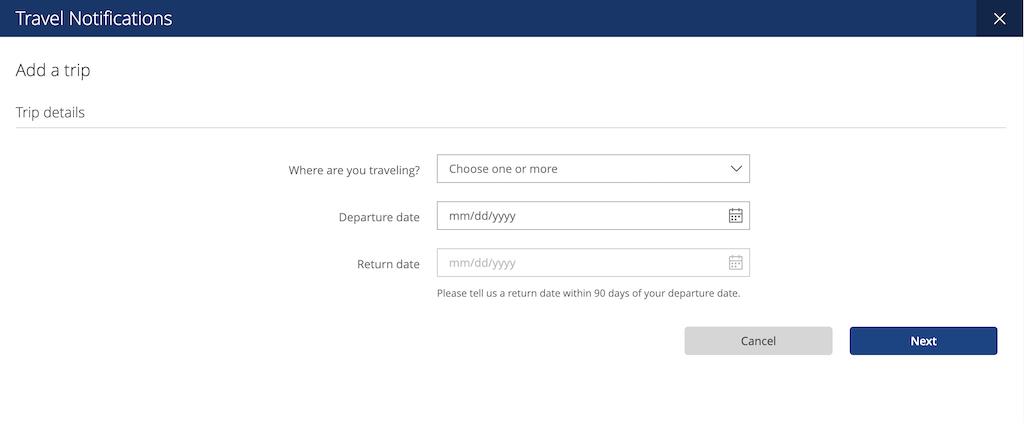

At the next screen, you will need to enter some basic information regarding your travels. This information includes the destination, the departure date, and the return date.

Your departure date can be as far as one year out. But n ote that the return date must be within 90 days of your departure date. You can choose different countries or you can even choose specific states within the US for your destination.

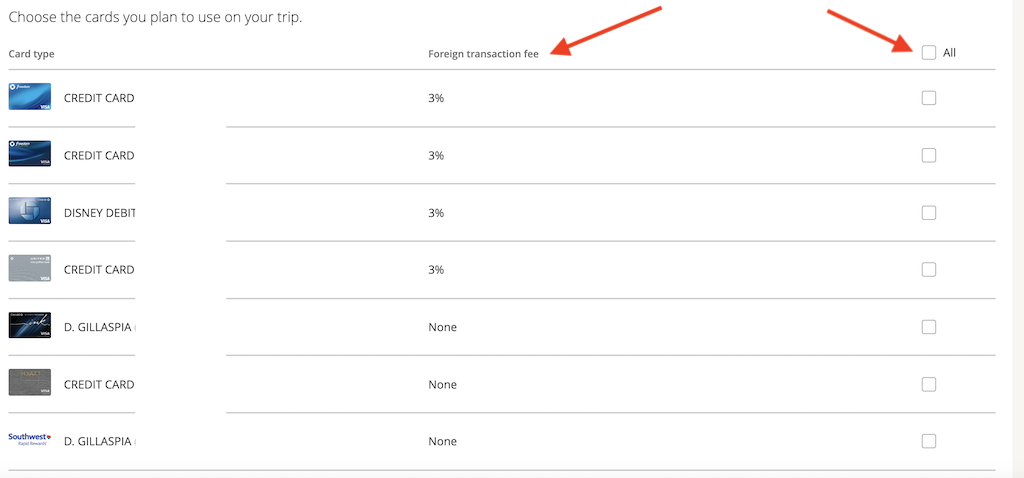

Once you click next, you will be asked to add the travel notification to specific cards.

You can choose to add the travel notification to only one or a few cards or you can select to add the travel notification to all of your cards. You can also choose to add a travel notification to a debit card so that your bank account has the travel notification on it as well.

Something that is cool about this screen is that it will tell you whether or not your cards have foreign transaction fees.

If they don’t have foreign transaction fees, that means that you won’t be charged extra to process a transaction in a foreign country. If they do have foreign transaction fees, you will be charged 3% for the transaction. That means that if you make a purchase of $100, you will be charged an extra $3 foreign transaction fee.

If you want a solid credit card that does NOT have foreign transaction fees look into getting the Chase Sapphire Preferred, which comes with a 60,000 point bonus after meeting the minimum spend requirements of $4,000 within the first 3 months.

This is worth over over $1,000 if you use points for premium airfare redemptions! Find out more details about this card here.

Once you click to move onto the next step, you will then be able to verify your travel notification and submit it.

Setting up the Chase travel notification online (old interface)

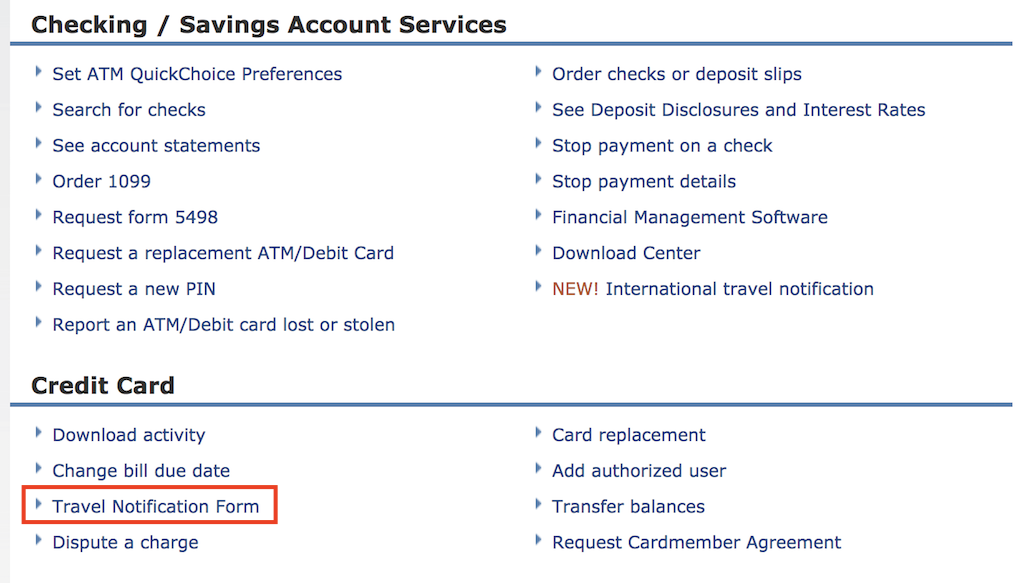

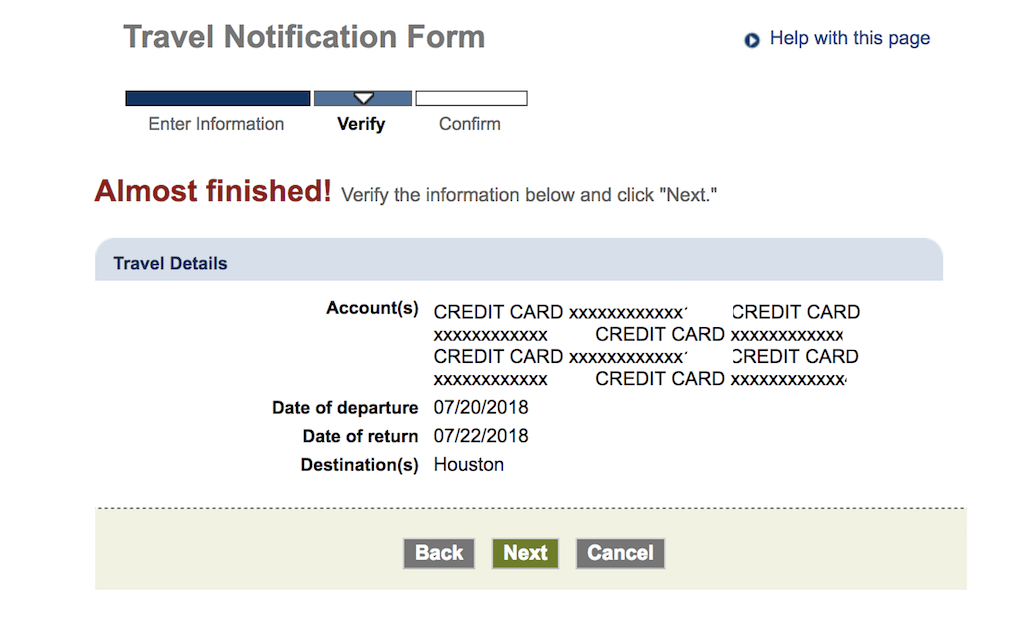

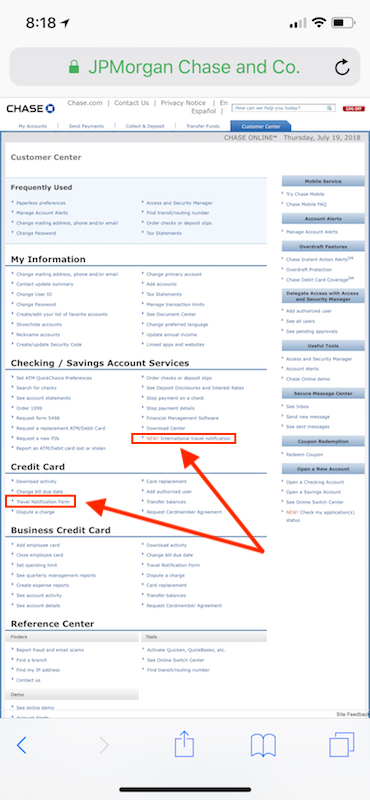

If you are somehow still working with the old Chase interface, then the directions below will apply to you. Log in to your Chase account and click on “Customer Center.” In the Credit Card section, you’ll see “Travel Notification Form” which you’ll need to click on.

That will take you to the first step of the travel notification process.

Enter Information

You can submit your travel notifications no more than 365 days before you depart.

Your return date must be no more than 365 days after your departure date. If you plan to travel longer than 365 days, you can extend your travel notification with them by updating the form before your original date of return.

When you begin to enter your information, you should see the full roster of credit card that you have with Chase. In my case, I have six credit cards with Chase.

The travel notification will be put on all of the credit cards.

All you have to do is enter in your date of departure and date of return and enter in your destinations. Chase requests that you input cities for the destination, and I’m not sure if it will work if you enter countries.

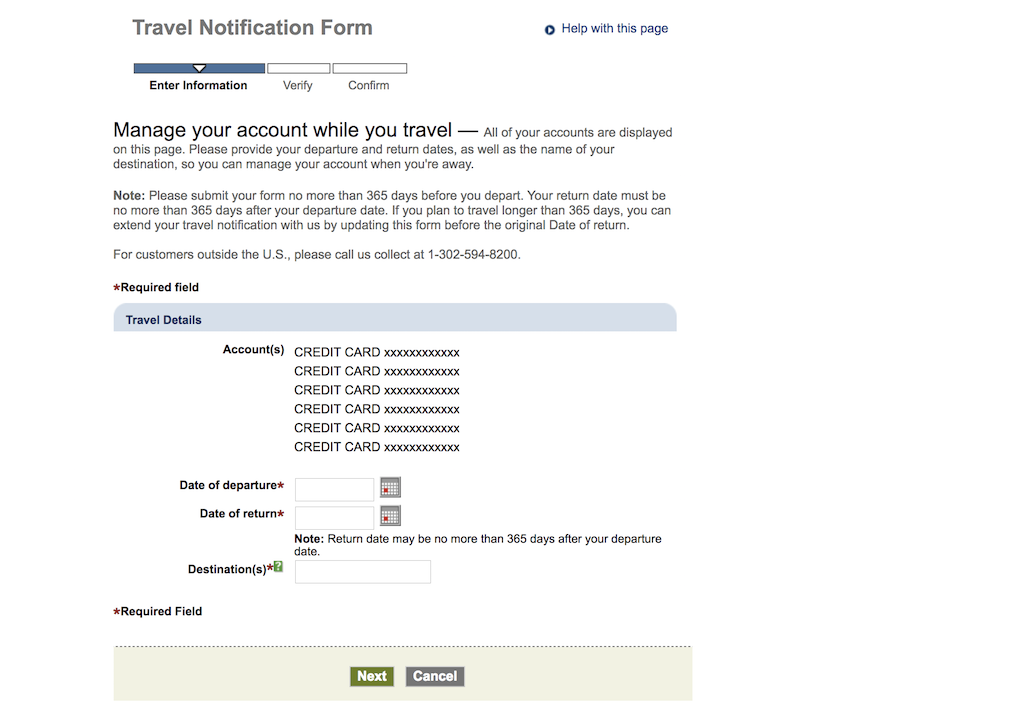

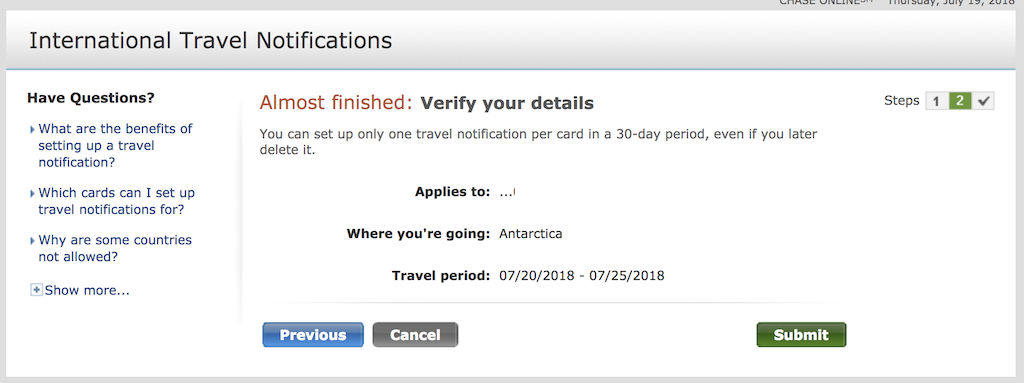

Verify your information

Next, all you have to do is verify your credit card information and your travel dates and destinations.

Once you do that you’ll move forward and confirm the notification.

Chase bank travel notice

If you need to put a travel notification on for your bank account (debit card, ATM, etc.), you can use the method above if you have the new Chase interface and simply select your debit card. But if you are still working with the old interface, the process is a little bit different.

You’ll notice in the image below that you click on a different section of the website to initiate the travel notice for a checking or savings account.

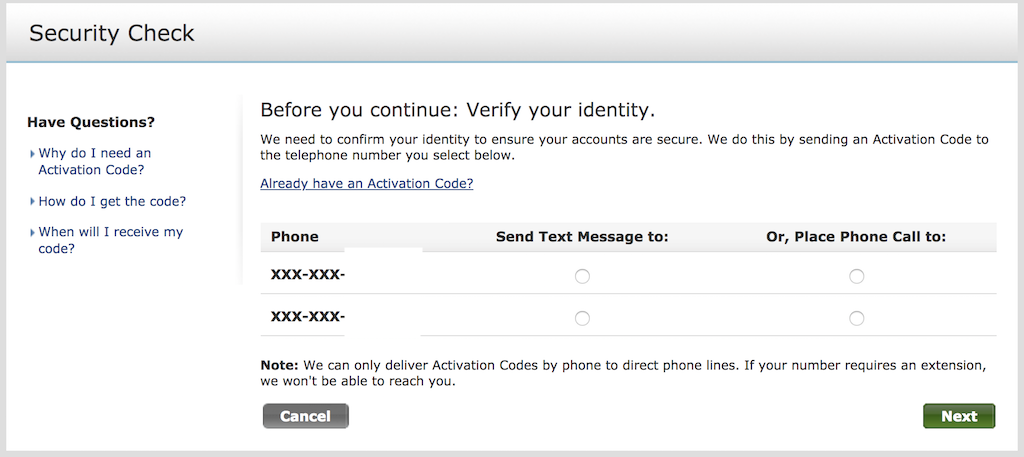

Security Check

When you first try to put on your travel notifications you’ll likely be stopped and asked to verify your identity. This is done by sending either a text message or a phone call to one of your phone numbers on record.

The code should arrive within two minutes (mine arrived instantly) and you should be able to enter in the activation code and verify your identity quickly.

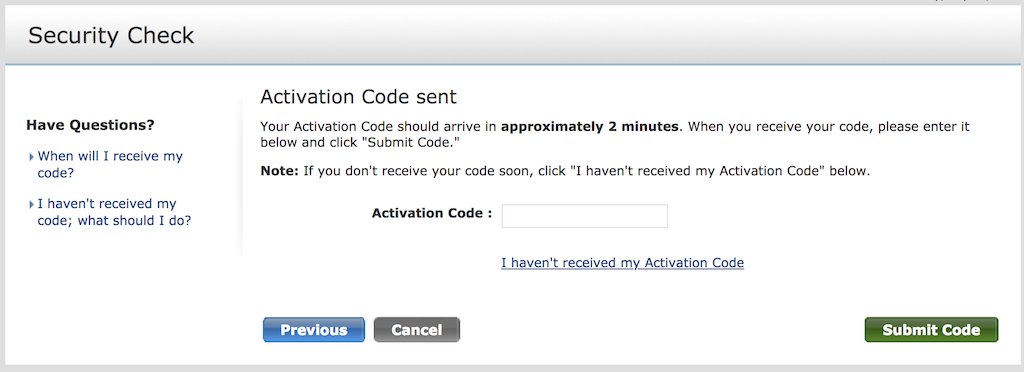

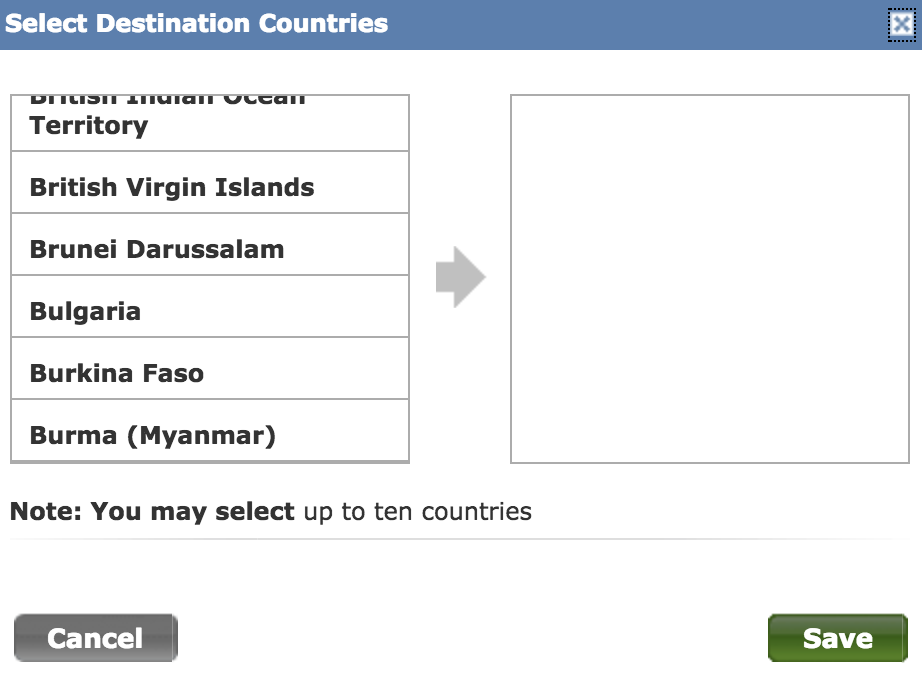

Once you’ve done that you’ll be taken to the International Travel Notifications screen where you can choose which cards you want to apply the travel notification to (debit, ATM, liquid cards, etc.)

You’ll also need to choose a destination and then also choose a departure date and a return date.

One of the big differences with the bank account notifications is that your travel must be within 14 days.

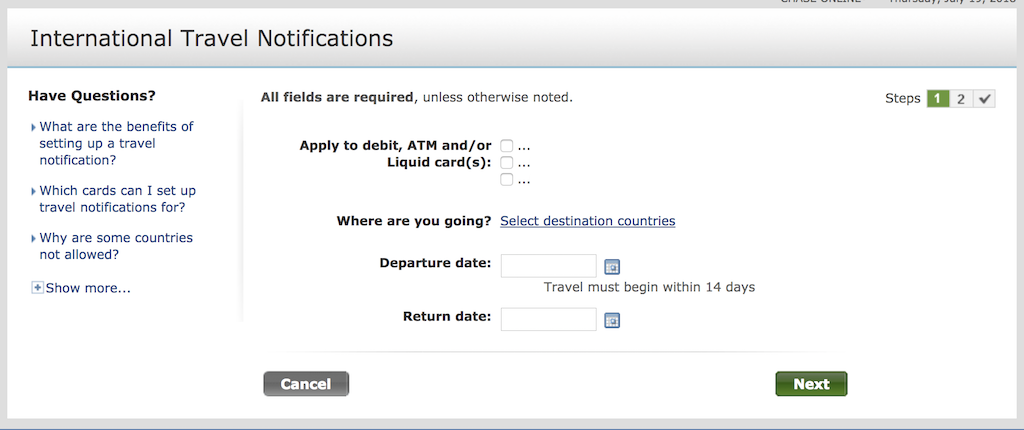

When you click on Select destination countries a small window will pop-up where you can add the countries.

Note that you can only select up to 10 countries.

To set up a travel notification for a country that’s not in the country list, call the phone number on the back of your card and inquire with Chase about that country.

Once you’ve selected your countries, you can advance to the next step where you’ll need to verify your details. You’ll see the debit card the notification is going to apply to along with the travel period and where you’re traveling to.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Do you need travel notifications?

Some people think that travel notifications are a waste because they are able to travel without any difficulties. But don’t fall into this trap.

Just because you didn’t have any hiccups on a trip, that doesn’t mean that other trips will be like that.

I highly recommend always putting on travel notifications.

You never know what kind of inconvenient experience might await you if you don’t bother with putting on the notifications. Since it’s so easy to add them, I really see no reason why you wouldn’t do it.

One thing that’s interesting about Chase is that if you start to do a lot of international travel, they will pick up on your travel habits. It’s not clear to me exactly how many trips are necessary, but once you start taking a lot of trips, you might not even need to put on travel notifications.

After about a year of travels, I called in to put in a travel notification for Belize one time and I was told that I no longer needed to provide travel notifications because they were aware of my frequent travel patterns. This has happened to other people in the past as well .

I’m not sure if there’s a way to disable this but I found it very convenient and felt okay with it because I monitor my transactions on a regular basis.

Still, sometimes I’ll call in just to make sure everything is fine before I depart to a foreign country just to be on the safe side. (You never know when these type of policies will be updated, changed, etc.)

Do you need travel notifications for out of state travel?

Regarding domestic travel notifications Chase states:

“No. You don’t need to set up a travel notification if you’re traveling to another state, only when you plan to travel abroad.”

My card has been denied in New York (out of my state) before because of fraud prevention and I had to call in to Chase to authorize the charge. Since, it was not abroad it wasn’t a major issue to make the quick phone call but I could have probably avoided the situation just by putting in a notification.

This is generally more of an issue for larger purchases.

So if you’re planning on spending quite a bit of money in another state or city from where you live, it might be a good idea to just call ahead of time and get them to clear the transaction.

What if your travel notifications don’t work?

If you get caught somewhere and your card is not working, then there’s one simple solution.

You can call the number on the back of your card and speak to the fraud prevention department to allow them to process your transaction. You’ll usually have to re-run the transaction when this happens.

(I usually make international phone calls with Skype for these purposes.)

Certain countries excluded

Chase notes that they “exclude certain countries from our travel notification service due to either fraud protection or to align with certain federal guidelines and restrictions.”

These are often referred to as “at risk” countries.

How will you know if a country is excluded?

You’ll know immediately after you submit your notification if they’ve excluded any of your destinations from this service. If you’re traveling to an excluded country and you need help using your debit, ATM and/or Liquid Card, just call the phone number on the back of your card.

Can you cancel travel notices?

If you set up a notification and then later you change your mind, you can click “Cancel.”

If you need to delete a notification you’ve already set up, click “Delete Travel Notification” and follow the steps on the next screen.

Avoiding foreign transaction fees

Chase offers several credit cards that will allow you to avoid those pesky foreign transactions fees.

Two of my favorite options are the Chase Sapphire Reserve and the Chase Sapphire Preferred . But many of their co-branded credit cards like the World of Hyatt Card and IHG Rewards Club Premier Credit Card don’t have foreign transaction fees, either.

However, some of their no annual fee cards like the Chase Freedom cards come with foreign transaction fees of 3% .

If you’re wanting to avoid ATM fees when traveling abroad, Chase offers the Chase Private Client program.

The program offers:

- No fees at non-Chase ATMs and this even includes international ATMs

- Refunds for ATM fees charged by the ATM owners up to five times per statement period

- No exchange rate adjustment fee for debit card purchases and ATM withdrawals in currencies other than U.S. dollars.

- No Chase fee for all domestic and foreign wire transfers, incoming or outgoing, completed at any Chase branch, chase.com, via telephone or email.

There are a ton of other benefits related to wealth management that the program offers and you read more about Chase Private Client here .

Does the Chase app offer travel notifications?

The Chase app allows you the ability to set travel notifications. To do this, log-in to the app and click on “Profile & Settings” -> “My Settings” -> “Travel” and you will see the options for setting up your travel notices.

You can also still pull up the Chase website on Mobile to enable your travel notifications.

International travel tips

If you are traveling internationally, you might also want to check out my international travel checklist . This runs you through many different things you want to do before heading out on a trip in addition to just setting Chase travel notifications. It’s easy to forget about checking for things like how tipping works, what’s taboo, and other common questions so be sure to check it out.

Setting up Chase travel notices is not difficult and you can do it over the phone, via the app, or online — whichever you feel more comfortable with. You might also be set them up via a secured message but I’ve never given that a try.

One last reminder: always keep a photo copy or make a note of the phone number on the back of your debit or credit card so that you have a phone number you can call to sort out any potential issues and you shouldn’t have any issues.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo . He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio .

You can do it on the Chase app under profile settings

Thanks — updated!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Privacy Overview

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

Here’s How to Quickly Notify the Bank About Your Travel Plans to Avoid a Declined Card Overseas!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

It’s usually a good idea to notify your bank about any international travel plans . This way, the bank won’t be surprised to see unusual charges on your account.

Million Mile Secrets team member Scott calls the number on the back of his Chase Sapphire Preferred Card to set travel alerts . Because a human picks up the phone right away. But now he’ll consider doing it online this way instead.

It can be a headache if your account is frozen by the bank (unable to make purchases) while attempting to pay for a souvenir or meal in a foreign country.

If you have a Chase debit or credit card, you can quickly set up travel notifications online .

You can also notify banks about international travel by calling the number on the back of your card. But some folks might prefer the convenience of doing it online!

Easy 4-Step Guide to Set up Travel Notifications for Chase Card Accounts

Step 1. log-in to your chase account.

First, log-in to your Chase account .

Keep in mind, you can NOT set up travel notices using the Chase mobile app. So you’ll have to log-in on your desktop or on mobile web browser.

Step 2. Go to the “Profile & Settings” Under the Account Management Tab

Once you log-in, you can click on “ Account Management ” in the top navigation bar, and then click “ Profile & Settings “ .

Step 3. Click “Travel” at the Bottom of the Left Menu

Scroll to the bottom of the menu on the left to find the “ Travel ” tab. Click it, and, you’ll see an “ Update ” link to the right of the page, where you can inform Chase about your upcoming globetrottery.

Step 4. Enter Your International Trip Details

Now, it’s time to enter your trip details.

If you’re creating a travel notification for your credit card account, simply enter your travel dates and destinations .

You can create a travel notification for your credit card accounts 1 year before your departure. That’s great for folks who like to plan ahead. 😉

It’s a similar process to set up an alert if you have a Chase debit card. One minor difference is you have to manually select the debit card or checking account you’d like to establish the notification for.

Keep in mind, you can only create a notification for debit cards 14 days prior to your travel dates.

Use These Chase Cards to Save Money on Transaction Fees!

Lots of credit cards charge up to 3 % when you use them for transactions in a foreign country. But many Chase cards have NO foreign transaction fees !

So not only is it easy to set up travel notifications with your Chase cards, but you can save money too. If you’re traveling overseas, you’ll want to use a Chase card like:

- Chase Sapphire Preferred® Card (our favorite card for beginners using travel miles and points)

- Ink Business Preferred Credit Card (our favorite card for small business owners!)

- IHG® Rewards Premier Credit Card (a fantastic hotel credit card)

We also really like this travel credit card for international trips:

- Capital One® Venture® Rewards Credit Card (our #1 card for easy-to-use miles)

Here’s our post with the best travel credit cards !

Here’s our post with the best no-foreign-transaction fee credit cards!

Bottom Line

When you’re traveling internationally, you can call Chase to notify them about your plans so your credit cards and debit cards don’t get declined. But it’s just as easy to set up a travel notification online .

You can do it in 4 quick steps . Simply log-in to your Chase account . Then, create separate notifications for your debit and credit card accounts.

While abroad, don’t forget to use a Chase card with no foreign transaction fees , like the Chase Sapphire Preferred!

Other Popular Million Mile Secrets Articles to Read

- Earn more rewards with the best credit cards for eBay sellers !

- Make of the most of your rewards with our Ultimate Guide to American Airlines miles !

- Unlock the freedom to travel with AMEX Membership Rewards points !

- This is the best way to book JetBlue Mint Class with points!

- Southwest doesn’t have change or cancellation fees , here’s how to make changes when you need to

Don’t forget to subscribe to the Million Mile Secrets daily email newsletter for more tips, tricks, and insights into traveling for free.

Million Mile Secrets

Contributor

Million Mile Secrets features a team of points and miles experts who have traveled to over 80 countries and have used 60+ credit cards responsibly to accumulate loyalty points and travel the world on the cheap! The Million Mile Secrets team has been featured on The Points Guy, TIME, Yahoo Finance and many other leading points & miles media outlets.

More Topics

Credit Cards

Join the Discussion!

Comments are closed.

You May Also Like

BonusTracker: Best credit card bonus offers

June 14, 2021 4

Best Hilton credit cards: Improved weekend night certificates, earning rates and more

June 12, 2021 2

Our Favorite Partner Cards

Popular posts.

How to Set a Travel Notice for Your Credit Cards

Susan Shain

Susan is a freelance writer who specializes in turning complex financial topics into engaging and accessible articles. She's been writing about personal finance for six years, and was previously the senior writer at The Penny Hoarder and a staff writer at Student Loan Hero. Her personal finance writing has also appeared in publications like MarketWatch and Lifehacker.

When I worked at a ski rental shop in Breckenridge, Colorado, I witnessed many international (and some out-of-state) customers’ credit cards get declined.

Not because their credit limits were too low or because they were purchasing too much — but because they failed to set up travel notifications with their card issuers.

So now, any time I travel to a foreign country, I always set up a travel notice on my credit card beforehand.

Since I travel with the Chase Sapphire Reserve® (Review), I create a Chase travel notice, but you can take this step with most major credit or debit cards. Here’s how.

What Is a Credit Card Travel Notice?

As a way to prevent fraud , your credit card issuer monitors your spending activity. If it notices a suspicious purchase — in an unusually large amount, or from a new location — it may decline the transaction. This could be more likely in countries where fraud is a bigger problem.

Which is why the answer to the question “Should I notify my credit card company when traveling?” is usually yes.

Although you can often get away with shopping in another state without triggering a red flag, international travel is another story.

By notifying your credit card of your travel plans, you’ll reduce the chances of getting your transaction declined in the checkout line — which, trust me, is never fun — and having to call your card issuer to verify your purchases. It’s still possible to have your purchases declined after setting a travel notice, but it’s much less likely.

How to Set Up Travel Notices for 8 Major Credit Card Issuers

Ready to create your first travel alert? While you could call your card issuer, it’s easier to do it online.

Here’s how to set up travel notices with eight different credit card issuers.

When you visit MoneyTips, we want you to know that you can trust what’s in front of you. We are an authoritative source of accurate and relevant financial guidance. When MoneyTips content contains a link to partner or sponsor affiliated content, we’ll clearly indicate where that happens. Any opinions, analyses, reviews or recommendations expressed in our content are of the author alone, and have not been reviewed, approved or otherwise endorsed by the advertiser.

We make every effort to provide up-to-date information; however, we do not guarantee the accuracy of the information presented. Consumers should verify terms and conditions with the institution providing the products. Some articles may contain sponsored content, content about affiliated entities or content about clients in the network. While reasonable efforts are made to maintain accurate information, the information is presented without warranty.

Chase travel notice

Because of the company’s abundant travel perks and partnership with the Visa network — which is widely accepted worldwide — Chase cards are a favorite among globetrotters.

You can create Chase travel notifications up to a year in advance for credit cards, and up to 14 days for debit cards. Your travel dates can span an entire year — if you’re away for longer, you’ll simply have to adjust your dates once you’re on the road. Chase will have your request on file within 24 hours from the time you submit.

To set up Chase travel notifications, you’ll need to log in to your account and click on the credit card you plan to use. Under the “Things you can do” dropdown menu on the right, you’ll see the “Travel notification” option. That will take you to your “Profile & Settings” page, where you’ll be able to create a travel alert.

Insider tip

Depending on the type of Chase account you have, the process may be slightly different for you. In any case, just look for your “Profile & Settings” page, and then look for a button to set a travel notice.

Alternatively, if you’re already outside the country, you can call Chase collect at 1-302-594-8200 to alert the issuer of your travel plans.

Setting up a travel notice with the Chase bank app

After logging in to the Chase mobile app, tap the profile icon (this should appear as the outline of a person) and select “My settings.” Choose “Travel” within the settings menu and tap “Update” near any credit or debit card products you’ll be taking.

This will allow you to enter the details for your upcoming trip, which can be edited at a later time. Saving this information will successfully set up a travel notice.

Our favorite Chase travel card: While many Chase credit cards are adventure-ready, we’d recommend the Chase Sapphire Preferred® Card for new travelers. Not only does it earn 2X Chase Ultimate Rewards points per dollar on travel, but you’ll also get a great introductory bonus: 60,000 bonus points after spending $4,000 on purchases in the first 3 months. You’ll also earn 5X Ultimate Rewards points per dollar on Lyft rides and travel purchased through Chase Ultimate Rewards. You can transfer the points you earn to a variety of airline and hotel loyalty programs. The Sapphire Preferred has a $95 annual fee.

American Express travel notice

Surprise! You actually can’t create an Amex travel notice.

On its site, the issuer says it uses “industry-leading fraud detection capabilities” that help it recognize when you’re on the road, thereby eliminating the need to create an American Express travel notification.

The issuer does recommend you update your contact information, so it can reach you in case of any complications, and download the Amex app, so you can manage your account on the go.

Note that Amex credit cards aren’t as widely accepted across the globe. If you’re a frequent international traveler, we’d recommend looking for a card with a Visa or Mastercard logo instead because they’re accepted by most merchants.

Our favorite American Express travel card: For its $695 Rates & Fees annual fee, The Platinum Card® from American Express offers a slew of travel perks. They include extensive airport lounge access; 5X Membership Rewards points per dollar on eligible flights and hotels (starting 1/1/21, on up to $500,000 spent per calendar year); and up to $200 in Uber credits per year. Its introductory bonus is Earn 100,000 Membership Rewards® points after you spend $6,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu..

Capital One travel notice

As with Amex, there’s no need to set a travel notice for Capital One credit cards.

If you log in and click “Set Travel Notification,” you’ll be greeted by this window:

The issuer, long popular with international travelers for its lack of foreign transaction fees, says: “With the added security of your Capital One chip card, travel notifications are no longer needed on your credit card.”

It notes Capital One will cover you with its $0 fraud liability policy, and will also be on the lookout for any suspicious activity.

Our favorite Capital One travel card: The Capital One Venture Rewards Credit Card is a fantastic, easy-to-use travel rewards card, offering 2X Venture miles per dollar on everything. The introductory bonus is 60,000 bonus miles for spending $3,000 in the first 3 months. It comes with a $95 annual fee.

Bank of America travel notice

Ready to travel with your Bank of America card? Log in to your account, and in the menu at the top right, you’ll see “Help & Support.”

Hover over those words, and a drop-down menu will appear. Click on “Set Travel Notice” — and voila! You’ll be able to add your travel dates and destinations, as well as extra details about your trip, like any planned layovers.

Setting a travel notice with Bank of America.

Bank of America cards allow you to set travel notices up to 60 days in advance, and they can last for up to 90 days. If you’ll be traveling longer than that you’ll need to adjust your travel notice later on.

Our favorite Bank of America travel credit card: If you don’t want to pay an annual fee, the Bank of America® Travel Rewards Credit Card might work for you. You’ll earn 3X points per dollar at the Bank of America travel center and 1.5X points on everything else. After you make $1,000 in purchases in the first 90 days, you’ll earn 25,000 points — enough for a $250 statement credit toward travel purchases.

Citi travel notice

If you have a Citi credit card, the first step is to log in to your account.

Then you should hover over the “Services” button in the menu, and then select “Travel Services.” Next you can select “Manage Travel Notices,” before selecting the card for which you want to set a notice. Unlike some other issuers, you’ll need to set a separate notice for each card you plan to travel with.

Citi advises making sure your contact information is up to date before traveling, and also to download the Citi Mobile App to more easily monitor your account.

Here’s what setting a Citi travel notice looks like:

Setting a travel notice with Citi.

Then, once you fill out your destination and dates and verify your info, you’ll be good to go!

Our favorite Citi travel credit card: The offers a generous 3X ThankYou points per dollar on air travel and at gas stations, restaurants, supermarkets, and hotels. You can earn None. There’s a None annual fee to pay for this card.

Discover travel notice

Although Discover credit cards aren’t the best for traveling internationally, as they aren’t accepted as widely as Visa or Mastercard, you should still set up a travel notice if you bring your Discover card overseas.

You can do this from your online account by selecting “Manage” at the top of your screen, then clicking “Manage Cards” and then “Register Travel.”

Setting a travel notice with Discover.

Our favorite Discover travel card: For a card with no annual fee, the Discover it® Miles isn’t a bad choice. You’ll get 1.5X miles per dollar spent on everything, with double your miles at the end of your first cardholder year.

PNC travel notice

If you have a PNC credit or debit card, the bank recommends you set up a travel notice, explaining: “You typically use your card at local merchants and online, but suddenly you’re buying tapas in Madrid or sushi in Tokyo. This unexpected activity is what triggers the alert. Although less likely, this kind of predicament also can happen when traveling domestically.”

To notify PNC, you can either call the financial institution at 1-888-PNC-BANK or set up an alert online. After logging in to your account, you’ll select: “Customer Service” –> “Account Services” –> “Debit/ATM Card Services” –> “Edit/View Preferences.”

Then, in the bottom right corner of your screen, you’ll see an option to “Notify PNC of Foreign Travel.” After filling it out with your dates, destinations, and phone number, you’ll be ready to go.

Recommended PNC travel credit card: Like the BofA card, the PNC Premier Traveler® Visa Signature® isn’t the best option out there — but it’s fine for PNC loyalists. It offers a 30,000-mile introductory bonus when you spend $3,000 in the first three billing cycles, and 2X miles per dollar spent on everything. Its $85 annual fee is waived the first year.

Wells Fargo travel notice

If you’d like to tell Wells Fargo of your travel plans, you can either call the number on the back of your card, use the bank’s mobile app, or log in to your online account.

If you choose the latter method, you’ll hover over the “Accounts” dropdown menu, then click on “Manage Cards” –> “Manage Travel Plans.” As with the other issuers, you’ll enter your dates and destinations before submitting.

Recommended Wells Fargo travel credit card: There aren’t any Wells Fargo travel cards at the moment.

If you’d prefer a Visa card from Wells Fargo for traveling, consider the Wells Fargo Active Cash℠ Card . It offers 2% cash back on everything you buy, with a solid introductory bonus, but it also has a foreign transaction fee.

4 Things to Consider When Choosing a Travel Credit Card

If you’re looking for another piece of plastic to add to your wallet, here are four things to consider when choosing the best travel rewards credit card:

- Foreign transaction fees: Some credit cards charge a 3% fee for making purchases in a foreign currency. If you plan to travel abroad, make sure your chosen card has no foreign transaction fees.

- Annual fees: Many of the top-tier travel rewards credit cards have hefty annual fees. But before getting scared off, see if the card offers any credits or benifits that offset it. For example, while the Chase Sapphire Reserve® has a $550 annual fee, it also offers a $300 annual travel credit that applies toward flights, car rentals, and even Lyft rides.

- Rewards and perks: One of the most compelling reasons to get a travel credit card is the opportunity to earn points and miles that you can exchange for free travel. So take a look at your potential card’s introductory bonus and earning ability. You should also read the fine print to learn all about its travel perks, which might include airport lounge access or travel insurance.

- Loyalty programs: The majority of hotel chains and airlines have co-branded cards that earn additional rewards when you spend money with them. So if you are loyal to a particular brand, it’s wise to consider the co-branded options. For hotel cards, examples include the IHG® Rewards Club Premier Credit Card, Marriott Bonvoy Boundless™ Credit Card, and The World of Hyatt Credit Card. For airline cards, you can choose from options like the United℠ Explorer Card or Southwest Rapid Rewards® Plus Credit Card.

Whichever card you choose, be sure to set a travel notice before you board your next train or cruise or flight — and then enjoy your vacation free of worries!

You don’t have to stick to “travel credit cards” just because you want to, you know, travel with your credit card. As long as you set up a travel notification when you go, you can use any card you’d like. So, in case they’re a better fit, here are links to the best cash back, balance transfer, and 0% intro APR credit cards.

Share Article

On This Page Jump to Close

You should also check out….

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

How to use the chase sapphire reserve travel credit, you can earn up to $300 annually with this flexible and easy-to-use benefit..

The Chase Sapphire Reserve® is loaded with luxury perks like airport lounge access , travel protections and the ability to earn transferrable travel rewards — but it also has a hefty $550 annual fee. Thankfully, you can recoup over half of that fee thanks to the card's easy-to-redeem travel credits, which can provide up to $300 of value every year.

If you've ever been tempted to sign up for the Chase Sapphire Reserve, now could be an excellent time to give in. Thanks to a limited-time bonus offer, new card members can earn 75,000 bonus points after spending $4,000 in the first three months from account opening. This bonus is 25% higher than the standard offer, making one of the best travel credit cards even better.

How to maximize the Chase Sapphire Reserve travel credit

How does the chase sapphire reserve travel credit work, what triggers the chase sapphire reserve travel credit, when does the chase sapphire reserve travel credit reset, alternate cards with travel credits, bottom line, chase sapphire reserve®.

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Welcome bonus

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

Regular APR

22.49% - 29.49% variable

Balance transfer fee

5%, minimum $5

Foreign transaction fee

Credit needed.

Terms apply.

Read our Chase Sapphire Reserve® review.

The Chase Sapphire Reserve's annual travel credit couldn't be any easier to get — simply use your card to make eligible travel purchases and the first $300 lands in your account as statement credits. Unlike many other cards with a similar benefit, you don't have to make these purchases through a specific site or rewards portal to earn the credit.

This card offers a generous return on travel spending, however, the first $300 in travel purchases won't earn points. Frankly, this is a small sacrifice for the opportunity to be reimbursed for over half of the card's annual fee. According to the card's terms, the statement credit will be posted to your account the same day as the eligible travel purchase posts.

Airfare and hotel bookings are just the beginning of what transactions qualify for this credit. These are some of the purchase categories that should count toward your $300 annual credit:

- Car rental agencies

- Cruise lines

- Travel agencies

- Discount travel sites

- Campgrounds

- Toll bridges and highways

- Parking lots and garages

Whether a purchase triggers the travel credit depends on how the merchant codes the transaction. While this shouldn't be a common issue, it's possible certain travel services purchased as part of a packaged offer may not qualify for the credit.

You can add authorized users to your Sapphire Reserve account for $75 per person each year, and authorized user purchases will trigger the credit. However, there is still only a single travel credit per account, not per card. So if the primary accountholder spends $300 in travel on their card and an authorized user spends $300 in travel, only the first $300 in combined travel purchases will be reimbursed.

The Sapphire Reserve's travel credit resets every card member year — not the calendar year. If you want to know how much of your credit you've used, you can call the number on the back of your card or find the information easily online on your Chase Ultimate Rewards® account page.

The Platinum Card® from American Express is a leader when it comes to offering cardholders travel credits. However, the Amex Platinum's credits can require enrollment or activation, which puts a barrier between you and your credits that doesn't exist with the Sapphire Reserve. That said, you can earn well over $1,000 back every year with this card for purchases that include airline fees, digital entertainment, hotels, CLEAR membership and much more. Terms apply.

The Platinum Card® from American Express

Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year, 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel, 1X points on all other eligible purchases

Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

See Pay Over Time APR

Credit Needed

Excellent/Good

See rates and fees , terms apply.

Read our The Platinum Card® from American Express review .

The U.S. Bank Altitude® Reserve Visa Infinite® Card has a higher annual credit and lower annual fee compared to the Sapphire Reserve. Every year, cardholders can take advantage of up to $325 in dining and travel credits, which covers all but $75 of this card's $400 annual fee. If you have the U.S. Bank Altitude Reserve card , it would be difficult not to fully use this credit every year.

U.S. Bank Altitude® Reserve Visa Infinite® Card

5X points on prepaid hotels and car rentals booked through the Altitude Rewards Center; 3X points on every $1 on eligible travel and mobile wallet spending

Earn 50,000 bonus points (worth about $750 in travel) after spending $4,500 within the first 90 days of account opening

22.24% to 29.24% (Variable)

3% of the amount of each transfer, with a $5 minimum

See rates and fees , terms apply.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

The Chase Sapphire Reserve has loads of luxury benefits and a pricey $550 annual fee to go along with these perks. However, it has an easy-to-use annual travel credit that allows card members to earn up to $300 back every card anniversary year for eligible travel purchases.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit card review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit cards . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

For rates and fees of the Platinum Card® from American Express, click here .

- Citi Strata Premier Card replaces Citi Premier: Enjoy travel insurance and other new benefits Jason Stauffer

- These are the best homeowners insurance companies in Florida Liz Knueven

- First-time homebuyer grants: What you need to know Kelsey Neubauer

How to Let Chase Know You’re Traveling

If you’ve recently decided to travel and want to keep your Chase bank and credit cards up-to-date, you may be wondering how to let Chase know you’re traveling. The good news is that there are a couple of ways to do this. First, you can set up a travel notice on your Chase bank account. You can even get a text message or phone call when you need to notify Chase that you’re traveling.

Set up a travel notice for your Chase credit card

If you are planning a trip, it is important to set up a travel notification on your Chase credit card. You can do this online or by calling the number on the back of your card. If you are going to travel internationally, you will need to input the country and city where you will be spending time. Once you have entered the required information, you will be able to confirm your trip details.

If you are planning a trip overseas, you should notify Chase ahead of time. It is important to note that you can still unfreeze your card from abroad by giving the number of your domestic travel. However, you may want to set up a travel notice for your Chase credit card if you are planning to travel for a long weekend or an international flight. You can also opt for a travel notification for your business card.

Set up a travel notification for your Chase bank account

When you’re planning to travel internationally, set up a travel notification for your Chase bank accounts. The first step is to login to your Chase account and create separate notifications for your credit and debit card accounts. If you’re traveling to another country, choose a card that doesn’t charge you a foreign transaction fee. You can also call Chase customer service to confirm your travel details. Once you have set up a travel notification, you can then use your card to pay for your travel expenses.

If you have a Chase account, setting up a travel notification is easy. You can even use the Chase Mobile App to do it. If you have an older version of the website, you will need to log in and click a different section. After you verify your identity, you’ll see a button with the same message as the one you signed up for. Once you’ve verified your identity, you’re ready to set up a travel notification for your account.

Notify Chase of travel plans for your Chase credit card

To notify Chase of your travel plans, visit their website or call their customer service line. This feature is available for both consumers and business customers. To set up this feature, simply call or visit the Chase App and follow the prompts. For convenience, you can even set up your notification online, over the phone, or over the internet. If you’re traveling overseas, you should call Chase to let them know.

You can create a travel notification up to a year in advance, but be aware that the notice is only valid for 90 days. To extend it, you’ll have to call the bank and request an extension. If you’re planning on traveling internationally, you can use the Travel Notification feature on multiple Chase credit cards. In addition to creating one notification, you can check which cards have foreign transaction fees and which don’t.

Back to Don’t Worry Go Travel Home

Recent Posts

The Art Lover's Guide to Clarksville

Clarksville, a burgeoning hub of art, history, and culture, offers a plethora of attractions for art lovers and travelers alike. This guide delves into the vibrant art scene, historic sites, and the...

Best Spots for Live Music in Clarksville

Clarksville, Tennessee, is a vibrant city with a rich musical culture, offering a plethora of venues for live music enthusiasts. From cozy jazz clubs to bustling live music venues, this city caters...

How to book travel (and save points) with Chase Travel

Editor's note : This is a recurring post, regularly updated with the latest information.

Chase Ultimate Rewards is one of the best flexible rewards currencies available, and you can get some incredible value from your Ultimate Rewards points .

Generally, we recommend transferring Chase points to the program's airline and hotel partners for award bookings. However, sometimes redeeming Ultimate Rewards points for paid travel through Chase Travel℠ is more advantageous. This option can save you money, particularly when traditional award space is unavailable, as you can book almost any available flight or hotel through Chase Travel.

Here's what you need to know about Chase Travel.

Related: New Chase Sapphire Preferred offer: Earn 75,000 of the most valuable points

What is Chase Travel?

To maximize your Ultimate Rewards points, it's often best to transfer them to partner programs like United MileagePlus , World of Hyatt or British Airways Executive Club for award reservations. However, it's important to compare the points needed for a direct booking through Chase Travel to those required for an award booking. Sometimes, booking through the portal can be beneficial, as the points price is tied to the cash cost of the flight or hotel stay, potentially resulting in lower point requirements.

However, you need to have some Chase points before using Chase Travel. If you're unfamiliar with Chase's most popular cards and welcome offers, here are a few current ones to be aware of.

Ink Business Preferred® Credit Card

The Ink Business Preferred® Credit Card is a TPG favorite. It currently comes with one of the highest sign-up bonuses from Chase — 100,000 bonus points after you spend $8,000 on purchases in the first three months of account opening.

Based on our valuations , the bonus points alone are worth $2,050. However, you can redeem these points through Chase Travel for a fixed value of 1.25 cents apiece.

Read more: Ink Business Preferred Credit Card review: A great all-around business card

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is another fantastic addition to your wallet. For a limited time, you'll earn an elevated 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. The bonus is worth $1,538 based on TPG valuations .

Like the Ink Business Preferred, you'll get a value of 1.25 cents per point when booking directly through Chase Travel with the Sapphire Preferred. You'll also earn 5 points per dollar on paid travel purchased through Chase (excluding the first $50 in hotel purchases that qualify for the card's annual hotel credit ).

Read more: Chase Sapphire Preferred credit card review: 75,000-point bonus for a top travel card

Chase Sapphire Reserve®

For a limited time only, the Chase Sapphire Reserve® offers 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening, which is worth $1,538 based on TPG valuations.

This card includes additional perks, like a PreCheck or Global Entry credit , Priority Pass lounge access and a $300 annual travel credit . This card also boosts your portal redemption rate to 1.5 cents per point, giving you 0.25 cents per point in additional purchase power over the Sapphire Preferred. When you book travel through Chase with the Sapphire Reserve, you'll earn 10 points per dollar on hotels and car rentals and 5 points per dollar on flights (excluding purchases that qualify for the $300 travel credit).

Read more: Chase Sapphire Reserve credit card review: Luxury perks and valuable rewards, plus a 75,000-point bonus

Cash-back cards

Chase also issues a number of cash-back credit cards — including the Chase Freedom Unlimited® , Ink Business Cash® Credit Card and Ink Business Unlimited® Credit Card . The rewards you earn on these cards are worth 1 cent apiece toward travel in Chase Travel. However, Chase allows you to combine your earnings into a single account . This means that you can effectively convert these cash-back rewards into fully transferable Ultimate Rewards points if you also have the Sapphire Preferred, Sapphire Reserve or Ink Business Preferred.

How to use Chase Travel

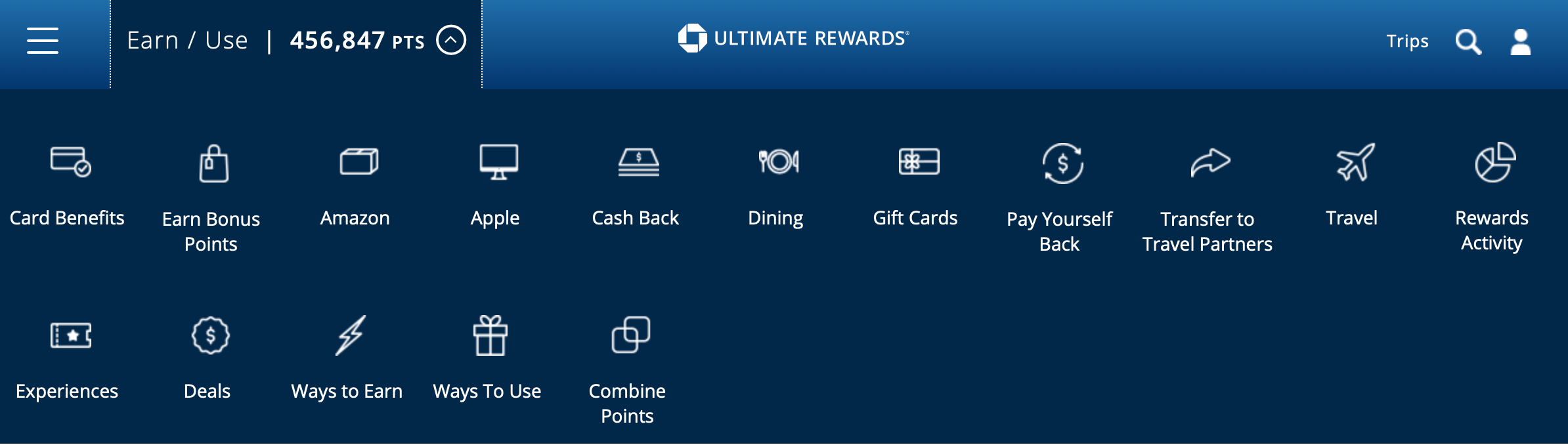

You can book flights, hotels, car rentals, cruises and other travel through Chase Travel, and it's relatively simple to access. First, you'll need to log into your Chase account, then navigate to the right side of the page, where you'll see a little box with your total Ultimate Rewards balance.

Click the box and it will bring you to the Ultimate Rewards dashboard, which looks like this:

Click "Travel" to access the travel homepage and search for airfare, hotels or vacation rentals.

Remember that when you book hotels through the portal with Ultimate Rewards points, you typically will not earn hotel points and elite credits and may not receive elite status perks because it's considered a third-party booking.

However, flights booked through the portal will typically earn frequent flyer miles and qualify for elite status.

How to book flights using Chase Travel

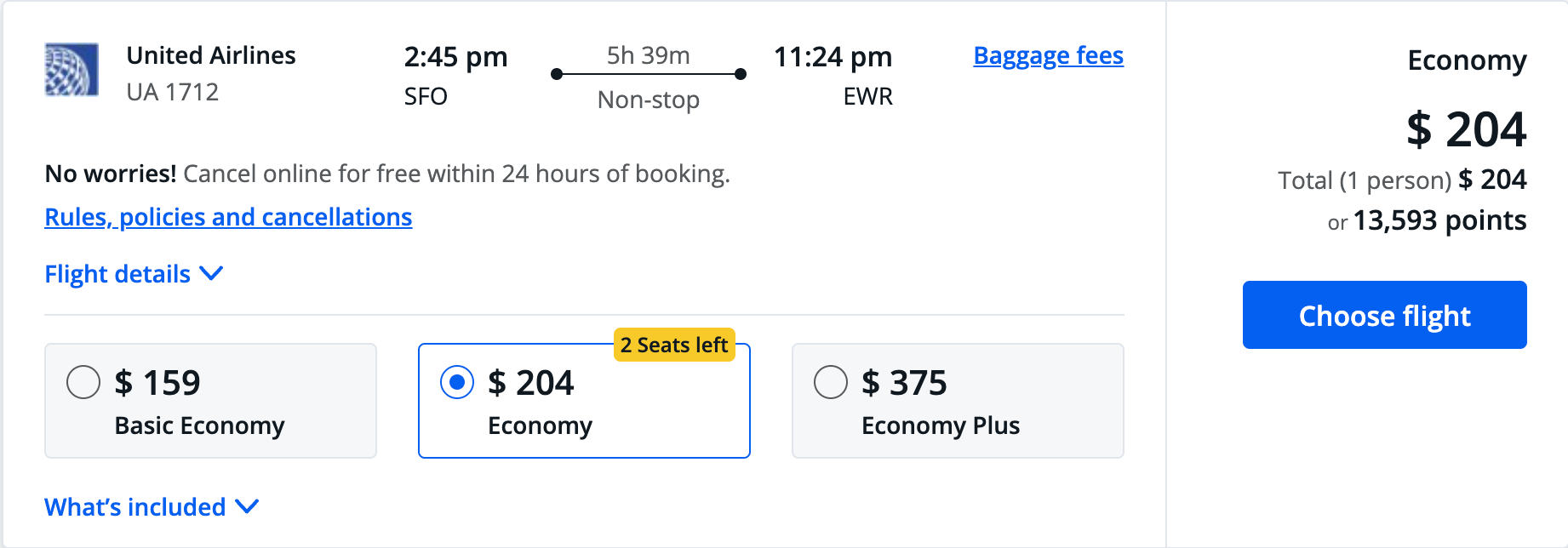

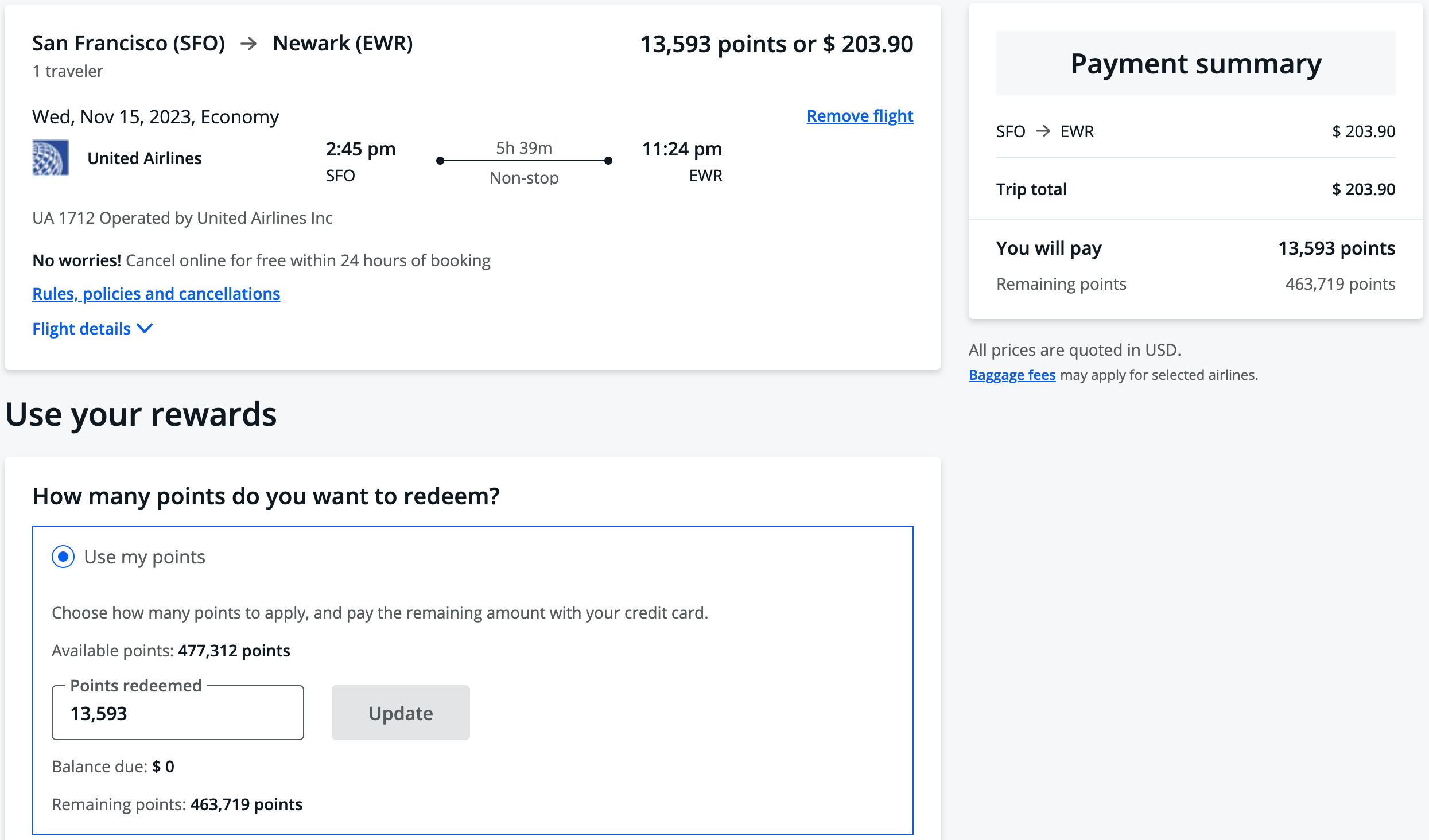

Booking your flights is a straightforward process once you've navigated to the portal's travel page. Type in your arrival and departure airports and travel dates, then hit the search button. For this search, I looked for a one-way flight from San Francisco International Airport (SFO) to Newark Liberty International Airport (EWR).

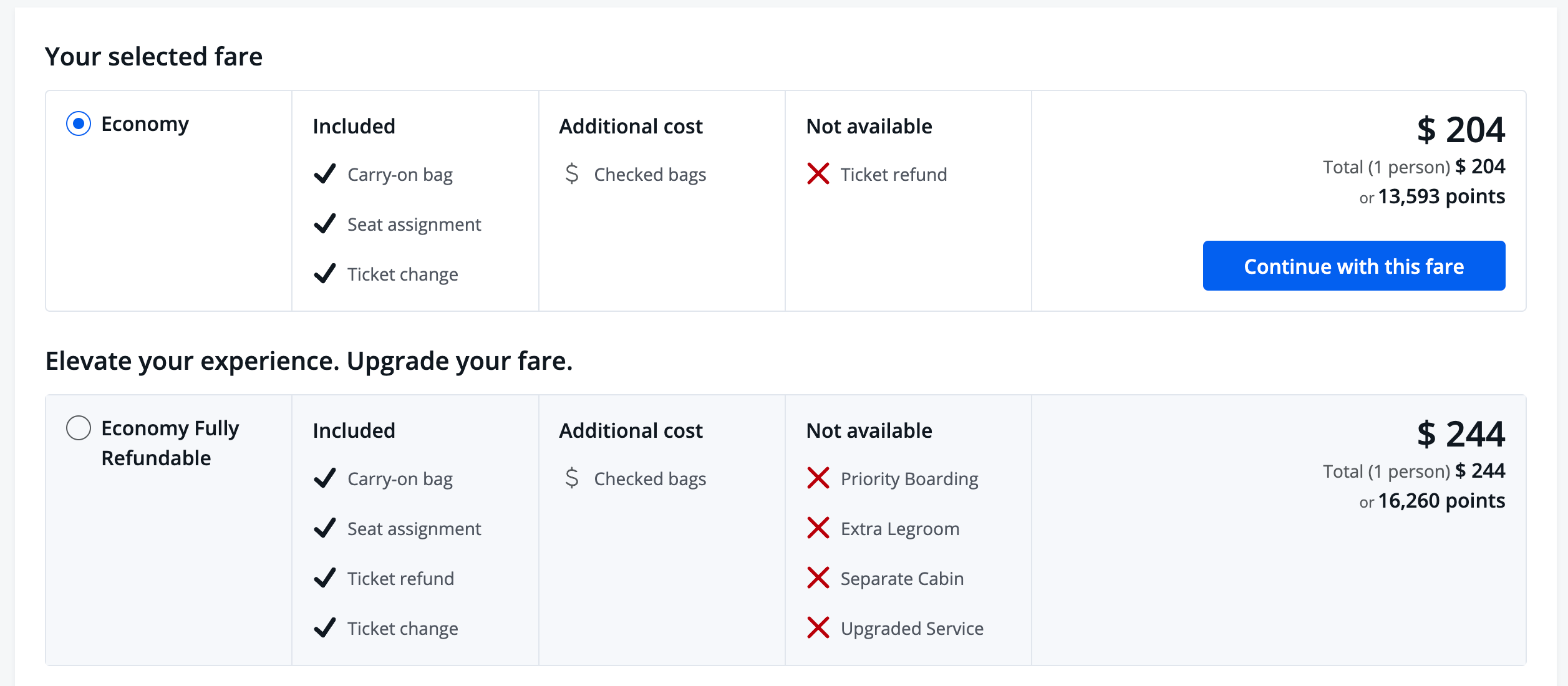

You'll then see the available flight options. When you find a flight you like, select the fare type you want to book and click the blue "Choose flight" button.

Once you've selected your preferred flights, you'll be taken to the next page to review your flight information and look over any upgrades you'd like to make.

Then, you'll be directed to the checkout page, where you can pay with cash, points or a combination of the two. Again, points linked to a Chase Sapphire Reserve account are worth 1.5 cents each. If you have a Chase Sapphire Preferred Card or Ink Business Preferred Credit Card , points are worth 1.25 cents each.

Finally, you'll be directed to a page where you will enter the traveler's information and finalize your flights.

How to book hotels using Chase Travel

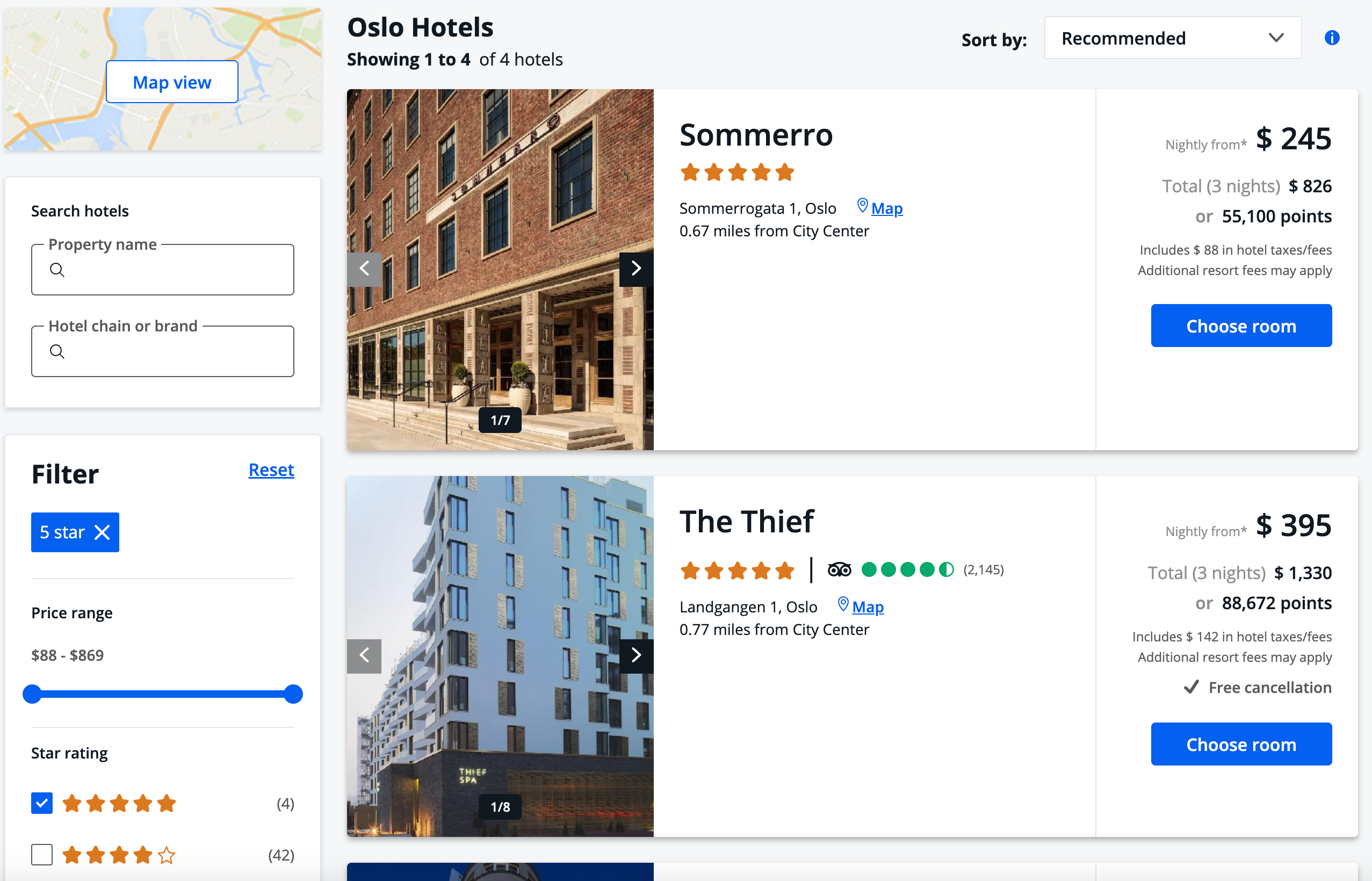

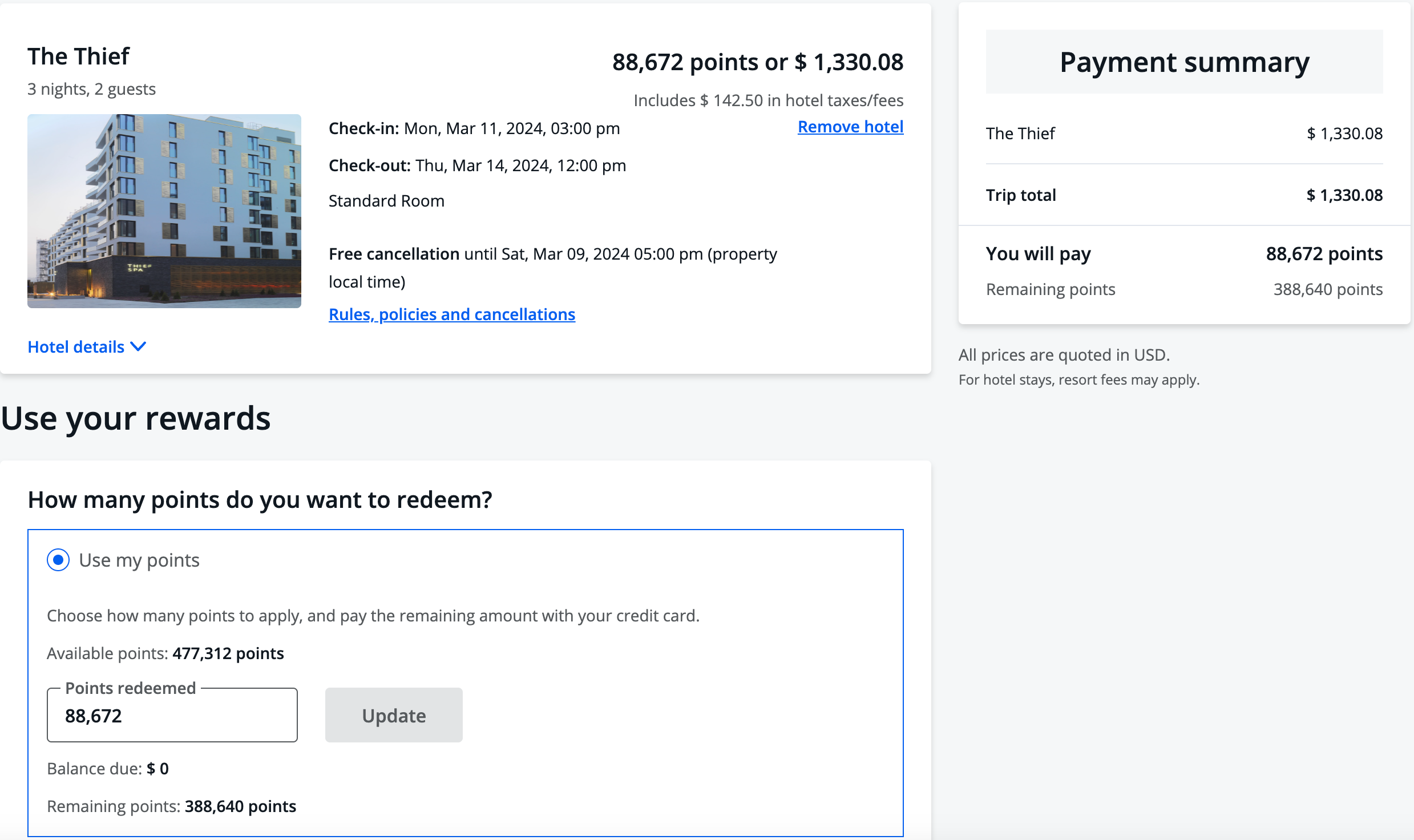

Booking hotels is similar to booking flights on the travel portal. This can be advantageous if you're looking at hotels outside of major chains that partner with Ultimate Rewards ( Hyatt , IHG and Marriott ). Regardless of how you book your hotel, compare the award rates required by these hotel loyalty programs to ensure you're getting the best deal.

Also, if you have an eligible card, you can access the Chase Luxury Hotel & Resort Collection , which gives you perks at around 1,000 luxury properties worldwide. Participating cards include the Chase Sapphire Reserve , United℠ Explorer Card , United Club℠ Infinite Card , United Quest℠ Card and United℠ Business Card .

Here's a sample search for hotels in Olso, Norway, which hosts mostly boutique hotels.

Once you've selected your desired property, room and rate, you can specify how many points you want to use on the checkout page.

Then, run through the on-screen prompts to finalize your booking, and you'll get an email confirmation.

Remember, you'll receive up to $50 in statement credits yearly for hotel reservations made through Chase Travel as a Sapphire Preferred cardholder.

Related: Book low-end or luxury hotels to get the best value from your points

How to book car rentals, cruises and other travel using Chase Travel

Using Chase Travel, you can rent cars, pay with points and still receive the excellent primary car rental insurance offered by the Chase Sapphire Reserve and Chase Sapphire Preferred Card .

The process of renting cars is similar to booking flights and hotels. Navigate to the "Cars" header from the main landing page and type in your itinerary, even if it's a one-way rental. Then, select "Search," and the results page will pop up. Once you choose your car, you'll be prompted to select add-ons.

When you've finished selecting, you'll head to the booking page, where you'll input your personal information and choose how many points you'd like to spend. Remember that to qualify for rental car insurance, you must decline the car rental company's collision damage waiver and ensure that anyone driving the car is on the rental agreement.

You can also book activities and cruises through Chase. Regarding activities, you can use your points to book fantastic tours like a Washington, D.C., night monument tour or Singapore heritage food tour at 1.25 or 1.5 cents each. This can be an excellent way to make a vacation free, instead of just your hotels and flights.

Cruises are also available, though you'll have to call to book those.

Related: The easiest ways to save on rental cars

More things to consider about Chase Travel

Below is some general guidance to maximize your experience with the portal.

We recommend comparing the points needed through Chase Travel with those required for partner transfers, factoring in taxes and fees. If you have or want hotel elite status, avoid booking hotels through the portal. These stays generally won't count toward status or qualify for hotel elite status benefits.

Booking through Chase Travel with cash can earn you extra points; Ink Business Preferred and Sapphire Preferred cardholders earn 5 points per dollar on all travel and Sapphire Reserve cardholders earn 5 points per dollar on flights and 10 points per dollar on hotels and rental cars. You might find better rates by booking directly with the travel provider; however, if your plans are firm and rates are comparable, booking through the portal can be worthwhile for earning extra points.

Remember that booking through third-party sites may result in issues if you change your plans, though. Travel providers are more likely to assist you if you've booked directly with them.

Bottom line

Chase Travel lets you use your points to book flights, hotels, rental cars, cruises and activities. If award flights aren't available or you find a cheap fare that requires fewer points, booking through the portal can be a good option.

With the Chase Sapphire Preferred and Chase Sapphire Reserve cards offering elevated welcome bonuses of 75,000 Ultimate Rewards points, now is a great time to look at Chase Travel.

Similarly, for hotels, it can be a good deal if you find a cheap rate or book a boutique property, but keep in mind that you may not earn hotel points or receive elite benefits. Whether booking rental cars, activities or cruises, always compare the options to see if using the portal or transferring to partners for an award is more advantageous.

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- Best Credit Cards

- Travel Credit Cards

- Best Credit Cards for International Travel

On This Page

- Key takeaways

Our top picks for the best credit cards for international travel

Best credit cards for international travel compared, best credit cards for international travel: editorial reviews, who should get a credit card for international travel, is a credit card or debit card better for international travel, how to choose the best credit card for international travel, should i have more than one card for international travel, tips for using a credit card when traveling internationally, alternatives to credit cards for overseas travel, faq: best credit cards for international travel.

Best Credit Cards for International Travel of 2024

- Some of the best credit cards for international travel are the Chase Sapphire Preferred® Card , Chase Sapphire Reserve® , The Platinum Card® from American Express , and the Capital One Venture Rewards Credit Card .