Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Seven Corners Travel Insurance Review — Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

311 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Director of Operations & Compliance

1 Published Article 1178 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

Why purchase travel insurance, travel insurance and covid-19, why purchase travel insurance from seven corners, type of policies available, how to obtain a quote, the value of travel insurance comparison sites, how seven corners travel insurance compares, everything else you need to know, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you’re planning a trip, especially in the current environment, chances are the topic of purchasing travel insurance crossed your mind. It’s good news that whether you’re looking for a comprehensive travel insurance package policy or 1 that focuses on providing medical insurance coverage during your travels, you’ll find coverage can be easily secured and it can be affordable.

The company we’re reviewing today offers both comprehensive travel insurance package plans and separate plan options that provide stand-alone travel medical coverage . Seven Corners has been offering these plans since 1993 to U.S. citizens traveling abroad, travelers who are visiting the U.S., and other international travelers.

Let’s continue as we look at why you’d want to purchase travel insurance and specifically why you’d want to consider Seven Corners. We’ll also look at the types of policies offered by Seven Corners, how the company compares to other travel insurance companies, and to the coverage that comes with your credit cards.

Join us now for a close-up look at Seven Corners and what it has to offer.

Travel insurance is designed to protect your trip investment from loss and from the additional expenses incurred due to an unexpected event, causing you to cancel your trip or resulting in disruption during your travels.

Here is a sampling of circumstances when travel insurance could provide a significant benefit:

- You break your ankle during your ski trip and need to return home early

- An immediate family member becomes seriously ill and you must cancel your trip to care for them

- You become ill or injured while staying at a remote lodge and must be evacuated to the nearest hospital

- There is a flood and your home becomes inhabitable, causing you to cancel your trip

- You suffer a dental injury on vacation and need immediate dental work

Bottom Line: Any trip that involves a significant investment in non-refundable expenses should be insured, as well as any trip that takes you where you would be without medical coverage.

Many travelers have recently found themselves in a position where they needed to cancel, postpone, or change their travel plans due to COVID-19 . While it’s reasonable to expect that travel insurance might cover these cancellations, normally, it does not.

It’s possible your travel insurance policy will cover you for canceling your trip due to getting ill from the virus, or if your trip is disrupted as a result, but many companies are excluding coverage for any COVID-19 related claims.

Additionally, voluntary cancellations due to the fear of getting ill are not a covered reason for trip cancellation on any travel insurance policy.

In order to be covered for COVID-19-related trip cancellation, you must purchase Cancel for Any Reason insurance (CFAR). Note that the coverage can be expensive, it will not cover all of your trip costs, and many companies do not offer the coverage.

If having this coverage is important, you’ll want to select a travel insurance company that offers CFAR insurance and/or offers coverage for trip cancellation, trip interruption, and medical care should you contract the COVID-19 virus.

Bottom Line: Travel insurance does not cover voluntary trip cancellations due to the fear of getting ill. In order to have coverage for voluntary cancellations, you must purchase Cancel for Any Reason insurance. Not all companies sell this CFAR insurance, it does not cover all your trip costs, and it can be expensive.

When you select a travel insurance company, you’ll first want to make sure it’s financially stable and that it has decent customer reviews. Seven Corners checks those boxes with an A+ rating of the company’s underwriters from the insurance financial rating company A.M. Best , and according to global consumer rating company Trustpilot , 81% of its customers view their experience as good or excellent.

Now that we know Seven Corners is a stable and well-respected company, we’ll next want to check out the company’s policy offerings.

We’ll compare coverages and costs shortly, but 2 critical items we’ve covered so far in this article are 1) the importance of a company offering the option to purchase CFAR insurance and 2) that a policy offers coverage for COVID-19.

If either of these items is important to you, have peace of mind knowing that Seven Corners offers both.

Let’s look closer at the types of policies Seven Corners offers.

Bottom Line: Seven Corners has highly rated underwriters, good customer service ratings, and offers both comprehensive travel insurance package plans and medical travel insurance. In addition, the company offers CFAR add-on insurance and coverage for COVID-19 related expenses.

Seven Corners offers both comprehensive trip insurance policies and travel medical insurance plans. You can expect to find a combination of key coverages offered on each policy.

Let’s look at Seven Corners trip insurance policy options.

Comprehensive Travel Insurance Package Policies

Whether you’re a U.S. resident or non-U.S. resident traveling internationally, Seven Corners offers a travel insurance package option that will cover you during your travels.

- Roundtrip Trip Cancellation Insurance — for U.S. residents traveling internationally; select between Roundtrip Economy, Roundtrip Choice, and Roundtrip Elite policy options

- Roundtrip International Trip Insurance — for non-U.S. residents traveling internationally

You’ll find a long list of coverage options on these single-trip comprehensive package travel insurance plans including the following:

- Trip cancellation/interruption/delay coverage

- Missed connection

- Lost, stolen, damaged, or delayed baggage

- Emergency medical, dental, and evacuation/repatriation

- Political evacuation

- Accidental death and dismemberment

- Pre-existing conditions waiver

- 24/7 worldwide assistance services

Optional coverages include car rental insurance, CFAR, cancel for work reasons, lost or damaged ski/golf equipment, and flight accident insurance.

With more focus on medical coverage while traveling and the ability to purchase 1 annual plan for multiple trips, Seven Corners’ Wander policies also provide incidental trip protections such as trip interruption/delay and luggage insurance.

- Wander Frequent Traveler — annual comprehensive medical coverage (not including COVID-19-related illness)

- Wander Frequent Traveler Plus — annual comprehensive medical coverage, including COVID-19-related illness

Hot Tip: Cancel for Any Reason insurance can be added to most Seven Corners Roundtrip package policies to cover up to 75% of non-refundable trip expenses.

Travel Medical Insurance Plans — Plans for International Travelers

Liaison travel medical insurance plans can cover up to 10 travelers, focusing on major medical coverages, and also includes incidental trip cancellation, interruption, delay, and baggage coverage.

- Liaison Travel Basic — designed for travelers traveling outside the U.S.

- Liaison Travel Plus — for those who are traveling outside the U.S., includes coverage for COVID-19

- Liaison Travel Basic U.S. — for non-U.S. visitors traveling to the U.S.

- Liaison Travel Plus U.S. — for non-U.S. visitors traveling to the U.S., includes coverage for COVID-19

Liaison Travel Plus and Travel Plus U.S. policies are recommended if you need a travel medical policy that meets Schengen visa insurance requirements.

Travel Medical Insurance Plans — Travel Within or To the U.S.

Explore North America plans focus on providing major medical coverage while visiting the U.S. but also include a $5,000 trip interruption benefit.

- Explore North America and Explore North America Plus — policies provide coverage for non-U.S. residents who are also non-U.S. citizens who need medical coverage while visiting the U.S., Canada, Mexico, and parts of the Caribbean; the plans can cover trips up to 364 in length

The Explore North America Plus plan includes coverage for COVID-19 related expenses .

Specialty Plans

- Group Plans — Find coverage for single trips or for extended periods up to 364 days. Whether you’re an individual traveling with a group, need a plan that covers your entire group, or want to cover your entire family, there’s a group plan that will fit your situation. Select a comprehensive travel insurance plan or 1 that focuses on medical coverage.

- Liaison Student Travel Medical Insurance — Liaison Student medical plans are designed for U.S. citizen students traveling abroad, non-U.S. student citizens traveling to the U.S., and non-U.S. citizens traveling outside of the U.S. The plan can also cover faculty, scholars, and their families.

- Liaison Medical Evacuation and Repatriation — This plan is designed for students traveling in the U.S. to meet J visa insurance requirements.

- Visitor Insurance Plans — Complete medical insurance plans are available for inbound non-U.S. citizens traveling to the U.S. Coverage for family members and travel companions is also available.

Bottom Line: Seven Corners offers an expansive collection of comprehensive travel insurance plans and options for stand-alone travel medical insurance coverage. Plans include single trip coverage, annual plans, group coverage, and coverage for students. Whether you’re a U.S. citizen traveling abroad or a foreign national traveling the world, there’s a Seven Corners plan that fits your situation.

Seven Corners provides an easy-to-use website to secure a quote for any of its travel insurance products. Minimal information is needed to receive an immediate quote. The site also provides information that can help educate you on the different types of insurance available.

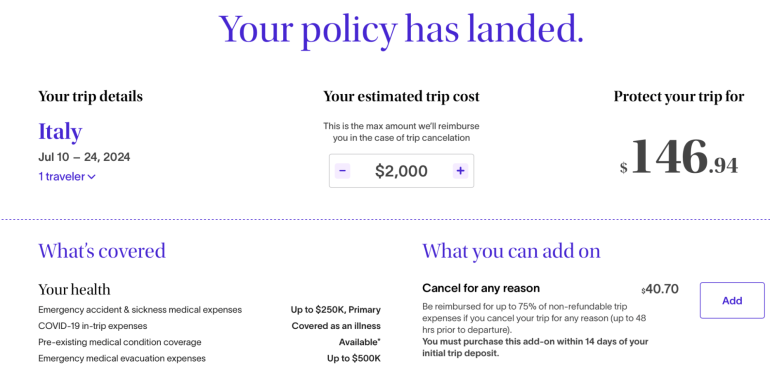

After submitting your information, you’ll receive an instant quote with the price and list of coverages. Review the coverages, select any desired additional coverage, and the policy is available for immediate purchase.

You’ll find the process of getting a quote and comparing coverages simple and easy to understand. Plus, you’ll be able to secure coverage for your trip immediately.

Bottom Line: Whether you need travel medical insurance or a comprehensive travel insurance policy, Seven Corners’ website makes it easy to secure a quote, review coverages, and purchase a policy with immediate coverage.

Regardless of the type of insurance you wish to purchase, it’s always prudent to compare policy coverages and costs. This is especially true with travel insurance and travel medical plans as coverage is widely available and costs can vary significantly between companies.

That’s where travel insurance comparison sites can add value. You’ll find each site compares scores of highly-rated companies and dozens of policies, making it easy to compare and select the policy that best meets your needs.

Here are a few we recommend.

Best for Comprehensive Travel Insurance Plans

- TravelInsurance.com — Compare travel insurance plans that also offer travel medical insurance. No stand-alone travel medical plans are offered.

- Squaremouth — Search for single trip, annual, group, and sports/adventure plans. While travel insurance plans can include medical coverage, there is no option to search for medical-only coverage.

Best for Travel Medical Plans

- InsureMyTrip — The site allows you to compare single and multi-trip travel medical policies as well as comprehensive travel insurance plans.

Bottom Line: Travel comparison websites are valuable resources for comparing travel insurance plans. However, not all sites allow you to search for stand-alone travel medical plans.

Seven Corners vs. Other Travel Insurance Companies

Purchasing travel medical insurance for a single trip is not an expensive decision, although costs can be much higher as you get older. In the above example, we searched for a quote for a 1-week $3,000 trip to Mexico for a traveler 40 years of age. All plans include COVID-19 coverage and cost $13 to $20. At 70 years of age, the same policy would cost approximately $50 to $90.

Seven Corners offers both competitive coverage and premium costs on travel medical insurance when compared to several other insurance companies. Your experience will vary based on the type of policy, the coverage selected, the age of the travelers, and the length/cost of the trip.

When we look at comprehensive travel insurance policies, Seven Corners, although competitive, had lower limits on medical coverage within the comprehensive travel insurance plans when compared to most other companies. However, higher limits are available via the Seven Corners website.

Seven Corners vs. Credit Card Insurance

Many credit cards come with complimentary travel insurance coverages that can provide a benefit if your trip is canceled/interrupted for covered reasons, your luggage becomes damaged, lost, or delayed , or even if you have an accident with your rental car .

It’s possible this coverage could be sufficient for a simple trip that doesn’t include a significant financial outlay. However, the coverage that comes on your credit card will not take the place of a comprehensive travel insurance policy. Plus, it’s rare to find any level of travel medical insurance on a credit card.

There are just a few additional reasons for considering travel insurance over the coverage that comes with your credit card:

- Coverage that comes with your credit card is normally secondary coverage that requires you to first file a claim with any other applicable insurance

- Claims for travel insurance are not handled by the credit card issuer but by a third-party company, making it potentially more complicated to file a claim

- Credit cards do not provide comprehensive travel medical coverage

- Credit card insurance does not cover cancellations due to the fear of getting ill, including the fear of getting the COVID-19 virus

- You are normally required to use the applicable credit card to purchase the trip in order to have coverage

If your trip does not involve a significant investment, you have medical insurance that covers you while traveling outside the country, and you feel comfortable relying on the coverages offered by travel rewards credit cards, here are a few of the best cards to consider:

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s over $900 when you redeem through Chase Travel SM .

- Enjoy benefits such as 5x on travel purchased through Chase Travel SM , 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel SM . For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Chase Ultimate Rewards

One of our favorite overall travel rewards cards, the Chase Sapphire Preferred card offers the following travel insurance benefits:

- Trip cancellation, trip interruption, and trip delay

- Primary car rental insurance

- Baggage insurance

- Travel and emergency assistance

- Travel accident insurance

For more information on the Chase Sapphire Preferred’s travel insurance benefits , you’ll want to read this informative article.

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $1,125 toward travel when you redeem through Chase Travel SM .

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel SM immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel SM . For example, 75,000 points are worth $1125 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass TM Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- APR: 22.49%-29.49% Variable

- Foreign Transaction Fees: $0

Examples of travel insurance benefits that come with the Chase Sapphire Reserve card include:

- Trip cancellation, trip interruption, trip delay

- Emergency medical, dental, and evacuation insurance

To review all the travel insurance coverages included with the Sapphire Reserve , you can learn more in our expanded article.

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck ® application fee for a 5-year plan only (through a TSA PreCheck ® official enrollment provider), when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

American Express Membership Rewards

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 125k (or 150k) points with the Amex Platinum. The current public offer is 80,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

You can expect to find a nice collection of travel insurance benefits on the Amex Platinum . Note that terms apply and enrollment may be required through your American Express account, so don’t miss out on these benefits.

- Trip cancellation, trip interruption, and trip delay reimbursement

- Secondary car rental insurance with the option to purchase Premium Protection for 1 low fee that covers the entire rental period

- Premium Global Assist Hotline

- Emergency transport and evacuation (included in the Premium Global Assist Hotline benefit)

Bottom Line: The travel insurance coverage that comes with your credit card is not a substitute for a travel insurance package policy or medical coverage. Credit card coverage could be sufficient for a trip that does not involve a significant investment or if your health insurance covers you during your travels. For an overview of the best credit cards for travel insurance coverages , check out our article on the topic.

Here is some additional helpful information regarding purchasing a policy from Seven Corners:

- You have 10 days after you receive your policy documents to review the plan and, if not satisfied, request a full refund

- Some Seven Corners medical plans are secondary and require you to have an underlying health insurance plan that covers you in the U.S. to be eligible

- Not all policies offered by Seven Corners are available in every state

- You can initiate a claim with Seven Corners by calling 800-335-0611 or 317-575-2652 worldwide or via the Seven Corners website

- Seven Corners offers plans that meet Schengen Visa requirements

Seven Corners is a highly rated, established, and respected travel insurance company that offers a wide variety of travel and medical insurance plans for travelers. It is overall competitive and offers both COVID-19 coverage and Cancel for Any Reason insurance.

The company also excels in providing long-term medical coverage for international travelers.

One caution to note is that, as with all travel insurance companies, many of Seven Corners’ plans do not offer COVID-19 related coverage. If this coverage is important to you, be sure to select a policy that includes it and if desired, add CFAR coverage.

Because there are so many variables when it comes to purchasing travel insurance or travel medical insurance, prices and coverages can vary significantly. Be sure to check several sources to find the right coverage at the right cost.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is seven corners travel insurance good.

Yes. Seven Corners receives good reviews and its underlying underwriting companies are rated highly by insurance rating company A.M. Best.

The company, unlike many other travel insurance companies, also provides the option to purchase Cancel for Any Reason insurance and coverage for COVID-19 related events that can disrupt your travels.

How do I make a travel insurance claim with Seven Corners?

You can call 800-335-0611 or 317-575-2652 worldwide. You can also initiate and track your claim via the Seven Corners website .

Does Seven Corners' policies meet Schengen Visa requirements?

Yes. You will find several medical insurance plans offered by Seven Corners that meet Schengen Visa requirements.

Does Seven Corners cover COVID-19?

Yes. Several of Seven Corners’ policies offer the option to include coverage for COVID-19 and some include this coverage. You can also cover cancellations of any type by adding CFAR coverage, available on many of Seven Corners’ policies.

Does Seven Corners cover evacuation?

Yes. There is coverage for evacuation on Seven Corners travel medical insurance policies. The level of coverage will depend on the policy and the level of coverage chosen.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Seven Corners

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Seven Corners travel insurance review 2024

Jennifer Simonson

Mandy Sleight

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Heidi Gollub

Updated 8:50 a.m. UTC May 6, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Top-scoring plan

Average cost, medical limit per person, what you should know.

Seven Corners’ Trip Protection Choice plan is more expensive than top-scoring plans in our rating of the best travel insurance . But it does provide robust coverage, including emergency medical benefits of $500,000 per person (primary coverage), $1,000,000 per person in emergency evacuation coverage and $20,000 per person for non-medical evacuation.

If COVID coverage is a priority when buying travel insurance, check out Seven Corners’ cheaper plan, Trip Basic. The basic plan gets 5 stars in our ratings of the best COVID travel insurance and the best “cancel for any reason” travel insurance .

- Emergency medical benefit is $500,000 primary coverage.

- Emergency medical evacuation coverage is $1,000,000 per person.

- Rare $20,000 in non-medical evacuation coverage.

- More expensive than top-scoring competitor plans.

- No “cancel for work reasons” coverage.

- Missed connections coverage of $1,500 per person is only for cruises and tours.

Why trust our travel insurance experts

Our travel insurance experts evaluate hundreds of insurance products and analyze thousands of data points to help you find the best trip insurance for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Seven Corners travel insurance plans

Seven Corners offers a variety of travel insurance plans for leisure trips, business trips, student trips and group trips. It also has options for travelers looking for travel medical insurance and annual travel insurance .

Trip Protection Basic

Seven Corners’ Trip Protection Basic plan gets 5 stars in our rating of the best “cancel for any reason” travel insurance and in our rating of the best COVID travel insurance . It is more affordable than Trip Protection Choice, but the coverage limits are lower.

This basic travel insurance plan includes the following benefits.

- Trip cancellation insurance : Coverage for 100% of your prepaid, nonrefundable trip expenses, up to $30,000.

- Trip interruption insurance: 100% coverage of your nonrefundable insured trip cost.

- Trip delay insurance: $200 per day per person, up to a maximum of $600, after a delay of at least six hours.

- Travel medical insurance : $100,000 per person in secondary medical coverage — this means you’ll have to file a claim with your health insurance first.

- Emergency medical evacuation : $250,000 per person.

With this plan, you also have the option to add rental car coverage, sports and golf equipment coverage, “trip interruption for any reason” (IFAR) coverage and “cancel for any reason” (CFAR) coverage that would cover up to 75% of nonrefundable trip costs.

Trip Protection Choice

Seven Corners’ Trip Protection Choice plan gets 3 stars in our rating of the best travel insurance , in large part due to its higher cost. But that doesn’t mean it isn’t worth considering.

This travel insurance plan provides all the benefits of the Trip Protection Basic plan, with higher coverage limits.

- Trip cancellation insurance: Coverage increases to $100,000 per person.

- Travel medical insurance: Emergency medical benefits go from $100,000 per person in secondary coverage with the Basic plan to $500,000 per person in primary coverage.

- Emergency medical evacuation: This benefit jumps from $250,000 per person to $1,000,000 per person with the Choice plan.

The Trip Protection Choice plan also includes a pre-existing medical condition exclusion waiver (provided conditions are met), accidental death and dismemberment benefits and coverage for pet kennels of $100 per day up to a maximum of $500.

With this plan, you have the option to purchase add-on coverage for an increased cost.

- Rental car coverage: Provides up to $35,000 if your rental car is stolen or damaged due to collision, theft, vandalism or natural disaster.

- Sports and golf equipment rental: Provides up to $5,000 to reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for more than six hours.

- “Cancel for any reason” (CFAR) coverage: Reimburses up to 75% of your prepaid, nonrefundable trip cost if you choose to cancel your trip at least two days before your scheduled departure date.

- “Interruption for any reason” (IFAR) coverage: Reimburses up to 75% of your prepaid, nonrefundable trip cost and provides additional transportation expenses if you interrupt a trip at least 48 hours after the scheduled departure date. To get this upgrade, you have to buy it within 20 days of your first trip payment.

Comparing Seven Corners travel insurance plans

What seven corners doesn't cover.

Seven Corners travel insurance does not cover every single situation that may arise during your travels. Like other travel insurance companies, Seven Corners’s plans contain exclusions, which is why it is always a good idea to review your policy’s fine print.

Here are some examples of exclusions in the Trip Protection Choice plan:

- Air travel on privately owned aircraft.

- Elective treatment and procedures.

- Mental health care.

- Normal pregnancy.

- Routine physical examinations or routine dental care.

- Suicide or attempted suicide or any intentionally self-inflicted injury.

Seven Corners travel insurance rates

The pricing for Seven Corners travel insurance will vary based on your age, destination, the length and cost of your trip, which plan you choose and whether to upgrade to “cancel for any reason” (CFAR) coverage .

Here are some example quotes for Seven Corners’ Trip Protection Choice plan.

Seven Corners annual travel insurance

Seven Corners also sells annual travel insurance for frequent travelers.

The Trip Protection Annual Multi-Trip plan includes coverage for all your trips throughout the year, as long as each one lasts less than 40 days. Benefits include:

- Trip cancellation. Choose from four levels of coverage up to $10,000.

- Trip interruption. Reimburses up to 150% of prepaid, nonrefundable trip costs.

- Trip delay. Reimburses up to $200 per day, $2,000 per year. This covers meal costs, local transportation and accommodations following a delay of at least six hours.

Compare the best travel insurance companies of 2024

Via TravelInsurance.com’s website

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024. For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- $3,000, 8-day trip to Mexico for two travelers age 30.

- $3,000, 8-day trip to Mexico for two travelers age 70.

- $6,000, 17-day trip to Italy for two travelers age 40.

- $6,000, 17-day trip to Italy for two travelers age 65.

- $15,000, 17-day trip to Italy for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to France for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to the U.K. for four travelers ages 40, 40, 10 and 7.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

Seven Corners travel insurance FAQs

Yes, Seven Corners offers international travel insurance. You can buy standalone travel medical insurance or a comprehensive travel insurance plan that includes emergency medical and emergency medical evacuation benefits.

Yes, Seven Corners is a good travel insurance company. Its Trip Protection Basic plan gets 5 stars in our rating of the best “cancel for any reason” travel insurance . The more comprehensive Trip Protection Choice plan gets 3 stars in our rating of the best travel insurance .

Yes, Seven Corners travel insurance covers emergency medical evacuation if the facility where you are located cannot provide the level of care necessary for your medical condition.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Jennifer Simonson covers everything from business to the wine industry to international travel. Outdoor adventure, water parks and all things Texas are by far her favorite beats. Her work has appeared in Forbes, Travel + Leisure, Texas Monthly, Smithsonian Magazine, Fodor's, Lonely Planet, Slate and more. You can follow her on Instagram at @storiestoldwell.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

AXA Assistance USA travel insurance review 2024

Travel Insurance Jennifer Simonson

Cheapest travel insurance of May 2024

Travel Insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance companies of May 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Suggested companies

Allianz partners usa.

Seven Corners Reviews

In the Travel Insurance Company category

Visit this website

Company activity See all

Write a review

Reviews 4.2.

5,216 total

Most relevant

Quick helpful service

I found out that we needed to cancel our trip due to my son tearing his shoulder, rotator cuff. His surgeon is not comfortable with him going to Africa now so we had to cancel our trip. I called and the agent answering the phone told me we could all reschedule our trip when my son's doctor felt comfortable he had healed enough to not damage the shoulder. They were so helpful and nice and so I am working with a tour company to rebook us for 2025. We were going to Africa for my 70th birthday so we will celebrate my 71 birthday next year in Africa. Also when it happen I thought "Thank God" I had insurance!

Date of experience : May 17, 2024

Reply from Seven Corners

Hello Jan, we are delighted to know that our agent was able to assist you efficiently and provide you with the necessary support. Thank you for choosing Seven Corners Inc as your travel insurance and for your positive feedback. We look forward to serving you next year!

Austria hospital visit

Very positive first time experience with 7 Corners. We took out a policy for medical coverage for our trip to Europe this winter. My wife got sick in Austria with a sinus infection and bronchitis resulting in hospital & pharmacy charges. We submitted a claim form online when we got back home. The claim process required a fair amount of documentation but was straightforward. We received our check in the mail w/in a few weeks. Will definitely use 7 corners again for our future travels.

Date of experience : March 16, 2024

Hello David, we understand that medical emergencies can be stressful, and we're glad that our straightforward claim process made it easier for you to submit a claim for reimbursement. Thank you for choosing us for your medical coverage during your trip to Europe. We look forward to serving you on your next trip!

The customer service reps helped me…

The customer service reps helped me fill Out the claim for my husband and I since I had difficulty understanding how to do both. They were kind, patient and very knowledgeable . It was a pleasure working with both representatives!

Date of experience : May 08, 2024

Hello Mary, we are happy to hear that our customer service representatives were able to assist you in completing your claim. Their dedication to providing exceptional support and their expertise in guiding you through the process is truly commendable. Thank you for taking the time to share your positive experience!

Call was promptly answered

Call was promptly answered. The agent was pleasant and checked to ensure my updated cost fell within the time sensitive period. Shortly thereafter, I received a confirmation email of the change.

Hello Nomad, we're happy to hear that your call was promptly answered and that our agent was able to assist you in updating your cost within the time frame. We appreciate your positive feedback and are glad that you received a confirmation email of the change. We look forward to serving you on your trip!

Our recent purchase through Squaremouth…

Our recent purchase through Squaremouth autofilled in incorrect dates for the policy so I called Seven Corners to talk to an agent. She was extremely courteous, helpful, and understanding and quickly corrected the problem.

Hi Ted, we're delighted to hear that our agent was able to promptly resolve the issue with your policy dates. Thank you for taking the time to leave us a review on your experience with us!

All my questions were answered

All my questions were answered. Kandy ( I hope I write their name correctly) was so helpful - they provided clarification on my insurance policy and all additional details beyond what I expected. Their acknowledgement of the complicated healthcare system and the need for clarification is also very important. Overall, I appreciate their time and resources provided.

Date of experience : May 16, 2024

Hi Solange, we are pleased to hear Candy was able to provide excellent customer service to you! She is one of the best representatives we have. We appreciate you taking the time to leave us a review about your experience!

Worst travel insurance experience ever! 8/19/19

Worst travel experience ever!! We were scheduled for a trip of a lifetime for our 50th anniversary. After arriving at the airport flights were being grounded due to weather after sitting for 5 hrs waiting for our flight it was finally cancelled. The airline had no other flights available for the next 48 hrs. Which meant our tour had already started overseas. So we went home and filed a claim. Our claim was denied. I filed another claim and spoke to agents to no avail. Then my 2nd claim was denied. Needless to say...never again!!

Date of experience : August 19, 2023

Hello Donna, we understand it's incredibly disappointing when travel plans are disrupted, especially due to circumstances beyond your control. We reviewed that your airline provider did have departure and arrivals on the date of your cancelled flight. If you have any questions about your claim, please email us at [email protected]. Thank you.

I was served by Andrea

I was served by Andrea, who was gracious and very supportive. Every question I had she answered and sent me supportive information.

Date of experience : May 13, 2024

Hello Lusajo, we strive to ensure that every customer interaction is positive and informative, and we're thrilled that Andrea was able to assist you effectively! Thank you for taking the time to leave us a review.

I think these annual plans are very…

I think these annual plans are very comprehensive covering all areas well, and are also a good value when comparing to other annual plans. I highly recommend Srven Corners for your travel insurance.

Date of experience : May 10, 2024

Hi Tim, thank you for taking the time to share your recommendation of our annual travel insurance policies. We appreciate your trust in Seven Corners and look forward to serving you on your trips!

We had to cancel our cruise before…

We had to cancel our cruise before departing, and Seven Corners let us save our insurance premium for a future cruise.

Date of experience : May 06, 2024

Hello Judy, thank you for trusting Seven Corners Inc as your travel insurance. We look forward to being able to serve you on that future cruise!

Quick, clear advice from Candy @ Seven Corners

The representative, Candy, answered my questions about documenting claimed expenses very clearly and quickly. My situation was complicated because of (i) a combination of payments and refunds, and (ii) inadequate documents from the tour provider.

Date of experience : May 15, 2024

Hello John, we are delighted to hear of the customer service Candy provided you - she is one of our best representatives on the team! Thank you for taking the time to leave a review on your experience.

Great customer service

Great customer service! I was provided all necessary information. This was a plan I purchased in 2/2023 for my trip 4/2024.

Date of experience : May 04, 2024

Hello Kathleen, we're delighted to hear that you had a great experience with our customer service and that you were provided with all the necessary information you needed. We appreciate your positive feedback and look forward to serving you again in the future!

She was sooo very helpful

She was sooo very helpful. She gave me the information I needed to fill out my travel insurance claim form with accuracy. She was professional, personable and truly a pleasure to work with. She needs a raise ! :)

Hello Melanie, we are delighted to hear about the service you were provided by one of our team members. Thank you for leaving us a 5 star review on your experience! We look forward to serving you again.

Great service

Call was answered quickly. Good telephone connection. Agent was knowledgeable and easy to understand--sounded like English was first language. Transaction (change in policy) was completed quickly.

Hello Jeff, thank you for taking the time to rate our customer service 5 stars. We look forward to continuing to serve you!

I felt confident and relieved to have purchased an insurance before leaving for the trip. The unexpected and unfortunate situation happened that my father had a stroke during our trip. Seven Corners insurance answered questions quickly and efficiently. When I was ready to fill out the claim I was too overwhelmed to find my way in the website. I called the company and received assistance immediately. The representative was so courteous and patient that she remain with me on the phone until I completed the claim. The support I received in this difficult situation is greatly appreciated. During unexpected situations when is hard to think and simple things can be hard to do, angels come along. Thank you madam, did not get your name, for being so helpful in this process. Thank You

Date of experience : May 03, 2024

Hello Mireya, we are delighted to hear that our insurance provided you with the confidence and support you needed during your difficult situation. It's truly heartwarming to know that our representative was able to assist you with such care and patience. Thank you for taking the time to share your positive experience with us!

SCAM INSURANCE

I don't even know what I can say about this insurance, it's a totally scam and they agents on the phone are very rude and disrespectful. My younger brother is currently lying dead in a mortuary fridge in Africa over two weeks now. Two days following my brother's death, we informed them about it and our incapacity of paying the repatriation costs up front. But they keeps telling us that we have to pay and submit for reimbursement although we told them several times that we are unable to do so. because the hospital bill we paid before his passing was too high. Seven corners is full of cruel people. Even though the policy certificate clearly states that in case of death of the insured, the insurer will arrange direct billing with the funeral home to repatriate the insured back to his country of residence. But they keep denying a deceased person access to his rightful benefits. I ADVISE ANYONE WHO WILL READ THIS TO BE AWARE OF THIS INSURANCE, BECAUSE IF SOMETHING HAPPENS TO YOU WHILE ON JOURNEY THEY WILL JUST ABANDON YOU LIKE THEY ARE DOING WITH BROTHER. THEY ARE JUST FAST ENOUGH TO COLLECT YOUR PREMIUM WITH FALSE PROMISES. AMERICANS DESERVE BETTER. SEVEN CORNERS IS A CRUAL AND CRIMINAL ORGANIZATION. PLEASE BEWARE!!!!!!!

Date of experience : April 24, 2024

Hi Anthony, thank you for your feedback. We have confirmed our Assist Team has been in communication with you. They will continue to provide information about how we can proceed.

Poor customer service

Poor customer service. The Manager is very rude and disrespectful. Needs training and basic phone skills. I would not recommend or trust this pharmacy at all. Clearly they hire anyone off the street with no common sense or education.

Date of experience : April 30, 2024

Hello, we are Seven Corners travel insurance. We can't directly address your experience you had with the pharmacy, but we're here to help if you have any questions or concerns related to travel insurance by emailing [email protected]. Thank you.

Horrible company that hides behind its…

Horrible company that hides behind its small print to deny claims.

Date of experience : May 07, 2024

Hello Mark, we're here to help understand how your claim was processed. Please email us at [email protected] with your certificate number so one of our senior representatives can walk you through the details of your claim and address any concerns you may have. Thank you.

Autumn was very clear and concise in…

Autumn was very clear and concise in helping me with my request. In my experience I am quite often confronted in a situation like this with someone who barely has a command of the English language. Good hire on your part. Cert # 1TPC23-AOS-132304

Hello Terrance, thank you for taking the time to share your positive experience with Autumn. She is one of our best representatives! We look forward to serving yo on your next trip!

Updates made easy

Every time I have called to ask questions I get polite responsive answers. The info is always very helpful.

Hello Michael, we are happy to hear that you have consistently received polite and helpful responses to your inquiries. Thank you for taking the time to leave us a review!

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

- Travel Insurance

- Seven Corners Review

Seven Corners Travel Insurance Review

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is Seven Corners rated?

Overall rating: 4.6 / 5 (excellent), seven corners plans & coverage, coverage - 4.6 / 5, emergency medical coverage details, baggage coverage details, seven corners financial strength, financial strength - 4.4 / 5, seven corners price & reputation, price & reputation - 5 / 5, seven corners customer assistance services, extra benefits - 4.6 / 5, travel assistance services.

- Lost Passport/Document Assistance

- Translation Services

- Up to the Minute Travel Advisories

Emergency Medical Assistance Services

- Physician Referral

- Emergency Medical Case Management

- Arrange Medical Payment Where Available

- Shipment of Medical Records

Concierge Assistance Services

- Weather Advisories

Our Comments Policy | How to Write an Effective Comment

35 Customer Comments & Reviews

- ← Previous

- Next →

- Coverage for trip cancelations, interruptions, medical emergencies, and more

- Lost, stolen, damaged, or delayed baggage costs

- 'Cancel for any reason' policy available

- Travel Accident Insurance for non-US citizens

Related to Travel Insurance

Top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- Travel Insurance

- Seven Corners Travel Insurance Review

On This Page

- Key takeaways

Is Seven Corners legit?

- Bottom line Main highlights of Seven Corners travel insurance

Seven Corners travel insurance plans & coverage

Things not covered by seven corners , cost of seven corners travel insurance plans, seven corners travel insurance reviews from customers , is seven corners travel insurance worth it, faq: seven corners travel insurance, related topics.

Seven Corners Travel Insurance Review May 2024

- Seven Corners is an extremely reputable travel insurance company with three decades of experience and an A+ rating from the Better Business Bureau.

- Seven Corners offers solid plans with great coverage limits at affordable prices.

- All six plans from Seven Corners offer trip cancellation, interruption, medical expenses and more .

- We recommend the Trip Protection Choice plan for high coverage limits across a range of categories.

- Consider optional add-ons like cancel for any reason (CFAR), sports equipment delay, rental car damage, and adventure sports coverage for extra protection.

- To find the best plan for your journey, we recommend using an online comparison tool so you can view and compare multiple policies at once.

Seven Corners is a leading provider of travel insurance in America and has been around since 1993.

Seven corners’ plans are well-known for offering robust coverage at an affordable price.

They offer six plans that cater to different travel needs and requirements such as US travel or International travel, but the Seven Corners Trip Protection Choice plan is the #1 selling insurance plan on our site!

Read on for more info on Seven Corners coverage options, pricing, and to see real customer reviews.

- A huge range of available plans

- Emergency 24/7 assistance with all plans

- Customizable medical coverage

- Lots of upgrade options

- Not all states are eligible for the RoundTrip Choice plan

Yes, Seven Corners is a legitimate travel insurance company and is recognized as a top provider in America.

Seven Corners has been in business for over 30 years and is a ccredited by the Better Business Bureau with rating of A+ . In other words, Seven Corners is an extremely reputable company.

This provider offers a multitude of plans and is known for offering robust coverage at affordable prices.

Bottom line: Main highlights of Seven Corners travel insurance

Seven Corners offers robust coverage across the board with a slew of plans to choose from. Really, it’s hard to go wrong.

Several key benefits plans from of Seven Corners:

- Large range of insurance plans: Unlike other providers that have a limited selection of plans, Seven Corners offers 6 types of travel insurance, making it easy to find the appropriate coverage for your trip without overpaying for things you don’t need.

- Solid coverage limits: Plans from seven corners include solid coverage limits that are enough to cover you in most travel scenarios. Unlike other providers who skimp on medical limits, Seven Corners has you covered.

- Traveler rewards: If frequent traveler rewards were used to buy the travel arrangements for your trip, Seven Corners’ insurance will cover the cost charged to re-deposit frequent traveler rewards into your account.

- Single-trip and annual insurance plans available: Most companies only offer single-trip coverage. If you’re planning a second trip during the same year, you have to buy a completely separate policy. Seven Corners offers an annual plan , ensuring you’re covered whenever you travel.

- Coverage for Americans and international citizens: You don’t have to reside in the United States to use this trip insurance. Some plans are available to travelers living in other countries.