Japan Tourism Statistics 日本の観光統計データ

Search for data, view summary.

Latest Information

Basic Information by Market

Find Out About Traveling to Japan

Visitor Arrivals

Facts on Trips to Japan

Visits to Regions of Japan

Travel Spending

Foreigners Entries

Find Out About Foreign Travels in the World

Number of Foreign Visitors

Find Out About Overseas Travels for Japanese

Japanese Overseas Travelers

Japanese Visitors

Find Out About International Conferences

Status of International Conferences Held by Year

Status of International Conferences Held by Month

Status of International Conferences Held by Field

Status of International Conferences Held by Scale

Status of International Conferences Held by City

About this Website

How many travelers visit japan.

"Visitor Arrivals" provides figures trend of foreign nationals traveling to Japan by year, month and the purpose of visit. A breakdown by country/area is provided, along with a feature that allows comparing the number of travelers between two designated countries.

Traveling to Japan: Visitor Arrivals

Which regions of Japan do foreign visitors travel to?

"Ranking of Visit Rates by Japanese Prefecture" shows visit rates of foreign travelers by prefecture. "Number of Total Lodgers by Prefecture" provide data on where foreign travelers stay overnight.

Traveling to Japan: Ranking of Visit Rates by Japanese Prefecture, Number of Total Lodgers by Prefecture

What do foreign visitors buy in Japan?

"Consumption During Travel" shows spending by foreign visitors in Japan by category, such as accommodation, transport, cuisine, and leisure. Spending by country/area is also available.

Traveling to Japan: Consumption During Travel

How many overseas travelers are there?

"Japanese Overseas Travelers" provides figures of Japanese nationals traveling abroad. Destination information can be compared yearly and monthly.

Overseas Travel by Japanese

Using this Website

The sidebar provides a list of data available on this website. Many of the data can be customized to show by year, country/area and so on.

The Usage Application Form will appear after clicking on the download button. Select the usage (personal/media) and click send. (*)

A popup window will appear for downloading the data. Please download accordingly.

*For personal usage, only the "Usage Application Form" is necessary. For media usage, please provide details regarding intended usage along with personal details. You will be notified whether you are granted permission to use the data or not. Please see Terms of Use for more details.

Videos on How to Use This Website

Explanations of how to use the graphs and tables published on this website are provided below along with videos.

One-Minute Usage Instructions

This one-minute video explains how to look at data, display graphs, etc.

Watch Video

- We use cookies on this site to enhance your user experience. If you continue to browse, you accept the use of cookies on our site. See our cookies policy for more information.

Tourism in Japan

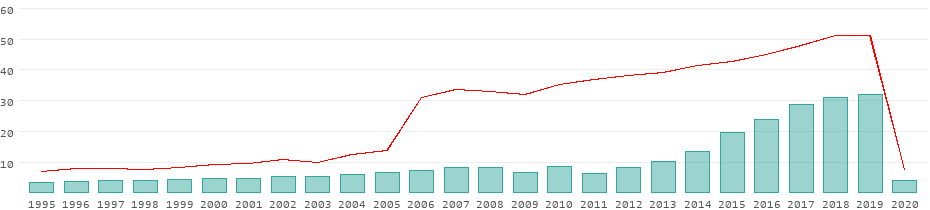

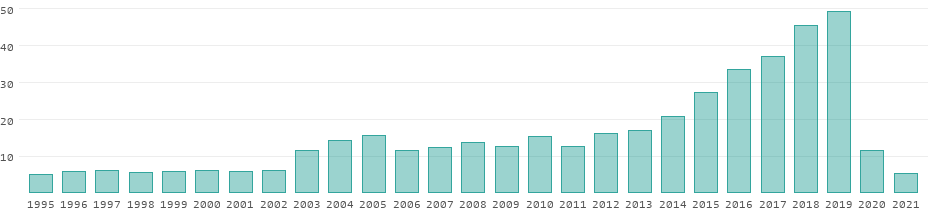

Development of the tourism sector in japan from 1995 to 2020.

Mix of tradition and technology

Revenues from tourism.

All data for Japan in detail

- Corporate customers

- Individual customers

- Business partners

- Our Business

- Sustainability

- Corporate information

- The JTB Way

- The Value Creation Process at JTB

- Brand Movie

- 110 years of JTB history

- Tourism business

- Area solution business

- Business solution

- Global Business (incl. Japan Inbound business)

- Top Commitment

- Sustainable Business Management

- Feature Story

- Materiality-Guided Sustainability Priorities

- Data Highlights

- The JTB Brighter Earth Project

- Report / Materials

- Sustainable business management

- Mental and Physical Wellbeing

- Personal Growth and Development

- Helping communities and businesses

- Empowering Our People to Shine

- Human Rights & Diversity

- Creating Regional Allur

- Caring for the Earth

- Stakeholder Connections

- JTB Sustainability Priorities and the SDGs

- Corporate Governance

- Sustainability Report

- Top message

- Company profile

- Company Brochure (ESSENCE BOOK)

- JTB group organization

- Our history

- Overseas Group Companies

Print to PDF

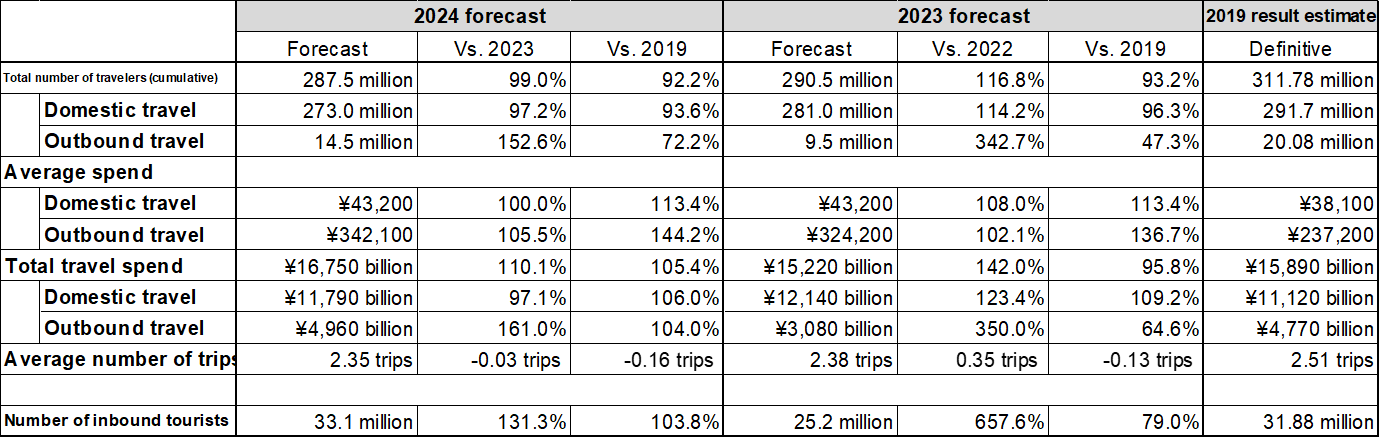

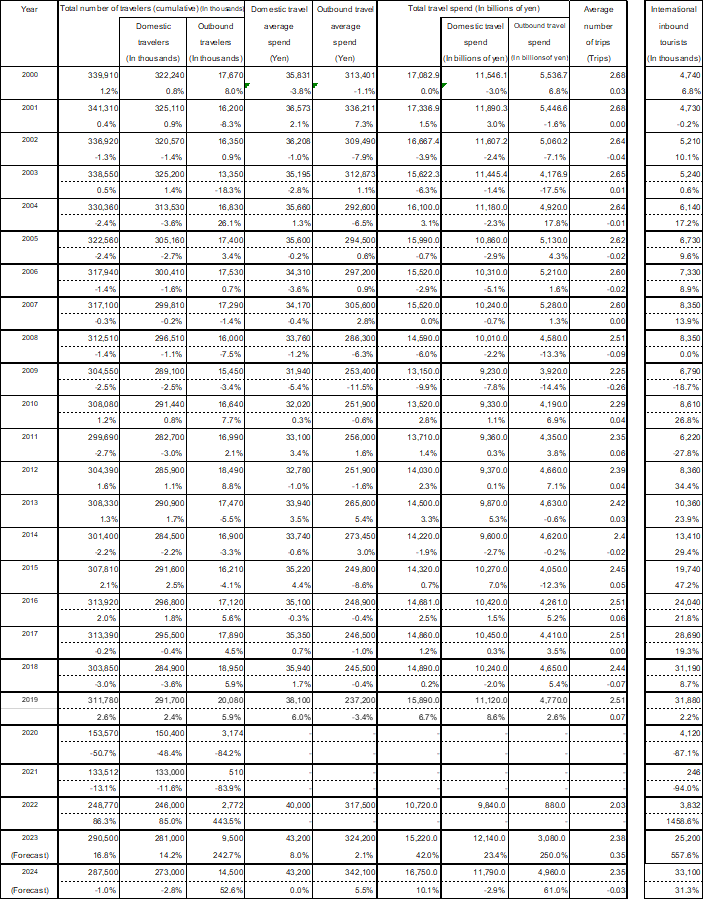

The number of inbound tourists is likely to hit record high at 33.1M. ●The number of Japanese domestic travelers is estimated at 273 million (97.2% of 2023 and 93.6% of 2019). ●The number of outbound travelers is estimated at 14.5 million (152.6% of 2023 and 72.2% of 2019). ●The number of international inbound tourists is estimated at 33.1 million (131.3% of 2023 and 103.8% of 2019).

JTB has compiled a report on a 2024 travel trend outlook. For 2021 and 2022 when COVID-19 had a significant impact, JTB released estimates for domestic trips only. JTB resumed releasing estimates for Japanese resident outbound trips and international inbound trips in 2023. The survey provides estimates on overnight or longer trips of Japanese residents travelling in Japan (including business trips and visits to hometowns) and of international visitors travelling to Japan. The estimates are made based on data such as economic indicators, consumer behavior surveys, transport/tourism related data, and surveys conducted by the JTB Group. The survey has been conducted continuously since 1981. The estimated size of the travel market in 2024 is as follows.

*Domestic travel spend means total expenditures incurred after leaving home and until returning home. It includes spending at travel destinations such as shopping and meals and does not include spending before and after a trip (e.g., the cost of purchasing clothing or other travel goods).

*Outbound travel spend includes travel expenditures (including fuel surcharges) and spending at travel destinations such as shopping and meals. It does not include spending before and after a trip (e.g., the cost of purchasing clothing or other travel goods).

*For inbound trips, only the number of inbound tourists is estimated. Travel spend is not calculated.

*Figures at or below the second decimal point are rounded for comparisons with previous years and with 2019.

*The number of domestic travelers is the number of travelers going on an overnight or longer trip.

*The numbers of domestic travelers and outbound travelers both include those on business trips and visiting their hometown.

*Because the survey results are rounded, there could be discrepancies in the sub-totals or differences with previous years' figures.

<Social and Economic Trends and Environment Surrounding Traveling>

1.Situation of COVID-19 and travel trends before the end of 2023

The World Health Organization (WHO) announced in May 2023 the end of a global health emergency brought about by COVID-19 after more than three years had elapsed since they had declared COVID-19 as a worldwide pandemic in March 2020. While economic activities have mostly returned to their pre-COVID conditions worldwide, ongoing inflations and high interest rates caused by factors such as the rapid recovery in demand are having various impacts on people's lives. With respect to travelling, except for some countries and regions, international arrival and departure restrictions have generally been removed, enabling international travel in the same manner as in the pre-COVID period. According to the World Tourism Barometer released by the United Nations World Tourism Organization (UNWTO) in November 2023, the number of international tourists worldwide during the January-September 2023 period recovered to 87% of its pre-COVID level. Unstable international situations and the resulting rises in energy and other prices, however, are causing concerns. Furthermore, there are regional differences in recovery: the Asia Pacific region including Japan is recovering slower than Europe and the United States.

The Japanese government ended its border control measures in April 2023 and re-classified COVID-19 into Class-5, the same category as seasonal influenza, under the country's infectious disease laws in May 2023. These brought people's lives mostly back to pre-pandemic conditions. Regulatory restrictions on travelling have also been removed, and some regions are implementing a government-funded travel discount program as well as travel support measures of local governments. Partly due to these measures, tourism activities are returning nationwide, combined with a recovery in inbound tourism. Meanwhile, some tourist spots and areas are experiencing a service staff shortage and rising accommodation charges due to changes in the environment caused by the COVID-19 pandemic. In addition, there are concerns about overtourism.

2.Economic environment surrounding traveling and living conditions

The Nikkei Stock Average has remained over ¥30,000 since May 2023, demonstrating robust market activities in Japan. Meanwhile, the country's economic outlook remains uncertain due to the impact of global conditions and monetary policies of European countries and the United States. The World Economic Outlook released by the International Monetary Fund (IMF) in October 2023 forecasted Japan's growth rate in 2023 at 2.0%, which was above the actual growth rate of 1.0% recorded in 2022. The IMF, however, makes a grimmer forecast for 2024, expecting the 2024 growth rate to decline to 1.0%.

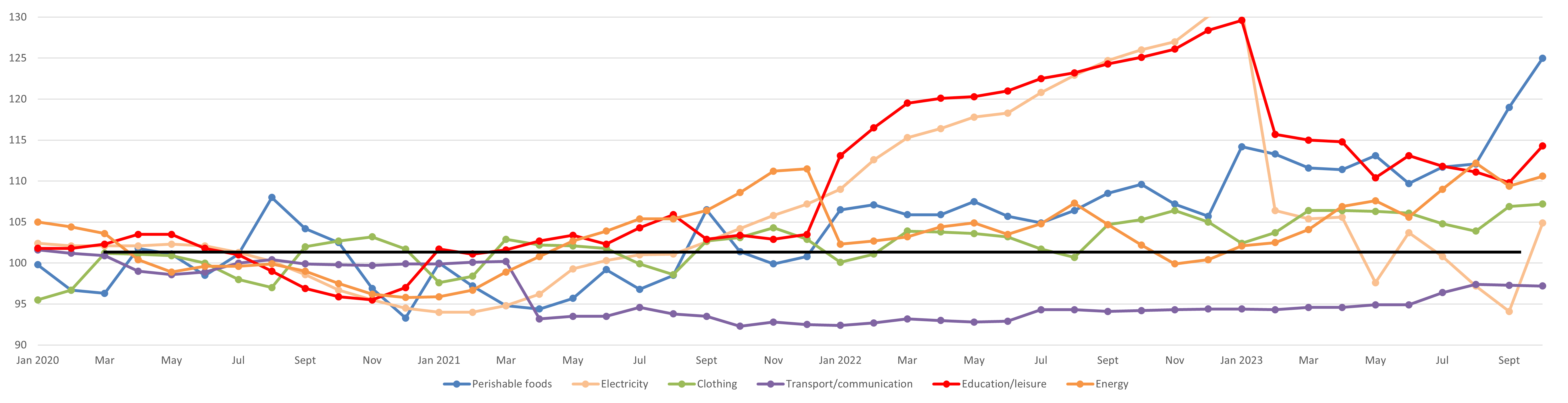

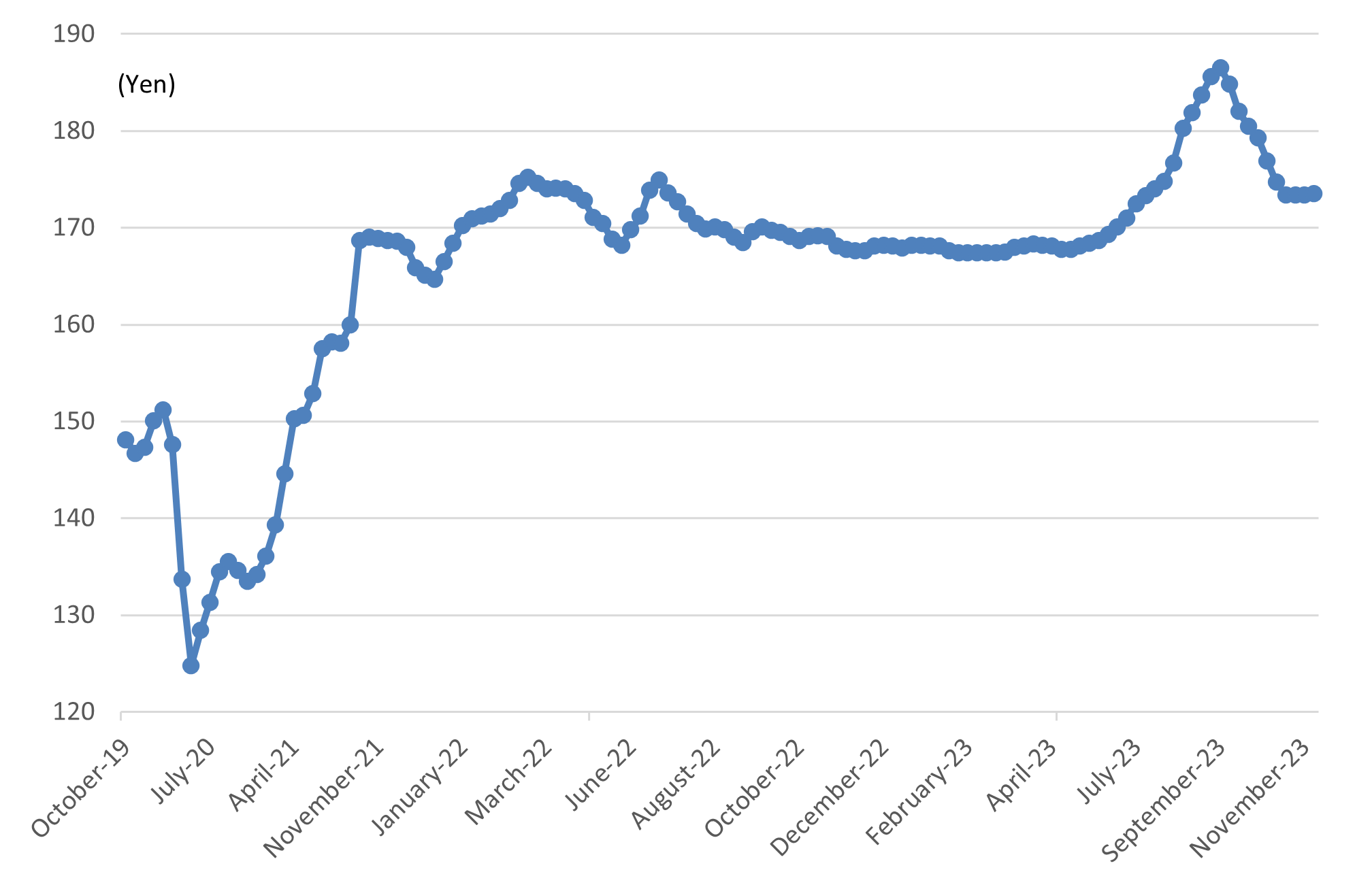

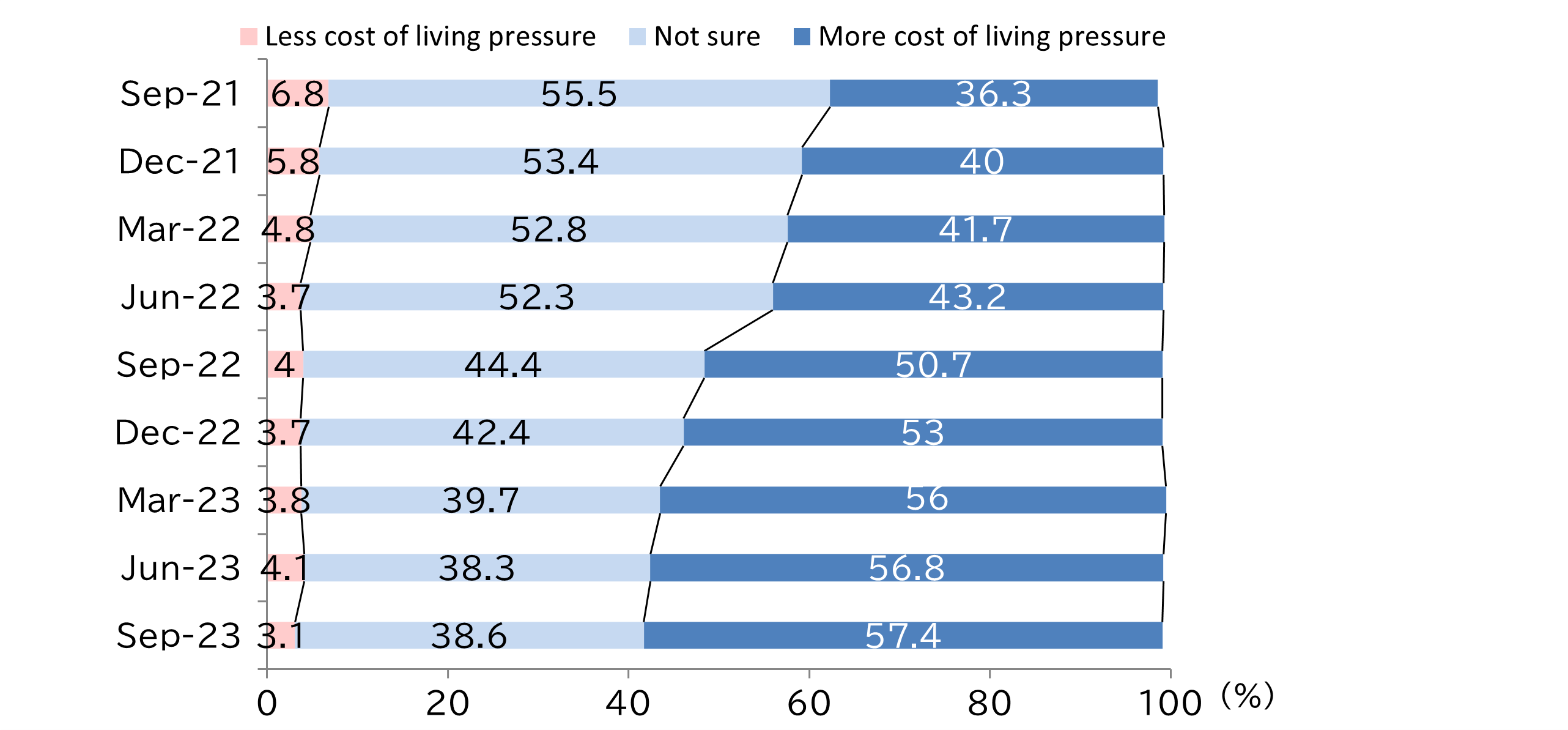

Looking at the current economic conditions, the trend of the rising US dollar against the Japanese yen accelerated in 2023 with a US dollar temporarily nearing the ¥152 mark on the FOREX market in November 2023. This has led to the ongoing rises in import prices, which are having a material impact on households (Figure 2). Looking at the consumer price index of major items, while electricity cost has relatively been stable thanks to the subsidies continuously provided by the Japanese government, prices of perishable foods, clothing, among others are rising and transport and communication costs are also steadily increasing (Figure 3). The prices of gasoline have also been kept down by the government subsidies, but they have constantly remained at around ¥170/liter (Figure 4). In this environment, looking at consumer sentiments, according to the current living conditions illustrated in a Bank of Japan survey on consumer sentiment, the ratio of respondents who are feeling a greater cost of living pressure has been consistently on the rise since September 2021, reaching 57.4% of all the respondents in September 2023, which is 21.1 percentage points (pp) higher compared with September 2021 (Figure 5). This shows that economic conditions remain difficult.

(Figure 2) 2023 FOREX Rates of Major Currencies Against Yen

Source: Telegraphic Transfer Middle Rate (TTM) in the Tokyo FOREX market (FOREX data provided by Mitsubishi UFJ Research & Consulting Co., Ltd.)

(Figure 3) Consumer Price Index of Major Items

Source: Prepared by JTB Tourism Research & Consulting Co. based on consumer price index data (2020=100) provided by the Ministry of Internal Affairs and Communications, Japan

(Figure 4) Regular Gasoline Price

Source: Prepared by JTB Tourism Research & Consulting Co. based on a survey of petroleum product prices by the Agency for Natural Resources and Energy, Japan

(Figure 5) Current Living Conditions

Source: Prepared by JTB Tourism Research & Consulting Co. based on data from the consumer sentiment surveys conducted by the Bank of Japan

3.Status of travelers

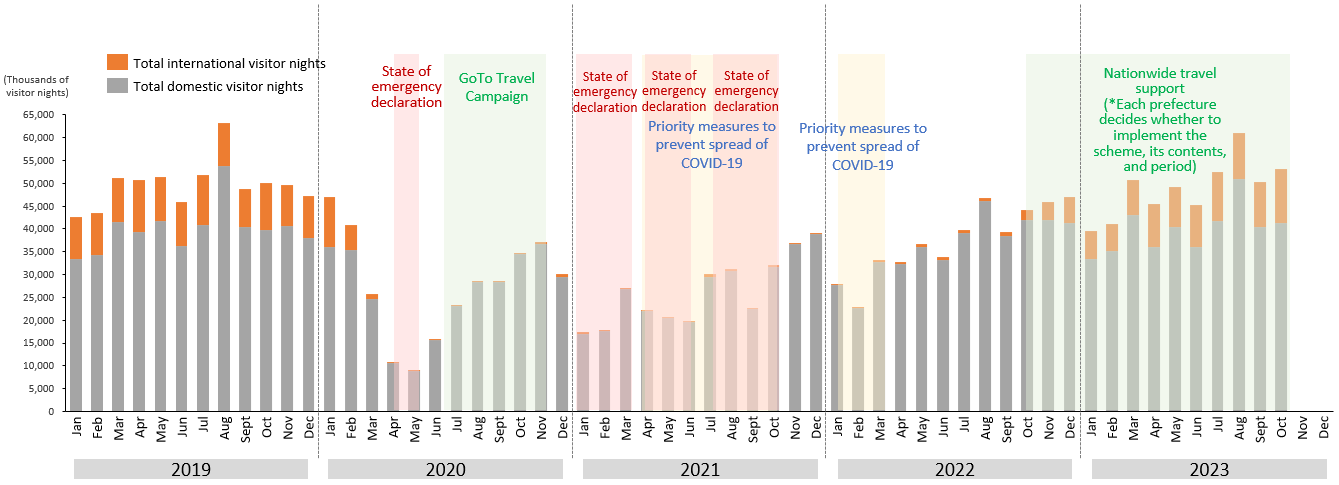

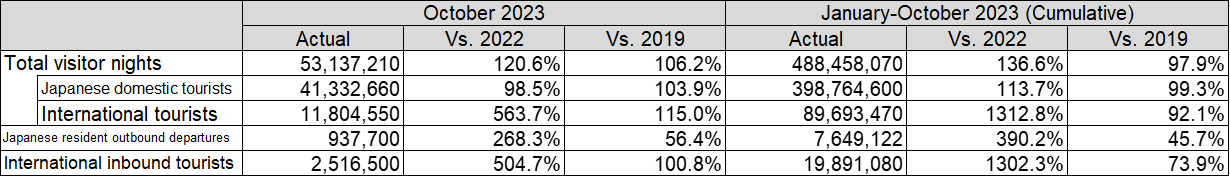

With respect to domestic travel, the number of visitor nights recovered to nearly its pre-COVID level in 2023 mainly because no COVID-related restrictions were placed on people's movements, the classification of COVID-19 was changed to Class-5 on May 8, and the Japanese government offered nationwide travel support subsidies. The total visitor nights in October 2023 were 41,333,000, representing 98.5% of the same figure in October 2022 (41,969,000) and 103.9% of the same month in 2019 (39,791,000). The cumulative total visitor nights from January to October 2023 stood at 398,765,000, representing 113.7% of the same period in 2022 (350,730,000) and 99.3% of the same period in 2019 (401,723,000) *1 (Figure 6).

*1: Source: Visitor nights statistic surveys by the Japan Tourism Agency; the first preliminary figure for October 2023, the second preliminary figure for January-September 2023, and definitive figures for 2019 and 2022.

After the Japanese government ended its border control measures on April 29, 2023, international travel has become easier in terms of national regulations. Recovery in outbound travelers, however, has been slow due to factors including inflations, the cheaper yen, and ongoing uncertainty in situations of certain areas. In October 2023, Japanese resident outbound departures stood at 938,000, representing 268.3% of the same figure in October 2022 (350,000 departures). The October 2023 figure, however, only represents 56.4% of the same figure in October 2019 (1,663,000 departures). The cumulative total for the January-October period was 7,649,000 departures, representing 390.2% of the same figure in the same period in 2022 (1,960,000 departures) and 45.7% of the same period in 2019 (16,726,000 departures) *2 (Figure 7).

*2: Numbers of inbound travelers to Japan and Japanese resident outbound departures provided by the Japan National Tourism Organization (JNTO); an estimate for October 2023, a provisional figure for January-September 2023, and definitive figures for October 2019 and October 2022.

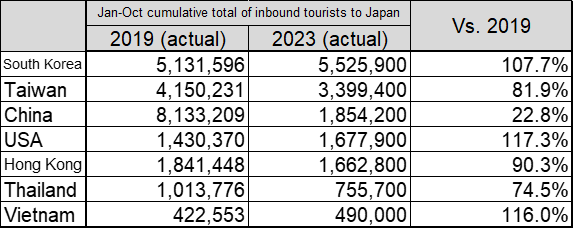

Recovery in inbound tourism accelerated in 2023 due to factors such as the end of Japan's border control measures and the termination or relaxation of measures to combat COVID-19 worldwide. The number of inbound tourists to Japan in October 2023 was 2,517,000, representing 504.7% of the same figure in October 2022 (499,000) and 100.8% of the same figure in October 2019 (2,497,000), exceeding its pre-COVID level for the first time on a single-month basis. The cumulative total for the January-October period was 19,891,000, representing 1,302.3% of the same period in 2022 (1,527,000) and 73.9% of the same period in 2019 (26,914,000) *3 (Figure 7). By country and region, the largest number of inbound tourists to Japan during the January-October 2023 period came from South Korea (5,526,000; 107.7% of the same period in 2019), followed by Taiwan (3,399,000; 81.9% of the same period in 2019), and China (1,854,000; 22.8% of the same period in 2019) (Figure 8).

*3: Numbers of inbound travelers to Japan and Japanese resident outbound departures provided by the Japan National Tourism Organization (JNTO); estimates for September and October 2023, a provisional figure for January-August 2023, and definitive figures for 2019 and 2022.

(Figure 6) Cumulative Total Visitor Nights

Source: Prepared by JTB Research & Consulting Co. based on visitor nights statistic surveys conducted by the Japan Tourism Agency; definitive figures for 2019 to 2022, the second preliminary figure for January-September 2023, and the first preliminary figure for October 2023).

(Figure 7) Total Visitor Nights, Japanese Resident Outbound Departures and International Inbound Tourists in October 2023 and January-October 2023 Period (Cumulative)

Source: Prepared by JTB Research & Consulting Co. based on visitor nights statistic surveys conducted by the Japan Tourism Agency and the numbers of inbound travelers to Japan and Japanese resident outbound departures provided by the Japan National Tourism Organization (JNTO).

(Figure 8) 2023 International Inbound Tourists by Country and Comparison with 2019 (Top 7 Countries)

Source: Prepared by JTB Research & Consulting Co. based on the numbers of inbound travelers to Japan and Japanese resident outbound departures provided by the Japan National Tourism Organization (JNTO).

<2024 Travel Market>

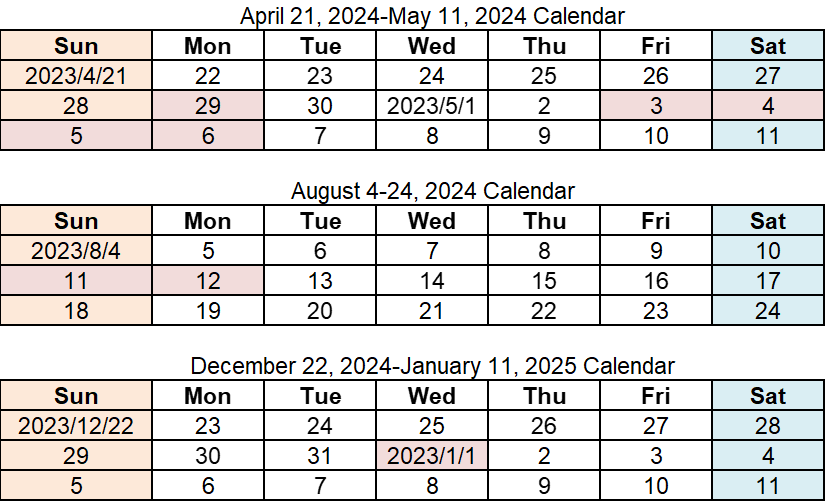

4.2024 calendar and major events

There are 11 long weekends in 2024. It is a significant increase from 2023 which had seven long weekends. While the Golden Week holidays are split into the first long weekend (Saturday, April 27 to Monday, April 29) and the second long weekend (Friday, May 3 to Monday, May 6), it can become 10 consecutive holidays from Saturday, April 27 to Monday, May 6, if one takes time off work from Tuesday, April 30 to Thursday, May 2. In summer, if one takes time off work during the Obon festival period (Tuesday, August 13 to Friday, August 16), there will be nine consecutive holidays from Saturday, August 10 to Sunday, August 18. The 2024/25 year-end/new year period can be turned into nine consecutive holidays from Saturday, December 28 to Sunday, January 5, if one takes time off work on Monday, December 30 and Tuesday, December 31.

*The red letters indicate national holidays.

[1]The 33rd Olympics Games (Paris 2024 Summer Olympics) and Paris 2024 Paralympics Games

One of the notable events in 2024 is the 33rd Olympics Games (Paris 2024 Summer Olympics) and Paris 2024 Paralympics Games that will take place in France. The 33rd Olympics Games (Paris 2024 Summer Olympics) will start on Friday, July 26 and end on Sunday, August 11, while the Paris 2024 Paralympics Games is scheduled to start on Wednesday, August 28 and to end on Sunday, September 8. Both events will take place in multiple cities including Paris, while the surfing Olympics event will be held in Tahiti, a French territory.

[2]Extension of Hokuriku Shinkansen and opening of Kurobe-Unazuki Canyon Route in Japan

In Japan, the Kanazawa-Tsuruga section of Hokuriku Shinkansen is scheduled to start operating on Saturday, March 16. This reduces the travel time between Tokyo Station and Fukui Station to as short as two hours 51 minutes. In addition, in the Kurobe Canyon in Toyama Prefecture, the Kurobe-Unazuki Canyon Route that connects the Kurobe Dam and the Kurobe Gorge Railway Keyakidaira Station will be opened to the public on Sunday, June 30.

In addition, there are art events scheduled in 2024 such as the 8th Yokohama Triennale (Yokohama City, Kanagawa; Friday, March 15 to Sunday, June 9) and Echigo-Tsumari Art Triennale 2024 (Tokamachi City, Niigata; Saturday, July 13 to Sunday, November 10).

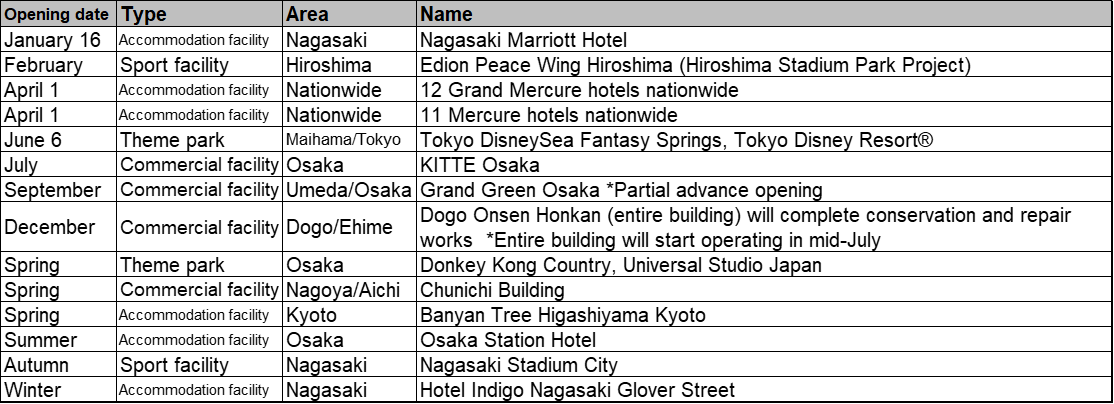

[3]Successive openings of new areas in popular theme parks and large commercial facilities

There are many scheduled openings of commercial facilities and launches of new contents in popular theme parks in 2024.

Universal Studio Japan plans to expand the Super Nintendo World™ area to 1.7 times the current size to open the Donkey Kong Country area featuring globally popular Donkey Kong. Meanwhile, Tokyo Disney Resort® plans to open a new theme port, Fantasy Springs, the eighth theme port in Tokyo DisneySea, on Thursday, June 6. The new port will consist of three areas themed after Frozen, Rapunzel, and Peter Pan and a new Disney Hotel, Tokyo DisneySea Fantasy Springs Hotel.

Regarding commercial facilities, as part of the redevelopment project around Osaka Station in Osaka City (Osaka), the Umekita 2nd Project "Grand Green Osaka," some facilities including a park, hotel, and commercial facilities will start operating in September ahead of others. In Nagoya City (Aichi), the Chunichi Building, which closed in 2019 due to ageing, has been rebuilt and is scheduled to open in spring. In Matsuyama City (Ehime), Dogo Onsen Honkan, which has been operating partially for conservation and repair works since 2019, will begin operating in full in mid-July for the first time in five years (conservation and repair works are scheduled to be fully completed in December).

[4]Lively activities for accommodation facilities; many new openings including openings of all the Mercure Hotels in Japan

New accommodation facilities are also scheduled to open successively. Daiwa Resort Co., Ltd. has rebranded 23 existing Daiwa Royal Hotels into 12 Grand Mercure hotels, the first group of Mercure hotels in Japan, and 11 Mercure hotels. All the hotels will start operating on April 1.

In the Kansai area, Banyan Tree Higashiyama Kyoto, the flagship brand of Banyan Tree Hotels & Resorts headquartered in Singapore, is scheduled to open in Kyoto City (Kyoto) in spring, while the Osaka Station Hotel is scheduled to open in Osaka City (Osaka) inside KITTE Osaka. which is scheduled to open in July (Figure 9).

(Figure 9) Main Facilities Scheduled to Open in 2024

5. Domestic travel trends *Domestic trips of residents of Japan excluding international inbound tourists

The number of domestic travelers in 2024 is projected at 273 million (97.2% of 2023 and 93.6% of 2019).

The average spend is estimated at ¥43,200 (100.0% of 2023 and 113.4% of 2019).

Total domestic travel spend is forecast at ¥11,790 billion (97.1% of 2023 and 106.0%of 2019).

In 2024, the number of domestic travelers is estimated at 273 million (97.2% of the same figure in 2023 and 93.6% of 2019), average spend at ¥43,200 (100.0% of the same figure in 2023 and 113.4% of 2019) due to the expected continuation of high prices, and total domestic travel spend at ¥11,790 billion (97.1% of the same figure in 2023 and 106.0% of 2019). Although the classification of COVID-19 was changed to Class-5 in May 2023 and its impacts were mostly eliminated, the number of travelers is likely to plateau due to factors such as high travel expenditures and the easing of travel appetite (as spending in reaction to the reduced activities during the COVID-19 pandemic will run its course). In 2024, the living environment is anticipated to remain difficult due to the ongoing inflation, while there are expectations for the Japanese government's economic policy.

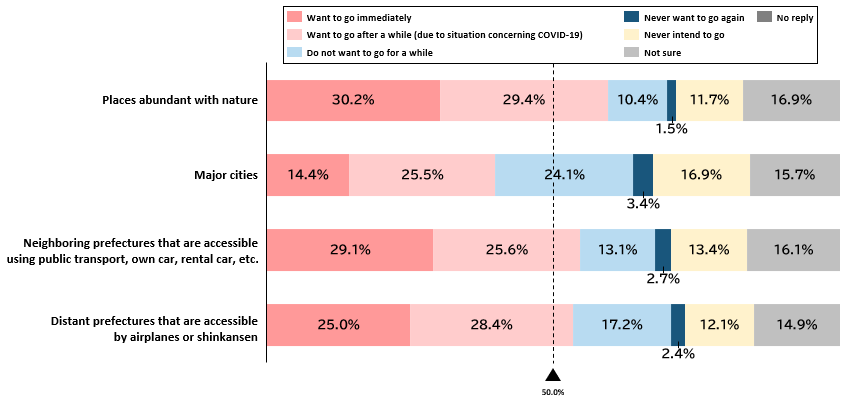

In the 2023/24 year-end/new year travel trend survey (December 23, 2023-January 3, 2024) conducted by JTB, on a question about future domestic travel plans by destination, "Places abundant with nature" ranked first as a place that the respondents "Want to go immediately" with 30.2% of the respondents choosing this option, followed by "Neighboring prefectures that are accessible using public transport, own car, rental car, etc." at 29.1%. This shows a trend of choosing places with nature and nearby places as travel destinations (Figure 10).

Due to COVID-19, climate change, uncertain international situations, and so on, lifestyles and values have changed worldwide, which is affecting Japanese residents' domestic travel preferences and tourist spots in Japan.

Promotion of travel/hospitality operators' and local communities' initiatives with awareness of SDGs

Travel companies are promoting various initiatives aiming to contribute to Sustainable Development Goals (SDGs) and sustainability. For instance, these include tours and events designed to reduce CO 2 emissions, the protection, development, and exchange of traditional local cultures and arts, and the use of natural resources for tourism. Airline carriers are also working on reducing their CO 2 emissions through efforts such as the introduction of sustainable aviation fuel (SAF).

Meanwhile, tourism destinations have begun initiatives to build sustainable tourism spots. For instance, 10 places in Japan were selected in the 2023 Top 100 Stories chosen by Green Destinations, a certification organization for international indices for sustainable tourism developed by the Global Sustainable Tourism Council (GSTC). The Japan Tourism Agency has been promoting the sustainable management of tourism places since the establishment of the Japan Sustainable Tourism Standard for Destinations (JSTS-D) in June 2020.

Nationwide promotion of measures to prevent overtourism

Since the end of the COVID-19 pandemic, some tourist places are facing an issue of overtourism brought about by a recovery in travel demand. In response, the Japanese government prepared a policy package for measures against overtourism and is scheduled to select approximately 20 places for its pilot projects. The government's support may include the dissemination of real-time crowd information of tourist spots to disperse visitors from overcrowded destinations and the introduction of a shared-taxi ride service.

Meanwhile, some tourist places have already started implementing measures to tackle overtourism. For instance, in Kyoto, visiting hours of temples and other tourist attractions have been extended to the early morning and nighttime to spread visitors and efforts are made to reduce congestion by displaying crowd situations on apps or transmitting real-time images of tourist destinations using installed cameras.

(Figure 10) Future Domestic Travel Intensions by Destination Type

Source: Prepared using the unpublished data of JTB's 2023/24 year-end/new year travel trend survey (December 3, 2023-January 3, 2024).

6.International travel trends

The number of outbound travelers in 2024 is estimated at 14.5 million (152.6% of 2023 and 72.2% of 2019).

The average spend is projected at ¥342,100 (105.5%t of 2023 and 144.2% of 2019).

Total outbound travel spend is estimated at ¥4,960 billion (161.0% of 2023 and 104.0% of 2019).

In 2024, the number of outbound travelers is estimated at 14.5 million (152.6% of the same figure in 2023 and 72.2% of 2019), average spend at ¥342,100 (105.5% of the same figure in 2023 and 144.2% of 2019) due to the continuing impact of the cheaper yen and overseas inflations, and total outbound travel spend at ¥4,960 billion (161.0% of the same figure in 2023 and 104.0% of 2019). While international travel has become easier in terms of national regulations after the termination of Japan's border control measures in April 2023, the number of outbound travelers in 2024 is expected to recover slowly due to factors such as uncertain international situations, in addition to economic factors. As a result, the number is not expected to recover to its pre-COVID level at least until 2025. The average spend per person is projected to exceed the previous year and reach the highest since 2000.

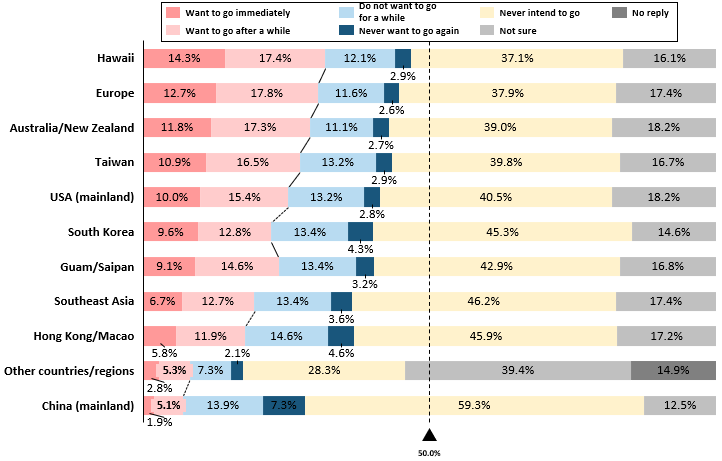

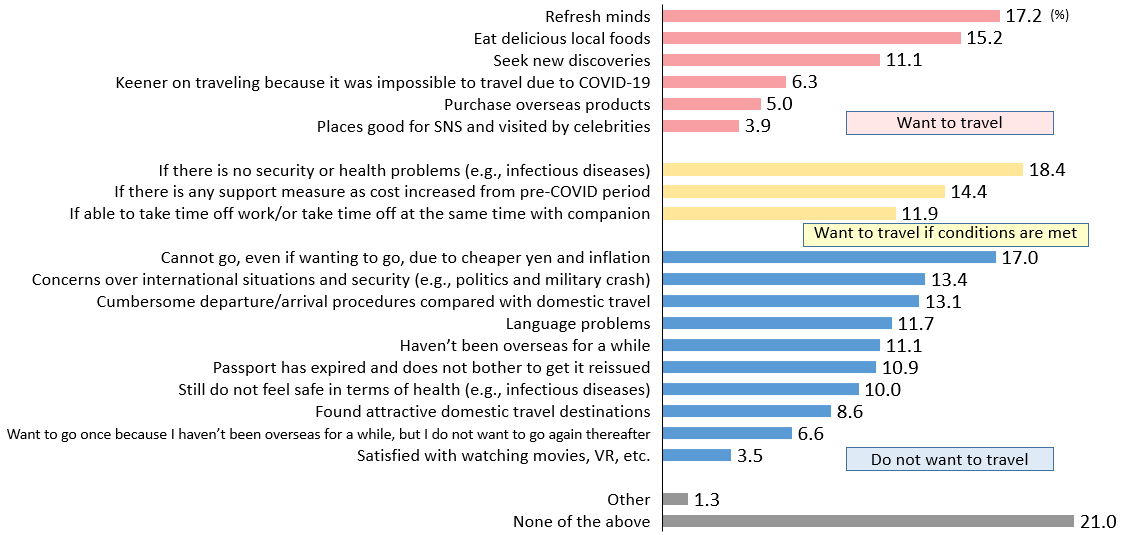

In the 2023/24 year-end/new year travel trend survey (December 23, 2023-January 3, 2024) conducted by JTB, Hawaii ranked highest at 14.3% among the destinations the respondents wanted to go immediately, in response to a question on future outbound travel plans. This was followed by "Europe (12.7%)," "Australia/New Zealand (11.8%)," "Taiwan (10.9%)," "USA (mainland) (10.0%)," "South Korea (9.6%)," and "Guam/Saipan (9.1%)." Relatively distant countries/regions ranked higher, followed by relatively closer countries/regions, showing a clear trend of division between close and distant destinations (Figure 11). With respect to the respondents' current international travel intentions, although they are positive about travelling overseas, economic and other factors are posing obstacles (Figure 12).

(Figure 11) Future International Travel Intensions by Destination

(Figure 12) Current International Travel Intensions

Source: 2023/24 Year-end/new year travel trend survey (December 23, 2023-January 3, 2024) by JTB

7 . Number of inbound travelers to Japan

The estimated number of inbound travelers to Japan in 2024 is 33.1 million (131.3% of 2023 and 103.8% of 2019).

The number of inbound travelers to Japan in 2024 is estimated at 33.1 million (131.3% of the same figure in 2023 and 103.8% of 2019). The number of inbound tourists is rapidly recovering due to the increased ease to travel to Japan from overseas following the end of Japan's border control measures in April 2023 and a sense of better value for money spent due to the cheaper Japanese yen and relatively low prices compared with Europe, the United States, and other areas. By country and region, the numbers of visitors from South Korea, Taiwan, the United States, and Hong Kong have already exceeded or recovered close to their pre-COVID levels. Inbound visitors from these places are expected to further increase in 2024 and to reach a record high exceeding the 2019 level. Although recovery in the number of visitors from China has been significantly slower than other countries/regions, the number is steadily increasing, albeit slowly, and is expected to further recover in 2024, especially those travelling as individuals.

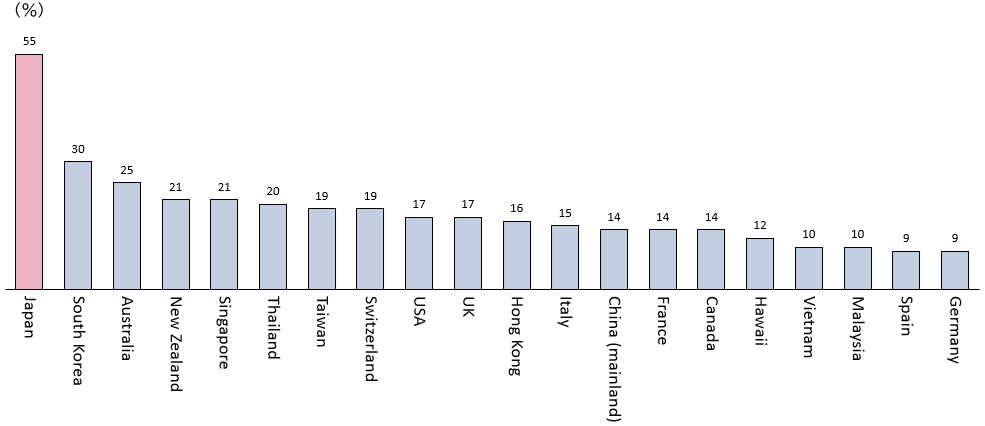

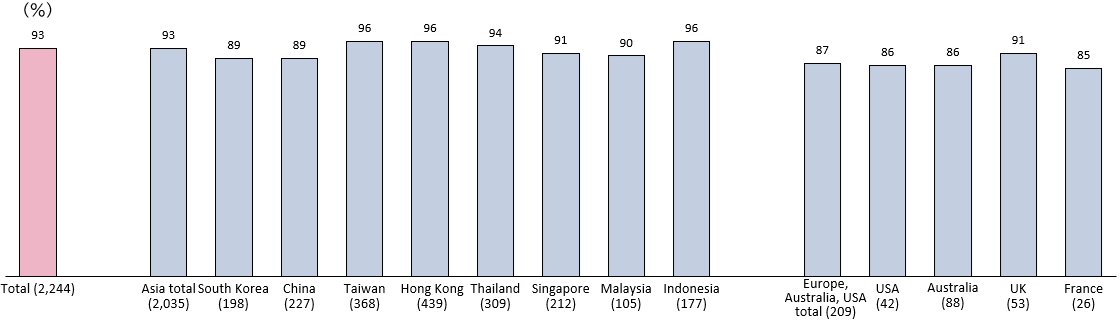

According to the Development Bank of Japan (DBJ) and Japan Travel Bureau Foundation (JTBF) 2023 survey of inbound visitors to Japan from Asia, Europe, the United States, and Australia, released by DBJ and JTBF in October 2023 *4 , Japan ranked first, as in the previous year, as the country/region the respondents wanted to travel next, showing strong popularity of Japan as a travel destination (Figure 13). In addition, there is a strong interest in visiting regional areas in Japan (among those wishing to visit Japan and those who have visited Japan), raising expectations for the spread of inbound visitors to regional communities as promoted by the Japanese government (Figure 14).

*4: A survey of male/female respondents aged 20-79 who have travelled overseas and live in 12 countries/regions including Asia, Europe, USA, and Australia (South Korea, China, Taiwan, Hong Kong, Thailand, Singapore, Malaysia, Indonesia, USA, Australia, UK, France).

(Figure 13) Countries/Regions Respondents Want to Visit Next (n = 7,414; allowed to choose up to 5 destinations; top 20 countries/regions)

Source: Prepared by JTB Research & Consulting Co. based on the DBJ/JTBF 2023 survey of inbound visitors to Japan from Asia, Europe, the United States, and Australia conducted by the Development Bank of Japan (DBJ) and Japan Travel Bureau Foundation (JTBF).

*The countries/regions where the respondents are from and their neighboring countries/regions (China/Hong Kong/Macao, Malaysia/Singapore, Thailand/Malaysia, USA/Canada/Mexico, Hawaii/Guam, Australia/New Zealand, UK/France/other European countries) were removed from the options for the countries/regions to visit next. When calculating percentages, if the "country/region respondents want to visit" and "the respondents' country/region" and "the respondents' neighboring countries/regions" are same, those respondents are removed from the number of samples (denominator).

(Figure 14) Interest in Regional Communities Among People Wishing to Travel to Japan and People Who Have Traveled to Japan (n = 2,244; single answer)

(The percentages of people who have responded that they are "Very keen to travel in the future" or "Keen to travel in the future if there is an opportunity")

(Figure 15) 2000-2022 Estimates and 2023-2024 Forecasts (The figures in the lower row show year-on-year percentage changes)

Back to Index

Japan aims to revive inbound tourism to pre-pandemic levels by 2025

Japan will aim to have inbound tourism recover to pre-pandemic levels by 2025, the tourism agency said Monday, with travel demand expected to return in line with a recovery in global air traffic.

The plan outlining goals for 2025, presented by the Japan Tourism Agency at a meeting of experts, also seeks to have the number of overnight stays in regional areas by foreign visitors increase from the 2019 total of 43.09 million.

The Cabinet of Prime Minister Fumio Kishida is set to approve the plan, which gained a broad consensus at Monday's meeting, at the end of March after considering specific measures.

In 2019, prior to the outbreak of the global coronavirus pandemic, a record 31.88 million tourists visited Japan. But the number fell sharply following the outbreak of COVID-19, totaling only 4.12 million in 2020 and 250,000 in 2021.

The agency expects travel demand to revive in line with forecasts by international organizations, which say that the number of international air passengers will recover to 2019 levels by 2025.

Upcoming international events to be held in Japan the same year, such as the Expo 2025 in Osaka and the World Athletics Championships in Tokyo, are also expected to boost visitor numbers.

The government will maintain its existing goal of an annual 60 million foreign visitors by 2030.

As part of its aim of revitalizing regional areas, the agency has also proposed promoting travel outside of metropolitan areas by highlighting historical and natural attractions offered by each region.

Supported by the recent weakness of the yen against other major currencies, the government aims for annual tourist spending to reach 5 trillion yen ($34 billion) as soon as possible, eclipsing about 4.8 trillion yen spent in 2019.

With the plan, the government will also consider measures to increase the amount spent per person and their length of stay in Japan, as well as how to address "tourism pollution" issues that accompanied the rapid increase of foreign visitors before the pandemic, such as congestion on public transportation and littering.

Nov 7, 2022 | KYODO NEWS

Japanese opt for short, cheap overseas trips for Golden Week holidays

May 1, 2024 | KYODO NEWS

90% in Japan support idea of reigning empress: survey

Apr 28, 2024 | KYODO NEWS

Japan likely conducted forex intervention worth around 5 tril. yen

Apr 30, 2024 | KYODO NEWS

M6.9 earthquake hits south of Tokyo, no tsunami threat

Apr 27, 2024 | KYODO NEWS

2 more arrested in case of burned bodies found outside Tokyo

More from Japan

Japan PM says no plan to dissolve Diet after defeat in by-elections

2 hours ago | KYODO NEWS

Japan PM Kishida vows to tackle global challenges with South America

May 5, 2024 | KYODO NEWS

Kyodo News Digest: May 5, 2024

Kyodo News Digest: May 4, 2024

May 4, 2024 | KYODO NEWS

Japan renews child population low in 43rd straight year of decline

Japan disappointed by Biden's "xenophobic" comments

Japan and beyond: Week in Photos - April 27-May 3

Japan, Brazil agree to jointly protect Amazon rainforest

Subscribe to get daily news.

To have the latest news and stories delivered to your inbox, subscribe here. Simply enter your email address below and an email will be sent through which to complete your subscription.

* Something went wrong

Please check your inbox for a confirmation email.

If you wish to change your message, press 'Cancel' to go back and edit.

Thank you for reaching out to us. We will get back to you as soon as possible.

JAL and ANA have received around 10% more international flight bookings for this coming Golden Week holiday period

Japanese outbound travelers still recovered slowly to 1.2 million in March 2024

International visitors to Japan exceeded 3 million in March 2024, the record-breaking single month result in the history

Guest nights in home-sharing in Japan for the first two months of 2024 were 30% more than a year ago

Interest in overseas travel of Japanese people is much lower than the world’s average

Foreigners’ guest nights in Japan were up 23% in February 2024 compared to pre-pandemic

Japanese outbound travelers still recovered slowly in February 2024

International visitors to Japan were record-high 2.8 million for February

Japanese passport issues were up 2.8 times to 3.4 million in 2023, with half issued to 30 years old or younger

Port calls of foreign-based cruise ships in Japan in 2023 recovered to 63% of the peak in 2017

60% of Japanese people agree to dual-pricing for inbound travelers, while 50% of 60s disagree

ikyu.com is top OTA in Japan for Net Promoter Score, followed by Rakuten Travel and Expedia

Japanese outbound travelers in January 2024 increased by 90% year on year, but still decreased by 40% over 2019

International visitors to Japan from 10 source markets reached record-high for January

Foreigners’ guest nights in Japan were up 32% in December 2023 compared to pre-pandemic

Narita Airport recovered international flight passengers to 70% of the pre-pandemic level in 2023 due to surge in inbound travelers

Spending in Japan by international travelers in 2023 reached record-high 5.3 trillion JPY

Japanese outbound travelers were 9.6 million in 2023, not reaching half of those in 2019

Japanese people who prefer to be alone has significantly increased across all generations, with 54% saying they prefer to be alone

Guest nights in Japan by both Japanese and foreigners finally exceeded the pre-pandemic level for three consecutive months

What are the reasons for foreigners to apply for japanese ‘digital nomad’ visa started on april 1 2024, japan national tourism organization continues focusing on sending inbound travelers to local regions in fy2024, ana unveils the taas platform concept for seamless travel, expanding travel opportunities without air, japan’s it solution provider tripla installs a multi-currency payment function in its booking engine for accommodations, a stay program in 400-years-old ‘marugame castle’ in kagawa prefecture will be on sale at 1.26 million jpy a night.

This site uses Cookie to enhance users’ experiences.

Everyone is visiting Japan. An extended currency slump means the tourists will just keep coming.

- Japan's weak currency is boosting tourism, with a record-breaking 3.1 million visitors in March.

- The devalued yen is encouraging tourists to spend more on luxury goods.

- The currency is negatively impacting outbound travel, with more Japanese tourists staying in the country.

Japan is a beloved tourist spot . A weak currency is ensuring that it will remain that way for foreigners.

The country just broke its pre-pandemic tourist record, with 3.1 million foreign visitors in March. The government said it's on track to surpass 2025's target of 32 million annual foreign visitors this year, after 8.6 million tourists visited in the first quarter of 2024.

Japan opened to tourists in October 2022, after over two years of strict, pandemic-induced border restrictions. Pent-up demand, combined with a cheaper currency, has fueled the record number of visitors.

Related stories

Tourists are staying longer and spending more due to the weak yen, which makes it cheaper for foreigners to purchase accommodation, activities, food, and gifts. The yen has fallen nearly 10% year-to-date , compared to the dollar.

Japan's currency has been depreciating largely due to high interest rates in the US, which makes the dollar more attractive to investors. A historic rate hike in Japan last month — the first since 2007 — did little to reverse the downward trend.

Japan is a tourist hot spot because of its status as a culture and entertainment icon, its natural wonders, and its unique cuisine. Tourists from South Korea, China, Taiwan, and the US made up the biggest portion of foreign visitors in March, according to Japan's National Tourism Organization.

Japanese carriers like Japan Airlines and ANA plan to cash in on the tourism boom by running more routes from Asia.

The sharp decline of the yen has also expanded demand for luxury goods. Foreign tourists are taking advantage of the currency discount by snapping up cheaper products in Japan from premium brands such as Swiss watchmaker TAG Heuer, Chanel, and Prada, Bloomberg reported earlier this month.

While the weak yen creates a sweet spot for foreigners, it is severely hurting Japanese travelers.

The number of outbound travelers was less than half the number of inbound travelers in March, per the National Tourism Organization. Outbound Japanese travel was down 37% last month compared to the same period in 2019, though it ticked up from February, the agency's data shows.

High airfare costs and low buying power is compelling more locals to skip international travel in favor of domestic locations.

Watch: Japanese denim is costly, but it's considered one of the best denims in the world. Here's why.

- Main content

JTB Outbound Tourism Report 2023

Published September 2023

Print on demand (Paperback): JPY13,200

- Japan domestic

- 返品期限・条件について

- Trends in the Number of Japanese Traveling Abroad

- Exchange Rates, GDP and the Number of Japanese Traveling Abroad

- Number of Passports Issued

- Overseas Travel Turnover of Major Travel Agencies

- Number of Overseas Travelers by Gender and Age Group

- Overseas Travelers and Departure Ratios by Japanese Prefecture

- Number of Overseas Travelers by Month

- Number of Japanese Overseas Travelers by Air- and Seaport

- Number of Japanese Passengers Boarding on Overseas Cruises

- Number of Japanese Overseas Travelers by Destination

- Market Segments and Size

- Number of Overseas Trips Taken and Previous Travel Experience

- Destinations and Markets

- Purpose of Travel

- Travel Duration and Number of Accommodation Sites Used

- Travel Companions

- Activities at Destinations

- Travel Costs

- Destinations and Repeat Visitors

- Motivation for Overseas Travel

- Use of Travel Agencies

- The Timing of Travel Arrangements

- Travel Arrangements and Travel Type

- Overseas Travel Experience

- Number of Previous Overseas Trips

- Overseas Travel Experience by Destination

- Preferences of Overseas Travelers

- Desire to Travel Overseas

- Factors Hindering Overseas Travel

- Travel Objectives

- Preferred Destinations

- Preferred Style of Travel

- The Progress of Recovery in Travel Demand

- The Structure of the Tourism Market

- Market Outlook

- Opportunities for travel demand recovery from our independent research

- BACKGROUND DATA

Our Publications

Japan Tourist Arrivals

Tourist arrivals in japan increased to 3080000 in march from 2788000 in february of 2024. tourist arrivals in japan averaged 806834.92 from 1991 until 2024, reaching an all time high of 3080000.00 in march of 2024 and a record low of 1700.00 in may of 2020. source: japan national tourist organization, tourist arrivals in japan is expected to be 2650000.00 by the end of this quarter, according to trading economics global macro models and analysts expectations., markets, gdp, labour, prices, money, trade, government, business, consumer, housing, taxes, health, climate.

- International edition

- Australia edition

- Europe edition

Why has the yen fallen to a decade’s low and what does it mean for Japan’s economy?

The accelerating slide in the value of Japan’s currency could ultimately be bad news for people in Japan who are heavily reliant on imports

The value of Japan’s currency has tumbled so much, that its value is back to where it was in 1990, shortly after Japan’s famous “bubble economy” burst. For a moment on Monday it was trading at 160 yen to US$1. A few years ago, it was closer to 100 yen to US$1.

The yen’s accelerating slide could ultimately be bad news for people in Japan. A weaker yen squeezes households by increasing import costs. Japan is heavily reliant on imports for both energy supplies and food, meaning inflation could rise.

A weaker yen is however a boon for Japanese exporters’ profits – and for tourists visiting Japan who find their currencies going further.

Why has the yen fallen so far?

The yen has been steadily sliding for more than three years, losing more than a third of its value since the start of 2021.

One factor behind its fall is momentum: the yen falls because investors are selling it – and investors continue to sell it because it is falling. In such instances, the market enters a self-fulfilling loop.

As a result of the falling currency, exporters are discouraged from converting foreign proceeds into yen, further decreasing demand.

However there are also major policy reasons for the currency’s sharp decline.

For years, the Bank of Japan (BOJ) has kept interest rates extraordinarily low to encourage more inflation in its economy, as well as to boost bank lending and spur demand.

In February, in the face of widespread labour shortages and a weakening yen, Japan was overtaken by Germany as the world’s third-biggest economy and slipped into recession .

With low interest rates seen as a key factor in the rapid decline of the yen, last month the BOJ ended its policy of keeping its benchmark interest rate below zero, lifting its short-term policy rate from -0.1% to between zero and 0.1%.

After that decision, markets were then focused on the pace of further rate rises. On Friday, the BOJ announced it would hold interest rates steady, signalling that further increases weren’t imminent. This precipitated another round of selloffs in the yen, putting more pressure on the currency.

It was this wave of selloffs that drove the currency down to 160 yen to the dollar for the first time since 1990.

What effect is it having?

The decades-low value of the yen means tourist dollars are going further than they have for generations, leading to a boom in the industry. As well as the US dollar, the yen has also hit multi-year lows against the euro, the Australian dollar and the Chinese yuan – all strong tourism markets for Japan.

In February, Japan recorded 2.79 million visitors – a record for the month.

Domestic consumption, however, remains a major weak spot. Households tend to be net importers and are facing higher prices due to the weak yen.

The weakening yen is also a factor in the decision by big Japanese investors’ to keep their cash abroad, where it can earn better returns. This trend is exacerbated by an unusually strong US dollar which has meant that American investments and assets offer far better returns for major financial institutions.

What are Japanese authorities doing?

In recent years, Japanese authorities have intervened to prop up the value of the currency , because a weak yen complicates its objective of achieving sustainable inflation, and strengthening it could help increase domestic consumption and local investment.

Japan intervened in the currency market three times in 2022, selling US dollars it holds in reserve in order to buy yen. Tokyo is estimated to have spent around $60bn defending the currency at that time.

On Monday, after briefly hitting its multi-decade low, the yen rose sharply, leading traders to suspect that after weeks of threatening to intervene, Japan had stepped in to support its currency.

Japan’s top currency diplomat, Masato Kanda, declined to comment when asked if authorities in Tokyo had intervened.

“Today’s move, if it represents intervention by the authorities, is unlikely to be a one-and-done move,” said Nicholas Chia, Asia macro strategist at Standard Chartered Bank in Singapore.

“We can likely expect more follow through from [Japan’s Ministry of Finance] if the dollar/yen pair travels to 160 again. In a sense, the 160-level represents the pain threshold, or new line in the sand for the authorities.”

Reuters contributed to this report

Most viewed

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

- Media & Industry

- Meetings & Events

- Select Language 简体中文 繁體中文(香港) 繁體中文(臺灣) India (English) Bahasa Indonesia 한국어 ภาษาไทย Tiếng Việt Singapore (English) Philippines (English) Malaysia (English) Australia/New Zealand (English) Français Deutsch Italiano Español United Kingdom (English) Nordic countries(English) Canada (English) Canada (Français) United States (English) Mexico (español) Português العربية Japan(日本語) Global (English)

- India (English)

- Bahasa Indonesia

- Singapore (English)

- Philippines (English)

- Malaysia (English)

- Australia/New Zealand (English)

- United Kingdom (English)

- Nordic countries(English)

- Canada (English)

- Canada (Français)

- United States (English)

- Mexico (español)

- Global (English)

- Fujiyoshida

- Shimonoseki

- Ishigaki Island

- Miyako Island

- Kerama Island

- Tokyo Island

- Koka & Shigaraki

- Hida Takayama

- Ginza, Nihonbashi

- Beppu & Yufuin (Onsen)

- Ginzan Onsen

- Nagasaki Islands

- Kumano Kodo

- Shikoku Karst

- Amami Oshima

- Hachimantai

- Omihachiman

- Aizuwakamatsu

- Diving in Japan

- Skiing in Japan

- Seasonal Flowers in Japan

- Sustainable Outdoors

- Off the Beaten Track in Japan

- Scenic Spots

- World Heritage

- Home Stays & Farm Stays

- Japanese Gardens

- Japanese Crafts

- Temple Stays

- Heritage Stays

- Festivals and Events

- Theater in Japan

- Japanese Tea Ceremony

- Cultural Experiences in Japan

- Culture in Japan

- Local Cuisine Eastern Japan

- Local Cuisine Western Japan

- Local Street Food

- Japan's Local Ekiben

- Japanese Whisky

- Vegetarian and Vegan Guide

- Sushi in Japan Guide

- Japanese Sake Breweries

- Art Museums

- Architecture

- Performing Arts

- Art Festivals

- Japanese Anime and Comics

- Japanese Ceramics

- Local Crafts

- Scenic Night Views

- Natural Wonders

- Theme Parks

- Samurai & Ninja

- Iconic Architecture

- Wellness Travel in Japan

- Japanese Ryokan Guide

- A Guide to Stargazing in Japan

- Relaxation in Japan

- Forest Bathing (Shinrin-yoku)

- Experiences in Japan

- Enjoy my Japan

- National Parks

- Japan's Local Treasures

- Japan Heritage

- Snow Like No Other

- Wonder Around Japan

- Visa Information

- Getting to Japan

- Airport Access

- COVID-19: Practical Information for Traveling to Japan

- Anime Tourism

- Countryside Stays

- Accessible Tourism

- Hokkaido Great Outdoors

- Scenic World Heritage in Tohoku

- Shikoku’s Nature and Traditions

- Southern Kyushu by Rail

- Traveling by Rail

- How to Travel by Train and Bus

- JR Rail Passes

- Scenic Railways

- Renting a Car

- Sustainable Travel in Japan

- Travel Brochures

- Useful Apps

- Online Reservation Sites

- Eco-friendly Accommodation

- Luxury Accommodations

- Traveling With a Disability

- Hands-free Travel

- How to Book a Certified Tour Guide

- Volunteer Guides

- Tourist Information Center

- Japanese Manners

- Spring in Japan

- Summer in Japan

- Autumn in Japan

- Winter in Japan

- Cherry Blossom Forecast

- Autumn Leaves Forecast

- Japan Visitor Hotline

- Travel Insurance in Japan

- Japan Safe Travel Information

- Accessibility in Japan

- Vegetarian Guide

- Muslim Travelers

- Safety Tips

- JAPAN Monthly Web Magazine

- Arts & Cultures

- Nature & Outdoor

- Festivals & Events

- Insider Blog

- Things to do

- Local Guides

- Food & drink

- Traditional

- Hokuriku Shinetsu

My Favorites

${v.desc | trunc(25)}

Planning a Trip to Japan?

Share your travel photos with us by hashtagging your images with #visitjapanjp

- International Tourist Tax

- Helping You Plan

Photo copyright: ©NARITA INTERNATIONAL AIRPORT CORPORATION

A small tax can make big changes

Visitors to Japan pay a 1,000 yen departure tax to expand and enhance the country's tourist infrastructure—a small tax that will make a significant difference.

Did this information help you?

out of found this information helpful.

Thank you for your feedback.

Recommended for you.

Please Choose Your Language

Browse the JNTO site in one of multiple languages

Travel, Tourism & Hospitality

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

- Number of overseas tourists in Tokyo 2013-2022

Why did foreign visitor numbers in Tokyo increase during the past decade?

How does tokyo compare to other places in japan, who is visiting, number of inbound tourists to tokyo, japan from 2013 to 2022 (in millions).

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

2013 to 2022

*October to December 2021. Values have been rounded. Figures prior to 2022 come from previous reporting.

Other statistics on the topic Travel and tourism industry in Japan

- Number of inbound visitors to Japan 2005-2023

- Number of inbound visitors in Japan 2023, by region

- Monthly number of foreign visitors to Japan 2019-2023

Accommodation

- Number of hotels and inns in Japan FY 2006-2023

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Statistics on " Travel and tourism in Japan "

- Tourism expenditure in Japan 2013-2022

- Economic impact of tourism on output in Japan 2012-2021

- Impact of tourism on employment in Japan 2012-2021

- Tourism expenditure by domestic travelers in Japan 2013-2022

- Tourism expenditure of international visitors in Japan 2010-2023

- International tourism balance of payments in Japan 2005-2023

- Number of domestic travels in Japan 2013-2022

- Distribution of domestic travels in Japan 2021, by type

- Number of domestic travels in Japan 2022, by purpose and type of trip

- Number of domestic trips in Japan 2022, by age of traveler

- Most desired destinations for domestic overnight travel in Japan 2023

- Leading sales channels for booking domestic overnight travel in Japan 2022

- Number of Japanese overseas travelers 2013-2022

- Number of monthly Japanese outbound travelers 2019-2022

- Leading overseas travel destinations of Japanese tourists 2022

- Share of Japanese outbound travelers 2022, by age group and gender

- Gender ratio of Japanese overseas travelers 2013-2022

- International travel booking distribution in Japan 2022, by sales channel

- Number of foreign tourists for holiday and recreational reasons in Japan 2013-2022

- Number of inbound travelers for business purposes to Japan 2013-2022

- Monthly occupancy rate of accommodations in Japan 2023, by type

- Number of overnight stays by Japanese at accommodations in Japan 2014-2023

- Number of stays at accommodations by foreigners in Japan 2014-2023

- Number of overnight stays by overseas guests in Japan 2023, by prefecture

- Occupancy rate of accommodations in Japan 2023, by prefecture

- Tourism spending in Japan 2022, by travel type

- Domestic day-trip travel expenditure in Japan 2022, by travel purpose

- Domestic overnight travel expenditure in Japan 2022, by travel purpose

- Expenses on overseas travel by Japanese 2013-2022

- Tourism expenditure by foreign visitors in Japan 2023, by expense category

- Average unit price per domestic trip per person in Japan 2013-2022

- Impact of COVID-19 on domestic leisure travel in Japan 2020-2023, by month

- Impact of COVID-19 on outbound travel plans in Japan 2020-2023, by month

- Estimated number of travelers during summer vacation in Japan 2014-2023

- Share of people intending to go on domestic leisure trips in Japan 2023

- Share of people intending to go on overseas leisure trips in Japan 2023

- Leading reasons to suspend overseas travels from Japan 2023

Other statistics that may interest you Travel and tourism in Japan

- Premium Statistic Tourism expenditure in Japan 2013-2022

- Premium Statistic Economic impact of tourism on output in Japan 2012-2021

- Premium Statistic Impact of tourism on employment in Japan 2012-2021

- Premium Statistic Tourism expenditure by domestic travelers in Japan 2013-2022

- Premium Statistic Tourism expenditure of international visitors in Japan 2010-2023

- Premium Statistic International tourism balance of payments in Japan 2005-2023

Domestic tourism

- Premium Statistic Number of domestic travels in Japan 2013-2022

- Premium Statistic Distribution of domestic travels in Japan 2021, by type

- Premium Statistic Number of domestic travels in Japan 2022, by purpose and type of trip

- Premium Statistic Number of domestic trips in Japan 2022, by age of traveler

- Premium Statistic Most desired destinations for domestic overnight travel in Japan 2023

- Premium Statistic Leading sales channels for booking domestic overnight travel in Japan 2022

Outbound tourism

- Premium Statistic Number of Japanese overseas travelers 2013-2022

- Premium Statistic Number of monthly Japanese outbound travelers 2019-2022

- Premium Statistic Leading overseas travel destinations of Japanese tourists 2022

- Premium Statistic Share of Japanese outbound travelers 2022, by age group and gender

- Premium Statistic Gender ratio of Japanese overseas travelers 2013-2022

- Premium Statistic International travel booking distribution in Japan 2022, by sales channel

Inbound tourism

- Premium Statistic Number of inbound visitors to Japan 2005-2023

- Premium Statistic Monthly number of foreign visitors to Japan 2019-2023

- Premium Statistic Number of inbound visitors in Japan 2023, by region

- Premium Statistic Number of foreign tourists for holiday and recreational reasons in Japan 2013-2022

- Premium Statistic Number of inbound travelers for business purposes to Japan 2013-2022

- Premium Statistic Number of overseas tourists in Tokyo 2013-2022

Hotel industry

- Premium Statistic Number of hotels and inns in Japan FY 2006-2023

- Premium Statistic Monthly occupancy rate of accommodations in Japan 2023, by type

- Premium Statistic Number of overnight stays by Japanese at accommodations in Japan 2014-2023

- Premium Statistic Number of stays at accommodations by foreigners in Japan 2014-2023

- Premium Statistic Number of overnight stays by overseas guests in Japan 2023, by prefecture

- Premium Statistic Occupancy rate of accommodations in Japan 2023, by prefecture

Tourism consumption

- Premium Statistic Tourism spending in Japan 2022, by travel type

- Premium Statistic Domestic day-trip travel expenditure in Japan 2022, by travel purpose

- Premium Statistic Domestic overnight travel expenditure in Japan 2022, by travel purpose

- Premium Statistic Expenses on overseas travel by Japanese 2013-2022

- Premium Statistic Tourism expenditure by foreign visitors in Japan 2023, by expense category

- Premium Statistic Average unit price per domestic trip per person in Japan 2013-2022

Travel and tourism during COVID-19

- Premium Statistic Impact of COVID-19 on domestic leisure travel in Japan 2020-2023, by month

- Premium Statistic Impact of COVID-19 on outbound travel plans in Japan 2020-2023, by month

- Premium Statistic Estimated number of travelers during summer vacation in Japan 2014-2023

- Premium Statistic Share of people intending to go on domestic leisure trips in Japan 2023

- Premium Statistic Share of people intending to go on overseas leisure trips in Japan 2023

- Premium Statistic Leading reasons to suspend overseas travels from Japan 2023

Further related statistics

- Premium Statistic Japanese national tourists in Tokyo 2013-2022

- Premium Statistic Favorite places among foreign tourists in Tokyo 2019

- Premium Statistic Monthly number of inbound overnight and same-day visitors in Spain 2020-2022

- Premium Statistic Occupancy rate Tokyo 2017, by hotel type

- Premium Statistic International tourism volume in the Balearics 2001-2022

- Premium Statistic Italy: per capita expenditure of foreign tourists by continent 2017

- Premium Statistic Most frequent problems for inbound tourists in Japan 2019

- Premium Statistic Tourists from the Americas in Spain 2016-2022, by origin

- Premium Statistic Italy: top ten countries of origin of inbound tourists in Apulia 2015

- Premium Statistic Tourists from Asia in Spain 2016-2022, by origin

- Premium Statistic International tourism volume in the Canary Islands 2010-2023

- Basic Statistic Monthly U.S. outbound tourism volume to Latin America and the Caribbean 2020

- Premium Statistic International tourism volume in the Community of Madrid 2001-2022

- Premium Statistic European travelers in Spain 2022, by origin

- Premium Statistic Visitors' satisfaction with food in South Korea 2013

- Premium Statistic Number of domestic tourists in Beijing, China 2010-2022

- Basic Statistic Share of travel package of French seniors 2014, by age

Further Content: You might find this interesting as well

- Japanese national tourists in Tokyo 2013-2022

- Favorite places among foreign tourists in Tokyo 2019

- Monthly number of inbound overnight and same-day visitors in Spain 2020-2022

- Occupancy rate Tokyo 2017, by hotel type

- International tourism volume in the Balearics 2001-2022

- Italy: per capita expenditure of foreign tourists by continent 2017

- Most frequent problems for inbound tourists in Japan 2019

- Tourists from the Americas in Spain 2016-2022, by origin

- Italy: top ten countries of origin of inbound tourists in Apulia 2015

- Tourists from Asia in Spain 2016-2022, by origin

- International tourism volume in the Canary Islands 2010-2023

- Monthly U.S. outbound tourism volume to Latin America and the Caribbean 2020

- International tourism volume in the Community of Madrid 2001-2022

- European travelers in Spain 2022, by origin

- Visitors' satisfaction with food in South Korea 2013

- Number of domestic tourists in Beijing, China 2010-2022

- Share of travel package of French seniors 2014, by age

BOJ keeps low rates, hints of future rate hikes fail to stem yen fall

- Medium Text

- BOJ keeps short-term rate target steady at 0-0.1%

- BOJ says to stick with bond-buying guidance made in March

- Board projects inflation to stay near 2% in coming years

- Ueda says BOJ will hike rates if data confirms its price view

- Ueda says weak yen, if persists, could affect inflation, policy

Sign up here.

Reporting by Leika Kihara; Additional reporting by Tom Westbrook in Singapore and Makiko Yamazaki, Satoshi Sugiyama, Kantaro Komiya and Tetsushi Kajimoto in Tokyo; Editing by Sam Holmes and Kim Coghill

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Markets Chevron

Stocks jump, yields drop as Fed cut hopes bloom

A gauge of global stocks rallied while Treasury yields fell on Friday after a U.S. payrolls report was softer than anticipated, easing concerns the Federal Reserve would keep interest rates higher for longer.

The South African rand was stronger on Friday after U.S. nonfarm payrolls grew less than expected in April, boosting hopes that the Federal Reserve could cut interest rates soon.

The Straits Times

- International

- Print Edition

- news with benefits

- SPH Rewards

- STClassifieds

- Berita Harian

- Hardwarezone

- Shin Min Daily News

- Tamil Murasu

- The Business Times

- The New Paper

- Lianhe Zaobao

- Advertise with us

Weak yen boosts tourist wallets in Japan

TOKYO - Foreign tourists are flocking to Japan in record numbers, and thanks to a sliding yen, many are living like kings, splashing out on everything from kimonos to knives and slap-up meals.

“I bought three pairs of shoes, which is something I would never normally do,” French tourist Katia Lelievre, 36, said with a laugh in the bustling Asakusa area of Tokyo famous for its Buddhist temple and souvenir shops.

The brands available in Japan are the same as in Europe – Converse, Nike and Adidas – but because of the exchange rate “it was really worth it” to buy, she told AFP.

“The food is really cheap. (I spent a lot) especially on food. I tried everything I wanted,” visitor Dominique Stabile, 31, from Italy, told AFP.

“I had a budget set and I didn’t exceed it, so I’m happy.”

Local businesses are also benefitting.

“A lot of people do the maths, and when they see the equivalent in their country’s currency, they say: ‘Wow, I’m going to buy that too,’” said Ms Saori Iida, who works in a shop selling traditional second-hand Japanese clothes.

“Yesterday, we had someone who bought 15 kimonos,” she said.

Ms Yuki Suzuki, 21, who works in a shop selling knives, another tourist favourite, said: “Thanks to the weak yen, foreign customers are buying a lot of handmade knives, even as prices rise.

“I feel like there are now more customers who want to own sets and buy a little more, for example, several blades made by the same craftsman.”

In March, the monthly number of foreign visitors surpassed three million for the first time, up 11.6 per cent from March 2019 before the Covid-19 pandemic torpedoed tourism.

Spending per head soared 52 per cent over the first three months compared with the same year.

Currency movements help explain why. In 2019, US$1 (S$1.37) bought 112 yen (97 Singapore cents), compared with almost 158 on May 1, a 34-year low. On April 29, it briefly hit 160 yen.

A bowl of ramen noodles costs around 1,000 yen, which in 2019 was around US$8.90 and is now US$6.30.

A luxury watch or handbag labelled at 700,000 yen in Tokyo now costs around US$4,430, a snip compared with US$6,250 five years ago.

Many shops exempt tourists from Japan’s 10 per cent sales tax if they show their passport.

The biggest spenders per capita are Australians, followed by visitors from Britain and Spain, according to the Japanese tourism agency.

The slide in the currency is blamed in part on the Bank of Japan’s maverick policy of ultra-low interest rates, while other central banks have hiked theirs.

Japanese household consumption has been in constant decline since March 2023, due to inflation – the weak yen makes imports pricier – weakening purchasing power.

Some Japanese are also unhappy about the invasion of big-spending tourists, thronging stores and clogging up their favourite restaurants. One town plans to put up a barrier blocking the view of Mount Fuji.

Visitors are “getting great value for money”, said Ms Akiko Kohsaka, an economist at the Japan Research Institute and an expert on tourism.

“It may mean tourists may choose to stay at better hotels than usual, or stay in Japan for an extra day or buy brand items,” she told AFP.

“Even with sandwiches or hamburgers – things that visitors can buy at home – they can sense that they would not get that kind of value for their money at home,” Ms Kohsaka added.

“I think Japan can have confidence in itself as a tourism destination. Even if the yen reverses its trend, I do not think it would lead to sharp falls in spending by tourists.” AFP

Join ST's Telegram channel and get the latest breaking news delivered to you.

Read 3 articles and stand to win rewards

Spin the wheel now

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, weekend print + standard digital, weekend print + premium digital.

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- Global news & analysis

- Exclusive FT analysis

- FT App on Android & iOS

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

- 20 monthly gift articles to share

- Lex: FT's flagship investment column

- 15+ Premium newsletters by leading experts

- FT Digital Edition: our digitised print edition

- Weekday Print Edition

- Videos & Podcasts

- Premium newsletters

- 10 additional gift articles per month

- FT Weekend Print delivery

- Everything in Standard Digital

- Everything in Premium Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- 10 monthly gift articles to share

- Everything in Print

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

IMAGES

VIDEO

COMMENTS

Which regions of Japan do foreign visitors travel to? "Ranking of Visit Rates by Japanese Prefecture" shows visit rates of foreign travelers by prefecture. "Number of Total Lodgers by Prefecture" provide data on where foreign travelers stay overnight.

Tourism Statistics Highlight 05 April 2024. Inbound According to Japan National Tourism Organization (JNTO), the estimated number of international travelers to Japan in February 2024 was 2,788,000 (+7.1% compared to 2019). Japanese tourists According to preliminary figures from the Immigration Service Agency of Japan, the number of Japanese ...

According to Japan National Tourism Organization (JNTO), the estimated number of international travelers to Japan in February 2024 was 2,788,000 (+7.1% compared to 2019). February 2024. Overseas Residents' Visits to Japan (Estimated figures) 2,788,000 Visits. YOY +89.0%.

Get the latest statistics and facts on tourism in Japan. Get the latest statistics and facts on tourism in Japan. ... Premium Statistic Monthly occupancy rate of accommodations in Japan 2023, ...

By putting the tourist numbers in relation to the population of Japan, the result is much more comparable picture: With 0.033 tourists per resident, Japan ranked 136th in the world. In East Asia, it ranked 4th. In 2021, Japan generated around 5.23 billion US dollars in the tourism sector alone.

The World Economic Outlook released by the International Monetary Fund (IMF) in October 2023 forecasted Japan's growth rate in 2023 at 2.0%, which was above the actual growth rate of 1.0% recorded in 2022. The IMF, however, makes a grimmer forecast for 2024, expecting the 2024 growth rate to decline to 1.0%. ... Visitor nights statistic surveys ...

[Part I] Tourism Trends in Japan (Travel by International Visitors to Japan) (1) The. number of international visitors to Japan . in 2020 was 4.12 million (down 87.1% from 2019). The breakdown of the number is as follows: 3.32 million people from Asia (80.6 % of the total), including 2.6 million

In 2019, tourism accounted for 2.0% of Japan's GDP. Following the COVID-19 pandemic, international visitors fell to 4.1 million in 2020, down by 87% from 2019. The inbound tourism expenditure in 2020 was JPY 1.2 trillion, a 77.1% decrease from the previous year. In 2021, international arrivals decreased to 246 000, a 99% decrease compared to ...

The steady growth rate was maintained for demand for travel to Japan, which represents the base. The number of travelers to Japan in 2019 totaled 31.88 million, with the growth rate dipping to a 2.1% increase year-on-year. The main factor for the decline in the growth rate was the significant reduction in numbers from South Korea. The total

Tourism in Japan is a major industry and contributor to the Japanese economy. Foreigners visit Japan to see natural wonders, cities, historic landmarks, and entertainment venues. Japanese people seek similar attractions, as well as recreation and vacation areas. In 2019, Japan attracted 31.88 million international tourists. [1]

Japan will aim to have inbound tourism recover to pre-pandemic levels by 2025, the tourism agency said Monday, with travel demand expected to return in line with a recovery in global air traffic. The plan outlining goals for 2025, presented by the Japan Tourism Agency at a meeting of experts, also seeks to have the number of overnight stays in ...

Japan Tourism Agency announced that travel spending by international visitors in Japan totaled 4.8 trillion JPY in 2019, 6.5% more spending than 2018. Travel Voice Japanese Travel Trade News ...

Get in touch with us now. , Feb 21, 2024. In December 2023, the number of international visitors entering Japan amounted to roughly 2.73 million people. Inbound tourism fully recovered from the ...

Occupancy rate of accommodations in Japan 2023, by prefecture; The most important statistics. ... Impact of COVID-19 on domestic leisure travel in Japan 2020-2023, by month;

The official site of Japan National Tourism Organization is your ultimate Japan guide with tourist information for Tokyo, Kyoto, Osaka, Hiroshima, Hokkaido and other top Japan holiday destinations. We offer travel information to make your Japan travel more comfortable and enjoyable.

Japan tourism statistics for 2021 was 0.00, a 100% decline from 2020. Japan tourism statistics for 2020 was 11,395,000,000.00, a 76.84% decline from 2019. Japan tourism statistics for 2019 was 49,209,000,000.00, a 8.69% increase from 2018. International tourism receipts are expenditures by international inbound visitors, including payments to ...

A historic rate hike in Japan last month — the first since 2007 — did little to reverse the downward trend. Japan is a tourist hot spot because of its status as a culture and entertainment ...

Publisher. JTB Tourism Research & Consulting Co. Price. Print on Demand (Paperback):JPY13,200 (including tax) Format. A4. Pages. 94 pages. Research Reports and White Papers NEW JTB Outbound Tourism Report 2023 All About Japanese Overseas Travelers Published September 2023 Print ….

Tourist Arrivals in Japan increased to 3080000 in March from 2788000 in February of 2024. This page provides - Japan Tourist Arrivals - actual values, historical data, forecast, chart, statistics, economic calendar and news. ... Japan Jobless Rate Remains at 2.6%. Bank of Japan Holds Rates, Sees Higher 2024 Inflation. Latest.

International Tourist Tax. Visitors to Japan pay a 1,000 yen departure tax to expand and enhance the country's tourist infrastructure—a small tax that will make a significant difference. Learn More . Japan Visitor Hotline. Japan National Tourism Organization (JNTO) operates a visitor hotline 24 hours a day, 365 days a year.

Bank of Japan Gov. Kazuo Ueda at a press conference last month, when rates were raised for the first time since 2007. Photo: Richard a. brooks/Agence France-Presse/Getty Images

For years, the Bank of Japan (BOJ) has kept interest rates extraordinarily low to encourage more inflation in its economy, as well as to boost bank lending and spur demand. ... all strong tourism ...

ANA Holdings Inc. Chief Executive Officer Koji Shibata said ¥125 to the dollar is an ideal rate for the airline, joining the chief of Japan Airlines Co. in expressing concern over the Japanese ...

A small tax can make big changes. Visitors to Japan pay a 1,000 yen departure tax to expand and enhance the country's tourist infrastructure—a small tax that will make a significant difference. For more information about International Tourist tax, visit the pages below: National Tax Agency. The leaflet for individuals departing from Japan ...

Occupancy rate of accommodations in Japan 2023, by prefecture; The most important statistics. ... Impact of COVID-19 on domestic leisure travel in Japan 2020-2023, by month;

The Bank of Japan kept interest rates around zero on Friday and highlighted a growing conviction that inflation was on track to durably hit its target of 2% in coming years, signalling its ...

The slide in currency is blamed in part on the Bank of Japan's policy of ultra-low interest rates. Read more at straitstimes.com. ... according to the Japanese tourism agency.

The Japanese government appears to have deployed roughly $35bn supporting the yen on Monday, according to money market data released by the Bank of Japan.