- Skip to Content

- Skip to Main Navigation

- Skip to Search

Indiana University Indiana University IU

- Accounts Payable

- Accounts Receivable

- Financial Processing In KFS

- P-Card or Meeting Card

- Course Catalog

- Credits and Refunds

- Invoice Review

- Invoice Submission

- Payment Details

- Reimbursements

- Stop Payments

- Credit Memos

- Document Searches

- Receiving Payments

- Administrative Documents

- Financial Processing Documents

- General Ledger Balance Inquiries

- System Overview

- Catalog Orders

- Change Requests

- Check Requests

- Non-Catalog Orders

- Order Management

- Searches & Dashboards

- Chrome River Reporting

- Approving Reports

- Booking Travel

- Reimbursing Travel

- Trip Authorization

- Capital Assets

- Financial Processing-KFS

- P-Card/Meeting Card

- Supplier Diversity

- Meet the Team

Financial Training & Communications

- Documentation

Reimburse Mileage

Mileage is a reimbursement paid to travelers for driving a personal vehicle on IU business.

A few notes about mileage:

- Mileage reimbursement covers costs associated with using your personal vehicle for IU business. Visit the Traveling by Personal Car page on the Travel website to learn more about what the reimbursement covers.

- Most mileage reimbursements are paid at a rate set by the IRS. If mileage is funded by a grant account, the mileage rate differs. In either case, the rate is programmed into Chrome River and automatically applied.

- The mileage reimbursement rate is reduced after the first 500 miles. The mileage calculator in Chrome River calculates reimbursements using this information.

This page demonstrates creating an expense report and adding the mielage expense in Chrome River.

Info for Travel Arrangers & Delegates

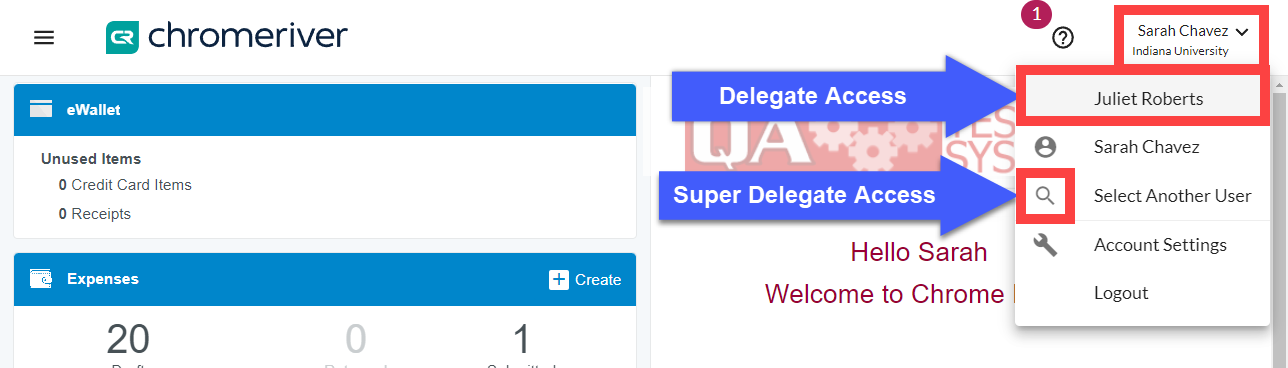

If you are a delegate arranging travel on behalf of another expense owner, be sure to switch to that expense owner’s Chrome River profile to submit the report on their behalf.

In the top right corner of Chrome River, click Your Name . Select the name of the expense owner from the list, or click Select Another User if you’re a Super Delegate

Click a trip type below to learn how to request that type of mileage reimbursement.

- In-State : mileage where most or all of the destinations are inside the state of Indiana

- Domestic : where most or all of the destinations are outside of Indiana.

- Accumulated mileage : mileage logged over a period of time capturing frequent or repeated trips. Can be submitted on In-State or Domestic trip expense reports.

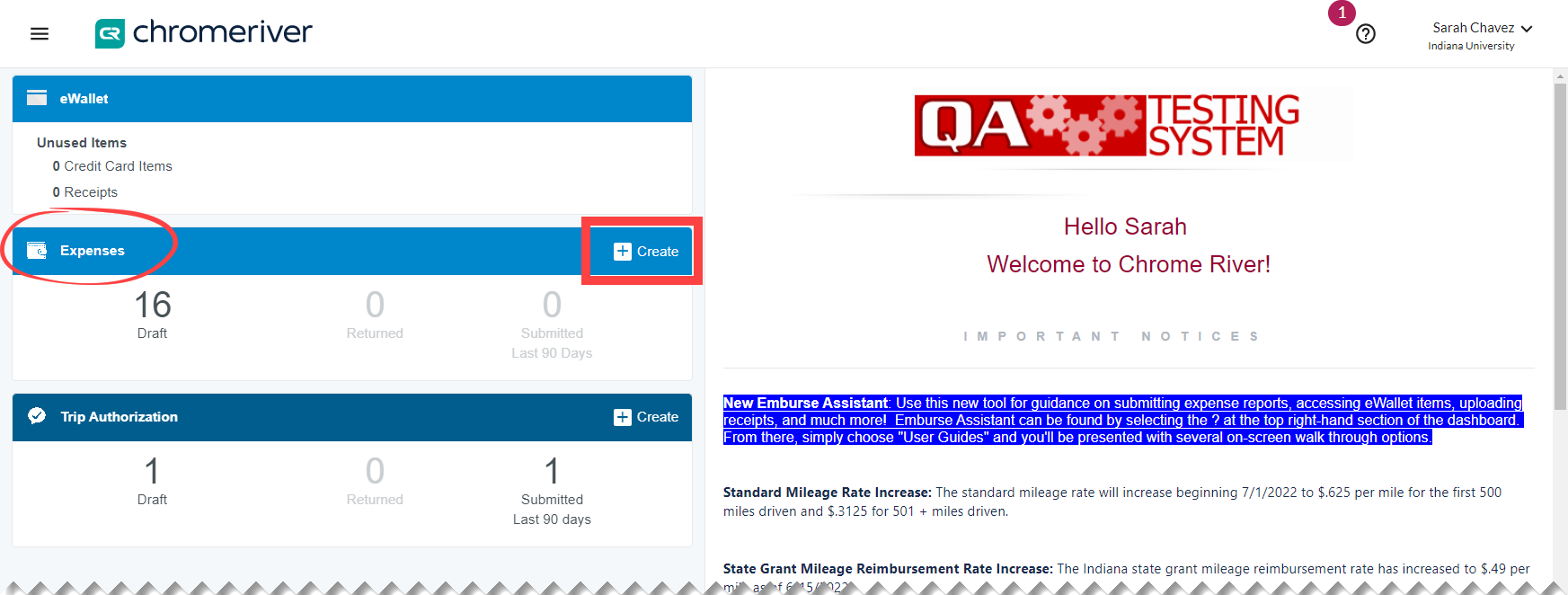

To get started, find the expenses ribbon on the Chrome River dashboard. Click +Create .

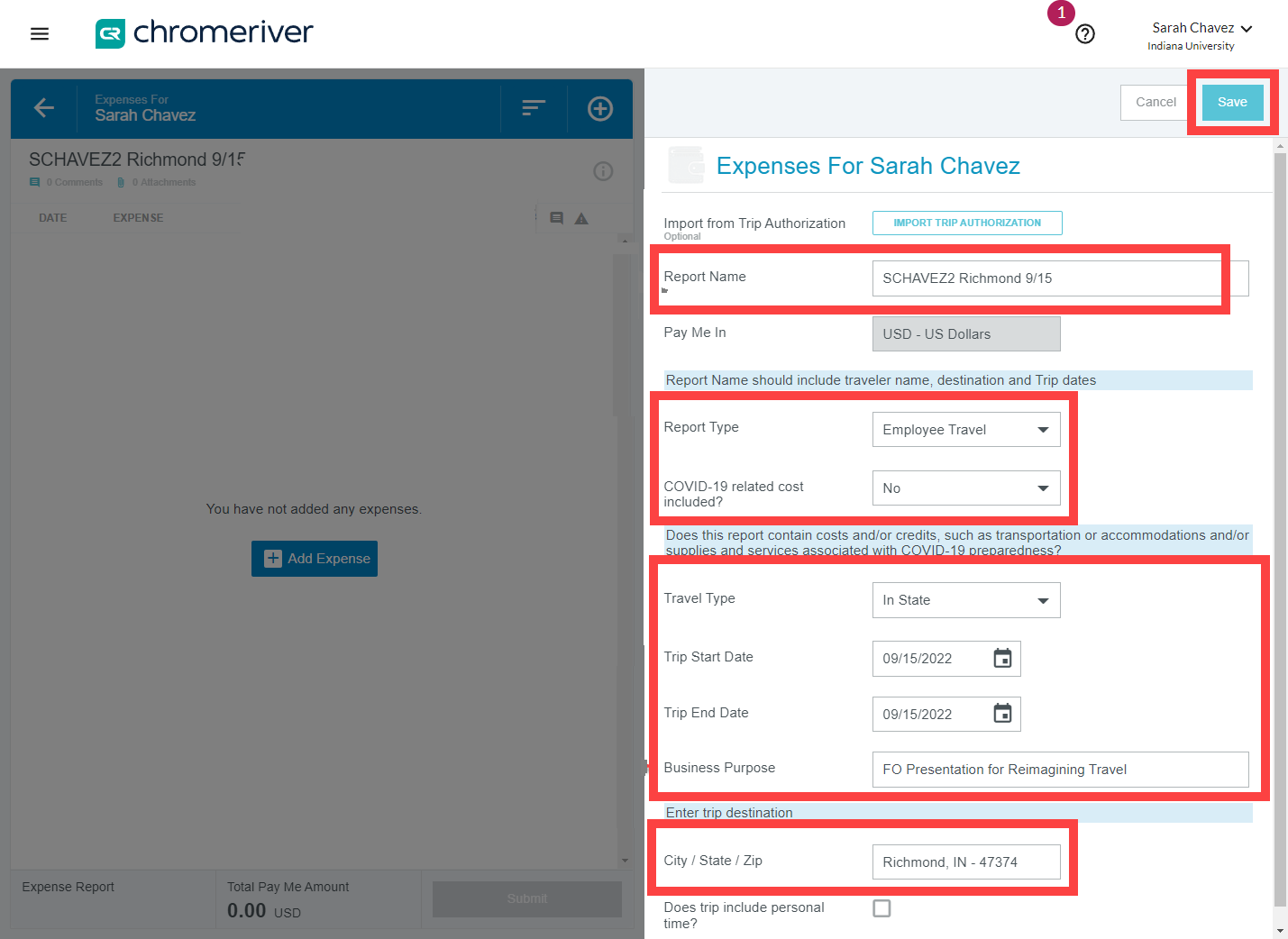

In-State trips do not require Trip Authorization, so you will need to manually fill out the summary page of the expense report. The summary page contains header level information that applies to the whole report.

Click here for help completing the summary page

The report name should include the traveler’s name or username, destination, and dates. This helps anyone reviewing the report to identify the trip at a glance. In this example, we’ve entered “SCHAVEZ2 Richmond 9/15.” The report type describes what kind of traveler is on the trip.

COVID-19 related cost: Does this report contain costs and/or credits, such as transportation or accommodations and/or supplies and services associated with COVID-19 preparedness? Mark “Yes” if so. A field will open requiring you to explain the COVID-19-related cost Business purpose: When entering a business purpose, the language should reflect why the trip expense is a legitimate business use of IU funds. Do not use acronyms in this field. This information should make sense to an auditor or someone outside your department viewing the report for the first time.

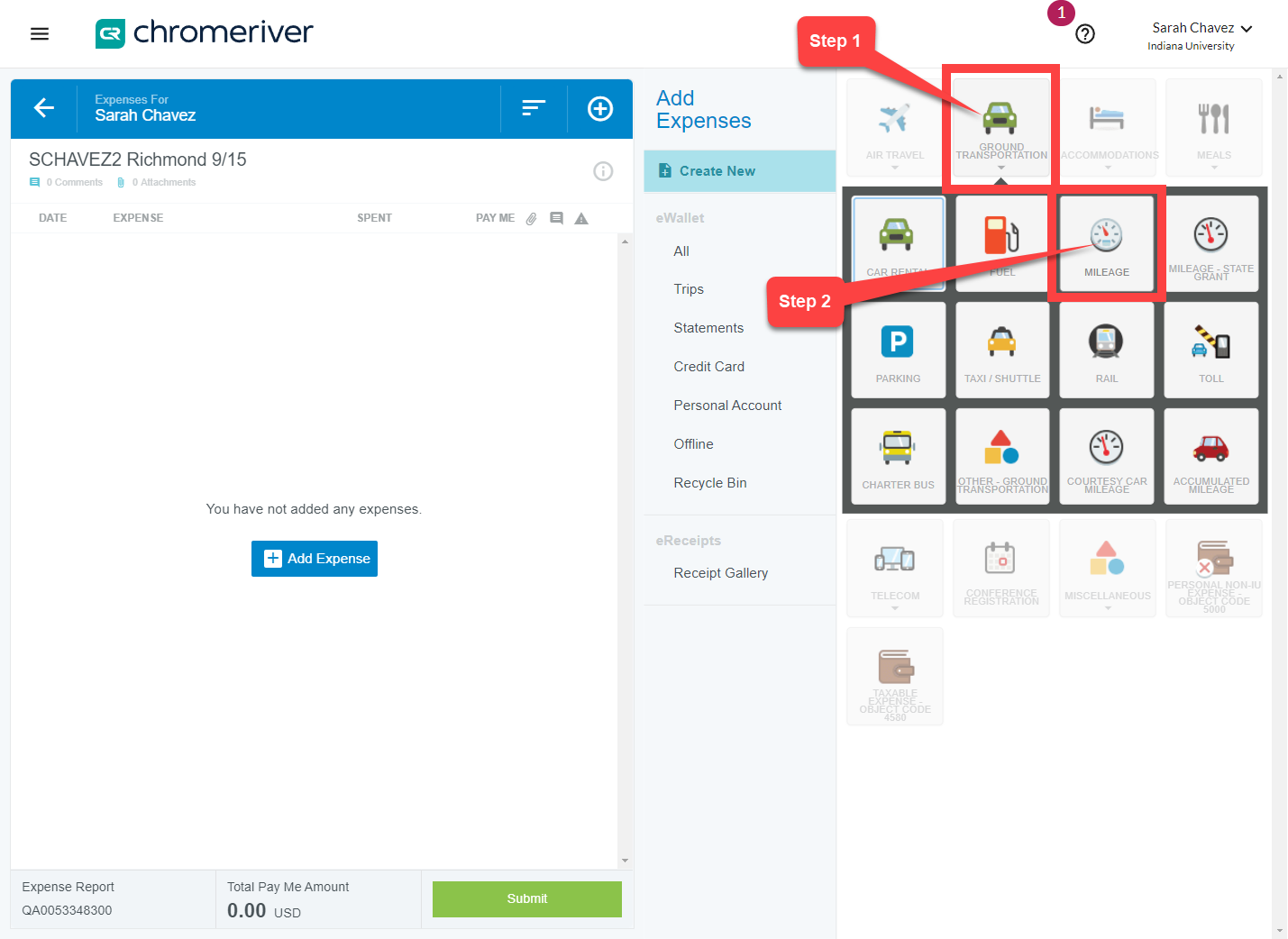

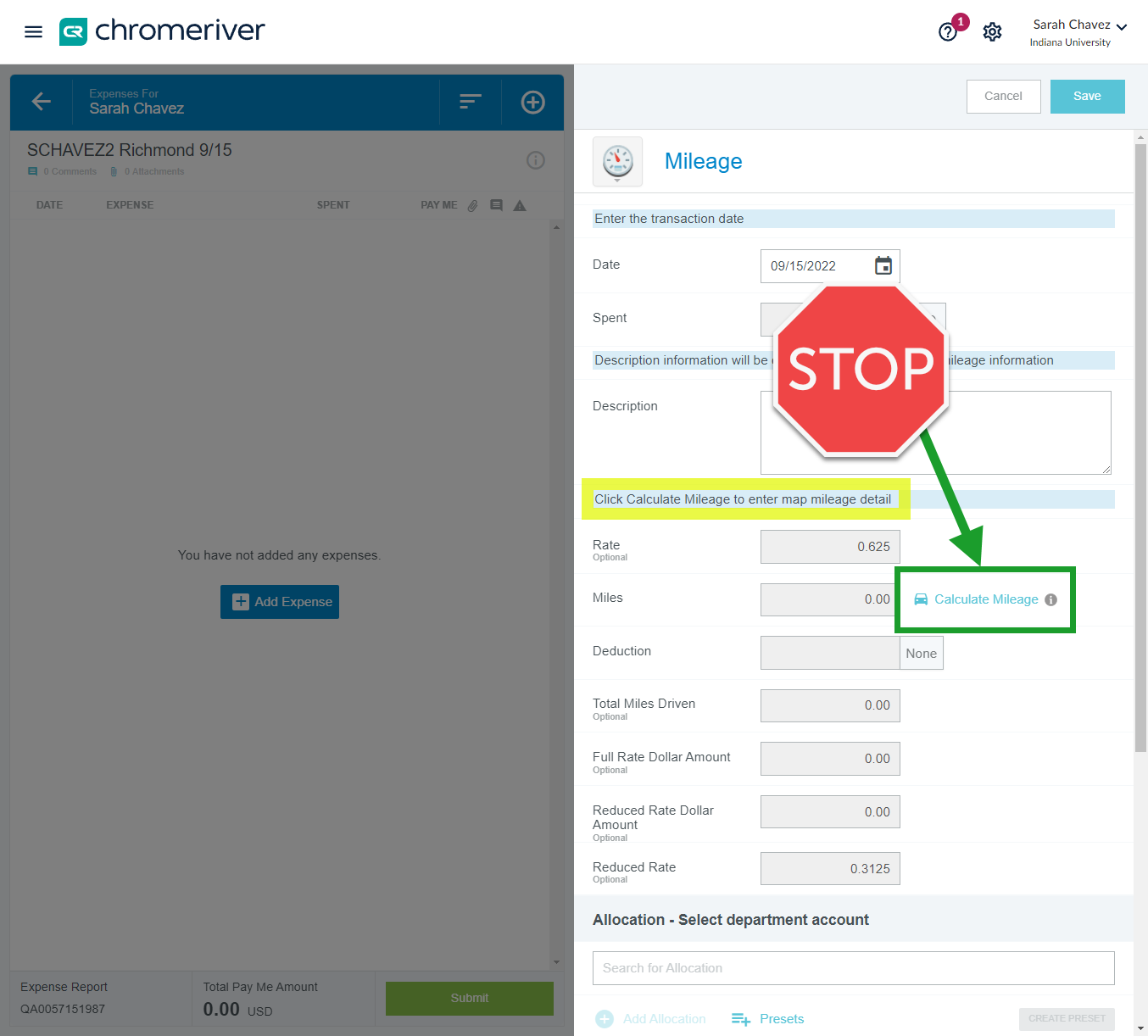

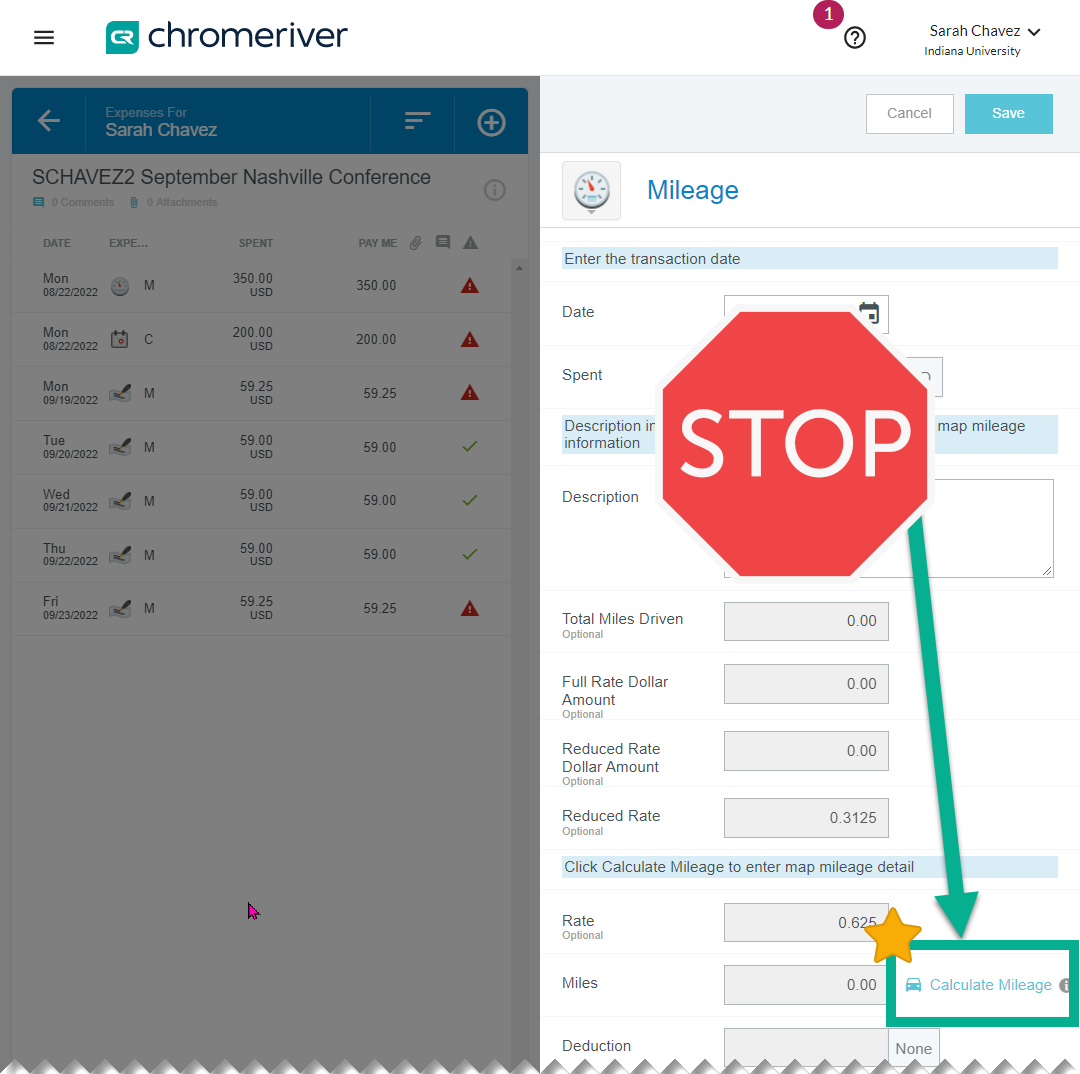

Select the Ground Transportation expense tile, followed by Mileage in the expense drawer.

The mileage expense opens on the right.

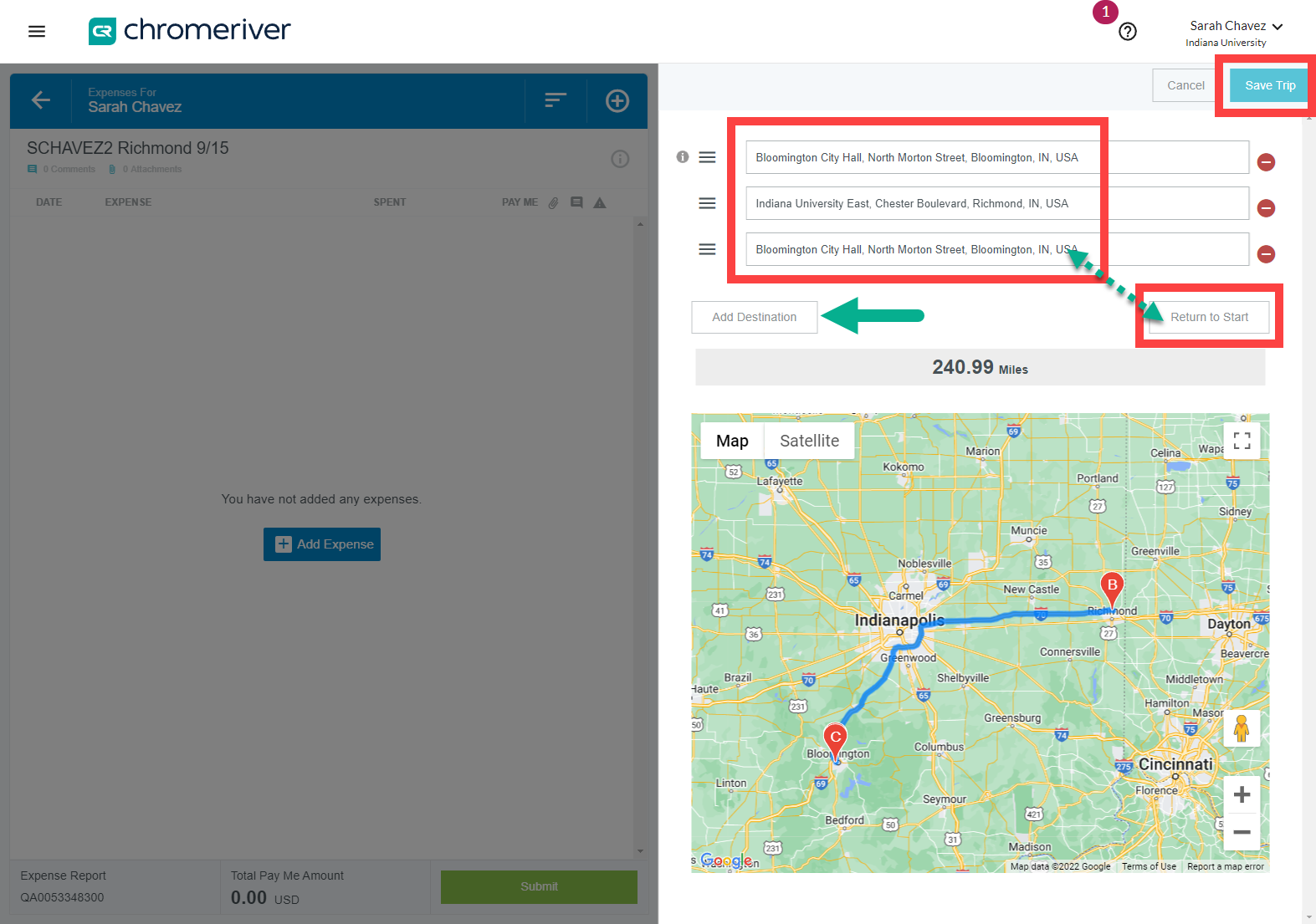

A map opens in the right-hand window. Enter your starting point and your destination(s) into the Google maps mileage calculator by typing the names of the destinations into the open fields. Continue clicking Add Destination until all destinations have been captured. Remember to click Return to Start to capture your drive home.

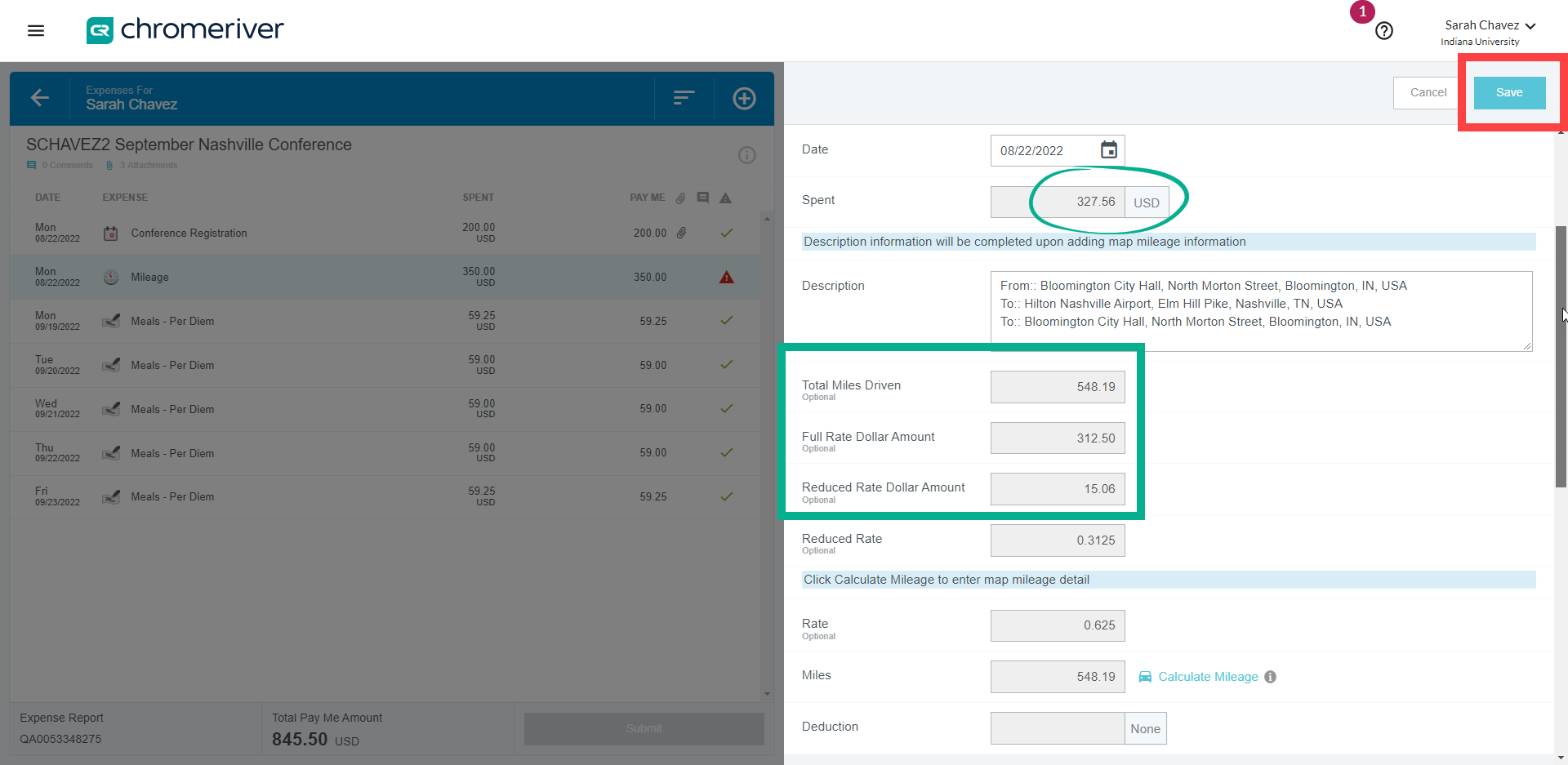

Click Save Trip in the upper right corner when finished adding destinations.

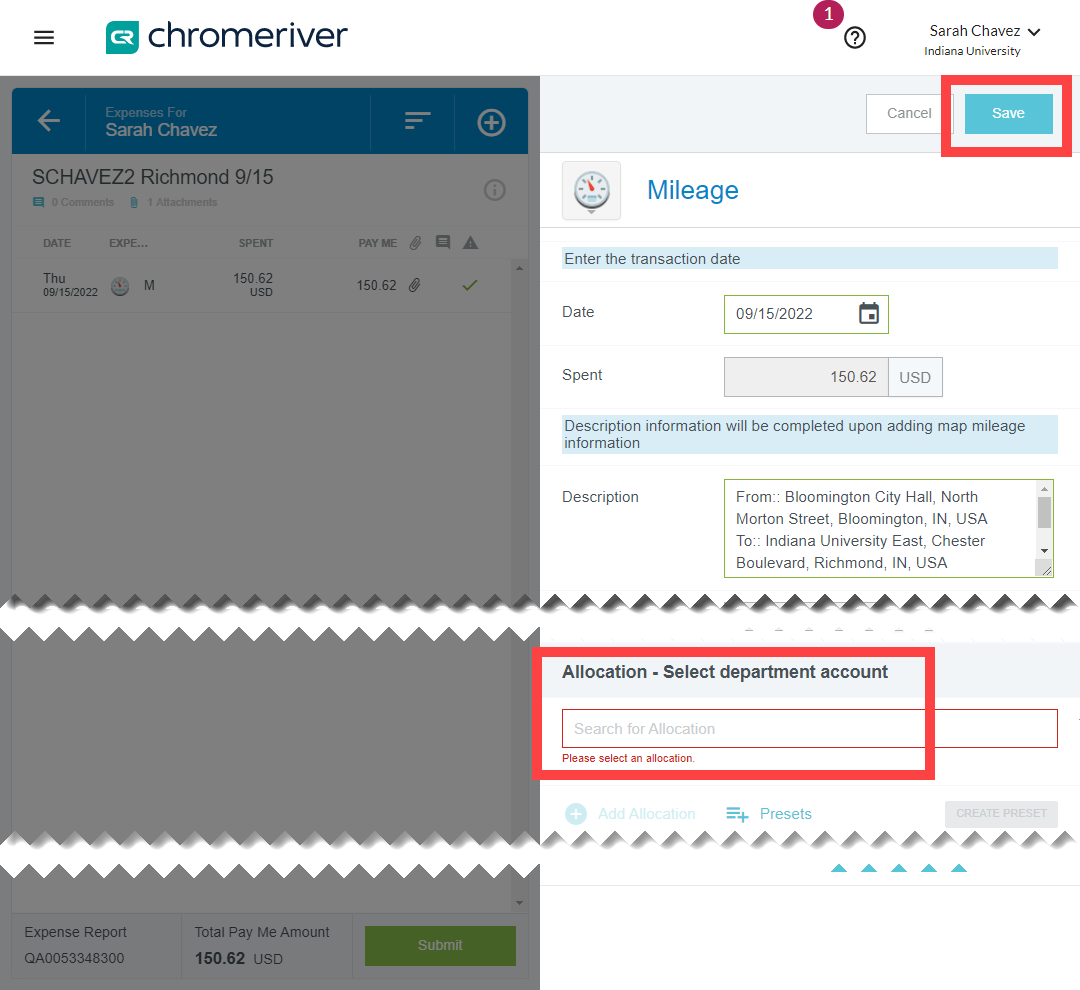

The Google maps information calculated for your trip is auto-populated into the fields of the expense. Note that any miles driven beyond the first 500 miles are reimbursed at a reduced rate. The Spent amount is the dollar amount you will be reimbursed for your mileage. This information is not editable.

Finally, enter the IU account/sub-account funding the trip into the Allocation field. If you aren’t sure which account number to use, contact your Fiscal Officer. If needed, add multiple allocations with the Add Allocation field.

Click Save to add the mileage reimbursement to the expense report.

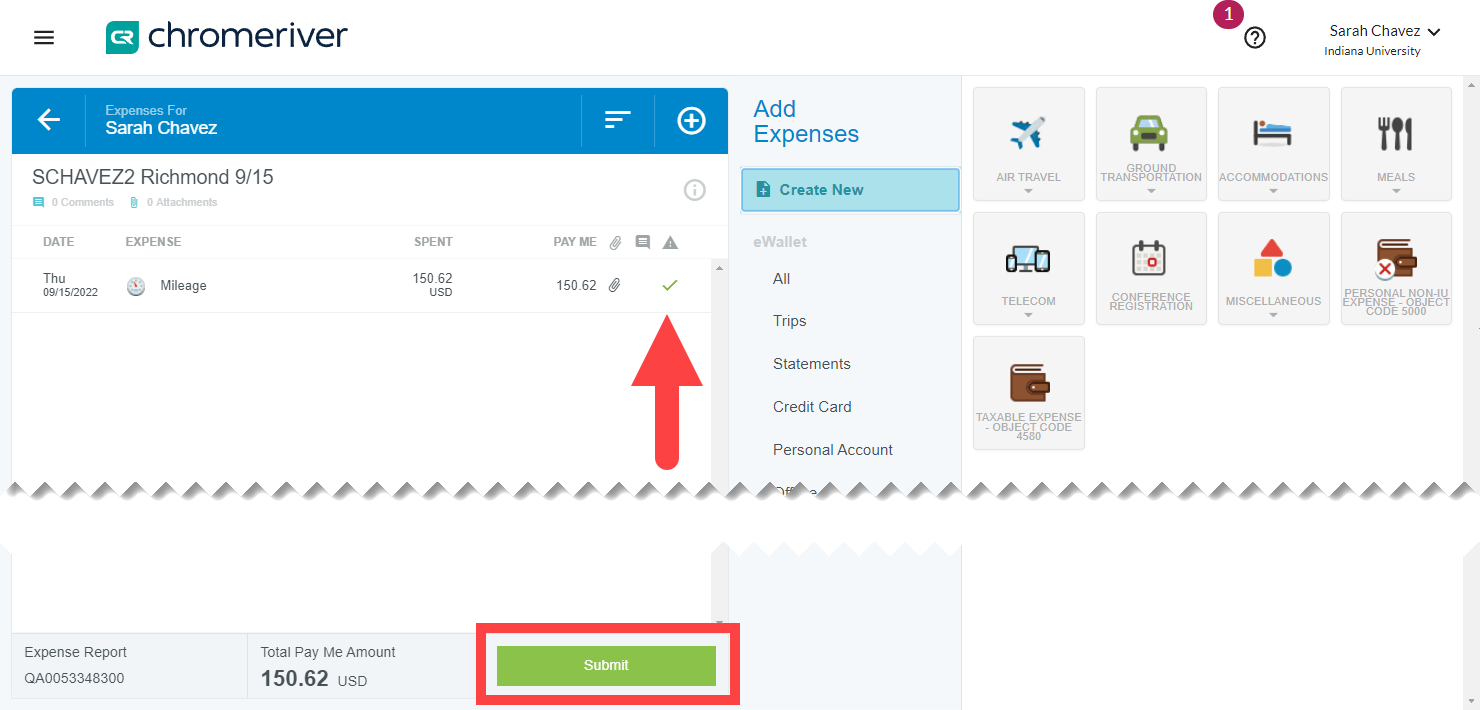

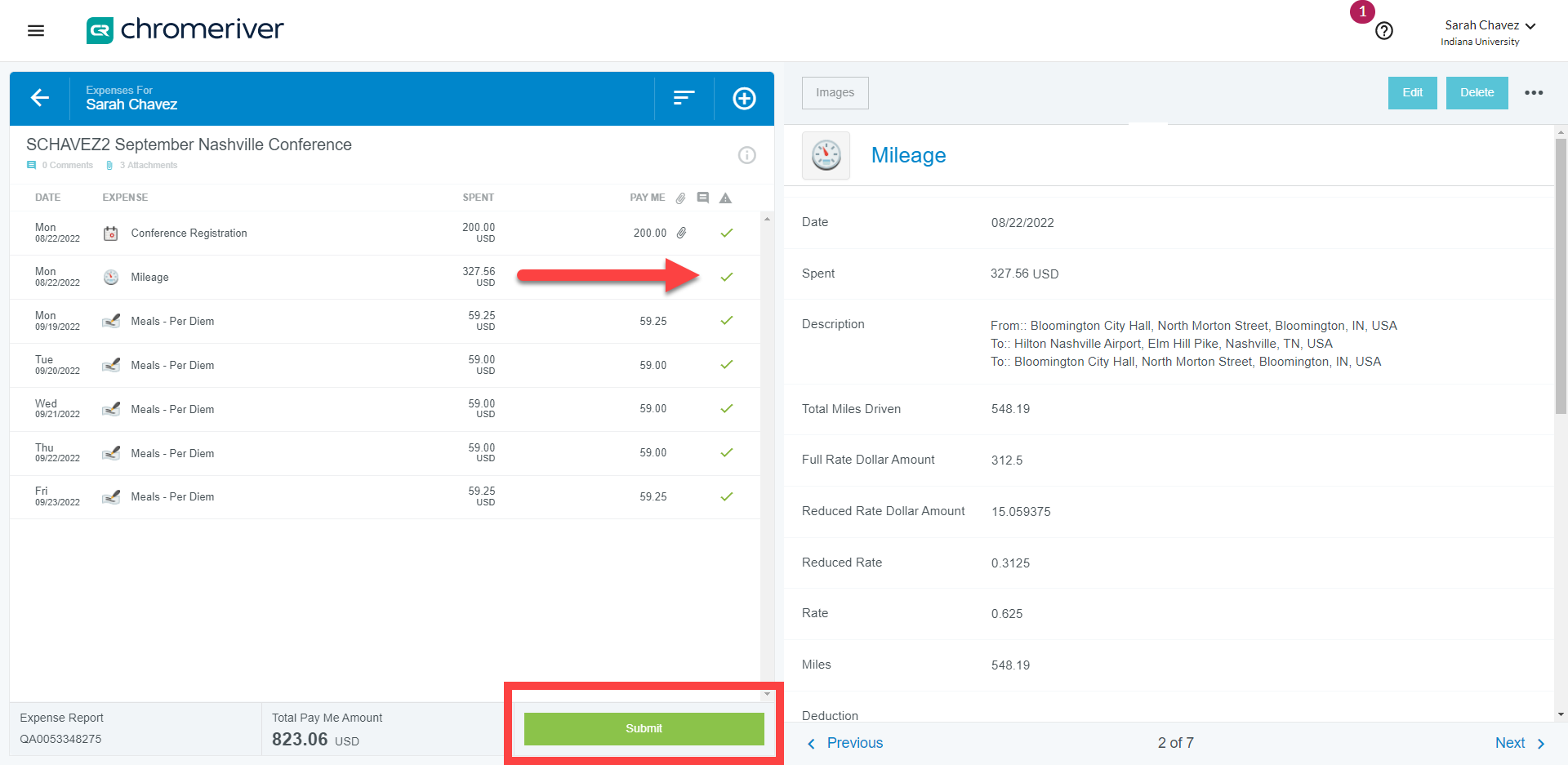

After saving, your mileage expense appears as a single expense line containing all destinations in the left-hand window. The green check mark indicates the expense is complete. Add any other reimbursements to the report. Once your expense report is complete, click Submit .

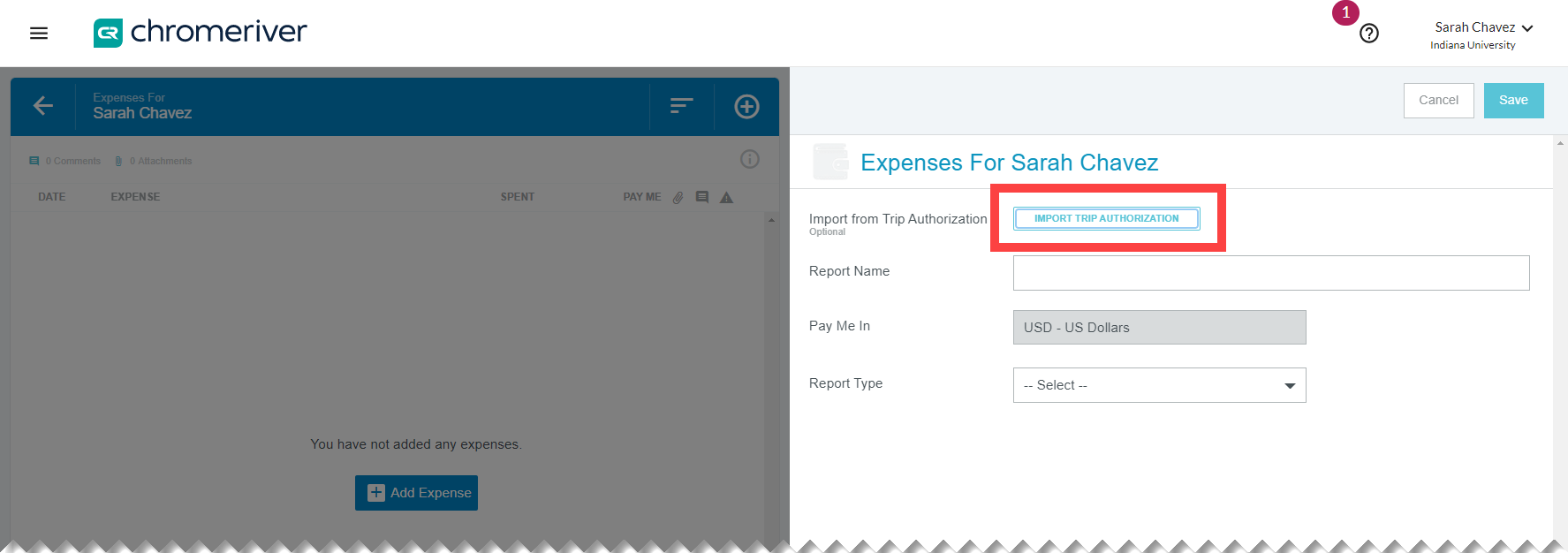

A new expense report opens on the right. Import your approved Trip Authorization (TA) report by clicking the IMPORT TRIP AUTHORIZATION button. The drop-down menu that appears contains your approved TA reports. Select the TA relevant to this specific trip.

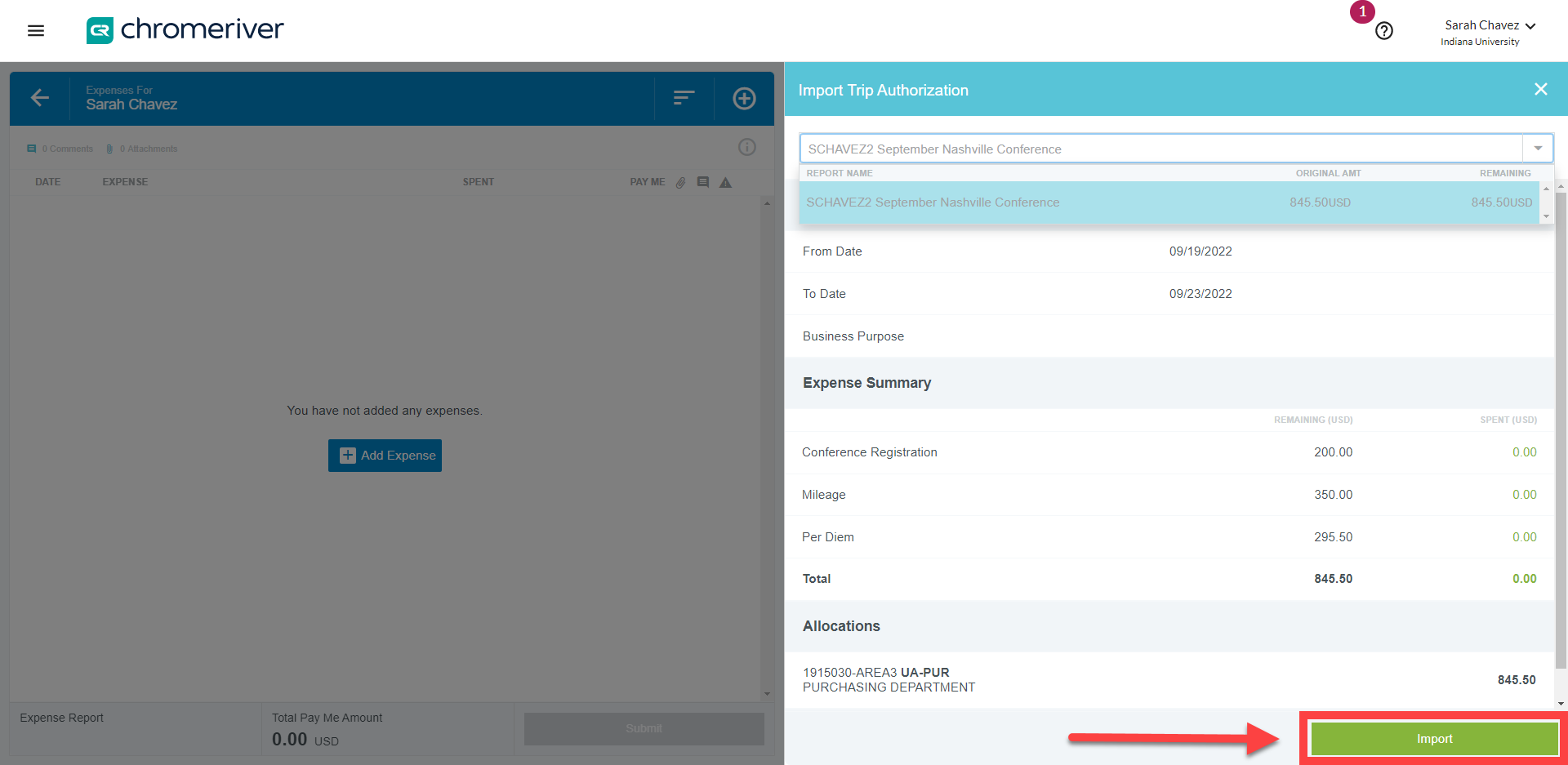

The selected TA opens to display on the right. Check over the details to be sure this is the correct TA and click Import.

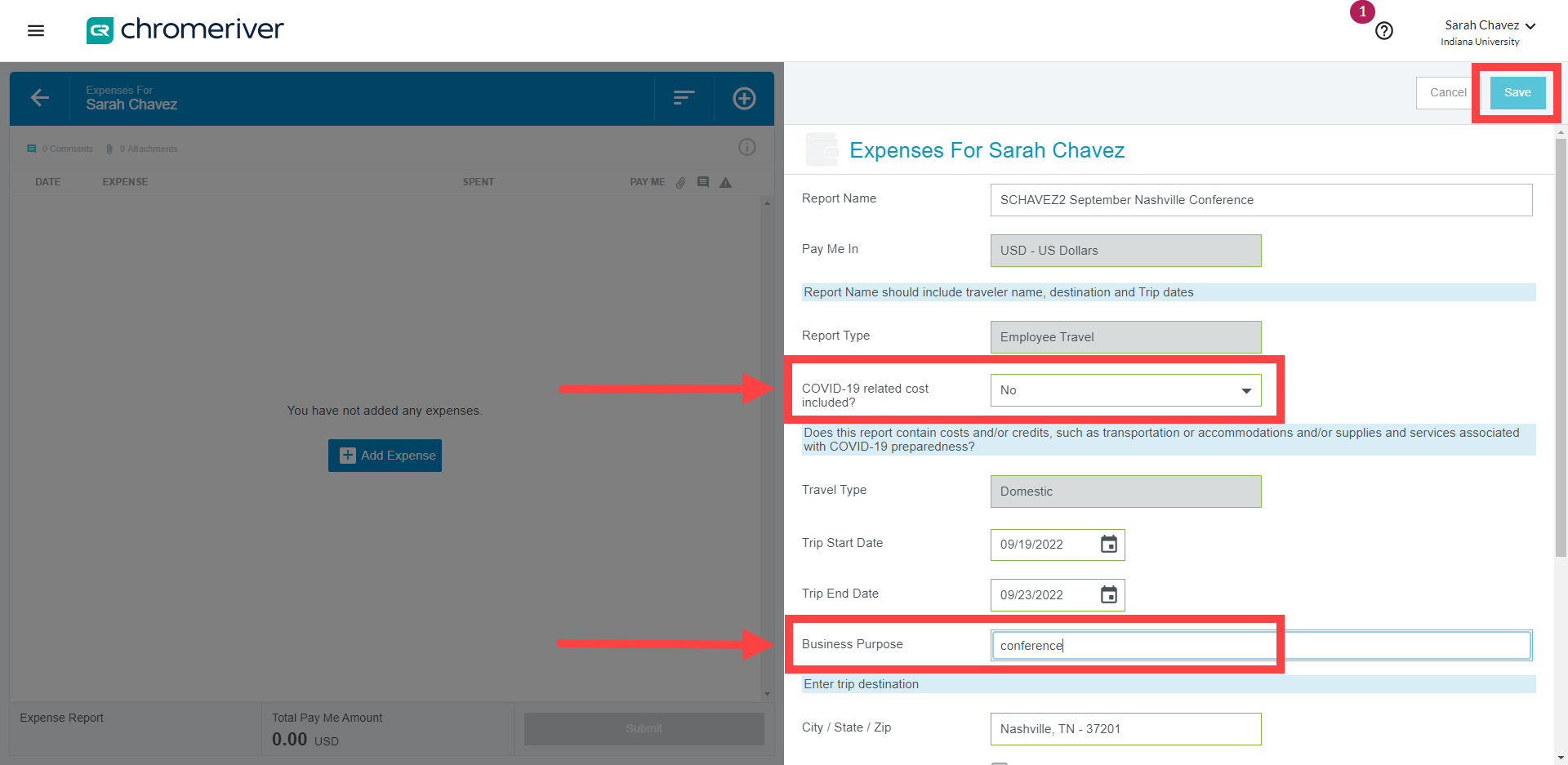

The header-level information from the TA is imported onto the expense report. Two additional fields need to be completed.

Indicate whether this trip exists for COVID-19 related business and fill out the Business Purpose field. Click here for guidance on completing this section .

Click Save in the upper right corner when finished.

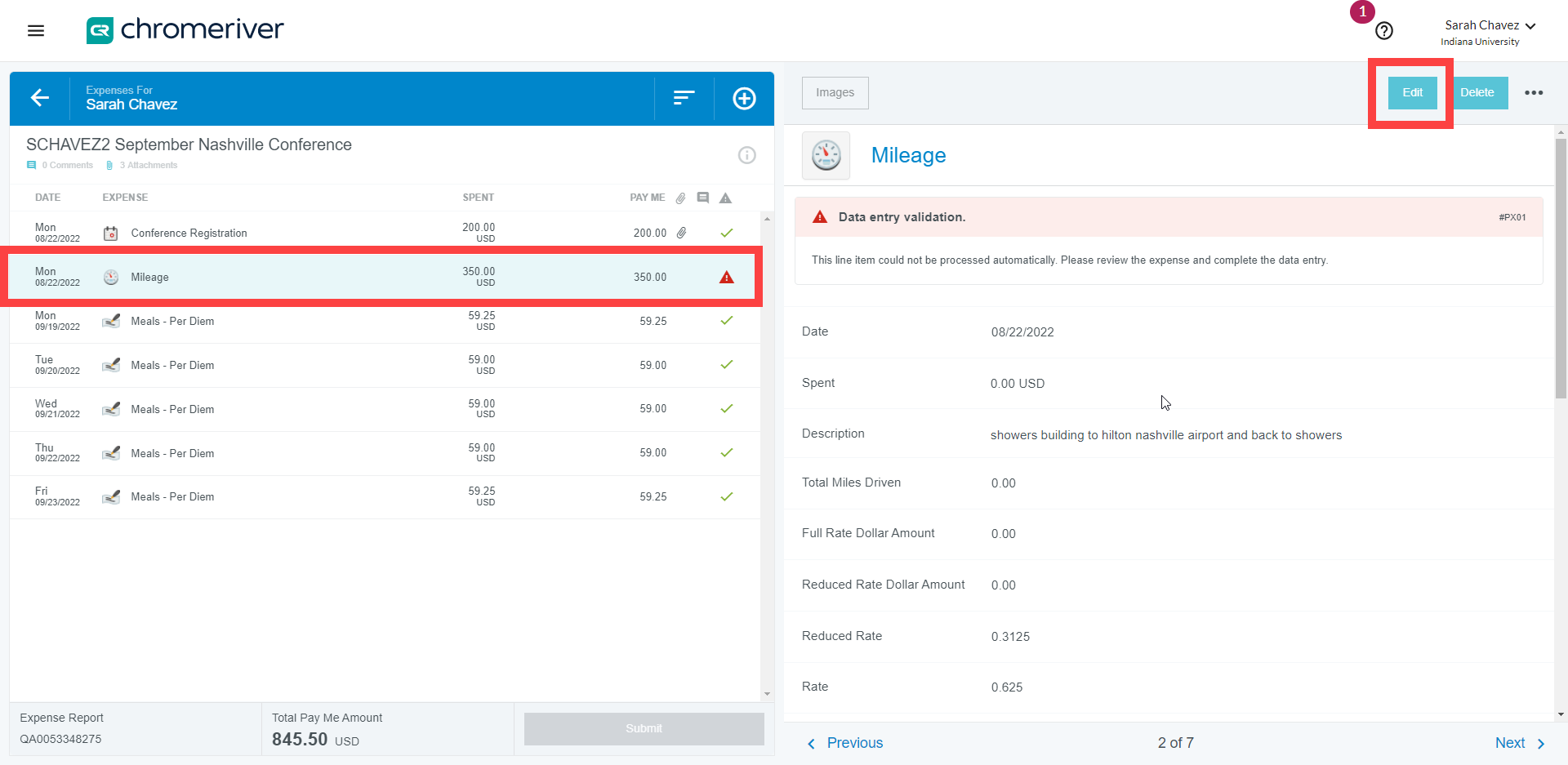

The expenses from the TA are imported onto the expense report. Click the Mileage expense to open it on the right-hand side. Select Edit on the mileage expense.

The mileage expense opens on the right. Scroll down and click Calculate Mileage .

If you need to change the funding account, the Allocation field is editable. When finished, click Save in the upper right corner.

After saving, your mileage expense appears as a single expense line containing all destinations in the left-hand window. The green check mark indicates the expense is complete.

Review the expenses on your expense report. Be sure all the expense lines are relevant and ready to be reimbursed, and delete any unused expenses (unused parking, taxis, miscellaneous expenses) that were imported from the TA. Once your expense report is complete, click Submit.

Accumulated Mileage

The accumulated mileage process allows a user to submit multiple mileage trips (such as weekly campus-to-campus visits) as a single reimbursement. This process is usually used by staff who must frequently travel between locations as part of their job & choose to use their personal vehicle to do so.

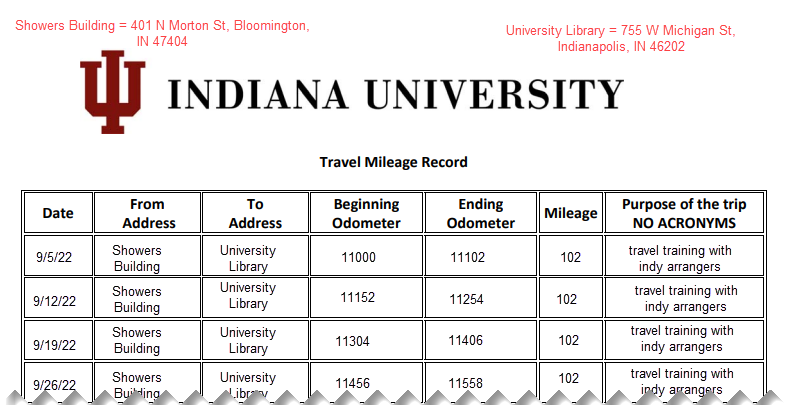

Click here to view an example Accumulated Mileage Travel Record

In the example record below, the traveler traveled 408 miles total. This is found by totaling the mileage column. This amount would be entered into the Total Miles Driven field.

How often should I submit Accumulated Mileage in Chrome River?

Travel Management recommends submitting an accumulated mileage log monthly. If you are traveling via personal car more frequently, i.e. several trips per week, submit your accumulated mileage weekly.

What if my trip crosses state lines?

Accumulated mileage expenses can be claimed on either In-State or Domestic trip types. Per Travel Management, when initiating your expense report, the best practice is to select Domestic travel as the Trip Type when all or most of the travel crosses state lines. Domestic accumulated mileage is most common with regional campuses close to state boarders.

This page demonstrates how to submit an Accumulated Mileage report for In-State travel.

To begin, find the expenses ribbon on the Chrome River dashboard. Click +Create . To learn how to complete the summary page of the expense report, see the In-State section of this page .

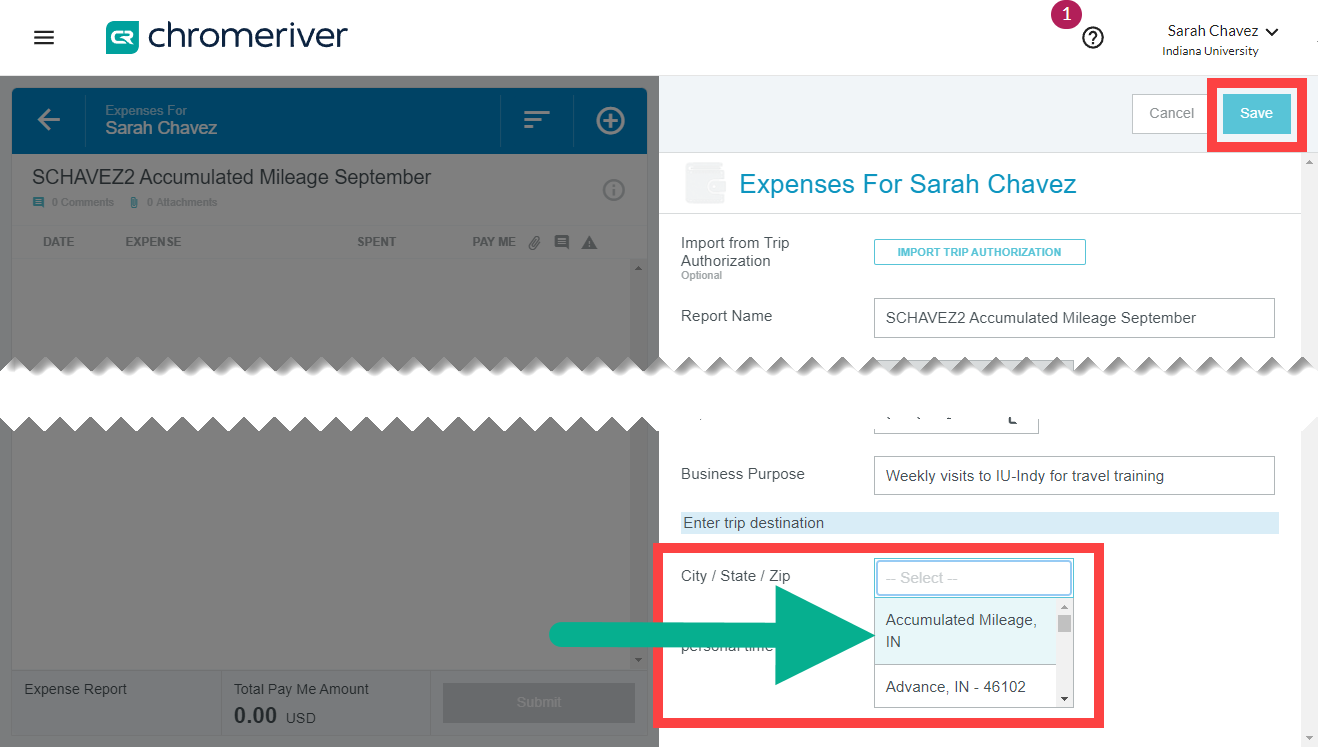

Click on the empty field in the City / State / Zip area. Search for Accumulated Mileage and select this option. Click Save in the upper right corner.

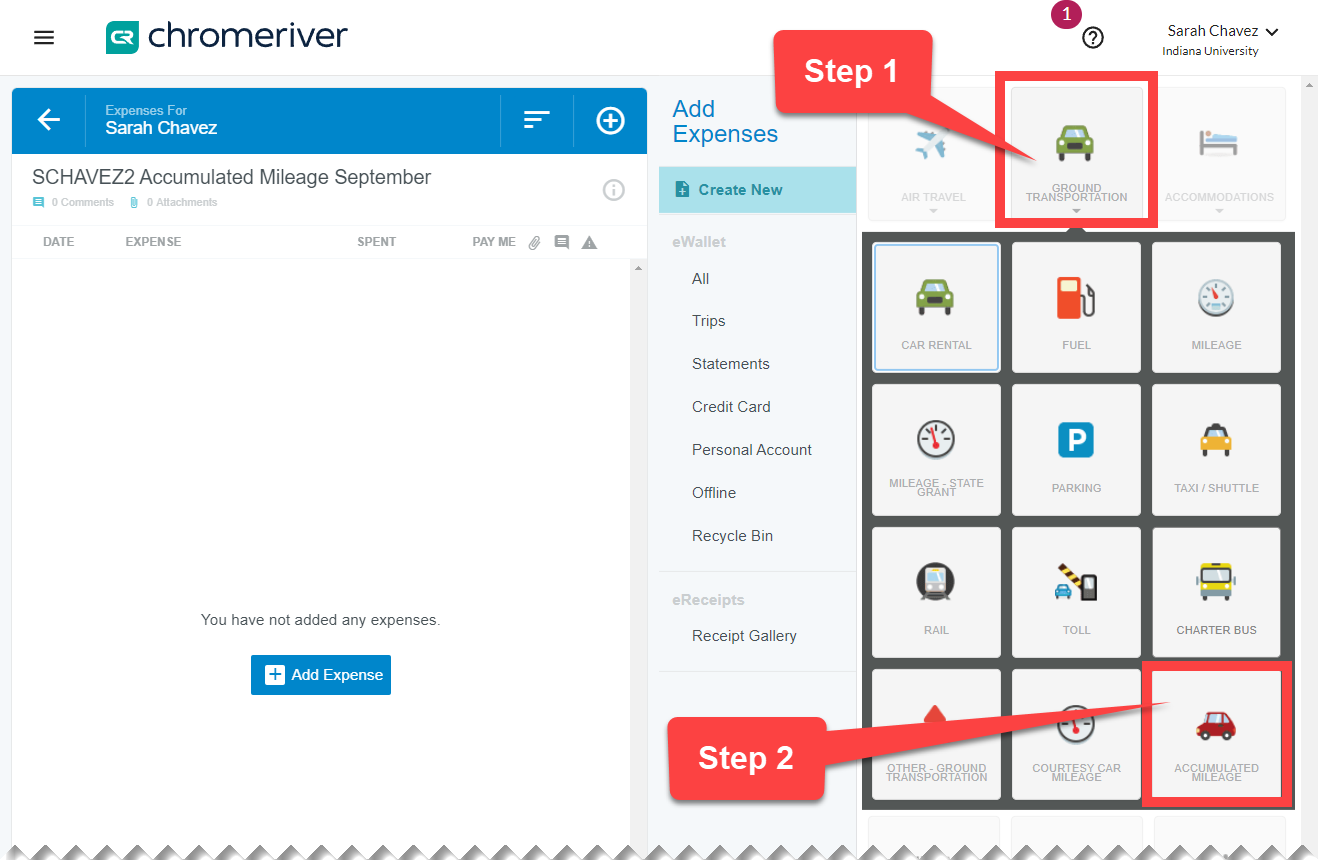

Select the Ground Transportation tile in the expense mosaic. A drawer opens containing ground transportation related expense tiles. Select Accumulated Mileage.

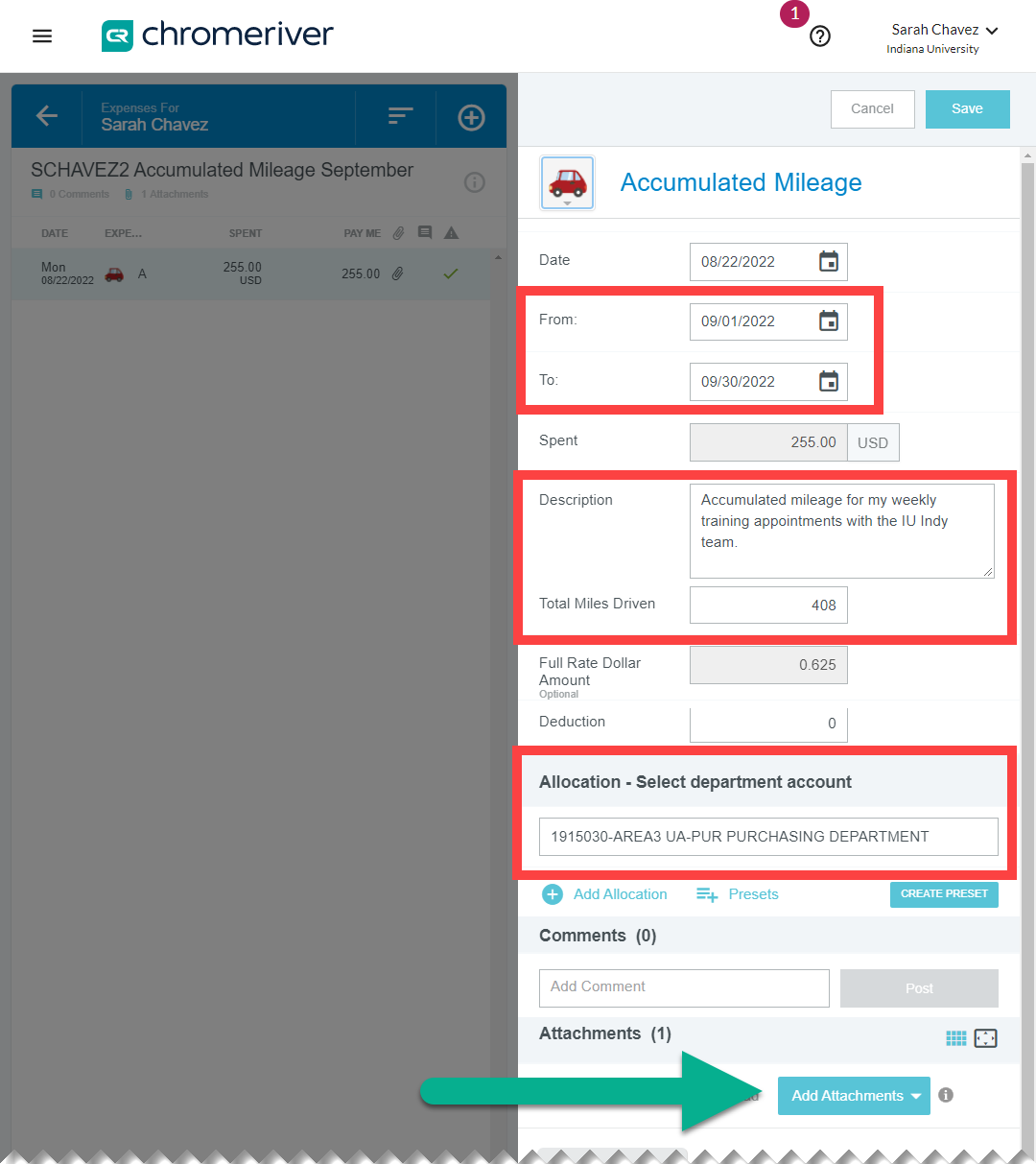

Using your Accumulated Mileage Travel Record, enter the first travel date in the From date field, and the last travel date in the To date field. Enter a description of the locations you traveled to in the Description field. Add up the mileage you logged on your travel record and enter this amount in the Total Miles Driven field.

If your grant or department requires any deductions, enter them in dollars in the Deduction field. The Spent amount, the amount you will be paid, is automatically reduced. This is an uncommon practice. By default, the Deduction field is zero.

Enter the IU account/sub-account funding the trip into the Allocation field.

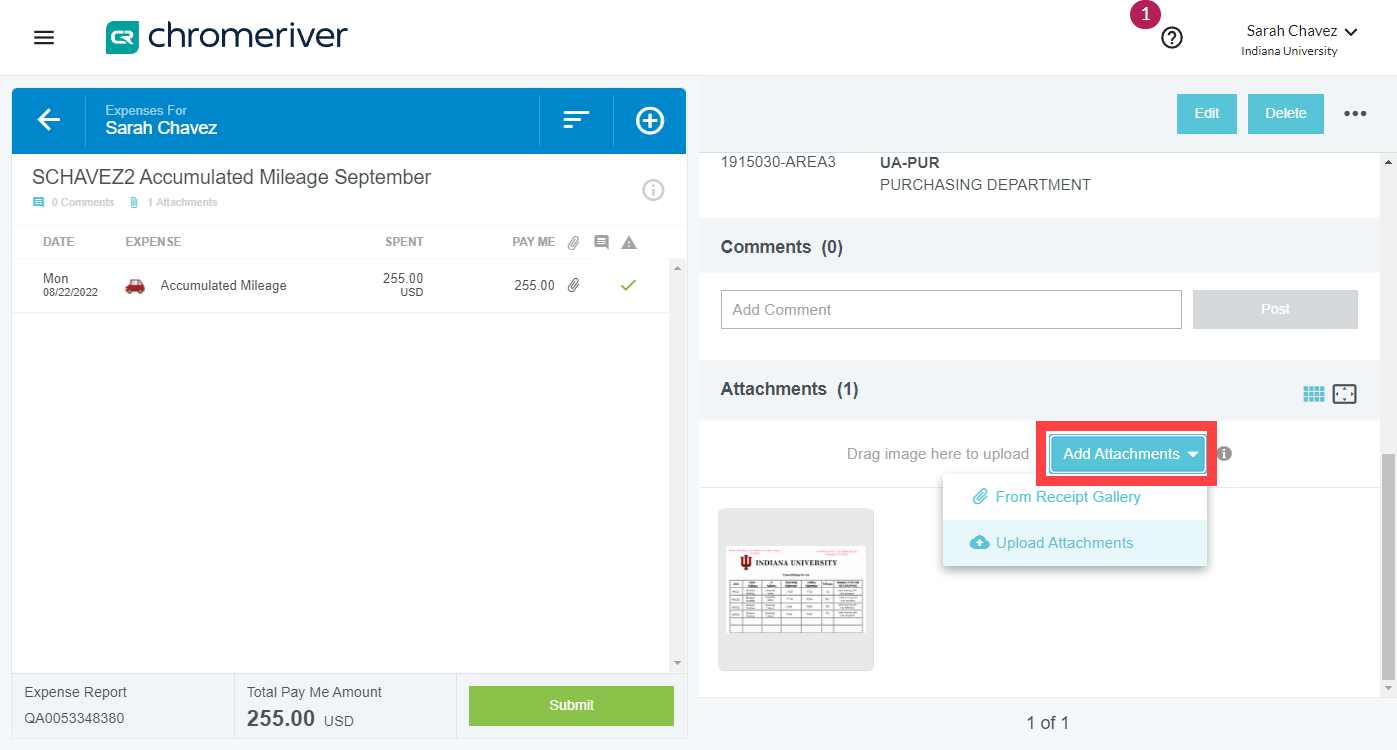

Finally, attach your Accumulated Mileage Travel Report to the expense. Scroll to the bottom of the mileage expense and click Add Attachments . Locate the file in your Gallery or on your device and upload it.

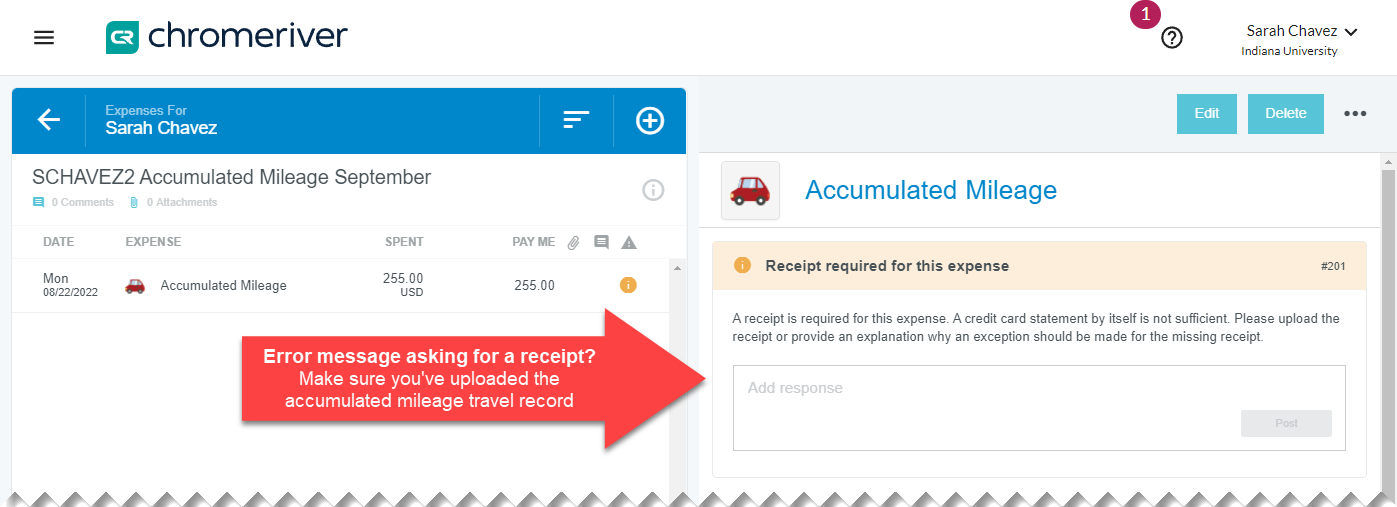

If you forget to attach your Travel Record, Chrome River will display an error message asking for a receipt to be attached. To clear this error, upload the Travel Record.

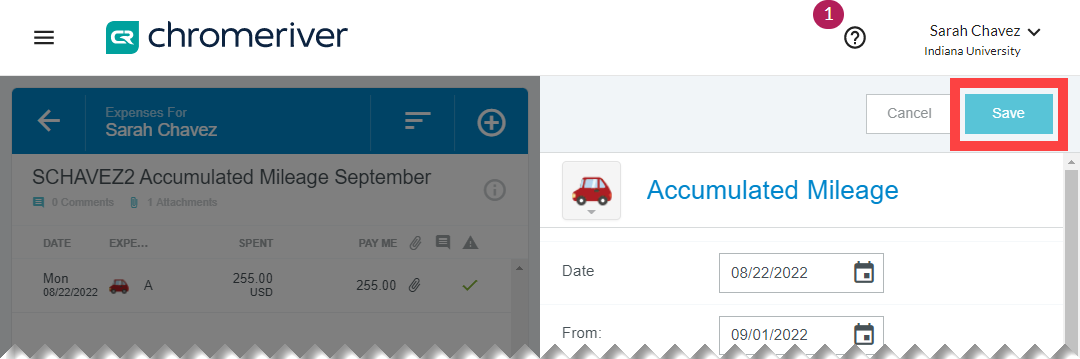

Click Save to return to the expense report.

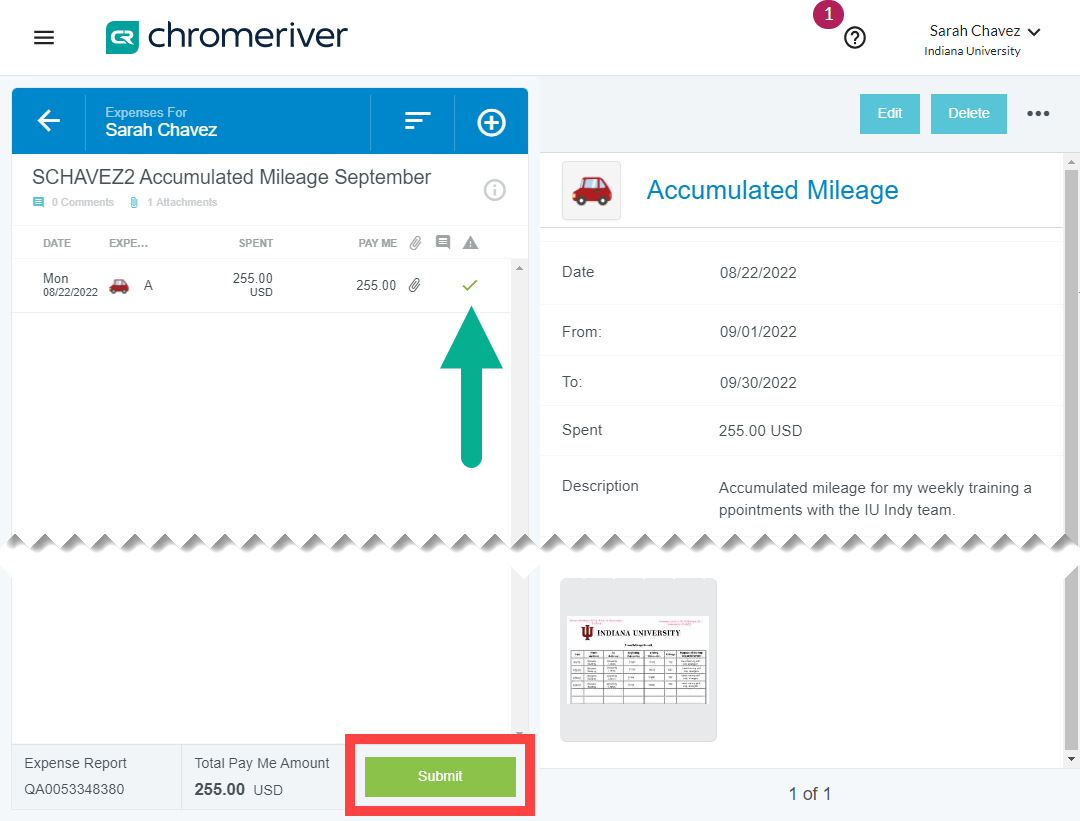

A green checkmark means your expense is ready to be submitted. If you have additional expenses to submit associated with these trips, such as parking, add them by clicking the white plus button . Click Submit to submit the report.

Additional links and resources

INDIANA UNIVERSITY Financial Training & Communications

Cyber Infrastructure Building (CIB) 2709 E 10th St Bloomington, IN 47408 Email: [email protected]

RELATED SITES

- Office of Procurement Services

- Insurance, Loss Control, and Claims

- Office of the Treasurer

- Office of the University Controller

- Travel Management Services

- University Budget Office

- Skip to Content

- Skip to Main Navigation

- Skip to Search

Indiana University Indiana University IU

- Policies Index

- Most Viewed

- New & Recently Revised

- Under Review

- Policy Advisory Council

University Policies

- Travel Policy

Policy Statement

Reason for policy, definitions, additional contacts.

- Related Information

About This Policy

Executive Vice President for Finance and Administration

Patty Cole Director, Travel Management Services [email protected]

- Any individual, including but not limited to faculty, staff, visiting scholars, students, and non-university personnel, seeking reimbursement of travel expenses from university or Sponsored Research funds, and any university unit seeking to use university funds to pay for travel expenses on behalf of any individual.

- This policy also applies to anyone who approves or processes travel arrangements and expenses.

- A unit may set more restrictive requirements. In such case, the unit is responsible for documenting, communicating, and enforcing any such requirements.

Back to top

- The university may pay for or reimburse travel expenses where an individual or university unit incurs those expenses for university business and the fiscal officer or unit leader approves those expenses.

- any expenses that will be reimbursed from another source;

- any expenses of a personal or political nature, or

- any expenses not actually incurred by that individual with their own personal funds.

- Travel Management Services publishes the university’s reimbursement rates for various types of expense (e.g., per diem, mileage, and shared ride transportation) at travel.iu.edu .

- provide guidance to individuals and university units regarding what travel expenses may be paid or reimbursed with university funds,

- promote good stewardship of university resources, and

- explain the relevant requirements and guidelines for travel expenses to be paid or reimbursed.

- Travelers are strongly encouraged to procure travel services, when available, from university preferred vendors. These vendors include Designated Travel Agencies, online booking provider(s), and vehicle rental agencies. See the Travel Management Services Website for a list of preferred vendors.

- Reimbursement requests must be submitted via an expense report through the IU travel system and will be paid after the completion of a trip. The expense report should be submitted by either the traveler or the travelers’ delegate within the travel system (“Delegate”).

- A business purpose must be clearly identified on the expense report for each trip to validate the business need for the travel.

- In compliance with IU’s Accountable Plan , employees, students, and non-employee travelers (or their Delegates) are required to submit reimbursement requests, with required supporting documentation, within a reasonable period of time (as defined in TSOP 9.02 Account Plan Reimbursements) .

- Travel charged to sponsored awards may be subject to specific restrictions set by the sponsor. Travel restrictions may vary between federal and non-federal sponsors.

- Travelers on university business funded by a federal award must comply with the requirements of both the Uniform Guidance (2 CFR Part 220) and are required by 49 U.S.C. 40118, commonly referred to as the “ Fly America Act ,” to use United States air carrier service for all travel and cargo transportation services funded by the United States Government.

- Certain expenses (e.g., for alcohol) are “unallowable” in accordance with federal cost principles and cannot be charged to a federal award. Some expenses not allowed on a sponsored award may, however, be reimbursed by a non-sponsored fund under specific circumstances if those expenses meet the requirements under this policy for reimbursement.

- Questions about sponsor restrictions should be addressed to the appropriate representative in the Office of Research Administration.

- If a sponsored research program has more restrictive receipt requirements, the more restrictive receipt requirement will take precedence. The traveler should confirm receipt requirements with the Office of Research Administration or the sponsor.

- Travel Days : For travel within the contiguous United States, an individual traveling solely on university business to one destination should only need one travel day to arrive at that destination and one travel day to return home. As such, the university will typically reimburse travel expenses for up to two travel days in total for an individual traveling for university business to one destination in the contiguous United States. If an individual has to travel to multiple locations and each location is for university business or if that individual is traveling internationally, the university may reimburse travel expenses for additional travel days where travel cannot reasonably be competed in two days.

- The following chart details the policies that govern travel expenditures:

Appropriate : An expense that is suitable or fitting for a particular valid business purpose.

Allowable Expense : a necessary, reasonable, and appropriate expense incurred for the primary benefit of university business and therefore permitted to be reimbursed or directly charged based on the permission of the university or by the terms of the federally or privately sponsored agreements.

Business Travel : Travel for the purpose of conducting business for the sole benefit of the university.

Necessary : Minimum purchase or service required to achieve a particular business objective.

Official Workstation : The primary physical location(s) where the majority of work is conducted.

Unit Leader : The director or vice president for an administrative unit, the dean of an academic unit, the vice chancellor or vice provost of administrative services of the campus, or the delegate of one of these individuals.

Out-of-Pocket Expense : An expense incurred by the traveler and paid with personal funds during the trip.

Per Diem : An allowance determined by the U.S. government to cover meals and incidentals while traveling for business purposes. Per Diem amounts are published by the General Services Administration (domestic) and State Department (international) and are specific to major cities.

Reasonable Expense : An expense that is ordinary and reflects a prudent decision to incur the expense on behalf of university business; not extreme or excessive.

Segment of the Trip : Non-stop, in-flight, continuous travel from one point to another point.

University Preferred Vendors : Vendors with whom Indiana University has an established business relationship and, in most cases, negotiated pricing and other benefits.

Travel Advance : Advance payment to the traveler to pay for travel expenses when other payment options are not available or do not meet the business need.

Indiana University Prepayment Programs : Programs established by Indiana University to allow payments to university preferred vendors via a direct bill process whereby a university account is used to charge the business travel expense. These programs include Designated Travel Agencies, online booking tools, and ground transportation providers.

Travel Meeting Card : An Indiana University corporate credit card that is used to pay approved travel expense for student group travel. The meeting card is for student group travel only. Eligibility for the credit card will be determined by Travel Management Services and will be based on the purchase needs of the group requesting the card.

- Failure to comply with this policy could result in a traveler’s expense report being denied by the unit or by Travel Management Services or a lower amount of reimbursement being provided to the traveler than requested.

- Falsification of travel expenses may subject travelers to disciplinary procedures according to university policies.

This policy was established on October 1, 1990.

Revised to add scope November 2016.

This policy was updated on August 2, 2018 and October 7, 2021.

The policy contact information was updated on March 27, 2023.

This policy consolidates the following historical policies;

FIN-TRV-1.0 Authorization for Out-of-State Travel

FIN-TRV-2.0 Reimbursement of Travel Expenditures

FIN-TRV-3.0 Travel Reimbursement Deadline Policy

Reimbursement Under the Accountable Plan, FIN-ACC-620

Mobile Plan and Device Allowance, FIN-ACC-480

Travel Management Services

Insurance, Loss Control and Claims

Allowable Travel Payments to Faculty Members on Leave, FIN-ACC-610

Use of Aircraft on University Business, FIN-INS-09

Vehicles Rented, Leased or Chartered, FIN-INS-06

Use of 12- and 15-Passenger Vans, FIN-INS-05

Fly America Act

Open Skies Act

Uniform Guidance (2CFR part 220)

Indiana University Indiana University IU

Travel Management Services Purchasing | Supplier Diversity

Traveling by Personal Car

Hotel discounts, mileage rates, approved drivers, accumulated mileage, personal car overview.

It is important to recognize following information when traveling by personal vehicle:

- Repairs to a personal car are the owner's responsibility.

- The University does not reimburse flat tires, dead batteries, etc., or any violations such as parking or speeding tickets.

- An employee's daily commute to and from their residence and official work station is not reimbursable under the Travel Policy and will not be reimbursed.

See the Travel Policy for university requirements regarding traveling via personal vehicle.

Mileage Stipulations

- Mileage is calculated from the traveler's official work location (or from their home) to their business destination, including lodging locations.

- Mileage reimbursement rates are determined by the IRS. This rate includes wear and tear, fuel and insurance costs for the personal vehicle.

- Mileage costs up to 500 miles are reimbursed at the full rate. Mileage above the first 500 miles is reimbursed at fifty percent (50%) of the full rate

- Reimbursement for mileage costs is limited to the cost of a comparable 30-day advance purchase round trip economy class airfare ticket if the airfare is more economical than reimbursing mileage. To substantiate mileage in lieu of airfare, an airfare quote must be printed and uploaded to the reimbursement expense report in the online travel system.

- Fuel charges may be claimed in lieu of mileage, but will be limited to the cost of the mileage calculation

- Business travelers are allowed a maximum of two full days of paid travel time to and from their official business location - one day before their official business begins and one day after their official business has concluded.

How to Claim Mileage

- Mileage for university business travel must be submitted through the online travel system (Chrome River).

- Mileage is determined using official state highway distances, as calculated by the Map feature in Chrome River.

- The full address for the business destination is required using the Map feature. Entering the city and state location in lieu of the full address is not sufficient substantiation for the mileage claim. Some exceptions apply, such as instances where the address must remain confidential.

- If the traveler is traveling to multiple destinations and claiming mileage for each leg of the trip, the Map feature in Chrome River must be used to enter each leg of the trip.

- the purpose of each trip is approved university business;

- each trip is non-overnight;

- no per diem is being claimed; and

- the daily mileage amount and the date and purpose of each trip is documented on the expense report. A completed Mileage Record form may be used in lieu of documenting the date, purpose and mileage within the expense report. The Mileage Record form, when used, must be uploaded to the expense report.

- $.67 per mile for the first 500 miles (Effective January 1, 2024)

- $.335 per mile for 501 miles or more

Airport Code List

- IND - Indianapolis International Airport

- SDF - Louisville Muhammad Ali International Airport

- CVG - Cincinnati/Northern Kentucky International Airport

- MDW - Midway International Airport

- ORD - Chicago O'Hare Interational Airport

Disclaimer: Mileage is from a general campus location to the airport and is for estimating purposes only. Actual mileage will vary.

University policy requires that, as a condition for driving any vehicle on university business, drivers will give Indiana University authorization to conduct a Motor Vehicle Record (MVR) check and provide all information needed for conducting the check. Driving on university business will be prohibited if authorization to conduct a MVR check is not given.

Before driving for any trip, complete the Authorization Form for Motor Vehicle Records Check , found on IU's Office of Insurance, Loss Control & Claims website.

The accumulated mileage process allows a user to submit multiple mileage trips (such as weekly campus-to-campus visits) as a single reimbursement. This process is usually used by staff who must frequently travel between locations as part of their job & choose to use their personal vehicle to do so.

- the daily mileage amount and the date and purpose of each trip is documented in the Chrome River expense report.

Download the Accumulated Mileage Travel Record and use it to keep a log of your daily destinations. Odometer readings should be taken per trip and individually accounted for on the record. This record must be attached to the expense report in Chrome River.

Click here to learn how to report accumulated mileage expenses in Chrome River

Travel Management recommends submitting an accumulated mileage log monthly. If you are traveling via personal car more frequently, i.e. several trips per week, submit your accumulated mileage weekly.

Out of state mileage

Accumulated mileage expenses can be claimed on either In-State or Domestic trip types. Per Travel Management, when initiating your expense report, the best practice is to select Domestic travel as the Trip Type when all or most of the travel crosses state lines. Domestic accumulated mileage is most common with regional campuses close to state boarders.

Indiana University Bloomington social media channels

INDIANA UNIVERSITY Travel Management Services

- Chrome River

- Contact & Newsletters

- PDF / Video / Webinar

- Live - Zoom Meetings (TBA)

Related Sites

- Office of Procurement Services

- IU Purchasing

- IU Supplier Diversity

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Salmon & Hewins, LLC Law Office

Evansville Injury Lawyers

FREE EVALUATION

Am I entitled to Mileage Payments in Indiana Worker’s Comp Cases?

There is nothing straight-forward and easy when it comes to Indiana Worker’s Compensation Law. One exception (mostly) is the concept of mileage. For Indiana Worker’s Comp cases, injured workers are entitled to mileage payments under certain criteria.

When Indiana Workers are Entitled to Mileage Payments

Whether or not you’re entitled to mileage payments depends on two things: (1) where you work, and (2) where your medical care takes place. The Indiana Worker’s Compensation Act states:

If the employee is requested or required by the employer to submit to treatment outside the county of employment, the employer shall also pay the reasonable expense of travel, food, and lodging necessary during the travel.

Where you live does not matter. So, if you work in one county, and have to leave that county to see your designated worker’s comp doctor, the worker’s compensation insurance company owes you mileage payments if you drive your own vehicle (food and lodging expenses apply in very rare circumstances – someday we’ll have a blog post about that too!). I have a lot of clients who live in Gibson, Posey and Spencer Counties. They frequently will be asked to travel to Evansville or Newburgh to see doctors there. As the statute says, these injured workers are entitled to be reimbursed for their round-trip mileage. I tell clients in this situation to keep a notebook and log their starting and ending mileage for each trip. Every month or so, we will compile the mileage, prepare a chart, and submit it to the worker’s compensation insurance company for payment.

There is a second section of Indiana Worker’s Comp law that discusses mileage. In some cases, the employer may require you to see a “second opinion” doctor. If that happens, the Indiana Worker’s Compensation Act requires the worker’s comp insurance company to “defray the necessary expenses of travel,” including mileage payments. This is a different type of medical exam than described above, and in this situation the statute does not limit mileage payments to travel outside the county of employment. It’s a minor detail, I know, but considering the treatment my clients often deal with at the hands of worker’s compensation insurance companies, they should insist on payment, even if it’s just a few miles.

One bit of bad news, though. If you were injured in Indiana, but moved to another state for whatever reason, your entitlement to mileage for these “second opinion” exams are limited to mileage payments from the nearest border to the place of examination. So, if you’ve moved to Florida, worker’s comp doesn’t have to buy you a plane ticket.

What if I don’t Have a Car or Can’t Drive?

Although the Indiana Worker’s Compensation Act does not specifically say so, it has been the practice and the policy of the worker’s compensation insurance companies and the Worker’s Comp Board to provide transportation (such as a taxi or some other ride service) for injured employees who cannot drive for one reason or another. In particular, if you suffer a catastrophic injury that prevents you from even riding in an ordinary car, the worker’s comp insurance company is required to make special transportation arrangements. If you simply do not have reliable transportation for trips outside the county, you should be able to ask the worker’s comp insurance company to provide transportation. Again, this only happens if you have to leave the county of employment – it’s unlikely worker’s comp will pay to drive you inside the county.

What is the Mileage Reimbursement Rate?

The Indiana Worker’s Compensation Act bases the mileage rate on what the State of Indiana pays to its employees who have to travel. It fluctuates over time. As of June 15, 2022, the reimbursement rate is $.49 per mile. Since it may change by the time you read this, the Indiana Worker’s Comp Board publishes the current reimbursement rate here .

Watch Out for Worker’s Comp Insurance Companies

Indiana worker’s comp law is frequently confusing. But it is actually quite clear when it comes to mileage payments. That is why, as a worker’s compensation lawyer, it frustrates me to no end that many worker’s compensation insurance companies ignore the obligation. They all know it’s owed, but they hope you never find out you should be receiving mileage payments. If you suffered a work injury, travelled outside the county of employment for medical care, and didn’t receive mileage payments, you are dealing with an insurance company that may withhold other valuable information about your worker’s comp case. Salmon & Hewins represents injured employees, and we can make sure you receive all the benefits – no matter how small – you are entitled to under Indiana law.

You’re always welcome to call our office with questions. The initial consultation is always free.

Contact us now for a free evaluation! We will review your case.

Your Email*

Case Type* Family Law Personal Injury Small Business Social Security Disability Wills, Trusts and Estates Worker's Compensation Any other legal issue

Describe Your Case*

Areas We Serve

Evansville • Newburgh • Boonville • Chandler • Mt. Vernon • Darmstadt • Haubstadt • Ft. Branch • Poseyville • New Harmony • Wadesville • Princeton

Welcome to BTSSS!

Veterans portal.

The Internet Explorer (IE) browser has been detected and is no longer supported by Microsoft Dynamics/Beneficiary Travel Self-Service System.

Please use another browser (e.g., Chrome, Edge or Safari) and try again.

Thank you for using the Veteran Portal to submit your travel claim to the Beneficiary Travel Self Service System (BTSSS).

In order to access the BTSSS interface you must log in using:

If you are a JAWS user, please refer to the JAWS Job Aid before using BTSSS.

Announcements

Claims approved for payment within this system are designed to use electronic funds transfer (EFT) to your checking/savings account or VA debit card. If your EFT information is not on file with Veterans Health Administration (VHA) Financial Management System (FMS) your approved payment may be delayed until the information is provided to process your claim or adjustments are made to allow for temporary payment by check. If you currently receive other benefit payments by EFT from the Veterans Benefits Administration (VBA) your EFT information is not on file with our system unless you have provided it previously to your local VA Medical Center. You can confirm if your EFT information is on file by reviewing your Veteran profile screen. If it is missing please contact your local BT office to update it. They will provide you with the necessary signature forms to have it added.

Facility for Payment

When entering claims, please identify the facility responsible for payment as the facility that provided your care or approved your care for care in the community. For example, if you submit a claim for care or services approved at a non-VA facility, you identify the care VA facility that authorized it as facility responsible for payment. In most situations this will be your preferred or home facility. If you receive care at a VA Community Based Outpatient Clinic (CBOC) this location will be available for selection as an associated facility of its larger parent VA Medical Center. You will see it when you select the location of your appointment.

The Paperwork Reduction Act of 1995 requires VA to notify you that this information collection is in accordance with the clearance requirements of Section 3507 of this Act. We anticipate the time expended by Individuals who must complete this form will average 10 minutes. This includes the time it will take to read instructions, gather the necessary facts and fill out the form. No person will be penalized for failing to furnish this information if it does not display a currently valid OMB control number. This information is collected under 38 CFR 70 and is intended to fulfill the need for Veterans and beneficiaries to claim Beneficiary Travel benefits and for VA to determine the individual’s eligibility for the benefit.

Privacy Act Information: VA is asking you to provide the information on this form under 38 U.S.C. Sections 111 to determine your eligibility for Beneficiary Travel benefits and will be used for that purpose. Information you supply may be verified through a computer-matching program. VA may disclose the information that you put on the form as permitted by law; possible disclosures include those described in the “routine use” identified in the VA systems of records 24VA19 Patient Medical Record-VA, published in the Federal Register in accordance with the Privacy Act of 1974. Providing the requested information is voluntary, but if any or all of the requested information is not provided, it may delay or result in denial of your request for benefits. Failure to furnish the information will not have any effect on any other benefits to which you may be entitled. If you provide VA your Social Security Number, VA will use it to administer your VA benefits. VA may also use this information to identify Veterans and persons claiming or receiving VA benefits and their records, and for other purposes authorized or required by law.

Indiana University Bloomington Indiana University Bloomington IU Bloomington

Alumni Journal →

ALUMNI JOURNAL

Emily Cessna ( [email protected] or (812) 855-1980) is the Departmental Travel Arranger. Her office is in the Chemistry Business Office CH115

Travel Management Website for more details

IU Policy on Travel

Travel & Seminar Request Form - Schedule Appointment Here

NO APPOINTMENTS: Nicole is currently out of the office. Please contact [email protected] or visit the Business Office (room C115) for assistance -->

Before Trip

- Discuss the trip with your professor.

- Fill out a travel request form and turn it in to the Department’s travel arranger. Currently: Emily Cessna or [email protected]

- Wait for approval, which can take 1-3 days.

- IU may be able to directly pay for the conference registrations, airfare, hotels, and rental cars.

- Setting this up may take several days. Please submit early.

- From One.iu.edu search for “Travel Direct deposit.”

- Choose the tile with an airplane and stack of money named "Travel Reimbursement Direct Deposit".

- Click continue, and fill out the forms

- Submit any questions to Emily Cessna at [email protected] .

During Trip

- Keep all receipts.

- Do not pay for anyone else or reimburse them, this might be against IU policy.

- IU can only reimburse you for business expenses. The University will not reimburse travelers for any expenses of a personal or political nature.

- Submit Travel reimbursement form to [email protected] .

- Receipts must be submitted within 30 days of your return.

- Receipts cannot be accepted after 120 days from your return due to IU and IRS policy.

- Reimbursement will take 1-8 weeks.

- Travel Request Form

- Travel Reimbursement Form

Travel Reimbursement

Travel expense reimbursement form (prior to march 1).

Please fill out this form if you incurred mileage expenses prior to March 1, 2024.

- County Program Name Adam-Wells Co. Allen County Bartholomew-Brown-Jennings Co. Benton County Boone County Carroll County Cass County Clark-Floyd Co. Clinton County Decatur County DeKalb County Delaware County Dubois County East Allen County Elkhart County Fayette County Franklin County Fulton County Gibson County Grant County Greene County Hamilton County Hancock County Harrison County Hendricks County Henry County Howard County Huntington County Jackson County Jasper-Newton Co. Jay County Jefferson-Switzerland Co. Johnson County Knox County Kosciusko County LaGrange County Lake County LaPorte County Lawrence County Madison County Marion County - East Marion County - NE Marion County - South Marion County - West Marshall-Starke Co. Monroe County Noble County Orange County Perry County Pike County Porter County Posey County Pulaski County Putnam County Randolph County Ripley-Ohio-Dearborn Co. Scott County Shelby County Spencer County St.Joseph County Steuben County Tippecanoe County Tipton County Vanderburgh County Vigo County Wabash County Warren-Fountain Co. Warrick County Washington County Washington Township Wayne County White County Area 01 Area 02 Area 03 Area 04 Area 05 Area 06 Area 07 Area 08 Area 09 Area 10

- Applicant's Name First Last

- Address Street Address Address Line 2 City Alabama Alaska American Samoa Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Guam Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Northern Mariana Islands Ohio Oklahoma Oregon Pennsylvania Puerto Rico Rhode Island South Carolina South Dakota Tennessee Texas Utah U.S. Virgin Islands Vermont Virginia Washington West Virginia Wisconsin Wyoming Armed Forces Americas Armed Forces Europe Armed Forces Pacific State ZIP Code

- Evening Phone

- Beginning Travel Date MM slash DD slash YYYY

- End Travel Date MM slash DD slash YYYY

- Beginning Mileage

- Ending Mileage

- Total Mileage Accrued

- Mileage Claimed

- Submission Date MM slash DD slash YYYY

Upcoming Events

Recent posts.

- Melony Salla Becomes First Indiana Athlete As County Coordinator July 18, 2024

- Longtime Porter County coordinator and coach Lorrie Woycik dies July 15, 2024

- Athlete Spotlight: Derrick Martin July 15, 2024

- 23rd Annual Plane Pull® Challenge to Support Special Olympics Indiana is Aug. 10 July 15, 2024

- Jayden Wiggins Shows Voice and Spirit through Special Olympics Indiana July 9, 2024

- Landon Johnson Finds His Perfect Pitch July 8, 2024

- Avery Brooks Earns Inaugural Jimmy Erskine Award in Madison County July 2, 2024

- Hopebridge and Special Olympics Indiana Team Up to Promote Empowerment in the Autism Community June 13, 2024

Subscribe to Our Newletter

- Name First Last

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Climate Action

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

Privately owned vehicle (POV) mileage reimbursement rates

GSA has adjusted all POV mileage reimbursement rates effective January 1, 2024.

* Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs).

For calculating the mileage difference between airports, please visit the U.S. Department of Transportation's Inter-Airport Distance website.

QUESTIONS: For all travel policy questions, email [email protected] .

Have travel policy questions? Use our ' Have a Question? ' site

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

IMAGES

COMMENTS

All state employees who are scheduled to travel outside of Indiana on state business must complete an Authorization for Out of State Travel form prior to their departure (State Form 823). ... Certification for Missing Receipt form enables state employees who have traveled on behalf of the state to apply for reimbursement without a ...

Lodging: $89.00/night (payments made using a State issued travel card or direct bill are tax exempt) For additional information and resources, please visit the IDOA Travel Services webpage. Rate is currently under evaluation. Indianapolis Airport Parking: $9.00/day, other airports may be reimbursed at Economy/Long-term rates. Mileage: $0.38/mile.

Mileage reimbursement rates Reimbursement rates for the use of your own vehicle while on official government travel. ... FY 2024 Per Diem Rates for Indiana. Change fiscal year: 2024. 2023. 2022. or. ... First & last day of travel - amount received on the first and last day of travel and equals 75% of total M&IE.

11. Sect. 24 State Travel Card, Reimbursement, and Payments - Connected State Travel Policy and State Travel Card requirements by reference. SBOA updated the Claim Amounts subsection and suggested removal of the Expenditure Classifications. 12. Sect. 27 Event Planning - Provided direction when hotel/lodging facilities are included in

We provide an efficient, cost-effective travel management program to assist faculty and staff with IU-sponsored travel and expense reimbursement. Find information on booking IU-paid travel, discounts, policy and procedures, and tips for faster reimbursement. ... INDIANA UNIVERSITY Travel Management Services. Cyber Infrastructure Building (CIB ...

Follow. To receive transportation benefits, a member enrolled in Hoosier Healthwise, Hoosier Care Connect or Healthy Indiana Plan must call their health plan's transportation broker (similar to a dispatching service) at least 48 hours in advance. The transportation broker arranges rides to and from the medical appointment.

Click a trip type below to learn how to request that type of mileage reimbursement. In-State: mileage where most or all of the destinations are inside the state of Indiana; Domestic: where most or all of the destinations are outside of Indiana.; Accumulated mileage: mileage logged over a period of time capturing frequent or repeated trips.Can be submitted on In-State or Domestic trip expense ...

Personal Vehicles: Reimbursement will be based on official state highway maps showing the shortest, most widely used travel route from the traveler's official workstation to their business destination unless travel from their home is closer. Reimbursement for mileage costs is limited to the cost of a comparable 30-day advance purchase round ...

Procedures. Reimbursement Requirements Travelers are expected to spend university funds prudently (and in accordance with sponsor requirements when the travel is supported by a sponsored award) and to request reimbursement for all travel expenses on a timely basis. Reimbursement requirements are as follows; Reimbursement requests must be submitted via an expense report through the IU travel ...

Mileage reimbursement rates are determined by the IRS. This rate includes wear and tear, fuel and insurance costs for the personal vehicle. ... INDIANA UNIVERSITY Travel Management Services. Cyber Infrastructure Building (CIB) 2709 E 10th St. Bloomington, IN 47408 Phone: 812-855-2873 Systems. Chrome River; P-Card; BUY.IU;

GSA establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred while on official travel within the continental United States (CONUS). A standard rate applies to most of CONUS. Individual rates apply to about 300 non-standard areas (NSAs).

The Indiana Worker's Compensation Act bases the mileage rate on what the State of Indiana pays to its employees who have to travel. It fluctuates over time. As of June 15, 2022, the reimbursement rate is $.49 per mile. Since it may change by the time you read this, the Indiana Worker's Comp Board publishes the current reimbursement rate here.

Both the driver and you must sign at the bottom of the Indiana Gas Reimbursement Form. The complete form can be faxed to Verida at 678-510-1352 or mailed to the following address for payment: Verida Claims. 843 Dallas Highway. Villa Rica, GA 30180. If you are a Healthy Indiana Plan (HIP), Hoosier Care Connect, or Hoosier Healthwise member, you ...

If you provide VA your Social Security Number, VA will use it to administer your VA benefits. VA may also use this information to identify Veterans and persons claiming or receiving VA benefits and their records, and for other purposes authorized or required by law. Respondent burden: 10 minutes. OMB Control : 2900-0798.

Submit Travel reimbursement form to [email protected]. Turn receipts in to [email protected]. Receipts must be submitted within 30 days of your return. Receipts cannot be accepted after 120 days from your return due to IU and IRS policy. Reimbursement will take 1-8 weeks. Forms. Travel Request Form; Travel Reimbursement Form

Mileage Reimbursement in Indiana (IN) Posted on May 16, 2016 by. With the high cost of gas and insurance today, and many of us having to travel for work I was curious to see how employers were compensating for the increased travel expenses. I was surprised to learn that there is no law in Indiana that requires employers to pay a certain mileage ...

Your agency's authorized travel management system will show the final price, excluding baggage fees. ... GSA has adjusted all POV mileage reimbursement rates effective January 1, 2024. Modes of transportation Effective/applicability date Rate per mile; Airplane* January 1, 2024:

The state's meal per diem reimbursement rates for in and out-of-state travel is available by clicking here. Mileage reimbursement. The State Budget Agency and Indiana Department of Administration have announced that the mileage reimbursement rate will be 49 cents for each business mile driven. Mileage from the workstation or from home

File a claim for general health care travel reimbursement online. General health care travel reimbursement covers these expenses for eligible Veterans and caregivers: Regular transportation, such as by car, plane, train, bus, taxi, or light rail. Approved meals and lodging expenses. You can file a claim online through the Beneficiary Travel ...

Travel Expense Reimbursement Form (Prior to March 1) ... Hopebridge and Special Olympics Indiana Team Up to Promote Empowerment in the Autism Community June 13, 2024; 2024 Summer Games Were a Celebration of Success June 13, 2024; R-O-D Runners Complete First Mini-Marathon May 29, 2024;

You must log all travel from the start of the month, including travel that is accounted for in the per diem. The mileage reimbursement rate is a flat rate per mile based on the approved state employee mileage rate, which will vary and is based on the Indiana Department of Administration (IDOA) Mileage

Mileage reimbursement is a process where a business repays employees for the miles they travel for work-related purposes. Examples include traveling for client or sales meetings, training, meeting with business partners, or shopping for business goods and supplies.It doesn't include employee travel from home to a regular workplace.

• Subgrantees reimbursement request may not exceed the Per Diem rate included in their grant budget if it is less than the State of Indiana current rate. • A traveler is not entitled to Per Diem or lodging if travel takes the person 50 miles or less from their workstation or home. The event or reason for travel must last more than 7.5 working

GSA has adjusted all POV mileage reimbursement rates effective January 1, 2024. Modes of transportation. Effective/applicability date. Rate per mile. Airplane*. January 1, 2024. $1.76. If use of privately owned automobile is authorized or if no government-furnished automobile is available. January 1, 2024.