- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AEGIS (Formerly GoReady) Travel Insurance Review: Is it Worth the Cost?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

AEGIS (GoReady)

- Offers specialty plans for pandemic-related coverages, those staying at vacation rentals and cruise coverage.

- Can customize protection for work-related trip interruption.

- It's Trip Cancellation plan is good complementary coverage if you already have separate medical insurance.

- Maximum trip length is 60 days.

- Pre-existing conditions waiver is only available if you purchase coverage within 14 days of your initial trip deposit.

- It's lower-cost comprehensive option does not include rental car coverage.

Purchasing travel insurance can provide peace of mind on your trips, especially when you opt for a policy that covers trip delays and includes emergency medical benefits.

AEGIS insurance is a travel insurance provider with a variety of options to suit travelers. Here's a look at the company's different plans, what’s covered and how to choose a plan that works for you.

What does AEGIS travel insurance cover?

AEGIS travel insurance provides six different policies to customers with varying levels of coverage. These are called:

Pandemic Plus.

Vacation Rental.

Trip Cancellation.

Depending on your itinerary, one plan may be superior; this is especially true if you opt for something specialized like a Vacation Rental policy or Cruise policy.

Otherwise, you can expect a fairly standard coverage from AEGIS, such as:

Accidental death insurance .

Emergency evacuation insurance .

Lost luggage insurance .

Rental car insurance .

Travel medical insurance .

Trip cancellation insurance .

Trip interruption insurance .

» Learn more: How much is travel insurance?

AEGIS insurance plans

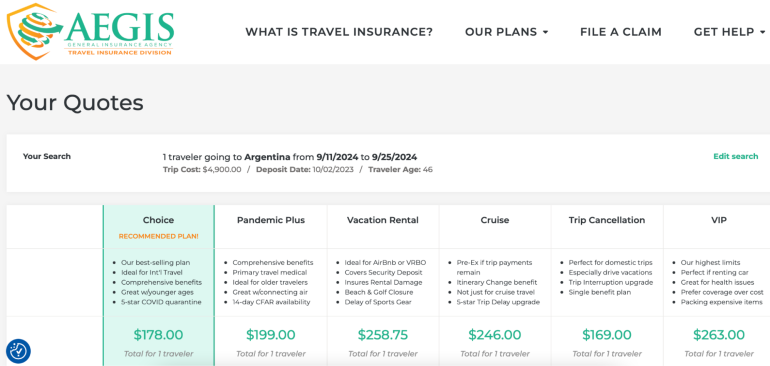

To generate quotes, we created a sample trip for one 46-year-old traveler from Colorado heading on a two-week trip to Argentina.

AEGIS offers three more "standard" travel insurance plans: Choice, Trip Cancellation and VIP. Here’s how the costs and coverage vary across these plan options.

AEGIS standard plans

The cost for our Argentina-bound traveler for the Choice plan is $178, while for Trip Cancellation and VIP, the price is $169 and $263, respectively.

AEGIS specialty plans

AEGIS also offers three travel insurance plans oriented toward specialty experiences, including for those staying in a vacation rental or going on a cruise.

Specialty plans don't always mean higher costs. The Pandemic Plus coverage will cost the sample trip traveler $199, while Vacation Rental coverage is $258.75 and Cruise coverage is $246.

» Learn more: How does travel insurance work?

What isn’t covered by AEGIS

An AEGIS insurance review wouldn't be complete without considering what types of situations aren’t covered. While these aren't included in the base package, you can consider adding this coverage by purchasing it as an add-on.

Baggage delay for sports equipment.

Cancel For Any Reason insurance .

Trip cancellation for work reasons.

There will be other situations that are excluded from your policy. To find these, review the full benefits schedule of the plan that you’re considering.

» Learn more: What to know before buying travel insurance

How to choose a AEGIS plan online

Is AEGIS insurance legitimate? It is, and purchasing a plan online is simple. To do so, go to AEGIS’s website . On the homepage, you’ll input your information to generate a quote. This includes travel destination, age and state of residence.

Once you’ve tapped “Get My Quote,” you’ll be presented with all six of AEGIS's available options, including costs and a breakdown of inclusions.

From here, you’ll be able to select the plan that suits your needs and pick any optional add-ons. Then, you’ll go through the checkout process. After you’ve paid, your plan becomes active.

» Learn more: The most common travel insurance myths

Which AEGIS plan is best for me?

Choosing the right plan for your trip involves understanding what type of coverage you need.

For cruises . The Cruise plan has the ability to include pre-existing conditions long after this option disappears with other policies. It also covers you in the event you miss prepaid events if your travel provider changes your itinerary.

For the best service . The VIP plan offers the most comprehensive suite of benefits and the highest payouts, including rental car coverage .

For vacation rental stays . The Vacation Rental plan is a superior option for those in short term rentals because of its coverage for damage, which includes up to $1,000 for security deposit loss.

For those with their own medical insurance . The Trip Cancellation plan is the least expensive option but still provides trip protections in the event that your travel is canceled.

AEGIS's travel insurance plans may make sense for you, but before purchasing a policy, check to see whether a travel credit card you hold offers its own complimentary travel insurance .

Is AEGIS travel insurance worth it?

AEGIS offers several travel insurance plans to choose from, with some levels of customization to help you get the exact coverage you're looking for.

Overall, travel insurance is worth it, but AEGIS might not give you the best deal. Shop around with other travel insurance companies to make sure you're getting the lowest price for the protections you need.

If you have a travel credit card, look at what travel insurance benefits are included to avoid duplicating your coverage .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Suggested companies

Aegis travel, trawick international, faye travel insurance.

goreadyinsurance.com Reviews

Visit this website

Company activity See all

Write a review

Reviews 2.0.

Most relevant

They will not pay for your trip

They refuse to pay for trip interruptions from delays, unless the airplane/train you take is delayed for 3 specific reasons: weather, mechanical breakdown, or labor strikes. If you are delayed for hours and hours and miss a connection for any other reason, they refuse to pay anything. It's the cheapest option for a reason. It's useless for most reasons that other insurance will cover. Then the company has the gall to come on here and fraudulently say they do cover mechanical breakdowns, when our communications proves the exact opposite (Amtrak broke down, leading me to miss connection).

Date of experience : June 25, 2023

Unreasonable cancelation policy

I bought travel insurance for my son a year in advance, in preparation for his school trip to Washington DC the next year. A couple weeks later, I learned that the trip organizer already included travel insurance. So I contacted customer service and asked to cancel the policy and get a refund. They said it was too late, customers only have 15 days to review and cancel. They refused to cancel and issue a refund, even if it's almost a year in advance :-/ It took several emails (with request to escalate to the managers) until they finally agreed to cancel and refund. That was needless hassle and aggravation.

Date of experience : June 10, 2024

Reply from goreadyinsurance.com

We’re sorry to hear that you were disappointed with the Free Look Period terms of your policy. We can assure you that it’s standard across the U.S. Travel Insurance Industry for policies to become non-refundable once they are 10-15 days from the purchase date. The reason for this is because the Trip Cancellation benefit on your policy (which represents the majority of the premium’s value) takes effect the day after you purchase it. From that point forward, you could potentially submit a claim that would return your fully insured trip cost of $1,500. To receive a refund of your $30 policy, you simply need to contact us within 15 days of your purchase date. It appears our call center was in steady contact with you throughout, so hopefully you were more understanding & pleased with the final outcome. Thanks, Isabella Siblesz Operations Manager

Redemption , they paid the claim 🙏🏼

Update: I continued to contact them regarding my claim and the ridiculous reason they were not covering it. I let them know I saw their reasoning as bad faith and low and behold they paid my claim. Rightfully so, I am updating my review. I’m also being generous at this point because I am happy they did the right thing even though I had to be persistent to be paid. The fact that they have a conscience goes far. Hope anyone else filing a valid claim is heard.

Date of experience : April 06, 2024

This is the biggest scam I’ve ever…

This is the biggest scam I’ve ever encountered. I bought this because there was a possibility that I’d have to cancel my concert tickets. Their policy said “100% coverage if you’re unable to attend the event”. When I emailed them saying that I’ll be unable to attend the event, they stated that this wasn’t covered and referred me back to the policy where it literally listed “not being able to attend the event” as a reason. What a scam…never get this insurance. They will take your money and refuse to reimburse you. “Businesses” like this need to be put out of business.

Date of experience : February 23, 2024

They are refusing to pay for travel and giving me the usual corporate run-around.

They are refusing to pay for travel delay using every excuse in the book. My United Airlines confirmation number is not valid. (Copied from my UA online account.) They cannot understand the concept that a flight delay on the first leg of a trip would clause you to miss your connection. This complicated concept has been explained many times without success.

Date of experience : January 11, 2023

Apologies for the late response, but our company had no affiliation with Trustpilot & never received notification of this review. We're unable to pinpoint who this client is based simply on the name "Ann," but we ask that you contact [email protected] so we can investigate your case further. Thank you!

Don't buy GoReady travel insurance!

Don't buy GoReady travel insurance!! In February 2023 I sent tons of documentation of my expenses related to a delay and flight cancellation and each time they asked for more information, I promptly sent it and asked for acknowledgement of receipt from them. Never acknowledged. Don't bother to call, they will never respond. Finally, May 16 I received a check which was fairly adequate, but was not related to everything I sent them. I am baffled that they would ask for so many receipts, then base their reimbursement on just one. If I'd known that, it would have saved me a lot of time

Date of experience : May 16, 2023

Apologies for the late response, but our company had no affiliation with Trustpilot & never received notification of this review. We researched your case & do see that a newer adjuster handled your claim, did not process things as efficiently as they should've, but actually overpaid your claim. Unfortunately, that individual is no longer with the company to provide additional coaching. We apologize for the negative experience but are glad you were made whole financially. If you still have any questions or doubts, we'd appreciate you contacting us at [email protected]. Thanks.

Called to ask a question about their…

Called to ask a question about their policy, was accused of fraud, laughed at and met with a condescending attitude. Paid for service, didn't need to file a claim I just called and questioned about the 15 day refund policy. A simple answer to the question would have sufficied.

Date of experience : December 28, 2023

This client called after returning from their trip to see if they could receive a refund on their policy since they didn't have to file a claim. Our agent explained that's not how insurance works. The Free Look Period is meant for clients to review their coverage within 15 days after their purchase date to ensure it meets their needs. They are entitled to a full refund of their insurance premium as long as: a. They have not filed a claim OR b. The Departure Date for their scheduled trip has not elapsed Our agent should not have mentioned the word "fraud" during your discussion as it's not pertinent to this situation. We apologize for that & the agent is receiving additional coaching to prevent future misunderstands.

Travel delay is not paid unless you have expenses

When it comes to travel delay - $150/day/person - you can only claim expenses not inconvenience. Our flight was delayed by 23 hours, we stayed at home, inquired about re-compensation for inconvenience and missing an important event at our destination. We cannot make a claim. Be aware of this interpretation of the policy you are buying.

Date of experience : January 01, 2023

Good luck collecting against your policy if you have a claim!

I have provided this company all of the documentation that they requested and they have not reimbursed me, nor are they responding to emails more than 2 months later. If they need more documentation, they should let me know, but I don't believe that is the case as this is a simple claim (train and AirBNB only). They are completely unhelpful, and inept. They even told me that my emailed submission got lost ??? Wow! I have a legitimate claim for only about $600... I can only imagine what it would be like working with GoReady on something that was actually involved and complicated. Forget it! I will NEVER use this terrible company again. I should be able to charge them for wasting so much of my valuable time.

Date of experience : October 02, 2023

We're unable to locate a policyholder named "Joan Hart," so perhaps your plan was under another name. We'd appreciate you contacting [email protected] so we can investigate your case further. Thank you!

Frustrated with the run around

Writing this review a year after we filed claim because of the run around that we were put and then they did not back the policy that was sold and denied our claim--one year after submitted. did not help me resolve with underwriter and ran me in circles. it was a frustrating experience. Cheaper for your time and money to self insure your trip. Will never buy through Go Ready again.

Date of experience : July 19, 2022

Apologies for the late response, but our company had no affiliation with Trustpilot & never received notification of this review. Insureds' flight at Amsterdam airport was cancelled. For coverage to apply on booking a completely new ticket, the only reasons that all travel insurance policies in the U.S. (not just ours) will cover are due to weather, mechanical issues, a strike, or F.A.A. mandate. The insureds' father tried to claim that a strike had occurred. However, the airline did not agree and there was no evidence provided that a strike had taken place. Therefore, the insureds' claim was denied.

Go Ready has ghosted or scammed me.

Go Ready has ghosted or scammed me. I tested + for Covid in port in Italy. Italian law required I self-isolate for 5 days. After excessive delays, I was eventually cut a check for a fraction of my hotel expenses, with no explanation. Literally. My request for an EOB with payout calculation has been ignored for over 3 weeks. So in addition to being sick and incurring additional expenses, 3 months later i'm still unreimbursed, frustrated and fighting for 1) the courtesy of a reply 2) an EOB 3) a calculation of interuption vs delay processing 4) appeal form/process 5) multi-state BBB complaint initiation 6) contacting MO state in Commissioner for advocacy So I'd avoid Go Ready ins unless youre prepared to live without requested docuemtnation, reimbursement, return calls or emails and are prepared to get a crash course of consumer rights in your state, and the ins co presiding state, and the presiding Better Business Bureau state. Thanks for the additional headaches on top of being sick and the resulting bills.

Date of experience : August 06, 2023

Useless if traveling to a foreign country

I purchased GoReady Insurance as South Korea required that I have travel insurance which covered covid related expenses before allowing me to enter the country. We did in fact contract covid while we were over there. Because we were staying with family and the government covered the cost of all testing and quarantine requirements my only claim was the additional cost that I incurred when I had to rebook my flight. This was four months ago and GoReady has yet to settle my claim. They expect the information provided in a foreign country to match the types of forms and information that a USA health department would provide. They apparently have little experience dealing with situations in countries other than the USA. I would not purchase their insurance again.

Date of experience : July 21, 2022

I don’t usually write negative reviews…

but I’m very frustrated by how Goready was unwilling to cover my trip disruption due to getting COVID. This was the one of the primary reasons I purchased the plan. Goready would not accept doctor’s notes or proctored COVID tests from my primary care provider in the US, claiming that telehealth results would not be accepted. They required a doctor’s note from a doctor in the foreign country I was in attesting that I was unable to travel due to quarantine guidance. Despite testing positive again on a proctored test, the doctor cleared me to travel during my most infectious period on day three of quarantine. CDC guidelines advise isolating for a minimum of five days following symptom onset and avoiding travel following a positive test result. So I had to choose between traveling while infectious and being out several hundred dollars. I chose to bite the ~$300 loss instead of exposing my fellow passengers. This policy incentivizes irresponsible behavior and I would not recommend it to anyone.

Date of experience : February 08, 2024

A word of caution on GoReady insurance

A word of caution on GoReady insurance. I used GoReady for a trip to New Zealand and Australia in January/February this year. My Air New Zealand flight was in jeopardy due to cataclysmic weather in Aukland in January that flooded and closed the airport. After being on the phone on hold for over 8 hours on two occasions, I finally got through and was advised by the airline to rebooked for two days later which still fit our schedule (at a higher price) to guarantee a flight. We were on a trip that included a cruise to Australia. As it turned out, my original flight ultimately left as scheduled but at the time I called, Air New Zealand could not guarantee this, was nearly impossible to get ahold of, and suggested the rebooking. My travel companion had AAA travel insurance. His AAA insurance paid the price difference between the flights. GoReady did not stating the flight eventually left on time and I suppose they thought I should ignore the advice of the airline and take my chances with my vacation. I would avoid this insurance company at all costs.

Date of experience : January 29, 2023

Apologies for the late response, but our company had no affiliation with Trustpilot & never received notification of this review. Mr. Incaudo, who was originally booked in Standard Economy Class, purchased a Business Class ticket for himself. This clearly goes against the language in his policy's Description of Coverage. In addition to his comments about his original flight ultimately having no issues, the policy not being in effect when he changed his flight, these were all reasons why his claim was denied.

Scam. Be ready to file BBB claims/get help from a lawyer to actually get any money from this company. I had a trip to Canada that I got Covid on. I started working with the company immediately to make sure I have enough documentation to have a seamless experience. They did not provide me with any guidance on what they want while I was still testing positive, and then came in and said that the documentation that I did have was insufficient when I was already testing negative and it was impossible to get another positive test (note: I was using official government of Canada guidelines for covid testing). I am now about to write a second BBB complaint and get help from a lawyer in order to get progress on my claim.

Date of experience : August 09, 2022

Apologies for the late response, but our company had no affiliation with Trustpilot & never received notification of this review. The insured took an at-home COVID test which is not permissible with our underwriters or any U.S. travel insurance company that we know of. Unfortunately, because of this the insured's claim was not approved.

This company is the worst and I…

This company is the worst and I wouldn't recommend them to anyone! They are a scam, will not respond and won't cover anything! Shame on AAA for recommending these scam artists

Date of experience : May 18, 2023

Go Ready Choice Nightmare Claim Processing

Aegis Policy 4GRCWSM1941904 In August 2023, I purchased a travel insurance policy at squaremouth.com, also known as Tin Leg, covering a January 2024 Caribbean Cruise. The provider is Aegis Travel Insurance, the product is Go Ready Choice. In late November 2023, my husband became too ill to travel. On 12/5/2023, I submitted to Go Ready Choice a claim along with the two (2) medical documents their representative requested. Another representative asked for more documents. On 12/6/2023, I submitted three (3) additional documents. On 12/7/2023, their underwriter Zurich American Insurance Company provided a different claim form and requested all the supporting documents be submitted again. On 12/12/2023, Zurich acknowledged claim submission stating “allow 7 to 10 business days for the processing of your claim”. On 1/8/2024, 17 business days later, I called and I was sent an email stating the claim had been approved that day and “our cheques have a processing period of 5-10 business days”. On 1/22/2024, 9 business days after approval, I called Zurich and I was told to “wait 5 or 10 or 15 more days” for check processing and delivery. It sounded like the woman who answered the call just made up a time frame as she spoke . . . On 2/6/2024, I called Zurich and I was advised the company had issues in their mailing department. The woman said my check was issued 1/9/2024 and in a batch “going out this week”. It has been 23 business days (with federal holidays excluded) since my undisputed claim was approved yet the claim still has NOT been paid.

Date of experience : December 10, 2023

Normal review time and adjudication is generally 3-4 weeks. December is a heavily traveled month generating a lot of claims & a few holidays which explains why yours was adjudicated on the longer end of that cycle (4 weeks). The check was mailed to the address on file, via United States Postal Service, ground service. As we do not have any control over mail deliveries, if it is not received by the end of next week, we may request a void and reissue. Please reach out to us at [email protected] if you don’t receive the check by mail next week. Thanks.

Waiting for an answer on my claim for…

Waiting for an answer on my claim for weeks no help nobodyknow nothing never get it again.

Date of experience : July 21, 2023

Apologies for the late response, but our company had no affiliation with Trustpilot & never received notification of this review. We reached out to the adjusters and were advised proof of loss claim forms were emailed to you on a couple different occasions and subsequent email correspondence has gone unanswered. If you are interested in pursuing this claim, and need another form, please contact our office at (877) 253-1613 (Press 1) or Email Claims [email protected]. Once the documents are received, the claim will be reopened, reviewed, and adjudicated by our adjusters at CBP Insure. If you would find it easier to manage your claim outside of email communications, you can use our App-based process by texting #STClaims to 727-592-5646. You’ll answer a series of questions & then take photos of your backup documentation. All the above information was included in the confirmation email you received back on 08/25/23 at 9:44 am ET in case you’d like to reference it there or use the included QR code to initiate your claim. Please let us know if we can be of any further assistance.

Impossible To File a Claim

I've had a horrible experience trying to file a claim for a ticket purchase for an event I was unable to attend. The insurance paperwork contains three different email addresses for filing a claim. I tried all three, and no reply. The website contains a phone number, but when I call it, I get routed in circles—a loop of automated messages that take you nowhere and never bring you to a live person. I tried their mobile claim system, which texts me a link that then times out and tells me I can close my browser window, or which prompts an automated phone call that simply puts me back into the loop of automated messages that never bring me to a live person. I have spent an entire week, hours of my time, trying to file a claim, to no avail. My guess is that they are a fraudulent company who tries to make it so hard to file a claim, that their purchasers will not do so, and they will not have to pay out. I tried contacting both the venue and the ticket sales company, who contracts with GoReady, but neither are able to help me. Edit Dec. 2023: I eventually did get in touch with them and did get a refund in the mail, but it was a huge headache and took up tons of time. Something that should be easy was super difficult to the extent that I will never again buy insurance from GoReady and I will never attend that venue again as long as they're contracting with this company for event insurance. It's not worth it. I had a death in the family and was going through a terrible life event. To have to waste hours of my time on phone and email trying to file a claim with a venue, a ticketing company, and an insurance company that all tried to pass the hat was unbearable. Anyone who thinks about purchasing insurance from this company should think twice. Response to GoReady's statement that they "simply require a death certificate or obituary." No, that is the point. That is the problem. It SHOULD be simple, but it wasn't. You "simply" ignored my emails, sent me in endless phone system loops that got me nowhere, and had completely nonfunctional online systems that could not process my claim. And the folks who should have helped just kept passing the buck. It was an awful experience—enough for me to want to share it online to warn others. There is nothing you can do or say now to change how you behaved then. Your customer service was completely inadequate to the extent that I originally assumed you had intentionally built broken systems so that no one could ever file a claim and get a repayment. In other words: Make it so that customers CAN'T file a claim, so then they WON'T file a claim. If you are trying to run an insurance company that actually processes valid claims in a reasonable timeframe, and you think a human being should be able to file a claim in 10-20 minutes rather than needing to spend hours and hours on the phone and email trying to get through to anyone, then you have a LOT of work to do to fix your broken system.

Date of experience : September 13, 2023

Apologies for the late response, but our company had no affiliation with Trustpilot & never received notification of this review. We're not sure why you've had these problems as we haven't had any phone, app, or website issues reported by anyone & continue to process tons of claims on a daily basis. Since no name was given for this review, we're not able to identify the policyholder. Please contact [email protected] & we'll help get your claim expedited. Edited 12/07/23 at 8:35 pm Condolences on the passing of your loved one. We're sorry you had to go through that & deal with an insurance claim around the same time. Unfortunately, insurance is a compliance-driven & audited industry that will always require backup documentation to substantiate the insured's situation. In cases of a death in the family, we simply require a death certificate or obituary with a proof of purchase of the ticket.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

GoReady Travel Insurance Review — Is it Worth It?

Senior Editor & Content Contributor

174 Published Articles 101 Edited Articles

Countries Visited: 197 U.S. States Visited: 50

Michael Y. Park

24 Published Articles 307 Edited Articles

Countries Visited: 60+ U.S. States Visited: 50

Keri Stooksbury

Editor-in-Chief

41 Published Articles 3360 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

Table of Contents

Do i need travel insurance, travel insurance and covid-19, what policies are available with goready travel insurance, how to obtain a quote, how goready compares to other insurance, how to file a claim with goready travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Travel insurance is one of those things you don’t know you need until it’s too late — or you read an in-depth review of one, like GoReady Insurance.

GoReady (formerly APRIL Travel Protection) is underwritten by Aegis General Insurance Agency. This is an independently owned insurance provider , meaning Aegis can pick and choose who it works with to provide services for its Go Ready travel insurance policies. This is different from most websites that are run by an underwriting company itself.

Aegis General Insurance Agency is a Harrisburg, Pennsylvania, company founded in 1977, focusing on property insurance. The company was acquired by K2 Insurance Services in 2013, but Aegis remains an independent operating company. Aegis acquired French company April Travel Insurance in 2021 , and it’s under that division of Aegis that the travel insurance branch, now called GoReady, still operates.

Aegis General Insurance Agency has a “Good” financial strength rating from A.M. Best . The company provides quotes and accepts claims via phone, website, and online chat.

Let’s look at what GoReady travel insurance policies cover to see if they mesh with your upcoming trip.

Travel insurance , like other types of insurance, protects the money you’ve invested in your vacation against losses from the unexpected, such as a canceled trip or delayed or lost luggage. The more your trip costs, the more it makes sense to protect your financial investment with a travel insurance policy.

Travel insurance can protect more than your money, though. It can provide medical coverage in case you or someone in your family becomes ill or gets injured while traveling.

Here are key reasons why buying a travel insurance policy can make sense:

- Your existing healthcare coverage won’t apply at your destination or won’t cover some of the activities you’re planning.

- Your vacation involves nonrefundable deposits or prepayments you would lose if you cancel your trip at the last minute.

- Medical facilities at your destination may not be sufficient, meaning you could need a costly medical evacuation if you get injured.

- You have a complex itinerary, moving between several locations and creating more opportunities for luggage to get lost along the way or for delays to create problems further down the line.

Travel insurance may not make sense for every trip, but if you’ve invested significant money in a trip or are worried about the medical facilities at your destination, having a travel insurance policy makes sense.

COVID-19 has affected nearly every corner of the planet. All GoReady travel insurance plans include pandemic coverage for COVID-19.

What benefits are included can vary by plan, though. For example, all plans can reimburse you for trip cancellations if you have to stay home after testing positive for COVID-19.

Premium plans, however, can provide additional coverage, reimbursing you for flight change fees after you test positive and even providing coverage if your babysitter or business partner tests positive, forcing you to alter your trip plans. And all plans cover quarantine obligations should you test positive while traveling.

Cancel for Any Reason (CFAR) coverage is an optional upgrade when purchasing a travel insurance plan. It can provide additional benefits if you cancel a trip because of COVID-19 — but it likely won’t provide a 100% refund. Coverage is for up to 75% of nonrefundable costs, and you must add CFAR within 14 days of your first trip deposit.

A few other situations worth considering:

- At-home tests are not considered sufficient proof to invoke coverage.

- If your plan includes medical expenses, the benefit should apply if you become sick with COVID-19 during a trip.

- If you are forced to quarantine, your plan should remain in effect until the quarantine ends, and trip cancellation, interruption, and medical expense benefits should apply.

GoReady provides 2 main general of plans : those for a single trip and those covering a full year of multiple trips.

Single-Trip Plans

Within the single-trip plans are several options. Let’s compare the 4 most popular.

- Go Ready Choice Plan offers the most basic coverage , including the option to upgrade your plan with add-ons

- Go Ready VIP Plan offers higher coverage limits and more types of coverage

- Go Ready Pandemic Plus Plan focuses on you or a travel companion testing positive for COVID-19 , with most of its coverage focusing on medical benefits but not delayed luggage or injuries during your trip

- Go Ready Cruise Plan focuses on specific concerns for cruise ship passengers , like missed ports of call and missed connections

The Trip Inconvenience clause on the VIP plan provides a unique benefit , insuring you for missed work from your transportation carrier’s delay or when key aspects of your trip are canceled for weather or mechanical reasons, such as at amusement parks or golf courses. Add-ons are also available for lost or delayed business equipment and sports equipment, and CFAR is available with all plans for an additional cost .

Annual/Multiple-Trip Insurance Policies

It’s also possible to purchase an annual travel insurance plan, effective on a date of your choosing. Along with differences in coverage types and maximum payouts, the 2 plans have different maximum trip lengths for any single trip within the year.

If you will take multiple trips over the next year, an annual plan could be cheaper than multiple single-trip plans.

To get a quote for GoReady travel insurance, head to goreadyinsurance.com .

Click on the option for a single trip or annual travel next to “ I need a quote for ,” then fill out the information.

For a single trip, fill out the cost of your trip, ages of the travelers, and the date of your initial trip payment. Provide travel dates and destinations.

For an annual policy, you don’t have to provide destinations or travel dates. Instead, you choose an effective date for the policy and provide traveler ages.

Note that policies aren’t effective in certain countries. Many of these are expected, such as North Korea and Syria, but you may be surprised to learn that Peru isn’t a covered destination . If you’re planning to hike the Inca Trail or visit Machu Picchu, this policy isn’t for you.

The next page shows prices for your plan options and allows you to compare them.

If you’re shopping for a single-trip plan, the website will show you the most popular plans, as well as other potential offerings like one centered on vacation rentals and a plan purely focused on trip cancellations .

Again, the layout allows you to compare inclusions, exclusions, and add-ons side by side.

If you’re considering any adventure activities or extreme sports during your trip, the trip cancellation policy isn’t for you. It includes these exclusions: “mountain climbing, bungee cord jumping, skydiving, parachuting, hang gliding, parasailing, caving, extreme skiing, heli-skiing, skiing outside marked trails, boxing, full contact martial arts, scuba diving below 120 feet (40 meters) or without a dive master, or travel on any air-supported device, other than on a regularly scheduled airline or air charter company.”

GoReady vs. Credit Card Travel Insurance

Inside your wallet, you may have a credit card with travel insurance . Coverage from a credit card may be sufficient for quick, simple, or trips without costly upfront payments, but it doesn’t include everything that a comprehensive travel insurance policy covers.

Let’s compare GoReady’s best policy against 2 premium cards with robust insurance coverage: The Platinum Card ® from American Express and the Chase Sapphire Reserve ® . Note that you may have to enroll for some of the Amex benefits described below.

While the cards both provide rental car coverage as an included benefit, this is an add-on with GoReady. GoReady also doesn’t include emergency evacuation coverage in its VIP plan, and its travel and emergency assistance services are considered secondary coverage.

GoReady does come out ahead in other areas , though. Its emergency medical and dental maximums are much higher than the card providers’, and it provides up to 175% reimbursement for trip interruption — rather than a fixed amount or simply reimbursing the money you lost.

Credit card insurance policies are not all the same. Read about our favorite cards for travel protection plans !

GoReady vs. Other Travel Insurance Companies

To compare GoReady against competitors, we used Squaremouth , a travel insurance shopping and comparison website. We looked for a 1-week policy for the following sample trip:

- 2 travelers

- Ages 40 and 38

- Going to Jamaica 6 months from now

- Trip cost: $3,000

- Initial trip deposit paid within the last 24 hours

- State of residence: California

The Go Ready Choice Plan was nearly the same price as the Nationwide Essential plan, offering the same coverage for COVID-19 and trip cancellation benefits. However, GoReady only required a 6-hour delay for hurricane and weather benefits, and it offered a 150% trip interruption maximum, rather than 125% for Nationwide.

Seven Corners cost the most of these 3 options, yet it had the lowest coverage for trip interruption. It also had the longest delay requirement for hurricane and weather issues.

For delay and baggage benefits, GoReady had the highest maximum travel delay payout — more than 3 times what Nationwide and Seven Corners offered. However, GoReady wouldn’t provide any reimbursement for expenses until your bags are delayed for 24 hours, while Nationwide’s coverage would kick in at 12 hours. Seven Corners’ coverage would take effect after just 6 hours.

GoReady’s lost luggage benefit didn’t stipulate any per-item maximums, unlike with competitors, and it offered the same maximum as Seven Corners. Nationwide offered up to $600 here, rather than the $500 its competitors did.

You can file a claim online . Fill out the requested information and upload your supporting documents.

It’s also possible to start a claim via online chat on the website or by calling 866-516-8592 and selecting the third option. Most claims are processed within 7 to 10 business days, according to GoReady.

If you’re experiencing an issue that should be covered by your policy, you may not need to pay for expenses up front and submit a claim for reimbursement . GoReady’s Stress Less Benefits are included in all plans and can provide direct payments to hospitals, airlines, or evacuation services on your behalf so you can avoid fronting the cost.

GoReady travel insurance, part of the Aegis General Insurance Agency, provides single-trip and annual travel insurance policies that you can customize in multiple ways. Given the range of policies, there should be something to suit most travelers. GoReady offers notable types of coverage you don’t see everywhere, such as for trip inconvenience and delayed sports equipment.

However, every trip you take is unique, and you should evaluate every insurance plan carefully to see what coverage works best for you. Every policy will have inclusions and exclusions, so ensure you read these carefully before purchasing. Having a policy that doesn’t cover your destination or intended activities is the same as not having a policy at all.

Always read the fine print!

For the secondary rental car coverage benefit of The Platinum Card ® from American Express, Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the baggage insurance benefit of The Platinum Card ® from American Express, Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the premium global assist benefit of The Platinum Card ® from American Express, you can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, we may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Visit americanexpress.com/benefitsguide for more details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

For the trip cancellation and interruption insurance benefit of The Platinum Card ® from American Express, the maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip delay insurance benefit of The Platinum Card ® from American Express, up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For rates and fees of The Platinum Card ® from American Express, click here .

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

Aegis GoReady travel insurance review 2024

Mandy Sleight

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 12:04 p.m. UTC April 16, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Top-scoring plan

Covers covid, medical & evacuation limits per person, why it’s the best.

GoReady travel insurance plans by Aegis General Insurance Agency include options for cruise, airline, international and domestic travelers. Choose from a single-trip or annual travel insurance to protect your travel investment.

GoReady travel insurance plans provide COVID-19 coverage and upgrades such as “cancel for any reason” (CFAR) coverage and rental car protection. However, with the GoReady Choice plan, CFAR is only available if you buy the travel insurance plan within one day of making your first trip deposit.

Explore the pros and cons of GoReady Choice below.

- GoReady Choice is a budget-friendly travel insurance plan.

- No waiting period for superior weather and hurricane coverage.

- Excellent $2,000 per person benefits for travel delays with just a six-hour delay.

- Very good $250,000 per person medical evacuation coverage.

- “Cancel for any reason” (CFAR) coverage is only available as an upgrade with GoReady Choice when travel insurance is purchased within one day of your first trip payment.

- Low baggage delay coverage of $200 per person with a 24-hour wait.

- Low medical expense coverage of $50,000 per person.

Why trust our travel insurance experts

Our team of travel experts evaluates hundreds of insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

About GoReady travel insurance from Aegis

Aegis sells GoReady travel insurance coverage for adventurers, cruisers, vacationers and international jetsetters. Its travel insurance policies range from basic trip cancellation insurance to comprehensive travel insurance plans with travel medical insurance .

If you experience an injury, flight disruption or illness, GoReady’s “Stress Less Benefits” can help you get reimbursement up front so you don’t have to wait for claim processing and a refund.

In our rating of the best travel insurance , the GoReady Choice plan gets 4.5 stars out of 5. Compared to other top-scoring travel insurance plans in our rating, GoReady Choice has the cheapest average cost of travel insurance per trip, but this plan offers comparably low coverage limits for medical and emergency evacuation benefits.

GoReady travel insurance plans

GoReady travel insurance plans come with “Stress Less Benefits” which pay to solve certain travel woes on your behalf, removing the need for you to pay out of pocket and file a claim for reimbursement.

GoReady plans also come with a “free look” period, so you have time after buying a travel insurance plan to decide if it’s right for you. If you decide you no longer want the plan, and haven’t started your trip or filed a claim, GoReady will fully refund your policy premium.

Consider each type of travel insurance plan to choose which is best for your travel needs.

GoReady Choice single-trip plan

The Go Ready Choice single-trip plan is for individuals who want robust domestic or international travel coverage and the ability to customize the policy.

The base GoReady Choice travel insurance plan includes:

- $50,000 per person in emergency medical expenses (secondary coverage).

- $250,000 in medical evacuation and repatriation (secondary coverage).

- $10,000 in accidental death and dismemberment benefit.

- $500 baggage coverage per day.

- $500 per person in missed connection coverage, after a three-hour delay.

- 150% of insured trip cost for trip interruption.

Upgrades are available to increase some coverage limits, for an additional cost. Other upgrade options include:

- 100% trip cancellation for work reasons.

- 75% CFAR coverage upgrade, up to $10,000.

- $50,000 rental car damage per person, with a $100 deductible.

- $1,000 in sports coverage.

- $1,000 in electronic and professional equipment coverage.

GoReady Pandemic travel insurance plus plan

For those worried about COVID and other pandemic-related issues, the Pandemic travel insurance plus plan may be for you.

This travel plan offers primary insurance benefits and “ cancel for any reason” (CFAR) coverage for any single trip. It includes coverage for airline ticket change fees, quarantine accommodations, trip interruption and trip cancellation.

GoReady trip cancellation insurance plan

The GoReady trip cancellation travel insurance plan is for domestic travelers concerned about their trip being canceled. This plan will cover stays with Airbnb or VRBO. There are more than 20 reasons this plan will cover you 100% for trip cancellation, including:

- Common carrier delays.

- Traffic accidents.

- Military leave.

- Injury, illness or death of you or your family member.

GoReady VIP plan

The most robust plan Aegis offers, the GoReady VIP plan may be a good choice for travelers driving a rental car or worrying about trip interruption due to a fragile or lengthy medical history.

It will reimburse up to 100% of the insured trip cost for trip cancellation or 175% for trip interruption.

GoReady VIP offers:

- $1,000,000 per person for medical emergency evacuation and repatriation (secondary coverage).

- $250,000 per person in medical coverage (secondary coverage).

- $2,500 per person for baggage coverage.

- $1,000 per person for a missed connection, after a three-hour delay.

- $250 per person per day for COVID-19 quarantine, after a six-hour delay.

GoReady cruise plan

The GoReady cruise plan is designed to cover single-trip domestic or international sea and land vacations. It includes:

- $250,000 per person for medical evacuation or repatriation (secondary coverage).

- $100,000 per person for medical expenses (secondary coverage).

- $750 per person for a missed connection, after a three-hour delay.

- $250 for an itinerary change.

You can also upgrade the limits for baggage coverage and travel delay coverage, or add “cancel for any reason” coverage to your plan.

Planning a cruise? Compare the best cruise travel insurance .

GoReady vacation rental plan

If you are looking to rent a vacation home, condo or Airbnb, GoReady’s vacation rental plan could be what you need.

GoReady vacation rental plan covers security deposit protection of up to $1,000 (upgraded coverage available), rental damage of $1,000 per accommodation, a pet bundle and travel inconvenience coverage of $100 per person for loss of access to the beach or golf course. Medical benefits include $50,000 of coverage per person and emergency evacuation and repatriation coverage is $250,000 per benefit per person.

Optional upgrades include rental car collision insurance of up to $40,000 (with a $100 deductible) and “cancel for any reason” coverage of 75% of your insured trip.

GoReady annual multi-trip travel insurance preferred plan

If you plan to go on two or more trips in the next year, GoReady’s annual multi-trip preferred travel insurance plan may be a good fit. You can travel internationally and with a large family to reap the benefits of this travel plan.

It includes features like baggage protection and delay, travel delay, rental car damage, accidental death and dismemberment, medical and emergency evacuation and repatriation.

You can also upgrade the COVID-19 quarantine travel delay, trip interruption and trip cancellation coverages. This Aegis travel plan will only cover up to 31 days per trip annually.

GoReady annual primary multi-trip travel insurance plan

If you take trips up to 90 days long or want primary medical insurance coverage, the GoReady annual primary multi-trip travel insurance plan may be the right choice.

This plan offers up to $2,000 in trip interruption coverage, $25,000 in accidental death and dismemberment, $30,000 in medical expenses per person (primary coverage) and $50,000 per person for emergency evacuation and repatriation (primary coverage). It also has airline ticket change fee coverage of $200 per person, after a minimum three-hour delay.

Other coverage options offered

GoReady travel insurance plans offer several optional ways to customize your travel insurance. Upgrade options and coverage limits vary by plan. For example, the GoReady Choice travel insurance plan comes with $250,000 in emergency medical evacuation coverage, but you can upgrade to $500,000 in coverage by paying extra.

Other upgrades available include:

- “Cancel for any reason” (CFAR) coverage.

- Cancel for work reasons coverage.

- Rental car damage coverage.

- Electronics and professional equipment coverage.

- Business and sporting equipment coverage.

- Upgraded baggage and personal effects coverage.

What GoReady doesn't cover

Like other travel plan policies, there are some exclusions GoReady doesn’t cover. Reading the fine print of your policy carefully can help you identify what your plan won’t cover. And don’t forget about the “free look” period, which gives you time to decide if the plan is the right choice. If you decide it isn’t, you can be eligible for a full refund of the premium you paid.

Here are some medical coverage exclusions that GoReady’s Choice plan won’t cover:

- Cosmetic surgery that isn’t the result of an injury sustained during your trip.

- Dental treatments that aren’t an accidental injury.

- Emotional or mental disorders.

- Injuries sustained in activities like bungee jumping, vehicle racing, parachuting, hang gliding or playing contact sports.

- Taking part in civil disorder or a riot.

- Traveling for medical treatment.

GoReady travel insurance cost

Your cost for travel insurance will depend on several factors such as your age, number of travelers, length of trip and trip cost. We’ve gathered some sample rates for the GoReady Choice travel insurance plan.

Compare the best travel insurance companies of 2024

Via TravelInsurance.com’s website

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024. For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- Cost: 40 points. We scored the average cost of each travel insurance policy for a variety of trips and traveler profiles.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

Aegis Go Ready travel insurance FAQs

Aegis Go Ready travel insurance has a rating of 4.06 stars out of 5 on Squaremouth , based on 1,131 reviews of policies purchased on the travel insurance comparison site since 2013. Its rating for customer service during a claim is 3.5 stars. If you filter reviews by people who filed a claim, the unhappy customers cite claims not being processed as quickly as they’d hoped and claims being denied for things not covered by the policy, such as mental health.

Yes, some GoReady travel insurance plans offer “cancel for any reason” (CFAR) coverage as an optional upgrade. To be eligible for this upgrade, you must buy the upgrade within one to 14 days (depending on the plan) of making your first trip payment.

With CFAR, you can be reimbursed for up to 75% of your nonrefundable trip expenses, provided you cancel your trip at least 48 hours before your scheduled departure date.

“Cancel for work reasons” is also available with some plans. If you want either coverage, make sure to choose a plan that offers these upgrades.

Yes, GoReady offers travel insurance plans that covers COVID-19.

GoReady Choice and Pandemic Plus plans are good options for COVID-19 travel insurance . Both plans will reimburse up to 100% of nonrefundable trip costs if you contract COVID-19 before your departure date and have to cancel your trip. They will also cover medical expenses, up to your policy limit, if you contract COVID-19 while on your trip.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel insurance Heidi Gollub

Travel insurance for UK trips

Travel insurance Amy Fontinelle

What is trip interruption insurance?

Travel insurance Mandy Sleight

10 worst US airports for flight cancellations last week

What are your rights during an airline meltdown?

Travel insurance Erica Lamberg

Hurricanes and travel insurance

Generali Global Assistance travel insurance review 2024

Travel insurance Jennifer Simonson

Travel insurance for vacations to Italy

Travel insurance Timothy Moore

Tricky travel insurance questions answered by experts

Survey: 20% of Americans have had a life-changing experience while traveling

Our travel insurance ratings methodology

AXA Assistance USA travel insurance review 2024

Cheapest travel insurance of August 2024

Average flight costs: Travel, airfare and flight statistics 2024

John Hancock travel insurance review 2024

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Review

- Best Car Buying Apps

- Best Sites To Sell a Car

- CarMax Review

- Carvana Review (July 2024)

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best Accounting Software

- Best Receipt Scanner Apps

- Best Free Accounting Software

- Best Online Bookkeeping Services

- Best Mileage Tracker Apps

- Best Business Expense Tracker Apps

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best SEO Services

- Best Mass Texting Services

- Best Email Marketing Software

- Best SEO Software

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Free Time Tracking Apps

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- Best Home Appliance Insurance

- American Home Shield Review

- Liberty Home Guard Review

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Brands

- Cheap Window Replacement

- Window Replacement Cost

- Best Gutter Guards

- Gutter Installation Costs

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Texas Electricity Companies

- Texas Electricity Rates

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Compare Car Insurance Quotes

- Best Car Insurance for New Drivers

- Best Pet Insurance

- Cheapest Pet Insurance

- Pet Insurance Cost

- Pet Insurance in Texas

- Pet Wellness Plans

- Is Pet Insurance Worth It?

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

- Cheapest Homeowners Insurance

- Cheapest Renters Insurance

- Travel Medical Insurance

MarketWatch Guides is a reviews and recommendations team, independent of the MarketWatch newsroom. We might earn a commission from links in this content. Learn More

AEGIS (GoReady) Travel Insurance Review (2024)

from AEGIS via travelinsurance.com

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Here’s a breakdown of how we reviewed and rated the best travel insurance companies

Travel insurance plans reimburse policyholders if their travel plans get canceled or interrupted by unexpected events or uncontrollable circumstances. Many companies, including Aegis Insurance, also provide coverage for medical emergencies occurring during the trip. If you get hurt or sick, Aegis will pay qualifying medical costs.

Aegis, formerly branded as GoReady, is the travel insurance wing of Aegis General Insurance Agency and is one of our top-rated travel insurance agencies . It offers multiple coverage options, including single-trip and annual travel plans. U.S. residents can buy coverage for international and domestic travel and pick among available packages for stand-alone cancellation, medical and comprehensive coverage.

- Average Cost: $173

- BBB Rating: N/A

- AM Best Score: N/A

- Medical Expense Max: $50,000

- Emergency Evacuation Max: $500,000

Aegis Travel Insurance Overview

Aegis General Insurance Agency now offers travel insurance plans under its general company name rather than its previous travel insurance division named GoReady. Aegis policies are still the same as they were under GoReady, and they still have the same slogan – Go Insured. Go Ready!

Aegis sells several travel insurance policies with various coverage limits, terms and covered items. Comprehensive plans like Aegis Choice provide insurance for emergencies, evacuations, cancellations and trip interruptions. Coverage works for domestic and international travel and includes options for pre-existing conditions.

You can opt to add special features, such as a “cancel for work reasons” clause. Aegis has a high-limit VIP Plan, a Cruise Plan , a stand-alone trip cancellation policy and two levels of annual travel insurance plans. The Preferred yearly option appeals to casual vacationers, while the Primary annual plan has benefits meant for road warriors and frequent international fliers.

Compare Aegis to the Competition

What does aegis general instant travel insurance cover.

Aegis’s Choice Single-Trip Plan delivers comprehensive coverage for medical emergencies and cancellations. The company calls this play a convenient and reasonably priced travel insurance option suitable for casual travelers who want coverage for one vacation. Aegis says this is its best-selling single-trip product.

Coverages on the Choice Plan are:

- 100% trip cancellation coverage for the insured cost

- 150% of insured trip cost for interruptions

- $10,000 accidental death and dismemberment

- $50,000 per person medical expenses