Schengen Travel Insurance

Traveling to a schengen area.

- Double-check the expiration date on your passport, paying particular attention to the validity of childrens passports, which are only valid for five years.

- Make sure your passport is valid for at least six months beyond your intended return date

- Always carry your passport with you when traveling to other countries within the Schengen Area. While there may not be any border checks at the time of your travel, officials have the authority to reinstate border controls at any time, without prior notice.

Schengen Travel Insurance of which AXA is a leading provider, covers you in all 27 Countries within the Schengen Territory that have abolished internal border controls for their citizens. The countries are:

Do I need travel insurance while traveling to Schengen Countries?

What do I receive with my Schengen travel insurance?

What countries are covered under my axa travel plan, how can axa help with your trip to europe, how to get a travel protection quote.

Receive a free quote within minutes Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8AM-7PM Central Time

Does AXA Travel Insurance provide coverage for Schengen Visa?

AXA Gold and Platinum plans offer the necessary medical and assistance coverage in all 27 countries in the Schengen Territory. However, the Gold and Platinum plans only provide coverage up to 60 – 90days.

What should I do if I have a medical issue while in the Schengen Area?

Please contact the local authority as soon as possible. Then contact us on the phone number given with the special conditions you receive after taking out your policy. Our helpful staff will then do all we can to resolve your issue and get you treatment or travel home, in line with the conditions of your policy. If you require assistance while traveling, call us at +1312-935-1719

The embassy states that I must get an insurance certificate with Covid protection. Is this possible?

Need help choosing a plan.

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

licensed agents available

Get Your Schengen Insurance

- Hospitalisation expenses up to 30,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area

Extend Your Coverage

- Hospitalisation expenses up to 60,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area + European Union

- Return/relocation and lodging expenses of a companion

Before traveling, please check the guidelines provided by the World Health Organization, the European Union and your local government. Important restrictions are applied to the Schengen Area and visas are likely to be limited to specific travels only. Our travel insurance policies are made to protect you against unforeseeable events, such as sudden illnesses or accidental bodily injuries. We remind you that epidemics and/or infectious diseases such as CoVid 19 are excluded from our policies.

Schengen travel insurance

Europ Assistance makes it easy for you to select and purchase your travel insurance online. Your insurance will be ready in a matter of minutes and our insurance certificates are recognized by embassies, consulates and visa centers around the world , which helps you acquire a Schengen visa for your next trip to Europe. You will immediately receive the certificate and you will be able to download it at any time in any of our six languages : English, French, Spanish, German, Russian or Chinese.

Which countries are in the Schengen area?

The Schengen area is made up of 26 countries (and 3 microstates) where travelers and residents can move freely from state to state without a passport, as there is no longer common border control between Schengen states. Travel insurance is highly suggested for all travelers, and for most countries is mandatory , as it is needed to obtain the visa to enter the Schengen area. You can obtain your visa application form from the country you plan to enter through first or the one you plan to spend the most time in.

The leading Schengen travel insurance provider

When you choose Europ Assistance as your Schengen visa travel insurance provider, you also get the support and expertise of 750,000 partners . If something goes wrong, not only will your medical expenses be properly reimbursed, but you will also get help from competent medical professionals at qualified medical centers, no matter where you are. During stressful situations or emergencies abroad, communicating in your native language can be a source of comfort. When such a situation occurs, you can trust that Europ Assistance will be there to help you 24/7 .

If you wish to subscribe for more than 20 people, please contact us

Travel dates

- Country of residence All travellers are from the same country of residence : Yes No

A Schengen visa is not required for your trip, however, you should still consider purchasing travel insurance. You can travel with peace of mind and are covered throughout the European Union with our Schengen Plus cover.

- Hospitalisation expenses up to 60,000€

- Coverage in the Schengen area + European Union

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Dog Insurance

- Senior Dog Insurance

- Exotic Pet Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- Cat vaccinations cost

- Dog vaccinations cost

- Dog dental cleaning cost

- Dog cataract surgery cost

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- Chase Ultimate Rewards Guide

- Capital One Rewards Guide

- Amex Membership Rewards Guide

- All Credit Card Guides

- Raisin (SaveBetter) Interest Rates

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- UFB Direct Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- How much will $1,000 earn in a HYSA?

- How much will $10,000 make in a HYSA?

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Is Savings Account Interest Taxable?

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- Best Money Market Accounts

- U.S. Bank Money Market Account

- Money Market vs. Savings Account

- How much will $10,000 make in a MMA?

- Best CD Rates

- Best 1-Year CD Rates

- Best 6-Month CD Rates

- Best 3-Month CD Rates

- 6% CD Rates

- How much will a $10,000 CD earn?

- How much will a $50,000 CD earn?

- Synchrony Bank CD Rates

- Capital One CD Rates

- Barclays CD Rates

- How To Get A Loan

- Loan Interest Calculator

- How To Prequalify for a Personal Loan

- What is a Payday Loan?

- How To Get a Loan With No Credit History

- Financial Hardship Loans

- Low-Income Personal Loans

- No Credit Check Loans

- Why Can't I Get a Loan?

- Cash Advance Apps

- All Insurance Guides

On This Page

- Key takeaways

Our top picks for Schengen travel insurance

What is schengen travel insurance, schengen visa travel insurance requirements, what does schengen travel insurance cover, how much does schengen travel insurance cost, schengen visa requirements, tips for buying schengen travel insurance, schengen travel information & requirements, faqs - schengen travel insurance, related topics.

Schengen Travel Insurance: Coverage for your Schengen Visa Application

- A Schengen travel visa is required for U.S. Citizens if they plan to stay in the Schengen Zone for more than 90 days .

- The Schengen visa application requirements include having travel insurance that covers a minimum of €30,000 in medical expenses and covers the cost of repatriating you to the United States in the event of a medical emergency.

- As of 31 March 2024, Romania and Bulgaria have joined the Schengen zone.

- In most cases, private U.S. health insurance or Medicare won’t cover medical expenses incurred overseas, so even if you don’t opt for a Schengen visa, it’s still a good idea to purchase travel insurance when visiting Europe’s Schengen area.

- Travel insurance for Schengen visits can cost around $1 per day for basic coverage.

- To find the right travel insurance for your trip to the Schengen Zone, we recommend using our online comparison tool . This will give you a clear overview of what’s available so you can easily compare your options.

Our top picks for the best schengen travel insurance

- Tin Leg: Best Overall Coverage

- Generali Global Assistance: Best Coverage on a Budget

- Travel Insured International: Best for Non-Medical Evacuation Coverage

- AXA Assistance USA: Best Premium Comprehensive Coverage

Best Overall Coverage

Why We Like It

Editor's take

Tin Leg is known for offering high-quality travel insurance coverage at a competitive, reasonable price.

All Tin Leg policies have an A- rating or better for their financial strength from AM Best. We like the Tin Leg Gold plan because it offers great medical and evacuation coverage limits at an affordable price.

This plan comes automatically with trip cancellation and interruption coverage for coronavirus and other covered instances, as well as up to $500,000 in emergency medical expense protection and up to $500,000 in coverage for emergency medical evacuation, just in case something were to happen while on your Italy trip.

You may also qualify for travel delay protection, baggage insurance, and insurance that protects against missed connections on your way to the Schengen area.

Read our full review

- Excellent primary coverage for medical expenses

- High limit for emergency evacuation coverage

- Optional cancel for any reason (CFAR) coverage available

- Comes with coverage for hurricanes and inclement weather

- Coverage for pre-existing conditions is available if purchased within 14 days of the trip deposit

- Baggage delay coverage requires a 24-hour waiting period

- Low coverage limits for baggage and personal effects

Best Coverage on a Budget

Generali global assistance.

Generali Global Assistance offers high coverage limits for medical expenses, emergency dental expenses, emergency medical evacuation coverage, and more for your trip to the Schengen zone.

This travel insurance provider has an A rating from AM Best and offers three tiers of travel insurance coverage to suit your needs:

- Standard plan

- Preferred plan

- Premium plan

If you’re looking for basic coverage at an affordable price point, the Standard plan may be just what you need. This plan offers coverage for up to 100% of the insured trip cost for cancellation and up to 125% of the insured trip cost for interruption. It also offers $1,000 per person in baggage coverage, up to $50,000 in medical coverage, and $250,000 in medical evacuation coverage.

- Lowest cost of all Generali Global Assistance plans

- 24/7 emergency travel assistance included

- Telemedicine included

- Lower coverage than other Generali plans

- Pre-existing conditions are not covered by the Standard plan

- No coverage for accidental death and dismemberment during on-land travel

Best for Non-Medical Evacuation Coverage

Travel insured international.

Travel Insured International offers two plans, Worldwide Trip Protector Edge and Worldwide Trip Protector. Of these two, we recommend the Worldwide Trip Protector plan for your trip to the Schengen area due to its superior coverage.

Worldwide Trip Protector covers 100% of the insured trip cost due to cancellation, 150% of the insured trip cost due to interruption, and $1,500 for trip delays and $500 for baggage delays after only 3 hours. It also includes $100,000 of secondary medical coverage and $1 million of evacuation coverage. it also offers $150,000 worth of non-medical evacuation coverage, providing transportation during a natural disaster or civil or political unrest.

- Travel delay coverage kicks in after just six hours

- Generous $150,000 non-medical evacuation coverage

- CFAR and IFAR coverage not included

- Baggage delay coverage only kicks in after 12 hours

- No rental car coverage

Best Premium Comprehensive Coverage

Axa assistance usa.

AXA Assistance USA is a highly-rated travel insurance company that offers comprehensive travel insurance plans with a ton of benefits for your trip to the Schengen area. This means the coverage you purchase from them includes medical evacuation protection as well as baggage insurance, trip cancellation insurance, trip interruption coverage, travel delay coverage, and more. The company also offers three tiers of coverage you can choose from based on your needs and your budget.

We recommend the Platinum plan from AXA Assistance USA due to its superior medical evacuation coverage and robust limits in other categories. This plan comes with up to $1 million in protection for emergency medical evacuation and repatriation of remains, up to $250,000 in coverage for emergency medical expenses, $300 per day (maximum of $1,250) in trip delay coverage, $3,000 in insurance for baggage and personal effects, and more. Optional cancel for any reason (CFAR) coverage is also available as an add-on with this plan.

- High coverage limits in every category. Extremely comprehensive

- Includes identity theft coverage & non-medical evacuation coverage

- CFAR coverage reimburses 75% of prepaid travel expenses

- Coverage cannot be extended unlike other plans

- Medical limit is lower than other cheaper plans, but still sufficient

Schengen travel insurance is simply a travel insurance plan that offers coverage while you’re traveling in Europe’s Schengen area, which now excludes the UK . This type of insurance is required for certain Schengen travel visas.

Typically, travel insurance plans offer coverage for certain destinations or areas of travel, and can sometimes exclude other destinations as part of the plan. Therefore, Schengen travel insurance refers to plans that offer coverage for travels within the Schengen area.

When do I need Schengen travel insurance?

It’s a good idea to have travel insurance any time you travel to this region, whether it be places such as France , Spain or Germany since most traditional health plans won’t work abroad, but you definitely need health insurance for a Schengen visa as noted by travel.state.gov ) if you plan to apply for a longer stay.

Having valid Schengen travel insurance is a basic requirement for applying for a Schengen visa. In other words, you cannot get a visa for the Schengen area unless you buy travel insurance for the length of your stay.

That said, we recommend buying travel insurance any time you travel to this region, regardless of if you plan to apply for a Schengen visa.

Travel medical insurance for a Schengen visa has the following requirements :

- It must be valid in all Schengen Zone countries and remain in effect until the end of your trip.

- It must cover at least €30,000 in medical expenses.

- Your insurance policy must cover repatriation due to medical emergencies. Repatriation is the technical term for returning to your own country.

Every insurance policy is a little different, but travel insurance usually covers these expenses:

Medical expenses: If you want a Schengen visa, your policy must include medical insurance . This type of insurance covers expenses arising from certain illnesses and injuries. Read your policy carefully, as Schengen travel health insurance typically excludes pre-existing conditions. Regardless of whether you require a Schengen visa or not, having medical insurance is a must for anyone traveling outside of the US . Medical insurance is generally broken down into two categories; emergency medical coverage, and emergency medical evacuation coverage.

Schengen medical insurance covers you for things such as hospitalization, emergency room treatment, X-rays, emergency dental care, and more. Emergency medical evacuation coverage will cover you for any transportation you require to receive medical care. This can include an ambulance to the nearest hospital or a pricey evacuation via a helicopter or plane.

- Lost/damaged luggage: Many Schengen visa travel insurance plans cover lost and damaged luggage. Your policy may even reimburse you for the cost of purchasing essential items while you wait for your delayed bag to arrive.

- Cancellations: Comprehensive travel insurance usually covers trip cancellations, giving you extra peace of mind in the event you have to cancel your plans due to severe weather, illness, serious medical problems, natural disasters or legal obligations. According to the Department of Financial Services , Schengen visa insurance won’t cover cancellations due to COVID-19 in most cases unless you have COVID-19 travel insurance . This is because it’s no longer an unforeseen complication.

- Delays: Some types of travel insurance cover losses arising from trip delays. This coverage kicks in if you experience a delay while traveling via one of these common carriers: airline, passenger railroad, ferry or long-distance bus service. Your policy may cover meals, hotel accommodations, toiletries and other related expenses.

What doesn’t Schengen travel insurance cover?

Travel insurance coverage depends heavily on the plan you choose. The more comprehensive your plan, the more things you will have covered.

That said, there are some common things not covered under travel insurance that extend to Schengen visa travel insurance.

Schengen visa travel insurance may not cover:

- Some scenarios relating to pregnancy – such as childbirth ( see pregnancy travel insurance )

- Some pre-existing conditions – depending on the plan and waiver criteria

- Some COVID-19 scenarios – such as self-imposed quarantine

- Anything mentioned in the “Exclusions” section of your specific plan – always read the fine print.

It’s important to review all the specific inclusions and exclusions of the plan you choose as there can be loopholes and exceptions to each of these scenarios.

For example, pre-existing conditions , which are health problems that existed before you purchased your policy, typically aren’t covered. However, there is often a limit to how far back this applies and certain criteria for waiving the exclusion.

Schengen travel insurance can cost as low as around $1 per day for the most basic coverage.

For more comprehensive travel insurance, you can expect to pay around $4 per day.

That said, the exact cost of travel insurance depends on several factors, including:

- The duration of your trip

- The cost of your trip

- The coverage limits you select

- The destination of your trip

For example, medical insurance usually costs less for younger people than it does for older people, so a 65-year-old can expect to pay more than a 23-year-old.

Let’s walk through a real-world example comparing coverage types. We got travel insurance quotes for the following trip information:

- Age: 35 years old

- Destination: Schengen area

- Trip Length: 14 days

- Trip cost: $3,000

- Date: September, 2024

The requirements for Schengen visa travel insurance are quite simple, so you can get a relatively inexpensive plan . In this first table, we got price quotes for basic Schengen travel insurance.

Example Where Plan Doesn’t Reimburse the Full Trip Cost

While you are at it, you may want to opt for more comprehensive benefits. For the example below, we chose plans that will reimburse the full cost of your trip.

Example Where Plan Does Reimburse the Full Trip Cost

When you purchase travel insurance, it’s up to you whether you want to stick with the required minimums or give yourself a little extra peace of mind. That can have a big impact on the cost of your policy. For example, it costs a lot more to purchase €100,000 in medical insurance than it does to purchase the minimum €30,000 in medical insurance.

Where can I purchase Schengen travel insurance?

Where you ultimately purchase Schengen visa travel insurance is up to you.

If you are going as part of a larger tour or study program, you may be able to purchase Schengen visa travel insurance through your tour operator. That said, you may be able to find a better deal buying Schengen travel insurance online. Most major travel insurance providers offer plans that match the Schengen visa requirements.

You can also have a look at an online comparison tool . To see Schengen visa travel insurance plans you can enter your trip details in the tool below. Once you reach the quote pages, there is a filter to select “Schengen Visa” under the preset filter options. This will highlight all the plans that match the Schengen visa requirements from multiple travel insurance companies at once.

Before you travel, you may need to obtain a Schengen visa. Here’s what you need to know about the visa requirements.

Who needs a Schengen visa?

Any American citizen who intends to stay in the Schengen Area for more than 90 days must obtain a visa before traveling. This includes both business travelers and leisure travelers.

How does a Schengen visa work?

A Type D Schengen visa, also known as a national long-stay visa, allows you to stay in the Schengen Area for more than 90 days in a 180-day period. It also allows you to travel from one Schengen country to another Schengen country.

If you need to travel to the Schengen Area several times, you may be able to obtain a 3-year, multiple-entry Schengen visa or a 5-year, multiple-entry Schengen visa.

It’s important to note that if you plan to get a Schengen visa, you must have valid Schengen travel insurance for the entirety of your stay within the Schengen area. Multi-trip insurance insurance can be especially beneficial in such cases.

Schengen visa requirements for children

Age criteria for Schengen Visa:

- Children aged 6 and over will often require their own Schengen Visa. This specific age can vary from country to country, so it is important to check the specific age requirements of the Schengen country you plan to visit.

Application Process:

- Minors need to pass through the same Visa application process as adults. This process generally contains the following stages:

- Applicants must complete a Schengen visa application form.

- You must gather the appropriate supporting documents (see below).

- Schedule an appointment with the respective embassy or consulate.

- Pay the Visa fee.

Required Documentation:

- A child’s Schengen Visa application requires the following documents:

- A valid passport with at least two blank pages.

- A completed Schengen Visa application form. Parents or legal guardians must ensure they sign this form for young children.

- A recent passport-sized photo.

Parental Consent:

- When a minor is traveling without one or both parents, it is important to provide a notarized letter of consent from the absent parent(s) or legal guardian(s). This letter contains information such as the child’s name, the names of the traveling and non-traveling parents or guardians, the travel dates, and a brief explanation of the trip’s purpose.

How do I apply for a Schengen visa?

To apply for a Schengen visa, follow these steps:

Type of Schengen visa.

Determine what type of Schengen visa you need.

Submit your Schengen visa application.

If you plan to visit one country, submit it to the consulate or embassy for the country you’ll be visiting. If you plan to visit multiple Schengen countries, submit it to the consulate or embassy for the first country on your itinerary.

Purchase travel insurance.

Make sure your policy meets the minimum requirements.

Submit documents.

Submit your passport, proof of financial insurance and proof that you’ve met all Schengen visa requirements to the embassy.

Travel insurance is a worthwhile expense, but not all plans offer the same level of protection, so it’s important to shop around.

Follow these tips to find a policy that meets your needs.

Decide what type of travel insurance you’d like

Remember, your U.S. health insurance won’t cover medical expenses incurred overseas, so you’ll need to purchase a Schengen insurance plan that includes medical coverage.

You should also consider the following types of travel insurance.

- Medevac: Medical evacuation insurance , commonly called medevac coverage, covers the cost of transporting you to a medical facility if you get into an accident or develop a serious illness while you’re traveling.

- Rental car insurance: If you decide to rent a car while traveling in the Schengen, rental car insurance covers you in the event of an accident. Many policies also cover theft and vandalism.

- Cancel-for-any-reason insurance: CFAR insurance allows you to recoup some of your expenses if you have to cancel a trip for a reason that’s not covered by your standard insurance policy. For example, if you encounter financial difficulties, you may have to cancel your trip to save money.

Compare plans

Several companies offer insurance plans designed to meet the minimum requirements for a Schengen visa. Before you purchase coverage, use the LA Times comparison tool to find the best plan for the best price.

Check the limitations of your policy

Most insurance policies have limitations. Before you apply for a Schengen visa, review your policy to make sure it meets the minimum requirements. During your review, make sure you have coverage for common travel scenarios.

See if your credit card already provides trip insurance

Some travel credit cards offer rental car insurance, trip interruption insurance and other types of insurance coverage. Before you travel, check your credit card terms to find out if you have any of these benefits available to you. If you have certain types of coverage through your credit card company, you won’t have to purchase them.

Tips for visiting the Schengen area

Where is the schengen area.

Named after a small village in Luxembourg, the Schengen Area is the largest free travel area in the world, according to the European Council . As of 2024, there are 27 Schengen countries, most of which belong to the European Union. Switzerland, Norway, Iceland and Liechtenstein are in the Schengen Area, but they aren’t in the EU. As part of the Schengen Borders Code, these countries don’t perform border checks unless there’s a specific threat.

Do I need a passport to visit the Schengen?

Yes. All U.S. citizens must obtain a passport before traveling to the Schengen Area. You’re allowed to enter the Schengen countries as long as your passport doesn’t expire until at least 90 days following your planned departure date. For example, if you plan to leave the Schengen countries on September 1, your passport should be valid until at least December 1. However, if you’re looking for places to travel without a passport , you might consider exploring countries and destinations that don’t require

Do I need to be vaccinated to enter the Schengen?

You don’t have to get vaccinated before traveling to the Schengen countries. However, scientists at the Centers for Disease Control and Prevention recommend getting routine vaccines before you travel outside the United States. For example, the CDC says you should have vaccinations for chickenpox, influenza, diphtheria-tetanus-pertussis, polio, shingles and measles-mumps-rubella before traveling to France.

This is some important travel information you should know before visiting the Schengen.

Schengen insurance protects you when you’re traveling in the Schengen Zone, a group of 27 European countries. If you have a covered loss, the insurance company reimburses you for certain expenses. If you need a visa for travel to the Schengen Zone, one of the requirements is having travel insurance that will cover you in this part of the world. This is often referred to as Schengen insurance or Schengen travel insurance

What type of insurance is required for a Schengen visa?

At minimum, your travel insurance must cover at least €30,000 in medical expenses. It must also cover your repatriation costs. If you purchase a comprehensive policy, it may also cover losses arising from trip delays, trip cancellations, lost baggage or damaged baggage.

Do I need travel insurance to visit the Schengen?

You’ll need travel insurance if you plan to stay in the Schengen Zone for more than 90 days. Although you don’t need a short-stay visa for trips lasting 1 to 90 days, you do need a visa for longer trips. See more at travel.state.gov .

Does Schengen insurance cover countries that are not part of the Schengen Area?

No. Your Schengen visa insurance only covers the 23 EU and four non-EU countries in the Schengen Zone.

Per travel.state.gov ,{:rel=’nofollow’ target=’_blank’} the following countries are members of the Schengen Zone: Austria, Belgium, Czech, Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland

About the Author

Leigh Morgan is a seasoned personal finance contributor with over 15 years of experience writing on a diverse range of professional legal and financial topics. She specializes in subjects like navigating the complexities of insurance, savings, zero-based budgeting and emergency fund development.

In the last five years, she’s authored over 300 articles for credit unions, digital banks, and financial professionals. Morgan is also the author of “77 Tips for Preventing Elder Financial Abuse,” a book focused on helping caregivers protect the elderly from financial scams.

In addition to her writing skills, she brings real-world financial acumen thanks to her previous experience managing rental properties as part of a $34 million real estate portfolio.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

Best Travel Insurance Companies & Plans in 2024

Best Travel Insurance for Seniors

Best Medical Evacuation Insurance Plans 2024

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Guide to Traveling While Pregnant: Pregnancy Travel Insurance

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions August 2024

22 Places to Travel Without a Passport in 2024

Costa Rica Travel Insurance: Requirements, Tips & Safety Info

Best Spain Travel Insurance: Top Plans & Cost

Best Italy Travel Insurance: Plans, Cost, & Tips

Best Travel Insurance for your Vacation to Disney World

Guide to Chase Sapphire Travel Insurance Benefits 2024

2024 Complete Guide to American Express Travel Insurance

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Plans for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Top Plans 2024

Best UK Travel Insurance: Coverage Tips & Plans August 2024

Best Travel Insurance for Trips to the Bahamas

Europe Travel Insurance: Your Essential Coverage Guide

Best Trip Cancellation Insurance Plans for 2024

What Countries Require Travel Insurance for Entry?

Philippines Travel Insurance: Coverage Requirements & Costs

Travel Insurance for the Dominican Republic: Requirements & Tips

Travel Insurance for Trips Cuba: Tips & Safety Info

AXA Travel Insurance Review August 2024

Best Travel Insurance for Thailand in 2024

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Best Travel Insurance for a Japan Vacation in 2024

Faye Travel Insurance Review August 2024

Travel Insurance for Brazil: Visitor Tips & Safety Info

Best Travel Insurance for Bali, Indonesia (2024)

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

Travel Insurance for India: U.S. Visitor Requirements & Quotes

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

Generali Travel Insurance Review August 2024

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for August 2024

Travel Insured International Review for 2024

Seven Corners Travel Insurance Review August 2024

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

Medjet Travel Insurance Review 2024: What You Need To Know

Antarctica Travel Insurance: Tips & Requirements for US Visitors

Travel Insurance for Kenya: Recommendations & Requirements

Travel Insurance for Botswana: Compare Your Coverage Options

Travel Insurance for Tanzania: Compare Your Coverage Options

Travel Insurance for an African Safari: Coverage Options & Costs

Nationwide Cruise Insurance Review 2024: Is It Worth It?

The Best Hurricane Travel Insurance for 2024

- Travel Insurance

- Travel Insurance for Seniors

- Cheap Travel Insurance

- Cancel for Any Reason Travel Insurance

- Travel Health Insurance

- How Much is Travel Insurance?

- Is Flight Insurance Worth It?

- Anniversary Trip Ideas

- Travel Insurance for Pre-Existing Conditions

- Places to Travel Without a Passport

- Christmas In Mexico

- Europe Travel Insurance

- Compulsory Insurance Destinations

- Philippines Travel Insurance

- Dominican Republic Travel Insurance

- Cuba Travel Insurance

- AXA Travel Insurance Review

- Travel Insurance for Thailand

- Ireland Travel Insurance

- Japan Travel Insurance

- Faye Travel Insurance Review

- Brazil Travel Insurance

- Travel Insurance Bali

- Travel Insurance Turkey

- India Travel Insurance

- Australia Travel Insurance

- Generali Travel Insurance Review

- Travelex Travel Insurance Review

- Tin Leg Travel Insurance Review

- Travel Insured International Travel Insurance Review

- Seven Corners Travel Insurance Review

- HTH WorldWide Travel Insurance Review

- Medjet Travel Insurance Review

- Antarctica Travel Insurance

- Kenya Travel Insurance

- Botswana Travel Insurance

- Tanzania Travel Insurance

- Safari Travel Insurance

- Nationwide Cruise Insurance Review

- Hurricane Travel Insurance

Policy Details

LA Times Compare is committed to helping you compare products and services in a safe and helpful manner. It’s our goal to help you make sound financial decisions and choose financial products with confidence. Although we don’t feature all of the products and services available on the market, we are confident in our ability to sound advice and guidance.

We work to ensure that the information and advice we offer on our website is objective, unbiased, verifiable, easy to understand for all audiences, and free of charge to our users.

We are able to offer this and our services thanks to partners that compensate us. This may affect which products we write about as well as where and how product offers appear on our website – such as the order in which they appear. This does not affect our ability to offer unbiased reviews and information about these products and all partner offers are clearly marked. Given our collaboration with top providers, it’s important to note that our partners are not involved in deciding the order in which brands and products appear. We leave this to our expert freelance writers who review and rate each product independently.

At LA Times Compare, our mission is to help our readers reach their financial goals by making smarter choices. As such, we follow stringent editorial guidelines to ensure we offer accurate, fact-checked and unbiased information that aligns with the needs of the Los Angeles Times audience. Learn how we are compensated by our partners.

Visa Traveler

Exploring the world one country at a time

How to Buy Schengen Travel Insurance from VisitorsCoverage: A Step-by-Step Guide

Updated: September 8, 2023

VisitorsCoverage is a travel medical insurance broker headquartered in the US. They sell insurance for all international travel including US trips and Schengen Visa.

VisitorsCoverage’s Europe Travel Plus meets all the requirements of Schengen visa insurance such as the minimum policy cover, copay and visa letter.

VisitorsCoverage is also the cheapest Schengen travel insurance, costing about $1 per day.

In this article, you will learn how to buy Schengen travel insurance from VisitorsCoverage and how to cancel and get a refund in case of visa refusal.

Table of Contents

Documents needed before starting the purchase.

Keep the following documents handy before you start the purchase.

- Your passport

- Your travel dates

- A credit or debit card

Steps to Buy Schengen Travel Insurance

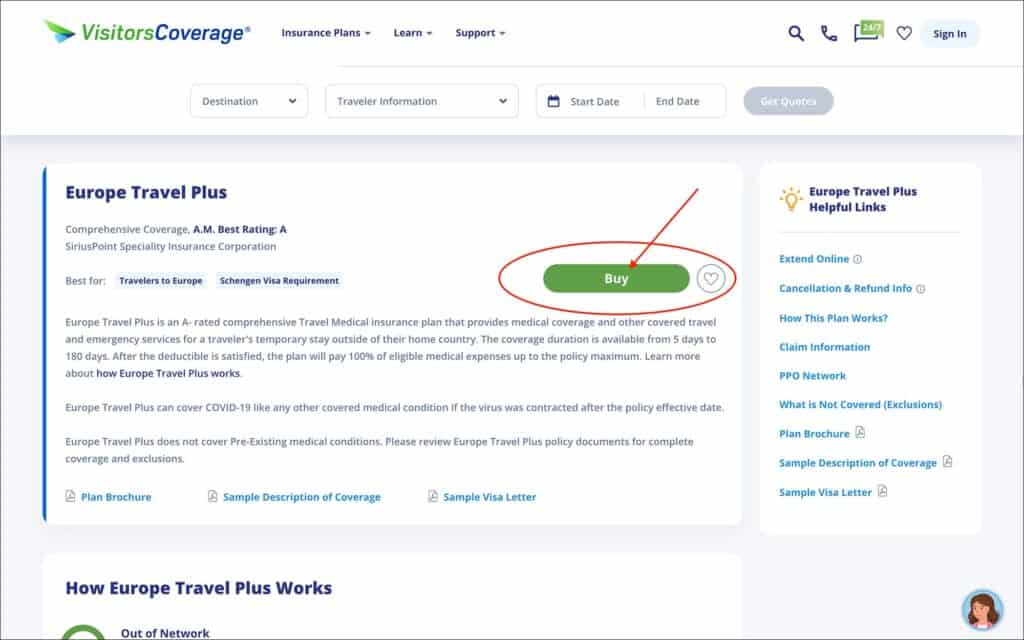

- Go to the VisitorsCoverage Europe Travel Plus page

- Click on the green “Buy” button.

You will be taken to the “Purchase Your Policy” page.

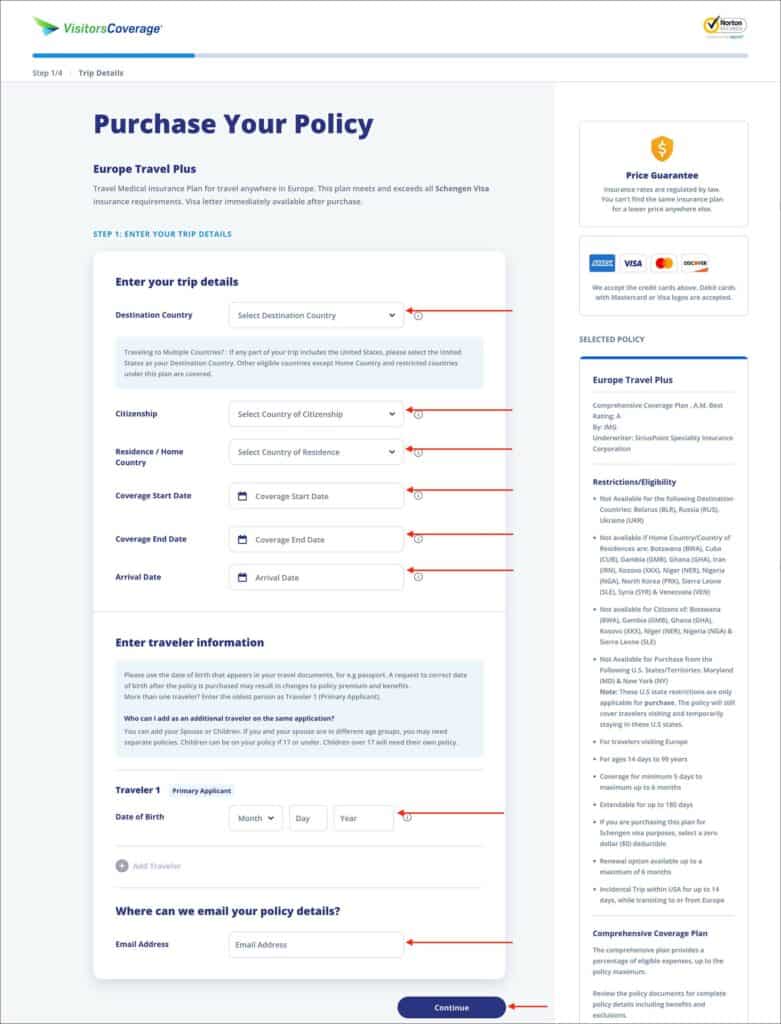

Step 1: Enter Your Trip Details

Enter the following information on the “Purchase Your Policy” page.

Section: Enter your trip details

- Destination Country [ Comment: Select your main Schengen country of application ]

- Citizenship [ Comment: Select your country of citizenship as per your passport ]

- Residence / Home Country [ Comment: Select your country of residence ]

- Coverage Start Date [ Comment: Select the policy start date ]

- Coverage End Date [ Comment: Select the policy end date ]

- Arrival Date [ Comment: Select your trip start date, which can be the same as the coverage start date ]

Destination Country Select the main Schengen country where you will be applying for your visa. For example, if you are applying for a Schengen visa at the France embassy or consulate, select “France” as your destination country.

Section: Enter travel information

- Traveler 1: Date of Birth [ Comment: Enter your date of birth as per your passport ]

Add more travelers and their date of birth by clicking on the + button.

Section: Where can we email your policy details?

- Email Address [ Comment: Enter the email address where you would like to receive your policy documents ]

Click on the blue “Continue” button.

You will be taken to the “Coverage Details” page.

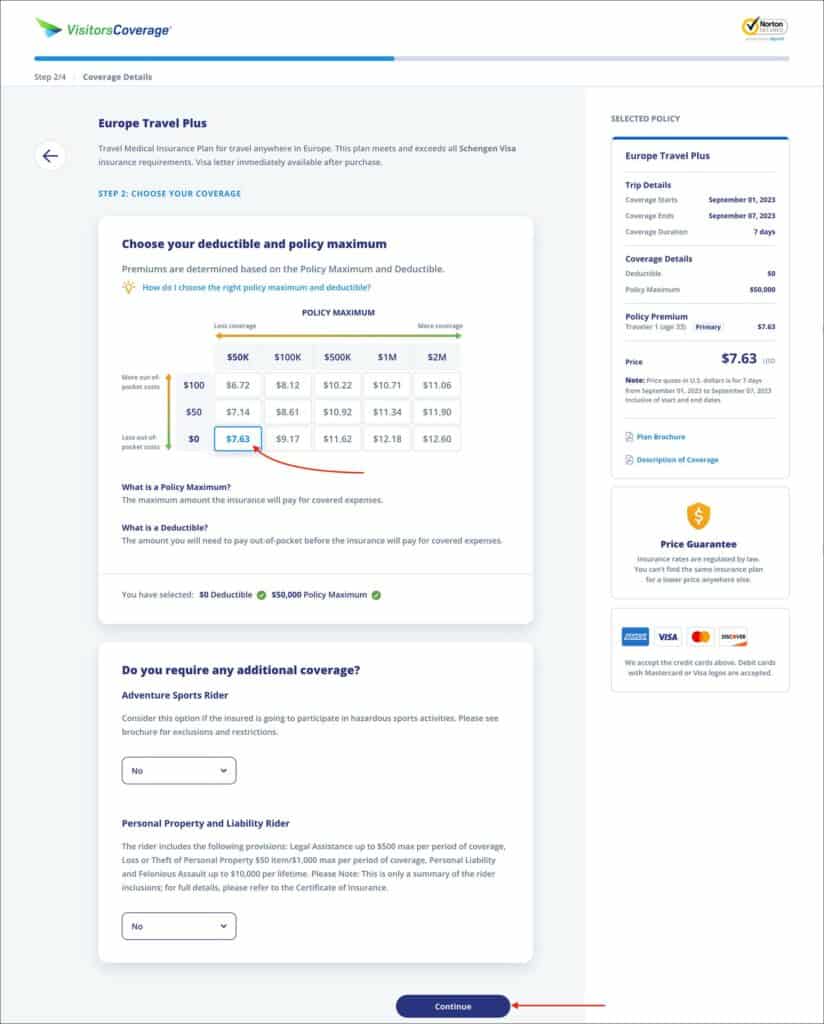

Step 2: Choose Your Coverage

Section: Choose your deductible and policy maximum.

- Deductible [ Comment: Select $0 ]

- Policy Maximum [ Comment: Select at least $50K ]

Deductible A deductible of $0 will be selected by default. Even then, make sure $0 is selected. $0 deductible is the Schengen visa insurance requirement. If you choose a different amount, the insurance will not be accepted for your Schengen visa.

Policy Maximum A policy maximum of $50,000 will be selected by default. You can increase your coverage if you prefer. But $50,000 is the minimum requirement for a Schengen visa.

Section: Do you require any additional coverage?

You can select the below additional coverage if necessary. But these are not required for a Schengen visa.

- Aventure Sports Rider [ Comment: This additional coverage may be beneficial if you plan to engage in adventure sports during your Europe trip ]

- Personal Property and Liability Rider [ Comment: This additional coverage may be beneficial if you prefer to insure your electronics, etc. ]

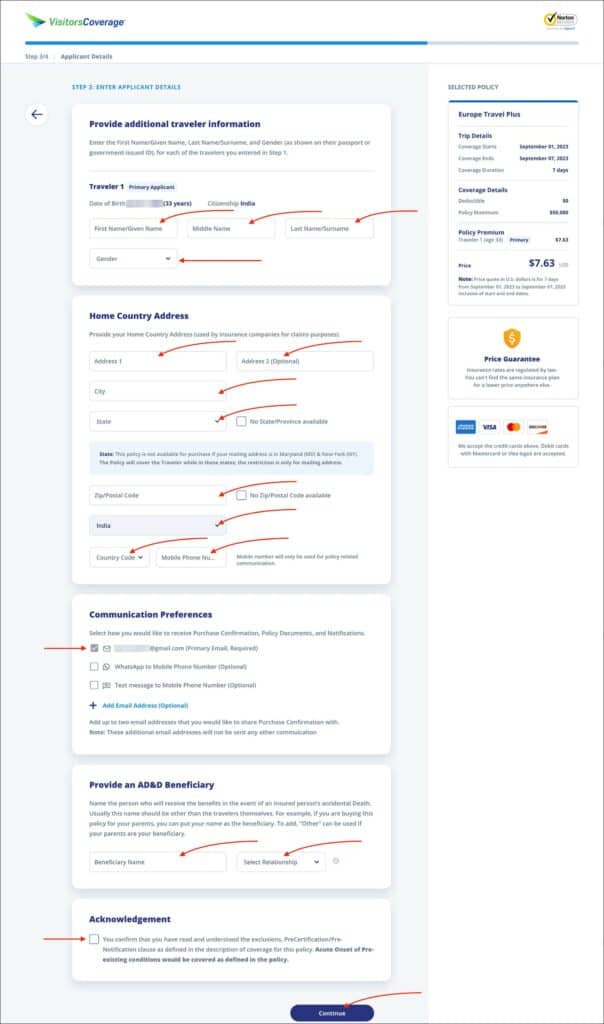

You will be taken to the “Applicant Details” page.

Step 3: Enter Applicant Details

Section: Provide additional travel information

Traveler 1: Primary Applicant

- First Name/Given Name [ Comment: If your passport has a Given Name, enter the given name here. If your passport has a First name, enter your first name here ]

- Middle Name [ Comment: If your passport has a Middle name, then enter the middle name here. Else leave it blank ]

- Last Name/Surname [ Comment: Enter your last name or surname as per your passport ]

- Gender [ Comment: Enter your gender ]

Traveler 2:

If you have more than one traveler in your policy, enter their details.

Section: Home Country Address

Enter your current residential address in the following fields.

- Address 1 [ Comment: Enter address line 1 of your current residential address ]

- Address 2 (optional) [ Comment: Enter Address line 2 of your current residential address ]

- City [ Comment: Enter your city ]

- State [ Comment: Enter your state ]

- Zip/Postal Code [ Comment: Enter your postal code ]

- Country [ Comment: Enter your country ]

Enter your current mobile phone number in the following fields.

- Country Code [ Comment: Enter the country code of your phone number ]

- Mobile Phone Number [ Comment: Enter your mobile phone number ]

Section: Communication Preferences

In this section, select how you would like to receive your purchase confirmation, policy documents and visa letter.

Email is mandatory, but you can also opt for phone or WhatsApp.

Section: Provide an AD&D Beneficiary

Enter the information of the beneficiary who will receive the benefits in case of accidental death of the insured.

- Beneficiary Name [ Comment: Enter the beneficiary’s full name as per their passport or ID card ]

- Relationship [ Comment: Select the relationship of your beneficiary ]

Section: Acknowledgement

Check the box to confirm that you have read and understood the coverage information.

You will be taken to the “Review and Pay” page.

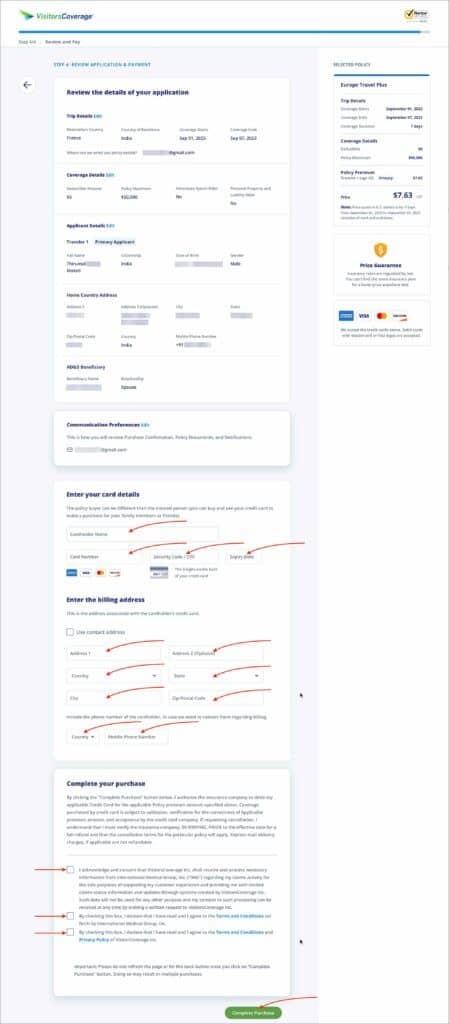

Step 4: Review Application and Payment

Section: Review the details of your application

Review all the information you have entered so far. Make sure the information is as per your passport.

Section : Enter your card details

In this section, enter your card details for payment.

Section : Enter the billing address

In this section, enter the billing address associated with your credit/debit card entered above.

Section : Complete your purchase

In this section, check all three boxes.

Click on the green “Complete your purchase” button.

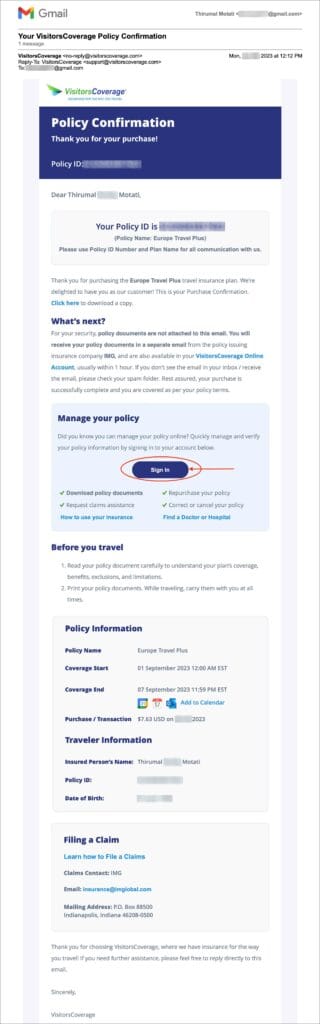

Once your purchase is complete, you will receive an email confirming your purchase.

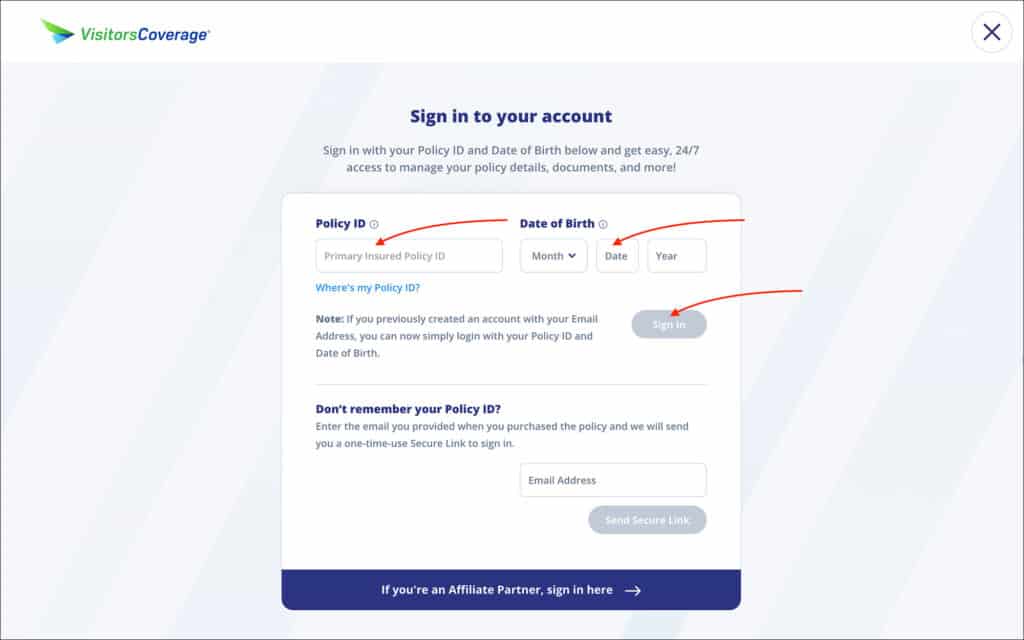

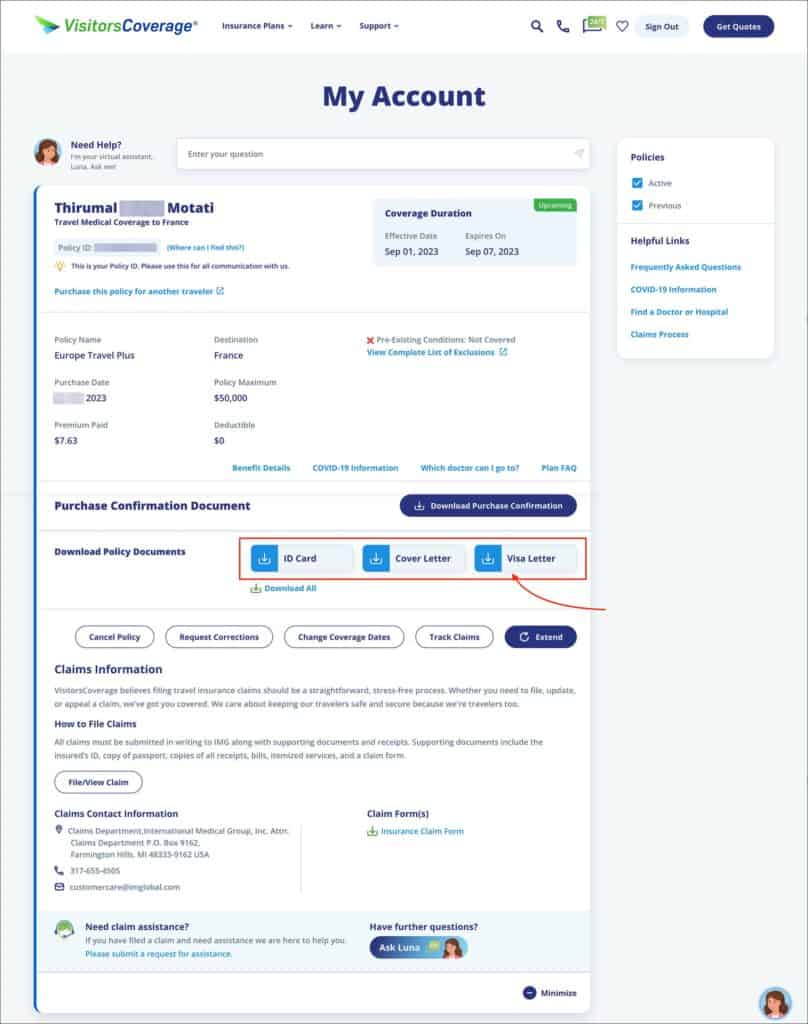

Steps to Download Visa Letter and Coverage Letter

You can download your visa letter and coverage document from the customer portal dashboard. You only need these two documents as proof of travel insurance for Schengen visa .

To go to the customer portal, you can click on the “Sign In” button in the email. Or you can follow the below steps.

Log into Customer Portal

- Go to the VisitorsCoverage Customer Portal page

- Log in using your Policy ID and Date of Birth or using your Email.

Once you log in, you will see your policy details such as the names, policy types, coverage duration, etc.

Download your Visa Letter

In the “Download Policy Documents” section, click on “Visa Letter” to download the visa letter for your Schengen visa.

You can also download the coverage letter from IMG International by clicking the “Cover Letter” button.

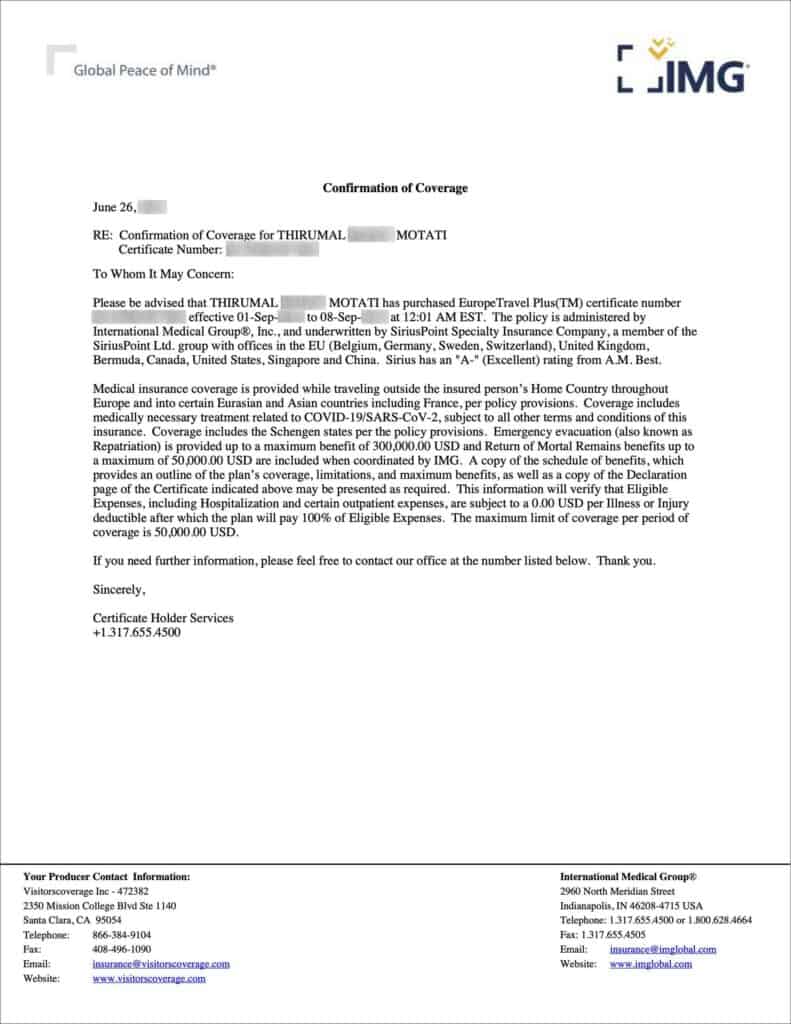

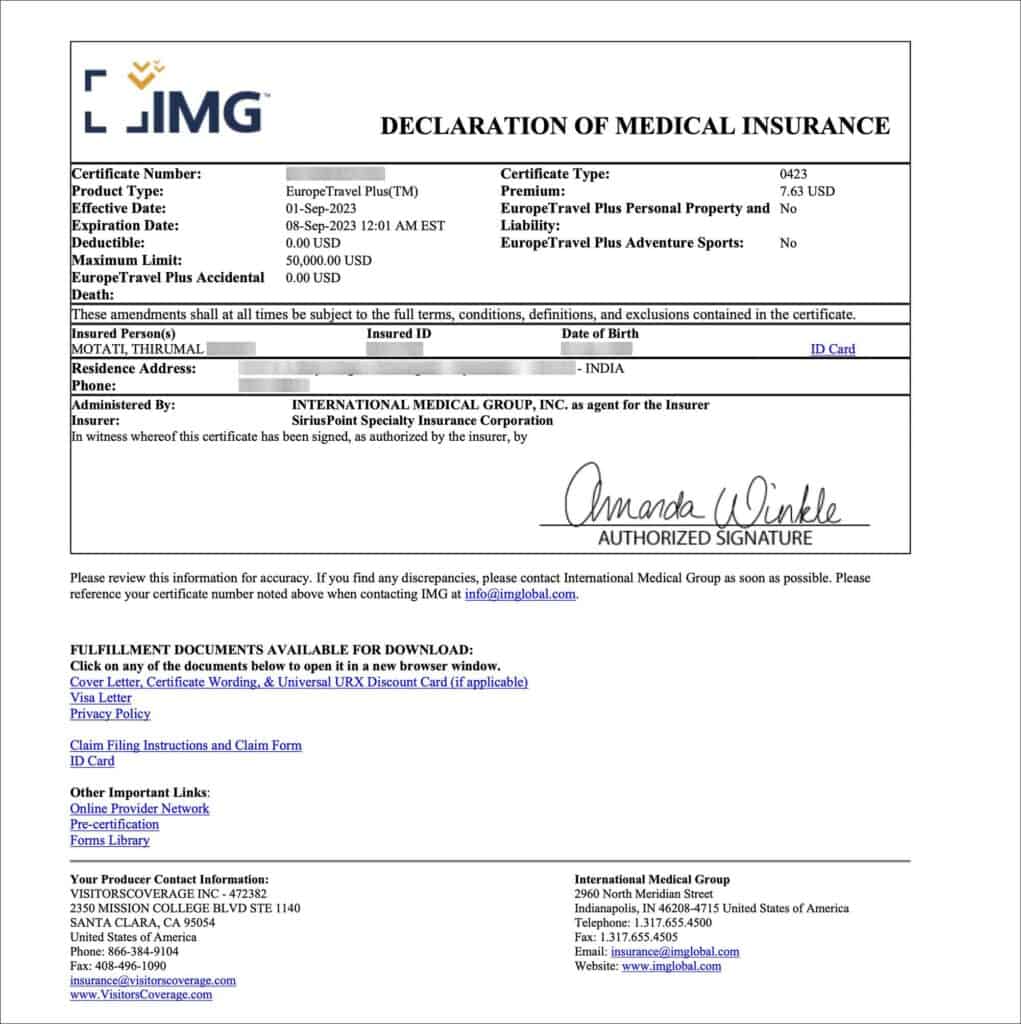

Sample Visa Letter from VisitorsCoverage

Sample Coverage Letter from IMG International

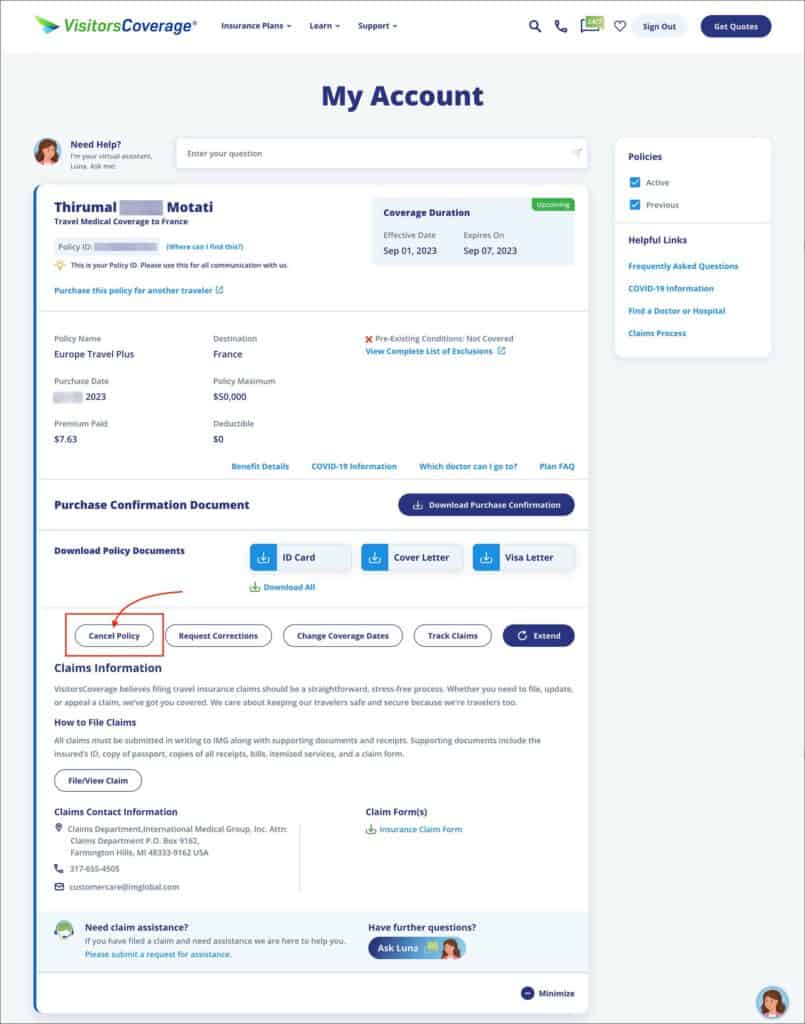

Steps to Cancel Your Policy in Case of Visa Refusal

In order to get a full refund, you must cancel your policy before the insurance start date. If your visa is refused, cancel your policy right away to avoid any issues with your refund.

Follow the below steps to cancel and receive a full refund of your policy.

- Go to VisitorsCoverage Customer Portal

Initiate Policy Cancellation

Within the “My Account” dashboard, click on the “Cancel Policy” button.

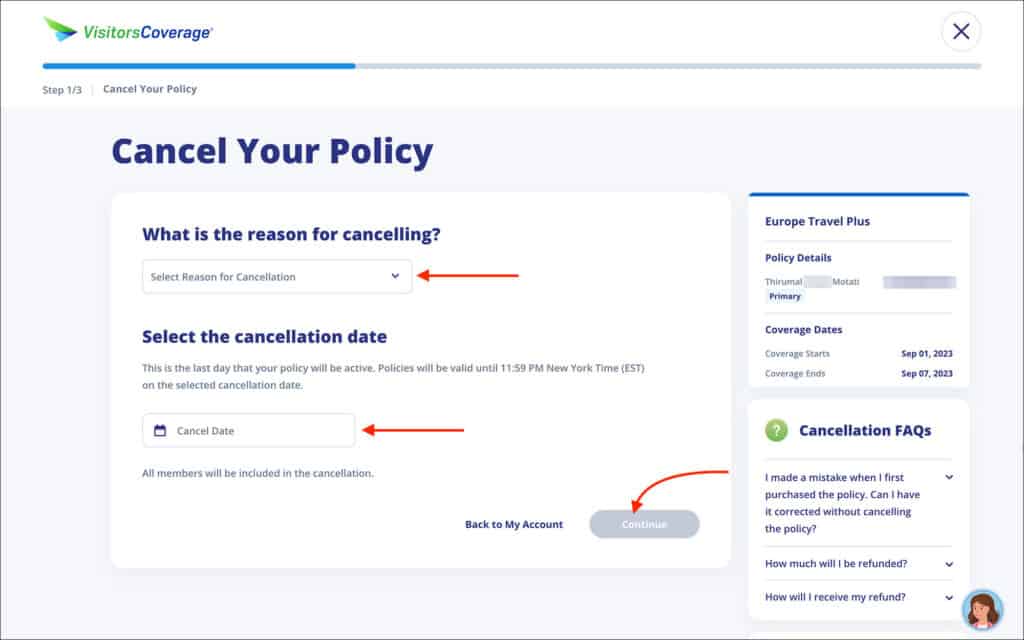

Step 1: Cancel Your Policy

- Travel plans changed

- Found a cheaper plan

- Purchased a wrong policy

- Accidentally submitted incorrect information

- Concerned with Coronavirus

- Select the cancellation date [ Comment: Select the most recent date so you can get your refund as soon as possible ]

You will be taken to the “Verify and Submit” page.

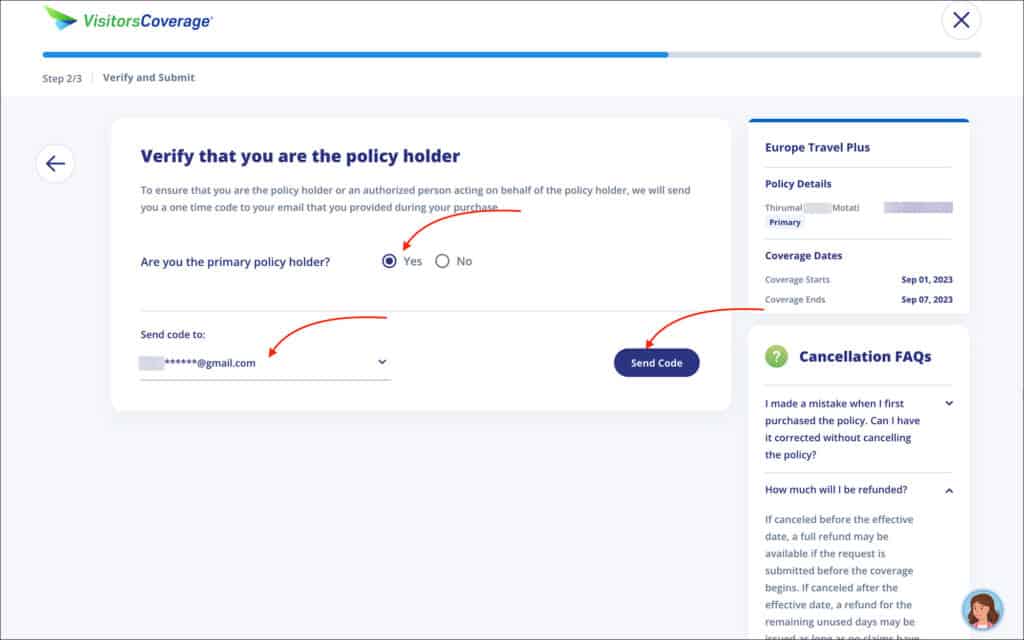

Step 2: Verify and Submit

- Are you the primary policy holder? [ Comment: Select “Yes” ]

- Send code to: [ Comment: Select your email from the dropdown ]

Click on the blue “Send Code” button.

Check your email for the verification code.

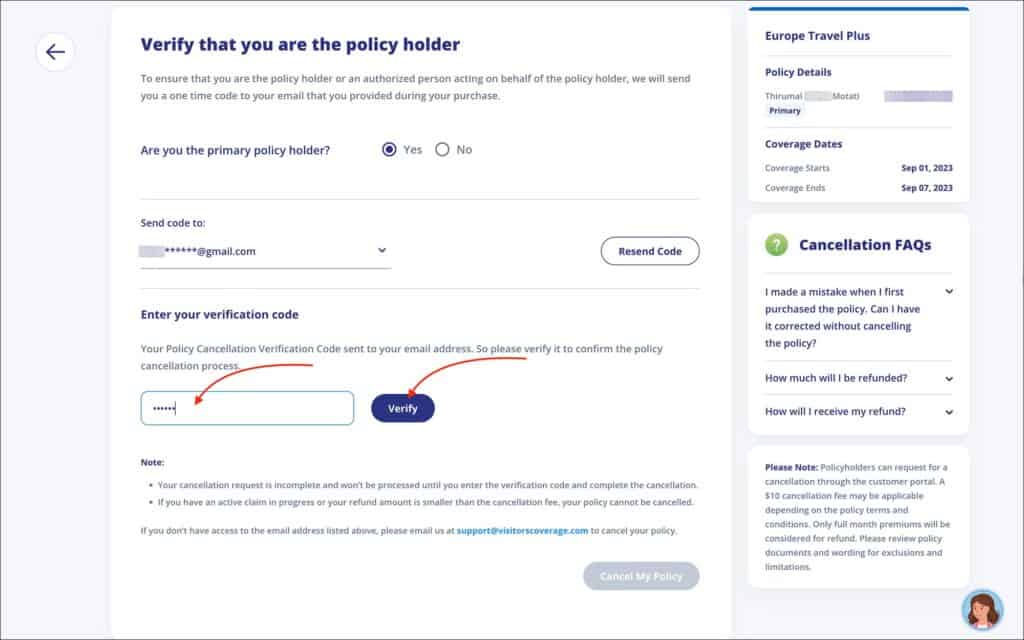

- Enter your verification code [ Comment: Enter the verification code that you received to your email ]

Click on the blue “Verify” button

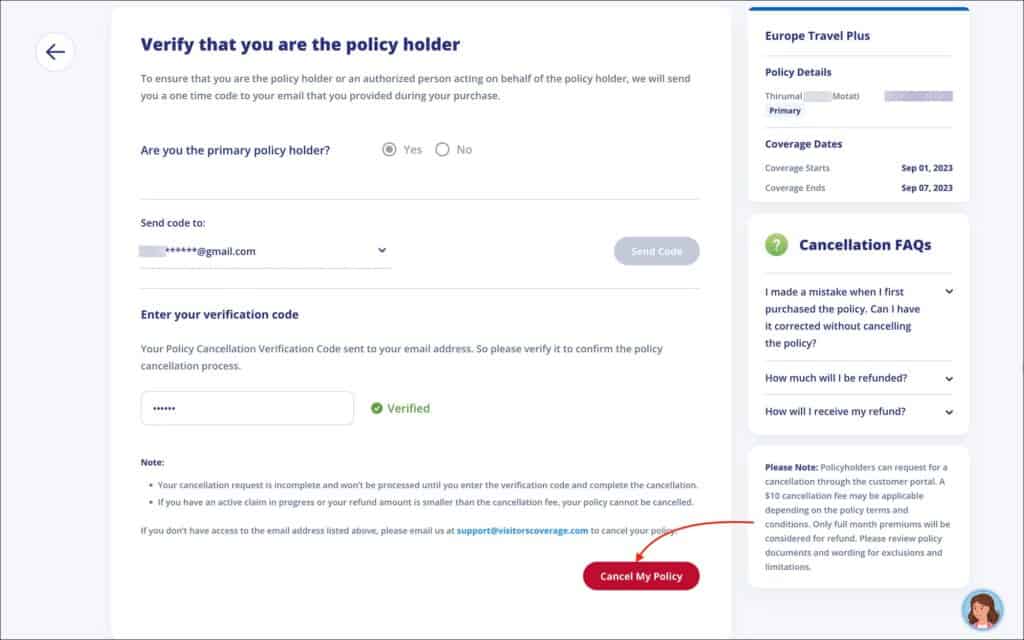

Then click on the red “Cancel My Policy” button.

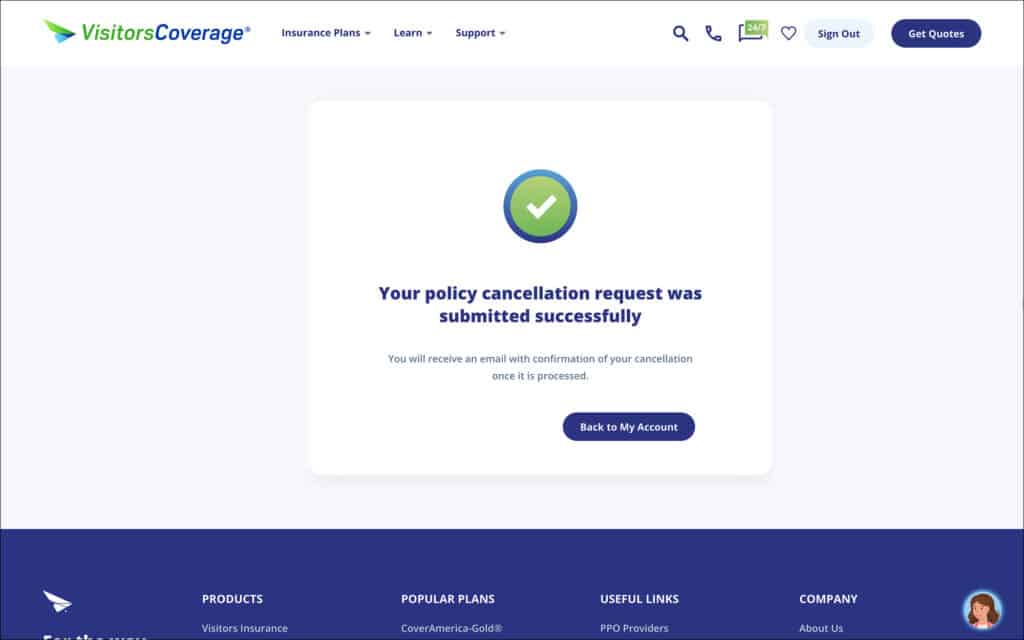

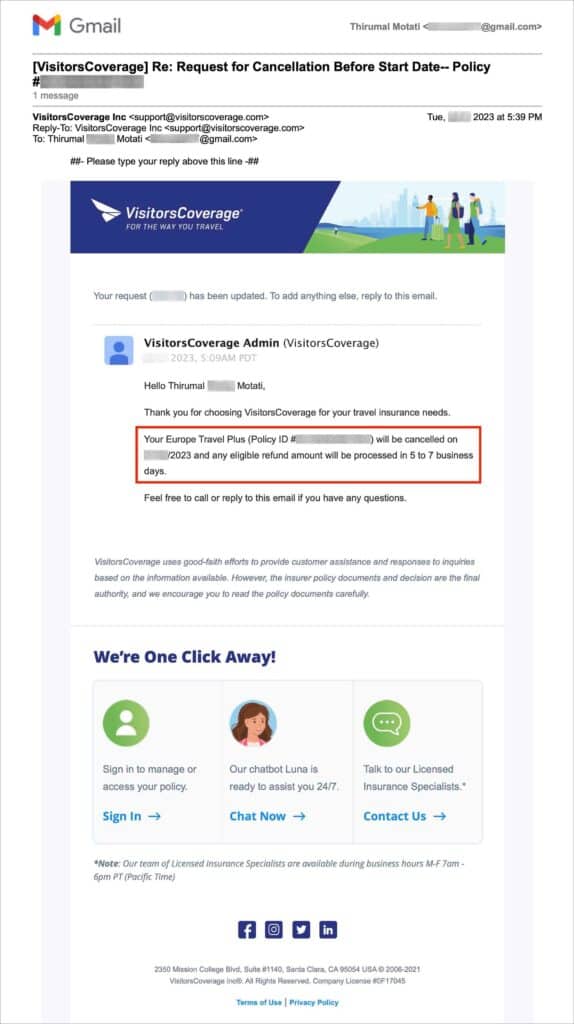

Step 3: Cancellation Success

You will be shown that your policy cancellation request was successfully submitted.

You will also receive emails from VisitorsCoverage and IMG International confirming your cancellation and refund. Save those emails as a reference if you need to contact VisitorsCoverage for any issues with refunds.

WRITTEN BY THIRUMAL MOTATI

Thirumal Motati is an expert in tourist visa matters. He has been traveling the world on tourist visas for more than a decade. With his expertise, he has obtained several tourist visas, including the most strenuous ones such as the US, UK, Canada, and Schengen, some of which were granted multiple times. He has also set foot inside US consulates on numerous occasions. Mr. Motati has uncovered the secrets to successful visa applications. His guidance has enabled countless individuals to obtain their visas and fulfill their travel dreams. His statements have been mentioned in publications like Yahoo, BBC, The Hindu, and Travel Zoo.

PLAN YOUR TRAVEL WITH VISA TRAVELER

I highly recommend using these websites to plan your trip. I use these websites myself to apply for my visas, book my flights and hotels and purchase my travel insurance.

01. Apply for your visa

Get a verifiable flight itinerary for your visa application from DummyTicket247 . DummyTicket247 is a flight search engine to search and book flight itineraries for visas instantly. These flight itineraries are guaranteed to be valid for 2 weeks and work for all visa applications.

02. Book your fight

Find the cheapest flight tickets using Skyscanner . Skyscanner includes all budget airlines and you are guaranteed to find the cheapest flight to your destination.

03. Book your hotel

Book your hotel from Booking.com . Booking.com has pretty much every hotel, hostel and guesthouse from every destination.

04. Get your onward ticket

If traveling on a one-way ticket, use BestOnwardTicket to get proof of onward ticket for just $12, valid for 48 hours.

05. Purchase your insurance

Purchase travel medical insurance for your trip from SafetyWing . Insurance from SafetyWing covers COVID-19 and also comes with a visa letter which you can use for your visas.

Need more? Check out my travel resources page for the best websites to plan your trip.

LEGAL DISCLAIMER We are not affiliated with immigration, embassies or governments of any country. The content in this article is for educational and general informational purposes only, and shall not be understood or construed as, visa, immigration or legal advice. Your use of information provided in this article is solely at your own risk and you expressly agree not to rely upon any information contained in this article as a substitute for professional visa or immigration advice. Under no circumstance shall be held liable or responsible for any errors or omissions in this article or for any damage you may suffer in respect to any actions taken or not taken based on any or all of the information in this article. Please refer to our full disclaimer for further information.

AFFILIATE DISCLOSURE This post may contain affiliate links, which means we may receive a commission, at no extra cost to you, if you make a purchase through a link. Please refer to our full disclosure for further information.

RELATED POSTS

- Cookie Policy

- Copyright Notice

- Privacy Policy

- Terms of Use

- Flight Itinerary

- Hotel Reservation

- Travel Insurance

- Onward Ticket

- Testimonials

Search this site

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Review

- Best Car Buying Apps

- Best Sites To Sell a Car

- CarMax Review

- Carvana Review (July 2024)

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best Accounting Software

- Best Receipt Scanner Apps

- Best Free Accounting Software

- Best Online Bookkeeping Services

- Best Mileage Tracker Apps

- Best Business Expense Tracker Apps

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best SEO Services

- Best Mass Texting Services

- Best Email Marketing Software

- Best SEO Software

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Free Time Tracking Apps

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- Best Home Appliance Insurance

- American Home Shield Review

- Liberty Home Guard Review

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Brands

- Cheap Window Replacement

- Window Replacement Cost

- Best Gutter Guards

- Gutter Installation Costs

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Texas Electricity Companies

- Texas Electricity Rates

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Compare Car Insurance Quotes

- Best Car Insurance for New Drivers

- Best Pet Insurance

- Cheapest Pet Insurance

- Pet Insurance Cost

- Pet Insurance in Texas

- Pet Wellness Plans

- Is Pet Insurance Worth It?

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

- Cheapest Homeowners Insurance

- Cheapest Renters Insurance

- Travel Medical Insurance

MarketWatch Guides is a reviews and recommendations team, independent of the MarketWatch newsroom. We might earn a commission from links in this content. Learn More

Guide to Schengen Visa Travel Insurance (2024 )

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Sabrina Lopez is a senior editor with over seven years of experience writing and editing digital content with a particular focus on home services, home products and personal finance. When she’s not working, Sabrina enjoys creative writing and spending time with her family and their two parrots.

Here’s a breakdown of how we reviewed and rated the best travel insurance companies

Is Insurance Required for a Schengen Visa?

With a few exceptions, travelers from the U.S. do not need a visa for the Schengen area if staying for 90 days or less. Americans visiting for over three months, permanent residents without citizenship and foreign nationals traveling from the U.S. will need a Schengen visa if they are citizens of a country without a visa-free arrangement with Schengen countries.

The countries in the Schengen area are: Austria , Belgium, Croatia, Czech Republic, Denmark , Estonia, Finland, France , Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovenia, Slovakia, Spain, Sweden and Switzerland. Bulgaria, Cyprus, Ireland and Romania are currently not Schengen countries.

Travelers from the U.S., Canada , and other visa-exempt countries only have to go through immigration and customs in the first country they visit in the Schengen zone. After that, they can travel to any other nation in the alliance without taking out their passport. For instance, you can fly, drive or take a train from Sweden all the way to Spain on the same visa.

Citizens from visa-exempt countries like the U.S. don’t need a visa or travel insurance to visit Europe. However, because of the high price of healthcare in Europe, travel insurance is still a good idea for visa-free travelers. But note that if you have to visit with a Schengen visa, you need to meet specific health insurance mandates.

Schengen visa holders must have comprehensive health insurance coverage. It should last for the length of their stay in the area (but does not need to cover the duration of the visa).

When you apply for a Schengen visa at the consulate or embassy of the country you plan to visit first or spend most of your time in, they will explain the specifics of the travel insurance requirements. You will need proof of a travel insurance plan for visa approval.

Schengen Visa Insurance Requirements

Schengen visa applicants need travel medical insurance . However, the policy must have specific features and minimum limits for medical coverage and medical evacuation.

Here is a closer look at the requirements for Schengen visa eligibility.

- Medical emergency insurance

- Repatriation coverage for death

- Medical evacuation insurance if you need long-term care in your home country

- Coverage limits of at least €30,000 (US$32,000)

- Coverage lasting for the entire length of your stay in the Schengen area

The purpose of these requirements is to ensure you can pay for medical treatment without requiring assistance from your host country’s healthcare system.

You need a document from your travel insurance company as proof that you have a visa-compliant policy. This insurance certificate shows that you have met the minimum requirements. It is a vital part of your visa application, and you won’t gain approval without it.

Types of Travel Insurance Policies

Schengen visa insurance plans focus on medical expenses, but travel policies can also offer other protections. Comprehensive travel insurance covers additional risks, including those related to cancellations and delays.

Here is a look at the different travel insurance coverages.

- Medical, evacuation and repatriation coverage is required for visa approval.

- Trip cancellation insurance provides reimbursement if your trip gets canceled due to covered reasons, such as an unexpected illness or injury or a crisis or disaster in your European destination.

- Trip delay and interruption coverages pay for expenses related to delays or incidents that cancel your journey earlier than planned.

- Baggage delay or loss reimburses you for missing items so that you can replace necessities and continue your travels.

- Add-ons to standard policies may include rental car insurance, pre-existing condition coverage and insurance for exclusions from standard insurance like scuba diving or climbing.

Schengen visa applicants can purchase travel insurance with comprehensive coverage to protect the non-medical aspects of their trip. International travel can be expensive, so cancellation insurance and other protections available through a complete travel policy can save you from frustration and financial loss.

Which Insurance Provider is Best for Schengen Visa?

Use the table below to compare the top recommended choice for travel insurance for a Schengen visa.

- Travelex offers budget and mid-range plans for international travelers. You can opt for both medical and trip cancellation coverage.

- Trawick International travel insurance offers stand-alone medical and cancellation policies, so you can opt for minimum requirements for your Schengen visa if you wish.

- AIG Travel Guard offers several tiers of travel insurance, all of which offer comprehensive coverage and provide optional add-ons.

- Seven Corners has customizable travel plans that include medical emergency, evacuation, and repatriation coverage necessary for a Schengen visa

- IMG offers stand-alone medical insurance policies and separate plans providing cancellation, lost baggage and delay benefits.

Choosing the Right Schengen Visa Insurance

There are several factors to consider when selecting travel insurance.

- Coverage limits are the maximums that the insurer will pay for each claim type. Schengen visas require €30,000 (about $32,800) in medical emergency, evacuation, and repatriation insurance, but you can get a policy with higher limits if you wish.

- Pre-existing conditions are another important factor. Insurers may or may not cover them on a standard policy, but those that do not provide coverage directly may sell waivers that add coverage for your conditions.

- Deductibles are another factor to consider. This amount is an out-of-pocket payment you have to make before the insurer takes over payment. Some low-cost policies have high deductibles.

Finally, you should always get insurance with a reputable company that can provide the necessary documentation for your visa application.

Applying for Schengen Visa with Travel Insurance

You apply for a Schengen visa at the consulate or embassy of the country you intend to travel to first or spend most of your time during your stay.

You must purchase a policy that covers the entire duration of your stay and is valid throughout the Schengen area, not just in the countries you plan to visit.

You need proof of insurance to include with the rest of application documents when applying for the visa. This means you need to purchase the insurance before submitting your application. You should only choose insurance companies able to provide the necessary documentation to include with your application.

Additional Expert Tips

There are some other considerations for Schengen visa insurance.

First, you should make copies of your insurance card, policy documents and other information and bring them with you on your trip.

Second, regulations require that you have coverage for the entire duration of your stay. If you have a multi-trip visa, you will need insurance that provides benefits for the entire stay. The best option in these cases is to get an annual or multi-trip policy that meets visa requirements for coverage types and limits.

Before leaving, you should perform a thorough policy review to ensure you have the appropriate coverage. You can consider the potential costs of medical care in your host countries and decide if the coverage you have is sufficient.

Frequently Asked Questions About Schengen Visa Insurance

Do you need travel insurance to visit schengen countries.

Travelers from visa-exempt countries can visit Europe without insurance, though they would not be protected from medical expenses or cancellations. However, those requiring a Schengen visa need €30,000 worth of medical coverage for approval.

Is Schengen travel insurance refundable?

You would be able to cancel your insurance if your visa application is not approved. Most companies will allow you to cancel the policy and get a full refund if you show evidence that your visa application was not approved.

Does travel insurance cover all of Europe?

Travel insurance for a Schengen visa must cover all 27 countries. However, some travel insurers may require that you specify all the countries you plan to visit to get comprehensive coverage.

What are the benefits of Schengen visa insurance?

In addition to being a requirement for the visa application process, Schengen insurance will cover medical costs if you get sick or suffer an injury during your Europe travel experiences. While travel health insurance is the only necessary policy component for the visa application, you can get additional benefits by purchasing a comprehensive policy.

If you have feedback or questions about this article, please email the MarketWatch Guides team at editors@marketwatchguides. com .

MarketWatch Guides may receive compensation from companies that appear on this page. The compensation may impact how, where and in what order products appear, but it does not influence the recommendations the editorial team provides. Not all companies, products, or offers were reviewed.

How To Find Cheap Travel Insurance for Your Next Trip | Money

Travel insurance can cover your medical bills if you experience an injury or illness during your holiday. Depending on the policy you select, the best travel insurance policies can also cover trip interruption, lost baggage, rental car damage and emergency evacuations.

If you’ve invested a good deal of money on pre-paid, non-refundable travel expenses or are planning an extended vacation, you don’t want to leave on a trip without protecting yourself from the unforeseen. But you also don’t want to overpay for that sense of security.

Read on to learn how to find cheap travel insurance for your next trip and get tips on buying the right coverage to meet your needs.

How much does travel insurance cost?

The cost of travel insurance varies significantly. According to the U.S. Travel Insurance Association, you can expect to pay between 4% and 8% of your total trip cost on a travel insurance policy. The exact price will depend on the trip’s length, your age and the coverage amount you select, among other factors.

For example, if your trip costs $5,000, you’ll pay between $200 and $400 for travel insurance. However, if you’re older or planning to be out of the country for a prolonged period, you can expect your insurance premium to reflect those risks.

You may also pay more or less depending on the type of coverage you purchase. For instance, a policy with trip cancellation and medical evacuation coverage will likely cost more than one that provides travel medical benefits only.

What is considered cheap for travel insurance?

Your definition of affordability may be very different from that of other travelers. So, if you want to find the least expensive travel insurance option, there’s no getting around comparison shopping. Cheap travel insurance can be any policy that affords the coverage you need at a lower price point than other options.

Say you’re traveling with professional equipment like cameras. Purchasing a medical-only travel insurance policy could be more affordable than buying one that provides generous coverage for baggage loss and personal effects. However, going for the cheaper option may result in higher out-of-pocket costs if your bags are lost or stolen.

How to find cheap travel insurance for an upcoming trip

Finding the most affordable travel insurance will require some legwork. Here are some tips to make your search easier.

1. Only purchase the travel insurance coverage you need

Buying more insurance coverage than you need will increase your expenses. With that in mind, it’s best to start by understanding what travel insurance covers and then defining your needs.

Most travel insurers offer different plan tiers with various levels of coverage. Plans that cover more scenarios and offer higher coverage limits will cost more. Purchasing add-ons like rental car coverage will further increase the cost of your policy.

So, for example, you probably don’t need a policy that covers baggage delay or flight cancellation if you’re driving over the border into Canada. Instead, you can save money by selecting a more basic plan offering only emergency medical and personal effects coverage.

Similarly, paying for an annual travel insurance policy doesn’t make sense if you only leave the country once or twice a year for a couple of days each time. It might sound like a good idea because these plans often offer cheaper medical travel insurance coverage per trip, but they will cost more if you don’t travel frequently enough to make them worthwhile.

2. Choose the right type of policy for your trip

If you purchase travel insurance, make sure to select a plan that covers the risks you’re likely to face during your trip. For instance, you might go with a policy that covers missed connections and trip delays if your travel plans are complicated and involve numerous stops.

Similarly, if you’re participating in high-risk activities such as rock climbing or scuba diving, look for a policy that covers these, as not all plans do. And if you are taking a cruise, a cruise travel insurance policy can cover risks unique to this form of travel, such as medical emergencies that necessitate an airlift to an on-shore medical facility.

3. Check whether you already have some form of rental car coverage

You’ll need rental car insurance if you’re renting a car during your travels. Depending on your destination, you may already be covered under your car insurance policy. That could be the case if you’re traveling to Canada in a rental vehicle, for example. However, if you’re traveling to Mexico, you’ll need a separate policy.

Similarly, your car insurance policy from back home typically won’t cover you overseas. In that case, you can purchase insurance from a rental car company at your destination or check whether your credit card offers such protection. Many of the best travel credit cards include rental car coverage. If your card does, check whether that coverage is primary or secondary. Secondary coverage applies after you’ve exceeded the limits of any other applicable insurance policies.

With this in mind, you may not need to purchase rental car coverage from your travel insurance company. If your travel insurer offers you a better deal on a collision damage waiver — which is what travel insurers generally offer — call your rental car company first to see if it accepts this form of coverage, as some companies do not.

4. Check your credit card for travel protection benefits

Your credit card may also offer travel protection benefits beyond rental car coverage. Depending on your credit card, you could receive reimbursement for baggage loss and delays, trip interruptions and cancellations, and travel accidents. Some cards also provide emergency medical, dental, and even medical evacuation coverage.

However, every card is different, so contact your credit card issuer to learn what it covers and whether limits and restrictions apply (and they generally do). For example, only trips you purchased with the card would be covered, and you may be required to meet a deductible before coverage kicks in.

Just as with a travel insurance policy, you’ll have to cover any expenses out of pocket and then submit a claim for reimbursement. You’ll also be required to provide documentation to support your claim, such as medical bills. So, whether you purchase travel insurance or rely on your credit card’s travel benefits, always budget for contingencies.

5. Consider purchasing group coverage

Not all companies offering group travel insurance policies consider the travelers’ ages when pricing these plans. That means group coverage may be more affordable than buying individual policies for each group member. If you’re traveling with family, friends or colleagues, shop for group travel insurance instead.

Just keep in mind that group policies aren’t as customizable and coverage limits may be lower than what you need.

6. Comparison shop

We really can’t stress this enough, but comparison shopping is the best way to get a good deal on any kind of insurance, even travel insurance. If you don’t have time to do the legwork yourself, a travel insurance marketplace can help you quickly compare options from various insurers in a single place. It can also give you a better idea of how much travel insurance will cost you .

One possible drawback of doing business with an insurance marketplace is that they don’t partner with all providers, so you could be missing out on a good deal from a carrier the comparison site doesn’t do business with.

Is cheap travel insurance good?

Whether an affordable insurance policy is adequate will depend on what it includes and the specifics of your trip. If you’re flying to multiple countries, a cheap policy that doesn’t cover flight interruption may not suffice. However, that policy may suffice if you drive over the border for a few days and only require basic emergency medical coverage.

A cheap policy that covers all of your main risks is better for you than an expensive plan that doesn’t, so it all comes down to the coverages you need to best protect yourself. When searching for a policy, consider where you’re going, what you’ll be doing and how long you’ll be gone.

Summary of Money’s guide to finding cheap travel insurance for your next trip

Planning a trip takes time, and finding the ideal travel insurance policy will add to your workload. However, travel insurance can give you great peace of mind during your travels by helping you protect your savings. Moreover, affordable options exist.

To save even more on travel insurance, define your coverage needs, check whether you already have other forms of insurance or travel benefits that can protect any aspects of your trip and comparison shop.

© Copyright 2023 Money Group, LLC . All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer .

GET A QUOTE

What is the minimum coverage required for a Schengen Visa?