- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Use an American Airlines Flight Credit

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

How to use a flight credit on American Airlines

How to use a trip credit on american airlines, 4 steps to book a flight with american airlines flight credit, 4 steps to book a flight with american airlines trip credit, final thoughts on american airlines flight credits and trip credits.

If you've previously canceled an American Airlines flight, you may be wondering how to use American Airlines flight credits or how to use American airlines trip credits. The good news is that redeeming flight credits and trip credits to book American Airlines flights is quick and easy.

Before learning more about each, including how to redeem these American Airlines credits, you’ll want to understand how flight credits and trip credits are earned and how these travel credits function.

Here's a look at how to use an American Airlines flight credit.

» Learn more: The best airline credit cards right now

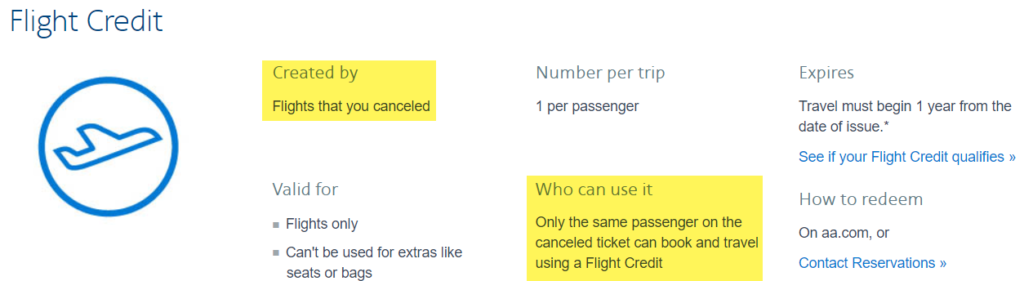

American Airlines issues flight credit for unused or canceled tickets. This type of compensation is different from trip credits because flight credits can generally be used for the passenger whose name was on the original ticket only.

Here's what you need to know about flight credits:

You can use these credits for flights only.

Flight credits can't be redeemed for extras like seats or bags.

Flight credit is valid for one year from the issue date unless otherwise noted.

You can use one flight credit per passenger when booking at AA.com (contact American Airlines to book with more than one flight credit).

Only the same passenger named on the flight credit can book and travel.

American Airlines issues trip credit as compensation, refunds and for the remaining value of flight credit exchanges.

Here's what you need to know about trip credits:

Trip credit is valid for non-award bookings.

You can use trip credit for domestic or international flights originating in the U.S.

These credits can't be redeemed for extras like seats or bags.

Trip credit is valid for one year from the issue date.

You can use eight trip credits in a single passenger reservation when booking at AA.com (contact American Airlines to book more than one passenger).

The trip credit recipient can use their credit to book and pay for travel for themselves or others.

» Learn more: Complete guide to American Airlines elite status

Where can you see your flight credit or trip credit balance?

American Airlines will send an email with flight credit and trip credit information directly to travelers. You can go back to the email to review your credit details.

You can also review your credit details another way.

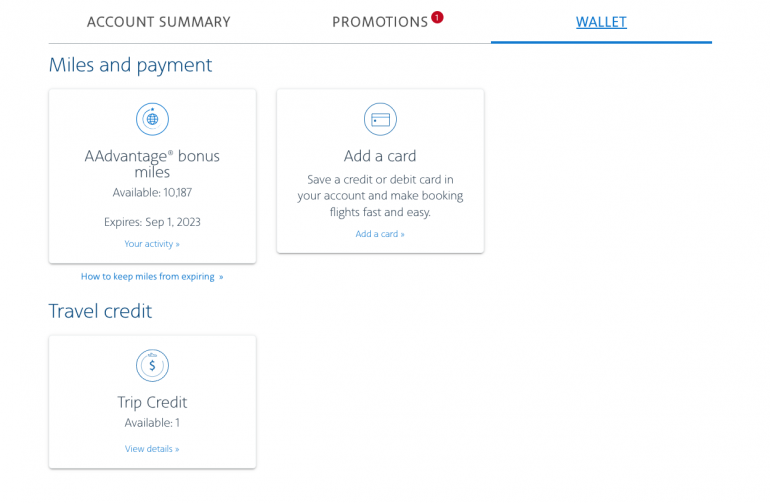

If you're an AAdvantage member, you can log in to your account and check any credits by clicking on your "Wallet." If you have active credits, they will be listed here.

How long are American Airlines flight credits and trip credits good for?

Most American Airlines travel credits are valid for one year from the issue date unless otherwise noted.

Special rules for eligible flight credits: If you're an AAdvantage member and have an original ticket issued from Jan. 1, 2020, to Dec. 31, 2021, the value of your unused ticket can be used by Sept. 30, 2022, for travel through Dec. 31, 2022.

What can I do if my flight credit or trip credit expired?

Make sure you check your flight credit and trip credit expiration dates. American Airlines won't make exceptions if your credit expires.

Here is a breakdown of what the airline's terms and conditions state about credit expirations:

American Airlines won't reissue trip credits past the expiration date and are not responsible for honoring invalid or expired trip credit.

American Airlines won't extend or reissue flight credits past the expiration date, and expired flight credits will not be honored.

» Learn more: Everything you need to know about the American Airlines AAdvantage program

Here is how to use American Airlines flight credit:

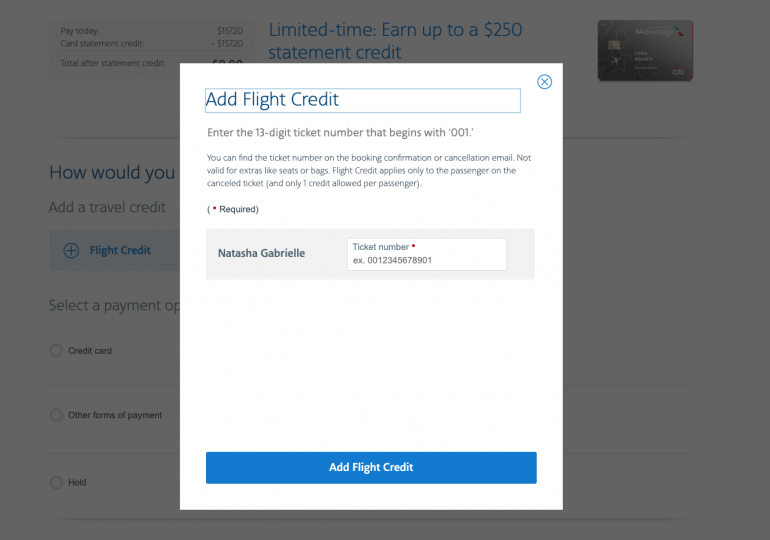

1. Have your flight credit details ready

You can find your flight credit ticket number in the email from American Airlines or by logging into your AAdvantage account and going to your wallet.

2. Browse and select flights

Search for and find your desired flights.

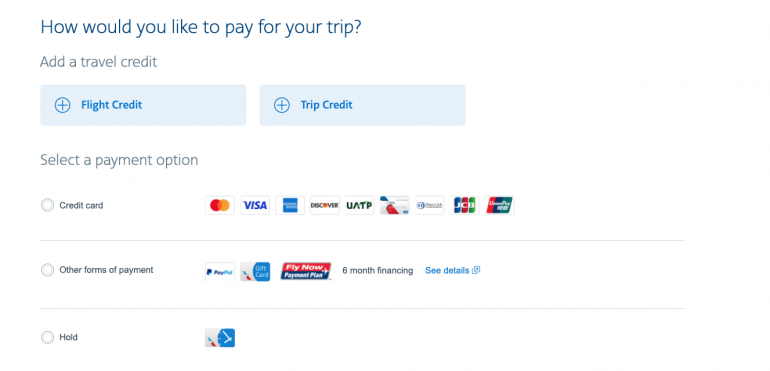

3. Click “+ Flight Credit” to apply your flight credit before checking out

After confirming your flight details, passenger details and selecting your seats, you'll see an option to add a flight credit before finalizing the payment and checkout process.

4. Finish the booking and checkout process

Once you apply your flight credit, you can complete the checkout process.

If you don't have enough credit to cover the cost of your flight, you'll choose a payment method to pay the difference.

If the ticket price is less than the value of your flight credit, you will receive the remaining credit balance issued as a credit to use for future travel.

The process of using an American Airlines trip credit is similar:

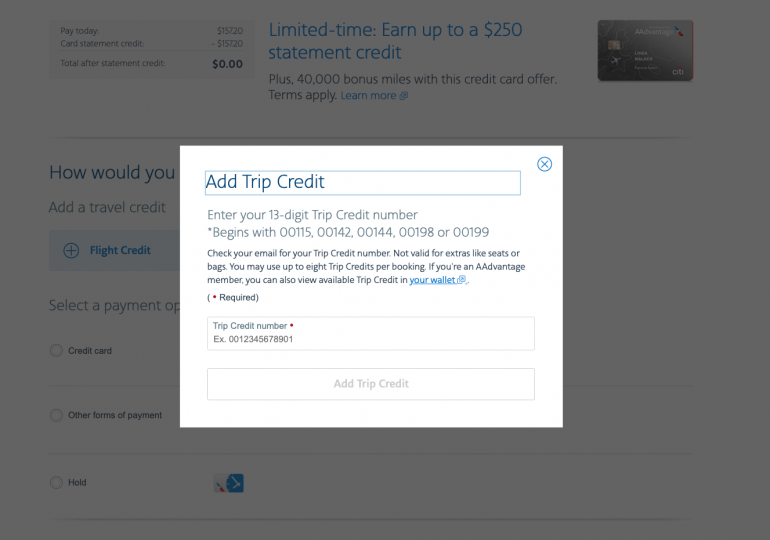

1. Have your trip credit details ready

You can locate your trip credit number in your email from American Airlines or in the wallet section of your AAdvantage member account.

2. Browse and select your flights

Search for and find the flights that you want to book.

3. Click “+ Trip Credit” to apply your trip credit before checking out

Once you confirm flight details, passenger details and select your seats, you'll be able to add a trip credit before finalizing the payment and checkout process.

Once you add your trip credit and see that it has been applied, you can continue through the checkout process.

If you don't have enough credit to cover the cost of your ticket, you'll choose a payment method to pay the difference.

If the ticket price is less than the value of your trip credit, you will receive the remaining value issued as a credit, which you can use for future trips.

American Airlines makes it easy to redeem travel credits when booking flights on their website. Now that you know how to use a flight credit and how to use a trip credit on American Airlines, you can put any remaining credits to use. Just make sure to keep on top of travel credit expiration dates so your credits don't go unused.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

IHG One Rewards Premier Credit Card

Earn 5 free nights at an IHG property after $4k in spend (each night valued at up to 60k points).

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

This trick can make American flight credits a whole lot more valuable

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

The coronavirus pandemic has reshaped U.S. airlines into more customer-friendly entities with generous change and cancellation policies . You can freely book speculative flights and not worry about losing your money if your plans change. This week American Airlines , Delta, United and Alaska announced that they’ve eliminated change fees forever . It’s a delight.

There are a few catches, however — the hardest to swallow is that these carriers won’t actually refund your money to your credit card when you make a cancellation (unless you bought a laughably expensive refundable ticket). American Airlines is the worst offender, as the flight credits they issue are quite restrictive. It’s still worlds better than their policies pre-COVID, but limiting enough to still make you think long and hard before booking a flight.

There’s actually a workaround to make your American Airlines flight credits more versatile. I’ll explain one big hindrance of American’s flight credit policy, and show you how to get around it.

American Airlines flight credit restrictions

When you cancel an American Airlines ticket, the airline will deposit flight credit into the accounts of each would-be traveler. It doesn’t matter who bought the tickets.

For example, if you purchased tickets for your family of five to visit Disney World and had to cancel it, the money you spent will be deposited into five different accounts. If you and your partner want to take a weekend vacation to Cancun without the kids, you can only use 2/5 of the money you spent.

RELATED: The Best American Airlines credit cards

I recently purchased two business class flights for my wife and myself for $458 each. When I canceled these tickets, American Airlines deposited $458 in credit into my account, and $458 in credit into my wife’s account. Again, the credits are not refunded to the actual purchaser of the ticket. If I wanted to use part of my $458 flight credit to book a flight for my wife, I can’t do it. My $458 credit can only be used by me, and her credit can only be used by her — even though I bought them both. That stinks.

The workaround

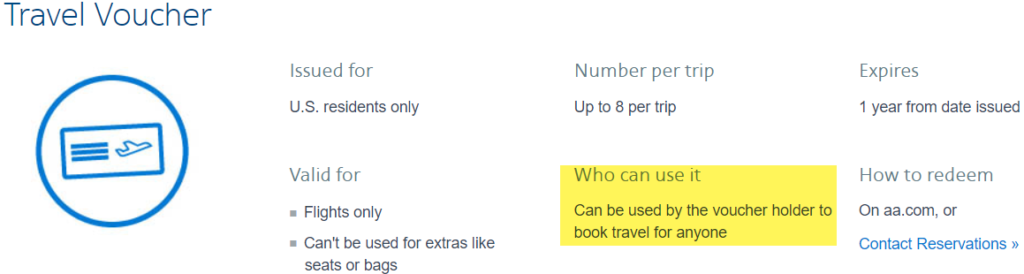

It’s not ideal, but there is a way to shatter the restrictions on these credits. It revolves around the difference between an American Airlines flight credit and an eVoucher .

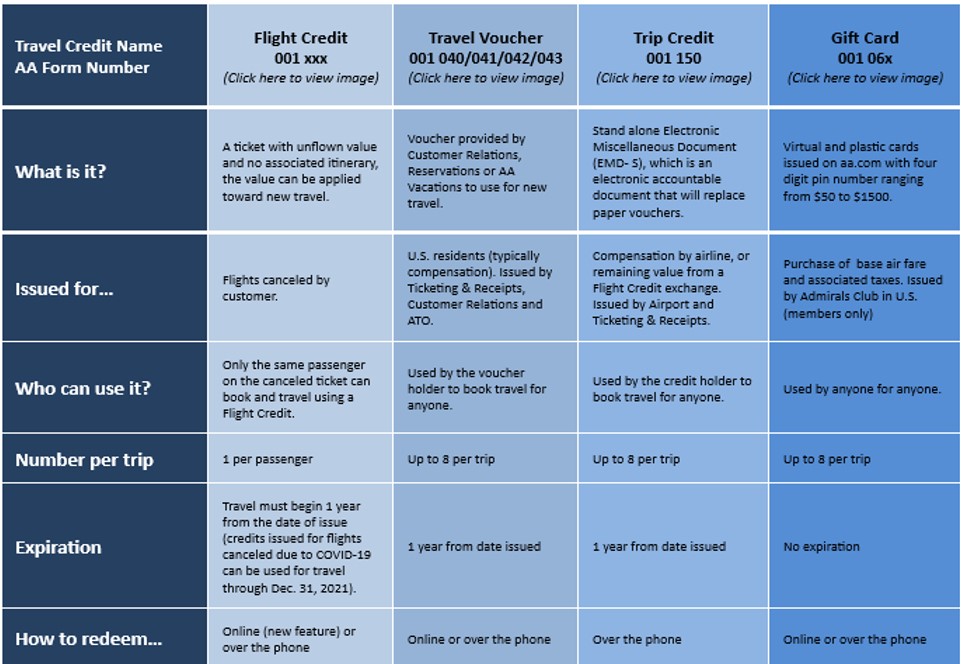

Here are the details of a flight credit:

And here are the details of an eVoucher:

The secret : When you book a flight with your American Airlines flight credit , you can only book a flight for yourself. But if the new flight you book costs less than your flight credit, American Airlines will issue you an eVoucher for the remaining value. eVouchers can be used for anyone — not just the holder of the credit!

Here’s an example of how I will go about “liquidating” flight credits to get money back.

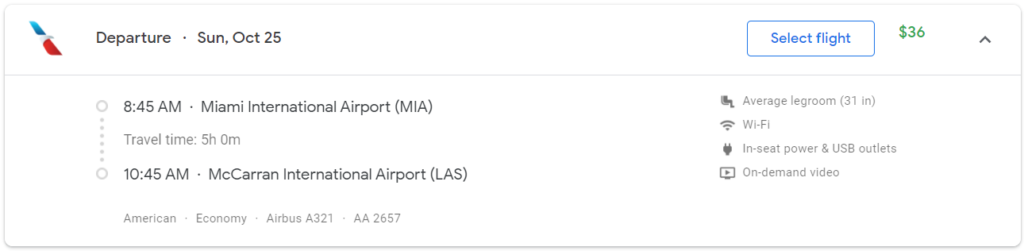

Step 1. Find the cheapest flight from anywhere to anywhere

One of my family members has a $300 flight credit in their name. She has no idea when she’ll be traveling again, so I want to use that credit for myself. I paid for it, after all.

I start by searching for the cheapest American Airlines flight I can find with Google Flights . I found a $36 one-way flight between Miami and Las Vegas.

Step 2. Book the flight

If my family member uses her $300 flight credit to book that flight, she’ll receive a $264 eVoucher, which can be used to book flights for anyone . I can either ask her to book this flight, or I can do it myself online if she gives me her credentials.

Within a day of booking travel with a flight credit, American Airlines will email an eVoucher to her for the value of the flight credit she didn’t use. In other words, she doesn’t need to actually fly that cheap flight to get the voucher. She’ll even get a $36 flight credit back if she cancels that flight.

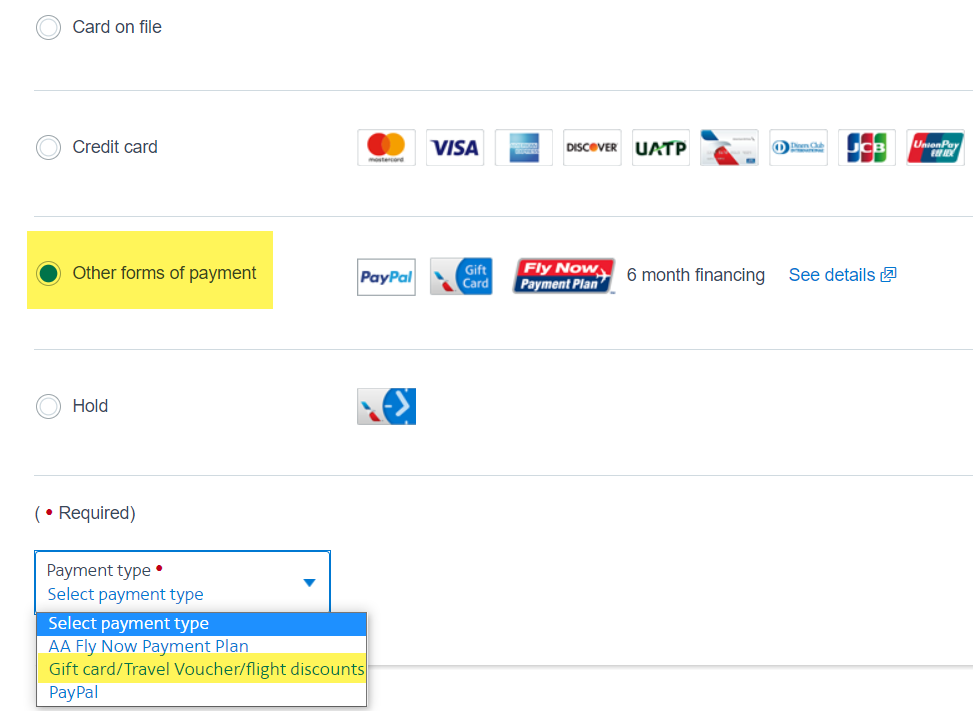

Step 3. Obtain the eVoucher

An American Airlines travel voucher has a unique number and PIN which you can use at the bottom of the American Airlines checkout page. You don’t need to provide any credentials to use the eVoucher. I tried using it without being logged in and for a made-up traveler, and it worked. All I have to do is ask my family member to forward me the voucher email when she gets it, and bam! I’ve recouped $264 from being tied up in someone else’s account, no sweat.

Note: If you’ve booked American’s Basic Economy tickets, flight credits can only be redeemed over the phone. You’ll need the participation of each traveler to turn their credits into vouchers.

Bottom line

If you’ve booked and canceled American Airlines flights for others, your money has essentially been deposited into other people’s accounts. But there is a way to get some of your money back — by converting your flight credits into eVouchers.

American Airlines’ eVouchers couldn’t be easier to use. Just select the “alternate form of payment” at the American Airlines checkout page, enter your voucher number, and it will be applied once you proceed to the next screen.

Let us know if you’ve experienced liquidating flight credits, or if you’ve got any other related tips. And subscribe to our newsletter for more travel tricks like this delivered to your inbox once per day.

Featured image by Thiago B Trevisan/Shutterstock

Joseph Hostetler

Joseph Hostetler is a full-time writer for Million Mile Secrets, covering miles and points tips and tricks, as well as helpful travel-related news and deals. He has also authored and edited for The Points Guy.

More Topics

Join the Discussion!

You May Also Like

BonusTracker: Best credit card bonus offers

June 14, 2021 4

Best Hilton credit cards: Improved weekend night certificates, earning rates and more

June 12, 2021 2

Our Favorite Partner Cards

Popular posts.

American Airlines Converted Flight Credits Into Trip Credits: What You Need To Know

by Gary Leff on September 12, 2021

American has been replacing paper vouchers with ‘trip credits’ which allow payment towards an adult passenger fare on American and American Airlines codeshares only. These can be used as partial payment towards a ticket (topped off with a credit card) or partially used towards full payment of a ticket, with residual amounts emailed to the passenger. Trip credits can also be used to book yourself an extra seat .

Eventually they will become combinable with other forms of payments (eVouchers, gift cards, flight discounts and towards award ticket taxes and fees), for multiple passengers in the same booking and for multiple passenger types.

American Airlines has now converted many old ‘flight credits’ into ‘trip credits’. Update: it’s been pointed out to me I should underscore that this process isn’t complete and won’t be for awhile.

These credits have been rolled out not quite ready for prime time. They don’t have full functionality. They can’t even be used for international tickets yet, which seems sort of insane. Eventually they should work as intended, however.

More From View from the Wing

About Gary Leff

Gary Leff is one of the foremost experts in the field of miles, points, and frequent business travel - a topic he has covered since 2002. Co-founder of frequent flyer community InsideFlyer.com, emcee of the Freddie Awards, and named one of the "World's Top Travel Experts" by Conde' Nast Traveler (2010-Present) Gary has been a guest on most major news media, profiled in several top print publications, and published broadly on the topic of consumer loyalty. More About Gary »

More articles by Gary Leff »

@ Gary — Yeah, I can confirm that mine have NOT been converted. I really hope this happens without me having to waste my time intervening.

Mine have not been converted either. DP- two people and cancelled and rebooked a couple times.

Still a total slog. Chat feature got miles reinstated after an hour with helpful rep. Had a trip credit in system with no value attached.

Mine have NOT been converted either. I sent an email to AA specifically asking about what , when and how this will be happening. Hoping to get a helpful response.

After 3 hour wait to talk to rep, was told yesterday (November 19, 2022) that only top tier elites were having flight credits converted to trip credits. And no way rep could convert my husband’s 3 flight credits totaling almost $1200 to trip credits. All expire March 31, 2022, and was told travel has to be completed by that date.

My flight credit was converted to trip credit and I am only Gold. My son’s was converted too and he has no status

Comments are closed.

Top Posts & Pages

- Guests Are Standing In Line For Hours Just To Check Into Las Vegas Hotels

- Delta's Sneaky 5-Minute Early Departures Are Ruining Your Travel Plans—And They're Not Even Sorry

- Marriott Platinum Status for Sale: The $20 Fraud That's Undermining Loyalty

- I Stayed At Hyatt Centric Waikiki, The Hotel That Punishes Loyal Hyatt Members: Here's What Happened

- Bold New United Airlines Strategy: Gestures To Thrill Elite Travelers, Skyrocket Satisfaction

Co-founder of frequent flyer community InsideFlyer.com, emcee of the Freddie Awards, and named one of the "World's Top Travel Experts" by Conde' Nast Traveler (2010-Present) Gary has been a guest on most major news media, profiled in several top print publications, and published broadly on the topic of consumer loyalty. More About Gary »

ALREADY A CARDHOLDER?

Special limited-time offer:

Earn up to 75,000 bonus miles terms apply, special limited-time offer: earn up to 75,000 bonus miles terms apply.

Select a category to find the best travel credit card for you:

Select a card category:

- Travel Needs

- Everyday Purchases

- Admirals Club® Membership

- Business Owners

Offers available if you apply here today. Offers may vary and these offers may not be available in other places where the cards are offered.

All your travel needs.

Earn 75,000 American Airlines AAdvantage® bonus miles plus travel benefits

Bonus miles earned after $3,500 in purchases within the first 4 months of account opening, citi® / aadvantage® platinum select® world elite mastercard®, $0 intro annual fee for the first year , then $99 *, variable purchase apr: 21.24% – 29.99% *, *pricing details.

EVERYDAY PURCHASES AND NO ANNUAL FEE*

American Airlines AAdvantage® MileUp® Mastercard®

Earn 15,000 american airlines aadvantage® bonus miles with our no annual fee credit card*, bonus miles earned after $500 in purchases within the first 3 months of account opening, bonus miles earned after $500 in purchases within the first 3 months of account opening, no annual fee *.

BEST VALUE FOR ADMIRALS CLUB® MEMBERSHIP

Citi® / AAdvantage® Executive World Elite Mastercard®

Earn 70,000 american airlines aadvantage® bonus miles and enjoy the only credit card with admirals club® membership, bonus miles earned after $7,000 in purchases within the first 3 months of account opening, annual fee $595 *.

BUSINESS OWNERS

Citi® / AAdvantage Business™ World Elite Mastercard®

Earn 65,000 american airlines aadvantage® bonus miles to redeem for business travel, bonus miles earned after you or your employees spend $4,000 in purchases within the first 4 months of account opening, make business travel more rewarding.

International credit cards

Find the country you live in and choose the card for you.

TERMS AND CONDITIONS

Offer availability.

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a Citi® / AAdvantage® Platinum Select® account in the past 48 months.

The card offer referenced in this communication is only available to individuals who reside in the United States and its territories, excluding Puerto Rico and U.S. Virgin Islands.

Bonus miles

Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) are not purchases. American Airlines AAdvantage® bonus miles typically will appear as a bonus in your AAdvantage® account 8-10 weeks after you have met the purchase requirements. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Purchases must post to your account during the promotional period. Many merchants will wait for a purchase to ship before they post the purchase to your account. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account.

First checked bag free

For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled.

Eligible Citi® / AAdvantage® primary credit cardmembers may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines, or on itineraries marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the Citi® / AAdvantage® credit card, up to four (4) companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation. Waiver does not apply to overweight or oversized bags. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Double miles on American Airlines purchases

Eligible American Airlines purchases are items billed by American Airlines as merchant of record booked through American Airlines channels (aa.com, American Airlines reservations, American Airlines Admirals Club®, American Airlines Vacations℠, Google Flights, and American Airlines airport and city ticket counters). Products or services that do not qualify are car rentals and hotel reservations, purchase of elite status boost or renewal, and AA Cargo℠ products and services. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

Double miles at restaurants and gas stations

Earn 2 AAdvantage miles for each $1 spent on purchases at restaurants (including cafes, bars, lounges, and fast food restaurants) and at gas stations. Food and beverage purchases made at the American Airlines Admirals Club® will be awarded 2 AAdvantage miles for each $1 spent as part of the Double Miles on American Airlines purchases benefit.

Certain non-qualifying purchases: Restaurant purchases not eligible to receive double miles include, but are not limited to, supercenters, warehouse clubs, discount stores, restaurants / cafes inside department stores, bowling alleys, public and private golf courses, country clubs, convenience stores, movie theaters, caterers and meal kit delivery services. Gas station purchases not eligible to receive double miles include, but are not limited to, purchases made at warehouse clubs that do not code gas station purchases under a gas station code, discount stores, department stores and convenience stores.

Merchant classification for rewards categories: Merchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. Citi does not control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, Citi is provided an MCC for that purchase. Citi groups similar merchant codes into categories for purposes of making rewards offers. Sometimes you may expect a purchase to fit within a rewards category, but if the code assigned to the merchant wasn’t grouped into that category as recognized by Citi, your purchase will not qualify for additional miles. [For example, you won’t earn additional miles for purchases at a restaurant located within a retailer if the restaurant is assigned a “retailer” code instead of a “restaurant” code.] Please also note – purchases made through mobile/wireless technology may not earn additional miles depending on how the technology is set up to process the purchase.

Citi® reserves the right to determine which purchases qualify for this offer. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) do not earn miles. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

1 mile per $1

AAdvantage® miles are earned on purchases, except balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions). Miles may be earned on purchases made by primary credit cardmembers and authorized users. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

Preferred boarding

For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, this benefit will be cancelled. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Up to four (4) companions traveling with and listed in the same reservation as the Citi® / AAdvantage® primary credit cardmember are eligible to board at the same time as the primary credit cardmember. Applicable terms and conditions are subject to change without notice.

Eligible credit cardmembers will board after Priority boarding is complete, but before the rest of economy boarding. The boarding benefit will display on your American Airlines boarding pass as Group 5. This benefit applies on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc.

$125 American Airlines Flight Discount

Earn a $125 American Airlines Flight Discount certificate (the “Flight Discount”) after you spend $20,000 or more in purchases that post to your Citi® / AAdvantage® Platinum Select® credit card billing statement during your credit cardmembership year (every 12 months from the billing cycle after your anniversary month through the billing cycle of your next anniversary month). With the exception of special account status or circumstances (e.g. Military relief programs), the anniversary month will coincide with the month in which the annual fee is billed. To receive the Flight Discount, your account must be open for one full billing cycle after your anniversary month. For your first year of credit cardmembership, purchases qualify as of the date of your account opening. The Flight Discount expires one year from date of issue of the certificate. The Flight Discount is redeemable toward the initial ticket purchase of air travel wholly on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. for itineraries originating in the U.S., Puerto Rico, or U.S. Virgin Islands, and sold in US Dollars. The Flight Discount is also redeemable for air travel on any oneworld® carrier or American Airlines codeshare flight. The Flight Discount is redeemable online at aa.com, or by calling American Airlines Reservations. A reservations services fee may apply for travel booked through American Airlines Reservations. The Flight Discount is redeemable only toward the purchase of the base airfare and directly associated taxes, fees and charges that are collected as part of the fare calculation for travel. The Flight Discount cannot be used to pay the taxes and charges on mileage redemption tickets where only taxes and fees are being collected. The Flight Discount may not be used for flight products and/or services that are sold separately or non-flight products and/or services sold by American Airlines. If the ticket price is greater than the value of the Flight Discount, the difference must be paid only with a credit, debit or charge card, or with American Airlines Gift Cards. Any unused balance can be applied towards eligible future travel until the stated expiration date. If travel booked with the Flight Discount is cancelled or changed by the credit cardmember, the Flight Discount will be forfeited and the credit cardmember will be responsible for any applicable fare difference and the applicable change fee. The Flight Discount will not be replaced for any reason. The Flight Discount is non-refundable, may not be sold and has no cash redemption value. After qualification, please allow 8-12 weeks for delivery of the Flight Discount.

25% savings on eligible inflight purchases

Citi® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their Citi® / AAdvantage® card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember’s card account. Applicable terms and conditions are subject to change without notice.

Authorized user

Before adding an authorized user to your credit card account you should know:

You’re responsible for all charges made or allowed to the credit card account by the authorized user. Miles earned on an authorized user’s credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not the authorized user. Authorized users have access to your credit card account information. Before adding an authorized user, you must let him/her know that we may report credit card account performance to the credit reporting agencies in the authorized user’s name. If we ask for information about the authorized user, you must obtain their permission to share their information with us and for us to share it as allowed by applicable law. Authorized users do not receive the first checked bag free or boarding benefits.

Fraud Disclosure

If Citi sees evidence of fraud, misuse, abuse, or suspicious activity, as determined by Citi in its sole discretion, Citi reserves the right to take action against you and your credit card account. This may include, without limitation and without prior notice, declining your credit card account application, stopping you from earning American Airlines AAdvantage® miles for purchases made with your card, suspending or closing your Citi® / AAdvantage® card account, and advising American Airlines of such activity. Citi may also take legal action against you to recover monetary losses, including litigation costs and damages. Examples of activities that may trigger such actions include, but are not limited to, the following: (1) application for a card account in an attempt to take advantage of a bonus offer that was not intended for you or for which you are not eligible per the terms of the offer; (2) repeated cancellation or conversion of your Citi card accounts within one year after account opening or conversion; (3) returns of purchases you made to satisfy all or a substantial portion of the purchase requirements for a bonus offer or excessive returns of purchases for which you have earned AAdvantage® miles or (4) using your account other than for personal, family or household purposes.

Card Account Disclosure

The Card Account is only available if you have an open AAdvantage® program membership in your name. Citi reserves the right to cancel your Card Account if you or American Airlines terminates or deactivates your AAdvantage® program membership.

American Airlines reserves the right to change the AAdvantage® program and its terms and conditions at any time without notice, and to end the AAdvantage® program with six months’ notice. Any such changes may affect your ability to use the awards or mileage credits that you have accumulated. Unless specified, AAdvantage® miles earned through this promotion/offer do not count toward elite-status qualification or AAdvantage Million Miler℠ status. American Airlines is not responsible for products or services offered by other participating companies. For complete details about the AAdvantage® program, visit aa.com/aadvantage » .

Travel booked on American Airlines may be American Eagle® service, operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc.

American Airlines, American Eagle, AAdvantage, AAdvantage Million Miler, MileSAAver, Business Extra, Flagship, Admirals Club, Platinum Pro, AAdvantage MileUp, AA Cargo, the Flight Symbol logo and the Tail Design are marks of American Airlines, Inc.

one world is a mark of the one world Alliance, LLC.

Citibank is not responsible for products or services offered by other companies. Cardmember program terms are subject to change.

Mastercard, World Elite and the circles design are registered trademarks of Mastercard International Incorporated.

© 2021 Citibank, N.A. Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world.

American Airlines AAdvantage MileUp® Mastercard®

Statement credit and American Airlines AAdvantage® bonus miles are not available if you have received a statement credit or American Airlines AAdvantage® bonus miles for a new AAdvantage MileUp® account in the past 48 months.

Double miles on grocery store purchases

Earn 2 AAdvantage miles for each $1 spent on purchases at grocery stores. Grocery stores are classified as supermarkets, freezer/meat locker provisioners, dairy product stores, miscellaneous food/convenience stores, markets, specialty vendors, and bakeries.

Certain non-qualifying purchases: You won’t earn double miles for purchases at general merchandise/discount superstores, wholesale/warehouse clubs, candy/confectionery stores, cafes, bars, lounges, and fast food restaurants.

Merchant classification for rewards categories: Merchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. Citi does not control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, Citi is provided an MCC for that purchase. Citi groups similar merchant codes into categories for purposes of making rewards offers. Sometimes you may expect a purchase to fit within a rewards category, but if the code assigned to the merchant wasn’t grouped into that category as recognized by Citi, your purchase will not qualify for additional miles. [For example, you won’t earn additional miles for purchases at a restaurant located within a retailer if the restaurant is assigned a “retailer” code instead of a “restaurant” code.] Please also note – purchases made through mobile/wireless technology may not earn additional miles depending on how the technology is set up to process the purchase.

AAdvantage MileUp® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their AAdvantage MileUp® credit card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember’s card account. Applicable terms and conditions are subject to change without notice.

No mileage cap

There is no maximum number of American Airlines AAdvantage® miles that you can accumulate through your Citi® / AAdvantage® credit card account.

You’re responsible for all charges made or allowed to the credit card account by the authorized user. Miles earned on an authorized user’s credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not the authorized user. Authorized users have access to your credit card account information. Before adding an authorized user, you must let him/her know that we may report credit card account performance to the credit reporting agencies in the authorized user’s name. If we ask for information about the authorized user, you must obtain their permission to share their information with us and for us to share it as allowed by applicable law.

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a Citi® / AAdvantage® Executive account in the past 48 months.

Eligible Citi® / AAdvantage® primary credit cardmembers may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines, or on domestic itineraries marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the Citi® / AAdvantage® card, up to eight (8) companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation. Waiver does not apply to overweight or oversized bags. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Enhanced airport experience

For benefits to apply, the Citi® / AAdvantage® Executive World Elite Mastercard® account must be open 7 days prior to air travel AND reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled. Citi® / AAdvantage® Executive credit cardmembers will have the following benefits: priority check-in (where available), priority airport screening (where available), and priority boarding privileges. The priority boarding benefit will display on your American Airlines boarding pass as Group 4.

These benefits apply when traveling on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. Up to eight (8) companions traveling with the eligible primary credit cardmember will also get priority check-in (where available), priority airport screening (where available), and priority boarding privileges if they are listed in the same reservation. You may check in at any Business Class check-in position or First Class check-in when Business Class is not available, regardless of the class of service in which you are traveling on American Airlines.

These benefits will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Exclusive lanes at security checkpoints are available, subject to TSA approval. Applicable terms and conditions are subject to change without notice.

Citi® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their Citi® / AAdvantage® credit card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember’s card account. Applicable terms and conditions are subject to change without notice.

Admirals Club® membership and credit card authorized user access

Only Citi® / AAdvantage® Executive World Elite Mastercard® primary credit cardmembers who are eighteen (18) years of age or older will receive full membership access privileges to Admirals Club® lounges. An authorized user of the Citi® / AAdvantage® Executive World Elite Mastercard® who is eighteen (18) years of age or older will receive access privileges to American Airlines Admirals Club® lounges. Full Admirals Club® membership privileges do not apply to a credit card authorized user. An Admirals Club® membership includes access to other airline lounges and clubs with which American Airlines may have reciprocal lounge or club access privileges. Membership also includes special pricing on conference rooms and other special offers that are available exclusively to Admirals Club® members. Neither membership nor the credit card authorized user access benefit provides access privileges to the Arrivals Lounge, International First Class Lounges, or Flagship® Lounge facilities, including Flagship® First Dining. Additionally, the credit card authorized user access benefit does not provide: (i) access privileges to other airline lounges or clubs with which American Airlines may have reciprocal lounge or club access privileges; or (ii) special pricing on conference rooms or other special offers. To locate a current list of Admirals Club® lounges please visit aa.com/admiralsclub » .

To access an Admirals Club® lounge, primary credit cardmembers and credit card authorized users must present: (i) their (a) active and valid Citi® / AAdvantage® Executive World Elite Mastercard® or (b) with respect to primary credit cardmembers only, AAdvantage® number; (ii) their current government-issued I.D.; and (iii) a boarding pass for same-day travel on an eligible flight, which includes any departing or arriving flight that is (1) marketed or operated by American Airlines, (2) marketed and operated by any oneworld® carrier, or (3) marketed and operated by Alaska Airlines; and (iv) any additional documentation required by American Airlines. Either immediate family members (spouse or domestic partner and children under eighteen (18) years of age) or up to two (2) guests traveling with the primary credit cardmember or authorized user may be admitted for free when accompanied by the primary credit cardmember or authorized user. Family members and guests must present a same-day boarding pass for an eligible flight as defined above. All persons must be of valid drinking age, based on applicable law, to consume alcohol.

If the primary credit cardmember is an Admirals Club® member on the date his or her Citi® / AAdvantage® Executive World Elite Mastercard® credit card account is approved by Citi® and has sixty (60) or more days remaining on such current Admirals Club® membership, he or she is eligible to receive a prorated refund from American Airlines for any unused portion of his or her current Admirals Club® membership fee. The refund will be a prorated amount of the annual membership fee calculated based on the number of days remaining on such primary credit cardmember’s current Admirals Club® membership as of the date his or her Citi® / AAdvantage® Executive World Elite Mastercard® credit card account is approved by Citi®. Refunds will be automatically made in the original form of payment within twelve (12) weeks of becoming a Citi® / AAdvantage® Executive World Elite Mastercard® credit cardmember. Memberships redeemed with Business Extra points, Lifetime Admirals Club® members and AirPass members with Admirals Club® privileges are not eligible for a refund.

Upon closure of the Citi® / AAdvantage® Executive World Elite Mastercard® account, all Admirals Club® benefits and access associated with the account will be immediately terminated, including, but not limited to, all benefits afforded to credit card authorized users. All Admirals Club® membership rules, terms and conditions apply. AMERICAN AIRLINES RESERVES THE RIGHT TO MODIFY ANY OR ALL RULES, TERMS AND CONDITIONS AT ANY TIME WITHOUT NOTICE. SUCH MODIFICATIONS SHALL BE EFFECTIVE IMMEDIATELY AND INCORPORATED INTO THIS AGREEMENT. BY ACCESSING ANY ADMIRALS CLUB® LOUNGE YOU SHALL BE DEEMED TO HAVE ACCEPTED THE ADMIRALS CLUB® TERMS AND CONDITIONS. To review the complete Admirals Club® membership terms and conditions, visit aa.com/admiralsclub » .

Global Entry or TSA PreCheck® application fee credit

Citi® / AAdvantage® Executive World Elite Mastercard® credit cardmembers are eligible to receive one statement credit up to $100 per account every five years for either the Global Entry or the TSA PreCheck® program application fee. Credit cardmembers must charge the application fee to their Citi®/ AAdvantage® Executive credit card to qualify for the statement credit. Credit cardmembers will receive a statement credit for the first program (either Global Entry or TSA PreCheck®) to which they apply and pay for with their eligible card, regardless of whether they are approved for Global Entry or TSA PreCheck®. Please allow 1-2 billing cycles after the qualifying Global Entry or TSA PreCheck® fee is charged to the eligible account for the statement credit to be posted to the account. Only fees associated with either the Global Entry or the TSA PreCheck® application fee will be eligible towards the statement credit.

For information on Global Entry, visit globalentry.gov. For information on TSA PreCheck®, visit tsa.gov. Applications are made directly with these organizations, and this information is not shared with Citi, nor does Citi have access to Global Entry or TSA records. Citi does not share account information with Global Entry or TSA. Decisions to approve/deny applications are made solely by these organizations, and Citi has no influence over these decisions. Citi is not notified of approvals or denials of applications.

TSA PreCheck® is a registered trademark of the Department of Homeland Security.

CitiBusiness® / AAdvantage® Platinum Select® World Elite Mastercard®

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a CitiBusiness® / AAdvantage® Platinum Select® account in the past 48 months.

Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) are not purchases. American Airlines AAdvantage® bonus miles typically will appear as a bonus in your AAdvantage® account 8-10 weeks after you have met the purchase requirements. Miles may be earned on purchases made by primary credit cardmember and employee cardmembers. Purchases must post to your account during the promotional period. Many merchants will wait for a purchase to ship before they post the purchase to your account. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account.

For benefit to apply, the CitiBusiness® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled.

Eligible CitiBusiness® / AAdvantage® primary credit cardmembers may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines, or on itineraries marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the CitiBusiness® / AAdvantage® card, up to four (4) companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation. Benefit does not apply to overweight or oversized bags. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Double miles on purchases in select business categories

Earn 2 AAdvantage® miles per $1 spent on purchases at certain telecommunications merchants, car rental merchants, cable and satellite providers, and at gas stations. Telecommunications merchants are classified as merchants that sell telecommunications equipment such as telephones, fax machines, pagers, and cellular phones, along with providers of telecommunications services including local and long-distance telephone calls and fax services. Car rental merchants are classified as providers of short-term or long-term rentals of cars, trucks, or vans. Cable and satellite providers are classified as merchants that provide the connection and ongoing delivery of television, internet (computer network, information services, email website hosting services) telephone and radio programming via cable or satellite on a subscription or fee basis. Gas stations are classified as merchants that sell fuel primarily for consumer use and may or may not be attended.

Certain non-qualifying purchases: Car rental purchases not eligible to receive double miles include purchases at merchants that rent motor homes or other recreational vehicles and purchases made through travel agencies, tour operators and online third party travel sites, and charges paid on car rental redemptions through RocketMiles. Gas station purchases not eligible to receive double miles include, but are not limited to, purchases made at warehouse clubs that do not code gas station purchases under a gas station code, discount stores, department stores and convenience stores.

Citi® reserves the right to determine which purchases qualify for this offer. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) account do not earn miles. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8–10 weeks.

For benefit to apply, the CitiBusiness® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, this benefit will be cancelled. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Up to four (4) companions traveling with and listed in the same reservation as the CitiBusiness® / AAdvantage® primary credit cardmember are eligible to board at the same time as the primary credit cardmember. Applicable terms and conditions are subject to change without notice.

Eligible CitiBusiness® / AAdvantage® credit cardmembers board after Priority boarding is complete, but before the rest of economy boarding. The boarding benefit will display on your American Airlines boarding pass as Group 5. This benefit applies on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc.

25% savings on eligible inflight purchases of food and beverage

CitiBusiness® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their CitiBusiness® / AAdvantage® card. Savings do not apply to any other inflight purchases. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember’s card account. Applicable terms and conditions are subject to change without notice.

25% savings on inflight Wi-Fi purchases

Receive a 25% savings when you use your CitiBusiness® / AAdvantage® Platinum® Select credit card for the purchase of inflight Wi-Fi service from American Airline’s Wi-Fi merchants Gogo, Viasat, or Panasonic, and on American Airlines’ Wi-Fi Subscription Plan. This benefit applies to flights marketed and operated by American Airlines or on flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember’s card account. Applicable terms and conditions are subject to change without notice.

American Airlines Companion Certificate

The primary credit cardmember will earn a $99 domestic economy fare American Airlines Companion Certificate after you spend $30,000 or more in purchases that post to your CitiBusiness® / AAdvantage® Platinum Select® credit card billing statement during your credit cardmembership year (every 12 months from the billing cycle after your anniversary month through the billing cycle of your next anniversary month). With the exception of special account status or circumstances (e.g. Military relief programs) the anniversary month will coincide with the month in which the annual fee is billed. To receive the Companion Certificate, your account must be open for one full billing cycle after your anniversary month. For your first year of credit cardmembership, purchases qualify as of the date of your account opening. After these conditions are met, please allow at least 8-10 weeks for availability of the Companion Certificate. You must have an open AAdvantage® account for the Companion Certificate to be awarded to your account and to redeem the certificate. When used according to its terms, the primary credit cardmember will pay a $99 companion ticket fee plus $21.60 to $43.20 in government taxes and fees, depending on itinerary, for one round trip qualifying domestic economy fare ticket for a companion when an individual round trip qualifying domestic Main Cabin fare ticket is purchased and redeemed through American Airlines Meeting Services. Travel must be booked and purchased in select Main Cabin inventory. The certificate must be redeemed and all travel completed by midnight of the Travel Expiration Date shown on the certificate. Valid for travel on flights within the 48 contiguous United States on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. For residents of Alaska and Hawaii, the companion certificate is also valid for round-trip travel originating in either of those two states and continuing to the 48 contiguous United States. For residents of U.S. Virgin Islands and Puerto Rico, companion certificate eligible travel is also defined as round-trip travel originating in either of those two territories and continuing to the 48 contiguous United States. The Companion Certificate is not redeemable for air travel on any oneworld® carrier or on an American Airlines codeshare flight. Applicable terms and conditions are subject to change without notice. Details, terms and conditions, certain restrictions, and restricted dates apply and will be disclosed on the certificate.

Employees may be added to the account as authorized users. Miles earned on an authorized user’s credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not to the authorized user. You must pay us for all charges made or allowed by authorized users. Authorized users are able to get account information. Authorized users must be employees or contractors of your business. You need the authorized user’s permission to give us any information about them that we request and to allow us to share information about them as allowed by applicable law. This includes information we may get from you, any authorized user and others. It also includes information about their transactions on the account.

If Citi sees evidence of fraud, misuse, abuse, or suspicious activity, as determined by Citi in its sole discretion, Citi reserves the right to take action against you and your credit card account. This may include, without limitation and without prior notice, declining your credit card account application, stopping you from earning American Airlines AAdvantage® miles for purchases made with your card, suspending or closing your CitiBusiness® / AAdvantage® card account, and advising American Airlines of such activity. Citi may also take legal action against you to recover monetary losses, including litigation costs and damages. Examples of activities that may trigger such actions include, but are not limited to, the following: (1) application for a card account in an attempt to take advantage of a bonus offer that was not intended for you or for which you are not eligible per the terms of the offer; (2) repeated cancellation or conversion of your Citi card accounts within one year after account opening or conversion; (3) returns of purchases you made to satisfy all or a substantial portion of the purchase requirements for a bonus offer or excessive returns of purchases for which you have earned AAdvantage® miles or (4) using the account other than for business purposes.

ApplyURLsHome

You Can Now Volunteer to Be Bumped Right In the American Airlines App

Despite technical advances in so much of the air travel experience, there's one aspect that's remained stubbornly manual: handling oversell situations. It's only been in the last couple of years that airlines have tried to add an electronic element to the process. Yet still, often the process still ends with a gate agent announcing the flight is oversold, and asking for volunteers to take another flight.

American Airlines is working to eliminate this often-chaotic process, and this week it took a step forward toward that goal: AA passengers are now able to volunteer to be bumped right in the AA app. After testing this feature recently with a limited group of passengers, this electronic volunteering process went live for all AA passengers and at all US airports for AA flights starting Friday, May 3.

Currently it's only available through the AA app, but the airline is planning to expand the system to the web and kiosk check-in procedures soon.

One of the passengers that got to test it early was Jamie Larounis, who shared the screenshots and experience on Twitter:

Jamie pointed out what seemed to be a quirk in the system: he went through the volunteer process through the app, but the gate agent said that he wasn't on the list . He figured that his being on the upgrade list prevented the system from letting him also be on the volunteer list. I checked with American Airlines about this situation, and they confirmed that this isn't a limitation of the new system. Passengers will be able to be on both the upgrade list and volunteer list.

An electronic volunteer process is something that both Delta and United have had enabled through their check-in process and/or app for a while now. So, this is certainly another catch-up step for American Airlines -- just like boarding push notifications that AA is beta testing now .

But AA doesn't plan on stopping here. It's working on dynamic rebooking solutions to avoid gate-bump situations by adding confirmable offers right in the app. For example, a passenger on a connecting itinerary through Dallas/Fort Worth might be offered an opportunity to rebook on an itinerary connecting in Chicago instead with compensation for the change. Doing this in advance of the departure gate would allow the airline more rebooking options and allow the passenger to adjust plans for the altered schedule.

When speaking with an American Airlines spokesperson about this process, I clarified an aspect of the volunteer bump process. Sure enough, it is AA policy that the compensation amount is the same for all passengers bumped at the gate.

For example, let's say that four passengers volunteer to be bumped, bidding $150, $200, $250 and $300. If the gate agent needs to bump three passengers from the flight, the passengers who bid $150-250 will have the option to be bumped for $250 each. If one of those three passengers is no longer interested in volunteering, the offer would increase to $300 each for the remaining three passengers.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Get more when you get away with American Express Travel®

Whether you’re planning a weekend staycation or the trip of a lifetime, American Express Travel is here to help you get the most out of your journey. Explore the benefits of booking with American Express Travel.

View American Express Travel benefits by card type below.

Enjoy elevated benefits through American Express Travel with your Platinum Card®

Unlock added value and special perks on flights, hotels, vacation rentals, cruises, car rentals and more through American Express Travel.

Explore by Benefit Type

Hotel Benefits

Flight Benefits

Membership Rewards

More Travel Benefits

Exceptional Benefits. Extraordinary Properties.

Enjoy unforgettable luxury and bask in the benefits with Fine Hotels + Resorts ® . With every stay booked through American Express Travel at over 1,600 properties worldwide, you'll receive this complimentary suite of benefits that offers an average total value of $550 † :

12pm check-in, when available

$100 credit, towards eligible charges 1

Room upgrade upon arrival, when available ‡

Complimentary Wi-Fi

Daily breakfast for two

Guaranteed 4pm check-out

† Average value based on Fine Hotels + Resorts bookings in 2023 for stays of two nights. Actual value will vary based on property, roomrate, upgrade availability, and use of benefits. ‡ Certain room categories are not eligible for upgrade. 1 Eligible charges vary by property.

Added Perks. Upscale Stays.

For upscale hotels in desirable destinations, book The Hotel Collection through American Express Travel. With every stay of two nights or more booked at over 1,000 hand-picked hotels, you'll receive these complimentary benefits that offer an average total value of $150 †† , plus two new benefits:

NEW: 12pm check-in, when available

NEW: Late check-out, when available

†† Average value based on The Hotel Collection bookings in 2023 for stays of two nights. Actual value will vary based on property, roomrate, upgrade availability, and use of benefits. ‡ Certain room categories are not eligible for upgrade. 1 Eligible charges vary by property.

$200 Hotel Credit

Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings through American Express Travel when you pay with your Platinum Card. The Hotel Collection requires a minimum two-night stay.*

Luxury Hotel Offers

Take advantage of special offers, like a complimentary night or added savings, at select Fine Hotels + Resorts ® and The Hotel Collection properties. Book at AmexTravel.com. Offers vary by property. Travel dates and terms apply.*

Maslina Resort

Let Membership Rewards® Points Inspire your Next Adventure

Earn points or use Membership Rewards ® Pay with Points to book your next trip at AmexTravel.com. You can even use a combination of points and Card.*

Get 5X Points on Travel*

Earn 5X Membership Rewards ® points on flights, prepaid hotels, and more booked through American Express Travel using your Platinum Card.

How to Earn Points

5X on Flights

Earn 5X points on flights booked through American Express Travel or directly with airlines, on up to $500,000 of these purchases per calendar year.

5X on Prepaid Hotels

Earn 5X points on prepaid hotels booked through American Express Travel. This includes 5X points on Fine Hotels + Resorts® and The Hotel Collection, where you’ll enjoy added benefits to enhance your stay.

5X on Select Homes + Retreats™

Earn 5X points on Select Homes + Retreats™, a curated collection of professionally managed vacation rentals, booked through AmexTravel.com.

5X on Flight + Hotel Packages

Earn 5X points on flight + hotel packages booked through AmexTravel.com

Use Pay with Points*

As a Platinum Card Member, you can use Pay with Points at AmexTravel.com toward all or part of your next flight, prepaid hotel, or other eligible travel booking.

How to Use Pay with Points

Use points for flights booked through American Express Travel.

Prepaid Hotels

Use points for prepaid hotels booked through American Express Travel, including The Hotel Collection and Fine Hotels + Resorts ® .

Select Homes + Retreats™

Use points to book Select Homes + Retreats™ stays through AmexTravel.com.

Flight + Hotel Packages

Use points for flight + hotel packages booked through AmexTravel.com.

Prepaid Car Rentals

Use points for prepaid car rentals booked through American Express Travel.

Use points for cruises booked through American Express Travel.

On top of Membership Rewards perks, you still earn loyalty benefits with airlines and hotels.

When you book flights at AmexTravel.com you'll earn 5X Membership Rewards ® points, on up to $500,000 of these purchases per calendar year. Plus, you'll earn miles with airlines as you typically would.

You'll also earn 5X points when you book prepaid stays with Fine Hotels + Resorts ® and The Hotel Collection through American Express Travel. Plus, you still earn loyalty points with hotels. 2

2 Hotel brands with loyalty or rewards programs and the terms and conditions applicable thereto are subject to change. Please contact hotels directly for information on individual loyalty or reward program rules and restrictions. Card Members may be required to provide correct loyalty information upon arrival to the property.

Take Flight with a Choice of Savings

Access lower fares on select routes and more when you book flights through American Express Travel with your Platinum Card.

International Airline Program

Enjoy savings on the best seats in the house with the International Airline Program. Explore lower fares on International First, Business, and Premium Economy seats when you book through American Express Travel with your Platinum Card. Maximum of 8 tickets per booking. Card Member must be traveling on the itinerary.*

Insider Fares

Go further with fewer Membership Rewards points. With Insider Fares*, it takes fewer points to get around the globe. When you book on AmexTravel.com with your Platinum Card and use Pay with Points for the entire fare, you get access to deals on select flights, because less points are needed.

Recommended Flights

Access lower fares on select domestic and international routes through October 1, 2024. Log in to AmexTravel.com with your Platinum Card account and filter flight search results by clicking on the Recommended Flights checkbox to find lower fares.*

Discover More Ways to Elevate your Travel

Take advantage of more travel benefits through American Express Travel and make your next trip one to remember.

As a Platinum Card Member, you have access to American Express Select Homes + Retreats™, a curated collection of professionally managed short-term rental properties. Plus, earn 5X Membership Rewards® points on all Select Homes + Retreats™ purchases booked through AmexTravel.com.*

- Explore Select Homes + Retreats™

Cruise Privileges Program

Receive valuable amenities on eligible sailings of 5-nights or more with participating cruise lines, including onboard credits and 2X Membership Rewards points, when you book through American Express Travel with your Platinum Card.*

- Learn More about Cruise Benefits

2X Points on Cruises & Prepaid Car Rentals

Get rewarded when you travel. Earn 2X points on cruises and prepaid car rentals booked at AmexTravel.com with your Platinum Card.*

- Plan a Cruise

Explore More Travel Benefits

Unlock more value for your next flight. Enjoy complimentary access to airport lounges through the American Express Global Lounge Collection®, and more with your Platinum Card. Terms apply.

- See More Travel Benefits

Enjoy elevated benefits through American Express Travel with your Business Platinum Card®

Unlock added value and special perks on flights, hotels, vacation rentals, cruises, car rentals and more when you book through American Express Travel.

Enjoy hotels that are destinations unto themselves with Fine Hotels + Resorts ® . With every stay booked at over 1,600 extraordinary properties through American Express Travel, you'll receive this complimentary suite of benefits that offers an average total value of $550 † :

Mandarin Oriental, Boston

Earn points or use Membership Rewards ® Pay with Points towards your next trip booked at AmexTravel.com. You can even use a combination of points and Card.*

Get rewarded when you travel. Earn 5X Membership Rewards ® points on flights, prepaid hotels, and more booked through American Express Travel with your Business Platinum Card.

Earn 5X points on flights booked through AmexTravel.com.

Earn 5X points on prepaid hotels booked through American Express Travel.This includes 5X points on our curated collections, Fine Hotels + Resorts ® and The Hotel Collection, where you’ll enjoy added benefits to enhance your stay.

Earn 5X points on Select Homes + Retreats, a curated collection of professionally managed vacation rentals, booked through AmexTravel.com.

Earn 5X points on flight + hotel packages booked through AmexTravel.com.

Go further with Membership Rewards ® Pay with Points. As a Business Platinum Card Member, you can use Pay with Points at AmexTravel.com toward all or part of your next flight, prepaid hotel, or other eligible travel booking.

All Flights

Use points to book Select Homes + Retreats stays through AmexTravel.com.

Earn 5X Membership Rewards ® points on flights booked at AmexTravel.com. Plus, earn miles as you typically would with airlines.

You'll also earn 5X points when you book prepaid stays with Fine Hotels + Resorts and The Hotel Collection through American Express Travel. Plus, you still earn loyalty points with hotels. 2

Access lower fares on select routes and more when you book flights through American Express Travel with your Business Platinum Card.