Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

The ideal card for people new to the world of travel benefits

- • Business credit cards

- • Credit card debt

- • Rewards credit cards

- • Writing/literature

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Bottom line

The Discover it® Miles card is a flexible no-annual-fee travel card that offers a number of benefits that can help make traveling less expensive. However, frequent travelers seeking premium perks may not receive a ton of long-term value.

Best for first-year value

Discover it® Miles

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

Intro offer

Unlimited Bonus: Unlimited Mile-for-Mile match for all new cardmembers—only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. You could turn 35,000 Miles to 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

Discover Match®

Rewards rate

Automatically earn unlimited 1.5x Miles on every dollar of every purchase.

Regular APR

18.24% - 28.24% Variable APR

Bankrate Score

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

Rewards value

Rewards flexibility

Why you'll like this: Discover’s first-year rewards match could carry more value than the bonuses you’ll find on even the best no-annual-fee travel cards.

Remove a card to add another to compare

On This Page

- Current offer details

- Pros and cons

- Reasons to get this card

- Reasons to skip this card

- Discover it® Miles vs. other travel cards

Best cards to pair with the Discover it® Miles

Who is the discover it® miles right for.

- Is this card worth getting?

How we rated this card

Frequently asked questions, discover it® miles overview.

The Discover it® Miles credit card stands apart from every other Discover card as the only travel card in the issuer’s portfolio. Yet, it still works remarkably similar to its cash back siblings. Rather than using your miles to book travel, you can redeem them for statement credits that can cover various travel purchases.

While the Discover it® Miles is a solid low-cost travel card option, its 1:1 value for all redemption options, including cash back, is what gives it a competitive edge over rival cards. If you want a backup plan for your rewards for when your future travel plans are uncertain, this card’s rewards program would be perfect for you.

However, frequent travelers may find that the Discover it® Miles’ streamlined structure can’t make up for the card’s lackluster travel perks.

- Unlimited 1.5X miles on all purchases

Expert Appraisal: Typical See our expert analysis

Welcome offer

- Discover Match®: All miles earned at the end of the first year are matched.

Expert Appraisal: Good See our expert analysis

0% intro APR offer

- 0 percent intro APR on purchases for 15 months

- 0 percent intro APR on balance transfers for 15 months

- 18.24 percent to 28.24 percent variable ongoing APR

Rates and fees

- $0 annual fee

- No foreign transaction fees

- No penalty APR

- No first late payment fee (none the first time you pay late; after that, up to $41).

Expert Appraisal: Exceptional See our expert analysis

Other cardholder perks

- Online privacy protection

- Miles never expire as long as account is in good standing

Discover it® Miles pros and cons

Because there is no annual fee, there's no cost to carry this card.

It offers unlimited, flat-rate miles and remarkable redemption flexibility for travel purchases.

You have the option to redeem miles for cash back at a 1:1 rate, so none of the reward’s value is lost.

You can’t transfer its reward miles to airline frequent-flier programs, which limits your travel redemption options.

The Discover credit card network has fewer international acceptance partners and perks compared to Visa and Mastercard.

The card lacks some travel benefits found on other no-annual-fee travel cards, like trip interruption insurance.

Why you might want the Discover it® Miles

While the best perks might come on cards with high annual fees, some competitive no-annual-fee cards like the Discover it® Miles carry a great deal of value beyond rewards earned through card spending.

Welcome offer: Limitless earning potential

Instead of a traditional sign-up bonus , Discover will match all the miles you’ve earned at the end of your first year. So cardholders who spend highly in their first year could potentially get more value out of this offer than with a traditional sign-up bonus.

For instance, spending just over $13,000 by the end of your first year with your Discover it® Miles card would earn you about 20,000 bonus miles, worth at least $200 in rewards. Discover would match those miles, giving you a total of 40,000 miles in your first year, worth $400 in travel.

Rewards rates: Slow but steady earning rate

Given that the Discover it® Miles is a no-annual-fee travel card , its 1.5X bonus mile rate could be hard to beat if you’re sticking to flat-rate rewards. One of Discover it® Miles’ closest rivals is the Capital One VentureOne Rewards Credit Card ( See Rates & Fees ), since it doesn’t have an annual fee, but it only earns a flat 1.25X miles. Although other flat-rate rewards cards earn at slightly higher rates, the Discover it® Miles stacks up pretty well as a middle-of-the-road option.

Rates & fees: Card’s versatility comes with minimal cost

There's no annual fee, no foreign transaction fees, no penalty APR and no first late payment fee (none the first time you pay late; after that, up to $41). You’ll also be able to keep interest at bay with a 15-month 0 percent intro APR on purchases and balance transfers, which can be great if you’re planning a big trip you need extra time to pay off.

You won’t have to worry about the ongoing APR much either since the lower end is below the current average interest rate — clocking in at 18.24 percent to 28.24 percent variable. This is a great deal considering comparable cards sometimes have these charges or higher rates.

Why you might want a different travel credit card

Unfortunately, the Discover it® Miles card’s versatility comes without much added benefits. Discover uses its own credit card network, so you won’t receive basic perks — like rental car damage insurance or travel and purchase protections — typically available to Visa and Mastercard members.

Perks: Slim beyond security features

Many of the Discover it® Miles’ benefits focus on card security. Discover it® Miles allows cardholders to opt into free online privacy protection. Approximately every 90 days, Discover searches 10 of the most popular people search sites for your personal information and submits opt-out requests on your behalf.

You're also protected if you ever lose your Discover it® Miles card. Freeze it ® is a feature available within the Discover mobile app or online account. With Freeze it, you can lock your card account instantly with an on/off switch. No one is able to use your card unless you turn it back on, rendering it useless if stolen.

However, coveted travel perks like lost baggage or trip delay insurance won't be found on this card.

Redemption: Consistent but not flexible

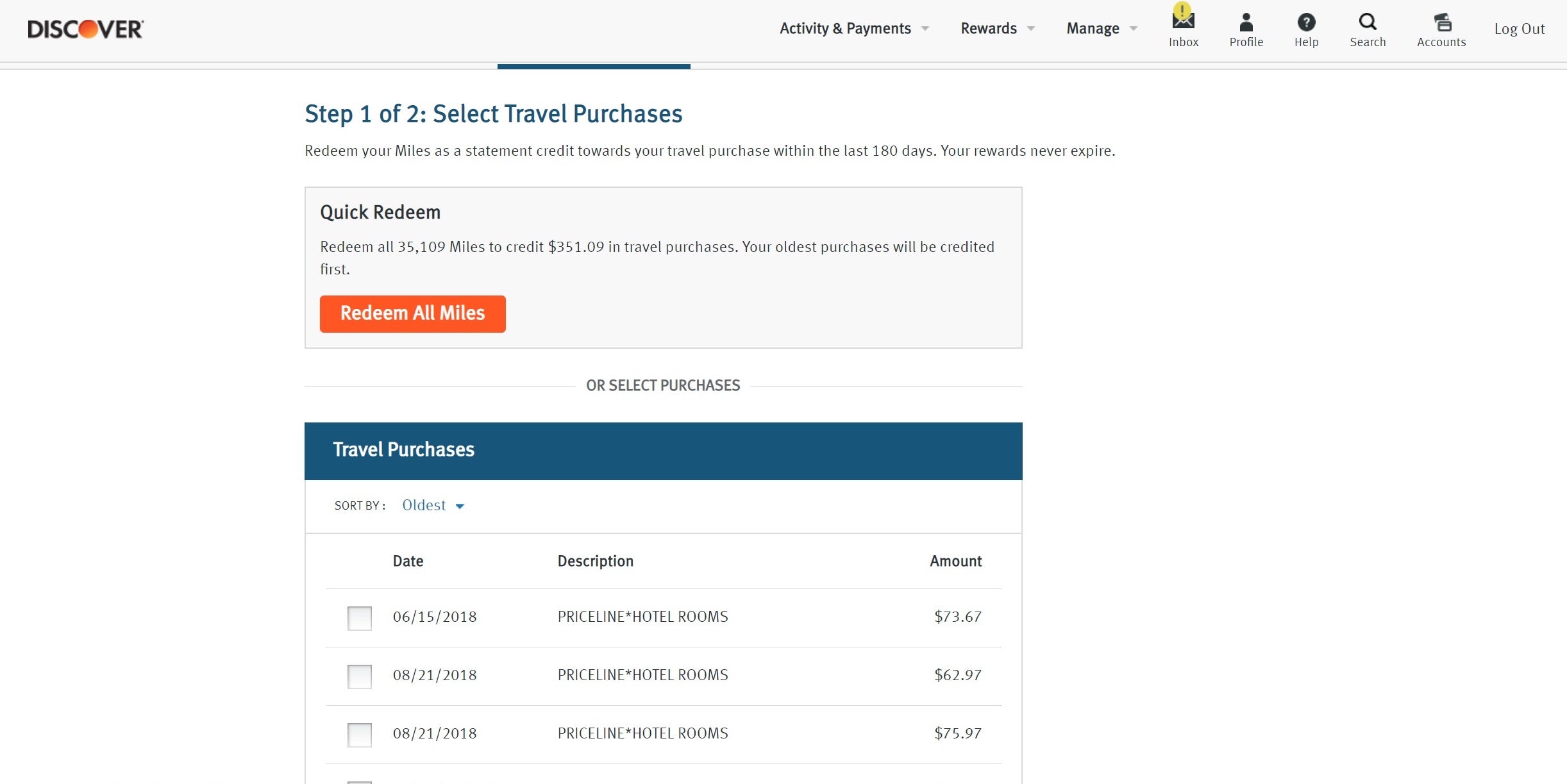

Rather than using your miles to book travel accommodations such as flights, hotels, vacation packages or rental cars, you use miles to reimburse yourself for travel purchases via statement credits.

According to Bankrate's latest valuations, Discover miles are worth roughly 1.0 cents apiece across all redemption options, including cash back. This is a great perk since it’s rare to find a travel card that lets you opt for non-travel redemptions without sacrificing point value. However, the Discover it® Miles card may not measure up to other cards that let you transfer points to partnering airlines or hotels to achieve a boosted point value (depending on the issuer and travel partner). The maximum point value you can expect with travel redemptions through Discover is 1.0 cents per mile.

How the Discover it® Miles card compares to other travel cards

The Discover it® Miles card is hard to beat when it comes to versatile and competitive flat-rate miles. However, even though it's accessible to newcomers with a good to excellent credit score (a FICO score of 670 or higher), this card’s major drawback is its lack of cardholder benefits. Other travel cards bring more value to the table, like travel and shopping protections, annual credits or upgrades that make traveling a bit smoother.

Recommended Credit Score

Bank of America® Travel Rewards credit card

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

Chase Sapphire Preferred® Card

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

5x on travel purchased through Chase Travel℠. 3x on dining, select streaming services and online groceries. 2x on all other travel purchases. 1x on all other purchases.

The Discover it® Miles vs. Bank of America® Travel Rewards Credit Card

If you want to avoid traditional travel miles, the Bank of America Travel Rewards credit card earns an unlimited 1.5X points for every dollar spent and rewards can be redeemed for travel purchase credits, gift cards or cash. The Bank of America card also comes with Visa Signature benefits and you can boost your rewards rate by up to 75 percent as a qualifying Bank of America Preferred Rewards® member. Depending on which tier you qualify for in the Preferred Rewards program, this card could boast a higher flat rate than the Discover it® Miles and its closest competitors.

If you plan to — or already do — bank with Bank of America, you’ll certainly want to reap the benefits of the Preferred Rewards membership as it can substantially boost how many points you’ll earn.

The Discover it® Miles vs. The Chase Sapphire Preferred® Card

The Chase Sapphire Preferred card is one of the best beginner travel cards thanks to its elevated rewards rate for travel purchases, 25 percent value boost to Chase Travel℠ redemptions, the ability to transfer points to partnering airlines and the card’s impressive list of additional perks. Although it comes with a $95 annual fee, it should be easy to offset by earning points or taking advantage of perks like baggage delay insurance and trip cancellation insurance.

You’ll also have an added 25 percent boost for travel redemptions through the issuer’s portal. Also, Chase points are worth 1 cent each when redeemed for cash, meaning you’ll retain point value if you don’t have a trip coming up but still want to redeem your rewards. However, you can really maximize the Chase Sapphire Preferred Card's point value if you transfer your points to partnering airline or hotel chains. Bankrate estimates you can get a value of around 2.0 cents per point. You might steer toward the Discover it® Miles if you want to use your card for purchases outside the travel category to earn a decent flat rate, but the Sapphire Preferred card’s elevated rewards rate will quickly outpace the Discover it® Miles’ flat rate on all purchases.

The Discover it® Miles card is a great option, but other cards may offer ways to earn more rewards in specific spending categories or offer more flexible redemptions and better benefits. Pairing several cards together gives you more flexibility and allows you to enjoy the perks of each card.

American Express Gold Card

The American Express® Gold Card is an excellent travel rewards card to pair with Discover it® Miles, especially if you spend considerable money each month on dining out and groceries.

The Amex Gold card earns 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. Also earns 4X Membership Rewards® points per dollar spent at U.S. supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

Although it has a $325 annual fee, the travel protections, perks, stellar welcome offer and ongoing rewards value should make it easy to offset the annual fee. Coupling it with a no-annual-fee card like the Discover it® Miles can be a great way to fill gaps in your rewards strategy and take advantage of some elite benefits.

( See Rates & Fees for the American Express® Gold Card.)

Chase Freedom Unlimited®

If you don’t want to pay extra for travel perks, the Chase Freedom Unlimited® can be good to pair with the Discover it® Miles. You can earn 5 percent cash back on bookings made through the Chase Travel℠ portal so you earn more on trips and vacations. Travel protections like trip cancellation and interruption insurance are also included on the card. However, a downside is the Freedom Unlimited’s 3 percent foreign transaction fee, so it may be better to use the Discover it® Miles abroad.

This may not be the best card for experienced travelers, but for those starting out or who don’t travel often, this can be a great fit.

Beginner travelers

If you’re new to travel, the Discover it® Miles can be a great starter card. You earn rewards through all your purchases and redemption is straightforward as you reimburse your travel purchases through statement credits. You can also enjoy going overseas without having to worry about foreign transaction fees cutting into the rewards you earn.

Infrequent travelers

The Discover it® Miles is slim on overall travel benefits but infrequent travelers may not mind. The flat-rate rewards lets you earn steadily over time without having to worry about categories. Also, with no annual fee you won't need to worry about offsetting a yearly cost as you would on premium travel cards.

Hassle-free travelers

This card doesn’t earn high rewards like other travel cards, but you also have more flexibility when you plan your next vacation. Instead of being limited to specific portals, categories or brands, you can book and earn rewards on any purchases. While there’s no redemption partners, for those who would rather get up and go, this may not be a deal breaker.

Bankrate’s Take — Is the Discover it® Miles card worth it?

If you are considering getting your first travel card, then the Discover it® Miles card has the basics to get you started in the rewards scene. Its low rates and fees plus its 1:1 cash back redemption rate make it easy for people to learn the ropes of travel rewards without annual fees or a complicated rewards structure. However, its lack of travel perks might make it a no-go for jet setters and frequent flyers who prefer luxury travel.

We rate credit cards using a proprietary card scoring system that ranks each card’s estimated average rewards rate, estimated annual earnings, welcome bonus value, APR, fees, perks and more against those of other cards in its primary category.

Each card feature is assigned a weighting based on how important it is to people looking for a card in a given category. These features are then scored based on how they rank relative to the features on other cards in the category. Based on these calculations, each card receives an overall rating of 1-5 stars (with 5 being the highest possible score and 1 being the lowest).

We analyzed over 150 of the most popular rewards and cash back cards to determine where each stacked up based on their value, cost, benefits and more. Here are some of the key factors that influenced this card’s overall score and how the score influenced our review:

The primary criteria for a rewards or cash back card’s rating is its rewards value. This includes the card’s average rewards rate, estimated annual rewards earnings, sign-up bonus value and reward redemption value.

To estimate a card’s average annual rewards earnings, we first calculate its average rewards rate based on how much it earns in different bonus categories and how closely its categories align with the average person’s spending habits, according to the Bureau of Labor Statistics (BLS).

The most recent BLS data estimates average total spending in 2022 was $72,967 per consumer. We then narrow our focus to which purchases are likely to be put on a credit card and earn rewards, subtracting expenditures like housing, vehicle purchases and education. This gives us a total “chargeable” annual spend of around $22,500.

Some of the major spending categories that contribute towards the annual spend include:

- Groceries: $5,700

- Dining out: $3,600

- Entertainment: $2,400

- Gas: $3,100

- Apparel and services: $1,900

Using this data, we assign a weighting to each of a card’s bonus categories. For example, a card’s grocery rewards rate receives a 22 percent weighting based on how much of the average person’s budget is spent on groceries. We also estimate the redemption value of points or miles from various issuer, airline and hotel rewards programs.

This weighting and rewards valuation allows us to estimate a card’s average annual rewards earnings — how many points or miles you’d earn with a given card if your spending was about average and you used the card for all of your purchases, as well as what those points are worth. We also use point valuations to determine a card’s sign-up bonus value.

With these calculations complete, we assign each card a score based on how its average rewards earnings, sign-up bonus value, rewards rate and redemption value stack up against other rewards cards.

We also rate cards based on how much it costs to keep them in your wallet or carry a balance.

To start, each rewards or cash back card is scored based on whether it offers an intro APR and how its ongoing APR compares to the rates available on other rewards or cash back cards.

We also score each card based on how its annual fee influences its overall value.

We consider a card’s annual fee in two ways — how it ranks relative to the fees you’ll find on other cards in the category and how it impacts a card’s overall rewards value. Cards with an annual fee will always be at a slight disadvantage in our scoring system since annual fees inherently cut into your rewards value, but if a card offers terrific value via its ongoing rewards and perks, it can earn a high score even if it carries a high annual fee.

With this in mind, we rate a card based primarily on how its ongoing rewards value and ongoing perk value (such as annual credits or bonuses) stack up against other cards in the category when you subtract its annual fee.

Flexibility

We rate each card’s flexibility based on the restrictions it imposes on earning and redeeming rewards and factor this rating into a card’s overall score.

Flexibility factors include whether a card only allows you to earn a high rewards rate on a small amount of spending or requires you to meet a certain earning threshold before you can redeem rewards. We also examine whether your points are worth less when you redeem for some options versus others and whether a card gives you the flexibility to transfer rewards to airline and hotel partners.

We also score each card’s set of features – its perks and benefits — against five tiers of features to provide a rating.

We break down these tiers as follows:

- Tier 1 has less than standard card features (an ultra-streamlined card that offers basic utility and next to nothing in the way of ancillary benefits.

- Tier 2 includes the benefits you’d expect on standard Visa or Mastercard credit cards, such as free access to your credit score, car rental insurance and $0 liability for fraudulent charges.

- Tier 3 includes “prime card” or better-than-average card features like cellphone insurance, lost luggage insurance, concierge services and purchase protection.

- Tier 4 includes luxury features such as airport lounge access, elite status with an airline or hotel and credits for expedited security screening membership programs.

- Tier 5 includes the sort of exemplary benefits you’ll find on top-tier luxury cards, such as high-value travel credits, cardholder memberships and other unique and valuable perks.

What is the recommended credit score for the Discover it® Miles card?

People interested in the Discover it® Miles should have good to excellent credit (a FICO score between 670 and 850) for the best odds for approval.

How do you redeem Discover miles?

You redeem Discover it® Miles rewards as a statement credit to pay for travel purchases like hotel rooms, rental cars, rideshares and more. You could also redeem for cash back, giving you a little extra cushion in your savings to spend on anything you want while you travel.

How many Discover it® Miles do I need to redeem a flight?

According to Bankrate’s latest evaluations, Discover points are worth on average 1.0 cents. This means that 100 Discover Miles earned would be worth about $1. So, if you want to book a $350 flight, you would have to earn 35,000 Discover Miles.

* See the online application for details about terms and conditions for these offers. Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

Editorial Disclosure: Opinions expressed here are the author's alone, and have not been reviewed or approved by any advertiser. The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information.

Chase Sapphire Reserve® Review

Chase Sapphire Preferred® Card Review

Wells Fargo Autograph℠ Card Review

Bilt Mastercard® Review

Wells Fargo Autograph Journey℠ Card Review

Advertiser Disclosure

Discover it Miles benefits guide

The Discover it Miles isn’t the most perk-packed card on the market, but there are a few benefits worth noting

Published: November 26, 2021

Author: Ana Staples

Editor: Emily Sherman

Reviewer: Cathleen McCarthy

How we Choose

The Discover it® Miles doesn’t come with as many attractive perks as other travel credit cards, but its list of benefits works for what the card strives to offer: simplicity.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

Travel credit cards have a certain glamorous flair to them. When we think of these cards, we think airfare booked with miles, lounge access, upgrades to first class and elite statuses at hotels. However, such cards usually charge significant annual fees, which might not be justified for an occasional traveler.

If you belong in this group, a card like the Discover it® Miles may make more sense for you. It offers benefits like 1.5 mile-per-dollar rate on all purchases, flexible redemptions and no foreign transaction fees, all of which can provide plenty of value to a budget-minded traveler.

We’ve compiled this benefit guide to help you determine whether the Discover it Miles is a good option for you. Read on to learn what the card offers and how you can maximize it.

Discover it Miles card benefits

Being aware of all the benefits your credit card offers allows you to get the most out of it.

Here’s what you can get if you have the Discover it Miles.

Simple travel rewards

The Discover it Miles is like a flat-rate cash back card with a travel twist. It earns an unlimited 1.5 miles per dollar on everything, which makes it a good choice for people who want the simplest rewards possible.

To boost your earnings, Discover matches all the miles you earn in the first year with the card. For example, if you spend $15,900 (what we consider the average annual spend), you’ll earn $238.50 worth of miles. Discover will then give you another $238.50, bringing your total first-year rewards to $477 worth of miles.

Flexible redemption options

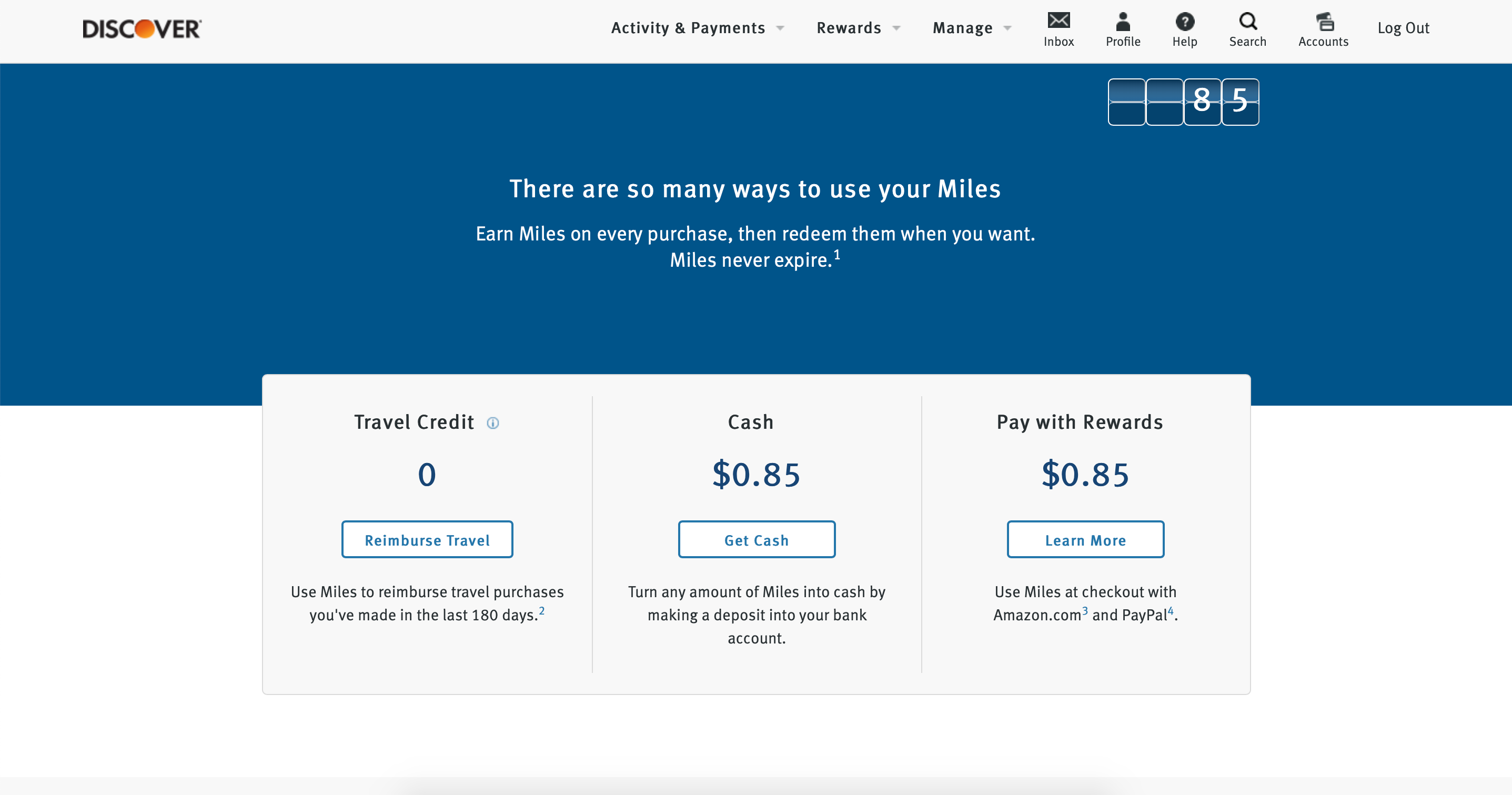

All redemption options on the Discover it Miles provide the same 1-cent-per-mile value.

Since the Discover it Miles is advertised as a travel credit card, you can naturally redeem your rewards for travel. The issuer doesn’t have a travel portal, but you can redeem your miles for statement credits for eligible travel purchases made within the last 180 days.

Alternatively, you can redeem for cash back or purchases made directly on Amazon.com or using PayPal.

The consistent mile value allows for excellent redemption flexibility, as you don’t have to worry about not maximizing your card’s potential.

At the same time, you don’t have the option to stretch your miles further by transferring them to travel partners or taking advantage of issuer portal deals or bonuses.

No foreign transaction fees

This is another must for a travel credit card. Many credit cards charge foreign transaction fees (typically around 3%) if you’re using them on an international trip. Travel credit cards, however, generally don’t charge these fees – including the Discover it Miles.

Tip : Note that the Discover cards might not be as widely accepted worldwide as Mastercard and Visa cards. Make sure you have different payment options to take with you on a trip outside of the U.S.

No late fee on your first late payment

Discover doesn’t charge a late fee the first time you pay your bill late (after that, up to $41). Additionally, paying late won’t impact your APR.

Remember that while Discover may be somewhat forgiving of potential late payments, they will still be recorded on your credit report and have a significantly negative effect on your scores.

U.S.-based customer service

Discover is known for its excellent customer service. When you reach out with an issue or a question, you can expect a prompt response from a customer service representative.

The Discover it Miles card provides 100% U.S.-based customer service available 24 hours a day. You can contact an agent via online chat or by phone.

Complimentary choice of card design

Discover allows you to customize your credit card and make it your own by choosing from multiple card design options.

Maximizing the Discover it Miles

The main value of the Discover it Miles comes from its simple rewards system. There are no bonus categories to keep in mind and no rotating categories to remember. You’ll earn 1.5 miles on everything – no reward limits or expiration dates.

If the Discover it Miles is your only rewards card and you avoid complex credit card strategies, all you have to do is make sure you use the card on all purchases to maximize rewards.

If you have other rewards credit cards, use it like you would a flat-rate cash back card – on purchases that fall outside of bonus categories on your other cash back or travel cards. This way, you’ll ensure you’re earning more than 1% or 1 point per dollar on all of your spending.

In your first year with the card, it may be a good idea to put as much of your spending on the Discover it Miles as you can (unless you’ll also be applying for other credit cards with valuable sign-up offers). This way, you can take advantage of double cash back in the first year.

Bottom line

While the Discover it Miles doesn’t have much to offer in terms of the perks travel cards are typically known for, it can still provide plenty of value.

It’s an incredibly simple rewards card, and that’s what makes it appealing. Cardholders can enjoy the same rewards rate on all purchases, as well as consistent value when redeeming their earned miles.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Ana Staples is a staff reporter and young credit expert reporter for CreditCards.com and covers product news and credit advice. She loves sharing financial expertise with her reader and believes that the right financial advice at the right time can make a real difference. In her free time, Anastasiia writes romance stories and plans a trip to the French Riviera she'll take one day—when she has enough points, that is.

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Card advice

Is the Discover it Student Cash Back worth it?

College students have plenty of cards from which to choose if they want to build credit. How does the Discover it Student Cash Back card compare?

Activate Discover bonus categories for Q3 2023

Discover has added a few new bonus categories in 2022, including gyms, fitness clubs and digital wallets.

Is the Discover it Cash Back worth it?

Activate Discover bonus categories for Q2 2023

Guide to Discover it Cash Back rewards and benefits

How to maximize Discover it Cash Back's benefits

Explore more categories

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

We'll Be Right Back!

When you use our links to explore products, we may earn a fee but that in no way affects our editorial independence. Some of these links are from our partners and terms apply.

Advertiser Disclosure

Terms Apply

On Discover 's Website.

Discover it® Miles

Discover it® Miles offers flexible travel rewards but lacks the benefits that come with some other travel rewards cards.

Credit Needed

Excellent, Good

Intro Offer

Discover will match all the Miles you’ve earned at the end of your first year.

Rewards Rate

1.5X Miles on every dollar of every purchase

Cardholders automatically earn unlimited 1.5x Miles on every dollar of every purchase .

Offers flexible redemption options to help you avoid blackout dates.

Lacks a traditional sign-up bonus.

Gives no opportunities to earn bonus rewards.

Offers no airline or hotel partners to transfer rewards.

Why Trust U.S. News

Your trust is important to us. To earn it, we conduct a rigorous, unbiased analysis with a transparent methodology, and maintain strict editorial standards and independence.

Discover it® Miles Summary

Discover it® Miles is a flexible travel rewards credit card with no annual fee. Cardholders automatically earn unlimited 1.5x Miles on every dollar of every purchase , which you can redeem as cash, a statement credit for travel purchases, at checkout with Amazon or as a PayPal payment.

Instead of a traditional sign-up bonus, Discover will match all the Miles you’ve earned at the end of your first year. Discover it® Miles features include Online Privacy Protection at no cost offered by Discover Bank, and free access to your FICO credit score.

- Rates and Fees

- Highlights from Issuer

- Issuer Name Discover

- Credit Needed Excellent, Good

- Annual Fee $0

- Regular APR 18.24% - 28.24% Variable APR

- Purchases Intro APR 0% Intro APR for 15 months

- Balance Transfer Fee 3% intro balance transfer fee, up to 5% fee on future balance transfers (see terms)*

- Cash Advance Fee Either $10 or 5% of the amount of each cash advance, whichever is greater.

- Foreign Transaction Fee None

On Discover's Website.

Is the Discover it® Miles Right for Me?

Yes, if you:

- Want to earn flexible flat-rate travel rewards with no annual fee.

- Spend enough to get a lot of value out of the first-year miles matching bonus.

- Don’t need extensive travel benefits.

Tips for Using the Discover it® Miles

The Discover it® Miles card offers a lot of value in the first year, since Discover will match all the Miles you’ve earned at the end of your first year. It’s a good idea to maximize this bonus if you need to make big purchases in the first year.

New cardholders can take advantage of the 0% intro APR for 15 months on purchases. You’ll also get 0% intro APR for 15 months on balance transfers from the date of your first transfer. After that, the 18.24% to 28.24% variable APR applies, so you should plan to pay off your balance before the introductory rate expires.

Editor's Take

This card is good if you want flexible travel rewards and don’t want to pay an annual fee. With a $0 annual fee and a flat-rate 1.5x Miles per dollar travel rewards, you can get a lot of value out of the Discover it® Miles card, especially if you can capitalize on the fact Discover will match all the Miles you’ve earned at the end of your first year.

But the Discover it® Miles card’s 1.5x Miles per dollar isn’t the greatest rewards rate you can earn with a travel rewards card. You could get more value from a card that charges an annual fee but offers more in rewards and travel benefits. For example, the Capital One Venture Rewards Credit Card has a $95 annual fee but earns a flat-rate 2 Miles per dollar on every purchase, every day , with the opportunity to earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel. ( See Rates & Fees )

Current Welcome Offers

You won’t get a traditional sign-up bonus with the Discover it® Miles card, but Discover will match all the Miles you’ve earned at the end of your first year.

How to Maximize Rewards With Discover it® Miles

With a flat-rate 1.5x Miles per dollar on all purchases, there are no bonus categories to keep track of to maximize earnings – you can just use your card to earn miles. You'll get a boost in earning rewards since Discover will match all the Miles you’ve earned at the end of your first year.

Comparing the Discover it® Miles With Other Credit Cards

U.s. news credit card rating methodology, alternative pick.

On Capital One 's Website.

Capital One Venture Rewards Credit Card

For Capital One products listed on this page, some of the benefits may be provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

How to redeem Discover it Miles, step-by-step

Update: Some offers mentioned below are no longer available. View the current offers here .

Editor's note: This page includes information about the Discover it Miles that is not currently available on The Points Guy and may be out of date.

Not all travel expenses can be covered by traditional credit card points or airline miles. You need to bolster your loyalty portfolio with cash back rewards or a cash equivalent currency that can cover non-travel expenses. Enter the Discover it Miles credit card.

Although this card calls its currency miles, it doesn't earn miles in the traditional sense of airline miles. The miles have a fixed value and can be redeemed for everything from travel to cash back to Amazon purchases and more.

So how exactly do you go about redeeming them? Here's a step-by-step guide for using your Discover it Miles.

New to The Points Guy? Sign-up for our daily newsletter and check out our beginner's guide .

Discover it Miles overview

The Discover it Miles is a no-annual-fee credit card that earns unlimited 1.5x miles on all purchases. As a bonus, Discover will match all the miles you earn in the first year, with no cap. In other words, you'll earn a respectable 3x miles on all purchases in the first year, which is equivalent to 3% cash back. These miles never expire and are worth 1 cent each, regardless of how you redeem them.

Related: Discover it Miles card review

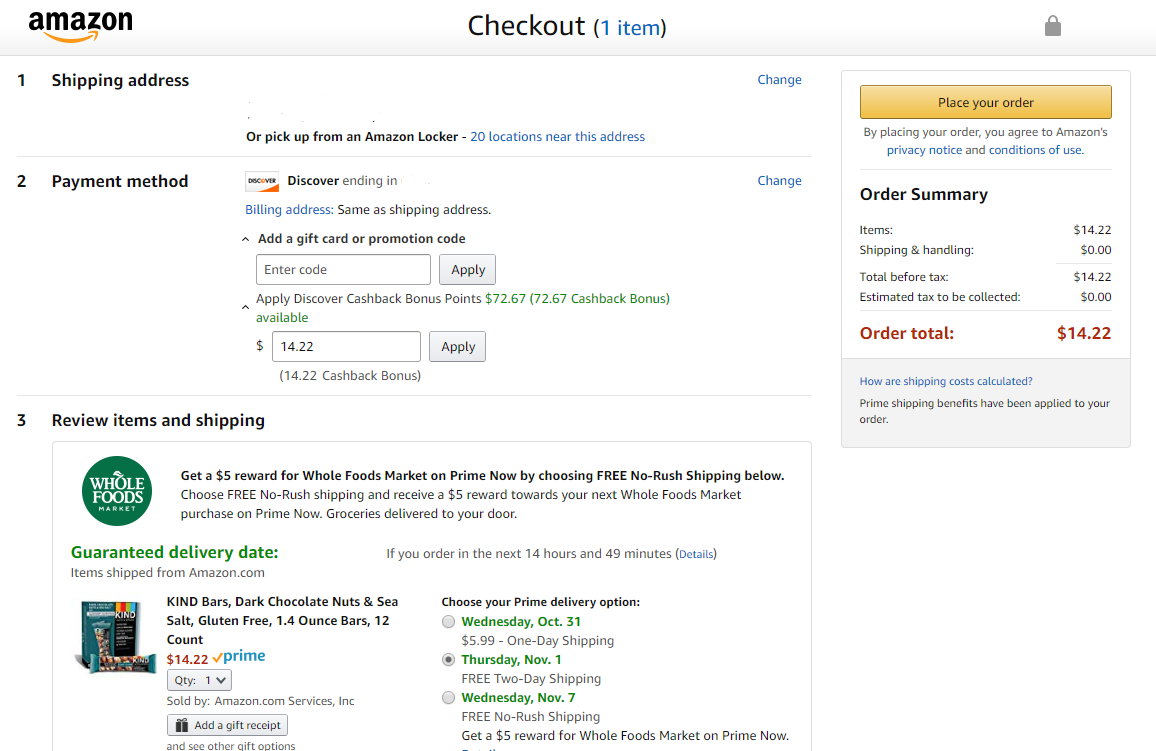

The process to redeem Discover it Miles is as simple as earning them. After you log in to your Discover account, you'll see your rewards total on the dashboard's right side.

After selecting "ways to redeem," you'll see your total available points and three redemption options:

- Travel credit

Pay with rewards

Redeem on travel

Discover doesn't have any airline or hotel transfer partners . Instead, you could redeem miles to offset recent travel purchases, as well as some non-travel purchases. This is useful for families who often travel during peak holiday seasons and can't always get award availability to line up with their schedules.

With a few simple clicks, you can use the miles to "erase" the cost of recognized travel purchases made within the last 180 days. After selecting the purchase you'd like to offset, you'll get a statement credit for the amount you spent. Unlike some similar cards, there is no minimum redemption.

Any purchase that codes as travel is eligible for this type of redemption, whether it's an Uber ride, flight or Airbnb booking. You do not need to book your travel through a specific portal for it to qualify.

In response to the pandemic, Discover expanded the qualifying category to allow redemptions for certain non-travel purchases. Purchases that can be reimbursed now include those made at restaurants and gas stations . You'll see the eligible non-travel purchases listed on the same page as your travel purchases.

Related: 5 reasons why your family may want a Discover it Miles card

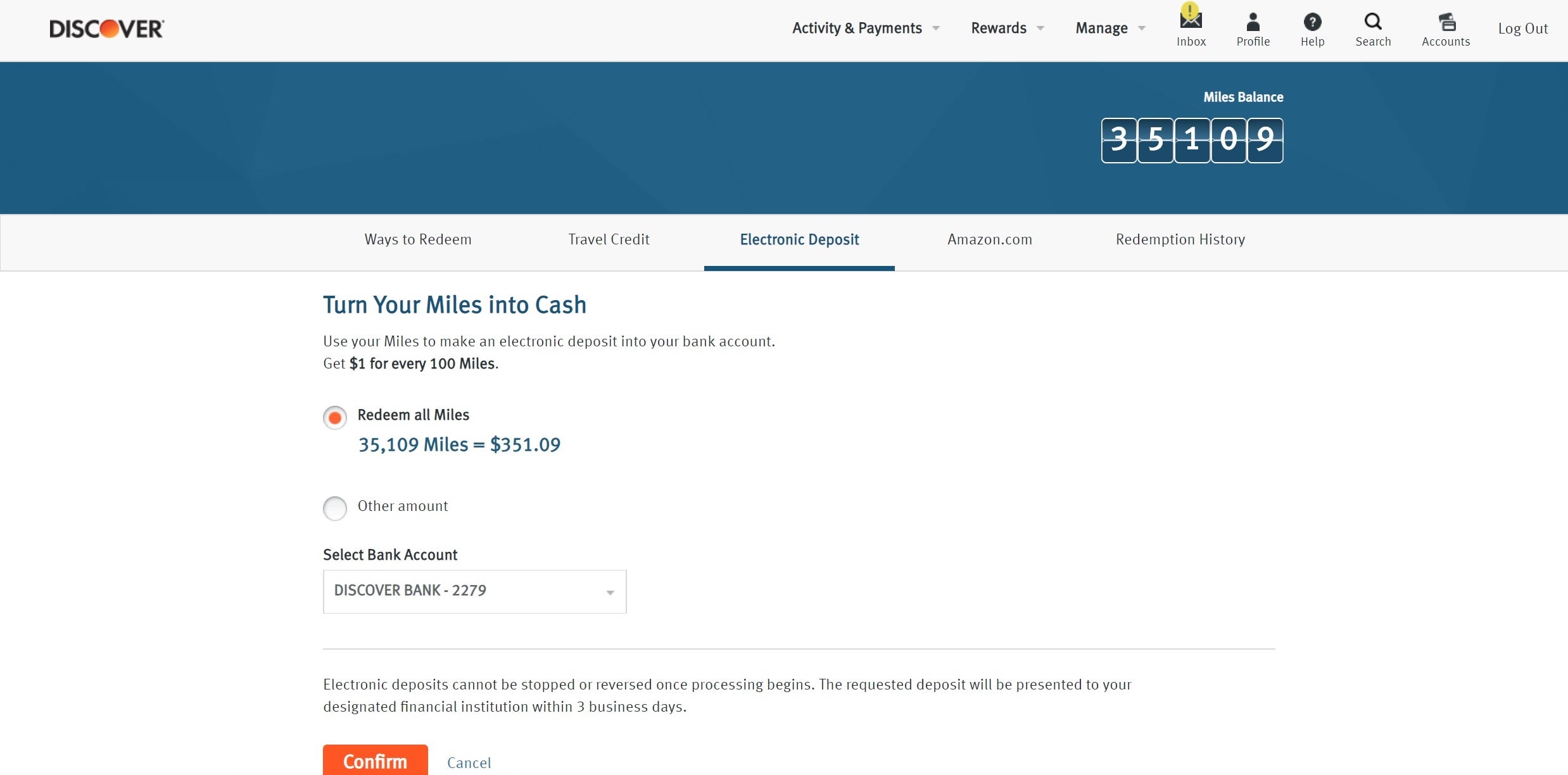

Redeem for cash back

Because Discover miles are worth one cent each, no matter how you redeem them, the best option would be to use them for cash and use as needed. This way, you could pay for your travel and dining purchases with a credit card that earns additional rewards on those purchases.

The cash back redemption option is straightforward, again with no minimum redemption amount. The funds will be deposited directly into your bank account within three business days.

Related: Your ultimate guide to Discover cards

If you want to redeem your miles toward shopping online, you can pay with miles at checkout on Amazon and PayPal. All you need to do is link your Discover card to your accounts and then you'll be able to use miles on the checkout page at the same rate of 1 cent each.

As is the case with other issuers , from time to time, Amazon offers cardholders discounts like 20% off when you redeem at least one Discover mile.

Related: When to use the Discover it Miles card

Bottom line

You're not going to find a more straightforward path to earning cash back and making hassle-free redemptions than with the Discover it Miles Card. Earning 3x miles on all purchases in the first year (once your miles are matched), equates to 3% cash back. That's the best cash rewards earning rate from any credit card out there.

You won't get perks like dining credits or automatic elite status as you do with the top rewards credit cards . However, the Discover it Miles card offers some other valuable benefits, such as no foreign transaction fees and no fee on your first late payment. This card is worth a look, especially if you have some big expenses coming up. Discover it Miles could save you money.

To learn how to redeem Discover it Cash Back rewards, visit this guide .

Additional reporting by Richard Kerr.

Screenshots courtesy of Discover unless otherwise noted.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Chase Sapphire Preferred vs. Discover it Miles: Two Travel Cards Go Head to Head

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

They're two of the most popular travel rewards cards on the market: the Chase Sapphire Preferred® Card , and the Discover it® Miles . Which is best for you depends on your spending habits, fee sensitivity, rewards redemption preferences and preferred perks.

Let’s see which card should take you on your next trip.

on Chase's website

on Discover's website, or call 800-347-0264

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers—only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. You could turn 35,000 Miles to 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

5 points per $1 spent on all travel booked through Chase.

3 points per $1 spent on dining (including eligible delivery services and takeout).

3 points per $1 spent on select streaming services.

3 points per $1 spent on online grocery purchases (not including Target, Walmart and wholesale clubs).

2 points per $1 spent on travel not booked through Chase.

1 point per $1 spent on other purchases.

Through March 2025: 5 points per $1 spent on eligible Peloton purchases (with a maximum earning of 25,000 points) and on Lyft.

1.5 miles per dollar spent on all purchases.

A $50 annual credit on hotel stays booked through Chase.

Each account anniversary, cardmembers will earn bonus points equal to 10% of total purchases made the previous year.

Hotel and airline transfer partners.

Primary rental car coverage .

Access to Discover's free Social Security number monitoring service .

The ongoing APR is 21.49%-28.49% Variable APR .

0% intro APR for 15 months on purchases and balance transfers, and then the ongoing APR of 18.24%-28.24% Variable APR .

Chase Sapphire Preferred® Card vs. Discover it® Miles : Rewards

The Chase Sapphire Preferred® Card earns bonus rewards in a variety of popular spending categories, including dining and travel. It has a generous sign-up bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Ultimate Rewards points are best redeemed for travel. You can use points to book travel through Chase's travel portal at a value of 1.25 cents each or you can transfer them to one of Chase’s partner programs for a potentially higher value. Check out our review of the Chase Sapphire Preferred® Card for partner information.

With the Discover it® Miles , cardholders get 1.5 miles for every $1 spent. Plus, you'll get a bonus: UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers—only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. You could turn 35,000 Miles to 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match. Miles are redeemable for travel or cash back, at a rate of 1 cent per point.

Chase Sapphire Preferred® Card vs. Discover it® Miles : Fees

The annual fee on Chase Sapphire Preferred® Card is $95 . The Discover it® Miles has an annual fee of $0 . Neither card charges foreign transaction fees, but Discover isn’t widely accepted overseas. The Discover it® Miles also has an introductory APR of 0% intro APR for 15 months on purchases and balance transfers, and then the ongoing APR of 18.24%-28.24% Variable APR .

The annual fee of the Chase Sapphire Preferred® Card looks steep, but it could be the better deal if you spend heavily on travel and dining.

Chase Sapphire Preferred® Card vs. Discover it® Miles : Additional benefits

The Chase Sapphire Preferred® Card comes with access to the Ultimate Rewards bonus mall . You can use it to get extra rewards on purchases from more than 250 online retailers.

The Discover it® Miles offers complimentary access to your FICO score and a way to skip the first late fee.

Bottom line: Choosing the best card for you

If you spend primarily on travel and dining, spend enough each year to justify an annual fee and plan on taking your card overseas, the Chase Sapphire Preferred® Card is the way to go. However, if you’re a smaller spender and want an introductory 0% offer, the Discover it® Miles is the better deal. Either way, you’ll end up with a great travel card.

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Action required: Update your browser

We noticed that you're using an old version of your internet browser to access this page. To protect your account security, you must update your browser as soon as possible. You'll be unable to log in to Discover.com in the future if your browser has not been updated. Learn more in the Discover Help Center

Please Note: JavaScript is not enabled in your web browser. In order to enjoy the full experience of the Discover website, please turn JavaScript on. If JavaScript is disabled, some of the functionality on our website will not work, such as the display of rates and APRs.

- Card Help Center

- Card Smarts

- Banking Help Center

- Home Loans Help Center

- Student Loans Help

- Personal Loans Help

- Gift Card Help

- Search Search Discover When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with swipe gestures.

- Log In Opens modal dialog

- Credit Card Products

- Credit Cards by Feature

- Tools and Resources

- All Credit Cards

- Discover it® Cash Back Earn cash back rewards

- Discover it® Student Cash Back Start building credit in college

- Discover it® Student Chrome Earn restaurant & gas rewards as a student

- Discover it® Secured Build or rebuild your credit

- Discover it® Miles Explore with the travel rewards credit card

- Discover it® Chrome Earn restaurant & gas rewards

- NHL Credit Card Represent your team & earn cash back

- Cash Back Credit Cards

- Balance Transfer Credit Card Offers

- Credit Cards for College Students

- Credit Cards for No Credit History

Credit Cards to Build Credit

- No Annual Fee Credit Cards

- Rewards Credit Cards

- Low Interest Credit Cards

- Gas Credit Cards

- Credit Card Interest Calculator

- Respond to Mail Offer

- Check Application Status

- Card Smarts Articles

- - Getting a credit card

- - Using your credit card

- - Credit card rewards

- Free Credit Score for Cardmembers

- Compare Credit Cards

Start your credit history or rebuild your credit

See if you’re pre-approved with no harm to your credit score. 8

No annual fee , no credit score required to apply 1

A card to build credit and earn rewards

Earn 2% Cashback Bonus ® at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. ††

Plus, earn 1% cash back on all other purchases.

Credit cards to build credit FAQs

How can a credit card help my credit score.

Your credit score is based on your credit history, which includes the length of time you've had credit and how you manage your credit. Opening a credit card account can establish your credit history if you don't have one, and using the card responsibly by paying bills on time can help your credit score.

Can any credit card help you build credit?

Yes, any credit line or type of credit card can help you build credit history by influencing the factors that affect your credit score . But you're responsible for managing your credit well if you want a good credit score. If you spend more on it than you repay, you'll accumulate credit card debt which can contribute to poor credit and a bad credit history.

What is a fast way to build credit with a credit card?

A new credit card account usually needs to be open and used for at least six months before it's considered for your credit score by the major credit bureaus. To use your credit cards to build credit, make sure your credit utilization remains low, don't charge above your credit limit, and make sure you pay every statement on time.

Do authorized users build credit history?

Authorized users can build their credit history if the primary cardmember uses their card responsibly, like paying their bill on time and keeping a low credit utilization. If the credit card issuer allows authorized users, you’ll want to make sure the issuer reports both the primary and the authorized user’s credit activity to credit bureaus.

But be aware of the risks involved too. An authorized user’s credit history could be negatively impacted if the primary account holder makes late payments or maintains a high balance on the account.

How many credit cards should I have to build credit history?

You only need one credit card account to start building a credit history. By making on-time payments and keeping your balance low, you can demonstrate responsible use of your credit card account and help improve your credit score.

Why is building credit important?

Building credit and achieving a high credit score can help you meet both near- and long-term financial goals. A good credit score may help you qualify for credit cards with exceptional rewards and a lower interest rate, or even help with renting an apartment or landing a job if your credit history is reviewed during the application process. A high credit score may also help you secure better terms and lower interest rates on other types of loans in the future, like a mortgage or auto loan. Better terms could end up saving you money over the duration of the loan.

How to get approved for a Discover credit card that can help build credit history?

Getting approved for a credit card isn’t guaranteed. Depending on the type of card you’re applying for, requirements may vary for approval.

A Discover it ® Secured Credit Card requires you to be at least 18, have a Social Security number, U.S. address, and U.S. bank account, and provide all required application information. If approved, you need to put down a refundable security deposit, which will equal your credit line, of at least $ 200. 2 For a Discover student credit card , you’ll need to be 18 years old, have a U.S. address and Social Security number, show proof of education, and provide any required information requested in your Discover application.

If you’re not sure which credit card you may qualify for, use the Discover pre-approval tool to check your eligibility. Checking to see if you’re pre-approved is fast, easy and won’t impact your credit score. 8

Which Discover Card is best for building credit history?

The best credit card to build credit history will depend on your specific financial needs and situation. If you’re a student, a Discover student credit card may be best, but if you can’t get approved for one, the Discover Secured Card may still be an option. If your credit has recently taken a hit and you’re looking to rebuild your credit history 3 , the Discover it ® Secured Card may be the best option for you.

College student? See how to build credit and earn cash back

Explore the different cash back cards designed specifically for students with no credit history to earn rewards.

What to look for in a credit building credit card

To build your credit history, make sure your credit activity is being reported to the credit bureaus. Discover reports your credit history to the 3 major credit bureaus, and every Discover ® Cardmember has access to their Credit Scorecard to help monitor their credit score.

When building credit history, you don’t want anything that could negatively impact your score. With Discover, see if you’re pre-approved without a hard credit inquiry. 8 Hard inquiries typically impact your credit score.

The best credit card to build credit history may be one that lets you seamlessly upgrade to a better card with more perks. With Discover, upgrade to an unsecured card after 6 consecutive on-time payments and maintaining good status on all your credit accounts. 9

Consider any fees your credit card issuer may charge and compare them to the rewards you can earn. If the fees, like an annual fee, cost more than you can earn in rewards, there may be better options for you that won’t cost you money. Discover cards have no annual fee .

There are lots of benefits if you're ready to build your credit history

Build your credit with responsible use. 3 Use it for everyday purchases, pay your bills on time and in full, and stay within your credit limit.

A card issuer sees a good credit score as proof that you have a history of responsible credit use. A credit card issuer expects a borrower with good credit to repay their credit; this is why good credit and a higher credit score often means lower interest rates.

Your credit score includes credit utilization ratio, overall credit limit, and credit account age. Your oldest credit account starts your credit history and will continue to appear on your credit report for at least as long as the account is open. Open a credit card account early and keep it open to help your credit score.

Benefits beyond building credit

Discover gives you more control over your personal information online by regularly helping you to remove it from select people-search sites. It’s free, activate with the mobile app. 5

If you misplace your card, you can prevent new purchases, cash advances, and balance transfers in seconds with the Freeze it ® on/off switch on our mobile app and website. 7

The Discover it ® Secured Credit Card is not a prepaid card or a debit card

It’s a real credit card that gives rewards with no annual fee .

Your credit line will equal your deposit amount, starting at $ 200. 2

Build your credit with responsible use. 3 Use it for everyday purchases, pay at least the minimum amount due, and stay within your credit limit.

We'll report your payment history, credit utilization and other habits to the 3 major credit bureaus that calculate your credit scores.

Learn how to build credit with credit cards

Learn more about the Discover it ® Secured credit card and how it can help you build your credit history. 1

Learn about the best ways to build credit with a credit card, including how to get a secured credit card or student card with little to no credit history.

Follow the path to learn more about secured credit cards and how they may be able to help you start building credit.

†† You earn a full 2% Cashback Bonus ® on your first $1000 in combined purchases at Gas Stations (stand-alone), and Restaurants each calendar quarter. Calendar quarters begin January 1, April 1, July 1, and October 1. Purchases at Gas Stations and Restaurants over the quarterly cap, and all other purchases, earn 1% cash back. Gas Station purchases include those made at merchants classified as places that sell automotive gasoline that can be bought at the pump or inside the station, and some public electric vehicle charging stations. Gas Stations affiliated with supermarkets, supercenters, and wholesale clubs may not be eligible. Restaurant purchases include those made at merchants classified as full-service restaurants, cafes, cafeterias, fast-food locations, and restaurant delivery services. Purchases must be made with merchants in the U.S. To qualify for 2%, the purchase transaction date must be before or on the last day of the offer or promotion. For online purchases, the transaction date from the merchant may be the date when the item ships. Rewards are added to your account within two billing periods. Even if a purchase appears to fit in a 2% category, the merchant may not have a merchant category code (MCC) in that category. Merchants and payment processors are assigned an MCC based on their typical products and services. Discover Card does not assign MCCs to merchants. Certain third-party payment accounts and digital wallet transactions may not earn 2% if the technology does not provide sufficient transaction details or a qualifying MCC. Learn more at Discover.com/digitalwallets . See Cashback Bonus Program Terms and Conditions for more information.

Student Credit Cards: Discover it Student ® Cash Back, Student Chrome Card

Secured Credit Card: Discover it ® Secured credit card

Student Credit Cards

Intro purchase APR is x % for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x % for x months from date of first transfer, for transfers under this offer that post to your account by then the standard purchase APR applies. Standard purchase APR: x % - x % variable, based on your creditworthiness. Cash APR: x % variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x % Intro fee on balances transferred by and up to x % fee for future balance transfers will apply. Annual Fee: None . Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

Secured Credit Card

x % standard variable purchase APR . Intro Balance Transfer APR is x % for x months from date of first transfer, for transfers under this offer that post to your account by then the standard purchase APR applies. Cash APR: x % variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50 . Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x % Intro fee on balances transferred by and up to x % fee for future balance transfers will apply. Annual Fee: None . Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

No Credit: Based on the preceding 12 months of Discover Student credit card application data. When we evaluate your creditworthiness we consider all the information you provide on your application, your credit report, which includes your credit score if applicable, and other information. Not having a credit record may impact your approval odds.

Based on 2023 Discover it Secured credit card application data, applicants without a credit score may qualify. You must meet other applicable underwriting criteria. When we evaluate your creditworthiness, we consider all the information you provide on your application, your credit report, and other information. If you have a credit score, we may use that in our evaluation.

Minimum Security Deposit: If approved, you must make a minimum security deposit of $200 (or more, in increments of $100 up to $2,500), which will equal your requested credit limit. Discover will determine your maximum credit limit by your income and ability to pay.

Build credit with responsible use(Secured) : Discover reports your credit history to the three major credit bureaus so it can help build/rebuild your credit if used responsibly. Late payments, delinquencies or other derogatory activity with your credit card accounts and loans may adversely impact your ability to build/rebuild credit.

Cashback Match: Only from Discover as of July 2024. We'll match all the cash back rewards you've earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or 365 days, whichever is longer, and add it to your rewards account within two billing periods. You've earned cash back rewards only when they're processed, which may be after the transaction date. We will not match: rewards that are processed after your match period ends; statement credits; rewards transfers from Discover checking or other deposit accounts; or rewards for accounts that are closed. This promotional offer may not be available in the future and is exclusively for new cardmembers. No purchase minimums.

Online Privacy Protection: Online Privacy Protection is offered by Discover Bank at no cost and only available in the mobile app. About every 90 days we will scan at least 10 people-search sites for your online personal information and help you submit opt-out requests. Types of personal information found on these sites will vary.

Discover ® Identity Alerts (Alerts) are offered by Discover Bank at no cost, are available only online, and do not impact your credit score. The Alerts currently provide: (a) daily monitoring of your Experian ® credit report and an alert when a new inquiry or account is listed on your report; (b) daily monitoring of thousands of Dark Web sites known for revealing personal information and an alert if your Social Security Number is found on such a website. Alerts are only provided to Primary cardmembers who agree to receive them online and whose accounts are open, in good standing, have a Social Security Number, and an email address on file. This benefit may change or end in the future. Discover Bank is not a credit repair organization as defined under federal or state law, including the Credit Repair Organizations Act. To see a list of Frequently Asked Questions, visit discover.com/freealerts .

Freeze it ® : When you freeze your account, Discover will not authorize new purchases, cash advances or balance transfers (including checks). However, some activity will continue including charges from merchants where your card is stored or billed regularly, as well as returns, credits, dispute adjustments, delayed authorizations (such as some transit purchases), payments, Discover protection product fees, other account fees, interest, rewards redemptions and certain other exempted transactions.

There is no hard inquiry to your credit report to check if you’re pre-approved. If you’re pre-approved, and you move forward with submitting an application for the credit card, it will result in a hard inquiry which may impact your credit score. Receiving a pre-approval offer does not guarantee approval. Applicants applying without a social security number are not eligible to receive pre-approval offers. Card applicants cannot be pre-approved for the NHL Discover Card.

Getting your deposit back: Monthly reviews start your seventh month as a customer. We will refund your security deposit if you have made all payments on time for the last six consecutive billing cycles on all your Discover accounts including any loans, and you've remained in "good status" on all credit accounts you are responsible for whether they are Discover accounts or not. "Good status" means: (1) your credit report shows no delinquencies, charge-offs, repossessions, or bankruptcies for the six months prior to our review; and (2) your Discover secured card is not in a prohibited status at the time of our review, including, but not limited to: closed, revoked, suspended, subject to tax levy, garnishment, deceased, lost/stolen, or fraud. Monthly reviews may be delayed if you change your payment due date. We typically process your refund in 2-3 business days based on your delivery preference. If you close your account and pay in full, we'll return your deposit within two billing cycles plus ten days.

IMAGES

VIDEO

COMMENTS

Earn unlimited 1.5x Miles on every purchase and get a match of all your Miles at the end of your first year. Redeem Miles for travel purchases, cash, or Amazon.com gift cards with no annual fee.

With so many travel sites that offer flight and hotel deals, you can almost always find a way to save on a trip. If you want a flexible travel card that lets you earn Miles on everyday purchases and redeem miles for cash to use on travel, consider a Discover it ® Miles credit card. Your morning coffee, online shopping, and even groceries automatically earn unlimited 1.5x Miles on every dollar ...

The Discover it® Miles earns 1.5 miles for every dollar spent — pretty good for a card with a $0 annual fee, but low compared with travel cards that charge an annual fee.

Learn how to earn unlimited 1.5x Miles on every purchase with the Discover it Miles card and redeem them for travel or cash. Discover Match will double your Miles at the end of your first year.

For example, if you spend $1,000 each month on your Discover it® Miles card, your 1.5 cents per dollar adds up to 18,000 miles for the year. Discover matches that with an additional 18,000 miles ...

The Discover it Miles has benefits and perks that are well-suited for first-time or less experienced cardholders. The card's most appealing benefit is the ease and simplicity of earning and redeeming — but since earning and redeeming will be discussed in detail in subsequent sections, let's focus on the card's other benefits in this section.

The Discover it® Miles is a flat-rate travel rewards card with a structure that's different from most travel rewards cards. You won't get a boosted rewards rate for travel-related purchases ...

For instance, spending just over $13,000 by the end of your first year with your Discover it® Miles card would earn you about 20,000 bonus miles, worth at least $200 in rewards. Discover would ...

The Discover it® Miles card offers unlimited 1.5 miles per dollar on every purchase (equivalent to 1.5% cash back when redeemed for travel or cash back) where the Discover it® Cash Back offers 5 ...

Discover it Miles card benefits. Being aware of all the benefits your credit card offers allows you to get the most out of it. Here's what you can get if you have the Discover it Miles. Simple travel rewards. The Discover it Miles is like a flat-rate cash back card with a travel twist. It earns an unlimited 1.5 miles per dollar on everything ...

The Discover it® Miles card is more flexible than some of its competitors. With a flat rate of 1.5 miles per $1 spent on all purchases, you'll never have to think about spending by category to make the most of your rewards. So if you're looking for a simple, flexible travel rewards card, Discover it® Miles could be a great fit for you.

A long 0% intro APR period. The Discover it® Cash Back offers a 0% intro APR for 15 months on purchases and balance transfers, and then the ongoing APR of 18.24%-28.24% Variable APR. 4. A ...

Limited-time offer: For a limited time, earn 75,000 Miles once you spend $4,000 on purchases within the first 3 months of account opening, plus receive a one-time $250 Capital One Travel credit in ...

About Us. Log in to your Discover Card account securely. Check your balance, pay bills, review transactions and more using the Discover Account Center, 24 hours a day, seven days a week.

Related: Discover it Miles card review. The process to redeem Discover it Miles is as simple as earning them. After you log in to your Discover account, you'll see your rewards total on the dashboard's right side. After selecting "ways to redeem," you'll see your total available points and three redemption options: Travel credit.

With the Discover it Miles Travel Credit Card, you can turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more. Learn More. Paying for a travel expense with a credit card can help protect you. If a company fails to deliver the goods or services you paid ...

The Discover it ® Miles is a good card for people looking for a $0-annual-fee travel credit card to get started using miles. It earns a flat rate of 1.5 Miles per dollar on all purchases. Even though it's a travel credit card, it operates almost exactly like a cash back credit card. You can't transfer miles — you could redeem them for ...

Discover miles are worth 1 cent each, so that balance is worth $752.60 toward travel purchases or directly into your bank account. This is a solid rewards potential for a card with no annual fee ...

High rewards and easy withdrawals. Cash back: Discover credit cards earn cash back rewards or Miles (that can also be used as cash back), and you can redeem in amounts as low as $0.01, should you ...

Discover Credit Card Benefits

If you prefer not to receive your FICO ® Credit Score just call us at 1-800-DISCOVER (1-800-347-2683). Please give us two billing cycles to process your request. You earn a full 2% Cashback Bonus® on your first $1000 in combined purchases at Gas Stations (stand-alone), and Restaurants each calendar quarter.

Limited time offer equal to $1,000 in travel plus, unlimited 2x miles on every purchase ... Why I chose the Discover it Student Cash Back card for my first credit card ... Benefits and perks.