What to Pack for a Trip to Israel? (And What Not to Bring Along!)

- By Traveling Anne

- February 2019

- In Israel Travel Advice

35 Comments

This post will provide you with the following lists -

- Things you absolutely should pack for a trip to Israel.

- Things you should probably bring along - depending on the nature of your trip.

- Things you shouldn't bring along.

This is a funny post for me to write because I actually live in Israel . However, as a fellow traveler, I fully appreciate the pains of packing for a new destination that you've never visited before.

The information is based on several sources.

First, questions and comments on my post about What to Wear in Israel . I have had hundreds of those over the years - and I always reply to them all!

Secondly, we love hosting people. We couchsurf and host other couchsurfers. Talking to so many travelers to Israel, I have a pretty good grasp of the things they were happy they brought along, the things they missed (and needed our help with) and the things they were sorry they had dragged along.

Keep reading so you can avoid repeating the same mistakes! And don't forget to follow the tips in the last section of this post as well - they're important!

Things you absolutely should pack for a trip to Israel

Here are the items that you either won't be able to replace or that replacing will take you way too much time. I'll also explain what to do in case you manage to forget or lose one of these.

Well, you won't be able to make it on board your flight without one, so the odds of you landing here without one are slim. However, it's possible to lose documents.

Before you leave, make a copy of your passport. Keep a print somewhere in your belongings, as well as a copy that you can access online.

If you happen to lose your passport while in Israel -

- If you suspect your passport was stolen, report the theft to the local police. Call the number 110 to find out where exactly you need to report the theft so you can get a written copy of the report. (The emergency number for the police in Israel is 100 - although dialing 911 will also work here. The 110 number is for their information center).

- Contact your embassy to find out how to get a new passport or alternative temporary travel documents for your flight back home.

Credit card

Almost all businesses in Israel accept credit cards. Israelis usually use local versions of VISA and Mastercard. You need to check with your bank to make sure that your card will work in Israel. At least some banks require you to state your travel plans in your account - or else the card will not be valid in a different country.

You can also use your card to get cash from ATM's. You'll find one next to every bank branch and in every shopping center. Just don't forget your code! By the way, you won't be asked for your PIN code when you pay at a store - just doesn't happen here.

What to do if you lose your credit card?

Call your bank back home right away to report the loss of the card. They should be able to instruct you on how to get money transferred to you so you can use it for the remainder of your trip.

Driver's license

You only need this if you plan on renting a vehicle. If you really want to see the country, beyond Jerusalem and Tel Aviv - renting a car in Israel will be a good idea . You can only do that with a valid driver's license. There's no need for any additional papers unless your driving license has no photo or doesn't have your name in English letters on it.

Yes, you can buy cell phones in Israel. In fact, that's easier to do here than in the US because all phones are - by law - unlocked. However, I'm sure you'd like to have your own phone with you - the one you're used to, which has all of your accounts on it etc. Also, phones are not cheap here.

In short, don't forget to pack your mobile phone!

Prescription glasses & sunglasses

You can get new prescription glasses in Israel but just like anywhere else in the world, it can be time-consuming. Save that for an actual emergency such as losing your spectacles, and just remember to pack both types.

Prescription Medications

Bring along whatever prescription medication you may need. If your meds include narcotics or anything which may look suspicious, it won't hurt to bring along a copy of your original prescription and/or a letter from your doctor. I've never heard of anyone who had any problem with legitimate quantities for personal use - even for a few months - but you never know, so if in doubt, have the papers with you.

If you lose your prescription medications -

You can get a replacement here but naturally, you'll need to see a doctor first. Again, having access to a letter from your doctor or to your medical files will help and make the process faster.

If you have travel insurance with medical coverage, call the insurance companies to find out which doctors they work with. Otherwise, just Google "doctor in Tel Aviv" or "doctor in Jerusalem" and you'll get links to English-speaking doctors who treat tourists.

Things you should bring along

Generally, the dress code in Israel is very casual. Some would call it "non-existent". Just bring your favorite comfortable clothes as the weather calls for. No tie required, and no evening gowns. Even if you're going to a wedding. You'll feel overdressed and out of place.

Take a few minutes to read my detailed post about what to wear in Israel . I included a guide on what to wear, by month of the year, so you can tell whether you need a light jacket or a heavy coat - or possibly neither.

Should you bring "modest clothing"?

I've seen this as an item in others packing lists for Israel. To clarify - you can wear whatever you want in Israel, as long as you're not trying to visit a religious site like a synagogue, a church or a mosque. These establishments tend to have their own rules about what's modest enough for you to wear when visiting.

In my experience, at mosques, both men and women are required to cover the elbows and knees when visiting. Neither are asked to cover their head, by the way. Jewish and Christian sites tend to be more lenient. At the very least, you'll be expected to cover your shoulders. Some places may ask women to cover the elbows and knees as well.

As for synagogues - Orthodox Jewish men wear a head cover (usually with a yarmulka, locally known as "kippa"). Married Jewish women usually cover their head as well. Many visitors to synagogues and other religious sites cover their head out of respect, but you really don't have to.

I know this sounds weird, but local secular Jews sometimes make a point of not covering their head in such places. It's perfectly legal - but may get you into an argument. As a tourist, you may want to anyway, just to avoid any arguments.

So back to packing -

Both women and men should pack at least one set of clothes that cover your elbows and knees, for visiting holy sites.

Women should also carry a shawl or pashmina with them - which can be used as a head cover as well as for covering the shoulders when necessary. Men may want to pack a hat to be used as a head cover if planning to visit synagogues. Actually, a hat is a good idea anyway, so just have accessible and available.

I get so many questions about footwear so clearly, this is on people's minds.

You should bring a pair of comfortable walking shoes. Period. Hiking boots? Sneakers? Sandals? Crocs? Your choice. Pretty much anything will work for any time of the year.

During summertime, you may want to go with a light and well-aired pair of shoes or sandals. But again, whatever works for you, as long as you're comfortable. By the way, if you're traveling light, you can just wear the shoes instead of packing them. One pair should be enough.

Toiletries etc.

Again, no problem with getting any type of toiletries here in Israel. Prices are a bit higher than in the US or even Europe but nothing too dramatic. If you forget anything, you can get it here.

Packing your usual set of toiletries makes sense, of course. You know which items and brands you like - there's no one-list-fits-all with these things. Don't forget any OTC medications that you're used to and female hygiene products (if you need them).

Other items

Finally - the "other items" section.

Adapter and/or converter

There are two separate issues - although you can find an all-in-one solution.

Adapter & Converter

You would need an adapter just so that you can plug something into an Israeli outlet (depending on where you come from). This is what our outlets look like -

If you're coming from the US or Canada, you also need a converter.

Israel - like most European countries - uses 220v system. If you plug in a US-bought appliance into an Israeli socket - using a simple adapter you'll basically fry that gadget. It will probably work at first - and then stop once the excess voltage heats it up and destroys it. Tried and tested...

To avoid that, you need a voltage converter as well as an adapter. Fortunately, these are easy to get since you can have an adapter and converter in one. It will come in handy in any country you'll travel to.

Not sure which to get and where? Click for my detailed guide about adapters and converters for those traveling to Israel.

Phone chargers

Can't live without your phone and the phone can't live for long without a charger! You can buy phone chargers here but they will be a local version, suitable for our electric system. On the plus side, you won't need an adapter/converter. On the other hand, you won't be able to use them elsewhere in the world.

If you have an iPhone, chargers tend to be expensive so it's best to bring your own and take good care of it. That means never plugging it in without an adapter/converter (see above).

Extra phone batteries or power banks

You're bound to be using your phone a lot when traveling. Israel has excellent data phone coverage and there's free WiFi in many places. You'll also be taking pictures and maybe shooting videos.

I usually run out of battery mid-day when traveling. My Samsung Galaxy S6 has a fixed battery, so I carry one or two power banks with me. If your phone has detachable batteries, get a couple of those. Don't run of juice during your trip.

Traveling during summertime, or just planning on being outdoors a lot? Consider bringing a hat with you. Your choice of hat or cap is personal - just keep in mind that some sort of head cover when out in the sun is important.

A hat is also useful if you plan on visiting local synagogues. You don't have to cover your head but it is the polite thing to do.

Did I mention the sun already? You can get sunburnt here just by spending a few hours outside on a summer day. Even more so if you're visiting the seaside. Get good quality sunscreen that's right for your skin and use it liberally.

Things you shouldn't bring along

You probably know all about the items you can't bring aboard the airplane. Obviously, don't bring with you any drugs or drug paraphernalia or any weapon of any kind.

There are some items which may be perfectly legal to bring in Israel - but I would advise against doing so.

These items basically include anything that may raise suspicion of any kind of involvement in the conflict -

- Toy weapons

- Books or other reading material in Arabic

- Political material relating to the local conflict (regardless of which side you happen to support)

- Clothes which carry political statements relating to the local conflicts

Again, all of the above are perfectly legal to carry around in Israel. And if you're an Arab Israeli citizen who happens to be reading a book in Arabic on board the flight, that's perfectly ok too. The problem would be with tourists who may be suspected of being affiliated with terrorists - either Palestinian or Jewish ones (yes, we have the latter as well).

What would happen if you do bring one of these items?

I can tell you what happened to one of our Couchsurfing guests. He was an American guy, a Mormon who had spent six months in Egypt on his mission. While there, he took the time to learn Arabic and so he had with him a copy of the Koran in Arabic.

He came to Israel from Egypt on a bus and crossed the border near Eilat. When he entered, they asked him to show the content of his bag and that book in Arabic simply meant he had to wait for a couple of hours for them to call the officer in charge, and go through further questioning. Once they were convinced he was ok - he was let in, along with his Koran, not a problem. Except for the aggravation and lost time.

A few more tips for packing for a trip to Israel

Travel light.

Most people who visit Israel seem to avoid renting a car or driving. With some itineraries, that's fully justified. With others, not so much, but that's another point. If you want to know what I really think about this, read my post about renting a car in Israel .

The point is unless you're renting a car at the airport for the duration of your trip, you should really travel light. Lugging a big suitcase behind you is never fun. Public transportation options in Israel are generally ok but they may require you to walk for 5-10 minutes between stations when switching bus lines. Easier to do when you have less luggage, especially in the rain or on a hot day.

And do yourself a favor, unless you have back issues, choose a carry on backpack instead of a suitcase-only type of luggage. It's just going to be so much easier for you to take your stuff on your back as you travel around.

Pack clothes for only 3-4 days

Still, on the "travel light" theme.

If you're traveling with a low-cost airline, you may get a much cheaper ticket if you avoid bringing a suitcase at all. Sticking to the trolley-sized allowance is actually preferable, IMO. We've done that several times when we traveled to Europe and it worked just fine.

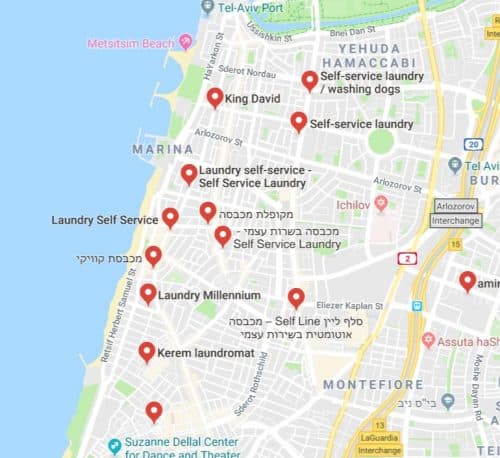

If you're traveling solo, you can absolutely pack clothes only for 3-4 days. You should be able to find self-service laundromats in any big city here, and in some of the smaller ones too. Just use Google Maps to find them. Here's what the search results look like in Tel Aviv -

Clicking on the pins will show you the opening hours. And they're super convenient with many places open 24/7. I only wish we could find laundromats that easily in European countries we travel to.

Other cities have their share of accessible laundromats, though with more limited opening hours. There's a reason why Tel Aviv's slogan is "The City That Never Stops".

The point is, you don't need to pack clothes for the entire trip - packing for 3-4 days is plenty. Just leave some time for doing your laundry.

If you travel solo, that is. If traveling with a group, you should discuss this with the tour organizer to see if you're going to get enough free time in major cities - and when that's going to happen.

You can find (almost) everything here

In other words: Don't fret.

Yes, I know. I suffer from travel anxiety myself, so I do fret before any trip, When packing is concerned, here's how my husband puts my mind at ease:

He reminds me that whatever we end up forgetting, we'll be able to buy once we reach our destination.

And he's right.

Get this - I was frantic about getting all of the right clothes, toiletries, and medical supplies in our suitcase before our very first trip to... the USA. Turns out, most of the stuff is actually available locally in the stores. Who would have thought?

Now, things are actually a little bit more expensive to buy in Israel. Also, your travel time is super valuable and you should make the most of it sightseeing and not shopping for sunscreen or band-aids. However, just know that if you do end up forgetting almost anything - you'll be able to find it here.

When I say "almost", I'm referring to the following -

- Driver's license (in case you'd like to rent a car)

- Credit car (getting one sent over would be a total PITA)

Other than that, you can absolutely forget anything else. Worst case scenario, you'll pay some money and buy a replacement while in Israel.

As far as “Married Jewish women usually cover their head as well” – halacha (Jewish law) means we cover our hair (wig, scarf, fully covering hat, etc). There is NO requirement or expectation for visitors to do the same, although you are welcome to do so if you want. However, a “chapel hat” or doily on a woman’s head – as worn in some churches etc – would just look wierd. This is different than exposed elbows and knees and deep necklines for women, which would be offensive in any Orthodox setting.

What about Israeli currency? How much you need besides having credit cards?

Hi JH, You can pay pretty much anywhere using credit cards. I would carry probably 100-200 NIS on me, just in case. You can always get more at any local ATM using an international card.

Hi there! This is going to be an unusual question. I’m European and want to travel to Israel. There’s an Israeli company named Mul-T-Lock with its headquarters in Yavne. Is it possible for me to go to the companies building and ask them to tell me a little more about some of their products and their history? And maybe entering the premises and visiting the workplace. I’m Mul-T-Lock’s biggest fan, I even have the companies logo as a tattoo.

Hi Dani, Yup, quite an unusual question. Why not email them and see? I have a feeling they would like to meet up with their biggest fan, but it’s something you should probably schedule in advance.

Loved your article! Spot on! Just came back and learned so much! Went with Imagine Tours and loved it! Only thing I would add about prescriptions – the original bottle or at least a written list of all meds and dosages in case you end up staying longer for whatever reason. (Covid, airline strikes,etc) I took my empty weekly container and then filled it once we got to the hotel. I traveled with pain meds (old lady here) in their bottle from the pharmacy but no one checked.

Also if traveling with checked bag – pack all your meds and a couple changes of clothes in your carry on. In our very large group two people’s luggage was misplaced for a couple of days.

Lol, I was just saying the same thing when replying to your previous comment. I should have read all of the comments first, but yeah, that’s the best thing to do these days.

Hi Charlotte,

Great tips! I would add this: have enough medication for a week in your carry on. So much luggage gets lost these days, it’s good to have enough on you until you find a local physician who can write more prescriptions should you need them. I’m glad you enjoyed your trip!

So, quick question, what open markets are better for fresh foods vs others to stay away from

Hi, This would depend on where exactly you are. All big cities have lively open markets and if you like them, you can check any local one and have a ball. In Jerusalem, look for Machne Yehuda Market, and in Tel Aviv for HaKarmel Market, to mention the two largest ones.

Hi, I am leaving November 1 on a spiritual trip to Israel with a tour group. I am so excited! However, I am concerned about currency in Israel. Do I need to convert my US dollars into Israel currency. And if I do, where do I need to go? I heard that the value of American dollars are not of high value in Israel. And you answered so many of my questions thru you web page. Thank you so much!

Great info, not sure how many people actually bring their pets, but I have a 3.5 lb 8 yrs old Chihuahua who hates being away from me more than a day or two. She travels with me everywhere and does really well around strangers. What are your thoughts on travel with pets? (Are there Pet friendly hotels)

Could you give me a little guidance on crafting tools? I am a knitter and I always bring along a project or two when there are long travel times. Do you think I will have any trouble with knitting needles, yarn, scissors, etc. while traveling within Israel or with the TSA rules leaving Israel?

Hi Sonia, I can only speak from my limited experience. I’ve just flown from Israel to the US and had a plastic crochet hook and some yarn on board with me. There was no issue with that. That was also the case in previous flights between the two countries, including coming from the US to Israel. Based on my experience, I believe a plastic hook or needles and yarn should be perfectly ok. Scissors, not so much. They’ll throw them away. You would either need to use a plastic knife (like the one they give you with your meals) or maybe something like this little gadget . I took that one with me once and had no issues (no guarantees though, just my own experience). I hope this helps! Have a safe flight and a good trip!

I was wondering if its ok to wear like spiritual t shirt?

Hi Denise, Do you mean one that advocates a specific religion? It would be fine when visiting a location where that religion is practiced. For example, a tee-shirt with an image of Christ would be perfectly ok when visiting a church. It should also be ok in most secular Israeli cities/towns, especially for a tourist. I’m not sure it would be welcome when visiting a mosque or a synagogue.

I take medication. Is it ok to put the daily meds into a weekly medication container ? Or do all the meds need to be in separate containers? I haven’t had any issues in other parts of Europe but am not sure about Israel

Good question, Lee. I don’t think this is specific to Israel, but generally speaking, it’s best to carry medications in their original packaging when going through customs. For prescription medications, especially opiates or amphetamines, it’s a good idea to carry with you a letter from your doctor, or at least your signed prescription. Having said all that, as long as the quantities are for personal use, I’ve never heard of anyone who had trouble bringing them into Israel (or into the US, as a visitor there). I don’t think anyone will even ask to see your luggage or their contents and I highly doubt they would mind a weekly medication container with a small amount of meds for personal use. I hope this helps! Enjoy your visit!

Should we bring washcloths to use in bathing? We have had to bring them on trips to Europe. Thanks for all of your advice. We’ll be arriving next week. Can’t wait!

Hi Janet, Everywhere you’ll say at will have a shower and maybe even a bathtub. I’ve never heard of anyone using a washcloth though. I hope this helps.

Anne, Can I bring with me a bag of beef jerky to Israel. Thank you. Steve

Sure, as long as it’s sealed you should have no issues. I am 99% sure that an open bag would be perfectly ok too. I know that going into the US, bringing non-sealed food items is a problem, but I’ve never heard of anyone getting stopped bringing food into Israel. The only thing to avoid would be seeds and *maybe* whole fruit. And even then, I know it’s an issue going into the US – never heard of it being an issue when entering Israel.

Hi, thank you for your detailed article. I have never been to Israel and have my first trip in December. You have said anything can be purchased if forgotten. What about hearing aid batteries? I have a bad habit of forgetting to take them with me. Thank you

Hi Kathryn, Yes, you should be able to buy them here. I know they’re available in our local pharmacy chain (like the US Wallgreens). Ours is called Super-Pharm and there’s usually one in every large shopping mall (several in every city). I hope this helps and enjoy your trip!

Thanks for your guides. They’re fantastic. I haven’t seen anything about pocket knives. I’ve carried a small 3″ folding pocket knife every day for 40 years now. Not as a weapon, but as a legitimate tool. Is that a problem anywhere in Israel? Thanks again!

Hi Joz, Clearly, you wouldn’t be able to bring it on board the plane with you, so it’ll have to go into a checked-in suitcase. Worth mentioning because if you forget to, you’ll lose the knife. Once in Israel, I doubt you’ll have any problems with it. People carry pocket knives and fruit knives and I’ve never heard of anyone having any problems. In fact, the only time I was asked to get rid of a similar item was in Washington DC. It wasn’t even a pocket knife, just a tiny pair of scissors that I used for my crochet work… I had to throw that in the trash before I could get into the museum.

Thank you! I’ve done some overseas traveling and have always packed my pocket knife in my luggage. I’ve never had an issue with it. There was one time I got away with it at a Kremlin museum in Moscow where you weren’t supposed to have a pocket knife. Fortunately, I wasn’t searched and was able to keep my knife.

I’ve been to some countries in the middle east where it was rude to show anyone the bottom of your shoes and abstain from using your left hand in polite company. Are there any social norms I need to follow closely as an American to avoid offending people around me?

I’m really looking forward to visiting your amazing country. Thanks again!

I’m glad you’re back for a follow-up, Joz! I asked a friend who knows the local law regarding weapons. He says that as long as it’s a folding pocket knife that doesn’t have a fixed blade (or can be turned into one), it’s legal to carry around. The blade needs to be shorter than 10 centimeters too. There are limitations on where you can carry that though. You’re not allowed to take it into schools, for example. A police officer can still stop you for holding a pocket knife but with a foldable small pocket knife, he would have to prove that you have malicious intent. With a regular fixed-blade knife, there’s no need to prove intent – it’s illegal to carry in public places. Now, having said all that. It’s really up to you as to whether you want to carry that pocket knife around. My friend says that as long as it’s a small one, surrounded by work tools etc, like a swiss army knife, you shouldn’t have any problems. Personally, as a tourist, I’m not sure I would be going around with it. Maybe keep it in your luggage for when you really need it?

As for other codes and social norms, I can’t think of anything specific. Israelis are generally very warm and forward. You may find people to be louder than what you’re used to in the US, depending on where in the States you come from 😉 If you’re coming from NYC/NJ you’ll probably feel right at home. We’re not “Minnesota nice” here but then again, no one will be offended if you are. No limitations on hand use, shoes or anything else that I can think of. This is a very informal society. We call our teachers and military superiors by their first name, for example. Dress codes are very lax too and most Israeli men don’t own a suit or even a tie. If they ever wore one, it was on their wedding day. I hope you’re getting the picture by now – enjoy your trip!

Can I bring binoculars? I’m ornithologist. I will come by the plain, and I’ll have in light back-pack.

Hi Deimante, I’m not aware of any limitation on bringing binoculars along with you. Make sure you visit the Hula nature reserve to see the migrating birds!

Thank you ….going to Israel tomorrow and this is one of the best articles I have found. You relieved some of my anxiety.

Hi Lynette, I hope you’re enjoying Israel! It was unexpectedly stormy yesterday but hopefully, you’ll enjoy some great weather later this week.

I am confused. Everything else I have read said that there is no need for a converter for phones/computers. They have built in converters. You do need adapters. IS your experience different?

Hi Janbo, If you’re coming from the US you definitely need an adapter. You’re right that most phones and laptops can work with 220V. However, not all do, so do check to see if your laptop is wired for 220V or else get a converter (not just an adapter). Also, for anything else, like a hairdryer or CPAP machine, you will definitely need a converter. Hope this helps!

Leave a Reply Cancel Reply

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment *

Post Comment

To learn more about the guidelines about travel to Israel - click here

Frequently Asked Questions

Isn’t Israel a long way away? Not nearly as far as you may think: just 10 hours from New York (it’s quicker to fly from New York to Israel than from New York to Hawaii!), or 14 hours from Los Angeles. There are about ten nonstop flights a day from North America to Israel, on Air Canada, American Airlines/US Airways, Delta, El Al Israel Airlines and United. Plus you can connect to Israel through dozens of European cities.

What documents do I need to travel to Israel? For U.S. and Canadian citizens, all you need is a passport that’s valid at least six months longer than your date of arrival in Israel. (For stays up to three months, you don’t need a visa.) If you’re not a U.S. or Canadian citizen, the same conditions apply to citizens of most western countries, but just to be sure: click here.

Is it safe to travel to Israel? We wouldn’t urge you to come if it wasn’t. Every year between 3 and 4 million tourists vacation in Israel – and apart from those who fall in love with an Israeli – or with Israel – they all go home again safe and sound. The planes of 90+ airlines wouldn’t fly to Israel if it weren’t safe.

I hear there is a security interview before my flight… If you are flying EL AL Israel Airlines (or from Europe on Arkia Israel Airlines or Israir), please know that the security precautions taken by Israeli airlines are the stuff of legend and the envy of the world’s airlines. On check-in for your flights you will be asked a variety of questions during a security interview. Some of the questions may seem un-PC, intrusive, irrelevant or repetitive. Just answer truthfully, go with the flow and don’t lose your cool. Remember, the questions are designed to protect you and your fellow passengers. When you leave Israel, the departure process is identical to that outlined above for all airlines.

What about health, medicines, vaccinations? Israel is an ultra-modern country with the world’s highest number of doctors per capita, and a health and hospital system that is the envy of the world. No vaccinations are required to visit Israel (unless you have recently been in an area where there have been epidemics of yellow fever, cholera or ebola). You can buy most standard over-the-counter equivalent of North American drugs in Israel. You can also bring supplies of your standard prescription drugs with you. (If you need to bring syringes and vials of medicine – bring along a letter from your doctor attesting to your needs, just in case.) If you need to see a doctor in Israel, check with your hotel concierge. Travel insurance (including medical coverage) is always recommended for all foreign travel.)

What to wear? Like almost everywhere in the world, casual is the "rule" for everyday sightseeing. Bring good walking shoes or sneakers and "layers." Israelis (especially women) like to be “elegant casual” on evenings in Tel Aviv and Jerusalem. Some religious shrines require modest dress (arms and legs covered, and, occasionally, no pants for women). Don't forget your swimsuit and, for the Dead Sea, plastic shoes or aqausox.

What about money? The Israeli currency is the Shekel (officially “New Israeli Shekel”), worth around 30 cents. Click here for the current conversion rate. On arrival in Israel, it’s a good idea to use your bank-card to withdraw some Shekels from the ATM in the arrival-halls at Ben Gurion - or change small amounts of dollars/or travelers’ checks at a bank or your hotel. There are ATM machines all over Israel and credit cards are widely accepted.

Electricity Almost all hotel rooms are equipped with hairdryers, and all have shaver sockets. For other appliances, Israel's electricity is 220V A/C, single phase 50-cycles; 110V-220V transformers can be used. Israeli outlets have three prongs, but European two-prong adapters usually work. If you don’t have an adapter that seems to work, call the hotel’s front desk or visit a hardware store.

Keeping in touch Most hotels have free wi-fi in the lobby, and some hotels provide it free in the room. Many hotels also have Business Centers where you can access e-mail and the internet without charge. American cell-phones that work overseas will work in Israel too. Israel is 6 or 7 hours ahead of the East Coast of the USA depending on the season.

Temperatures Temperatures can vary widely so just pack for the "right" weather and you'll be fine. Seasons overlap of course, but general guidelines are:

SUMMER (Jun/Jul/Aug/early Sep): Temperatures in the high 80º's, 90º's. Tel Aviv, and Tiberias will be hot and humid (like New York or Miami). Jerusalem is dryer and cooler, particularly at night. Masada and Eilat are extremely hot (110º+!)...but dry. There won't be a drop of rain.

SHOULDERS (late Mar/Apr/May/late Sep/Oct/Nov): Daytime temperatures will be very pleasant: 75º-ish in most of the country (but hotter at the Red and Dead Seas). Jerusalem will be in the 70º's, 50º's in the evening. There'll be some rain - nothing torrential.

WINTER (Dec/Jan/Feb/early Mar): Winter weather can fluctuate. Some winters are mild and sunny, some severe and overcast. There's often heavy rain and, in January and February, even snow sometimes. It'll probably be in the 50º's, 60º's most places, but in Jerusalem and the Galilee in the forties, and cold at night.

Getting around BUS : Israel has one of the world’s best and most inexpensive bus systems, with almost every city, town, village and settlement connected to the system. Click here for schedules and prices.

TRAIN : High speed trains link Ben Gurion Airport with Tel Aviv, Jerusalem and Haifa, and there are fast and, efficient and inexpensive train service throughout much of the country. Rail travel is inexpensive and very easy to navigate. Click for full information.

FLIGHTS : Tel Aviv and Eilat are connected by multiple flights daily aboard Arkia, El Al and Israir, and there are also flights to Haifa and the Galilee.

TAXIS : There are taxis available in the cities, and taxi drivers are also happy to take you between cities. Check the price before you start your journey.

SHARED TAXIS : Shared taxis or “Sherut” are very popular. There are “Sherut” stations throughout the cities. Ask at your hotel for the nearest Sherut stand.

CAR RENTAL : Most international car rental groups have offices in Israel – and there are excellent Israeli car rental firms too. Your American or Canadian drivers’ license is valid in Israel.

SITES TO SIGNIFICANCE

Itineraries.

- LATEST INFORMATION AND UPDATES

- ISRAEL GOVERNMENT TOURISM OFFICES

- ISRAEL IN THE MEDIA

- STATISTICS AND RESEARCH

Photographers: Guy Yehieli, Adam Primer, Kfir Boltin, Linnea Andres, Kfir Sivan, Haim Yafim, Dana Fridlander, refael Ben Ari, Itamar Greenberg, Moshik Lindbaum, Ori Ackerman Video Credits: Israeli food channel, National Geographic

- OFFICIAL BROCHURE

- TERMS OF USE

- PRIVACY POLICY

FOR MORE DEALS:

- Altitude Sickness

Sleeplessness

- Traveler’s Diarrhea

Motion Sickness

- Malaria Prevention

Top Countries

South Africa

Have a question?

Runway offers travelers like you, the medications you may need before you go. Email us at anytime.

Nausea Prevention

- Vaginal Yeast Infection

- Urinary Tract Infection

- How it works

Email us at anytime at:

Learn more about country requirements

- List Item 1

- Dominican Republic

- Netherlands

- Philippines

- Saudi Arabia

- Switzerland

- United Arab Emirates

- United Kingdom

Runway offers many of the most commonly prescribed travel medications. Create your Israel treatment plan and initiate a consultation with one of our licensed physicians today, so you can explore more and worry less.

- Quick, online questionnaire for physician review

- Free 3-5 day shipping to your door

- No in-person appointments or pickups needed

US-licensed healthcare providers

FDA-approved prescription medication

- Unlimited chat based care before, during and after your travels

Just in case

Our standard prescription includes medication for 14 restful nights.

Includes 3 Scopolamine patches. Each patch provides motion sickness relief for up to 72 hours.

Price includes 20 orally disintegrating tablets (ODT). Additional tablets may be requested for $10 per 10 tablets.

One of the world’s most sacred places, Israel has been enveloped in conflict for thousands of years. Despite this, millions flock per year to experience the rich culture of contemporary Israelis, the marvelous scenery on the coast of the Dead Sea, and the extraordinary religious heritage found in sites like the Temple Mount in Jerusalem, the Wailing Wall, and Nazareth Village.

Our benefits

Worry less, explore more

Quick questionnaire for physician review

Fast and free shipping

Unlimited chat based care before, during and after your travel

Your Voices

I chose Runway because I couldn’t get an appointment to see the doctor in time for my trip. The site was easy to navigate, the process was straightforward, and shipping was fast!

Jesse C. traveled to

It was super straightforward and easy to get my medications I needed for for my trip to Ecuador! They shipped so fast as well!

Grace M. traveled to

Runway made it so much easier to get malaria medication for our 5-day safari. We felt protected the entire time we were out exploring the amazing Sabi Sands Game Reserve!

Matt S. traveled to

I was scrambling to find a travel clinic before my trip to the Amazon. Runway made it quick and easy to connect with a doctor and get everything I needed delivered before I left.

Sarkis A. traveled to

Brazil (Amazon)

I order all my motion sickness patches from Runway. It’s way easier than chasing down doctors for prescriptions and shows up right on my doorstep.

Scott R. traveled to

Galápagos Islands

Motion sickness medicine didn’t work for me until I discovered the patch!

Nadav B. traveled to

I was having the best time in Mexico until I got an awful stomach bug. Thankfully, I had brought my own medication with me so I didn’t have to deal with language barriers and a local pharmacy. After a quick recovery day, I was still able to enjoy the rest of my trip.

Carly R. traveled to

Runway offers travelers like you, the medications you may need before you go.

- Donor Portal

- Community Calendar

- Israel Travel Resources

We are so excited you are planning a trip to Israel! As you prepare for your trip, here are some travel tips and general information.

Want to take these travel resources with you on your trip?

- Click to download a PDF of Israel Travel Handbook .

- Click to download a PDF of Israeli Money Guide .

Check that your passport is not expired or about to expire. Your passport must be valid for at least six months following the date you arrive in Israel. Information about ordering a passport is found here . Make a copy of your passport photo/signature page which includes your passport number and keep it in your suitcase.

Be sure to check with both your domestic and international airline carrier about baggage rules and fees. It is recommended that you bring at least one change of clothes, toiletries, prescription medications and valuables in your carry-on bag in the unlikely event that your checked luggage gets delayed. You may also want to bring some snacks with you for your flight. It can be difficult and expensive to get over-the-counter medication. Consider bringing a small quantity of items such as Tylenol, Imodium and motion sickness medication.

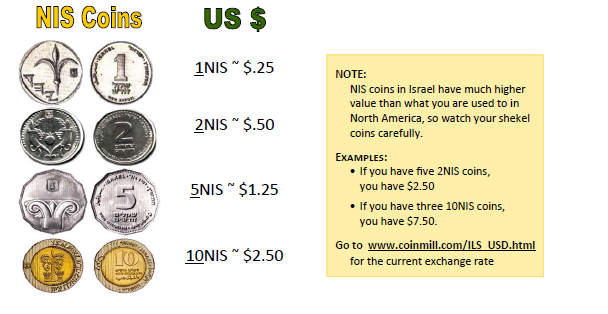

The local currency is the New Israeli Shekel. Each shekel is worth about 25 cents. Shekel coins come in units of 1 (~25 cents), 2 (~50 cents), 5 (~$1.25),and 10 (~$2.50), as well as much smaller coin denominations called agorot. Shekel bills come in units of 20 (~$5), 50 (~$12.50), 100 (~$25) and 200 (~$50) denominations. One important thing to keep in mind is that coins in Israel have much higher values than what we are used to in North America, so watch your coins carefully. Go to Coinmill.com/ILS_USD.html for the current exchange rate.

Exchanging Money, Debit, and Credit Cards

The most convenient place to exchange cash is at the airport. There are two exchange booths near the luggage carousels. If your ATM/Debit card has a Visa, MasterCard, Star, Cirrus, or Maestro logo imprint, there should not be a problem withdrawing money. PLUS cards will not work in Israel. Major credit cards like VISA and MasterCard are accepted throughout Israel. Most banks and credit card companies charge a foreign transaction fee. Be sure to check with your bank/credit card company about what their fee is and also let them know you will be traveling abroad prior to your departure. Some credit card companies, such as Capital One, do not charge foreign transaction fees.

Electrical Current

The electrical current in Israel is 220 volts, which is twice the voltage used in North America. The electrical plugs are also different, with two rounded prongs. You will need a voltage converter if you are bringing electronic or electrical items (unless they have a built-in one) as well as an adapter for plugging in your items. Adapters can be purchased at an electronics store, travel store or in the travel section of a discount store (i.e. Target & Walmart).

Medication and Contact Lenses

If you are taking prescription medication, bring enough for the duration of your trip. Take all medication on the plane with you in your carry-on luggage. Do NOT pack any medication with your checked luggage. The same is true for contact lenses.

The water in Israel is properly treated and is perfectly safe to drink. Bottled water is widely available and inexpensive or you can bring a water bottle and fill it as needed. If you plan on hiking in Israel, especially in the summer, consider a CamelBak or other device to carry larger quantities of water.

If you use a cab anywhere in Israel, insist they turn the meter on – “moneh b’vakasha” (meter please). Cab drivers will try to negotiate a price in advance and not use the meter so they do not need to report the income. Unless you know how much the ride will cost, you are almost always better off paying the meter price. If the driver refuses to put the meter on, simply get out of the car and wait for another cab.

Internet Access

In many areas of Israel, in particular Jerusalem, you can find free internet access. Many hotels still charge for a wi-fi connection. It may be beneficial to purchase a wi-fi modem through your phone company to have internet access at all times. There are also companies in Israel that rent modems for your computer. The rental fee is normally less than what hotels charge and you would have internet access at all times.

Israel enjoys warm, dry summers (April-October) and generally mild winters (November-March) with somewhat drier, cooler weather in hilly regions, such as Jerusalem and Safed. January is the wettest month and June, July and August are the driest months with no precipitation. Average temperatures are listed below.

Popular Israeli Foods

While there is a tremendous variety of cuisines and foods eaten in Israel, certain dishes are considered typical Israeli food. These traditional foods of Israel can be found throughout the country in restaurants and cafés, food stands, and of course, in many Israeli homes.

Israeli Breakfast Foods

Israeli lunch/dinner foods, israeli drinks, commonly used hebrew words & expressions, as one, we build community.

Your generosity ensures we can make a lasting impact in Jewish communities at home and abroad. Give today!

Community Leadership & Engagement

- Millstone Leadership Initiatives

- Chai St. Louis

- Passport to Israel

- Israel Trips & Missions

- Israel Teen and Young Adult Subsidies

- Contact the Israel Center

- One Happy Camper

- Professional Society

- Sh’ma: Listen! Speaker Series

- Shalom Baby

- Teen Tzedek

- Women’s Philanthropy

- Young Professionals Division (YPD)

Stay Up to Date

Choose from a variety of community newsletters and receive updates straight to your inbox.

EMA Care Blog

Prescription medication in israel.

Prescription medications in Israel can oftentimes be different than in other countries. Whether planning a trip or sending a child for a Gap Year , understanding the availability of medication locally can help guide decision making and planning for health needs.

Here are 10 rules about prescription medication in Israel:

- Some medications are not available here. Medications in Israel must be approved through a lengthy bureaucratic and often political process. Some medications, deemed either unnecessary or too expensive, or too rarely needed – are simply not available.

- Medications may come in different doses. For example, thyroid medication is not available in 25mcg increments. This requires mild dosing adjustments, but can be initially frustrating for people who need these doses. Some medication available in long-acting forms may not be available in these forms in Israel. This can include blood pressure medication, seizure medications, and other critical medications. This can lead to serious medication issues for people who are in Israel and requires careful adjustment and monitoring.

- Generic prescription drug names are more common, and many brand names are different or unavailable. For example, Fosamax is called Fosalan in Israel. This is not such a big deal, but it can be confusing , especially for older adults transferring prescription medications to Israel.

- Some prescription medications must be prescribed by a specialist physician , as opposed to a family doctor or pediatrician. This can include some psychiatric medications, including some ADHD drugs, and biological medications.

- Some Over the Counter (OTC) medications require prescriptions here. This can include medications for yeast infections, heartburn, allergies, and topical preparations. Regulations are slowly loosening for this (emphasis on “slowly”).

- Prescription medications may be available in Israel that are not available in the US or Europe. Israel requires approval from either local authorities, the FDA (USA), or the European Medicines Agency (EMA – not related to EMA Care!).

- Most prescription medication cannot be obtained in increments on more than 1 month’s supply. In the US and elsewhere, you can usually get a 3-month prescription filled. In Israel, few medications can be filled with more than a 30-day supply… so you will need to make monthly trips to the pharmacy.

- Prescription medications are cheaper in Israel than they are in the US , because of government subsidies. Ironically, most OTC medications cost much more than in other countries. Obviously, if you pay a small copayment only, it will not be cheaper here for brand name drugs. This compares full cost to full cost. For example, many commonly prescribed medications cost 13nis only, or a bit over 3 US dollars.

- Medications are only available at pharmacies. In the US, you can get pharmaceuticals at supermarkets and even gas stations. In Israel, only pharmacies sell pharmaceuticals making it less convenient and a more tightly regulated market.

- Prescriptions must be written only by locally licensed physicians. Understandably, foreign prescriptions are not allowed in Israel. Israel does not give authority to nurse practitioners or physician assistants to write prescriptions freely, unlike dozens of other countries. EMA Care is hoping that this will change in the future.

If you have to bring in medication from abroad for your child or yourself

...there is a sometimes lengthy bureaucratic process . It can be done, but it can take some time. EMA Care has vast experience helping clients ship their prescription medication into Israel, and can help navigate the system. EMA Care recommends that you plan well in advance and that you have a backup plan in case things get tied up in shipping. EMA Care professionals coordinate with your prescribers at home and physicians in Israel to assure that transition to local prescription medication is smooth. Managing medication is one of our specialties! We can also guide you in advance of any trip or visit to Israel regarding the availability of medication and alternative approaches, such as shipping your medication here. We can help order special medications here through pharmacies and assure that your dosing is as prescribed. EMA Care is here to help navigate you or your child through the Israeli healthcare system. When you or your child is sick in Israel, you don’t have to be alone. Our professionals will advocate for you or your child to get the best care available.

EMA Care provides medical concierge, case management, and patient advocacy services to tourists, students and residents of Israel. We can be reached at [email protected] . Schedule your free consultation today.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.

Our Latest Blogs

EMA Care in the News

What Our Clients Say

Our covid-19 whatsapp informational group.

I want to express my appreciation for these very informative updates.

Thank you so much

Entry to Israel services

Your team was so attentive to my needs. Everyone was so incredibly quick to respond and were proactive when they were able!

Interview with Dr. Mobeen & Dr. Eliana Aaron

Many thanks for your hour-long session on Dr. Syed's YouTube channel. This is the best Hasbara Israel could wish for!

EMA Care information and Q&A conference

Thank you for the zoom (and all your updates). It was great. I wish the news was like that. Straight forward, factual, unemotional. Bravo to both of you ladies!!

Thanks so much for your time and attention! It was excellent! Thank you guys so much for organizing.

Thank you! Very helpful and comprehensive.

WhatsApp groups

I really appreciate being apart of your WhatsApp groups. It keeps me informed and up to date!

Ema Care WhatsApp groups

I have been following your updates closely and I really appreciate your posts and I know that I am reading accurate information

Recommended by an Infectious Disease Specialist

My experience with Ema Care has been so positive that I wanted to share it in case it could help someone else. Eight days ago my daughter, a Shanah Bet student, called to say she wasn’t feeling well and had symptoms of Covid-19. I was put in touch with an Infectious Disease specialist who recommended Ema Care. I reached Dr. Eliana Aaron easily and signed my daughter up. The next morning, Ema Care gave my daughter a telehealth exam and provided her with prescriptions, as well as a list of

- Share full article

Advertisement

Supported by

Travel Tips

How to Make Sure You Travel with Medication Legally

Traveling with medication — even prescription drugs — isn’t as simple as packing it. Here’s how to stay on the right side of the law, anywhere you go.

By Tanya Mohn

Travelers often pack medications when they go abroad, but some popular prescription and over-the-counter ones Americans use for things like pain relief, better sleep, allergies and even the common cold are illegal in some countries.

The United Arab Emirates and Japan, for example, are among the most restrictive nations, but many ban or restrict importing narcotics, sedatives, amphetamines and other common over-the-counter medications.

Most travelers won’t run into problems for carrying small amounts for personal use, said Katherine L. Harmon, who oversees health analysis for iJET International , a travel risk management company. But noncompliance can result in confiscation,(which could, in turn, have severe medical consequences), deportation, jail time, and even the death penalty. “Does it happen a lot? No. Could it? Yes,” Ms. Harmon said. “Consumers need to understand this and how it might adversely impact them before they book that awesome trip to an exotic location.”

She shared a few tips to keep you on the right side of the law, whatever you take and wherever you roam.

Laws vary by country and there is no central, up-to date repository, so Ms. Harmon suggests consulting your physician, travel medical insurance company, or local pharmacist four to six weeks before traveling. “When you inquire about your shots, ask about medications. Odds are they may not know off the top of their head, but they have the resources to find out.”

She also suggests checking with the embassy of your destination country. The State Department website lists foreign embassies in the United States, and their contact information. It also lists insurance providers that offer overseas health coverage. Comparison websites Insure My Trip and SquareMouth can help assess those insurance plans, if they’re necessary.

Label and Pack Your Medication Properly

Carry all of your medication — even vitamins and supplements — in their original, clearly marked containers or packaging in a clear plastic bag in carry on luggage. Make sure the name on the prescription, the medicine container and your passport (or one for the recepient of the medication) all match. If you lost the product information insert, ask the pharmacist to print a new one for you.

Also, check the Transportation Security Administration’s website for up-to-date rules and regulations on packing and carrying your medication when you depart. The standard rules for liquid carry-ons don’t apply to medications in liquid or gel form, but you need to inform the T.S.A. when you pass through security so they don’t confiscate it .

Obtain and Carry Necessary Documentation

Keep copies of your original prescriptions, if you can . Better yet, obtain a letter on official letterhead from your physician that lists the medicines you need and why they were prescribed. Ideally, you would get this translated to the language of your destination country, so it’s easy to read.

For some medication and specialized equipment used to administer them, some countries require documents to be submitted to government officials well in advance of your arrival. Ms. Harmon, for example, was questioned at the Singapore airport once for entering with an EpiPen, but she had prior authorization allowing its transport.

Know the Names and Amounts of Active Ingredients

The documentation you carry should also indicate the generic and chemical names of the active ingredients, which determines permissibility, not brand names.

For example, the active ingredient in Benadryl, diphenhydramine, is banned in Zambia in over-the counter products. In Japan, it is allowed only if the amount in a tablet or injection is limited. However, a typical 25 milligram tablet of Tylenol PM in the United States exceeds the 10 milligram maximum amount in a tablet you can bring into Japan. Some countries restrict the overall total amount of an active ingredient an individual traveler can legally import, which may impact longer stays.

Reduce or Substitute Medication

In countries where a medication is allowed, but its amount is capped, reducing your dosage or switching to another available medication is the best way to stay compliant. Allow enough time beforehand to ensure the smaller dose or new medicine works effectively, and consider making the switch before your trip to give yourself time to adjust.

Some medications can be used for several diagnoses. Hormones used for birth control may also be used to treat excessive menstrual bleeding, Ms. Harmon said. “Doctors need to get creative sometimes. Substitutions can allow authorities to accept the drug as a medical need rather than going against the country’s religious or moral code.”

Reassess Your Travel Plans

Parents with a child doing well on Adderall for attention deficit hyperactivity disorder who prefer not to make adjustments on the fly, or a student with bipolar disorder may want to consider vacation or study abroad locations where the medications they rely on for mental health are not banned or restricted.

“Viewpoints on treatment and diagnoses can vary widely,” Ms. Harmon said. “Western Europe and North America understand that brain chemistry is often at the root of these problems. But some countries, like Russia, do not consider mental health challenges as medical problems and often treat them criminally.”

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

- Travel Medical Insurance Plans

- Trip Cancellation Insurance

- Annual Travel Insurance

- Visitors Insurance

- Top 10 Travel Insurance Companies

- Best Travel Insurance for Seniors

- Evacuation Insurance Plans

- International Life Insurance for US Citizens Living Abroad

- The Importance of a Life Insurance Review for Expats

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Health Insurance Plan

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- Trawick Safe Travels USA

- SafeTreker Travel Insurance Plan

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

- Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

Safety Advice and Travel Insurance for Israel

Update regarding travel insurance to israel (update: feb. 7, 2024).

Select travel insurance plans for travelers with Israel as their destination country are now available. Previously, they were not available d ue to the current war. Existing policies are not affected unless you hear otherwise from your carrier. Anything related to the hostilities may not be covered. These are all insurer-specific, so check your policy documents for complete details.

Israel Travel Insurance for Visitors

Despite constantly erupting political tensions, Israel attracts millions of visitors each year. Some people visit to experience the sacred sites of three of the world’s major religions. Others come to enjoy the coastal restaurants and famous nightlife of Tel Aviv. Nearly everyone wants to float in the Dead Sea. When visiting, make sure you have travel insurance for Israel . In the last decade, more people have also traveled to Israel for medical tourism in one of the most advanced healthcare systems in the world. Israel’s modern society exists side by side with ongoing political struggles and the ever-present threat of sudden violence. While there have been periods of calm, the region has experienced regular conflict for more than half a century.

Do I Need Travel Insurance for Israel?

Yes. Israel requires visitors to have travel insurance when they arrive. You must show proof of your travel insurance, though COVID-19 coverage is no longer required as of May 15, 2023.

Best Travel Insurance for Visitors to Israel

The safety situation in Israel, the West Bank, and Gaza can change quickly. The sudden eruption of conflict or a terrorist attack is possible. To prepare, the U.S. State Department recommends that your travel insurance include medical evacuation. For complete peace of mind, it should also cover emergency travel changes and repatriation of remains. International Citizens Insurance can help you find a travel insurance plan that meets all your needs.

The IMG Patriot Travel Insurance plan is a good option for most travelers. For US citizens traveling abroad, you can purchase trip cancellation coverage through the iTravelInsured plan below.

Patriot Platinum Travel Insurance

- Maximum limits up to $8,000,000

- IMG pays 100% of medical expenses in-network

- Evacuation due to Natural Disasters & Political Unrest

iTravelInsured Trip Cancellation Insurance

- Three levels of trip protection for U.S. residents traveling abroad.

- Medical cover, trip cancelation and medical evacuation included.

- Optional Cancel for Any Reason coverage available (LX Plan).

Medical Preparation for Travel to Israel

As with many destinations, Israel may expose you to new illnesses and unfamiliar environments. You may also need to manage existing health issues during your stay. The following information will help you protect your health in Israel.

What Vaccinations Do I Need to Travel to Israel?

Israel does not currently have vaccination requirements for visitors — not even for COVID-19. However, the U.S. Centers for Disease Control and Prevention (CDC) advises all travelers to Israel be up to date on their routine vaccinations (influenza, chickenpox, MMR, DPT), as well as rabies, polio, COVID-19, and others. The CDC also recommends the typhoid vaccine for those planning to go to Gaza or the West Bank.

How to Bring Medications to Israel

Travelers can bring prescription medications for personal use into Israel. Any time you travel internationally, keep prescription medications in the original packaging and packed in your carry-on bag along with the prescriptions from your doctor. You may want to list the generic names of your medications for easier identification by authorities. If your medical condition requires syringes and vials, be sure to travel with a letter from your doctor explaining your medical needs.

Some visitors may need to travel with narcotic or psychotropic drugs to manage a medical condition. The Israeli Ministry of Health allows up to 31 days of each type of drug as long as you have all of the proper documentation. If you are concerned about the legality of your prescription medication in Israel, contact Israel’s embassy or consulate in your current country to confirm.

Standard over-the-counter medications in North America are usually found at local pharmacies in Israel. You may still want to travel with some of the CDC’s Israel packing list recommendations for convenience.

Related: Health Insurance in Israel for Expats

How to Access Medical Care in Israel for Visitors

Israeli law provides all residents with health insurance plans through one of four non-profit companies. Visitors do not qualify for this coverage. They are legally required to arrive with an active travel insurance plan.

Israel has one of the most efficient and highly-ranked healthcare systems in the world. This means you have a variety of options for excellent medical care should you need it. Your travel insurer will provide you with recommendations for medical institutions in Israel. Cross-reference your list with our article on the best hospitals in Israel for expatriates . Sometimes, travel insurance can provide telehealth visits or a translator via phone. English is widely spoken in Israel, especially in the medical field.

In a medical emergency, your condition will determine your care options. Urgent care centers (like Terem, Tel Aviv Doctor, or Bikur Rofeh) operate around the country, with some open 24 hours a day, seven days a week. Doctors can write prescriptions and give you referrals for more extensive care.

How to Call an Ambulance in Israel

For more serious emergencies, you can call an ambulance by dialing 101 and Israel’s Magen David Adom ambulance will arrive. If you are in the West Bank or Gaza, it may be a Palestinian Red Crescent Society ambulance that comes. As a visitor not covered by national health insurance, you will be charged for the transportation. You will need to submit the claim to your travel insurance company for reimbursement. The ambulance will likely take you to the nearest hospital with the services you require based on your condition. Your stay will include paying for your care. Emergency rooms in the major cities are crowded. In Tel Aviv, the emergency room wait time could be four hours or more. While care is the same, you can expect Israel’s private hospitals to offer more amenities and services than the public hospitals.

In the event of a disaster or terrorist attack, dialing 101 will alert Magen David Adom (if you are deaf or hearing impaired, send a text to 052-7000-101) or the Palestinian Red Crescent Society. Like the American Red Cross, both of these organizations are members of the Red Cross and Red Crescent Movement and provide ambulance and other medical services during disasters.

Visitors going to the West Bank and Gaza should be aware that hospitals in those areas may lack equipment or be overwhelmed. The U.S. State Department warns that ambulances may be in short supply or not available in Gaza and the West Bank.

Related: Israel Healthcare System

Travel Warnings and Alerts for Israel

The security situation in Israel, the West Bank and Gaza is constantly shifting. Travelers should check the latest travel alerts from government sources leading up to and just before their departure.

It is also wise to check on alerts throughout your stay. The U.S. Smart Traveler Enrollment Program (S.T.E.P.) is an easy way for U.S. travelers to get alerts on a specific country. They can also register their trip with the nearest U.S. embassy.

Other websites that offer up-to-date alerts on Israel include:

- U.S Department of State “Israel, the West Bank and Gaza” page

- Australian Government Smartraveller “Israel and the Palestinian Territories” page

- U.K. Government Foreign Travel Advice “Israel” page

- Government of Canada Travel Advisory “Israel, the West Bank and Gaza Strip” page

- Singapore Ministry of Foreign Affairs “Israel and the Palestinian Territories” page

The governments of the countries listed above advise their citizens against traveling to Gaza.

Emergency Contact Information for Israel

The following is a guide to the emergency numbers you need to know for Israel.

Emergency Assistance Numbers in Israel

- Police – 100

- Medical Assistance/Ambulance – 101

- Fire Service – 102

- Disaster Victim Identification – 1220 (ZAKA)

- Emotional Crisis Hotline – 1201 (ERAN)

- Rape Crisis & Sexual Abuse – 1202 (Women) 1203 (Men)

- Student Hotline – 1-800-222-003

- Violence Hotline for Students -1204

- Israel Assoc. for Child Protection (ELI) – 1-800-223-966

- 24 Hour Poison Information Center & Hotline at Rambam Hospital – 04-7771900

Israel does not use the United States emergency number 911. However, dialing the United Kingdom emergency number 112 from any GSM mobile phone will connect you with the local emergency line.

Global Medical Plan for Foreigners Residing in Israel

Cigna Global Insurance Plan

- The flexibility to tailor a plan to suit your individual needs

- Access to Cigna Global’s trusted network of hospitals and doctors

- The convenience and confidence of 24/7/365 customer service

Embassy Phone Numbers in Israel

The following is a list of contact information for certain embassies in and near Israel:

- U.S. Embassy Jerusalem 14 David Flusser Street Jerusalem, Israel 93392 + (972) (2) 630-4000 (Main Phone) + (972) (2) 622-7230 (Emergency After-Hours Number – Ask for the Duty Officer) + (972) (3) 519-7551 (Emergency After-Hours Number)U.S. Embassy Tel Aviv Branch 71 HaYarkon Street Tel Aviv, Israel 63903 + (972) (3) 519-7475 (Main Phone) + (972) (3) 519-7575 (Emergency After-Hours Number – Ask for the Duty Officer) + (972) (3) 519-7551 (Emergency After-Hours Number)

- Canada House 3/5 Nirim Street, 4th Floor, Tel Aviv, Israel 6706038 + (972) (3) 636-3300 (Main Phone)

- British Embassy Tel Aviv 192 Hayarkon Street Tel Aviv, Israel 6340502 + (972) (3) 725 1222 (Emergency – After hours, select the emergency option.)

- French Embassy in Israel 112 promenade Herbert Samuel BP 3480 Tel Aviv, Israel 6357231 + (972) (3) 520 85 00 (Main Phone)

- Australian Embassy Israel Bank Discount Tower, 28th Floor, 23 Yehuda Halevi St. Tel Aviv, Israel 6513601 + (972) (3) 693 5000 (Main Phone) + (61) (2) 6261 3305 (Consular Emergency Centre – from outside of Australia)

4 Tips for Safe Travel in Israel

1. stay alert, especially in crowded areas.

Violent attacks happen without warning. In any country, the best way to prepare for the unexpected is by planning ahead. If you know you will be in a crowded area or place of significance (like a tourist site), plan your exits. Stay aware of your surroundings and report any suspicious activity to local authorities. If you feel unsafe, leave immediately. The CDC recommends carrying a card with your blood type, medications and emergency contact numbers in Hebrew and Arabic just in case.

2. Frequently Check Travel Updates

You may not be near the place where an attack or protest happened, but you could still be impacted by resulting new security measures, such as curfews. If you are a U.S. citizen, enroll in the U.S. Smart Traveler Enrollment Program (S.T.E.P.) to receive alerts on Israel throughout your trip.

3. Watch Your Step and Your Belongings

You may be walking over the ruins of ancient structures or hiking through more remote, rocky areas like Appolonia National Park. Wear comfortable shoes and watch where you step to avoid a sprained ankle (or worse), which could spoil your trip. Cities like Jerusalem and Tel Aviv are modern with maintained streets and sidewalks. Still, historic neighborhoods may have unexpected hazards. Pickpocketing is also common, so be mindful of your possessions. Pack important belongings securely to minimize risk.

4. Bring Water and Dress in Comfortable Layers

Israel has a Mediterranean climate to the north and a more arid climate to the south. Its terrain includes mountains, beaches and deserts and it can get very hot in the summer months. Bring sunscreen, hats, sunglasses and plenty of water when you’re out exploring in dry, hot areas. Dress in layers as temperatures can fluctuate throughout the day. Layered clothing will also help you quickly adapt to more modest clothing requirements at certain religious buildings and sites.

Israel is Best When You’re Prepared for the Worst

While most visitors will never encounter a violent incident, Israel’s tense geopolitical climate cannot be ignored. Despite the possible threats, visitors will find busy cafes and shops where conversation fills the air in Hebrew, Arabic, English, Yiddish, and more.

Paying attention to the news and the latest government travel advisories is key to making informed travel decisions about Israel. If the situation abruptly changes, your travel insurance can help you cancel a trip before you ever set foot in the country or help you get home quickly. Let International Citizens Insurance help you find the right travel insurance for Israel.

From the Sea of Galilee to the Mediterranean coast, Israel’s ancient history, diverse culture, and complex politics combine to make it a unique destination. Arriving prepared and with the right travel insurance will allow you to absorb the gravity of Israel freely — a place that means as much to those who live there as it does to millions who have yet to make the journey.

Related Articles:

- Best Hospitals in Israel for Foreigners

- Health Insurance in Israel for Foreigners

- Israel’s Healthcare System

Author: Alon Cohen is the Director of Digital Marketing at International Citizens Insurance . His background is in online marketing & technology, with over 20 years of experience in the field. Over the years, he helped hundreds of companies, from small mom-and-pop shops to growing start-ups to Fortune 500 companies. Alon spent 15 years living in Israel as an expatriate with his family before moving back to the States and has traveled there multiple times since then. Connect with him on LinkedIn .

Get a fast, free, international insurance quote.

Global medical plans, specialty coverage, company info, customer service.

Security Alert May 17, 2024

Worldwide caution, update may 10, 2024, information for u.s. citizens in the middle east.

- Travel Advisories |

- Contact Us |

- MyTravelGov |

Find U.S. Embassies & Consulates

Travel.state.gov, congressional liaison, special issuance agency, u.s. passports, international travel, intercountry adoption, international parental child abduction, records and authentications, popular links, travel advisories, mytravelgov, stay connected, legal resources, legal information, info for u.s. law enforcement, replace or certify documents.

Before You Go

Learn About Your Destination

While Abroad

Emergencies

Share this page:

Israel, The West Bank and Gaza

Travel Advisory June 27, 2024

See individual summaries.

Updated with information on travel restrictions for U.S. government employees under Chief of Mission security responsibility.

Do Not Travel To :

- Gaza due to terrorism and armed conflict

Reconsider Travel To :

- Israel due to terrorism and civil unrest

- West Bank due to terrorism and civil unrest

Country Summary: Terrorist groups, lone-actor terrorists and other violent extremists continue plotting possible attacks in Israel, the West Bank, and Gaza. Terrorists and violent extremists may attack with little or no warning, targeting tourist locations, transportation hubs, markets/shopping malls, and local government facilities. Violence can occur in Israel, the West Bank, and Gaza without warning.

Some areas have increased risk. Read the country information page for additional information on travel to Israel and the West Bank, and Gaza.

Visit the CDC page for the latest Travel Health Information related to your travel.

If you decide to travel to Israel, the West Bank, and Gaza.

- Visit our website for Travel to High-Risk Areas .

- Check the most recent Alerts at the Embassy website for the latest information on travel in all of these areas.

- Maintain a high degree of situational awareness and exercise caution at all times, especially at checkpoints and other areas with a significant presence of security forces.

- Avoid demonstrations and crowds.

- Follow the instructions of security and emergency response officials.

- Beware of and report suspicious activities, including unattended items, to local police.

- Learn the location of the nearest bomb shelter or other hardened shelter. Download the Home Front Command Red Alert application for mobile devices (available on devices within Israel) to receive real time alerts for rocket attacks.

- Obtain comprehensive travel medical insurance that includes medical evacuation prior to travel. Most travel insurance packages do not cover mental health related illnesses/care.

- Enroll in the Smart Traveler Enrollment Program (STEP) to receive Alerts and make it easier to locate you in an emergency.

- Follow the Department of State on Facebook and Twitter .

- Review the Country Security Report for Israel, the West Bank, and Gaza.

- Prepare a contingency plan for emergency situations. Review the Traveler’s Checklist .

Gaza – Do Not Travel

Do not travel due to terrorism and armed conflict .