Quote & Buy Worldwide Trip Protector Travel Insurance

Why travelers trust worldwide trip protector.

When your travel needs call for a broad plan but cost-saving takes priority, our signature worldwide trip protector is the answer. Worldwide Trip Protector, popular with families, features coverage for children at no extra charge when traveling with their related adult on the same plan. Available to U.S. residents.

Eligibility for time-sensitive benefits are based on the initial payment/deposit for the originally scheduled trip, for which cash was paid, and not the date the Future Travel Credit (FTC) was applied towards the trip, if such a travel credit was used.

Worldwide Trip Protector

- Trip Cancellation

- Optional – Cancel For Any Reason

- Trip Interruption

- Optional – Interruption For Any Reason

- Travel Delay

- Missed Connection

- Itinerary Change

- Change Fee Coverage

- Reimbursement of Miles or Reward Points

- Baggage Delay

- Baggage & Personal Effects

- Primary - Accident & Sickness Medical Expense

- Emergency Medical Evacuation

- Non-Medical Emergency Evacuation

- Accidental Death & Dismemberment (24 HR)

- Assistance Services

- Concierge Services

- Family-friendly coverage - All children under 18 traveling with an adult family member are covered at no additional charge.

Optional Coverage Available

- Event Ticket Fee Protection

- Electronic Equipment Benefit

- Rental Car Damage

- Air Flight AD&D

- Travel Inconvenience Benefits

- Additional Bed Rest Travel Inconvenience

- For Costa Rica and Other Countries to meet COVID lodging requirement

Worldwide Trip Protector plan benefits

Eligibility information about this plan.

Citizenship: All Nationalities Residency: United States Ages: All Ages Max Trip Length: 180 days

Worldwide Trip Protector Plan Documents

Worldwide Trip Protector Summary

Need help? Request a quote from a Travel Insurance Center ® expert.

Get a Recommendation

User feedback.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Travel Insured International Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Travel Insured International cover?

Travel insured international single trip plan costs, can you buy travel insured international online, what’s isn't covered by travel insured international, is a travel insured international policy worth it.

Travel Insured International

- Annual or single-trip policies are available.

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

When thinking about your next vacation, giving some thought to travel insurance can make a lot of sense. It can protect you in case something goes wrong, not to mention give you peace of mind. One travel insurance provider to consider is Travel Insured International, a company with over 25 years in this space. In 2015, it was acquired by Crum & Forster, a 200-year-old specialty and standard insurance provider.

Here’s what you need to know about Travel Insured International.

» Learn more: See why Travel Insured International is one of the best options out there

Travel Insured International offers four plans to choose from: Worldwide Trip Protector Plus, Worldwide Trip Protector, Worldwide Trip Protector Lite and Travel Medical Protector.

The plans include trip cancellation, trip interruption/delay, medical protection, baggage protection, rental car coverage and cancel-for-any-reason coverage.

Travel Insured International also allows you to upgrade certain elements of your policy through add-ons including: cancel for work reason, flight accident, medical, rental car damage, primary coverage and travel benefits.

» Learn more: Everything you need to know before buying travel insurance

To see how the policies shake out, we input a $3,000, three-week trip to Mexico by a 45-year-old resident of Alaska:

The Worldwide Trip Protector Plus plan ($216) and the Worldwide Trip Protector plan ($144) are nearly identical in the benefits offered, with both providing 100% trip cancellation , 150% trip interruption , $1,000 travel delay, $1 million in medical evacuation, $100,000 for medical expenses and many other benefits.

The primary difference between the two plans is that the more expensive option includes CFAR coverage and interrupt-for-any-reason coverage.

CFAR allows you to cancel a trip for nearly any reason and receive up to 75% of your nonrefundable deposit back (so long as you cancel within 48 hours before departure and you add all of your travel arrangements to your trip within 21 days of payment). This is a great option for those who have nonrefundable reservations and want the flexibility to cancel a trip on the fly.

IFAR allows you to interrupt your trip for any reason as long as it is 72 hours or more after you’ve departed. If you use this benefit, you will receive a refund of up to 75% of your nonrefundable and unused land or water travel arrangements. This could be useful coverage if you decide to cut your trip short and the reason for interruption is not considered a covered reason as per the policy.

If you value these two benefits, you’d want to go with the more expensive Worldwide Trip Protector Plus plan.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

The Worldwide Trip Protector Lite plan ($109) offers 100% trip cancellation coverage, 100% trip interruption, $300 travel delay, $100,000 medical evacuation and repatriation and $10,000 for medical expenses and other benefits.

The limits offered by this plan are lower; however, if you’re only looking for trip cancellation benefits and the medical coverage is sufficient for you, this policy could make sense.

The Travel Medical Protector plan ($73.50) focuses mostly on providing benefits surrounding medical care, with $1 million for medical evacuation and repatriation, $50,000 for medical expenses, $150,000 for non-medical evacuation and $5,000 for trip interruption.

This policy could be a good choice for someone who doesn't need trip cancellation benefits. Additionally, if you have a premium travel card that offers trip cancellation insurance (like the Chase Sapphire Reserve® or The Platinum Card® from American Express ) and the limits are sufficient, a standalone medical plan might be enough to provide adequate coverage for your trip.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Additional options and add-ons

These add-ons are a great way to improve limits on specific items of coverage. For example, for $35 per person, the Worldwide Trip Protector Plus plan and the Worldwide Trip Protector plan let you double your trip delay, missed connection, baggage delay and baggage and personal effects limits.

For $24 per person, the Worldwide Trip Protector Lite plan allows you to add a cancel-for-work-reason benefit. Cancel for work reason would permit you to cancel a trip if it's related to work. The reason will need to satisfy the conditions of the policy, but if this is a benefit you’d like to have, it's good to know it's available.

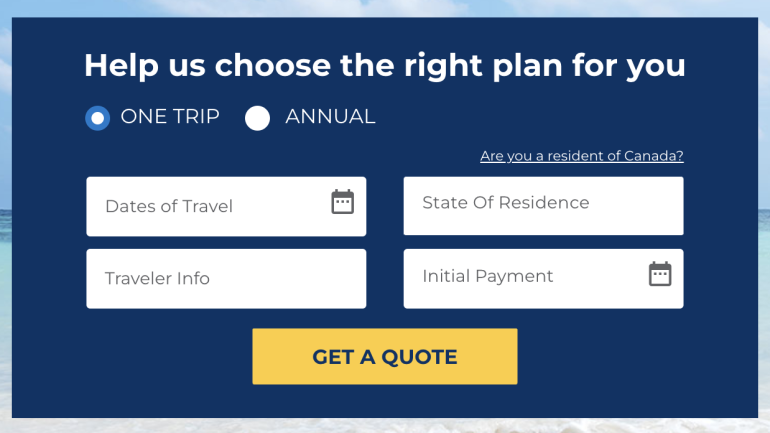

To see which policies are available in your state, head over to the Travel Insured International website . You will need to input your destination, your residence, your trip dates and the number of travelers. Then click “Get a Quote.”

Once you select “View Quote,” you will see a list of plans to choose from based on your state of residence and trip details.

Though all of the above plans offer varying levels of coverage, not everything will be covered, including:

Being scared to travel. Unless you have the CFAR add-on, you can only cancel your trip for a covered reason under the policy. Being nervous about your travels is not a covered reason, so if you’d like ultimate flexibility, you’d want to choose the Worldwide Trip Protector Plus plan.

Baggage loss for eyeglasses, contact lenses, hearing aids or orthodontic devices. Keep these items with you in a carry-on or backpack because a Travel Insured International policy won’t cover them.

Certain events. General exclusions not usually covered by insurers won't be covered here either. Example events include self-harm, war, participating in dangerous activities (e.g., skydiving), committing a felony or getting into an accident while intoxicated. You’ll need to review the policy's fine print to know exactly what is and isn’t covered.

Travel Insured International has been offering insurance for over 25 years. They're owned by Crum & Forster, a stand insurance provider that has been in business for 200 years. Travel Insured International is well established and offers four plans to fit many different needs.

Plan benefits offered by Travel Insured International include trip cancellation or interruption, mileage or rewards reimbursement, Cancel For Any Reason (CFAR) or Interrupt For Any Reason, travel delay, missed connection, change fee coverage, itinerary change, accident & sickness medical expense, baggage delay, rental car damage and more. Each plan is different and has the option for add-ons.

Yes, the Worldwide Trip Protector Plus plan covers Cancel For Any Reason (CFAR). You receive up to 75% of your nonrefundable deposit back as long as you cancel within 48 hours before departure and you add all of your travel arrangements to your trip within 21 days of payment.

Most often, you will need to file a claim after you’ve incurred costs. Travel Insured International strongly recommends filing online. You can then check the status of your claim in your portal. If your claim is approved, you will receive a reimbursement. In some instances, the insurer pays a fixed fee for any claims.

The cost of travel insurance through Travel Insured International will vary depending on a variety of factors. This can include:

Your trip length.

What state you live in.

Where you’re going.

What type of activities you’re engaging in.

How old you are.

The coverage levels that you select.

Yes. Travel Insured International can provide you with either a single-trip policy or an annual insurance plan for international or domestic travel. You also have the option to add on customized per-trip benefits to your selected policy.

Travel insurance can provide peace of mind while you’re on vacation, especially if you’re worried about changes, cancellations or other mishaps occurring. However, before you go in on a policy, you’ll want to double check if you already have coverage through your credit card .

You can also find travel insurance from multiple providers by getting a quote from insurance aggregators like Squaremouth or InsureMyTrip. This will allow you to compare different coverage levels and pricing from a variety of companies.

cost of travel insurance

through Travel Insured International will vary depending on a variety of factors. This can include:

Travel insurance can provide peace of mind while you’re on vacation, especially if you’re worried about changes, cancellations or other mishaps occurring. However, before you go in on a policy, you’ll want to double check if you already have

coverage through your credit card

If you’re heading on a major international vacation and you don’t have a premium travel credit card with sufficient limits, considering a Travel Insured International insurance policy could be a good bet.

The CFAR and IFAR options are solid benefits for those who want ultimate flexibility — especially since you can add coverages like these a la carte. If you’re looking for fewer benefits with lower limits, the Worldwide Trip Protector Lite plan is a good choice. Those seeking medical coverage can consider the Travel Medical Protector plan.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- C&F Travel Insured International plans

- C&F Travel Insured International cost

Compare C&F Travel Insurance

- Why You Should Trust Us

C&F Travel Insured International insurance review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Between booking your hotel and packing all your travel essentials, even the most avid planners may overlook trip insurance. Travel insurance can help you recuperate financial losses to give you peace of mind, no matter how far away you are from home.

We are here to break down Crum & Forster's coverage options, costs, and how the company compares to its competitors.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 2 major plans including CFAR coverage on the more expensive option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancellation for job loss included as a covered reason for trip cancellation/interruption (does not require CFAR coverage to qualify)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Frequent traveler reward included in both policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1 million in medical evacuation coverage available

- con icon Two crossed lines that form an 'X'. Medical coverage is only $100,000

- con icon Two crossed lines that form an 'X'. Reviews on claims processing indicate ongoing issues

- C&F's Travel Insured policies allow travelers customize travel insurance to fit their specific needs. Frequent travelers may benefit from purchasing an annual travel insurance plan, then adding on CFAR coverage for any portions of travel that may incur greater risk.

C&F Travel Insurance Review: Types of Policies Offered

Crum & Forster offers four coverage options: Worldwide Trip Protector Plus, Worldwide Trip Protector, Worldwide Trip Protector Edge, and Worldwide Trip Protector Lite.

With this travel insurance agency, you'll find an a la carte of coverage options and optional policy add-ons like "cancel for any reason" (CFAR) and "interrupt for any reason" (IFAR) coverage.

You'll find a comprehensive list of features included in each policy below:

C&F Insured Travel Medical Protector Plan

The Medical Protector Plan is Crum & Forster's least comprehensive plan, only offering medical insurance. So, if you're looking for trip cancellation coverage, consider purchasing one of the company's WorldWide options instead.

Below, you'll find coverage types and limits offered by C&F Travel Insured's Medical Protector Plan.

- Up to $5,000 in trip cancellation coverage

- Up to $50,000 in accident and sickness coverage which you can upgrade to a maximum of $1 million in coverage

- Up to $1 million in emergency medical evacuations, repatriation, and return of remains

- Up to $150,000 in non-medical emergency evacuation coverage

- Up to $1,000 in coverage for lost, stolen, or damaged personal items

- Up to $300 in coverage after 12 hours for baggage delay

- A total of $1,000 or $200 daily limit for travel delays

- Up to $50,000 in coverage for accident, death, and dismemberment on a flight

- Waiver of pre-existing medical conditions included

Additional coverage options from C&F Travel Insured International

If you need more coverage, you may fancy Crum & Forster's vast array of insurance add-ons and riders.

- Cancel for any reason coverage — Receive up to 75% of the cost of your trip for unused, forfeited, or nonrefundable deposits.

- Interrupt for any reason coverage — Starting 72 hours after your scheduled departure, C&F will reimburse up to 75% of nonrefundable costs. IFAR coverage is specific to land and water bookings.

- Cancel for work reasons coverage — Get reimbursed for up to 100% of the cost of your or your traveling partner's trip due to a work conflict.

- Air flight only, accident, death, and dismemberment coverage — Provides compensation for accidents during your flight.

- Electronic equipment coverage — Get reimbursed for electronics stolen, damaged, or destroyed during your trip.

- Event ticket registration fee protection — Receive reimbursement for unused, forfeited, or nonrefundable event ticket registration fees.

- Rental car damage and theft — Get coverage for rental car damages beyond your control.

- Travel inconvenience — Receive reimbursement for covered events such as closed attractions, beach closures, and flight delays.

- Bed rest — Get reimbursed for unforeseen ailments and injuries requiring bed rest or quarantine for at least 48 hours.

C&F Travel Insurance Cost

We ran various ages, travel destinations, and trip dates through Crum & Forster's quoting tool to generate several sample rates.

Scenario 1: 30-year-old/Australia/2023

If you're a 30-year-old Florida resident traveling to Australia for a week in January 2023, an $8,000 trip will run you about $297 to $417 in travel insurance.

The average cost of travel insurance sits at 4% to 8% of your total trip cost. So the average cost of travel insurance for an $8,000 trip would be $320 to $640. In this case, C&F Travel Insured is cheaper than the average price of travel insurance.

Scenario 2: 40-year-old/Mexico/2022

In this scenario, we used the profile of a 40-year-old California resident scheduled to travel by plane to Mexico for a week in December 2022. We've plugged in a trip cost of $6,000, and the company's travel insurance coverage estimated a cost of $267 to $373.

The average travel insurance cost for a $6,000 trip is about $240 to $480. Therefore, C&F Travel Insured's prices are below the industry average.

Scenario 3: 50-year-old/France/2023

Finally, we ran the numbers for a 50-year-old New York resident traveling by plane to France . A week in May 2023 will run the traveler $10,000.

Residents of New York can only purchase the Worldwide Trip Protector Plan, which costs $492. The average insurance cost for a $10,000 trip ranges from $400 to $800. So, a New York Resident can purchase a plan with this company at a slightly cheaper rate than the industry average.

How to File a Claim with C&F Travel Insured International

Filing a claim with Crum & Forster is simple. You can start a claim by filling out a short form with the plan number listed on your confirmation of benefits document and your last name.

Alternatively, you can give the company a call at 855-752-8303. C&F Travel Insured's hours of operation are Monday through Friday from 8:00 a.m. to 6:00 p.m. EST. You can also email the team at [email protected].

Learn more about how C&F Travel Insurance compares to popular travel insurance plans.

C&F Travel Insured International vs AIG Travel Guard

The most similar plan from AIG Travel Guard is the mid-tier Travel Guard Preferred Plan. Below, we've outlined some of the main features of this insurance policy.

- Up to $150,000 in trip cancellation coverage

- Up to $225,000 in trip interruption coverage

- A maximum of $800 in travel delay coverage

- A maximum of $50,000 in emergency medical coverage

- Up to $150,000 in emergency evacuations

- Up to $1,000 coverage for baggage loss, theft, or damage

Below, you'll find coverages for C&F Travel Insured's Worldwide Trip Protector plan.

- 100% in trip cancellation coverage

- 150% trip interruption coverage

- Up to $1,000 in travel delay coverage after 6 hours

- A maximum of $100,000 in medical emergency coverage

- Up to $1 million in emergency evacuations

- Up to $1,000 in coverage for baggage loss, theft, or damage

At a glance, C&F Insured's Worldwide Trip Protector offers more travel insurance coverage than AIG Travel Guard. AIG's travel insurance also caps the dollar amount of its trip cancellation and interruption coverage, which is something to keep in mind before buying travel insurance.

AIG Travel Insurance Review

C&F Travel Insurance vs iTravelInsured

iTravelInsured 's most popular plan is the Travel SE plan.

- 150% in trip interruption coverage

- Up to $250,000 (primary coverage) for emergency medical coverage

- Up to $2,000 ($125 daily limit) in travel delay coverage for delays after 12 hours.

- $1,500 ($250 per item) maximum for baggage loss, theft, or damage

You'll find more comprehensive medical and baggage loss coverage with iTravelInsured's SE plan than C&F Travel Insured Worldwide Trip Protector.

iTravelInsured Travel LX and C&F Travel Insure's WorldWide premium package also offer CFAR and IFAR coverage. Remember, your cost may vary based on personal factors such as age and travel destination. It's best to generate rates using the companies' quote tools and compare prices.

iTravelInsured Insurance Review

C&F Travel Insurance vs Credit Card Travel Insurance

Buying insurance through a travel insurance company like Crum & Forster is one of many ways to get coverage. However, travel insurance may also be a perk included in your credit card. It's essential to check if any of your credit cards offer travel insurance and if the coverage is sufficient to meet your needs.

A separate travel insurance policy can help you fill gaps in your credit card's travel insurance coverage. For instance, many credit cards offer trip cancellation and interruption coverage but not medical coverage. C&F Travel Insured's Travel Medical Protector plan may be a good addition if you only need to add medical-related coverage.

Best Credit Cards with Travel Insurance

Why You Should Trust Us: How We Reviewed C&F Travel Insurance

We looked at Crum & Forster's coverages and compared it to the best travel insurance policies. We analyzed coverage options, claim limits, available add-ons, and typical insurance policy costs. The right policy will offer sufficient coverage for your situation at the most competitive price.

C&F offers aggressive options if you're willing to pay a bit more. It also offers budget travel insurance plans for those looking to supplement credit card or other protections already in place. To find the travel insurance that makes sense, check out different providers and compare quotes. You can also read more about our ratings methods for insurance providers .

C&F Travel Insurance FAQs

Yes, C&F Travel Insured International is a legitimate travel insurance company. Founded in 1994, Crum & Forster (C&F) owns the insurance agency. C&F is a 200-year-old risk management company with an "A" (excellent) rating from AM's Best, an insurance credit rating industry, in 2021.

C&F allows travelers to buy insurance up to 3 years before the departure date. You can buy your coverage later as well.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Travel Insured International Review

One of my top-rated companies, they have better coverage and more options than comparable plans

Top reasons to buy

- Value for traveler- lots of coverage for low cost

- Unique coverage for hurricane season (see below)

- Very reputable company backed by one of the oldest insurers in the world.

Flaws but not dealbreakers

- Baggage coverage is slightly lower than comparable plans

Bottom line

Always in my top recommended plans. Travel Insured has better coverage, unique coverage other plans lack, and are priced similarly. Backed by one of the world’s oldest insurance companies, very reputable.

Company information

Worldwide Trip Protector (Most Popular)

Worldwide Trip Protector Edge

Travel Medical Protector

Money Back Guarantee

Free look up to 14 days after purchase

Customer Service

800-243-3174 Hours of Operation: Weekdays, 8:00am – 9:00pm ET

Emergency Assistance:

Inside USA 800-575-5014 Outside USA 603-328-1926

800-243-3174 Claims Hours of Operation: Weekdays, 8:00am – 6:00pm ET

Full Travel Insured International Review

Summary: Travel Insured offers one of my top-recommended plans– Worldwide Trip Protector. Their plans have better coverage for weather/hurricanes, and include coverage that other plans don’t have. Their plans cover Covid-19 for cancellation and medical treatment. They also offer the popular Cancel For Any Reason upgrade.

Their Worldwide Trip Protector plan is a great overall recommendation. I have personally purchased this plan for a family trip, and they paid my claim for a canceled trip.

Worldwide Trip Protector is featured on both of these lists:

- Best Cruise Insurance Plans

- Best Family Plans

Travel Insured keeps things simple with only three plans. Most travelers will buy Worldwide Trip Protector as a great overall plan. They also offer Worldwide Trip Protector Edge, which is a budget-friendly version of the same plan but with lower coverage limits. Finally, they offer Travel Medical Protector. This is a plan without cancellation coverage, and it focuses on emergency medical for international travel.

Company Information Travel Insured was founded in 1994 so they have been in the business for a long time. In 2015, Travel Insured was acquired by Crum & Forster– an insurance company with a 200 year (!) history and plenty of financial backing. Travel Insured is a reputable company that can be relied on to pay claims.

What does Travel Insured insurance cover?

Travel Insured’s two travel insurance plans (Worldwide Trip Protector & Worldwide Trip Protector Edge) are for most travelers. They are the plan you would buy for a vacation, cruise, tour, or any other trip where you are worried about losing money for a canceled trip.

Like all travel insurance plans, they cover:

- Trip cancellation & interruption

- Emergency medical expenses

- Medical evacuation expenses

- Lost, stolen, or damaged baggage

- Travel delays

- Delayed baggage

- 24/7 worldwide assistance

Travel Insured International & Cancel For Any Reason Insurance

Travel Insured offers Cancel For Any Reason coverage as an optional upgrade with Worldwide Trip Protector. It is not available with Worldwide Trip Protector Edge, because this plan is designed to be budget-friendly. It is not available with Travel Medical Protector because this plan doesn’t cover canceled trips– it focuses on medical emergency coverage abroad.

Some companies, such as Allianz, don’t offer this upgrade. Even though it is optional, I believe it is better to have the option. This is why I recommend Travel Insured over Allianz.

Travelers like the peace-of-mind this coverage provides. It gives you a lot of flexibility in cancelling your trip and still getting most of your money back.

Travel Insured International and Covid-19

Worldwide Trip Protector covers Covid-19 for both trip cancellation and emergency medical expenses.

Trip Cancellation and Covid-19

Travel Insured treats Coronavirus like any other sickness when it comes to trip cancellation coverage . Trip cancellation covers cancellations if someone gets sick or injured before the trip and cannot travel. This is the most popular reason for trip cancellation, and travelers make claims for this all the time. It might be a child with the flu. Or a parent having a stroke and you need to care for them.

In the case of Covid, if you get sick before departure and your doctor advises you to cancel, this is a covered reason for cancelling . You would receive any trip expenses you lose as a reimbursement from the insurance company. Physicians provide verification for this all the time.

Emergency Medical Treatment and Covid-19

Similarly, Travel Insured’s plans cover Covid as they would any other sickness for emergency medical care . If you are traveling abroad and get sick or have an illness, you are covered for medical care costs.

Travel Insured International Hurricane & Weather Coverage

Travel Insured has some of the best hurricane & weather coverage for trip cancellation. Here is what makes their coverage better than other plans.

They cover hurricane warnings from the NOAA

This is some small print that many plans don’t have, and it makes Travel Insured a better plan for hurricane & weather concerns.

Many plans cover sever weather that damages your destination. In these cases, you need the hurricane it actually strike and cause damage to your resort that shuts it down. But, what if it strikes and leaves a mess behind, but doesn’t close your resort? Technically you can still take your trip.

With this coverage, if the NOAA issues a hurricane warning that includes your destination within 48 hours of your departure, you ‘re covered. You can cancel and receive reimbursement. That extends your coverage by a lot, and protects your money better.

Their delay trigger is 6 hours instead 12+

Travel insurance covers cancellation for common carrier delays. This means an airline being shut down due to severe weather. But all plans have a different amount of time before that coverage is “triggered”. Some plans require a delay of 12, 24, or even 48 hours. This means you can be delayed 47 hours and you still can’t cancel your trip and be covered.

Travel Insured has a delay trigger of 6 hours, which is low. That’s good. There are plans that have a trigger that states “delay of any length of time”, which is better. But these plans don’t have the NOAA warning coverage. If I had to choose I’d rather have 6 hours and warning covered, instead of 0 hours and no warning covered.

How much is Travel Insured insurance?

Travel Insured tends to be similar in price to comparable plans, but with better coverage and options.

Here is an example of the difference in price and coverage:

Trip information: Two-week trip with a trip cost of $4,000, one traveler aged 46.

Travel Insured Worldwide Trip Protector – $228 This is a plan with medical limit of $100,000. This is an adequate amount of travel medical coverage for most trips. Compare this to only $50,000 on the Allianz plan below. Travel Insured has better hurricane & weather coverage (more below). This plan also has the option to upgrade with Cancel For Any Reason.

Trawick Safe Travels Voyager – $241 Similar coverage, but the medical limit here is even higher at $250,000. This is more than adequate travel medical coverage for most trips. This plan also has the option to upgrade with Cancel For Any Reason, but the hurricane coverage is not as good.

Allianz OneTrip Prime- $217 Most coverage is similar, but this plan only has emergency medical coverage up to $50,000. This is a decent amount, but for trips like cruises and travel abroad, I recommend a minimum of $100,000. This plan also has no option for Cancel For Any Reason coverage. This is an upgrade that many travelers like to have for their trip. Most companies offer CFAR upgrades on at least one plan, but Allianz has no coverage for this.

All of the plans are a little more than 5% of the trip cost, which falls within the usual travel insurance range of 4-10%.

Travel Insured International Plans

Single trip trip insurance plans.

Worldwide Trip Protector This is Travel Insured’s most popular plan. It is also one of my top recommendations for all travelers. It has $100,000 of Primary medical coverage, and $1,000,000 of emergency evacuation coverage. It covers Covid for both cancellation and medical treatment. It also includes the better hurricane and weather coverage with NOAA warnings covered. Overall an excellent plan.

Worldwide Trip Protector Edge This is similar coverage, but less coverage limits. It is for budget-minded travelers who want coverage without increasing their travel budget as much. This plan does not have the Cancel For Any Reason option available. It also does not have coverage for NOAA hurricane warnings.

Travel Medical Plans

Travel Medical Protector This is Travel Insured’s plan for travelers who don’t need cancellation coverage, but want medical coverage abroad. It covers $50,000 for medical emergencies, $1,000,000 for evacuation. It’s a fine plan, but there are better options for travel medical insurance.

Travel Insured International FAQs

Is Travel Insured International a good company?

Yes, absolutely. Travel Insured has been in business since 1994. They were recently acquired by 200 year old Crum & Forster. They have incredible financial backing, and are a stable, trustworthy, and reputable company.

Which Travel Insured plan is best?

Worldwide Trip Protector is their best plan. It has high coverage limits, covers NOAA hurricane warnings, has the option for Cancel For Any Reason, and is reasonably priced.

Travel with peace-of-mind... Compare quotes for free

Travel Insurance Review

Travel Insured International – Worldwide Trip Protector Plus

Editor review.

The Good: Offering very broad coverage for trip cancellation and interruption, this plan also comes with an unusual benefit: ‘interruption for any reason’ as well as ‘cancel for any reason’. High car rental coverage is included in the base plan, as well as good coverage for delays, missed connections, and baggage losses. Travel accident protection is also included in base plan and trips as long as 180 days are covered.

The Drawbacks: Plans with $0 trip costs have reduced benefits.

The Bottom Line: It’s easy to see why this is Travel Insured’s most popular plan because it has high limits and inclusive benefits like pet protection, car rental coverage, and AD&D in the base plan. Optional coverage upgrades have simple and affordable per-person pricing, so it’s easy to know how much the coverage will cost right up front.

Get Travel Insured Quotes now

Instant quotes & secure online purchasing

Plan Details

This plan is unique in that it provides the following:

- High limits for emergency medical, evacuation and repatriation.

- ‘Cancel for any reason’ coverage for up to 75% of trip cost if purchased within 21 days of initial trip deposit

- ‘Interruption for any reason’ for up to 75% of trip cost.

- Covered reasons for trip cancellation are broad and include ‘cancel for work reason’, school year extensions, job loss, terrorist attacks at your destination, traffic accidents, hospitalization of destination host, pregnancies occurring after the plan effective date, and more.

- Purchase the plan within 21 days of initial trip deposit and you’re eligible for pre-existing medical conditions coverage.

- The renters collision benefit is higher than that offered by many plans.

- The baggage loss and baggage delay limits are relatively high when compared to other plans, as are the coverage limit for missed connections and travel delays.

- Plan includes political and natural disaster evacuation services.

- Travel Insured International’s worldwide travel assistance services include a high number of services, including translation services, meet and greet services, shopping assistance, emergency cash advances, and more.

Optional Coverage

The following optional coverage is available when you purchase this plan:

- Option to increase benefit limits for travel delays, missed connections and baggage coverage ($35 per person).

- Optional air flight only AD&D available up to the amount purchased.

Limitations

The following are the limitations on this plan’s coverage:

- Plans with $0 trip cost have reduced coverage. Specifically, return air only for trip interruption is limited to $1,000 if $0 trip costs is selected.

Related Travel Insured International Plans

- Worldwide Trip Protector

- Trip Protector Lite

- Airline Ticket Protector

Popular Companies

- Allianz Insurance

- CSA Travel Insurance

- Seven Corners Insurance

- Travel Guard Insurance

- Travel Insured

- Travelex Insurance

- TravelSafe Insurance

Learn about Travel Insurance

- Beginner’s Guide

- Coverage Guide

- Tips and Advice

- Company Reviews

- Types of Plans

- Types of Trips

Blog Article Categories

- In The News

- Travel Insured International

- Available Policies

View All Policies for Travel Insured International

All Travel Insured International policies are listed below. You can review policies, coverages, and sample certificates.

Remember, you are only a few quick questions away from an instant quote from all the major travel insurance providers.

Compare All Policies for Travel Insured International

Policy 1 Worldwide Trip Protector Plus

Policy Description:

Worldwide Trip Protector Plus is our most inclusive protection program. Primary Coverage with Cancel For Any Reason, Interruption For Any Reason and Rental Car Damage coverage included. Also included Baggage Delay, Loss, Theft, and Damage. ID/Credit Recovery. Political Evacuation. 24/7 Customer Care and Travel Assistance.

Policy Detail

Underwritten By:

United States Fire Insurance Company

Underwritten Location:

305 Madison Avenue Morristown, New Jersey 07960

AM Best Rating:

A (Excellent)

Policy 2 Worldwide Trip Protector

Worldwide Trip Protector, popular with families, features kids under 18 provided coverage at no extra charge with related adult on the same plan. Medical, Evacuation and Travel Accident. Eligibility for Pre-existing Medical Conditions coverage up to 21 days after trip deposit. Broad Trip Cancellation, Interruption, and Delay. Baggage Delay, Loss, Theft, and Damage. ID/Credit Recovery. 24/7 Customer Care and Travel Assistance.

Policy 3 Worldwide Trip Protector Edge

Worldwide Trip Protector Edge is our most cost-effective travel protection plan. This plan includes primary coverage and important benefits like Trip Interruption, Trip Cancellation, and a Pre-Existing Medical Condition Exclusion Waiver for eligible travelers. Edge also offers various optional benefit upgrades including an additional $40,000 in Accident and Sickness Medical Expense coverage and up to $25,000 in Rental Car Damage coverage. Other benefits include Medical Evacuation coverage, Trip Delay, Missed Tour or Cruise Connection, and Baggage Delay, Loss, Theft, and Damage.

Insurance Providers

- Arch RoamRight

- AXA Assistance USA

- Azimuth Risk Solutions, LLC

- Berkshire Hathaway Travel Protection

- CSA Travel Protection

- Detour Insurance

- Generali Global Assistance

- Global Alert

- Global Guardian Air Ambulance

- Global Underwriters

- HTH Travel Insurance

- INF Visitor Care

- John Hancock Insurance Agency, Inc.

- MedjetAssist

- Nationwide Mutual Insurance Company

- Seven Corners

- Travelex Insurance Services

- Trawick International

- USA-Assist Worldwide Protection

- USI Affinity Travel Insurance Services

Additional Information

- AM Best Ratings

IMAGES

COMMENTS

Optional Rental Car Damage and Theft. $50,000. $25,000. Optional Travel Inconvenience. $750 ($250 each) —. Optional benefits are available for an additional cost. Cancel for Any Reason and Interruption for Any Reason are not available to residents of New York State.

The Worldwide Trip Protector Edge plan is more budget-friendly than the Worldwide Trip Protection plan, but it provides less coverage. Still, it checks all the boxes for core types of benefits ...

For Worldwide Trip Protector Edge: Trip Interruption is not applicable when $0 Trip Cost displayed on Your confirmation of coverage. ¹The plan must be purchased within 21 days for WTP, or 14 days for Edge, of initial trip payment or deposit to be eligible. Additional terms apply.

When your travel needs call for a broad plan but cost-saving takes priority, our signature worldwide trip protector is the answer. Worldwide Trip Protector, popular with families, features coverage for children at no extra charge when traveling with their related adult on the same plan. Available to U.S. residents.

2.45%. The Worldwide Trip Protector Plus plan ($216) and the Worldwide Trip Protector plan ($144) are nearly identical in the benefits offered, with both providing 100% trip cancellation, 150% ...

For Worldwide Trip Protector Edge: Trip Interruption is not applicable when $0 Trip Cost displayed on Your confirmation of coverage. 1The plan must be purchased within 21 days for WTP, or 14 days for Edge, of initial trip payment or deposit to be eligible. Additional terms apply.

Worldwide Trip Protector Plan Optional Upgrades. For only $7 per day, customers can purchase $50,000 in collision coverage for rental vehicles. Other upgrades include additional coverage for lost luggage, medical costs and expenses resulting from travel delays and missed connections. Flight-only AD&D is also available for an extra charge.

The average cost of travel insurance sits at 4% to 8% of your total trip cost. So the average cost of travel insurance for an $8,000 trip would be $320 to $640. In this case, C&F Travel Insured is ...

Trip information: Two-week trip with a trip cost of $4,000, one traveler aged 46. Travel Insured Worldwide Trip Protector - $228. This is a plan with medical limit of $100,000. This is an adequate amount of travel medical coverage for most trips. Compare this to only $50,000 on the Allianz plan below.

Medical Coverage. Under the Worldwide Trip Protector Plus Plan, the medical coverage portion of the program will become your main insurance during your vacation. A supplemental plan is not needed. If you or another covered member of your travel party becomes ill or injured, you will be covered. The plan does limit the medical coverage to $100,000.

🙋♂️Greetings, U.S travelers! Join us today as G1G Travel Insurance provides an in-depth review of the Worldwide Trip Protector Edge plan. This robust trave...

The Worldwide Trip Protector can also protect travelers' belongings in the event of loss, theft, damage, or destruction of baggage and personal effects during their trip. This coverage extends to fees associated with replacing essential travel documents, such as passports and visas, as well as charges resulting from unauthorized use or ...

Travelers also receive the benefit of 24/7 non-insurance travel assistance services, providing immediate support for issues ranging from lost passports to medical emergencies. Inclusions such as these are what set Worldwide Trip Protector policies apart. In addition to coverage for problems that occur before or during a trip, the policy can ...

The Worldwide Trip Protector policy is a better choice if you're looking for more financial protection than the Edge plan. It has higher coverage limits across the board.

Travel accident protection is also included in base plan and trips as long as 180 days are covered. The Drawbacks: Plans with $0 trip costs have reduced benefits. The Bottom Line: It’s easy to see why this is Travel Insured’s most popular plan because it has high limits and inclusive benefits like pet protection, car rental ...

WOrdWide Trip prOTecTOr edge SCHEDULE OF INSURANCE COVERAGE AND OTHER NON-INSURANCE SERVICES ... Travel Insured International 855 Winding Brook Drive Glastonbury, CT 06033 ... .com 1 Must be purchased within 14 days of the date the initial trip deposit is received. *Up to the lesser of the Trip Cost paid or the limit of coverage on Your ...

Worldwide Trip Protector Edge is our most cost-effective travel protection plan. This plan includes primary coverage and important benefits like Trip Interruption, Trip Cancellation, and a Pre-Existing Medical Condition Exclusion Waiver for eligible travelers. Edge also offers various optional benefit upgrades including an additional $40,000 in ...

See plan details for the Travel Insured International Worldwide Trip Protector Edge Policy. Every major travel insurance company. Quick Quote or research, instant cover. 1-800-240-0369 1-800-240-0369 8AM to ... Worldwide Trip Protector Edge. Certificate: View Certificate. Zero Complaint Guarantee: This provider complies with Squaremouth's Zero ...

C&F Travel Insured International Worldwide Trip Protector Plus. I was allowed to use this plan for a different trip after the original trip was cancelled. The pricing for the change, an upgrade to cost of trip total, was almost double what it would have been if I had bought the plan for the different trip from the start.

Worldwide Trip Protector Edge is our most cost-effective travel protection plan. This plan includes primary coverage and important benefits like Trip Interruption, Trip Cancellation, and a Pre-Existing Medical Condition Exclusion Waiver for eligible travelers. Edge also offers various optional benefit upgrades including an additional $40,000 in ...

Travel insurance is a regulated product that covers losses that you might face while traveling. These can include car rental damage, flight delays, lost luggage, medical expenses and trip ...

WORLDWIDE TRIP PROTECTOR EDGE Benefit Maximum Amount Trip Cancellation** 100% of Trip Cost* Trip Interruption** 100% of Trip Cost* Trip Delay - 12 hours $300 ($100/day) Change Fee $250 ... Your travel retailer may provide general information about the plans offered, including a description of the coverage and price. ...

The Crum & Forster - Travel Insured International Worldwide Trip Protector is a comprehensive trip cost protection plan with increased coverage limits and flexibility, available for residents of Montana only. If you are looking for a plan that gives you standard comprehensive benefits as well as a little extra cushion, and you live in Montana ...