Indiana University Indiana University IU

- Trip Authorization

Travel Management Services Purchasing | Supplier Diversity

Welcome to IU Travel

We provide an efficient, cost-effective travel management program to assist faculty and staff with IU-sponsored travel and expense reimbursement. Find information on booking IU-paid travel, discounts, policy and procedures, and tips for faster reimbursement.

New/infrequent travelers and arrangers will find training support at the Financial Training & Communications team’s website .

Travel Advisories and New Resources

New duplicate a trip authorization.

Chrome River rolled out a helpful new feature that allows users to duplicate a submitted Trip Authorization (TA) report. This new feature can help Delegates and Travelers alike to reduce the amount of time you spend creating TA reports. Learn about the use cases for this feature and how to use it on the Training team’s website .

Update to Non-employee Guest Travel in Egencia

Travel Arrangers with Egencia Guest profiles prior to March 31, 2023, will find their legacy guest traveler profile deactivated. Effective April 3, the new guest process involves creating a temporary profile unique to each individual guest traveler. Review the new process here .

New! Interactive Video Resources

Are you brand new to IU Travel, or could you use a quick reference? This new, interactive video covers expense reporting for both reimbursements and IU-paid expenses on in-state trips.

- Click here to view the new Travel Expense Report Quickstart Guide

Traveling out of state? Before booking your trip, ensure you’re up to speed on Trip Authorization by enrolling in this self-guided, interactive TA course.

- Click here to enroll in the course

Southwest Airline Business Booking

IU Travel Management has partnered with Southwest Airlines to provide access to SWABIZ: Southwest's business travel booking tool that comes pre-loaded with negotiated rates and links directly to your rapid rewards account. Click here to learn more!

Upload receipts in a SNAP

Uploading receipts is a snap with Chrome River SNAP app! This free app available on iOS/Apple and Android devices allows users to upload photos of physical receipts directly to Chrome River while on the go. Uploaded receipt images are housed in the Receipt Gallery within Chrome River and are accessible to anyone with access to the expense owner’s account. Learn more about CR SNAP .

Stay in the Know with Egencia Travel Alerts

Travelers nationwide are experiencing flight delays and cancellations. For trips booked in Egencia, please make sure you have enabled notifications in your Egencia profile settings. Travelers can opt in to receive alerts for check in reminders, gate changes, baggage claim reminders, flight cancellation alerts, and flight delay alerts via text message or email. This can be toggled in either the Egencia desktop or mobile app. Learn how to opt in .

Applying for a Passport

When applying for a passport, there are two routes you can take.

- Apply for a passport directly at the US Post Office or

- Use the CIBT contract for expedited service. IU has negotiated discounted fees for expediting services for passports and visas via CIBTvisas. Click here to access the CIBTvisas portal .

Please visit https://overseas.iu.edu/planning/passports.html for more information.

Will your license fly on May 7, 2025?

Beginning May 7, 2025 a Real ID-compliant driver's license, permit or identification card will be required to board commercial flights. Visit the Indiana BMV Real ID resource page to learn how to meet this requirement before the deadline.

Indiana University Bloomington social media channels

INDIANA UNIVERSITY Travel Management Services

- Chrome River

- Contact & Newsletters

- PDF / Video / Webinar

- Live - Zoom Meetings (TBA)

Related Sites

- IU Purchasing

- IU Supplier Diversity

- Skip to Content

- Skip to Main Navigation

- Skip to Search

Indiana University Indiana University IU

- Accounts Payable

- Accounts Receivable

- Financial Processing In KFS

- P-Card or Meeting Card

- Course Catalog

- Credits and Refunds

- Invoice Review

- Invoice Submission

- Payment Details

- Reimbursements

- Stop Payments

- Credit Memos

- Document Searches

- Receiving Payments

- Administrative Documents

- Financial Processing Documents

- General Ledger Balance Inquiries

- System Overview

- P-Card/Meeting Card

- Catalog Orders

- Change Requests

- Check Requests

- Non-Catalog Orders

- Order Management

- Searches & Dashboards

- Chrome River Reporting

- Approving Reports

- Booking Travel

- Reimbursing Travel

- Trip Authorization

- Capital Assets

- Financial Processing-KFS

- Supplier Diversity

- Meet the Team

Financial Training & Communications

- Documentation

Reimburse Mileage

Mileage is a reimbursement paid to travelers for driving a personal vehicle on IU business.

A few notes about mileage:

- Mileage reimbursement covers costs associated with using your personal vehicle for IU business. Visit the Traveling by Personal Car page on the Travel website to learn more about what the reimbursement covers.

- Most mileage reimbursements are paid at a rate set by the IRS. If mileage is funded by a grant account, the mileage rate differs. In either case, the rate is programmed into Chrome River and automatically applied.

- The mileage reimbursement rate is reduced after the first 500 miles. The mileage calculator in Chrome River calculates reimbursements using this information.

This page demonstrates creating an expense report and adding the mielage expense in Chrome River.

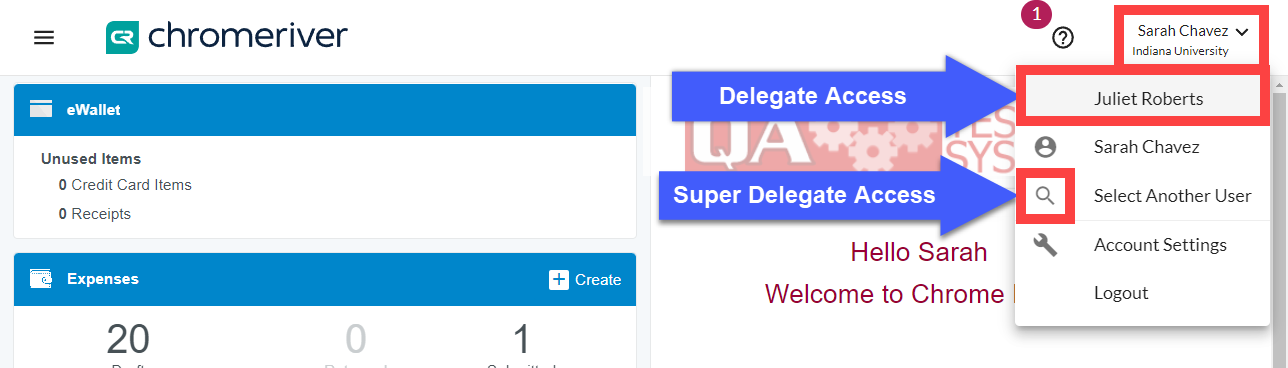

Info for Travel Arrangers & Delegates

If you are a delegate arranging travel on behalf of another expense owner, be sure to switch to that expense owner’s Chrome River profile to submit the report on their behalf.

In the top right corner of Chrome River, click Your Name . Select the name of the expense owner from the list, or click Select Another User if you’re a Super Delegate

Click a trip type below to learn how to request that type of mileage reimbursement.

- In-State : mileage where most or all of the destinations are inside the state of Indiana

- Domestic : where most or all of the destinations are outside of Indiana.

- Accumulated mileage : mileage logged over a period of time capturing frequent or repeated trips. Can be submitted on In-State or Domestic trip expense reports.

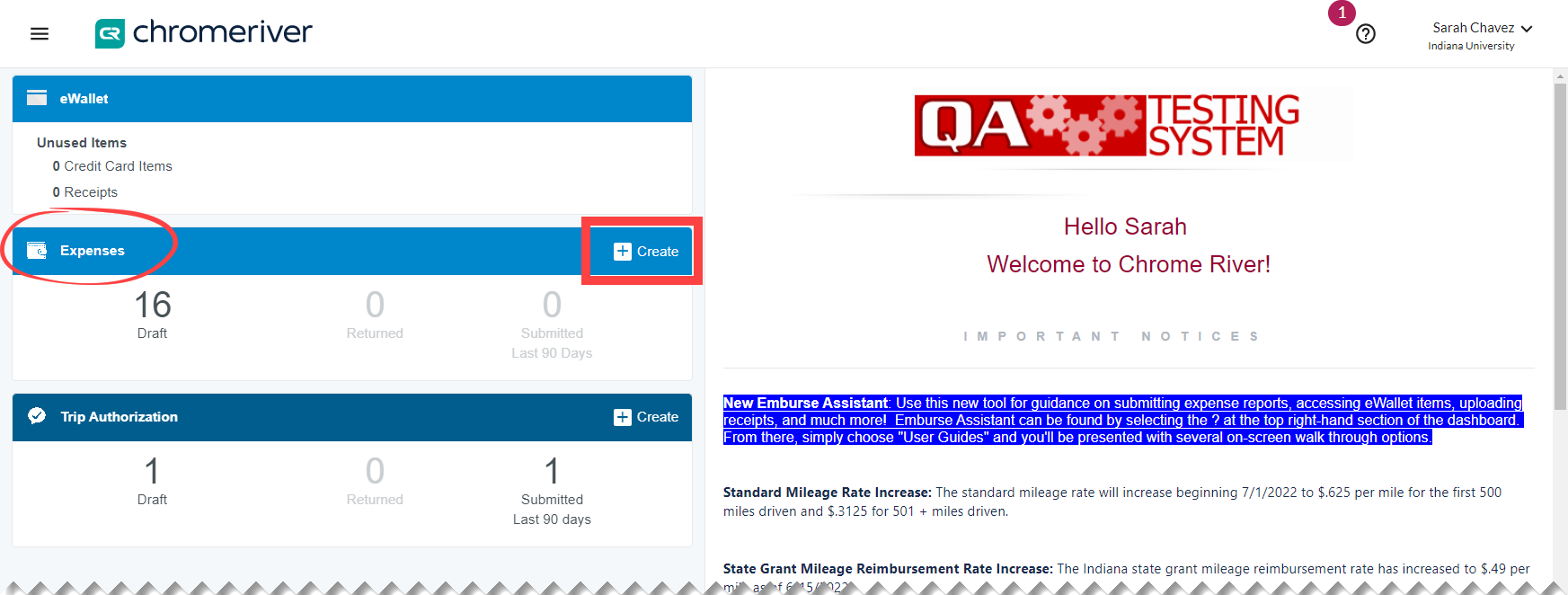

To get started, find the expenses ribbon on the Chrome River dashboard. Click +Create .

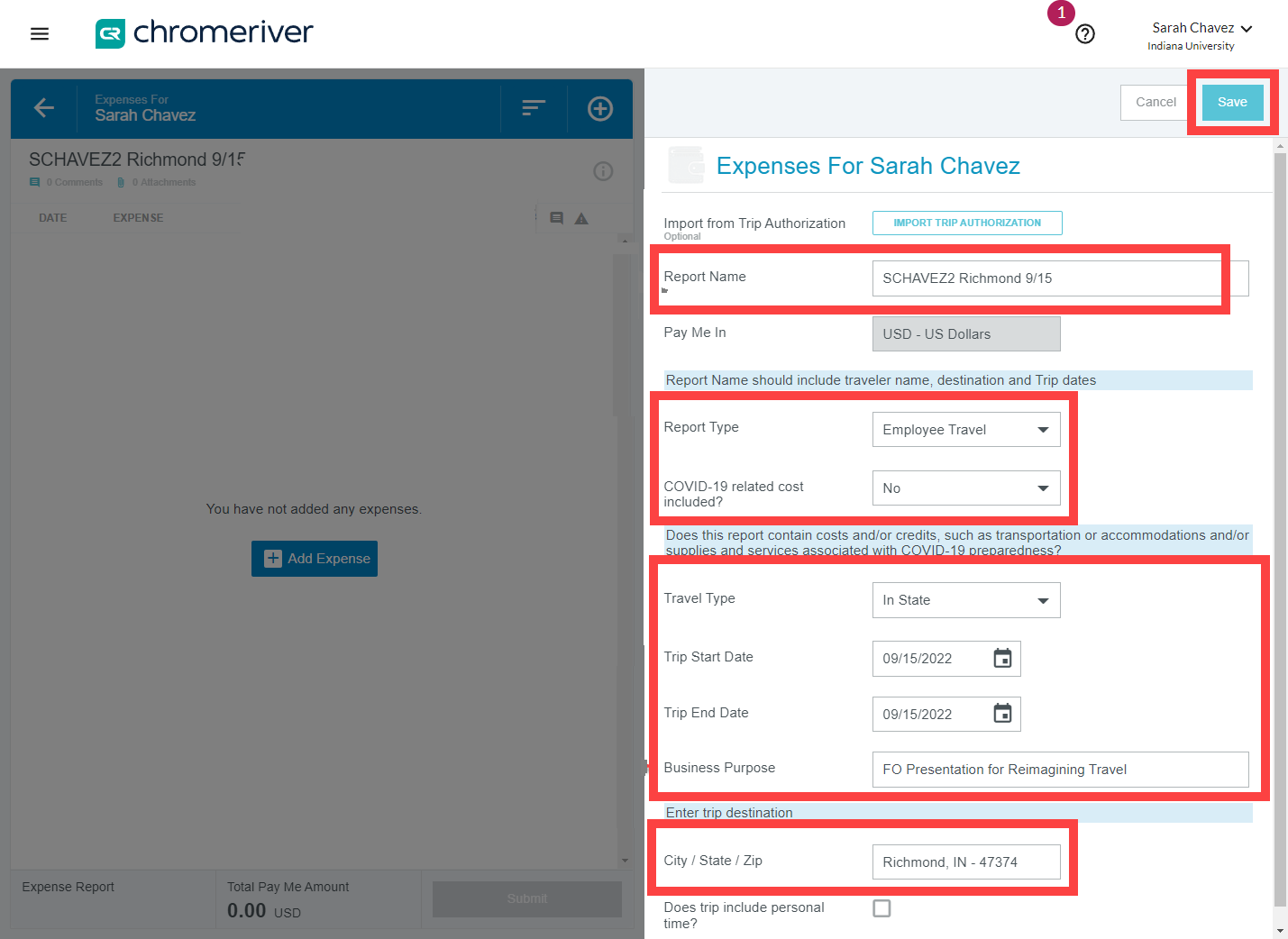

In-State trips do not require Trip Authorization, so you will need to manually fill out the summary page of the expense report. The summary page contains header level information that applies to the whole report.

Click here for help completing the summary page

The report name should include the traveler’s name or username, destination, and dates. This helps anyone reviewing the report to identify the trip at a glance. In this example, we’ve entered “SCHAVEZ2 Richmond 9/15.” The report type describes what kind of traveler is on the trip.

COVID-19 related cost: Does this report contain costs and/or credits, such as transportation or accommodations and/or supplies and services associated with COVID-19 preparedness? Mark “Yes” if so. A field will open requiring you to explain the COVID-19-related cost Business purpose: When entering a business purpose, the language should reflect why the trip expense is a legitimate business use of IU funds. Do not use acronyms in this field. This information should make sense to an auditor or someone outside your department viewing the report for the first time.

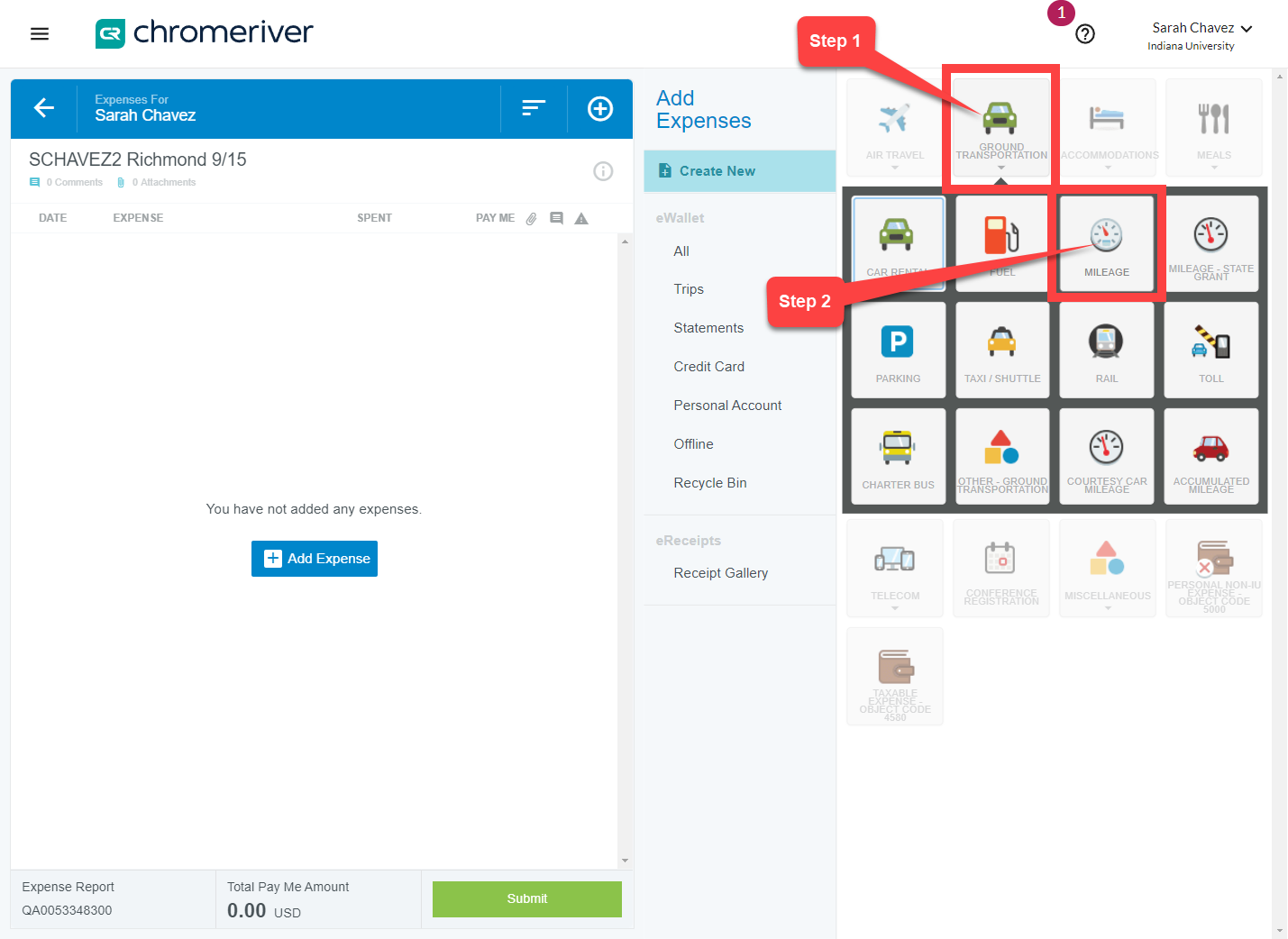

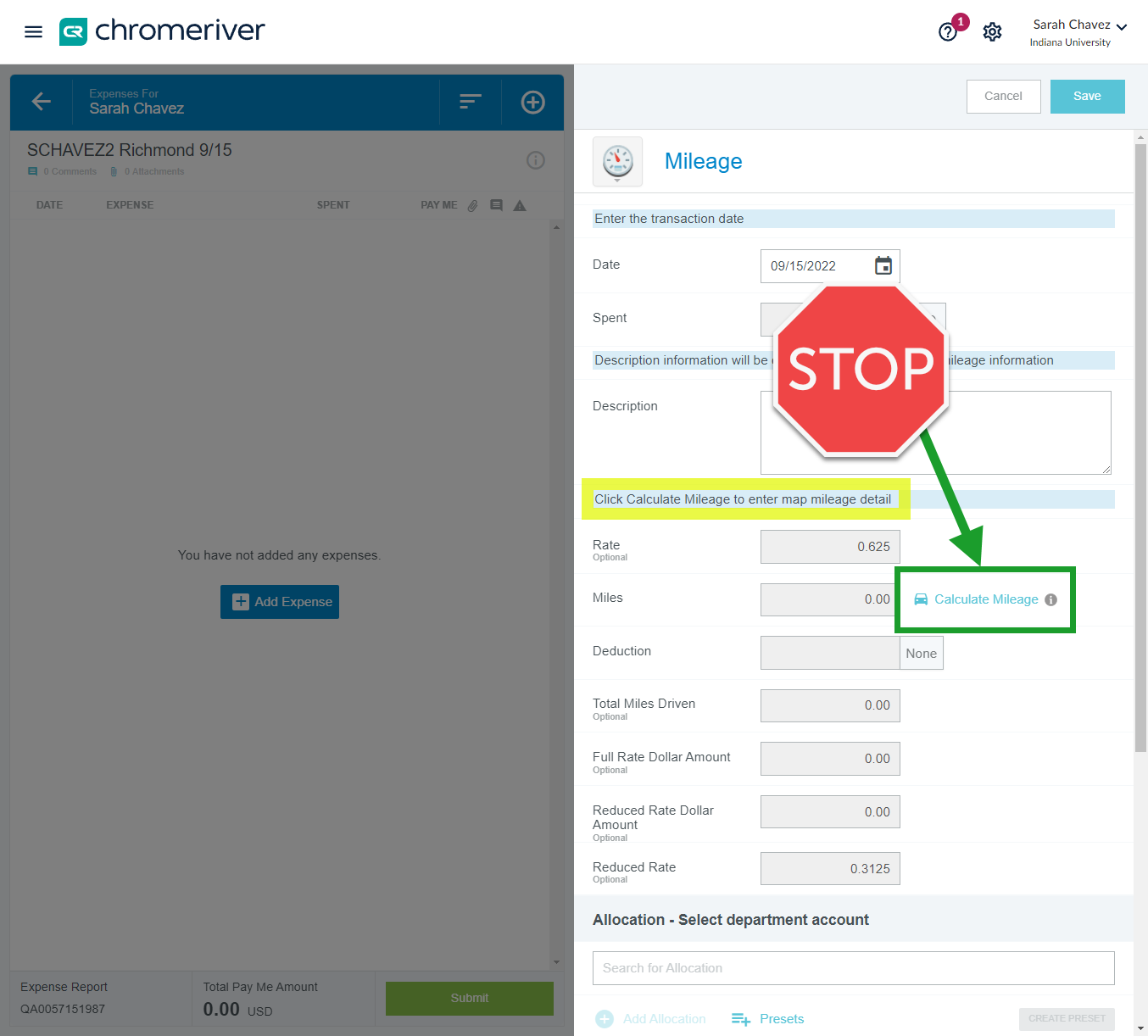

Select the Ground Transportation expense tile, followed by Mileage in the expense drawer.

The mileage expense opens on the right.

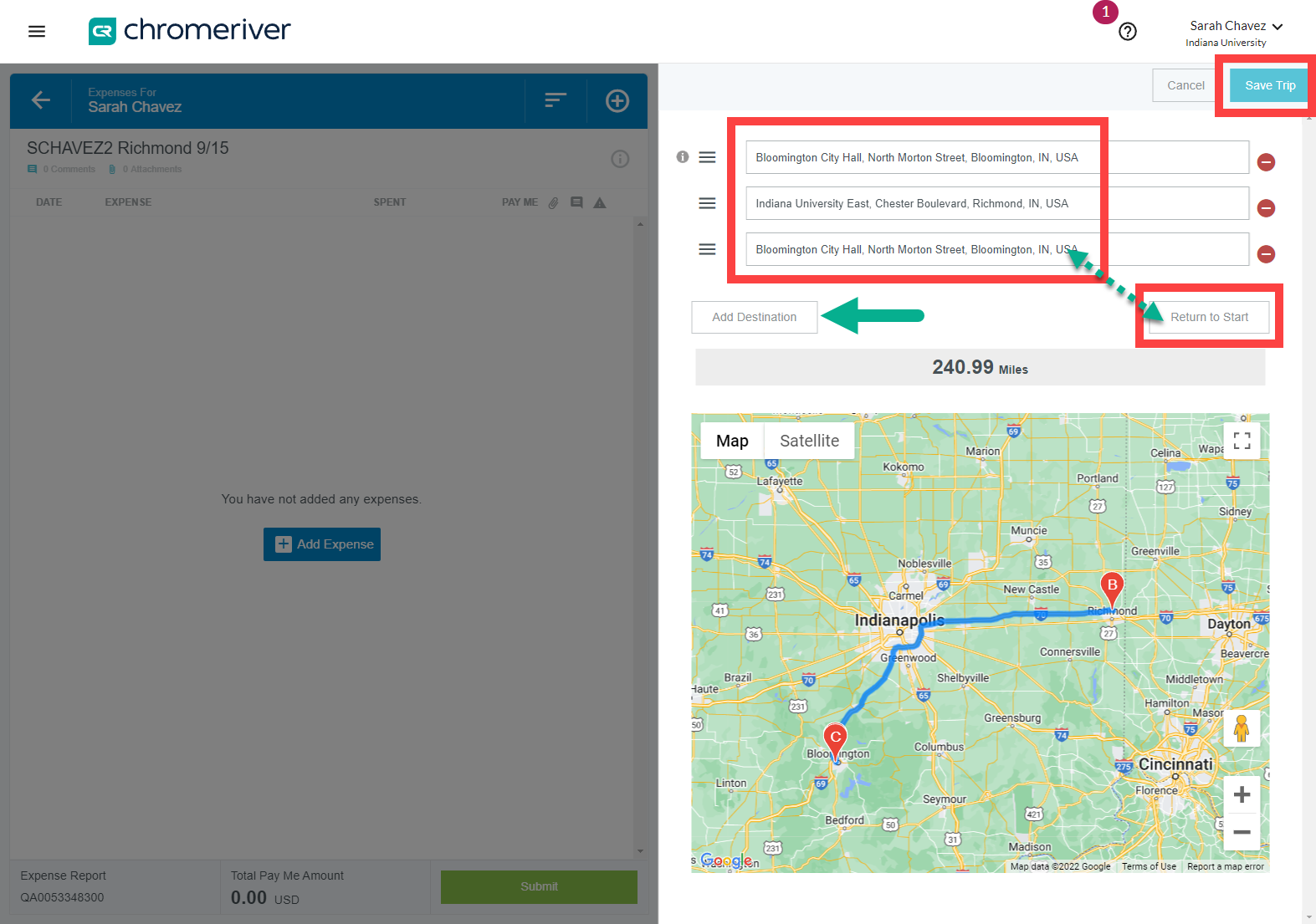

A map opens in the right-hand window. Enter your starting point and your destination(s) into the Google maps mileage calculator by typing the names of the destinations into the open fields. Continue clicking Add Destination until all destinations have been captured. Remember to click Return to Start to capture your drive home.

Click Save Trip in the upper right corner when finished adding destinations.

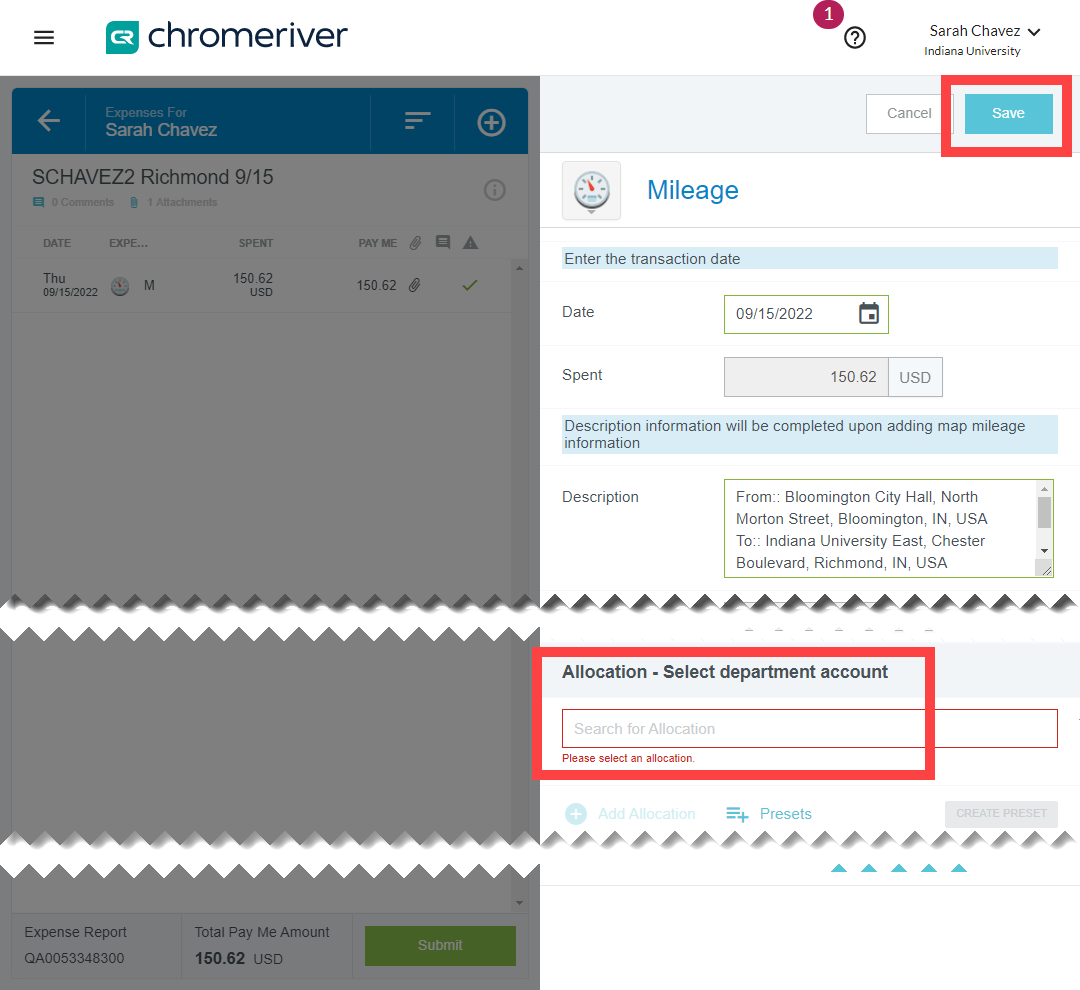

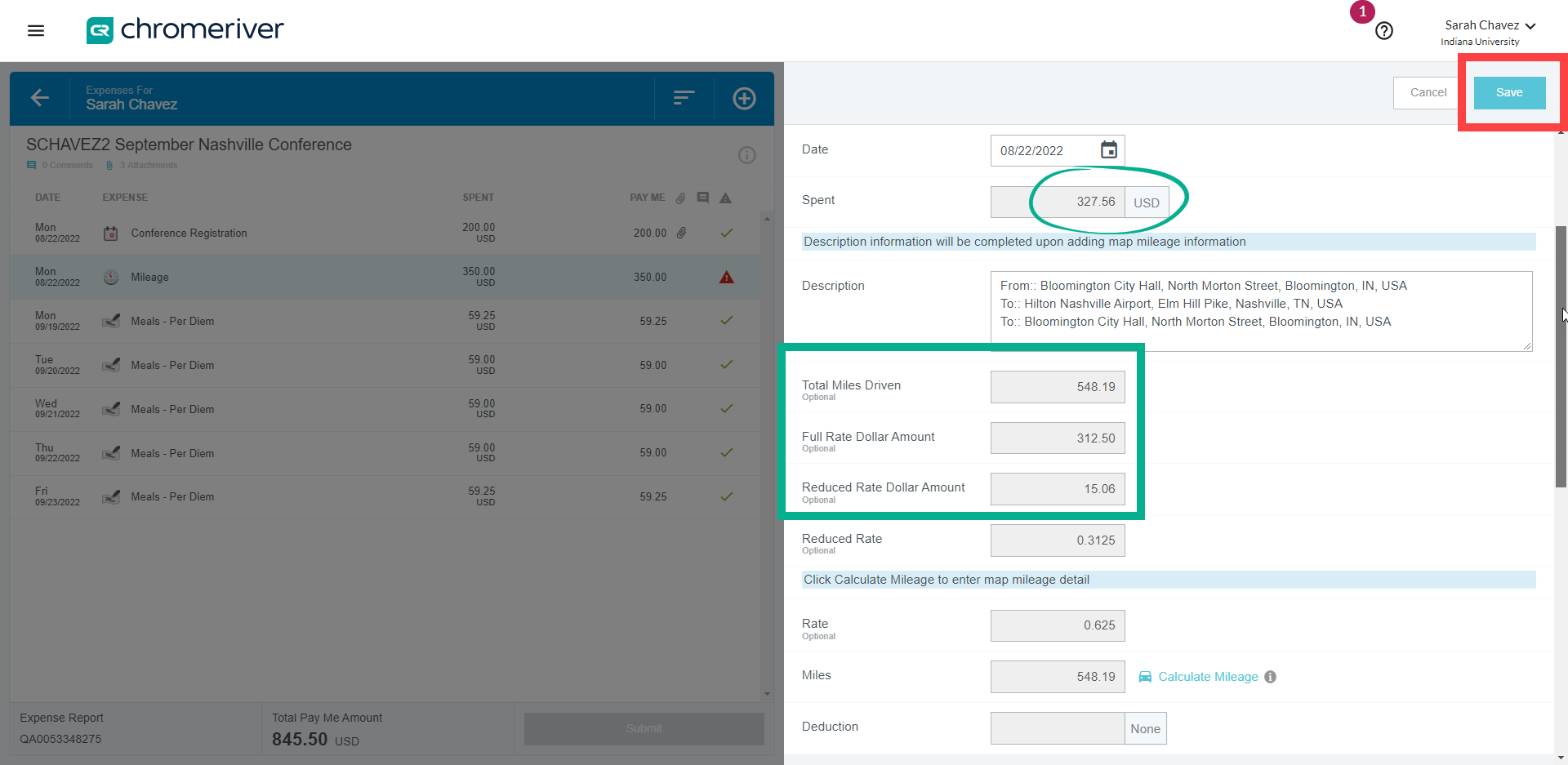

The Google maps information calculated for your trip is auto-populated into the fields of the expense. Note that any miles driven beyond the first 500 miles are reimbursed at a reduced rate. The Spent amount is the dollar amount you will be reimbursed for your mileage. This information is not editable.

Finally, enter the IU account/sub-account funding the trip into the Allocation field. If you aren’t sure which account number to use, contact your Fiscal Officer. If needed, add multiple allocations with the Add Allocation field.

Click Save to add the mileage reimbursement to the expense report.

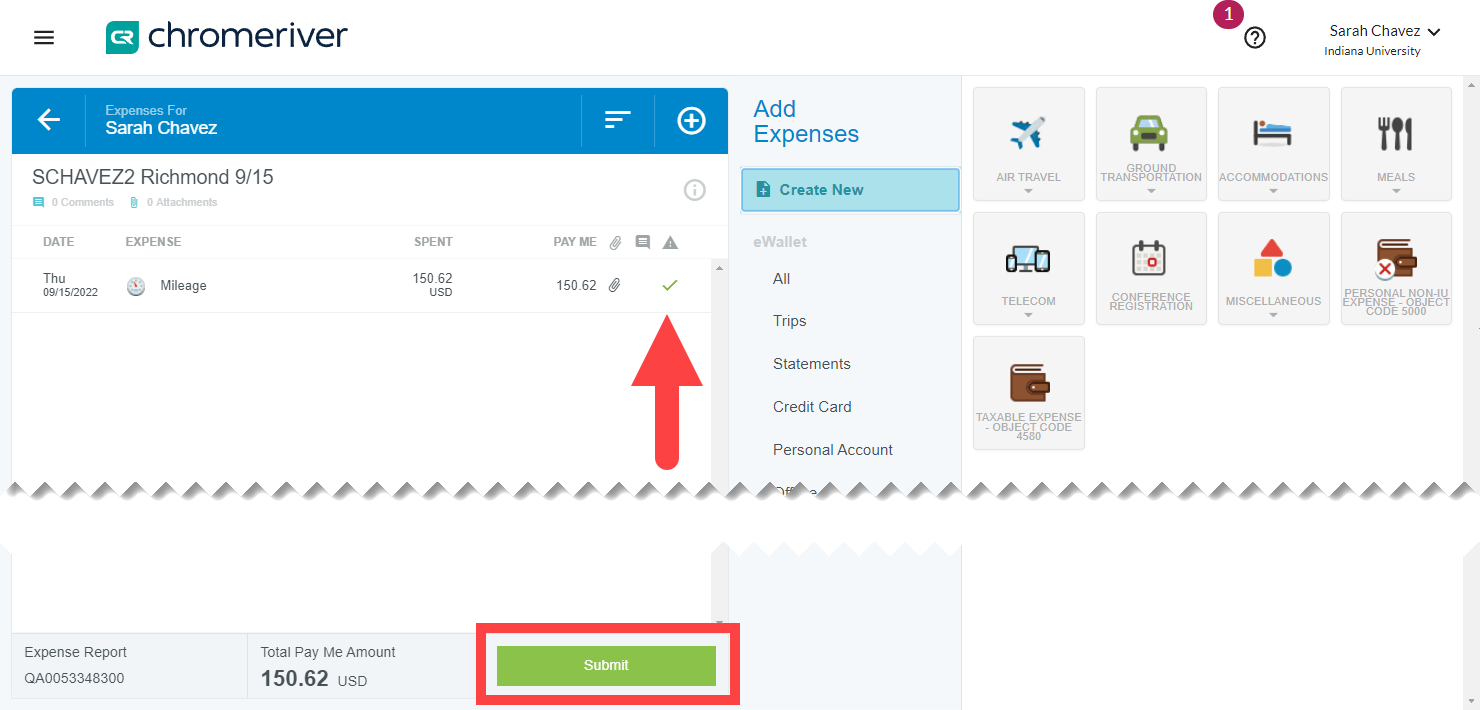

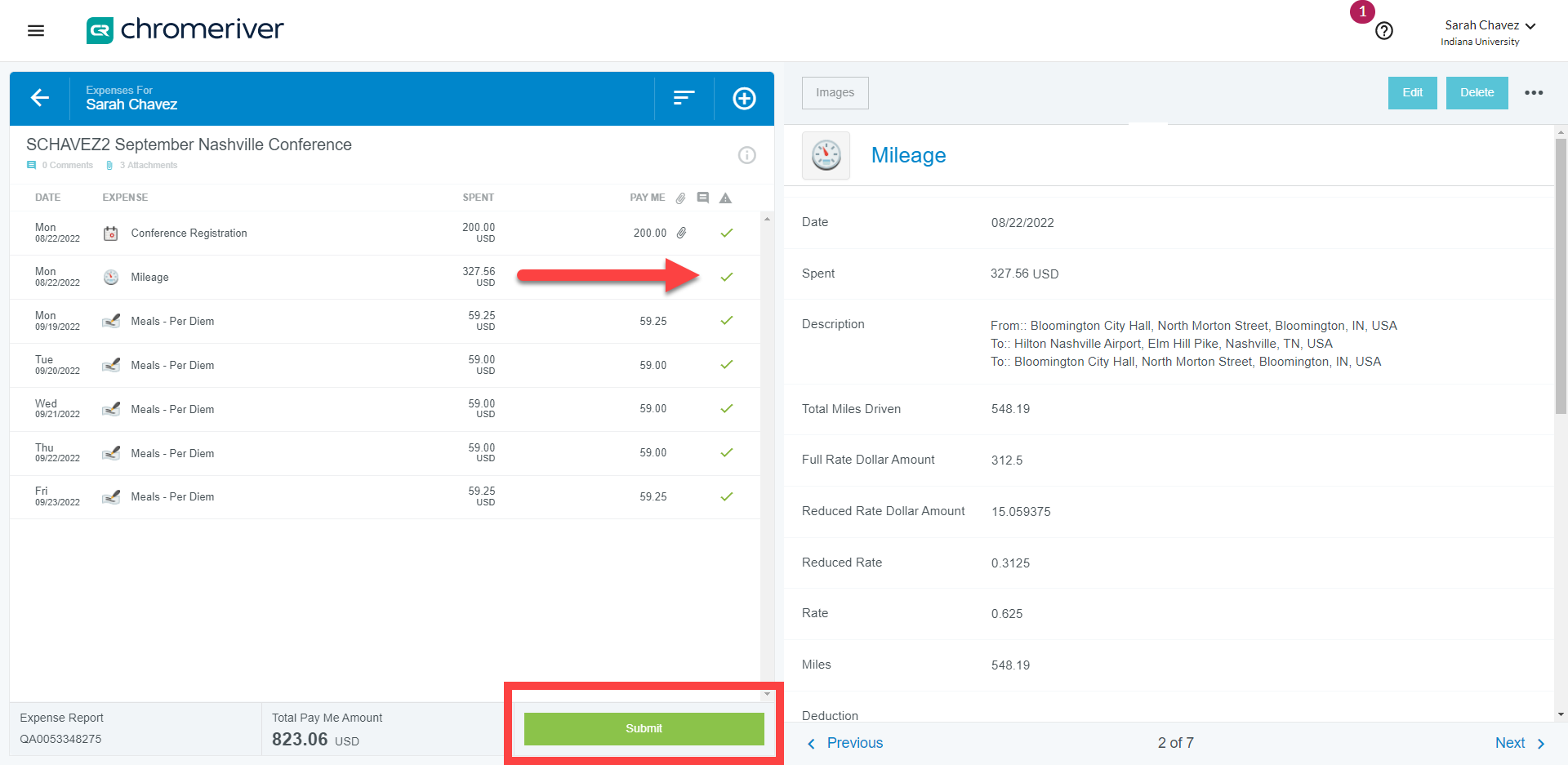

After saving, your mileage expense appears as a single expense line containing all destinations in the left-hand window. The green check mark indicates the expense is complete. Add any other reimbursements to the report. Once your expense report is complete, click Submit .

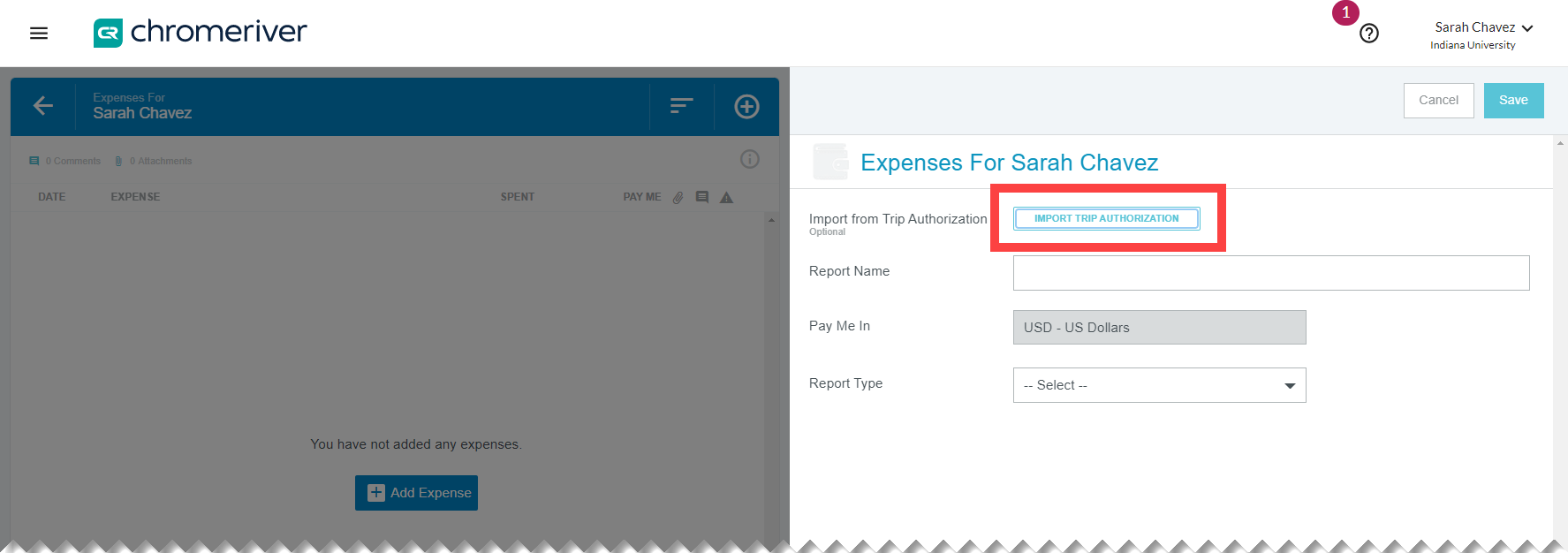

A new expense report opens on the right. Import your approved Trip Authorization (TA) report by clicking the IMPORT TRIP AUTHORIZATION button. The drop-down menu that appears contains your approved TA reports. Select the TA relevant to this specific trip.

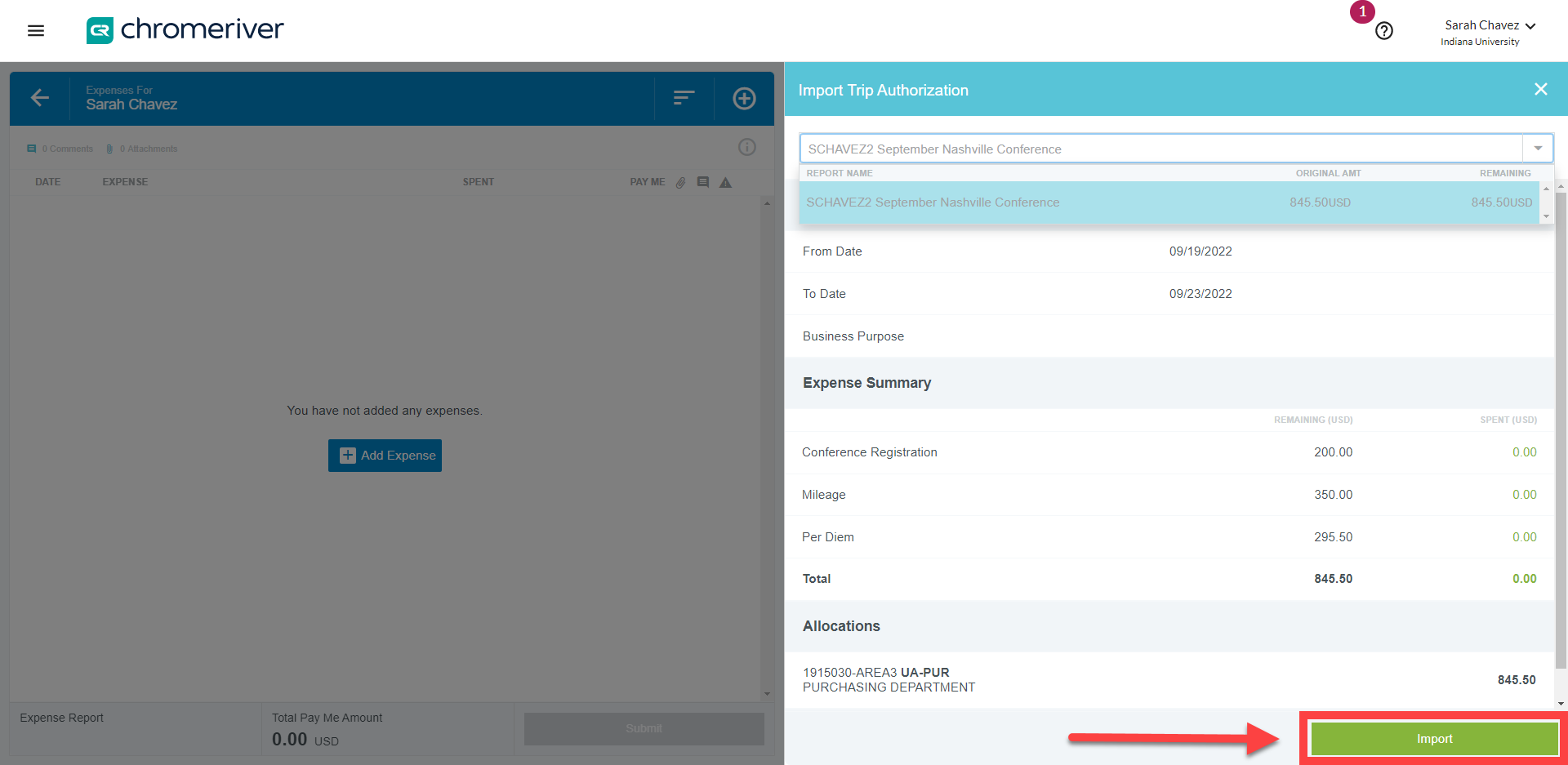

The selected TA opens to display on the right. Check over the details to be sure this is the correct TA and click Import.

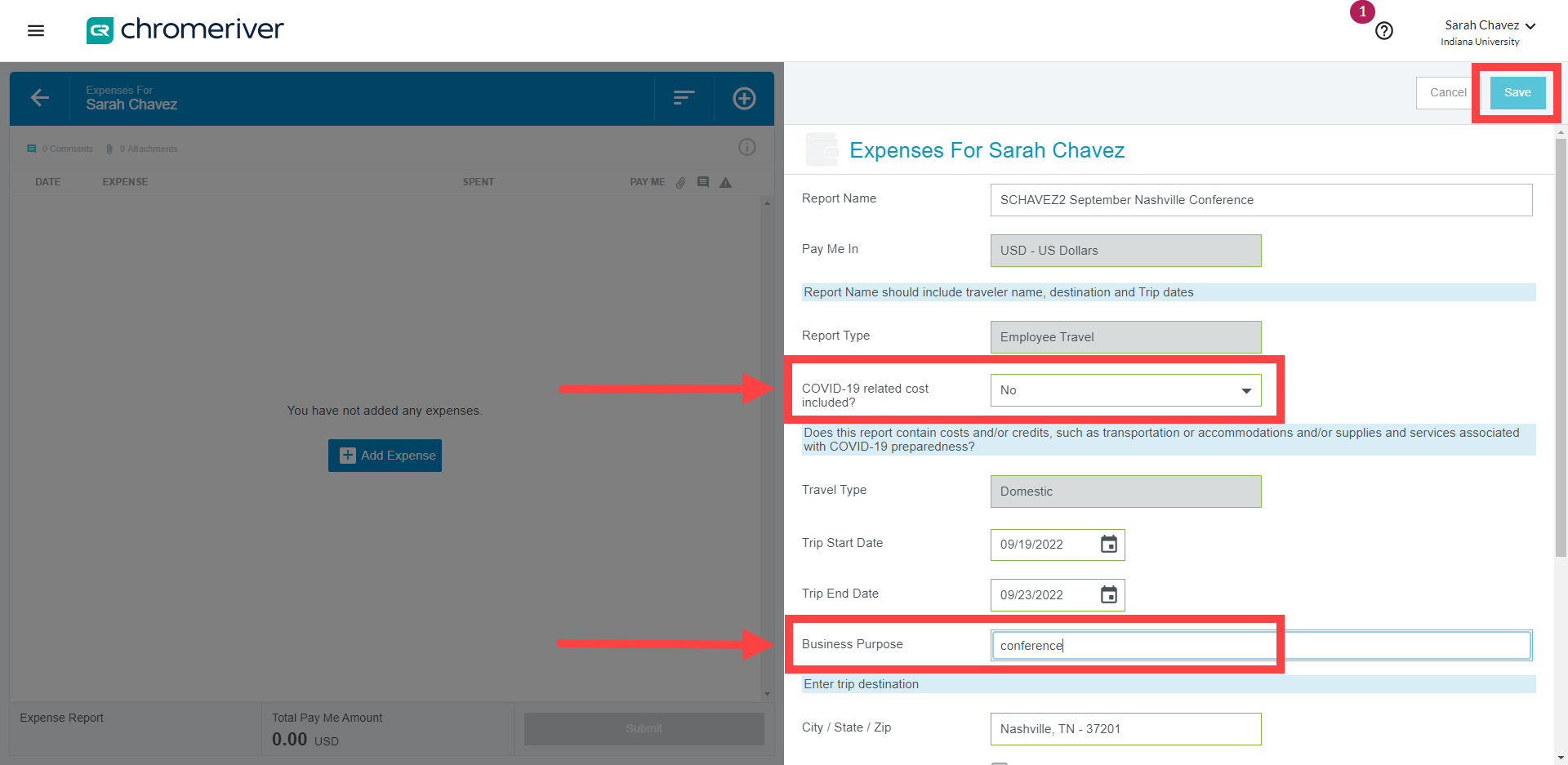

The header-level information from the TA is imported onto the expense report. Two additional fields need to be completed.

Indicate whether this trip exists for COVID-19 related business and fill out the Business Purpose field. Click here for guidance on completing this section .

Click Save in the upper right corner when finished.

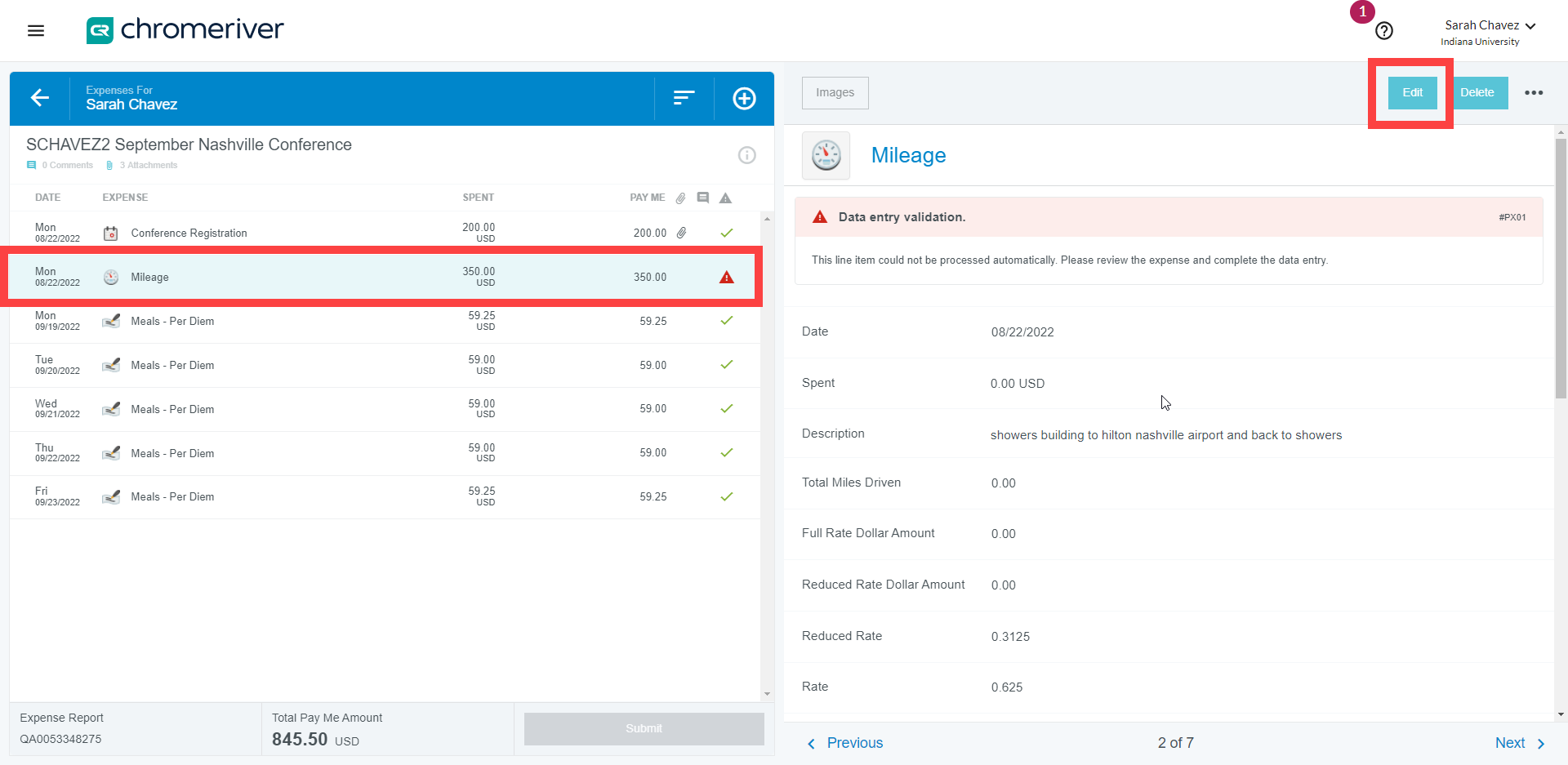

The expenses from the TA are imported onto the expense report. Click the Mileage expense to open it on the right-hand side. Select Edit on the mileage expense.

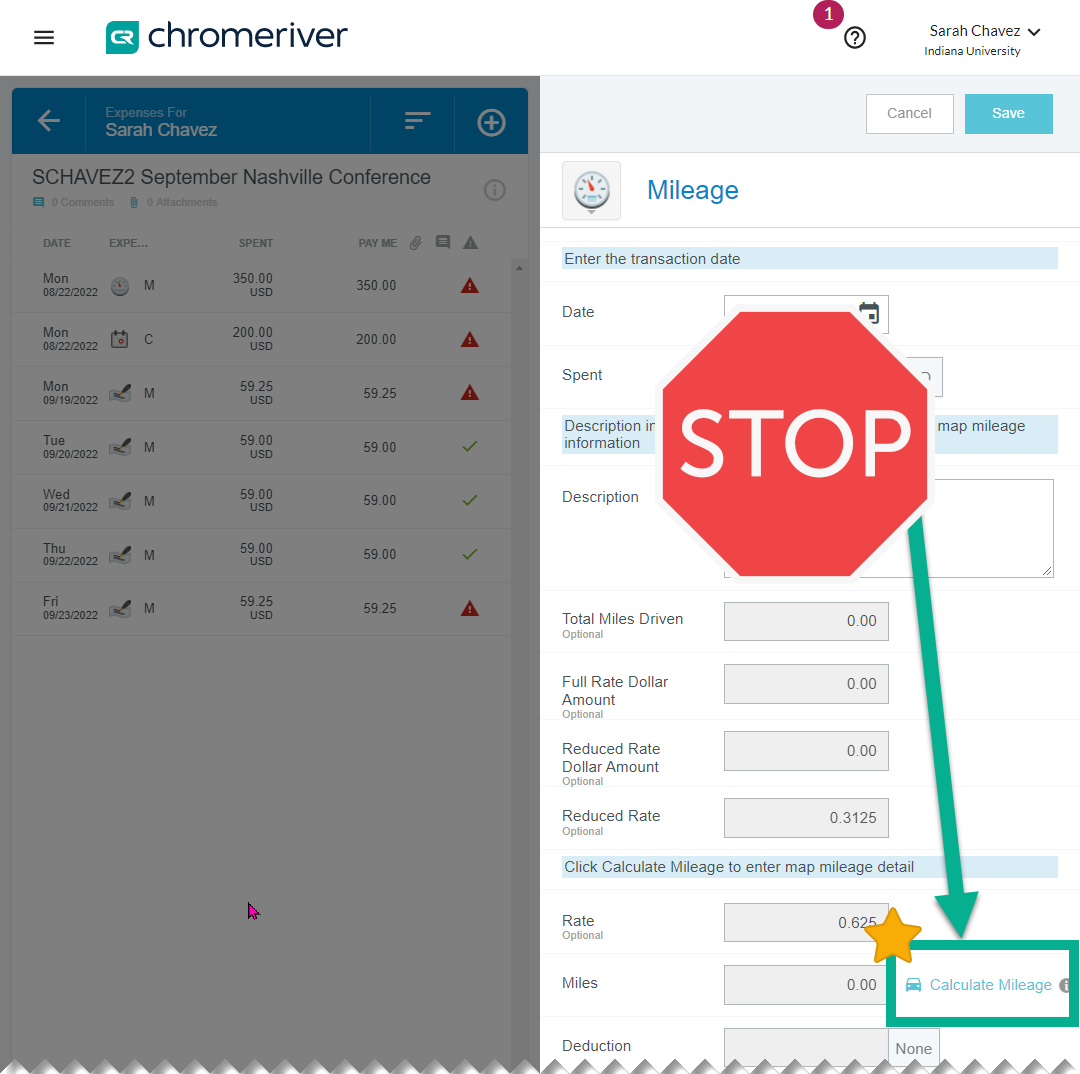

The mileage expense opens on the right. Scroll down and click Calculate Mileage .

If you need to change the funding account, the Allocation field is editable. When finished, click Save in the upper right corner.

After saving, your mileage expense appears as a single expense line containing all destinations in the left-hand window. The green check mark indicates the expense is complete.

Review the expenses on your expense report. Be sure all the expense lines are relevant and ready to be reimbursed, and delete any unused expenses (unused parking, taxis, miscellaneous expenses) that were imported from the TA. Once your expense report is complete, click Submit.

Accumulated Mileage

The accumulated mileage process allows a user to submit multiple mileage trips (such as weekly campus-to-campus visits) as a single reimbursement. This process is usually used by staff who must frequently travel between locations as part of their job & choose to use their personal vehicle to do so.

Click here to view an example Accumulated Mileage Travel Record

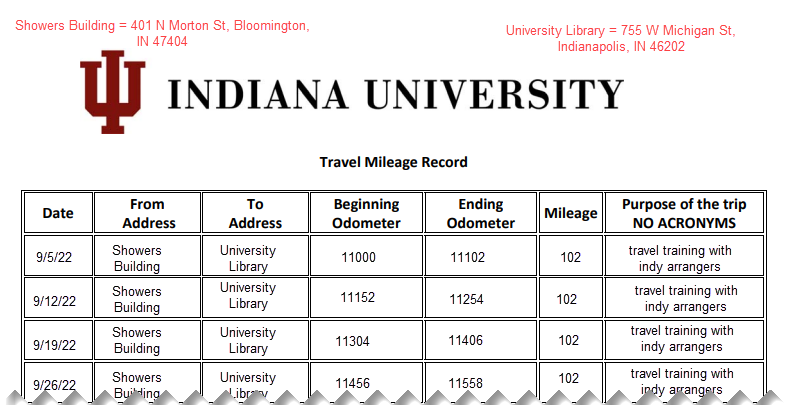

In the example record below, the traveler traveled 408 miles total. This is found by totaling the mileage column. This amount would be entered into the Total Miles Driven field.

How often should I submit Accumulated Mileage in Chrome River?

Travel Management recommends submitting an accumulated mileage log monthly. If you are traveling via personal car more frequently, i.e. several trips per week, submit your accumulated mileage weekly.

What if my trip crosses state lines?

Accumulated mileage expenses can be claimed on either In-State or Domestic trip types. Per Travel Management, when initiating your expense report, the best practice is to select Domestic travel as the Trip Type when all or most of the travel crosses state lines. Domestic accumulated mileage is most common with regional campuses close to state boarders.

This page demonstrates how to submit an Accumulated Mileage report for In-State travel.

To begin, find the expenses ribbon on the Chrome River dashboard. Click +Create . To learn how to complete the summary page of the expense report, see the In-State section of this page .

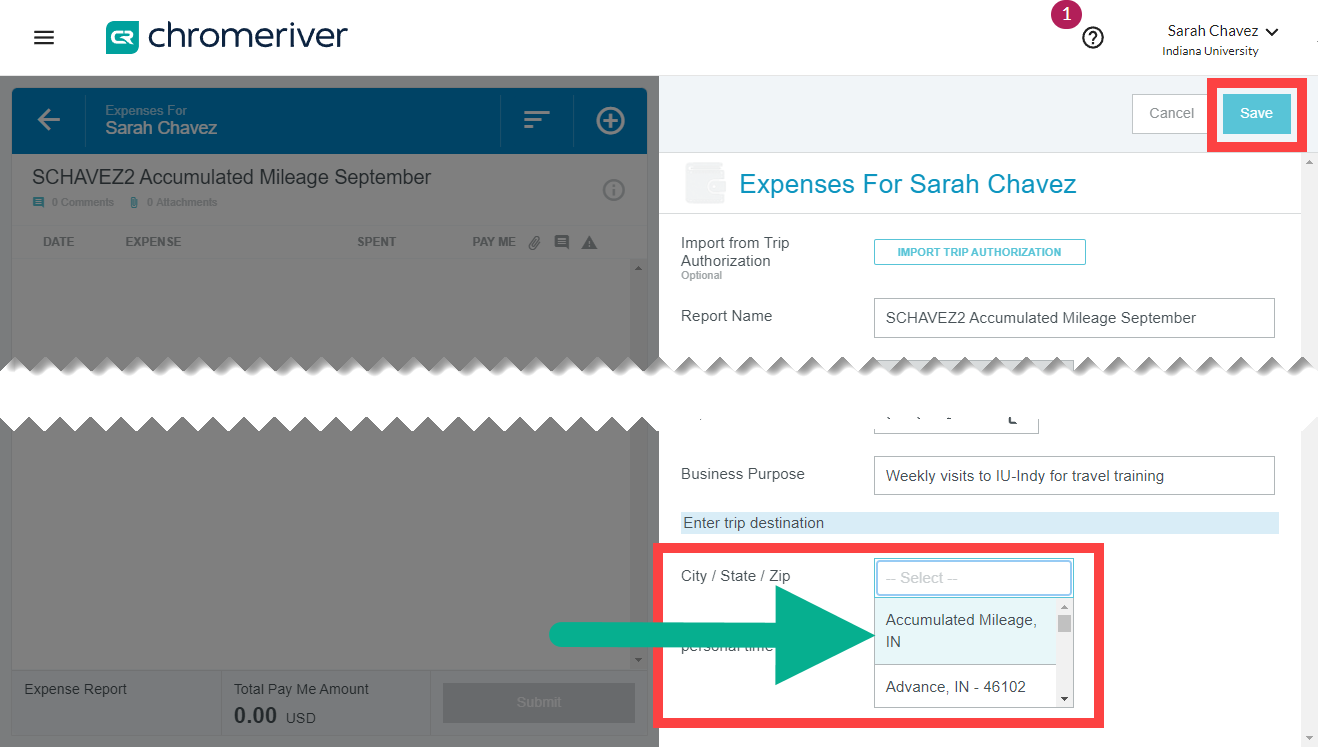

Click on the empty field in the City / State / Zip area. Search for Accumulated Mileage and select this option. Click Save in the upper right corner.

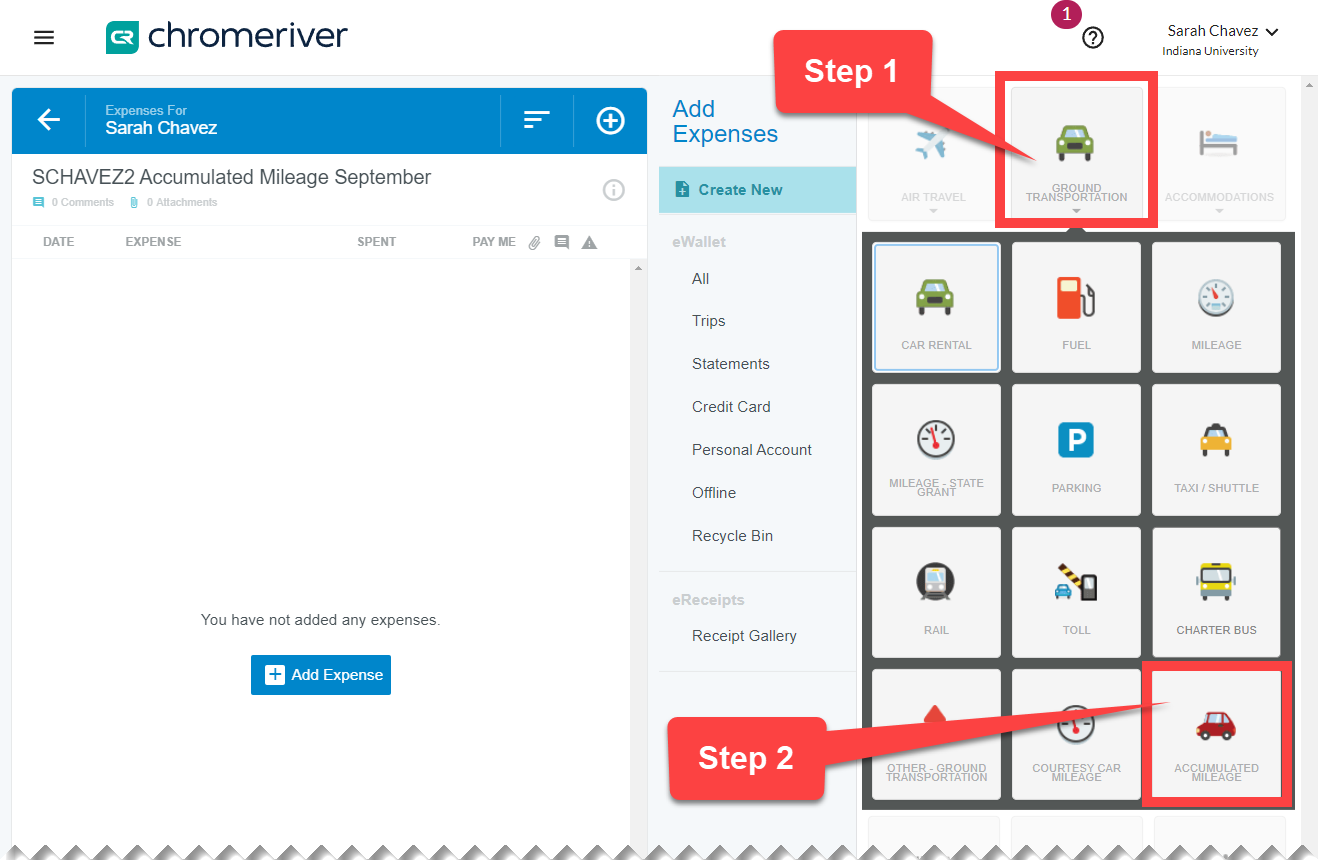

Select the Ground Transportation tile in the expense mosaic. A drawer opens containing ground transportation related expense tiles. Select Accumulated Mileage.

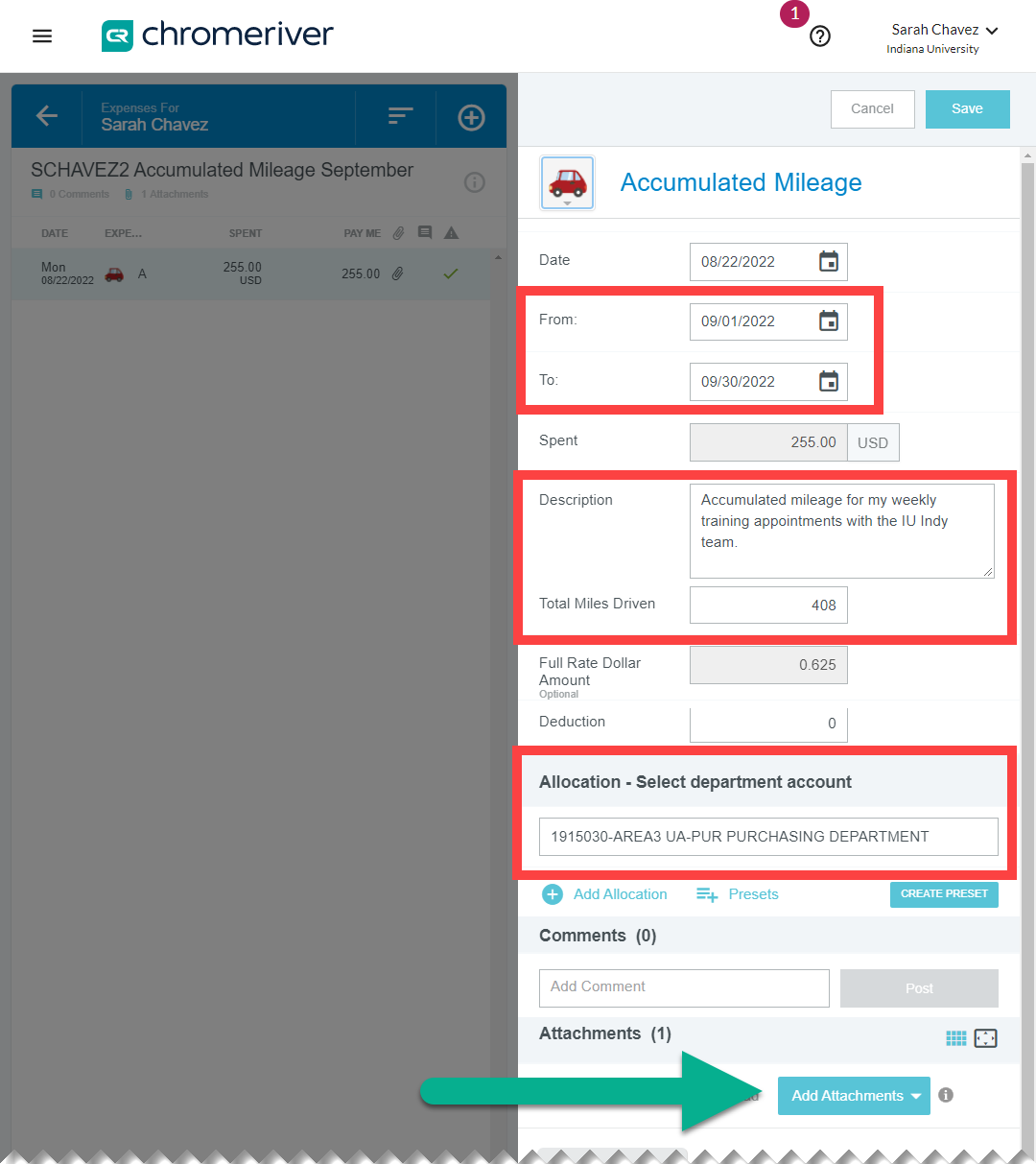

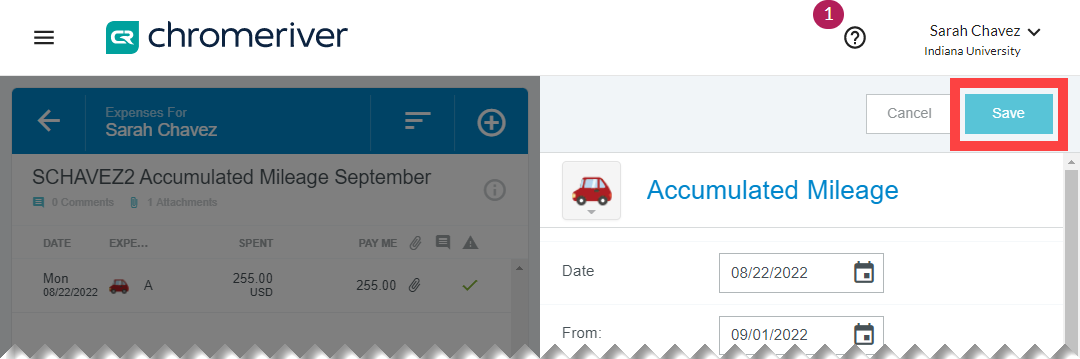

Using your Accumulated Mileage Travel Record, enter the first travel date in the From date field, and the last travel date in the To date field. Enter a description of the locations you traveled to in the Description field. Add up the mileage you logged on your travel record and enter this amount in the Total Miles Driven field.

If your grant or department requires any deductions, enter them in dollars in the Deduction field. The Spent amount, the amount you will be paid, is automatically reduced. This is an uncommon practice. By default, the Deduction field is zero.

Enter the IU account/sub-account funding the trip into the Allocation field.

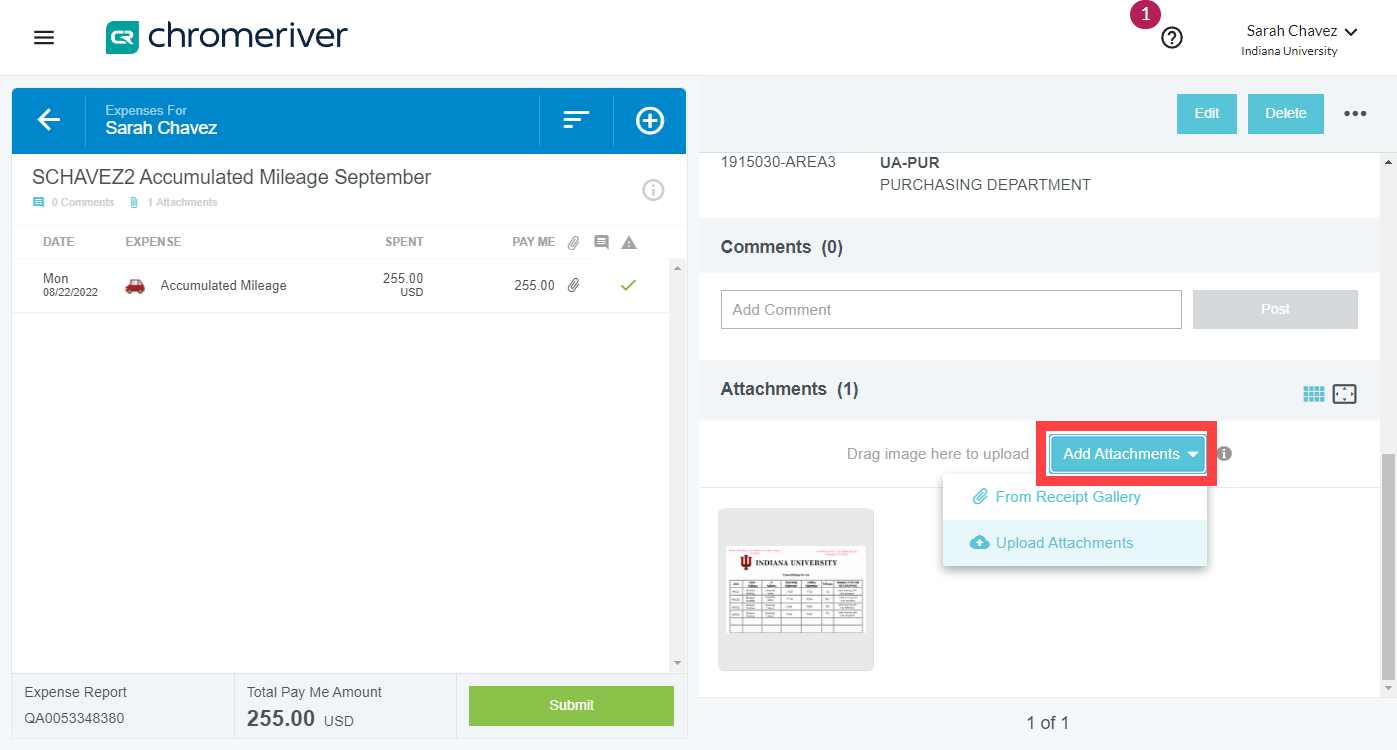

Finally, attach your Accumulated Mileage Travel Report to the expense. Scroll to the bottom of the mileage expense and click Add Attachments . Locate the file in your Gallery or on your device and upload it.

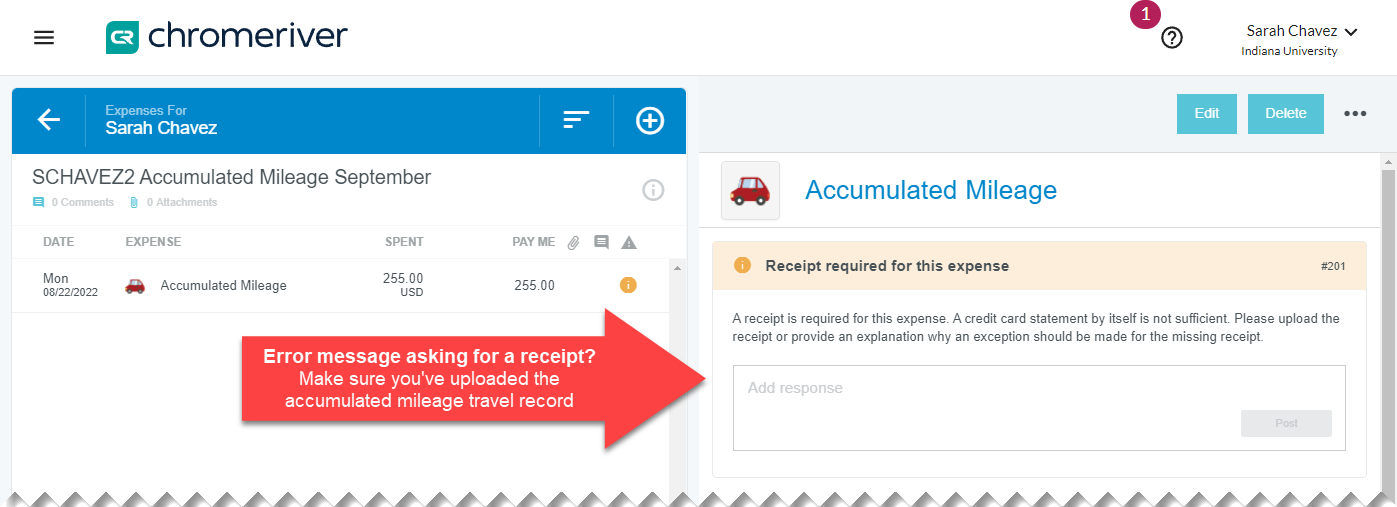

If you forget to attach your Travel Record, Chrome River will display an error message asking for a receipt to be attached. To clear this error, upload the Travel Record.

Click Save to return to the expense report.

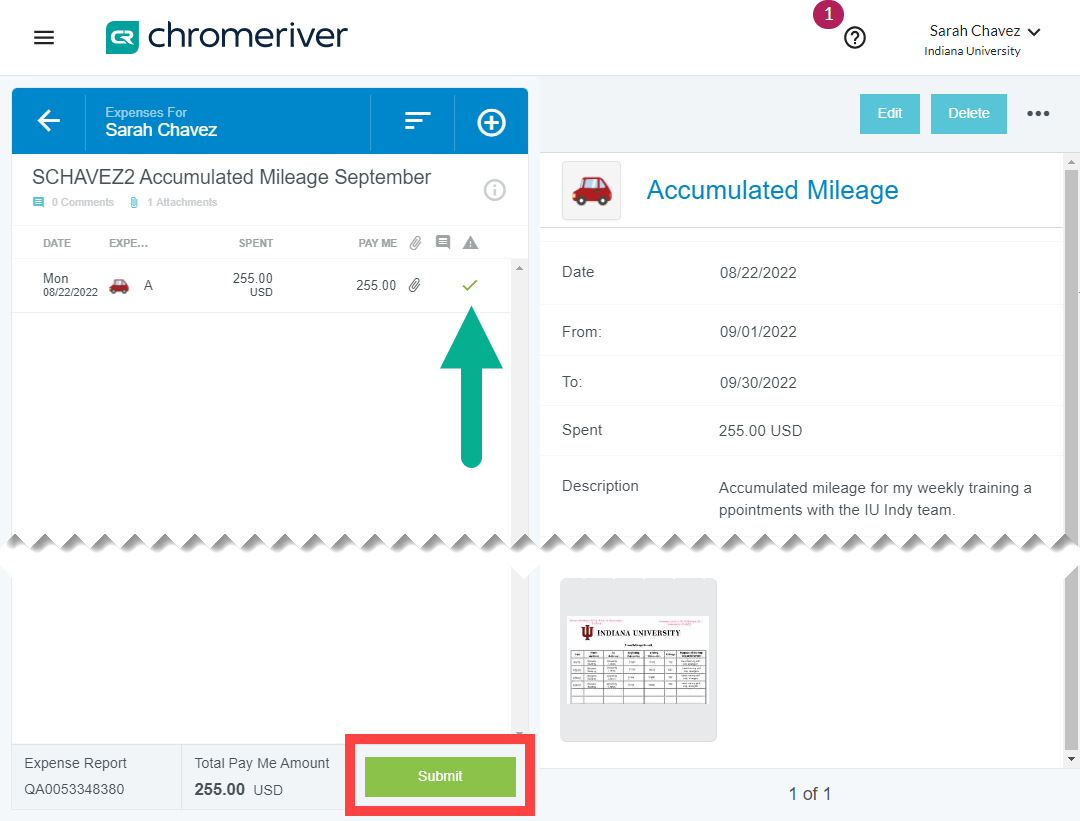

A green checkmark means your expense is ready to be submitted. If you have additional expenses to submit associated with these trips, such as parking, add them by clicking the white plus button . Click Submit to submit the report.

Additional links and resources

INDIANA UNIVERSITY Financial Training & Communications

Cyber Infrastructure Building (CIB) 2709 E 10th St Bloomington, IN 47408 Email: [email protected]

RELATED SITES

- Office of the Executive Vice President for Finance and Administration

- Office of Procurement Services

- Insurance, Loss Control, and Claims

- Office of the Treasurer

- Office of the University Controller

- Travel Management Services

- University Budget Office

Indiana University Indiana University IU

Travel Management Services Purchasing | Supplier Diversity

Traveling by Personal Car

Hotel discounts, mileage rates, approved drivers, accumulated mileage, personal car overview.

It is important to recognize following information when traveling by personal vehicle:

- Repairs to a personal car are the owner's responsibility.

- The University does not reimburse flat tires, dead batteries, etc., or any violations such as parking or speeding tickets.

- An employee's daily commute to and from their residence and official work station is not reimbursable under the Travel Policy and will not be reimbursed.

See the Travel Policy for university requirements regarding traveling via personal vehicle.

Mileage Stipulations

- Mileage is calculated from the traveler's official work location (or from their home) to their business destination, including lodging locations.

- Mileage reimbursement rates are determined by the IRS. This rate includes wear and tear, fuel and insurance costs for the personal vehicle.

- Mileage costs up to 500 miles are reimbursed at the full rate. Mileage above the first 500 miles is reimbursed at fifty percent (50%) of the full rate

- Reimbursement for mileage costs is limited to the cost of a comparable 30-day advance purchase round trip economy class airfare ticket if the airfare is more economical than reimbursing mileage. To substantiate mileage in lieu of airfare, an airfare quote must be printed and uploaded to the reimbursement expense report in the online travel system.

- Fuel charges may be claimed in lieu of mileage, but will be limited to the cost of the mileage calculation

- Business travelers are allowed a maximum of two full days of paid travel time to and from their official business location - one day before their official business begins and one day after their official business has concluded.

How to Claim Mileage

- Mileage for university business travel must be submitted through the online travel system (Chrome River).

- Mileage is determined using official state highway distances, as calculated by the Map feature in Chrome River.

- The full address for the business destination is required using the Map feature. Entering the city and state location in lieu of the full address is not sufficient substantiation for the mileage claim. Some exceptions apply, such as instances where the address must remain confidential.

- If the traveler is traveling to multiple destinations and claiming mileage for each leg of the trip, the Map feature in Chrome River must be used to enter each leg of the trip.

- the purpose of each trip is approved university business;

- each trip is non-overnight;

- no per diem is being claimed; and

- the daily mileage amount and the date and purpose of each trip is documented on the expense report. A completed Mileage Record form may be used in lieu of documenting the date, purpose and mileage within the expense report. The Mileage Record form, when used, must be uploaded to the expense report.

- $.67 per mile for the first 500 miles (Effective January 1, 2024)

- $.335 per mile for 501 miles or more

Airport Code List

- IND - Indianapolis International Airport

- SDF - Louisville Muhammad Ali International Airport

- CVG - Cincinnati/Northern Kentucky International Airport

- MDW - Midway International Airport

- ORD - Chicago O'Hare Interational Airport

Disclaimer: Mileage is from a general campus location to the airport and is for estimating purposes only. Actual mileage will vary.

University policy requires that, as a condition for driving any vehicle on university business, drivers will give Indiana University authorization to conduct a Motor Vehicle Record (MVR) check and provide all information needed for conducting the check. Driving on university business will be prohibited if authorization to conduct a MVR check is not given.

Before driving for any trip, complete the Authorization Form for Motor Vehicle Records Check , found on IU's Office of Insurance, Loss Control & Claims website.

The accumulated mileage process allows a user to submit multiple mileage trips (such as weekly campus-to-campus visits) as a single reimbursement. This process is usually used by staff who must frequently travel between locations as part of their job & choose to use their personal vehicle to do so.

- the daily mileage amount and the date and purpose of each trip is documented in the Chrome River expense report.

Download the Accumulated Mileage Travel Record and use it to keep a log of your daily destinations. Odometer readings should be taken per trip and individually accounted for on the record. This record must be attached to the expense report in Chrome River.

Click here to learn how to report accumulated mileage expenses in Chrome River

Travel Management recommends submitting an accumulated mileage log monthly. If you are traveling via personal car more frequently, i.e. several trips per week, submit your accumulated mileage weekly.

Out of state mileage

Accumulated mileage expenses can be claimed on either In-State or Domestic trip types. Per Travel Management, when initiating your expense report, the best practice is to select Domestic travel as the Trip Type when all or most of the travel crosses state lines. Domestic accumulated mileage is most common with regional campuses close to state boarders.

Indiana University Bloomington social media channels

INDIANA UNIVERSITY Travel Management Services

- Chrome River

- Contact & Newsletters

- PDF / Video / Webinar

- Live - Zoom Meetings (TBA)

Related Sites

- IU Purchasing

- IU Supplier Diversity

Search form

- Employment Opportunities

- General Counsel

- Communications and Marketing

- STATE Magazine

- Board of Trustees

- Academic Affairs / Provost

- Enrollment Management, Marketing and Communications

- Finance and Administration

- Student Affairs

- University Engagement

- Organizational Chart

- List of Offices

- Location and Visiting

- Emergency Information

- University Police

- Virtual Tour

- Alumni Association

- Arts and Sciences

- Bayh College of Education

- Graduate and Professional Studies

- Health and Human Services

- Scott College of Business

- Bailey College Engineering & Technology

- University College

- Majors and Minors

- Graduate Programs

- Honors Program

- Study Abroad

- Indiana State Online

- Academic Calendar

- Accreditation

- Find Your Advisor

- Course Catalog

- Cunningham Memorial Library

- Registration and Records

- Undergraduate

- International

- College Challenge

- New Student Orientation

- Paying for college

- Residential Life

- Scholarships

- Veterans Services

- Schedule a Visit

- Virtual Campus Tour

- Directions, Maps, and Parking

- Signup for Emails

Costs & Aid

- Net Price Calculator

- Applying for Aid

- Types of Aid

- Freshman Scholarships

- Transfer Scholarships

- Current Student Scholarships

- Graduate Scholarships

- Outside Scholarships

- International Scholarships

- Graduate Assistantships

- Payment Plan

- Payment Due Dates

- Pay My Bill

- Financial Aid

- Controller's Office

Campus Life

- Event Calendar

- Hulman Center

- Hulman Memorial Student Union

- Speaker Series

- Student Media

- Community Service

- International Student Organizations

- Leadership Development

- Programs All Weekend (PAW)

- Spiritual Life

- Student Organizations

- African American Cultural Center

- Center for Global Engagement

- Office of Campus Life

- (Housing) Residential Life

- Creative and Web Services

- Facilities Management

- Human Resources

- OIT Help Desk

- Staff Benefits

- Accessibility

- Career Center

- Counseling Center

- Math & Writing Center

- Health Center

- Sexual Violence Prevention

- Student Employment

- 21st Century Scholars

- Center for Student Success

- Class Schedule

- Download Software

- Student Conduct and Integrity

- Technology (OIT)

- Cross Country

- Track and Field

- Sparkette Dance Team

- Swimming and Diving

- Athletics Home

- Camps and Clinics

- Varsity Club

- Make a Gift

The ISU Travel Department assists University departments by relaying information, explaining and interpreting travel policies and procedures, processing Travel Authorizations, processing Travel Reimbursements, and keeping accurate travel records. We will make our best effort to ensure that you will receive reimbursement for travel expenses within five working days from the time your complete and accurate expense report has been fully approved.

Official University travel is defined as travel by University personnel, non-University personnel, and University students when the authorizing individuals consider such travel to be in the professional and/or business interest of both the traveler and the University. Such expenses may include transportation, lodging, subsistence, and registration fees. Travelers are expected to observe the University's policies and procedures in the type and amount of expenses incurred. In order for your reimbursement to be non-taxable, you must follow ISU's Accountable Plan Guidelines . ISU will only pay for travel that is properly authorized.

All student travel, including local field trips, require pre-approval through the University’s travel authorization system.

Field trip information also must be submitted to the Office of Risk Management. Field trip information is available at: https://www.indstate.edu/budget/riskman .

International Travel Warnings/Alerts: The Vice President of your area or Provost must review and approve faculty/staff/student travel to countries/areas for which the U.S. State Department has issued a Travel Warning or Alert (see U.S. Department of State Travel Alerts ). Approvals will also be needed if the U.S. State Department issues a Travel Alert or Warning after the initial authorization was granted, but prior to the date of the actual trip. It is the responsibility of the traveler to get approval prior to departure. Please see the International Travel section below for additional information.

Visit the tabs below to learn more about the travel policies and procedures of the University.

Authorization

Travel Checklists

Pre-Travel:

- Traveler or Delegate: Complete a Pre-Approval in Chrome River that includes travel details and estimates for each expense category. If the traveler is an individual visiting ISU such as a candidate, honoraria, consultant, speaker, etc. a Pre-Approval must be completed under the Chrome River account of an ISU employee. Submission of the Pre-Approval acknowledges that travel is directly related to University business. See Chrome River Travel Procedure Manual for more details. All travel reimbursements for employees are completed via direct deposit. Accounts Payable direct deposit is different from Payroll. Please refer to the Direct Deposit page for more information.

- A blanket Pre-Approval should be used for employees whose primary job duties require travel on a routine and repeating basis. The department would not have to create a new Pre-Approval each time the individual travels while allowing for multiple reimbursements to be submitted against the same Pre-Approval. During the process of creating the Pre-Approval in Chrome River, select the box labeled "Blanket" on the header page. A blanket Pre-Approval will not require the city and state to be entered as the travel may be completed at multiple locations on different dates.

- Pre-Approvals are not required for official business travel that will not result in a reimbursement. Divisions and/or departments should implement their own approval requirements that include, at a minimum, verbal approval by the traveler's supervisor. If you have questions about completing the Pre-Approval, please contact a Travel Account Specialist at x3541.

Department: Make sure funds are available within your travel budget to cover estimates. If the budget is not available the Pre-Approval may be held up or returned. If the travel has a maximum payable amount that the department will reimburse make sure the total estimate of the Pre-Approval does not exceed the maximum allowed. Direct bill expenses should be included in the total estimate. Authorizing Official(s): Routing steps for Pre-Approvals and Expense Reports are determined by the financial managers of the organization and fund associated with the Index being used, the type of travel, and the total amount being requested. Foreign travel and any requests above $2,000 are automatically routed to the Dean (if applicable) and the Office of the Vice President. The Grant Department the associated Principal Invesigator will be in the routing steps for all indexes related to grant funding. Controller’s Office: Travel Account Specialist will review the Pre-Approval, checking for appropriate estimates, validating that adequate funds are available to cover the estimated expenditures and that travel is an appropriate expenditure of University funds. If a Pre-Approval is filled out incorrectly, incomplete, or does not have appropriate authorization, it will be returned to the traveler for editing or explanation and re-submission. Department/Traveler: Once the Pre-Approval has been fully approved, a Travel Authorization number will be created in Banner. All Travel Authorization Numbers will begin with "TA" followed by a 6-digit number and will be emailed directly to the traveler. This is not the Pre-Approval report number generated in Chrome River. The traveler will use the "TA" number when booking all travel arrangements with any preferred travel provider for airfare, car rental or lodging and include it in any forms submitted directly to the Travel Department.

During Travel:

Traveler: Get and keep original "itemized" receipts for EVERYTHING including hotel/motel, taxi, parking, registration, etc. A credit card receipt is not an acceptable receipt or invoice if it is not itemized. Save all original receipts until reimbursement has been completed through Chrome River and payment received. ISU will only reimburse the standard room rate.

Within 30 Days After Trip:

- Traveler/Department: Submit an Expense Report in Chrome River if the traveler is requesting reimbursement. Chrome River will not allow the Expense Report to be submitted without an attached receipt for all expenses that require documentation. Make sure that the receipt is legible. Travel expenditures that were not approved on the Pre-Approval prior to the trip may not be eligible for reimbursement and are the responsibility of the traveler.

- Controller’s Office: Approve Expense Report after auditing each line item for actual cost and eligibility. Return all Expense Reports that are completed incorrectly, lack authorization, or do not have necessary receipts attached.

- Authorizing Official(s): Routing steps for Expense Reports are determined by the financial managers of the organization and fund associated with the Index being used, the type of travel, and the total amount being requested. Foreign travel and any requests above $2,000 are automatically routed to the Dean (if applicable) and the Office of the Vice President. The Grant Department the associated Principal Invesigator will be in the routing steps for all indexes related to grant funding.

Travel Without a Pre-Approval

As soon as staff become aware of the need to travel, begin the Pre-Approval process in Chrome River. The Pre-Approval report should ideally be approved before the travel starts. Your reimbursement may be denied if proper Pre-Approval is not obtained . The only instance where a Pre-Approval is not required is when it is for business travel that will not result in a reimbursement. However departments should implement their own approval requirements that should include either a written or verbal pre-approval by the traveler’s supervisor. On the rare occasion that a Pre-Approval was not completed prior to travel, the traveler may still request reimbursement via a Check Request and Chrome River Expense Report.

- Create a Chrome River Expense Report showing the detail of all expenses (see Reimbursements section). This information will be used to support the legitimacy of expenses during an audit. Note that Chrome River will not allow this form to be submitted for approval, but it can be completed and printed.

- Complete a Check Request and attach your Chrome River Expense report and include a Memo or comment stating your reason for not following ISU Travel policy and procedure. The Check Request should be signed by your Department Head and Dean (if applicable). Any Request over $2,000 or for International travel should be approved by your Vice President or Provost as well.

- Attach all receipts, unless the Expense Report includes images. In order to capture this documentation from Chrome River, click on the expense report to be printed, select "Full Report with Notes & Receipts" from the PDF drop down and then print.

Field Trips

A Pre-Approval must be filled out and funds encumbered for travel, including travel for field trips. A list of names for all graduate and undergraduate students participating, along with their University ID numbers will be needed attached to the Pre-Approval created under the account of the ISU employee that is accompanying the students.

Review the information found on the Office of Risk Management site regarding field trip procedures and liability coverage before field trip arrangements are made.

International Travel

Foreign travel is defined as travel to, between, or within countries 'outside' the United States and its territories and possessions, including Canada and Mexico. All foreign travel will be reimbursed using Federal Foreign Travel Reimbursement Rates ( OCONUS ). For travel outside the U.S. travelers should check the entry requirements for the specific country to which they are traveling. This information is available on the U.S. Department of State web site. Chrome River automatically routes all international Pre-Approvals to the appropriate Dean (if applicable) and Vice President or Provost to review and approve faculty/staff/student travel to countries/areas for which the U.S. State Department has issued a Travel Warning or Alert (see U.S. Department of State Travel Alerts ). Additional approval will also be needed if the U.S. State Department issues a Travel Alert or Warning after the initial authorization was granted, but prior to the date of the actual trip. It is the responsibility of the traveler to get approval prior to departure.

Additionally, the STEP (Smart Traveler Enrollment Program) is a free service provided by the U.S. Department of State which allows the traveler to enroll their trip with the nearest U.S. Embassy or Consulate. Benefits of this enrollment include receiving important information from the Embassy about safety conditions in your destination country, help the U.S. Embassy contact you in an emergency and help family and friends get in touch with you in an emergency. Indiana State University encourages all international travelers to enroll in this program.

Federally Funded Air Travel

When federal funds are used for international air tickets, travelers must comply with the Fly America Act. This act mandates that any foreign travel paid from federal funds, including foreign travelers coming to the U.S., must be accomplished through U.S. Flag Air Carriers. Please refer to the Fly America Act for more information.

Cash Advances for Foreign Travel

Travel Cash Advances are allowed for foreign travel. Money the University gives you in advance or after your trip will be paid in U.S. currency. You are responsible for exchanging those dollars for the currency of the foreign country you visit. Keep track of the exchange rates you receive as you travel (e.g., from Thomas Cook, a bank, hotel receipts, your notes on meal receipts, or even your AMEX bill). Cash advances are requested at the time the Pre-Approval is submitted. Please see instructions by loggin into the Help section of the Chrome River Welcome Page. Chrome River has a currency converter built in for your convenience. Please enter the currency type, transaction date, and amount. The system will convert to the USD rate. It is important to provide the correct date for each transaction. This is the date the expense was incurred.

Travel Account Codes

Budget pool.

Only budget for travel is to be recorded within this account code.

70500 - Travel Budget Pool

REGISTRATION

70580 - Registration

PROFESSIONAL DEVELOPMENT TRAVEL

Professional development travel is designed to expose faculty and staff to developments in their fields and other areas of knowledge that may be utilized to improve our operations. This type of travel focuses primarily on attending conferences and other training opportunities. The following account codes are to be used when coding professional development travel:

70550 - Lodging, Per Diem

70600 - Airfare

70625 - Car Rental

70650 - Other Transportation (mileage, taxi, parking, bus, train, tolls, etc.)

OPERATIONAL TRAVEL

Operational travel is defined as travel that your job requires in order to operate the University on a daily basis. Examples of this type of travel include the delivery of educational programs to off-campus locations and attendance at government meetings related to the operation of the University. The following account codes are to be used when coding operational travel expenditures:

70675 - Operational – Lodging, Per Diem

70685 - Operational – Transportation

70685 - Other Travel (parking, shuttles, baggage, misc.)

STUDENT RECRUITING

Student recruiting travel is targeted travel that is designed to promote student recruitment. The following account codes are to be used when coding strategic travel expenditures:

70670 - Student Recruitment

70850 - Field Trip Travel (Student traveling with faculty or alone, including field work)

MISCELLANEOUS TRAVEL

70160 - Honorarium (speakers, consultants, etc.)

70560 – Athletic Recruiting

70615 - International Airfare

70630 - Enterprise Rent-A-Car Fuel

70750 - Team Travel (for athletic competition only)

70775 - Candidate Travel (for entertainment and travel expenses of candidates for employment)

70800 - Board Travel (to pay travel expenses of board members only)

Transportation & Lodging

The most economical means of transportation and lodging should be used when traveling on University business. Click on the headings below to learn more about topics related to transportation and lodging. Please note that travel allowances are not granted within the confines of Vigo County.

Travel Packages

As a way to save money, some travelers may consider booking a package with airfare, hotel and/or car rental on a discount website such as Expedia, Orbitz or Priceline. The IRS requires that the expense of each travel component (airfare, hotel, car, etc.) be listed out separately on an itemized statement from the vendor. When purchasing travel packages, it is important to make sure an itemized statement is obtained because, without proper substantiation, expense reimbursements will be treated as taxable income and will be reimbursed through Payroll. Please see airline travel guidelines below

Airline Travel

All airline travel using University funds must be purchased through the University's preferred travel agency or online provider (See Direct Billing tab above). Tickets will be direct billed to the University. The preferred travel agency has a professional staff that is familiar with the University's guidelines and travel procedures. They are trained to find the lowest fare possible that meets the traveler's needs.

First class travel is not allowed.

Airfare upgrades and additional fees : Airlines may offer you a number of options to make your flight more comfortable. These upgrades may include but are not limited to:

- Premium seating — more leg room, closer to the front of the plane, etc.

- Early check-in

- Seat changes

This type of cost can only be interpreted as an upgrade and beyond what is considered the standard airfare and baggage costs that the university would consider reimbursable. If you elect to purchase one of these options, it will be at your own expense and would not be reimbursed.

Airport Parking

General airport parking guidelines.

Airport parking should be reimbursed up to the equivalency of the long term parking rate for reasonable parking expenses incurred by the traveler. While it is impractical to list parking rates for every airport in the country or even in the State, there are some general guidelines that all University travelers are to follow when parking at airports.

- Economy, long-term, or off-premises parking serviced by shuttle is preferred, when available.

- The University will not reimburse upcharges for premium or valet airport parking.

- Receipts with details are required.

See these websites for helpful airport parking resources:

Indianapolis Airport

- FastPark ISU Enrollment - IND Airport

World Airport Guides

Privately-Owned Vehicles

Travel in private vehicles is reimbursed as mileage. The amount paid for mileage is intended to compensate the traveler for wear and tear and gas. The official station (starting point) will be the location of the traveler's permanent office or home, whichever is less. Whenever an employee travels other than by the shortest route, an explanation must be indicated on the Expense Report. Mileage reimbursement will be calculated in Chrome River using Google maps.

Only one round trip mileage to and from the Indianapolis airport is allowed for reimbursement with the exception of picking up a candidate or an honoraria person. University employees are expected, when possible, to share a vehicle when traveling to common events.

Use of a private vehicle on University business will be reimbursed based on the current Federal mileage rate (these rates will be updated each time the Federal rates change):

- January 1 through December 31, 2023 Rates

- Full Federal rate for the first 500 miles (currently 65.5 cents)

- One half of Federal rate per mile for the next 2,500 miles (currently 32.75 cents)

- 0 cents per mile for all miles over 3,000

- January 1,2024 Rates

- Full Federal rate for the first 500 miles (currently 67 cents)

- One half of Federal rate per mile for the next 2,500 miles (currently 33.5 cents)

ISU does not generally reimburse mileage for use of a personal vehicle within Vigo County. The exception being local travel is a part of your job to support University sponsored activities such as visiting local schools or businesses. Local mileage reimbursement may require an additional level of approval if it is not clearly stated as a part of your routine job duties.

Rental Vehicles

The cost of renting an automobile while on University business may be reimbursed when suitable local transportation is not available, or when such rental is considered more advantageous to the University than the use of taxies or other local transportation due to routing or time factors. When reserving your car, you should request the least expensive practical vehicle. Do not purchase additional insurance when renting a car (see ISU car insurance policy ).

Eligibility Requirements

To rent a vehicle for University business, all drivers must be 25 years old and take the Defensive Driving Course. To rent a 12 passenger van, the driver must take a driving test with a driver’s education instructor. Contact Risk Management at ext. 7946, or go to the Office of Risk Management website.

Direct Billing Rental

The University has direct billing contract with Enterprise . [NOTE: You must use your University Username and password to access the Enterprise site.] You must have a valid Travel Authorization number (TA) to direct bill a rental vehicle . When renting a car through Enterprise (Wabash Ave. branch), you will be required to refuel the vehicle at the same level as it was received before returning it to Enterprise. Maintain your refueling receipts, which will be submitted with your Expense Report. Please keep in mind that refueling rates charged by the rental agency are extremely expensive.

If you have questions regarding Enterprise/National direct billing, please contact a Travel Account Specialist (x3541) or Catherine Procarione (x3525).

Other Rental Arrangement

When renting a car that will not be direct billed through Enterprise, remember to refuel your rental car prior to its return and save the gas receipts for reimbursement. Refueling rates charged by the rental agency are extremely expensive. Your receipts will be submitted with the Travel Expense Report.

Drive Vs. Fly Rule

The mileage reimbursement cannot exceed the cost of comparable 30-day advance purchase airfare rates. Persons who choose to drive rather than fly long distances are allowed to claim subsistence and lodging one day prior and one day after official ISU Business for travel expenses.

Other Means of Travel

Other means of travel are available in lieu of commercial airlines and cars. Unless noted otherwise, the Pre-Approval and Expense Report process is the same. Save all receipts related to these modes of transportation.

- Train tickets are reimbursed up to the lowest airfare cost available for your destination.

- Bus tickets are reimbursed at the actual cost of the ticket.

- Motorcycle mileage is reimbursed using the same rates as privately-owned vehicles.

- Trailers, motor homes, or camper mileage is reimbursed using the same rates as privately-owned vehicles, plus the actual cost of space rental. Trailer rentals or leases are not reimbursable.

- Employee piloted aircraft (either rented or privately-owned) is not authorized or reimbursable travel.

- Charter aircraft is contracted through the preferred travel provider.

You will need a Travel Authorization number before you can make your reservation.

Important – Lodging paid using a personal credit card will be reimbursed after the trip has been taken by completing an Expense Report.

Reimbursable vs. Non-Reimbursable Lodging

Reimbursable lodging.

The following are allowable reimbursements for lodging expenses:

- Standard Occupancy room rate

- Applicable taxes

- 3 minute phone call home to say you have arrived safely

- Hotel parking

- Business faxes

- Business photo copy charges

Non-Reimbursable Lodging

The following examples are non-reimbursable lodging expenses:

- Room service

- Mini bars (alcohol)

Sharing a Room

When sharing a room with an ISU employee or student, the total room charge may be claimed by only one traveler as long as it is noted on each of the Expense Reports involved.

If each person is claiming their prorated share of the total room charge, the travelers will need to request a hotel bill to be issued in both of their names showing payment by each person.

The Expense Report for each traveler must reflect that the room was shared and with whom it was shared.

Prepaid Expenses

Registration Fees

Registration fees can be paid in the following ways:

Procurement Card: The preferred method of payment for registration fees is the Purchasing Card Site (Procard). If the registration fee is greater than your credit limit, you will need to pay via check request or personal credit card. All University travel must be approved prior to payment of registration fees with the Procard. Please make sure you have a Pre-Approval in place prior to your trip.

Policies and procedures regarding the Procard may be found by visiting the Purchasing Card site. For additional questions regarding this process, contact Kim McCleary-Beams at Ext. 3519 or [email protected]

Check Request: The University will prepay registration fees for a conference if a Procard is not used via a Check Request. Forward the check request plus two copies of the registration form to the Travel Department in the Office of the Controller for payment (one copy to mail & one copy as backup). Please allow five (5) days for processing. If a non-reimbursable expense has been incurred via the registration fee (spouse ticket, entertainment, etc.) this must be paid back to the University with a personal check.

Personal Check/Credit Card: The traveler can prepay for registration with a personal credit card or check, but will not be able to claim reimbursement for it until after the travel has been completed.

Travelers should register early to reserve the sessions, workshops, and lodging of their choice. You may register for any meals pertinent to the trip, such as roundtable discussions, seminars, or speakers. Do not claim subsistence on your Expense Report for the meals that are included in the conference registration fee.

If the form includes registration for a "night on the town", tour, or other such fun, sign up remembering that such events are considered entertainment, and thus, you pay for them yourself. If you are registering online, please make sure to print the registration page before actually completing registration to be used for payment of subsistence.

Chrome River: The traveler can prepay for registration, but will not be able to claim reimbursement for it until after the travel has been completed. Registration can be reimbursed on the Expense Report created in Chrome River.

Travel Cash Advances

Travel Cash advances are only allowed for:

- Field trips

- Foreign travel

A travel cash advance may not be requested by anyone who already has an open cash advance.

REQUESTING A CASH ADVANCE

A request for Cash Advqance is completed with the Pre-Approval in Chrome River. Please see detailed instructions listed on the help section of the Chrome River Welcome page.

CLOSING OUT A CASH ADVANCE

All Cash Advances must be closed out within thirty (30) days after returning from the trip. The Cash Advance close out is completed on the Expense Report in Chrome River. Please see the detailed instructions listed in the help section of the Chrome River Welcome page.

Misc. Expenses

While traveling, you will incur expenses for items other than your airfare, conference registration, lodging, meals, and car rental. The University reimburses you for some of these miscellaneous expenses. Some miscellaneous expenses are not reimbursable. It's usually best to be aware of what is and is not reimbursable before you spend your money and run the risk of discovering that the University, by law, cannot repay you. Before you travel, check with your department, review the lists below, and contact the Travel Account Specialists if you have particular concerns about extra expenses. All Reimbursements must be submitted within 60 days of travel. (See Accountable Plan Guidelines ).

REMINDER: SAVE ALL OF YOUR RECEIPTS

Reimbursable Expenses

The following lists some of the most common reimbursable expenses:

Getting Around

- Baggage Fees

- Parking – Hotel parking is fully reimbursable. Airport parking should be reimbursed up to the equivalency of the long term parking rate for reasonable parking expenses incurred by the traveler. See Airport Parking under Transportation and Lodging for additional airport parking guidelines.

- Taxi, Uber, Lyft, Ride Share, etc.

Communications

- Internet Fees at your Hotel

- Faxes for business purposes

Foreign Travel

- Passport and/or Visa fees

- Immunizations

- Foreign currency exchange fees

Non-Reimbursable Expenses

The following are some examples of items the traveler might have to incur themselves:

Entertainment Expenses

- Meals for other people

- Food in excess of the daily subsistence amount

- Video, VCR, TV or radio rentals

- Event tickets

- Taxis or other transportation to and from entertainment events

Personal Expenses

- Any kind of insurance

- Extra boarding fees for seat assignment or early boarding check in

- Medical and hospital services

- Commuting expenses between your home and work station

- Additional transportation, hotel or other expenses for personal travel in conjunction with University travel

- Personal phone calls

Reimbursements

Click on the headings below for information regarding the reimbursement of travel expenses.

Create an Expense Report in Chrome River to request reimbursement for travel expenses incurred on official University business. Employees cannot be reimbursed for the same travel expenses from an outside organization and the University. Please see detailed instructions listed on the help section of the Chrome River Welcome Page.

Timing of Travel Reimbursements

An Expense Report will need to be submitted no more than 120 days after the last day of travel listed on the Pre-Approval. Any travel submitted after 120 days of your return will become taxable income and must be processed on a One Time Only (See Accountable Plan Guidelines ).

Direct Deposit

Employees are required to sign up for direct deposit for travel reimbursements. Direct deposit facilitates a significant cost savings and provides a more efficient means of payment disbursement. Reducing the number of checks sent through U.S. mail and campus mail also reduces the likelihood of lost checks.

Sign up for direct deposit for travel reimbursements here . Please note: Direct deposit for travel reimbursement is separate from direct deposit for payroll. Contact the travel department if you have questions (ext: 3541).

See Cash Advances for instructions for closing out a travel cash advance.

Subsistence

Subsistence includes meals, tips, porters, and other miscellaneous incidental expenses. Subsistence is reimbursed based on location of lodging. Chrome River will automatically calculate the rate of Per Diem based on the city, state, and/or country that has been entered. Subsistence for overnight travel on University business will be based on federal per diem rates for all 50 States and U.S. territories ( CONUS ). This includes travel within the State of Indiana. All foreign travel will be reimbursed using Federal Foreign Travel Reimbursement Rates ( OCONUS ). All travel required to follow state regulations (state grants) will be reimbursed at the approved state per diem rates. Subsistence is paid at the rate applicable to the location of lodging obtained for the night. If a city is not found on the CONUS list then the lowest CONUS rate is applicable. On the day travel status begins and on the day travel status ends, the rate will be 75% of one day’s subsistence. Persons are allowed to claim subsistence and lodging one day before and one day after the date of ISU business.

When reimbursement for subsistence is claimed, the traveler shall verify that no meals were furnished. The exceptions being:

- Continental breakfast

- Finger foods or hors d'oeuvres

When attending a conference or meeting, a full copy of the agenda must be included indicating which meals were provided. If a meal is provided, no subsistence shall be claimed for that meal, and the per diem must be adjusted by deducting the appropriate meal from that day’s allowance.

- Breakfast 25% of applicable CONUS rate

- Lunch 25% of applicable CONUS rate

- Dinner 50% of applicable CONUS rate

Actual Food Expenses

The actual cost of meals may be claimed in lieu of subsistence ONLY if the expenses are LESS than or EQUAL to the total subsistence allowed. Receipts must be provided. The University does not reimburse for alcoholic beverages.

Meals on One Day Trips (no overnight stay)

Generally, reimbursement to faculty and staff are not allowed for subsistence or meals receipts for any one day (non-overnight) trips. On the occasion when a traveler needs to attend a business meal during a trip, actual meal expenses (as opposed to per diem) are reimbursed. All reimbursements for business travel meals must include the Hospitality form and actual food receipts are required. Reasonable meal expenses related to travel of one day or less may be claimed for the following cases:

- When a meal at a convention, conference or meeting is part of the agenda and the cost of the meal has not previously been paid with the registration fee. The menu and the cost are arranged by the event organizers and beyond the control of the claimant. Receipt and proof that the meal is part of the agenda are required. If one individual is seeking reimbursement for a group of faculty/staff, all employee’s names should be included on a Hospitality Form.

- When directed or required to attend mealtime business meetings, including community or public relations meetings. Receipt and Hospitality Form which states a clear business purpose are required.

- Meal expenses for a student group on a one-day trip may be reimbursed at the actual cost (should be reasonable compared to current federal per-diem rate for that city). An itemized receipt is required and the request for payment must state that the expenses result from a trip by a student group. University faculty/staff or group leaders who accompany and are responsible for the care, custody, or control of the group are also eligible for meal-expense reimbursement. Students must be greater in number than faculty/staff. When a single reimbursement (receipt) is requested for multiple employees, all employee’s names should be identified on a Hospitality Form.

Direct Billing

The ISU Travel Department partners with a number of providers to offer convenient direct billing options for travel expenses. Click on the headings below for more information regarding direct billing vendors.

Airfare Direct Billing

Car rental direct billing, enterprise car rental.

FREE unlimited daily and weekly mileage for business travel. Phone: 812-235-1527 [NOTE: You must use your University Username and password to access this site.] Must have a valid driver's license, your TA number and completion of the safety course with Risk Management.

Hotel Direct Billing

ISU has direct billing arrangements with the hotels listed below in Terre Haute.

In order to receive the rates listed below for area hotels, the individual hotel must be contacted directly. A travel authorization number is required at the time of booking in order to have the charge direct billed to ISU.

NOTE: Prices listed below do not include taxes. (Hotels are not tax exempt.) The rates listed below are subject to change without notice by the hotels.

Terre Haute Hotels

Candlewood suites.

$90.99 per night/plus tax 721 Wabash Ave Terre Haute, IN 47807 Phone: (812) 234-3400 / Fax: (812) 234-3144

$89 per night 3040 Hwy 41 S Terre Haute, IN 47802 Phone: (812) 238-1206 / Fax: same

Fairfield Inn

$89.99 king or double per night 475 E Margaret Ave Terre Haute, IN 47802 Phone: (812) 235-2444 / Fax: same

Hilton Garden Inn

$119 per night, includes breakfast buffet 750 Wabash Ave Terre Haute, IN 47807 Phone: (812) 234-8900 / Fax: (812) 234-8903

Holiday Inn Express & Suites

ISU receives 15% off the daily rate. You must have a Travel Authorization number and notify the guest service attendant that you are with ISU in order to receive this discount. 2645 Joe Fox St Terre Haute, IN 47803 Phone: (812) 234-3200 / Fax: (812) 234-6070

Home2 Suites Terre Haute

$119.00 - Standard Room $139.00 - Deluxe Room 2625 Lucy Jane Lane Terre Haute, IN 47803 Phone: (812) 814-4400 / Fax: 812-814-4420

Springhill Suites by Marriott

$114 per night 3304 US Highway 41 South Terre Haute,IN 47802 Phone: (812) 235-0696

- Chrome River Travel Procedure Manual

- Enterprise Rent-A-Car

- EHIDirect Training for Enterprise Rentals

- Egencia.com

- Egencia Training Video

- Altour Travel Agency

- Altour Information and Training

- Federal Per Diem Rates: CONUS

- Federal Foreign Travel Reimbursement Rates: OCONUS

- U.S. Department of State Travel Alerts

- STEP (Smart Traveler Enrollment Program)

- Round Trip Mileage Guide

Billie Dill Travel Account Specialist Ext. 3541

Hope Waldbieser Tax Compliance Officer Ext. 3524

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

FY 2024 Per Diem Rates Now Available

Please note! The FY 2024 rates are NOT the default rates until October 1, 2023.

You must follow these instructions to view the FY 2024 rates. Select FY 2024 from the drop-down box above the “Search By City, State, or ZIP Code” or “Search by State" map. Otherwise, the search box only returns current FY 2023 rates.

Rates are set by fiscal year, effective Oct. 1 each year. Find current rates in the continental United States, or CONUS rates, by searching below with city and state or ZIP code, or by clicking on the map, or use the new per diem tool to calculate trip allowances .

Search by city, state, or ZIP code

Required fields are marked with an asterisk ( * ).

Search by state

Need a state tax exemption form.

Per OMB Circular A-123, federal travelers "...must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." GSA's SmartPay team maintains the most current state tax information , including any applicable forms.

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

- Skip to Content

- Skip to Main Navigation

- Skip to Search

Indiana University Indiana University IU

- Policies Index

- Most Viewed

- New & Recently Revised

- Under Review

- Policy Advisory Council

University Policies

- Travel Policy

Travel Reimbursement Deadline Policy

FIN-TRV-3.0

Policy Statement

Reason for policy, definitions, additional contacts.

- Related Information

About This Policy

Tammy Bean Director of Travel Travel Management Services tbean@iu.edu

All travelers seeking reimbursement for travel expenses from the university.

Back to top

Travelers (employee and non-employee) will have 60 days from the return date of their trip in which to submit travel reimbursement claims. Reimbursements submitted after this 60 day period will require written justification with travel receipts. After 120 days from the return date of the trip, there will be no reimbursement. As with all travel reimbursements, Indiana University Foundation funds may not be used to directly pay for travel reimbursements.

The policy is to prompt travelers to complete their reimbursement documents within a reasonable time frame. This allows expenses to be recorded in a timely manner pursuant to generally accepted accounting principles and to support accurate and timely contract and grant reporting.

In addition, the IRS safe harbor guidelines for deeming expenses as substantiated under an accountable plan within a reasonable period of time is 60 days.

In order to receive reimbursement, an accurate and complete trip document must exist in the on-line travel system and the appropriate receipts must be submitted to Travel Management Services.

Reimbursements must be submitted within 60 days of the return of the trip.

If the trip document is completed after the 60 day limit, or the associated receipts are submitted after this limit, a written justification must be provided with receipts to justify the late submission. If the facts and circumstances do not justify the late reimbursement request then the payment will be considered income subject to withholding for employees. Taxable payments will be reimbursed through the travel system. The taxable amount will be added to the employee's next available paycheck for tax withholding.

Reimbursement policies and procedures apply to all employees and non-employees who provide services to the University and who will be reimbursed for University approved travel and related costs. In order to ensure compliance, it is the department's responsibility to inform non-employees who provide services of the University's travel policies and procedures prior to the non-employee's visit. Volunteers and prospective faculty and staff are not subject to this policy.

Request for reimbursement after 120 days will not be allowed.

Travel Management Services will consider extenuating circumstances such as natural disaster, civil unrest, etc.

Accountable Plan: An IRS plan that allows employee reimbursement of business expenses to be excluded from an employee's gross income. To be covered under an accountable plan the reimbursement must be for a business purpose, must be substantiated in a reasonable period of time and any advances in excess of expenses be returned to IU in a reasonable time.

Tax Withholding: Travel payments that are considered taxable because they were not properly substantiated will be subject to tax withholding. Travel will reimburse the approved amount and the payroll taxes will be withheld from your next available paycheck. This will reduce the employee take home pay.

Volunteer: A volunteer is an individual who performs services for the University without receiving compensation for those services. A volunteer may be subject to other Travel policies if being reimbursed by the University, but they are not governed by this travel reimbursement deadline policy.

University faculty , staff , agents and students that must be reimbursed for University travel must do so prior to sixty (60) days after the return of their trip. After sixty (60) days, they must provide a written justification with their receipts. A lack of a justification will lead to the reimbursement being treated as taxable wages.

No reimbursement will be provided after 120 days of the return date of the travel.

This is a revision of this policy which removes the sanction of reimbursing as taxable supplemental pay through the payroll system. This revision assures compliance with travel reimbursement requirements on federal grant funds.

Please note: This is an archived version of the policy. View the current version.

Travel Reimbursement

Travel expense reimbursement form (prior to march 1).

Please fill out this form if you incurred mileage expenses prior to March 1, 2024.

- County Program Name Adam-Wells Co. Allen County Bartholomew-Brown-Jennings Co. Benton County Boone County Carroll County Cass County Clark-Floyd Co. Clinton County Decatur County DeKalb County Delaware County Dubois County East Allen County Elkhart County Fayette County Franklin County Fulton County Gibson County Grant County Greene County Hamilton County Hancock County Harrison County Hendricks County Henry County Howard County Huntington County Jackson County Jasper-Newton Co. Jay County Jefferson-Switzerland Co. Johnson County Knox County Kosciusko County LaGrange County Lake County LaPorte County Lawrence County Madison County Marion County - East Marion County - NE Marion County - South Marion County - West Marshall-Starke Co. Monroe County Noble County Orange County Perry County Pike County Porter County Posey County Pulaski County Putnam County Randolph County Ripley-Ohio-Dearborn Co. Scott County Shelby County Spencer County St.Joseph County Steuben County Tippecanoe County Tipton County Vanderburgh County Vigo County Wabash County Warren-Fountain Co. Warrick County Washington County Washington Township Wayne County White County Area 01 Area 02 Area 03 Area 04 Area 05 Area 06 Area 07 Area 08 Area 09 Area 10

- Applicant's Name First Last

- Address Street Address Address Line 2 City Alabama Alaska American Samoa Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Guam Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Northern Mariana Islands Ohio Oklahoma Oregon Pennsylvania Puerto Rico Rhode Island South Carolina South Dakota Tennessee Texas Utah U.S. Virgin Islands Vermont Virginia Washington West Virginia Wisconsin Wyoming Armed Forces Americas Armed Forces Europe Armed Forces Pacific State ZIP Code

- Evening Phone

- Beginning Travel Date MM slash DD slash YYYY

- End Travel Date MM slash DD slash YYYY

- Beginning Mileage

- Ending Mileage

- Total Mileage Accrued

- Mileage Claimed

- Submission Date MM slash DD slash YYYY

Upcoming Events

Recent posts.

- The Mental Health Benefits of Strength Training May 16, 2024

- Summer Games Volunteer Spotlight: Linda Behm May 15, 2024

- Physics Lends Plane Pull Challenge Participants a Hand May 14, 2024

- Special Olympics Indiana Summer Games Return to Terre Haute on June 7-9 May 13, 2024

- Boosting Mental Health One Workout at a Time May 9, 2024

- Special Olympics Indiana Adds Jen Kelso as Vice President May 2, 2024

- 5 Benefits of Strength Training April 18, 2024

- Tomas Sliva Heads to Special Olympics World Winter Games Trials April 17, 2024

Subscribe to Our Newletter

- Name First Last

IMAGES

COMMENTS

All state employees who are scheduled to travel outside of Indiana on state business must complete an Authorization for Out of State Travel form prior to their departure (State Form 823). ... Certification for Missing Receipt form enables state employees who have traveled on behalf of the state to apply for reimbursement without a ...

Breakfast, lunch, dinner, incidentals - Separate amounts for meals and incidentals. M&IE Total = Breakfast + Lunch + Dinner + Incidentals. Sometimes meal amounts must be deducted from trip voucher. See More Information. First & last day of travel - amount received on the first and last day of travel and equals 75% of total M&IE. Search this table.

We provide an efficient, cost-effective travel management program to assist faculty and staff with IU-sponsored travel and expense reimbursement. Find information on booking IU-paid travel, discounts, policy and procedures, and tips for faster reimbursement. ... INDIANA UNIVERSITY Travel Management Services. Cyber Infrastructure Building (CIB ...

You (or IOT) may only pay for travel once there is an approved travel authorization (TA) within PeopleSoft. IDOA Travel Policy and guidelines must be followed. IDOA Travel Policy: https://www.i...

Personal Vehicles: Reimbursement will be based on official state highway maps showing the shortest, most widely used travel route from the traveler's official workstation to their business destination unless travel from their home is closer. Reimbursement for mileage costs is limited to the cost of a comparable 30-day advance purchase round ...

Click a trip type below to learn how to request that type of mileage reimbursement. In-State: mileage where most or all of the destinations are inside the state of Indiana; Domestic: where most or all of the destinations are outside of Indiana.; Accumulated mileage: mileage logged over a period of time capturing frequent or repeated trips.Can be submitted on In-State or Domestic trip expense ...

Mileage reimbursement rates are determined by the IRS. This rate includes wear and tear, fuel and insurance costs for the personal vehicle. Mileage costs up to 500 miles are reimbursed at the full rate. Mileage above the first 500 miles is reimbursed at fifty percent (50%) of the full rate. Reimbursement for mileage costs is limited to the cost ...

Mileage Reimbursement in Indiana (IN) Posted on May 16, 2016 by. With the high cost of gas and insurance today, and many of us having to travel for work I was curious to see how employers were compensating for the increased travel expenses. I was surprised to learn that there is no law in Indiana that requires employers to pay a certain mileage ...

Procedures. Reimbursement Requirements Travelers are expected to spend university funds prudently (and in accordance with sponsor requirements when the travel is supported by a sponsored award) and to request reimbursement for all travel expenses on a timely basis. Reimbursement requirements are as follows; Reimbursement requests must be submitted via an expense report through the IU travel ...

11. Sect. 24 State Travel Card, Reimbursement, and Payments - Connected State Travel Policy and State Travel Card requirements by reference. SBOA updated the Claim Amounts subsection and suggested removal of the Expenditure Classifications. 12. Sect. 27 Event Planning - Provided direction when hotel/lodging facilities are included in

Subsistence for overnight travel on University business will be based on federal per diem rates for all 50 States and U.S. territories . This includes travel within the State of Indiana. All foreign travel will be reimbursed using Federal Foreign Travel Reimbursement Rates . All travel required to follow state regulations (state grants) will be ...