- United States

- United Kingdom

Travel debit cards to use overseas

A travel debit card can save you money on international atm fees and foreign transaction fees when you're overseas..

In this guide

What is a travel debit card?

What's the best debit card to use overseas, how to compare travel debit cards, other ways to pay when travelling, pros and cons of using a debit card for travelling, how to apply for a travel debit card.

Investments

There are a bunch of Australian debit cards that charge no overseas ATM fees and no foreign transaction fees. These are great travel debit card options that you can use at home in Australia or overseas to save on fees.

You can also find a comparison of travel friendly credit cards and travel cards by reading our travel money guide .

A travel debit card is a regular debit card with features designed for travel. For example, the card may charge no international transaction fees on overseas purchases or no overseas ATM fees. Or, it may allow you to hold different currencies as well as AUD.

The debit card is attached to a bank account with your own money, and you can only spend what's available in the account. You can use the debit card to make purchases in stores or to withdraw cash from ATMs while you're overseas, just like you would here in Australia.

These debit cards won the 2023 Finder Banking Awards for their impressive travel benefits:

Macquarie Transaction Account

The Macquarie Transaction Account and debit card has no account keeping fees, no international ATM fees and pays a refund on any local ATM fees charged. Plus, you can earn a high interest rate of 4.75% p.a. on balances up to $250,000 in your account without needing to meet any conditions. So you can earn interest while you travel.

HSBC Everyday Global Account

The HSBC Everyday Global Account has no account keeping fees, no international transaction fees and access to free ATMs around the world. However what really makes this account a great travel option is that you can hold up to 10 different currencies in the one account.

The good part about the ability to hold multiple currencies is that you can transfer money before you go. So when the Australian dollar is strong against a particular currency, I transfer money into that account, and then when I go, I just spend in local currency. That way, I'm not getting hit with a potentially higher exchange rate, or being forced to spend in AUD and charged for the conversion.

Alanna Glenn Lead Publisher, Money and HSBC Everyday Global Account holder

Account keeping fees

Look for a debit card with non monthly account keeping fee.

Overseas ATM fees

This is charged by your bank when you use your card at an overseas ATM, and can be as much as $5 (or more) per transaction. It's best to look for a debit card without this fee, if possible.

International transaction fees

This is charged by your bank when a currency conversion is needed (e.g.: when using your AUD card to make purchases in the UK). This fee can be as high as 4% of the transaction value. Luckily, there are several Australian debit cards that don't charge this fee.

Account accessibility

It's handy to choose a debit card from a bank that has a good mobile baking app, which you can use overseas to keep an eye on your account and transfer money if needed.

Multiple currencies

Some debit cards allow you to hold multiple currencies at once. This is handy for travelling as it allows you to load up on the currency you need ahead of your trip while the exchange rate is good.

Contactless payment options

Being able to link the debit card to Apple Pay or Google Pay could be helpful while you're travelling if you don't want to keep your physical debit card on you.

Safety features

Some debit cards will come with a 'card lock' feature in the attached mobile banking app that allows you to temporarily freeze or lock your card if you've misplaced it while travelling.

Here's the difference between a travel debit card, a prepaid travel card and a travel credit card.

Travel debit card

Just like a regular debit card, a travel debit card comes linked to a transaction or everyday banking account, giving you easy access to your own money while you're travelling. You don't need to convert any currency before you leave, as you can just use your AUD and the currency will be converted at the time of purchase while you're overseas.

Prepaid travel card

A prepaid travel card lets you pre-load with the currency you need before you leave for your trip. It's not linked to a bank account like a regular debit card is. You can stock up on the currency you need in the weeks and months leading up to your trip when you notice the exchange rate is favourable. However, these cards still do come with fees and charges and if you have currency leftover when you return home you'll need to convert it back into AUD.

Travel credit cards

Unlike prepaid cards and debit cards, a travel credit card offers a line of credit for your to spend what you need and then repay at the end of the payment period (usually monthly). However, if you don't repay it in full, you'll be charged interest at a fairly high rate. Some credit cards allow you to earn points or other rewards, and offer things like complimentary travel insurance or airport lounge access.

- Access your funds anytime, anywhere. A Visa or Mastercard debit card gives you instant access to money in your bank account, no matter where in the world you are. All you have to do is look for the Visa or Mastercard logo.

- You can avoid overseas ATM fees. You can save on overseas ATM fees by using a partner bank's ATM or choosing a card that doesn't charge this fee.

- You can avoid international transaction fees. Using a debit card that doesn't charge international transaction fees will save you 3.5% or more on every single transaction.

- It's a safe way to spend your money. Debit cards give you a safe and secure way to access money when travelling overseas, given that multiple security layers work in keeping your information secure.

- Use it at home or overseas . There's no need to switch between different banking products when you travel and when you're home in Australia. If you choose the right debit card, you can use the one account for all your day-to-day banking at home and take it overseas too.

- Getting your card replaced overseas is difficult. Replacing a lost or stolen debit card when you’re travelling overseas might not happen in a hurry and you might have to pay a fee for the same.

- Only access your only funds . Unlike a credit card, a debit card will only give you access to the money in your account, and no more.

- Can't choose your exchange rate. A debit card will do the currency exchange with the exchange rate at the time of purchase, which might not be very good.

- No points or extra perks. Unlike a credit card you don't earn points with a debit card and you usually won't be offered other perks either, like free insurance.

You can apply for a travel debit card in the same way you'd apply for a standard bank account and debit card.

- Complete the online application form (you'll usually need to be over 18 with an Australian residential address).

- Verify your identity with your Passport, Medicare card or driver's licence.

- Transfer some money into your account to make it active, and activate your debit card when it arrives in the mail.

Frequently asked questions

Should i use a prepaid debit card.

Debit cards are not prepaid, they use the money that's available in your bank account. A prepaid card, instead, allows you to load up on currency before you leave. However, prepaid travel cards can often come with extra fees and charges.

Do Australian banks have ATMs overseas?

Some of the big banks do have ATMs overseas, or they'll be part of a global alliance or network of partnering banks. For example Westpac's global ATM alliance allows you to access tens of thousands of ATMs overseas.

Do debit cards come with travel insurance?

Debit cards typically don't come with travel insurance, this is more commonly offered with a credit card. There are a few debit cards that do offer insurance, for example the NAB Platinum visa Debit Card, however they usually also have a monthly account fee.

Can you use a travel debit card online?

Yes you can, and it's a great idea to do so. If you make an online purchase from a retailer located outside of Australia, you'd usually need to pay a foreign transaction fee of 3.5% (or more) on the value of your transaction. However if you opt for a debit card that waives this fee, you can save a fair bit of money.

How we choose the Best Transaction Accounts – Methodology

Finder used a data-driven methodology to find our best transaction accounts based on the following criteria:

Selection Criteria

- Accounts needed to have no account keeping fees, no local ATM fees and no international transaction fees to be included

- As many transaction account charge minimal fees, this award was then chosen based on extra features

- Products which offer a value return were rated by the value of that return

- Products which offer free ATM withdrawals were rated based on the universality of those withdrawals

Presumptions

- Ties decided by fewest value conditions

Alison Banney

Alison Banney is the money editorial manager at Finder. She covers all areas of personal finance, and her areas of expertise are superannuation, banking and saving. She has written about finance for 10 years, having previously worked at Westpac and written for several other major banks and super funds.

More guides on Finder

With inflation still high and the annual indexation looming, should you make some extra repayments to your debt?

Are runes and ordinals about to be the next big thing in crypto?

Save $1,297 by investing some of your savings in an exchange-traded fund.

Find all the weekly tips from our Dollar Saver newsletter and see how you could save.

Drive a banger that needs some TLC?

More Australians are resorting to theft as they struggle with the rising cost of living, according to new research by Finder.

No one wants to spend years and years paying off what ends up being mostly interest. Here are several tips on how to pay off your home loan faster.

SPONSORED: We take a look at how term deposits can help you save more cash and build wealth.

Australian pet owners would fork out an eye-watering amount before considering putting their pet down, according to new research by Finder.

The fourth Bitcoin halving is here - what to expect next from Bitcoin.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

12 Responses

Going to Sri Lanka. We have 28 degrees for shopping, hotel payments etc. Is there a debit card available that would give us better rates for cash withdrawals in Sri Lanka. Thanks.

Thank you for getting in touch with Finder.

While we don’t provide a specific product recommendation, we can help guide you through the process of comparing your options. This page provides a list of debit cards for overseas travel and online shopping, you can use our comparison table to help you find the card that suits you. You can also visit our travel money guide for Sri Lanka to know your other travel money options.

Once you have chosen a particular card, you may then click on the “Go to site” button and you will be redirected to the bank’s website where you can proceed with your application or get in touch with their representatives for further assistance.

Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

I hope this helps.

Have a great day!

Cheers, Jeniƒ√

If I use my debit / credit card overseas to purchase items Restuarants etc but do not use A T M S to get cash out I know I will incur 3% transaction fee is there any other charges I can incur because I have looked at getting a travel card and loading it with foreign currency but the conversation rates are very low then if I dont spend all the money I would be charged a fee again to convert the money back to aussie dollars what can you advise

Thanks for your inquiry.

For credit cards, you have to take note of 3 charges. Foreign transaction fees, Annual fees, and ATM withdrawal fees. For travel money cards, you need to be mindful of conversion rates and the time it takes to reload the card. Travel money cards can take up to 3 days to make funds available when you transfer more money onto your card in a reload. This is not ideal because it can leave you stranded if you do not have another payment method with you and you have run out of money on that card. For convenience, I would opt for a credit card. You may check a list of overseas travel credit cards here https://www.finder.com.au/best-credit-card-to-use-overseas

Hope this information helped.

Cheers, Arnold

just slightly confused about this point stated above:

You can avoid international transaction fees. Just about every Australian debit card you use overseas will require that you pay currency conversion fees every time you use your card.

This is down as a benefit which confuses me. Could you please explain why this is a positive?

Thanks for your question.

That statement falls under benefits because unlike the usual debit cards with high-interest charges on foreign currency transactions, the travel debit cards we feature on this page have minimal or no foreign transaction fees.

Cheers, Anndy

I am co-treasurer for a group of 40 travelling to South Africa for a month. We want to pre-fund an account in Australia before leaving and have access to the money in South Africa to meet group expenses. A debit card for myself and my co treasurer seems the best. Question is which card is best for wide access within South Africa? Look forward to your suggestions. Thanks

Hi Richard,

There are a couple of things to consider when looking for a debit card to use overseas.

Fees and access – there are some debit cards on the market that charge little to no fees for international transactions or ATM withdrawals.

For example, Citibank Plus doesn’t charge ATM withdrawal fees from Citibank branded ATMs or international transaction fees. However in South Africa, although Citibank operates there, there are no ATMs so you may be charged ATM fees by the owner of the ATM.

It sounds like you’re keen to use a prepaid travel money card . You may find our travel money comparison page useful. Travel money cards allow you to load it with your own cash before you travel overseas. This means you can ‘lock-in’ exchange rates and avoid ATM withdrawal fees.

Please note, we are a comparison site and as such can provide general advice only.

I am moving to China from Australia and have a commonwealth bank savings/debit card account which l want to keep active to pay for loan repayments in Australia, and will have my wages paid in RMB at a Chinese bank. Can l manage my Australian account online, and can l transfer funds from my Chinese account into my commonwealth acct in Australia. Lastly, do you advise l get a travel debit card from the commonwealth bank before l leave? Thank you :)

Hi Julie-Ann,

Yes, you can continue managing your account from overseas, however, please be mindful international transfers will incur fees.

If you would like to open a travel debit card , we recommend looking into how its features would benefit you. The travel debit card features will vary between products and it would be worth comparing these before opening an account. For example, with the Citibank Plus Everyday account, you can make withdrawals from any Citibank ATM around the world at no charge. There are also no international transaction fees. This travel money debit cards page might also help you compare other products.

Hope that helps.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Choose a Travel Credit Card

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A good travel credit card helps you earn free trips, comes to your aid in travel-related emergencies and doesn't charge you extra fees for using it overseas. If you know what to look for, you can more easily find the travel credit card that best suits your lifestyle.

» Learn more: NerdWallet's best travel credit cards

Decide between co-branded or general

When looking at travel cards, your first big decision will be between a co-branded card and a general travel card.

Co-branded cards bear the name of an airline or hotel chain. Rewards on these cards can usually be redeemed only with that airline or hotel. This limits your options, but these cards also give you exclusive perks such as free checked bags and priority boarding for airlines, or free upgrades and bonus amenities at hotels.

General travel cards earn rewards that you can use for any travel expense, either by using your points to book travel directly or by redeeming points for a credit on your account.

If you regularly travel on a single airline or stay with a single hotel group, a co-branded card is a smart way to get more of your costs covered. If not, a general travel card will give you much more flexibility.

Aim for high rewards and a signup bonus

A good travel credit card will offer rewards equal to 1.5% to 2% of your spending. For cards with larger annual fees, the rewards rates can get even higher.

Look at sign-up bonuses, too. This is a windfall of points you can earn by putting a certain amount in purchases on the card in the first few months you have it — say, $2,000 worth of spending within 90 days of account opening. A good sign-up bonus could translate into a free round-trip flight. In general, the higher the annual fee, the higher the sign-up bonus should be.

» Learn more: How to pick the best credit card for you: 4 easy steps

What to look for in a travel card: When evaluating cards, look at both how they earn rewards and how you can redeem those rewards. Some cards offer higher rewards on travel spending and a lower base rate (usually 1%) on everything else. Other cards pay the same rate on all spending. Look for at least 2% rewards on a card with an annual fee and 1.5% on a no-fee card.

As a general rule, avoid cards that give you less than 1 cent per point or mile when you redeem. Check out our rewards program reviews for our current estimate of average point values.

Sign-up bonuses aren’t quite as important as ongoing rewards — especially if you plan on keeping your card long term — but they are a fantastic perk. Compare our top credit card sign-up bonuses . But before you sign up, ensure that you can reasonably cover the spending required to earn the bonus. There's no sense in getting into heavy debt just to earn a bonus.

Get the travel perks and protections you need

Some credit card perks and protections come in especially handy as you travel. For example, some credit card issuers and networks offer rental car coverage , lost luggage insurance, travel delay and accident insurance, concierge services and emergency assistance. Many of the premium travel credit cards — especially co-branded airline and hotel cards — offer valuable perks such as free checked bags, priority boarding, discounts, upgrades and various travel credits.

What to look for in a travel card: Decide which perks and protections are must-haves for you and ensure the card you choose has these features. For instance, if you regularly check bags with expensive items, you may want lost baggage protection. If you rent cars frequently, you’ll want a card with good rental car coverage. For these protections and more, check out these credit cards that offer free travel insurance .

Those who want perks and frequently fly on a specific airline may look into a co-branded travel card . However, you should know that co-branded cards typically earn less on non-travel purchases than general travel credit cards. So if you fly with your favorite airline carrier on a semi-regular basis, limit yourself to just one co-branded card.

Take international travel into account

If you travel internationally, keep in mind that:

Some cards aren’t accepted as widely overseas as they are in the U.S. The payment network, rather than the card issuer, determines acceptance. Visa or Mastercard are accepted just about everywhere. For American Express and Discover, it's much more hit or miss.

Many cards charge extra fees on purchases outside the U.S. These foreign transaction fees typically run to about 3% of every purchase.

What to look for in a travel card: If you plan to travel overseas in the foreseeable future, you'll want to bring along at least one card that’s widely accepted. Even if an AmEx is your primary card, take a Visa or Mastercard as a backup.

And if you ever travel internationally, you should have a card that doesn't charge you for the privilege. Here are our top cards without foreign transaction fees .

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Mozo experts choice awards won:

- Small Business Exceptional Everyday Account - 2024

AMP Bank Access Account

Mozo editorial review amp bank access account - last updated: 21 march 2024.

- No minimum balance

- No account keeping fee

- $4.50 overseas ATM fee

Mozo snapshot

The AMP Bank Access Account gives you hassle free access to your money, and there are no domestic electronic, cheque, phone and Bank@Post fees or any monthly account keeping fee.

Key features

With this transaction account you’ll be able to use your linked AMP Bank Visa Debit card anywhere Visa is accepted globally and “tap and go” with the Visa payWave functionality for any contactless purchases under $100. Your card is covered under Visa’s zero liability insurance, which means you'll be protected for any unauthorised transactions (conditions apply). Other available payment options include Google Pay, Apple Pay and Samsung Pay.

Despite not having branch access with the AMP Bank Access Account, you can easily manage and review your account from any device via BankNet, mobile banking and BankPhone. You'll also have the added convenience of Bank@Post, which allows you to make deposits and withdrawals, check your account balance and pay credit card bills at Australia Post, either online or over the counter at any post offices across Australia.

Like most Australian transaction accounts, the AMP Bank Access Account doesn't have an interest rate, so if you want more bang for your buck, then you might want to keep the bulk of your money in a competitive high-interest savings account .

Who is it good for

With no account keeping fees, the AMP Bank Access Account is a great option for Aussies wanting a solid everyday transaction account.

Any catches

Keep in mind, like many bank accounts in Australia, the AMP Bank Access Account is not specifically designed for overseas purchases because the debit card comes with a hefty $4.50 overseas ATM withdrawal fee and a 2.50% foreign exchange commission fee. So, if you’re in the market for a travel-friendly piece of plastic, then head to our travel money hub instead.

Other financial bits

Payment options.

Apple Pay, Google Wallet, Samsung Pay

Customer Reviews

How are amp bank bank accounts rated by the mozo community, latest reviews of amp bank access account bank account.

Love this bank. No physical card so saving for me is easier as I don't have the option to get cash out. As an online bank account the interest is higher if you put a minimum amount every month. They also have just added osko payments and a higher Interest rate.

Total waste of time-A bunch of incompetent people

Tried to open an everyday account as someone who is not a permanent resident of AU. They made me to fill in many forms re TFN with many ID validations, etc, all approved. After a month I received an email stating that your account is open, soon you'll receive a letter. A week later we were asked for the proof of residential address which we couldn't provide as we visit AU a couple of times a year and during the visit do not have any utility bill under our name or don't need AU's driver's license, etc.; stay with our child. They closed the application after a month just because of that! Such a waste of time. Couldn't you check it first?

WOULD TRUST A CRACKHEAD WITH MY MONEY BEFORE AMP

These people are thieves , I am still asking myself ‘how it’s a bank like this legally operating in 2022. The wait times for your pay to go in can take up to 2-3 days, they have no real time payments or Osko, they have customer service which is basically careless people that just tell you to wait.

Can't access our own savings account money!

We changed banks several years go from AMP to another bank, but kept a savings account open with AMP. Recently I tried to transfer remaining funds, and was blocked by AMP to access our own funds. The reason stated was that AMP had to verify the joint account holders ID, even though this was all done many years ago when we applied for the home loan. After several phone calls and emails, still no access to our funds

Don't trust AMP BANK if you get scammed!

I wouldn't trust AMP Bank to bank with. If you get scammed they take nearly 108 days to get back to you to tell you in the end that they won't be repaying you the money you lost! I was scammed $2000, as a low wage earner $2000 is a lot of money to me! Don't trust them with your money!

About AMP Bank

Spend Account

Apple Pay, Google Wallet, PayID, Samsung Pay, Fitbit Pay, Garmin Pay

Everyday Options

Apple Pay, Google Wallet, PayID

Everyday Global Account

Apple Pay, Google Wallet

MyState Bank

Glide Account

Apple Pay, Google Wallet, PayID, Samsung Pay, FitBit Pay, Garmin

About Mozo’s Editorial Star Ratings

Mozo’s Editorial Star Ratings are a score out of 5 stars arrived at by the author of the review after careful consideration of a product’s rates, fees and features when compared with other products that offer similar features.

As a guide, this is how the Editorial Star Ratings should be interpreted:

- 5 stars - a best in class blend of great value and features

- 4 stars - excellent value and features overall

- 3 stars - good value and features overall

- 2 stars - below average, but may be worth considering for some people

- 1 star - well below average

Ratings are just one factor you may want to consider when choosing a financial product. Our ratings have been determined without considering your personal objectives, and a product with a high rating may not be the best one for you.

Important information on terms, conditions and sub-limits

Terms, conditions, exclusions, limits and sub-limits may apply to any of the insurance products shown on the Mozo website. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider's website for further information before making any decisions about an insurance product.

Who we are and how we get paid

Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. As a marketplace business, we do earn money from advertising and this page features products with Go To Site links and/or other paid links where the provider pays us a fee if you go to their site from ours, or you take out a product with them. You do not pay any extra for using our service.

We are proud of the tools and information we provide and unlike some other comparison sites, we also include the option to search all the products in our database, regardless of whether we have a commercial relationship with the providers of those products or not.

'Sponsored', 'Hot deal' and 'Featured Product' labels denote products where the provider has paid to advertise more prominently.

'Mozo sort order' refers to the initial sort order and is not intended in any way to imply that particular products are better than others. You can easily change the sort order of the products displayed on the page.

Should you get a travel rewards card?

What are the benefits of travel rewards credit cards, how to choose a travel rewards card, how experts suggest choosing the right travel credit card, what are travel points and miles worth, how to maximize your travel card, how to apply, other credit cards we researched, our methodology.

Why You Can Trust CNET Money

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and services, we earn a commission. The compensation we receive may impact how products and links appear on our site.

Best Travel Credit Cards for April 2024

Travel credit cards could save you money on your next adventure with their rewards, welcome bonuses and other perks.

Evan Zimmer

Staff Writer

Evan Zimmer has been writing about finance for years. After graduating with a journalism degree from SUNY Oswego, he wrote credit card content for Credit Card Insider (now Money Tips) before moving to ZDNET Finance to cover credit card, banking and blockchain news. He currently works with CNET Money to bring readers the most accurate and up-to-date financial information. Otherwise, you can find him reading, rock climbing, snowboarding and enjoying the outdoors.

Joe Van Brussel

Contributor

Joe Van Brussel is a freelance writer for CNET Money, where he deciphers obfuscatory credit card offers and breaks them down so consumers actually know what belongs in their wallet. He also covers other aspects of personal finance, from life insurance and loans to tax software and the impact of broader economic trends on individuals. Joe believes the United States will win the World Cup in his lifetime, and wishes New York City apartments came standard with thick, noise-reducing windows.

Courtney Johnston

Senior Editor

Courtney Johnston is a senior editor leading the CNET Money team. Passionate about financial literacy and inclusion, she has a decade of experience as a freelance journalist covering policy, financial news, real estate and investing. A New Jersey native, she graduated with an M.A. in English Literature and Professional Writing from the University of Indianapolis, where she also worked as a graduate writing instructor.

Jason Steele

Credit card expert and founder of CardCon

As a freelance personal finance writer since 2008, Jason has contributed to over 100 outlets including Forbes, USA Today, Newsweek, Time, U.S. News, Money.com and NerdWallet. As an industry leader, Jason has spoken at dozens of conferences and is the founder and producer of CardCon, an annual conference for credit card media. Jason also consults with individuals and small business owners to create customized plans to help them earn and spend travel rewards. He can be reached via his website; JasonSteele.com and on LinkedIn.

A travel credit card can help lower trip and transportation costs with travel-specific rewards that can be used to fund airfare, hotel stays and other purchases. In addition to rewards, travel credit cards offer useful perks that could cut down on time spent in the airport, like TSA Precheck or Global Entry credits, and can make your travels more comfortable by providing airport lounge access. However, the best travel cards charge an annual fee, so be sure it fits into your travel budget before applying.

Picking the right travel credit card comes down to several factors.

Fees: The travel credit cards that offer the most often charge an annual fee. You’ll need to factor that into your budget.

Perks: Travel cards often include perks like airport lounge access, annual travel credits or travel protections. Choose the card that matches what you’re looking for, and make sure you can use enough of the benefits it offers to justify any fees.

Rewards: Match the purchase types the card earns rewards for with your spending habits. Avoid overspending to earn rewards though — this can lead to credit card debt.

Welcome offer: Many travel credit cards feature welcome bonuses. Check to see if you can reach the spending threshold without making any unnecessary purchases.

Redemption: How you can redeem your rewards matters more with travel cards than other reward cards. If you’re looking to exchange rewards for future trips, make sure the card offers an easy way to do so. Or, if you’re looking to increase how much your rewards are worth, check to see if the card offers point transfers to travel partners.

Travel can be expensive, but for many, it’s a price worth paying. Once it’s all said and done -- your hotels are booked, your plane ticket is in hand and your rental car is ready to be picked up -- you’re probably looking for a way to save. Luckily, travel credit cards can help reduce some travel costs through their rewards, perks and welcome offers .

Usually in exchange for an annual fee , a travel credit card can help you save time and money through its perks. These might include an application fee credit for TSA PreCheck or Global Entry or could help limit the stress of a layover with airport lounge access. They’ll sometimes even include annual credits to put toward your travel expenses, or free checked bags and travel insurance. Here are some of the top travel credit cards to choose from.

Chase Sapphire Preferred® Card

See more details in our full review of the Chase Sapphire Preferred .

Chase Sapphire Reserve®

The Chase Sapphire Reserve may look expensive at first glance, but the credits and rewards can easily compensate for the cost for frequent travelers. Not only will you earn great travel rewards, but you’ll receive perks that save you time and energy during your journey. You’ll get a statement credit reimbursement for Global Entry or TSA PreCheck (worth $100 for Global Entry or $85 for TSA PreCheck, both valid for five years), which can save you the hassle of long security lines at the airport.

You’ll automatically be reimbursed for up to $300 of travel expenses per year via the annual travel credit, plus you’ll get airport lounge access through Priority Pass Select and a number of other VIP-style travel perks.

For more details, see our full review of the Chase Sapphire Reserve .

Citi Premier® Card

The Citi Premier® Card is Citi’s competitor to the Chase Sapphire Preferred Card. Though the Sapphire Preferred may offer higher rewards rates on certain travel, the Citi Premier Card is less restrictive in the purchases that earn you points -- and 3x points is a respectable rate to offer for so many categories. The 60,000 point welcome bonus after spending $4,000 in the first three months is fairly competitive too: If you earn it, it’s redeemable for $600 in gift cards or travel rewards at Thankyou.com.

There is a travel credit -- $100 Annual Hotel Savings Benefit toward a single hotel stay of $500 or more when booked through Thankyou.com, excluding taxes and fees -- but it’s more restrictive than that of some of its competitors.

For more information, check out our full review of the Citi Premier Card .

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card* is a straightforward, easy-to-use option for those who want to book travel with travel reward miles generated from general spending, instead of worrying about eligible purchase spending categories. Besides the rewards and welcome bonus, the Capital One Venture also gives cardholders up to a $100 statement credit for TSA PreCheck or Global Entry, as well as travel accident insurance and auto rental collision insurance (terms, conditions and exclusions apply. Refer to your Guide to Benefits for more details).

Check out our full review of the Capital One Venture Rewards Credit Card .

American Express® Gold Card

The American Express Gold Card* is good for travelers with a proclivity for eating out or cooking from where they’re staying, as it offers high rewards at restaurants or U.S. supermarkets. It does have a high $250 annual fee, so you’ll want to be sure it fits into your budget before you apply.

Along with its strong rewards, it features no foreign transaction fees ( see rates and fees ) and a number of annual credits to take advantage of, including up to a $120 dining credit (up to $10 in statement credits each month) at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. How much your points are worth will vary, however, and you’ll want to be sure you’re redeeming for airfare through American Express Travel to get the most from them.

You can find out more in our Amex Gold Card review .

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Bank of America® Travel Rewards credit card

For travel cards with no annual fee , the Bank of America® Travel Rewards credit card* offers one of the best flat rewards rate at 1.5 points per $1 spent on purchases. If you use the card to book your flights, hotels or other accommodations when you first get it, you’ll likely be able to earn the welcome bonus -- and then later spend it on your charges as a statement credit. The introductory APR on purchases can offer some security as an emergency card while you’re traveling, as well. If the unexpected happens and you need a last-minute flight back, you’ll have time to pay it off.

For more details, see our full review of the Bank of America Travel Rewards card .

Capital One Spark Miles for Business

The Capital One Spark Miles for Business* offers a simple way to earn miles and turn them into trips.

It’s especially useful thanks to its application fee credit for Global Entry or TSA PreCheck . Anyone who has spent time in airports knows what a pain TSA can be, but with this card you could skip right through it.

Credit One Bank Wander® Card

The Credit One Bank Wander Card could be a rewarding choice, but its rewards are more restrictive than most travel cards.

You’ll earn a high 10x points per dollar on eligible hotel and car rentals but only with a designated travel provider (through the Credit One Bank travel partner site) that may change from time to time. It does offer 5x points per dollar for eligible travel including airfare, hotels and car rentals outside of the designated travel provider. It has an annual fee of $95 but doesn’t offer too much in the way of travel protections.

Delta SkyMiles® Gold American Express Card

For travelers who fly Delta frequently enough, the Delta SkyMiles Gold* card offers a way to put some money back in your pocket while gaining a few travel protections.

It includes an annual $200 Delta flight credit each calendar year you spend $10,000 or more on the card. It’s a high spend requirement with a small payout, but a little back is better than none at all. You’ll also get your first checked bag free of charge and 20% back on eligible in-flight Delta purchases, plus it’s one of the few airline cards that offers good rewards for non-airline purchases.

You can learn more in our Delta SkyMiles Gold card review .

Discover it® Miles

The Discover it® Miles* has a simple yet lucrative rewards program that offers miles for everything you buy. It also has one of the best welcome bonuses around: Discover will essentially double the rewards you earn for your first year with the card at the end of your first year.

It doesn’t offer many additional travel perks, but you won’t have to pay any foreign transaction fees if you use this card abroad. You could get used to how a travel card operates before moving on to a more advanced card offering that includes more bells and whistles.

Ink Business Preferred® Credit Card

The Ink Business Preferred is best if you travel relatively often on business. It has better redemption options than most cards, a high welcome bonus and a selection of travel protections.

Not only does it feature a 1:1 transfer rate to Chase’s travel partners (1 point equals 1 partner point/mile), but you can also get a 25% redemption bonus for redeeming for travel through Chase Travel℠. Its welcome bonus is higher than most cards at this fee level, and it provides cardholders with primary auto rental collision damage waiver.

Find out more in our Ink Business Preferred review .

The World of Hyatt Credit Card

The World of Hyatt Credit Card* offers extra amenities and rewards at World of Hyatt properties. It features a welcome bonus plus an annual free night award after your cardmember anniversary.

It charges a $95 annual fee, but it could be worth it if you stay at World of Hyatt properties often enough. Hyatt properties dot the US but don’t have many international locations. Along with its hotel rewards, it provides World of Hyatt Discoverist status, which gives cardholders expedited check-in and late check-out, as well as preferred room upgrades when available.

If you travel a few times a year, then yes. Travel credit cards are great tools for making your trips less stressful and in some cases, less expensive. Which travel card you should get depends on which one provides you with the most valuable rewards and benefits.

Cut down on travel expenses with credit card rewards

Gain useful travel perks that can save you time and money

Earn rewards for booking travel

The best travel credit cards typically require an annual fee

Usually require good to excellent credit

Travel rewards cards tend to have higher interest rates

Travel rewards cards are designed for a few purposes. They can help you earn points or miles to be redeemed for travel expenses, insure trips from unexpected mishaps or upgrade your accommodations. Some even let you earn a companion pass . Annual fees for travel cards can range from $0 to hundreds of dollars, so it’s important to understand what you’ll get before signing up.

Common travel card benefits include:

Boosted travel rewards: Many travel credit cards offer elevated rewards rates for travel purchases, such as flights and hotels.

Travel booking portals: Several major credit card issuers have their own travel portals for booking flights, hotels, rental cars and more. Using your points rather than cash to book travel can limit your travel expenses.

Trip insurance: Many travel credit cards offer some combination of baggage insurance, trip delay, trip cancellation, trip interruption or car rental collision insurance. You’ll have to check the card’s guide to benefits for the specific details.

TSA PreCheck or Global Entry: Some credit cards will offer a credit for TSA PreCheck or Global Entry. TSA PreCheck helps you get through security lines at the airport faster, while Global Entry expedites immigration.

Lounge access: A perk common among premium travel cards, some credit cards offer access to airport lounges . There, you can wait for your flight in comfort with refreshments and private work areas.

Annual travel credits: Many travel cards offer some sort of annual travel credit, whether for hotels, flights or general travel purchases. These credits can range from $50 to hundreds of dollars, but they only come with travel cards that charge an annual fee.

Weigh the value of the rewards and benefits against a credit card’s annual fee to choose the best one for you.

There are a number of different card features you’ll need to consider when deciding which travel card is right for you, including the fees, rewards, redemption methods and additional card perks.

Foreign transaction fees : If you plan to travel out of the US, you’ll want to be sure the card you’re eyeing doesn’t require foreign transaction fees. Many credit cards tack these fees on while you’re abroad. They’re typically 3% of your transaction. Most travel credit cards don’t have foreign transaction fees.

Annual fees: You’ll want to make sure that the card’s rewards and benefits provide enough value through your normal spending to cover its annual fee. That means your spending generates enough rewards to cover the fee and you travel enough to use all of the card benefits. A travel card without an annual fee is better for travelers who don’t travel too often throughout the year, but it won’t provide as lucrative card perks like annual statement credits.

Rewards: A travel credit card’s rewards are one of the most important things to consider. They should match how you usually spend while traveling and have a competitive value when it’s time to redeem. Choose a credit card that matches your travel budget and spending habits to avoid overspending.

Rewards redemption: Generally, you’ll have a better chance to maximize your rewards if you have more options available. Avoid redeeming for statement credits and instead use your points for airfare or hotels. If you’re looking to get the most from your points, consider a credit card that offers point transfers to the credit card issuer’s partners.

Travel perks: And lastly, consider the card’s additional perks. Does it offer annual statement credits? How about amenities like airport lounge access or an application fee credit for Global Entry or TSA PreCheck? Many premium travel cards will offer ways to offset their annual fees through their benefits, but you’ll need to make sure you can make full use of them to do so.

Gerri Detweiler

Expert Reviewer

Julia Menez

Credit card expert and host of the Geobreeze Travel Podcast

Daniel Braun

There are dozens of travel credit cards, so finding the right fit can be daunting.

“The most important factor you need to look at when choosing a travel credit card is whether you value a specific brand,” said credit expert Gerri Detweiler.

If you always fly with one airline or stay at a particular hotel, you may want the benefits that come with a co-branded card that earns rewards specifically for that brand, Detweiler said. Perks could include jumping up to a higher airline membership tier for airline cards or annual free night stay certificates with hotel cards. But if you’re not loyal to one brand, Detweiler instead suggests a general travel credit card for avid travelers.

You also want to consider the type of rewards the card earns, said credit card expert Julia Menez.

“For those looking to travel with points and miles, the best way to pick the right travel credit card is to work backward,” Menez said. Once you choose your destination, Menez said it’s important to check which type of points will most effectively cover the cost.

“Once you know which type and how many points you’ll need to earn, select a travel credit card that earns those types of points,” she said.

Since many of the best travel cards charge an annual fee, figure out if you can justify it with the rewards and card perks you’ll earn. “If you’re going to pay a high annual fee, then you really need to look at whether you’ll earn enough in benefits to offset most or hopefully all of that fee,” Detweiler said.

If you won’t earn enough to make up for an annual fee, consider a lower-annual-fee credit card or even a cash-back card that might better suit your spending and budget, Detweiler added.

Lastly, consider how you can redeem a card’s points, the value of its rewards and whether you plan to transfer points to travel partners.

“Flexible points currencies like Chase, American Express, Capital One, Citi and Bilt are some of the most valuable because they can be used with many different airlines and hotel chains,” Menez said.

Once you’ve chosen the right travel card for you, the next step is to make sure you can get value from it. According to credit expert Daniel Braun, the best way to do that is to redeem your rewards correctly. “To get the best value from travel credit card rewards, people should be looking to redeem points and miles for travel and not cash back or gift cards,” he said. “Many times I’ll see people earn flexible points currencies from banks and then just cash them out at lower values, but if they can be patient and learn a few ways to redeem for flights and hotels by transferring those points to transfer partners, then the value of their points could double, triple or multiply by even more!”

The value of points and miles will vary depending on the card and how you redeem them. Travel credit cards usually have two main forms of redemption: Using rewards for past travel expenses and transferring them to hotel and airline partners.

Point transfers could provide a higher per-point value than standard forms of redemption, but again, it depends on what card you’re using and which brands you’re transferring them to. Generally, travel cards encourage you to redeem for travel, which could mean booking airfare, hotels or rental cars.

When redeeming for airfare or hotels, factors including the time of year you’re booking your travel will also impact the value of your points or miles. But generally speaking, points and miles will always be worth the most when used for travel as opposed to statement credits or other forms of redemption.

To maximize your cards’ value, use it strategically for purchases that provide the most rewards and then redeem those rewards in the most lucrative way -- that usually means for airfare or hotel stays, but you could find the best per-point value by utilizing point transfers. Choosing your travel date ahead of time could also give you the opportunity to shop around for the most lucrative transfer deals.

Remember to take advantage of any annual statement credits that may apply to you to offset your card’s annual fee. Using airport amenities like airport lounges, priority boarding or having checked bag fees waived are other ways to ensure you’re getting the most from your card.

Follow these steps to apply for a travel rewards card:

- Find the card that best fits your travel habits.

- Follow the links above to a secure application on the credit card issuer’s website.

- Fill out all the required financial and personal information.

- Use your card responsibly and pay on time.

Make sure to redeem your travel rewards in the way that provides the greatest value and to use its perks whenever possible.

While most don’t, you’ll need to read the terms that come with your credit card to be certain.

No, the IRS categorizes credit card reward redemption as non-taxable.

It varies from airline to airline. For travel rewards or frequent flyer miles, you can check on the respective airline’s website when booking a flight by choosing the option that lets you pay for a flight with credit card rewards.

Recommended Articles

Best airbnb credit cards for april 2024, best credit cards for airport lounge access april 2024, the best credit cards for earning hyatt points in april 2024, best american airlines credit cards for april 2024, pairing the chase sapphire preferred card and chase freedom unlimited to level up your rewards, best credit cards for streaming services for april 2024, what are emv chips and do they make credit cards more secure, best high-limit credit cards for april 2024.

- Capital One VentureOne Rewards Credit Card

- Chase Freedom Unlimited ®

- Chase Freedom Flex℠

- U.S. Bank Altitude® Connect Visa Signature® Card

- PenFed Pathfinder® Rewards Visa Signature® Card

CNET reviews credit cards by exhaustively comparing them across set criteria developed for each major category, including cash-back, welcome bonus, travel rewards and balance transfer. We take into consideration the typical spending behavior of a range of consumer profiles -- with the understanding that everyone’s financial situation is different -- and the designated function of a card.

For rates and fees of the American Express Gold Card, click here

For rates and fees of the Delta SkyMiles Gold American Express Card, click here

*All information about the Capital One Spark Miles for Business, Bank of America Travel Rewards credit card, Capital One Venture Rewards Credit Card, World of Hyatt Credit Card, the American Express Gold Card , the Delta SkyMiles Gold Card and Discover it Miles has been collected independently by CNET and has not been reviewed by the issuer.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

Using AMP with Discounted Fares

AMP cards and fare capping can be combined with discounted fares for qualified users. In order to associate your AMP Card as a Reduced Fare, Equifare or CapMetro Access user, you must provide your AMP card number to us through the form below.

You can find the card number on the back of your physical AMP card at the bottom left or in the CapMetro App by tapping the manage tab and finding the card number at the top.

You should already be enrolled as a Reduced Fare, Equifare or CapMetro Access user BEFORE filling out this form. We will process this form within 3-5 business days and your appropriate discount will then be reflected when using your AMP Card.

Provide Your AMP Card information

- CapMetro Access User

- Reduced Fare User

- Equifare User

If using the app, provide your Virtual AMP Card number. If you're using a Physical AMP Card, provide the Card number on the back of the card.

- Skip to Main Content

- Skip to Main Navigation

Some of our customers are receiving scam emails from people who claim to work for our AMP Investments business. The emails talk about exclusive term deposit and fixed bond rate investments. These are not related to our AMP Bank or AMP Investments business.

If you are concerned that you may have been targeted by scammers, please contact us on 13 30 30 .

More information on scams can also be found on the ACCC's website Scamwatch .

Login to My AMP

Or login to, adviser & wholesale, introducing the new amp bank debit cards, your new visa debit card is a little bit special.

To celebrate the rich history and Indigenous cultures of Australia, we teamed up with emerging artist Chloe Little to create a series of artworks for AMP which now feature on our new VISA debit cards.

These designs are a symbol of gratitude and respect for the deep enduring connection to the lands, waterways and sky. We acknowledge and share pride of First Nations Peoples’ artistic and cultural expressions. There’s something very special about cultural art, it connects you to the Country and to the ancestors in a way that deepens one’s connection, respect and curiosity for the history of our Land. This is one way that Indigenous Australians and the ancestors of this Country have recorded moments in time, told a story and have passed on information for thousands of years. It is our responsibility to share these cultural stories and preserve the traditions, ensuring true reconciliation between two Peoples.

“These cards are an important marker of AMP’s responsibility to the reconciliation journey. We’re proud to be one of the first banks to bring Aboriginal art to the wallets of our customers.”

Marina Harpur, Director Everyday Banking, AMP Bank

A sustainable card, for a sustainable future

We’re introducing eco-friendly debit cards to contribute towards a more sustainable future. These cards are manufactured using sustainable materials that are gentler on the planet;

- Made from degradable PVC

- Uses less energy to manufacture than a conventional plastic card and produces fewer greenhouse gases

At the end of your card’s life, all you need to do is cut the card through the chip plus your personal details and dispose of in your normal waste, it will break down naturally in landfill.

Your debit card makes it easy to pay for everyday expenses.

Hear from Marina Harpur (Director, Everyday Banking) & Chloe Little (Artist)

Introducing chloe little.

Chloe is a proud Yorta Yorta and Yuin woman who lives on Dharug country in Hawkesbury, NSW.

She set up The Scribbly Gum studio in 2018 to create stories and share her expressions through contemporary Aboriginal art by connecting with her culture, ancestors and Country. Her art is an expression of Chloe’s life experiences and journey through life.

Discover more about Chloe, her artworks and expanding business here .

“Creating art helps me to connect with my culture. It gives me a voice to share my stories and my culture, but it also allows the opportunity to inspire others to share their voice.”

Chloe Little, Artist

Where the land meets the sea

Where the land meets the sea is a representation of three Indigenous people from the past, present and future, practicing spear fishing.

Being a Yorta Yorta-Yuin woman, Chloe feels a strong connection to culture and water, where spear fishing is still practiced by Indigenous peoples today.

“My motivation behind the artwork is to raise awareness and celebrate the continuing culture specifically through spear fishing that supports our communities to thrive then, now and into the future.”

Celebrating Sydney

Celebrating Sydney looks at the land, the sea and the prominent features of Sydney featuring the ‘Warrane’ or Circular Quay motif, the Sydney tide pools, the sandstone and the Harbour Bridge which is represented by a connector in the bottom right of each circle.

Celebrating Sydney portrays Sydney as an area that is bold and alive thorough its bright contrasting colours of land and earth including oranges and sandy tones and blues of the sea.

The design additionally references the AMP building in relation to the Quay and looks at the geography of the Quay through symbols.

“Ulupna explores my connection to the land on which my ancestors, my family, myself and my artwork have and will exist.“

These are represented as a journey predominantly along the NSW coast from Yorta Yorta to Yuin, Dharug and Gadigal country. It explores the sacredness of this journey and connection as home in the past, the present and the future.

AMP’s Reconciliation Action Plan

Creating a shared future together.

AMP is committed to working together with industry, community and like-minded organisations to promote financial wellbeing, and improve social and cultural outcomes.

Our vision for reconciliation is for a unified nation that celebrates and pays respects to Australia’s First Peoples, cultures and Country.

We’re collaborating with like‑minded organisations to improve outcomes for Indigenous Australians. We all play a role in creating generational change that supports a brighter, more inclusive future for all Australians. One where we celebrate respectful relationships with Indigenous Australians, valuing the diversity of perspective and thought, embracing our multicultural Australia.

We’re establishing employment and career pathways to increase the number of Indigenous Australians working at AMP.

We’re supporting Indigenous entrepreneurs and community programs through AMP Foundation’s Tomorrow Fund

We’re engaging Indigenous-owned businesses like The Scribbly Gum Studio in commercial partnerships

Learn more about how you can use your card

Aside from traditional methods of payment, you can link your AMP Visa Debit card to your digital wallet to transact using a smartphone or device.

Looking for other banking options?

Find out more about our range of everyday accounts, savings accounts and term deposits.

What you need to know

© Copyright 2022 AMP Limited. All rights reserved.

The product issuer and credit provider is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517.

Debit cards are only distributed with particular products. Any application for these products is subject to AMP Bank’s approval. Terms and conditions apply and are available at amp.com.au/bankterms or 13 30 30. Fees and charges may be payable.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

- Personal Finance

- Today's Paper

- Partner Content

- Entertainment

- Social Viral

- Pro Kabaddi League

Now, a travel-focused core credit card from SBI: Here are all the benefits

Sbi card miles comes in three variants - elite, prime, and miles - each with different benefits and fees to suit your travel needs..

)

You can save on petrol spends with fuel credit cards: Which are the best?

Analysts slash sbi card's earnings estimates post q2 result; shares tank 7%, love shopping online, ordering in how to save with the right credit cards, card devaluation: how to pick between axis bank magnus and hdfc regalia gold, axis magnus to sbi aurum: top premium lifestyle cards for high earners, eu eases schengen visa rules for indians: costs, processing time explained, amid varied risk levels, review portfolio before choosing credit risk fund, what are debt funds who should invest in them here's all you need to know, 69% indians prefer us for higher education over uk, canada, shows survey, new rules for getting driving licence, training: here is what has changed.

)

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Apr 24 2024 | 10:43 AM IST

Explore News

- Suzlon Energy Share Price Adani Enterprises Share Price Adani Power Share Price IRFC Share Price Tata Motors Share Price Tata Steel Share Price Yes Bank Share Price Infosys Share Price SBI Share Price Tata Power Share Price HDFC Bank Share Price

- Latest News Company News Market News India News Politics News Cricket News Personal Finance Technology News World News Industry News Education News Opinion Shows Economy News Lifestyle News Health News

- Today's Paper About Us T&C Privacy Policy Cookie Policy Disclaimer Investor Communication GST registration number List Compliance Contact Us Advertise with Us Sitemap Subscribe Careers BS Apps

- Budget 2024 Lok Sabha Election 2024 IPL 2024 Pro Kabaddi League IPL Points Table 2024

Everything you need to know about Amex Travel

The American Express Travel portal allows you to redeem Membership Rewards points directly for travel reservations and activities rather than transfer your rewards to airline or hotel partners like Delta Air Lines SkyMiles and Marriott Bonvoy .

You also can book discounted premium tickets, use benefits like a 35% points rebate on certain bookings and even book premium hotels with additional perks through Amex Travel.

Let's explore this booking portal to uncover all its benefits and potential disadvantages.

What is the American Express Travel portal?

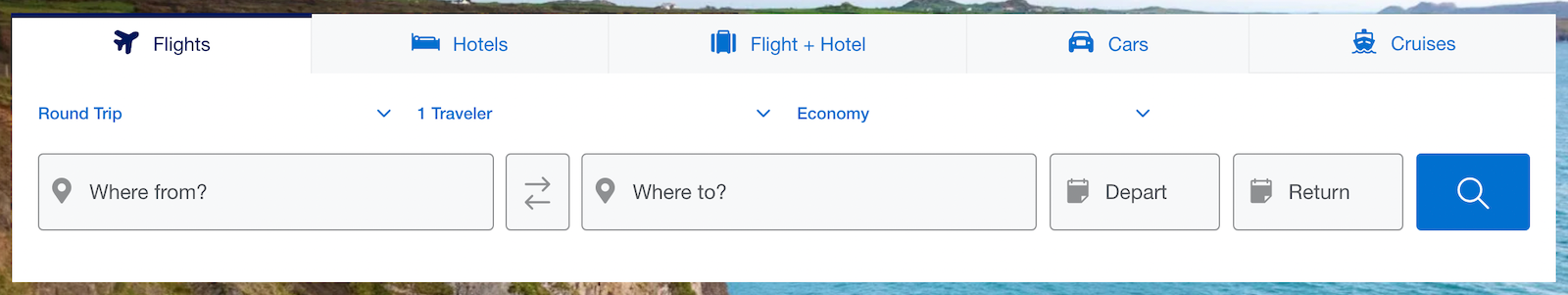

Amex Travel is the booking portal for most American Express cards . You can book flights, hotels, rental cars and cruises through the site, and you can pay with points, cash or a combination of the two.

How to book flights on the Amex Travel portal

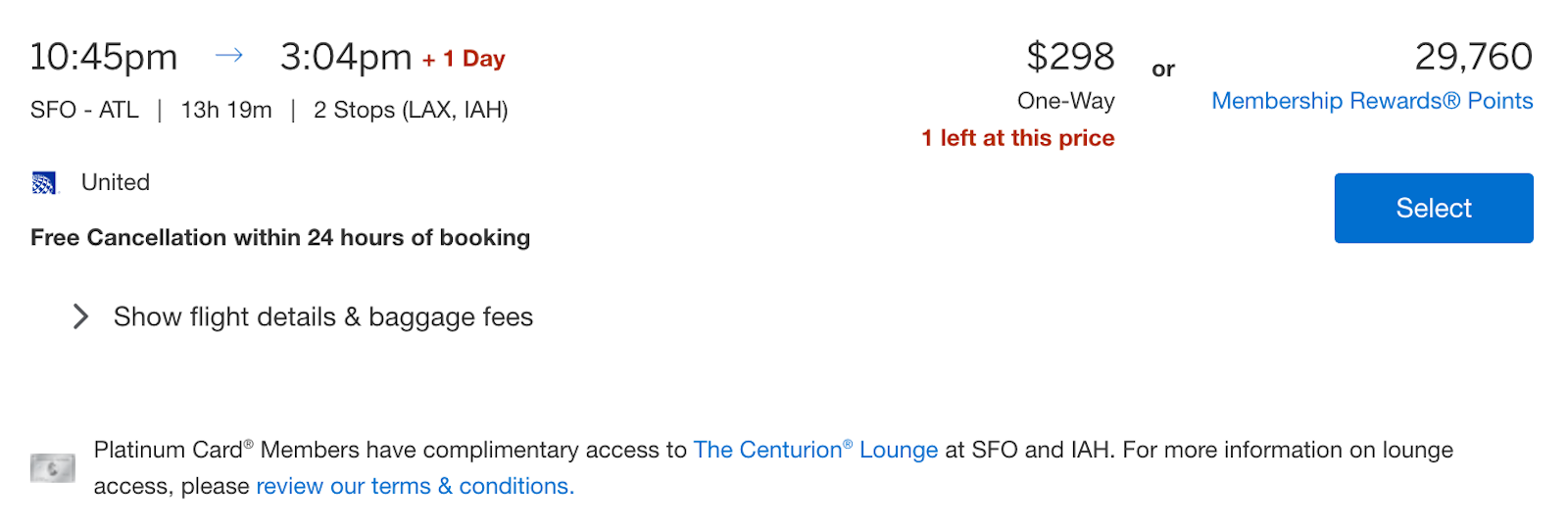

To find flights on American Express Travel, visit this webpage . The flight booking process on the Amex Travel portal is similar to other popular sites like Kayak and Orbitz. You'll find a search box where you can enter your departure and destination cities.

If you're flexible with your departure airport, you can choose an entire city, such as New York, which has multiple airports. Additionally, you can customize your booking by selecting your preferred class and the number of travelers, and choosing between one-way and round-trip flights.

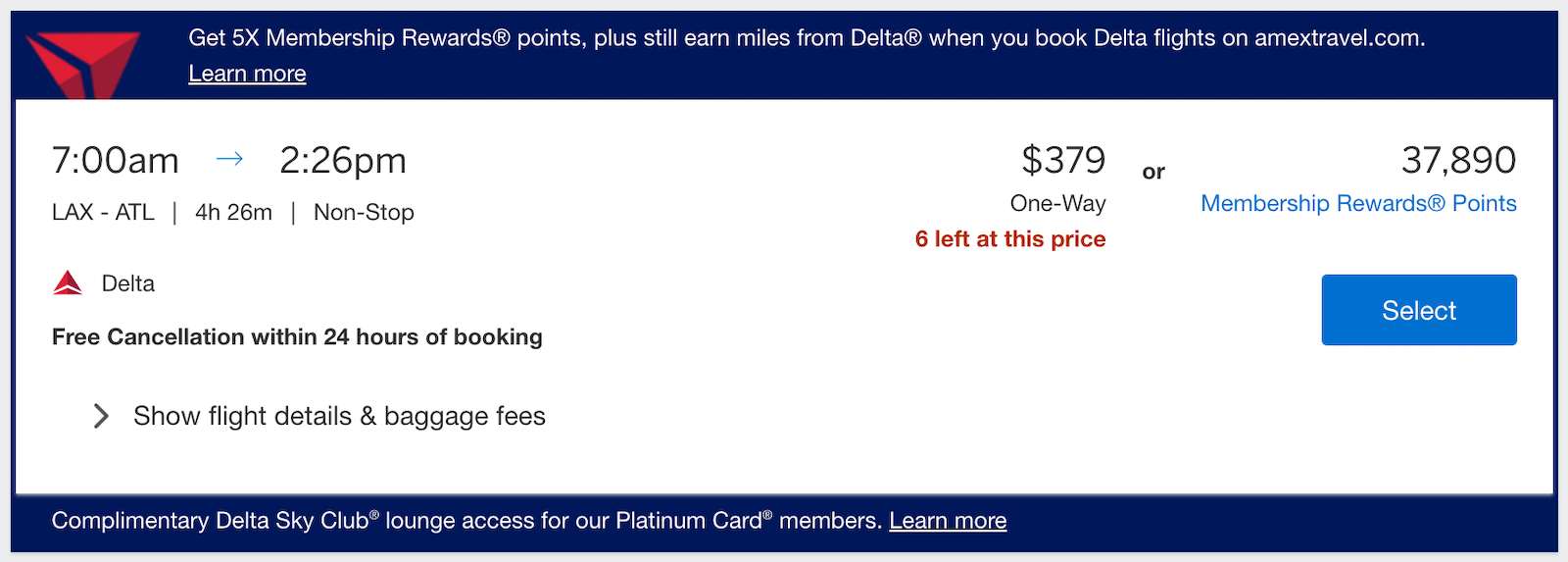

You'll see the price listed in dollars and the number of Amex Membership Rewards points during the booking process.

You can also use the options on the left-hand side to filter flights by number of stops, departure and arrival times, flight duration and airline.

Delta Air Lines is a featured airline in the Amex Travel portal. Sometimes, Delta flights appear at the top of your results, listed as "recommended," but this doesn't mean those flights are always the cheapest.

Additionally, if you have The Platinum Card® from American Express or The Business Platinum Card® from American Express and are flying from an airport with a Centurion Lounge , you'll see an indicator that a lounge is available.

Points vs. cash

When paying for your flights on Amex Travel, several American Express cards offer elevated earning rates:

You can also pay with Amex Membership Rewards points to cover the cost of your flight.

You'll see the number of points required next to the cash price of a flight. You can expect a value of 1 cent per point when using Pay with Points . However, TPG values Membership Rewards points at 2 cents apiece when you maximize Amex's transfer partners.

Related: How to redeem American Express Membership Rewards for maximum value

It's important to compare the number of points required for bookings on Amex Travel with the points you'd need to transfer to an airline program . If you can't book a flight through transfer partners and prefer to use your points, Amex Travel remains an option.

There's an additional benefit for Amex Business Platinum cardmembers: You can get 35% of your points back when paying with points on Amex Travel. This applies to first- and business-class flights on any airline plus tickets in any class on your preferred airline (the same one used for your airline incidental credits ; enrollment is required in advance). This 35% points rebate can provide a value of 1.54 cents per point, which may influence your decision to pay with cash or points.

Similarly, the Business Centurion® Card from American Express offers a 50% Pay with Points rebate on eligible flights. Note that Centurion cards are available by invitation only.

The information for the Business Centurion Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

More details about flights through Amex Travel

During the payment process, you can use points, your credit card or a combination of both. The minimum number of points you can use is 5,000, and each point is valued at 1 cent.

You can upgrade your flights using cash or points in the Amex Travel portal. This generally gives you a return of 1 cent each, and you can book using your Amex card, points or a combination of both.

During your flight search, you might come across "Insider Fares" that offer a discounted price. But to benefit from the discount, you must redeem points to cover the full fare amount.

Amex Platinum and Amex Business Platinum cardmembers have another benefit: discounted premium tickets through Amex Travel's International Airline Program . This program offers discounts on first-class, business-class and premium economy tickets from over 20 participating airlines.

To book a premium ticket using the IAP, go to the Amex Travel portal and pay with cash or points, including the Business Platinum card's 35% airline rebate. Keep in mind that not all flights are eligible and there are restrictions:

- The cardmember must travel on the itinerary.

- A maximum of eight tickets can be booked per itinerary; travel must begin and end in the U.S. or Canadian international airports.

- Tickets are nonrefundable unless stated otherwise.

- Name changes for passengers are not allowed.

Finally, note that flights booked through Amex Travel are typically treated as normal paid tickets, meaning you're eligible to earn points or miles with participating airline loyalty programs.

Related: Why I love the Amex Business Platinum's Pay with Points perk

How to book hotels on the Amex Travel portal

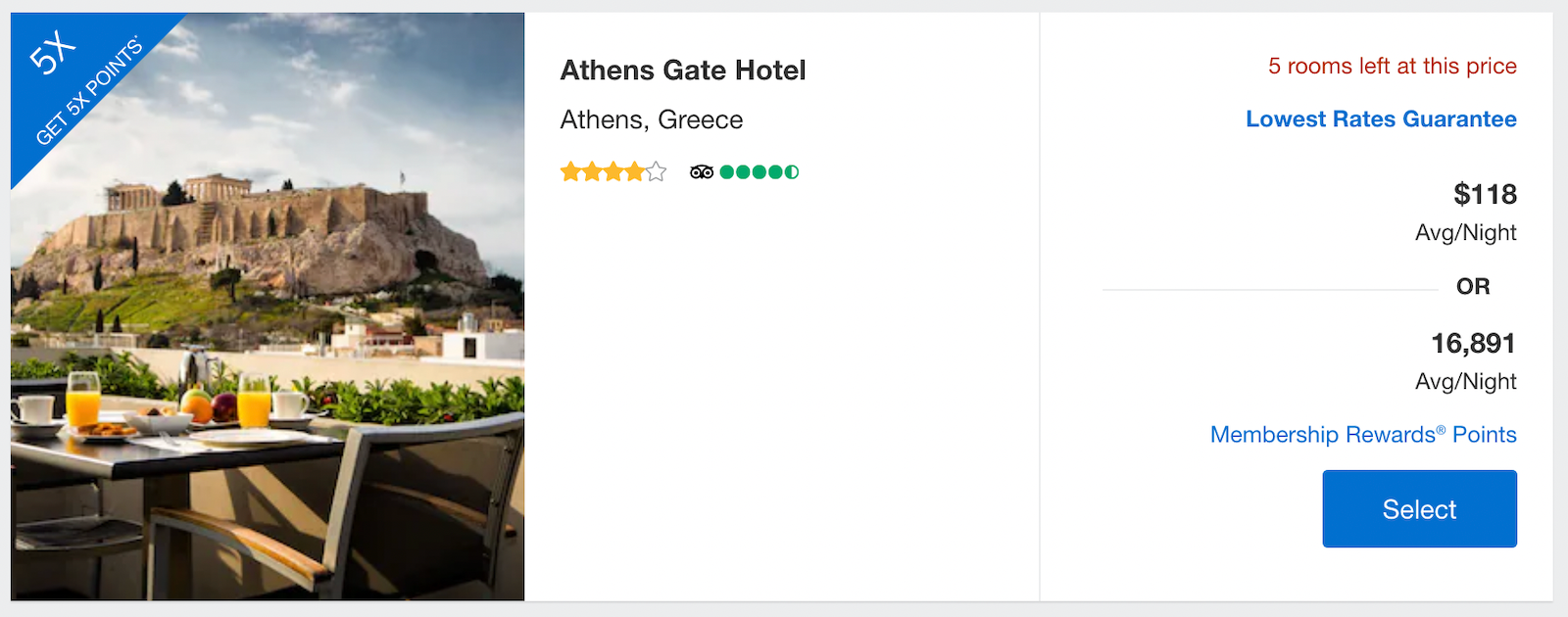

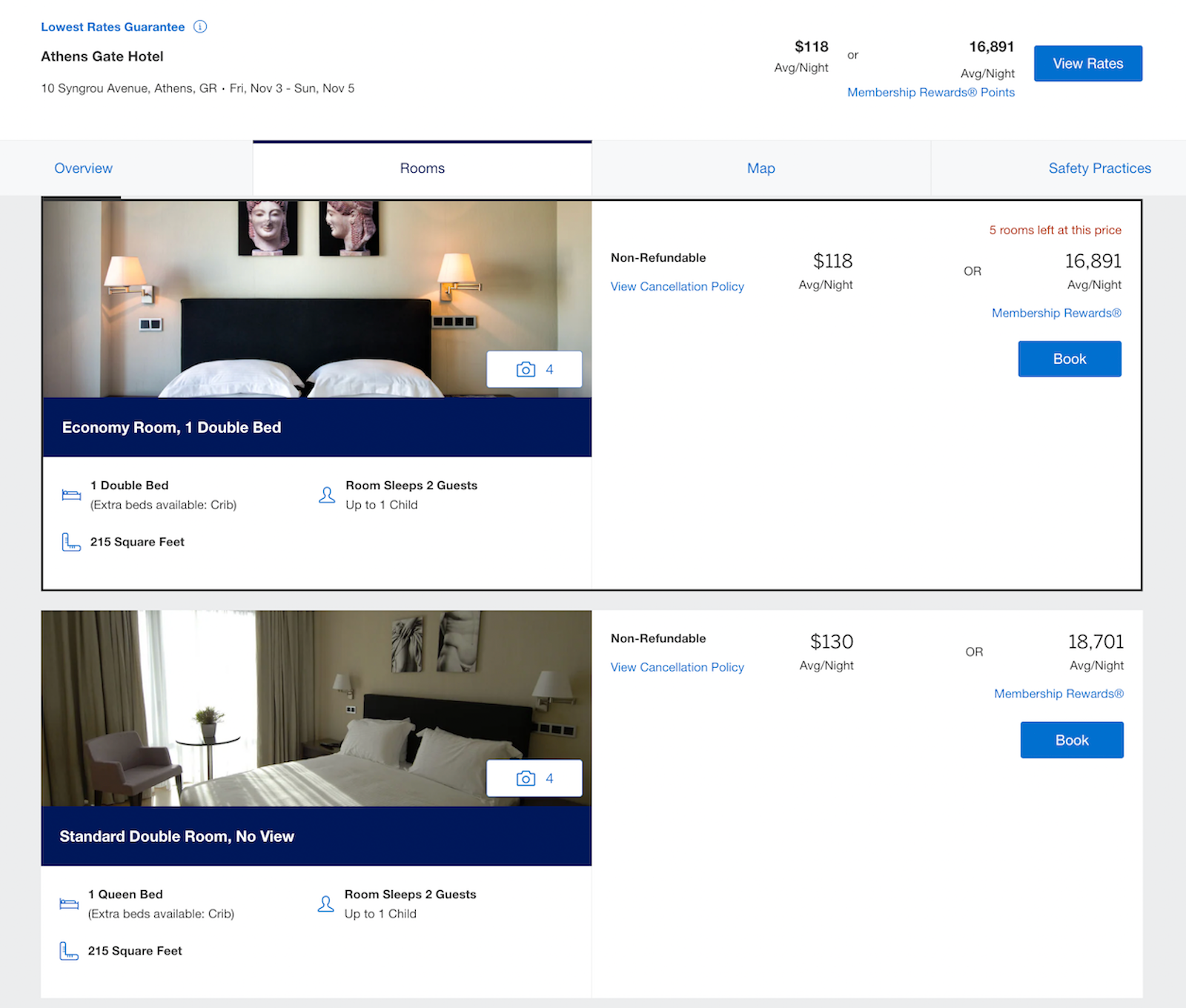

You can book hotels through American Express Travel with a Gold, Platinum or Centurion card. As with other travel portals, you can input your destination, dates, number of rooms and number of guests (with separate input fields for adults and children).

Platinum and Business Platinum cardmembers earn 5 points per dollar on prepaid hotel reservations.

After selecting your hotel, you'll choose your preferred room and pay with points or cash. If you pay with points, you'll only get a value of 0.7 cents per point (compared to 1 cent when you book flights).

Note that these are considered third-party bookings, so you likely won't earn hotel points or elite credits for your stay . While there are reports of people receiving stay credits with Marriott Bonvoy or Hilton Honors on rooms booked through Amex Travel, the hotel is not guaranteed to recognize your elite status in these programs or provide status-qualifying stay credits.

Related: 9 things to consider when choosing to book via a portal vs. booking directly

Amex Fine Hotels + Resorts

Platinum and Centurion cardholders also have access to the Fine Hotels + Resorts program through Amex Travel. This can add some great benefits to your hotel stays — and may not cost much more than booking directly with the hotel.

Here are the perks you'll receive with every FHR booking, regardless of the length of your stay:

- Room upgrade upon arrival (when available): Some room types may be excluded, but you could receive an upgrade to preferred rooms with better views or a better location in the hotel.

- Daily breakfast for two people: The provided breakfast must be, at a minimum, a continental breakfast.

- Guaranteed 4 p.m. late checkout

- Noon check-in when available

- Complimentary Wi-Fi

- Unique property amenity: The amenity varies by hotel but should be valued at $100 or more and usually consists of a property credit, dining credit, spa credit, private airport transfer or similar amenity.

You'll need to book these stays through Amex Travel, but note that FHR is considered a separate program from Amex Travel.

In addition, if you have the personal Amex Platinum , you can also get up to $200 in statement credits every year for prepaid reservations through Fine Hotels + Resorts or The Hotel Collection — which we'll discuss next. Enrollment is required.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

The Hotel Collection

A lesser-known American Express benefit is The Hotel Collection , which allows you to book in cash or with points. Those with Amex Gold, Platinum and Centurion cards have access to this program, which offers the following benefits:

- A room upgrade at check-in (if available)

- $100 on-property credit for qualifying dining, spa and resort activities

Note that The Hotel Collection bookings require a minimum stay of two nights, though they too are eligible for the $200 hotel credit on the Amex Platinum.

How to book rental cars and cruises on the Amex Travel portal

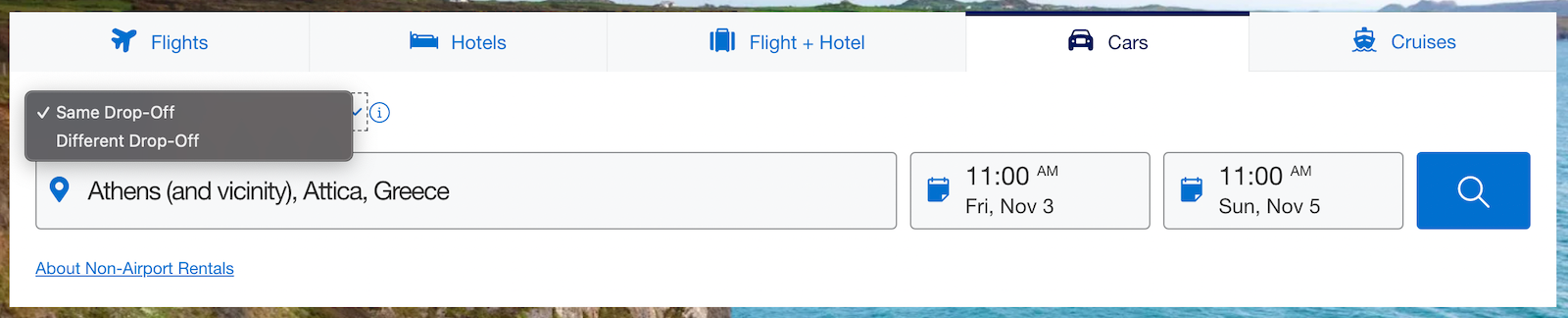

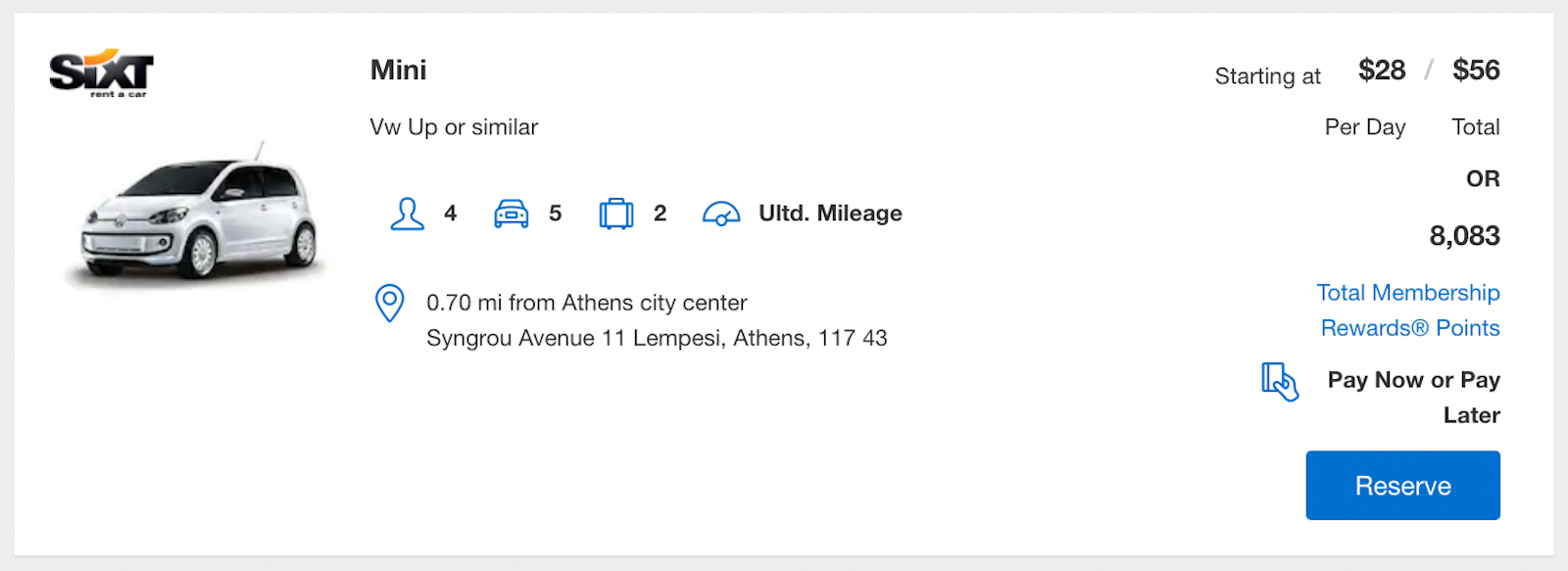

Reserving a car in the Amex portal is relatively simple. You'll input your pickup and drop-off times and location.

You'll see rental car prices listed in cash and points. When using Pay with Points , your points are worth 0.7 cents — just over a third of TPG's valuation of Amex Membership Rewards points.

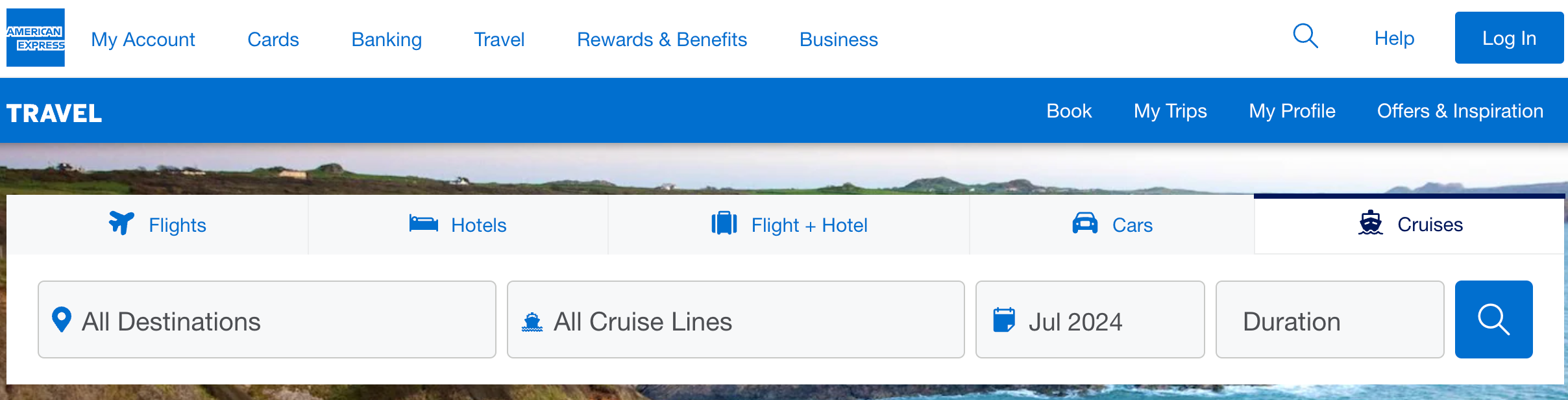

Although the format differs, you can also search for cruises on Amex Travel.

Rather than typing specific dates and numbers of passengers, you'll see four drop-down menus. These allow you to choose a destination (by region), filter by cruise lines and choose a month for travel — though not specific dates — on this first page. You can also select your desired cruise duration.

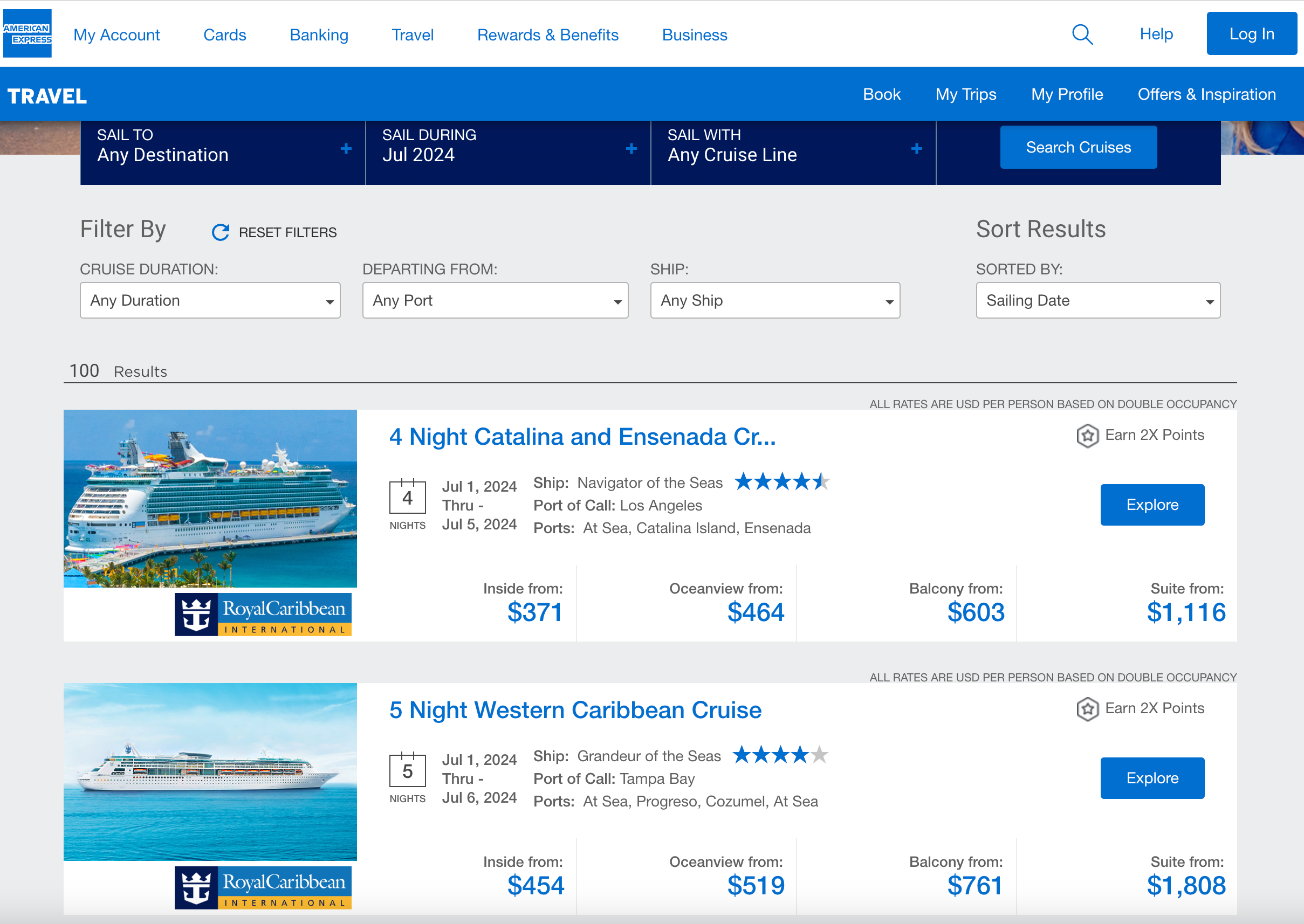

From here, you can filter by cruise duration, departure port and ship. You can sort your results by sailing date, value, price or ship rating.

On the final payment page, you can use your card or redeem points, ranging from 1 point to enough to cover the entire cost. Using points for a cruise will result in a low valuation of 0.7 cents per point, but it can be a money-saving option if you prefer not to spend cash.

There's another benefit available if you're a Platinum or Centurion cardholder (including personal and business versions of these cards): the Cruise Privileges Program .

This is available on cruises of five nights or more with select cruise lines, and it offers the following perks:

- $100-$500 in onboard ship credit (note that this cannot be used for casino or gratuity charges)

- Additional onboard amenities vary by line, such as spa vouchers, a bottle of Champagne, shore excursion credits or a private ship tour

Note that the Platinum cardmember must be one of the travelers on the cruise to enjoy these benefits.

Related: How to book a cruise using points and miles

Further things to consider about Amex Travel

When booking through the Amex Travel portal, there are a few factors to consider.