- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

A traveler’s guide to the Chase Travel portal

Tamara Aydinyan

Julie Sherrier

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Updated 5:23 p.m. UTC Nov. 28, 2023

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

hocus-focus, Getty Images

For qualifying Chase cardholders, the easy-to-use Chase Travel℠ portal offers a flexible and convenient way to book hotels, flights, rental cars, cruises and more using points or a combination of points and cash.

What is the Chase travel portal?

A favorite among frequent travelers for its versatility and redemption options, Chase Ultimate Rewards® (UR) is one of the major transferable credit card rewards points programs and UR points are Chase’s flexible rewards currency.

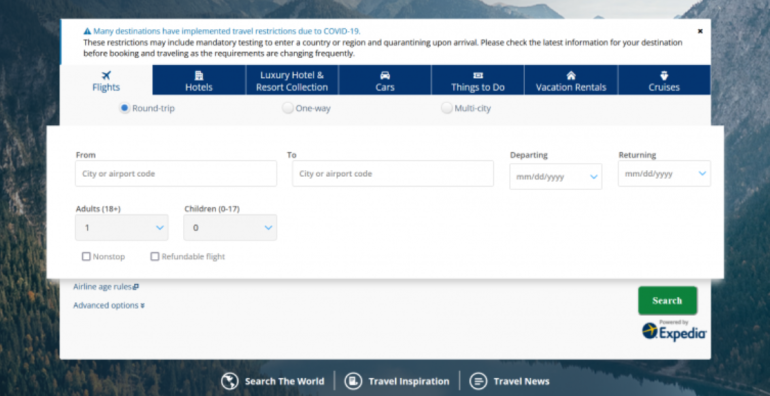

The Chase travel portal works much like an online travel agency (OTA) similar to Orbitz or Priceline where you can book hotels, flights, cars, activities and cruises. But unlike a traditional OTA, with the Chase travel portal you can book travel with your Chase card’s rewards points, cash or a combination of the two.

Who can use the portal?

A handful of exclusively Chase-issued credit cards grant cardholders access to the Chase travel portal, but how you can utilize the portal and the value you can receive is card-specific.

The following credit cards are the only cards that earn Chase Ultimate Rewards points outright:

- Chase Sapphire Reserve®

- Chase Sapphire Preferred® Card

- Ink Business Preferred® Credit Card * The information for the Ink Business Preferred® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

But if you or a household member own at least one of the cards above, the rewards on the following cash-back credit cards can be combined with any of the cards listed above and used as Chase Ultimate Rewards points:

- Chase Freedom Flex℠ * The information for the Chase Freedom Flex℠ has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Chase Freedom Unlimited®

- Ink Business Cash® Credit Card

- Ink Business Unlimited® Credit Card

And while the points earned cannot be combined with any of the UR-earning cards, the following pay-in-full card does have access to the Chase travel portal:

- Ink Business Premier℠ Credit Card * The information for the Ink Business Premier℠ Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Is the portal worth using?

It’s often said that having the right travel credit card is important, but knowing how to redeem your miles and points can be as paramount as which card you use to earn them. However, not everybody has the patience or interest to learn the intricacies of different rewards programs to maximize the value of every mile and point.

So while transferring UR points to individual loyalty programs is still one of the best ways to get the most cents per point at a 1:1 basis, for those who value simplicity, the Chase travel portal offers a straightforward way to book travel, earn and redeem points and still receive a great deal. Best of all, you won’t be limited by any loyalty program or award space availability.

When transferring points, the minimum you can transfer is 1,000 points to the following UR travel partners with either the Chase Sapphire Reserve, Chase Sapphire Preferred or the Ink Business Preferred cards:

Regardless of how you’re using the Chase travel portal, it’s worth considering the pros and cons.

- The standard rate for Ultimate Rewards points when redeemed for travel through the Chase travel portal is 1 UR point = 1 cent, but can be worth significantly more with the UR-earning cards. The Chase Sapphire Reserve gets a redemption value of 1.5 cents per point through the Chase Travel℠ portal while the Chase Sapphire Preferred and Chase Ink Business Preferred cards each get 1.25 cents per point.

- Since you’re not limited to any loyalty programs, you can use your UR points to book boutique hotels that you’d otherwise only be able to book with cash.

- Flights booked through the Chase travel portal can earn frequent flyer miles and can be used toward advancing your elite status.

- You can earn a substantial amount of bonus points when booking through the Chase portal depending on the card you’re using.

- You can use a combination of points plus cash to purchase your reservation.

- Hotels booked through the Chase travel portal do not earn hotel points or credits toward elite status. Any elite status perks you’d receive if booking directly with the hotel will likely be forgone.

- If you experience any issues while traveling, you’d have to go through Chase to resolve the issue. For example, if there is a problem with your hotel reservation, you’ll have to contact a Chase representative for help resolving it since you didn’t book directly with the hotel. Dealing with a middleman during travel emergencies is less than ideal and something to be wary of when considering booking through the portal.

- Southwest Airlines flights do not show up in the UR travel portal, but can be reserved by calling the Chase Travel Center at 855-233-9462.

How to book travel through the Chase travel portal

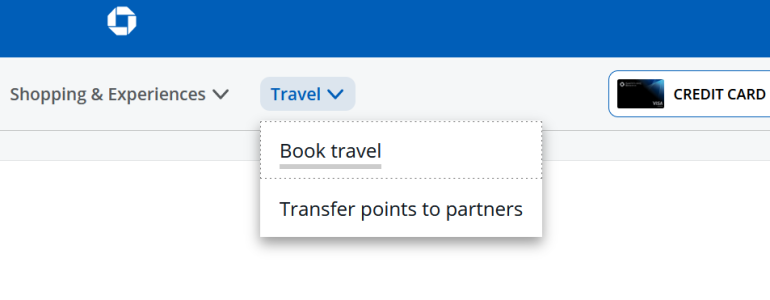

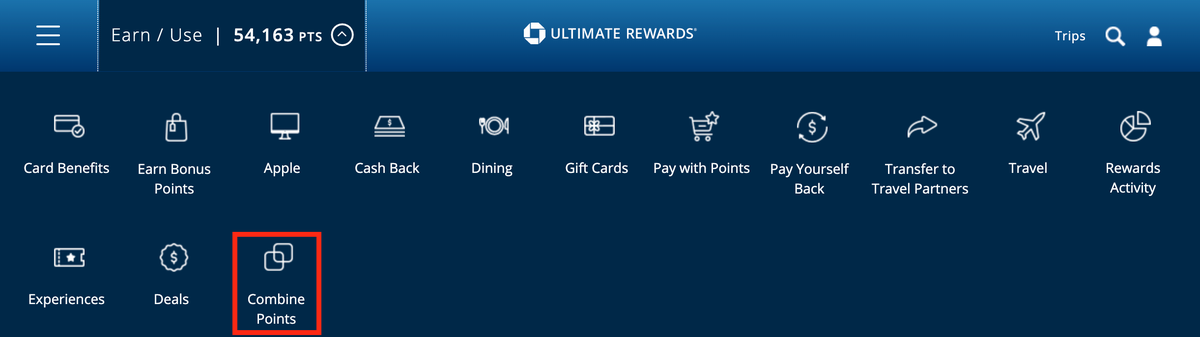

You can access the Chase travel portal by logging into your Chase account and clicking on the Rewards balance on the right or by going to the Chase Ultimate Rewards website .

Once you’re logged in, if you have more than one UR-earning Chase card, you’ll be asked to select one to proceed with — a crucial step as each card has different earning and redemption rates.

After clicking on your selection, you will be taken to the Ultimate Rewards dashboard. If you click on the Earn / Use dropdown button, all of your Ultimate Rewards options will be presented. Click on Travel to proceed to the portal.

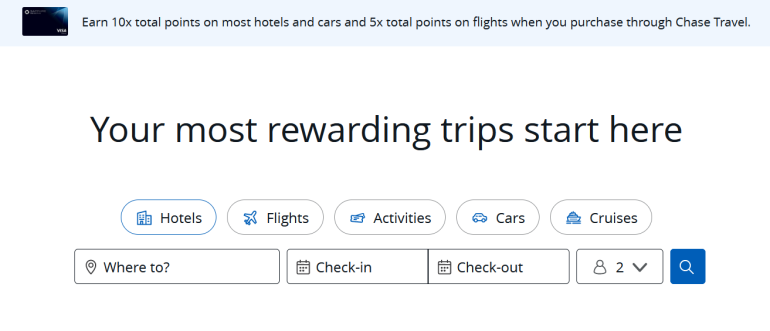

Once in the travel portal, you’ll have the option of selecting the type of booking you’d like to make.

From there, your user experience will be similar to any other OTA where you can search your travel options.

Because the Chase travel portal doesn’t limit you to transfer partners or loyalty programs, you’ll be able to search almost all major airlines. One notable exception is Southwest Airlines, which is still bookable using UR points but will require a phone call to the Chase Travel Center to reserve your flight.

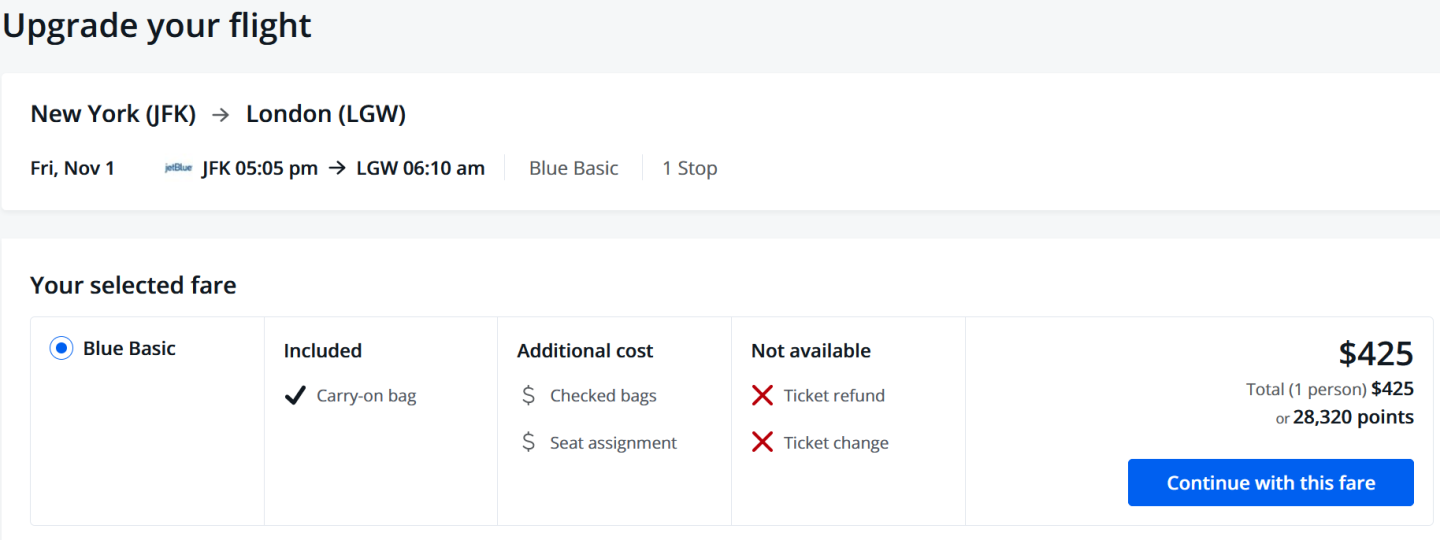

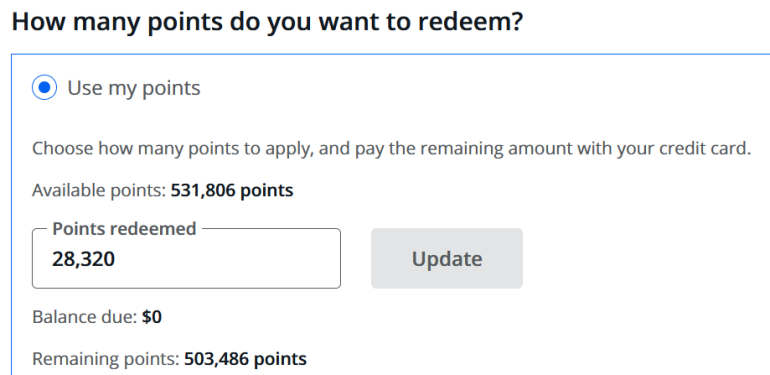

One difference compared to a traditional OTA is the option to buy in cash, points or a combination of both.

If you’re short on points or if you’d like to offset the cash price with some points, you’re given the option to choose how to pay.

After that, you’ll be prompted to enter your traveler information and you’re all booked. However, you will have to log into the specific airline with your reservation code in order to reserve seats.

Booking hotels through the Chase travel portal is a similar process. And with the portal’s easy-to-use search function, you can find boutique hotels that would otherwise be unbookable with loyalty-program-based points.

However, if you have elite status with a hotel chain, you’ll want to book directly rather than going through the Chase portal in order to access status benefits and have that hotel stay count toward achieving a higher status. Or, you can transfer UR points to one of three UR hotel loyalty program transfer partners, including Marriott Bonvoy, World of Hyatt or IHG One Rewards.

Rental cars can also be booked through the portal in a similar fashion. And as in many cases, being aware of which card you’re booking your car rental with can make a big difference in case of an accident as both the Chase Sapphire Reserve and Chase Sapphire Preferred offer primary car insurance , an uncommon, money-saving benefit, which saves you from having to file a claim with your private car insurance carrier first.

A quick guide to the Chase Ultimate Rewards program

As some of the most sought-after flexible points, Chase Ultimate Rewards can be accrued through several avenues. The most lucrative way is by applying for Chase credit cards and earning their respective welcome bonuses — but be wary of Chase’s 5/24 rule , which blocks applicants from opening a Chase credit card if they’ve opened five or more cards from any issuer in the past 24 months.

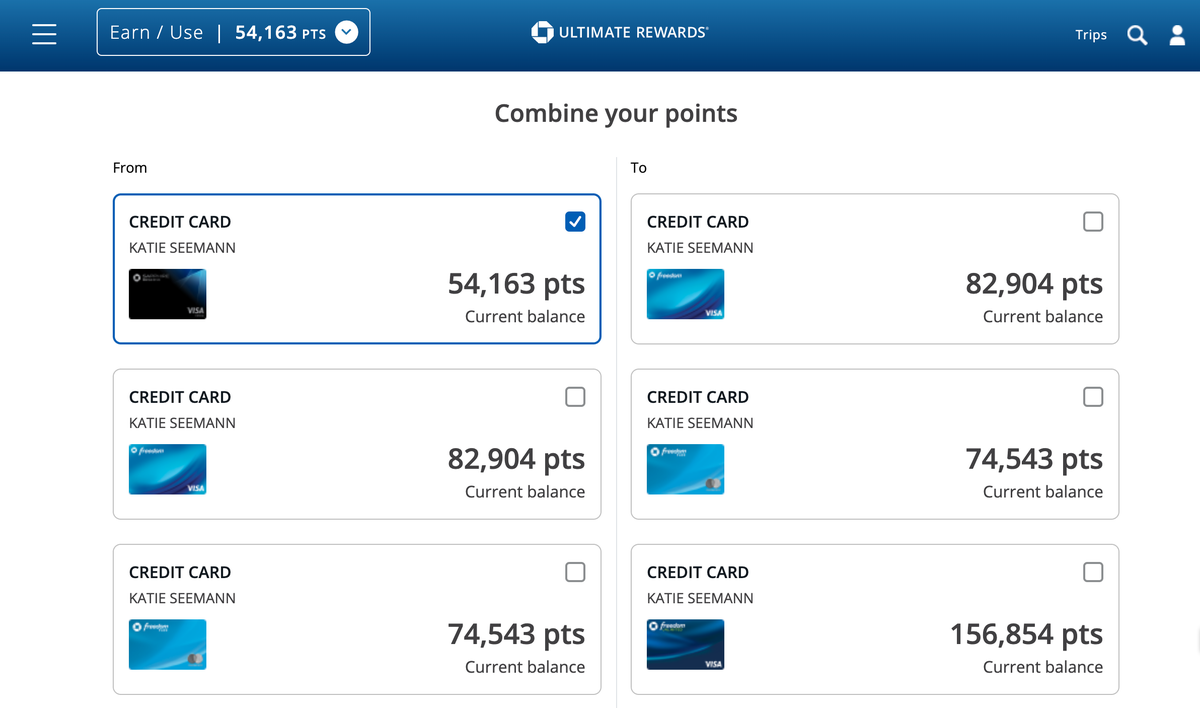

If you have two Chase cards that earn UR points, you can then transfer the rewards earned to the card that carries the most redemption value. For example, you can open the Chase Sapphire Preferred card and then the Chase Freedom Flex and move any points earned on the Flex card to the Preferred card, which has a boosted value of 25% more when redeemed through the portal.

Looking to add more than one new credit card to your wallet? Here’s why you shouldn’t apply for multiple cards at the same time.

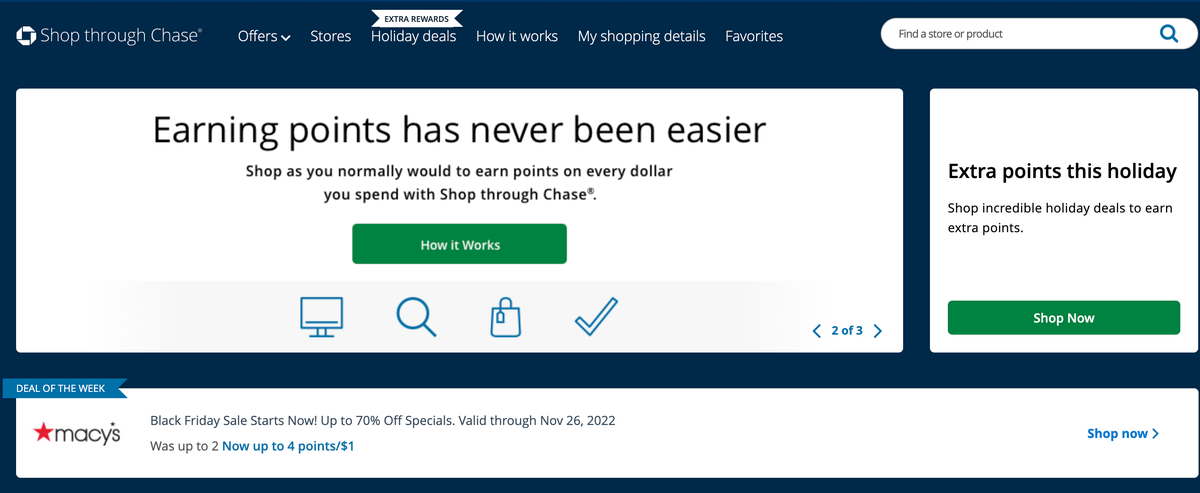

Outside of regular credit card spending, you can also grow your Ultimate Rewards pile by using the Chase shopping portal. By adding just one extra step to your online shopping, you can earn bonus points for your future travels.

While transferring points to partners is one option to maximize the value of your Chase Ultimate Rewards points, there are numerous other ways to use the Chase Ultimate Rewards program to your benefit. Whether it’s redeeming your points as a statement credit for eligible, rotating categories throughout the year through the “Pay Yourself Back” feature, booking special dining experiences with your points or using the portal to book your next vacation, the Chase Ultimate Rewards program’s flexibility makes it a great option regardless of your lifestyle.

Frequently asked questions (FAQs)

Chase Ultimate Rewards (UR) are Chase Bank’s flexible rewards currency that can be earned on several of its credit cards.

The Chase travel portal can be accessed through the Chase app or the Chase website. After logging in, you can select the option to book travel.

You can use your Chase travel credit, like the up to $50 annual hotel statement credit offered by the Chase Sapphire Preferred, by booking your travel through the Chase travel portal. The statement credit will automatically be applied to your account within one to two billing cycles after your purchase posts to your account — up to an annual maximum accumulation of $50.

You can redeem your Chase Ultimate Rewards directly through the travel portal with almost all major airlines with the exception of Southwest Airlines, which can be booked over the phone. With Southwest, select the flight you want at Southwest.com and then call Chase Travel Center at 855-233-9462 with the flight details.

The value you receive from the Chase travel portal will depend on the credit card you’re using. For example, if you have either the Chase Sapphire Reserve or the Chase Sapphire Preferred, your points are worth either 50% or 25% more, respectively, when redeemed for travel.

*The information for the Chase Freedom Flex℠, Ink Business Preferred® Credit Card and Ink Business Premier℠ Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Tamara Aydinyan has been traveling the world with the help of miles and points for over a decade and enjoys teaching others to do the same. When she's not on the move, you can find her in Los Angeles or New York City, or on Instagram @deadlytravel.

Julie Stephen Sherrier is a personal finance writer and editor based in Austin, TX. She is the former senior managing editor for LendingTree, responsible for all credit card and credit health content. Before joining LendingTree, Julie spent more than a decade as the managing editor and then editorial director at Bankrate and CreditCards.com. She also served as an adjunct journalism instructor at the University of Texas at Austin.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Capital One Venture X benefits guide: Packed with premium perks for a lower fee than its peers

Credit Cards Carissa Rawson

Credit card application rules by issuer

Credit Cards Lee Huffman

Why the Chase Ink Business Unlimited is part of my core credit card setup

Credit Cards Eric Rosenberg

U.S. Bank Business Platinum review 2024: It’s got one job – an intro APR for purchases and balance transfers

Credit Cards Julie Sherrier

How to do a balance transfer with Capital One

Credit Cards Harrison Pierce

Amex Gold vs. Chase Sapphire Reserve

Credit Cards Natasha Etzel

How to avoid interest on a credit card

Credit Cards Sarah Brady

New Citi Strata Premier Card layers on the perks, replaces the Citi Premier Card

How do credit card refunds work?

Credit Cards Tamara Aydinyan

I’m an expat, and here’s why I love my Bank of America Travel Rewards card

Credit Cards Kelly Dilworth

Amex purchase protection benefits guide

Credit Cards Ryan Smith

Limited-time 75K offers on Chase Sapphire Preferred and Sapphire Reserve

Credit card statement balance vs current balance: What’s the difference?

Credit Cards Michelle Lambright Black

Check it out: This is what the average household spends on grocery costs per month

Credit Cards Stella Shon

Capital One Quicksilver benefits guide 2024

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Chase’s Travel Portal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use Chase's travel portal?

How to use chase's travel portal, other things you can do in chase's portal, chase travel contact options, chase's travel portal can be lucrative.

Chase Ultimate Rewards® points are among the most useful rewards you can earn. When it comes time to redeem them, you will be directed to Chase's travel portal. This is where you can book flights, hotels and rental cars with points, redeem them for merchandise and gift cards, or transfer points to other programs.

Should you redeem points to pay for a trip instead of using cash or transfer them to a loyalty program partner to get better value? You'll need to do a little homework to find the right answer as each situation is different.

Chase points are the currency you earn when using cards like Chase Sapphire Preferred® Card or Chase Sapphire Reserve® . They are superior in many ways to other point currencies because you earn more than one penny in value per point with these two cards. For example, when redeeming through Chase's travel portal, the Chase Sapphire Reserve® will net you 1.5 cents in value per point and the Chase Sapphire Preferred® Card will net you 1.25 cents in value per point. When you transfer to a partner, your per-point-value may be even greater.

With the travel portal, you can redeem points to pay for an entire trip or you can use a mix of points and cash to cover a travel booking. You can also pay all in cash, earning 5 to 10 points per $1 spent, depending on the card you have. Using points for travel is the most valuable way to extract value from Chase Ultimate Rewards® for most people.

It's an efficient website, but some irritants snag even savvy travelers. Let's dig into Chase's travel portal's good and bad. You'll find that it is mostly good, if not great.

Chase cards vary in earning and redemption benefits so you will want to pay attention to which one you use, especially if you have more than one card. The most valuable cards earn Ultimate Rewards® points, but some Chase cards, like the United℠ Explorer Card , earn miles or points in that co-branded program (in this example, United MileagePlus miles ).

Let’s review the cards that earn Chase Ultimate Rewards®, with the most rewarding cards first. Keep in mind that if you have more than one of these cards, you can move points between Chase Ultimate Rewards® accounts to redeem them from an account that delivers more cents per point in value.

These cards earn Chase Ultimate Rewards® and provide access to Chase's travel portal:

Chase Sapphire Reserve® .

Chase Sapphire Preferred® Card .

Ink Business Preferred® Credit Card .

Chase Freedom Unlimited® .

Chase Freedom Flex℠ .

Ink Business Cash® Credit Card .

Ink Business Unlimited® Credit Card .

Chase Freedom Rise Credit Card.

There is an important perk to remember if you have multiple cards. Since the Chase Sapphire Reserve® card offers 1.5 cents in value per point and the Ink Business Preferred® Credit Card and the Chase Sapphire Preferred® Card offer 1.25 cents in value, it is best to redeem points from these accounts rather than any other Chase card. c

If you have one of those two premium cards and another Chase card (like Chase Freedom Unlimited® , for example), you can move your Ultimate Rewards® points from the Chase Freedom Unlimited® account to a premium card’s account (like the Chase Sapphire Reserve® card).

This strategy allows you to unlock half a cent more in value in seconds. It’s one of the best benefits of Ultimate Rewards® when you have a premium card and one of its no-fee cards.

Want to earn a bunch of points quickly to make a redemption? The sign-up bonuses on these cards can rake in extra points if you meet the terms and conditions.

on Chase's website

• 5 points per $1 on travel booked through Chase.

• 3 points per $1 on dining (including eligible delivery services and takeout), select streaming services and online grocery purchases (not including Target, Walmart and wholesale clubs).

• 2 points per $1 on other travel.

• 1 point per $1 on other purchases.

Point value in Chase's travel portal: 1.25 cents apiece.

• 10 points per $1 on Chase Dining, hotel stays and car rentals purchased through Chase.

• 5 points per $1 on air travel purchased through Chase.

• 3 points per $1 on other travel and dining not booked with Chase.

Point value in Chase's travel portal: 1.5 cents apiece.

• In the first year, 6.5% cash back on travel purchased through Chase, 4.5% cash back on drugstores and restaurants, and 3% on all other purchases on up to $20,000 in spending.

• After that, 5% cash back on travel purchased through Chase, 3% cash back at drugstores and restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Point value in Chase's travel portal: 1 cent apiece.

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

» Learn more: The best travel credit cards right now

Here’s a primer on what you can and cannot do with Ultimate Rewards® points.

Log in to your account, then navigate to the Chase Ultimate Rewards® tab on the right of the screen. If you have more than one card that earns this currency, you can see each balance and select the account from which you want to redeem points.

Once you select the card, you’ll be taken to a homepage that shows the points you have earned and how you can redeem them. We recommend sticking to travel redemptions rather than using points for merchandise as the value diminishes significantly with the latter.

Select the "Travel" tab at the top of the screen. From here, you can decide whether to transfer points to a partner or redeem them as cash for a trip.

One of the best perks of using this travel portal to make a points redemption is that you still earn frequent flyer miles on most airline tickets since these are booked as a revenue ticket (not as an award redemption like when using airline miles to book a flight).

How to book award flights in Chase's travel portal

This is one of the more popular features of using points, but keep in mind it doesn't feature all airlines, which can be frustrating. Even if you find a flight on an airline's website or third-party booking site, it doesn't mean it will be available at Chase.

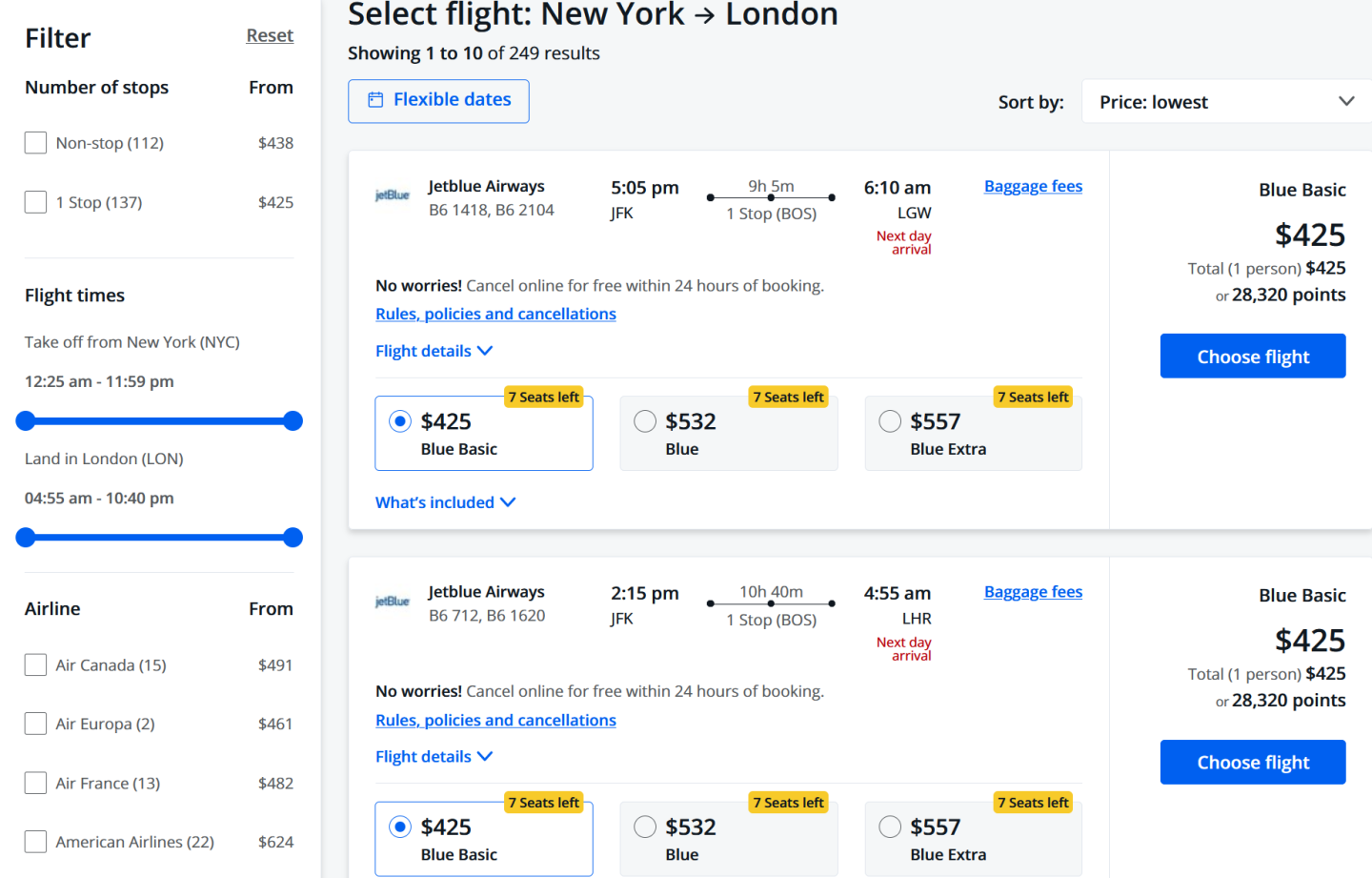

Enter the relevant details in the search bar to find a flight. Results can be filtered by stops, airline or price. Another benefit of this portal is that you aren't subject to award seat availability in the same way you might be when redeeming miles through an airline's program.

If there is a seat that could be bought with cash, you can usually redeem points for it. Plain and simple.

Compare how many miles you would need if booking directly with the airline with what Chase is charging.

If it would cost fewer points to book directly with the airline, you’ll want to use miles instead. For example, Delta co-branded American Express cardholders can often redeem their miles like cash on Delta’s website (at 1 cent per mile’s value). That’s just average, but if it is cheaper than what Chase is charging, consider that the better option. But don’t forget that airlines will add on taxes and fees when redeeming miles . Airfare booked with Chase Ultimate Rewards® points don't have additional costs tacked on — these are already bundled into the fare.

Another important note is that some low-cost airlines like Allegiant don't appear in search results. If you want to travel on a budget airline, then you'll need to visit those websites to compare fares.

You can pay in cash, points or a combination. Chase will display particular details about your fare, like whether assigned seats or checked bags are included. This may not take into account any elite status perks you hold.

How to book hotels in Chase's travel portal

You can also redeem points for hotel stays using Ultimate Rewards® points. This is great news, especially when staying at hotels where you may not have elite status or don't care about elite perks or points earned.

Keep in mind that when making a reservation outside a hotel’s official reservation channels, you won’t earn points in its program or be able to take advantage of elite status benefits. So if you have status with a hotel chain, this isn't the best value unless you are willing to forgo those benefits.

Making a reservation is straightforward. Enter the city and travel dates to see a list of hotels available for redemption. Then, you can redeem points or pay in cash for your trip.

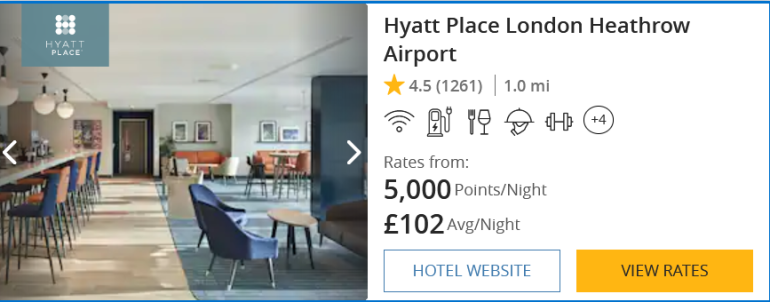

Like with flights, compare the cost of Chase Ultimate Rewards® points with the number of points a hotel’s program is charging. A particular favorite is World of Hyatt, which still uses an award chart and, as a transfer partner of Chase Ultimate Rewards®, can often deliver more favorable deals when using Hyatt’s points rather than Chase points.

For example, it would cost about 9,000 Chase Ultimate Rewards® points to redeem a night at Hyatt Place London Heathrow Airport. But, if you transfer points to World of Hyatt, you would need 5,000 points for the same night’s stay.

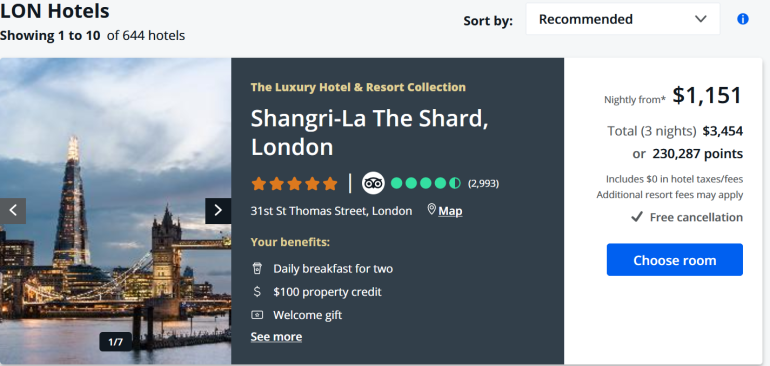

One of the booking tabs also leads to the Chase Luxury Hotel & Resort Collection . This subset of high-end hotels delivers bonus perks like free breakfast, a $100 hotel credit and room upgrades, depending on the property and other things.

You can book directly through Chase or redeem points and be eligible. It’s nice to have elite status-style perks at a hotel where you may not have status or that doesn't have a loyalty program.

How to book car rentals in Chase's travel portal

This is a great place to reserve rental cars using points, and Chase rental car insurance benefits apply when using the card and paying with points. But, for that to be the case, you will want to pay for part of the rental in cash so the insurance benefits are activated. To do that, pay with a combination of cash and points, and decline the rental company's insurance first.

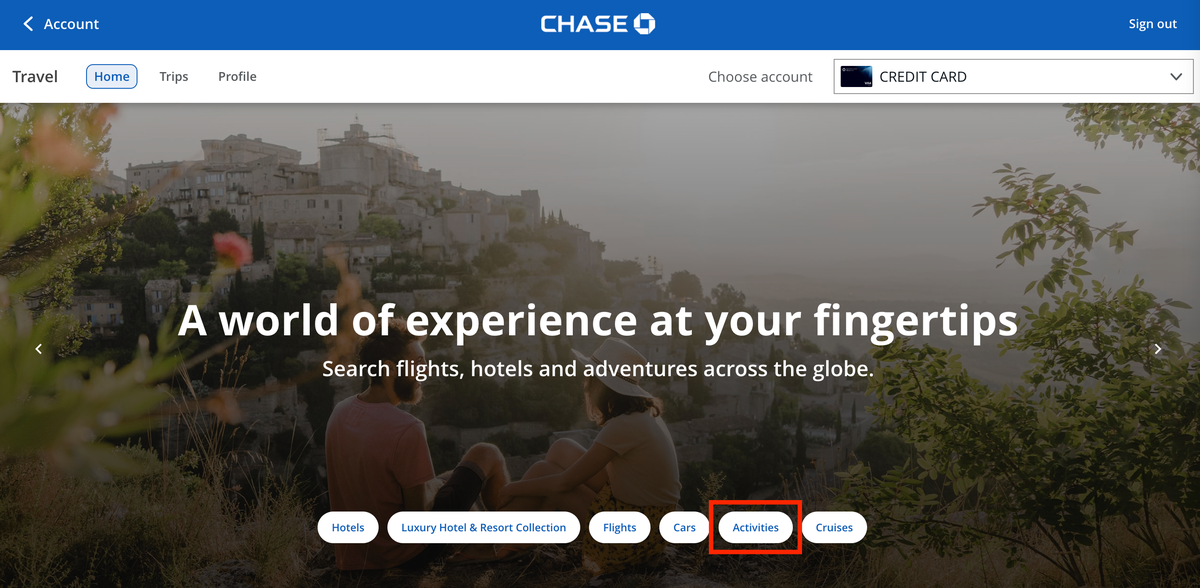

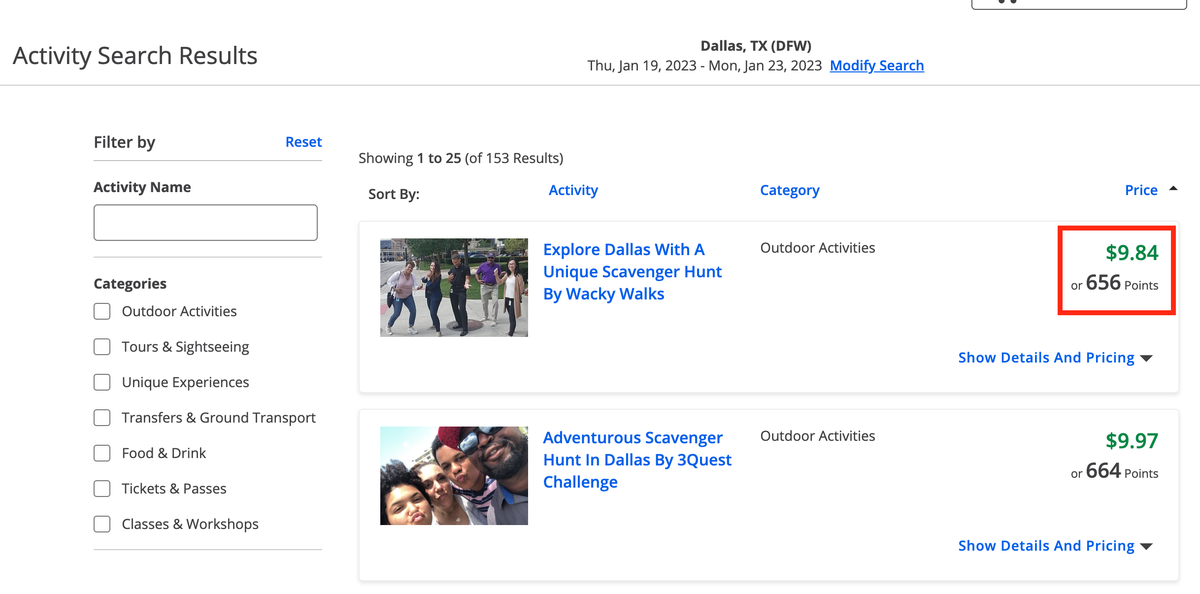

How to book activities in Chase's travel portal

Activities available for booking through Chase's travel portal include tours and experiences at home or when traveling and airport transfers. Price comparison plays a role here, too, since many hotel brands have their own platforms like Marriott Bonvoy Moments or FIND Experiences from World of Hyatt. These allow you to redeem points for experiences.

Check which program is cheaper before redeeming Chase points if you find similar options in either program.

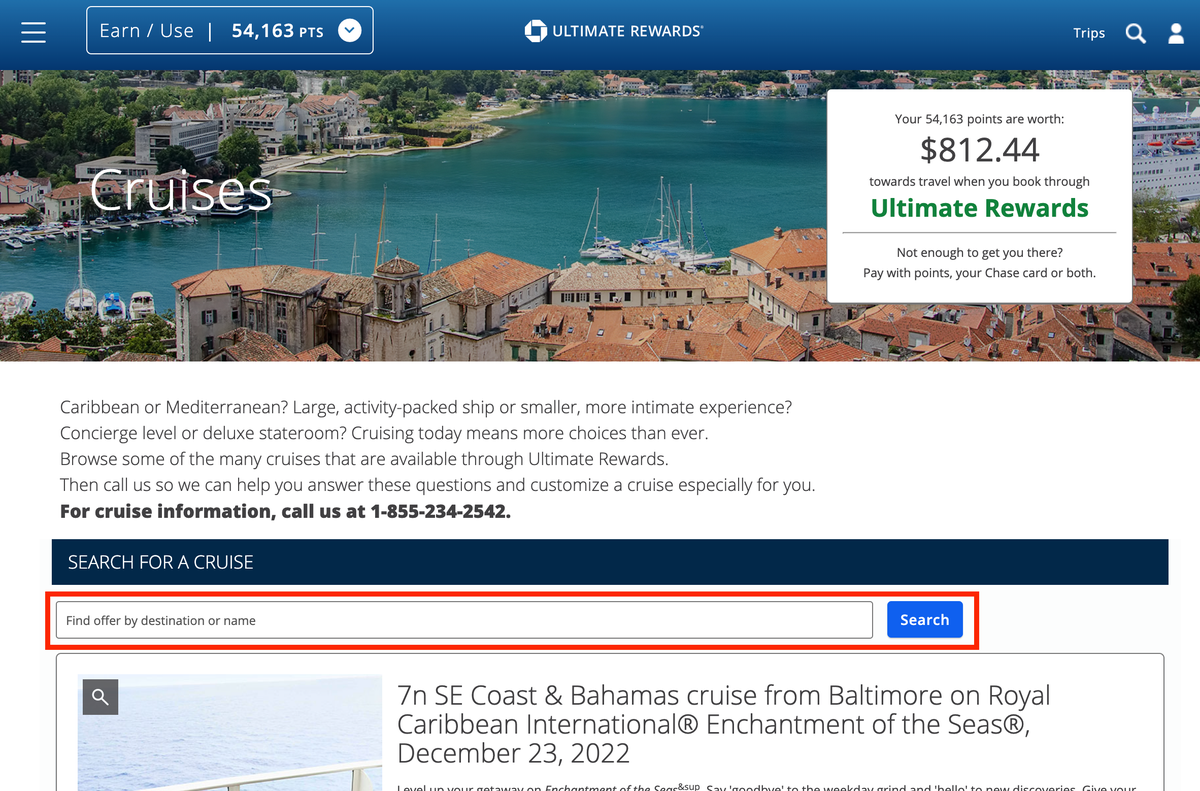

How to book cruises in Chase's travel portal

Since cruise bookings can be more complex, you will need to call Chase Ultimate Rewards® at 855-234-2542 to make a reservation. There are many ways to earn multiple points when booking a cruise that may be better than using Chase, but when redeeming points for a cruise , there can be a lot of value.

Using Chase's portal to make a travel reservation is also strategic, as depending on your card, you can earn a healthy stash of points this way. Just be sure to compare the benefits you can earn with the opportunity cost of booking elsewhere.

Benefits of booking travel in Chase's portal

Let’s say you have a premium card like Chase Sapphire Reserve® . It earns 5x points per $1 when booking flights through the portal. The sweet spot is when using this card for hotel stays and rental cars booked via the portal for 10x points per dollar spent. Consider what’s in your wallet, and decide which card will net the most points.

Another benefit is that you will earn miles from flights booked through the portal, even when redeeming Chase Ultimate Rewards® points since these are viewed as a revenue ticket.

Remember, you will want to compare if it is cheaper to redeem airline miles directly through a carrier’s redemption program or if you can use fewer points by redeeming Chase points via the portal.

Sometimes it might make more sense to transfer points from Chase to an airline partner when redeeming a flight (or a hotel program when making a hotel stay). Be as vigilant with price comparison when redeeming miles and points as you would when using cash.

Does Chase's travel portal price match?

No. You cannot submit a lower fare elsewhere for a price guarantee here since this isn't a publicly available site. It is only available to those who have a Chase card.

What else you need to know

When booking through this reservation site, keep in mind that most airlines and hotels cannot assist directly with a reservation. They see this as a third-party booking through Expedia and will direct you to Chase's agents.

Many travelers report the experience can be frustrating when travel disruptions or cancellations occur. Agents are friendly but can sometimes be limited in their abilities, often reading prompts on their screens in international call centers.

It can be a hazard booking a reservation with a third party, but the trade-off in redeeming points is worth it for some travelers.

If you do need to contact a Chase portal agent for support on a reservation made through the site — whether for a flight, hotel booking, car rental or activity — you've got one option: a good, old-fashioned telephone call.

Dial 866-331-0773 for assistance regarding changes or cancellations to your bookings.

You might have better luck dialing the support line for your specific Chase card. You might opt to give one of these a try:

Chase Sapphire Reserve® : 855-234-2542.

Chase Sapphire Preferred® Card : 866-331-0773.

All other cards: 866-951-6592.

If you compare prices and consider the opportunity cost of using the portal instead of booking elsewhere, you can almost always come out ahead.

You can save money, earn bonus points and travel better with transferable loyalty points like Chase Ultimate Rewards®. They have the flexibility and versatility necessary to deliver excellent value on travel (rather than being locked into one airline or hotel loyalty program). With the right card (or suite of cards), you’ll be able to accumulate points and benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Dream, discover, book with Chase Travel

Go further when you book with Chase Travel

Competitive rates.

Take advantage of competitive rates at thousands of hotels and resorts, with no booking fees.

Seamless booking

Smoothly plan and book your whole trip, from coveted hotels and convenient flights to cars and must-do local experiences.

Premium benefits

Make the most of your card rewards. Access exclusive benefits and earn and redeem like never before.

Find inspiration

Don’t just dream it. Discover your next adventure with help from fresh trip recommendations and curated picks for unforgettable stays.

Get rewarded

Earn and redeem Ultimate Rewards points with your eligible Chase card, including Chase Sapphire, Freedom, Ink Business credit cards and more.

Earn up to 8,000 bonus points or more

Eligible cardmembers can purchase a trip through Chase Travel with their eligible Chase credit card and get rewarded with 5,000 bonus Ultimate Rewards points when purchasing 2 qualifying travel components, or 8,000 when purchasing 3. Choose from hotels, flights, cars and cruises.

Haven’t traveled with us in a while? You may be eligible for an extra 2,000 bonus points.

Activate and book March 1 to May 31, 2024 for stays through the end of the year.

How much is Chase’s new travel card welcome bonus?

About chase’s premium travel cards, how can i redeem the new 75,000-point bonus, do i qualify for the new chase welcome offer, the chase sapphire preferred’s new 75,000-point bonus could cover your next trip.

If you're interested in a premium travel credit card, act fast to earn this limited time offer.

Dashia Milden

Dashia is a staff editor for CNET Money who covers all angles of personal finance, including credit cards and banking. From reviews to news coverage, she aims to help readers make more informed decisions about their money. Dashia was previously a staff writer at NextAdvisor, where she covered credit cards, taxes, banking B2B payments. She has also written about safety, home automation, technology and fintech.

Evan Zimmer

Staff Writer

Evan Zimmer has been writing about finance for years. After graduating with a journalism degree from SUNY Oswego, he wrote credit card content for Credit Card Insider (now Money Tips) before moving to ZDNET Finance to cover credit card, banking and blockchain news. He currently works with CNET Money to bring readers the most accurate and up-to-date financial information. Otherwise, you can find him reading, rock climbing, snowboarding and enjoying the outdoors.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

Summer is right around the corner. And the recently elevated welcome bonus Chase is offering on its two premium travel credit cards could help fund your next vacation.

You can earn a 75,000-point welcome bonus if you open a Chase Sapphire Preferred® Card or Chase Sapphire Reserve® and spend $4,000 within three months.

“This is a strong bonus on an excellent card,” said Jason Steele, a credit card expert and CNET Expert Review Board member. “It’s not the highest ever, but it’s better than the standard offer on cards that should be in the wallets of anyone who wants to earn travel rewards.”

The standard welcome bonus for these cards is 60,000 points, and we’re not sure when this offer will expire. But history tells us it won’t last long. Here’s what to know if you’re on the fence about whether either of these cards are right for you.

Starting now, if you spend $4,000 on qualifying purchases within the first three months of opening a Sapphire Preferred or Sapphire Reserve card, you’ll receive 75,000 points. That means you’ll need to spend at least $1,334 per month to earn the bonus.

That’s a 15,000-point increase from Chase’s typical 60,000 bonus with the same spending requirement and timeframe.

“While we’ve seen slightly higher offers on the CSP in the past, there’s never a guarantee those will return, or if they do, when that will happen,” said Mark Reese, a credit card expert and member of the CNET Money Expert Review Board . With summer vacation around the corner, this is a great opportunity to save hundreds on an upcoming trip.

To earn this bonus, you can pay your bills with your credit card to reach the bonus faster. Or you may be able to earn the bonus if you have a big purchase coming up that you already have the money set aside for, such as home renovations or travel.

Never overspend to earn a credit card welcome bonus. If you’re not able to pay off your balance in full each month, the interest you accrue could quickly wipe out any value you earn in rewards. If you can’t comfortably spend $1,334 per month, it’s not worth trying for this bonus.

The Sapphire Preferred is already our top travel credit card pick. Beyond the welcome bonus, these two popular travel cards have some useful perks for booking a flight or taking a road trip. Have a plan in place for how you want to use the card before applying.

“Both of these cards have excellent travel insurance and purchase protection benefits,” Steele said. “The CSR even has paid roadside assistance and emergency evacuation coverage. Both have primary automobile insurance, along with trip delay and trip cancellation coverage.”

But there are big differences, such as the annual fee, cardholder credits and rewards rates -- which can all make a big difference in the long run. Here’s a quick look at both cards and a comparison to help you determine which one is best for you.

Chase Sapphire Preferred® Card

Chase Sapphire Reserve®

Read more: Chase Sapphire Preferred Card vs. Chase Sapphire Reserve: Which Is Better?

This boosted welcome bonus could help you earn a free flight, hotel stay or other travel accommodations just in time for an end-of-summer trip -- if you earn the bonus before the three-month period ends.

If you redeem the rewards for travel using Chase Travel℠, you’ll redeem points at a boosted rate of 1.25 cents per point with the Sapphire Preferred and 1.5 cents per point with the Sapphire Reserve. That means it could be worth $937 to $1,125.

Beyond the Chase portal, you may also be able to redeem your points at an even higher rate with Chase’s travel partners .

You can also redeem the points toward other purchases, gift cards and statement credits but at a lesser value.

Read more: 6 Reasons the Chase Sapphire Preferred Should Be Your Next Credit Card

Chase’s travel cards usually require good to excellent credit -- so a FICO score of 670 or higher. There are also a few other factors that would disqualify you:

- You cannot be a current Sapphire cardholder.

- You cannot have earned a Chase Sapphire bonus in the past two years.

- You must not have exceeded Chase’s 5/24 rule, which means you cannot have applied for five cards within the past 24 months from any issuer.

If you’re unsure, it’s best to call Chase’s customer service line at 1-800-432-3117 for questions and assistance.

Recommended Articles

Pairing the chase sapphire preferred card and chase freedom unlimited to level up your rewards, chase trifecta: how to use multiple credit cards to maximize your rewards, save on food, travel and more: how to maximize the chase sapphire preferred card, 5 common questions people ask me as a credit card editor.

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and services, we earn a commission. The compensation we receive may impact how products and links appear on our site.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Complete Guide To Using the Chase Travel Portal — Maximize Your Options

Katie Seemann

Senior Content Contributor and News Editor

344 Published Articles 53 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Senior Editor & Content Contributor

98 Published Articles 692 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

Table of Contents

Why book travel through the chase travel portal, cards that earn chase ultimate rewards points, what are chase ultimate rewards points worth, earning chase points by booking travel, how to access the chase travel portal, how to book a flight through chase travel, how to book a hotel through chase travel, how to book a rental car through the chase travel portal, how to book activities through chase travel, how to book a cruise through the portal, how do the prices compare to other sites, other ways to use the chase travel portal, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Chase Ultimate Rewards is one of the major transferrable points programs and a favorite among many travelers. Points are easy to earn and can be transferred to many different hotel and airline partners. But you can also book travel directly through Chase’s travel portal using Ultimate Rewards points.

Booking travel through the Chase Travel portal is simple and can be a great way to use your points.

We’ll show you everything you need to know about how to redeem your points, including the benefits, how to know what your points are worth, and how to book airlines, hotels, and more through the Chase Travel portal.

Generally, you can get maximum value from your Chase Ultimate Rewards points by transferring them to the Chase airline and hotel partners , so why are we talking about using points through a travel portal? While it’s true that the only way to get the highest value redemptions is by transferring, there is still a lot of value to be had by booking directly through the Chase Travel portal.

Flexibility

Flexibility is not often available with points bookings. Unlike an award booking, booking through Chase Travel is like using any other online travel agency (OTA) . There are no blackout dates or limited inventory award seats. If a flight or hotel is available, you can book it with points through the Chase travel portal.

You Can Earn Frequent Flyer Miles

One of the major bummers of booking flights with frequent flyer miles is that you don’t earn miles on award bookings. You can end up doing a lot of travel without earning miles. However, any booking you make with your Chase Ultimate Rewards points through the Chase Travel portal will earn frequent flyer miles and accrue status points. Unfortunately, hotel and car rental bookings still won’t earn points.

We have talked to so many people over the years that love the idea of collecting points and miles but don’t want to deal with the hassle. While many don’t mind putting a little work into getting an awesome redemption, others are just looking for a simple way to book travel and hopefully save some money in the process.

That’s where the Chase Travel portal comes in. With this method of redeeming points, there is no transferring, comparing points values, blackout dates, limited award availability, or multiple travel accounts. You only have to deal with 1 type of point and 1 travel portal but can still retain many of the benefits of collecting points and miles in the first place.

Bottom Line: You can book flights, hotels, rental cars, activities, and cruises through the Chase Travel portal.

If you like the idea of using the Chase Travel portal, you’ll need a credit card that earns Chase Ultimate Rewards points:

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s over $900 when you redeem through Chase Travel SM .

- Enjoy benefits such as 5x on travel purchased through Chase Travel SM , 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel SM . For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Chase Ultimate Rewards

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $1,125 toward travel when you redeem through Chase Travel SM .

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel SM immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel SM . For example, 75,000 points are worth $1125 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass TM Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- APR: 22.49%-29.49% Variable

- Foreign Transaction Fees: $0

The Ink Business Preferred card is hard to beat, with a huge welcome bonus offer and 3x points per $1 on the first $150,000 in so many business categories.

The Ink Business Preferred ® Credit Card is a powerhouse for earning lots of points from your business purchases , especially for business owners that spend regularly on ads.

Plus the card offers flexible redemption options, including access to Chase airline and hotel transfer partners where you can achieve outsized value.

Business owners will also love the protections the card provides like excellent cell phone insurance , rental car insurance, purchase protection, and more.

- 3x Ultimate Rewards points per $1 on up to $150,000 in combined purchases on internet, cable and phone services, shipping expenses, travel, and ads purchased with search engines or social media sites

- Cell phone protection

- Purchase protection

- No elite travel benefits like airport lounge access

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- APR: 21.24%-26.24% Variable

There are also some great cash-back cards from Chase that can be used to book travel through Chase Travel. The points earned on these cards can be converted into cash-back or alternatively, they can be used in the Chase travel portal.

- Chase Freedom Flex℠

- Chase Freedom Unlimited ®

- Chase Freedom ® card (no longer open to new applicants)

- Ink Business Cash ® Credit Card

- Ink Business Plus ® Credit Card (no longer open to new applicants)

- Ink Business Unlimited ® Credit Card

- Ink Business Premier ® Credit Card

It’s easy to earn lots of Chase Ultimate Rewards points , but do you know how much they are worth ? If you’re transferring your Chase Ultimate Rewards points to a travel partner, their value will go up or down depending on the type of redemption.

However, when you are booking your travel directly through Chase’s travel portal, each Chase Ultimate Rewards point has a set value that won’t change . The credit card you have will determine the value of your Chase Ultimate Rewards points.

Transfer Your Points Between Credit Cards for Maximum Value

If you have multiple Chase credit cards, it makes sense to transfer your points to the card with the most valuable redemption rate. The only exception to this is the Ink Business Premier card because points earned on this card can’t be transferred to any other card.

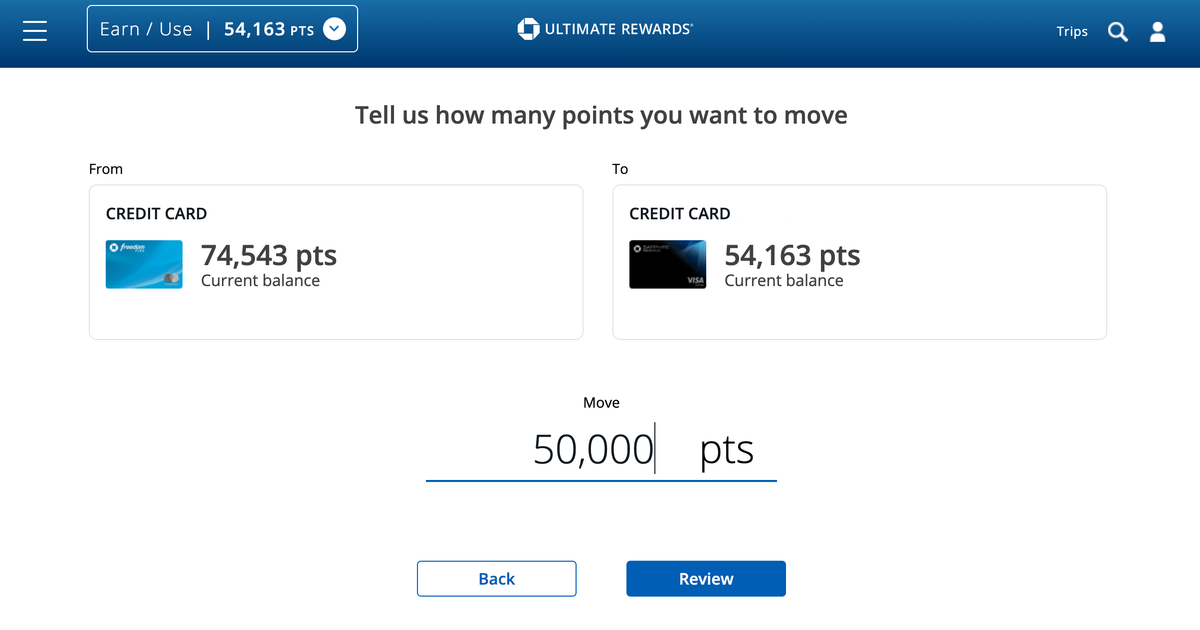

1. To transfer your points between 2 cards, log on to the Chase dashboard and select Combine Points .

2. Then you will be able to select the card you want to transfer points from and the card you want to receive the points. After you choose, click Next.

3. You can transfer all of your points or just what you need. Click Review to continue.

4. Double-check the details and click on the Submit button to complete the transfer.

Bottom Line: Your credit card will determine the value of your Chase Ultimate Rewards points. Your points are worth between 1 to 1.5 cents each depending on which credit card you’re redeeming points through.

What if you’d prefer to pay for your travel with a Chase credit card to earn Ultimate Rewards points? The number of points you’ll earn through the Chase travel portal is dependent on which credit card you have and what type of travel you’re purchasing.

You can log into your account in 2 ways.

First, you can go directly to the Ultimate Rewards website to log in or you can log in through your Chase account .

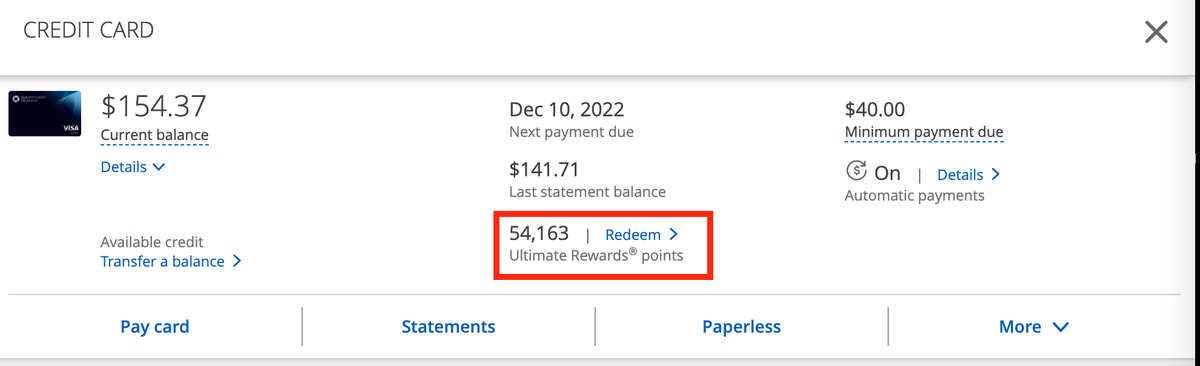

If you’re in your Chase account, click on one of your Ultimate Rewards credit cards and then click on Redeem next to the card’s Ultimate Rewards balance.

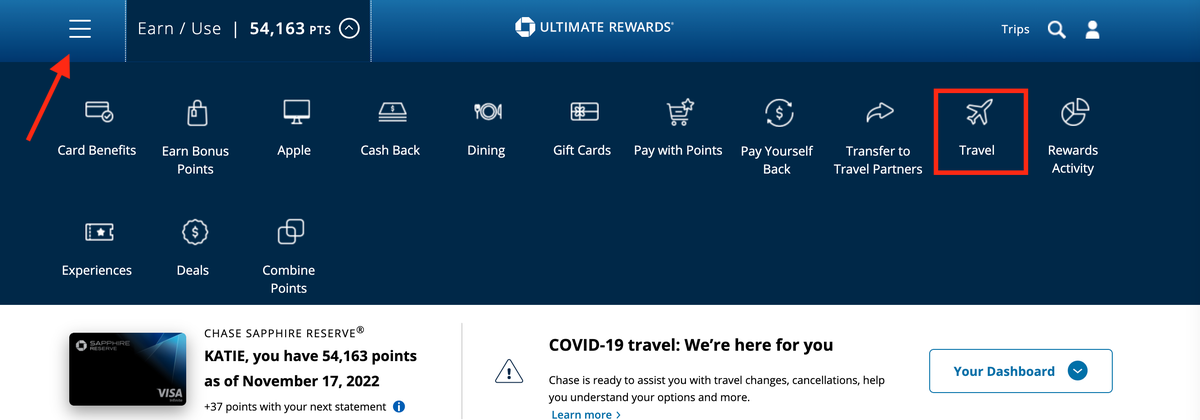

Then choose the card you want to use.

From here you can access Chase Travel by clicking on Travel in the top search box or you can switch to another card’s account by clicking on the 3-line icon in the upper left-hand corner.

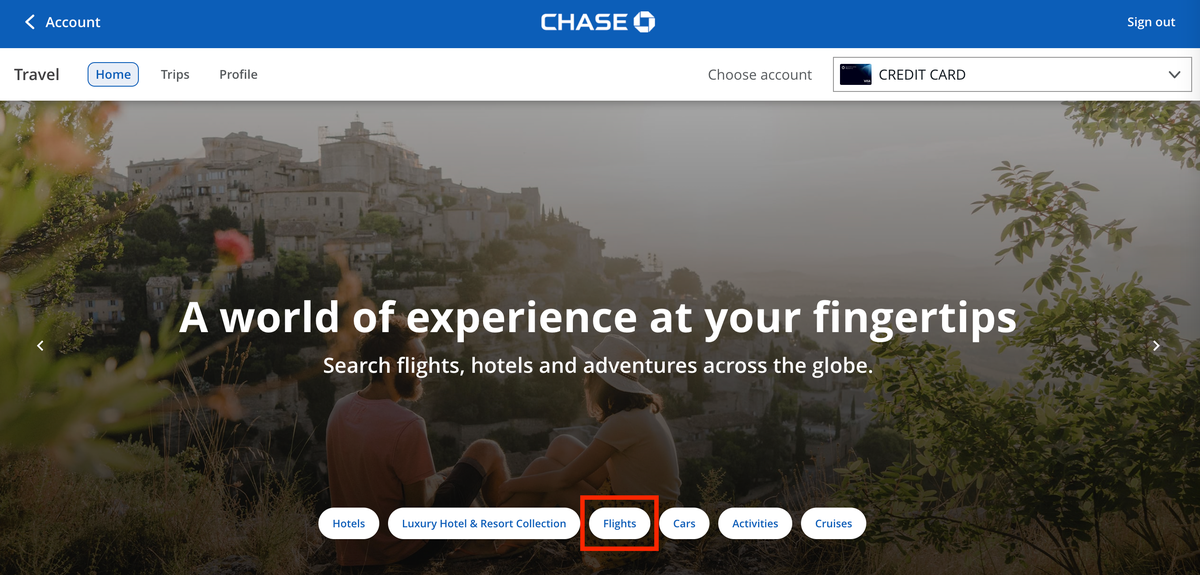

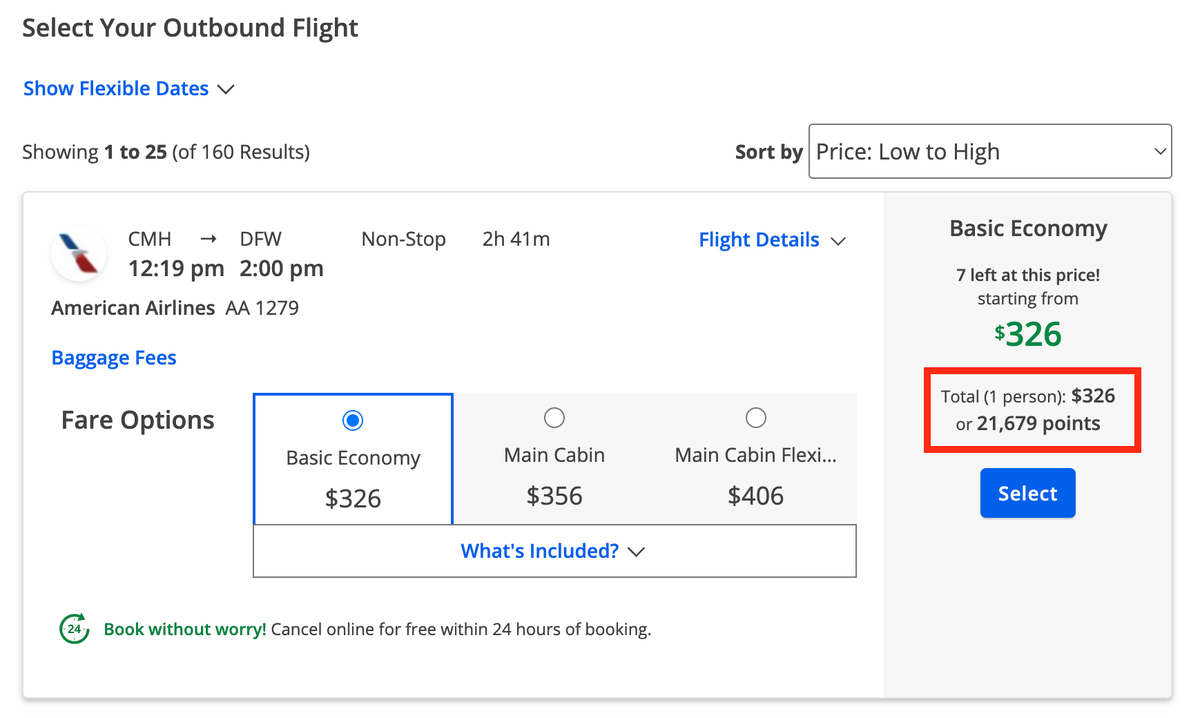

1. In the Travel section of your Ultimate Rewards account, click on Flights to start your search for a flight. As with any other OTA, you begin your search by inputting basic information such as departure and arrival city, travel dates, and the number of passengers.

2. Next, you will be able to narrow your search results . At the left-hand side of the page, you can filter your results by things like airline or flight times. Then you can sort your results by price, trip duration, or times using the drop-down box at the top of the search results.

3. For each flight option, you’ll be able to see the price in dollars and in points on the right-hand side of the results box.

4. Once you’ve found the flight you want, click the blue Select button. Next, you can choose your return flight using the same process as you did for selecting the outbound flight. Click the blue Select button once you have made your choice.

5. From here you can confirm your flight details and select a fare upgrade if you wish. Then, you’ll be able to choose how to pay for your flight . You can pay for the entire purchase with points or a Chase credit card, or you can split your payment between points and a Chase credit card.

6. Finally, input your passenger information next. Don’t forget to add a frequent flyer number, a Known Traveler Number, or a Redress number if you have them.

Hot Tip: When purchasing travel through the Chase travel portal, you can split your payment between Chase Ultimate Rewards points and a Chase credit card.

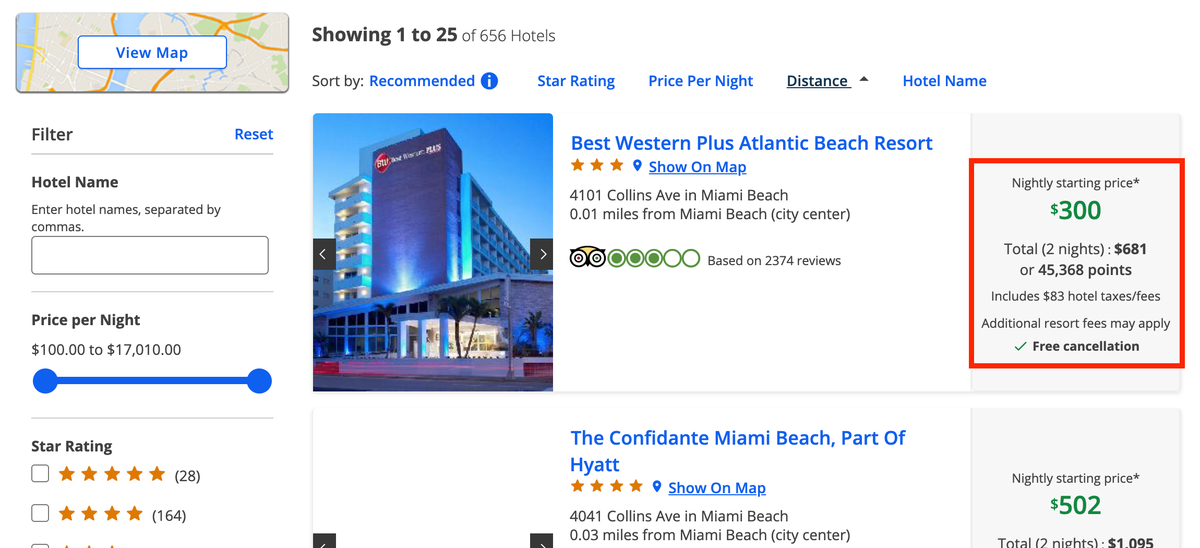

1. To book a hotel through the Chase Travel portal , you’ll need to start by clicking on the Hotels tab in the main search box. Then, input your destination, check-in and check-out dates, and the number of travelers. Next, click on the blue Search button.

2. Your search results will look like other sites that you may be familiar with. You’ll see filtering options to the left and sorting options above your search results.

3. Each search result will show the price in both dollars and Chase Ultimate Rewards points. These prices include taxes and fees with the exception of resort fees.

4. Once you select your hotel, click on Add to Itinerary . You can choose to pay for all or part of your hotel cost using Ultimate Rewards points. Click Begin Checkout to input your reservation details and finalize your booking.

Hot Tip: When booking a hotel through the Chase Travel portal, you won’t be eligible to earn points in the hotel’s loyalty program or take advantage of any elite status you may have.

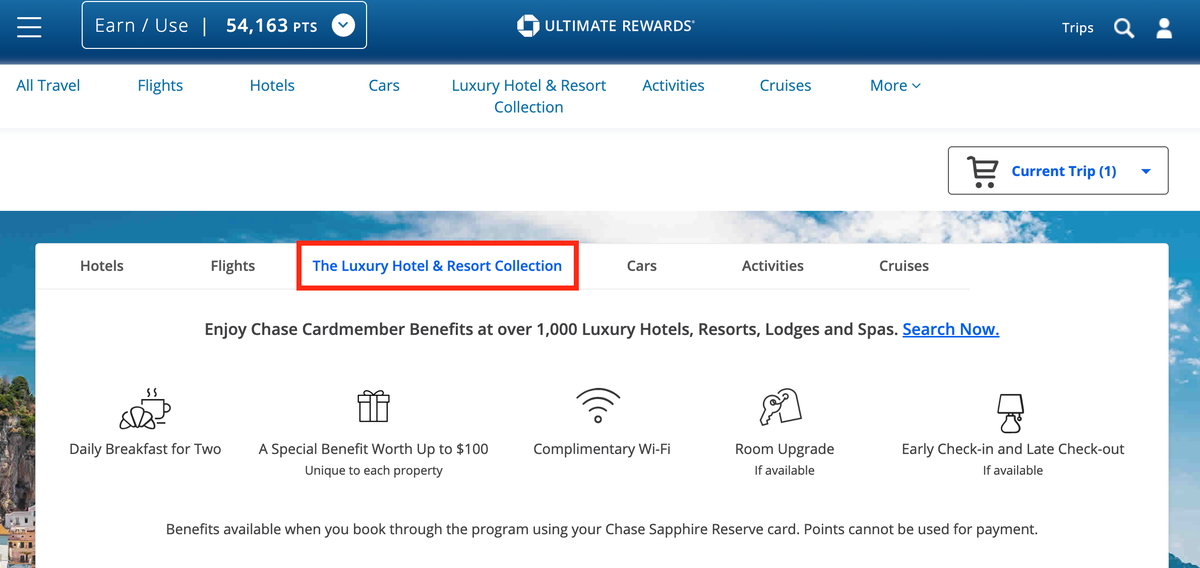

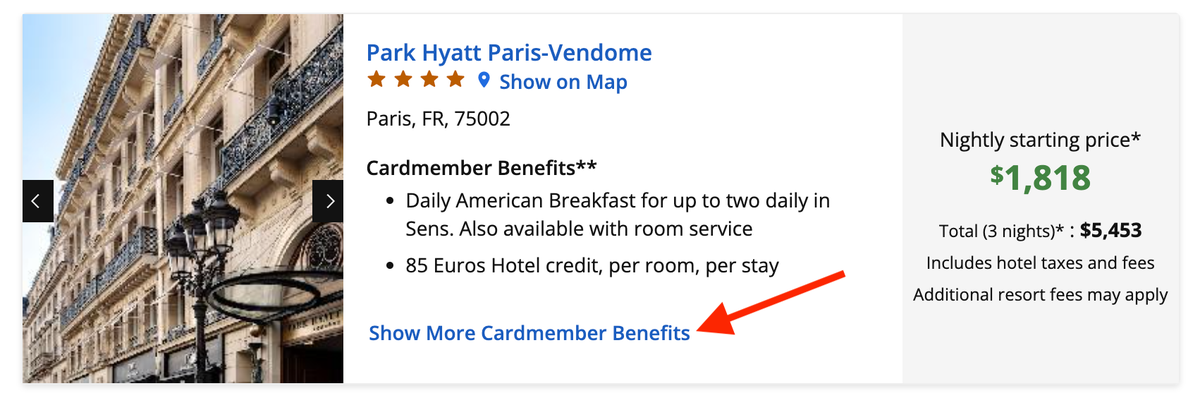

The Luxury Hotel and Resort Collection

The Luxury Hotel and Resort Collection (LHRC) is exclusively for Chase Sapphire Reserve cardholders. From the Ultimate Rewards travel home page, just click on The Luxury Hotel & Resort Collection tab.

Once you are on the LHRC homepage, type in your destination and click Search to view available properties. Each listing will display the property’s unique cardmember benefits. Click on the listing for more information and to continue the booking process.

When booked through the Chase Travel portal, these properties offer the following benefits:

- Daily breakfast for 2

- Special amenity (varies by property)

- Room upgrades (based on availability)

- Early check-in and late checkout (based on availability)

The Luxury Hotel and Resort Collection properties are reservation-only bookings. You’ll make your reservations online and payment doesn’t happen until you check out from the hotel. These bookings will not take Chase Ultimate Rewards points as payment.

Bottom Line: Luxury Hotel and Resort Collection properties are only available to Chase Sapphire Reserve cardmembers. These properties can’t be booked with points.

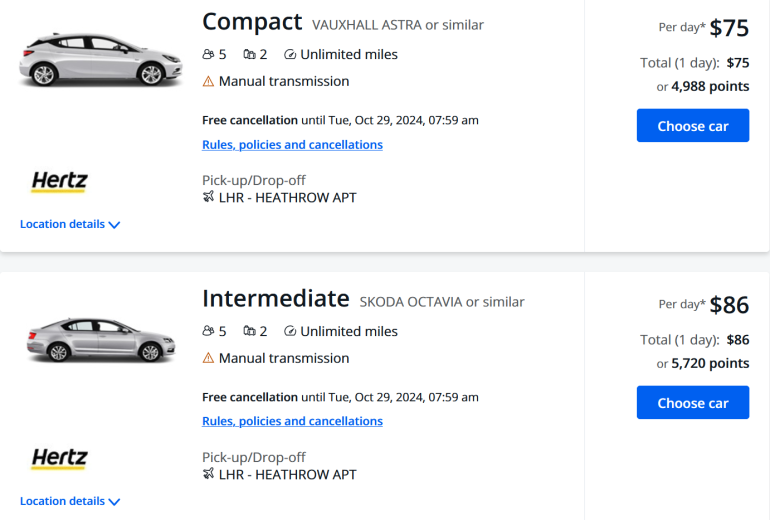

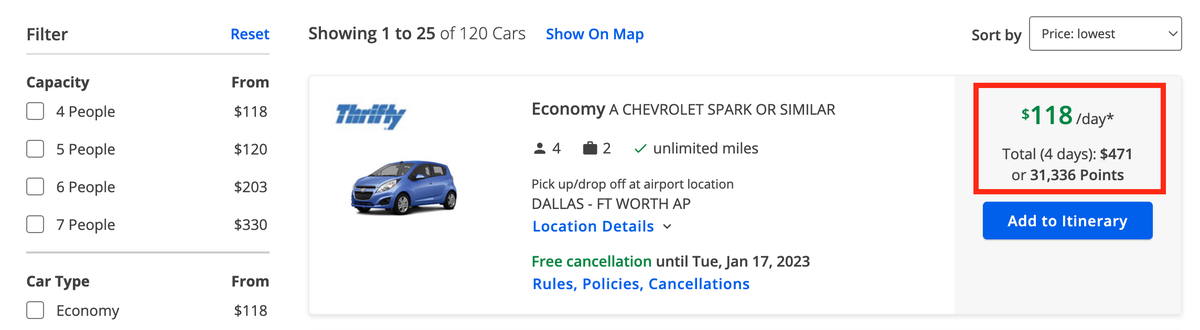

1. To rent a car through the Chase Travel portal, start by clicking on the Cars tab in the main search box. Then, input your pick-up location, drop-off location, dates, times, and age of the driver. Click on the blue Search box to continue.

2. You can then narrow your search with the filtering options on the left-hand side of the page.

3. For each car option, you will be able to see the car details, rental company, and price in both dollars and Chase Ultimate Rewards points. Once you have selected the car you want to rent, click on Add to Itinerary .

4. You can pay for the entire purchase with points or a Chase credit card or split your payment in any amount. Double-check all of the details before completing your purchase.

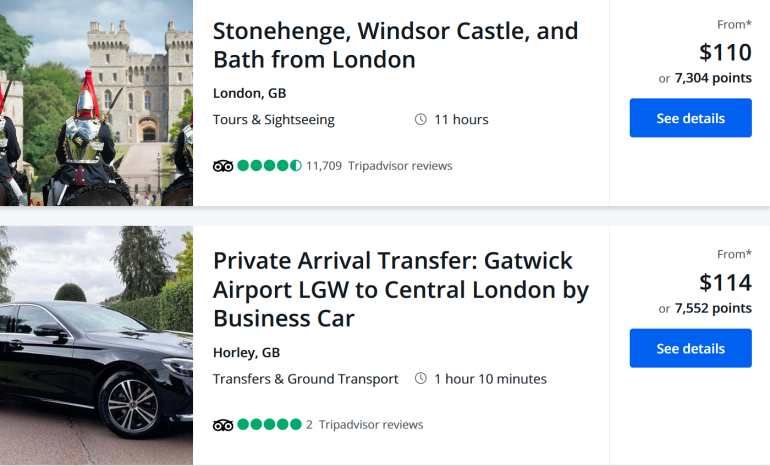

Did you know you can also book activities through Chase Travel?

1. Click the Activities tab on the Ultimate Rewards travel homepage to get started. Then, input your destination and travel dates and click the Search button to continue.

2. You can narrow your search by selecting 1 or more categories at the left-hand side of the page. Categories can include things like:

- Classes & workshops

- Cruises & sailing

- Food & drink

- Outdoor activities

- Seasonal & special occasions

- Tickets & passes

- Tours & sightseeing

- Transfers & ground transport

- Unique experiences

3. Each activity will show the price in both dollars and points to the right side of the screen. Click on Show Details and Pricing for more information and to book the activity.

6. Double-check all of the details on the final page before completing your purchase. Click the box confirming you understand the travel disclosures, then click Complete Checkout to finish your purchase.

Bottom Line: You can book lots of activities through the Chase Travel portal, including airport transfers!

If you’re a fan of cruises, you’ll be pleased to know you can book them through your Chase Travel portal. To get started, click on the Cruises tab on the Ultimate Rewards travel homepage.

This will bring up a list of available cruises, but there’s also a search box at the top of the screen, so you can input a specific destination or cruise line.

Each listing will display the cruise line, ship, ports of call, sailing dates, and baseline pricing for an interior or oceanview cabin. Unfortunately, if you want any more specific information or if you want to book, you will need to call 855-234-2542 .

You’ll notice that only cash prices are listed for cruises, however, they can be booked using your Chase Ultimate Rewards points, too.

Hot Tip: You can book a cruise through Chase Travel but you’ll have to call to make your reservation as they can’t be booked online.

Are you getting a good deal by booking through Chase? Let’s look at how the prices available through the Chase Travel portal stack up to other OTAs and search engines including Hotwire , Kayak , and Expedia .

We did some flight searches and found there’s no clear-cut pattern on prices between the Chase portal to other websites.

Example #1: Round-trip flight between Philadelphia (PHL) and San Francisco (SFO) for 1 person in economy.

We searched this route in the Chase travel portal and the cheapest option was a flight that was split between Alaska Airlines and Delta Air Lines for $526.20. This worked out to be the cheapest price we found, and Priceline had the same low price. Expedia and Hotwire both charge booking fees, making the price a little higher. Each airline’s own website couldn’t split the itinerary between different airlines, so those ended up being much more expensive.

If you are in doubt or would like to check prices yourself, Kayak is a great place to start. Kayak will show you prices for a flight on all of the OTAs as well as the airline’s website. It’s a great one-stop shop to compare flight prices.

Example #2: Round-trip flight between New York City (JFK) and Paris, France (CDG) for 1 person in economy.

We searched this route in the Chase travel portal and the cheapest option was a flight that was split between American Airlines and British Airways for $689.78. This wasn’t the overall best price we found, though. That award goes to Expedia and Priceline.

Hot Tip: You will earn frequent flyer miles when you book your flight through the Chase Travel portal.

Example #1: Here’s how prices looked for a week-long stay at the JW Marriott Cancun Resort & Spa in Mexico for 2 people including all taxes and fees. The $291.55 resort fee can’t be paid with points.

In this example, the best cash rate by far was through Marriott. However, if you wanted to pay with points, booking with Chase Ultimate Rewards points through the travel portal would be your best bet.

Keep in mind that Marriott doesn’t have an award chart, so different time periods can have different point costs. A 7-night stay at this hotel can dip down to 240,000 points for a 7-night stay. If you’re going to pay for your hotel stay in points, it’s always smart to calculate how many points it would cost to book through Chase versus transferring points . This information can help you make the best and least expensive choice.

Hot Tip: You won’t earn hotel loyalty points when booking a hotel through Chase and any elite status you have may not be recognized.

Example #2: Let’s look at an example of a hotel that doesn’t have a loyalty program. We priced out a 2-night stay at Almond Tree Inn Hotel in Key West, FL for 2 people. The highest prices were direct via the hotel with all other websites surveyed being cheaper.

Here’s how the prices stacked up:

Chase’s low price matched the other online travel websites and was actually lower than the hotel’s own website, so it would be a great option in this case. It also affords the opportunity to use points for a hotel that doesn’t have its own loyalty program.

Car Rentals

In many cases, car rental prices found through the Chase Travel portal were similar to prices found on the rental agency’s own website.

The main difference in booking through Chase vs. directly through a car rental agency is that the car rental agency often has the ability to book the car without paying up front. With the Chase portal, you will be paying at the time of booking and there may be change or cancellation fees if you need to modify your reservation.

In both of these examples, Chase Travel didn’t offer the lowest price, however, that won’t always necessarily be the case. Of course, the advantage of booking through Chase is the ability to use your Chase Ultimate Rewards points. It’s always a good idea to price out your car rental on a few different websites before booking to ensure you’re getting the best price.

Chase actually offered the lowest prices on activities for both examples:

Earn Bonus Ultimate Rewards Points

The Chase Travel portal also helps you earn bonus points. With the Shop through Chase feature, you can earn extra Ultimate Rewards points through your online shopping.

Just click Earn Bonus Points in the top search bar to access the shopping portal. Click on a featured store or search for a specific one. Then simply click through the portal to your website of choice to make your purchase. Your bonus points will be added to your Chase Ultimate Rewards points total within 3 to 5 days in most cases.

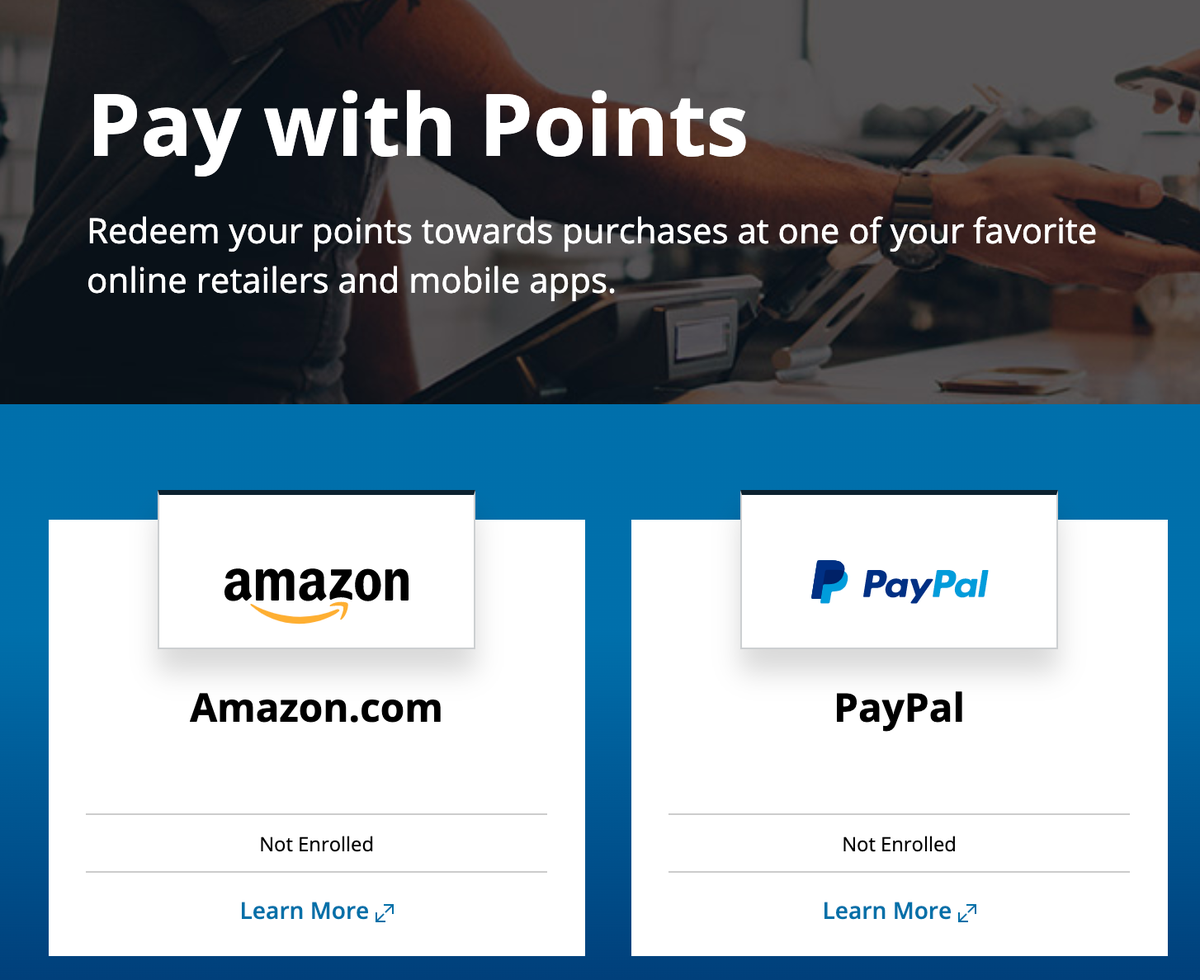

Pay With Points

Did you know you can use your Chase Ultimate Rewards points to make purchases at Amazon and PayPal? Click on Pay with Points in the top search bar, then select either Amazon or PayPal to enroll and shop.

Unfortunately, the redemption value you get when shopping through Amazon or PayPal is pretty bad — only 0.8 cents per point. While it’s great to have this as an option, we don’t recommend using points to shop at Amazon or PayPal as your main use of Chase Ultimate Rewards points.

Bottom Line: The value of using your Chase Ultimate Rewards points to shop through Amazon or PayPal isn’t great: you will only get 0.8 cents per point!

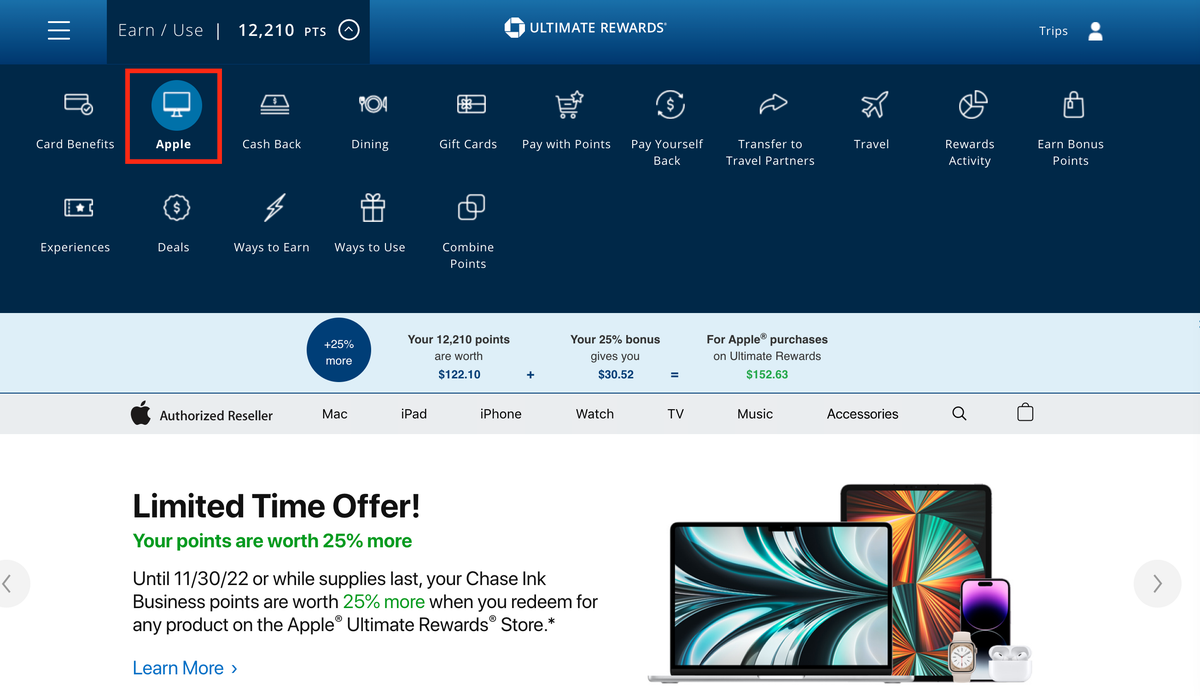

Apple Purchases

By clicking on Apple in the main search box in your Ultimate Rewards account, you can use your Chase points to make purchases. Normally, you’ll get 1 cent per point in value when using your points for Apple purchases, but there are occasional bonuses offered to get a better redemption rate.

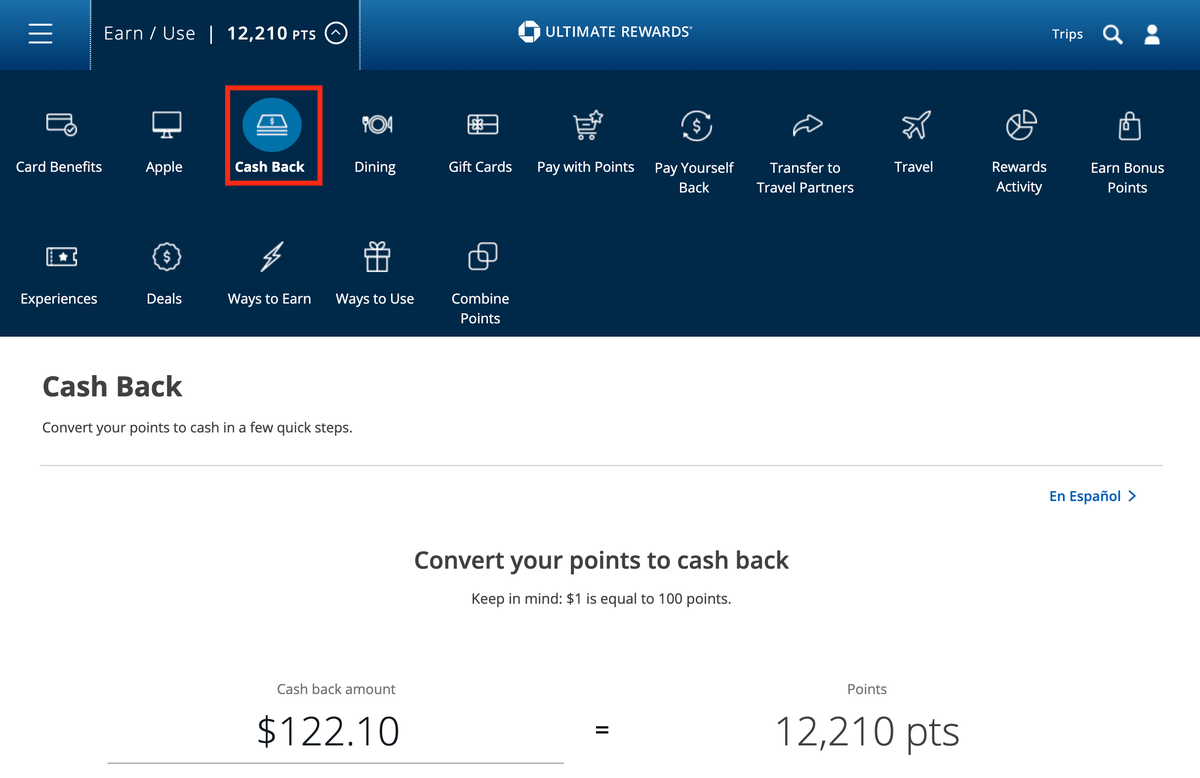

You can also redeem your Ultimate Rewards points for cash-back. To do this, simply select Cash-back from the main search bar at the top of the screen. You will then be able to see choose how many points you’d like to redeem for cash-back at a value of 1 cent per point .

You can choose to have your cash direct deposited into a checking or savings account or as a statement credit. The deposit or statement credit will be posted within 3 days.

Bottom Line: Your Chase Ultimate Rewards points are worth 1 cent each when redeemed as cash-back. We do not recommend this as a primary redemption option because you can get more value via the Chase Travel portal, and a lot more when transferring to airline and hotel partners.

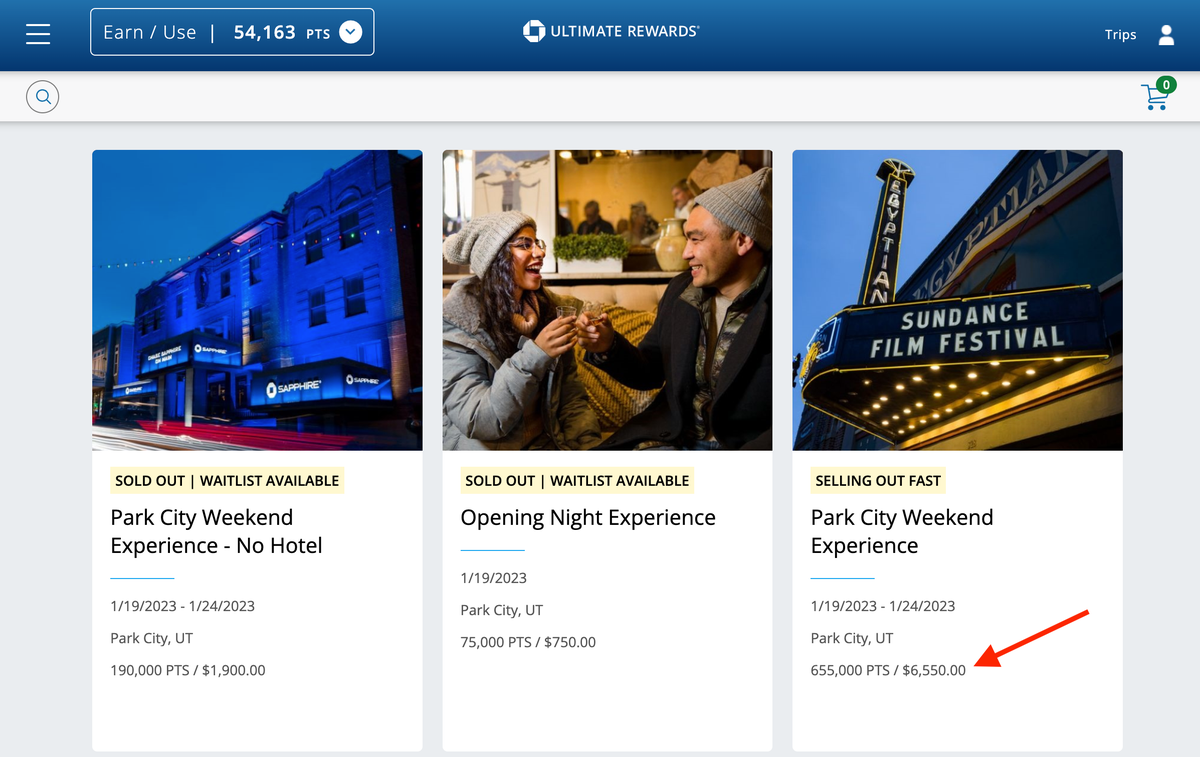

Experiences

This is a really cool section of the Chase Travel portal. When you click on Experiences in the main search bar, you’ll see a list of exclusive events, preferred seating, and other offers for select Chase cardmembers.

Experiences can be purchased with a credit card or with points. You will get 1 cent per point in value when redeeming points for experiences. Some experiences are only available to cardholders of specific cards so be sure to check all of your cards if you have more than 1 to make sure you don’t miss anything.

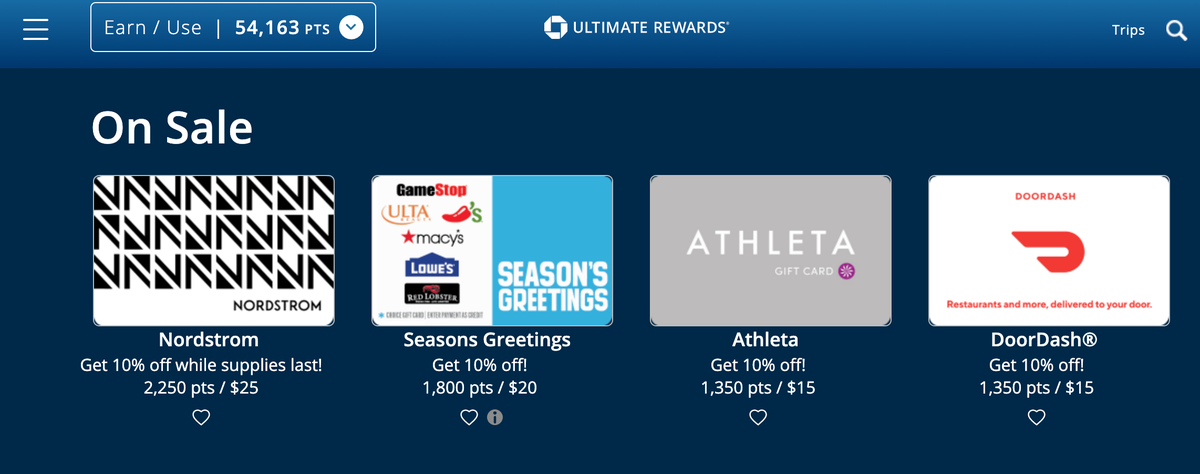

If you prefer gift cards, you can purchase them through the Chase Travel portal using points. Just click Gift Cards in the main search bar to get started. From here, you will be able to scroll through all of the available gift cards. You’ll get 1 cent per point in value, with occasional sales offering better redemption rates.

Hot Tip: Points redeemed for gift cards have a 1-cent per point value. However, you might notice some cards offer discounts, so there is the opportunity to get a bit more value!

Pay Yourself Back

Another way to use your Ultimate Rewards points is through the Pay Yourself Back feature. This allows you to redeem your points for a statement credit for purchases in select categories. The current categories include groceries, dining, select charities, credit card annual fee, internet, cable, phone, and shipping and the redemption value varies by card.

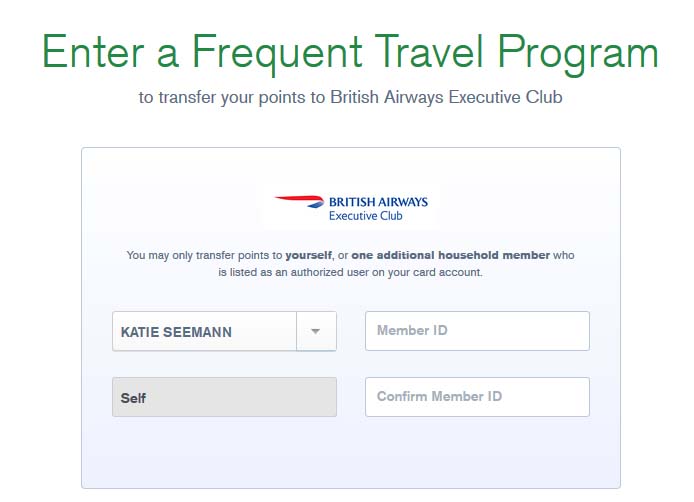

Transfer To Travel Partners

Transferring points to travel partners is the best way to get the most value out of your points . By transferring, you can potentially get 2, 3, or more cents per point value.

Chase Airline Transfer Partners

Chase Hotel Transfer Partners

To transfer your Chase Ultimate Rewards points to any of the above airline and hotel partners, log on to your account and click on Transfer To Travel Partners in the top search box. Choose your airline or hotel and then select Transfer Points . You’ll need to fill out your frequent flyer information or hotel loyalty membership number to complete the transfer.

Bottom Line: You can currently transfer your Chase Ultimate Rewards points to 14 different hotel and airline partners.

There are many ways to use your Chase Ultimate Rewards points. While transferring points to one of Chase’s airline and hotel travel partners can get you maximum value, there are a lot of benefits for booking travel directly through the Chase Travel portal .

In addition to hotels and flights, you can book car rentals, activities, and cruises. Or, you can use your points for cash back, shopping, gift cards, or Chase exclusive experiences. With so many ways to use your Chase Ultimate Rewards points, your next trip is only a few clicks away!

The information regarding the Chase Freedom Flex℠ was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Chase Freedom ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Ink Business Plus ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

Do chase ultimate rewards points expire.

No. As long as you keep your Chase credit card open, your points will not expire.

Can I transfer my Chase points to someone else?

Yes. You can transfer your points to another member of your household who also has a Chase Ultimate Rewards account.

What are Chase Ultimate Rewards points worth?

When redeeming points through the Chase travel portal, the credit card you hold will determine your points’ value.

When redeeming for travel, your points have the following value:

- 1 cent : Freedom card, Freedom Flex card, Freedom Unlimited card, Ink Business Cash card, Ink Business Premier card, Ink Business Unlimited card

- 1.25 cents : Chase Sapphire Preferred card or Ink Business Preferred card

- 1.5 cents : Chase Sapphire Reserve card

When using your points to shop through Amazon or Chase Pay, they are worth 0.8 cents per point.

When redeeming your points for cash back, gift cards, or experiences they are worth 1 cent per point.

What airline partners can I transfer my Chase Ultimate Rewards points to?