DBS Live Fresh Card – MoneySmart Review 2022

Singapore’s go-to bank DBS must really want to change up their mundane, workaday image — just look at the snazzy DBS Live Fresh Card. The cashback credit card has a graphic, illustrated card design and fuss-free mechanics to appeal to the millennial crowd.

Let’s see if the DBS Live Fresh Card has the substance to match its style.

- DBS Live Fresh Card: Summary

- DBS Live Fresh Card: Annual Fee, Minimum Income

- DBS Live Fresh Card Cashback Benefits

- DBS Live Fresh Card Minimum Spend

- DBS Live Fresh Card Exclusions

- How do I maximise my DBS Live Fresh Card?

- Should I get the DBS Live Fresh Card?

- DBS Live Fresh Card Privileges, Promotion

- DBS Live Fresh Card Sign-Up Promotion

- Alternatives to the DBS Live Fresh Card

1. DBS Live Fresh Card: Summary

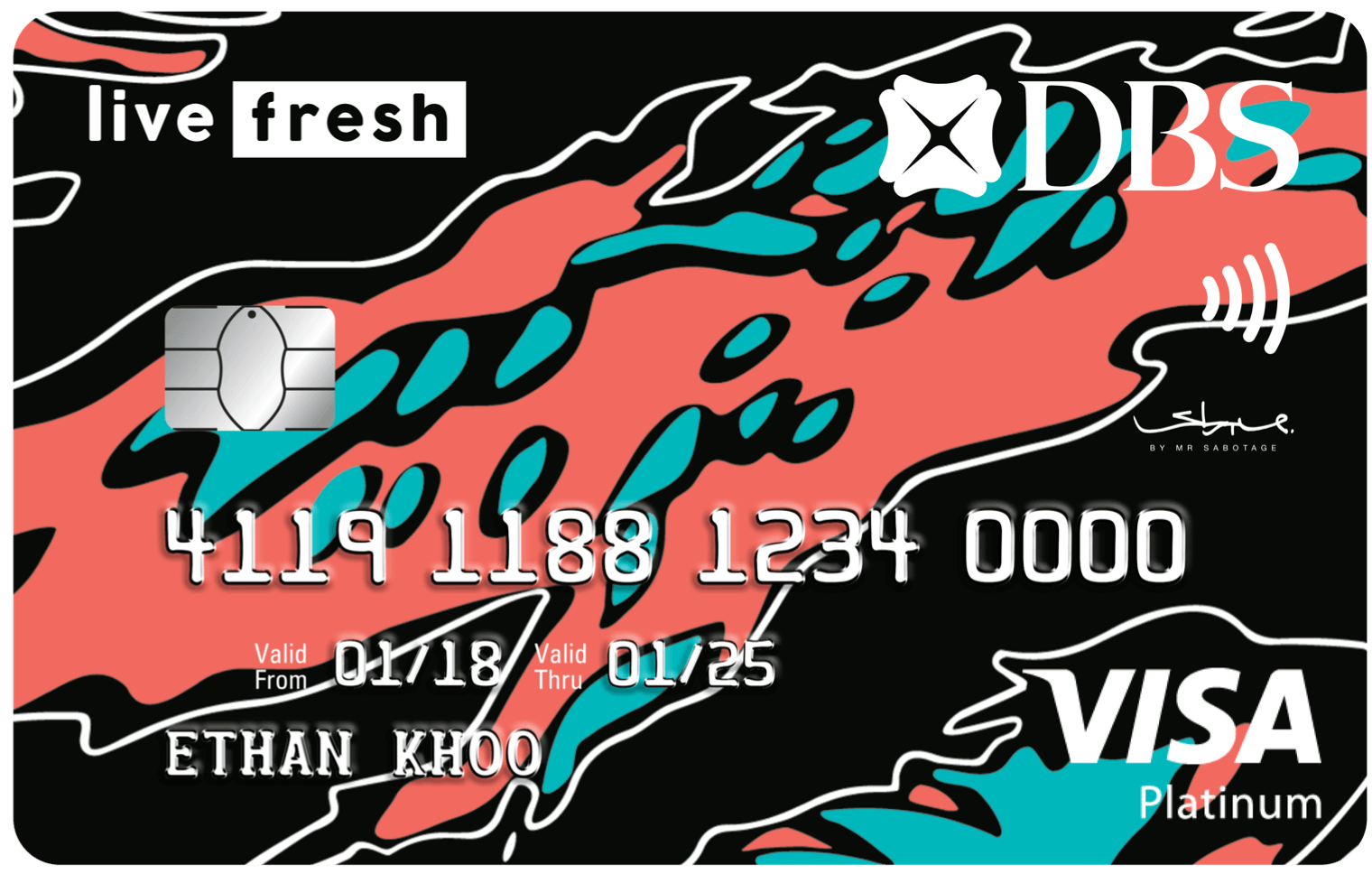

The DBS Live Fresh Card is a basic cashback credit card, but it’s not one your parents will appreciate. There are absolutely no perks for necessities like grocery shopping, petrol or utilities.

100% targeted at millennials and Gen Z, the DBS Live Fresh Card offers up to 5% cash rebate on online and Visa contactless spend . Everything else earns a measly 0.3%.

Total monthly cashback is capped at $60; adding to that, the cap is further split into 3 categories: $20 for Online Spend, $20 for Visa Contactless Spend and $20 for all other spend.

There’s an additional 5% cashback (capped at $15 a month) for sustainable spending, if you can be bothered to game that. This category includes public transport, bike/car sharing and selected F&B and retail outlets.

(1).jpg)

DBS Live Fresh Card

Key features.

Score up to 6% cashback on your shopping sprees & daily commutes

Up to 6% cashback on Shopping & Transport Spend

0.3% unlimited cashback on All Spend

Enjoy first year annual fee waiver

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

2. DBS Live Fresh Card: Annual Fee, Minimum Income

3. dbs live fresh card cashback benefits.

The DBS Live Fresh Card’s cashback benefits are pretty straightforward:

The online spend and Visa contactless payments categories are nothing new to most of us. The sustainable spend category, on the other hand, is one that many of us might be unfamiliar with. So let’s dive into a few merchants that qualify under the DBS Live Fresh Card’s sustainable spend category. This includes:

If you like to go grocery shopping at atas supermarkets and dine at expensive cafes, you can get an additional 5% cashback on the online spend category with the DBS Live Fresh Card. For the rest of us who stick to NTUC and the kopitiam, you can still benefit from the bonus cashback when you take public transport or use car sharing services .

Besides the sustainable spend category, the other bonus cashback categories – online spend and Visa contactless payments – give you 5% cashback. It’s not exactly anything to shout and scream about. The UOB Evol Card gives you 8% cashback in the same bonus categories.

On top of that, the 0.3% cashback on all other spend is basically negligible and not even really worth thinking about. Overall, the most appealing thing about the DBS Live Fresh Card is its additional 5% cashback on public transport and car sharing services.

4. DBS Live Fresh Card: Minimum Spend

To qualify for DBS Live Fresh Card’s bonus cashback, you have to hit a minimum spend of $600 for each calendar month. To hit the cashback cap on Visa contactless payments and online spend, you’ll have to shell out $400 in each category for $40 cashback.

If you do your due to max out the cashback cap, you’ll automatically meet the monthly minimum spend. Otherwise, you’ll only earn 0.3% on all your spend. Trust me, you really don’t want to see all your efforts go to nought.

In order to avoid that, the following are DBS Live Fresh Card exclusions to keep in mind when you’re using your DBS Live Fresh Card.

5. DBS Live Fresh Card Exclusions

The DBS Live Fresh Card’s exclusions are pretty standard. Here are some of the key transactions which will not qualify for any cashback rewards:

- Insurance payments

- Hospital bills

- Utility payments

- Cryptocurrencies purchases

- School fees

- Payments to financial institutions

- Payments to non-profit organisations

- Government services

If you were thinking of raking up cashback rewards by charging your bills, parking, and insurance payments to the card…tough luck! We must say, the DBS Live Fresh Card is pretty lenient otherwise.

6. How do I maximise my DBS Live Fresh Card?

With every cashback card, the goal is to earn as much cashback as you possibly can. The highest cashback you can earn with the DBS Live Fresh card is $75. However, in order to do so, you’ll have to spend the following amounts in each category:

That’s a total spend of $2,767 to hit the maximum cashback of $75. However, the 0.3% cashback on all spend is honestly not even worth it. So, ignore the all other spend category and focus on the online spend and Visa contactless payments categories instead. That way, you’ll also hit your monthly minimum spend of $600.

Altogether, you’ll earn $40 in cashback and up to $15 more if you take the public transport or go to a fancy supermarket.

7. Should I get the DBS Live Fresh Card?

If you haven’t already guessed, the DBS Live Fresh Card belongs in the pockets of Gen Z and millennials who rely on the internet to get stuff done. Even better if you’re a Gen Z and millennial who takes it upon yourself to save the planet.

There aren’t any specific bonus rebates for key categories (like groceries, dining and the likes), but in this day and age, you can pay for everything with just a click or wave right?

If it can’t be ordered online, cardholders can make use of the 5% cashback on contactless payment methods to still earn some rebates when spending on those necessities. But bear in mind — cashback is capped at $20.

Plus, if you take the bus and train with your DBS Live Fresh Card, shop at sustainable grocery stores, and dine at eco-friendly restaurants you get an additional 5% cashback!

8. DBS Live Fresh Card Privileges, Promotions

If you love saving the environment, you’ll love the DBS Live Fresh Card. Not only does it give you additional cashback for sustainable spend, you can also enjoy the following promotions with sustainable merchants:

And if you’re a lover of mother earth, granted you’d want to travel the world to see the sights and scenes. Here are some of the exclusive hotel and flight deals you can get with the DBS Live Fresh Card:

9. DBS Live Fresh Card Sign-Up Promotion

If you’re convinced that the DBS Live Fresh Card is one that’ll work for you, sign-up by 31 Jan 2023 to earn $150 in cashback. Wondering how? Here’s what you have to do:

- You must be new to DBS credit cards (or have cancelled yours more than a year ago)

- Apply online through digibank or Myinfo with Singpass, using promo code 150CASH

- Spend at least $800 in eligible transactions within 60 days of card approval

- Promotion ends 31 December 2023

Don’t say no to free cashback!

10. Alternatives to the DBS Live Fresh Card

Almost all the banks in Singapore are fighting over millennial dollars — after all, young Singaporeans have zero brand loyalty (how many credit cards do you have?) and can be easily persuaded to part with what little money we have.

So as expected, the DBS Live Fresh Card has some serious competition. Let’s see how it stacks up against the others:

UOB EVOL Card – Another credit card obviously targeting the same demographic as the DBS Live Fresh Card, the UOB EVOL Card offers a more attractive 8% cashback for online shopping and PayWave transactions, but with the same cashback cap of $60.

OCBC FRANK Card – Similar to DBS offerings, the OCBC FRANK Card lets you earn 6% on online shopping and mobile contactless (Apple Pay etc.) payments. The same minimum spend of $600 applies, but the cap is higher at $75.

OCBC Frank Card

Earn 8% cashback on online/ contactless mobile transactions in SGD

Earn 8% cashback on Foreign Currency transactions

Earn 2% bonus cashback at selected Green Merchants: SimplyGo, BlueSG, Scoop Wholefoods and more.

0.3% cashback on other eligible spends

To enjoy the cashback, you need to spend a minimum of S$800 based on posted transactions in a calendar month

If you spend less than S$800, a flat 0.3% cashback is awarded

Min. annual spend of S$10,000 from date of approval to qualify for automatic annual fee waiver

Found this article useful? Share it with your friends.

Related Articles

Best POSB & DBS Credit Cards in Singapore – Credit Card Reviews 2020

12 Best Cashback Credit Cards in Singapore (Apr 2024)

7 Best Credit Cards for Online Shopping in Singapore (2022)

DBS Live Fresh Card Review: The Ultimate Guide for Singaporeans

If you’re looking for a credit card that offers cashback rewards on your everyday spending , then the DBS Live Fresh Card might be worth considering. This all-in-one card allows you to use the same card for your bus and train rides, ATM withdrawals, and even ride-hailing services. Plus, you can enjoy a 1-year annual fee waiver and earn up to 5% cashback on your transport spend with a minimum spend of S$600 per calendar month for the first 180 days from Card Approval Date.

In addition to its transport cashback rewards, the DBS Live Fresh Card is also eco-friendly, earning up to 10% cashback on your favourite eco-merchants and more. With this card, you can turn your everyday spend into effortless cashback, all while supporting environmentally-friendly businesses. But is the DBS Live Fresh Card the right choice for you? Read on to find out more about its key features, how to apply, and how to maximise its benefits.

Key Takeaways

- The DBS Live Fresh Card offers up to 5% cashback on transport spend and up to 10% cashback on eco-merchants.

- To apply for the card, you’ll need to meet certain eligibility criteria and provide the required documents.

- Maximise the benefits of the DBS Live Fresh Card by understanding the fine print, taking advantage of lifestyle perks and privileges, and using it for your everyday spending.

Key Features of DBS Live Fresh Card

If you’re looking for a credit card that is eco-friendly and offers great rewards and cashback, the DBS Live Fresh Card might be the perfect fit for you. Here are some of its key features:

Eco-Friendly Aspects

The DBS Live Fresh Card is Singapore’s first-ever eco-friendly recycled card, made from 85.5% recycled plastic. By using this card, you can help reduce plastic waste and contribute towards a more sustainable future.

Rewards and Cashback

With the DBS Live Fresh Card, you can enjoy up to 10% cashback on your spending. Get up to 5% cashback on contactless and online spend , and an additional 5% green cashback on selected eco-eateries, retailers and transport services. Plus, you can also earn 0.3% cashback on all other spend.

Online and Contactless Spend Benefits

The DBS Live Fresh Card offers great benefits for online and contactless spending. You can get 5% cashback on online and Visa contactless spend, and FavePay counts as an online transaction if used at retail outlets. Visa contactless transactions are those made through a contactless terminal via the Card or mobile wallets on Apple Pay, Samsung Pay, Google Pay.

Overall, the DBS Live Fresh Card is a great option if you’re looking for an eco-friendly credit card that offers great rewards and benefits for online and contactless spending.

Applying for the DBS Live Fresh Card

If you’re looking for a credit card that rewards you for your online shopping and contactless payments, then the DBS Live Fresh Card might be the perfect fit for you. Here’s what you need to know about applying for the card.

Eligibility Criteria

Before you apply for the DBS Live Fresh Card, you need to make sure that you meet the eligibility criteria. To be eligible for the card, you need to be at least 21 years old and have a minimum income of £30,000 per year. Additionally, you need to be a Singaporean citizen or a permanent resident.

Application Process

Applying for the DBS Live Fresh Card is a simple and straightforward process. You can apply for the card online, and the application process should take no more than 15 minutes. Here’s what you need to do:

- Visit the DBS website and navigate to the Live Fresh Card application page.

- Fill in your personal details, including your name, address, and contact information.

- Provide your employment details, including your current job and income.

- Upload the necessary documents, such as your NRIC or passport, and your latest payslip.

- Review your application and submit it.

Once you’ve submitted your application, you should receive a response within a few working days. If your application is approved, you’ll receive your DBS Live Fresh Card in the mail within a few weeks.

So, if you’re looking for a credit card that rewards you for your online shopping and contactless payments, the DBS Live Fresh Card might be the perfect fit for you. Just make sure you meet the eligibility criteria and follow the simple application process, and you’ll be on your way to earning cashback on your purchases in no time.

Maximising Benefits

When it comes to the DBS Live Fresh Card, there are a few things you can do to maximise your benefits and get the most out of your card. Here are some tips to help you make the most of your DBS Live Fresh Card.

Meeting the Minimum Spend

To qualify for the 5% cashback on contactless and online spend, you need to meet the minimum spend requirement of $600 per month. This means you need to spend at least $600 in a calendar month to earn the full 5% cashback. If you don’t meet the minimum spend requirement, you will only earn 0.3% cashback on all your spend.

One way to meet the minimum spend requirement is to use your DBS Live Fresh Card for all your daily expenses, such as groceries, dining, and transport. You can also use your card for big-ticket items, such as electronics or travel, to help you reach the minimum spend requirement.

Understanding the Cashback Cap

While the DBS Live Fresh Card offers up to 10% cashback, there is a cashback cap of $60 per calendar month. This means that once you have earned $60 in cashback, you will not earn any more cashback for the rest of the month.

To maximise your cashback, you should aim to hit the cashback cap every month. This means you need to spend at least $1,200 per month on contactless and online spend to earn the full $60 cashback. You can also earn bonus cashback by using your card at selected eco-eateries, retailers, and transport services.

In conclusion, to get the most out of your DBS Live Fresh Card, you need to meet the minimum monthly spend requirement and understand the cashback cap. By doing so, you can earn up to 10% cashback on your favourite eco-merchants and more.

Lifestyle Perks and Privileges

As a DBS Live Fresh Cardholder, you get to enjoy a range of lifestyle perks and privileges that cater to your dining, entertainment, travel, and overseas spending needs. Here are some of the benefits you can look forward to:

Dining and Entertainment

DBS Live Fresh Card offers a 5% cash rebate on online and contactless dining and entertainment spend. This means that you can enjoy your favourite meals and entertainment activities while earning cashback at the same time.

In addition to the cash rebate, you also get to enjoy exclusive dining privileges at selected restaurants. For instance, you can enjoy up to 50% off your total bill at participating restaurants in Singapore.

Travel and Overseas Spending

If you’re planning to travel overseas, DBS Live Fresh Card has got you covered. You can earn up to 5% cashback on your overseas spend, including overseas online shopping. This means that you can shop to your heart’s content while earning cashback at the same time.

Moreover, you can enjoy exclusive privileges such as discounts on airport limousine transfers, complimentary travel insurance, and more.

Overall, DBS Live Fresh Card offers a range of lifestyle perks and privileges that cater to your dining, entertainment, travel, and overseas spending needs. With its generous cash rebates and exclusive privileges, this card is definitely worth considering if you’re looking for a card that offers great value for your money.

Understanding the Fine Print

When it comes to credit cards, understanding the fine print is crucial. The DBS Live Fresh Card is no exception, and it’s important to know what fees and charges you may incur and what terms and exclusions apply.

Fees and Charges

The DBS Live Fresh Card comes with a first-year annual fee waiver, which means you won’t have to pay anything for the first year. After that, the annual fee is $128. However, if you spend at least $12,000 per year, the annual fee will be waived for the following year.

If you carry a balance on your card, you’ll be charged an interest rate of 26.8% p.a. This rate is on the high side, so it’s important to pay off your balance in full each month to avoid finance charges.

If you use your card for foreign currency transactions, you’ll be charged a fee of 3.25% of the transaction amount. This is standard for most credit cards, but it’s something to keep in mind if you plan on using your card overseas.

Terms and Exclusions

There are certain terms and exclusions that apply to the DBS Live Fresh Card. For example, to qualify for the cashback rewards, you’ll need to spend at least $600 per month. Additionally, the cashback rewards are capped at $60 per month.

There are also certain exclusions to the cashback rewards. For example, you won’t earn cashback on transactions related to insurance, education, government services, and more. It’s important to read the terms and conditions carefully to understand what transactions are eligible for cashback rewards.

Overall, the DBS Live Fresh Card is a great option for those looking for a cashback credit card . Just be sure to understand the fees and charges, as well as the terms and exclusions, before you apply.

Frequently Asked Questions

What fabulous benefits can one enjoy with the DBS Live Fresh Card?

The DBS Live Fresh Card offers a range of benefits that are tailored to the needs of millennials and Gen Z. You can receive up to 5% cashback on online and Visa contactless spend, and an additional 5% Green Cashback on selected Eco-Eateries, Retailers and Transport Services. The card also offers 0.3% Cashback on All Other Spend, making it a great all-rounder.

How can I snag an annual fee waiver for my DBS Live Fresh Card?

You can enjoy a first-year annual fee waiver with the DBS Live Fresh Card. To continue enjoying this benefit, you must spend at least $12,000 per year on your card. If you are unable to meet this requirement, an annual fee of $128.40 will apply.

What’s the minimum spend required to unlock the perks of the DBS Live Fresh Card?

There is no minimum spend required to unlock the perks of the DBS Live Fresh Card. However, to enjoy the maximum cashback of 5%, you must spend at least $600 per month on online and Visa contactless spend. If you spend less than this amount, you will still receive cashback, but at a lower rate.

Could you enlighten me on how the cashback system operates for the DBS Live Fresh Card?

The cashback system for the DBS Live Fresh Card is straightforward. You will receive cashback on eligible transactions made with your card. The cashback will be credited to your account by the end of the following month. There is no limit to the amount of cashback you can earn, and it never expires.

Is the DBS Live Fresh Card the ultimate choice for online shopping aficionados in Singapore?

The DBS Live Fresh Card is a great choice for online shopping aficionados in Singapore. With up to 5% cashback on online spend, you can save money while shopping for your favourite items. The card also offers an additional 5% Green Cashback on selected Eco-Eateries, Retailers and Transport Services, making it an eco-friendly choice for those who care about the environment.

Are there any special terms and conditions I should be aware of before diving into the DBS Live Fresh Card experience?

Yes, there are some special terms and conditions you should be aware of before diving into the DBS Live Fresh Card experience. For example, to be eligible for cashback, you must make a minimum of 5 transactions per month. Also, cashback is not awarded on transactions such as cash advances, balance transfers, and instalment payment plans. It’s always a good idea to read the fine print before signing up for any credit card.

You Might Find The Following Interesting...

Apartment Cleaning Services Singapore: The Ultimate Solution for a Spotless Home

Tempura Restaurant in Singapore: A Crispy and Delicious Experience

Dbs altitude card review: the best travel credit card in singapore, brand positioning 101: how to stand out in singapore’s competitive market, where to buy rudy project in singapore: your ultimate guide, get cash on sundays best money lender open on sunday in singapore, buy bag handles online: upgrade your bag game in singapore.

Change Tyre Service Singapore: Convenient and Affordable Solutions for Your Tyre Needs

Rigging Marine Services Singapore: Enhancing Your Boating Experience

Japanese Hotpot Singapore: The Best Places to Satisfy Your Cravings!

Citibank personal loan rates: get excited for low interest rates in singapore.

Halal Japanese Restaurants in Singapore: Satisfy Your Cravings with Authentic Japanese Cuisine

Horse brand abalone: the latest must-try delicacy in singapore, get ahead with hong leong personal loan early settlement: save big on interest payments, start your dream business today: how to get a small business loan in singapore, get your hands on leech oil: where to buy in singapore, upgrade your apple watch: buy the best straps in singapore today, where to buy kites in singapore: the ultimate guide for kite enthusiasts, online clothing brands: the ultimate guide to fashion shopping in singapore.

Email Marketing Services Singapore: Boost Your Business’ Online Presence

DBS Live Fresh Student Card: Is It a Good Option for You?

DBS Live Fresh Student Card

- High cashback on student-friendly brands

- Fee waivers for 5 years – enough to last through tertiary education

- No minimum spend

- Doubles up as a public transport card with cashback via SimplyGo

- Limited eligible categories

- Low cashback (0.3%) if the merchant doesn’t fall in the selected eligible categories

- Minimum 21 years of age, which means many polytechnic students aren’t eligible

- Limited eligible tertiary institutions

Current Promotion

The DBS Live Fresh Student Card is Singapore’s first eco-friendly card: it promises a ‘green’ way to shop, eat, and travel.

With no minimum income requirement and a bunch of tantalising benefits, this card seems ideal for young adults. But is it really all that it promises to be?

Here’s what we’ll cover:

- Who’s eligible to apply

- Features and benefits

- Tiers of cashback

- How much cashback you can really get in a month

- Who would benefit most from the DBS Live Fresh Student Card

Who is Eligible to Apply for the DBS Live Fresh Student Card?

The criteria are pretty basic:

- Between 21 to 27 years old

- Studying in a tertiary institution in Singapore*

- Don’t have an existing DBS/POSB credit card and/or other unsecured facilities # with DBS/POSB

You don’t even need a minimum income; it’s that simple.

Card applications can be made via the DBS website . Remember to get your IC and Student Matriculation Card ready because these are the two basic supporting documents required.

* Existing student from NUS, NTU, SMU, SIM, SUTD, SIT, SUSS, NYP, NP, TP, SP, or RP

What Features and Benefits Does It Offer?

Let’s break down the features and discuss how you can benefit from them:

What Are the Different Tiers of Cashback?

The DBS Live Fresh Student Card mentions a fair bit about cashback benefits, so it’s worth diving deeper to see if they’re all that they promise.

The cashback programme is broken down into three categories:

#1 – 5% cashback on brands popular with students, capped at S$15 per month

The list current features these merchants:

- Golden Village

#2 – Extra 5% green cashback, capped at S$15 per month

As of 4 November, here’s the current list of eligible ‘green’ merchants:

#3 – 0.3% on all other spend, capped at S$20 per month

What’s not eligible for cashback.

As with most credit cards, there are certain items that are excluded from cashback. Here’s what the DBS Live Fresh Student card doesn’t give rebates on:

- Interest-free instalment plans

- Utility bills

- AXS payments

- Payments to financial institutions (e.g. banks, online trading platforms)

- Payments to government institutions and services

- Hospital bills

- Insurance premiums

- Payments to non-profits

- Top-ups of prepaid cards (e.g. EZ-Link, GrabPay, ShopeePay)

- Betting transactions

- Cryptocurrency transactions

- Any fees DBS charges

- Any cancelled or voided transactions

How Much Cashback Can You Actually Get In a Month?

According to DBS, the maximum cashback you can get is S$50. That doesn’t sound too bad, especially considering that other student cards like the Maybank eVibes Card only offer 1% cashback on all spending.

But is it really possible to collect S$50 in rebates each month? Not quite.

Say you spend S$300 on standard brand partners to collect the maximum S$15 cashback. Then you spend the remaining S$200 on eco-partners to collect S$10 cashback. That puts you at S$25 total cashback.

And that’s assuming that you only spend on eligible merchants, which is highly unlikely.

Realistically, most people report only getting a few dollars in rebates per month. (Then again, that’s not bad on a student card.)

Who Would Benefit from the DBS Live Fresh Student Card?

This credit card is best for:

- Eco-conscious young adults who want a card that aligns with their values

- Those who regularly visit Golden Village, McDonald’s, Starbucks, and have monthly subscriptions to Netflix and Spotify

- Those looking for a starter card with straightforward options and perks

Who’s NOT suitable for this card:

- Those who aren’t active consumers of eco-friendly products and services

- Those looking to purchase bigger-ticket items with a credit card

- Those who don’t spend frequently at the DBS partner merchants

-minv1-min.jpg)

DBS LIVE FRESH

-minv1-min.jpg)

Looking for Rewards? You Came to the Right Place.

Sign up for free to explore our selection of gifts and claim yours today..

By continuing I agree to MoneySmart.hk’s Terms of Use and Privacy Policy

Already have an account? Login

From now until 30 April 2024, apply for designated cards through MoneySmart( DBS Eminent Card/ DBS Live Fresh/ DBS Compass Visa)successfully to get HK$200 Apple Store Gift Card or HK$200 Klook Voucher or HK$200 ParknShop Voucher!

Are you eligible?

You need to apply through MoneySmart and credit card is approved. There are no spending requirements

Must be a new-to-bank cardholder.

Before the application through the MoneySmart, please first Turn off ad block; Clear the cookies; Don’t use incognito mode; Turn off the prevent cross-site tracking (Safari users) or Turn off do not track function (Chrome users)

After clicking MoneySmart’s designated link, please complete the application from asap; Do not open another web page.

When applying for a DBS credit card, the DBS Card+ app will require you to upload HKID image. Please place your HKID on a piece of white paper, take a photo with your mobile device, and make sure the HKID number in both front and back of see-through windows can be clearly seen (applicable to New Smart Identity Card).

What you need to know

Customers must complete and submit the redemption form after logging in to MoneySmart on or before 30 June 2024

By 2 July 2024, new customers who have downloaded DBS Card+ mobile application via the designated link, and successfully applied for a DBS credit card, can earn an extra HK$50 InstaRedeem Amount

Get an extra HK$100 cash rebate if new customers successfully accumulate Octopus Automatic Add-Value transaction of HK$1,000 or above OR apply for 12-month or above Flexi Shopping Programme (of any amount) with the New Card within 2 months of the New Card issuance date!

All Details

Key features.

Up to 5% Cash Rebate Reward of Your Choice Selection List(Online Foreign Currency Spending; Online Travel Merchant Spending; Online Supermarket Spending; Online Dining Spending; Online Entertainment Spending; Online Fashion & Apparel Spending; Online Charity Donations

1% Unlimited Cash Rebate for Online Spending in foreign currencies

10 Free Trials for Flexi Shopping

iFlexi - up to 90-day Interest-free Repayment Period for Online Transaction

Flexi Travel - up to 90-day Interest-free Repayment Period for Overseas and Travelling Transaction

Online Shopping

Up to 5% Cash Rebate Reward of Your Choice Selection List (Online Foreign Currency Spending; Online Travel Merchant Spending; Online Supermarket Spending; Online Dining Spending; Online Entertainment Spending; Online Fashion & Apparel Spending; Online Charity Donations)

Overseas Spending

Welcome offers.

New Customers^ who fulfilled the relevant spending requirements within 3 months from the card issuance date (“Spending Period”), and register and activate DBS Card+ account within 1 month of the New Card issuance date, can enjoy the first-year annual fee waiver and the following welcome offer:

HK$4,800 within 3 months from the new card issuance date: HK$350 InstaRedeem Discount

HK$1,000 or above in total for top up amount via Octopus Automatic Add Value Service or successfully apply 12-month or above Flexi Shopping Programme with New Card within 3 months from the new card issuance date, no amount requirement: Extra HK$100 Cash Rebate

New Customers^ and Existing Customers^ successfully activate the physical New Card via DBS Card+ app within 2 month after its issuance: HK$50 InstaRedeem Discount

New Customers^ apply via DBS Card+ Extra Welcome Offer: HK$50 InstaRedeem Discount(Details:go.dbs.com/hk-online-acq-50SIR)

^New Customers shall mean applicants who, during the New Card approval process have not applied for, do not currently hold, or in the 12 months prior to the date of application for the New Card, have not held and/or cancelled any principal credit cards (including co-branded cards) issued by the Bank (“New Customers ”). Existing Customers shall mean applicants who, during the New Card approval process have not applied for, do not currently hold, or in the 12 months prior to the date of application for the New Card, have not held and/or cancelled DBS Live Fresh Card issued by the Bank (“Existing Customers ”).

Credit card offers are subject to Terms and Conditions. Please refer to go.dbs.com/hk-livefresh-en for details

To borrow or not to borrow? Borrow only if you can repay!

Best Credit Cards

Annual interest rate and fees, minimum income requirements, card association.

Disclaimer: At MoneySmart.hk, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. For any discrepancy in product information, please refer to the financial institution’s website for the most updated version. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.

Key Features

Spend in over 150 currencies

No fee on international ATM withdrawals, up to S$1,050 per month depending on the plan (subject to 5 withdrawals per month)

Send money domestically and internationally to 150+ countries (both bank transfer and instant card transfer)

Debit card with minimum top-up of S$20

In-app budgeting & analytics and Vault features to manager your savings

Ability to split bills easily with anyone

Free and instant P2P transfers to other Revolut users globally

Invest in 1000+ global company shares, 110+ crypto tokens, commodities with live watchlists, trading charts, market news and learn modules

Premium and Metal Add ons : Lower or no fees across multiple products (e.g., FX, Remittance, ATM, Crypto, Stocks, Commodities), Complimentary travel insurance, Customised metal card, Premium card with three exclusive designs, Priority customer service and LoungeKey Pass access to airport lounges around the world

Apply via MoneySmart and easy 5 minute setup via Revolut mobile app

See all details

The hidden fees I talked about above are related to overseas spending. I would still recommend this card for local spending for its fuss-free cashback mechanisms. Let’s take a look at what the DBS Visa Debit Card has to offer.

Benefits of the DBS Visa Debit Card

Even if you’re rolling in enough dough to get any credit card you want, you might still be tempted to sign up for a DBS debit card for several reasons:

No annual fee

Very accessible —as long as you’re 16 years old and have a DBS savings or current account, you can get your hands on this sleek black debit card.

4% cashback on online food delivery

3% cashback on local transport (Ride-hailing, taxis, Simply Go)

2% cashback on all foreign currency spend (including online purchases)

Cashback will be automatically credited and reflected in your monthly statement within 60 days. Good for lazy folks who don’t even want to lift a finger to redeem cashback (that finger is pointing at myself).

No foreign exchange fees if you link your My Account as the primary account to your DBS Visa Debit Card. But read what I wrote in the previous section about the foreign transaction fees that will still apply.

The DBS Visa Debit Card is a great option to earn cashback on everyday expenses like food and transport.

However, there are some catches. Firstly, your eligibility to earn cashback depends on 2 factors:

You need to spend at least $500 a month on qualifying Visa cards. The other qualifying cards are less accessible—the DBS Treasures Visa Debit Card, DBS Treasures Private Client Visa Debit Card, DBS Private Bank Visa Debit Card, and DBS SUTD Visa Debit Card.

Keep your cash withdrawals to $400 and below across all your DBS/POSB cards in the same month.

Fulfil these 2 requirements are you’ll earn the cashback promised! …up to the cashback cap of $20 per month .

Who should use the DBS Visa Debit Card?

For a start, just about anyone can get hold of this card because it’s a debit card, i.e. there’s no minimum income and no annual fee . Yay! If you don’t qualify for a credit card (e.g. you’re still a student), this is hands down one of the best debit cards in Singapore you could be using right now.

But of course, it also means the funds are debited directly . You definitely cannot spend beyond your means. Think twice about getting this card if you’re planning for large purchases or if you have really poor self-control. Alternatively, you could also log in to iBanking and set your daily debit card transaction limit ($2,000 by default) to something within your means.

However, it works well as a day-to-day expenses card as there’s a generous bonus cashback of 4% on food delivery and 3% on transport. That means you earn every time you tap your card to get onto the bus or MRT.

Don’t forget that you will need to spend at least $500 in a month to qualify for the cashback.

There’s also the “troublesome factor”. If you aren’t an existing POSB or DBS account holder, or if you don’t want to have to limit cash withdrawals from your account to $400 and below , you’ll have to sign up for a new savings or current account, which is an added inconvenience.

If you are a POSB or DBS account holder and are using a plain vanilla ATM or debit card, it wouldn’t hurt to swap it for the DBS Visa Debit Card.

Alternatives to the DBS Visa Debit Card

While DBS Visa Debit Card is one of the most generous debit cards out there when it comes to cashback, there are many credit cards that reward you with similar or higher cashback.

Standard Chartered Smart Credit Card —With its $0 annual fee and $0 minimum spend requirement, the Standard Chartered Smart Credit Card is a fierce contender. You’ll also earn a higher cashback rate of up to 6% on fast food dining, coffee and toast, digital subscriptions (Netflix, Disney+ and Spotify) and on your daily commute (Bus/MRT).

MoneySmart Exclusive

Up to 6% Cashback

Standard Chartered Smart Credit Card

Cashback from Netflix, Spotify, fast food joints and more. *T&Cs apply.

Minimum Spend

MoneySmart Exclusive:

Get a Sony LinkBuds S Earbuds (worth S$309) or a Lenovo Tab M10 Gen 3 (worth S$299.01) or up to S$230 Cash via PayNow when you apply and meet the relevant spend criteria! T&Cs apply .

Valid until 21 Apr 2024

6%* cashback on your everyday spend at your favourite merchants across fast food dining, coffee and toast, digital subscriptions and on your daily commute (Bus/MRT). No minimum spend requirement. *T&Cs apply.

No Annual Fees ever

3-month interest-free instalments with no service fees

Enjoy dining and shopping discount privileges at over 3,000 outlets in Asia with Standard Chartered’s The Good Life Program

Complimentary travel medical insurance - Have a peace of mind when you travel with complimentary travel insurance coverage of up to S$500,000. Simply charge your full travel fare to your card before you go abroad. Terms and conditions apply.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

See all card details

DBS Live Fresh Card –Get up to 6% cashback on shopping and transport. Note, however, that the minimum spending requirement is a higher $800 a month. At least the monthly cap on cashback is also raised to $70.

Online Promo

Shopping and Transportation

DBS Live Fresh Card

on Shopping & Transport Spend

Cashback Cap

Score up to 6% cashback on your shopping sprees & daily commutes

Up to 6% cashback on Shopping & Transport Spend

0.3% unlimited cashback on All Spend

Enjoy first year annual fee waiver

UOB One Card —One of the highest cashback rates out there at 10%. The catch is that there’s a $500 minimum spend and the cashback only applies to merchants like McDonalds, Shopee, Giant, Grab and SimplyGo instead of a blanket category like “food delivery”.

AMAZING APRIL PROMOTION

UOB One Card

Cashback on McDonald's, DFI Retail Group, Grab, Shopee, SP and more

Cashback Cap per quarter

Min. Spend per month

[Amazing April Promotion | CASH BONUS] Stand a chance to get an Sony PlayStation®5 (SLIM) Disc Edition (worth S$799) when you apply through MoneySmart! The first 6 successful applicants who submit the claim form at 2pm or 9pm can also receive a S$88 Cash Bonus via PayNow! T&Cs apply . PLUS get S$350 Cash Credit from UOB when you are the first 200 new-to-UOB customers who successfully apply for an eligible UOB Credit Card and spend a min. of S$1,000 per month, for 2 consecutive months from the card approval date. T&Cs apply.

Up to 10% cashback on McDonald's (including McDelivery®)

Up to 10% cashback at Shopee Singapore (excludes ShopeePay)

Up to 10% cashback at DFI Retail Group (Cold Storage, CS Fresh, Giant, Guardian, 7-Eleven & more)

Up to 10% cashback at Grab (including GrabFood, excludes Grab mobile wallet top-ups)

Up to 10% cashback (bus and train rides)

Up to 10% cashback on UOB Travel

Up to 4.33% cashback on Singapore Power utilities bill.

Up to 3.33% cashback on all retail spend (based on S$500, S$1,000 or S$2,000)

Fuel savings of up to 22.66% at Shell and SPC

Exclusions and T&Cs at uob.com.sg/onetncs

P.S. Here’s our MoneySmart credit card ranking rubric

In case you’re wondering, here’s how we decide on our credit card rankings.

Don’t miss all our Singapore credit card reviews .

Has this article swayed you from Team Credit Card to Team Debit Card? Share it with someone else who could use an eye-opener!

About the author

Vanessa Nah is a personal finance content writer who pens articles on the ins and outs of savings accounts, the T&Cs of credit cards, and the ups and downs of alternative investments. She’s a researcher at heart and leaves no stone unturned when it comes to breaking down complex finance concepts and making them easy to understand for the everyday Singaporean. When Vanessa’s not debunking finance myths, you’ll find her attending dance classes, fingerpicking a guitar, or (most im paw tently) fulfilling her life mission to make her one-eyed cat the most spoiled and loved kitty in the world.

The post Is the DBS Visa Debit Card Better Than a Credit Card?—MoneySmart Review 2024 appeared first on the MoneySmart blog .

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans , Insurance and Credit Cards on our site now!

The post Is the DBS Visa Debit Card Better Than a Credit Card?—MoneySmart Review 2024 appeared first on MoneySmart Blog .

Original article: Is the DBS Visa Debit Card Better Than a Credit Card?—MoneySmart Review 2024 .

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Latest stories

Lentor mansion, lumina grand ec, and more: how did major new condo launches perform in q1 2024.

Hillhaven, Lumina Grand EC, The Arcady, Lentoria, Lentor Mansion and Ardor Residence were the six new condo launches this Q1 2024. Read more to find out how they performed.

How to teach kids about financial literacy — in a way they'll call 'fun'

The effectiveness of financial literacy classes has been long debated, but research shows that high school financial education improves credit and debt behaviors.

CareShield Life Guide 2024: What It Is & How to Make the Most of It

By 2050, nearly half of Singapore’s population will be at least 65 years old. With an ageing population, Singapore is bracing for a surge in healthcare spending. It’s vital that... The post CareShield Life Guide 2024: What It Is & How to Make the Most of It appeared first on MoneySmart Blog.

CICT is Well-Positioned to Grow its DPU: Can its Share Price Soar This Year?

The retail and commercial REIT has done well to grow its DPU in a difficult environment, but can its unit price soar to greater heights this year? The post CICT is Well-Positioned to Grow its DPU: Can its Share Price Soar This Year? appeared first on The Smart Investor.

UPDATE 2-China's c.bank signals caution over credit boost as demand weakens

There is still room for China's central bank to take steps to support the economy, but efforts are needed to prevent cash from sloshing around the banking system as real credit demand weakens, senior officials at the bank said on Thursday. The People's Bank of China (PBOC) has pledged to step up policy support for the economy this year and promote a rebound in prices. "A series of monetary policy measures introduced earlier are gradually taking effect, and the economy continues to rebound with a good start," Zhu Hexin, a deputy governor of the PBOC, told a news conference on Thursday.

EMERGING MARKETS-Currencies rise as dollar retreats, South Korea's won advances

Currencies in emerging markets gained on Thursday as the dollar rally took a breather, while the South Korean won jumped after the finance chiefs of U.S., Japan and South Korea agreed to cooperate on foreign exchange. "The hawkish Fed expectations support a stronger U.S. dollar, but the authorities around the world are not happy to see the U.S. dollar rally," said Ipek Ozkardeskaya, a senior analyst at Swissquote Bank. The won firmed for its second straight session since hitting a 17-month low on Tuesday, after U.S., Japan and South Korea agreed to "consult closely" on foreign exchange markets in their first trilateral finance dialogue on Wednesday.

Fed to cut rates in September and maybe once more this year: Reuters poll

The U.S. Federal Reserve will wait until September to cut its key interest rate, according to a majority of 100 economists polled by Reuters, with half saying there will be only two cuts this year and only about a third forecasting more. Fed Chair Jerome Powell also said on Tuesday "the recent data ... indicate that it's likely to take longer than expected to achieve that confidence" that inflation is falling back to the U.S. central bank's 2% target, remarks that dimmed hopes for rate cuts anytime soon. Financial markets, which earlier this year were pricing six Fed rate cuts starting in March, are also expecting the first reduction in September and one more in either November or December.

Nubank Discusses Credit Underwriting Differentials: Tech, Governance, and Customer Focus

SÃO PAULO, April 17, 2024--Nubank's credit strategy is characterized by technological agility, large-scale data analysis, customized risk management, innovation, and high levels of satisfaction. This unique combination allows the company to offer competitive rates to its more than 90 million customers and maintain a strong performance in credit, with NPL rates better than the industry average, even in challenging economic conditions.

Kennedy Family Endorses Biden Over RFK Jr

Members of the Kennedy family endorsed Joe Biden for re-election during a campaign event in Philadelphia, Pennsylvania, on Thursday, April 18.Footage posted to Biden’s official YouTube channel shows Kerry Kennedy, a daughter of former Attorney General Robert F. Kennedy, niece of former President John F Kennedy, and sister of the current presidential candidate Robert Kennedy Jr, delivering the endorsement, calling Biden “my hero” at Thursday’s event.“We want to make crystal-clear our feelings that the best way forward for America is to reelect Joe Biden and Kamala Harris for four more years,” she said.Playing down the endorsement, Independant candidate Robert Kennedy Jr wrote on X that his family was “divided in our opinions but united in our love for each other.” He said his campaign was about “healing America.” Credit: Joe Biden via Storyful

Residential Building in Central Gaza in Ruins After Israeli Strikes

Furniture and blankets were among the personal belongings seen strewn across the ground after strikes destroyed a residential building in central Gaza.Journalist Mohammed Abo Oun captured this footage of the condominium building, which was near the Nuseirat camp in central Gaza, on Thursday, April 18.The building was hit by strikes on April 17, according to another local journalist. Al Jazeera reported that the building was under intense bombardment over the past few days. Credit: Mohammed Abo Oun via Storyful

California McDonald’s franchisee says he's focused on ‘survival’ after new $20 minimum wage law

He claims his restaurants employ 800 workers.

GXS FlexiLoan Review 2024 — Could This Be One Of The Most Flexible Loans Out There?

When it comes to personal loans, we usually think of high interest rates and high fees by the big bad banks, right? But there’s one out there that’s different. Digital... The post GXS FlexiLoan Review 2024 — Could This Be One Of The Most Flexible Loans Out There? appeared first on MoneySmart Blog.

Hindu nationalist Modi the favourite as India votes

India began voting Friday in a six-week election with an all but assured victory for Hindu nationalist Prime Minister Narendra Modi, as a weakened opposition is pushed to the sidelines."I urge all those voting... to exercise their franchise in record numbers," Modi wrote in a social media post on X as the election began.

Those who invested in Visa (NYSE:V) five years ago are up 75%

The simplest way to invest in stocks is to buy exchange traded funds. But you can do a lot better than that by buying...

Best fixed deposit rates 2024: Grow your money with little risk

The post Best fixed deposit rates 2024: Grow your money with little risk appeared first on SETHLUI.com.

T-bills in Singapore: What it is, how to buy and the latest cut-off yield (16 April 2024)

Find out the latest auction updates of Singapore Treasury Bills (T-bills), as announced by the Monetary Authority of Singapore (MAS).

I’m an Average Middle-Class Retiree: Here’s How Much Savings I Have

Though your pre-retirement income alone isn't enough to determine whether you'll retire comfortably, it certainly plays a role. For example, if you're earning a middle-class salary, the amount you can...

Japan tourism hits record, but business mood sours

STORY: Japan just posted more record figures for tourism. The number of visitors surpassed 3 million in March - the first time they’ve ever gone above that level. Arrivals have been boosted by factors including the weak yen. The Japanese currency is languishing at multi-decade lows versus the dollar, making the country a cheap destination for travellers. That drew tourists to enjoy Japan’s famous cherry blossom season. But if that’s all a big boost for the country’s economy, other numbers out Wednesday paint a less pretty picture. The latest Reuters Tankan index of business sentiment showed the mood turning sour at big companies. Manufacturers and service firms both saw falling confidence in April. Companies cited factors including uncertainty over the outlook for China’s economy, and weak demand among consumers at home. Some said price hikes had stopped shoppers spending. The weak yen is a factor there too, as it’s driven the cost of imports ever higher. The effect showed up in trade figures as well, with exports jumping 7.3% in March, boosted by the helpful exchange rate.

5 Reliable Singapore REITs Sporting Dividend Yields of 5.7% and Higher

We highlight five dependable REITs whose shares offer distribution yields of 5.7% and above. The post 5 Reliable Singapore REITs Sporting Dividend Yields of 5.7% and Higher appeared first on The Smart Investor.

We Ran A Stock Scan For Earnings Growth And Singapore Airlines (SGX:C6L) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks...

Compare the Best DBS Credit Cards in Singapore 2024

Compare all available DBS credit cards in Singapore based on what you can get out of your spending, be it cash back, rewards, petrol, grocery, shopping, buffet, air miles or no annual fee.

Looking For The Right Credit Card?

Create a free account, do a 1-min quiz and we'll match you with your perfect card..

- All credit cards

- Overseas Spending

- Entertainment

- No Annual Fee

- Buffet Promotion

- 0% Instalment

- Bill Payment

- Online Shopping

Refine Your Results

DBS yuu American Express® Card

Are all your details correct?

DBS yuu Visa Card

(1).jpg)

DBS Live Fresh Card

DBS Altitude Visa Signature Card

DBS Altitude American Express Card

AA.png)

DBS Vantage Visa Infinite Card

DBS Woman's Card

DBS Woman's World Card

DBS Takashimaya American Express Card

DBS Esso Card

SAFRA DBS Card

DBS Live Fresh Student Card

Disclaimer: At MoneySmart.sg, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.

Best DBS Credit Card 2024

Dbs credit card hotline, dbs credit card waiver, dbs credit card promotion, dbs credit card application, cancel dbs credit card, dbs rewards.

If you’re using a DBS credit card, you’ll be able to accumulate DBS rewards points from your purchases. If you’re using a DBS Corporate, Purchasing, Country Club, Live Fresh Card, Takashimaya Esso, or SAFRA card, you don’t earn DBS points.

Your rewards points earn rate differs from card to card. For example, DBS Altitude card holders may earn 3 DBS Points per S$5 spent online in local currency but DBS Woman’s card holders may earn 10 DBS Points per S$5 spent online in local currency. Some transactions do not qualify for DBS points accrual, such as bill payments via AXS, SAM, payments to educational, governmental, insurance, financial, medical, and non-profit organisations, gambling and betting, top-ups to prepaid mobile wallets and cards such as EZ-Link, GrabPay, and Singtel Dash, and instalment plans. These are called general exclusions and you will find them across all major banks in Singapore. An important thing to note is the expiry date: your DBS Points expire a year from your credit card account opening date. In subsequent years, DBS Points expire a year from the date it was earned. That means you will need to keep track of your DBS Points and redeem them promptly.

DBS points to miles

Any DBS credit card can be a “DBS miles card” because you can easily convert your DBS rewards points to Singapore Airlines’ KrisFlyer miles, Cathay Pacific’s Asia Miles, Qantas Points, or AirAsia BIG Points when you enrol in the DBS Rewards Frequent Flyer Programme. For every 1 DBS point, you get 2 air miles. Conversions must be done in blocks of 5,000 DBS points, takes 7 working days, and is subject to a $26.75 transfer fee for each transaction.

DBS rewards redemption

To redeem your DBS rewards points, log in to DBS digibank, select “Cards”, followed by “Redeem Rewards”. You will then be able to browse the rewards redemption catalogue and add items to cart. Alternatively, log in to the DBS Rewards website to browse the rewards redemption catalogue and redeem e-vouchers, rebates, and air miles. Finally, if you have the DBS Lifestyle App downloaded on your mobile device, find the “Rewards” category and you will be able to browse the catalogue. To check your DBS points balance, call the DBS customer s service hotline at 1800 111 1111.

DBS Credit Card Overseas Activation

Try moneysmart's new savings account comparison tool.

Compare Savings Accounts and maximise your earnings with best interest rates by finding the right bank.

DBS Student Credit Card

Frequently asked questions, how to activate dbs credit card via sms, how to activate dbs credit card via ibanking, how to set sms alert for dbs credit card, how to activate ez link on dbs credit card.

- Credit Cards

- Best Rewards Credit Cards

- Best Credit Card Promotions

- Best Credit Cards for Dining

- Best Credit Cards for Shopping

- Best Cashback Credit Cards

- Best Miles Credit Cards for Travel

- Best No Annual Fee Credit Cards

- Best Credit Cards for Petrol

- Best Credit Cards for Businesses/SMEs

- Best Personal Loans

- Best Home Mortgage Loans

- Best Renovation Loans

- Best Car Loans

- Best Education Loans

- Best Debt Consolidation Loans

- Best Business/SME Loans

- Best Car Insurance

- Best Travel Insurance

- Best Home Insurance

- Best Mortgage Insurance

- Best Health Insurance

- Best Endowment Insurance

- Best Critical Illness Insurance

- Best Maid Insurance

- Best Whole Life Insurance

- Best Term Life Insurance

- Best Personal Accident Insurance

- Best Motorcycle Insurance

- Best Pet Insurance

Investments

- Best Online Brokerages

- Best Robo Advisors

- Best P2P/Crowdfunding Platforms

Bank Accounts

- Best Savings Accounts

- Best Fixed Deposit Accounts

- Best Debit Cards

- Best Hotel Booking Sites

- Best Wire Transfers

- Best Electrical Retailers

- Best Travel Deals

Personal Finance Guides

We'll help you make informed decisions on everything from choosing a job to saving on your family activities.

- Average Cost of Home Renovation

- Average Cost of Monthly SP Bills

- Average Cost of Domestic Help

- Average Cost of Moving Your Home

- Average Cost of Renting a Car

- Average Cost of a Wedding

- Average Cost of a Divorce

- Average Cost of a Funeral

- Average Cost of an Engagement Ring

- Research Reports

- Evaluation Methodology

- DBS Live Fresh Credit Card - Best Eco-Friendly Online Shopping Cashback Card

- Great rewards on contactless payment methods (Visa payWave)

- Green cashback on eco-eateries and retailers

- Various entertainment discounts and promotions

- Lacks travel and overseas spend rewards

- Not suitable for low budgets

DBS Live Fresh is a great option for modern spending, offering 5% cashback that applies broadly to any online transaction and any Visa contactless payments. It's also advertised as the first eco-friendly credit card in Singapore, offering an extra 5% cashback at select eco-eateries, retailers and transport services. While its online rebate isn't the highest, DBS Live Fresh Card delivers a unique combination of cashback, ATM, and SimplyGo capabilities.

DBS Live Fresh Credit Card Features and Benefits

- Enter the promo code 150CASH and spend a minimum of S$800 within 60 days of card approval to be eligible

- New DBS/POSB cardmembers can get S$150 cashback when you apply through ValueChampion

Our Evaluation: Decent Cashback and Eco-Friendly Savings, But No Fee Waivers

DBS Live Fresh Card is great if you want versatile cashback from both online and mobile payments. You earn 5% cashback on online retail spend and on payments made via Visa payWave through a contactless terminal or mobile wallet (Apple Pay, Samsung Pay, Google Pay). In today's economy, this means you can earn 5% on nearly any spend - up to the card's limit of S$40 per month in those two categories.

On top of its core 5% cashback, DBS Live Fresh also offers 5% back at select eco-eateries, eco-retailers and eco-transportation, up to a monthly category limit of S$15. All other spend earns a standard base rate of 0.3% cashback. Compared to other credit cards with online cashback, DBS Live Fresh Card stands out for its all-in-one functionality: you get ATM and SimplyGo features to complement the cashback benefits.

However, DBS Live Fresh falls behind in some ways. Its 5% rebate is decent, but not the highest available. It also requires you spend S$600 per month to earn the 5% rate, and your maximum rewards are limited to no more than S$20 in each 5% category. It also carries an annual fee of S$192.6 that is only waived in the first year, with no way of avoiding it in subsequent years. Finally, DBS Live Fresh does not earn cashback on payment platforms like CardUp, iPayMy and SmoovePay.

Still, we think that there are plenty of people who will find DBS Live Fresh Card a useful option for getting cashback without having to pay close attention to their spending habits. As long as you tap your card to pay in person or use Google Pay, Apple Pay or Samsung Pay, you'll earn 5% every month.

How Does DBS Live Fresh Credit Card's Rewards Program Work?

- Every 1 dollar of cashback earned is equal to S$1

- Cashback is credited to the cardholder's account monthly

- Cashback is automatically applied to pay part of the billed amount for that month

Before You Apply: Caps, Minimums, and Exclusions

Like most other credit cards, DBS Live Fresh comes with some restrictions that you'll need to keep in mind if you want to get the most value out of its rewards. First of all, the cashback you can earn each month is limited to S$75, divided into four categories: online spend, Visa contactless spend, sustainable spend and general spend.

Among these four categories, the sustainable spend works like an extra bonus and can be earned on top of online or contactless spend for a total of 10% cashback on a single transaction. This means that even in an ideal scenario, you must spend at least S$2,467 per month in order to reach the maximum S$75 cashback possible with DBS Live Fresh Card.

That said, much of that required spend is concentrated in the general spend rate of 0.3%, which we don't believe is a great deal compared to the 5% cashback rates in the other three categories. The more efficient method of using this card would be to target the combined S$40 cap on online purchases and Visa contactless spend, which only requires S$800 per month.

Finally, keep in mind that there are many specific types of transactions that do not qualify for any rewards with DBS Live Fresh (nor with most other credit cards). For DBS Live Fresh, the following exclusions apply:

How DBS Live Fresh Credit Card Compares to Other Cards

Read our comparisons of DBS Live Fresh Card with other cards and learn what makes each card unique in their own way. We compare and contrast each card to highlight its uniqueness to help you identify the card that you need.

DBS Live Fresh Credit Card v. OCBC Frank Card

- 6% rebate on online, mobile contactless, and FX spend

- Fee waiver with S$10,000 annual spend

- 0.3% rebate on general purchases

- Annual fee after 2 years

- Capped cashback at S$75

OCBC Frank Card is great for online shoppers who are comfortable with making mobile payments and seek rewards for entertainment spend. The card offers higher cashback rates for both online shopping and contactless payments than DBS Live Fresh Card at 6% versus 5%, respectively. It also has a lower minimum spend to unlock higher rates (just S$400/month), and cardholders can reach the cashback cap of S$60/month with spend across any category. It also provides an annual fee waiver for those who spend S$10,000 on the card annually.

Though OCBC Frank Card is not an all-in-one card, it stands apart from DBS Live Fresh Card by offering 3% cashback on the first 2 NETS FlashPay Auto Top-Ups. Finally, DBS Live Fresh Card offers discounts and promotions for nightlife experiences, while OCBC Frank Card offers up to 5% cashback on entertainment. For like-minded consumers, OCBC Frank Card is more likely to maximise rewards quickly and easily than DBS Fresh Live Card. The latter however does have all-in-one functionality.

DBS Live Fresh Credit Card v. Standard Chartered SingPost Spree Card

- Great for monthly budgets below S$500

- Rewards overseas retailer shopping

- Not suitable for monthly budgets of S$500+

- Lacks local shopping rewards

Shoppers who buy online overseas and use vPost shopping might be interested in Standard Chartered SingPost Spree Card . Cardholders earn lower rates for local and overseas online shopping than with DBS Live Fresh Card, but earn higher cashback on general spend, plus 3% on vPost transactions. Another difference is that SC SingPost Spree Card's cashback cap of S$60/month is not subdivided into categories, making it easier to max rewards than with DBS Live Fresh.

By combining cashback from overseas online spend (like through Amazon, for example) with shipping by vPost, cardholders can double up on rewards and quickly benefit from SC SingPost Spree Card. Consumers who rarely shop overseas, but do spend quite a bit online and offline locally with mobile wallets might be interested in DBS Live Fresh Card.

DBS Live Fresh Credit Card v. OCBC 365 Card

- 6% rebate on dining, 3% on groceries, transport, utilities, online travel

- Up to 22.1% fuel savings at Caltex, 20.2% at Esso

- 0.3% rebate on general spend

- High S$800 minimum spend requirement

Consumers looking for a broad, no-fee cashback card that rewards utilities payments might benefit from OCBC 365 Card . While OCBC 365 Card rewards groceries and online travel at a lower cashback rate than DBS Live Fresh Card (assuming purchase online or via mobile wallet), OCBC 365 offers higher cashback for dining (6%) and transport (3%). The card also offers 3% cashback on utility bills, which are excluded from cashback with DBS Live Fresh Card.

Finally, OCBC 365 Card's fee of S$192.6 is waived for two years and then subsequently with every annual spend of S$10,000–unlike DBS Live Fresh Card, which only waives its S$192.6 fee the first year. Ultimately, OCBC 365 Card is better for consumers seeking no-fee cashback and rewards for dining, transport, and utility payments. DBS Live Fresh Card's all-in-one functionality may be more appealing to some consumers, however.

DBS Live Fresh Credit Card v. CIMB Visa Signature Card

- Rewards online shopping, groceries and beauty spend

- Rewards pet spend and cruises

- No annual fee credit card

- Lacks discounts on transport & petrol

- Speciliazed spend

- Doesn't fit frequent travellers

Consumers intent on maximising cashback for online shopping with a no-fee card might want to consider CIMB Visa Signature Card . Consumers earn 10% rebates on online shopping, beauty, groceries,pet care and overseas travel expenses after a qualifying spend of S$800–with no annual fee. While DBS Live Fresh Card has a lower minimum spend requirement, it only offers 5% cashback for online spend and has a S$192.6 fee, waived only 1 year.

To view the best cashback credit cards available in Singapore, check over here for more!

- How to Reduce Your Singapore Credit Card Fees to Effectively Zero

- Should You Get a Cashback Credit Card to Curb Inflation in Singapore?

- The Best Cashback Credit Cards For Different Types Of Spenders

Zoryana is a Senior Research Analyst at ValueChampion, who focuses on evaluating credit cards, savings and fixed deposits in Singapore. She holds a BA in Political Science and an MPA in International Finance and Economic Policy, both from Columbia University. Prior to joining ValueChampion, Zoryana worked in treasury management consulting.

Keep up with our news and analysis.

Stay up to date.

Our Top Credit Cards

- Overall Best Credit Cards

- Best Air Miles Credit Cards

- Best Agoda Credit Card Promotions

- Best Expedia Credit Card Promotions

- Best Booking.com Credit Card Promotions

- Best Credit Cards with Klook Promo Codes

- Best Miles Cards with No Annual Fee

- Best Cashback Cards with No Annual Fee

- Best Petrol Credit Cards

- Best Cards for SPC Discounts

- Best Cards for Esso Promotions

- Best Cards for Shell Discounts

- Best Shopping Credit Cards

- Best Student Credit Cards

- Best Credit Cards for Seniors

- Best Expat Credit Cards

- Best Unlimited Cashback Credit Cards

- Best Cards for High Income

- Best Dining Credit Cards

- Best Cards for Food Delivery

- Best Credit Card 1 for 1 Buffet Promotions

- Best Grocery Credit Cards

- Best Entertainment Credit Cards

- Best Credit Cards for TransitLink SimplyGo

- Best EZ-Link Credit Cards

- Best Cards for Insurance

- Medical Credit Cards

- Wedding Credit Cards

- Best Cards for Seniors

Compare Credit Cards by Value

- Rewards Credit Cards

- Cashback Credit Cards

- Petrol Credit Cards

- Travel Credit Cards

Featured Credit Cards

- Citi Cashback Card

- HSBC Visa Platinum Credit Card

- Maybank FC Barcelona Visa Signature Card

- Citi PremierMiles Visa Card

- HSBC Revolution Card

- DBS Altitude Card

Credit Card Basics

- How to Find the Best Rewards Credit Card

- How to Use a Credit Card: Best Practices Explained

- Everything You Need to Know To Optimise Points Redemption

- Guide to the Risks of Credit Card Churning

- Everything to Know about 0% Instal Plans

- Understanding Credit Card APRs & Interest Rates

- Average Interest Rate of Credit Cards

- What Is Credit Card Cash Advance?

- Average Cost of Cash Advance

- What Is a Balance Transfer?

- Repercussions of a Late Payment on Your Credit Card

- Credit Card Minimum Payment: What You Need To Know

- Understanding Credit Cards' Minimum Spend Requirements

- A Basic Guide to Supplementary Credit Cards

- VISA vs MasterCard – Which is better?

- Everything to Know about Foreign Transaction Fees

- Cash vs Credit Cards: Which Is Better To Use When Travelling?

- Cash Back vs Points vs Miles

- Cashback Cards vs Miles Cards

- Guide to Redeeming Miles Credit Card Rewards

- Understanding Caps on Monthly Rewards Earnings

- No Annual Fee Cards vs Fee Cards

- Debit Cards vs Credit Cards

- Common Credit Card Transactions Excluded from Earning Rewards

Featured Credit Card Services

- RentHero vs CardUp

- Youtrip vs. Revolut Digital Wallets

- CardUp Review

- RentHero Review

- Revolut Standard Review

- YouTrip Debit Card Review

Related Articles

- How to Put Your Salary Increment to Good Use

- 10 Best Free-Flow Brunch Buffets in Singapore for All Budgets

- Last-Minute Christmas Shopping Hacks and Gift Ideas For The Procrastinator In All Of Us

- The Best Christmas Dining Specials for a Merry Holiday Season in Singapore (2023)

- 3 Easy Ways to Host Christmas Dinner on a Budget

- Pros and Cons of Contributing to Your Supplementary Retirement Scheme (SRS)

- Everything You Need To Know About Supplementary Retirement Scheme (SRS)

- Copyright © 2024 ValueChampion

Advertiser Disclosure: ValueChampion is a free source of information and tools for consumers. Our site may not feature every company or financial product available on the market. However, the guides and tools we create are based on objective and independent analysis so that they can help everyone make financial decisions with confidence. Some of the offers that appear on this website are from companies which ValueChampion receives compensation. This compensation may impact how and where offers appear on this site (including, for example, the order in which they appear). However, this does not affect our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services

We strive to have the most current information on our site, but consumers should inquire with the relevant financial institution if they have any questions, including eligibility to buy financial products. ValueChampion is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. The site does not review or include all companies or all available products.

IMAGES

VIDEO

COMMENTS

Enquiries. Overseas Emergency Assistance. Call Chubb's Customer Service Hotline at +65 6398 8797 (Mondays to Fridays, 9.00am to 5.00pm, excluding Public Holidays) or via email at [email protected]. If you are overseas and require any emergency assistance, you may call the 24-hr Chubb Assistance at +65 6322 2132.

100% targeted at millennials and Gen Z, the DBS Live Fresh Card offers up to 5% cash rebate on online and Visa contactless spend. Everything else earns a measly 0.3%. Total monthly cashback is capped at $60; adding to that, the cap is further split into 3 categories: $20 for Online Spend, $20 for Visa Contactless Spend and $20 for all other spend.

DBS TravellerShield Plus Travel Insurance Review: Alluring Combination Of High Coverage, Flexibility And Low Premiums. DBS TravellerShield Plus stands as one of the best travel insurance plans on the market, with the uncanny ability to fit almost any type of itinerary. But unfortunately, this plan stumbles when addressing the needs of those ...

Welcome Offer. S$388 cashback. Promotion is valid for new DBS credit cardmembers only. Apply for the DBS Live Fresh Card with promo code 388CASH and make a min. spend of S$800 within 60 days of card approval to be eligible for reward. Promotion is valid until 31 May 2024.

Complimentary travel insurance coverage up to NT$30,000,000; Learn more (Chinese only) Apply now (Bilingual) ... DBS Live Fresh Business Signature Card (Benefit) Domestic rebate 1.2%; Overseas rebate 2.52% cashback; Complimentary City Parking (1 time per day, up to 2 hours parking)

Anastassia Evlanova, Senior Research Analyst. DBS's travel insurance plans share in common a tendency to offer average coverage in most areas at prices close to the industry average, standing out only for their high coverage for baggage delay. 3.5/5.0. ValueChampion Rating. Personal Accident Coverage. Trip Delay Coverage. Baggage Delay Coverage.

As a DBS Live Fresh Cardholder, you get to enjoy a range of lifestyle perks and privileges that cater to your dining, entertainment, travel, and overseas spending needs. Here are some of the benefits you can look forward to: Dining and Entertainment. DBS Live Fresh Card offers a 5% cash rebate on online and contactless dining and entertainment ...

DBS Live Fresh Student Card. Apply Now. Back to all Credit Cards. DBS Live Fresh Student Card is one of the best starter cashback student credit cards in Singapore. Benefits include annual fee waivers, no minimum spend and income, and attractive 5% cash back on McDelivery, Netflix, and more. This credit card comes with a S$500 credit limit.

Earn up to 5% cashback on your Transport spend (includes bus, train and taxi rides, and even ride-hailing services) with a minimum spend of S$600 per calendar month for the first 180 days from Card Approval Date. Get up to 5% cashback on Online & Visa contactless spend with a minimum spend of S$600 per calendar month. Earn 0.3% cashback on all other spend. All-in-one card: Use the same card ...

The DBS Live Fresh Card lets you turn every day into fresh new experiences. Taste into new cuisines, discover amazing hangouts around the corner or around the world, reinvent your style and more - all while earning rewards your way! Best of all, be rewarded with 6% cash boost # for your online spending. Play by your own rules!

Benefits. Eco-friendly credit card. Singapore's first eco-friendly credit card made from 85.5% recycled plastic. No minimum spend. Reduce the need to spend unnecessarily just to meet the bank's requirements. Annual fee of S$194.40, waived for 5 years. The card is basically free for your entire tertiary education.

6%. Designated Cash Back for Online Transaction. MoneySmart Exclusive. From now until 30 April 2024, apply for designated cards through MoneySmart( DBS Eminent Card/ DBS Live Fresh/ DBS Compass Visa)successfully to get HK$200 Apple Store Gift Card or HK$200 Klook Voucher or HK$200 ParknShop Voucher! Valid until 30 Apr 2024 - See more ...

DBS Live Fresh and POSB Everyday Card each have perks that cater to a specific audience. The first focuses on young millennials. ... DBS Live Fresh POSB Everyday; Travel Insurance: N/A: N/A: Petrol Savings: Up to 14% fuel savings at Esso: Up to 20.1% + 2% fuel savings at SPC: Transit Perks: SimplyGo Compatible: SimplyGo Compatible:

Here are the DBS/POSB credit cards worth your consideration. Up to 6% cashback on select spend, plus 0.3% unlimited base cashback: DBS Live Fresh. Best cashback on dining, groceries, shopping, etc.: POSB Everyday Card. 1.3 mpd on local spend and 2.2 mpd on foreign spend: DBS Altitude Visa | DBS Altitude AMEX.

Complimentary travel medical insurance - Have a peace of mind when you travel with complimentary travel insurance coverage of up to S$500,000. ... DBS Live Fresh Card-Get up to 6% cashback on shopping and transport. Note, however, that the minimum spending requirement is a higher $800 a month. At least the monthly cap on cashback is also ...

DBS Live Fresh UOB EVOL; Travel Insurance: N/A: S$500k Personal Accident; S$50k Medical, Evac & Repatriation: Petrol Savings: Up to 14% fuel savings at Esso: Up to 20% fuel savings at SPC, 14% at Shell: Transit Perks: SimplyGo Compatible: SimplyGo Compatible: Mobile Pay: Google Pay, Apple Pay, Samsung Pay & more:

DBS SAFRA Credit Card. 3% Cash rebates on online purchases. N/A (As long as you are paying for your Safra membership) DBS Altitude American Express Card Card. S$1 = 3 miles on online travel bookings. First Year Waived. DBS Live Fresh Card. 5% Cashback on online and contactless payments. First Year Waived.

What the DBS Live Fresh Credit Card can do for you. Apply Now. DBS Live Fresh Credit Card product summary: Earn 6% cashback on your shopping sprees and daily commutes. Get unlimited 0.3% cashback on all other eligible spend. Minimum spend: S$800 per calendar month. Capped at S$70 total cashback per month.