clock This article was published more than 4 years ago

What does ‘discretionary travel’ mean?

The novel coronavirus outbreak has introduced some new terms to our everyday conversation: “social distancing,” “flattening the curve” and now “discretionary travel.”

President Trump has, as of Tuesday morning, not imposed any domestic travel bans, but guidelines issued by the White House advise avoiding all discretionary travel, along with now-familiar dictates like practicing good hygiene, avoiding social gatherings of more than 10 people and halting visits to nursing homes. The guidelines describe “discretionary travel” as shopping trips and social visits, but in these times of high anxiety, what qualifies as discretionary (or “nonessential,” in the Centers for Disease Control and Prevention’s literature) isn’t necessarily cut and dried. The fact that “discretionary travel” was among the most-searched terms on Google on Monday is testament to that.

Find the latest developments on The Post’s coronavirus live blog

According to the National Household Travel Survey , which the Federal Highway Administration has conducted periodically since 1969, discretionary travel falls into five categories: shopping, family or personal business, visits with family or friends, social or recreational gatherings, and medical or dental purposes. Nondiscretionary, meanwhile, refers to trips for work and school — anything that takes place at a set location and time.

But in a crisis, when work and school are vagaries at best, it comes down to one simple matter: accountability.

The main goal right now, scientists have been telling us, is flattening the curve of the contagion’s spread. Everyone has a role to play in that.

“The fundamental issue, as you’re hearing from all the authorities, is how we as individuals have a responsibility in mitigating against the spread of this disease. Without turning this into a horror show or downplaying the significance, we really want to blunt the pandemic spike,” said Robert Quigley, regional medical director and a senior vice president of International SOS, the world’s largest travel risk-mitigation organization, and a retired cardiothoracic surgeon.

When it comes to making decisions about travel, Quigley speculates that it’s a matter of time before the decisions are made for us.

“A lot of it is simplified by saying ‘Just avoid public transportation’ — buses, trains, airplanes. The beauty of where we are is that it’s likely going to be mandated before we know it. We haven’t seen the extent of what can happen on the municipal or state or federal level,” Quigley said.

But that’s not to say you have to lock yourself in your house.

“We’re concerned about public health and safety, but also about mental health,” Quigley said. “When cabin fever sets in, there’s nothing wrong with going for a walk, as long as you practice social distancing and don’t touch surfaces. It’s important for our psychic well-being. Just be accountable and be responsible so that we as a society can get hold of this.”

Weisstuch is a writer based in New York. Find her on Twitter and Instagram: @livingtheproof .

More from Travel:

Mapping the spread of the new coronavirus in the U.S. and worldwide

Everything travelers need to know about being sick overseas

What happens when college kids leave the nest — and coronavirus sends them back

Coronavirus: What you need to know

Covid isolation guidelines: Americans who test positive for the coronavirus no longer need to routinely stay home from work and school for five days under new guidance planned by the Centers for Disease Control and Prevention. The change has raised concerns among medically vulnerable people .

New coronavirus variant: The United States is in the throes of another covid-19 uptick and coronavirus samples detected in wastewater suggests infections could be as rampant as they were last winter. JN.1, the new dominant variant , appears to be especially adept at infecting those who have been vaccinated or previously infected. Here’s how this covid surge compares with earlier spikes .

Latest coronavirus booster: The CDC recommends that anyone 6 months or older gets an updated coronavirus shot , but the vaccine rollout has seen some hiccups , especially for children . Here’s what you need to know about the latest coronavirus vaccines , including when you should get it.

25% Off Benzinga's Most Powerful Trading Tools

Traders Win More with Benzinga's Exclusive News and Squawk

- Personal Finance Accounts Best Credit Cards Best Financial Advisors Best Savings Accounts Apps Best Banking Apps Best Stock Trading Software Robinhood Alternatives TurboTax Alternatives Brokers Brokerage Account Taxes Brokers for Bonds Brokers for Index Funds Brokers for Options Trading Brokers for Short Selling Compare Online Brokers Forex Brokers Futures Brokers High-Leverage Forex Brokers MetaTrader 5 Brokers Stock Brokers Stock Brokers For Beginners

- Insurance Car Best Car Insurance Rental Car Insurance Motorcycle Best Motorcycle Insurance Seasonal Insurance Vision Best Vision Insurance Types of Vision Insurance Vision Insurance For Kids Vision Insurance For Seniors Health Affordable Health Insurance Best Health Insurance Companies Individual Health Insurance Self-employed Health Insurance House Earthquake Insurance Flood Insurance Homeowners Insurance Mobile Homes Moving Insurance Renters Insurance Sewer Line Dental Affordable Dental Insurance Best Dental Insurance Dental Insurance With No Annual Maximum Dental Insurance With No Waiting Period Kids Dental Insurance Medicare Compare Medicare Plans Cost of Hospital Stays Life Term Life Insurance Business Best Business Insurance Pet Best Pet Insurance

- Investing Penny Stocks Best EV Penny Stocks Best Penny Stocks Penny Stocks Under 10 Cents Penny Stocks With Dividends Futures Best Futures Trading Software Futures to Trade Futures Trading Courses Strategies Trading Platforms for E-Mini Futures Stocks Best Stock Charts Best Stocks Under $50 Best Stocks Under $100 Best Swing Trade Stocks Best Time to Trade Cash App Stocks How to Invest Stock Market Scanners Stock Market Simulators Stocks to Day Trade Forex Forex Demo Accounts Forex Robots Forex Signals Forex Trading Apps Forex Trading Software How to Trade Forex Making Money Trading Forex Trading Courses Trading Strategies Options Options to Buy Options Trading Apps Options Trading Books Options Trading Courses Paper Trading Swing Trading Options Trading Examples Trading Simulators Trading Software Trading Day Trading Apps Day Trading Books Day Trading Courses Day Trading Software Day Trading Taxes Prop Trading Firms Trading Chat Rooms Trading Strategies Alternative investing Alternative Investment Platforms Best REITs Best Alternative Investments Best Cards to Collect Best Gold IRAs Investing in Precious Metals Investing in Startups Real Estate Crowdfunding ETFs Commercial Real Estate ETFs International ETFs Monthly Dividing ETFs

- Mortgage Best Mortgage Companies FHA Lenders First Time Buyers HELOC & Refinancing Lenders for Self-Employed People Lenders That Do Not Require Tax Returns Online Mortgage Lenders

- Crypto Best Crypto Apps Business Crypto Accounts Crypto Day Trading Crypto Exchanges Crypto Scanners Crypto Screeners Earning Interest on Crypto Get Free Crypto How to Trade Crypto Is Bitcoin a Good Investment?

Understanding Discretionary Expenses: What Are They and How to Manage Them?

In building your budget, you’ll often hear financial advisers suggest cutting back on discretionary expenses. In theory, that sounds good. But what exactly are discretionary expenses? The most common examples are a $6 coffee or avocado toast at a restaurant. While $6 per month is unlikely to make or break your budget, small decisions on where you spend money on anything other than essentials can have a big impact on your financial health over time.

Discretionary spending is how you spend on anything other than basics like food, housing, and medical care. Learning what discretionary expenses are and how to build them into your budget and financial planning could help you save thousands a year. Read on to learn how.

What Are Discretionary Expenses?

Common types of discretionary expenses, the role of discretionary expenses in personal finance, tips for managing discretionary expenses, building your financial freedom, frequently asked questions.

First, essentials. Essential expenses are expenses you must make to live. They’re not necessarily fun but are, as the name implies, essential for living. This includes housing, food, transportation, utilities, insurance, medicine and debt repayment. Everything that doesn’t fall into the “essential” category is a discretionary expense. Discretionary expenses are “wants” rather than “needs.”

Wants mean you can choose to spend on that item or activity, but your accommodation, health or safety would not be affected if you opt out. Examples of discretionary expenses include everything from eating out to concert tickets, clothes, streaming services and recreational activities.

Keep in mind that the goal isn’t to reach zero discretionary expenses. It’s to understand that you can choose how you use these funds, and allocating even a small amount each week to savings can have a big long-term effect.

Discretionary expenses, collectively, could make up one-third or more of the average family’s spending. It’s important to understand how you’re using your money and whether it adds value to your life.

For example, a more long-term discretionary expense could include saving for a special vacation. While investing doesn’t usually fall into definitions of discretionary expenses, you can always allocate more of your discretionary funds to investments or retirement savings .

Examples of discretionary expenses are as diverse as individuals making the expenses. Here are some common discretionary categories:

- Vacations and travel expenses

- Automobiles — especially if you could take public transport

- Alcohol and tobacco

- Restaurant meals

- Movie tickets, concert tickets, sports tickets and other entertainment-related expenses.

- Coffee and specialty beverages

- Hobbies such as crafting, sewing, knitting, woodworking or other creative pursuits

- Sports and gym memberships, such as tennis, golf, rock climbing or yoga

- Specialty foods or extra treats

- Personal care beyond the basics, such as luxury skincare or hair products

The impact of discretionary expenses on savings and financial goals is bigger than most consumers realize. Spending — or saving— an extra $30 per day adds up to over $10,000 in a year. Likewise, saving just $50 per week would result in $2,600 in additional savings; that’s just $7.14 a day or about the cost of that take-out coffee.

Most financial advisers will tell you that small expenses add up over time. It’s true and important to understand. But it’s equally important to understand how those discretionary expenses can bring extra joy or comfort to your day. If that $7 cup of take-out coffee is the best part of your day, don’t cut it out. Consider where else you could cut expenses without reducing your quality of life.

You’ll also want to consider how you balance discretionary expenses with fixed expenses. Fixed expenses include regular monthly payments like a mortgage or rental payment as well as fixed payments like student or auto loans.

While the exact amount of utility payments may vary slightly by month, most financial advisers consider utilities, insurance and regular medicine purchases in the category of fixed expenses as they are more or less the same every month. If you maintain a food budget, that could also fall into the category of fixed expenses.

Practical tips for managing discretionary expenses start with knowing what you’re spending. You can consider using a budgeting app to track expenses. You can do this manually with pen and paper or in a simple spreadsheet. Once you’ve tracked your expenses for a month, look at where each percentage of your funds are going. How much are you spending on discretionary categories?

Then, list where you can cut back and create a provisional budget . You can continue to adapt the budget as you adjust. Learn more about creating a budget or consider the 70-20-10 budget .

Remember to make gradual changes. If you spent $500 in the first month eating out, start by reducing that amount by 20% to 50%, rather than declaring you’ll stop eating out altogether. Sustainable changes are easier to stick with long-term.

Other strategies to reduce discretionary spending include:

- Make a list and stick to it when grocery shopping

- Reevaluate or pause recurring expenses like app subscriptions or streaming services

- Pay off credit cards to reduce interest payments

- Consider a no-spend challenge for one week to one month to avoid all discretionary spending for a period. This can give you a sense of which expenses add value and which you’re happy to cut out permanently.

- Find free or low-cost activities in your area to replace some high-expense activities without sacrificing fun.

Remember that there’s no single destination; it’s more like a dance in which you continuously adjust your expenses with savings goals to reach long-term financial stability. If you spend more in one category, you can always cut back on another. Like anything, with practice, it gets easier. If it seems daunting at first, set smaller goals and keep adjusting.

Understanding discretionary expenses empowers you to use your money in a way that gives you the greatest value. The first step is to understand what you’re spending on now and look for opportunities to cut back. Even an extra $100 a week in savings is $5,200 a year.

Start with small changes, surround yourself with others who have similar goals, and consider opportunities to add greater value to your life while spending less. You can also find more budgeting tips for young adults and come back to Benzinga Money for more financial information and tips to take control of your financial health.

Why should you monitor discretionary spending?

Monitoring your discretionary spending can help you save more money for things that are really important for you, like special vacations, college or retirement. Taking control of your finances and knowing where your dollars go can be empowering.

How much should I allocate to discretionary expenses?

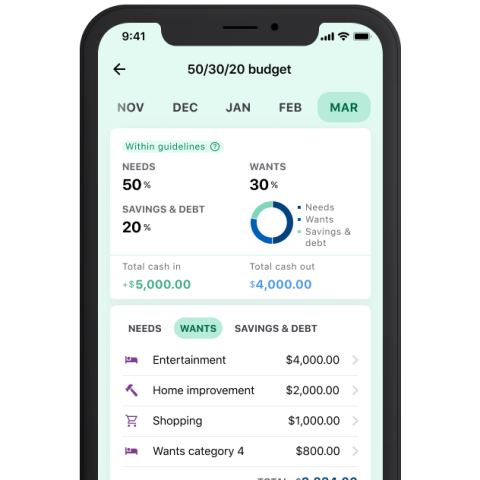

Approximately 30% of your net income can go toward discretionary spending.

How can I reduce my discretionary expenses?

You can reduce discretionary spending by tracking spending, canceling recurring charges and subscriptions and putting a 24-hour to seven-day pause on any discretionary purchase to reduce impulse spending.

About Alison Plaut

Alison Plaut is a personal finance writer with a sustainable MBA, passionate about helping people learn more about financial basics for wealth building and financial freedom. She has more than 17 years of writing experience, focused on real estate and mortgage, business, personal finance, and investing. Her work has been published in The Motley Fool, MoneyLion, and she is a regular contributor for Benzinga.

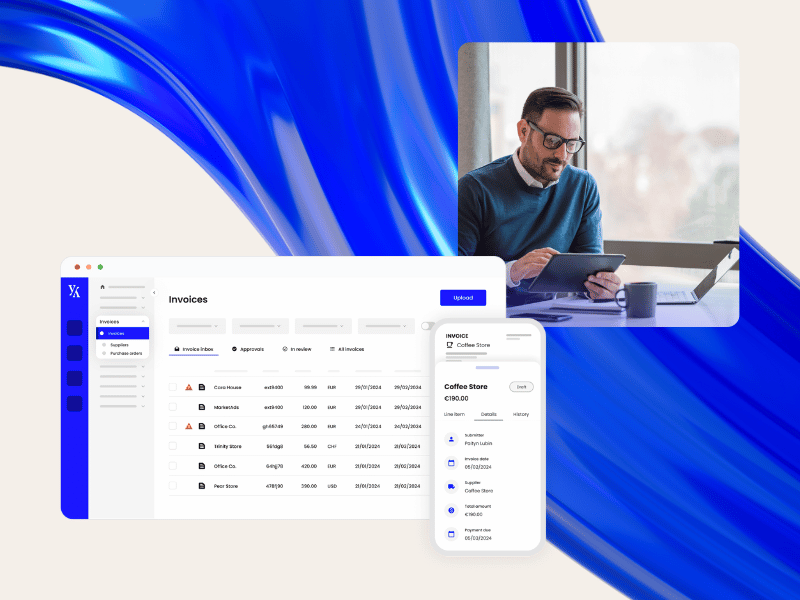

Travel & Expense

Procure-to-pay, integrations, spend management transformation in the ai era: a framework, finance transformation readiness checklist, solving automotive accounts payable challenges with ai automation, demo on demand, mastering nonessential expenses: a guide to discretionary spending.

Home / Mastering Nonessential Expenses: A Guide to Discretionary Spending

- Last updated: October 10, 2023

- Spend management , Travel and expense management

Co-founder & CCO, Yokoy

One common misconception about discretionary expenses is the belief that they are always expendable. This implies that you can cut discretionary spending without considering the consequences.

The reality is more nuanced.

Discretionary expenses encompass costs that are optional and can be trimmed when necessary. However, they are far from being dispensable in all scenarios.

Let’s delve into this topic to gain insight into when it’s prudent to reduce these expenses and explore alternative solutions for effective business expense management.

What are discretionary expenses?

Discretionary expenses, also known as non-essential expenses, refer to the costs that a company incurs voluntarily.

These are the expenses that are not directly tied to the core operations of the business. They encompass various areas such as marketing, investments, company subscriptions, travel, team perks, and office improvements.

For example, branding campaigns or advertising campaigns aren’t “essential” per se. A company can perfectly survive without paying for advertising. However, such investments do benefit the organization in the long and short term, so “non-essential” or discretionary expenses doesn’t mean non-important.

Now that this is clear, let’s see what qualifies as essential spend.

Difference between discretionary spending and essential expenses

To comprehend the significance of discretionary expenses, it’s essential to differentiate them from essential expenses.

Essential expenditure, as it’s name implies, represents costs that are essential for a company’s survival and proper functioning or well being. These include costs such as rent, utilities, and employee salaries.

In contrast, discretionary or nonessential spending is optional and can be trimmed down or eliminated when necessary.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Examples of discretionary expenses

To provide a clear picture of discretionary items, let’s explore some common categories:

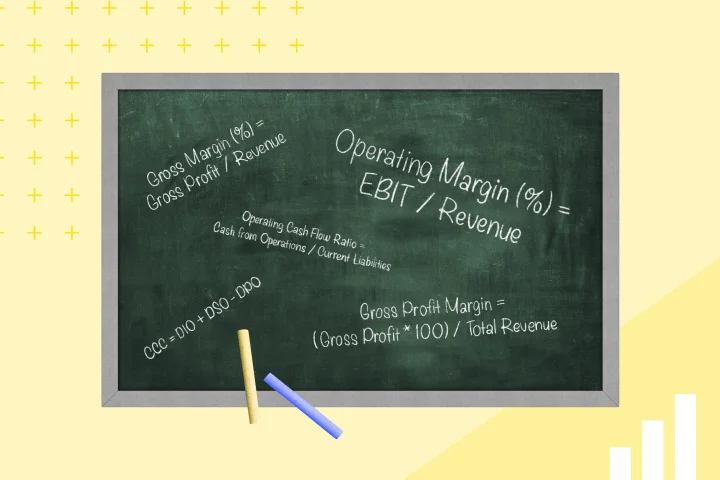

Marketing expenses

Marketing is a fundamental aspect of any business. However, the budget allocated to marketing campaigns, advertising, and promotions is considered discretionary budget. Finance professionals need to assess the ROI of marketing expenses carefully.

Some examples of discretionary marketing expenses include:

Advertising

Collateral materials like business cards, posters, and flyers

Event participation – whether it’s attending or hosting events

Video production

Agency and freelancer fees

Public relations, including press release distribution

Now, please note that certain marketing expenses are instrumental for business growth. Cutting them indiscriminately can hamper revenue generation and market presence. The key is to optimize these expenses rather than eliminating them entirely.

Investments

Investing in various ventures, stocks, or bonds is a discretionary expense. It’s essential to have a well-defined investment strategy to ensure these expenses align with your financial goals.

However, it’s crucial to have a well-defined investment strategy to ensure that these expenses align with your financial objectives. Some examples include:

Real estate

Cryptocurrencies

Commodities

Company subscriptions

Subscriptions to services and software can be a significant discretionary expense. Evaluating the necessity and cost-effectiveness of each subscription is vital. Here are some examples of subscriptions a company might be using:

Software services

Cloud storage and web hosting services

Industry-specific software

Market research tools

Travel expenses

Business travel is a common discretionary cost. Managing travel expenses efficiently can significantly impact your company’s bottom line. Here are examples of non-essential travel costs:

Accommodations

Meals and dining out

Transportation

Conferences and trade shows

Client and staff entertainment

Travel insurance

Daedalean manages travel expenses with Yokoy & Travelperk

“Yokoy and Travelperk helped us with end-to-end travel expense management automation. Now employees easily book trips in Travelperk, and all data is sent to Yokoy in real time, with all compliance checks and VAT validation already in place.”

Yvonne Gross, VP of Finance & Operations, Daedalean

Team perks and office improvements fall within discretionary expenses. For example, offering employee perks such as gym memberships or wellness programs falls into the discretionary category.

While they may not be immediately necessary, they contribute to employee satisfaction and productivity. Neglecting these expenses can lead to reduced morale and lower retention rates.

Here are other examples of team perks that are non-essential expenses:

Gym memberships and wellness programs

Health insurance benefits

Education assistance and certifications

Transportation subsidies

Employee recognition programs

Again, it’s essential to strike a balance between employee satisfaction and the amount of money that goes into such perks, before deciding to invest more or to cut costs from this category of expenses.

Office improvements

Upgrading the office environment and infrastructure is discretionary. However, these improvements can enhance productivity and employee satisfaction, making them worth the investment.

Examples of essential expenses

As said, certain expenses such as rent, employee salaries, and specific insurance premiums are considered essential. Legal obligations require the consistent payment of these expenses each month, so these qualify as mandatory spending.

Failing to meet these financial obligations could result in severe consequences, including legal actions, fines, or even the need to cease business operations altogether.

These business costs include:

Employee salaries

Debt repayments, including loans and mortgages

Rent and inventory

Utility bills

Software that is essential for the company’s functioning

Necessary hardware

These examples demonstrate the diversity of discretionary expenses that finance professionals may encounter in their roles, highlighting the importance of strategic management in each category.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

How to manage discretionary spending effectively

Effectively managing discretionary spending is essential for maintaining financial control and optimizing resource allocation. Here are some guidelines to help you manage discretionary expenses efficiently:

1. Establish clear budgets

Create well-defined budgets that distinguish between essential and discretionary expenses. Allocate specific amounts for each discretionary category, setting clear spending limits. This proactive approach ensures cost control and accountability.

2. Perform regular expense reviews

Regularly review discretionary expenses, ideally on a monthly or quarterly basis. This allows you to identify areas where cost savings can be achieved. Look for redundant or underutilized expenses and consider eliminating or reducing them.

3. Prioritize spending based on impact

Prioritize discretionary expenses based on their impact on your business’s goals and objectives. Focus on investments or strategies that contribute significantly to revenue growth or cost savings. Not all discretionary expenses carry equal weight.

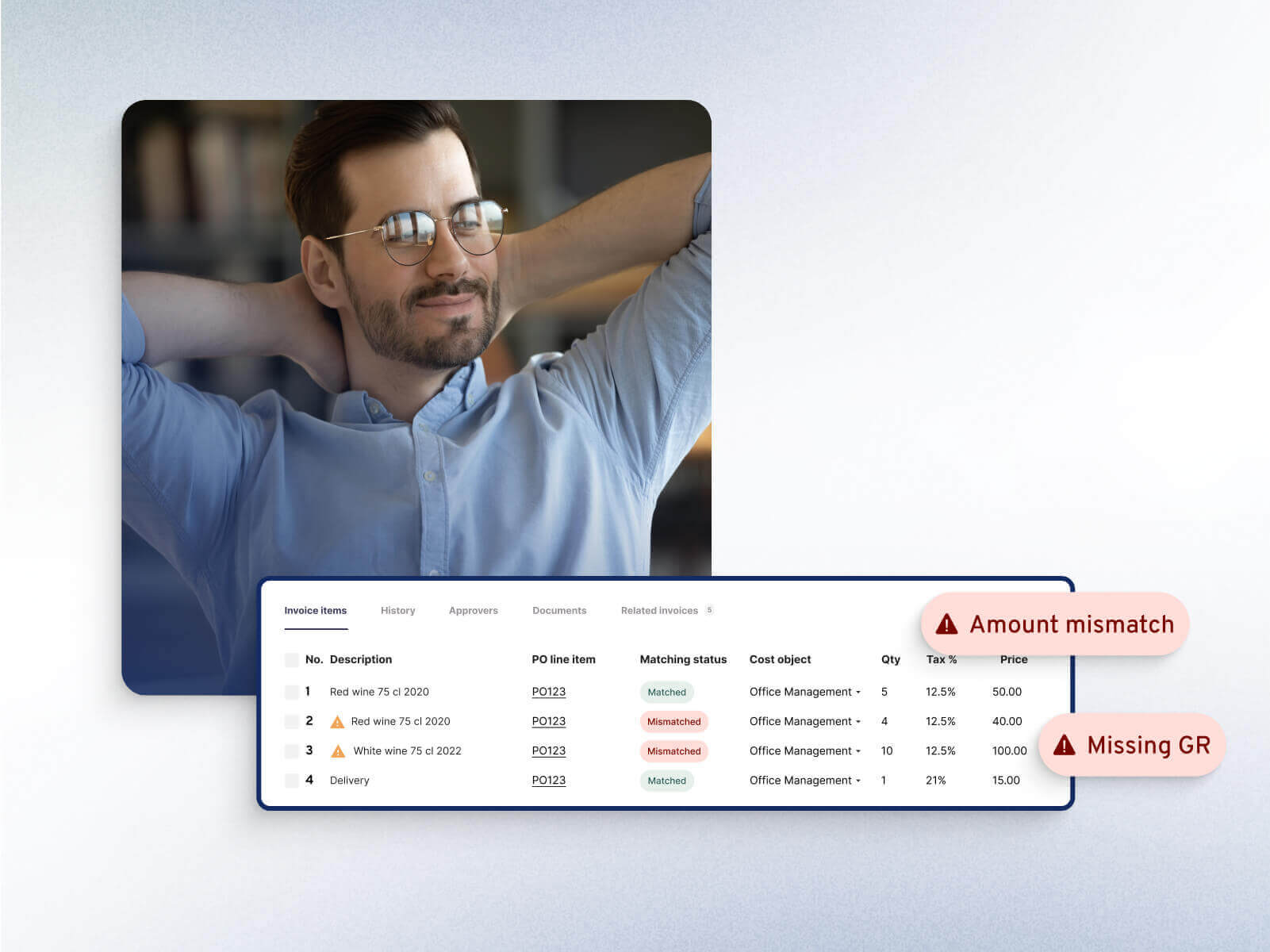

4. Use spend management software

Leverage automation and AI-driven solutions to streamline your spend or expense management. These technologies can help in tracking, reporting, and controlling discretionary spending more effectively, reducing manual errors and improving efficiency.

Before selecting a tool for managing your business expenses :

Define your needs: Identify your specific requirements for expense management software. Consider factors like scalability, integration with existing systems, mobile accessibility, and user-friendliness.

Research solutions: Explore different expense management software options available in the market. Look for user reviews, request demos, and assess their features against your needs.

Consider integrations: Ensure that the software can seamlessly integrate with accounting and financial systems, making the expense management process more efficient.

Create clear spend policies: Develop clear and comprehensive expense policies. These policies should detail what expenses are allowed, approval workflows, and documentation requirements.

If you’re ready to take this step, we’ve detailed the topic of selecting the right expense management software in the article below.

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

5. Employee involvement

Educate your team about the importance of managing discretionary expenses and involve them in cost-saving initiatives.

Raise awareness of the company’s financial goals and encourage employees to identify areas where discretionary expenses can be reduced or optimized. Incentivize cost-conscious behavior through recognition or rewards.

This can lead to more conscientious spending decisions at all levels of the organization.

6. Vendor negotiations

Negotiate with vendors and service providers for better terms. Explore opportunities for volume discounts, extended contracts, or alternative pricing structures. Reducing the cost of subscriptions and services can significantly impact your discretionary spending.

7. ROI analysis

Conduct a return on investment (ROI) analysis for each discretionary expense. Assess how these investments contribute to the company’s bottom line. If an expense doesn’t deliver a clear return, consider reallocating those resources to more productive areas.

You can try out our ROI calculator below for a quick assessment of your potential savings.

ROI calculator

Calculate your savings

How much can you save annually if you choose Yokoy as your spend management suite? Our ROI calculator helps you quantify the return on investment, so you can build a solid case for finance transformation.

8. Benchmarking

Benchmark your discretionary spending against industry standards or competitors. This provides context and helps identify areas where you might be overspending or underinvesting in critical areas.

By following these strategies, you can effectively manage discretionary spending, reduce waste, and ensure that resources are allocated to areas that align with the company’s strategic objectives.

The misconception that discretionary expenses are always expendable can be detrimental to businesses. While they provide flexibility, they are not devoid of importance.

Effective expense management involves striking a balance between controlling costs and supporting growth, employee satisfaction, and long-term financial health.

If you’re curious to learn more, we recommend to read the article below.

From $456K Lost/Year, to Full Spend Control: Three Process Changes You Can Implement Today

In the current economic context, with inflation peaking and recession looming , finance departments are under pressure to control costs and cut unnecessary spending. The fastest way to do this is to identify hidden costs – a task proves to be more challenging than it should.

Thomas Inhelder ,

CFO at Yokoy

Simplify your spend management

Related content.

If you enjoyed this article, you might find the resources below useful.

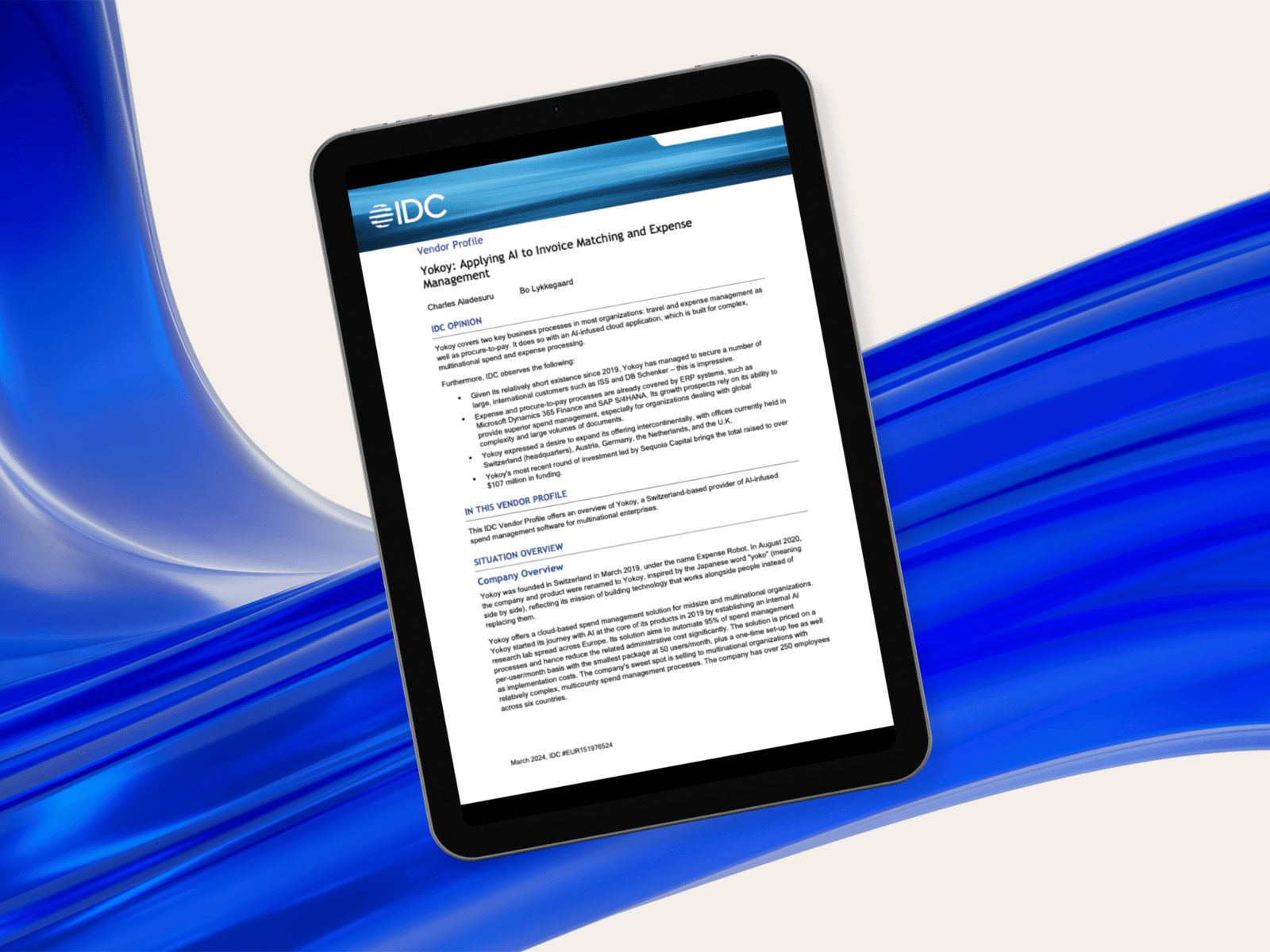

IDC: Yokoy Applying AI to Invoice Matching and Expense Management

Common Challenges in Manual Spend Management Processes

Spend Management Automation: 5 Critical Mistakes to Avoid During Implementation

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Discretionary Expenses

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on July 05, 2023

Get Any Financial Question Answered

Table of contents, what are discretionary expenses.

Discretionary expenses refer to non-essential spending on goods and services that are not required to maintain basic living standards. These expenses are often associated with leisure, entertainment, and personal indulgence.

Proper management of discretionary expenses is crucial for maintaining financial stability and achieving financial goals. By controlling discretionary spending, individuals can prioritize savings, reduce debt, and allocate resources to essential needs.

Discretionary expenses can be divided into various categories, such as dining out, hobbies, travel, and personal care. Explore the common types of discretionary expenses, budgeting strategies, and tips for reducing discretionary spending while maintaining a balanced lifestyle.

Common Types of Discretionary Expenses

Dining out and entertainment.

Eating at restaurants, going to the movies, or attending concerts are examples of discretionary spending on dining out and entertainment. These expenses can add up quickly and have a significant impact on one's budget .

Hobbies and Recreation

Spending on hobbies and recreational activities, such as sports equipment, art supplies, or memberships to clubs, also falls under discretionary expenses. These costs can vary widely depending on individual interests and preferences.

Travel and Vacations

Travel and vacations are often significant discretionary expenses, including airfare, accommodation, and sightseeing. These costs can be managed through budgeting and planning, but they still represent non-essential spending.

Clothing and Accessories

While clothing is a necessity, spending on high-end brands, luxury items, or excessive purchases is considered discretionary. This category also includes accessories such as jewelry, handbags, and shoes.

Electronics and Gadgets

Purchasing the latest smartphones, tablets, or gaming consoles are examples of discretionary spending on electronics and gadgets. These items can be expensive and may need to be balanced against other financial priorities.

Personal Care and Beauty

Discretionary expenses in personal care and beauty include salon visits, spa treatments, and high-end cosmetics. These costs can be reduced through DIY alternatives or by finding less expensive options.

Budgeting for Discretionary Expenses

Creating a realistic budget.

To manage discretionary expenses, create a realistic budget that accounts for all sources of income and essential expenses. This process will help identify how much money can be allocated to discretionary spending without jeopardizing financial stability.

Allocating a Percentage of Income

One popular budgeting method is to allocate a specific percentage of income to discretionary expenses, such as the 50/30/20 rule . This approach suggests allocating 50% of income to essential needs, 30% to discretionary wants, and 20% to savings and debt repayment.

Separating Needs From Wants

Distinguish between essential needs and discretionary wants to better control spending. This distinction can help prioritize spending on necessities and allocate the remaining funds to discretionary expenses.

Setting Spending Limits

Establish spending limits for discretionary expense categories to maintain control over spending. Regularly review and adjust these limits to ensure they remain appropriate for current financial goals and circumstances.

Strategies for Reducing Discretionary Expenses

Comparison shopping.

When making discretionary purchases, compare prices across multiple retailers to find the best deals. This practice can help save money without sacrificing quality or enjoyment.

Utilizing Coupons and Discounts

Take advantage of coupons, discounts, and sales to reduce discretionary spending. These savings opportunities can be found online, in newspapers, or through mobile apps.

DIY and Home-Based Alternatives

Consider do-it-yourself or home-based alternatives to discretionary expenses, such as cooking at home, engaging in hobbies that require minimal investment , or exercising without a gym membership.

Cutting Back on Non-essential Items

Evaluate discretionary spending habits and identify areas where costs can be reduced. For example, limit dining out to special occasions, eliminate unnecessary subscriptions, or postpone non-essential purchases.

Tracking and Monitoring Discretionary Expenses

Importance of tracking spending.

Tracking discretionary spending is crucial for understanding where money is being spent and identifying opportunities to reduce costs. Regularly monitoring expenses can also help identify patterns and develop healthier spending habits.

Tools for Monitoring Discretionary Expenses

Various tools can help track and monitor discretionary expenses, such as budgeting apps, spreadsheets, or expense tracking software. These tools can provide valuable insights into spending habits and help individuals stay on track with their financial goals .

Regularly Reviewing and Adjusting Spending Habits

Consistently review discretionary spending and make adjustments as needed. This practice ensures that spending remains within budget limits and supports long-term financial goals.

Balancing Discretionary Expenses With Financial Goals

Prioritizing savings and debt repayment.

Ensure that discretionary spending does not impede progress towards savings and debt repayment goals. Prioritize setting aside funds for an emergency fund, retirement savings, or paying off high-interest debt before allocating money to discretionary expenses.

Establishing Short- and Long-Term Financial Goals

Set short- and long-term financial goals to provide a clear direction for discretionary spending decisions. These goals can help individuals determine how much money should be allocated to discretionary expenses and when to adjust spending habits.

Adjusting Discretionary Spending to Support Goals

If financial goals are not being met, evaluate discretionary spending habits and make necessary adjustments. This may involve cutting back on certain expenses, reallocating funds, or finding alternative sources of income .

The Role of Discretionary Expenses in Financial Planning

Discretionary expenses play a significant role in financial planning and overall quality of life. By managing these expenses effectively, individuals can enjoy the things they love while maintaining financial stability and working towards long-term financial success.

Importance of Balancing Enjoyment and Financial Responsibility

Finding the right balance between enjoyment and financial responsibility is crucial for maintaining a healthy financial life. By making informed decisions about discretionary spending, individuals can enjoy their preferred lifestyle without sacrificing financial security.

Developing Healthy Spending Habits for Long-Term Financial Success

Developing healthy spending habits and consistently monitoring discretionary expenses can lead to long-term financial success. By prioritizing financial goals and making thoughtful spending decisions, individuals can create a stable financial foundation and work towards achieving their dreams.

Discretionary Expenses FAQs

What are discretionary expenses.

Discretionary expenses are expenses that are not essential to daily living and can be postponed or avoided without affecting one's basic needs, such as food, shelter, and clothing. Examples of discretionary expenses include dining out, entertainment, travel, and luxury items.

Why is it important to track discretionary expenses?

Tracking discretionary expenses can help individuals or households identify areas where they can cut back on spending to save money and prioritize their financial goals. It can also provide insight into spending patterns and help to create a more realistic budget.

How can I reduce my discretionary expenses?

Some ways to reduce discretionary expenses include limiting the frequency of dining out, finding free or low-cost entertainment options, choosing less expensive travel options, and prioritizing needs over wants when making purchases.

How much of my income should I allocate to discretionary expenses?

The amount of income to allocate to discretionary expenses varies depending on an individual's financial situation and priorities. Some financial experts recommend using the 50/30/20 rule, which allocates 50% of income to necessities, 30% to discretionary expenses, and 20% to savings and debt repayment.

What are some strategies for managing discretionary expenses?

Some strategies for managing discretionary expenses include setting a monthly spending limit for certain categories, such as dining out or entertainment, using cash instead of credit to limit spending, and regularly reviewing spending patterns to identify areas where adjustments can be made. It's also important to prioritize financial goals and make sure discretionary expenses are not preventing progress toward those goals.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Cost of Living for Retirees

- Fixed Expense

- Total Expense Ratio (TER)

- Dual Income, No Kids (DINK)

- Dual Listing

- Financial Education for Children and Grandchildren

- Financial Wellness Program

- How Does Passive Income Affect Social Security Benefits

- Income Sources

- Inheritances and Financial Windfalls

- Intra-Family Loans

- Is Passive Income Subject to Self Employment Tax?

- Part-Time Work

- Passive Income Taxation

- Passive Income Through Blogging

- Passive Income Through Car Washing

- Passive Income Through Real Estate

- Pay-Yourself-First Strategy

- Periodic Savings Plans

- Personal Balance Sheet

- Post-9/11 GI Bill Education Benefits

- Post-Divorce Budgeting

- Post-Divorce Debt Management

- Rainy Day Funds

- Sandwich Generation

- Saving Strategies

- Spousal Consent

- Student Loan Consolidation

Ask a Financial Professional Any Question

Meet top certified financial advisors near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

What's Planergy?

Modern Spend Management and Accounts Payable software.

Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing.

We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with Planergy.

Cristian Maradiaga

Download a free copy of "indirect spend guide", to learn:.

- Where the best opportunities for savings are in indirect spend.

- How to gain visibility and control of your indirect spend.

- How to report and analyze indirect spend to identify savings opportunities.

- How strategic sourcing, cost management, and cost avoidance strategies can be applied to indirect spend.

Discretionary Expenses: What Are They, Examples, and How To Control Them In Business

- Written by Rob Biedron

- 18 min read

KEY TAKEAWAYS

- In business and personal finance, many essential expenses are the same. These are what you have to pay to keep business running as usual (or to maintain a home, job, etc.)

- Discretionary spending is what you choose to spend – it’s not required to keep things running – but is nice to be able to do.

- Budgeting isn’t optional if you want to make the most of your money.

Discretionary expenses are costs that are not essential for the maintenance of a home or business.

These expenses can be adjusted or eliminated depending on an individual’s or a company’s financial situation and priorities. When finances are tight these will be the costs that you can cut when tightening your belt.

In this article, we will explore discretionary expenses in both personal and business contexts, including their definition, examples, and best practices for managing them.

Discretionary Expenses in Personal Finance

In a household setting, discretionary expenses are incurred for non-essential items such as entertainment, vacations, and hobbies.

These expenses are considered discretionary because they are unnecessary for maintaining a basic standard of living, unlike non-discretionary expenses such as housing, utilities, groceries, and transportation.

Some examples of discretionary spending, or non-essential expenses in households include:

Entertainment

Entertainment expenses can include many activities that provide enjoyment and relaxation.

These may consist of movie tickets, streaming service subscriptions, concert tickets, and other forms of amusement.

While entertainment is essential for personal well-being, it is not necessary for maintaining a basic standard of living, making it a discretionary expense.

Vacation expenses encompass all costs related to travel and leisure, such as hotel stays, airfare, car rentals, and sightseeing.

These expenses are considered discretionary because they are not required for day-to-day living and can be adjusted or postponed based on an individual’s financial situation.

Hobby-related expenses include the costs of pursuing personal interests and passions, such as art supplies, sports equipment, club memberships, and classes.

These expenses are discretionary because they are not essential for maintaining one’s basic needs and can be reduced or eliminated.

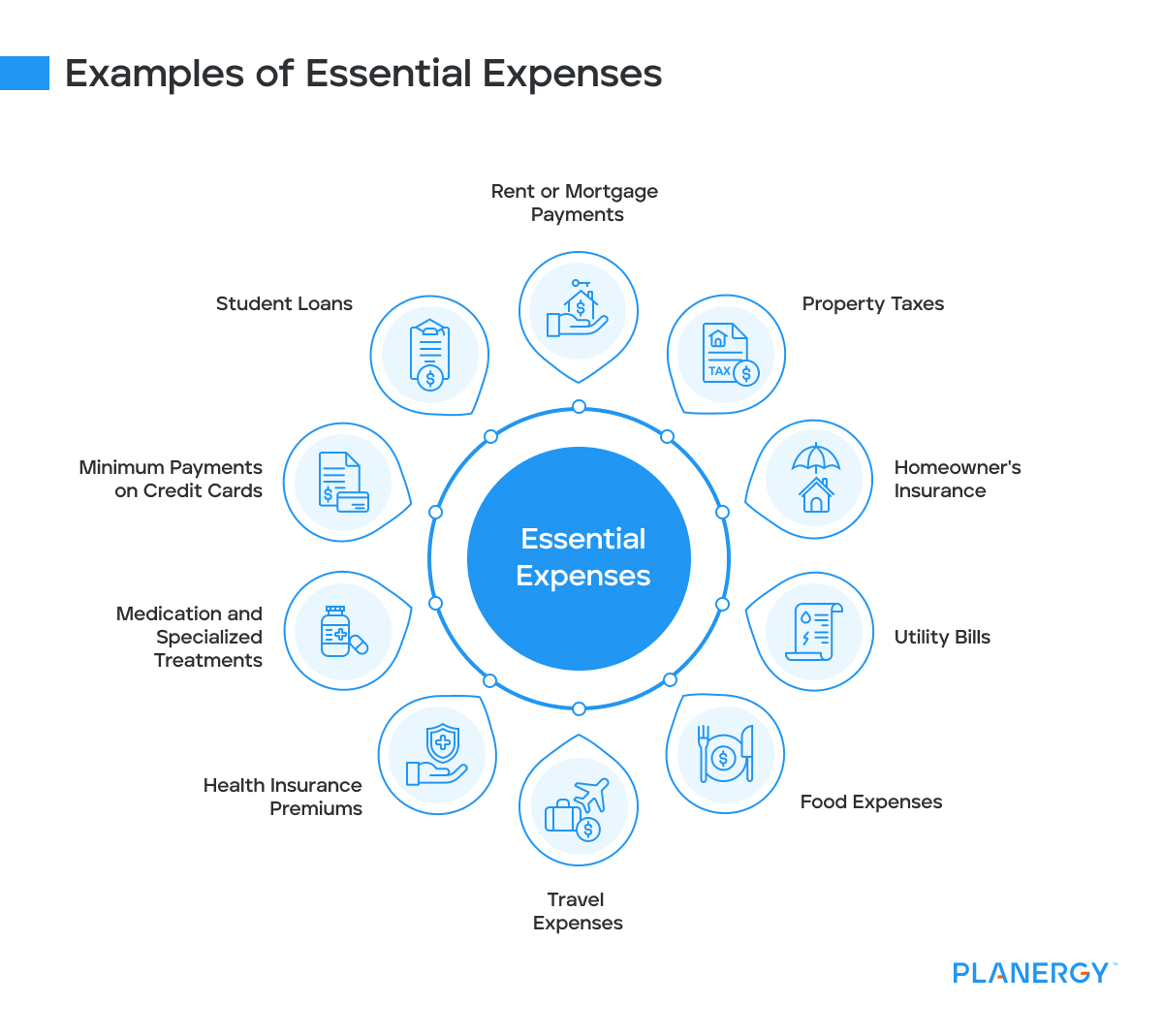

Essential Expenses

Essential expenses are the costs necessary for maintaining a basic standard of living. These expenses are fundamental to your well-being and cannot be eliminated without significantly impacting on your quality of life.

Examples of Essential Expenses

Rent or mortgage payments.

Rent or mortgage payments are essential expenses for maintaining a place to live. They represent the monthly cost of occupying a residence, whether a rental property or a home purchased through a mortgage loan.

Property Taxes

Property taxes are levied on homeowners by local governments and are based on the property’s assessed value. These taxes contribute to funding public services such as education, public safety, and infrastructure.

Homeowner’s Insurance

Homeowner’s insurance is a policy that provides financial protection against damage to your home and personal belongings due to events like fires, storms, or theft. It may also cover liability for accidents that occur on your property.

Utility Bills

This includes things like your electricity, water, gas, etc. Other essential utilities may include basic telephone service, trash removal, and sewer services.

Food Expenses

Groceries are an essential expense, as they provide the food necessary for daily sustenance and nutrition.

Basic dining expenses include occasional meals at affordable restaurants or takeout options. Luxury or non-essential dining experiences are considered discretionary expenses.

Travel Expenses

Costs associated with commuting to work may include public transit fares, carpooling fees, or parking expenses.

Car payments are a necessary expense if you have financed the purchase of a vehicle through a loan.

Fuel costs are essential for vehicle operation and depend on fuel efficiency and driving habits.

Auto insurance premiums provide financial protection in case of accidents or other incidents involving your vehicle.

Health Insurance Premiums

Health insurance premiums are paid to maintain coverage for medical expenses, including doctor visits, hospital stays, and prescription medications.

Medication and Specialized Treatments

Medication costs include prescription drugs and over-the-counter medicines required to maintain good health. You may also need to pay for medical devices, therapy, or other specialized treatments.

Minimum Payments on Credit Cards

Credit card debt payments are essential to avoid late fees, maintain a good credit score, and eventually eliminate debt.

Student Loans

Student loan payments are necessary to repay educational loans and avoid defaulting on the debt.

Many of these essential personal expenses also translate to the business world. You must pay for your building/offices/product facilities (whether through rental or mortgage), utilities, credit cards, loans, etc.

While you don’t necessarily have to pay for employee healthcare expenses but if you choose to offer benefits, that benefits package becomes an essential expense.

Discretionary Expenses in Business

In a business context, discretionary expenses are costs that can be adjusted or eliminated without directly impacting the company’s core operations. These expenses often vary across departments, such as marketing, human resources, and operations.

Examples of discretionary expenses in various business areas include:

Employee Perks and Benefits

Employee perks and benefits are incentives offered to employees beyond their regular salary.

These include gym memberships, team-building events, workplace wellness programs , tuition reimbursement, retirement planning, and flexible work arrangements.

While these perks can improve job satisfaction, employee engagement , and staff retention , they are considered discretionary because they are not essential for the day-to-day functioning of the business.

Office Decor and Aesthetics

Office decor and aesthetics involve the design and layout of your workspace, including furniture, artwork, and other decorative elements.

The basic elements of desks, chairs, and computers will be a required part of the office management setup to cover core business operations. Above and beyond that it will depend where the leadership team want to draw the line.

These expenses can create a comfortable and visually appealing work environment, positively impacting employee morale and productivity. However, they are considered discretionary expenses because they do not directly affect the business’s core operations.

Professional Development and Training Programs

Investing in professional development and training programs for your employees can enhance their skills, knowledge, and overall performance.

These programs may include workshops, seminars, conferences, or online courses.

While professional development can benefit your business in the long run, it is considered a discretionary expense because it is not essential for daily operations.

Non-Essential Software Subscriptions

Non-essential software subscriptions refer to tools and applications that are not crucial for the daily functioning of your business but may offer convenience or additional features.

Examples include project management tools, graphic design software, and social media scheduling platforms.

These might be paid for on behalf of the member of staff or handled by an expense reimbursement fulfilled based on a properly returned expense report .

While these subscriptions can provide value, they are considered discretionary expenses because they are not vital to your business’s core functions.

Business Travel and Entertainment Expenses

Business travel and entertainment expenses include attending conferences, networking events, trade shows, client meetings, employee outings, and recreational activities.

If travel and expense management practices are poor, or worse if there is no travel and expense policy in place, these expenses can get out of hand when financial circumstances are strong.

This makes them an ideal candidate for cutting back on when times are hard.

These expenses can help build relationships, foster collaboration, and expand your business network. There is a lot of value to the business created when this expenditure is managed correctly.

However, they are discretionary because they are not required for the business’s day-to-day operations.

Donations and Sponsorships

Donations and sponsorships are voluntary contributions a business makes to support charitable causes, community events, or industry initiatives.

These expenses can improve your company’s reputation and public image, but they are considered discretionary because they do not directly impact the core functions of your business.

Monitoring and controlling discretionary expenditures is crucial for businesses, as it can significantly impact overall expenses and help avoid potential financial setbacks.

Distinguishing Between Essential and Discretionary Expenses

The primary difference between essential and discretionary expenses lies in their necessity for maintaining a basic standard of living.

Necessary expenses are fundamental and cannot be eliminated without negatively impacting one’s quality of life. Discretionary costs, however, are non-essential and can be adjusted or eliminated based on an individual’s financial priorities.

To effectively manage your finances, it’s crucial to distinguish between these two types of expenses.

By categorizing your expenses as either essential or discretionary, you can better identify areas where spending can be reduced and allocate resources more effectively.

In most cases a split of direct and indirect expenditure is a good starting point. Indirect spend categories are where you likely find the majority of your discretionary expenses.

Improving how you manage indirect procurement will have a lot of benefits for your indirect procurement process now but can also help if you need to review what expenses you can cut out without impacting core operations.

In times of financial hardship, it’s crucial to prioritize essential expenses and cut back on discretionary spending.

Focus on maintaining the core functions of your business, including paying employees, keeping the lights on, and ensuring that your products or services are still available to customers.

Reducing non-essential spending can help your business weather the storm and emerge stronger when conditions improve.

Closely monitoring spending and comparing it to your budget can help control expenses.

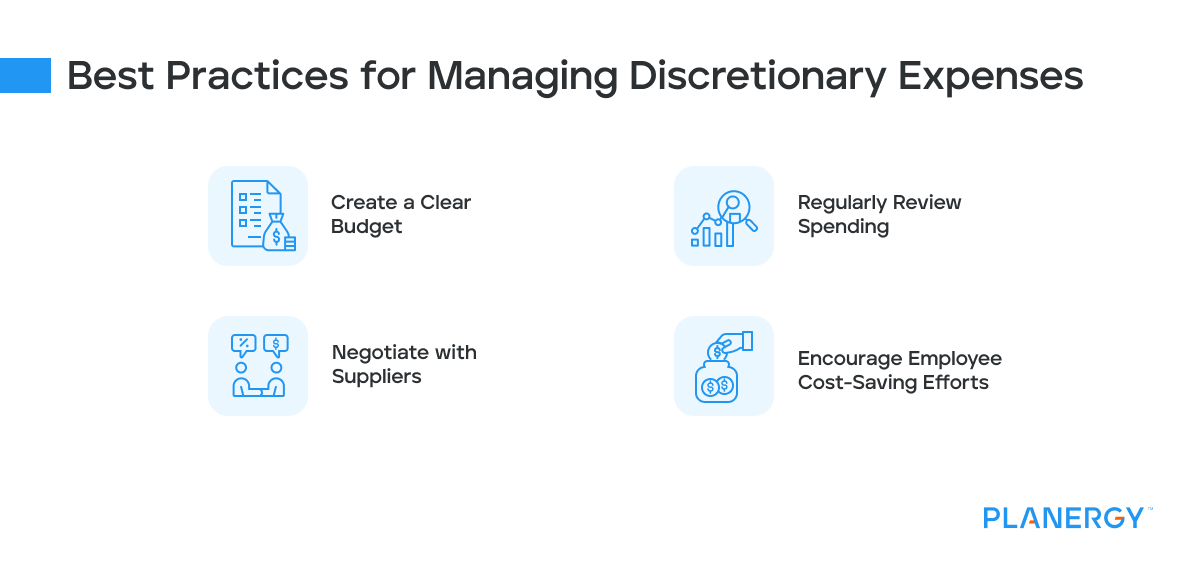

Best Practices for Managing Discretionary Expenses

Create a clear budget.

Establishing a comprehensive and strategic budget is crucial for effectively managing discretionary expenses.

A detailed budget should outline all discretionary and non-discretionary expenses, making it easier to identify areas where spending can be reduced.

Both individuals and businesses can benefit from tracking their income and expenses, setting spending limits, and prioritizing financial goals.

Regularly Review Spending

Periodically assessing spending habits is essential for identifying and eliminating unnecessary expenses or areas of overspending.

By regularly reviewing bank statements, credit card transactions, and expense reports, individuals and businesses can gain better control over their finances and adjust as needed to stay within their budget.

For businesses, a dedicated spend management software , like Planergy, with automated spend analytics and drill down reporting makes this much easier.

Negotiate with Suppliers

Seeking better deals or alternative options for products and services can lead to significant cost savings for both individuals and businesses.

Negotiating with suppliers , comparing prices, and exploring different vendors can potentially secure more favorable terms and reduce discretionary expenses.

Encourage Employee Cost-Saving Efforts

Implementing company-wide initiatives that promote cost-saving behaviors among employees can help businesses manage their discretionary expenses more effectively.

These initiatives may include offering incentives for cost-saving ideas, providing training on expense management, and encouraging employees to be mindful of their spending habits.

By fostering a cost-conscious culture within the organization, businesses can reduce expenses and improve their financial health.

Using Software to Manage Discretionary Expenses

Software solutions, such as Planergy’s spend management software, can be instrumental in better management of discretionary costs .

By tracking spending, identifying areas of overspending, monitoring employee spending habits, and providing detailed reports for more accurate budgeting you can improve the management of discretionary spend.

Tools like this ensure you have enough money to cover mandatory spending and can appropriately plan for discretionary items. Some common questions about using software to manage discretionary expenses include:

Can the software integrate with existing financial systems?

Planergy, and many other expense management software, can integrate seamlessly with popular accounting systems and ERPs, making tracking and analyzing expenses easier.

How customizable are the reports?

Planergy offers customizable reporting options and dashboards, allowing businesses to focus on specific areas of concern or interest. Create standard reports, schedule them, and use spend analytics software to gain better insights.

This is not standard for all spend management software. Often they include basic reporting options without significant flexibility.

Is the software user-friendly?

Look for a solution that is easy to use and offers accessible customer support. If you fail to achieve user adoption across the company, you will be missing out on valuable data.

Understanding and managing discretionary expenses is vital for both individuals and businesses to maintain healthy finances.

By implementing best practices and utilizing tools such as expense management software, it is possible to gain control over discretionary spending and make informed decisions that benefit overall financial health.

Whether business or personal, financial planning and saving money when and wherever possible is important.

What’s your goal today?

1. use planergy to manage purchasing and accounts payable.

- Read our case studies, client success stories, and testimonials.

- Visit our Procure-to-Pay Software page to see how Planergy can digitize and automate your P2P process saving you time and money.

- Learn about us, and our long history of helping companies just like yours.

2. Download our “Indirect Spend Guide”

3. learn best practices for purchasing, finance, and more.

Browse hundreds of articles , containing an amazing number of useful tools, techniques, and best practices. Many readers tell us they would have paid consultants for the advice in these articles.

Related Posts

- Spend Management

Catalog Management in Procurement: What Is It, Types of Catalogs, Challenges and Best Practices To Manage Them

- 17 min read

Procurement Methods: How To Source and Evaluate The Best Suppliers To Work With

- 16 min read

Services Procurement: What Is It and How To Manage It

- 15 min read

PROCUREMENT

- Purchasing Software

- Purchase Order Software

- Procurement Solutions

- Procure-to-Pay Software

- E-Procurement Software

- PO System For Small Business

- Spend Analysis Software

- Vendor Management Software

- Inventory Management Software

AP & FINANCE

- Accounts Payable Software

- AP Automation Software

- Compliance Management Software

- Business Budgeting Software

- Workflow Automation Software

- Integrations

- Reseller Partner Program

Business is Our Business

Stay up-to-date with news sent straight to your inbox

Sign up with your email to receive updates from our blog

This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Read our privacy statement here .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Discretionary Expenses: The Extras, Not Essentials

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

When it comes to spending money, there are things that you want to buy — and things you have to pay for. That's the line between discretionary expenses and everything else. Wants versus needs .

What are discretionary expenses?

A discretionary expense is voluntary spending. You want to buy something, but it isn't mandatory. Entertainment and recreational purchases fall into this category.

On the other hand, bills such as rent, mortgage payments and utilities are nondiscretionary expenses. You have to pay those. When working with a budget , discretionary spending is drawn from the money left over after paying the essential bills.

» MORE: Budget calculator

What are examples of discretionary expenses?

"I would describe discretionary spending as the fun stuff, the things you want to spend money on, such as going out to eat, buying clothes, gifts, hobbies, entertainment, vacations, things like that," says Amy Jo Lauber, a certified financial planner with Lauber Financial Planning in West Seneca, New York.

Like there are different types of finance , discretionary expenses can take many forms and may include:

Electronics, such as a television or a phone upgrade.

New furniture.

A new vehicle.

Appliance upgrades.

Travel for pleasure.

Home gym equipment, like a treadmill or Peloton bike .

Tickets to concerts and sporting events.

Charitable contributions.

Spa visits (including the tip for a massage ).

All of these items add to your quality of life but need to come after paying the bills and, optimally, after paying yourself .

How do discretionary expenses fit into a budget?

You may be spending more on wants than you realize. That can block you from putting aside enough money for emergency needs and retirement savings.

Accounting for discretionary expenses is a part of the 50/30/20 budget , a plan for controlled spending. In this system, up to half of your budget is allocated to needs, 30% to wants (the discretionary expenses we're talking about) and 20% to savings and debt repayment.

"I do like and use the 50/30/20 budget," Lauber says. "I think it works for people who don't want to feel guilty about spending on certain things and need guidance on saving. It provides a simple, reasonable framework free from the fuss of tracking spending in all the categories."

To start a simple budget, determine your monthly take-home pay, choose a budget plan that works for you and keep an eye on it. You may find it's easier than you thought.

» MORE: What is my take-home income?

Making good financial decisions

Thinking of money like this — in buckets of wants, needs and saving for the future — is part of a process for making good financial decisions.

"I encourage people to pay attention to all of their spending, not only discretionary, and moreover, to be intentional about their money, to make decisions with self-awareness, based on one's values and needs," Lauber says.

"This involves using the positive emotions such as hope, joy, delight, generosity, creativity and dreams to help us manage money in a way that is enjoyable and sustainable."

For example, try prioritizing the positive emotions tied to long-term plans, such as retirement or having no financial worries, rather than those related to the short-term satisfaction of impulse spending. Being thoughtful about today's discretionary expenses can feed your long-term wants and goals.

If you want to start getting a handle on your spending, NerdWallet has compiled the best expense tracking apps based on ratings and popularity among users.

on Capitalize's website

- Travel & Expense Management Software

- Employee Tax Benefits

- Branch Petty Cash

- FleetXpress

- Prepaid cards

- World Travel Card

- Customer Speaks

- Press Release

- Partner with us

Discretionary Expenses: Definition, Types, and Budgeting

Table of Contents

Know the difference between your necessary and discretionary expenses – Alexa Von Tobel

Discretionary expenses are non-essential costs that don’t significantly impact the day-to-day operations of an organization. CFOs and accounting teams track and analyze this non-essential capital expenditure to reduce overall business expe nses , boost margins, and improve short-term profitability during a crisis.

This article walks you through discretionary and non-discretionary expenses, how to budget for them, and ways to balance them with financial goals.

What is a discretionary expense?

A discretionary expense is voluntary spending that isn’t essential for core business operations. Organizations can survive without these non-essential expenses, which is why they are also known as non-essential spending.

Most organizations spend discretionary costs to improve their reputation and customer and employee relationships. Common examples include expenses related to research and development, employee benefits, office improvement, and training.

Discretionary expenses are born out of wants, whereas non-discretionary expenses arise from needs. Companies typically pay for these spending with discretionary income, the amount of money they have left after paying for necessities, including rent and tax. Tracking discretionary costs aids organizations in identifying and cutting unnecessary expenses during financial difficulties.

Suggested Reads: Expense Management

Importance of discretionary expenses

Keeping an eye on discretionary expenses enables business leaders to improve cash flow , maintain profitability, mitigate financial risks, and optimize resources for the long-term economic sustainability of their organizations.

- Improved cash flow: Organizations tracking discretionary can quickly cut costs and reallocate that budget to revenue-generating activities. Analyzing discretionary spending patterns also enables them to avoid overspending and create emergency funds for economically turbulent situations.

- Business profitability: Lowering discretionary business expenses allows organizations to offer competitive prices, reduce waste, and boost operational efficiency — all key to improving profit margins.

- Reduced financial risks: Businesses controlling discretionary cash outflow can free up funds for meeting financial obligations, paying interests, and reducing the cost of debt . They can also use the savings from reduced discretionary costs to create financial reserves, which can help them avoid liquidity crises during revenue shortfalls and market fluctuations.

- Strategic growth: Efficient discretionary cost management is also essential for efficient financial management and resource allocation to strategic areas such as marketing or employee training.

Now, let’s look at the different discretionary costs in business.

Types of discretionary expenses

While discretionary expenses are unique to every business depending on their industry and nature of work, here are some common discretionary items.

- Marketing expenses: While the budget may vary, most companies spend quarterly on paid ads, inbound marketing, content production, public relations, brand design, and website design. These marketing activities are discretionary as an organization still offers its core services without them.

- Investments: Business investments like mergers, buyouts, real estate, and research and development may help organizations increase profits but are discretionary.

- Non-essential SaaS subscriptions: Enterprises use multiple tools for daily operations, including but not limited to project management tools, accounting software, and expense management software . An organization may use these solutions to boost ROI but can control how much they spend for them.

- Employee perks and benefits: Some organizations may offer employee perks (transport, gym memberships, fitness passes, pantry) or conduct team-building exercises. While these perks may be crucial for talent retention, companies can control how much they spend.

- Business travel expenses: Large enterprises may offer generous T&E expenses for their traveling employees and sales teams, whereas smaller organizations may not be able to provide the same. The fact that organizations can regulate this spending with T&E policy makes it discretionary.

- Office and workspace upgrades: Companies investing in workspace design and layouts can moderate the amount they spend toward these upgrades, making workspace enhancement expenses discretionary.

- Professional training and development: Some organizations conduct workshops, offer online courses, and other professional development initiatives. These expenses are discretionary as they aren’t necessary for day-to-day operations.

Related Reads: Expense Category

Discretionary costs examples

Examples of these expenses include:

- Marketing and advertising

- Employee training and development

- Business travel and entertainment

- Research and development

- Charitable contributions

- Employee perks and benefits

- Office upgrades and renovations

- Software technology investments

Now, let’s understand how these expenses differ from non-discretionary business spending.

Discretionary vs non-discretionary expenses

Discretionary expenses are non-essential spending, whereas non-discretionary spending is unavoidable capital expenditures necessary for business operations.

Non-discretionary expenses are fundamental costs an organization must pay to run daily operations, regardless of financial performance. Companies can’t quickly eliminate these costs as they are rigid and don’t change in the short run. Examples of non-discretionary spending include:

- Employee salaries, benefits, and retirement contributions.

- Utility costs for essential services like water, heating, and electricity.

- Rent for office spaces, manufacturing units, and production equipment.

- Premiums for property insurance, liability insurance, and workers’ compensation insurance.

- Income and property taxes payable to government regulations.

Suggested Reads: Non-operating Expenses

Fixed expenses vs discretionary expenses

Fixed expenses refer to fixed business costs that don’t change with production outputs or business activity levels. Businesses must pay these fixed costs to remain operational. Examples include phone service, utility bills, interest payments, property tax, and employee salaries.

Discretionary expenses are non-essential costs that a business spends at its discretion. These costs have no bearing on the daily operations of an organization. Examples include expenses related to training and development, marketing, employee benefits, and software subscriptions.

How to balance discretionary expenses with financial goals

Companies struggling to control discretionary expenses must start by creating short-term and long-term goals. The next step for them is to optimize discretionary spending, repay debts, and prioritize savings to achieve their goals.

- Set short and long-term financial goals: Setting financial goals is the foundation of robust financial planning . These goals provide organizations with clarity around how much discretionary spending they should allocate and when they should optimize discretionary expenses.

- Adjust discretionary spending: The next step is to evaluate discretionary spending patterns. Based on that analysis, an organization can find areas to curtail spend and reallocate those funds to revenue-generating business areas.

- Repay debt: Organizations should also consider repaying debts with high-interest rates faster or consolidating them to put aside funds for emergencies or invest in other high-growth areas.

Now, let’s look at how companies can budget for discretionary expenses.

What is discretionary expense budgeting?

Discretionary expense budgeting refers to using financial systems for tracking and optimizing discretionary spending. It enables organizations to gather intelligence on how discretionary spending varies throughout the year.

How to budget for discretionary expenses

Organizations looking to excel at discretionary expense budgeting must focus on measuring expense ROI, categorizing discretionary spending trends, and creating and enforcing an expense management policy.