- United States

- United Kingdom

In this guide

Restrictions

Your reviews, ask a question, commbank travel money card review.

Enjoy the safety and convenience of a CommBank Travel Money Card that lets you load 13 currencies at the same time.

The CommBank Travel Money Card is a prepaid Visa card that lets you load up to 13 foreign currencies and lock in exchange rates. You can manage your account online, save on loading fees and enjoy peace of mind thanks to chip and PIN-protection.

Compare more travel money options on finder now

What currencies can I load on the CommBank Travel Money Card?

The CommBank Travel Money Card supports 13 major currencies including:

- United States dollar

- Great British pound

- Australian dollar

- Japanese yen

- New Zealand dollar

- Hong Kong dollar

- Canadian dollar

- Singapore dollar

- Vietnamese dong

- Chinese renminbi

- Emirati dirham

There are no fees involved when you load funds into a foreign currency wallet, transfer funds between currency wallets on the card, or spend money in a currency that isn't loaded or supported by your card. Instead, a retail foreign exchange rate determined by CommBank is applied at the time of conversion. You can find the foreign exchange rates on the CommBank website or on the CommBank app under "Tools & Calculators" and "Foreign Exchange Toolkit".

Your currencies will be locked in at the bank's retail foreign exchange rate applicable on the day your transfer or payment is processed. When loading or reloading, the money will be available the same day for transfers from CommBank transaction accounts and up to two business days for BPAY transactions.

What if I want to spend money in a different currency to the ones loaded on my card?

When spending money in a currency that is unsupported or insufficiently loaded on your card, the next available currency balance in your currency order will be used. You may customise your currency order through NetBank or by calling +61 1300 660 700. Otherwise, the following default currency order applies.

Default currency order:

To illustrate, when paying for a US$50 lunch in Los Angeles, it turns out that you only have US$21 in your US dollar wallet. Instead of declining the transaction, your card is debited in Euros instead, since you have sufficient Euros in your account. CommBank's prevailing retail foreign exchange rate is applied to convert your Euros into US dollars.

Where can I use my Commonwealth Bank Travel Money Card

The CommBank Travel Money Card enjoys the worldwide acceptance of the Visa network and can be used in-store, at ATMs, online, over the phone and by mail order. However certain merchants and financial institutions may not accept the card, including stores where Visa prepaid cards are not accepted or where merchants process transactions manually.

Features of the CommBank Travel Money Card

When you apply for a CommBank Travel Money Card, you can look forward to the following benefits and features:

- Locked-in exchange rates. When you load funds on your card, they'll be locked in at the exchange rate you got when you loaded your card. This will give you peace of mind and help you manage your budget since you don't have to deal with fluctuating exchange rates. Foreign exchange rates are available on the CommBank website or in the CommBank app by following "Tools & calculators" to the "Foreign Exchange Toolkit".

- Additional card. Your free backup card ensures that you'll still be able to access your money should the first card be lost, damaged or stolen.

- Smartphone app. Enjoy the modern convenience of currency planning from your smartphone with the CommBank app. Monitor your expenses, convert currencies and reload funds while on the go.

- Worldwide ATM alliance. The robust Visa alliance ensures that you will be able to access cash almost anywhere in the world.

- Concierge service. Enjoy the luxury of personal concierge services when you need dinner reservations, air tickets, accommodation or concert tickets booked for you.

- Purchase security insurance. If an item purchased on your card gets lost, stolen or damaged in the first 90 days, your card insurance coverage ensures that it will be repaired or replaced for free.

How much does the CommBank Travel Money Card cost?

This table lists the costs associated with this card and when you'll be charged them.

How to use the CommBank Travel Money Card

Follow these simple steps to start using your CommBank Travel Money Card:

- Activating the card. For cards purchased in-branch, your two cards have already been automatically activated. For cards purchased online via NetBank, including replacement or reissued cards, you will need to activate your cards online. In any case, you should set up a PIN for each card by logging in to NetBank, going to a CommBank branch or calling the Travel Money Customer Service Centre at 1300 660 700, or +61 2 9374 0609 from overseas.

- Loading funds on the card. Different currencies can be loaded on your card at the time of purchase, which will be subject to the bank's foreign exchange rates at that time. When reloading the card, funds will be accepted in Australian dollars and converted into your primary currency according to your currency order. The applicable exchange rate is taken on the day your payment is processed, which is instant when paying cash in-branch or transferring funds via NetBank from a CommBank transaction account and up to two business days when using BPAY.When reloading via BPAY, you may only load one currency at a time. You will need to wait for your first BPAY transaction to be completed before changing your currency order and making another transfer to that primary currency. Each load and reload must be more than the equivalent of AUD$1 and less than AUD$100,000.

- Managing your online account. You can manage your account online at NetBank or on your smartphone's CommBank app. You can view your balances and transaction history, transfer currencies within the account, reload funds, and make real-time fund transfers to and from eligible CommBank accounts. You can also change your PIN and currency order, set up SMS alerts and lock or unlock your card for security reasons when necessary.

What do I do if I return home with foreign currency remaining on the card?

Who do i contact if my card is lost, stolen or damaged.

Report loss or theft immediately by calling 1300 660 700 or +61 2 9374 0609 when overseas. Similarly, if you suspect your card has been subject to unauthorised use, notify the bank immediately by calling 13 22 21 or +61 2 9374 0609 when overseas.

How to apply for a CommBank Travel Money Card

For existing CommBank customers with NetBank accounts, ordering is a simple online process which involves logging into NetBank. Your card will then arrive in the mail in under six business days. If you are not an existing CommBank customer, you may get your card straight away by heading into any CommBank branch. Bring your Australian passport or driver's licence for identification purposes.

Are there any eligibility requirements?

While you do not need to be an existing Commonwealth bank customer, you must be more than 14 years old and satisfy customer identification requirements. You will have to register with NetBank when purchasing the card. Also, you are limited to only having five active Travel Money Cards at any one time.

The CommBank Travel Money Card offers up to 13 major currencies and fee-free loads and reloads. Make sure to factor the card issue, replacement fees and ATM withdrawal fees when comparing your options. When deciding which travel card to get, use our travel money comparison table to compare your available options and find the right card for your spending needs.

- CommBank Travel Money Card information PDF

- CommBank Travel Money Card TMD

To ask a question simply log in via your email or create an account .

AAAAFinder Finder

Hi there, looking for more information? Ask us a question.

Error label

You are about to post a question on finder.com.au :

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our 1. Terms Of Service and 6. Finder Group Privacy & Cookies Policy .

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

February 26, 2024

When useing my travel card is it credit i push to withdraw cash from it at the atm ? Thanks

Elizabeth Barry Finder

April 05, 2024

You should select “Credit” when using this card.

I hope this helps,

December 02, 2019

Can I use this card for everyday purchases within australia, and will there be a fee if I do so?

Nikki Angco

December 04, 2019

Thanks for your comment and I hope you are doing well. You can use the travel money card in Australia. The card can be used everywhere Mastercard is accepted. There can be a fee if you are paying in a currency not loaded onto your card so be sure to nominate AUD as your preferred currency when making purchases and do cash withdrawals at CommBank ATMs.

Hope this helps and feel free to reach out to us again for further assistance.

Best, Nikki

October 21, 2019

I’m in USA. I’m drawing cash from ATM. Do I draw it as Credit or Savings?

October 24, 2019

Hi Marlene,

Thanks for reaching out to Finder. When using the Commonwealth Bank Travel Money Card review, you would select the credit option. As added information, the maximum value of purchases per day is AUD 7,500 or its foreign currency equivalent. The maximum amount you can withdraw from ATMs per day is AUD 2,500 or its foreign currency equivalent. However, most ATM operators have a limit on how much you can withdraw from an ATM per transaction which may be less than the Commonwealth Bank’s maximum. You may want to check out that specific information before withdrawing.

Hope this helps and feel free to write back, we’re here to help.

Cheers, Nikki

September 16, 2019

Do I get charged the 5.25% fee if I am changing currency with in my card eg: US$ to AUD $

September 18, 2019

Hello Connie,

Thanks for getting in touch! As mentioned on our page above, there is no fee when you are transferring between currency wallets on the card, Instead, a retail foreign exchange rate determined by CommBank is applied at the time of conversion. You can find the foreign exchange rates on the CommBank website or on the CommBank app under “Tools & Calculators” and “Foreign Exchange Toolkit”.

Hope this helps!

September 10, 2019

With my CBC travelcard is there any withdrawal fee to withdraw Aus dollars while in Australia (currency on card is Aus dollars)

September 11, 2019

Thanks for getting in touch! The Commonwealth Bank Travelcard doesn’t have any withdrawal charge at any Commonwealth Bank or BankWest ATM in Australia when you withdraw in Australian dollars. Hope this helps and feel free to reach out to us again for further assistance.

The Finder team is dedicated to helping you start making better financial decisions right now. See full profile

- Debit cards

- Wise Travel Money Card Review

- Revolut travel account review

- South Korea

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Investing & super

- Institutional

- CommBank Yello

- NetBank log on

- CommBiz log on

- CommSec log on

Help & support

Popular searches

Travel insurance

Foreign exchange calculator

Discharge/ Refinance authority form

Activate a CommBank card

Cardless cash

Interest rates & fees

Travel Money Card: How to manage multiple currencies

If your holiday is looking more like a round the world tour, then you’re going to want to look at loading multiple currencies on to your Travel Money Card.

A Travel Money Card lets you lock in exchange rates for multiple currencies onto one card, so you can easily manage and access your money while you’re overseas.

Related articles

How does a Travel Money Card work?

If you’re in a country that uses a currency you’ve already loaded on your card, that currency will automatically be used for any purchases or withdrawals you make with your card.

If you’re in Europe, for example, and you have Euros, United States Dollars and New Zealand Dollars loaded on your Travel Money Card, your Euros will automatically be used as the local currency, provided you have enough in that currency for your transaction.

If you don’t have enough, the next currency in your currency order with a sufficient balance will be used. For example:

You have 20 Euros (EUR) and 100 New Zealand Dollars (NZD) left on your Travel Money Card and are paying for a meal costing 30 EUR. Since you have insufficient EUR for the full transaction, but sufficient funds in NZD, your Travel Money Card will automatically convert NZD into the equivalent of 30 EUR to pay for your meal (leaving the original 20 Euros on your card), instead of declining the transaction.

With our Travel Money Card , you can easily load up to 13 currencies online:

- United States Dollars (USD)

- Euros (EUR)

- Great British pounds (GBP)

- Australian Dollars (AUD)

- Japanese Yen (JPY)

- New Zealand Dollars (NZD)

- Hong Kong Dollars (HKD)

- Canadian Dollars (CAD)

- Singapore Dollars (SGD)

- Thai Baht (THB)

- Vietnamese Dong (VND)

- Chinese Renminbi (CNY)

- Emirati Dirham (AED)

If we need to automatically transfer money between the currencies on your card to complete a transaction, we'll use the Visa exchange rate at the time of conversion, plus a margin. The margin is subject to change from time to time. For the current margin, see Travel Money Card fees and charges .

To avoid additional fees, always make sure your card is topped up with the local currency by reloading in NetBank or the CommBank app.

Set the currency order on your card

If you have multiple currencies loaded on your card, even though the local currency for where the transaction takes place will automatically be used (assuming you have the currency loaded on your card and sufficient local funds), you may want to set your own order for the currencies loaded on your card. This is especially important if you reload your card via BPAY ® , because the funds will automatically go to the first currency in order.

This is the default currency order which you can change:

To find out more about setting the order of currencies on your card, or to change your current order, log on to NetBank or call (+61) 1300 660 700.

What to do in an emergency

- Lock, Block, Limit your CommBank credit card or lock your Travel Money Card for added security

- Cancel and order replacement CommBank cards in NetBank or the CommBank app

- Call us 24/7 on +61 2 9999 3283 to report lost or stolen CommBank cards

For 24-hour travel insurance emergency assistance, call Cover-More in Australia direct and toll free on +61 2 8907 5641. You can also call from:

- Canada on 1844 345 1662

- New Zealand on 0800 632 031

- UK on 0808 234 3737

- USA on 1844 345 1662

Charges apply if calling from a pay phone or a mobile phone.

Take your next step

Order a Travel Money Card online

Things you should know

This article is intended to provide general information of an educational nature only. It does not have regard to the financial situation or needs of any reader and must not be relied upon as financial product advice. Insurance issued and managed by Cover-More Insurance Services Pty Ltd (AFSL 241713, ABN 95 003 114 145) on behalf of the insurer Zurich Australian Insurance Limited (AFSL 232507, ABN 13 000 296 640) for Commonwealth Bank of Australia (‘CBA’) (ABN 48 123 123 124, AFSL 234945). CBA and its related bodies corporate do not issue or guarantee this insurance. It does not represent a deposit with or liability of either CBA or any of its related bodies corporate. Terms, conditions, exclusions, (including for pre-existing medical conditions and persons aged 80 years or over for international travel insurance included with an eligible CommBank credit card or persons aged 74 years or over for CBA Travel Insurance) limits and excesses apply. Before making a decision, refer to the relevant Product Disclosure Statement for full conditions at commbank.com.au. You need to activate your international travel insurance included with eligible CommBank credit cards before each trip in order to have comprehensive level of cover. If you don’t activate, you’ll receive personal liability cover and overseas emergency medical assistance and overseas emergency medical and hospital expenses cover only. We (CBA) do not provide any advice on this insurance based on any consideration of your objectives, financial situation or needs. If you purchase or upgrade a policy, we (CBA) receive a commission which is a percentage of your premium.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Commonwealth Travel Card Review – [2023]

The Commonwealth Travel Money Card is a prepaid Visa debit card you can top up in 13 different currencies, for global spending and ATM withdrawals. That can be handy for managing your budget when you’re overseas, as you can lock in exchange rates in advance so you know exactly what you have to spend.

This guide covers the Commonwealth travel card in detail, including how the card works and the fees that you’ll pay to use it. We’ll also touch on a couple of Commonwealth travel card alternatives from Wise and Revolut , which support more currencies and may come with lower fees.

Commonwealth travel card: key features

The Commonwealth Travel Money Card has a good selection of supported currencies, and is globally accepted wherever you see the Visa logo. However, there are currency conversion fees to pay when you use the card to spend unsupported currencies, or when you don’t have enough balance to cover the cost of your purchase in a particular currency. Plus, you’ll pay an ATM fee at home and abroad.

This guide walks through the Commonwealth Travel Money Card in detail – to kick off, here’s a quick look at the key pros and cons of using the card on your travels.

Travel money cards can be handy when you’re away. They let you convert funds to the currency you need in advance, so you know your budget before you leave – plus, they’re not linked to your normal bank account which can increase security and offer peace of mind when you travel. However, the features and fees you find in travel money cards from different banks and providers can vary pretty widely. Shopping around is essential to make sure you get the best deal for your specific needs – this guide should tell you all you’ll need to know to help you pick.

Who is the Commonwealth travel card for?

The Commonwealth travel card supports 13 currencies including those used in popular holiday destinations like Thailand, Japan, Vietnam and New Zealand, plus major global currencies like US dollars, euros and British pounds. That can mean it’s a handy card to have for people travelling for business or pleasure, or for anyone shopping online with overseas retailers.

What is the Commonwealth travel card?

The Commonwealth Travel Money Card is a Visa debit card you can load in advance in AUD or any of the other supported currencies, for international spending and withdrawals. You can use your Commonwealth travel card when you travel, and also for online shopping in foreign currencies.

Is the Commonwealth Travel Money Card a multi-currency card?

Yes. You can add AUD to your Commonwealth card, and convert to any of the following supported foreign currencies:

- United States dollars (USD)

- Euros (EUR)

- Great British pounds (GBP)

- Japanese yen (JPY)

- New Zealand dollars (NZD)

- Hong Kong dollars (HKD)

- Canadian dollars (CAD)

- Singapore dollars (SGD)

- Thai baht (THB)

- Vietnamese dong (VND)

- Chinese renminbi (CNY)

- Emirati dirham (AED)

There is a fee – in the form of an exchange rate markup – added when you switch to the currency you need from AUD. However, it’s then usually free to spend the currencies you hold in your account.

If you’re looking for different currencies – or you’re planning on travelling more widely – you can also consider a travel card from a specialist service like Wise or Revolut. Wise supports 50+ currencies, while Revolut covers 25+ – more on that, including some other important features of Wise and Revolut, next.

Alternatives to Commonwealth travel card

The Commonwealth travel card has some handy features, but there are also some fees you’ll need to think about before you order one. One important cost is rolled into the price of switching from one currency to another. There’s a markup added to the exchange rate used when you initially switch from AUD to the currency you need, and if you use your card to spend an unsupported currency, or if you run low on the currency you need while you’re away, extra fees of 3% kick in too.

To weigh up whether the Commonwealth card is best for you, take a look at our comparison against alternative providers Wise and Revolut:

Information taken from CommBank Travel Money Card desktop site and Fees , Wise pricing page , Revolut international transfer fees and Revolut Australia ; correct at time of writing, 24th May 2023

As you can see, Wise and Revolut both support a broader selection of currencies compared to the Commbank card, which can be helpful if you’re travelling more widely. Plus, you may find you get lower overall currency conversion costs with a specialist service. Revolut has some fee free currency conversion which uses the mid-market rate for all account holders – even if you’re using a standard account plan with no monthly fees. And Wise has mid-market rates for all currency exchange, with low fees based on the currencies you need, starting at 0.41%.

There’s a quick introduction to Wise and Revolut next, to help you decide if either may suit your needs.

Read a full Wise review here

Wise accounts can hold and exchange 50+ currencies, and come with an optional linked Wise card to spend with the mid-market rate and low fees from 0.41%, in 170+ countries. You can apply, and manage your account, from your smartphone, and get extra perks like fast payments to 70+ countries, and local bank details for 9 currencies, to get paid easily from 30+ countries.

Get a Wise travel card

Revolut accounts come with linked debit cards, and can hold 25+ currencies. You can either get a standard plan which has no monthly fees, or pay a monthly charge to access extra features and perks. Revolut currency exchange uses the mid-market exchange rate to plan limits, with fair usage fees after that. Out of hours fees may also apply if you switch currencies when the global markets are shut.

Go to Revolut

Commonwealth travel card fees & spending limits

Let’s take a look at the fees and limits that apply to the Commbank travel card. First, here are some important limits to know in advance:

And what about the charges involved with using a Commonwealth Bank Travel Money Card? Here’s a rundown of the key costs:

Information correct at time of writing – 24th May 2023

Exchange rates

When you top up your card in AUD and convert to a foreign currency for overseas spending, the Commbank retail exchange rate applies. This rate can be found online, but it’s handy to know it won’t be the same as the mid-market rate you find using a Google search or currency conversion tool, as it includes a margin – which is a fee. The margin used by Commonwealth Bank can vary depending on the currencies in question, so you’ll need to take a look on their website to see the rate for your currency pair, and then compare it back to the rate you get from a conversion tool, to spot the margin that’s been added.

If you’re spending a currency you don’t hold in your account, the exchange rate applied is set by Visa, and there’s then an extra 3% fee to pay. That doesn’t sound like a lot, but it can mount up quickly if you’re travelling for a while.

As an alternative, you might want to check out prepaid international debit cards which offer the mid-market exchange rate – like those from Wise and Revolut.

How to get Commonwealth travel card

You can order a Commonwealth Travel Money Card if you fulfil the eligibility criteria:

- You must be at least 14 years old

- You must be a Commonwealth Bank customer, registered to use NetBank

- You’ll need an Australian residential address

Assuming you fit these criteria you can order in a Commonwealth Bank branch, or online. Once you have your card in your hands, you then need to activate it in NetBank or the Commbank app. You can also set a PIN for security.

What documents you’ll need

To open a Commonwealth Travel Money Card account you’ll need to be registered with NetBank. That means you’ll also need a valid Commbank account and card to get started. If you already have a Commonwealth Bank account you can open your travel card account with no new documents – just log into NetBank or visit a branch to get started.

If you don’t have a Commbank account yet, the process is a bit more involved as you’ll have to first select and open a bank account. This normally means you also need to provide proof of ID and address, which you can upload online or show in a branch.

What happens when the card expires?

The Commonwealth Travel money Card is valid for 4 years. Once it expires it’s not automatically replaced with a new card. You’ll need to request a new card in NetBank. If you don’t do this within 3 months of the card expiry date, you’ll lose access to your account – so make sure you open a new card in time, or remove any remaining funds from the account to avoid extra hassle.

How to use a Commonwealth travel card?

The Commonwealth travel card is a Visa debit card you can use online and in person for spending and withdrawals. You can also send money from the card account to other Commbank cards and accounts, although fees may apply for this service if you’re switching currencies as part of the transfer.

How to withdraw cash with a Commonwealth travel card?

Once you have funds on your Commbank card you can make withdrawals around the world, just as you would with your regular debit card. There’s a Commonwealth ATM limit of 2,500 AUD per day – although most ATMs have their own limits which are likely to be lower than this. You’ll also pay a fee of 3.5 AUD or the currency equivalent when you make a cash withdrawal, plus any applicable currency conversion fee if you’re withdrawing in a currency you don’t hold in your account.

Is the card safe?

Yes. Commonwealth Bank is a trusted and regulated bank, making it a safe provider to use. Plus, using a prepaid travel card when you’re abroad can be safer than using your normal card. As it’s not linked to your main day to day account, even if you’re unlucky enough to have your travel card stolen, thieves don’t have access to your primary account balance.

How to use the Commonwealth travel card overseas?

The Commbank travel card is issued on the Visa network, which means you can use it in millions of ATMs and with merchants worldwide. If you’ve got a balance in the currency you need, there’s no extra fee for paying at a merchant abroad. However, it’s useful to know that a 3% fee applies if you spend in a currency you don’t hold in your account, or if the balance you have in that currency isn’t enough to cover the purchase. This can push up costs significantly, so it’s worth keeping an eye on your balance in the Commbank app, so you don’t run low without realising.

Conclusion: is the Commonwealth travel card worth it?

The Commonwealth Travel Money Card is a helpful card for travel to any of the countries and regions covered by the 13 supported currencies. Using a prepaid card can help you set your travel budget in advance as you’ve locked in exchange rates before you leave. However, the Commbank card isn’t free to use. There’s a fee to switch currencies – either a 3% conversion cost for direct spending, or a margin added to the exchange rate when you convert within your account. Plus, there’s a 3.5 AUD fee for ATM withdrawals overseas.

Compare the costs and flexibility of the Commbank travel card against alternatives like the international debit cards from Wise and Revolut. Both offer a broader selection of currencies, and use the mid-market exchange rate to switch over your funds from AUD to the currency you need. This can cut the costs overall, and it’s more transparent as you can easily see all the fees involved in currency exchange.

Commonwealth travel card review FAQ

How does the Commonwealth travel card work?

The Commonwealth Travel Money Card is a prepaid international Visa card you can use for spending and withdrawals around the world. You’ll need to add money in AUD and can then convert to any of the 13 supported currencies within NetBank.

Is the Commonwealth travel card an international card?

Yes. The Commonwealth Travel Money Card can hold 13 different currencies, and as it’s issued on the Visa network you can use it more or less anywhere in the world. There’s a 3% fee to spend currencies you don’t hold in your account though – so if your currency isn’t supported by the Commbank card you might be better off with an alternative like the multi-currency cards from Wise and Revolut.

Are there any alternatives to the Commonwealth travel card?

Commonwealth Travel Money Card alternatives are available from banks and specialist digital providers. Compare the options from Wise and revolut as an example – both offer dozens of supported currencies, with low, transparent fees and great global acceptance.

Money Tips you should know

Commission rates, exchange rates, currency conversion and transaction fees can all add up to a lot of your travel budget. It pays to be organised with your money while travelling. There are some important things to know about using and accessing your money in Bali, and about the Bali currency. We have compiled all of the information, and best tips on how to both keep your money safe in Bali, and to get the best value out of your money while visiting Bali.

What Currency is used in Bali?

The Indonesian Rupiah is the currency of Indonesia.

The currency code for Rupiahs is IDR, and the currency symbol is Rp.

Indonesian Rupiah

In Indonesia, you pay for everything primarily with 7 different denominations of banknotes.

The Indonesian rupiah is in increments of 1000, so you will often come across amounts in 10,000 denominations in Bali, which can be confusing sometimes.It is also good to know that the coins, because of their low value they are often not used for rounding amounts or returning change.

Notes of IDR:

– Rp 1,000 (approx 10 cents AUD)

– Rp 2,000 (approx 20 cents AUD)

– Rp 5,000 (approx 50 cents AUD)

– Rp 10,000 (approx $1 AUD)

– Rp 20,000 (approx $2 AUD)

– Rp 50,000 (approx $5 AUD)

– Rp 100,000 (approx $10 AUD)

Bali Insider tips:

*If on a menu for example you see that a burger is listed as “80”, check the fine print at the bottom of the menu. It will usually say, prices are listed in thousands of Rupiah, which means you times the number listed by 1000. The burger would be Rp 80,000 (approx $8 AUD).

*Taxes are not included on menus and are added in the final bill. It is common for taxes to be up to 21%, so keep this in mind when ordering and when splitting bills.

Change your cash money in Bali or Australia?

You will always get a better exchange rate if you wait to change your money once you land in Bali (or any country you are travelling to for that matter). If you are nervous about arriving with no currency you can always exchange a little amount of money before you leave for Bali (in Australia we recommend doing this at Australia Post as they have no fees). The worst exchange rates you will find at the airports, try not to change any currency at the airports as their exchange rates are always significantly lower than genuine money exchangers outside the airport.

When in Bali it is very important to only ever change your money at safe, well-known locations. Never be tempted by street money exchangers advertising a very high exchange rate. These peddlers are like magicians – they will literally make your money disappear before your eyes!

BMC banks. Click here for LOCATIONS

Central Kuta Money Exchange Click here for LOCATIONS

Where to change money in Bali?

When you arrive at the airport after a long flight, it is tempting to exchange money as soon as you leave the airport. It seems to be the fastest and most convenient way, but it’s also very expensive. Money exchange offices outside of the Airport offer a much better exchange rate, which means you get more RP for your money.

Some banks offer currency exchange, but this is not as common as you might think, especially with the increasing trend of using cards abroad. Major banks such as ANZ and Westpac, for example, have stopped buying and selling cash abroad. Instead, they advise their customers to choose their prepaid travel money card (such as WISE or Revolut) or recommend the use of credit or debit cards for payments abroad.

Money Exchanger

It is common for local money changers to display the daily exchange rates on white signs on the side of the street. They usually promote their business with slogans such as “Authorized Money Changer” or “No Commission”.

Some of our favourite places to exchange money are below:

Central Kuta Money Exchange – Click here for LOCATIONS

Are ATMs in Bali safe?

Card skimming is happening more and more all over South East Asia and there have been 1000s of reports of this happening in Bali also. If you are going to use an ATM machine in Bali be sure it is one in a very public area and preferably one that has a security guard or is in a bank, resort or shopping mall. Avoid using ATMs at Minimarts or Circle K’s or random locations on the street.

We also wrote a blog about common Scams in Bali (including ATM scams) – Click here to read it.

When using your bank card in Bali, also check with your bank before you leave your country about fees associated with withdrawing money internationally. The maximum amount you can withdraw at most Bali ATMs is 3,000,000 Rp (approx $300 AUD). This is why we recommend using a WISE or a Revolut card in Bali, rather than your traditional bank ATM card.

Using Bank Cards, Travel Cards or Credit Cards

Paying by card in Bali has become common practice in most restaurants and shopping malls, in fact even some of the more savvy market stores even accept cards these days. Taxis, small local restaurants (warungs), beach bars, and a lot of market stalls still only accept cash, so you are definitely going to always still have at least a small amount of cash on you in Bali.

Travel Crads in Bali

Pay like a local with amazing exchange rates, zero or super low fees and no fee ATM withdrawals overseas – does that sound amazing to you? This is why we recommend getting either a WISE or a Revolut Card (or be like us and have both!) before travelling to Bali.

A travel card, or bank card offering currency buying and selling offers many advantages that you don’t have with a normal credit or debit card.

Both WISE and Revolut cards are easy to set up prior to your trip. You can order a physical card to be delivered to your home address, and you can easily transfer your home currency into IDR with a click of your finger on your app. These two cards have the most favourable exchange rates, and lowest fees when it comes to using your card internationally. We love the security of these cards, and the fact that you can see every transaction on your app, and control all of your security settings on your app too. We literally would not travel anywhere without these cards these days, they make managing your money abroad a breeze.

Set up your WISE account here

How much to pay for things in Bali

The prices in Bali depend very much on the location and the season. It also depends on your personal preferences when it comes to food, accommodation and activities.

Transport & Short Term Scooter Hire in Bali

The quickest & cheapest way to get from a to b in Bali, the best way to get around is by scooter, but you need to ensure you are properly licensed and insured to do this in the case of an accident.

There are different types of scooters, but most of them have 125cc and are able to transport 2 people. However, if you prefer a faster bike, you can rent anything from a 170cc scooter to a superbike. We recommend you take a look at Bikeago, they have a great service and a large selection of bikes.

For holiday makers we recommend only renting scooters from trusted and authorised rental companies. Our personal favourite company is Bikago . They have fair pricing and exceptional service.

Click here to check out their range of bikes & to get a quote

Bali Insider tip:

*If you are staying in Bali long term, it makes sense to rent a scooter for a longer time period as the prices are significantly lower per day.

If travelling in a car or van is more your style, the most cost efficient way to get around in Bali is via the Grab app (in fact you can order rides in both cars and on the back of a scooter on the app).

We recommend linking your WISE or Revolut card to the app, so that payment is automatically debited from your card, this is far easier than having to pay in cash and dealing with trying to get change from the drivers. Cash payment is an option on the app though if you prefer. For day trips exploring the island, the most cost efficient way is to book a car via Klook . You can either choose to make your own itinerary for the day, or book one of their pre planned itineraries.

You can find a laundry service on almost every corner in Bali. The usual price is per kilogram and costs around 10,000 Rp ($1 AUD) to wash, dry and iron your laundry. They usually keep your laundry overnight, but you can find some express laundromats.

When shopping in the supermarkets, you can often buy a shopping bag for a little money. They are not only large, but also sustainably produced, which makes them the perfect bag for storing your dirty laundry.

*If you have delicate items we suggest you wash your laundry yourself in one of the many self-service laundromats. You can find them easily across the island and they are very cheap.

Internet for your Smartphone

In these days of travel we always recommend having access to the internet on your phone. It’s handy for directions and using apps such as Grab to arrange your transport. There are several options when it comes to having access to the roaming data.

You can buy a tourist sim card for your phone at a very reasonable rate (a sim card with 20 Gb Internet costs around 200,000 rupiah – $20 AUD). We love the convenience of an e-sim though, that way you don’t need to worry about removing your physical SIM card, and you can still receive texts and calls on your main SIM card. We recommend using AIRALO as a travel eSIM with very reasonable rates!

Common money traps to avoid in Bali

- You have not checked the fees and conditions of your credit card – Good planning before your trip can save you a lot of money, stress and surprises on your credit/debit cards.

- Too much cash – and yes there is such a thing. In Bali you don’t need a lot of cash, you can get far without carrying a lot of cash around with you.

- Not having any cash – it makes sense to always have a small amount of cash in your wallet.

- You have used the ATM too often – If you go to an ATM to withdraw money, you should withdraw as large an amount as possible, this will avoid you paying too many fees for each transaction.

- Paying in foreign Currency – If you have the option when paying by card, you should always choose to pay in IDR. Foreign currency exchange rates can result in dynamic currency fluctuations, leading to higher conversion fees and lower exchange rates.

We hope these money tips help you make using your money in Bali a breeze and give you the best “Bang for your Buck!”.

Bali Buddies Tips

- Looking for the best flight deals to Bali? Compare prices on Skyscanner

- Need accommodation in one of Bali’s top hotels or resorts? Visit Klook.com

- If you prefer alternative accommodation, check out Bali’s stunning treehouses .

- Want to explore Bali on a bike? Rent a bike via Bikago.

- Accidents do happen. In case they happen to you, make sure you have a travel insurance. We recommend Cover-More Travel Insurance .

- Arrive without any hassle, book the Airport VIP Fast Track service and your airport transfer in advance.

- Download the Grab app . It's your reliable app for transportation, food delivery, and more.

- Book your tours and activities prior to departure with Klook

- Need to transfer money without the huge fees then check out Wise .

- Always connected to WiFi? Buy a Skyroam hotspot.

- Ensure your devices are secure with a VPN .

More Travel Tips

Things to Avoid

Tourists are usually easy pickings, which is why you should keep an eye out at all times! Only transact with reliable money changers, be aware of potential card skimming and pick-pocketing, and learn to recognize banknotes.

Baby Equipment and Pool Fence Hire

In Bali we are lucky enough to have some really well-stocked companies to hire everything you need for travelling with young children. Staying in a villa and worried about the pool? Rent a pool fence for a worry-free holiday.

Departing Bali

And eventually, your vacation in Bali is got to come to an end. Do not sacrifice all of the good times because of serious lapses of memory on travel regulations: check the weight of your suitcases, make your luggage even safer, carry the right amount of liquids in your hand-luggage, and always make a copy of your documents!

Grab isn’t a one-size-fits-all ride. You can use the app in 4 different ways, making it perfect for tailoring your evening with no speed bumps in sight. That’s exactly what makes it such an “everyday everything” app for the contemporary consumer.

Privacy Overview

- Bali Tourism

- Bali Hotels

- Bali Guest House

- Bali Holiday Homes

- Bali Flights

- Bali Restaurants

- Bali Attractions

- Bali Travel Forum

- Bali Photos

- All Bali Hotels

- Bali Hotel Deals

- Last Minute Hotels in Bali

- Things to Do

- Restaurants

- Holiday homes

- Travel Stories

- Add a Place

- Travel Forum

- Travellers' Choice

- Help Centre

Travel cards - Bali Forum

- Asia

- Indonesia

- Bali

Travel cards

- India Forums

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Holiday Rentals

- Indonesia forums

I would like to stick with Commonwealth Bank as we are going to Thailand before Bali and will be using a Commonwealth travel card, but it doesn't list Bali as one of their currencies you can load on to the card. Granted, i haven't yet gone in to a branch yet.

I would love to get peoples own personal experiences!

Thanks in advance!

Bank travel cards have many fees, but what gets me is the fee/exchange rate to change back to $AUD any money you have left on it. They talk up the advantages of having 'local' currency stored on your card, but really, there are zero benefits other than locking in the exchange rate.

Citibank charges you no fees, 28 degrees charges $4 (or 3%, whichever is greater) to withdraw cash (your own cash that you load on before you go) and no fees if you use it as a credit card.

CBA travel card charges you these fees that they tell you up front. They are not as bad as some:

$15 to buy it

1% to reload cash

Around $3 per withdrawal

Conversion Fees if you run out of your 'local' loaded currency and use a different loaded currency.

Probably a competitive currency exchange rate to load the card, you'd have to check... ok I checked, it's lousy ! As an example, compare $US, CBA rate today is 0.8845, the midpoint rate on xe is 0.9256. When I used the 28 degree card to withdraw from ATM's overseas, it was always just under the xe rate eg if xe was 0.9256, 28 degrees would be 0.9180 or something like that. Not 0.8845 !

To insult you further, when CBA buys your $US back, it charges you 0.9676 for the dollars it sold you at 0.8845 eg you change $100 AUD to $US you have $88.45 US on your card. Immediately try to change that money back into Australian dollars, they will give you $91.42 AUD back. If you use a travel card you have loaded with money, spend all of it ! And only ever get one in the first place if you want to lock in the exchange rate, otherwise they are a waste of money.

You could find out what your bank charges for an ATM withdrawal overseas, but I think CBA charges 3% plus $5 per withdrawal, but at least you will get the Mastercard or Visa exchange rate (which is close to the xe rate), and not the travel card exchange rate.

As snooky says, cash is king. Or Citibank Plus (has to be Plus) for ATM withdrawals, 28 degrees card for credit card purchases. 28 Degree card I applied online and had it delivered within a week. Citibank plus applied online and got it in 2.5 weeks.

Oh, todays' mastercard/28 degree/Citibank exchange rate for $US is 0.9206. Like I said, pretty close to the xe midrate. Load your travel card with $2000, you've cost yourself over $72 for no good reason. Plus whatever it costs to change it back if you don't spend it all.

(.... why yes, travel cards are one of my favourite topics !)

The two cards I mention are the best ones available. travel cards from banks / post offices are just not worth it.

I use my 28 degree card for overseas purchases from home as there are no fees and charges.

All these other travel cards seem appealing to start with but once you read all the fees, charges and exchange rates it is evident you are being quickly stripped of hard earned cash.

Loading cards with cash in particular currencies is of no advantage. (You then have more loss when you try to convert any left over cash back once you return home). You are locked into the rate on the day which is ALWAYS far less than it should be. You can withdraw cash from ATM's in the local currency using the 28 degree or citibank plus.

Thanks for all the info people! Seems I will have to locate a Citibank and go in there to see them due to lack of info online!

A 2 second Google search reveals this:

http://www.citibank.com.au/plus3/index.htm?code=LCFA

You apply on line all the information is available online

This post was determined to be inappropriate by the Tripadvisor community and has been removed.

- Stupid Question… 09:21

- lax to Bali, add days in HKG or Thailand? 08:22

- Dongle use and SIM cards. 07:35

- Legian Seminyak abandoned or closed hotels 05:36

- Visa still active 04:12

- Returning to my birth country 03:44

- Bali Visa 03:39

- Local fresh food/fruits market 03:02

- Nan Opti-pro 1 baby formula 01:49

- 4 Girls - early 20s - feedback for near term visit please! 00:36

- Private car/driver OR pre planned day tours today

- 101 Bali Oasis vs Puri Santrian today

- Bali zoo vs Bali safari today

- Ubud to Nusa Penida via Sanur or Padang Bai today

- flight length- uk to bali? 4 replies

- Nusa Dua or Seminyak ? 3 replies

- what is the distance between kuta & nusa dua/kuta & seminyak 2 replies

- Bali weather in November? 3 replies

- bali vs maldives for honeymoon? 13 replies

- Ferry from Sanur to Lembongan 8 replies

- Distance to Legian / Kuta from Seminyak 4 replies

- Denpasar to Nusa Dua 5 replies

- food and drink prices 5 replies

- Differences between the areas - Kuta v Seminyak v Legian 6 replies

Bali Hotels and Places to Stay

- Visa/ Immigration / Customs / Tourist Tax Update

- The Different Areas of Bali and What They Offer Update Jan 2020

- The Weather in Bali and Best Time to Visit

- Hints for traveling to Bali with babies, toddlers and young children: do not respond

- Driving & Riding in Bali

- Currency, Money Changers & ATMs

- Airport Taxi February 2020

- Snorkel and/or dive in Bali?

- North Bali Attractions

- Basics about Nyepi Holiday in Bali

- Warning: all marijuana, and many ADHD meds, are 100% illegal

- Recommended Driver's List Update 2024

Bali Holiday Secrets

Wise Debit Card: 7 Reasons Why it’s the Best Travel Card for Bali

updated April 1, 2022, 5:24 pm 24.6k Views 54 Comments

If you are looking for a sure-fire way to save money while travelling, the Wise Debit Card is a must-have. I’ve been using Wise (formerly Transferwise) to transfer money between bank accounts in different currencies for a couple of years, and I swear by it. But the addition of personal debit cards as well as their original business debit card makes this the best travel debit card by a country mile.

Why Wise Debit Card is cheaper than banks and credit cards.

The reason Wise can exchange currencies cheaper than your bank is that they process so much volume they acquire (formerly Transferwise) real-time foreign exchange rates without the markup your bank charges for the privilege of exchanging currencies.

Think of it this way – every moment there is a market between two commodities. The amount you are buying another currency (for example, the Indonesian Rupiah) and the rate someone else (your bank) is willing to sell that Rupiah. Your bank charges a fat margin – Transferwise has lower margins – therefore you get more Rupiah for your Dollar.

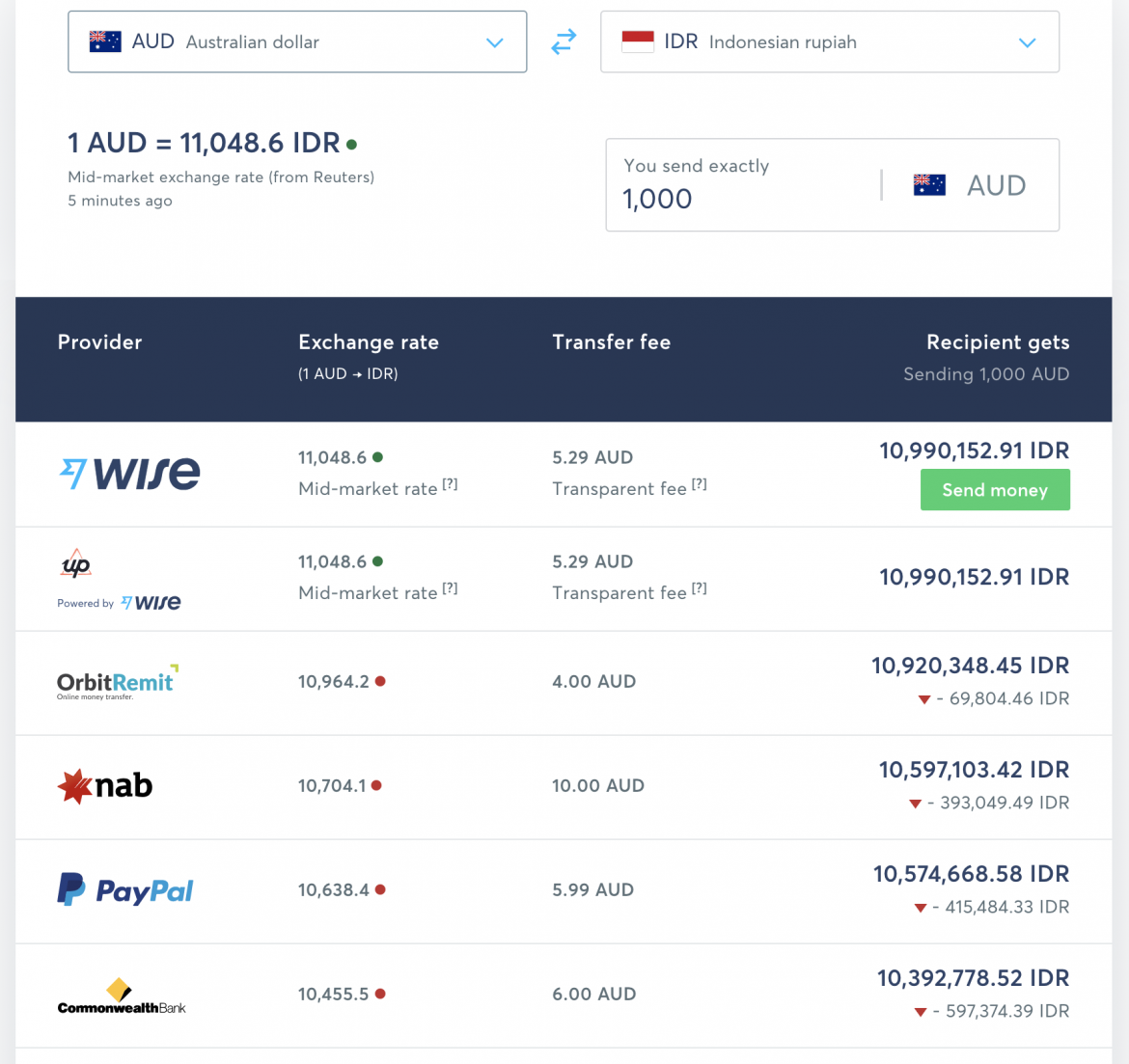

Check out the screenshot below showing the transfer of AUD$1,000 using Wise compared with NAB, PayPal and Commonwealth Bank.

The difference can be as much as IDR600,000, which is around AUD$60. The currency in Bali is the Indonesian Rupiah (IDR), and let me tell you, AUD$60 goes a long way in Bali.

Using Wise for sending money from Australia to Bali.

Many Australians have friends and family in Bali and need to send money from Australia to a Bali bank account.

Let’s use an example of sending AUD$100 from your Australian bank account to a friend’s bank account in Bali. Remember, the currency in Bali is the Indonesian Rupiah (IDR).

First, you register your own personal Wise account . Register on a desktop or laptop first, then download the smartphone apps for Android and Apple .

It’s very easy to confirm your identity (required by law, same as any Australian bank) using a passport or driver’s license, but the verification process is quite quick.

Next, you create a new Australian bank account complete with BSB Code and Account number. This account behaves exactly the same as any of your other Australian bank accounts. Now you have the new account number, it’s dead easy to transfer money from your current local bank account to your new Wise bank account .

So now you have an account within Wise in Australian Dollars. Next, you use the menu options to open an IDR balance . The difference between a balance and an account is that a balance is simply holding a foreign currency without a bank account attached to it — an account is a proper bank account with account numbers.

Now here is the fun bit — you can send IDR to your friend’s Indonesian bank account. All you need is the name on their account, the name of the bank and the account number. This makes it almost impossible to make a mistake and send it to the wrong person because the confirmation screen will display the name of the account holder, which you can check against the details they provided you.

Once confirming the transfer, you can track its progress online and also receive email notifications when it arrives in their account.

The difference when transferring from your bank directly to a foreign bank is huge.

- You get charged an “administrative fee”, usually around $20-50.

- The exchange rate they transfer your money is the retail rate , meaning they are making a significant margin off you.

- A “delivery” fee is often charged. The recipient’s bank is literally charging them for receiving the funds being transferred.

Wise cuts out the middle-man , in this case, your bank, and withdraws the money from your account (without fees), exchanges it for the destination currency (which is where you save the most) and deposits it in the recipient account for a tiny fraction of the fee that your bank would charge.

The Wise Travel Debit Card.

If you apply for a Wise Debit Card , you can use it to spend Indonesian Rupiah while in Bali without any transaction fees at all .

Think about this. You go to dinner in a restaurant in Seminyak and in a fit of generosity pay the bill for your four guests. Maybe drinks and dinner come to IDR 4,000,000.

Using the rates in the above example, you will be charged around AUD$360 if you pay with your Visa or Mastercard. The bank decides what exchange rate it will charge you in Australian Dollars, and let’s be frank – the rate isn’t great.

On top of that they may charge you an “overseas transaction fee” because, well, they can. That’s just another bank tax. Since the consumer commissions in several countries made “overseas transaction fees” against the law, most banks simply sneak it in with an even worse foreign currency conversion rate.

Either way, they get you, and you end up paying a lot more than the original IDR4,000,000 bill.

I cannot thank you enough for this tip

I cannot thank you enough for this tip. I have used Transferwise in BALI last week and it worked perfectly without the horrible australian banks fees. also, it’s so easy to withdraw money from the many ATM’s around and I must say that I am now using it in Australia if and when I need to transfer money abroad. Best tip ever.

With a Wise Debit Card , you pay… Rp 4,000,000 for dinner. No extra fees, no transaction charges. That’s because the money you are holding in your IDR currency is used to pay just like a local would using their Indonesian debit card.

And the best feature is that whenever you make a transaction you get an alert on your smartphone telling you where the transaction was made and how much. That means whenever I use it (and I make several transactions a day) I get an instant confirmation showing the local currency transaction.

Not only does this give me a great sense of security but I can also confirm how much is left in the local currency account where I’m travelling.

Withdraw Local Currency with your Transferwise Debit Card

Other than using the card for purchases without any transaction fees while you’re on holiday in Bali, you can also withdraw cash from ATMs in Bali as well.

That means you don’t need to bring cash to exchange at a money changer or get hit with exorbitant bank fees by using your existing Visa or Mastercard.

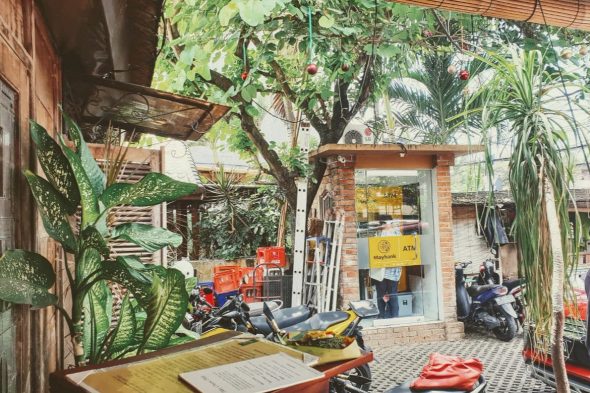

Not all ATMs will accept the Transferwise Debit Card but many do — I’ve found several around Bali that allow cash withdrawals, with my favourite being the yellow-coloured Maybank (there’s one outside Biku in Seminyak ).

No leftover foreign currency at the end of the holiday.

One of the biggest pains when travelling is using up the local currency before you leave. Or conversely, for me, it’s not having any when I land in a new country.

Using the Transferwise smartphone app I can move money between currencies at the most competitive rate on the market. Which means if I’m a bit short because of a big splurge with a few days to go, I can exchange money from one of my other currency wallets into the local currency.

And when leaving, or anytime after I leave, I can move the leftover money into the currency I’m going to use next. Because the rates are better than I can find anywhere else, the stress of getting a horrible exchange rate for small or large amounts is no longer a factor.

It’s just one less friction point when travelling, so I can focus on making my Indonesian Rupiah, Vietnamese Dong, Malaysian Ringgit or Euro go further.

Save money by spending local currency during airport transits.

One of the pains of travelling far and wide is the transit times while changing flights at foreign airports. There’s not enough time to get outside immigration, but enough time that you may want some food or drink (always a good idea), or check-out the local airport shopping (never a good idea).

The problem is you don’t have any local currency, and using the currency exchange booths means paying either a commission or a shockingly expensive exchange rate , especially for small amounts.

My solution is to figure out what I’m going to get (usually food or drink while waiting for my connecting flight) and transfer that amount using my Transferwise smartphone app and then paying for it using my Transferwise Debit Card.

That way I get the most competitive rate even with small amounts, and paying for it using my card means it’s being transacted in the local currency.

So buying a laksa at KLIA doesn’t mean paying my credit card issuing bank an “overseas transaction fee” along with a grossly uncompetitive exchange rate. The last time I tested the difference I paid 54% more than I would with my Transferwise Debit Card using local currency. An AUD$8.20 curry turned into a $12.67 charge on my credit card.

And if you doubt this, or have had a similar experience, please leave a comment below.

Saving for a holiday made easy.

We all know that saving for a holiday is hard work. And when you go to change your hard-earned cash into the local currency you are at the whim of the prevailing exchange rate.

What I do is transfer money from my home bank account into my Transferwise Debit Card account and regularly exchange those dollars into my destination currency.

For example, for a holiday to Vietnam, I transfer a few hundred dollars a month into my Transferwise account and then swap those dollars for Vietnamese Dong regularly. That way I’m averaging the exchange rate over a length of time – which means I won’t get the best rate or the worst rate – but an average rate over the time I’m saving for the trip.

So there it is. Put funds into your Transferwise account, change it into any currency you like, and spend like a local. You can try it out by getting a Transferwise account, connecting it with your own bank account, putting in a small amount to try it out (that’s what I did) and testing the exchange rate by using the same amount as a foreign exchange transaction using your own own Internet banking, or asking for an over-the-counter transaction at your local bank branch (like that’s somewhere we go any more).

While most anyone can open a Transferwise account, Debit Cards can only be issued to residents of certain countries.

Disclaimer: Using the links from this website means I get a very small commission from anyone who signs up for a Transferwise account and makes a currency conversion. I’ve been using Transferwise for over two years and I love it. Ask any questions in the comments section below.

© 2024 Bali Holiday Secrets. Hosted with Cloudways .

- Bali Tourism

- Bali Hotels

- Bed and Breakfast Bali

- Bali Holiday Rentals

- Flights to Bali

- Bali Restaurants

- Bali Attractions

- Bali Travel Forum

- Bali Photos

- All Bali Hotels

- Bali Hotel Deals

- Last Minute Hotels in Bali

- Things to Do

- Restaurants

- Holiday Rentals

- Travel Stories

- Add a Place

- Travel Forum

- Travellers' Choice

- Help Centre

Commonwealth bank Travel Money Card - Bali Forum

- Asia

- Indonesia

- Bali

Commonwealth bank Travel Money Card

- United Kingdom Forums

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Holiday Rentals

- Indonesia forums

Hi Limited,

I have used travel cards in bali and while not the commonwealth one i am sure they will do the job, as there are commonwealth atms there and that minimises the cost...But.

You will be slugged with a currency conversion fee, and withdrawal fee every transaction.

I think i should get a job with the NAB with commission, with all the referals i have given them..

Happy to answer anymore questions.

Happy travels.

Very convenient. We are heading off to Bali next week and I am going to get another one. If you have any account with the commonwealth they are free to open. However there is a top up fee, its cheaper just open a new one than top up..

I may be wrong Jenny, but i was sure you do get a currency conversion fee with the commonwealth card unless u load it with the currency of the country you are travelling to, eg if u go to the US and load it with US$ then there is no currency conversion fee, but as indonesian rupiah are not one of the currencies available then u have to select another currency, $A, then u are charged a currency conversion fee when u withdraw over there... using it here in aust and withdrawing $A there is no fee.... I am pretty sure i have got it right... but i will certainly stand corrected if i am wrong and apologise if i have....

It ends up being around 3% currency conversion fee and A$2, withdrwawl fee with the commonwealth travel card i think... it does add up.

Would love to hear if i am wrong.

Hope this helps....

Just a quick look at comm bank site, and its a 2% currency conversion fee and $A3.50 withdrawal fee at overseas atms, but i am sure if u use the comm banks atms over there it is only $A2. Hope this helps.

Here is the page...

http://www.commbank.com.au/personal/international/travel-money-card/fees-charges/default.aspx

Hi Bluechomsky..may I say you have a very good understanding of debit/credit cards.I am actually with the CBA so that is why my enquiry was about a TMC.

The devil is in the detail so I may be leaning towards a 28 degrees M/C.I had a quick lokk at the online Application and it looked very straight forward.

Thankyou for your advice.

Hi Jenny , I am also with the CBA and it does make it a lot easier to obtain a debit card.I will have another look a the fees and costs involved as they can be a bit sneeky..thanks

I did alot of research for our months trip with a family of 5.... we had been stung travelling o/s b4 with various travel cards and knew we needed heaps of money for a month with a family in tow.... I really did do alot of studying.. hehehehehe.

Just watch it with the 28deg, they will not insure you for your own cash loaded onto the card, just the credit component... I am also with the cba and was shocked that nab could do better.. the only cards i have with nab is the visa gold and only when i travel, poor nab. hehehehe

NAB is truely the way to go, Gabbyo on here loves it too..

you can always pm her and ask... we both should get commission.

Also be aware that 28 degrees master card and I’m assuming nab visa gold use your pre-loaded money first before going into credit balance account. 28 degrees master card no monthly fees or annual card charges.

NAB card is a visa gold debit card, just like a travel card it has no credit component, i guess thats why they insure yr money against theft etc, you can still use the card at shops etc, just like a credit card but it uses yr own money......... while the 28deg is a credit card that u can load with yr own money and also has a credit component, they insure the credit bit but not yr own money.... it is a great card if u need credit to travel...... its just the insurance thing of my own money i didnt like.

- Stupid Question… 04:51

- lax to Bali, add days in HKG or Thailand? 03:52

- Dongle use and SIM cards. 03:05

- Legian Seminyak abandoned or closed hotels 01:06

- Visa still active 23:42

- Returning to my birth country 23:14

- Bali Visa 23:09

- Local fresh food/fruits market 22:32

- Nan Opti-pro 1 baby formula 21:19

- 4 Girls - early 20s - feedback for near term visit please! 20:06

- Private car/driver OR pre planned day tours today

- 101 Bali Oasis vs Puri Santrian today

- Bali zoo vs Bali safari today

- Ubud to Nusa Penida via Sanur or Padang Bai today

- first trip to Bali- best currency to take 6 replies

- Weather in Bali in October 16 replies

- Otel.com scam? No record of pre-paid hotel booking-help! 22 replies

- April weather in Bali 12 replies

- March weather in Bali - please help!! 4 replies

- UK to Bali - Visa Question 5 replies

- what plug sockets??? 4 replies

- Best Mosquito repellent 11 replies

- Weather May/June what's it like? 3 replies

- How long is the flight from Manchester to Bali? 16 replies

Bali Hotels and Places to Stay

- Visa/ Immigration / Customs / Tourist Tax Update

- The Different Areas of Bali and What They Offer Update Jan 2020

- The Weather in Bali and Best Time to Visit

- Hints for traveling to Bali with babies, toddlers and young children: do not respond

- Driving & Riding in Bali

- Currency, Money Changers & ATMs

- Airport Taxi February 2020

- Snorkel and/or dive in Bali?

- North Bali Attractions

- Basics about Nyepi Holiday in Bali

- Warning: all marijuana, and many ADHD meds, are 100% illegal

- Recommended Driver's List Update 2024

- Bali Tourism

- Bali Accommodation

- Bali Bed and Breakfast

- Bali Holiday Rentals

- Bali Flights

- Bali Restaurants

- Bali Attractions

- Bali Travel Forum

- Bali Photos

- All Bali Hotels

- Bali Hotel Deals

- Last Minute Hotels in Bali

- Things to Do

- Restaurants

- Holiday Rentals

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travellers' Choice

- Help Centre

Debit Cards - Bali Forum

- Asia

- Indonesia

- Bali

Debit Cards

- Australia Forums

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Holiday Rentals

- Indonesia forums

You can use your Mastercard debit cards at any ATM where the Mastercard sign is displayed and the majority of retailers / merchants will accept it as well. In saying that, ATMs will only allow you to withdraw small amounts of cash Rp1 million - 1.5million at a time (less than AUD$200) and you will be charged about $5 each time you do this.

For larger expenses, such as paying for your hotel room, this is probably when I would recommend using your Mastercard debit card.

Hope you have a great time in Bali!

They have Commowealth Bank branches and ATM's in Bali. So if you bank with them you are set! The exchange rates through the ATM's are pretty good too.

There will be a fee using an ATM by the bank that owns it unless you bank with that bank. The fee isn't too bad though.

The trick is to withdraw larger amounts less often.

Hope this helps.

The best card for OS travel I have found and use is Wizard Clear Advantage Master Card: With no annual fee.

http://www.wizardclearadvantage.com.au/

If you add your money by Bpay onto the card so it is in positive credit, cash withdrawals are fee free as you are effectively using your own money. There are also no foreign exchange fees.

Have a look at this blog it fully explains its advantages.

http://www.bhatt.id.au/blog/no-foreign-currency-fees-wizard-clear-advantage-creditcard-review/

Just check with your bank what fees they charge. Ours, BOQ, charged a conversion fee (fair enough). It was about $3.00 per $100 we withdrew from our Visa debit card, but then at the end of the month they processed a flat fee of $25 for using the card internationally. I intend to take this up with them. We used our card in Japan less than a year ago and were never hit up with this fee. We deliberately didn't use the Commonwealth Bank ATMs because I thought the CBA would no doubt have more fees than the local banks.

For the convenience of using ATMs you will pay. I highly recommend taking cash and have it exchanged at reputable BMC agencies - too easy. The ATMs are so easy, but cost you and you do tend to withdraw more than you need, just because you can!

I use a visa debit card & can usually withdraw up to 3 million rupiah in 2 transactions, some will allow you to withdraw more than this, others less. Some ATM's dispense 50,000 notes & others 100,000 most machines are labelled as to which notes they dispense.

1) Note: The Wizard Clear Advantage Master Card: With no annual fee is NOT the best card, only the opinion of a previous poster.

I have used (in positive credit so no cash advance fee) in Indonesia VISA by: HSBC, NAB, Chase. Also, Mastercard by: Westpac. Many cards have no annual fee, choose the institution you least dislike.

slk8000:Can you confirm that HSBC, NAB, Chase. Also, Mastercard by: Westpac. Do not charge international conversion fee on purchases when converting back to Australian dollars? I said the Wizard Master Card was THE BEST CARD THAT I HAD fOUND. I did not say it is the best card outright. Your opinion is valued but please don’t be patronizing.

The Wizard card exchange rates are very favorable and the card has no annual fee.

If there is a better card out there for foreign travel, I am yet to find it.

I don't particularly like GE Money but this is a good product.

I was able to withdraw 3 million Rupiah at Denpasar Airport on arrival last night and I think the ATM fee was about $5 A approximately.

- Stupid Question… 13:51

- lax to Bali, add days in HKG or Thailand? 12:52

- Dongle use and SIM cards. 12:05

- Legian Seminyak abandoned or closed hotels 10:06

- Visa still active 08:42

- Returning to my birth country 08:14

- Bali Visa 08:09

- Local fresh food/fruits market 07:32

- Nan Opti-pro 1 baby formula 06:19

- 4 Girls - early 20s - feedback for near term visit please! 05:06

- Private car/driver OR pre planned day tours today

- 101 Bali Oasis vs Puri Santrian today

- Bali zoo vs Bali safari today

- Ubud to Nusa Penida via Sanur or Padang Bai today

- Bali Visa on arrival and departure tax 98 replies

- How rainy is the weather in December in Bali 7 replies

- Weather in Bali in October 16 replies

- Links to good street maps of Seminyak, Legian and Kuta 16 replies

- Planning New Years Eve in Bali 16 replies

- Departure tax from bali 8 replies

- Food Prices and Costs of doing things?? 11 replies

- Family holiday - best place to stay 15 replies

- April weather in Bali 12 replies

- Best place to shop in Seminyak & Legian? 8 replies

Bali Hotels and Places to Stay

- Visa/ Immigration / Customs / Tourist Tax Update

- The Different Areas of Bali and What They Offer Update Jan 2020

- The Weather in Bali and Best Time to Visit

- Hints for traveling to Bali with babies, toddlers and young children: do not respond

- Driving & Riding in Bali

- Currency, Money Changers & ATMs

- Airport Taxi February 2020

- Snorkel and/or dive in Bali?

- North Bali Attractions

- Basics about Nyepi Holiday in Bali

- Warning: all marijuana, and many ADHD meds, are 100% illegal

- Recommended Driver's List Update 2024

IMAGES

VIDEO

COMMENTS

When you open a new Travel Money Card account online via NetBank or in branch. $0. Initial load/reload fee. When you initially load/reload funds onto your Travel Money Card or transfer funds from your Travel Money Card to an eligible CommBank account via NetBank or the CommBank app. The rate applicable is the CommBank Retail Foreign Exchange ...

Things you should know Your Travel Money Card can be accepted all over the . world wherever Visa is accepted. If the currency of your travel destination isn't listed, you can still load and use Australian Dollars when you're overseas (see 4.5). If you have more than one currency on your Travel Money . Card, a Currency Order will apply (see ...

We've listed what we think are three of the best travel cards you can use while you're in Bali. They can be either prepaid, debit or credit cards designed specially for overseas use. You can use travel cards to make purchases online, in stores and to withdraw money at ATMs. There are 3 popular types: Prepaid Travel Cards; Travel Debit Cards

I have used Commonwealth money cards twice, USA & my daughter used it in Bali last month. They are great, saves taking a whole lot of cash with you. and saves heaps on fees at the ATM. There is no currency conversion fee when you withdraw from the ATM, all you pay is a fee to use the ATM, I think is was either $1 or $2. Very convenient.

We're sharing the most important travel moment traps we think you should avoid, and the travel money tips for Bali that can really help you save some money. 1. Not taking a prepaid card. Our first point is an important one. Using a prepaid card in Bali is a great way to avoid the fees and costly exchange rates that often come with ordinary ...