Student Health Insurance

- CGU Emergency Information

- Academic & Student Life Support

- Medi-Cal Resources

- Public Charge and use of Medi-Cal

- CDC Country Ranking

- DHS Travel Advisories

- CAʻs Public Health Department

- COVID-19 Vaccine Rollout

- 7C COVID-19 Vaccine Town Hall

Health Insurance Plans

CGU offers two health insurance plans:

- The Student Health Insurance Plan (SHIP) for domestic, permanent residents, and undocumented students through UnitedHealthCare, and;

- The GeoBlue plan for international (F-1 and J-1 visa) students.

For more information about the insurance plans and waiver information, please view Domestic Plan or International Plan pages (link in the menu bar). For the official university policy, click here.

Dental & Vision Coverage

CGU students, whether enrolled in a CGU insurance plan or an outside carrier, may opt in to the dental and vision plans provided through UHC. Pricing varies based on the plan selected.

Learn More About Dental and Vision

Immunizations & Vaccinations

CGU requires all incoming students complete a list of required immunizations and vaccinations. Please review the immunization page (link in menu bar) for a detailed list of required and recommended vaccinations and immunizations. For the official university policy, click here .

International Travel Insurance

The Claremont Colleges Services offers supplemental travel insurance coverage through AIG Insurance to CGU staff, faculty and students for academic related reasons. For more information, click here .

- Join CHOICE

Travel insurance

CGU Domestic review

Cgu insurance provider..

This is the provider of the insurance product and correlates with the Financial Services Provider (FSP) as registered with the Australian Financial Complaints Authority. You can look up your insurer's provider in the AFCA comparative tables to see how likely consumers were to bring a travel insurance dispute to AFCA about them.

In years (up to and including given number).

Limit per person for cancellation or amendment expenses.

No means 'not covered'. Cover is assessed on individual circumstances.

The limit for additional travel expenses per person if travel is interrupted by an insured event (not including injury or sickness as that is covered separately under 'Additional travel expenses for injury or sickness').

Cover limit for additional travel expenses to reach a special event such as a wedding, conference or sporting event on time if the scheduled transport is cancelled or delayed.

Cover limit for additional travel expenses to reach pre-paid travel arrangements on time if the scheduled transport is cancelled or delayed.

Cover is assessed on individual circumstances.

Limit per person for additional meal and accommodation expenses if scheduled transport is delayed.

The minimum number of hours before transport delay is covered.

Limit per person per 24 hour period for this transport delay. No means 'not covered'. Cover is assessed on individual circumstances.

The overall limit per person for stolen or damaged personal belongings.

Limit for a single unspecified item.

Limit per item for a video or photo camera.

Limit for a laptop or tablet.

Limit for a smartphone.

Overall limit for a single person for baggage lost temporarily.

No means 'Not covered'. Cover is assessed on individual circumstances.

Overall limit for a family for baggage lost temporarily.

The minimum period of time in hours before which cover applies for temporarily lost baggage.

Cover collision damage excess for a hire car.

Limit for collision damage excess for a hire car.

Average rating

Compare domestic travel insurance | choice, everything you need to know about travel insurance.

Common Level 1 Menu

Travel insurance

We have ceased selling travel insurance effective 14 august 2024. for any enquiries or changes to existing policies please contact cgu by calling 13 24 81 and follow the prompts to make a change to an existing travel policy. for any claim enquiries for existing policies, please call 13 24 80., important documents.

- Product Disclosure Statement

- Target Market Determination

Emergency Assistance

Call the CGU 24/7 emergency hotline if you run into trouble on holiday.

From overseas: +61 2 8895 0698

From Australia: (02) 8895 0698

Are you travelling overseas soon?

Don't forget to let People's Choice know of your travel plans (including the countries and dates involved in the travel) so we can keep an eye out for suspicious transactions.

Sending us a Secure Mail via Internet Banking.

Call us on 13 11 82 .

Talk to your local branch .

Guides and tips

Accessing my money overseas

Online safety tips to protect your banking

- QBANK Membership

- BSB 704-052

What are you looking for?

- Internet Banking

- Travel Insurance - CGU Insurance

- Insurance Options

Need travel insurance for your next trip? Cover-More Travel Insurance offers a range of insurance options. In partnering with CGU Insurance, we can help you access Cover-More Travel Insurance.

Choose your cover

International Cover

International Travel Insurance plans help to protect your trip abroad and can provide cover for overseas emergency medical expenses, missed flight connections or travel delays, lost or stolen luggage, and so much more.

Domestic Cover

Need a little extra protection for your Australian holiday? Domestic Travel Insurance plans give Australian residents cover for expenses such as lost or damaged luggage and personal effects, cancellation costs, rental car insurance excess and more.

Single or multi-trip options

Cover-More offer a range of plans to choose from, depending on your travel needs. Annual multi-trip plans give you the flexibility to travel without the need to purchase a new policy for every trip.

Going overseas?

Travel more and worry less, knowing your travel insurance is sorted if things go wrong while you're away. Cover-More’s International Travel Insurance plans give you a choice of cover options which can provide cover for overseas emergency medical expenses, personal liability, luggage and travel documents, cancellation costs and more.

We can help arrange Domestic Travel Insurance for your trip, through Cover-More Travel Insurance.

Cover-More offer Domestic Comprehensive and Domestic Cancellation plans, if you’re an Australian resident travelling within Australia. Domestic travel insurance can help if something unexpected happens and you need to rearrange or cancel your trip (like if you get sick while you're away).

When you choose Domestic Comprehensive cover, your policy will include cover for:

- Luggage and travel documents

- Rental car insurance excess

- Travel delays

- Additional travel and accommodation expenses.

This cover has limits, sub-limits and exclusions, so read the Product Disclosure Statement (PDS) for full details of what’s covered.

Cover-More offer a range of plans to suit different travel needs and budgets. Annual Multi-Trip plans give you the flexibility to travel without the need to purchase a new policy for every trip. Whether you are planning just one trip this year or several, Cover-More have a range of travel insurance plans to choose from. Cover-More’s International Comprehensive Plan and Domestic Comprehensive Plan are both available as a Single Trip or Annual Multi-Trip policy.

Travel Insurance Plan options

Annual multi-trip

Annual multi-trip plans give you the flexibility to travel without the need to purchase a new policy for every trip.

- Gives you year round cover to destinations that are over 250 km from your home.

- Gives you year round cover to destinations that are less than 250km from home, if your trip includes at least one night of paid accommodation (like in a hotel or Airbnb).

- The option to select your preferred trip duration and the flexibility to take an unlimited number of trips within your annual policy period. You can choose 30, 45 or 60 days on the International Comprehensive Plan, or 15 or 30 days on the Domestic Comprehensive Plan.

Single trip

A Single Trip policy gives you insurance cover for one journey. If you don’t need cover for multiple trips in a year, consider if a Single Trip policy suits your travel needs.

COVID-19 Cover

If you are diagnosed with COVID-19 whilst travelling, we have benefits available on our domestic and international policies including cover for overseas medical costs.

Common scenarios for COVID-19 cover will be automatically included when taking out travel insurance with Cover-More. The level of benefits included will depend on the coverage and the type of policy you decide to purchase.

COVID-19 benefits may include:

- COVID-19 cover for overseas medical costs 1

- COVID-19 cover for cancellation and amendments 2

- Cover for additional COVID-19 expenses 3

IMPORTANT DOCUMENTS

We're here when you need us, we're here when you need us.

Emergency Assistance

Travel Advice

If you need urgent help, you can call Cover-More 24/7

From Australia

1300 889 137

Depending on your needs, Cover-More can help if:

- You need to find a medical facility and/or a doctor who speaks English

- You need to pay medical bills (if your claim is approved)

- You’ve lost your passports, travel documents or credit cards

- You need legal help or help getting home

Calling from overseas

Cover-More also have numbers you can call from outside Australia. If you're in:

- New Zealand, call 0800 600 702

- The United Kingdom, call 0800 001 5068

- USA 833 462 8181

- Canada 1833 511 9289

- Any other country, call (02) 8907 5221

When you call, have your Cover-More Travel Insurance policy number handy and a phone number Cover-More can call you back on.

Claim online now through Cover-More’s easy, 5-step process:

1.Describe the incident

2.Enter your expenses or losses

3.Upload any supporting documents

4.Provide your bank details

5.Review and finalise your claim

You can save and return to an incomplete claim for up to 28 days.

Once you've lodged your claim, Cover-More will update you on how it's progressing within 10 working days.

Follow up an existing claim.

Cover-More understand that as a result of your incident, you might already be out of pocket. That's why Cover-More try to process claims as quickly as possible.

You'll hear from Cover-More within 10 working days from the time they receive your claim.

To check your claim's progress, log into Cover-More’s online claims centre or contact them for more details.

Important information

CGU Travel Insurance is issued by Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507) (ZAIL). Cover-More Insurance Services Pty Ltd (ABN 95 003 114 145, AFSL 241713) acts under a binder authority from ZAIL. Cover-More will administer the policies and arrange for the issue of insurance on behalf of ZAIL. Cover-More has authorised Insurance Australia Limited (ABN 11 000 016 722; AFSL 227681) trading as CGU Insurance to distribute the product. QPCU Limited trading as QBANK ABN 79 087 651 036, AFSL No. 241413 distributes the product under a contract with CGU.

Any advice is general advice only and does not take into account your individual objectives, financial situation or needs (“your personal circumstances”). Before using this advice to decide whether to purchase CGU Travel Insurance, you should consider your personal circumstances, the Combined Financial Services Guide (FSG) and Product Disclosure Statement (PDS) and Target Market Determination available at policy.poweredbycovermore.com . If you decide to purchase CGU Travel Insurance from CGU, they receive a commission. For more information please refer to the Combined FSG/PDS .

1 Medical cover will not exceed 12 months from onset. Medical evacuation cover subject to claim approval. 2 Conditions and limits apply to COVID-19 cancellation cover. Cancellation cover applies to the International and Domestic Comprehensive policies. See the Combined FSG/PDS for more information. 3 Cover is for reasonable Additional accommodation expenses (room rate only) and Additional transport expenses. Conditions apply to COVID-19 additional expense cover. See the Combined FSG/PDS for more information.

Useful links

- Who Can Join

- Benefits of QBANK

- Join Online

- Everyday Plus Account

- On Call Account

- Teen On Call Account

- Term Deposits

- Pension Plus Account

- Owner Occupier

- First Home Buyer

- Home Buyer Resources

More Products

- Personal Loans

- Vehicle Loans

- Credit Cards

- Rates and Fees

- History of QBANK

- Latest News

- Forms and Documents

- Everyday Heroes

- Sponsorship

- Contact QBANK

- Financial Hardship

- General Enquiry

- Security Information

Disclaimer Privacy Financial Services Guide General Information Terms & Conditions Contact Us

Copyright © 2024 QPCU Limited T/A QBANK ABN 79 087 651 036 – AFSL / Australian Credit Licence 241413 – BSB 704-052

We acknowledge the Traditional Owners of the lands on which we operate and pay our respects to Elders past, present, and emerging. We also acknowledge the important role Aboriginal and Torres Strait Islander peoples continue to play within the communities in which QBANK operates and where our team members reside.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Travel Insurance for Domestic Vacations Works

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

You’ve probably heard of travel insurance, which promises to cover you if things go awry during your vacation. This perhaps seems obvious when you’re traveling overseas, but unexpected travel disruptions can happen when you travel domestically, too.

Let’s look at travel insurance for domestic vacations, what it covers and credit cards that’ll cover you during your trip.

Types of travel insurance

There’s more than one kind of travel insurance, including health coverage, trip interruption and rental car insurance. Depending on how you’re traveling, you likely won’t need every type of insurance, but here are the kinds you can generally expect to see:

Trip interruption insurance. This insurance will reimburse you for expenses incurred during a delay or interruption while traveling.

Trip cancellation insurance. This type of insurance will refund your costs if your trip is canceled for a covered reason.

Lost luggage insurance. This insurance will reimburse you for the items you have to repurchase when your bags are lost.

Rental car insurance. This type of insurance protects you while you're using a rental car.

Health insurance. Travel health insurance can differ but may include emergency medical and standard care coverage.

Cancel for Any Reason insurance. As the name suggests, this insurance allows you to cancel for any reason and receive a refund.

Accidental death insurance.

Emergency evacuation insurance.

» Learn more: Common myths about travel insurance and what it covers

Can you buy domestic travel insurance?

So, is it possible to get travel insurance for a domestic U.S. trip? The short answer is: Yes, you can. The longer answer is: Yes, but not all types of coverage may be available to you, and you may need to meet certain requirements to qualify.

For example, the travel insurance offered by the Chase Sapphire Reserve® requires that you be at least 100 miles away from home before its emergency evacuation and transportation benefit kicks in. Your trip must also be at least five days long but no longer than 60 days total.

Meanwhile, some providers of travel health insurance indicate that their coverage doesn’t work within the U.S. Instead, your plan will only work once you’re traveling internationally. This is true for the health plans offered by GeoBlue; those plans are limited to countries outside the U.S. and available only to people who already have a qualifying insurance plan.

» Learn more: How much is travel insurance?

Domestic travel health insurance

It’s possible to get travel insurance within the U.S. whether you’re looking for comprehensive coverage or simply a medical care plan. Companies such as Squaremouth collect quotes from a variety of insurance providers and allow you to compare them.

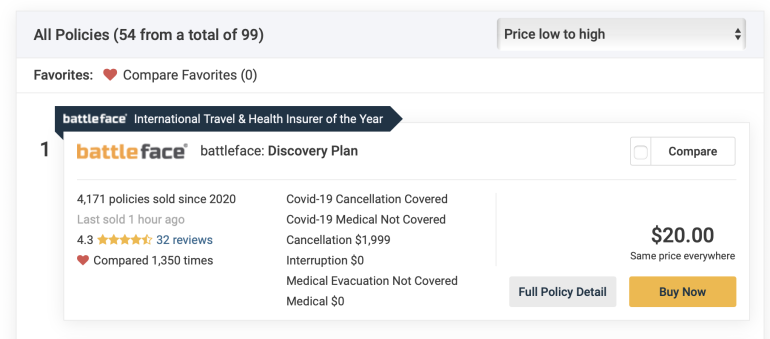

For example, we put in a search for a 32-year-old from California traveling within the U.S. The total trip cost was $1,999 and took place over two weeks during the summer.

Squaremouth returned results from 54 providers, with the lowest charging $20 total.

However, this plan doesn’t include medical insurance. To find policies that offer this coverage, you’ll want to use the filters next to the search results.

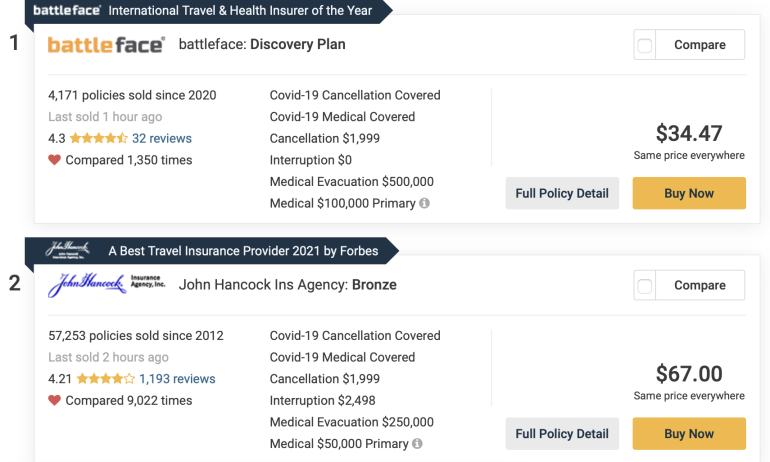

Including filters for domestic travel health insurance limits the total results, but pricing doesn’t change that significantly.

The policies shown will now include primary coverage, coverage for pre-existing conditions, medical evacuation and emergency medical. Even with all those options selected, the cheapest plan comes in at a relatively affordable $34.47.

For those unfamiliar with the terminology, primary insurance acts as the first payer for any claims you have. So if you visit a doctor during your trip, your primary policy will cover costs first. If that plan is exhausted and you also have secondary insurance, the secondary insurance can then pay off the rest.

It’s important to know the difference so you’ll be completely covered during your travels. Note, however, that if you don’t have primary insurance, any secondary insurance becomes primary.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Travel cards with domestic travel insurance

Interested in cheap domestic travel insurance? You won’t find anything cheaper than the complimentary travel insurance offered by many travel cards. We’ve already mentioned that the Chase Sapphire Reserve® has its own travel insurance benefits, but so do many other cards.

Generally, you don’t need to pay anything to be eligible for the travel insurance offered by these types of cards. Instead, you’ll simply need to charge the cost of the trip to your card and the insurance will be automatically activated. This is true whether you’re traveling domestically or internationally.

Here are a few cards that offer complimentary travel insurance:

Chase Sapphire Reserve® .

The Platinum Card® from American Express .

United℠ Explorer Card .

Hilton Honors American Express Aspire Card .

Capital One Venture X Rewards Credit Card .

Terms apply.

» Learn more: The best travel credit cards right now

Travel insurance for domestic vacations recapped

Hopefully we’ve answered the question: “Do I need travel insurance for domestic travel?”

The truth is, whether or not you opt to obtain travel insurance for your trip is going to depend on you. Some travelers have a higher tolerance for risk and are willing to forgo insurance while hoping things go the way they should.

Others may be more interested in being covered for events such as trip delay, emergency medical and rental car insurance.

Whatever you choose, compare quotes from multiple insurance providers to be sure you’re getting a policy that suits your needs. Otherwise, check out the complimentary travel insurance offered by a variety of credit cards to see whether their coverage limits fit your travel budget.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

CGU Travel Insurance

Our verdict: although cgu has a good range of benefits and customisation options, it was one of the only brands we found with absolutely no cover for covid-19..

In this guide

Summary of CGU Platinum Plan

How does cgu travel insurance cover covid-19, what policies does cgu offer, here's a breakdown of cgu travel insurance features, standard features, optional add-ons, how to make a cgu travel insurance claim, here's the bottom line about cgu travel insurance, frequently asked questions, request travel insurance quotes and compare policies.

Destinations

- Financial default is covered up to $2,500, so you'll be protected if a provider goes bust. Many travel insurance brands don't provide any cover at all.

- Riding a motorbike or moped is covered as standard, as long as you have the appropriate licence and are behaving in a safe way.

- There's no cover for any claims related to COVID-19, including overseas medical care. This is extremely rare. Most travel insurance brands offer at least some cover.

- There's no option to add an adventure pack so some higher-risk activities can't be covered, such as quad biking, parachuting or trekking the Kokoda Trail.

Compare other options

Table updated October 2023

CGU offers no cover for any claims related to COVID-19. This is extremely rare.

Most Australian travel insurance brands offer some cover for COVID-19. Often, brands will cover overseas medical expenses incurred as a result of COVID-19 and some brands even cover the cost of delays, cancellations, emergency transport or accommodation costs, and other related incidents.

CGU offers six insurance policies to travellers. The Platinum Plan, Premium Plan, Essentials Plan, Domestic Plan and Cancellation Only Plan.

Cancellation-Only

Annual Multi-Trip

The insurer of this product is Insurance Australia Limited. It comes with a cooling-off period of 21 days and choice of $200 standard excess for international plans.

These are some of the main insured events that CGU will cover.

Be aware, some of these benefits only apply on the Premium International Plan and exclusions apply. Always read the PDS.

- Overseas medical treatment

- Lost, damaged or stolen property

- Trip cancellation or amendment

- Additional accommodation and transport

- Rental vehicle excess

- Financial default

- Theft of money

- Luggage and travel delay

- Kidnap and hijack

- Personal liability

- Accidental disability

- Accidental death

CGU also offers two add-ons that provide cover for a wider range of risks.

- Ski and Winter Sports Option. Extend your policy to cover you while on the slopes, plus a range of specific risks such as piste closure, life passes, and avalanche.

- Cruise Cover Extends your insurance policy to cover you while on a cruise as well as a range of cruise-related risks such as marine rescue, shore excursion cancellation, and formal attire. li>

Unfortunately, travel insurance doesn't cover everything. Generally, CGU will not pay your claim if it relates to:

- COVID-19 or any other pandemic or epidemic

- Unlawful, wreckless or unreasonably unsafe behaviour by you

- Behaviour while you were drunk or under the influence of drugs

- Expenses related to a pre-existing medical condition not listed on your policy

- An act of war, invasion or revolution

- Mandatory quarantines or isolations

- You being unfit to travel or travelling against medical advice

- Childbirth or pregnancy complications after the 24th week of gestation

- An elective medical or dental treatment , cosmetic procedure or body modification (including tattoos or piercing)

- Self-inflicted injury or illness, suicide or attempted suicide

Make sure you review the CGU PDS for a detailed breakdown of what won't be covered, found under its list of general exclusions .

To start your claim, call CGU on 13 24 80. You'll need any relevant evidence or supporting documentation on hand, including medical reports, police reports, receipts, photos, tickets, etc.

Once your claim is lodged with CGU, a case manager will be allocated and you'll be contacted regarding the next steps.

While CGU has some good travel insurance benefits that other brands are missing, such as cover for financial default and loss of income, it lags in some major areas.

Namely, COVID-19. CGU offers no protection whatsoever for claims related to COVID-19, including overseas medical expenses. Many other brands cover this as standard, and some even cover any COVID-19 related incident outside of your control.

While motorcycle riding is covered as standard, there is also limited protection for adventure activities and cover for pregnancy ends at the end of the 24th week.

I'm based in SA and can't buy CGU travel insurance. Why?

If you're based in SA, WA or the NT you'll need to contact one of CGU's insurance partners or associated insurance brokers to buy a policy.

Is there an age limit for CGU travel insurance?

Generally speaking, there is no age limit for CGU travel insurance. However, age limits may come into force depending on your location or length of trip..

Does CGU offer emergency help while overseas?

Yes, you can call CGU's emergency assistance line on 0288 950 698, 24/7.

Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Compare other products from CGU

- CGU home insurance

- CGU car insurance

- CGU motorcycle insurance

- CGU caravan insurance

- CGU landlord insurance

Nicola Middlemiss

Nicola Middlemiss is a contributing writer at Finder, with a special interest in personal finance and insurance. Formerly a business and finance journalist, Nicola has written thousands of articles helping Australians better understand insurance and grow their personal wealth. She has contributed to a wide range of publications, including Domain, the Educator, Financy, Fundraising and Philanthropy, Insurance Business, MoneyMag, Mortgage Professional, Yahoo Finance, Your Investment Property, and Wealth Professional. Nicola has a Tier 1 General Insurance (General Advice) certification and a Bachelor's degree from the University of Leeds. See full bio

- Personal finance

- Personal insurance, including car, health, home, life, pet and travel insurance

- Commercial business insurance

More guides on Finder

Planning a holiday is a lot of fun, but what happens when something goes wrong and your plans are thrown into disarray?

Airline lost your luggage? Here's what you need to know.

Guide to travel insurance for strikes and industrial action.

If you've booked a Contiki trip, don't forget to pack travel insurance. Meet tour requirements and get protection against travel risks.

If you plan to hire a car on your holiday, beware of car hire excess charges if you get into an accident. Travel insurance can protect you for this charge up to $6,000.

Lost your wallet? Did someone steal your brand new laptop overseas? Find out how much you will really get back for lost and stolen items.

Is travel insurance compulsory for the USA? What about the UK? How about on my Contiki tour? Read Finder's guide.

If you’re planning to travel to a country that has high travel risks, learn how cover is and is not provided.

This guide looks at when insurers will cover you for alcohol-related claims and whether consuming booze is entirely at your own risk.

RAA Travel Insurance - Compare benefits, see features and more.

Ask a question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

4 Responses

Travel Insurance – Can you let me know if I can get 12months cover as I plan to do maybe three trips in this period. Japan, Europe, USA. Can you give me contact details so I can obtain quote.

Thanks for leaving a question on finder.

Unfortunately, finder.com.au does not currently have access to this travel insurance brand. If you are looking for an Annual Multi trip insurance, you can compare and weigh your options here:

https://www.finder.com.au/travel-insurance/annual-multi-trip-travel-insurance

You will have to choose worldwide when filling out the form.

Cheers, Joel

Travel Insurance query – I am 24 years of age, flying Perth to Paris depart 21 Sept arrive 22 Sept and then taking the train Paris to London on 24 Sept to study for several years in England. I would like one way cover for the trip, ‘super’ cover. Can you do this? What is the premium? How do I get this cover – note there is no ‘return’ date. Regards Amy

Thanks for your question. finder.com.au is a comparison service and not an insurer. You’ll need to contact CGU directly as they are not part of the panel of insurers that we have access to.

All the best, Richard

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

It’s important that you’re aware of how Comprehensive Credit Reporting impacts your credit report.

Our focus is protecting you with market-leading Insurance

- Financial Planning

- Transaction Accounts

- Savings Accounts

- Term Deposits

- Credit Cards

- Travel and Foreign Exchange

- School Accounts

- Preschool Accounts

- Interest Rates Banking

Fast, secure and easy way to pay.

- Car and Personal Loans

- Interest Rates Loans

- Home and Contents

- Other Vehicle

- Internet Banking

- Online Identity Verification

Search Results

Popular topics.

- Get started with Internet Banking

- 1300 654 822

- BSB 704-191

Travel Insurance

Need travel insurance for your next trip? Cover-More Travel Insurance offers a range of insurance options. In partnering with CGU Insurance, we can help you access Cover-More Travel Insurance.

Notice: If you have purchased your travel insurance before 13 August 2024, 11.59pm and need to make a claim, please contact CGU on 13 22 94 . Claims can be lodged 24 hours / 7 days a week.

Choose your cover

Need a little extra protection for your Australian holiday? Domestic Travel Insurance plans give Australian residents cover for expenses such as lost or damaged luggage and personal effects, cancellation costs, rental car insurance excess and more.

COVID-19 cover

If you are diagnosed with COVID-19 whilst travelling, we have benefits available on our domestic and international policies including cover for overseas medical costs. Common scenarios for COVID-19 cover will be automatically included when taking out travel insurance with Cover-More. The level of benefits included will depend on the coverage and the type of policy you decide to purchase. COVID-19 benefits may include:

COVID-19 cover for overseas medical costs¹

COVID-19 cover for cancellation and amendments²

Cover for additional COVID-19 expenses³

Speak to us about an existing policy.

Important documents

Product disclosure statement (pds) and financial services guide (fgs), target market determinations, cgu insurance's fsg, we're here when you need us.

Emergency assistance

If you need urgent help, you can call Cover-More 24/7

From overseas: (02) 8907 5221 From Australia: 1300 889 137

Call Cover-More to get started.

From Australia: 1300 889 137 From overseas: (02) 8907 5221 Or lodge a claim online

Travel advice

Dip your toe before you dive in by finding out everything you need to know before you go.

Visit www.smartraveller.gov.au to find out the latest travel advice.

CGU Travel Insurance is issued by Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507) (ZAIL). Cover-More Insurance Services Pty Ltd (ABN 95 003 114 145, AFSL 241713) acts under a binder authority from ZAIL. Cover-More will administer the policies and arrange for the issue of insurance on behalf of ZAIL. Cover-More has authorised Insurance Australia Limited (ABN 11 000 016 722; AFSL 227681) trading as CGU Insurance to distribute the product. Bank First ABN 44 087 651 769 AFSL/Australian Credit Licence Number 240 960 distributes the product under a contract with CGU. Limits, sub-limits, exclusions, terms and conditions (including eligibility criteria) apply.

Any advice is general advice only and does not take into account your individual objectives, financial situation or needs (“your personal circumstances”). Before using this advice to decide whether to purchase CGU Travel Insurance, you should consider your personal circumstances, the Combined Financial Services Guide (FSG) and Product Disclosure Statement (PDS) and Target Market Determination (TMD) .

If you decide to purchase CGU Travel Insurance from Bank First they receive a commission. For more information, please refer to the Combined Financial Services Guide (FSG)/Product Disclosure Statement (PDS) .

COVID-19 Cover Disclaimer

Medical cover will not exceed 12 months from onset. Medical evacuation cover subject to claim approval.

Conditions and limits apply to COVID-19 cancellation cover. Cancellation cover applies to the International and Domestic Comprehensive policies. See the Combined Financial Services Guide (FSG)/Product Disclosure Statement (PDS) for more information.

Cover is for reasonable Additional accommodation expenses (room rate only) and Additional transport expenses. Conditions apply to COVID-19 additional expense cover. See the Combined Financial Services Guide (FSG)/Product Disclosure Statement (PDS) for more information.

Please refer to CGU policy document . Insurance issued by Insurance Australia Limited ABN 11 000 016 722, AFSL 227681 trading as CGU Insurance (CGU). In arranging this insurance, Victoria Teachers Limited ABN 44 087 651 769 AFSL 240960 trading as Bank First (Bank First), acts under its own AFSL and under an agreement with CGU, not as your agent. If you have a question or need to make a claim under the CGU policy, please contact CGU using the contact details included in the policy document.

Travel Insurance

Let’s get you travel ready.

From Australia

1300 889 137

Depending on your needs, Cover-More can help if:

- You need to find a medical facility and/or a doctor who speaks English

- You need to pay medical bills (if your claim is approved)

- You’ve lost your passports, travel documents or credit cards

- You need legal help or help getting home

Calling from overseas

Cover-More also have numbers you can call from outside Australia. If you're in:

- New Zealand, call 0800 600 702

- The United Kingdom, call 0800 001 5068

- USA 833 462 8181

- Canada 1833 511 9289

- Any other country, call (02) 8907 5221

When you call, have your Cover-More Travel Insurance policy number handy and a phone number Cover-More can call you back on.

Claim online now through Cover-More’s easy, 5-step process:

- Describe the incident

- Enter your expenses or losses

- Upload any supporting documents

- Provide your bank details

- Review and finalise your claim

You can save and return to an incomplete claim for up to 28 days .

Once you've lodged your claim, Cover-More will update you on how it's progressing within 10 working days.

Follow up an existing claim

Cover-More understand that as a result of your incident, you might already be out of pocket. That's why Cover-More try to process claims as quickly as possible.

You'll hear from Cover-More within 10 working days from the time they receive your claim.

To check your claim's progress, log into Cover-More’s online claims centre or contact them for more details.

We’re here to help

- Travel Insurance

Need travel insurance for your next trip?

Cover-More Travel Insurance offers a range of insurance options. In partnering with CGU Insurance, we can help you access Cover-More Travel Insurance.

Choose your cover

International cover.

International Travel Insurance plans help to protect your trip abroad and can provide cover for overseas emergency medical expenses, missed flight connections or travel delays, lost or stolen luggage, and so much more.

Tell me more

Going overseas?

Travel more and worry less, knowing your travel insurance is sorted if things go wrong while you're away.

Cover-More’s International Travel Insurance plans give you a choice of cover options which can provide cover for overseas emergency medical expenses, personal liability, luggage and travel documents, cancellation costs and more.

Domestic travel

Need a little extra protection for your Australian holiday? Domestic Travel Insurance plans give Australian residents cover for expenses such as lost or damaged luggage and personal effects, cancellation costs, rental car insurance excess and more.

We can help arrange Domestic Travel Insurance for your trip, through Cover-More Travel Insurance.

Cover-More offer Domestic Comprehensive and Domestic Cancellation plans, if you’re an Australian resident travelling within Australia. Domestic travel insurance can help if something unexpected happens and you need to rearrange or cancel your trip (like if you get sick while you're away).

When you choose Domestic Comprehensive cover, your policy will include cover for:

• Luggage and travel documents

• Rental car insurance excess

• Travel delays

• Additional travel and accommodation expenses.

This cover has limits, sub-limits and exclusions, so read the Product Disclosure Statement (PDS) for full details of what’s covered.

Single or multi-trip options

Cover-More offer a range of plans to choose from, depending on your travel needs. Annual multi-trip plans give you the flexibility to travel without the need to purchase a new policy for every trip.

Cover-More offer a range of plans to suit different travel needs and budgets. Annual Multi-Trip plans give you the flexibility to travel without the need to purchase a new policy for every trip. Whether you are planning just one trip this year or several, Cover-More have a range of travel insurance plans to choose from. Cover-More’s International Comprehensive Plan and Domestic Comprehensive Plan are both available as a Single Trip or Annual Multi-Trip policy.

Travel Insurance Plan options

Annual multi-trip.

Annual multi-trip plans give you the flexibility to travel without the need to purchase a new policy for every trip.

•Gives you year round cover to destinations that are over 250 km from your home.

•Gives you year round cover to destinations that are less than 250km from home, if your trip includes at least one night of paid accommodation (like in a hotel or Airbnb).

•The option to select your preferred trip duration and the flexibility to take an unlimited number of trips within your annual policy period. You can choose 30, 45 or 60 days on the International Comprehensive Plan, or 15 or 30 days on the Domestic Comprehensive Plan.

Single trip

A Single Trip policy gives you insurance cover for one journey. If you don’t need cover for multiple trips in a year, consider if a Single Trip policy suits your travel needs.

COVID-19 Cover

If you are diagnosed with COVID-19 whilst travelling, we have benefits available on our domestic and international policies including cover for overseas medical costs.

Common scenarios for COVID-19 cover will be automatically included when taking out travel insurance with Cover-More. The level of benefits included will depend on the coverage and the type of policy you decide to purchase. COVID-19 benefits may include:

- COVID-19 cover for overseas medical costs 1

- COVID-19 cover for cancellation and amendments 2

- Cover for additional COVID-19 expenses 3

To speak to us about an existing policy

Call 1300 889 137

Email [email protected]

Important documents

- Product Disclosure Statement (PDS) and Financial Services Guide (FSG) PDF

- Target Market Determination PDF

- CGU Insurance’s FSG PDF

We are here when you need us

Emergency assistance.

If you need urgent help, you can call Cover-More 24/7

From overseas: (02) 8907 5221

From Australia: 1300 889 137

Calling from overseas

Cover-More also have numbers you can call from outside Australia. If you're in:

New Zealand, call 0800 600 702

The United Kingdom, call 0800 001 5068

USA 833 462 8181

Canada 1833 511 9289

Any other country, call (02) 8907 5221

When you call, have your Cover-More Travel Insurance policy number handy and a phone number Cover-More can call you back on.

It’s simple and easy to make a claim. Call Cover-More to get started.

Or lodge a claim online

Claim online now through Cover-More’s easy, 5-step process:

1. Describe the incident

2. Enter your expenses or losses

3. Upload any supporting documents

4. Provide your bank details

5. Review and finalise your claim

You can save and return to an incomplete claim for up to 28 days. Once you've lodged your claim, Cover-More will update you on how it's progressing within 10 working days.

Follow up an existing claim

Log in

Cover-More understand that as a result of your incident, you might already be out of pocket. That's why Cover-More try to process claims as quickly as possible. You'll hear from Cover-More within 10 working days from the time they receive your claim. To check your claim's progress, log into Cover-More’s online claims centre or contact them for more details.

Travel Advice

Dip your toe before you dive in by finding out everything you need to know before you go.

Website smartraveller.gov.au

Our other insurance products

Home insurance, motor insurance, landlords insurance, boat & caravan insurance.

Limits, sub-limits, conditions and exclusions apply. Any advice provided is general only and does not consider your needs or financial situation. To see if the product is right for you, always consider the Product Disclosure Statement and Target Market Determination.

Cover is subject to limits, sub-limits, conditions, and exclusions in the PDS. Travel insurance issued by Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507), arranged and administered by Cover-More Insurance Services Pty Ltd (ABN 95 003 114 145, AFSL 241713), and promoted and distributed by Insurance Australia Limited (ABN 11 000 106 722; AFSL 227681) trading as CGU Insurance and its distribution partners (including Bank of us (ABN 32 087 652 088; AFSL 236870)). Any advice provided is general only and does not take into account your individual objectives, financial situation or needs. Consider your own needs and the Combined PDS/FSG available to decide if this product is right for you. Visit the following link for information on the Target Market and Target Market Determinations .

1 Medical cover will not exceed 12 months from onset. Medical evacuation cover subject to claim approval.

2 Conditions and limits apply to COVID-19 cancellation cover. Cancellation cover applies to the International and Domestic Comprehensive policies. See the Combined FSG/PDS for more information.

3 Cover is for reasonable Additional accommodation expenses (room rate only) and Additional transport expenses. Conditions apply to COVID-19 additional expense cover. See the Combined FSG/PDS for more information.

Bank of us acknowledges and pays respect to the palawa - Tasmanian Aboriginal people - as the traditional owners of all the lands and waters. And we pay our respects to Elders past, present and emerging for they hold the knowledge, memories and culture of Aboriginal people in lutruwita/ Tasmania.

Bank of us is a trading name of B&E Ltd

ABN: 32 087 652 088

AFSL & Australian Credit Licence: 236870

BSB: 632 001

Website by Walker Designs

Insurance policy quote

Boat & caravan, boat & caravan policy quote.

Hey there! Owning a boat, caravan or other vehicle that this policy protects is a highly personalised situation we take really seriously. Book in a time to chat with us, and we'll help you fill out a quote once we've gotten to know you a little bit better.

Book an appointment

Your contact details.

Please nominate the best phone number to contact you on during business hours.

Ready to join? Select an option to continue.

Are you registered for Bank of us Internet Banking?

To make it speedier, have the following information handy:

- The contact details for your current employer

- Any financial details for your current commitments such as a mortgage, credit cards, or personal loans.

If you're not a Bank of us customer, we'll need to make sure you are who you say you are, which can be done at one of our Retail Stores.

Identification: Under the Anti-Money Laundering and Counter Terrorism Financing Act 2006, we require specific forms of identification in order to open your account. Bank of us is required to verify your full name, residential address and/or date of birth.

Unfortunately we can't offer this product to new customers who are not existing Tasmanian residents.

1300 306 716

via our online contact form

we'd love to see you

Need to find something quick smart?

(Our BSB is 632 001 )

View the latest interest rates.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best Annual Travel Insurance Plans of 2024

Allianz Travel Insurance »

AIG Travel Guard »

Seven Corners »

GeoBlue »

Trawick International »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Annual Travel Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

Buying travel insurance can be a smart move for most trips, but those who travel more than a few times a year should consider an annual travel insurance policy. Whether you regularly travel for business and/or take several vacations a year, annual travel insurance plans can help you get the coverage you need without having to price out and purchase protection every time you leave home.

If you find yourself in a situation where an annual plan makes sense, know that not all travel insurance companies offer this kind of coverage. You'll also want to consider the available annual travel insurance plans to see which options make sense for your travel style and the level of coverage you want.

Frequently Asked Questions

Annual travel insurance plans all work in their own way, but the majority let travelers pay one annual premium for coverage that lasts for up to 364 days. These plans often limit the length of individual trips that are covered within the coverage year. Per-trip and annual limits on coverage can also apply.

In some cases, annual travel insurance plans require a deductible or coinsurance for certain types of coverage. If you're considering an annual travel insurance plan because you take multiple trips each year, make sure you read over the policy details and understand all coverage limits and trip limits that apply.

The cost of annual travel insurance typically varies based on factors like the age of the travelers applying, included benefits and coverage limits. You will want to shop around to compare plans across multiple providers using a platform like TravelInsurance.com or Squaremouth before you settle on a travel insurance policy.

To provide an example of the cost of annual travel insurance, U.S. News applied for a quote for two 40-year-old travelers seeking coverage for eight trips over a 12-month period. The Squaremouth travel insurance portal quoted policies with costs that range from $206 for the GeoBlue Trekker Essential plan to $610 for the Safe Travels Annual Deluxe plan by Trawick International.

Annual travel insurance can be worth it if you take multiple trips each year and want to make sure you always have coverage in place. After all, the alternative to having a multitrip policy is buying a new travel insurance plan for every vacation you take. That's not always feasible for frequent travelers who are always jetting off somewhere new – often at the last minute.

Just keep in mind that annual travel insurance plans tend to come with lower coverage limits than plans for single trips, and that you'll pay a premium for coverage that comes with comprehensive benefits and high limits for medical expenses and emergency evacuation.

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for Basic Coverage

- Seven Corners: Best for Medical

- GeoBlue: Best for Expats

- Trawick International: Best for the Cost

Tailor your annual travel insurance plan to your needs

Most plans include coverage for trip cancellation and interruption, travel delays, medical expenses, and more

Lowest-tier plans (AllTrips Basic and AllTrips Prime) come with no or relatively low coverage limits for trip cancellation

Most annual plans (except for AllTrips Premier) do not cover trips longer than 45 days

- Trip cancellation coverage worth up to between $2,000 and $15,000

- Trip interruption coverage worth up to between $2,000 and $15,000

- Emergency medical coverage worth up to $50,000

- Up to $500,000 in emergency medical transportation coverage

- Up to $2,000 in coverage for lost or damaged baggage

- Up to $2,000 in coverage for baggage delays

- Travel delay coverage worth up to $1,500 ($300 daily limit)

- Rental car coverage worth up to $45,000

- Up to $50,000 in travel accident coverage

- 24-hour hotline assistance and concierge service

SEE FULL REVIEW »

Annual Travel Insurance Plan offers year-round travel insurance protection

Relatively high limits for medical expenses ($50,000) and emergency evacuation ($500,000)

No trip cancellation coverage and relatively low limit ($2,500) for trip interruption coverage

No coverage for preexisting medical conditions

- Up to $2,500 in coverage for trip interruption

- Up to $1,500 in coverage for trip delays of five-plus hours ($150 per day limit)

- Missed connection coverage worth up to $500

- Up to $2,500 in baggage insurance

- Baggage delay coverage worth up to $1,000 for delays of at least 12 hours.

- Up to $50,000 for emergency medical expenses ($500 for emergency dental sublimit)

- Up to $500,000 for emergency evacuation and repatriation of remains

- Up to $50,000 in accidental death and dismemberment (AD&D) insurance

- Up to $100,000 in protection for security evacuation

Provides coverage worth up to $250,000 for emergency medical expenses

Tailor other included benefit levels to your needs

Coverage only applies to trips up to 40 days

Deductible up to $100 applies for emergency medical coverage and baggage and personal effects

- Trip cancellation coverage worth up to between $2,500 and $10,000

- Trip interruption coverage worth up to 150% of the trip cancellation limit

- Up to $2,000 in trip delay coverage ($200 daily limit)

- Up to $1,000 in protection for missed connections

- Up to $250,000 in coverage for emergency medical expenses ($50,000 in New Hampshire)

- $750 dental sublimit within emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Up to $2,000 in coverage for baggage and personal effects

- Baggage delay coverage worth up to $1,000 ($100 daily limit)

- 24/7 travel assistance services

Get annual coverage for medical expenses and routine medical care

High limits for medical expenses and emergency medical evacuation

GeoBlue plans don't offer comprehensive travel protection

Deductibles and copays apply

- Ambulatory and therapeutic services

- Inpatient hospital services

- Emergency medical services

- Rehabilitation and therapy

- Preventive and primary care

Choose among three tiers of annual travel protection

Option for basic protection with affordable premiums

No coverage for preexisting conditions

Maximum trip duration of 30 days per trip

- Trip cancellation coverage up to $2,500 maximum per year

- Trip interruption coverage up to $2,500 maximum per year

- $200 per trip for trip delays (up to $100 per day for delays of 12 hours or longer)

- Up to $500 in coverage per trip for baggage and personal effects

- Baggage delay coverage up to $100 per trip

- Up to $10,000 for emergency medical expenses per trip

- Up to $50,000 in emergency medical evacuation coverage per trip

- Up to $10,000 in AD&D coverage

- 24-hour travel assistance services

Why Trust U.S. News Travel

Holly Johnson is a travel expert who has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – within their family media business and travel agency .

You might also be interested in:

The 5 Best Family Travel Insurance Plans

Holly Johnson

Explore the options to protect your family wherever you roam.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The 6 Best Vacation Rental Travel Insurance Plans

Protect your trip and give yourself peace of mind with the top options.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

We're here for you

Whether you need make a claim or to ask a question we're only a phone call away.

24 hours, 7 days a week

For general enquiries

Personal Insurance 8:30am to 5:00pm AEDST, Monday to Friday

Business Insurance 8:00am to 8:00pm AEDST, Monday to Friday

8:30am to 5:00pm AEDST, Monday to Friday

While overseas

Need your current policy documents, insurance for domestic services.

Business Insurance can help protect your small business. Choose your cover online in just a few easy steps.

You can get a range of cover

Business Insurance is flexible and can be easily customised to meet your business’ needs.

You can choose from a range of options to cover your business, from Public Liability cover to protection for your work tools, commercial vehicles, and more.

Covers your business premises for damage to buildings, contents, stock, tools and equipment caused by fire, natural perils like storms, and/or malicious damage.

Theft and money

Covers you if a person breaks into your premises (or the premises you are renting) and steals your business stock, contents, equipment or money.

Public and product liability

Protects your business against claims for accidental damage or injury caused to an individual or their property as a result of your work.

Covers breakage to shop front windows, glass shelving, display cabinets, sign writing and advertising signs.

Covers breakdown of certain machinery you need to run your business – for example, cash registers, salon equipment or air conditioners.

This is a summary only, for the full details of what is and is not covered, please read your Product Disclosure Statement (PDS) .

Start your quote now

Or call us on 13 24 81

Looking for policy documents?

Or you can:

More cover options

Business interruption.

Covers a shortfall in your gross profit if your business is interrupted by an incident we cover.

Portable property

Covers you for loss, damage or burglary for insured property (e.g. tools) you take on the road with you or stored at a worksite away from your main premises.

Personal accident and illness

Provides a weekly benefit in the event of certain injuries, accidents or illnesses.

Employee dishonesty

Covers you against loss of money caused by any fraudulent or dishonest act by an employee with the clear intent of making improper personal financial gain.

Covers breakdown of machinery you need to run your business, for example cash registers, salon equipment or air conditioners.

Commercial motor vehicles

Covers the motor vehicles you use to operate your business.

Tax investigation

Covers the cost of professional fees resulting from an audit or investigation which relates to you paying a tax.

This is a summary only, for the full details of what is and is not covered, please read your PDS .

Get a Business Insurance quote

Want a quick quote right away? You can get a quote and buy your Business Insurance online in minutes. Need help choosing the right insurance? Our Business Insurance specialists can help answer your questions, or help you find an insurance broker if you need more help.

Business Insurance FAQs

What is public liability insurance.

Public Liability Insurance protects your business against claims resulting from accidents or injuries that occur as result of your business activities or products, as well as damage to property owned or controlled by someone else.

Find out more about Public Liability Insurance .

How much Public Liability Insurance do I need?

Every business is different, and there is no ‘one size fits all’ rule for how much Public Liability Insurance your business needs.

We offer multiple levels of public liability cover which can be purchased from us directly:

- $10 million

- $20 million

If you need more cover, call us on 13 24 81 (8am–7pm AEST, Mon–Fri).

Public liability claims can be very costly, so it’s important you choose a level of cover that will financially protect your business should you need to make a claim.

What’s the difference between ‘theft’, ‘money’ and ‘employee dishonesty’?

Theft covers you from a person breaking into your business premises and stealing business stock, contents or equipment.

Money covers money being stolen (theft just covers physical contents, not currency).

Employee dishonesty covers you for loss of money caused by a dishonest or fraudulent act by an employee with the clear intent of making an improper personal financial gain.

For more information about the cover options, and what is covered, please read your PDS .

What does business interruption cover?

Business interruption can cover the shortfall in gross profits caused by the interruption to your business resulting from an insured event (eg storm or fire damage) and can help pay ongoing costs and protects profit margins until your business is back on its feet and back at its profit level before the interruption.

Find out more about business interruption and how it works.

For more information about this cover, please read your PDS .

What is personal accident and illness cover?

Personal accident and illness insurance helps you cover your costs if you are unable to work due to injury or illness. You can also select an option for compensation if certain specified permanent injuries occur (this is referred to as Lump Sum benefits).

What is the difference between personal accident and illness cover and income protection cover?

Personal accident and illness can cover you if you are self-employed, and it provides short to medium term cover (maximum 104 weeks) if you are unable to work because of injury or illness.

Income protection can cover anyone (self-employed, home-makers, part time workers, full time employees, etc) and is intended to be a long-term cover.

Do I need workers compensation insurance?

Generally, if you employ or engage anyone else to work for you, you need workers compensation insurance. A ‘worker’ is a person who has entered into work under a contract of service with you. There doesn’t necessarily need to be a formal written contract in place. A verbal agreement or simply intent or understanding of an arrangement might be enough for someone to legally be considered a ‘worker’ under your state’s workers compensation legislation.

Each state and territory in Australia has different types of workers compensation schemes. For more information about workers compensation in your state, please visit our workers compensation section.

Can I pay monthly at no extra cost?

Yes, you can choose to pay monthly at no extra cost to help your business manage cash flow.

Understanding public liability

Public liability explained.

Wondering what's covered under Public Liability insurance? Find out on the CGU Blog .

Forms and downloads

For previous policy booklets, check our policy booklets page .

- Product Disclosure Statement

- Target Market Determination

Things you should know

1 You can save up to 10% on the Business Insurance 'base premium' when you first purchase online. The base premium doesn't include any government or statutory charges. You will only get a discount on your first year's premium. Discounts only apply until you reach your minimum premium, so your discount might be limited by your minimum premium. When we calculate your premium on renewal, we may also limit any increases or decreases by considering factors like your previous year’s premium. This online offer may be withdrawn at any time and is subject to the full terms and conditions .

We no longer support Internet Explorer

For a better browsing experience, you could try using Microsoft Edge , Google Chrome or Mozilla Firefox .

Get a quote

Select your location.

IMAGES

COMMENTS

Claims. It's simple and easy to make a claim. Call us to get started. From Australia: 13 24 80. From overseas: +61 3 9601 8222. Learn more. CGU acknowledges the Traditional Owners of the lands across Australia as the continuing custodians of land and waterways in which we live and work. We pay our respects to Elders and ancestors past and ...

CGU offers two health insurance plans: The Student Health Insurance Plan (SHIP) for domestic, permanent residents, and undocumented students through UnitedHealthCare, and; The GeoBlue plan for international (F-1 and J-1 visa) students. For more information about the insurance plans and waiver information, please view Domestic Plan or ...

Hours before cover applies for baggage lost temporarily. 10. Car rental. Rental car excess. Yes. Limit for rental car excess. $4000. Average rating. We independently review and compare CGU Domestic against 23 other domestic travel insurance comparison products from 21 brands to help you choose the best.

Travel insurance. We have ceased selling Travel Insurance effective 14 August 2024. For any enquiries or changes to existing policies please contact CGU by calling 13 24 81 and follow the prompts to make a change to an existing travel policy. For any claim enquiries for existing policies, please call 13 24 80.

Domestic travel insurance can help if something unexpected happens and you need to rearrange or cancel your trip (like if you get sick while you're away). When you choose Domestic Comprehensive cover, your policy will include cover for: ... CGU Travel Insurance is issued by Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507 ...

Generally, you don't need to pay anything to be eligible for the travel insurance offered by these types of cards. Instead, you'll simply need to charge the cost of the trip to your card and ...

Thankyou CGU Insurance for always being polite and helpful while we navigated our Insurance Claim. After finally getting all the documents you required to assess our Claim and months of dealing with our Travel Agent, you paid our Claim in full within days of us lodging. We have used your Travel Insurance 8 times. We have never made a Claim.

CGU can help you get covered with our car, home buildings and contents, landlord or strata insurance for your property and precious belongings. CGU is also right beside you to make sure you can concentrate on running your business covering you for your business insurance needs, including liability and workers compensation.

Domestic travel insurance can help if something unexpected happens and you need to rearrange or cancel your trip (like if you get sick while you're away). When you choose Domestic Comprehensive cover, your policy will include cover for: ... CGU Travel Insurance is issued by Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507 ...

CGU offers six insurance policies to travellers. The Platinum Plan, Premium Plan, Essentials Plan, Domestic Plan and Cancellation Only Plan. The insurer of this product is Insurance Australia ...

For claims Call 13 24 80. 24 hours, 7 days a week. For general enquiries Call 13 24 81. Personal Insurance 8:30am to 5:00pm AEDST, Monday to Friday. Business Insurance 8:00am to 8:00pm AEDST, Monday to Friday

Domestic travel insurance can help if something unexpected happens and you need to rearrange or cancel your trip (like if you get sick while you're away). When you choose Domestic Comprehensive cover, your policy will include cover for: ... CGU Insurance's FSG . FSG. We're here when you need us. Emergency assistance . If you need urgent help ...

Within Australia: (02) 8895 0698 While overseas: +61 2 8895 0698 For all non-emergency claims, please contact CGU upon your return to Australia. Making a travel insurance claim. Simply call CGU Insurance on 13 24 80. Once your claim is lodged with CGU, we will allocate a case manager who will contact you regarding next steps.

Domestic Travel Insurance plans give Australian residents cover for expenses such as lost or damaged luggage and personal effects, cancellation costs, rental car insurance excess and more. ... CGU Travel Insurance is issued by Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507) (ZAIL). Cover-More Insurance Services Pty Ltd ...

We can help arrange Domestic Travel Insurance for your trip, through Cover-More Travel Insurance. ... AFSL 241713), and promoted and distributed by Insurance Australia Limited (ABN 11 000 106 722; AFSL 227681) trading as CGU Insurance and its distribution partners (including The Capricornian (ABN 54 087 650 940; AFSL 246780)). Any advice ...

We can help arrange Domestic Travel Insurance for your trip, through Cover-More Travel Insurance. ... AFSL 241713), and promoted and distributed by Insurance Australia Limited (ABN 11 000 106 722; AFSL 227681) trading as CGU Insurance and its distribution partners (including MyState Bank Limited (MyState Bank) ABN 89 067 729 195 AFSL 240896). ...

Domestic Comprehensive Travel Insurance plans give Australian residents cover for expenses such as lost or damaged luggage and personal effects, cancellation costs, rental car insurance excess and more. ... Cover-More has authorised Insurance Australia Limited (ABN 11 000 016 722; AFSL 227681) trading as CGU Insurance to distribute the product ...

We can help arrange Domestic Travel Insurance for your trip, through Cover-More Travel Insurance. ... AFSL 241713), and promoted and distributed by Insurance Australia Limited (ABN 11 000 106 722; AFSL 227681) trading as CGU Insurance and its distribution partners (including Bank of us (ABN 32 087 652 088; AFSL 236870)). Any advice provided is ...

TRAVEL INSURANCE PRODUCT DISCLOSURE STATEMENT AND POLICY. TRAVEL TRAVEL INSURANCE PRODUCT ... Section 12:Domestic Services 37 Section 13:Travel Delay 38 Section 14:Hijack and Kidnap 38. Section 15:Mugging 39 ... contact CGU upon your return to your home in Australia.

From overseas: (02) 8907 5221. Or lodge a claim online. Travel Advice. Dip your toe before you dive in by. finding out everything you need to know before you go. Learn more. To speak to us about an existing policy. Call 1300 889 137. Email [email protected].

This booklet contains information you need to know about your Travel Insurance policy. If you have any questions, or if there's anything we can help with, get in touch today. Travel Insurance contact details To buy a policy Visit: cgu.insurancebycovermore.com Enquiries and Claims Call: 1300 889 137 (within Australia) or +61 2 8907 5072 (from ...

To provide an example of the cost of annual travel insurance, U.S. News applied for a quote for two 40-year-old travelers seeking coverage for eight trips over a 12-month period.

Insurance for Domestic services. Business Insurance can help protect your small business. Choose your cover online in just a few easy steps. Speak to us on 13 24 81. Business Insurance quote. Save up to 10% when you buy a new Business Insurance policy online1. 1 Conditions apply.