Global directory

Global offices, our businesses, production & refineries, joint ventures, research centers, headquarters, global - saudi arabia, contact details & info, saudi aramco.

P.O. Box 5000 Dhahran 31311 Kingdom of Saudi Arabia

1200 Smith Street Houston, TX 77002

Mailing Address

Aramco Americas P.O. Box 4534 Houston, TX 77002

Aramco Far East (Beijing) Business Services Co., Ltd (ABS)

43/F, 45/F20-26, China World Tower 3, No.1 Jianguomenwai Avenue, Chaoyang District, Beijing, China 100004

Aramco Far East (Beijing) Business Services Co., Ltd. Shanghai Branch

Room 16T60, 16/F – SWFC, 100 Century Avenue, Pudong District, Shanghai 200120, China

Aramco Far East (Beijing) Business Services Co., Ltd. Xiamen Branch

15F, Paragon Center, No.1 Lianyue Road, Siming District, Xiamen 361012, Fujian, China

Aramco Asia India Pvt. Ltd.

2A-0801, 8th Floor, Two Horizon Center, DLF 5, Sector 43, Gurugram 122002, Haryana, India

Aramco Asia Japan K.K.

Aramco asia korea limited.

45, Three IFC, 10 Gukjegeumyung-ro Yeongdeungpo-gu, Seoul, 07326, Korea

Aramco Overseas Malaysia Sdn Bhd

Level 32, Maxis Tower Kuala Lumpur City Center 50088 Kuala Lumpur

Aramco Asia Singapore Pte. Ltd.

OUE Bayfront, 50 Collyer Quay #13-01, Singapore 049321

Aramco Overseas Company

Via Lombardia 2/A, 1st floor, Building B 20068 – Peschiera Borromeo (MI) Italy

The Netherlands

Prinses Beartrixlaan 35 2595 AK The Hague The Netherlands

United Kingdom

10 Portman Square W1H 6AZ, London United Kingdom

Aramco Fuels Poland sp. z o.o.

St. John of Kolno 11 80-864 Gdansk Poland

Global Businesses

Aramco entrepreneurship center (wa'ed), aramco trading company, in-kingdom value add program.

8386 Ring Rd, Gharb Al Dhahran, Dhahran 34461, Saudi Arabia

Aramco Ventures

Al-Midra Tower Building 11th floor, West Wing Dhahran 31311, Saudi Arabia

Gas production

The cutting edge Fadhili Gas Plant (FGP) is emblematic of Saudi Aramco’s broad impact on not only boosting gas supply to displace crude burning, but also driving economic growth, developing the Saudi workforce, spearheading technology deployment, and reducing CO2 emissions. FGP construction started in 2016 and was completed and put fully onstream in 2020.

With a total processing capacity of 2.5 BSCFD, FGP is the first plant in the region to have the capability of sweetening low BTU gas, then directly powering an independent power plant, yet able to switch to regular sales gas as needed. In addition, Fadhili is the first plant to treat nonassociated gas from both onshore and offshore fields.

FGP is also the first SA Gas plant to deploy the Sulfur Recovery Unit Tail Gas Treatment process to attain a sulfur recovery rate of 99.9%, helping to protect air quality, and reducing SO2 emissions by more than 18,000 Metric Tons per year as compared to the conventional Claus process.

The development of Fadhili added billions of dollars to the local economy through IKTVA. 46% of the project’s materials and services were sourced and manufactured in Saudi Arabia.

A unique feature of Fadhili is that its multiple downstream treated gas pipelines enhanced the connectivity, reliability, and responsiveness of Saudi Aramco’s Master Gas System (MGS), as those pipelines are connected to the northern and central sections of the MGS.

We are expanding the gas processing capacity of our Hawiyah gas plant by more than 1 BSCFD. The new gas processing facilities, expected to be on stream in 2022, are anticipated to raise total production capacity of the plant to approximately 3.6 BSCFD, making it one of the largest gas processing facilities in the world.

We are making improvements to sustain gas production from both the Haradh and Hawiyah fields for the next 20 years and boost production by an average of 1.2 BSCFD. The program includes installing gas compression facilities, liquid separation stations, and transmission lines to our Haradh and Hawiyah gas plants, along with expanding the existing gas gathering pipeline network.

Karan, was our first non-associated offshore gas field development. Discovered in 2006 in the thickest, extremely prolific and complex carbonate layers, the project was fast-tracked, taking only six years to go from discovery to production.

Non-associated gas fields do not have an associated oil column and, therefore, can be accessed without producing oil. The raw gas is transported through a 110-kilometer subsea pipeline to the Khursaniyah Gas Plant for processing.

The natural gas liquids (NGL) recovery plant at Shaybah was commissioned and began production in late 2015, with a second processing train starting up in 2016. The plant NGL production helps Saudi Aramco to meet increasing demand for petrochemical feedstock.

Designed to process as much as 2.4 BSCFD of associated gas and recover 275,000 bpd of ethane plus NGL, the Shaybah facility feeds these volumes of NGL via pipeline to Ju’aymah for further processing before being delivered as petrochemical feedstock to industrial cities.

FIND OUT MORE

Wasit, one of the largest gas plants we have ever built, was brought onstream in October 2015 and reached full operating capacity in mid-2016. Unlike our other gas plants, Wasit is designed to process solely nonassociated gas.

To feed Wasit, we brought gas production onstream from the big bore nonassociated gas wells in our offshore Arabiyah and Hasbah fields, situated approximately 150 km northeast of Jubail Industrial City in the Arabian Gulf. With the startup of production from these two fields, more than 40% of our nonassociated gas now comes from offshore fields.

Our continued success in increasing supplies of cleaner burning natural gas makes it possible for us to reduce emissions, enable new industries and release more crude oil for value-added refining or export.

Oil production & Refineries

As the company's largest oil processing facility and the largest crude oil stabilization plant in the world, Abqaiq plays a pivotal role in our day-to-day operations.

Abqaiq oil facilities receive sour crude oil from gas-oil separation plants (GOSPs), process it into sweet crude oil, and then transport it to Ras Tanura and Jubail on the east coast, Yanbu' on the west coast and to Bapco Refinery in Bahrain. The off gases from the spheroids and stabilizer columns that are part of the conversion process are then sent to Abqaiq natural gas liquids (NGL) facilities for further processing.

Abqaiq is the main oil processing center for Arabian Extra Light and Arabian Light crude oils.

The northern-most portion of the Ghawar field lies approximately 100 kilometers west of Dhahran. The field comprises six main areas (Fazran, Ain Dar, Shedgum, Uthaminyah, Hawiyah and Haradh) and extends southward over more than 200 kilometers as one long continuous anticline. It is approximately 36 kilometers across at its widest point.

We believe that the Ghawar field is the largest oil field in the world in terms of conventional proved reserves, totaling 58.32 billion barrels of oil equivalent as at 31 December 2018. It has accounted for more than half of the total cumulative crude oil production in the Kingdom.

The Ghawar field facilities and infrastructure remain a central component in our long-term strategic framework for optimizing both technical recovery of resources and the economic of resource management.

The Haradh area, located at the southern tip of the Ghawar oil field, was developed in three increments of 300,000 bpd of Arabian Light crude oil capacity.

Haradh III was also the first plant in the Southern Area of company operations to have completely automated well control and monitoring, allowing remote operations. The project benefited from successful integration of four technologies: multilateral, maximum reservoir contact (MRC) wells; Smart Well completions (using control valves for preventing premature water breakthrough); geosteering (for optimal placement of wells in the reservoir for maximum recovery); and the “intelligent field” concept, in which real-time sub-surface data transmissions enable continual monitoring of key reservoir indicators. The integrated use of these four technologies slashed unit well development costs three-fold.

The Khurais complex, which comprises of the Abu Jifan and Mazalij fields in addition to Khurais itself, is approximately 106 kilometers long and 18 kilometers across at its widest point.

Khursaniyah

The Khursaniyah program includes facilities to process and stabilize 500,000 bpd of Arabian Light crude oil blend from the Abu Hadriya, Fadhili and Khursaniyah fields, and a grassroots gas plant to process one billion scfd of associated gas.

Khursaniyah began producing oil in August 2008. The facility also has the capacity to inject 1.1 million bpd of non-potable water for reservoir pressure maintenance.

The UNESCO environmental responsibility award nominated Manifa crude oil development was designed to produce 900,000 bpd of Arabian Heavy crude oil, 90 million scfd of sour gas, and 65,000 bpd of hydrocarbon condensate.

By employing best-in-class technologies in infrastructure, drilling and production activities, the project consumed more than 80 million man hours without a lost time injury.

Prior to construction, extensive engineering and ecological assessments were conducted to ensure that the marine ecosystem would not be adversely affected by developing the field. As a direct result of these studies, Saudi Aramco constructed three kilometers of bridges to span the migration paths of various marine species, maintaining natural water flow and preserving natural marine nurseries.

Nuayyim crude oil increment added 100,000 bpd of Arabian Super Light crude oil and 90 million scfd of associated gas to our production capacity.

The project – the first in-Kingdom project of this scale with a project proposal completed entirely in Saudi Arabia – also included a gas-oil separation plant, 140 kilometers of 16” gas pipeline, and water supply facilities at Hawtah. Smokeless flaring has been used to significantly reduce emissions.

The field, which entered production in August 2009, is 250 kilometers south of Riyadh and about 50 kilometers northeast of our Hawtah crude oil facility, the first producing facility in the Central Region of Saudi Arabia.

Qatif Producing Plants Program consists of facilities to produce, process, and transport 500,000 bpd of blended Arabian Light crude oil from the Qatif field and 300,000 bpd of Arabian Medium crude oil from the offshore Abu Sa'fah field.

The Qatif facility was the first to produce Arabian Light crude oil by blending Arabian Extra Light, Light and Medium grades.

We believe that Safaniyah field is the world's largest conventional offshore oil field in terms of proved reserves. It is located approximately 260 kilometers north of Dhahran. Most of the field lies offshore in the Arabian Gulf. Within the Concession area, the Safaniyah field is approximately 50 kilometers long and 15 kilometers wide.

The Shaybah field, located in the Rub’ al-Khali or Empty Quarter, was discovered in 1968. Its remote location, local summer temperatures in excess of 50 degrees Celsius and sand dunes higher than 300 meters presented serious challenges. So for technical and economic reasons, development was held off until 20 years later. However, by the 1990s, advances in 3D seismic imaging technology, horizontal drilling and other technologies gave us the tools we needed to begin production.

The field is approximately 13 kilometers wide and 64 kilometers long. Due to the field's remoteness, its facilities include a dedicated NGL recovery unit, an airfield and accommodation for staff.

Our second 250,000 bpd expansion project at Shaybah came on-stream in 2016, raising its overall production capacity to 1 million bpd of Arabian Extra Light crude oil — double the facility’s original capacity.

The Zuluf field is located in the Arabian Gulf, approximately 240 kilometers north of Dhahran, in average water depth of 118 feet. The field has two main structures, Zuluf and Ribyan, and is of similar area to Safaniyah to the north.

Jazan Refinery

Aramco operates one of the world’s largest refining businesses, and its integrated petrochemical refinery complex at Jazan City for Primary and Downstream Industries is part of the Company’s vibrant downstream growth strategy.

In 2020, Aramco confirmed that it would proceed with the divestment of the Jazan Integrated Gasification and Combined Cycle Plant into a Joint Venture (JV) between Aramco, Air Products, ACWA Power, and Air Products Qudra, integrating the Air Separation Unit into the JV.

With the addition of our Jazan Refinery Complex, Aramco has five wholly owned refineries within the Kingdom, three of which were built specifically to supply transportation and utility fuels for the domestic marketplace. Aramco’s four domestic affiliated refineries within the Kingdom are highly competitive with other world-class facilities based on scale, configurations and product yields.

Hyundai Oilbank

Hyundai Oilbank is a refinery in South Korea, established in 1964. The Daesan Complex, where Hyundai Oilbank’s major facilities are located, is a fully integrated refining plant with a processing capacity of 650,000 barrels of crude oil per day. Aramco has a 17% equity interest in Hyundai Oilbank.

Idemitsu Kosan

Idemitsu kosan co., ltd.

Idemitsu Kosan, one of leading refining and marketing companies in Japan, is a result of a merger between Idemitsu and Showa Shell Sekiyu. Its sales in Japan are primarily gasoline, diesel oil, kerosene and automotive lubricants. Idemitsu Kosan owns and operates more than 6,400 retail service stations, has equity stakes in six refineries, and a gross refining capacity of 945,000 bpd. Aramco owns a 7.7% equity interest in Idemitsu Kosan.

Motiva Enterprises

Motiva Enterprises, a fully owned affiliate of Saudi Aramco, operates the Port Arthur Refinery, the largest refinery in the U.S. at 635,000 bpd in Port Arthur, Texas. Motiva has acquired a 100% equity interest in Motiva Chemicals LLC (formerly Flint Hills), a chemical plant in Port Arthur, Texas.

Saudi Aramco Mobil Refinery Company

SAMREF is an equally owned joint venture between Saudi Arabian Oil Company (Saudi Aramco) and Mobil Yanbu Refining Company Inc. (a wholly owned subsidiary of Exxon Mobil Corporation). Its current refining capacity is 400,000 bpd.

Sinopec SenMei

Sinopec senmei petroleum company ltd..

Sinopec SenMei Petroleum Company Limited is a joint venture of Sinopec, ExxonMobil China Petroleum & Petrochemical Company Limited and Saudi Aramco Sino Company Limited. Sinopec SenMei, with headquarters in Fuzhou, is mainly engaged in the wholesale, retail, storage, throughput and transport of the processed oil, lubricant and other petroleum products, operation of convenience stores of service stations, car washing, lubricant replacement, restaurant and other auxiliary services.

Based in Maastricht, Netherlands, as a wholly-owned subsidiary of Saudi Aramco, ARLANXEO serves the development, production, marketing, sale and distribution of specialty chemicals and synthetic rubber products, principally for the high-volume global tire and automotive industries.

Fujian Refining and Petrochemical Company Ltd. (FREP)

FREP, is our joint venture with ExxonMobil, China Petroleum and Petrochemical Company Limited (Sinopec) and the Fujian provincial government.

Petro Rabigh

Rabigh refining and petrochemical company (petro rabigh).

A joint venture between Saudi Aramco and Sumitomo Chemical. The products produced are used in such end products as plastics, detergents, lubricants, resins, coolants, anti-freeze, paint, carpets, rope, clothing, shampoo, auto interiors, epoxy glue, insulation, film, fibers, household appliances, packaging, candles, pipes and many other applications.

PRefChem venture is a strategic alliance between Saudi Aramco and Petronas, through equal ownership in two joint ventures, namely the Pengerang Refining Company Sdn. Bhd. (PRefChem Refining) and the Pengerang Petrochemical Company Sdn. Bhd. (PRefChem Petrochemical), collectively known as PRefChem.

Saudi Basic Industries Corporation (SABIC)

Saudi Aramco has a 70% majority stake in Saudi Basic Industries Corporation (SABIC). Headquartered in Riyadh, SABIC has global operations in over 50 countries with 34,000 employees.

Sadara Chemical Company (SADARA)

A joint venture developed by Saudi Aramco and the Dow Chemical Company. The Sadara chemical complex―the largest of its kind ever built in a single phase― manufactures a portfolio of valued-added performance plastics and specialty chemicals.

Saudi Aramco Jubail Refinery Company - SASREF

A Saudi company wholly-owned by Saudi Aramco. The refinery is located in Jubail Industrial city. The refinery processes crude oil into petroleum products for both local and international markets.

Saudi Aramco Total Refining and Petrochemical company

The Saudi Aramco Total Refining and Petrochemical Co. (SATORP), a joint venture between Saudi Aramco and Total in Jubail, supports Saudi Aramco’s efforts to expand the value chain and achieve maximum value from the Kingdom’s resources. It processes heavy Arabian crude daily into low-sulfur gasoline, diesel and jets fuel that comply with the standards in the United States, Europe and Japan. It also produces paraxylene, benzene, sulfur and pure petroleum coke that fuels cement plants and electric power stations.

S-Oil Corporation

Our investment in South Korea’s S-OIL, one of the country’s leading refiners, complements our downstream ventures in China and Japan and creates new opportunities along the value chain in the major energy markets in Asia.

Yanbu Aramco Sinopec Refining Company

The Yanbu Aramco Sinopec Refining Company (YASREF) Ltd., a joint venture between Saudi Aramco and China Petrochemical Corporation (Sinopec), is a world-class, full-conversion refinery that covers about 5.2 million square meters in the Yanbu Industrial City, and is the key anchor project in Yanbu. YASREF uses 400,000 barrels per day (bpd) of Arabian heavy crude oil to produce premium transportation fuels, as well as high-value refined products for both international and domestic markets.

YASREF is a significant addition to the impressive downstream portfolio of Saudi Aramco, while building on and cementing the strategic partnership with Sinopec, Saudi Aramco’s largest crude oil partner and buyer. Both companies bring commercial and technical expertise to the joint venture to enhance trade of transportation fuels between a significant energy producer and its consumer.

In addition, YASREF represents a continuing step forward in the strategies of Saudi Aramco and Sinopec to drive growth further downstream to capture additional value along the hydrocarbon chain.

All centers

Aberdeen, scotland.

Our Technology Office in Aberdeen focuses on drilling and production technologies. The European arm of Saudi Aramco Energy Ventures (SAEV) is located within the office, whose mission is to source and develop relationships with strategically significant and innovative energy technology companies.

Our Beijing Research Center conducts research on chemical enhanced oil recovery and advanced seismic imaging technologies, including automated fault detection and improvements in data quality through super resolution.

The Center is also evaluating the expansion of research activities into the downstream sector in areas such as transportation efficiency, greenhouse gas management, advanced control and power systems, robotics, materials science, nanotechnology and advanced computing.

South Korea

Our CO2 Management Collaboration at the Korean Advanced Institute of Science and Technology (KAIST) in Daejeon, South Korea, is dedicated to addressing issues related to carbon management. The collaboration follows an interdisciplinary approach to innovative and cost-effective CO2 capture, storage, and conversion from fixed and mobile sources.

The Delft University of Technology in the Netherlands is home to our technology office that focuses mainly on seismic processing and subsurface imaging to help us better understand the nature of our subsurface geology.

Aramco Innovations Research Cente r Leninskiye Gory 1 bldg 75-B 119234 Moscow Russia

Our Aramco Fuel Research Center in Paris is located at IFP Energies nouvelles (IFPen) . IFP Energies nouvelles is a public-sector research, innovation and training center active in the fields of energy, transport and the environment. Thanks to this strategic placement, we can capitalize on IFPen’s facilities and links to various European automakers to accelerate the innovation cycle of different fuel technologies.

Saudi Arabia

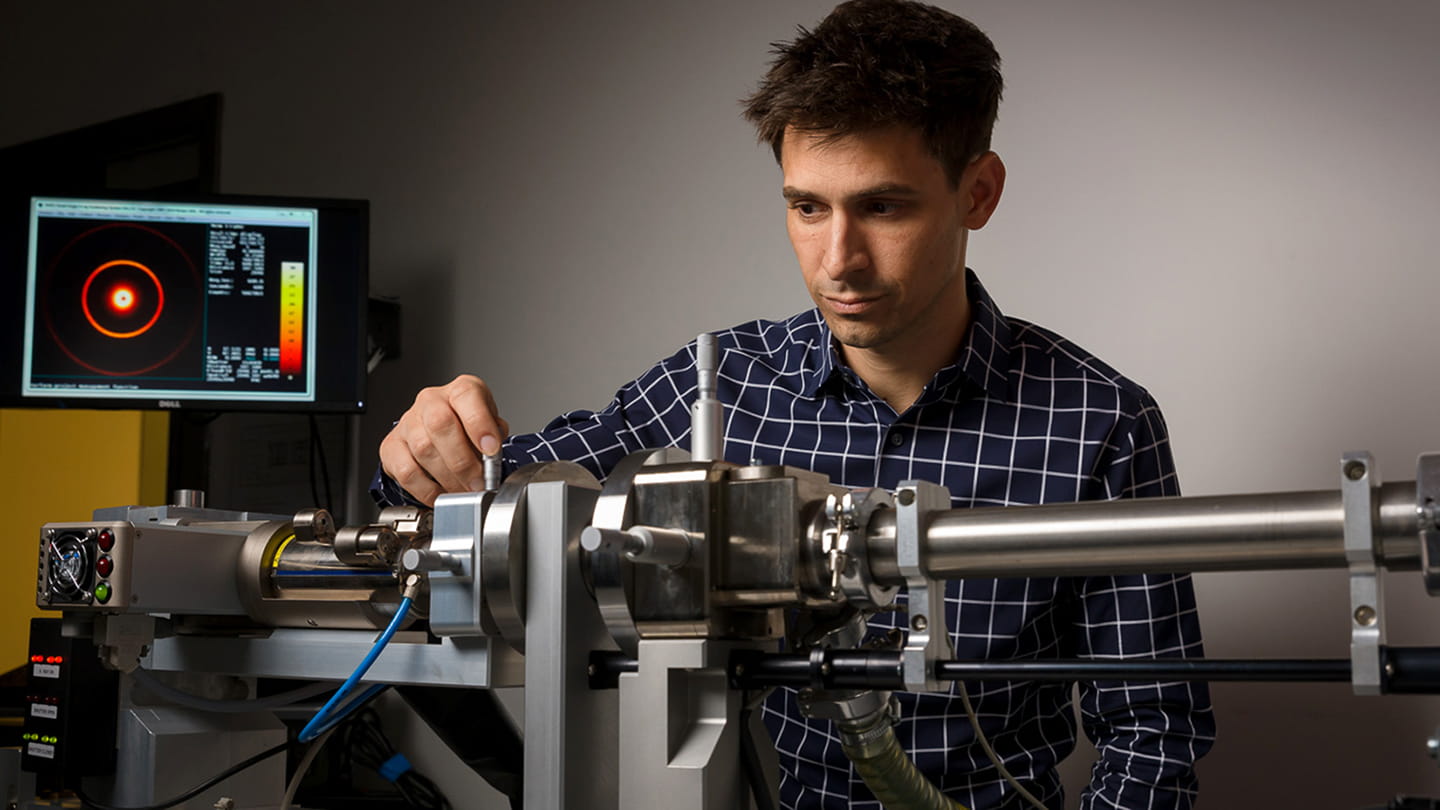

Our research areas at our Dhahran headquarters include the Research & Development Center (R&DC) and the EXPEC Advanced Research Center (EXPEC ARC).

EXPEC ARC develops specialized technologies necessary to achieve its upstream objectives of increasing discovery of oil resources and increasing reservoir recovery. An expansion of the EXPEC Advanced Research Center is currently underway, with new facilities to enable integrated research on sustainability technologies.

Our R&DC focuses on cutting-edge technologies that enhance operational reliability, efficiency and safety, as well as investigating clean fuels and the management of carbon release.

Our research center at the King Abdullah University of Science and Technology (KAUST) focuses on catalyst development, materials science, nanotechnology, robotics, solar energy materials and fuel technology. The strong capabilities provided in downstream areas are complemented by our FUELCOM collaboration with the KAUST Clean Combustion Research Center .

Aramco Research Center-Boston supports development in the areas of computational modeling, advanced materials, and nanotechnology. The center works on collaborative research projects with the nearby Massachusetts Institute of Technology (MIT ) faculty, with a focus on modeling, visualization, simulation, and advanced materials.

Our Aramco Research Centers in Detroit, Houston, and Boston have a collaboration with the MIT Energy Initiative (MITEI) to support research by two Low-Carbon Energy Centers designed to address climate change challenges. The centers bring together researchers from multiple disciplines at MIT to engage with companies, governmental agencies, and other stakeholders to further research and promote clean energy technologies to mitigate climate change.

Our Aramco Research Center in Detroit focuses on competitive transportation solutions, improving the efficiency of current and future engines, reducing overall environmental impact, cost, and complexity of engine systems.

The Center can accommodate light-duty and heavy-duty fuels research programs and also offers full on-site integration and the demonstration of new vehicle technologies. Our Strategic Transportation Analysis Team, based in the Detroit Center, provides dynamic industry analysis relevant to our fuels research and development activities.

Aramco Research Center in Houston focuses on upstream technologies for conventional and unconventional resources to support discovery and recovery goals. Specific areas of research include advanced seismic imaging, unconventional productivity enhancement, smart fluids to improve well productivity, nano-based polymers, surfactants, cement technologies related to drilling operations, quantitative geology, and advanced downhole sensors. It is our largest center outside Saudi Arabia.

Aramco Asia, Yatra Online join hands to address regional travel demand

~ Ensuring convenient travel booking, hotels, and other ancillary services for Aramco employees across Asia

Aramco Asia India, a wholly-owned subsidiary of Aramco, has formally announced a strategic partnership with Yatra Online, Inc. (NASDAQ: YTRA), operating through its Indian subsidiary, Yatra Online Limited, to improve corporate travel management.

As the largest corporate travel service provider and the third-largest online travel company in India, Yatra will cater to Aramco Asia’s varied needs with easy booking and greater travel options. The association is grounded in Aramco Asia's distinct preferences and underscores Yatra's commitment to providing outstanding service, cost efficiency, and state-of-the-art technology.

Commenting on the partnership, Mohammed Al-Herbish, Aramco Asia India Managing Director, noted, “This strategic partnership will provide Aramco Asia with the opportunity to avail the efficient and reliable travel services of Yatra Online. The collaboration reflects our commitment to delivering a seamless and enhanced travel experience for our employees across Asia.”

Sabina Chopra, COO-Corporate Travel and Head - Industry Relations, Yatra Online Limited , said, “We're thrilled to welcome Aramco Asia as a valued client and partner. This partnership is a big step for us, and we're excited to offer Aramco Asia our top-notch travel management services. With our 'Yatra for Business' platform's advanced technology and our quick customer onboarding, we've solidified our leadership in corporate travel. We're committed to providing Aramco Asia with excellent travel experiences, saving costs, and making their operations even more efficient.”

The partnership aims to better understand and meet Aramco Asia's unique travel needs and enable comprehensive travel solutions like flight and train ticket booking, hotel reservation and other ancillary services for the employees in India, Japan, Korea, Singapore, and Australia.

About Aramco

Aramco is a global integrated energy and chemicals company. We are driven by our core belief that energy is opportunity. From producing approximately one in every eight barrels of the world’s oil supply to developing new energy technologies, our global team is dedicated to creating impact in all that we do. We focus on making our resources more dependable, more sustainable and more useful. This helps promote stability and long-term growth around the world. www.aramco.com

About Yatra Online, Inc.

Yatra Online Limited (BSE: 543992, NSE: YATRA) is India’s largest corporate travel services provider and the third largest online travel company in India among key OTA players in terms of gross booking revenue and operating revenue, for Fiscal Year 2023. (Source: CRISIL Report). Through the website, www.yatra.com, mobile applications, Corporate SaaS platform, and other associated platforms, leisure and business travelers can explore, research, compare prices and book a wide range of services, which include domestic and international air ticketing, hotel bookings, homestays, holiday packages, bus ticketing, rail ticketing, activities and ancillary services catering to the travel needs.

Media contact information

All media enquiries are handled by Aramco India's Public Affairs Department, India.

India Media Relations Email Address: [email protected]

+966 13 8413535

3+ Decades of reputation

Technological excellence, mice & events, dmc services, welcome to gts.

GTS, a part of the Saeed Raddad Group, is a travel management company serving all travel needs, be it business, leisure or VIP luxury services. Our expert travel consultants will chart out inbound and outbound travel catering to customers’ needs at optimised rates. The company has a team of experienced travel professionals who can help businesses and individuals plan their travel itineraries, book flights and accommodation, and provide other assistance during the trip. We have dedicated 24-hour customer service, with knowledgeable and experienced representatives who can support our clients. At GTS, we don’t just create itineraries—we create memories! We want our clients to experience unforgettable trips they will cherish for a long time. Know more

What we do ?

- Corporate Travel

- Retail & Leisure Travel

- Destination Management Company

- Government Travel Management

- GTS Franchise

- Saudi Arabia Tours & Activities

- VIP Services

- Travel Insurance

- Visa Assistance

- Regional & International Cruise

AlUla Moments

Wheels bike hub.

Arabian Travel Market

Trending services.

Corporate - Business Travel

Worldwide Hotels & Resorts

Saudi Arabia - Tours & Activities

Global - Holiday Packages

- Aramco China

- Aramco Japan

- Aramco Korea

- Aramco Singapore

- Aramco Americas

- Aramco Europe

Living in saudi arabia

- About Saudi Arabia

- Living Overseas

Frequent domestic and international travel is important for our expats and part of our company culture. Employees have generous vacation allowances that give expatriates and their families ample time to visit home or to explore the world around them on relatively short flights to domestic locales or destinations such as the Maldives, Bali, Paris, Greece, and Egypt.

Domestic travel is full of options for scenic adventures and unique experiences. If you’re not up for a domestic road trip, we operate a system of a free bus network that runs between work sites, local towns, and residential communities.

Some popular weekend trips include visits to The Red Sea for scuba diving in pristine coral reefs and enjoying private beaches for picnics, swimming, windsurfing, and sailing.

The country's many historic sites, like the ancient city of Mada'in Salih (a UNESCO World Heritage Site), provide educational and cultural enrichment for casual explorers, amateur archaeologists, and professional geologists.

SRG company Global Travel Solution held its team meeting to find new ways and solutions to provide the best travel experience

Saudi Aramco signs contracts with SRACO, subsidiary company of Saeed Raddad Group for community maintenance

- Election 2024

- Entertainment

- Newsletters

- Photography

- Personal Finance

- AP Investigations

- AP Buyline Personal Finance

- AP Buyline Shopping

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- Election Results

- Delegate Tracker

- AP & Elections

- Auto Racing

- 2024 Paris Olympic Games

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

FIFA seals closer ties to Saudi Arabia with World Cup sponsor deal for oil firm Aramco

FILE - Saudi Arabia Crown Prince Mohammed bin Salman, left, and FIFA President Gianni Infantino, stand for the anthem prior to the match between Russia and Saudi Arabia which opened the 2018 soccer World Cup at the Luzhniki stadium in Moscow, Russia, on June 14, 2018. World soccer body FIFA has deepened its ties to Saudi Arabia by confirming a sponsorship with the Middle East kingdom’s state oil firm Aramco. (Alexei Nikolsky, Sputnik, Kremlin Pool Photo via AP, File)

- Copy Link copied

GENEVA (AP) — FIFA deepened its ties to Saudi Arabia by confirming a sponsorship on Thursday with the kingdom’s state oil firm Aramco which made a profit of $121 billion last year.

The deal was expected and became inevitable once Saudi Arabia was all but sealed last October as the 2034 host of the men’s World Cup.

The deal through 2027 includes the men’s World Cup in 2026 co-hosted by the United States, Canada and Mexico and the 2027 Women’s World Cup. Hosts of that tournament will be decided next month in a three-candidate vote .

The value of the Aramco deal was not disclosed but is likely the richest ever for FIFA by average annual value. The inaugural 32-team Club World Cup being hosted next year in the U.S. was not specified by FIFA though could be part of a separate deal.

“Through the partnership, Aramco and FIFA intend to leverage the power of football to create impactful social initiatives around the world,” the soccer body said in a statement.

Saudi sponsorship will help fuel income for FIFA’s 2023-26 commercial cycle which was conservatively budgeted to be $11 billion .

Revenue from broadcasting, sponsorship, licensing video games plus sales of tickets and hospitality packages was $7.5 billion for the four-year period tied to the 2022 World Cup in Qatar.

FIFA President Gianni Infantino has built close ties to Saudi Arabia and its Crown Prince Mohammed bin Salman since before the 2018 World Cup. That tournament in Russia was sponsored by state energy firm Gazprom.

The FIFA-Saudi links were maintained through fallout from the 2018 killing of Saudi journalist Jamal Khashoggi and despite critics making claims of “sportswashing” by the kingdom to improve its reputation.

The 2034 World Cup bidding was unexpectedly opened last October in a fast-track process seemingly expressly designed for Saudi Arabia to win, with only FIFA member federations in Asia and Oceania allowed to compete. It was made possible by FIFA brokering a three-continent deal announced the same day for the 2030 World Cup which will be played in Spain, Portugal, Morocco, Argentina, Paraguay and Uruguay.

Saudi Arabia was confirmed as the only 2034 candidate by the end of that month. Both the 2030 and 2034 decisions must be rubber-stamped by FIFA member federations later this year. No date or venue has been announced for the 211-member meeting.

Those members are in line for increased annual payments from FIFA in the decade leading to the Saudi-hosted World Cup.

FIFA’s development program pays each federation up to $8 million over four years through 2026 with more available for specific projects such as stadiums, training centers and federation headquarters.

FIFA already had reserves of $4 billion after the 2022 World Cup in Qatar, which also had a top-tier sponsor from the fossil fuel industry: Qatar Energy.

The Visit Saudi tourist board was a third-tier sponsor of the tournament in Qatar, though a planned deal for the 2023 Women’s World Cup was ended after pushback by organizers in Australia and New Zealand.

Soccer officials in those host countries cited the importance of gender equality in a reference to the limits on women’s freedoms in traditionally conservative Saudi society.

Saudi soccer officials stress life there is changing fast as part of the Vision 2030 program to modernize society and the economy, directed by the crown prince, widely known as MBS.

Soccer, sports and entertainment have been key elements to the program with headline investments including the breakaway LIV Golf tour and buying English Premier League club Newcastle, which played in the Champions League within two years of a Saudi-backed takeover.

The Saudi domestic league was boosted with huge salaries to lure a slew of star players including Cristiano Ronaldo and Neymar to clubs which were effectively nationalized last year by the sovereign wealth Public Investment Fund chaired by the crown prince.

AP soccer: https://apnews.com/hub/soccer

Exclusive deal for Saudi Aramco

Enjoy 20% special discount on your next trip from Dammam and Riyadh. Use the internet discount code (KLMLTPSA20). Enter the discount code during the online booking process after you have entered your personal details and proceeded to the payment page.

Terms and Conditions

· Discount is valid in Economy and Business cabins for departure.

· Booking Period: until 30 June 2024.

· Travel Period till: 31 December 2024

· Destinations: World.

· Discount: 20% off the net fares for Economy and Business class.

· Minimum purchase of SAR 280 (base fare excluding taxes) is required in Economy and Business class.

· KLM discount code can only be used on KLM website: https://saudi.klm.com/ .

· The discount is not refundable.

· Marketing Carrier: KLM.

· Operating Carrier: Air France, KLM, HOP!, Delta Airlines, KLM Cityhopper, Transavia and Virgin Atlantic .

Does not include any other operating carriers like ( FlyDubai , Etihad , Saudi Airlines and West Jet)

· IDC code only applicable on direct flights.

· Connections like DMM-AMS-NYC-AMS-DMM also qualify as direct flights, if no stopover is included in AMS.

· IDC is not applicable on flights including 2 transfers.

· IDC does not work when extra options are selected during booking flow.

· Discount not valid in combination with other promotional offers.

· Discount is not applicable for bookings with:

* Fares that are part of a package.

* Travel including a segment operated by Eurostar.

· Cancellation and refund of the ticket will follow the fare rules applicable and excluding the discount.

· KLM reserves the right to have final interpretation of the above conditions.

· For queries, please contact: 8008142222

· Since the outbreak of the coronavirus (COVID-19), KLM have been monitoring the situation minutely and are doing everything possible to assist you with your upcoming travel plans. Please visit COVID-19 most asked FAQ ; you will find up-to date answers to the most asked questions.

· Check KLM KLM TravelDoc shortly before departure to find out which test requirements apply to your trip and how to make sure you're allowed to board. Make sure to enter your entire route if your trip includes transfers.

Pardon Our Interruption

As you were browsing something about your browser made us think you were a bot. There are a few reasons this might happen:

- You've disabled JavaScript in your web browser.

- You're a power user moving through this website with super-human speed.

- You've disabled cookies in your web browser.

- A third-party browser plugin, such as Ghostery or NoScript, is preventing JavaScript from running. Additional information is available in this support article .

To regain access, please make sure that cookies and JavaScript are enabled before reloading the page.

- Latest News

- Emergencies

- Ask the Law

- GN Fun Drive

- Visa+Immigration

- Phone+Internet

- Reader Queries

- Safety+Security

- Banking & Insurance

- Dubai Airshow

- Corporate Tax

- Top Destinations

- Corporate News

- Electronics

- Home and Kitchen

- Consumables

- Saving and Investment

- Budget Living

- Expert Columns

- Community Tips

- Cryptocurrency

- Cooking and Cuisines

- Guide to Cooking

- Art & People

- Friday Partner

- Daily Crossword

- Word Search

- Philippines

- Australia-New Zealand

- Corrections

- From the Editors

- Special Reports

- Pregnancy & Baby

- Learning & Play

- Child Health

- For Mums & Dads

- UAE Success Stories

- Live the Luxury

- Culture and History

- Staying Connected

- Entertainment

- Live Scores

- Point Table

- Top Scorers

- Photos & Videos

- Course Reviews

- Learn to Play

- South Indian

- Arab Celebs

- Health+Fitness

- Gitex Global 2023

- Best Of Bollywood

- Special Features

- Investing in the Future

- Know Plan Go

- Gratuity Calculator

- Notifications

- Prayer Times

Aramco and Rongsheng explore new opportunities in Saudi Arabia and China

Business corporate news.

- Travel & Tourism

Cooperation framework agreement paves way for new downstream partnerships

Dhahran: Aramco is exploring the formation of a joint venture in the Saudi Aramco Jubail Refinery Company (SASREF) with Chinese partner Rongsheng Petrochemical Co. Ltd. (Rongsheng) and significant investments in the Saudi and Chinese petrochemical sectors, in partnership with Rongsheng.

The company recently signed a cooperation framework agreement that envisions Rongsheng’s potential acquisition of a 50 per cent stake in SASREF. The agreement also lays the groundwork for the development of a liquids-to-chemicals expansion project at SASREF, in addition to Aramco’s potential acquisition of a 50 per cent stake in Rongsheng affiliate Ningbo Zhongjin Petrochemical Co. Ltd. (ZJPC) and participation in ZJPC’s expansion project.

In July 2023, Aramco acquired a 10 per cent interest in Rongsheng through its subsidiary Aramco Overseas Company BV, based in the Netherlands. Rongsheng, in turn, owns a 100 per cent equity interest in ZJPC, which operates an aromatics production complex and has an interest in a joint venture that produces purified terephthalic acid.

Mohammed Y. Al Qahtani, Aramco Downstream President, said: “These discussions highlight our ambition to advance our liquids-to-chemicals strategy with strategic partner Rongsheng, both in the Kingdom of Saudi Arabia and China. In building on our existing relationship, we aim to advance our expansion in a key geography and attract new investment to the Saudi downstream sector.”

More From Corporate-News

ABC Cargo leads relief efforts in UAE flood crisis

New era of connectivity in the humanitarian sector

Marhaba Auctions offers support to UAE flood affected

TVM Capital Healthcare invests $17m in neurocare

Dubai Airports' disaster responses did its part: CEO

Gulf Air announces resumption of its flights to Iraq

Dubai embarks on world’s largest airport project

Emergency slide falls off Delta plane after takeoff

Dubai rolls out loans for firms impacted by heavy rains

We're full! Europe's fight against overtourism

Gaikwad, deshpande shine as chennai defeat hyderabad, psg win ligue 1 title after monaco lose at lyon, difc hits record $2.6b in 2023 gross written premiums, elon musk makes unannounced visit to china, city see off forest to close on leaders arsenal.

Get Breaking News Alerts From Gulf News

We’ll send you latest news updates through the day. You can manage them any time by clicking on the notification icon.

More From Forbes

Fifa and aramco agree global partnership.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Saudi Crown Prince Mohammed bin Salman and FIFA president Gianni Infantino sealed the partnership ... [+] between Aramco and FIFA.

Aramco, the Saudi state-owned oil and gas major, agreed a four-year global partnership with FIFA, global soccer’s governing body. The deal makes Aramco FIFA’s Major Worldwide Partner, and gives it sponsorship rights at the 2026 FIFA Men’s World Cup being hosted in the U.S. Mexico and Canada, as well as the 2027 Women’s World Cup. Aramco’s deal with FIFA is reported to be with $100 million annually and follows on the coattails of its new partnership with CONCACAF .

Signing lucrative financial agreements with state-run companies is nothing new for FIFA. Ahead of the 2018 Men’s World Cup in Russia, it signed a deal with Gazprom, the Russian gas company. In 2022 it did the same, making state airline Qatar Airways the main sponsor of the tournament. It also attempted to make Saudi Tourism the title sponsor of the 2023 Women’s World Cup, only to see the deal scuppered by public outcry. The larger issue is that by bringing on Aramco as a sponsor — the world’s largest oil and gas producer and the main source of funding for an authoritarian state — FIFA is eroding what limited credibility existed in its climate change strategy and human rights agenda.

As the climate crisis continues to accelerate, positive impact and emissions reduction plans are what is expected from global leaders, including soccer’s governing body. Sports’ power to change the world, and solve complicated political issues is routinely talked about, yet in a moment of need, FIFA has abdicated its leadership responsibilities, showing a lack of concern for climate change and human rights violations.

FIFA President Gianni Infantino says, “Aramco has a strong track record of supporting world-class events, but also a focus on developing grassroots sport initiatives.” Infantino is right about the former, over the past several years, Saudi Arabia — including Aramco, the Public Investment Fund and other state-owned companies — has secured over 300 sponsorship deals in 21 sports. There is no question the oil company has excelled at pumping money into elite-level sporting events and competitions. Excellent reporting from Danish research organization Play the Game has explained why Saudi Arabia is making these investments, and what the cost is for the integrity of the sports we hold dear.

The 150th Kentucky Derby Post Draw, Odds And 2024 Top Win Contenders

The good, bad and ugly from the green bay packers’ draft, earth s new second moon is as big as the statue of liberty and scientists just found its origin.

Amin H. Nasser, President and CEO of Aramco said, “Through this partnership with FIFA we aim to contribute to football development and harness the power of sport to make an impact around the globe. It reflects our ambition to enable vibrant communities and extends our backing of sport as a platform for growth.” This is the same CEO who just weeks ago at the CERAWeek Conference called on policymakers to “abandon the fantasy of phasing out oil and gas, and instead invest in them adequately, reflecting realistic demand assumptions.” It is therefore hard to understand how Aramco’s partnership with FIFA will “enable vibrant communities.”

In 2022, Aramco had Scope 1 and 2 greenhouse gas emissions of roughly 71.8 million tons of CO2e. This is equivalent to those of Norway, and greater than those of over 140 countries. Forbes estimates Aramco’s 2023 profits to have been $156.4 billion, and lists the Saudi company's assets at $661 billion. Moreover, the Saudi Arabian state has routinely attempted to slow and obstruct UN climate talks and has developed an Oil Demand Sustainability Programme with the express purpose of creating new demand for oil and gas in Africa, and in the shipping and aviation industries.

Despite being a signatory of the United Nations Sports for Climate Action Network, FIFA has seen fit to seek sponsorship from the very industry that causes climate change. Furthermore, soccer’s governing body remains convinced that the sponsorship deal will help develop the sport globally. When asked how the agreement can be reconciled with FIFA’s Climate Strategy a FIFA Spokesperson said the following:

“In line with its statutes, FIFA reinvests its revenue, including the income of the Aramco sponsorship, in developing football worldwide. It is expected that in the 2023-2026 cycle FIFA will invest in excess of a record USD 3.9 billion in development and education. This includes FIFA Forward 3.0, the Football Development Fund and other initiatives such as women's football promotion and development, refereeing and technical development.

Without FIFA’s support more than half of FIFA’s member associations simply couldn’t operate and properly equip their youth and women’s national teams to participate in international competitions.”

What FIFA’s statement neglects to recognize is that by signing an agreement with Aramco, the governing body of the world’s most popular sport is giving the world’s largest oil and gas producer the license to continue operating in the same manner, which according to last year’s figures means producing 12.8 million barrels of oil equivalent per day at a time when production and emissions must cease. Moreover, the deal will provide Aramco the largest sports advertising platform available, spreading its name, image and influence around the world, everyday, during multiple game broadcasts for over a month.

As if the climate grievances surrounding this partnership did not create enough alarm, Amnesty International has condemned the Aramco becoming FIFA’s Major Worldwide Partner due to human rights concerns. “There is a cruel irony that a Saudi Arabian state-owned company should be considered fit to sponsor the Women’s World Cup when women like Salma al-Shehabopens and Manahel al-Otaibiopens remain imprisoned in the Kingdom for peacefully speaking out for gender equality,” said Steve Cockburn, Amnesty International's Head of economic and Social Justice.

Cockburn went on to say “With Saudi Arabia also currently being the sole bidder to host the 2034 Men’s World Cup, world football could be dogged by human rights violations for years to come unless urgent action is taken to address the country’s atrocious human rights record,” before calling on FIFA to seek binding agreements to protect the people from exploitation before awarding the Gulf kingdom the rights to the 2034 Men’s World Cup.

In just over 24 hours, there has been fierce public backlash to the sponsorship deal. Badvertising , the British organization campaigning “to stop adverts and sponsorships fuelling the climate emergency,” drew up a petition demanding the deal be terminated immediately. Fossil Free Football said the deal “sets the world’s most popular sport on a regressive course just as the global community must lower emissions by around 50% this decade.” Moreover, major U.K. media outlets including the BBC, the Daily Mirror and SportsPro Media have all published pieces laying out similar concerns with the deal.

What remains to be seen is if this backlash will create any change in behavior from FIFA or Aramco, or more importantly increase awareness among fans of the hypocrisy of this agreement.

- Editorial Standards

- Reprints & Permissions

- Our Business

- Sustainability

Investing in the Gulf’s Potential

Serving global maritime traffic: King Salman International Complex for Maritime Industries and Services

Aramco’s project management brings expertise to project that looks to unlock the promise of the arabian gulf..

- The Arabian Sun

The Arabian Gulf is an integral part of the region’s heritage. Ancient metropolises and cities have arisen on its shores, built on fishing, pearls, and other industries, and for over 90 years, oil installations have operated close to, or in, Gulf waters; offshore drilling platforms and supertankers like floating cities.

With the launch of Saudi Vision 2030, the Kingdom continues to invest in the potential of Arabian Gulf. Testimony to this is King Salman International Complex for Maritime Industries and Services (KSICMS), which will support the 6% of global maritime traffic that uses the Kingdom’s waters.

By the numbers

35 million .

cubic meters of project land were dredged and reclaimed

7.4 million

squared meters of land was rehabilitated and improved

kilometers are the approximate length of concrete piers constructed with a depth of 16 meters

kilometers of rock and concrete barriers/seawalls were constructed

23 km-long, 330 m-wide, 11 m-deep

below-sea-level canal constructed

Aramco’s Project Management, which supervised the construction of KSICMS, demonstrated its versatility, overseeing the giant project which falls outside its more usual remit of oil and gas fields. Adding complexity to the project was catering to the individual needs of the cross-disciplinary companies that operate the complex.

“IMI, a joint venture with Aramco, is an integral part of the Kingdom’s vision to build a regional logistics center that enhances its position as a strategic gateway to three continents,” explained Abdullah Alahmari, CEO of International Maritime Industries (IMI). “The company aims to achieve global leadership by providing advanced products and innovative solutions to shipyards and drilling platforms. The development of IMI as an advanced maritime facility is essential to achieving the objectives of the National Industrial Development Program.”

As a major support project for the KSICMS, IMI acts as a catalyst for economic growth and to support the goals of the Kingdom’s Vision 2030 by creating a new logistics industry. — Abdullah Alahmari

“It is also the largest full-service marine yard in the Middle East and North Africa region, with an ambitious plan for global expansion,” Alahmari added. “IMI also provides advanced and sustainable maritime services that shape the maritime industry future, and provides construction and maintenance services for commercial ships.”

Young engineers

Murad A. Al Sayed, Maritime, Building, and Infrastructure Projects vice president, praised the young Saudi engineers who worked on the project.

“This is a unique project and provides them with extensive new experience,” he said, emphasizing the complex nature and different types of work involved. Aramco’s Project Management helped address this complexity by working through the infrastructure requirements of each company separately, since some specialized in engines, others in shipbuilding, and others still in offshore platforms.

Al Sayed also emphasized Aramco’s commitments to safety and the environment. Testimony to this was the project’s recognition through the Saudi Green Initiative Award 2023 for efforts in minimizing its environmental impact.

Naser K. Al Bishi, KSICMS Project Management director, explained that the implementation of the project is taking place in stages, starting with the site’s rehabilitation work, which included dredging and reclaiming land and marine sites — KSICMS is set to include three dry docks, equivalent to the area of 14 football fields, necessitating the displacement of vast amounts of seawater. Al Bishi also said that 6 million tons of rocks were transported over thousands of kilometers, and that to secure 3 million cubic meters of concrete, the project team encouraged companies to establish on-site plants.

Other stages of the project included the design, supply, and installation of facilities, support services, residential facilities, administrative offices, and more — all the while adhering to strict standards. The project is divided into five production areas: two areas for the manufacture of offshore platforms and rigs; one area for shipbuilding; and two areas for the maintenance of ships and offshore platforms and rigs.

Aramco employee Ahmed Al-Ghubaini, who works as a senior KSICMS representative, said that during the COVID-19 pandemic, the team found effective solutions to manage risk and ensure progress.

Also recalling the challenges during the pandemic, Bader Q. Al-Otaibi, who supervised the mechanical engineering designs of the project, explained how the team was able to complete and finalize designs remotely, which required considerable coordination and flexibility.

New job opportunities

More recently, Al-Ghubaini has chaired the committee consisting of representatives from several Aramco departments and operating companies, to approve and hand over some of the facilities to KSICMS operating companies.

A number of facilities have been completed and handed over to IMI to start manufacturing.This will create new job opportunities and contribute to GDP. — Ahmed Al-Ghubaini

Ahmed S. Al-Aradi, senior project engineer, supervised the development of one of the KSICMS production areas, which consists of large underground networks such as water, air, and industrial gas facilities. He says that despite the complexity of the project, thanks to good planning, the team completed the work in excellent time.

“We were able to install over 250 kilometers of metal and nonmetallic pipes in less than a year,” Al-Aradi said.

A wonderful moment

Mohammed A. Al Teraiki from Maritime Yard Development Projects supervised material supply chains and high-precision heavy equipment. Major challenges included maintaining the supply chains amid sharp market fluctuations and engaging more local services and suppliers — both of which were addressed successfully.

Teraiki recounts a “wonderful moment” when a number of the largest cranes in the world arrived at the project site — one with a lifting capacity of 1,600 tons.

Haitham M. Alsaraj, a senior project engineer who participated in the project implementation, recounted the remarkable scale of operations. “A 14-meter deep temporary dam was constructed to isolate seawater and prepare the location of the dry docks for construction work. Water was displaced inside the docks at a rate of 4 million cubic meters daily. It was tremendous work.”

Caption for top photo: King Salman International Complex for Maritime Industries and Services will support the 6% of global maritime traffic that uses the Kingdom’s waters.

Share this article

You are currently using an older browser. Please note that using a more modern browser such as Microsoft Edge might improve the user experience. Download Microsoft Edge

Your benefits

As well as offering exciting professional opportunities, we have a range of attractive supporting benefits.

- Compelling remuneration package.

- Permanent Employment on an Indefinite Term Employment Agreement.

- Saudi Aramco Incentive Plan: This is a broad-based annual and performance based incentive plan based on company and individual performance, base salary, and length of service during the plan year. The objective of this plan is to drive organizational performance, as well as, recognize and reward your contributions beyond the normal annual merit increases.

- Annual repatriation travel allowance: An annual cash payment that more than covers airfare costs to your home country. You have full flexibility to use this payment in any way you choose.

- Annual vacation: You can look forward to up to 38 calendar days of paid leave each year. In addition, you’ll typically be granted between 9 and 11 days of national public holidays each year.

- Severance award: In accordance with the Saudi labor law, a severance award is payable by the company to employees who leave after two years or more of satisfactory service. The severance award is based on length of continuous service and final base pay. The severance award can be a substantial benefit for longer service employees.

- Education Assistance Plan: If you are hired on family status, you may be eligible to benefit from the company’s excellent education assistance plan for dependent children. This may include the option for them to attend Saudi Aramco’s high quality private schools or to attend international schools in the local community.

- Quality housing in company communities or a rental assistance allowance: We have four communities in the Eastern Province where we provide quality accommodation in pleasant surroundings. Alternatively, employees may obtain housing in the local communities outside of the Saudi Aramco communities, for which we provide a rental assistance allowance.

- Free medical care: We provide medical care via our Johns Hopkins Aramco Healthcare subsidiary medical network or contracted hospitals and clinics. These facilities are among the finest in the Middle East.

- Free access to recreational facilities: You will have access to our extensive range of recreational facilities that include: private beaches, tennis courts, exercise gyms, swimming pools, golf courses, tennis and squash courts, and much more.

- Free scheduled transportation: Air-conditioned buses are provided free of charge for transportation within camp areas, to work locations, local shopping areas outside camp, the beach and our other communities.

- Voluntary Group Life and Accident Insurance: you may enroll in a voluntary program providing term life insurance and accidental death and dismemberment (AD&D) coverage equal to 12, 18, 24 or 30 times your monthly base salary. Favorable group rates keep the premium low.

- Short-term Disability: In the event you are unable to work due to illness or injury, short-term disability income benefits are provided. The benefit is 30 days full pay and 60 days at three-quarters pay, in any one year period.

- Death Benefit: Saudi Aramco pays an ex-gratia death benefit equal to 24 months base pay if death is from an industrial accident and 12 months base pay if death is non-industrial related.

- Career development: We recognize and value professional growth and achievement, so you’ll have many opportunities to develop your career and expertise.

Explore careers in Saudi

You can find out more about our expatriate career opportunities in Saudi Arabia by visiting our dedicated career websites, specific to your region.

International schools

Since 1940, we have provided educational services for the dependents of Saudi Aramco employees.

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, weekend print + standard digital, weekend print + premium digital.

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- 10 additional gift articles per month

- Global news & analysis

- Exclusive FT analysis

- Videos & Podcasts

- FT App on Android & iOS

- Everything in Standard Digital

- Premium newsletters

- Weekday Print Edition

- FT Weekend Print delivery

- Everything in Premium Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Everything in Print

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

‘To the Future’: Saudi Arabia Spends Big to Become an A.I. Superpower

The oil-rich kingdom is plowing money into glitzy events, computing power and artificial intelligence research, putting it in the middle of an escalating U.S.-China struggle for technological influence.

More than 200,000 people converged on the Leap tech conference in the desert outside Riyadh in March. Credit... Iman Al-Dabbagh for The New York Times

Supported by

- Share full article

By Adam Satariano and Paul Mozur

Adam Satariano reported from Riyadh, Saudi Arabia, and Paul Mozur from Taipei, Taiwan.

- Published April 25, 2024 Updated April 26, 2024

On a Monday morning last month, tech executives, engineers and sales representatives from Amazon, Google, TikTok and other companies endured a three-hour traffic jam as their cars crawled toward a mammoth conference at an event space in the desert, 50 miles outside Riyadh.

The lure: billions of dollars in Saudi money as the kingdom seeks to build a tech industry to complement its oil dominance.

To bypass the congestion, frustrated eventgoers drove onto the highway shoulder, kicking up plumes of desert sand as they sped past those following traffic rules. A lucky few took advantage of a special freeway exit dedicated to “V.V.I.P.s” — very, very important people.

“To the Future,” a sign read on the approach to the event, called Leap.

More than 200,000 people converged at the conference, including Adam Selipsky, chief executive of Amazon’s cloud computing division, who announced a $5.3 billion investment in Saudi Arabia for data centers and artificial intelligence technology. Arvind Krishna, the chief executive of IBM, spoke of what a government minister called a “lifetime friendship” with the kingdom. Executives from Huawei and dozens of other firms made speeches. More than $10 billion in deals were done there, according to Saudi Arabia’s state press agency.

“This is a great country,” Shou Chew, TikTok’s chief executive, said during the conference, heralding the video app’s growth in the kingdom. “We expect to invest even more.”

- Shou Chew, TikTok’s chief executive, promoted the video app’s growth in Saudi Arabia during the Leap conference. Iman Al-Dabbagh for The New York Times

- One of the booths at the Leap conference, which was attended by executives from Google, Amazon, TikTok and others. Iman Al-Dabbagh for The New York Times

- A robotic dog walking through the Leap conference. Iman Al-Dabbagh for The New York Times

Everybody in tech seems to want to make friends with Saudi Arabia right now as the kingdom has trained its sights on becoming a dominant player in A.I. — and is pumping in eye-popping sums to do so.

Saudi Arabia created a $100 billion fund this year to invest in A.I. and other technology. It is in talks with Andreessen Horowitz, the Silicon Valley venture capital firm, and other investors to put an additional $40 billion into A.I. companies. In March, the government said it would invest $1 billion in a Silicon Valley-inspired start-up accelerator to lure A.I. entrepreneurs to the kingdom. The initiatives easily dwarf those of most major nation-state investments, like Britain’s $100 million pledge for the Alan Turing Institute.

The spending blitz stems from a generational effort outlined in 2016 by Crown Prince Mohammed bin Salman and known as “Vision 2030.” Saudi Arabia is racing to diversify its oil-rich economy in areas like tech, tourism, culture and sports — investing a reported $200 million a year for the soccer superstar Cristiano Ronaldo and planning a 100-mile-long mirrored skyscraper in the desert.

For the tech industry, Saudi Arabia has long been a funding spigot. But the kingdom is now redirecting its oil wealth into building a domestic tech industry, requiring international firms to establish roots there if they want its money.

If Prince Mohammed succeeds, he will place Saudi Arabia in the middle of an escalating global competition among China, the United States and other countries like France that have made breakthroughs in generative A.I. Combined with A.I. efforts by its neighbor, the United Arab Emirates, Saudi Arabia’s plan has the potential to create a new power center in the global tech industry.

“I hereby invite all dreamers, innovators, investors and thinkers to join us, here in the kingdom, to achieve our ambitions together,” Prince Mohammed remarked in a 2020 speech about A.I.

His ambitions are geopolitically delicate as China and the United States seek to carve out spheres of influence over A.I. to shape the future of critical technologies.

In Washington, many worry that the kingdom’s goals and authoritarian leanings could work against U.S. interests — for instance, if Saudi Arabia ends up providing computing power to Chinese researchers and companies. This month, the White House brokered a deal for Microsoft to invest in G42, an A.I. company in the Emirates, which was intended partly to diminish China’s influence.

For China, the Persian Gulf region offers a big market, access to deep-pocketed investors and a chance to wield influence in countries traditionally allied with the United States. China’s form of A.I.-powered surveillance has already been embedded into policing in the region .

Some industry leaders have begun to arrive. Jürgen Schmidhuber, an A.I. pioneer who now heads an A.I. program at Saudi Arabia’s premier research university, King Abdullah University of Science and Technology, recalled the kingdom’s roots centuries ago as a center for science and mathematics.

“It would be lovely to contribute to a new world and resurrect this golden age,” he said. “Yes, it will cost money, but there’s a lot of money in this country.”

The willingness to spend was front and center last month at a gala in Riyadh hosted by the Saudi government, which coincided with the Leap conference. Hollywood klieg lights blazed in the sky above the city as guests arrived in chauffeured Maseratis, Mercedes-Benzes and Porsches. Inside a 300,000-square-foot parking garage that had been converted two years ago into one of the world’s largest start-up spaces, attendees mingled, debated opening offices in Riyadh and sipped pomegranate juice and cardamom-flavored coffee.

“There’s something happening here,” said Hilmar Veigar Petursson, the chief executive of CCP Games, the Icelandic company behind the popular game Eve Online, who was at the gala. “I got a very similar sense when I came back from China in 2005.”

A Sci-Fi Script

Prince Mohammed’s Vision 2030 project, unveiled eight years ago, seems taken from a science-fiction script.

Under the plan, new futuristic cities will be built in the desert along the Red Sea, oriented around tech and digital services. And the kingdom, which has piled billions into tech start-ups like Uber and investment vehicles such as SoftBank’s Vision Fund, would spend more.

That drew Silicon Valley’s attention. When Prince Mohammed visited California in 2018, Sergey Brin, Google’s co-founder, escorted him through a tree-lined path at the company’s campus. Tim Cook, Apple’s chief executive, showed him the company’s products. The prince also traveled to Seattle, where he met with Bill Gates of Microsoft; Satya Nadella, the company’s chief executive; and Jeff Bezos of Amazon.

It was a key moment for Saudi Arabia’s tech ambitions as Prince Mohammed presented himself as a youthful, digitally savvy reformer. But enthusiasm dimmed a few months later when Jamal Khashoggi, a Washington Post columnist and critic of the crown prince, was killed at the Saudi Consulate in Istanbul. Prince Mohammed denied involvement, but the C.I.A. concluded that he had approved the killing .

For a brief period, it was seen as untoward to associate with Saudi Arabia. Business executives canceled visits to the kingdom. But the lure of its money was ultimately too strong.

A.I. development depends on two key things that Saudi Arabia has in abundance: money and energy. The kingdom is pouring oil profits into buying semiconductors, building supercomputers, attracting talent and constructing data centers powered by its plentiful electricity. The bet is that Saudi Arabia will eventually export A.I. computing muscle.

Majid Ali AlShehry, the general manager of studies for the Saudi Data and A.I. Authority, a government agency overseeing A.I. initiatives, said 70 percent of the 96 strategic goals outlined in Vision 2030 involved using data and A.I.

“We see A.I. as one of the main enablers of all sectors,” he said in an interview at the agency’s office in Riyadh, where employees nearby worked on an Arabic chatbot called Allam.

Those goals have permeated the kingdom. Posters for Vision 2030 are visible throughout Riyadh. Young Saudis describe the crown prince as running the kingdom as if it were a start-up. Many tech leaders have parroted the sentiment.

“Saudi has a founder,” Ben Horowitz, a founder of Andreessen Horowitz, said last year at a conference in Miami. “You don’t call him a founder. You call him his royal highness.”

Some question whether Saudi Arabia can become a global tech hub. The kingdom has faced scrutiny for its human rights record, intolerance to homosexuality and brutal heat. But for those in the tech world who descended on Riyadh last month, the concerns seemed secondary to the dizzying amount of deal-making underway.

“They are just pouring money into A.I.,” said Peter Lillian, an engineer at Groq, a U.S. maker of semiconductors that power A.I. systems. Groq is working with Neom, a futuristic city that Saudi Arabia is building in the desert, and Aramco, the state oil giant. “We’re doing so many deals,” he said.

Torn Between Superpowers

Situated along the Red Sea’s turquoise waters, King Abdullah University of Science and Technology has become a site of the U.S.-Chinese technological showdown.

The university, known as KAUST, is central to Saudi Arabia’s plans to vault to A.I. leadership. Modeled on universities like Caltech, KAUST has brought in foreign A.I. leaders and provided computing resources to build an epicenter for A.I. research.

To achieve that aim, KAUST has often turned to China to recruit students and professors and to strike research partnerships , alarming American officials. They fear students and professors from Chinese military-linked universities will use KAUST to sidestep U.S. sanctions and boost China in the race for A.I. supremacy , analysts and U.S. officials said.

Of particular concern is the university’s construction of one of the region’s fastest supercomputers, which needs thousands of microchips made by Nvidia, the biggest maker of precious chips that power A.I. systems. The university’s chip order, with an estimated value of more than $100 million, is being held up by a review from the U.S. government, which must provide an export license before the sale can go through.

Both China and the United States want to keep Prince Mohammed close. A.I. ambitions add a new layer of geopolitical significance to a kingdom already key to Middle East policy and global energy supplies. A 2016 visit to Saudi Arabia by Xi Jinping, China’s leader, paved the way for new tech cooperation. Accustomed to top-down industrial policy, Chinese companies have expanded rapidly in the kingdom, forming partnerships with major state-owned companies. The United States has pushed Saudi Arabia to pick a side, but Prince Mohammed seems content to benefit from both nations.

Mr. Schmidhuber, the researcher leading KAUST’s A.I. efforts, has seen the jostling up close. Considered a pioneer of modern A.I. — students in a lab he led included a founder of DeepMind, an innovative A.I. company now owned by Google — he was lured to the desert in 2021.

He was reluctant to move at first, he said, but university officials, via a headhunter, “tried to make it more attractive and even more attractive and even more attractive for me.”

Now Mr. Schmidhuber is awaiting the completion of the supercomputer, Shaheen 3, which is a chance to attract more top talent to the Persian Gulf and to give researchers access to computing power often reserved for major companies.

“No other university is going to have a similar thing,” he said.

Some in Washington fear the supercomputer may provide researchers from Chinese universities access to cutting-edge computing resources they would not have in China. More than a dozen students and staff members at KAUST are from military-linked Chinese universities known as the Seven Sons of National Defense, according to a review by The New York Times. During the Trump administration, the United States blocked entry to students from those universities over concerns they could take sensitive technologies back to China’s military.

“The United States should quickly move to deny export licenses to any entity if the end user is likely to be a P.R.C. actor affiliated with the People’s Liberation Army,” Representative Mike Gallagher, a Republican from Wisconsin, said in a statement.

A senior White House official, speaking on the condition of anonymity, said that the default U.S. policy was to share technology with Saudi Arabia, a critical ally in the gulf, but that there were national security concerns and risks with A.I.

The Commerce Department declined to comment. In a statement, China’s Ministry of Foreign Affairs said, “We hope that relevant countries will work with China to resist coercion, jointly safeguard a fair and open international economic and trade order, and safeguard their own long-term interests.”

A KAUST spokeswoman said, “We will strictly comply with all U.S. export license terms and conditions for the full life cycle of Shaheen 3.”

Mr. Schmidhuber said the Saudi government was ultimately aligned with the United States. Just as U.S. technology helped create Saudi Arabia’s oil industry, it will play a critical role in A.I. development.

“Nobody wants to jeopardize that,” he said.

The Gold Rush

Aladin Ben, a German Tunisian A.I. entrepreneur, was in Bali last year when he received an email from a Saudi agency working on A.I. issues. The agency knew his software start-up, Memorality, which designs tools to make it easier for businesses to incorporate A.I., and wanted to work together.

Since then, Mr. Ben, 31, has traveled to Saudi Arabia five times. He is now negotiating with the kingdom on an investment and other partnerships. But his company may need to incorporate in Saudi Arabia to get the full benefit of the government’s offer, which includes buying hundreds of annual subscriptions to his software in a contract worth roughly $800,000 a month.

“If you want a serious deal, you need to be here,” Mr. Ben said in an interview in Riyadh.

Saudi Arabia was once viewed as a source of few-strings-attached cash. Now it has added conditions to its deals, requiring many companies to establish roots in the kingdom to partake in the financial windfall.

That was evident at GAIA, an A.I. start-up accelerator, for which Saudi officials announced $1 billion in funding last month.

Each start-up in the program receives a grant worth about $40,000 in exchange for spending at least three months in Riyadh, along with a potential $100,000 investment. Entrepreneurs are required to register their company in the kingdom and spend 50 percent of their investment in Saudi Arabia. They also receive access to computing power purchased from Amazon and Google free of charge.

About 50 start-ups — including from Taiwan, South Korea, Sweden, Poland and the United States — have gone through GAIA’s program since it started last year.

“We want to attract talent, and we want them to stay,” said Mohammed Almazyad, a program manager for GAIA. “We used to rely heavily on oil, and now we want to diversify.”

One of the biggest enticements for A.I. start-ups is the chance to make the deep-pocketed Saudi government a customer. In one recent meeting, Abdullah Alswaha, a senior minister for communications and information technology, asked GAIA’s start-ups to suggest what they could provide for the Saudi government, including for megacity projects like Neom . Afterward, many of the companies received messages introducing them to state-owned businesses, Mr. Almazyad said.