Travel & Tourism - Myanmar

- The projected revenue for Myanmar's Travel & Tourism market is set to reach US$578.90m by 2024, with a CAGR of 4.56% from 2024 to 2028.

- This growth rate is expected to result in a projected market volume of US$691.90m by 2028.

- Hotels are the market's largest market in Myanmar, with a projected market volume of US$301.30m by 2024.

- The number of users in this market is expected to reach 3,394.00k users by 2028.

- As for user penetration, it is 8.3% in 2024 and is expected to increase to 9.1% by 2028.

- Additionally, the average revenue per user (ARPU) is projected to be US$126.30.

- Online sales are expected to generate 70% of the total revenue in Myanmar's Travel & Tourism market by 2028.

- When compared globally, United States is expected to generate the most revenue, with US$199bn in 2024.

- Myanmar's Travel & Tourism industry is experiencing a rise in demand due to the country's rich cultural heritage and untouched natural beauty.

Key regions: Malaysia , Europe , Singapore , Vietnam , United States

Definition:

The Travel & Tourism market encompasses a diverse range of accommodation services catering to the needs and preferences of travelers. This dynamic market includes package holidays, hotel accommodations, private vacation rentals, camping experiences, and cruises.

The market consists of five further markets.

- The Cruises market covers multi-day vacation trips on a cruise ship. The Cruises market encompasses exclusively passenger ticket revenues.

- The Vacation Rentals market comprises of private accommodation bookings which includes private holiday homes and houses as well as short-term rental of private rooms or flats.

- The Hotels market includes stays in hotels and professionally run guest houses.

- The Package Holidays market comprises of travel deals that normally contain travel and accommodation sold for one price, although optional further provisions can be included such as catering and tourist services.

- The Camping market includes bookings at camping sites for pitches using tents, campervans, or trailers. These can be associated with big chains or privately managed campsites.

Additional Information:

The main performance indicators of the Travel & Tourism market are revenues, average revenue per user (ARPU), users and user penetration rates. Additionally, online and offline sales channel shares display the distribution of online and offline bookings. The ARPU refers to the average revenue one user generates per year while the revenue represents the total booking volume. Revenues are generated through both online and offline sales channels and include exclusively B2C revenues and users for the above-mentioned markets. Users represent the aggregated number of guests. Each user is only counted once per year. Additional definitions for each market can be found within the respective market pages.

The booking volume includes all booked travels made by users from the selected region, independent of the departure and arrival. The scope includes domestic and outbound travel.

Prominent players in this sector include online travel agencies (OTAs) like Expedia and Opodo, as well as tour operators such as TUI. Specialized platforms like Hotels.com, Booking.com, and Airbnb facilitate the online booking of hotels and private accommodations, contributing significantly to the market's vibrancy.

For further information on the data displayed, refer to the info button right next to each box.

- Bookings directly via the website of the service provider, travel agencies, online travel agencies (OTAs) or telephone

out-of-scope

- Business trips

- Other forms of trips (e.g. excursions, etc.)

Travel & Tourism

- Vacation Rentals

- Package Holidays

- Analyst Opinion

Myanmar's Travel & Tourism market is showing promising signs of growth and development. Customer preferences: Travelers in Myanmar are increasingly seeking unique and authentic experiences, moving away from traditional tourist hotspots to explore off-the-beaten-path destinations. There is a growing demand for sustainable and responsible travel options, with tourists showing a preference for eco-friendly accommodations and activities that support local communities. Trends in the market: One notable trend in Myanmar's Travel & Tourism market is the rise of adventure tourism, with more visitors looking to engage in activities such as trekking, cycling, and river cruises. This shift towards experiential travel is driving the development of new tour packages and services that cater to adventurous travelers. Additionally, the country's rich cultural heritage and diverse landscapes are attracting a growing number of cultural and nature enthusiasts. Local special circumstances: Myanmar's unique cultural heritage, including ancient temples, pagodas, and traditions, sets it apart as a distinctive travel destination in the region. The country's recent opening up to international tourism has sparked interest among travelers looking to explore its unspoiled beauty and immerse themselves in its rich history. The warm hospitality of the local population and the opportunity to engage with different ethnic groups add to the allure of visiting Myanmar. Underlying macroeconomic factors: The gradual easing of travel restrictions, improved infrastructure, and government initiatives to promote tourism are key factors driving the growth of Myanmar's Travel & Tourism market. Economic development in the country has led to an increase in disposable income among the local population, contributing to a rise in domestic travel. Furthermore, investments in hospitality and tourism-related infrastructure are enhancing the overall travel experience for visitors, supporting the sector's expansion.

- Methodology

Data coverage:

Modeling approach:

Additional notes:

- Sales Channels

- Travel Behavior

- Global Comparison

- Key Market Indicators

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Unlimited access to our Market Insights

- Statistics and reports

- Usage and publication rights

This website stores cookies on your computer. These cookies are used to collect information about how you interact with our website and allow us to remember you. We use this information in order to improve and customize your browsing experience and for analytics and metrics about our visitors both on this website and other media. To find out more about the cookies we use, see our Cookies Policy .

If you decline, your information won’t be tracked when you visit this website. A single cookie will be used in your browser to remember your preference not to be tracked.

Myanmar Tourism Statistic

Myanmar avg expenditure: per capita: per day, view myanmar's myanmar avg expenditure: per capita: per day from 2006 to 2017 in the chart:.

Myanmar Tourism Income: Total Earning

View myanmar's myanmar tourism income: total earning from 2006 to 2017 in the chart:.

Myanmar Tourist Arrivals: Border Tourism

View myanmar's myanmar tourist arrivals: border tourism from 2003 to 2017 in the chart:.

Myanmar Tourist Arrivals: Border Tourism: Eastern Region

View myanmar's myanmar tourist arrivals: border tourism: eastern region from 2003 to 2017 in the chart:.

Myanmar Tourist Arrivals: Border Tourism: North Eastern Region

View myanmar's myanmar tourist arrivals: border tourism: north eastern region from 2003 to 2017 in the chart:.

Myanmar Tourist Arrivals: Border Tourism: South Eastern Region

View myanmar's myanmar tourist arrivals: border tourism: south eastern region from 2003 to 2017 in the chart:.

Tourist Arrivals: Cruise and Yacht

View myanmar's tourist arrivals: cruise and yacht from 2016 to 2021 in the chart:.

Explore our Data

- ASSOCIATIONS

- CLIMATE CHANGE

- TRAVEL COMPANIES

- ASIA PACIFIC

- MIDDLE EAST

- NORTH AMERICA

- PHILIPPINES

- BANYAN TREE

- NORWEGIAN CRUISE LINE

- PANDAW CRUISES

- PRINCESS CRUISES

- ROYAL CLIFF

- THAI AIRWAYS

- TRAVEL DEALS

WTTC sings the praise of AI

Vietnam Airlines increases Dien Bien flights

Oceania cruises sells 2025-2026 sailings, airasia revives bkk-hdy service, thai vietjet presents family power pack.

Philippines over the moon with ITB sales

Community-based tourism goes to market

Langkawi: A cracking beach deal for summer

Emirates rejigs commercial teams

Thai Vietjet makes Songkran fare splash

Emirates bargains up for grabs

India’s Vistara launches Points Fest

Emirates rolls out fare bargains

AirAsia launches FREE Seats campaign

Early bookers catch cheap fares

International buyers splurge on Phuket homes

Skyscanner reveals 2024 travel outlook

American Express reveals 2024 travel trends

Portugal leads the World’s top beaches

Smog and dams a threat to tourism?

Sailing on calmer waters

Is the global travel industry isolating Russia?

Will China reopen outbound travel soon?

Agoda clarifies reviewer privacy rules

Myanmar tourism growth rate soars

YANGON, 12 February 2020: Myanmar scored the highest spike in tourist arrivals among the world’s 10 fastest-growing travel destinations in 2019, according to the United Nations World Tourism Organisation.

Based on tourist arrival growth rates, Myanmar topped the ranking list with a year-on-year increase of 40.2% in 2019, followed by Puerto Rico (31.2%) and Iran (27.9%).

“This is good news for Myanmar, and we need to keep this momentum going for many more years,” said Myanmar Tourism Marketing chairperson, May Myat Mon Win

The Myanmar government has introduced new regulations to facilitate easier access for tourists to visit the country. Japan, South Korea, Hong Kong, Macau and some Southeast Asian countries were granted visa-free entry.

Indian, Chinese nationals from the mainland and other countries (Australia, Austria, Czech Republic, Germany, Hungary, Italy, Luxembourg, New Zealand, Russia, Spain and Switzerland) were granted a visa on arrival.

Citizens of over 100 countries are eligible for Myanmar e-visas (evisa.moip.gov.mm/) and can get an approval letter within three days.

Travel from China is on hold due to the suspension of tour package sales in China and the cancellation of airline services in a bid to counter the coronavirus outbreak across Asia.

To keep up the momentum of tourist arrivals rise and win back business interrupted by the virus crisis, Myanmar Tourism Marketing will launch its “Green Season” campaign (May to the end of September) with the support of hotels, airlines and tour operators.

UNWTO’s top-10 fastest-growing travel destinations

1. Myanmar 40.2% 2. Puerto Rico 31.2% 3. Iran 27.9% 4. Uzbekistan 27.3% 5. Montenegro 21.4% 6. Egypt 21.1% 7. Vietnam 16.2% 8. Philippines 15.1% 9. Maldives 14.9% 10. Bahamas 14.6%

RELATED ARTICLES

Tourist taxes in europe on the rise, phuket one°15 marina expands.

About the MTSRR

The impact of COVID-19 is not just about GDP or the economy: it is about our lives and livelihoods. The overriding imperative of our government is to safeguard people’s lives and to safeguard their livelihoods by prioritising health and by supporting our people and businesses affected by lockdowns and loss of income.

Mission for Recovery

To provide a response to COVID-19 aligned with UNWTO guidelines, based on the Myanmar Tourism Master Plan, for Recovery and Future Development of a Sustainable and Inclusive Tourism Sector in Myanmar.

Goals for Recovery

- Immediate – Restore confidence to boost and restart the domestic industry

- Medium Term – Rebuild Visitor Demand and Improve Product Offerings

- Long term – Develop a more resilient, balanced, responsible, and sustainable tourism sector

Strategies & Actions

The MTSRR provides a series of Strategies and specific Actions in order to achieve Immediate, Medium, and Long-Term Goals. There are a total of 18 Strategies, which are divided into 80 specific Actions. The Strategies and Actions are not static and will be constantly reviewed and changed, the uncertainties around COVID-19 are a reality of the need for constant change and review.

Immediate Strategy: Restore confidence to boost and restart the domestic tourism sector

- Enhance health and safety protocols to generate trust in Myanmar as a safe destination

- Continue economic support to MSMEs and individuals in the tourism sector

- Reassure and inspire the public to travel again and explore new experiences

- Re-align tourism destinations to “the new normal”

- Develop Human Resource Capacity and strengthen skills and knowledge for the new normal

Medium-Term Strategy: Rebuild Visitor Demand and Improve Product Offerings

- Establish Myanmar as a trusted and safe destination

- Position Myanmar in the heart and minds of International travellers

- Diversify the tourism product base, improve quality and strengthen protected areas

- Support MSMEs through digitisation, tourism investments and technical assistance

- Set national tourism standards, ensure access to learning and create new tourism jobs

- Develop destination management strategies, standards and guidelines for DMOs

Long-Term Strategy: Develop a resilient, balanced, responsible, and sustainable tourism sector

- Establish A Smart Tourism Ecosystem and digital infrastructure

- Establish a “Myanmar Tourism Board” for coordination of Marketing & Communication activities

- Strengthen tourism human capital by establishing pathways to higher education and by updating the national HRD Strategy

- Improve tourism connectivity and accessibility

- Ensure destination management is inclusive and in consultation with local stakeholders

- Invest in developing and expanding the scope of Inclusive and Community-Based Tourism

- Safeguard tourism resources and prevent negative impacts on social and natural environment

Source: https://www.myanmore.com/2021/01/myanmar-tourism-strategic-recovery-roadmap/

How to create world-class tourism village from isolated community: Oxalis Adventure CEO explains

Mekong Tourism Newsletter – April 2024 Issue

Follow Us on Social Media

Subscribe Newsletter

Follow Us On Social Media

© Mekongtourism.org 2024, All Rights Reserved. Privacy Policy I Terms & Conditions

- Mekong Tourism Coordinating Office (MTCO)

- GMS Member Countries

- MTCO Activities

- GMS Tourism Minister Meetings Member Countries

- GMS Tourism Working Group Meetings

- MTCO Publications

- Partners & Supporters

- About Mekong Tourism Forum 2024

- Destination

- Registration

- Mekong Travel Tips

- Travel News

- Press Releases

- Mekong Voices

- Mekong’s Hidden Gems

- Mekong’s Community Charm

- Mekong’s Easy Getaway

- Interactive Mekong Map

- Tourism Performance

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Tourism Industry and Economy: A Comparative Analysis of Myanmar with Thailand and Cambodia

2023, Aeint Thiri Wai

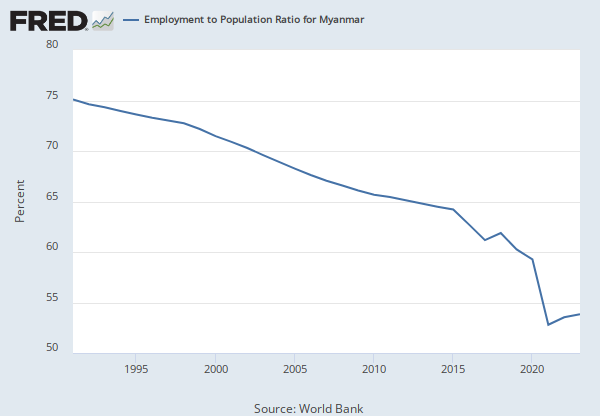

In Among the ASEAN nations, Myanmar is the second-largest country in terms of size, natural resource abundance, cultural heritage, and variety of tourist attractions. Myanmar's tourism industry is experiencing a recent surge in growth and has been designated as a priority sector in the government's "export strategy." This study aims to explore which points are main contributors to Myanmar’s tourism industry and what are the barriers for development by comparing analysis with its counterparts in Thailand and Cambodia, utilizing secondary data from 2010 to 2019 through descriptive method. In the study, various factors were using to analyze such as visa issuance, port of entry, tourist arrival numbers and regions, tourism revenue per capita, GDP contribution, and employment opportunities. The results indicate that Myanmar's tourism industry is in its early stages and requires further development of its infrastructure and services, a more relaxed visa policy, and more effective promotion to attract higher numbers of visitors and generate greater revenue for the country. KEY WORDS: Myanmar, Thailand, Cambodia, Tourism, Visa, GDP, Employment

Related Papers

Frank Janmaat

Report written for the Ministry of Tourism and the Myanmar Tourism Committee in 2011.

When Myanmar began opening its door to the outside world, most tourists became keen to visit and see Myanmar since 2010s. This research will focus on workable strategy development of Myanmar tourism GDP as other popular neighboring countries. The total contribution of Travel & Tourism to GDP was MMK 6,468.9bn (USD 4,918.2mn), 6.6% of GDP in 2017, and the forecast to rise by 5.4% in 2018. Moreover, in 2017 Travel & Tourism directly supported 570,000 jobs (2.5% of total employment). The research methodology is desk review of country tourism GDP related success and challenges as well as field interview to tourism key stakeholders like hotel, restaurant, visitors/tourists, and local community. These research recommendations advised ten strategies to survive and thrive of Myanmar Tourism GDP with more profitable Win-Win status of tourists/visitors and tourism stakeholders through community-based tourism inspirations.

Naw Thiri Han

Myat Chaw Su Thet

European Journal of Business and Management

Sauwanee Rodyu

The tourism industry is a very important part of the Thai economy. The purpose of this study was to investigate the potential of Thai tourism and to analyze the competitive advantage of Thai tourism with Chinese tourists compared to other ASEAN + 6 countries except China from 2000 to 2015. The investigation of the competitive advantage of Thai tourism with Chinese tourists compared to other ASEAN + 6 countries except China was analyzed by the Revealed Comparative Advantage a methodology. The result of the study demonstrated that Vietnam had the greatest RCA with the Chinese tourists followed by Korea, Laos, Japan, Thailand, Australia, Singapore, Cambodia, New Zealand, The Philippines, Myanmar, Brunei, Malaysia, Indonesia, and India. Firstly, Vietnam, Korea, Laos, Japan, and Thailand have tourism competitiveness with Chinese tourists throughout the whole period of study. The largest RCA for Vietnam, Korea, Laos, Japan, and Thailand were 9.68, 12.69, 6.97, 4.35, and 4.62 in 2000, 2013...

woko suparwoko

This chapter discusses the growth of tourism internationally and in Southeast Asia as well as the constraints on further development. The chapter will also examine the various roles of international, regional and national tourism industry in the region. In the global context, international tourism covers major markets including the world-regions of America, Europe, Africa, the Middle East, and the Asia Pacific. Critical indicators of international tourism growth are tourist arrivals and revenues. The constraints on tourism include terrorism- and other security-related issues, health issues such as SARS1 and Indonesia‟s economic, political and security crisis. These issues will be examined in the context of their impact on local communities, particularly in the three case study areas of Bali, Yogyakarta, and Central Java. The regional tourism development in South East Asia will focus on Indonesia, Malaysia, Thailand and the Philippines and in this comparative context the potential fo...

Elita Zhumabaeva

Vilas B Khandare

Tourism is the second largest foreign exchange earner in India and Thailand. Tourism development has promotes national integration and generate foreign exchange and job opportunities and also promotes the traditional handicraft business. This study is undertaken mainly to study the tourism development in India and Thailand a comparative analysis. The direct contribution of Travel & Tourism is 3.1 percent of World GDP in 2016. The share of direct contribution of Travel and Tourism is 3.3 percent of total GDP of India in 2016. The share of direct contribution of Travel and Tourism to total GDP of Thailand is found to be 9.2 percent in 2016. In 2016 Travel and Tourism directly supported 2,313,500 jobs which contribute 6.1 percent of total employment of Thailand. While, in 2016 Travel and Tourism directly supported 25,394,500 jobs 5.8 percent of total employment of the India. The contribution of travel and tourism to GDP has been increased by compound annual growth rate of 7.42 percent in India and by 9.94 percent in Thailand during the study period. It found that the compound annual growth rates of direct and total contribution of travel and tourism industry to employment of Thailand (5.2 and 5.87 percent) were higher than India (1.75 and 1.79 percent). But, the variations in the growth rates are higher in Thailand than India. The growth rates of total and direct contribution of travel and tourism industry to employment in India were continuously positive during the study period. Keywords: GDP Growth, Tourism Development, Tourism Industry, India, Thailand.

International Journal of Tourism Research

Larry Dwyer

RELATED PAPERS

Setyo Aji I M A M Maliki

Omolara Duke

Archival Outlook

Kayla Harris

International Journal of Astrobiology

Joni Marie Clark Cunningham

Antonia Machado

Ruben Willems

Paramasivan Perumal

Jurnal Pertahanan: Media Informasi ttg Kajian & Strategi Pertahanan yang Mengedepankan Identity, Nasionalism & Integrity

Eko G Samudro

International Journal of Bifurcation and Chaos

Donald Dichmann

Journal of Instrumentation

Pieter Jacques

Journal of Occupational and Environmental Hygiene

David MCKINNEY

The Idaho Archaeologist

Cameron R Hogin

Clinical and translational allergy

Polsko-czeskie i polsko-słowackie kontakty filmowe

Joanna Wojnicka

Journal of Materials Chemistry A

Jianjun Song

Sartini Sartini

Journal of Business Strategies

Kenneth York

Revista Med

ZULMA CONSUELO URREGO MENDOZA

percetakan buku bogor

SIGART newsletter

Angelo Monfroglio

keisha allifa

Physical Review X

Tamás Rozgonyi

Gastroia: Journal of Gastronomy And Travel Research

bayram şahin

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Tourism: COVID-19, then a coup de grace

- November 15, 2022

A booming tourism industry was one of Myanmar’s great success stories after 2011, but big talk from the junta is unlikely to aid the recovery of a sector ravaged by COVID-19 and the military coup.

By FRONTIER

On October 12, three women from Yangon were reportedly killed during a pilgrimage to the famed Kyaiktiyo “Golden Rock” Pagoda in Mon State’s Kyaikto Township during a clash between the Myanmar military and anti-junta forces.

The violence was the latest blow to Myanmar’s floundering tourism industry, which was rocked by COVID-19 and then the 2021 military coup overthrowing the elected National League for Democracy government.

“Due to the current political instability, prospective travellers are concerned for their safety, citing the incident at Kyaiktiyo Hill,” said U Naung Naung Han, chair of the Union of Myanmar Tourism Association, a private body that maintains a good relationship with the junta. But even this relationship did not stop Naung Naung Han from speaking frankly about the bleak outlook for Myanmar’s tourism industry.

While the Kyaiktiyo victims were domestic tourists, he said some foreign travellers, mostly from Thailand, cancelled tours after the incident. Official figures in 2019 show Thailand accounted for more than 273,000 foreign visitors to Myanmar, second only to China with nearly 750,000.

Multiple attempts to entice Thai tourists have so far fallen flat. In cooperation with the junta, Thailand’s Channel 5, owned by the Thai Army, produced a documentary promoting travel to the ancient capital of Bagan, a UNESCO World Heritage site in Mandalay Region.

The UMTA had also been heavily promoting Yangon-Bago-Kyaiktiyo packages, also popular with Thai tourists, visiting other major Buddhist sites, like Shwedagon Pagoda in Yangon and Shwemawdaw Pagoda in Bago.

“But even this simple trip has not been successful; [foreign tourists] dare not come anymore,” Naung Naung Han told Frontier on October 18.

And Golden Rock is not the only tourist destination under fire.

On October 24, the military allegedly torched villages and killed civilians in Sagaing Region’s Wetlet Township near the Hanlin Pyu Ancient City, a UNESCO World Heritage site. Meanwhile, fighting between the Arakan Army and the military has recently restarted in the historical Arakan capital Mrauk-U, home to unique Buddhist temples of stone built hundreds of years ago.

Temples of gloom

Residents of Bagan said that, although tourism numbers were up slightly on last year, the overall slump had negatively impacted regional living standards, and that authorities had begun to neglect the town’s famous pagodas.

Local businesspeople who had seen their incomes rise in step with Myanmar’s tourism boom told Frontier that they were now struggling to make ends meet.

“I work here as a taxi and horse-cart driver, mainly for foreigners. There are now far less foreigners coming to Bagan – it’s almost like nobody’s come here for the whole year. Of course, my income is down,” said driver Ko Myo*.

Before COVID-19 and the coup, these drivers could typically earn K400,000 a month (US$300 at the pre-coup exchange rate), but now they struggle to make K100,000 ($35 at the current exchange rate), he said.

The loss of tourism income has knock-on effects to other industries, and farmers have been especially hard hit by the absence of visitors. Some have been left with no option but to sell their land .

“In Bagan we’re still a long way from recovering to pre-COVID-19 levels,” said Ko Si Thu*, who provides car and scooter rentals and bullock cart tours to Bagan’s tourists. “Everyone who depends on tourism has been affected – when business is good for hotels and restaurants, it’s also good for farmers and and other merchants.”

A woman who produces poneyaygyi, a regional condiment made of fermented beans which is popular with visitors, said that her sales had fallen by 40 percent since the pandemic, and that she now relies almost entirely on the wholesale market to turn a profit.

U Thet Lwin Toe, managing director of Myanmar Voyages International Tourism Co Ltd, said the raging conflict in other states and regions would put off tourism for the foreseeable future.

“Sagaing, Kachin and Rakhine cannot be considered as tourist destinations; it is too dangerous to go there now. Even Yangon and Mandalay are not entirely safe to visit, and even domestic travellers have to take great care. For foreign tourists, it is out of the question,” he said.

Naung Naung Han said that although the military had not officially banned travel to areas affected by fighting, tourism companies were avoiding trips to Sagaing and Magway regions and Kayah State.

The most popular destinations for domestic travellers have been locations where they feel safe, such as the beach resorts on the Bay of Bengal at Chaung Tha and Ngwe Saung in Ayeyarwady Region and Ngapali in southern Rakhine State, and Bagan, Mandalay, Pyin Oo Lwin and Taunggyi.

“Domestic tourism only compensates for about 3pc of what’s lost with the decline in international tourism. The only time people are really travelling is on national holidays, whereas before you’d see elevated levels of tourism for most of the month surrounding important calendar events,” a foreign travel specialist familiar with the Myanmar market told Frontier .

Boom and bust

Myanmar’s tourism industry boomed after the transition to democracy began in 2011 but Naung Naung Han said the country would be lucky to attract 1pc of the 4.3 million tourists that visited in 2019.

Official figures showed that international passenger volumes more than tripled between 2010 and 2015, from 1 million to more than 3.4 million, and the number of foreign airlines serving the country rose from 13 to 28. During the same period, the number of domestic travellers jumped from 1.2 million to 4.6 million.

“2012 to 2016 were the real growth years, but afterwards the NLD administration put in a number of measures that further improved the sector,” said the foreign travel expert

“Not only were roads and airports improved, but hotels and guesthouses were renovated and improvements to internet connectivity, payments systems and visa regulations made the country more accessible to visitors.”

The steady growth in foreign tourists slowed amid international outcry over the military’s brutal crackdowns on the Rohingya Muslims in 2017, with arrivals in 2018 at just over 3.5 million, up only about 100,000 on the previous year.

Shunned by the West for its refusal to condemn the atrocities, the NLD turned to its neighbours, easing visa restrictions for visitors from China, Japan, South Korea and India – statistics from Yangon International Airport show that in 2019 and 2020, over 70pc of arrivals were from Asian countries.

But Myanmar was not exempt from the devastation of the COVID-19 pandemic; in 2020, arrivals slumped to 900,000, and slid further to 130,000 in 2021, with most coming on business visas.

“In the whole year of 2021, tourist arrivals constituted almost zero percent of total arrivals. The number of incoming foreign travellers was only a few thousand, but they were all business travellers,” said Naung Naung Han. “We can only expect some visitors in the first quarter of 2023.”

Failed pivot to Russia and China

According to state-run Myanma Alin, in September junta leader Min Aung Hlaing claimed the reopening of international commercial flights in April 17 was followed by signs of recovery in the tourism sector and called on the industry to prepare accordingly.

The junta likely wants to boost tourism both as a source of income – figures released by the NLD government showed that Myanmar earned US$2.8 billion from tourism in 2019 – and in order to portray the country as stable.

But with the regime increasingly isolated, it has been scrambling to reinvent Myanmar as a destination for Russian tourists, while also continuing to appeal to the Chinese. Moscow and Beijing are two of the only governments continuing to support the junta.

The junta’s tourism minister Dr Htay Aung admitted at an October workshop in Yangon, also covered by Myanma Alin, that the arrival of Chinese tourists would depend on Beijing relaxing its “zero” COVID-19 policy and allowing citizens to holiday abroad. Later that day, he said visa free travel had been extended to Russian tourists.

But Thet Lwin Toe, from Myanmar Voyages, said so far only Russian business travellers had come to Myanmar.

“Russian tourists typically want to visit a happy country, with good access to the beach – like Thailand. They just aren’t coming to Myanmar – and I can’t see busloads of Russians wanting to take a 6-hour trip from Yangon to Ngwe Saung beach [in Ayeyarwady Region],” the foreign travel specialist said.

Naung Naung Han said the absence of direct air links between Russia and Myanmar is another obstacle. Yangon Aerodrome Company figures show that there were only 1,486 Russian arrivals to Yangon International Airport over the first six months of 2020.

Frontier tried repeatedly to call U Hlaing Oo, director-general of the junta’s Ministry of Hotels and Tourism, but he did not answer his phone.

Naung Naung Han said the tourism industry is also facing a cash crunch. Western sanctions, limited resources due to the devastation of COVID-19 and a lack of support from the junta have combined to further hobble the sector.

“Because of sanctions, tourists cannot transfer their money to Myanmar and only a few will think about coming. We cannot make arrangements for the trips if we do not receive money in advance; it is just not possible to do it with our money. The flow of money must be smooth in the first place to support a recovery of the tourism industry,” he said.

He said the Myanmar Tourism Entrepreneurs’ Association proposed that the junta fund a promotional documentary featuring top destinations to screen in foreign countries.

“If the government can implement this plan, it will create greater awareness about what Myanmar has to offer as a destination and would benefit the tourism sector,” he said.

But he said the junta’s outward messages of support for the industry had so far not been met with any significant investment or support.

The foreign tourism expert said the industry’s problems run much deeper than a lack of support from the military.

“Who wants to visit Myanmar at the moment?” they asked. “There are still obligatory COVID-19 tests with the threat of a five-day quarantine, and Western government travel advice puts Myanmar in the red or orange category, affecting the price of insurance… The Asian tourist market, which makes up the bulk of Myanmar’s visitors, is also known to be very sensitive to security risks.”

For now, the industry remains on life support, with grassroots tour operators suffering the most.

“My income’s fallen so much that I can just about afford to eat,” said Si Thu in Bagan. “There’s nothing left for other expenses.”

*denotes use of a pseudonym on request for safety reasons

More stories

Video: A fading dream of return for Myanmar migrant families

Related stories.

CDM medics still trying to provide health services despite high risks

Unwanted in Malaysia, Myanmar migrants live in fear

Religious communities overcome displacement, destruction

Latest issue.

Volume 6, Issue 18

- January 27, 2021

Myanmar enters 2021 with more friends than foes

Will the kayin bgf go quietly, become a frontier member.

Support our independent journalism and get exclusive behind-the-scenes content and analysis

Get exclusive daily updates

Stay on top of Myanmar current affairs with our Daily Briefing and Media Monitor newsletters.

Join the community

Sign up for our Frontier Fridays newsletter. It’s a free weekly round-up featuring the most important events shaping Myanmar

© 2024 Frontier Myanmar

This post is also available in: English

Federal Reserve Economic Data: Your trusted data source since 1991

Your trusted data source since 1991.

Gross national income for myanmar (nygnpmktpcdmmr).

Observation:

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

- Page short URL

- Embed in website

- Image short URL

- Add to data list

- Get email notification

Units: Current U.S. Dollars , Not Seasonally Adjusted

Frequency: Annual

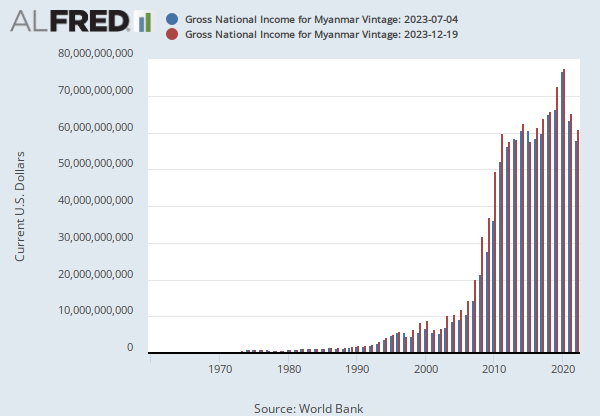

GNI (formerly GNP) is the sum of value added by all resident producers plus any product taxes (less subsidies) not included in the valuation of output plus net receipts of primary income (compensation of employees and property income) from abroad. Data are in current U.S. dollars. Source Code: NY.GNP.MKTP.CD

Suggested Citation:

World Bank, Gross National Income for Myanmar [NYGNPMKTPCDMMR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NYGNPMKTPCDMMR, April 20, 2024.

RELEASE TABLES

Related data and content, data suggestions based on your search.

Content Suggestions

Related Categories

Permalink/embed, subscribe to the fred newsletter.

- Get involved

Middle class disappearing and poverty deepening in Myanmar

UNDP's report points to a disappearing middle class amidst deepening poverty, with vulnerable populations, particularly women and children, hardest hit. Urges immediate international support to Myanmar households

April 11, 2024

The report underscores an urgent need for international support tailored to the specific needs of various communities, in both urban and rural areas across all parts of the country.

New York – Myanmar's middle class has shrunk by 50 percent over the past three years, coupled with a surge in poverty, amidst widespread insecurity and conflict, as well as a dire economic crisis, according to a new report released today by the United Nations Development Programme (UNDP).

The report, titled "Poverty and the Household Economy of Myanmar: A Disappearing Middle Class" , reveals the profound impact of ongoing challenges exacerbated since the military takeover in February 2021. Seventy-six (76) percent of the population lives below or perilously close to a subsistence existence and poverty rates have almost doubled from 24.8 percent in 2017 to 49.7 percent in 2023, while foreign direct investments have plummeted.

The protracted recession has taken a heavy toll across Myanmar's economy, which is yet to recover in any significant way since the severe contraction of - 17.9 percent in GDP in 2021. A middle class that can buffer shocks and help a country recover faster, is rapidly eroding, with a fall back into poverty. The report estimates that $4 billion per year would now be required to effectively address this swell of poverty, via cash transfers and other means.

“The new data show that less than 25% of the population in Myanmar manage to secure steady incomes to live above the poverty line. Without immediate interventions to provide cash transfers, food security and access to basic services, vulnerability will keep growing, and impacts will be felt across generations” said UNDP Administrator Achim Steiner. “We call on all stakeholders - inside and outside Myanmar - to take action and preserve vulnerable households from slipping into irreversible poverty and despair” he added.

The report polled over 12,000 households across Myanmar, one of the largest nationwide surveys conducted in recent years, finding that most families and households have been forced to resort to various, often unsustainable, coping mechanisms like cutting healthcare and education expenses, depleting savings, borrowing, and eating less.

The brunt of the crisis disproportionately falls on women, children, and people living in conflict areas. The data shows an increasing feminization of poverty, where women-headed households are 1.2 times more likely than male-headed households to live in poverty. Rising poverty and education costs have forced low-income households to allot just two percent of their resources towards schooling. With over half of Myanmar’s children living below the poverty line, the crisis poses a threat to the country’s future brain trust and impacting on capabilities for generations.

The report points to a middle class hanging by a thread. Once the driver of Myanmar’s rise as one of the fastest-emerging economies in the Asia-Pacific region, it is being eroded by stagnant wages, limited mobility and deteriorating labour market conditions. For half of the households surveyed, the situation has been compounded by the loss of secondary incomes – an economic lifeline that allowed many families to maintain their socioeconomic status. Moreover, the crowding out of investments in human capital, such as in health and education, undermines future generations. Money for basic needs to simply survive, takes precedence.

Internal regional disparities further exacerbate Myanmar's crisis. Conflict-ridden areas show heightened poverty levels attributed to factors such as the destruction of homes, restricted access to farmlands, and an increase in internally displaced populations, all leading to deepening instability and economic hardship. The states with the highest rates of non-secondary income – Kayah (67%), Chin (63%), and Sagaing (57%) – which are also experiencing high levels of conflict, report the lowest income per capita.

Moreover, poverty is now spreading into urban areas, affecting once-affluent areas such as Yangon and Mandalay. Even the relatively well-off are struggling, with 75 percent resorting to negative coping mechanisms. The report underscores an urgent need for international support tailored to the specific needs of various communities, in both urban and rural areas across all parts of the country. “This alarming data and voices represented here, shows how widespread the combined impact of the conflict and economic crisis is; and hence that support needs to reach all vulnerable communities wherever they are”, Kanni Wignaraja, UNDP Regional Director for Asia and the Pacific affirmed, emphasizing that “localized, area-based programmes that are designed for specific micro contexts can go a long way to help the people of Myanmar.”

Link to the report

Media contacts

For more information or to request an interview, contact:

In New York City: [email protected] (+1 631 464 86 17)

In Bangkok: [email protected] (+66 2 304 9100)

DATA POINTS:

- Poverty headcount as a percentage of the population has doubled from 2017 to 2023, from 24.8% to 49.7%, almost half of the population. An additional 25% of the population are hanging by a thread.

- Only the top 20% of the population as measured by assets, reported a higher income per capita. However, this income remains well below what would be required for a middle-class standard of living.

- More people, over 76% of the population, are falling into poverty or facing subsistence insecurity.

- Half of all households lack a secondary income source. Women-headed households are 1.2 times more likely to live in poverty compared to households headed by men, as indicated by regression models.

- Foreign Direct Investment (FDI) commitments dropped below USD 2 billion in 2021, compared to levels exceeding USD 5 billion in 2017. Despite a slight recovery in 2022-23, average annual FDI commitments remain significantly lower than in previous years.

- Kayah State recorded the highest percentage of households experiencing income declines at 50%. Sagaing, Tanintharyi, and Rakhine also saw significant drops, with 40%, 37%, and 36% of households affected, respectively.

Related content

Press Releases

Un reports staggering us$ 402.9 million in recovery needs following last year’s earthquakes in herat, afghanistan.

The PDNA emphasizes the critical need to transition from immediate humanitarian aid to long-term recovery. Recovery strategies should prioritize building communit...

Afghanistan's recovery hinges on international assistance, reviving productive sectors and reinstating women's rights

The report, titled “Two Years in Review: Changes in Afghan Economy, Households and Cross Cutting Sectors”, shows that the Afghan economy has not recovered from th...

Thanks to European Union assistance to Moldova’s efforts on an energy transition, residents of four blocks of flats in Chișinău will pay up to 30% less for heating

Four hundred and forty-five families in four blocks of flats in Chișinău, the Republic of Moldova, will pay up to 30% less for heating, after changing the heating...

Sweden contributes $9.63 million to Moldova’s Energy Vulnerability Reduction Fund

Sweden is contributing $US9.63 million to Moldova's Energy Vulnerability Reduction Fund (EVRF), through an agreement with the United Nations Development Programme...

For Asia-Pacific, climate change poses an ‘existential threat’ of extreme weather, worsening poverty and risks to public health, says UNDP report

Climate change poses a ‘profound existential threat’ for Asia and the Pacific, with the potential to disrupt decades of progress and burden future generations wit...

Content Search

Myanmar population living below the poverty line – 2023 est., attachments.

Nearly half country below poverty line In the past six years the est. percentage of population living below the national poverty line, set at 1,590 MMK/Day (approx. 0.75 USD/Day), almost doubled, from the 24.8% of 2017 to the 49.7% of 2023, nearly half of Myanmar’s population (UNDP, 2024). In the same period, reduced labor productivity, lack of labor demand and high inflation, caused workers' earnings to decline by 15 percent in real terms (World Bank Myanmar Economic Monitor). As result of the combination of these factors, the estimated national median income per capita in 2023 was only 75,000 MMK per month (approx. 35 USD), which in rural areas is further reduced of an average 24%

Related Content

Myanmar : l'onu tire la sonnette d'alarme face à la montée des tensions dans l'état de rakhine, myanmar: türk sounds alarm amid rising tensions in rakhine, how a near-total absence of humanitarian access is impacting lives in myanmar, mergui-tavoy district short update: forced recruitment of villagers by an sac-affiliated militia causing displacement in ler k’saw township (december 2023 to march 2024) [en/karen/my].

IMAGES

VIDEO

COMMENTS

Myanmar's Tourism Revenue data is updated yearly, available from Dec 2006 to Dec 2022. The data reached an all-time high of 2,819 USD mn in Dec 2019 and a record low of 30 USD mn in Dec 2021. The Ministry of Hotel and Tourism provides annual Tourism Revenue in USD. ... BoP: CA: Primary Income: Payments (USD mn) 670.100 Mar 2023: quarterly Mar ...

Learn about Myanmar's tourism income, tourism destinations entrance fees, visa formalities and data about tourist arrivals in this booklet. Download. Myanmar Tourism Statistics 2009. Quick facts about Myanmar's climate, foreign currency exchange, business hours and climate can be found in this pamphlet.

Myanmar Tourism Income: Total Earning data is updated yearly, averaging 426.500 USD mn from Dec 2006 to 2017, with 12 observations. The data reached an all-time high of 2.197 USD bn in 2016 and a record low of 164.000 USD mn in 2006. Myanmar Tourism Income: Total Earning data remains active status in CEIC and is reported by Ministry of Hotels ...

Myanmar tourism statistics for 2017 was 1,988,000,000.00, a 13.15% decline from 2016. Myanmar tourism statistics for 2016 was 2,289,000,000.00, a 4.09% increase from 2015. Download Historical Data Save as Image. Data Source: World Bank MLA Citation: Similar Country Ranking; Country Name Spending ($)

Myanmar Tourism Revenue grew 724.1 % YoY in Dec 2022, compared with a decrease of -94.4 % YoY in the previous year. Myanmar Tourism Revenue Growth rate data is updated yearly, available from Dec 2007 to Dec 2022. The data reached an all-time high of 724.1 % in Dec 2022 and a record low of -94.4 % in Dec 2021.

this Master Plan is to maximize tourism's contribution to national employment and income generation while ensuring that the social and economic benefits of tourism are distributed equitably. In this sense, this Master Plan will be used as a roadmap to shape the future of tourism in Myanmar.

The Myanmar Tourism Master Plan 2013-20 is diversifying the sector, while also ensuring that initiatives are implemented in a way that preserves and respects the country's culture and natural beauty. ... it is unsurprising that almost half of the growth in tourist numbers was in departures from low- and middle-income countries, which ...

The Travel & Tourism market in in Myanmar is projected to grow by 4.56% (2024-2028) resulting in a market volume of US$691.90m in 2028.

Introduction. The Myanmar Tourism Master Plan 2013-20 aims to increase tourism employment and income that is distributed in a way that maximises benefits. It was followed by the Myanmar Tourism Strategic Recovery Roadmap 2021-25, which continues the earlier master plan but also proposes a devolution of tourism planning to regional centres, the enhancement of existing destinations and products ...

Tourism in Myanmar (also known as Burma) is a developing sector. As at 2023, new tourist visa applications resume. [1] Although Myanmar possesses tourist potential, much of the industry remains to be developed. The number of visitors to Burma is small compared to its neighbouring countries.

Myanmar. Travel & Tourism is a truly global economic activity - one which takes place in destinations across the world, from leading capital cities and smaller towns and villages in rural and coastal areas, to some of the remotest points on the planet. It is one of the world's largest industries, or economic sectors, contributing trillions of dollars annually to the global economy ...

Find out more about Myanmar's tourism income, types of tourists, climate, population and religion in this brochure of statistics. Download Guide. Myanmar Tourism Statistics Year 2005. Learn about Myanmar's visa formalities, licenced tour companies and guide, types of tourist and their nationality in this booklet.

Tourism is one of the most important income generators for countries. The world travel and tourism council reported that the travel and tourism (T&T) sector contributed 10.4 % of global GDP and ...

travel and tourism. While international tourist arrival increased compared to FY2021, this was well below the pre-pandemic level. Inflation reached 16.0% in FY2022 (Figure 2.27.2). The causes were steep depreciation of the Myanmar kyat, high international commodity prices, and supply distortions throughout FY2022. Average food prices

6.6 (%) in 2017. The share of Travel & Tourism spending or employment in the equivalent economy-wide concept in the published national income accounts or labour market statistics. Visitor exports are compared with exports of all goods and services Domestic Travel & Tourism spending is compared with GDP Government individual Travel & Tourism spending is compared with total government spending ...

The data reached an all-time high of 2.197 USD bn in 2016 and a record low of 164.000 USD mn in 2006. Tourism Income: Total Earning data remains active status in CEIC and is reported by Ministry of Hotels and Tourism. The data is categorized under Global Database's Myanmar - Table MM.Q003: Tourism Statistic. Last.

YANGON, 12 February 2020: Myanmar scored the highest spike in tourist arrivals among the world's 10 fastest-growing travel destinations in 2019, according to the United Nations World Tourism Organisation. Based on tourist arrival growth rates, Myanmar topped the ranking list with a year-on-year increase of 40.2% in 2019, followed by Puerto Rico (31.2%) and Iran […]

Myanmar Government has now issued its Myanmar Tourism Strategic Recovery Roadmap (MTSRR).Based on the previous Tourism Master Plan (2013-2020), the MTSRR is a response to COVID-19 and aligned with UNWTO Global Guidelines to Restart Tourism.The Roadmap will integrate and expand the new six-pillar Tourism Master Plan outline, and all State and Regional Tourism Committees (RTCs) will develop ...

The economy of Myanmar is the seventh largest in Southeast Asia. After the return of civilian rule in 2011, ... of Hotels and Tourism Major-General Saw Lwin admitted that the government receives a significant percentage of the income of private sector tourism services. In addition, only a very small minority of impoverished people in Burma ...

This research will focus on workable strategy development of Myanmar tourism GDP as other popular neighboring countries. The. ... by researcher (Oct 2018) in Bagan As in table 1 shown, 69% of tourism business sector is strongly agreed that more income earned by tourism. But, it needs to improve Government policy and more assistance to support ...

Though Myanmar contribution of travel and tourism to GDP (% of GDP) fluctuated substantially in recent years, it tended to increase through 2000 - 2019 period ending at 6.7 % in 2019. The share of Travel & Tourism spending or employment in the equivalent economy-wide concept in the published national income accounts or labour market statistics.

Build the Image, Position, and Brand of Tourism Myanmar"① 3.2.2 Institution The crucial institution mandated with the "Myanmar Tourism Master Plan (the Master Plan)" was the Ministry of Hotels and Tourism, which outlined "ways for tourism development, including goals, strategic programs, priority projects, and activities, in a long ...

A booming tourism industry was one of Myanmar's great success stories after 2011, but big talk from the junta is unlikely to aid the recovery of a sector ravaged by COVID-19 and the military coup. ... The junta likely wants to boost tourism both as a source of income - figures released by the NLD government showed that Myanmar earned US$2.8 ...

Graph and download economic data for Gross National Income for Myanmar (NYGNPMKTPCDMMR) from 1960 to 2022 about Myanmar, GNI, and income.

New York - Myanmar's middle class has shrunk by 50 percent over the past three years, coupled with a surge in poverty, amidst widespread insecurity and conflict, as well as a dire economic crisis, according to a new report released today by the United Nations Development Programme (UNDP). The report, titled "Poverty and the Household Economy of Myanmar: A Disappearing Middle Class", reveals ...

17 Apr 2024. Download Map (PDF | 629.9 KB) Nearly half country below poverty line In the past six years the est. percentage of population living below the national poverty line, set at 1,590 MMK ...