By logging into your account, you agree to our Terms of Use and Privacy Policy , and the use of cookies as described therein.

Platinum airline fee $200 reimbursement reports: UA (2024)

- Type of Card (Personal Plat, Biz Plat)

- Type of Purchase (e.g. TravelBank, baggage fees, etc.)

- Date of Purchase

- Amount of Purchase

- Credit Date and Amount

- Checked baggage fees (including overweight/oversize)

- Itinerary change fees

- Phone reservation fees

- Pet flight fees

- Seat assignment fees (E+)

- In-flight amenity fees (beverages, food, pillows/blankets, headphones)

- In-flight entertainment fees (excluding wireless internet unless it is billed by the airline.)

- Airport lounge day passes & annual memberships

- Onboard WIFI (provided it is billed by the airline.)

Contact Us - Manage Preferences Archive - Advertising - Cookie Policy - Privacy Statement - Terms of Service -

This site is owned, operated, and maintained by MH Sub I, LLC dba Internet Brands. Copyright © 2024 MH Sub I, LLC dba Internet Brands. All rights reserved. Designated trademarks are the property of their respective owners.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Maximize the AmEx Platinum Hotel Credit

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The Platinum Card® from American Express offers cardholders benefits that can cover its $695 annual fee, and many users can come out ahead in value. From lounge access via The American Express Global Lounge Collection to hotel elite status and Membership Rewards points , the perks are solid.

Easy to overlook are the numerous benefits that come with the card for airlines, shopping and entertainment, as well as the card’s travel credits. Those include both a $200 airline fee credit (enrollment required) and a $200 hotel credit when booked through the AmEx portal at participating hotels.

Don’t let the valuable hotel perk go to waste if you have the card (or are considering getting it). Here’s what you need to know about the The Platinum Card® from American Express $200 hotel credit and its Fine Hotels and Resorts (FHR) program. Terms apply.

» Learn more: Benefits of The Platinum Card® from American Express

What is the $200 American Express Platinum hotel credit?

The $200 The Platinum Card® from American Express hotel credit is received in the form of a statement credit. Terms apply.

To use it, cardholders must make an eligible, prepaid (you must pay immediately rather than at the hotel) Fine Hotels and Resorts or The Hotel Collection reservation via the American Express travel portal . Reservations can also be made by contacting the phone number on the back of the credit card.

When booking accommodations from The Hotel Collection, a two-night minimum stay is required. It is available to use once each calendar year, and no enrollment is required.

Once booked, the credit will be refunded to your card within 90 days — although travelers who use it report that it appears much faster.

The $200 FHR American Express credit will still apply if you choose to Pay With Points for your hotel reservation.

Even better, valuable benefits (similar to what hotel elite status members generally receive) for booking Fine Hotels and Resorts hotels are still part of the deal when using the credit. They include:

Noon check-in (based on availability).

4 p.m. late checkout.

Room upgrade (based on availability).

Daily breakfast for two.

Complimentary Wi-Fi.

$100 property credit (varies by hotel for dining, spa and beverages).

This $200 hotel credit benefit is available for U.S. cardholders of The Platinum Card® from American Express , but it is not available to The Business Platinum Card® from American Express cardholders.

How do you book a hotel stay through the AmEx Travel portal?

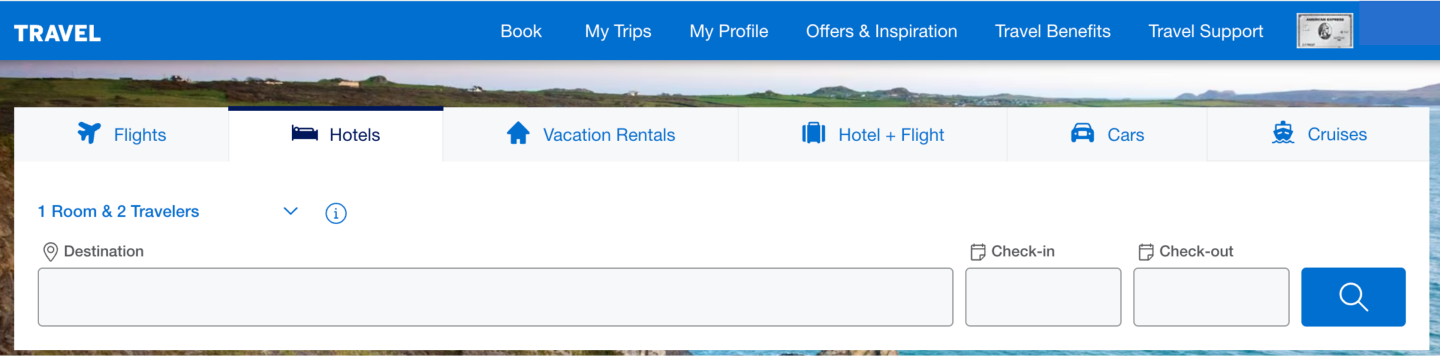

Cardholders can access the AmEx travel portal by logging in to their credit card account or visiting AmexTravel.com directly.

Members can pay with cash or Membership Rewards points to take advantage of the $200 hotel credit and the associated benefits. Paying with points is a convenient feature, but members can often secure more value for their points by transferring to AmEx’s travel partners to redeem for outsized value.

Aer Lingus (1:1 ratio).

AeroMexico (1:1.6 ratio).

Air Canada. (1:1 ratio).

Air France/KLM (1:1 ratio).

ANA (1:1 ratio).

Avianca (1:1 ratio).

British Airways (1:1 ratio).

Cathay Pacific (1:1 ratio)

Delta Air Lines (1:1 ratio).

Emirates (1:1 ratio).

Etihad Airways (1:1 ratio).

Hawaiian Airlines (1:1 ratio).

Iberia Plus (1:1 ratio).

JetBlue Airways (2.5:2 ratio).

Qantas (1:1 ratio).

Qatar Airways (1:1 ratio).

Singapore Airlines (1:1 ratio).

Virgin Atlantic Airways (1:1 ratio).

Choice Hotels (1:1 ratio).

Hilton Hotels & Resorts (1:2 ratio).

Marriott Hotels & Resorts (1:1 ratio).

For details on transfer ratios, see AmEx's website .

While the AmEx travel site has a variety of hotels, you can check the Fine Hotels and Resorts and The Hotel Collection boxes in the sidebar under 'Hotel Programs' to filter for hotels that are eligible for this credit.

When using The Platinum Card® from American Express or The Business Platinum Card® from American Express , members earn 5 points per dollar spent on up to $500,000 when booking prepaid travel through this site (although you won’t earn points on the $200 statement credit). A reminder that The Business Platinum Card® from American Express is not eligible for the FHR hotel credit. Terms apply.

How to get the most value

Stay at unique properties.

It may be wise to use this credit at expensive hotels that are not affiliated with a hotel loyalty program and where you cannot use miles or points to stay. You can shave off some of the cost of the stay while adding value from the perks that come with this card.

» Learn more: 9 awesome FHR options to book

Pay attention to how it affects your elite status

If you do choose to use the credit at a hotel that has a loyalty program , some, but not all, hotels still award points, elite benefits and status-counting nights for a stay booked through the FHR program.

This trade-off might not matter if you aren’t actively pursuing your chosen program's next elite status tier.

» Learn more: The best hotel elite status programs this year

Consider the costs — it may be more expensive, but still worth it

The AmEx Travel portal may not always be the cheapest, so it is wise to compare the cost to book through the portal versus directly with the hotel. The added perks (and $200 hotel credit) can sometimes make an upcharge worth it.

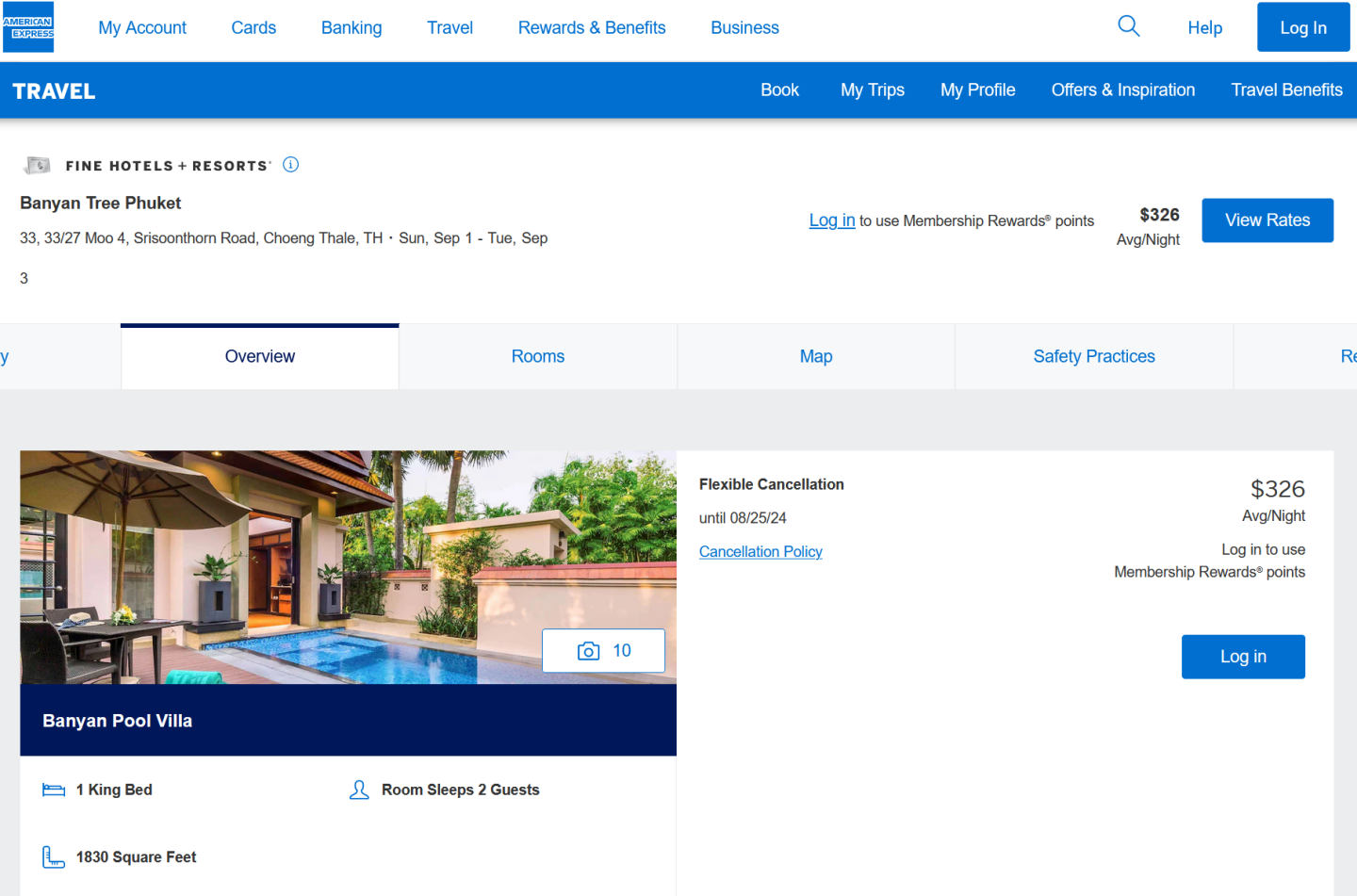

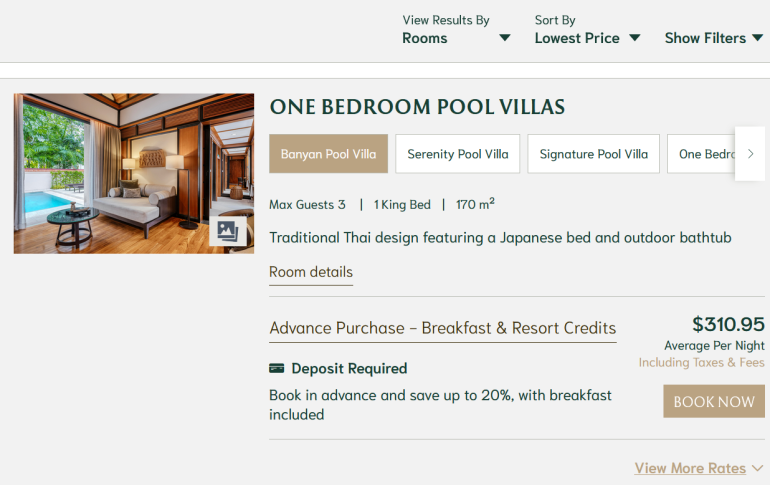

For example, AmEx is charging $326 per night plus eligible perks for a stay at Banyan Tree Phuket booked through the portal.

Meanwhile, the hotel’s website is charging slightly less if booked directly, for $310.95. This rate also includes meaningful perks like breakfast and resort credits.

When booking through the AmEx travel portal is more expensive than the hotel’s website, you should consider whether the $200 hotel credit and any built-in FHR benefits (such as breakfast, early check-in and late checkout) will make up for the extra cost. If not, save the $200 FHR credit for another time.

» Learn more: Best American Express credit cards

Use the entire credit

If the hotel stay is less than the $200 credit, any remaining value can be applied to another reservation within the calendar year. You can track your status for how much has been used after logging into the benefits section of your account. Additional cardholders on the account can also use the credit, but a maximum of $200 per account is available as a credit each year.

If you have not used the benefit before the end of the year, consider booking a reservation for the next year (as long as it posts to your account by Dec. 31 of the current year). The expiration date is for using the credit as payment, not for the actual hotel stay.

If you have to cancel a booking after having received the $200 credit, expect that American Express will reverse the credit.

Maximize The Platinum Card® from American Express ’s $200 hotel credit

The Platinum Card® from American Express is packed with benefits, including a $200 statement credit on eligible hotels booked through its travel portal.

While it is always worth comparing the benefits and rates that the hotel is offering directly, in many scenarios, this FHR hotel credit can net you a lot of value. Terms apply.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Prince of Travel

Prince of Travel is a full-service travel brand with an emphasis on luxury travel.

Get in-depth information on hotel programs and learn more about Prince Collection’s premier brands and vendors.

Credit Cards

Get the latest news, deals, guides, and travel reviews straight to your inbox with a Prince of Travel newsletter subscription.

Join Our Newsletter

Subscribe to the prince of travel newsletter.

You'll receive priority information about the newest luxury properties worldwide, exclusive reservations and deals through Prince of Travel , and unique destinations across the globe.

By providing your email, you agree to the Prince of Travel Privacy Policy

Thank you for subscribing!

Please check your email to confirm your subscription!

Id ea eiusmod magna cupidatat proident commodo tempor sit incididunt. Fugiat aliquip officia exercitation ad culpa ipsum est.

Points Programs

Hotel programs, best credit cards, back to guides, how does the american express platinum card $200 annual travel credit work.

The American Express Platinum and Business Platinum Cards come with a $200 annual travel credit, which can be used for eligible Amex Travel bookings.

Written by T.J. Dunn

On January 9, 2024

Read time 14 mins

The American Express Platinum Card and the Business Platinum Card from American Express are two of the best travel cards in Canada, as they come with a bevy of travel-related perks and a hefty welcome bonus to help justify the high annual fees.

One of the key travel benefits available on the cards is the $200 annual travel credit, which can be used to offset the cost of eligible purchases made through Amex Travel.

What Is the American Express Platinum Card Annual Travel Credit?

The American Express Platinum Card and Business Platinum Card from American Express ‘s $200 annual travel credit is exactly what it sounds like. Each year, cardholders are given a $200 credit that can be used to book flights, hotels, car rentals, or other travel through the Amex Travel portal.

Aside from being approved for the card and paying the $799 annual fee, you don’t have to do anything extra to earn the $200 travel credit. It becomes available as soon as you activate your card, and then once per year on your cardholder anniversary date.

For example, if you’re approved for the American Express Platinum Card in March 2024, you’ll have one $200 travel credit that must be used before March 2025. Then, in March 2025, you’ll have a new $200 annual travel credit available in your account, which must be used by March 2026.

The $200 annual travel credit can only be used for bookings made through Amex Travel. This means that you won’t be able to book travel on your own elsewhere, and then apply the credit against your own travel expenses retroactively.

The $200 travel credit has to be used all at once towards a single travel booking of $200 or more. This means that you won’t be able to use it if your travel booking is less than $200, and you won’t be able to spread it out over multiple bookings.

Lastly, you need to opt in to using the travel credit at the time of booking. Simply booking $200 in travel through Amex Travel isn’t enough to trigger the credit — rather, you have to specify that you want to use your $200 annual travel credit, which we’ll cover in detail below.

Once you’ve made a booking, you’ll receive $200 as a statement credit on your Platinum Card within two business days or so. This means that you’re charged the full amount of the booking first, and then you receive a separate $200 statement credit posted to your account.

On September 26, 2023, the $200 annual travel credit became available on the Business Platinum Card from American Express . This new benefit came in tandem with other changes to the cards, including increasing the annual fee.

If you’re already a Business Platinum cardholder, you’ll have access to the $200 annual travel credit on the next anniversary date that falls on or after September 26, 2023, and every year thereafter on your anniversary date.

How to Use the American Express Platinum Card Annual Travel Credit

There are two ways to use the $200 annual travel credit from the American Express Platinum Card : over the phone, or online.

If you choose to phone in to book travel and redeem your credit, make sure the Amex Travel agent knows that you’d like to make use of your $200 travel credit. You’ll also need to use your personal or business version of the Platinum Card to pay for the rest of the charges on your booking, so be sure to have it handy.

If redeeming online, you’ll have to first login to your American Express account, and then head to Amex Travel.

You can do this by clicking on the “Menu” tab after you’ve logged in, selecting “Travel”, and then “Book Travel Online”.

If you have multiple American Express cards, you’ll be prompted to select the card you’d like to use.

In order to use the $200 annual travel credit, you’ll need to choose a Platinum Card from the list. If you haven’t used the travel credit yet, it’ll indicate that it’s available on this screen, as well as its expiry date.

After selecting the Platinum Card, you can choose which type of travel you’d like to book. The options include flights, hotels, or car rentals, as well as combinations of those three in the “Bundles” tab.

Once you’ve found your desired travel booking, head to the payment screen, and then keep an eye out for the option to apply your $200 annual travel credit.

If you don’t select it as an option at this point, the credit won’t automatically be applied against your travel.

After you’ve opted to use the travel credit, you’ll still need to enter the rest of your Platinum Card information. Your card will then be charged the full amount of the booking, and the $200 credit will appear on your Platinum Card account shortly thereafter.

How to Maximize the American Express Platinum Card Annual Travel Credit

Even though American Express restricts the $200 annual travel credit in that it can only be used through Amex Travel, there are still ways you can make the most out of your credit, and elevate your travel.

Amex Fine Hotels & Resorts

One of the best ways to use the $200 annual travel credit is for a hotel stay with Amex Fine Hotels & Resorts , which gives you additional perks to enjoy during your stay.

You can use the $200 annual travel credit to get a free or very inexpensive night if the stay costs around $200, or you could use it to offset the cost of a more luxurious stay.

For example, a one-night stay at The Tasman, a Luxury Collection Hotel , in Hobart, Tasmania might cost around $455 (CAD).

By booking through Amex Fine Hotels & Resorts, you’ll be able to use your $200 travel credit to reduce the cost down to $255 (CAD), and you’ll also have access to a number of additional perks.

You’ll receive a $100 (USD) property credit, free breakfast for two, guaranteed 4pm late check-out, and, when available, a room upgrade upon arrival and early check-in.

What’s more, if you have Marriott Bonvoy Elite status , you’ll still be able to enjoy your status benefits through hotels booked through Amex Travel, and you’ll also be credited with an elite qualifying night to work towards reaching a higher status, or retaining your status for next year.

If you have an upcoming trip planned and want to try out a luxury hotel, be sure to apply your $200 annual travel credit against the cost.

Amex Travel Amex Offers

American Express cardholders have exclusive access to Amex Offers , which are special opt-in promotions offered through your online account.

In the past, there have been specific Amex Offers available for spending on Amex Travel online.

One offer that’s popped up over the past couple of years has been a “Spend $800, Get $200” Amex Offer for bookings made through Amex Travel .

If you’ve been targeted with such an offer, you’d receive a $200 statement credit after making $800 worth of eligible prepaid hotel or car rental bookings through Amex Travel, which is separate from your $200 annual travel credit.

However, it’s also possible to stack the $200 annual travel credit with offers like this, which would effectively result in an out-of-pocket cost of $400 for $800 worth of travel.

Therefore, if you’re able to take advantage of both an Amex Travel Amex Offer and the $200 annual travel credit, you’ll end up with a significant discount on your booking.

A situation such as this can also be a great opportunity to try out a high-end property, such as the Four Seasons, Shangri-La, or Mandarin Oriental, without paying anywhere near the full price.

Offset the Annual Fee

Lastly, the $200 annual credit can be used as a way to offset the card’s annual fee.

If your plans fall through and you have to cancel a refundable travel booking, you’ll no longer have access to the travel credit.

As per the terms and conditions on the American Express Platinum Card :

If you cancel your travel booking after redeeming the Annual Travel Credit, you will not be able to use it again in the same year.

However, since you’re charged the full amount to begin with, you’ll still receive a full refund for the Amex Travel booking, even after the $200 annual travel credit has been applied to your account.

For example, if you make a refundable hotel booking for $400, you’ll have two items post to your account: a charge for $400 (your hotel booking), and a statement credit of $200 (from your travel credit). At this point, the net cost to you is $200.

If you need to cancel the hotel booking, you’ll receive a full refund of $400, and the $200 statement credit will remain posted to your account. Therefore, if you had a $0 balance before you made the booking, you’d now have a balance of –$200, since the annual travel credit can’t be reversed.

Having to cancel a booking due to unforeseen circumstances may not be ideal; however, if it comes to that, it’s nice to know that at least your $200 credit doesn’t go to waste.

The $200 annual travel credit is a great perk that comes with every Canadian-issued American Express Platinum Card and Business Platinum Card from American Express .

Fortunately, the credit is easy to use through Amex Travel. While you’re limited to what’s available on the platform, you can use it to score a deal on a luxury hotel stay through American Express Fine Hotels & Resorts , or to otherwise lower the cost of other expenses for a trip.

If you’re lucky, you’ll be able to stack the $200 annual travel credit with an Amex Travel Amex Offer to unlock even more value. And if your plans fall through, it’s nice to know that the statement credit will remain on your account even after your booking is refunded.

It doesn’t matter how you make use of the $200 annual travel credit — just be sure to use it up before it expires each year.

Share this post

Copied to clipboard!

Here's how much value you can get from the Amex Platinum card in your 1st year

O ne of my first major decisions after beginning my points and miles education was to finally get my first premium travel card, The Platinum Card® from American Express . I documented my journey through a series of stories last year on my favorite benefits, my love of airport lounges and booking my first big points redemption on a business-class flight to Europe .

Now that I've gleaned a year's worth of data (and travel memories) to look back on, it's time to determine if the Amex Platinum's benefits outweigh the high $695 annual fee (see rates and fees ), earning it a permanent spot in my wallet.

Determining the value of the Amex Platinum

In my opinion, the value of a credit card can't be determined solely using math. Certain things, like alleviating stress at the airport or the comfort of a lie-flat seat on a transatlantic flight, cannot be measured in numbers alone.

For the sake of this exercise, however, I will focus mostly on the monetary value of the Amex Platinum card.

I added up the money I saved on things like grocery delivery through Amex's partnership with Walmart+, programs like Clear Plus and Global Entry that expedite airport security wait times, and the extra hotel perks I enjoyed by booking trips through Amex's The Hotel Collection and Fine Hotels + Resorts (minimum two night stay).

Taking it a step further, I included savings on complimentary food and drinks at airport lounges that I would have otherwise spent money on and the monetary value of the card's generous welcome offer.

However, I didn't include things like the up to $200 in airline fee statement credits because I used mine for upgraded Southwest boarding, which I wouldn't have spent my own money on.

This demonstrates that this card's value — or any card's, really — will vary from person to person. A long list of perks is meaningless if you can't use them. My advice is: Before applying for a card, read through the benefits to make sure you will actually take full advantage of the card.

Enrollment required for some benefits.

Amex Platinum Welcome offer

The Amex Platinum consistently has one of the most valuable welcome offers out there. Currently, you can earn 80,000 Membership Rewards points after spending $8,000 during your first six months of card membership.

You could also be targeted for a higher bonus through the CardMatch tool (although offers through CardMatch are not guaranteed and are subject to change at any time).

According to TPG's August 2024 valuations , American Express Membership Rewards points are currently worth 2 cents each. That makes this welcome offer worth $1,600, which can be used toward flights and hotels booked through the American Express Travel portal.

The welcome bonus alone outweighs the card's annual fee (see rates and fees ), but you obviously have to spend $8,000 to get there. I switched almost all of my family's everyday spending to my new Platinum card to help me meet the minimum spending requirement without buying anything I couldn't afford — the most important rule of credit card usage.

It's worth noting that this $1,600 in value can only be realized in the first year. It makes the card quite valuable in the first year, but it can't be included in calculations for the second year and beyond.

Travel benefits

The Amex Platinum stays true to its " premium travel card " designation with a bevy of travel benefits that I took full advantage of over the past year.

I signed up for Global Entry (which includes TSA PreCheck) and a Clear Plus membership to expedite my time waiting in security at the airport.

With the Amex Platinum, you can receive statement credits up to $100 every four years for Global Entry (or $85 every 4 1/2 years for TSA PreCheck) and up to $199 in statement credits annually for your Clear Plus membership. These benefits saved me $299 last year and precious time (and stress) at the airport. (Enrollment is required.)

The Amex Platinum also offers an up-to-$200 statement credit when you book through Amex Fine Hotels + Resorts or The Hotel Collection . Both programs offer additional perks during your stay, as well.

My husband and I stayed two nights at The Eliza Jane , part of The Hotel Collection, in New Orleans last March. We received our up to$200 statement credit, an upgrade from a standard king-bed room to a suite with a view of Magazine Street and a $100 credit to use on food and drinks or at the gift shop during our stay.

I also stayed at Loews Portofino Bay Hotel during a visit to Universal Orlando last November. This hotel is part of the Fine Hotels + Resorts program, which got me daily breakfast for two, early check-in and late checkout, and a $100 food and beverage credit to use during my stay.

I was up and headed to the parks too early to use the free breakfast, but I did use the $100 dining credit to treat some of my fellow TPG staffers who were in town to dinner and drinks.

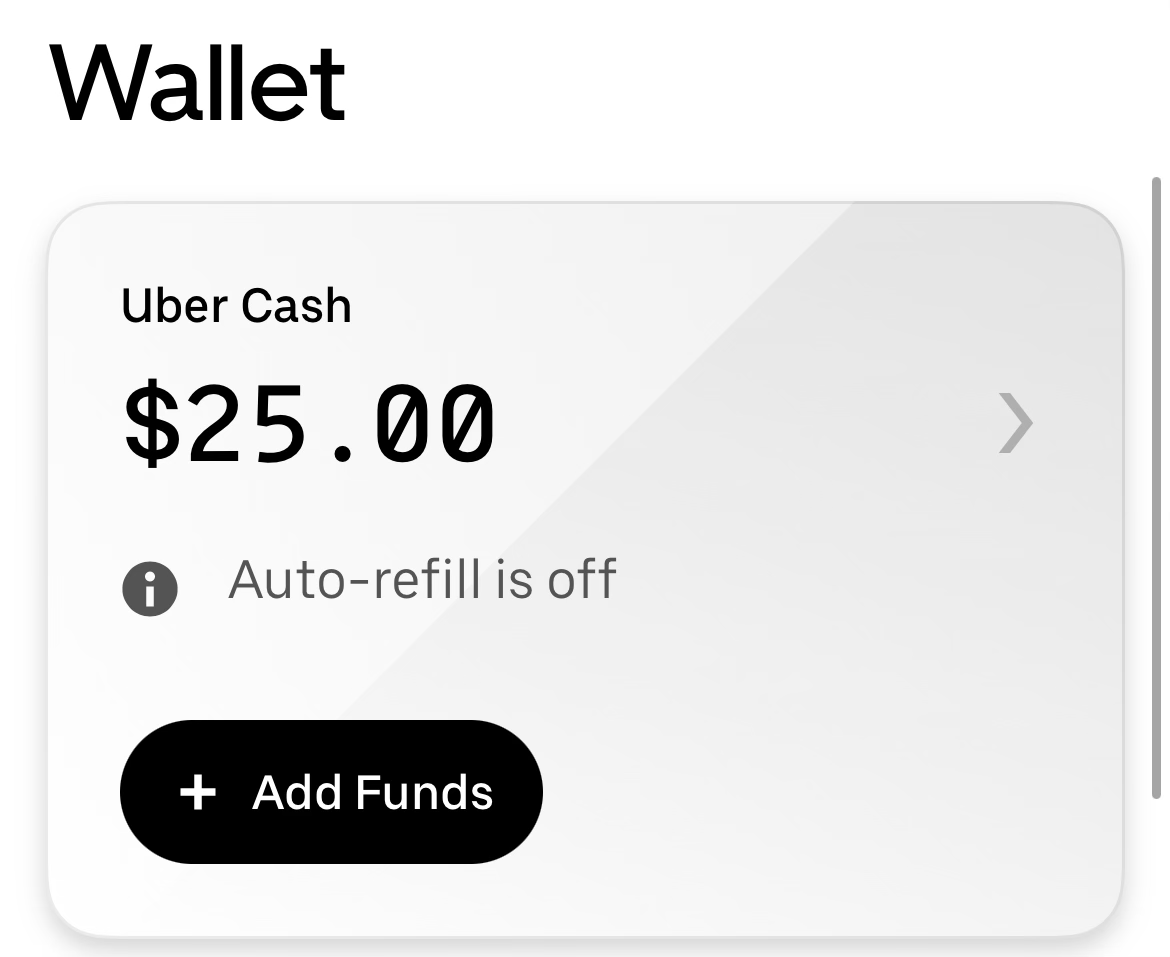

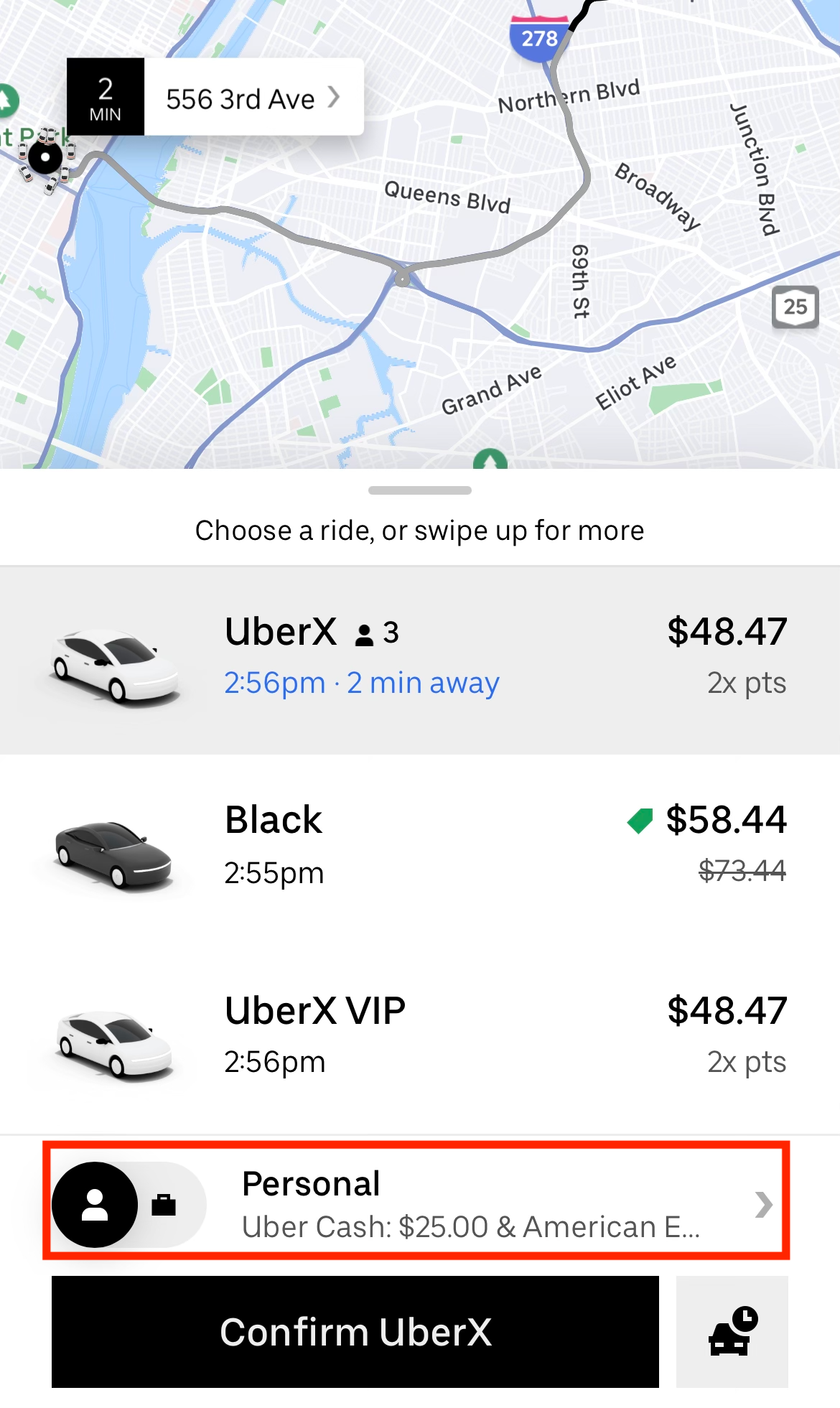

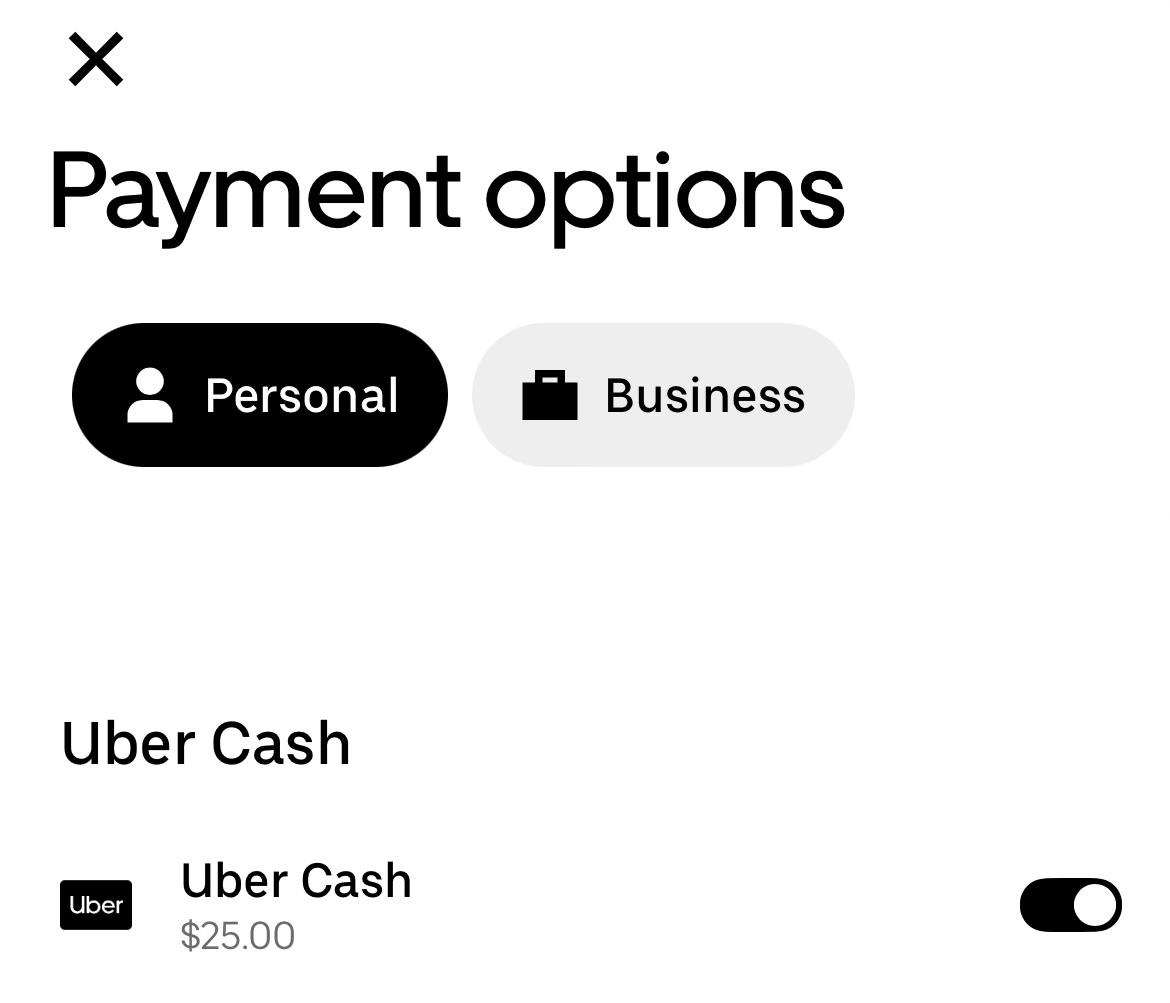

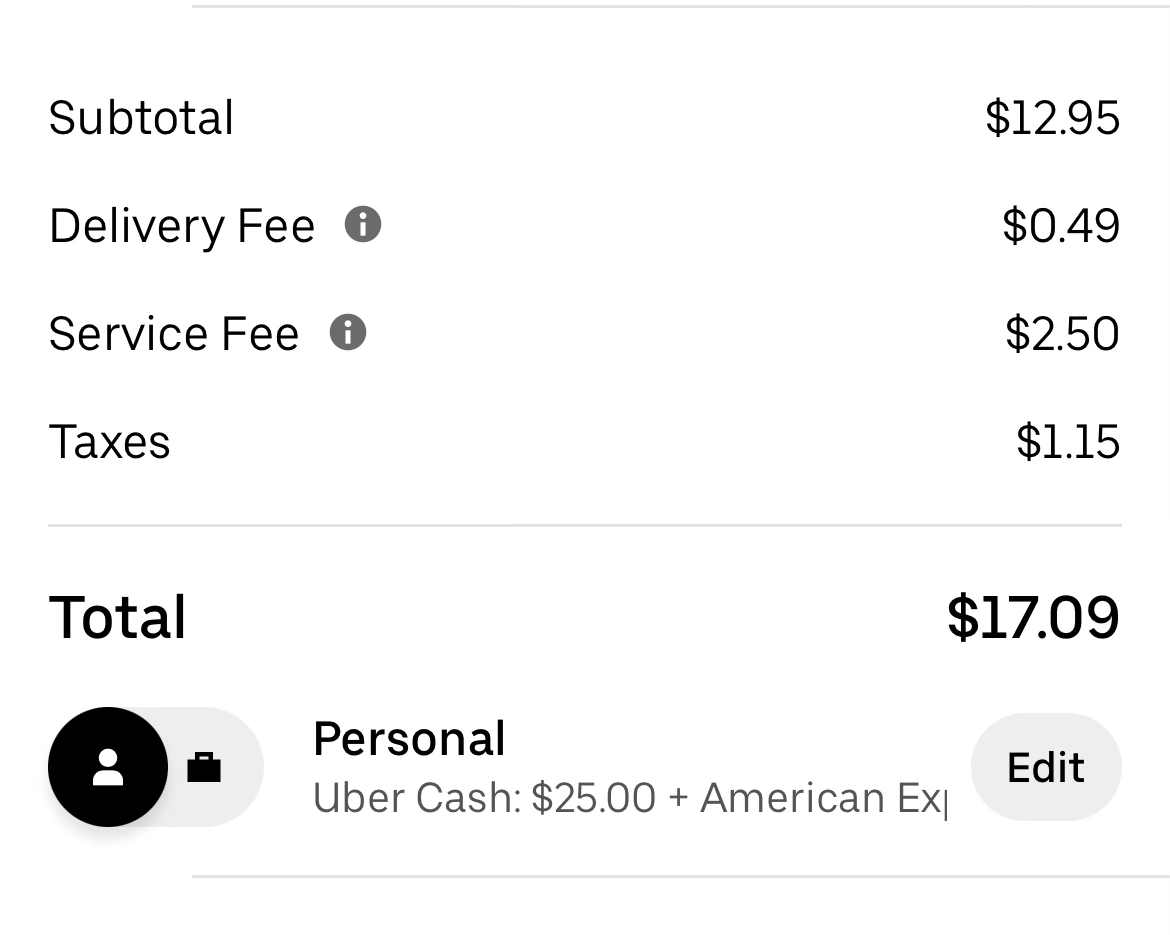

The Amex Platinum also offers up to $200 annually in Uber Cash , which can be used for Uber's ride-hailing services or Uber Eats food delivery.

I received $15 in Uber Cash each month — plus a $20 bonus in December. I had no issues using it up on rides to and from the airport and the occasional coffee delivery when I was stuck at home with sick kids and in need of a caffeine fix. (Enrollment is required.) You must have downloaded the latest version of the Uber App and your eligible American Express Platinum Card must be a method of payment in your Uber account.

I'm not loyal enough to any one hotel brand to have earned elite status. Still, you can receive automatic elite status with Marriott Bonvoy and Hilton Honors with the Amex Platinum card, though it's difficult to put a monetary value on these perks.

Last but not least is complimentary airport lounge access through the Global Lounge Collection . This benefit gets you into more than 1,400 Amex-branded and partner lounges at airports across the globe.

The amount of money I saved by drinking and dining in airport lounges over the past year rather than hitting up a Starbucks by my gate is well over $100, but we will use that number to be conservative. (Enrollment is required.)

Lifestyle benefits

The Amex Platinum offers benefits outside of the travel realm that I found a lot of value in, as well.

The card offers cardmembers a statement credit of up to $155 per year toward a monthly Walmart+ grocery delivery membership (subject to auto-renewal). Plus Up Benefits not eligible.

Walmart+ costs $12.95 monthly, so the annual credit knocks the effective cost down to zero. Walmart+ offers free next-day and two-day shipping on items from Walmart.com, fuel savings of 5 cents off per gallon at Walmart and Murphy stations, prescription savings and free delivery from your local Walmart store on orders of $35 or more. (Enrollment is required.)

Related: Walmart+ adds complimentary Paramount+ subscription, free for Amex Platinum cardholders

With the card's up to $240 annual digital entertainment statement credit , you can receive monthly statement credits for the following subscriptions:

- The New York Times

- Disney+, Hulu and ESPN+ — or the Disney Bundle (which includes all three services)

- The Wall Street Journal

I use mine for the Disney Bundle, which is $19.99 per month, but effectively free with the statement credits. (Enrollment is required.)

There is also an up-to-$100 Saks Fifth Avenue statement credit , broken down into a $50 credit from January through June and an additional $50 from July through December.

Last year, I got my hands on a sparkly pair of Kate Spade earrings and a cheetah-print Michael Kors dress that I found on the clearance rack for just under $50. (Enrollment is required for select benefits.)

Deciding whether to keep the Amex Platinum in my wallet

So, what was my grand total for the year? Based solely on the benefits listed here, I received $3,084 in value from the Amex Platinum card in my first year.

That more than makes up for the $695 annual fee (see rates and fees ), but more importantly helped me save money on both everyday and travel expenses. It also allowed me to travel in a way that I wasn't able to before applying up for the card .

Including the welcome bonus, I earned just under 270,000 points on my Amex Platinum in the first year. I redeemed most of those points for the trip to Europe I mentioned above and used the points for a mix of business-class and economy flights and hotel stays.

Even if I subtract the $1,600 value from the welcome bonus, I'll still receive plenty of value from the card this year and hereby decree that the Amex Platinum has earned a permanent place in my wallet. Also, I'll ask for a retention offer each year when my annual fee posts to earn bonus points or statement credits.

Bottom line

Looking back on my first year with a premium travel rewards card, I've learned a lot about maximizing a card's benefits and my long-term approach to credit cards. Everyone has different goals when it comes to using credit cards and playing the points and miles game.

I know myself well enough to know that I don't have the time or patience to carry more than a handful of cards, and that's OK. I now know enough (thanks to TPG's helpful credit card experts) to make the most of the cards I have without stressing myself out.

After a full year with the Amex Platinum card, I'm familiar with the benefits and how to use them. This will help me reap the benefits of the card for years to come.

It will also help me better understand how to maximize future cards I add to my wallet, which is pretty much guaranteed to happen now that I've learned how powerful they can be.

Related: How many credit cards should I have?

Apply here: The Platinum Card from American Express with a welcome bonus of 80,000 points after spending $8,000 in the first six months of card membership

For rates and fees of the Amex Platinum card, click here.

Editorial disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Get more when you get away with American Express Travel®

Whether you’re planning a weekend staycation or the trip of a lifetime, American Express Travel is here to help you get the most out of your journey. Explore the benefits of booking with American Express Travel.

View American Express Travel benefits by card type below.

Enjoy elevated benefits through American Express Travel with your Platinum Card®

Unlock added value and special perks on flights, hotels, vacation rentals, cruises, car rentals and more through American Express Travel.

Explore by Benefit Type

Hotel Benefits

Flight Benefits

Membership Rewards

More Travel Benefits

Exceptional Benefits. Extraordinary Properties.

Enjoy unforgettable luxury and bask in the benefits with Fine Hotels + Resorts ® . With every stay booked through American Express Travel at over 1,600 properties worldwide, you'll receive this complimentary suite of benefits that offers an average total value of $550 † :

12pm check-in, when available

$100 credit, towards eligible charges 1

Room upgrade upon arrival, when available ‡

Complimentary Wi-Fi

Daily breakfast for two

Guaranteed 4pm check-out

† Average value based on Fine Hotels + Resorts bookings in 2023 for stays of two nights. Actual value will vary based on property, roomrate, upgrade availability, and use of benefits. ‡ Certain room categories are not eligible for upgrade. 1 Eligible charges vary by property.

Added Perks. Upscale Stays.

For upscale hotels in desirable destinations, book The Hotel Collection through American Express Travel. With every stay of two nights or more booked at over 1,000 hand-picked hotels, you'll receive these complimentary benefits that offer an average total value of $150 †† , plus two new benefits:

NEW: 12pm check-in, when available

NEW: Late check-out, when available

†† Average value based on The Hotel Collection bookings in 2023 for stays of two nights. Actual value will vary based on property, roomrate, upgrade availability, and use of benefits. ‡ Certain room categories are not eligible for upgrade. 1 Eligible charges vary by property.

$200 Hotel Credit

Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings through American Express Travel when you pay with your Platinum Card. The Hotel Collection requires a minimum two-night stay.*

Luxury Hotel Offers

Take advantage of special offers, like a complimentary night or added savings, at select Fine Hotels + Resorts ® and The Hotel Collection properties. Book at AmexTravel.com. Offers vary by property. Travel dates and terms apply.*

Maslina Resort

Let Membership Rewards® Points Inspire your Next Adventure

Earn points or use Membership Rewards ® Pay with Points to book your next trip at AmexTravel.com. You can even use a combination of points and Card.*

Get 5X Points on Travel*

Earn 5X Membership Rewards ® points on flights, prepaid hotels, and more booked through American Express Travel using your Platinum Card.

How to Earn Points

5X on Flights

Earn 5X points on flights booked through American Express Travel or directly with airlines, on up to $500,000 of these purchases per calendar year.

5X on Prepaid Hotels

Earn 5X points on prepaid hotels booked through American Express Travel. This includes 5X points on Fine Hotels + Resorts® and The Hotel Collection, where you’ll enjoy added benefits to enhance your stay.

5X on Select Homes + Retreats™

Earn 5X points on Select Homes + Retreats™, a curated collection of professionally managed vacation rentals, booked through AmexTravel.com.

5X on Flight + Hotel Packages

Earn 5X points on flight + hotel packages booked through AmexTravel.com

Use Pay with Points*

As a Platinum Card Member, you can use Pay with Points at AmexTravel.com toward all or part of your next flight, prepaid hotel, or other eligible travel booking.

How to Use Pay with Points

Use points for flights booked through American Express Travel.

Prepaid Hotels

Use points for prepaid hotels booked through American Express Travel, including The Hotel Collection and Fine Hotels + Resorts ® .

Select Homes + Retreats™

Use points to book Select Homes + Retreats™ stays through AmexTravel.com.

Flight + Hotel Packages

Use points for flight + hotel packages booked through AmexTravel.com.

Prepaid Car Rentals

Use points for prepaid car rentals booked through American Express Travel.

Use points for cruises booked through American Express Travel.

On top of Membership Rewards perks, you still earn loyalty benefits with airlines and hotels.

When you book flights at AmexTravel.com you'll earn 5X Membership Rewards ® points, on up to $500,000 of these purchases per calendar year. Plus, you'll earn miles with airlines as you typically would.

You'll also earn 5X points when you book prepaid stays with Fine Hotels + Resorts ® and The Hotel Collection through American Express Travel. Plus, you still earn loyalty points with hotels. 2

2 Hotel brands with loyalty or rewards programs and the terms and conditions applicable thereto are subject to change. Please contact hotels directly for information on individual loyalty or reward program rules and restrictions. Card Members may be required to provide correct loyalty information upon arrival to the property.

Take Flight with a Choice of Savings

Access lower fares on select routes and more when you book flights through American Express Travel with your Platinum Card.

International Airline Program

Enjoy savings on the best seats in the house with the International Airline Program. Explore lower fares on International First, Business, and Premium Economy seats when you book through American Express Travel with your Platinum Card. Maximum of 8 tickets per booking. Card Member must be traveling on the itinerary.*

Insider Fares

Go further with fewer Membership Rewards points. With Insider Fares*, it takes fewer points to get around the globe. When you book on AmexTravel.com with your Platinum Card and use Pay with Points for the entire fare, you get access to deals on select flights, because less points are needed.

Recommended Flights

Access lower fares on select domestic and international routes through October 1, 2024. Log in to AmexTravel.com with your Platinum Card account and filter flight search results by clicking on the Recommended Flights checkbox to find lower fares.*

Discover More Ways to Elevate your Travel

Take advantage of more travel benefits through American Express Travel and make your next trip one to remember.

As a Platinum Card Member, you have access to American Express Select Homes + Retreats™, a curated collection of professionally managed short-term rental properties. Plus, earn 5X Membership Rewards® points on all Select Homes + Retreats™ purchases booked through AmexTravel.com.*

- Explore Select Homes + Retreats™

Cruise Privileges Program

Receive valuable amenities on eligible sailings of 5-nights or more with participating cruise lines, including onboard credits and 2X Membership Rewards points, when you book through American Express Travel with your Platinum Card.*

- Learn More about Cruise Benefits

2X Points on Cruises & Prepaid Car Rentals

Get rewarded when you travel. Earn 2X points on cruises and prepaid car rentals booked at AmexTravel.com with your Platinum Card.*

- Plan a Cruise

Explore More Travel Benefits

Unlock more value for your next flight. Enjoy complimentary access to airport lounges through the American Express Global Lounge Collection®, and more with your Platinum Card. Terms apply.

- See More Travel Benefits

Enjoy elevated benefits through American Express Travel with your Business Platinum Card®

Unlock added value and special perks on flights, hotels, vacation rentals, cruises, car rentals and more when you book through American Express Travel.

Enjoy hotels that are destinations unto themselves with Fine Hotels + Resorts ® . With every stay booked at over 1,600 extraordinary properties through American Express Travel, you'll receive this complimentary suite of benefits that offers an average total value of $550 † :

Mandarin Oriental, Boston

Earn points or use Membership Rewards ® Pay with Points towards your next trip booked at AmexTravel.com. You can even use a combination of points and Card.*

Get rewarded when you travel. Earn 5X Membership Rewards ® points on flights, prepaid hotels, and more booked through American Express Travel with your Business Platinum Card.

Earn 5X points on flights booked through AmexTravel.com.

Earn 5X points on prepaid hotels booked through American Express Travel.This includes 5X points on our curated collections, Fine Hotels + Resorts ® and The Hotel Collection, where you’ll enjoy added benefits to enhance your stay.

Earn 5X points on Select Homes + Retreats, a curated collection of professionally managed vacation rentals, booked through AmexTravel.com.

Earn 5X points on flight + hotel packages booked through AmexTravel.com.

Go further with Membership Rewards ® Pay with Points. As a Business Platinum Card Member, you can use Pay with Points at AmexTravel.com toward all or part of your next flight, prepaid hotel, or other eligible travel booking.

All Flights

Use points to book Select Homes + Retreats stays through AmexTravel.com.

Earn 5X Membership Rewards ® points on flights booked at AmexTravel.com. Plus, earn miles as you typically would with airlines.

You'll also earn 5X points when you book prepaid stays with Fine Hotels + Resorts and The Hotel Collection through American Express Travel. Plus, you still earn loyalty points with hotels. 2

Access lower fares on select routes and more when you book flights through American Express Travel with your Business Platinum Card.

Explore lower fares on International First, Business, and Premium Economy seats with the International Airline Program when you book through American Express Travel with your Business Platinum Card. Maximum of 8 tickets per booking. Card Member must be traveling on the itinerary.*

Go further with fewer Membership Rewards points. With Insider Fares* , it takes fewer points to get around the globe. When you book on AmexTravel.com with your Business Platinum Card and use Pay with Points for the entire fare, you get access to deals on select flights, because less points are needed.

Access lower fares on select domestic and international routes through October 1, 2024. Log in to AmexTravel.com with your Business Platinum Card account and filter flight search results by clicking on the Recommended Flights checkbox to find lower fares.*

Take advantage of more travel benefits and offers through American Express Travel and make your next trip one to remember.

Work remotely in comfort with Select Homes + Retreats™, a curated collection of professionally managed short-term rentals. Book your Select Homes + Retreats™ stay through AmexTravel.com using your Business Platinum Card® and earn 5X Membership Rewards® points, or you can use Pay with Points towards your trip.*

- Explore Destinations

As a Business Platinum Card Member, you can receive valuable amenities on eligible sailings of 5-nights or more with participating cruise lines, including onboard credits and 2X Membership Rewards points, when you book through American Express Travel.*

- View Cruise Benefits

Earn 2X Membership Rewards points on cruises and prepaid car rentals booked at AmexTravel.com with your Business Platinum Card.*

Unlock more value for your next flight. Enjoy complimentary access to airport lounges through the American Express Global Lounge Collection® and more with your Business Platinum Card. Terms apply.

Enjoy added benefits with American Express Travel and your American Express® Gold Card

Unlock elevated perks on flights, hotels, cruises, car rentals and more when you book through American Express Travel with your Gold Card.

Corazon Cabo Resort & Spa

Elevate your Stay with The Hotel Collection

For upscale hotels in desirable destinations, book The Hotel Collection through American Express Travel with your Gold Card. With every stay of two or more nights booked at over 1,000 hand-picked hotels, you'll receive these added benefits that offer an average total value of $150 †† , plus two new benefits:

Late check-out, when available

†† Average value based on The Hotel Collection bookings in 2023 for stays of two nights. Actual value will vary based on property, roomrate, upgrade availability, and use of benefits. 1 Eligible charges vary by property. ‡ Certain room categories are not eligible for upgrade.

Get rewarded when you travel. When you book through AmexTravel.com with your Gold Card, you can earn points or use Membership Rewards ® Pay with Points towards your next trip. You can even use a combination of points and Card.*

Get up to 3X Points on Travel

Get to your next trip faster with 3X Membership Rewards ® points on flights*, and 2X points on prepaid hotels* and more when you book through American Express Travel using your Gold Card.

3X on Flights

Earn 3X points on flights booked through AmexTravel.com.

2X on Prepaid Hotels

Earn 2X points on prepaid hotels booked through AmexTravel.com. This includes 2X points on The Hotel Collection properties, where you'll enjoy added benefits to enhance your stay.

2X on Flight + Hotel Packages

Earn 2X points on flight + hotel packages booked through AmexTravel.com.

2X on Prepaid Car Rentals*

Earn 2X points on prepaid car rentals booked through AmexTravel.com.

2X on Cruises*

Earn 2X points on cruises booked through AmexTravel.com.

Let Membership Rewards ® points take you further. As a Gold Card Member, you can use Pay with Points at AmexTravel.com toward all or part of your next flight, prepaid hotel, prepaid car rental, cruise or flight + hotel package.

Use points for prepaid hotels booked through American Express Travel, including properties in The Hotel Collection.

With your Membership Rewards perks, you still earn loyalty benefits with airlines and hotels.

When you book a flight at AmexTravel.com, you'll earn 3X Membership Rewards points. Plus, you'll still earn miles with airlines as you typically would.

You'll also earn 2X points on prepaid stays booked with The Hotel Collection through American Express Travel. Plus, you still earn loyalty points with hotels. 2

Discover More Travel Benefits

Special Hotel Offers

Take advantage of special offers like an extra night, added savings, and more at select properties in The Hotel Collection booked through American Express Travel.* Offers vary by property. Travel dates and terms apply.

- See Offers with The Hotel Collection

With Insider Fares*, it takes fewer points to get around the globe. When you book on AmexTravel.com and use Pay with Points for the entire fare, you get access to deals on select flights, because less points are needed.

- Access Insider Fares

Lowest Hotel Rates Guarantee

Book your next hotel stay online at AmexTravel.com and get the Lowest Hotel Rates Guarantee for eligible bookings.* Excludes rates booked through Fine Hotels + Resorts and The Hotel Collection.

- Explore Hotels and Save

Enjoy valuable benefits with American Express Travel and your Business Gold Card

Unlock added value, like earning 3X Membership Rewards ® points on flights and prepaid hotels, when you book at AmexTravel.com with your Business Gold Card.*

Conrad New York Downtown

Elevate your Business Travel with The Hotel Collection

For upscale hotels in desirable destinations, book The Hotel Collection through American Express Travel with your Business Gold Card. With every stay of two or more nights booked at over 1,000 hand-picked hotels, you'll receive these added benefits that offer an average total value of $150 †† , plus two new benefits:

Let Membership Rewards® Points Inspire Your Next Adventure

Get rewarded when you travel. When you book through AmexTravel.com with your Business Gold Card, you can earn points or use Membership Rewards ® Pay with Points towards your next trip. You can even use a combination of points and Card.*

Get to your next trip faster with 3X Membership Rewards ® points when you book flights, prepaid hotels and more through American Express Travel using your Business Gold Card.*

3X on Flights*

3X on Prepaid Hotels*

Earn 3X points on prepaid hotels booked through American Express Travel. This includes 3X points on The Hotel Collection, where you'll enjoy added benefits to enhance your stay.

3X on Flight + Hotel Packages*

Earn 3X points on flight + hotel packages booked through AmexTravel.com.

Let Membership Rewards ® points take you further. As a Business Gold Card Member, you can use Pay with Points at AmexTravel.com toward all or part of your next flight, prepaid hotel, prepaid car rental, cruise or flight + hotel package.

How to Pay with Points

Use points for prepaid hotels booked through American Express Travel, including The Hotel Collection.

Use points for Flight + Hotel package booked through AmexTravel.com.

You'll also earn 3X points on prepaid stays booked with The Hotel Collection through American Express Travel. Plus, you still earn loyalty points with hotels. 2

Take advantage of more travel perks through American Express Travel and make your next trip one to remember.

Explore the benefits of booking through American Express Travel with your American Express® Green Card

Unlock special perks, like earning 3X Membership Rewards ® points on flights and prepaid hotels, when you book through American Express Travel with your Green Card.*

Get 3X Points on Travel*

Get to your next trip faster with 3X Membership Rewards ® points on flights, prepaid hotels, prepaid car rentals, cruises and flight + hotel packages when you book through American Express Travel using your American Express Green Card.

Earn 3X points on flights booked through American Express Travel.

3X on Prepaid Hotels

Earn 3X points on prepaid hotels booked through American Express Travel.

3X on Flight + Hotel Package

Earn 3X points on flight + hotel packages booked at AmexTravel.com.

3X on Prepaid Car Rentals

Earn 3X points on prepaid car rentals booked at AmexTravel.com.

3X on Cruises

Earn 3X points on cruises booked at AmexTravel.com.

Let Membership Rewards ® points take you further. As a Green Card Member, you can use Pay with Points at AmexTravel.com toward all or part of your next flight, prepaid hotel, prepaid car rental, cruise or flight + hotel package.

Use points for prepaid hotels booked through American Express Travel.

Use points for Flight + Hotel package booked at AmexTravel.com.

Use points for prepaid car rentals booked at AmexTravel.com.

Insider Fares*

With Insider Fares, it takes fewer points to get around the globe. When you book on AmexTravel.com with your American Express Green Card and use Pay with Points* for the entire fare, you get access to deals on select flights, because less points are needed.

Lowest Hotel Rates Guarantee*

Book with confidence, knowing you’ll always get the lowest rate through American Express Travel. If you book a qualifying hotel rate online on AmexTravel.com and then find the same room, in the same hotel, for the same dates, the same number of children and adults, at a lower price online, before taxes and fees, we’ll refund you the difference.

Make everlasting memories. Start your booking with American Express Travel today.

*Terms and Conditions

Basic Card Members on U.S. Consumer Platinum Card Account are eligible to receive up to $200 in statement credits per calendar year when they or Additional Platinum Card Members use their Cards to pay for eligible prepaid Fine Hotels + Resorts® and The Hotel Collection bookings made through American Express Travel (meaning through amextravel.com, the Amex® App, or by calling the phone number on the back of your eligible Card) or when Companion Platinum Card Members on such Platinum Card Accounts pay for eligible prepaid bookings for The Hotel Collection made through American Express Travel (meaning through amextravel.com, the Amex® App, or by calling the phone number on the back of your eligible Card). Purchases by both the Basic Card Member and any Additional Card Members on the Card Account are eligible for statement credits. However, the total amount of statement credits for eligible purchases will not exceed $200 per calendar year, per Card Account. Fine Hotels + Resorts® program bookings may be made only by eligible U.S. Consumer Basic Platinum and Additional Platinum Card Members. The Hotel Collection bookings may be made by eligible U.S. Consumer Basic and Additional Platinum Card Members and Companion Platinum Card Members on the Platinum Card Account. Delta SkyMiles® Platinum Card Members are not eligible for the benefit. To receive the statement credits, an eligible Card Member must make a new booking using their eligible Card through American Express Travel on or after July 1st, 2021, that is prepaid (referred to as "Pay Now" on amextravel.com and the Amex App), for a qualifying stay at an available, participating Fine Hotels + Resorts or The Hotel Collection property. Bookings of The Hotel Collection require a minimum stay of two consecutive nights. Eligible bookings must be processed before December 31st, 11:59PM Central Time, each calendar year to be eligible for statement credits within that year. Eligible bookings do not include interest charges, cancellation fees, property fees or other similar fees, or any charges by a property to you (whether for your booking, your stay or otherwise).

Statement credits are typically received within a few days, however it may take 90 days after an eligible prepaid hotel booking is charged to the Card Account. American Express relies on the merchant’s processing of transactions to determine the transaction date. The transaction date may differ from the date you made the purchase if, for example, there is a delay in the merchant submitting the transaction to us or if the merchant uses another date as the transaction date. This means that in some cases your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. For example, if an eligible purchase is made on December 31st but the merchant processes the transaction such that it is identified to us as occurring on January 1st, then the statement credit available in the next calendar year will be applied. Statement credits may not be received or may be reversed if the booking is cancelled or modified. If the Card Account is cancelled or past due, it may not qualify to receive a statement credit. If American Express does not receive information that identifies your transaction as eligible, you will not receive the statement credits. For example, your transaction will not be eligible if it is a booking: (i) made with a property not included in the Fine Hotels + Resorts or The Hotel Collection programs, (ii) not made through American Express Travel, or (iii) not made with an eligible Card. Participating properties and their availability are subject to change. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide and may reverse any statement credits provided to you. If a charge for an eligible purchase is included in a Pay Over Time balance on your Card Account, the statement credit associated with that charge may not be applied to that Pay Over Time balance. Instead, the statement credit may be applied to your Pay In Full balance. Please refer to AmericanExpress.com/FHR and AmericanExpress.com/HC for more information about Fine Hotels + Resorts and The Hotel Collection, respectively.

2X Membership Rewards® Points

Membership Rewards-enrolled Card Members get at least 1 Membership Rewards® point for every eligible dollar spent on their Membership Rewards program-enrolled American Express® Card. Those same Card Members will also get at least 1 additional point for each dollar of eligible travel purchases made on amextravel.com on their Membership Rewards program-enrolled American Express Card. Corporate Card Members are not eligible for the additional point. Eligible travel purchases include all travel purchases made with your Membership Rewards program-enrolled American Express® Card on amextravel.com, including air, prepaid hotels, prepaid short-term rentals, prepaid car rentals, vacation packages (flight + hotel packages) or cruise reservations, minus returns and other credits. Platinum and Business Platinum Card Members are only eligible for 1 additional point on cruise reservations. Eligible travel purchases do NOT include non-prepaid car rentals, non-prepaid hotels, ticketing service or other fees, or interest charges. Additional point bonuses you may receive with your Card on other purchase categories from American Express may not be combined with this offer (e.g., 5X bonuses for Platinum and Business Platinum Card Members, 3X bonuses for Business Gold Card Members, or 1.5X bonuses for Business Centurion and Business Platinum Card Members, etc.). Any portion of a charge that you elect to cover through redemption of Membership Rewards points is not eligible to receive points. Additional points will be credited to the Membership Rewards account 10-12 weeks after final payment is made.

3X Membership Rewards Points Business Gold

Basic American Express® Business Gold Card Members will get at least one Membership Rewards® point for each dollar of eligible travel purchases on their Card and on any Employee Cards on their Card Account. Basic Card Members will get 2 additional points (for a total of 3 points) for each dollar spent on eligible travel purchases on their Business Gold Card Account from American Express. Eligible travel purchases include scheduled flights and prepaid flight+hotel packages made online at AmexTravel.com, minus returns and other credits. Additionally, eligible travel purchases include prepaid hotel purchases made through American Express Travel over the phone with our Travel Consultants or made online at AmexTravel.com, minus returns and other credits. Eligible travel purchases do NOT include non-prepaid hotel bookings, scheduled flights and prepaid flight+hotel packages booked over the phone, vacation packages, car rentals, cruise, hotel group reservations or events, ticketing service, cancellation or other fees, interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents. To be eligible for the 3X Membership Rewards® points, the booking must be both reserved and charged on the Basic or Additional/Employee Card on the Card Account. To modify a reservation, you can cancel and rebook your reservation on AmexTravel.com or by calling a representative of AmexTravel.com at 1-800-297-2977. To be eligible for the 3X Membership Rewards® points, any changes to an existing reservation must be made through the same method as your original booking. Cancellations are subject to hotel cancellation penalty policies. If hotel reservations are made or modified directly with the hotel provider, the reservation will not be eligible for this 3X Membership Rewards® point benefit. To be eligible to receive extra points, Card Account(s) must not be cancelled or past due at the time of extra points fulfillment. If a booking is canceled, the extra points will be deducted from the Membership Rewards account. Extra points will be credited to the Membership Rewards account approximately 6-10 weeks after eligible purchases appear on the billing statement. Bonuses you may receive with your Card on other purchase categories or in connection with promotions or offers from American Express may not be combined with this benefit.

Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for additional points. A purchase with a merchant will not earn additional points if the merchant’s code is not included in an additional points category. You may not receive additional points if we receive inaccurate information or are otherwise unable to identify your purchase as eligible for an additional points category. For example, you may not receive additional points when: a merchant uses a third-party to sell their products or services; or a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

Please visit americanexpress.com/rewards-info for more information about rewards.

5X Membership Rewards Points for Business Platinum Card

You will get one point for each dollar charged for an eligible purchase on your Business Platinum Card® from American Express. You will get 4 additional points (for a total of 5 points) for each dollar spent on eligible travel purchases. Eligible travel purchases include scheduled flights and prepaid flight and hotel packages made online at AmexTravel.com, minus returns and other credits. Additionally, eligible travel purchases include prepaid hotel purchases made through American Express Travel, over the phone with our Travel Consultants or made online at AmexTravel.com, minus returns and other credits. Eligible travel purchases do NOT include non-prepaid hotel bookings, scheduled flights and prepaid flight and hotel packages over the phone, vacation packages, car rentals, cruise, hotel group reservations or events, ticketing service, cancellation or other fees, interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents. To be eligible for the 5x Membership Rewards® points, you must both reserve and charge the travel purchase with the same eligible Business Platinum Card®. To modify a reservation you must cancel and rebook your reservation. You can cancel and rebook your reservation on AmexTravel.com or by calling a representative of AmexTravel.com at 1-800-297-2977. Cancellations are subject to hotel cancellation penalty policies. If hotel reservations are made or modified directly with the hotel provider, the reservation will not be eligible for this 5X Membership Rewards® point benefit. To be eligible to receive extra points, Card account(s) must not be cancelled or past due at the time of extra points fulfillment. If booking is cancelled, the extra points will be deducted from the Membership Rewards account. Extra points will be credited to the Membership Rewards account approximately 6-10 weeks after eligible purchases appear on the billing statement. Additional point bonuses you may receive with your Card on other purchase categories from American Express may not be combined with this benefit (e.g., 1.5X and 2X bonuses for Business Platinum Card Members, etc.). Purchases eligible for multiple additional point bonuses will only receive the highest eligible bonus. The benefits associated with the Additional Card(s) you choose may be different than the benefits associated with your basic Card. To learn about the benefits associated with Additional Card(s) you choose, please call the number on the back of your Card.

5X Membership Rewards® Points Platinum Card

Basic Card Members will get 1 Membership Rewards® point for each dollar charged for eligible purchases on their Platinum Card® or an Additional Card on their Account and 4 additional points (for a total of 5 points) for each dollar charged for eligible travel purchases on any Card on the Account (“Additional Points”), minus cancellations and credits. Eligible travel purchases are limited to: (i) purchases of air tickets on scheduled flights, of up to $500,000 in charges per calendar year, booked directly with passenger airlines or through American Express Travel (by calling 1-800-525-3355 or through AmexTravel.com); (ii) purchases of prepaid hotel reservations booked through American Express Travel; and (iii) purchases of prepaid flight+hotel packages booked through AmexTravel.com. Eligible travel purchases do not include: charter flights, private jet flights, flights that are part of tours, cruises, or travel packages (other than prepaid flight+hotel packages booked through AmexTravel.com), ticketing or similar service fees, ticket cancellation or change fees, property fees or similar fees, hotel group reservations or events, interest charges, or purchases of cash equivalents. Eligible prepaid hotel bookings or prepaid flight+hotel bookings that are modified directly with the hotel will not be eligible for Additional Points.

Bonuses that may be received with your Card on other purchase categories or in connection with promotions or offers from American Express cannot be combined with this benefit. Any portion of a charge that the Basic Card Member elects to cover through redemption of Membership Rewards points is not eligible to receive points. Additional terms and restrictions apply.

Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for Additional Points. A purchase with a merchant will not earn Additional Points if the merchant’s code is not included in an Additional Points category. Basic Card Members may not receive Additional Points if we receive inaccurate information or are otherwise unable to identify your purchase as eligible for an Additional Points category. For example, you may not receive Additional Points when: a merchant uses a third-party to sell their products or services, a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers), or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

To be eligible for this benefit, the Card Account must not be cancelled. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit in any way American Express may remove access to this benefit from the Account. For additional information, call the number on the back of your Card or visit americanexpress.com/rewards-info for more information about rewards.

Cruise Privileges Program Cruise Privileges Program (“CPP”) benefits are valid only for new CPP bookings made with participating cruise lines through American Express Travel. CPP benefits are valid only for eligible U.S. Consumer and Business Platinum and Centurion® Card Members (Delta SkyMiles® Platinum Card Members are not eligible). CPP bookings must be made using the eligible Card. CPP benefits are non-transferable. Participating cruise lines and program benefits are subject to change. The benefits of an onboard credit and amenity are valid for new CPP bookings of at least five nights and require double occupancy; the eligible Card Member must be traveling on the itinerary booked; the total cost of the CPP booking must be paid using an American Express® Card in the eligible Card Member's name. Onboard credits and amenities cannot be combined with other offers unless indicated; blackout dates, category and fare restrictions may apply. Onboard credits and amenities may not be available to residents outside of the 50 United States. Onboard credits and amenities apply per stateroom, with a three-stateroom limit per eligible Card Member, per cruise. For new CPP bookings with Celebrity Cruises, Norwegian Cruise Line, Holland America Line, Princess Cruises, and Royal Caribbean International, eligible Card Members receive an onboard credit (in USD) of: $100 for inside and outside staterooms, $200 for balcony, verandah, and mini-suite staterooms, and/or $300 for suites. For new CPP bookings with Cunard, eligible Card Members receive an onboard credit (in USD) of: $300 for all Queen Mary ocean-view staterooms category EF or higher, and/or Queen Victoria or Queen Elizabeth ocean-view staterooms category FA or higher. For new CPP bookings with Ama Waterways, Oceania, Regent, Azamara, Seabourn, Silversea, Uniworld, Windstar, and Explora Journeys, eligible Card Members receive an onboard credit of US$300 for all stateroom categories. For new CPP bookings, Centurion Members receive an additional US$200 onboard credit on Explora Journeys, Regent Seven Seas Cruises, Seabourn, and Silversea. Onboard credits will be applied at checkout upon completion of the cruise; credit amounts in local currency may vary due to foreign exchange rates; credits are subject to cruise line terms and policies; credits cannot be used for casino charges, gratuities or other similar charges. Any unused portion of a credit is non-refundable and is not redeemable for cash. Other restrictions may apply. Onboard amenities vary by participating cruise line and are not available on Silver Explorer, Silver Galapagos and Silver Discoverer. Onboard credits and amenities are not available on Celebrity Cruises Galapagos sailings.

Extra Membership Rewards® points: CPP-eligible Card Members that are Membership Rewards program-enrolled will receive one (1) extra Membership Reward® point per eligible dollar spent on new CPP bookings made with participating cruise lines through American Express Travel; separate airfare and other charges associated with such bookings are not eligible. CPP bookings must be made using the eligible Card (described above). The extra points will be credited to the Card Member’s Membership Rewards account 8-12 weeks after completion of the CPP cruise. For more information visit membershiprewards.com/terms .

Fine Hotels + Resorts®

Fine Hotels + Resorts® (FHR) program benefits are available for new bookings made through American Express Travel with participating properties and are valid only for eligible U.S. Consumer, Business, and Corporate Platinum Card® Members, and Centurion® Members. Additional Platinum Card Members on Consumer and Business Platinum and Centurion Card Accounts are also eligible for FHR program benefits. Companion Card Members on Consumer Platinum and Centurion Card Accounts, Additional Business Gold and Additional Business Expense Card Members on Business Platinum and Centurion Card Accounts, and Delta SkyMiles® Platinum Card Members are not eligible for FHR program benefits. Bookings must be made using an eligible Card and must be paid using that Card, or another American Express® Card, in the eligible Card Member's name, and that Card Member must be traveling on the itinerary booked. The average total value of the program benefits is based on prior-year bookings for stays of two nights; the actual value varies. Noon check-in and room upgrade are subject to availability and are provided at check-in; certain room categories are not eligible for upgrade. The type of $100 credit and additional amenity (if applicable) varies by property; the credit will be applied to eligible charges up to the amount of the credit. To receive the credit, the eligible spend must be charged to your hotel room. The credit will be applied at check-out. Advance reservations are recommended for certain credits. The type and value of the daily breakfast (for two) varies by property; breakfast will be valued at a minimum of US$60 per room per day. To receive the breakfast credit, the breakfast bill must be charged to your hotel room. The breakfast credit will be applied at check-out. If the cost of Wi-Fi is included in a mandatory property fee, a daily credit of that amount will be applied at check-out. Benefits are applied per room, per stay (with a three-room limit per stay). Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members traveling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional FHR benefits (“Prohibited Action”). American Express and the Property reserve the right to modify or revoke FHR benefits at any time without notice if we or they determine, in our or their sole discretion, that you may have engaged in a Prohibited Action, or have engaged in abuse, misuse, or gaming in connection with your FHR benefits. Benefit restrictions vary by property. Benefits cannot be redeemed for cash and are not combinable with other offers unless indicated. Benefits must be used during the stay booked. Any credits applicable are applied at check-out in USD or the local currency equivalent. Benefits, participating properties, and availability and amenities at those properties are subject to change. To be eligible for FHR program benefits, your eligible Card Account must not be cancelled. For additional information, call the number on the back of your Card.

Fine Hotels + Resorts Special Offers

Special offer and Fine Hotels + Resorts® (FHR) program benefits are available for new bookings made through American Express Travel® with participating properties and are valid only for eligible U.S. Consumer, Business, Corporate Platinum Card® Members and Centurion® Members. Additional Platinum Card Members on Consumer and Business Platinum and Centurion Card Accounts are also eligible for FHR program benefits. Companion Card Members on Consumer Platinum and Centurion Card Accounts, Additional Business Gold and Additional Business Expense Card Members on Business Platinum and Centurion Card Accounts, and Delta SkyMiles® Platinum Card Members are not eligible for FHR program benefits or related special offers. Special offers are not combinable with other offers unless indicated, including, without limitation, lower rate offers. Special offer book by and travel by dates apply and vary by property. The availability and related terms of this special offer applies at the point of booking. The special offer is subject to change at the discretion of the property and you may see a different offer if you navigate away and return later. A minimum number of consecutive nights of stay are required and blackout dates may apply, please refer to the offer terms associated with a given property for details. Any complimentary nights will be reflected at the time of booking; applicable taxes and fees for the complimentary nights will be removed at check-out. Bookings must be made using an eligible Card and must be paid using that Card, or another American Express® Card, in the eligible Card Member's name, and that Card Member must be traveling on the itinerary booked. The average total value of the program benefits is based on prior-year bookings for stays of two nights; the actual value varies. Noon check-in and room upgrade are subject to availability and are provided at check-in; certain room categories are not eligible for upgrade. The type of $100 credit and additional amenity (if applicable) varies by property; the credit will be applied to eligible charges up to the amount of the credit. To receive the credit, the eligible spend must be charged to your hotel room. The credit will be applied at check-out. Advance reservations are recommended for certain credits. The type and value of the daily breakfast (for two) varies by property; breakfast will be valued at a minimum of US$60 per room per day. To receive the breakfast credit, the breakfast bill must be charged to your hotel room. The breakfast credit will be applied at check-out. If the cost of Wi-Fi is included in a mandatory property fee, a daily credit of that amount will be applied at check-out. Benefits are applied per room, per stay (with a three-room limit per stay). Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members traveling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional FHR benefits (“Prohibited Action”). American Express and the Property reserve the right to modify or revoke FHR benefits at any time without notice if we or they determine, in our or their sole discretion, that you may have engaged in a Prohibited Action, or have engaged in abuse, misuse, or gaming in connection with your FHR benefits. Benefit restrictions vary by property. Benefits cannot be redeemed for cash and are not combinable with other offers unless indicated. Benefits must be used during the stay booked. Any credits applicable are applied at check-out in USD or the local currency equivalent. Benefits, participating properties, and availability and amenities at those properties are subject to change. To be eligible for FHR program benefits, your eligible Card Account must not be cancelled. For additional information, call the number on the back of your Card.

Gold Card Membership Rewards®