- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Mortgage Renewal

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- Types of Houses in Canada

- First-Time Home Buyer Grants and Assistance Programs

- Types of Mortgages in Canada: Which Is Right for You?

- How Does a Mortgage Work in Canada?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

18 Best Travel Credit Cards in Canada for May 2024

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.

Our picks for Canada’s best travel credit cards include top cards across numerous categories to help you earn discounts, perks and rewards before your next trip.

Best travel credit cards in Canada

- How we evaluate cards

- Summary of our selections

How travel credit cards work in Canada

American express cobalt® card.

Welcome Offer: Earn up to 15,000 points (up to $150)! In your first year, as a new Cobalt Cardmember, you can earn 1,250 Membership Rewards ® points for each monthly billing period in which you spend $750. Earn 5X points on eligible Eats & Drinks. Earn 3X points on eligible streaming subscriptions. Earn 2X points on Travel and Transit. Terms and Conditions Apply.

Best Travel Credit Cards in Canada from Our Partners

Best overall.

Best overall travel card

Scotiabank platinum american express® card.

- Earn up to $2,100* in value in your first 14 months, including up to 60,000* bonus Scene+ points. Offer ends October 31, 2024.

- You will not pay 2.5% foreign transaction fees on any foreign currency purchases, including online shopping and when travelling abroad. Only the exchange rate applies.

- Earn 2X Scene+™ points for every $1 CAD you spend on all your eligible purchases.

- Scene+ points can be redeemed for travel purchase, merchandise and other non-travel rewards such as gift cards and prepaid cards.

- You must redeem a minimum of 5,000 points per travel-related rewards redemption, equivalent to $50 in travel savings. Points must be redeemed within 12 months of the purchase date.

- $399 annual fee.

- Redeem points for any flight, any time through Scene+ Travel, a full-service travel agency. Plus, take advantage of a best price guarantee on airfare.

- Get a Hertz #1 Club Gold membership for special privileges and rental car benefits at over 8,500 locations in 147 countries.

- Enjoy culinary events and experiences, entertainment, luxury fashion, tours, and more through American Express benefits, including American Express Invites, Platinum VIP offers and access to 24/7 premium concierge services for restaurant reservations, show tickets, and gift purchases.

- Lounge access at over 600 VIP airport lounges around the world with a complimentary Priority Pass membership, which includes 10 free visits per year.

- 12 types of insurance provided, including 31-day travel medical benefits — up to $2 million in coverage — for you, your spouse and any dependent children under the age of 65. 10-day coverage available for those over the age of 65.

- Preferred rates: 9.99% for purchases, 9.99% for cash advances.

- To be eligible, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

- Terms and Conditions Apply. Click ‘Apply Now’ for complete details.

If this card doesn’t seem like a good fit for your wallet, take a look at NerdWallet’s selection of the best credit cards to help find the right option for you.

Best for: Expedia bookings

Td first class travel® visa infinite* card.

- Earn up to $800 in value†, including up to 100,000 TD Rewards Points† and no Annual Fee for the first year†. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of up to 10,000 TD Rewards Points†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening.

- To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

- Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†.

- Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†.

- Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†.

- Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card† plus earn an annual Birthday Bonus† of up to 10,000 TD Rewards Points.

- No travel blackouts†, no seat restrictions† and no expiry† for your TD Rewards Points as long as your account is open and in good standing.

- Each year, you will receive one $100.00 TD Travel Credit on your first Eligible Travel Credit Purchase of $500.00 or more made with Expedia For TD and posted to the Account in a calendar year.

- Interest Rates: 20.99% on purchases and 22.99% on cash advances.

- Go Places on Points: Your Points are worth more when you redeem through Expedia® For TD: Search over a million flights, hotels, packages and more! When you’re ready to book, you can redeem† your TD Rewards Points towards your travel purchase right away.

- Redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop with Points. Conditions apply.

- Shop online through TDRewards.com Redeem your TD Rewards Points for great deals on a wide selection of merchandise and gift cards.

- Option to purchase TD Auto Club Membership†: and be covered 24 hours a day for emergency roadside assistance services in case something goes wrong when you are out on the road.

- Travel Medical Insurance†: Up to $2 million of coverage for the first 21 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.

- Trip Cancellation/Trip Interruption Insurance†: For Trip Cancellation, up to $1,500 of coverage per insured person, with a maximum of $5,000 for all insured persons, and for Trip Interruption, up to $5,000 of coverage per insured person, with a maximum of $25,000 for all insured persons on the same covered trip.

- To be eligible, $60,000 (individual) or $100,000 (household) annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

- †Terms and conditions apply.

- This offer is not available for residents of Quebec.

- The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

Best for: Airport lounge access

The platinum card® from american express.

- Unlock special experiences with the Platinum Card®.

- Earn up to 100,000 Membership Rewards® points – that’s up to $1,000 towards a weekend away.

- New Platinum® Cardmembers, earn 70,000 Welcome Bonus points after you charge $10,000 in net purchases to your Card in your first 3 months of Cardmembership.

- Plus, earn 30,000 points when you make a purchase between 14 and 17 months of Cardmembership.

- Earn 2 points for every $1 in Card purchases on eligible dining and food delivery in Canada, 2points for every $1 in Card purchases on eligible travel, and 1 point for every $1 in all other Card purchases.

- Access a $200 Annual Travel Credit through American Express Travel Online or Platinum® Card Travel Service.

- Enjoy a $200 Annual Dining Credit at some of Canada’s best restaurants.

- Unlock $200 or more in additional value with Member extras. You can earn statement credits for qualifying purchases with participating brands.

- Take full advantage of The American Express Global Lounge Collection™ which unlocks access to over 1300 airport lounges worldwide. This includes The Centurion® Lounge network, Plaza Premium Lounges, and hundreds of other domestic and international lounges designed to enhance your travel experience.

- Enjoy flexible ways to use your points such as statement credits for any eligible purchase charged to your Card, new travel purchases booked on American Express Travel Online through the Flexible Points Travel Program, and eligible flights through the Fixed Points Travel Program.

- Transfer points 1:1 to several frequent flyer and other loyalty programs.

- Enjoy complimentary benefits that offer an average value of $600 USD at over 1,500 extraordinary properties worldwide when you book Fine Hotels + Resorts

- Platinum Cardmembers can enjoy access to special events and unique opportunities.

- Enjoy premium benefits at the Toronto Pearson Airport.

- You will also have access to many leading hotel and car rental companies’ loyalty programs. Our partners include Marriott International, Hilton Hotels and Resorts, Hertz and Avis.

- Interest applies in accordance with your Cardmember Agreement, Information Box, and Disclosure statement if the total New Balance is not paid by the Payment Due Date each month. All payments must be received by the Payment Due Date shown on the monthly statement.

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, NerdWallet may receive compensation from American Express, which can be in the form of monetary payment.

Best for: Aeroplan points

American express® aeroplan® reserve card.

- New American Express® Aeroplan®* Reserve Cardmembers can earn up to 85,000 Aeroplan points.

- Earn 60,000 Aeroplan points after spending $7,500 in purchases on your Card within the first 3 months.

- Plus, earn an additional 25,000 Aeroplan points when you spend $2,500 in purchases in month 13.

- That’s up to $2,600 or more in value when you combine your welcome bonus points and card benefits.

- New Offer: Cardmembers can now get an extra night free for every 3 consecutive hotel nights redeemed with Aeroplan points. Offer ends December 31, 2024.

- Highest Air Canada earn rate on an Aeroplan payment card in Canada: Earn 3X the points on eligible purchases made directly with Air Canada®* and Air Canada Vacations®*.

- Standard Earn Rate: Earn 2X the points on eligible Dining and Food Delivery purchases in Canada and earn 1.25X the points on everything else.

- Get through the airport quicker with Air Canada Priority Check-In, Air Canada Priority Boarding and Air Canada Priority Baggage Handling.

- Enjoy access to select Air Canada Maple Leaf Lounges™* and Air Canada Café™ in North America for you and a guest, with a same day ticket on a departing Air Canada or Star Alliance flight.

- Enjoy your eligible first checked bag free for up to 9 people travelling on the same reservation on Air Canada flights.

- Roll over any unallocated Aeroplan Elite™* Status Qualifying Miles and unused eUpgrade Credits to the following year to enjoy during your travels.

- Get access to more than 1,200 Priority Pass™ airport lounges and enjoy an oasis of comfort before your flight, regardless of your airline or cabin class.

- Insurance Coverage: whether you’re shopping nearby or travelling abroad, you can feel confident knowing you can be taken care of.

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information click the Apply now link. If you apply and get approved for an American Express Card, NerdWallet may receive compensation from American Express, which can be in the form of monetary payment.

Best for: Hotel rewards

Marriott bonvoy® american express®* card.

- New Marriott Bonvoy® American Express®* Cardmembers earn 50,000 Marriott Bonvoy® points after you charge $1,500 in purchases to your Card in your first three months of Cardmembership. Subject to change at any time

- Earn 5 points for every dollar in eligible Card purchases at hotels participating in Marriott Bonvoy®.

- Earn 2 points for every $1 in all other Card purchases.

- Receive an Annual Free Night Award for up to 35,000 points at eligible hotels and resorts worldwide every year after your first anniversary.

- No annual fee on Additional Cards.

- Redeem points for free nights with no blackout dates at over 7,000 of the world’s most desired hotels.

- Automatic Marriott Bonvoy Silver Elite status membership.

- Receive 15 Elite Night Credits each calendar year with your Marriott Bonvoy® American Express®* Card. These can be used towards attaining the next level of Elite status in the Marriott Bonvoy program.

- Enjoy an automatic upgrade to Marriott Bonvoy Gold Elite status when you reach $30,000 in purchases on the Card each year or when you combine 10 qualifying paid nights within one calendar year with the 15 Elite Night Credits from your card.

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. Conditions Apply. If you apply and get approved for an American Express Card, NerdWallet may receive compensation from American Express, which can be in the form of monetary payment.

Best for: British Airways flyers

Rbc® british airways visa infinite‡.

- Intro offer: Get Up to 60,000 Aviosˆ: Receive 15,000 Avios as welcome bonus upon approval. 35,000 bonus Avios when you spend $6,000 CAD in the first 3 months. Another 10,000 bonus Avios after your first yearˆ.

- Earn 3 Avios for every $1 CAD spent at British Airways and British Airways Holidays

- Earn 2 Avios for every $1 CAD spent on qualifying dining spend

- Earn 1 Avios for every $1 CAD spent on all other qualifying net purchases

- Earn a companion voucher when you spend $30,000 CAD annually. You can either take a companion with you or fly solo instead for a 50% Avios discount on the cost of one reward seat ticket. Plus, you’ll have the flexibility to pay a lower, flat fee to cover taxes, fees and carrier charges and a fixed Avios amount when you make a Reward Flight booking.

- Eligible members who spend a minimum of $30,000 CAD on qualifying purchases on their card in a calendar year (“calendar year” refers to the time period starting from January 1 and ending December 31) will receive a maximum of one Companion Voucher for that calendar year. See ba.com/rbc-visa for full terms and conditions.

- 10% off British Airways flights when you book and pay with your card∞

- Redeem for flights and more – you can spend your Avios on all of the travel things you love, including cabin upgrades with British Airways or reward flights with British Airways and any of the oneworld partner airlines to almost 1,000 destinations worldwide**

- Comprehensive Insurances including 31–day out of country/province emergency medical insurance¹, flight delay insurance², hotel burglary³ and rental car⁴ insurance. Even eligible purchases you make with the card are protected³.

- Luxury Visa Infinite benefits⁵ such as first in line service for exclusive events and hotel and dining exclusives via www.visainfinite.ca

- Complimentary 24/7 Concierge Service⁵.

- Link your RBC card with a Petro-Points membership to instantly save 3₵ per litre on fuel at Petro-Canada stations and earn 20% more Petro-Points and 20% more Avion points

- Get $0 delivery fees for 12 months from DoorDash

- Link your RBC British Airways Visa Infinite card with a Rexall Be Well account and get 50 Be Well points for every $1 spent on eligible products at Rexall. Redeem Be Well points faster for savings in store on eligible purchases where 25,000 Be Well points = $10

- Eligibility: This card requires a minimum personal income of $60,000 or a minimum household income of $100,000. Must also be a Canadian resident of the age of majority in the province or territory of residence.

- Corresponding legal references and product terms are available on the RBC website, which will be available and agreed upon in the customer onboarding process.

Best for: AIR MILES rewards

Bmo air miles®† world elite®* mastercard®*.

- Welcome offer: Get 2,000 AIR MILES Bonus Miles and we’ll waive the $120 annual fee for the first year.*

- Get 3x the Miles for every $12 spent at participating AIR MILES Partners and 2x the Miles for every $12 spent at any eligible grocery store*.

- Earn 1 reward mile for every $12 in credit card purchases, everywhere you spend.*

- Get valuable benefits and offers for digital everyday services from a variety of on-demand apps and subscription services.

- Use your card at Costco.*

- Extended Warranty.

- Access over 1 million Wi-Fi hotspots around the world – all at no added cost, and no added fees or roaming charges.*

- Complimentary membership in Mastercard Travel Pass provided by DragonPass.*

- Use less Miles with our exclusive 25% discount on one worldwide AIR MILES flight redemption during the calendar year.*

- BMO AIR MILES World Elite Travel and Medical Protection.*

- BMO Concierge Service.*

- Unlock Mastercard Travel Rewards cashback offers when you travel and shop outside of Canada.

- *Terms and conditions apply.

- BMO is not responsible for maintaining the content on this site. Please click on the Apply now link for the most up to date information.

Best for: Newcomers to Canada

Scotiabank passport™ visa infinite* card.

- Earn up to $1,100+ in value in the first 12 months, including up to 35,000 bonus Scene+ points and first year annual fee waived on your first supplementary card. Offer Ends January 3, 2024.

- The only major bank credit card offering you no foreign transaction fees, including for shopping online or abroad.

- Your Award Winning Card For Travel.

- Earn 2 Scene+ points on every $1 you spend on eligible grocery stores, dining, entertainment purchases, and daily transit purchases (including buses, subways, taxis and more).

- Earn 1 Scene+ point on every $1 you spend on all other eligible purchases.

- You’ll earn 3X Scene+ points for each dollar charged to your account on all eligible purchases¹ at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés TradItIon, Rachelle Béry and Co-Op.

- Airport lounge access through complimentary Visa Airport Companion Program membership, plus six complimentary lounge visits per year from the date of enrollment, providing you with access to 1,200+ airport lounges globally, including participating Plaza Premium Lounges.

- Visa Infinite* benefits including Visa Infinite Concierge, Visa Infinite* Luxury Hotel Collection, Visa Infinite* Dining Series, and Entertainment & Lifestyle Offers.

- Access to Scotia SelectPay™.

- To be eligible, $60,000 (individual) or $100,000 (household) annual income is required, or a minimum assets under management of $250,000. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

If this card doesn’t seem like a good fit for your wallet, take a look at NerdWallet’s selection of the best newcomer credit cards to help find the right option for you.

Best for: Cash back

Bmo cashback® world elite®* mastercard®*.

- Welcome offer: Get up to 10% cash back in your first 3 months and the $120 annual fee waived in the first year.*

- Earn more cash back on the categories that mean the most: 5% on groceries.* 4% on transit including ride sharing, taxis and public transportation.* 3% on gas and electric vehicle charging.* 2% on recurring bill payments like your monthly phone bill or favourite streaming service.* 1% unlimited cashback on all other purchases.*

- Get the highest cash back earn rate on groceries in Canada.†

- Extended Warranty Plus.*

- Purchase Protection Plus.*

- Complimentary membership in Mastercard Airport Experiences provided by LoungeKey.*

- Complimentary Roadside Assistance Program.*

- BMO CashBack World Elite Travel and Medical Protection.*

- †Statement based on a comparison of the non-promotional grocery rewards earn rate on Canadian cash back credit cards as of January 4, 2023.

Best for: WestJet flyers

Westjet rbc world elite mastercard.

- Get up to $450 in WestJet dollars¹ with the WestJet RBC® World Elite Mastercard. Plus, get a Round-Trip Companion Voucher Every Year – for any WestJet destination starting from $119 CAD³ (plus taxes, fees, charges and other ATC).

- Get free first checked bags for the primary cardholder and up to 8 guests on the same reservation⁴

- Earn WestJet dollars 1.5% on everyday purchases and 2% on flights or packages with WestJet or WestJet Vacations⁸

- WestJet dollars never expire¹⁰ Use your WestJet dollars to book flights anytime so you can travel when and where you want.

- No blackout periods.

- Travel coverage including emergency medical insurance²⁰ as well as trip interruption insurance²¹, hotel burglary¹⁸ and rental car insurance¹⁸. Even eligible purchases you make on the card are protected.

- Link your RBC card with a Petro-Points membership to and instantly save 3₵ per litre on fuel¹² and always earn 20% more Petro-Points¹³ at Petro-Canada.

- Free Boingo Wifi for Mastercard holders¹¹ at over 1 million hot spots.

- Get $0 delivery fees for 12 months from DoorDash^. Add your eligible RBC credit card to your DoorDash account to: Get a 12-month complimentary DashPass subscription± – a value of almost $120. Enjoy unlimited deliveries with $0 delivery fees on orders of $15 or more when you pay with your eligible RBC credit card.

- Eligibility: This card requires a minimum personal income of $80,000 or a minimum household income of $150,000. Must also be a Canadian resident of the age of majority in the province or territory of residence.

Best for: Aventura points

Cibc aventura® gold visa* card.

- Earn up to 35,000 Aventura Points (up to $800 in value) during your first year. Receive 15,000 Aventura Points when you spend $3,000 or more in the first 4 monthly statement periods.

- Get a one-time annual fee rebate ($139) for you (the primary cardholder) and up to three authorized users ($50 each): over $189 value.

- Enjoy 4 complimentary visits with the Visa Airport Companion Program.

- Plus, get a NEXUS Application Fee rebate: a $50 value.

- Offer applies to newly approved card accounts only.

- 2x for every $1 spent on travel purchased through the CIBC Rewards Centre.

- 1.5x on for every $1 spent at eligible gas stations, electric vehicle charging stations, grocery stores and drug stores, up to $80,000 annual spend.

- 1x for every $1 spent on all other purchases.

- 1x for every $4.00 spent on a CIBC Global Money Transfer, through June 30, 2022.

- Redeem points for airline tickets, merchandise, gift cards and more.

- Apply points to your CIBC Aventura card balance or select CIBC financial products.

- $139 annual fee.

- Access to more than 1,300 airport lounges across the globe. Priority Pass membership with 4 complimentary lounge visits a year. Zip in and out of the country with a rebate on one NEXUS™ application fee every 4 years.

- Fly any airline with points that don’t expire.

- Use Aventura Points to cover full airfare including taxes and fees.

- Link your Journie Rewards card to save on every fill-up at participating Pioneer, Fas Gas, Ultramar and Chevron gas stationsabout the features of this card.

- Visa’s Zero Liability Policy and Fraud Alerts.

- Valuable insurance included: Out-of-Province Emergency Travel Medical Insurance, Flight Delay and Baggage Insurance, Auto Rental Collision and Loss Damage Insurance, $500,000 Common Carrier Accident Insurance, Purchase Security and Extended Protection Insurance, Hotel Burglary Insurance and Mobile Device Insurance.

- Access to installment plans through CIBC Pace It.

- Preferred rates: 20.99% for purchases, and 22.99% for cash advances (21.99% for Quebec residents).

- To be eligible, a $15,000 individual annual income is required and you must be a Canadian resident that has reached the age of majority in your province.

Best for: Students

Cibc aeroplan® visa card for students.

- 1x Aeroplan points per dollar on gas, electric vehicle charging, groceries and Air Canada travel purchases, up to $40,000 annual spend.

- 1x Aeroplan points per $1.50 spent on all other purchases, including gas, electric vehicle charging, groceries and Air Canada travel purchases that exceed the $40,000 threshold.

- Earn points twice at over 150 Aeroplan partners and 170+ online retailers through the Aeroplan eStore.

- Aeroplan Points never expire and can be redeemed for a variety of travel, merchandise, gift card, and other rewards offered by Aeroplan’s participating partners and suppliers.

- $0 annual fee.

- Get three free months of Uber Pass for discounts on rides, meals and more. Offer ends September 8, 2022.

- Earn 1 Aeroplan point for every $6 spent on CIBC Global Money Transfer, with no transaction fees or interest as long as you pay your balance on time. Offer ends June 30, 2022.

- Maximize your points by adding up to three additional cards and giving them to your spouse or other family members. Points can be shared with other Aeroplan members in your household.

- Earn points by using your CIBC Aeroplan Visa to automatically make recurring bill payments.

- Receive preferred pricing when paying for flights with your Aeroplan points.

- Save up to 25% on car rentals at participating Budget and Avis locations worldwide when paying with your card.

- Save up to 10 cents per litre at participating Chevron, Ultramar and Pioneer gas stations if you link your card with Journie Rewards.

- Use the CIBC Pace It feature to make installment payments on large purchases.

- Four types of insurance are provided: auto rental collision and loss damage insurance, purchase security, extended protection insurance, and $100,000 in common carrier accident insurance.

- Preferred rates: 20.99% for purchases, 22.99% for cash advances.

- To be eligible, you must have full-time status in a college or university.

Best for: Businesses

Td® aeroplan® visa* business card.

- Earn up to 60,000 Aeroplan points¹, with no Annual Fee in the first year¹. Conditions Apply. Account must be opened by June 3, 2024.

- Earn 2 Aeroplan points for every dollar spent on eligible purchases made directly with Air Canada, including Air Canada Vacations.

- Earn 1.5 Aeroplan points for every dollar spent on eligible travel, dining and select business categories, such as shipping, internet, cable and phone services.

- Earn 1 Aeroplan point for every dollar spent on all other eligible purchases.

- Earn points twice when paying with a TD Aeroplan Visa Business Card and providing an Aeroplan number at over 150 Aeroplan partner brands and more than 170 online retailers via the Aeroplan eStore.

- Points can be redeemed for flights, hotels, merchandise, gift cards and more. They can also be used to pay down the card’s balance.

- Linked cards earn 50% more Aeroplan points and Stars at participating Starbucks stores.

- $149 annual fee — rebated in the first year.

- Free first checked bag for up to 9 people travelling on the same reservation on Air Canada flights.

- One free one-time guest pass to Maple Leaf Lounges for every $10,000 in net purchases. Maximum of 4 passes a year.

- Reach Aeroplan Elite Status more quickly by earning 1,000 Status Qualifying Miles and one Status Qualifying Segment for every $5,000 in net purchases.

- Access online reporting, review business expenses, managing existing credit limits and apply spend controls through the TD Card Management Tool.

- Visa SavingsEdge program: save up to 25% on eligible business purchases.

- Travel benefits: travel medical insurance (up to $2 million in coverage for the first 15 days for those under 65; coverage lasts for 4 days for those 65 and older); common carrier travel accident insurance (up to $500,000 for covered losses), trip cancellation insurance (up to $1,500 per insured person; maximum of $5,000), trip interruption insurance (up to $5,000 per insured person; maximum of $25,000), flight/trip delay insurance (up to $500 if a flight or trip is delayed for longer than 4 hours), delayed and lost baggage insurance (up to $1,000 of overall coverage per insured person), auto rental collision/loss damage insurance (covers the full cost of a car rental for up to 48 days), hotel/motel burglary insurance (up to $2,500), mobile device insurance (up to $1,000 in coverage).

- Toll-free emergency travel assistance services.

- Receive a rebate of up to $100 on NEXUS enrolment application/renewal fee costs once every 48 months.

- Save a minimum of 10% on the lowest available base rates in Canada and the U.S., and a minimum of 5% on the lowest base rates internationally on qualifying car rentals at participating Avis and Budget locations.

- Visa Zero Liability protection, Verified by Visa and instant alerts to prevent fraudulent card use.

- Purchase security and extended warranty protection.

- Minimum credit limit of $1,000.

- Interest rates: 14.99% on purchases, 22.99% on cash advances.

Best for: USD purchases

Rogers™ mastercard®.

- No annual fee.

- 10% cashback on eligible purchases for the first three months, up to $1,000 spend.

- 2% unlimited cash back on all eligible purchases if you have 1 qualifying service with Rogers, Fido or Shaw.

- For cardholders who don’t have a qualifying service, earn 2% unlimited cash back on U.S. dollar purchases and 1% unlimited cash back on all other eligible purchases.

- 1.5x More cash back every time you redeem for Rogers, Fido or Shaw purchases – that’s a 3% cash back value.

- Get five free Roam Like Home days in 185 destinations for talk, text and data.

- Pay your bill using your mobile phone device.

- Transaction monitoring and fraud alerts.

- Balance protection insurance helps pay your minimum payment in the event of illness, disability or job loss.

- To apply, you must be the age of majority, be a resident of Canada, and have not filed for bankruptcy in the last seven years or have worked with a trustee under a formal Consumer Proposal.

Best for: Rewards on travel spending

Td® aeroplan® visa infinite privilege* credit card.

- Earn up to $2,900 in value† including up to 85,000 Aeroplan points (enough for a round trip to Honolulu†) and additional travel benefits. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†.

- Earn an additional 40,000 Aeroplan points when you spend $10,000 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 25,000 Aeroplan points when you spend $15,000 within 12 months of Account opening†.

- Earn 2 points† for every $1 spent on eligible purchases made direct through Air Canada® purchases (including Air Canada Vacations®).

- Earn 1.5 points† for every $1 spent on eligible gas, grocery, travel and dining purchases.

- Earn 1.25 points† for every $1 spent on all other purchases made with your Card.

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore.

- Global Airport Lounge Access†: Receive a complimentary membership to the Visa Airport Companion† Program hosted by Dragonpass International Ltd. and take advantage of six lounge visits included for each Cardholder per membership year at over 1,200 airport lounges worldwide. Enroll through the Visa Airport Companion App or through visaairportcompanion.ca

- Complimentary Visa Infinite Concierge† : On-call 24 hours a day, seven days a week, the Visa Infinite Concierge can help with any Cardholder request — big or small, to help you get the most out of life whenever you travel, shop and use your Card.

- Visa Infinite Luxury Hotel Collection†: Receive seven exclusive benefits when you book your stay through the Visa Infinite Luxury Hotel Collection featuring over 900 of the world’s most intriguing properties. Enjoy an additional 8th benefit at over 200 properties, exclusively for Visa Infinite Privilege cardholders.

- Travel Medical Insurance†: Up to $5 million of coverage for the first 31 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.

- Trip Cancellation/Trip Interruption Insurance†: For Trip Cancellation coverage of up to $2,500 per insured person, with a maximum of $5,000 for all insured persons, and for Trip Interruption coverage of up to $5,000 per insured person, with a maximum of $25,000 for all insured persons on the same covered trip.

- Flight/Trip Delay Insurance†: Up to $1,000 in coverage per insured person if your flight/trip is delayed for over 4 hours.

- Delayed and Lost Baggage Insurance†: For delayed baggage over 4 hours, up to $1,000 of coverage per insured person for the purchase of essentials, such as clothing and toiletries. For lost baggage, up to $2,500 of coverage per insured person.

- Common Carrier Travel Accident Insurance†: Up to $500,000 of coverage for covered losses while travelling on a common carrier (for example, a bus, ferry, plane, train or auto rental).

- Save time at the border with NEXUS: Enroll for a NEXUS and once every 48 months get an application fee rebate (up to $100 CAD)†. Additional Cardholders can also take advantage of this NEXUS rebate.

- To be eligible, $150,000 annual personal income or $200,000 household annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

Best for: NEXUS rebates

Cibc aventura visa infinite card.

- Earn 2 points for every $1 spent on travel purchased through the CIBC Rewards Centre.

- Earn 1.5 points for every $1 spent at eligible gas stations, electric vehicle charging stations, grocery stores and drug stores, up to $80,000 annual spend.

- Earn 1 point for every $1 spent on other purchases or on category spending in excess of the $80,000 annual limit.

- Earn 1 Aventura Point for every $4.00 spent on a CIBC Global Money Transfer. There are no transaction fees, and you won’t be charged interest as long as you pay your balance by the payment due date.

- Use Aventura Points to cover full airfare, including taxes and fees.

- To redeem your points for hotel stays, vacation packages, cruises, merchandise, gift cards and one-of-a-kind activities, visit the CIBC Rewards Centre.

- Use your Aventura Points to help pay down your credit card balance or contribute them to select financial products.

- Enjoy an annual fee rebate every year for the primary cardholder of up to $139 if you have a CIBC Smart Plus Account.

- Out-of-province emergency travel medical insurance.

- Flight delay and baggage insurance.

- Trip cancellation and trip interruption insurance.

- Auto rental collision and loss damage insurance.

- $500,000 common carrier accident insurance.

- Purchase security and extended protection insurance.

- Hotel burglary insurance.

- Mobile device insurance.

- Kick back in a comfortable lounge before boarding and enjoy your four complimentary visits with the Visa Airport Companion Program. Zip in and out of the country with a rebate on one NEXUS application fee every four years.

- Score luxury upgrades, tickets and tours through Visa Infinite Exclusive Offers.

- Fly any airline with points that don’t expire. Access personalized travel booking and trip planning with no booking fees through the Aventura Travel Assistant.

- Link your Journie Rewards card to save on every fill-up at participating Pioneer, Fas Gas, Ultramar and Chevron gas stations.

- To be eligible, a $60,000 individual or $100,000 household minimum annual income is required.

Best for: Premium travel perks

Cibc aeroplan® visa infinite privilege card.

- Get up to 110,000 Points: You’ll receive 20,000 Aeroplan points when you make your first purchase, another 30,000 points if you spend $6,000 or more during your first four monthly statement periods, and 60,000 more points as an additional anniversary bonus if you have at least $25,000 in net eligible purchases posted on your account during the first 12 monthly statement periods. This offer only applies to newly approved card accounts.

- 2x Aeroplan points on Air Canada purchases, including Air Canada Travel Vacations.

- 1.5x Aeroplan points on gas, electric vehicle charging, groceries, travel and dining, up to annual $100,000 spend.

- 1.25x Aeroplan points on other purchases.

- Earn points twice by providing your Aeroplan number at over 150 Aeroplan partner brands and over 170 online retailers through the Aeroplan eStore.

- Points can be redeemed for flights, car rentals and hotel stays, as well as complete vacation packages like cruises and all-inclusive resort visits. Points can also be redeemed for gift cards and merchandise sold through the Aeroplan eStore.

- $599 annual fee, which can be reduced by up to $139 each year if you have a CIBC Smart Plus account.

- An annual Worldwide Companion Pass, worth up to $599, to any destination in the world that Air Canada flies when you spend $25,000 on your card.

- Exclusive access to Visa Infinite Luxury Hotel Program, Visa Infinite Dining Series and the Visa Infinite Wine Country Program.

- Reach Aeroplan Elite status sooner by earning 1,000 Status Qualifying miles and one Status Qualifying segment for every $5,000 you spend on eligible purchases.

- Save up to 25% on car rentals at participating Avis and Budget locations.

- Authorized users can access travel benefits when travelling without you by linking their Aeroplan number.

- Access to CIBC Pace It, an installment plan designed to help you pay off large or unexpected purchases over time at a lower interest rate.

- 13 types of insurance provided, including 31-day travel medical benefits (10 days if you’re 65 or older on your departure date) — worth up to $5 million in coverage per insured person.

- To be eligible, $150,000 (individual) or $200,000 (household) annual income is required. You must be a Canadian resident who has reached the age of majority in your province or territory and who hasn’t made a bankruptcy claim in the last seven years.

Best prepaid card

Eq bank card.

- Customers who set up direct deposit on their EQ Bank account will also get a bonus interest on recurring pre-authorized debits.

- Here’s how to get the bonus interest: (a) Set up $500/month or more in either direct deposit for your pay or recurring pre-authorized debits. (b) Applies to your Savings Plus Account, Joint Savings Plus Account and EQ Bank Card¹ balance. (c) Once set it up, they’ll be eligible for the increased rate of 4.00%* for 12 months! (d) Those who already set up the above automatically qualify for bonus interest!

- Free withdrawals from any ATM in Canada.***

- Earn 0.50% cash back on every purchase.***

- Earn 2.50% interest right up until you spend.

- No FX fees, monthly fees, or other hidden fees.

- Use your card anywhere in the world where Mastercard® is accepted.

- Open and fund an EQ Bank Savings Plus Account to start.

Methodology: How we evaluate cards

NerdWallet Canada selects the best travel rewards credit cards based on overall consumer value as well as their suitability for specific kinds of travellers. Factors in our evaluation methodology include each card’s annual fee, foreign transaction fees, rewards earning rates, ease of use, redemption options, domestic and international acceptance, promotional APR period, bonus offers, insurance offers, and cardholder perks such as automatic statement credits and airport lounge access.

Summary of the best travel credit cards

Travel rewards credit cards earn points or miles as a reward for making eligible purchases. The type and rate of rewards you earn depends on the travel credit card you have. Additionally, how you can use those rewards may depend on the loyalty program associated with your card.

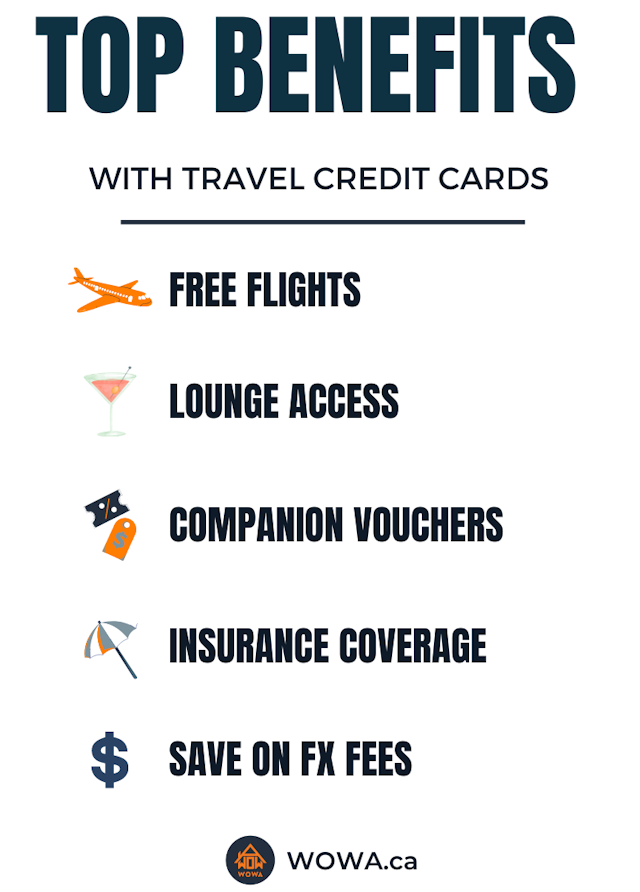

Why get a travel credit card?

Travel rewards credit cards account for 22% of credit cards in Canada, according to a 2021 report by Payments Canada. Outside reduced travel costs, travel cards can offer travel insurance, airport lounge access , baggage fee discounts, no foreign transaction fees and more. The right travel credit card can help you plan trips and access upgraded services that may have once been out of reach.

Types of travel credit cards in Canada

Generally speaking, there are three different categories of travel rewards credit cards. Knowing how they differ will help you determine what card is best for you.

General travel rewards credit cards

If you’re not loyal to one specific airline or hotel chain, then a general travel rewards program is something that will interest you. The points you earn can typically be used for any type of travel redemption, such as airfare, hotels, car rentals, cruises, and even vacation packages. Since your points don’t belong to one specific program, you have more options.

Some general travel rewards credit cards only allow you to use your points when booking travel through their online portal, while others let you use your points for any travel purchases you charge to your card.

Airline rewards credit cards

Airline credit cards allow you to earn points or miles for a specific airline. What’s interesting about airline credit cards is that the points you earn can usually be used on any airline that’s part of their network.

For example, Aeroplan is the loyalty program for Air Canada. Even if you don’t have one of the best Aeroplan credit cards, you can redeem your points for a flight on any carrier that’s part of the Star Alliance network. There are also some general travel rewards programs, such as Air Miles , that also earn miles and can offer some additional value.

Depending on the tier of your airline rewards credit card, you may get additional perks such as free checked bags, priority boarding and increased status. Having an airline credit card is highly lucrative if you frequently fly with one airline or network.

Hotel rewards credit cards

While some people love the idea of free flights, getting a luxury stay at a nice hotel appeals to other people. Some would argue that hotel rewards are better than airline rewards since some hotel chains have a greater reach. For example, Marriott has over 7,000 properties in 130+ countries, so no matter where you’re travelling, it won’t be hard to find a room where you can use your points.

Hotel rewards credit cards will also typically include benefits that will make your stay more comfortable. For instance, you could get early check-in and late check-out. You could also get free high speed WiFi or enhanced status.

Additional rewards to look for in a travel card

Besides the main rewards categories that come with travel credit cards, consider the additional perks that are included. These extra perks can often be the thing that helps you choose one card over another.

Consider the following benefits that often come with travel rewards credit cards:

- Free checked bags. Airlines charge anywhere from $30-$60 per checked bag, each way, so getting free checked bags can save you a fair amount of money.

- Airport lounge access. Some credit cards include airport lounge access , plus free annual lounge passes. These benefits could easily have a value of over $300, so it can offset any annual fee you might pay.

- Travel insurance. An extensive travel insurance package is included on some credit cards. This could cover things such as medical expenses, trip cancellation, lost luggage, and more.

- No foreign transaction fees. Many credit cards charge a 2.5% fee when you make a purchase in any currency that’s not Canadian dollars. You simply pay the straight exchange rate if your card has no foreign transaction fees .

- Extended warranty. Many credit cards will lengthen your warranty up to one additional year as long as you charge the full cost of the purchase to your card.

- Price protection. If you find a lower price after making a purchase, some credit cards will give you back the difference if it falls within a specific period.

- Concierge service. A credit card concierge can help you with basic tasks such as booking travel, ordering fits and securing event tickets.

As you can see, the list of additional benefits you can get with your travel rewards credit cards can be pretty extensive. Some of the best travel credit cards in Canada will have many of the above benefits, but not all of them. Always prioritize the perks that are important to you when applying for a credit card .

Travel credit card pros and cons

- Earn points or miles to reduce travel costs, like discounted flights and hotel stays.

- Get additional perks, like travel insurance, discounted baggage fees, airport lounge access and more.

- Earn introductory bonus points when you sign up for certain travel credit cards.

- Some cards let you transfer points to airline and hotel loyalty programs.

- Many travel credit cards carry annual fees.

- Blackout periods may restrict when you can redeem your points.

- Introductory bonus offers may require you to spend a large sum of money in a short period of time.

- Some travel rewards points expire if you don’t use them quickly enough.

Using travel rewards

Understanding travel credit card earn rates.

The earn rate on a travel credit card is the number of rewards points or miles you earn on each dollar spent.

Some cards offer a flat rate, meaning you earn the same rewards on every purchase. For example, you may earn 2 points for every $1 you spend with your card.

Most rewards credit cards have a tiered rewards structure when making purchases. The type of structure can vary quite a bit between cards. For example, you may have an accelerated earn rate on purchases made in certain categories, such as travel, groceries, gas and drugstores. All other purchases will use the lower base earn rate.

Ideally, you want to choose a credit card with an accelerated earn rate that is aligned with your spending habits.

“You have to make sure the loyalty program is going to let you do what you want,” says Laura Scheck, vice president of credit cards at Scotiabank. “Or else you’ll end up with points that you can’t necessarily use. And no one wants to be in that situation. Points are fun!”

Additionally, travel credit cards may deliver additional points or miles when you make purchases with their main partner, if they have one. For example, an Aeroplan credit card gives you an accelerated earn rate on Air Canada purchases. Some loyalty programs even have a network of partners where you can earn additional points or miles.

How to calculate the value of travel credit card points

Knowing how to calculate the value of your points or miles is essential since not every redemption value is the same. By establishing a baseline value for your points, you can decide if specific redemptions are worth it — even if you’re not getting the maximum value.

The formula used to determine the value of one point is as follows:

Cash value of the redemption x 100 / number of points required = Cost per point

Let’s say you want to fly from Vancouver to Toronto, and it’s going to cost $585 in cash, or 25,000 Aeroplan points, plus $75 in taxes. You would use the following formula. Note that since you have to pay $75 in taxes, you’d have to subtract that amount from the cash value for an accurate assessment.

$510 x 100 / 25,000 = 2.04 cents per point

This formula can be applied to any redemption regardless of the loyalty program. For example, let’s say you want to redeem 13,400 points for a $100 gift card. Your formula would be the following:

$100 x 100 / 13,400 = .75 cents per point

The flight is a better bang for your points if these redemption options are available with the same program.

Do travel rewards points ever expire?

It doesn’t matter how long you’ve been a loyalty program member or how many points you’ve accumulated; you can lose everything if you’re not paying attention.

Generally speaking, most loyalty programs that belong to an airline or hotel have a defined expiry date of 12 – 18 months. However, that only applies if there’s been no account activity in your account during that time. If you earn or redeem just one point during that time, your clock would reset. Even if you’re not travelling anytime soon, you could make a small redemption or donate some points to ensure you don’t lose the rest of your points.

When it comes to bank credit card rewards programs, it’s unlikely your points will expire as long as your credit card account is in good standing. Your account would only fall out of good standing if it becomes delinquent or your credit card is used for fraudulent activity.

How to redeem travel credit card rewards

Some credit card rewards programs only let you redeem points or miles through their rewards portals. Others allow point redemption for any eligible purchase you make with your credit card.

Rewards programs offered through banks typically have their own website where you can make redemptions. They often have separate tabs where you can choose from travel, gift cards, merchandise, and financial rewards. While this can be handy, you’re typically limited to their offerings — what you see is what you get.

Airline and hotel loyalty programs will almost always allow you to redeem your points or miles directly on their website or mobile app. When searching for flights or hotels, you’ll likely see a box that says “use points.” The prices displayed will be in points, so you’ll know exactly how much you’ll need to make a redemption.

Knowing where to go to redeem your points is important, but you may also want to familiarize yourself with the different point redemption systems.

Travel reward point redemption options

Not all rewards programs are created equal, especially when it comes time to cash in your travel points. These three redemption models tend to be the most popular among travel credit cards:

Consistent points

Consistent points hold a constant value, regardless of season or travel destination. This point redemption model is the most transparent and user-friendly of the three.

Fluctuating points

The value of fluctuating points can be impacted by several factors, including travel destination and time of year. A point may carry less value when travelling during peak season instead of in the off-season. This model can make it challenging to determine the value of your points when trip planning. Look for any provider-issued charts or tables that outline what factors impact the value of your points.

Point transfers

Point transfers let you transfer points to affiliated rewards programs. This model may be useful for those trying to take advantage of multiple rewards programs. The catch? The value of your points may be different once they’ve been transferred, which means you’ll need to figure out the transfer ratio before you make a decision.

What to know about credit card travel insurance

For many, travel insurance is essential — especially when venturing outside Canada. While it’s likely the last thing you want to worry about when on vacation, medical emergencies happen. And your federal, provincial and territorial health plans may not cover the medical expenses you incur while travelling. That’s where travel insurance comes in.

Not only does travel insurance help cover medical expenses, it can also offer trip cancellation coverage, vehicle damage insurance, flight delay insurance and more.

You can get travel insurance from a third party, like a travel agent or insurance provider, but many travel credit cards offer it , too — and at no added cost to the cardholder.

Out-of-province travel emergency medical insurance

Travel medical insurance isn’t only for those travelling outside Canada; it can also provide coverage for those exploring another province or territory. Your provincial plan may not extend to emergency medical expenses incurred out of province. Out-of-province medical insurance can provide coverage for a range of medical needs and services, from prescription medication to emergency evacuations and hospital stays.

If your travel card offers out-of-province medical insurance, ask your provider about coverage limitations. Your medical expenses may not be covered if they’re the result of a pre-existing medical condition or high-risk activity, like bungee jumping or motorized racing.

Travel accident insurance

This type of insurance can be useful in the event of accidental injury or death while travelling on public or ticketed transportation, sometimes referred to as a common carrier. Some policies only cover accidents that happen on airplanes while others encompass a wider range of common transports, like trains, ships and buses.

Travel interruption/cancellation insurance

Trip cancellation coverage reimburses non-refundable travel expenses if your trip gets cancelled. Eligible cancellation circumstances may include dangerous weather conditions, pregnancy complications or the death of an immediate family member.

Trip interruption coverage activates once you’ve departed and reimburses non-refundable travel expenses if your trip is cut short. Again, not every circumstance will qualify for trip interruption coverage. Covered reasons for heading home ahead of schedule are often similar to those that qualify for cancellation coverage.

Flight delay insurance

Flight delays are frustrating, but they happen. If your flight is postponed and you need to book a place to stay or grab a bite to eat while you wait, flight delay insurance may reimburse those costs.

Lost/delayed baggage insurance

If your bags are delayed, this type of insurance will cover the cost of essential items you may need to purchase — like clothes or toiletries — while you wait for your bags to arrive. And if your bags are lost outright, you may be covered up to a predetermined amount for your lost property.

Rental car collision/loss damage insurance

If you plan to rent a car on your next trip, collision and damage insurance may come in handy. This insurance covers costs associated with theft or damage to your rental car. But it doesn’t replace liability insurance — the insurance that provides coverage if you injure someone or damage another vehicle on the road.

Your personal auto insurance policy may come with liability insurance that extends to rental vehicles, but contact your insurance provider to confirm you’re covered before you hit the road.

To take advantage of your credit card’s collision and damage insurance, you’ll need to decline coverage offered by your car rental company.

Hotel/motel burglary insurance

If your hotel or motel room is broken into while on the road, this coverage will reimburse you for the loss of stolen goods up to a set amount. Not all stolen items may be eligible for reimbursement.

How to choose the right travel credit card

Every credit card is good for at least one thing, so deciding on which card is best for you can be difficult. Here are some important criteria you can use to compare different travel credit card options.

Welcome bonus

If you’re trying to decide between several travel cards with similar rewards, the tiebreaker can often be the sign up bonus. Some credit cards offer a generous welcome offer that covers the annual fee or jumpstarts your rewards collection with thousands of free points or miles.

Every credit card has a base earn rate, but many of the best travel credit cards in Canada have an increased earn rate for specific bonus categories — like the TD First Class Travel® Visa Infinite* Card, which offers up to 8x the points per dollar spent on travel through its online Expedia portal.

If you have a general travel credit card, you could earn extra points on categories such as groceries, gas, pharmacies and more, like the Scotiabank Passport® Visa Infinite* Card , which offers 2x the points on food, drink and groceries . The earn rate is essential since choosing a card that lines up with your spending habits can quickly increase the number of points or miles you earn.

If you’re firmly against paying an annual fee for your credit card, you’ll instantly narrow down your choices. That said, there are some instances where an annual fee is worth the cost . Travel credit cards with a yearly fee typically have more benefits than their fee-free counterparts.

Reward flexibility

Having a lot of points is meaningless if it’s hard to redeem them. Look for a loyalty or rewards program where you know you’ll be able to use your points without much trouble. This means programs with no blackout dates and multiple redemption options.

You’ll also want to consider whether the program has any transfer partners, as that’s another way to use your points. Additionally, knowing if and when your points expire is key to ensuring you don’t lose your hard-earned rewards.

Perks and benefits

Besides the type of rewards, welcome bonus and earn rate, additional perks may sweeten the deal and sway your decision.

“Lounge access is always very important,” says Scheck. “It’s nice to have as you’re catching your flight. It’s a little bit quieter — a bit of an oasis from the rest of the airport.”

Another make-or-break consideration? Foreign transaction fees. Scheck says they can really add up, especially if you’re making a lot of transactions while travelling. A card with no transaction fees, like the Scotiabank Gold American Express® Card , can help you save in the long run.

Scout for travel card perks when comparing your options:

- Seat upgrades.

- Room upgrades.

- Premium lounge passes.

- Entertainment ticket presale access.

- Car rental discounts.

- Priority check-in and boarding.

- Various types of credit card insurance.

How to apply for a travel rewards credit card in Canada

Make sure you’re eligible.

Different travel credit cards have different eligibility criteria, so check whether you meet a card’s requirements before you begin the sign-up process. Here are some general eligibility criteria you may encounter when applying for a travel credit card:

- Canadian resident with a Canadian credit file.

- Age of majority in the province or territory where you live.

- Minimum annual income thresholds.

Fill out the application

When you apply for a credit card , you’re typically able to follow an online application process that can be completed from the card issuer’s website. Here’s a general rundown of the application process:

- Review the card’s details, terms and conditions.

- Enter your personal information, including your full name, date of birth, residential address and mobile phone number.

- Enter your Social Insurance Number.

- Enter your financial information, including your annual income and monthly expenses.

- Verify your identity by submitting photos of your original government-issued ID, like your passport or Driver’s Licence.

- Review the information you’ve supplied and submit your application.

Keep in mind that applying for a credit card may impact your credit score .

Tips to maximize your travel credit card rewards

If you’ve decided that a travel credit card is for you, follow these few tips to ensure you get the most out of your credit card rewards .

- Pay your bills in full and on time, so you don’t pay any interest.

- Make sure you meet the minimum spending requirement to get your welcome bonus.

- Pay attention to your earn rate and use your rewards card on purchases that earn extra points.

- Research your rewards program so you know what you can do with your points or miles.

- Calculate the value of your points before making a redemption.

- See if your loyalty program has a partner network where you can earn additional points.

Although choosing a travel credit card may require you to do some research, the value you get is often worth it. Getting free stuff on points feels great, especially if it’s something you’ve been saving a long time for.

FAQs for Canada’s Travel Reward Credit Cards

Yes, travel credit card rewards can expire. Most loyalty programs that belong to an airline or hotel have a defined expiry date of 12 – 18 months. However, that only applies if there’s been no account activity in your account during that time. If you earn or redeem just one point during that time, your clock would reset.

When it comes to bank rewards programs, your points may never expire as long as your credit card account is in good standing. Of course, your account would only fall out of good standing if it becomes delinquent or you use your credit card for fraudulent activity.

In most cases, a good credit score — generally 660 to 724 — is required to get the best travel credit cards. However, some secured credit cards and prepaid options offer rewards, and are more suitable for people with lower credit scores.

About the Author

Shannon Terrell is a lead writer and spokesperson for NerdWallet, where she writes about credit cards and personal finance. Previously, she was a writer, editor and video host for financial…

DIVE EVEN DEEPER

22 Best Credit Cards in Canada for May 2024

NerdWallet Canada’s picks for the best credit cards include top contenders across numerous card categories. Compare these options to find the ideal card for you.

Interest charges don’t need to be a mystery. Use our credit card interest calculator to see how much interest you’d owe if you carry a credit card balance.

25 Best Rewards Credit Cards in Canada for May 2024

Compare the best rewards credit cards in Canada across numerous rewards categories, including travel, cash back and more, to find the ideal card for your spending preferences.

6 Simple Ways to Save on Your Next Family Vacation

Travelling off-season, booking early and redeeming credit card points are simple ways to vacation smart and save big.

- Credit Cards

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Best Rewards Credit Cards In Canada For May 2024

Updated: May 3, 2024, 11:29am

The best rewards credit card is the one that effortlessly earns you points on every purchase you make. Having one of these cards in your wallet can be the key to earning vacations, flights, merchandise, statement credits and more. In fact, these cards can actually be so valuable that many Canadians have even turned collecting rewards points into a hobby.

That said, with so many rewards cards to choose from, it can be overwhelming to try to find the best one for you. You need to consider everything from earn rates and spending categories to annual fees, interest rates and whether the card has any other useful benefits, like travel insurance or airport perks. With this in mind, Forbes Advisor has done the legwork for you and ranked the 10 best rewards credit cards in Canada. Use this list of the best rewards credit cards in Canada to narrow down your search and see how the top cards align with your needs.

- Feature Partner

Best Rewards Credit Cards in Canada for May 2024

Rbc ion+ visa card.

- MBNA Rewards Platinum Plus Mastercard

CIBC Aeroplan Visa Card

- American Express Cobalt

Scotiabank Gold American Express

- TD Aeroplan Visa Platinum Card

- The Royal Canadian Legion MBNA Rewards Mastercard

PC World Elite Mastercard

- CIBC Aeroplan Visa Infinite Card

Here’s a Summary of the Best Rewards Credit Cards in Canada

Methodology, best cash back credit cards in canada, what is a rewards credit card, how to redeem for general credit card rewards, how to maximize your credit card rewards, types of rewards credit cards, popular credit card rewards programs in canada, how to pick the right rewards credit cards, other benefits of rewards credit cards, pros and cons of rewards credit cards, should you have multiple rewards credit cards, how to get a rewards credit card, frequently asked questions (faqs), how do i transfer rewards points, how do i minimize fees when redeeming points, advertiser's disclosure.

- Best Credit Cards

- Best Travel Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Cash Back Credit Cards

- Best Credit Cards for Bad Credit

- Best Aeroplan Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Balance Transfer Credit cards

Featured Partner Offer

American Express Cobalt® Card

On American Express’s Secure Website

Welcome Bonus

Up to 15,000 Membership Rewards points

$155.88 ($12.99 per month)

Regular APR

Scotiabank gold american express® card.

On Scotiabank’s Secure Website

Up to 40,000 Scene+ Points

Tangerine World Mastercard

On Tangerine’s Website

Up to 7,000 Avion Points*

$48 ($4 paid monthly)

Regular APR (Purchases) / Regular APR (Cash Advances)

20.99% / 22.99%

This card offers a wide variety of spending categories to earn Avion points in and has a very low annual fee.

- Generous welcome bonus

- Low annual fee ($48)

- Typical RBC benefits, including savings on fuel at Petro-Canada and 50 Be Well Points per $1 spent at Rexall

- Includes three types of insurance

- Get a three month complimentary DoorDash subscription (almost a $30 value)

- Monthly fee rebate when you have an RBC Signature No Limit Banking or RBC Advantage Banking for students account

- A low number of insurance varieties

- Lower redemption value than other RBC Avion credit cards

- $10 redemption minimum for Avion Rewards earned through this card

- Get 3,500 Welcome Points on approval and earn 3,500 bonus points when you spend $500 in your first 3 months.*

- Grocery, Dining & Food Delivery – Satisfy your taste buds by earning points on groceries, dining out, food delivery.

- Rides, Gas & EV Charging – Enjoy earning points on gas, rideshare, daily public transit, electric vehicle charging.

- Streaming, Digital Gaming & Subscriptions– Stay entertained while earning points on streaming, gaming, eligible digital subscriptions, eligible digital downloads, and in-game purchases.

- Earn 1 Avion point for every $1 spent on all other qualifying purchases

- Annual Fee $482 ($4 charged monthly)

- Redeem your Avion points to pay bills, your credit card balance or even send money to friends with Interac e-Transfer. Minimum redemption is only $10, so you can use your points where you need them most.

- Automatically become an Avion Rewards Premium member when you get the RBC ION+ Visa. Download the Avion Rewards app to access points, cash back deals, and savings all in one program. Plus, download the Avion Rewards ShopPlus browser extension to save with cash back deals right where you shop online from 1,900+ retailers.

- Save 3¢/L on fuel and earn 20% more points when you pay with a linked RBC card.

- Earn 50 Be Well points for every $1 spent on eligible purchases at Rexall when you pay with your linked RBC card and scan your Be Well card.

- Get a 3-month complimentary DashPass subscription – a value of almost $30

- Enjoy unlimited deliveries with $0 delivery fees on qualifying orders of $15 or more when you pay with your eligible RBC credit card. See how to save with DoorDash.

- Enjoy a Monthly Fee Rebate

- Get a $4 rebate each month ($48/year) on the monthly fee of your credit card when you have an RBC Signature No Limit Banking or RBC Advantage Banking for students account.

- Get 2 years of coverage up to $1,000 in the event your mobile device such as your cell phone is lost, stolen, accidentally damaged or experiences mechanical failure when you purchase your mobile device with this credit card.

- Automatically protects eligible card purchases against loss, theft or damage within 90 days of purchase, and doubles the manufacturer’s original Canadian warranty by up to one additional year, to a maximum of five years.

MBNA Rewards Platinum Plus® Mastercard®

Up to 10,000 bonus points††

19.99% / 24.99%

For a no-annual-fee card , the MBNA Rewards Platinum Plus® Mastercard® has one of the best reward earn rates available in a variety of purchase categories—and that’s perfect, since there are a variety of redemption options, including travel, merchandise and gift cards. You also get bonus points on your birthday equal to 10% of the points earned during the previous calendar year. Plus, you’re entitled to three types of insurance, including the coveted mobile device insurance.

- Generous welcome bonus for the first 90 days (10,000 points).

- A high earn rate on grocery, restaurant, digital media and household utility purchases.

- Points that can be redeemed for travel, merchandise, gift cards, charitable donations and cash back.

- No annual fee.

- Three types of insurance, including mobile device insurance.

- Bonus points for going paperless.

- Bonus points on your birthday are valued at 10% of the points earned during the previous year.

- High value redemption options for travel, merchandise and gift cards.

- Poor redemption value on cash back and charitable donations.

- Annual $10,000 cap on purchase categories.

- One of only two cards that collect MBNA Rewards points.

- Highest earn rate only applies to the first 90 days of the account.

- Earn 4 points†† for every $1 spent on eligible restaurant, grocery, digital media, membership and household utility purchases during the first 90 days, and 2 points‡ for every $1 spent on eligible purchases in those categories thereafter – in both cases, these earn rates apply until $10,000 is spent annually in the applicable category. 1 point‡ for every $1 spent on all other eligible purchases

- 5,000 bonus points†† ($25 in cash back value) after you make $500 or more in eligible purchases within the first 90 days of your account opening

- 5,000 bonus points††($25 in cash back value) once enrolled for paperless e-statements within the first 90 days of account opening

- Each year, you will receive Birthday Bonus Points‡ equal to 10% of the total number of Points earned in the 12 months before the month of your birthday, to a maximum Birthday Bonus each year of 10,000 Points

- Redeem points‡ for cash back, brand-name merchandise, gift cards from participating retailers, charitable donations, and travel.

- Standard Annual Interest Rates of 19.99% on purchases, 22.99% on balance transfers✪ and 24.99% on cash advances

- Mobile Device Insurance*** With Mobile Device Insurance, you’ve got up to $1,000 in coverage for eligible mobile devices in the event of loss, theft, accidental damage or mechanical breakdown

- No annual fee

- This offer is not available to residents of Quebec

- ‡, ††, ✪, ***, Terms and Conditions apply

10,000 Aeroplan Points

This card doesn’t just offer over $400 worth of rewards potential per year, it also boasts the flexibility to redeem points for merchandise, gift cards, entertainment and travel. Travel redemptions cover taxes and fees on flights, too—which is a reason in and of itself to pick this card. But, you also can add additional cardholders for free and you get four types of insurance, including rental car insurance and travel accident.

- Welcome bonus has a $200 value (enough for a short-haul flight within North America).

- Redemptions cover taxes and fees on flights.

- Combine Aeroplan points with another Aeroplan member in your family to redeem flights faster.

- Redeem flight rewards with a combination of Aeroplan points and cash.

- Flexible redemption for flights, merchandise, gift cards and entertainment.

- Low earn rates on common purchase categories.

- No travel insurance beyond travel accident insurance and rental car insurance.

- Travel earnings are relatively low.

- Earn 10,000 Aeroplan Points (a $200 travel value) after your first purchase.

- 1 point per dollar spent on gas, groceries and Air Canada purchases, including Air Canada Vacations.

- 1 point per $1.50 spent on all other purchases, including CIBC Global Money Transfer with no transaction fees.