- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

7 Best places to exchange currency in Manchester - 2024

If you're in the UK and planning a trip abroad, or if you've recently arrived and need GBP in cash, you might be searching for the top currency exchange options in Manchester. Shopping around before you hand over your hard earned cash is essential to make sure you get the best available exchange rate for your specific currency, and don’t pay too much in fees.

Use this guide to review the things to consider when choosing currency exchange services, so you can get foreign currency or travel money in a safe and cheap way for your specific situation. We’ll also introduce some of the top rated Manchester currency exchange services, so you can see if any suit you.

Beat the money changer rates with a prepaid travel card

Going to a currency exchange before a holiday can be exciting, but you will often be paying hidden fees that are baked into the exchange rate.

With a prepaid travel card from Wise or Revolut you get the market exchange rate with low fees and complete transparency. Read here 5 best prepaid cards to use abroad.

Things to consider before exchanging money

Before you buy foreign currency for your trip, here are a few things to think about.

Avoid airport currency exchanges

You’ll often find currency exchange desks at the airport or at major hotels - however, they can be pretty poor value, as there’s not much nearby competition. Choosing a currency exchange in the city center where there are more options available can work out better value - or why not use a travel money card at an ATM on arrival, to get convenient cash as and when you need it.

Check the mid-market rate

It’s common to find the exchange rates offered by currency exchange services include a markup added onto the mid-market rate. Check the mid-market rate for your currency pairing before you head out to buy foreign currency - this can be done easily online or with a currency converter app. Finding a currency exchange service offering this rate, or as close as possible to it, can mean you get the best available value.

Beware of ATM rates

Always choose to be charged in the local currency wherever you are when you take cash out from an ATM. Often you’ll find you’re given the option to pay in your home currency instead, but in this case, the ATM operator controls the exchange rate, and fees, which can mean it costs you more in the end. Paying in the local currency means your bank or card provider sets the rate, which is usually better value overall.

Get a travel money card to cut costs

Why not get a digital account and travel money card from a provider like Wise or Revolut before you go abroad, to access ways to hold and exchange dozens of currencies, and linked cards for easy payment and cash withdrawals. Both Wise and Revolut have accounts with no monthly fees, good exchange rates and low, transparent fees.

Here’s a quick overview of some of the pros and cons of Wise vs Revolut, to give you an idea of which may work for you.

- Wise card full review

- Revolut card full review

- Best prepaid travel card in the UK

Best place to exchange currency in Manchester?

Let’s take a look at some of the top rated exchange services in Manchester, according to Google. Which works best for you will depend on where you are, and which currencies you need, as not all stores will keep all currencies on hand.

Where available, as well as the contact information and Google rating, we’ve also included the GBP - AUD exchange rate at the time of research, as an example for comparison. Before you head out, call the exchange service you pick to get the live details for the currency you need.

Correct at time of writing, 8th August 2023

Find more currency exchange services in Manchester here.

How we rated the best places to exchange money

To create our table, we’ve used the live Google ratings at the time of research, for exchange services in central Manchester and around popular tourist and shopping sites. Do your own research to see the live ratings and exchange rates available from different services, before you head out to exchange your money.

Factors to consider when choosing an exchange provider in Manchester

The most important thing when picking an exchange service in Manchester is to look for one which is licensed and regulated by relevant authorities. That should mean you’re using a legitimate provider which will treat you fairly. You can also ask around for feedback from friends and family who use local currency exchange services, or check out Google reviews as we have, to see what other users are saying about any specific provider.

The next thing to consider is the fees and exchange rates on offer. If a provider claims to offer fee free, or zero commission currency exchange it’s especially important to check the exchange rate used to convert your funds. Often the provider’s fees are simply bundled in here, which can mean you’re paying more than you think for currency exchange.

Avoid this by looking out for a provider which offers the mid-market exchange rate - or consider an alternative like a travel money card from a provider like Wise or Revolut, which gives access to mid-market rate currency conversion with low, transparent fees.

Tips for finding the best currency exchange rates in Manchester

Here are a few extra tips to help you when exchanging currency in Manchester:

Use a currency converter to find the live mid-market rate for your currency and look for a provider offering this rate or close to it

Check if it’s cheaper to order your currency online for collection - you can sometimes get a better rate this way

Bear in mind that there may be a fee to pay if you buy foreign currency with a credit card, either from the provider or from your card issuer

Compare as many options as possible across both fees and rates to make sure you get a fair deal

Check out online currency converters or mobile apps to stay updated on current exchange rates - or use the Exiap currency conversion tools to keep on top of the rates available conveniently

Consider online alternatives such as Wise and Revolut, for travel money cards you can use for free or low cost ATM withdrawals in the UK and abroad

Where to get foreign currency outside the UK

It’s worth planning your travel money in advance so you know you’ve got easy access to the funds you need, in the currency wherever you’re headed.

You don’t necessarily have to change money in advance of travel. Instead you might want to get a multi-currency card from a service like Revolut or Wise before you leave, to add money in pounds for spending overseas. You’ll often find you can get currency exchange with the mid-market exchange rate and low fees, to do more with your travel budget while you’re away.

Prefer to convert cash in your destination? While airports, hotels or banks often offer currency exchange services, they may not have the best rates or fees. Picking a currency exchange provider in a popular area where there’s a lot of competition can mean you get a better deal - shop around if you can, so you know you’re not getting ripped off.

How do I exchange currency after a trip?

If you have foreign currency cash left over from a previous trip you may be able to sell your higher value foreign currency notes - as long as they’re undamaged and clean - at the UK exchange service where you originally bought them. Be aware that the rate to convert back may not be as good as the one you bought at, and fees may apply.

If you don’t want to lose out on fees when changing your money back to pounds, you could also use a digital multi-currency account from a service like Wise or Revolut. Just add money in pounds, and then withdraw local currency cash at your destination as and when you need to. If you have pounds left at the end of your trip you can withdraw back to your bank, make payments to others, or even take out cash in pounds at a UK ATM instead.

FAQs - best places to exchange currency in Manchester

What is the cheapest way to get foreign currency in manchester .

There’s no single cheapest way to get foreign currency in Manchester. Shop around, looking carefully at fees and rates, which can vary widely. Use the tools and reviews on Exiap, to help you find a good provider for your specific needs.

Should I exchange money before I travel?

It’s not usually necessary to change money to your destination currency before you travel. A better option may be to get a multi-currency account and card from a service like Wise or Revolut, and just make cash withdrawals in your destination when you need to. That’s convenient and safe, and can mean you pay less overall, too.

Does it matter where you exchange currency?

Yes. Use a currency exchange service with good rates and low fees to have more to spend in foreign currency when you’re away. Do some research into the best options for your needs, including exchanging cash and using a specialist travel money card instead.

What is the best reloadable prepaid card?

There’s no single best reloadable prepaid debit card. Use this guide to compare a few options to pick the one that’s right for you, thinking about features, fees and the range of supported currencies you’ll need.

Manchester Airport (MAN) banks, ATMs and currency exchange

Location: Manchester , United Kingdom Currency: GBP UK£ United Kingdom Pound Sterling

A list of currency exchange, ATMs and banks' branches in Manchester Airport (MAN). See locations, phone numbers, working hours and services.

ATMs / Cash Machines

American express atm, barclays atm, midland bank atm, natwest atm, royal bank of scotland atm, barclays bank (3.6 miles from airport), currency exchanges, travelex global foreign exchange, intl currency exchange (ice), manchester airport (man) currency exchange rate.

Here's the estimated foreign currency exchange rates at Manchester Airport for August 17, 2024 . Just enter the amount you want to convert and the from/to currency. The official currency for Manchester is GBP UK£ United Kingdom Pound Sterling . These live exchange rates are updated daily but only gives you an estimate rate that may be different at the airport . We are not associated with Manchester Airport or any currency exchange services.

Manchester Airport (MAN) Lounge Access for Credit Cards & Banks

If you're a credit card or bank holder with lounge access you may have access to the following lounges at Manchester Airport . You can also access most of these lounges with a Priority Pass membership . If you live in United Kingdom, check out the best credit cards with lounge access in United Kingdom .

Manchester Airport Related Services

- - BOOK an AIRPORT HOTEL in Manchester or SLEEPING PODS

- - RENT a CAR in Manchester Airport or BOOK a PRIVATE TRANSFER

- - STORE your LUGGAGE in Manchester Airport or NEARBY

- - BUY a LOCAL eSIM for Manchester, United Kingdom or a GLOBAL eSIM

About Manchester Airport (MAN)

Manchester Airport (MAN) is an international airport located in Ringway, Manchester, England. It’s located about 8.6 miles (13.9 km) south-west of Manchester city centre. It covers an area of 1,400 acres & is equipped with two runways and three passenger terminals. It first opened in 25 June 1938. It’s the hub for Flybe.

Phone: +44 800 042 0213 Website: manchesterairport.co.uk

Things to do in Manchester:

- Taxi Transfers

- Coach Travel

- Airport Hotels

- Airport Lounges

- Bars & Restaurants

- At the Terminals

- Flight Arrivals

- Flight Departures

- Book Flights

- Planning Your Trip

- Special Assistance

- Children's Facilities

- Travel Money

- Delays & Cancellations

- Things to Do in Manchester

- Airport Contacts

- Airport News

Manchester Airport Travel Money

Currency exchange at manchester airport, travelex at manchester airport.

Located throughout all three terminals for your convenience, travelex is here to provide you will all of your foreign currency needs. Collect your pre-ordered cash or currency card, add to your existing card balance or simply purchase your currency easily with a desk located before and after security in each terminal.

Why use travelex?

- Order currency online

- World's Largest FX provider

- Located Before and After Security Control

- Best Price Promise

- Home Delivery

- 6 desks throughout the 3 terminals

Travelex is the world's biggest foreign currency exchange provider, serving over 30 million customers each year. They can provide all your usual currency exchange services, along with a VAT refund service for non-EU residents. Why not use the tool above to calculate your exchange rate, and if you're happy, order your foreign currency online and arrange to collect from one of the 6 desks throughout the 3 terminals at Manchester?

The Post Office at Manchester Airport

The Post Office have a branch in Terminal 1. Their exchange rates are very competitive, as they take 0% commission and will buy back any money you don’t spend.

- Order Currency online with the Post Office

They have over 60 currencies available from Australian dollars to Vietnamese dong, and the more you buy, the better the rate – on every currency (minimum and maximum spends apply). If you’re picking up Euros or US Dollars, select “Click & Collect” at checkout, and collect in 2 hours from selected branches. All other currencies are available to collect from branch the next working day if you order before 3pm (Monday – Friday) – with some branches even offering immediate pickup. And if your holiday is cancelled, we offer a 100% refund guarantee. T&Cs apply.

Carrying Foreign Currency as Cash

Cash benefits.

- 0% Commission rates offered

- Convenient Spending Method

- Competitive Rates when ordered online

- Home Delivery Available

- Fixed-rate upon purchase

Cash Drawbacks

- No section 75 purchase protection

- Not as secure as cards

- Traveller's cheques less convenient

Prepaid Travel Money Cards

Travelex money card.

Post Office Travel Money Card

With the Post Office travel money card, you can store up to 23 currencies! It's a much safer way to use money as it's not linked to your bank account and via their app, you can manage your account and even freeze the card should you need to! The card is accepted in 36 locations in more than 200 countries.

- United States Australia Canada France --> Germany --> Holland --> India Japan --> Ireland --> Malaysia --> Mexico --> New Zealand Philippines --> Singapore Spain --> UAE United Kingdom Other countries Global

- Profile -->

- My Rates -->

- Search Rates

Home Guides Best Travel Money Exchange Rates – Manchester

Best Travel Money Exchange Rates – Manchester

In this article we show you how to save money if you find yourself looking for Foreign Cash in Manchester.

Manchester is globally renowned for it’s football, but there are countless reasons why one might visit Manchester other than for a trip to the ‘theatre of dreams’, Old Trafford.

Many come to marvel at the gothic architecture of the John Rylands Library; immerse themselves in the fine art at the Manchester Art Gallery; or, to enjoy the great oudoors on the outskirts of the city centre at Hollingworth Lake, Heaton Park or Haigh Hall.

Being a diverse and multifaceted city, Manchester has something to offer everyone and whether you are visiting as a tourist or over on business, you will want to be prepared for your trip and ready with some british pounds in your wallet.

In the bricks and mortar, established, tourist attractions you’ll have no problems using a topped up travel card or credit card . But as always with travelling, it’s always wise to have some cash at the ready.

Ordering your foreign cash online from Travelex for delivery or if you’re in a rush then picking up the cash at a Travelex branch is your best bet for convenience and getting more for your currency

You will find that you can save a couple of percent on the exchange rate margin by pre-ordering your cash. Our Review of Travelex exchange rates includes the following table that shows you an example of how much you can save online vs buying your cash at the airport.

Manchester Currency Exchange Locations

Online Currency Exchange Rates vs the Banks

The below live travel money comparison table shows how much you could save on your next foreign transfer or travel money purchase by ordering online vs the Average Bank Rate. This example shows you the situation where you want to change sterling for foreign cash, note the margins are compared to the current market mid-rate.

Compare Exchange Rates

Loading exchange rates...

Pre-Order Foreign Cash & Save

Order travel money online

Get better rates than available to you by walking into Travelex branches by pre-ordering online from Travelex, you can still pick up in person at any Travelex branch or at the airport.

Disclaimer: Please note any provider recommendations, currency forecasts or any opinions of our authors or users should not be taken as a reference to buy or sell any financial product.

- Best Rate Calculator

- Foreign Transfers

- Currency Exchange

- Large Transfers

- Cross Rate Matrix

- Who We Compare

- Rate Tracker

- Market Update

- Currency Forecasts

- Country guides

- Content Hub

- How-to-Save Guides

- User Forums

- Log in to BER

- Country Sites

- BER.me Profile

- Transfers - Quote

BER is operated by Best Exchange Rates Pty Ltd, a company incorporated under the laws of Australia with company number ABN 68082714841. BER is a comparison website only and not a currency trading platform. BestExchangeRates.com uses cookies. Disclaimer & Terms of Service Privacy

- Partnership Card

- Home Insurance

- Car Insurance

- International Payments

- Investments

- Partnership Credit Card

- Points calculator

- Mobile payments & app

- Online account

- Fraud & security

- Cardholder exclusives

- Guides & articles

Customer support

- Contents Insurance

- Buildings Insurance

- High-Value Home Insurance

- Get a quote

- Show your saved quote

- Renew your policy

- Make a claim

- Policy documents

- Older drivers

- Retrieve a quote

- Things to consider

- How to register

- Pet Insurance

- Dog Insurance

- Cat Insurance

- Travel Money

- Bureau de Change

- Click & Collect

- Travel Money Delivered

- Pre-packed Currency

- Currency Buy Back

- Currency exchange rate table

- Regular transfers

- One-off payments

John Lewis Bureau de Change, Trafford Centre

Travel money at trafford john lewis.

Buy your currency in-store from at the John Lewis Trafford Centre's Bureau de Change in Manchester.

Get a great rate and pay no commission Buy or sell from a range of currencies we offer in-store Find our location using the handy map

Exchange rates online may vary from those offered in-store.

John Lewis & Partners (1st floor) Trafford Centre 1 Peel Avenue Manchester, M17 8JL

Our calls are handled by our Contact Centre – if you wish to speak to an in-store Partner it’s best to visit the shop.

Opening times

Monday* 10:00 - 22:00

Tuesday 10:00 - 22:00

Wednesday 10:00 - 22:00

Thursday 10:00 - 22:00

Friday 10:00 - 22:00

Saturday 10:00 - 21:00

Sunday** 12:00 - 18:00

* Bank Holiday Hours: 10:00 to 20:00

** Browsing from 11:30

What you'll need to bring

When you’re buying or selling currency at a Bureau de Change, you'll need to have some valid ID with you. This can be any of the following:

- Full UK photocard driving licence

- EU national identity photocard

Occasionally we may ask you for additional ID dependent upon the transaction. In this case we would accept recent utility bills, bank or credit card statements or other formal ID that shows your address.

About our Bureau de Change at the Trafford Centre

Tick one last thing off your holiday to-do list. You can buy travel money before your trip when you visit the John Lewis Bureau de Change at the Trafford Centre in Manchester. We're located on the first floor of the John Lewis & Partners store in the shopping centre, near customer services. If you need help finding us, one of our Partners will be happy to point you in the right direction.

Frequently asked questions

What are the exchange rates in store.

You can find the Bureau rate table here . Please be aware that not all currencies in the rate table will be available in the Trafford branch. Exchange rates online may vary from those offered in-store.

What currencies can I get?

To find out what specific currencies you can get in the Bureau, please use the contact details above.

Can I sell currency at this branch?

Yes, you can sell leftover currency at this branch. Please note we only accept notes.

John Lewis Money, John Lewis Finance and John Lewis & Partners Bureau de Change are trading names of John Lewis plc. John Lewis plc introduces the panel of carefully chosen providers in Bureau de Change products and services, who each hold the appropriate licences with the Financial Conduct Authority and HMRC.

Travel Money online from John Lewis Money, John Lewis Finance, and John Lewis & Partners, is provided by First Rate Exchange Services Limited (company number: 04287490 and Money Service Business licence number: MLR-64068). Registered office: Great West House, Great West Road, Brentford, West London, TW8 9DF, England.

Our products

The partnership.

- About John Lewis Money

- Accessibility

- Meet our money experts

- John Lewis & Partners

- Payment Plans

- Waitrose & Partners

- Terms and conditions

- Modern slavery statement

- Privacy notice

- Sustainability

Rate sale on all currencies now on! For a limited time only - ends Tuesday 20 August 2024 at 9.30am. T&Cs apply .

A world of choices with Travelex.

Cash and card delivered direct to your door or to a convenient click and collect location.

- Top Up Card

- Our best rates

- No commission or hidden charges

- Free Click and Collect

- Next day home delivery

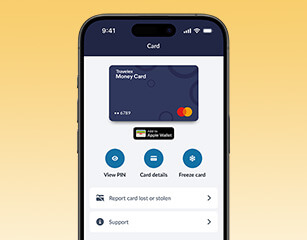

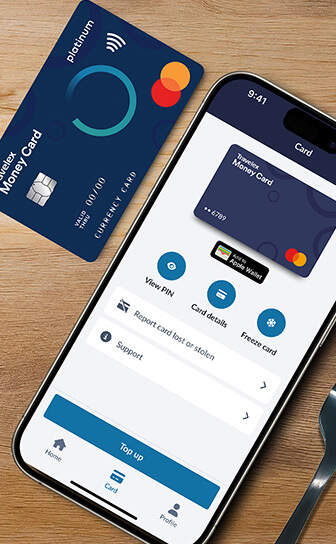

Travelex Money Card

- A safe way to carry and spend travel money abroad

- Load up to 22 currencies on your Travelex Money Card

- Manage your balance 24/7 through the Travelex Money App

- Freeze and unfreeze your card, reveal your PIN or other card details via the Travelex Money App

- Pay with confidence anywhere Mastercard Prepaid is accepted

A world of choices.

Loads of currencies from popular destinations and multiple ways to get them.

Currencies available on the Travelex Money Card

Currencies available in cash, options to get it with home delivery, click & collect, and atms., click & collect locations in the uk including airports..

A world of possibilities with Travelex Money Card

Popular currencies

We have 45+ currencies available, with 22 of these available on our Travelex Money Card

On your doorstep, or on the fly.

Order travel money online to get great rates and choose home delivery or click and collect from stores or the airport.

Home delivery

Spend more time packing, planning, and working on your tan with home delivery.

- Fast, secure, convenient

- Next day delivery available for cash

- Free delivery for Travelex Money Card

Store click & collect

Order online and pick up on your way. Over 25 locations in stores and airports across the UK.

- Lock in your exchange rate 1

- EUR and USD available from as little as 4 hours

- Located in major UK airports

ATM click & collect

Skip the queues thanks to our very smart click & collect ATMs.

- Verification code (OTP) sent to your mobile

- ATMs in Heathrow, Manchester and Birmingham

- No withdrawal fee

We’ve got Heathrow covered.

Order online, collect on your way.

- Get online rates with the convenience of collecting at the terminal

- Collect EUR & USD from as little as 4 hours after ordering online

- Collect Travelex Money Card from as little as 4 hours after ordering online

- Find us easily in every Heathrow terminal

- Collect Travelex Money card from as little as 4 hours after ordering online

Travel money in a jiffy

Get your travel money quickly, easily, and securely.

Choose delivery or collection

Enjoy your trip, what our customers say.

See why they trust Travelex services.

We get around

Smart travellers all around the world choose us for their travel money needs.

Summer travel essentials

Life’s a beach with the Travelex Money App. Manage and top up your Travelex Money Card from anywhere.

Travel blog

Discover top tips, great guides, and indulgent inspiration. We’ve got travel advice for the far-flung adventures, last minute city breaks, family getaways, and everything in between so you can plan, budget for, and enjoy your next trip.

Common questions about Travelex

What is a travel money card, do you get charged for using a travel money card, how do i get a travel money card, where can i use my travel money card, can i withdraw money from my travel money card, still have questions, have questions.

Explore the support categories for help

- 1 Lock in your exchange rates mean the exchange rate is locked in for the initial load only. The exchange rates for subsequent reloads will be set at the prevailing exchange rate at the time of the transaction.

- 2 Although Travelex does not charge ATM fees, some operators may charge their own fee or set their own limits. We advise to check with the ATM operator before using.

- Travelex Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International.

- PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

- Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC.

Quick Links

- Travel Money Card

- Exchange Rates

- Bureau de Change

- Max Your Foreign Currency

- Compare Your Travel Money

- Travellers Cheques

- Precious Metals

About Travelex

- Store Finder

- Download Our App

Useful Information

- Help & FAQs

- Privacy Centre

- Terms & Conditions

- Travelex Money Card Terms & Conditions

- Statement of Compliance

- Website Terms of Use

- Safety & Security

- Modern Slavery Statement

Customer Support

Travelex foreign coin services limited.

Worldwide House Thorpe Wood Peterborough PE3 6SB

Reg Number: 02884875

Your safety is our priority. Click here for our latest Customer update

Compare our best travel money deals

Get maximum value for your travel money, currency calculator.

Join our personal finance newsletter for top deals and insight

You can unsubscribe at any time - privacy notice .

Today’s best exchange rates

How do you get the best holiday money exchange rate, use our currency converter, high exchange rates, delivery charges, special offers, pros and cons, five golden rules of travel money, 1. know how much cash you'll need.

Carrying around a large amount of cash isn't the safest thing to do. At the same time, not having enough cash can cause a lot headaches too. It's a good idea to take a little more than you think you'll need.

But it's also good sense to have a backup prepaid , debit or travel credit card that you can rely on - assuming you're going to a destination that widely accepts card transactions.

2. Shop around

Not all currency exchange companies are created equal. Some may have good exchange rates, but higher fees. Others may have higher rates, but no fees. You have to make sure which one offers the best value to you.

This is why it’s worth comparing the deals on offer from several companies before ordering your travel money. Factor in the fees and the exchange rate and see where you end up better off. Often the amount of money you're exchanging can be a deciding factor.

3. Don't buy your travel money at the airport

Airport holiday money providers have notoriously high prices because they offer a last-chance solution for those who are just about to board a plane. By planning ahead you can save a small fortune.

4. Don't carry too many large notes

Notes of large denominations can be tricky, as small shops and taxi cabs, which are more likely to require cash, might not have enough change to accept a large note.

Some retailers are also often wary of accepting large notes. Smaller notes and change can also be handy when it comes to tipping or buying small everyday items.

5. Don't use your credit card to buy travel money

Avoid buying foreign currency with a credit card as credit card providers treat the transaction as a 'cash advance' . Not only will you be charged daily interest, you're also likely to be hit with a fee.

Budgeting for your holiday

How much travel money you need to take depends on your plans. You'll need to budget for your holiday to make sure you don't run out of money before the end.

Deciding how much money to take depends on were you're going, whether debit or credit card usage is prevalent, and if you want to have some local currency on hand for emergencies.

Having some cash is extremely important, as there's always a possibility your cards could get declined or blocked for some reason, and it may take some time to resolve the issue.

Also, some countries still rely predominantly on cash transactions, so you should factor that into how much cash you decide to take.

What are the top alternatives to buying travel money?

Travel credit cards.

Travel credit cards - i.e. the ones with no foreign transaction fees - offer two key advantages over travel money:

Great exchange rates - when you spend on a travel credit card you get the Mastercard or Visa exchange rate, which is about the best you can find as a regular consumer

Purchase protection – for purchases costing between £100 and £30,000 you're covered by Section 75 of the consumer credit act , meaning if something goes wrong you can make a claim with your card provider should the vendor fail to pay up

However, not everywhere accepts travel credit cards and using them at a cash machine abroad can come with hefty fees. It can also be easier to overspend on a credit card, leaving you with debts on which interest is charged.

Travel money cards

Currency cards and travel bank accounts let you spend overseas without being charged a foreign transaction fee. Their key strengths are:

Great exchange rates - you card provider will pass on the Mastercard or Visa rate to you without adding extra charges

No charges for ATM use overseas - if you need extra cash on holiday, you can withdraw it without being charged by your provider. Watch out for local ATM fees though, as these might still apply

The downsides include that there can be limits on how much you can withdraw abroad using a travel money card, and that they're not accepted quite as widely as cash. Some travel current accounts also come with fees.

Prepaid travel cards

Prepaid travel cards can be loaded with currency and used abroad without paying foreign exchange fees. You can load a prepaid card with a specific foreign currency or a variety of different currencies, depending on your travel plans. The key advantages are:

Low or no fees to use abroad – prepaid travel card providers charge far less than traditional banks for overseas usage

Safer than carrying cash - you can cancel or freeze the card if it's lost or stolen, protecting your balance

However, you’ll need to watch out for general usage fees, which often apply when you load the card with cash and may also be charged monthly.

Can you get commission-free travel currency?

Yes and no. It depends on how you define it. Commission refers to the service fee that a currency exchange broker charges for exchanging your money.

Many companies advertise 0% commission to exchange money online or on the high street, but, instead of charging commission, they offer a less competitive exchange rate. This is why you need to compare the whole deal rather than just opting for a zero-fee travel money deal.

Are there restrictions on getting currency delivered?

When you buy your currency online, it's normally sent via Royal Mail's Special Delivery service. This means you have to sign for the package. Cash orders that exceed £2,500 will be sent in batches because that's the maximum value that can be insured for each delivery.

Can you get next-day delivery for currency?

Some travel money providers do offer next-day delivery. These brokers send out currency using Royal Mail's Special Delivery Guaranteed by 1pm service.

Our comparison shows which operators offer this option and how much they charge for it. With some companies, you also have the option to pre-order your travel money for collection in person from a local branch, meaning you don't have to pay for delivery.

Will anyone buy my currency back?

If you've got leftover travel money from a trip abroad, you can use a buy-back service to convert it back into pounds.

The buy-back rate tells you how much sterling you'll get back.

Remember to factor in the rate and delivery costs, and compare exchange rates. You can check out the best euro-to-pound exchange rate by looking at our comparison table.

About our comparison

Who do we include in this comparison.

We include every company that gives you the option of buying euros online. Discover how our website works .

How do we make money from our comparison?

We have commercial agreements with some of the companies in this comparison. We get paid commission if we help you take out one of their products or services. Find out more here .

You do not pay any extra and the deal you get is not affected.

Learn more about travel money

About the author

Didn't find what you were looking for?

Below you can find a list of currencies to exchange

Other products that you might need for your trip

We’ve been featured in

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

YOUR MONEY YOUR WAY

Travel money, hays travel foreign exchange, 4 great ways to buy your holiday money, click & collect.

Great rates & currency expertise come as standard with our Click & collect service & with no minimum spend, your holiday money is just a few clicks away.

This brings the total quotes to £000.00

£000.00 for currency

£000.00 for Buy Back Guarantee

Guarantee Peace of mind when buying your currency from Hays Travel

Save money on your unused currency with our Buyback Guarantee^

Return your unused currency for the same rate as you purchased it.

Available on all currencies sold in cash.

Available on multiple currency transactions

Available Instore & online

Terms & Conditions

^Please speak to one of our Hays Travel colleagues for the full Terms & Conditions of the Hays Travel Buy Back Guarantee. ^^In-branch rates will differ from our online rates. The rates displayed online are for currency banknotes pre-order only, and guaranteed if currency is collected before close of business on Sunday 18th August 2024. ^^^Not all notes presented for buy back may be able to be exchanged, please ask our staff for more details. ^^^^Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC. ^^^^^Hays Travel Prepaid Currency Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

Exchange Rates

Always great value and no minimum spend*

Travel Money Card

- Use anywhere Mastercard® prepaid is accepted worldwide.

- Carry less cash.

- Top up in 22 currencies including Euro, US Dollar, Australian Dollars and UAE Dirhams.

- Phone support available worldwide 24/7.

- Manage on the go via Hays Travel Currency Card App.

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

It is free to use in millions of locations worldwide where Mastercard Prepaid is accepted: including restaurants, bars, and shops when you spend in a currency loaded on the card.

This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals wherever you see the Mastercard Acceptance Mark, and also 24/7 phone support.

Take your money card with you on every holiday, simply top up and go!

- BUY IN BRANCH

WHY CHOOSE HAYS TRAVEL?

For your next departure, buy your holiday money from Hays Travel. Always commission free currency with competitive online and high street exchange rates.

- Wide selection of currencies available

- Hundreds of nationwide Hays Travel branches offering on-demand Foreign Exchange; buy from branch to receive high quality customer service from the travel experts or order online for convenient home delivery

- 0% commission when we buy and sell foreign currency

Home Delivery

Ordering currency from the comfort of you own home has never been easier, with our great rates & over 60 currencies to choose from as well as next day delivery why not choose your currency to be delivered to your doorstep?

Holiday Money to your door

Order before 3pm for next working day home delivery via Royal Mail Special Delivery. *Customer must be home to sign for delivery. Over 60 currencies to select from. Free delivery on all orders £500 and over Convenient Saturday delivery available for no extra charge Minimum order value of £200 up to a maximum of £2500 Peace of mind, your local Hays Travel branch will buy back any leftover currency purchased through Hays Home Delivery commission free

Call Into a Branch

With over 400 branches to choose from arranging your holiday money has never been more convenient – Why not call into branch today where one of our experienced & Friendly Foreign Exchange Consultants will be on hand with our great rates, expert advice & fantastic service.

Bank on our branches for your Holiday Money

Over 400 branches Nationwide - Use our branch locator to find your nearest Hays Travel branch.

A wide selection of currencies & Hays Travel Money Cards available Instantly in-store

Competitive high street rates and always commission free

Exotic Currency Ordering service – Over 70 currencies available to order

Buyback Guarantee – Save money on your leftover Currency.

All major currencies Bought Back Commission Free

Experienced & Friendly Staff instore

- FIND YOUR NEAREST BRANCH

Flight attendant warns trying money-saving hack could get you 'banned from flying'

A flight attendant has issued a stark warning to skiplagging holidaymakers, claiming they could be banned from flying if they are caught using the money-saving technique.

- 09:00, 17 AUG 2024

- Updated 09:01, 17 AUG 2024

Sign up for our daily newsletter to get the day's biggest stories sent direct to your inbox

We have more newsletters

It's no secret that travel can be expensive.

Many of us would like to jet off abroad more often – but costs can restrict us. For that reason, people have been coming up with inventive ways to save costs.

One of these hacks is skiplagging, also known as "hidden city ticketing". It is a travel hack where a passenger books a flight with a layover in their desired destination instead of booking a direct flight to that destination.

The passenger then disembarks at the layover city and skips the final leg of the flight. This method is sometimes used by travellers to save money, as flights with layovers can sometimes be cheaper than direct flights to the layover city.

It sounds genius, right? But before you get booking flights yourself, a flight attendant has some words of warning you should pay attention to.

The cabin crew member, known as @traveling.mermaidd on TikTok, shared a story about a friend who was apparently banned from flying when they tried the hack.

Even though the money-saving method seems harmless, skiplagging can lead to serious repercussions if the airline catches you doing it. While it's not illegal, some companies have policies against it.

In the comments section, a commenter called Patrick explained why this may be the case. He said: "Skiplagging is definitely a no no. If you do it once a year with some normal flights in between you will be okay. But yeah lifetime ban and it usually carries over to any airline that codeshares."

Explaining why airlines would care about this behaviour, he elaborated: "For one it takes seats from butts. Also they price to compete with other airlines... really you're just affecting their bottom line."

- Travel advice

- Most Recent

NEWS... BUT NOT AS YOU KNOW IT

What is the ‘just give me my money’ TikTok trend about, exactly?

Share this with

If (like us) you spend endless hours scrolling on your FYP, you’ve likely come across the latest viral trend – ‘just give me your money’.

TikTok dances and challenges might feel a little… old hat these days, but every now and then, a viral trend will sweep across the internet and have us harking back to 2020. And, frankly, who doesn’t love a bit of nostalgia?

While its name may sound rather abrasive, this new TikTok craze is actually anything but. Instead, it’s a silly, harmless bit of fun shared between friends and family.

So popular is the trend that even actor Will Smith has taken part in it.

Although it’s not clear where it originated, people believe that it was popular Twitch streamer Kai Cenat who started it all off, when he used the phrase during a session with American rapper DreamDoll in January.

@vrewls just gimme my money #kaicenat #dreamdoll #fyp ♬ original sound – vrewls

So, what on earth is the ‘just give me my money’ TikTok trend?

Essentially, a group of pals or family members take it in turn to sing or say the words, ‘just give me my money.’

They each put on a funny voice or deliver the phrase with flare, congratulating one another after each line is delivered.

For one poor soul, though, they are instead met with awkward glances and silences rather than applause.

And that’s literally it.

@.worldofy Why is this so funny #typ #foryou #foryoupage #trend #comedy #givememymoney #mum #sisters #challenge #willsmith ♬ original sound – worldofy

@w_thorn #justgivememymoney 😂 ♬ original sound – Wil Thornalley

@theysfamily Just give me my money Prank 😅 ♬ original sound – Yahya and sahar

So far, the #justgivememymoney hashtag has over 31,000 results on the short form video platform and some clips in the category have well over 400,000 likes.

One user wrote in the comments section under Wil Thornally’s video: ‘Never skipping a just give me my money video,’ while another added: ‘Damn I love this trend.’

Others, however, weren’t so convinced.

Alex King demanded: ‘Apologise IMMEDIATELY,’ as @lollydrew proclaimed, ‘this trend is evil.’

More still just couldn’t understand what all the fuss was about. ‘I’m the only person who can’t understand this trend,’ one commenter said.

And another sceptic pointed out that it was obvious who the victim would be at the beginning of the clip and that it was clearly rehearsed ahead of hitting record.

No matter which camp you belong to, it looks as though the trend is here to stay – that is, until the next one comes along or the internet gets sick of it.

Elsewhere on TikTok, we’ve seen various fads and crazes explode in recent months.

In the world of health, TikTokers are claiming that starchy rice water is the DIY version of Ozempic and similar weight loss drugs.

The ‘health hack’ sees people soak rice in warm water overnight, before they down the concoction first thing in the morning before their breakfast.

Fans claim the longer you consume ‘ricezempic’ for, the more weight you’ll lose. One content creator even claimed that introducing the drink into your diet can lead to a weight loss of up to 27 kilograms in two months.

Another food-related trend that is definitely not about being healthy, is ‘fluffy coke’, which involves adding Marshmallow Fluff to your glass of cola.

Metro’s food and drink writer Courtney Pochin put it to the test – along with the viral KitKat/ketchup combo – to see what all the fuss was about. You can read her thoughts here .

And let’s not forget Hawk Tuah Girl and her words of wisdom…

Will you be giving the ‘just give me my money’ trend a go?

Do you have a story to share?

Get in touch by emailing [email protected] .

MORE : Nicole Scherzinger slammed for posting ‘most tasteless’ video from her luxury yacht

MORE : Don’t do that: New Metro podcast blows the lid on whacky science and not-so-miracle cures

MORE : This is the telltale sign that marks you out as a Millennial on a night out

Sign up to our guide to what’s on in London, trusted reviews, brilliant offers and competitions. London’s best bits in your inbox

By ticking this box, you confirm you are over the age of 18*. Privacy Policy »

Enter your birthday for your free daily horoscope sent straight to your inbox!

Get us in your feed

We use cookies to improve your experience on our website. Please let us know your preference. Want to know more? Check out our cookies policy Accept all cookies Manage cookies

Baguley Extra Tesco Travel Money

About tesco travel money at baguley extra.

Tesco Travel Money Manchester is conveniently located inside our store so you can easily exchange currency. Take a look at the Tesco Bank website to see our stocked currencies. Our bureaus are sometimes single-staffed meaning there may be periods where the bureau is unmanned, but signage will let you know when colleagues are returning from breaks.

Frequently Asked Questions

You can view exchange rates on our Travel Money website - https://www.tescobank.com/travel-money/ . Exchange rates may vary during the day and will vary whether you're buying in store, online or over the phone.

You can find our opening times at the top of this page.

Please contact Travel Money on 0345 366 0103 or visit https://www.tescobank.com/travel-money/contact-us/ .

You can search for your nearest Travel Money kiosk on our store locator https://www.tesco.com/store-locator/ .

Contact Information

Nearby stores, f&f clothing altrincham road, tesco cafe altrincham road, tesco pharmacy altrincham road.

Manchester Is Giving London a Run for Its Money

A building boom is happening in the UK’s second city as young workers flee soaring living costs in the capital and others in the region are drawn to its energy and quality of life.

Manchester, England, is going through a building boom.

Photo: Frank Fell/Robert Harding/Collection Mix: Subjects RF via Getty Images.

Manchester is having a moment.

Ten years after gaining powers from the central government in London over areas ranging from urban transport to local planning, the world’s first industrial city in the north of England is at the center of a political, cultural and commercial growth spurt.

Money blog: Couples reveal how they split finances when one earns more than other

Welcome to the Money, your place for personal finance and consumer news and tips. Read our weekend feature on relationship finances below and let us know how you and your partner divide money in the comments box. We'll be back with live updates on Monday.

Saturday 17 August 2024 12:43, UK

Essential reads

- Couples on how they split finances when one earns more than other

- What's gone wrong at Asda?

- The week in money

- Best of the Money blog - an archive of features

Tips and advice

- All discounts you get as student or young person

- Save up to half price on top attractions with this trick

- Fines for parents taking kids out of school increasing next month

- TV chef picks best cheap eats in London

- 'I cancelled swimming with plenty of notice - can they keep my money?'

Ask a question or make a comment

By Emily Mee , news reporter

Openly discussing how you split your finances with your partner feels pretty taboo - even among friends.

As a consequence, it can be difficult to know how to approach these conversations with our partner or what is largely considered fair - especially if there's a big imbalance salary-wise.

Research by Hargreaves Lansdown suggests in an average household with a couple, three-quarters of the income is earned by one person.

Even when there is a large disparity, some couples will want to pay the same amount on bills as they want to contribute equally.

But for others, one partner can feel resentful if they are spending all of their money on bills while the other has much more to spend and is living a different lifestyle as a result.

At what stage of the relationship can you talk about money?

"We've kind of formally agreed there is some point in a relationship you start talking about kids - there is no generally agreed time that we start talking about money," says Sarah Coles, head of personal finance at Hargreaves Lansdown.

Some couples may never get around to mentioning it, leading to "lopsided finances".

Ms Coles says if you want to keep on top of finances with your partner, you could set a specific date in the year that you go through it all.

"If it's in the diary and it's not emotional and it's not personal then you can properly go through it," she says.

"It's not a question of 'you need to pull more weight'. It's purely just this is what we've agreed, this is the maths and this is how we need to do that."

While many people start talking about finances around Christmas, Ms Coles suggests this can be a "trying time" for couples so February might be a "less emotional time to sit down".

How do you have the conversation if you feel the current arrangement is unfair?

Relationship counsellor at Relate , Peter Saddington, says that setting out the balance as "unfair" shouldn't be your starting point.

You need to be honest about your position, he says, but your conversation should be negotiating as a couple what works for both of you.

Before you have to jump into the conversation, think about:

- Letting your partner know in advance rather than springing it on them;

- Making sure you and your partner haven't drunk alcohol before having the conversation, as this can make it easy for it to spiral;

- Having all the facts to hand, so you know exactly how much you are spending;

- Using 'I' statements rather than 'you'. For example, you could say to your partner: "I'm really worried about my finances and I would like to sit down and talk about how we manage it. Can we plan a time when we can sit down and do it?"

Mr Saddington says if your partner is not willing to help, you should look at the reasons or question if there are other things in the relationship that need sorting out.

If you're having repeated arguments about money, he says you might have opposite communication styles causing you to "keep headbutting".

Another reason could be there is a "big resentment" lurking in the background - and it may be that you need a third party such as a counsellor, therapist or mediator to help resolve it.

Mr Saddington says there needs to be a "safe space" to have these conversations, and that a third party can help untangle resentments from what is happening now.

He also suggests considering both of your attitudes to money, which he says can be formed by your early life and your family.

"If you grew up in a family where there wasn't any money, or it wasn't talked about, or it was pushed that you save instead of spend, and the other person had the opposite, you can see where those conversations go horribly wrong.

"Understanding what influences each of you when it comes to money is important to do before you have significant conversations about it."

What are the different ways you can split your finances?

There's no one-size-fits-all approach, but there are several ways you can do it - with Money blog readers getting in touch to let us know their approach...

1. Separate personal accounts - both pay the same amount into a joint account regardless of income

Paul Fuller, 40, earns approximately £40,000 a year while his wife earns about £70,000.

They each have separate accounts, including savings accounts, but they pay the same amount (£900) each a month into a joint account to pay for their bills.

Paul says this pays for the things they both benefit from or have a responsibility for, but when it comes to other spending his wife should be able to spend as she likes.

"It's not for me to turn around to my wife and expect her to justify why she thinks it's appropriate to spend £150 in a hairdresser. She works her backside off and she has a very stressful job," he says.

However, their arrangement is still flexible. Their mortgage is going up by £350 a month soon, so his wife has agreed to pay £200 of that.

And if his wife wants a takeaway but he can't afford to pay for it, she'll say it's on her.

"Where a lot of people go wrong is being unable to have those conversations," says Paul.

2. Separate personal accounts - whoever earns the most puts more into a joint account

This is a more formal arrangement than the hybrid approach Paul and his wife use, and many Money blog readers seem to do this in one form or another judging by our inbox.

There's no right or wrong way to do the maths - you could both put in the same percentage of your individual salaries, or come up with a figure you think is fair, or ensure you're both left with the same amount of spending money after each payday.

3. Everything is shared

Gordon Hurd and his wife Brenda live by their spreadsheet.

Brenda earns about £800 more a month as she is working full-time while Gordon is freelance. Previously Gordon had been the breadwinner - so it's a big turnaround.

They each have separate accounts with different banks, but they can both access the two accounts.

How much is left in each account - and their incomings and outgoings - is all detailed in the spreadsheet, which is managed weekly.

Whenever they need to buy something, they can see how much is left in each account and pay from either one.

Gordon says this means "everyone knows how much is available" and "each person's money belongs to the other".

"We have never in the last decade had a single disagreement about money and that is because of this strategy," he says.

Money blog reader Shredder79 got in touch to say he takes a similar approach.

"I earn £50k and my wife earns just under £150k. We have one joint bank account that our wages go into and all our outgoings come out of. Some friends can't get their head around that but it's normal for us."

Another reader, Curtis, also puts his wages into a joint account with his wife.

"After all, when you have a family (three kids) it shouldn't matter who earns more or less!" he says.

Reader Alec goes further and says he questions "the authenticity of any long-term relationship or the certainly of a marriage if a couple does not completely share a bank account for all earnings and all outgoings".

"As for earning significantly more than the other, so what? If you are one couple or long-term partnership you are one team and you simply communicate and share everything," he says.

"Personally I couldn't imagine doing it any other way and I do instinctively wonder what issues or insecurities, whether it be in trust or something else, sit beneath the need to feel like you need to keep your finances separate from one another, especially if you are a married couple."

A reader going by the name lljdc agrees, saying: "I earn half of what my husband does because I work part-time. Neither of us has a solo account. We have one joint account and everything goes into this and we just spend it however we like. All bills come out of this too. Sometimes I spend more, sometimes he spends more."

4. Separate accounts - but the higher earner pays their partner an 'allowance'

If one partner is earning much more than the other, or one partner isn't earning for whatever reason, they could keep separate accounts and have the higher earner pay their partner an allowance.

This would see them transfer an agreed amount each week or month to their partner's account.

Let us know how you and your partner talk about and split finances in the comments box - we'll feature some of the best next week

By Jimmy Rice, Money blog editor

The centre-point of a significant week in the economy was inflation data, released first thing on Wednesday, that showed price rises accelerated in July to 2.2%.

Economists attributed part of the rise to energy prices - which have fallen this year, but at a much slower rate than they did last year.

As our business correspondent Paul Kelso pointed out, it felt like the kind of mild fluctuation we can probably expect month to month now that sky high price hikes are behind us, though analysts do expect inflation to tick up further through the remainder of the year...

Underneath the bonnet, service inflation, taking in restaurants and hotels, dropped from 5.7% to 5.2%.

This is important because a large part of this is wages - and they've been a concern for the Bank of England as they plot a route for interest rates.

On Tuesday we learned average weekly earnings had also fallen - from 5.7% to 5.4% in the latest statistics.

High wages can be inflationary (1/ people have more to spend, 2/ employers might raise prices to cover staff costs), so any easing will only aid the case for a less restrictive monetary policy. Or, to put it in words most people use, the case for interest rate cuts.

Markets think there'll be two more cuts this year - nothing has changed there.

Away from the economy, official data also illustrated the pain being felt by renters across the UK.

The ONS said:

- Average UK private rents increased by 8.6% in the 12 months to July 2024, unchanged from in the 12 months to June 2024;

- Average rents increased to £1,319 (8.6%) in England, £748 (7.9%) in Wales, and £965 (8.2%) in Scotland;

- In Northern Ireland, average rents increased by 10% in the 12 months to May 2024;

- In England, rents inflation was highest in London (9.7%) and lowest in the North East (6.1%).

Yesterday, we found the UK economy grew 0.6% over three months to the end of June.

That growth rate was the second highest among the G7 group of industrialised nations - only the United States performed better with 0.7%, though Japan and Germany have yet to released their latest data.

Interestingly, there was no growth at all in June, the Office for National Statistics said, as businesses delayed purchases until after the general election.

"In a range of industries across the economy, businesses stated that customers were delaying placing orders until the outcome of the election was known," the ONS said.

Finally, a shout for this analysis from business presenter Ian King examining what's gone wrong at Asda. It's been one of our most read articles this week and is well worth five minutes of your Friday commute or weekend...

We're signing out of regular updates now until Monday - but do check out our weekend read from 8am on Saturday. This week we're examining how couples who earn different amounts split their finances.

Each week we feature comments from Money blog readers on the story or stories that elicited most correspondence.

Our weekend probe into the myriad reasons for pub closures in the UK prompted hundreds of comments.

Landlords and campaigners, researchers and residents revealed to Sky News the "thousand cuts" killing Britain's boozers - and what it takes to survive the assault.

Here was your take on the subject...

I've been a publican for 19 years. This article is bang on! It's like you've overheard my conversations with my customers - COVID, cost of living, wages - the traditional British boozer going out of fashion. (My place: no food, no small children). Hey Jood

I own a small craft ale bar or micropub as some say. The current climate is sickening for the whole hospitality sector. This summer has been ridiculously quiet compared to previous ones. Micropubs were on the rise pre-COVID, but not now even we're struggling to survive… Lauren

I am an ex-landlord. It's ridiculous you can buy 10 cans for £10 or one pint for £5 now. It's not rocket science, it's a no-brainer: reverse the situation. Make supermarket beer more expensive than pub beer, then people will start to go out and mix again rather than getting drunk at home. Ivanlordpeers

Bought four pints of my regular drink at a supermarket for less than one pint in our local pub. It's becoming a luxury to go to a pub these days. Torquay David

Traditional pubs are being taken over by conglomerates who don't sell traditional beer, only very expensive lager, usually foreign, and other similar gassy drinks. How can they be called traditional pubs? Bronzestraw

The main reason for pubs closing is twofold! 1: The out-of-reach rents that the big groups charge landlords. 2: Landlords are told what stock they can hold and restrict where they can purchase it from. Strange, but most pubs belonged to the same groups! A pub-goer

Less pubs are managed now, pub companies are changing them to managed partnerships, putting the pressure onto inexperienced young ex-managers. Locals complain that their local pub has gone. but they don't use them enough. Can government regulate rents and beer prices for business owners? John Darkins

I was a brewery tenant in Scotland for many years and sequestrated because of the constant grabbing at my money by greedy brewers who wanted more and more. I made my pub very successful and was penalised by the brewery. James MacQuarrie

The only reason pubs are closing is locals only use them on Boxing Day, New Year's Eve, and one Sunday a year. Plus breweries don't need pubs, they sell enough through supermarkets! Use them or lose them. Peter Smith

The closing of pubs is a terrible shame. I still go to my local and have great memories of getting drunk in many in my hometown. They are important places in society. As someone once said: "No good story ever started with a salad." Kev K

It's the taxman killing pubs. £1 of every £3 sold. Utter disgrace. Stef

I go with my girlfriend, Prue, every day to my local. It's a shame what's happening to prices. It used to be full of people and joy but now it's a ghost town in the pub since prices are too high now. I wish we could turn back time and find out what went wrong. Niall Benson

Minimum wage is around £11 and the tax threshold is £12,600 per year. How can you possibly afford a night in a pub out when a pint costs between £3 and £8 a pint on those wages? Allan7777blue

Unfortunately, the very people who have kept these establishments going over the years (the working man) have been priced out, and they're paying the price. Dandexter

The pubs are too expensive for people to go out regularly as we once did a decade or so ago. People's priorities are on survival, not recreation. Until the living wage increases beyond an inflation that wages haven't risen above in years, then we will see shops, pubs, etc. close JD

Who wants to spend hard-earned money going into a pub that's nearly always empty. It takes away one of the main attractions - socialising. Michael

Monzo has been named the best bank in the UK for customer satisfaction, according to a major survey.

More than 17,000 personal current account customers rated their bank on the quality of its services and how likely they would be to recommend to friends or family.

Digital banks made up the top three, with Monzo coming out on top, followed by Starling Bank and then Chase.

Some 80% of Monzo customers said they would recommend the bank.

The digital banking app said topping the tables "time and time again" was not something it would "ever take for granted".

Royal Bank of Scotland (RBS) was bottom of the ranking for another year.

The banks with the best services in branches were Nationwide, Lloyds Bank and Metro Bank.

Gail's bakery chain has come under fire for repurposing unsold pastries into croissants and selling them for almost £4 the next day.

The retailer lists the "twice baked" chocolate almond croissants as part of its "Waste Not" range, which means it is made using leftover croissants that are then "topped with almond frangipane and flaked almonds".

The scheme has been hit with criticism online, with many pointing out the £3.90 price tag is 95p more than the original croissant.

One X user said: "The audacity of bragging about it being part of their 'Waste Not' range like we should be grateful to them and proud of ourselves for contributing to reducing food waste when they could just sell it for less money – not one pound more than yesterday.

"Unsure whether to be impressed or horrified that someone has come up with a concept to capitalise on yellow sticker goods to make more profit."

It should be added, however, that the practice was not invented by Gail's - and almond croissants were originally created by French boulangeries to reuse day-old croissants and stop them going stale.

When factoring in the extra ingredients (almond frangipane and flaked almonds) and baking time, the bakery chain would likely defend the increased price by pointing to the additional costs incurred.

It comes as locals in a trendy London neighbourhood signed a petition against a Gail's bakery setting up shop in their area.

After (unconfirmed) rumours began circulating that the chain was looking to open a site in Walthamstow village, more than 600 have signed a petition opposing the plans.

The petition says the village "faces a threat to its uniqueness" should Gail's move into the area (see yesterday's 11.54am post for more).

Gail's has been contacted for comment.

British retailers saw a rise in sales last month after a boost from Euro 2024 and summer discounting, according to official figures.

High street retailers said sales of football shirts, electronics such as TVs, and alcoholic drinks were all stronger amid the Three Lions' journey to the final.

Total retail sales volumes rose by 0.5% in July, the Office for National Statistics (ONS) said. It was, however, slightly below predictions, with economists forecasting a 0.7% increase.

It followed a 0.9% slump in volumes in June as retail firms blamed uncertainty ahead of the general election and poor weather.

ONS director of economic statistics, Liz McKeown, said: "Retail sales grew in July led by increases in department stores and sports equipment shops, with both the Euros and discounting across many stores boosting sales.

"These increases were offset by a poor month for clothing and furniture shops, and falling fuel sales, despite prices at the pump falling."

The data showed that non-food stores saw a 1.4% rise, driven by a strong performance from department stores, where sales grew by 4% for the month as summer sales helped to stoke demand.

However, clothing and footwear shops saw a 0.6% dip, whilst homeware retailers also saw volumes fall 0.6%. Food stores, meanwhile, saw sales remain flat for the month.

There are fears that the £2-cap on single bus fares could be scrapped after the government declined to say whether the policy would continue past December.

Bus companies said it was vital the cost of using their services is kept low for young people to "enhance their access to education and jobs".

Alison Edwards, director of policy and external relations at industry body the Confederation of Passenger Transport, said: "Bus operators are working closely with the government so that together we can find a way to avoid a cliff edge return to commercial fares.

"Analysis has shown that supporting fares, which can be done in a range of different ways, is great value for money and can support many other government objectives.

"For example, keeping fares low for young people would enhance their access to education and jobs, while also encouraging them to develop sustainable travel habits to last a lifetime."

Transport Secretary Louise Haigh said in a recent interview with the PA news agency that her officials were "looking at various options" in relation to the cap, including whether they could "target it better".

It's been a busy week on the economic front.

There was no major shift in the overall outlook - since Monday we've had it confirmed that the UK economy has lower inflation and more growth than the last two years, while wages have grown faster than the overall pace of price rises.

On the back of all that news the pound is at the highest rate since early this month against the dollar, worth $1.2882, and the highest since July when it comes to buying euro with one pound equal to €1.1733.

Signs of a recovery from the global market sell-off of Monday last week can be seen in the share prices of companies listed on the London Stock Exchange.

Share prices have grown among the most valuable companies on the stock exchange, those that comprise the Financial Times Stock Exchange (FTSE) 100 list of most valuable companies.

Today though, this benchmark UK index fell 0.19% but finishes the week higher than the start.

Also finishing the week higher than the start are the more UK-based companies of the FTSE 250 (the 101st to the 250th most valuable firms on the London Stock Exchange).

On Friday morning that index was up 0.08%.

With tensions in the Middle East and Eastern Europe high as Iran mulled a retaliatory strike on Israel and Ukraine made incursions into Russian territory, there had been concern about energy price spikes.

But the benchmark oil price has remained steady at $80.13 dollars for a barrel of Brent crude oil.

Gas prices have remained below the Monday high of 100 pence a therm (the measurement for heat) and now are 94.50 pence a therm.

A Cabinet Office minister has said it is "unfair" to suggest other public sector workers will be queuing up for a pay rise after the government's offer of a 15% increase for train drivers and junior doctors.

"I think that's an unfair characterisation as well," paymaster general Nick Thomas-Symonds told Times Radio.

"I think what is absolutely crucial here is we are a Government again that is sticking to the promises we made in opposition.

"We promised we would sit down and find solutions, and people expressed scepticism about that, but actually that is precisely what we have done in Government."

Last month, the government and the British Medical Association struck an improved pay deal for junior doctors in England worth 22% on average over two years.

Meanwhile, train drivers will vote on a new pay deal following talks between representatives of drivers' union ASLEF and the Department for Transport.

The new offer is for a 5% backdated pay rise for 2022/23, a 4.75% rise for 23/24, and 4.5% increase for 24/25.

The Dartford Crossing is the highest-earning toll road in the UK, new data shows.

The Kent to Essex route raked in £215.9m in the last year - 2,159 times more than the Whitney toll bridge in Hereford.

The crossing, which was supposed to stop charging customers in 2003, costs between £2 and £6 to use (depending on the vehicle you're driving) between 10am and 6pm every day.

Car finance company Moneybarn found it earned just over £209m in 2022.

It topped the chart of 13 toll roads in the country, making over £100m more than the second highest-earning road in 2023 - the M6 Toll in the West Midlands.

In third place was the Mersey Gateway Bridge between Halton and Cheshire, which made £48.9m.

You can see how the other toll roads fared below...

Be the first to get Breaking News

Install the Sky News app for free

IMAGES

COMMENTS

Travelex Foreign Currency Exchange and Travel Money: Airside, Manchester Airport T2 +44 345 8727627: 1 GBP = 1.8779 AUD: 4.3 out of 5 stars: Post Office Travel money: Various locations in Manchester: Contact your preferred branch - numbers available on Post Office website: 1 GBP = 1.886 AUD:

eurochange - Manchester - Trafford Centre - Regent Crescent. Regent Crescent, intu Trafford Centre, Manchester, M17 8AR. 0161 5460396 View Branch Details. Visit a eurochange branch in Manchester for currency exchange and secure great rates! Click & Collect online in 60 seconds or order in-store for better rates than the airport!

New-look travel app out now. Our revamped travel app's out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user ...

Intl Currency Exchange (ICE) Manchester Airport Terminal 1. Hours: Open 05:30 to 23:00 Mon and 5:00 to 24:00 Fri to Sun. Services: travel money, currency card, money transfer, currency exchange. WISE!

We have bureaux conveniently located after Security across Manchester Airport Terminal 1 and Terminal 3. Our friendly colleagues will be able to help you with all your currency needs and provide travel money tips for any destination. Buy your currency now . Get your currency in 3 easy steps. Order online for our best rates, no hidden charges ...

The Post Office at Manchester Airport. The Post Office have a branch in Terminal 1. Their exchange rates are very competitive, as they take 0% commission and will buy back any money you don't spend. Order Currency online with the Post Office. They have over 60 currencies available from Australian dollars to Vietnamese dong, and the more you ...

139.0441. 132.1712. 5.2%. Travelex Online vs Airport (GBP exchange rates were valid for 2nd August 2018) Manchester Currency Exchange Locations.

You can buy travel money before your trip when you visit the John Lewis Bureau de Change at the Trafford Centre in Manchester. We're located on the first floor of the John Lewis & Partners store in the shopping centre, near customer services. If you need help finding us, one of our Partners will be happy to point you in the right direction.

Find out more about the Travel Money services at Manchester Airport including on-site locations and an FAQ. Travel Advice - M56 night closures between J4 - 7 from 10 June to August 2024 affecting travel to and from the airport.

Before you head to Manchester Airport, be sure to buy your travel money. With eurochange, you have the convenience of having your currency delivered straight to your home, or you can click and collect it from one of our 240+ UK branches as you make your way to the airport. Save an average of £169. Over 240 branches. Free delivery on orders £500+.

Manchester Currency Exchange. Mays Pawnbrokers & Jewellers. 192 Rochdale Road. Collyhurst. Manchester. M40 7RA. Click here for directions >>. We'll find us just 1.5 miles northeast of Manchester city centre on Rochdale Road in Collyhurst. We're located in Mays Pawnbrokers & Jewellers on Rochdale Road, beside the Go Local Extra convenience ...

192 Rochdale Road. Collyhurst. Manchester. M40 7RA. Click here for directions >>. We'll find us just 1.5 miles northeast of Manchester city centre on Rochdale Road in Collyhurst. We're located in Mays Pawnbrokers & Jewellers on Rochdale Road, beside the Go Local Extra convenience store and across from Sandhills Park.

Compare travel money with MoneySavingExpert. Find a better exchange rate for spending overseas. Choose from a number of different currencies. Compare rates in minutes. Compare rates. Explore page: Pros and cons. Top tips.