Find out more about sending money to your location of choice.

Read our range of money transfer and banking guides.

Reviews and comparisons of the best money transfer providers, banks, and apps.

Unlock efficient global money movement for your business.

A Guide to Travel Money Cards

Often deemed the cheapest way to spend money abroad , travel money cards are deemed a failsafe option for many travellers. Given the rapid growth of the financial services sector, we want to find out if travel money cards are still as cutting edge as they once were, by comparing them to the new alternatives. Our job is to identify the best international money transfer services and payment providers in the industry: will travel money cards make the cut?

What are travel money cards?

Travel money cards are a popular payment method for individuals headed abroad. Customers will load funds onto the card, using the money as foreign currency when overseas, much like a debit card is used at home. Also known as travel money prepaid cards or currency cards, they facilitate free foreign transactions and overseas ATM withdrawals.

We recommend finding a travel money card which lets you lock-in a favourable exchange rate and supports multiple currencies on one card, to make sure you are securing a flexible and cost-effective deal.

How do you use a travel money card?

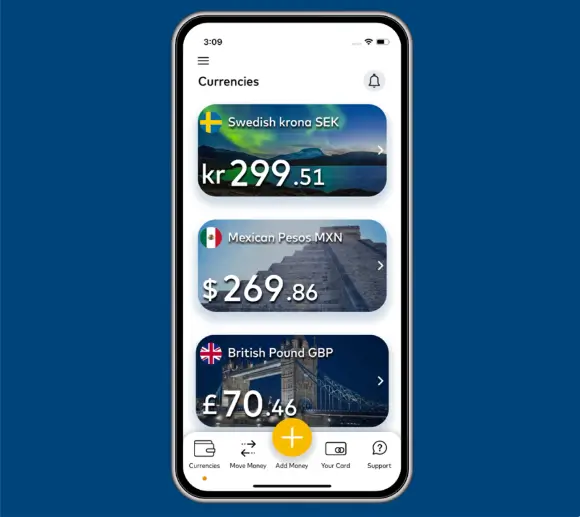

Using a travel money card should be straightforward and stress-free. Simply load funds onto the card before you leave, and once abroad, you will be able to reload funds and change currencies using the website or associated money transfer app . The card can be used to make withdrawals, in-store purchases and book travel arrangements.

Where can I get a travel money card?

Travel money cards are available from different retailers and can be purchased and preloaded online, over the phone or in-store, depending on the brand. In the UK, popular brands include Travelex and the Post Office.

Where can I use a travel money card?

Again, this depends on the brand and where you get your money travel card from. Available currencies vary from card to card but commonly used currencies include US Dollars, UK Pound sterling, Euros, Japanese Yen and New Zealand Dollars. Make sure you check with the provider before ordering a travel money card.

How secure are travel money cards?

Generally, travel money cards are considered a lot safer than handling multiple currencies in cash, or travellers cheques, as your provider will be able to cancel it if need be. Furthermore, some of the best travel money cards employ an equivalent level of security to traditional debit cards, including a PIN code, touch ID and face recognition.

Many consider it safer to use a travel money card abroad than a debit card, as they are not associated with your bank account and therefore cannot be linked if lost or stolen.

Travel money cards vs. Credit cards: What is the difference?

One of the biggest advantages of using a travel money card is that your chosen currency is preloaded before you arrive in the foreign country and you won’t be charged conversion fees. This means you are able to benefit from the most favourable exchange rates, locking it in ahead of time and using the funds at a later date.

Most people who use their credit card abroad do it because it is more convenient. The cost of this convenience, however, can sometimes amount to 3 - 5% per use, depending on the transaction and financial institution. Making a foreign ATM withdrawal with your credit card can incur flat-fees of $5 and up, each time.

This being said, there are some excellent traveller credit cards on the market, so we would recommend users compare exchange rates and transfer fees offered by each provider before making a decision on which card is more beneficial.

If you're planning on using your credit card, we suggest you take a look at our credit card wire transfer guide.

What are the alternatives to travel money cards?

Multi-currency accounts.

International money transfer companies are often tailoring their products and services to meet the needs of their customers. Wise , offers a multi-currency account designed with “international people" in mind. This savvy travel credit card is aimed at frequent flyers who want to spend in various currencies in over 200 countries. Wise is a reliable company to trust with your overseas spending habits.

Challenger banks

More and more alternative service providers are popping up around the world, many of them offering reputable banking features for the modern traveller. In a bid to distinguish themselves from traditional banks, challenger banks are scrapping fees on foreign exchange and international spending. Monzo customers, for example, can benefit from free international ATM withdrawals as well as fee-free spending overseas.

We hope this guide to travel money cards has enlightened you and helped you make a decision about whether this is a suitable payment method for your next trip overseas. We appreciate the value of your hard-earned cash and want all our customers to benefit from the best possible rates when dealing with international payments. Use our comparison tool today to make sure you are offered the most desirable exchange rate for your currency.

Related Content

- Revealed: Summer Cruises Increase your CO2 Emission by 4700% per KM vs Train Travel Travelling by cruise ship rather than train this summer could increase passengers’ CO2 emissions each kilometre by 4716%, MoneyTransfers.com can reveal. May 3rd, 2024

- 10 Years of Data Predicts the Go-to Holiday Destinations for Brits Now COVID Is Over To establish the expected changes to tourism and GBP(£) spend abroad going forwards, MoneyTransfers.com analysed 10 years' worth of UK travel data from the Office for National Statistics (ONS) - 2009 - 2019, to discover and predict where Brits will be travelling to in the next 10 years now that travel is well and truly back on again since Covid! May 22nd, 2024

.jpg)

- A Guide to Travellers Cheques The history of the travellers cheque spans as far back as 1772 when the first of its kind was issued by the London Credit Exchange Company, in the UK. Over the coming centuries the concept became popularised on a global scale, with major banks and financial institutions adopting this form of travel money in the 20th century. American Express became the largest issuer of travellers cheques and continues to offer these services to customers to this day. May 3rd, 2024

- Millennial Guide For Baby Boomers & Generation X We looked over the stats for the past few years, and found that out of £1.5 billion payments abroad, 1 in 5 debit cards payments are made by the UK residents travelling abroad and credit card payments made outside the UK has increased in recent years, reaching 467 million payments. May 3rd, 2024

Contributors

April Summers

- Join CHOICE

Travel money cards with the lowest fees

We look at seven travel money cards from the big banks and airlines..

Prepaid travel money cards are offered by major banks, airlines and foreign exchange retailers like Travelex. Before travelling overseas, you load money into the card account, which locks in the exchange rate for foreign currencies at that time.

You can then use the card for purchases and cash withdrawals just like a debit or credit card, usually wherever Visa and Mastercard are accepted.

You can reload money on-the-go via an app or website, and if the card is lost or stolen, it can be replaced (usually at no cost to you).

Prepaid travel money cards also give you assurance that you're not handing the details of your everyday banking account to merchants you're not familiar with, and they provide easy access to cash when you want some, says Peter Marshall, head of research at money comparison website Mozo .

CHOICE tip: Travel money cards are best for longer trips. They're usually not worth your while if you're only taking a short trip, as some have closure, cash out and inactivity fees.

Travel money card fees

A major difference between prepaid travel cards and debit or credit cards is their fees. Some costs aren't immediately apparent, such as hefty margins built into the exchange rates.

And although fees have come down since we looked at these cards two years ago, you still need to watch out for:

- fees to load the card – either a percentage of the total or a flat fee

- ATM withdrawal fees

- a cross currency fee or margin when you use the card in a currency you haven't preloaded

- further fees if you close the account or haven't used the card for a period of time.

Travel money card with the lowest fees and best exchange rate

Westpac worldwide wallet.

Westpac closed its Global Currency Card in July 2021 and offers its new card in partnership with Mastercard. It's also available from Bank of Melbourne and BankSA.

Currencies: AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, ZAR.

Key features:

- No loading, reloading, closing or inactivity fees.

- Free to use it in network ATMs in Australia and partner ATMs overseas in a range of countries including the UK, US and New Zealand.

- A charge applies at non-Westpac and non-partner ATMs in Australia and overseas.

- Best exchange rates for the US dollar, the Euro and GBP in our comparison.*

- The only card that lets you preload the South African rand.

Other travel money cards

Next to the Westpac Worldwide Wallet, there are six other travel money cards available.

Australia Post Travel Platinum Mastercard

Available online or at post offices.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED.

- Fee to reload the card via BPay, debit card or instore, but free via online bank transfer.

- Closure fee.

- Fees for ATM withdrawals in Australia and overseas.

Cash Passport Platinum Mastercard

It's issued by Heritage Bank and is available online and from a number of smaller banks and credit unions (like Bendigo Bank and Bank of Queensland) as well as travel agents.

- Fee to reload with a debit card or instore, but free via BPay.

CommBank Travel Money Card

CommBank Travel Money Card (Visa)

As NAB and ANZ have closed their travel money cards, this is the only other travel money card available from a major bank. This card has the largest variety of currencies that can be preloaded.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED, VND, CNY.

- Fee if you make a purchase with currencies not preloaded.

- Fee for withdrawals at overseas ATMs.

Qantas Travel Money Card

Qantas Travel Money Card (Mastercard)

The only travel money card offering from an airline. It can be added as a feature to your Qantas Frequent Flyer card, so you don't need a dedicated card, and you can earn points using it.

- Free to reload via bank transfer or BPay, but there's a reload fee if using debit card.

Travelex Money Card

Travelex Money Card (Mastercard)

Travelex is an international foreign exchange retailer. In Australia, it operates more than 140 stores at major airports and shopping centres, across CBDs and in the suburbs. It was the card with the best exchange rate for New Zealand dollars.*

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD.

Fees :

- Load fee instore, but free via Travelex website or app.

- Reload fee instore or via BPay, but free via Travelex website or app.

- Closure fee and monthly inactivity fee (if not used for 12 months).

Travel Money Oz Currency Pass

Travel Money Oz Currency Pass (Mastercard)

The Travel Money Group is owned by Flight Centre and is a foreign exchange retailer.

- Reloading the card via an online bank transfer or instore is free, but there's a fee if you reload via BPay, debit card or credit card.

- Cash out (closure) fee.

Travel money card tips

- Make sure the card allows the currencies you'll need, and also consider stopovers. For example, the South African rand is only supported by the Westpac card.

- Try to load your card with the right currencies and amounts on days with good exchange rates.

- Make sure you know how to reload your card if you run out of funds while overseas.

- It may be more convenient to choose a card that has an app that can be linked to your bank account.

- Avoid loading more money than you'll need as there may be fees and exchange rate margins to get the unused money back.

- Remember to cancel the card once you're finished your trip, especially if it has inactivity fees.

- Be mindful that you still may need a credit card, as travel money cards may not be accepted as security for hotels and car rental agencies.

Stock images: Getty, unless otherwise stated.

Join the conversation

To share your thoughts or ask a question, visit the CHOICE Community forum.

- Credit cards

- Personal Finance

What Is A Travel Money Card?

How does a travel money card work?

How many currencies can you load at once, other features to compare, how to get a travel money card, when is a travel money card worth it, alternative options.

A travel money card, also called a prepaid travel card, is a type of card that can hold foreign currencies. It’s intended for overseas travel, and you can use one to withdraw foreign cash from ATMs and to make purchases in a local currency.

Think of a travel money card as a debit card that uses local currency. Before you use a travel money card, you’ll preload a set amount of a specific international currency onto the card at the day’s exchange rate. For example, if you’re travelling to Italy and France for two weeks, you’d load Euros (€) onto the card and use it instead of your regular debit or credit card during your trip.

You can continue reloading money onto the card via an app or website as you spend your funds. So, if you blow through your Euros in Rome, you can top off your card’s balance before arriving in Paris.

Understanding the value of your exchange

The value you exchange currency for will depend on when you load your funds. Rates change from day to day, but you’ll lock in the rate used at the time you exchange currency. So, you’ll know the exact worth of the foreign currency in Australian dollars every time you use your preloaded card.

On the one hand, a locked-in rate protects you from volatile currencies with fluctuating values. However, if the rate drops, you could be stuck with devalued foreign funds. So, while you can’t predict the future, try to coordinate the load when the exchange rate is most valuable — even if that means waiting a few days.

The number of foreign currencies available will depend on the company providing the card, but you’ll generally find a wide variety of options. Even if dozens of currencies are available, there are typically limits to the number someone can load onto a travel money card. These limits vary by card, but these cards generally only allow for about a dozen currencies at once.

For example, here are common travel money cards and the number of currencies they can support simultaneously:

- Australia Post Travel Platinum Mastercard: up to 11 currencies

- Cash Passport Platinum Mastercard (issued by Heritage Bank): load up to 11 currencies

- CommBank Travel Money Card: up to 13 currencies

- Qantas Travel Money Card: up to 10 currencies

- Travelex Money Card: up to 10 currencies

- Travel Money Oz Currency Pass Travel Money Card: up to 10 currencies

- Westpac Worldwide Wallet: up to 10 currencies.

The number of currencies available and the ability to load multiple currencies onto one card have obvious advantages: it helps you save on fees and makes it easier to manage your money while travelling overseas .

However, there are other key features to compare when choosing a travel money card.

Another thing to look for is reduced or waived fees for loading or reloading funds, account keeping, account closing and emergency card replacements.

Be sure to check for any potential fees when accessing leftover foreign funds you didn’t use on your trip, as there may be an unloading fee or an extra charge to withdraw funds and close your account. For example, Travelex charges a $4 monthly inactivity fee when the card hasn’t been used for more than 12 months.

Top-up options

How easy it is to use a financial product is typically important, but simplicity and convenience may feel more essential when you’re on holiday. In that case, options to quickly load or reload funds and notifications when your balance is low can be very helpful. Some cards may allow you to top up your balance immediately and with little cost. With others, you may have to wait a few days and pay a small fee.

Top-up methods also vary. For example, you can use BPAY with certain cards, but not all. Some cards may require you to use a specific app or portal. If convenience and flexible top-up options are important to you, compare options accordingly.

Perks and benefits

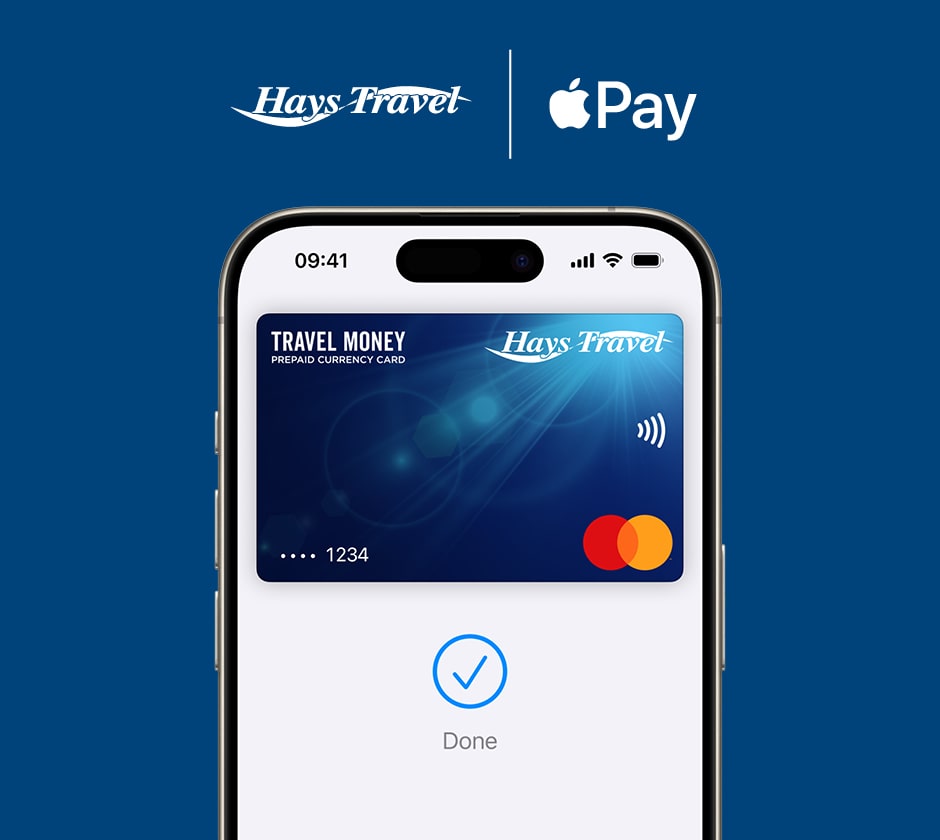

Travel perks, such as airport lounge access or the ability to earn rewards, are also great features to look for. Digital wallet compatibility, allowing you to use a virtual version of your card, can also be helpful.

Security and customer service

Security features are also important. Look for a card with a PIN to use at ATMs and the ability to lock the card instantly if lost or stolen.

And, since you’re travelling overseas, 24/7 customer support is essential to ensure you have access to help when you need it.

To get a travel money card , you can go through your bank, an airline, a foreign exchange retailer or a payment merchant.

Prepaid travel card eligibility is comparable to the requirements for a debit card. For example, CommBank requests that cardholders are at least age 14, are registered with NetBank, and provide a valid email and residential address.

You can apply directly on the provider’s website once you choose your favourite prepaid travel money card. Make sure to submit your application at least a few weeks before your trip in case of delays.

» MORE: How old do you have to get a credit card?

Activating the card

Once you receive the card:

- download the provider’s app and familiarise yourself with how it works

- register your account

- activate the card

- convert your money to the chosen currency. You might want to start with a smaller amount for the first part of your trip and reload while overseas or make one big transfer.

While overseas, you’ll likely alternate between paying in local cash and pulling out your travel card. Your goal is to find the best travel card that allows you to pay for items with minimal fees and maximum protections flexibly.

Possible advantages

- Provides access to multiple currencies. Most options allow you to convert Australian dollars into several different currencies simultaneously. That means you can have secure access to a handful of foreign funds during your next multi-country adventure.

- Saves on ATM fees. Credit card holders won’t usually be charged the standard 3% foreign transaction fee or pay extra for in-network ATM withdrawals, loading, and topping up their cards. However, these are just generalisations — each credit card company or bank will have its own fee structure.

- Exchange rates are locked. You’ll pay for the local currency using the exchange rate available when you load funds, which locks in the rate. Having dependable value for your funds goes a long way for peace of mind, especially when travelling.

- Fewer risks when lost. Losing a prepaid card while travelling is undoubtedly a hassle. However, a lost or stolen credit card can mean more risks, like thieves potentially accessing your personal banking details and account funds. Since a lost travel money card is unlikely to result in identity theft and fraud , some travellers find it a safer choice while abroad.

- Helps with budgeting. Trying to keep to preloaded funds may help you stick to a budget while on vacation. Plus, you see the value of money in the local currency, which can help you manage your finances while travelling.

- May come with rewards and perks. Some travel money cards earn frequent flyer points or come with other special travel perks, like overseas customer service. For example, the Qantas Travel Money Card earns Qantas points, and the Westpac Worldwide Wallet prepaid travel money card offers airport lounge access to the cardholder and one companion access when a flight is delayed.

Potential risks

- There are delays when reloading. If you need to top up your balance, you may need to wait up to a few days before funds are available to use.

- Other fees. Some travel money cards may levy typical credit card fees for reloading funds, emergency card replacement, account maintenance, closures, inactivity and more. For example, Travelex and the Australia Post Travel Platinum Mastercard charge a $10 account closing fee.

- Limited acceptance. Travel money cards are less common than other payment options, so you may need help using one for all purchases. So, it’s always a good idea to carry emergency cash.

- Typically lack rewards or major perks. Travel money cards may come with some, but these extras are usually less robust than the offerings on rewards credit cards .

The right travel money card supports a stress-free trip, but you don’t have to use one when travelling overseas — your bank card or credit card could also be a suitable option.

If you’re deciding between a travel money card and a travel credit card , it’s important to understand the differences in how they work.

- Travel money cards are preloaded with foreign currencies, while travel credit cards spend borrowed money. Travel money cards are generally easier to obtain as they don’t require good credit or income thresholds. With a travel money card, you can withdraw funds from an ATM without incurring interest or cash advance fees .

- Travel credit cards don’t usually hold foreign currency but offer perks such as international buyer protections, free insurance , airport lounge access and frequent flyer travel points .

Be sure to consider other important features — such as security, reduced fees and travel perks — to decide if a travel money card is worth it for you.

Frequently asked questions about travel money cards

The available currencies will depend on the card, but you’ll generally find the following options:

- United States Dollars (USD)

- Europe Euros (EUR)

- Great British Pounds (GBP)

- Japanese Yen (JPY)

- New Zealand Dollars (NZD)

- Hong Kong Dollars (HKD)

- Canadian Dollars (CAD)

- Singapore Dollars (SGD)

- Thai Baht (THB)

- Vietnamese Dong (VND)

- Chinese Renminbi (CNY)

- Emirati Dirham (AED).

Most Australian banks — including Westpac, CommBank, ANZ and NAB — have some sort of travel product, whether that’s a travel money card, a travel-friendly debit card or a travel credit card. However, ANZ and NAB no longer offer prepaid travel money cards.

About the Author

Amanda Smith is a freelance reporter, journalist, and cultural commentator. She covers culture + society, travel, LGBTQ+, human interest, and business. Amanda has written stories about planning for retirement for…

DIVE EVEN DEEPER

How Do I Pay With My Phone?

Instead of carrying your wallet around and pulling it out at check-out, you can just tap your phone, which is always on you, to pay for most things now.

What Is a Travel Credit Card?

Using a travel rewards credit card can help you get your next flight on a discount, hotel upgrades, or even cover the full cost of a trip.

What Is a Frequent Flyer Program Credit Card?

Frequent flyer credit cards earn points or miles that can upgrade your travel and help you score free flights.

How To Lock, Block Or Freeze Your Credit Card

A card lock is essentially an on-off switch that allows you to temporarily freeze or block your credit card and most debit cards.

- Travel Money Card

Get our best rate on the award-winning Travelex Money Card. Manage your card via our app or online.

Buy currency, top up card.

Rate last updated Friday, 30 August 2024 10:07:27 AM AEST. Please note that these are the Travelex online sell rates.

[fromExchangeAmount] [fromCurrencyCode] Australian Dollar

[toExchangeAmount] [toCurrencyCode] [toCurrencyName]

Enter the card number of the Prepaid Card you would like to top up. The number of the Prepaid Card you are topping up must be the Primary Card Number and must have been originally purchased from Travelex.

Card number confirmed

Select the currency you would like to top up to your card

Enter how much you'd like to top up, either in Australian Dollars, or in the foreign currency amount for the currency you have selected.

This section is optional on mobile

E!am commodo accumsan scelerisque. Quisque posuere laoreet lectus a elementum. Mauris euismod, lectus sed gravida dictum, magna orci iaculis ligula, quis blandit lorem enim at magna.

Save with the Travelex Money Card

An award-winning travel money card that can be used wherever Mastercard is accepted online or in-store at millions of outlets around the world, conveniently allowing you to tap & go worldwide with your card and phone via Google Wallet™. 5☆ Canstar rating: 2016, 2017, 2018 2019, 2020 and Mozo best prepaid travel card winner 2022, 2023 & 2024.

$0 Eftpos Fees

$0 atm fees 1, $0 currency conversion fees ^, $0 online shopping fees*, $0 free delivery to your home, travel card exchange rates & currencies, choose among 10 currencies available on the travelex prepaid travel card., $0 currency conversion fee when spending a currency not on your travel card:.

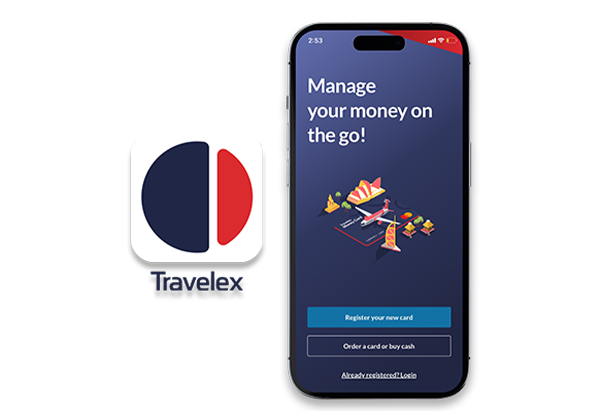

The below calculator is a handy tool to help you estimate the applicable exchange rate for your transaction 2 :

Spend Calculator

You can use this calculator to see what your spend would look like for your trip. It will help you estimate the applicable exchange rate for your transaction.

- Netherlands

- Vatican City

- Czech Republic

Features and Benefits

UNLIMITED FREE overseas ATM withdrawals 1

Highly competitive exchange rates

NO fees when you buy online $0 Currency conversion fee ^

24/7 Global Assistance

Convenient Mobile App Download it here

Shop at millions of outlets wherever Mastercard is accepted and on international websites with the local currency

Buy online, collect in-store or get it delivered to your home (allow up to 7 days from when payment is received)

5 ☆ outstanding value award winning travel money card

Earn cash rewards for shopping with Mastercard Travel Rewards

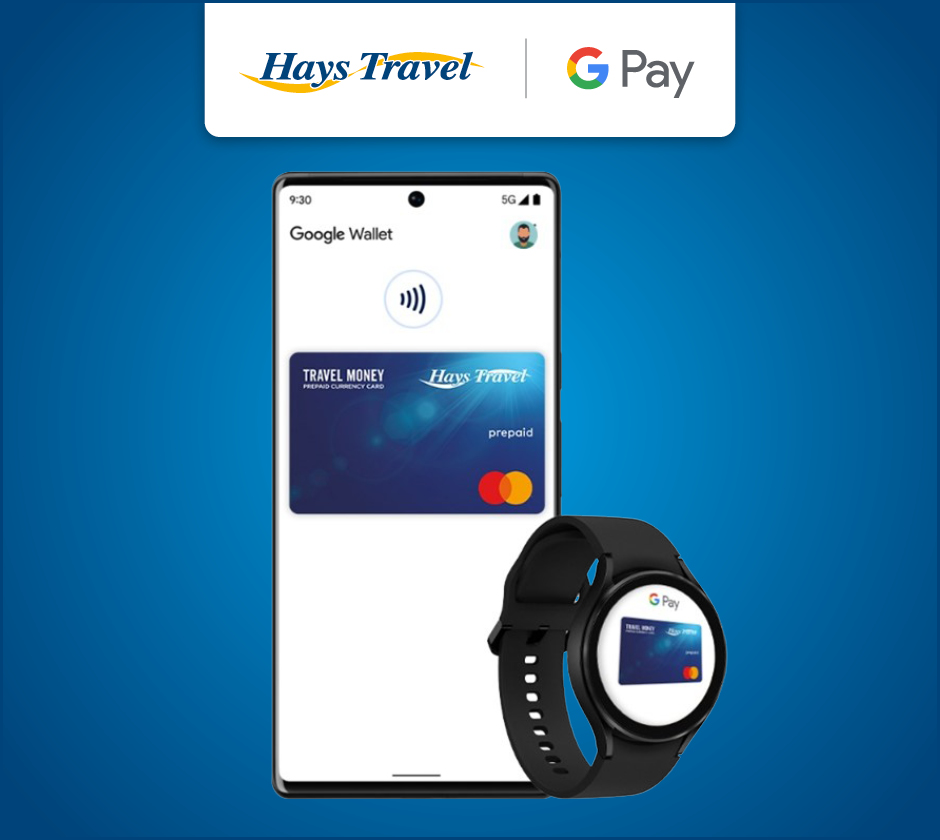

TAP & GO with your Android phone via Google Pay™ and Google Wallet™ Read more

How our Travel Card Works

Order your travel card.

Order your Travelex Money Card online or in-store (passport or driver's license required)

Get your travel card

Collect from a Travelex store or delivered FREE to your home (allow up to 7 days from when payment is received)

Download the App

Download the app from the Google Play and Apple App stores

Register for My Account

Simply activate your card by registering your account via the app or online

Manage and check your balance online and on your mobile

Exchange leftover currency

After your trip, exchange leftover money for another currency, transfer into your bank account or withdraw in-store or at an ATM.

Fees and Limits

NO fees online $0 Currency conversion fee ^

Withdraw daily up to AU$3,000 (or currency equivalent)

Maximum Card limit of AU$50,000

Free initial and replacement card

The following fees and limits apply. Fees and limits are subject to variation in accordance with the Terms and Conditions. Unless otherwise specified, all fees will be debited in AU$ Currency

If there are insufficient funds in AU$ Currency to pay such fees, then we will automatically deduct funds from other Currencies in the following order of priority: AU$, US$, EU€, GB£, NZ$, THB, CA$, HK$, JP¥, SG$.

• Online: FREE via travelex.com.au or the Travelex Money App • In-Store: FREE for loads of foreign currency (loads of Australian dollars (AUD) incur a fee of 1.1% of the amount or $15 whichever is greater).

• Online: FREE via travelex.com.au or the Travelex Money App • In-Store: FREE for top-ups of foreign currency (top-ups of AUD incur a fee of 1.1% of the amount or $15 whichever is greater). • BPAY: Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount. - MasterCard Biller Code: 184416 - Reference No: your 16 digit Travelex Money Card number - Funds will be allocated to your default currency. To check your default currency login to your account.

FREE (note: Some ATM operators may charge their own fees or set their own limits)

- Charged at the start of each month if you have not made any transactions on the card in the previous 12 months

- Unless your card is used again, or reloaded, this fee applies each month until the card is closed or the remaining card balance is less than the inactivity fee.

AU$4.00 per month

- Charged when you close your card or withdraw from your Card Fund. This fee is set and charged by Mastercard Prepaid.

- This is applied when you move your funds from one currency to another currency.

At the then applicable retail foreign exchange rate determined by us. We will notify you of the rate that will apply at the time you allocate your funds from one currency to another.

- Applied when a purchase or ATM withdrawal is conducted in a currency either not loaded or sufficient to complete the transaction and the cost is allocated against the currency/ies used to fund the transaction.

FREE* *The Spend Rate will apply to foreign exchange transactions in accordance with the Terms and Conditions.

AU$350 or currency equivalent AU$100 or currency equivalent

AU$50 or currency equivalent

The maximum amount you can load on the card at the time of the initial online purchase is AU$5,000 equivalent.

to a maximum of $10,050 per single top-up; and to a maximum of $10,050 top-up value over 24hrs; and to a maximum of $20,000 top-up value over 21 days.

AU$3,000 or currency equivalent

AU$15,000 or currency equivalent

Other Important Information

Please read the following information about your Travelex Money Card carefully:

- Your Travelex Money Card does not generate any interest or any other similar return. You do not earn interest on the amount standing to the credit of the Travelex Money Card Fund accessed by the card.

- Although the issuer of the card is an authorised deposit-taking institution in Australia, the Card is not a deposit account with the Issuer.

Important Information about Fees & Limits for loads/top ups made online:

- If you are making a purchase or topping up the Card online via www.travelex.com.au (i) the initial load and top up fee may differ to (but not be greater than) those contained in the “Fees and Limits Table” of this Product Disclosure Statement; and (ii) the limits may differ to those contained in the “Fees and Limits Table” of this Product Disclosure Statement. Travelex may also charge a card surcharge if you pay with a credit or debit card. Please refer to the relevant online terms and conditions available at www.travelex.com.au for details of the applicable fees and limits.

- AU$ cannot be loaded or topped up onto a card online via www.travelex.com.au

Terms & Conditions

Download the travelex travel money app.

Experience the benefits

- Top up your Travelex Money Card wallet

- Check your balance and move funds between currencies

- Instantly freeze and unfreeze your card

- Reveal your PIN and card details for online shopping

The app requires Android 8.0 and up or iOS 14.0 or later. Compatible with iPhone, iPad and iPod touch.

Special Offer

Load aud on your travelex money card and save when spending in the below currencies.

- Free Online AUD Load and Top-Ups

- $0 International ATM Fees

Other Ways to Get Foreign Currency

All the easy options to access foreign currencies with travelex.

About Travelex Money Card online and in-store

- Travel Insurance

Discover more of the world with travel insurance by your side

All you need to know getting foreign cash with Travelex

Get foreign cash from an ATM in Australia

About Your Destination

Browse our Destination Guides

Historical Rates

Check out current and historical AUD to FX Travelex rates

Track Currency Rates

Receive an alert when your selected foreign currency has reached your desired rate

- Find a Store

Purchase cash, a Travelex Money Card or transfer money in-store

Travelex Travel Card Currency Information

Travel card faq links.

Getting Started

Using the Card

Topping up the Card

Travelex Money Card FAQ

You can only hold one card in your name at any one time.

Mastercard Card Services and Travelex Customer Support Centre are here to help.

Find who to contact here (local and international numbers).

Top-up via the Travelex website

Note that you must use your unique reference number when paying or the transfer may be delayed.

Top-up via the Travelex Money App

Move currencies on your card, instantly.

If you have AUD (or any other currency) already loaded on the card, you can move your funds to another currency within the Travelex Money App. Instant top-up!

Top-up in a Travelex store

Direct top-up via bpay:.

Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount. You must make payment using your own account.

MasterCard Biller Code: 184416 Reference No: your 16 digit Travelex Money Card number

Funds will be allocated to your default currency. To check your default currency login to your account. Top ups will generally take two business days to be processed however may take longer if the payment is not made before 2pm on a business day Australian Eastern Standard Time.

Yes, travel money cards come with a host of advantages that can save you money when travelling. These include the ability to load multiple currencies at a fixed and competitive exchange rate, and the capability to make purchases in-store, online, and at ATMs worldwide with no overseas ATM or withdrawal fees.

- Locking in fixed foreign currency exchange rates and avoiding foreign transaction fees before you travel

- The ability to load multiple currencies onto one card, similar to a travel debit card

- The ability to spend money conveniently and comfortably overseas

- No overseas ATM withdrawal fees

- No fees when making online purchases

- Travel money cards can be ordered online and collected in store next day (when paying by debit/credit card).

- Just walk in store. Cards purchased and loaded in-store are active and ready-to-use on the spot. We will automatically transfer funds between currencies complete your card transactions.

- Home delivery within 5-7 business days (from when payment is received).

Travelex stores abroad cannot provide balance enquiries or offer cash-out as they do not have access to your Australian issued Travelex Money Card details. - For balance enquires, you can check it on the Travelex Money App or call us on 1800 440 039 . - Cash-out may be offered in local shops that provide this service.

Most common questions

The best travel money card for Australians is the one that caters to the currencies available at your destination, removes ATM withdrawal and foreign purchase fees, and has the best exchange rate. The Travelex Money Card is a prepaid travel card and has been awarded the best prepaid travel card by Mozo two years in a row.

A travel money card is a global currency card that allows you to load several foreign currencies into a personal account at a prevailing exchange rate . Like debit and credit cards, a travel money card can be used to make purchases in stores, online, and to withdraw cash at ATMs while travelling. You can buy currencies and add or reload them into your travel money card account via a mobile app whilst abroad.

One of the best ways to use the Travelex Money Card is with the Travelex Money App. The Travelex Money App makes ordering, transferring, and checking currencies quick and simple on your travel card. You can also use the Travelex travel exchange rate tracker to check currencies in real time.

You can order a travel money card online or purchase one directly from a Travelex store. Find a store near you.

- Travel money cards can be ordered online and collected in store next day.

- Home delivery within 5-7 business days.

The Travelex Money Card is a Mastercard travel card, meaning it is free to make international withdrawals at ATMs displaying the Mastercard acceptance mark. It is also free to obtain cash over the counter and to make online purchases with a travel money card. However, some ATM operators may charge their own withdrawal ATM fees. Be sure to check with the ATM in question prior to making cash withdrawals.

Similar to any bank account, you can withdraw money from your travel money card at ATMs worldwide. When withdrawing cash, select the “credit” option on the ATM machine screen to access funds. You will not be charged credit card fees by selecting this option. If the “credit” option does not work, try selecting “debit” or “savings”. The maximum withdrawal amount is 3,000 Australian dollars each 24 hour period. Bear in mind that some ATMs may also have their own ATM fee, adding a cost to your withdrawal.

The Travelex Money Card is a multi currency card that can be used in most countries around the world. Widely considered the best travel money card for overseas travel, the Travelex Money Card can be used in the US, Europe, Japan, Canada, Hong Kong, Singapore, Japan, New Zealand, and many more countries.

The initial card fee is free, subject to minimum load amounts. Please see the fees and limits section for more information. There are fees associated with the way you use your card e.g. the type of transaction, the currency you use, and when you move currencies on your card. Limits also apply to top up amounts and method of top up. Please see more information on applicable fees and limits section.

Activity on your Travelex Money Card is monitored every day to detect unusual behaviour, and if something is spotted you'll be contacted to check your transactions. There are also things you can do to help keep your travel money secure: • Sign your card as soon as you receive it • Check your transactions regularly and report anything unusual to Card Services immediately • If you print statements from the internet, keep them safe and shred them when you've finished using them • Never give your personal details to someone on the phone • Don't give out your details in response to unsolicited email • Be wary of anyone who asks for common security details like your mother's maiden name, passwords, date of birth, or information about your work • Never give your PIN to anyone, even if they claim to be from your card issuer • Don't let yourself get distracted when using cash machines or point of sale terminals - somebody may be trying to find out your PIN

Google Pay and Google Wallet are trademarks of Google LLC. Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386 837) arranges for the issue of the Travelex Money Card in conjunction with the issuer, EML Payment Solutions Limited (‘EML’)(ABN 30 131 436 532, AFSL 404131). You should consider the Product Disclosure Statement for the relevant Travelex Money Card and Target Market Determination available at www.travelex.com.au , before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

* Transacting via some online merchants may incur a surcharge.

- Join our Mailing List

- Price Promise

- About Travelex

- Best Ways to Buy Foreign Currency

- Travelex Money App

- Currencies Available to Buy

- Currency Converter

- Rate Tracker

- Sell Your Currency

- Travelex Travel Hub

- Australia Post

- Become an Affiliate

- Other Services

- International SIM Cards

Travelex Info

- Business Services

- Product Disclosure Documents and Terms & Conditions

- Website Terms of Use

- Privacy Policy

- Fraud & Scams

- Modern Slavery Statement

Join the conversation

Customer support.

Online Order Queries:

- Tel.: 1800 440 039

- Email: [email protected]

- Map: Suite 45.01, Level 45, 25 Martin Place, Sydney NSW 2000

By clicking a retailer link you consent to third-party cookies that track your onward journey. If you make a purchase, Which? will receive an affiliate commission , which supports our mission to be the UK's consumer champion .

Best prepaid travel money cards 2024

In this article

Which prepaid travel card do you need?

Best multi-currency prepaid cards, best sterling prepaid cards, what exchange rate do you pay.

- Fees and charges to watch out for

Is it worth getting a prepaid card?

Are prepaid cards secure, alternatives to prepaid travel cards.

Your holiday could be ruined by fees on overseas spending if you pack the wrong card to spend with.

Prepaid travel cards, also known as 'currency cards', allow you to load money in pounds and spend in another currency fee-free and usually allow you to lock in competitive exchange rates, saving you money compared with using your everyday debit or credit card.

However, these types of deals can come with their own special variety of hidden fees. In this guide, we take the hard work out of comparing these deals and explain the pros and cons of using a prepaid card for your trip.

Be more money savvy

free newsletter

Get a firmer grip on your finances with the expert tips in our Money newsletter – it's free weekly.

This newsletter delivers free money-related content, along with other information about Which? Group products and services. Unsubscribe whenever you want. Your data will be processed in accordance with our Privacy policy

There are two main ypes of prepaid travel cards to consider packing for your next trip:

- Multi-currency prepaid cards allow you to load several currencies onto one card, ideal for visiting multiple destinations. For example, you could have £100, $200 and €300 stored on one card in different 'wallets'. You can lock in rates by converting when you load the cash, or store some money in pounds to convert later.

- Sterling prepaid cards offer the most flexibility, as you can load your card with pounds and spend in dozens of different currencies. Each time you spend or withdraw cash, the pounds are converted to the required currency at the exchange rate on the day. This may make it harder to forecast how much money you'll have available in any given destination.

Multi-currency prepaid cards allow you to load a variety of major currencies in one place.

We've analysed the main providers of multi-currency prepaid cards including the type of currency offered, load fees (loading money onto the card), fees for withdrawing cash, and inactivity fees that could catch you out.

Please note the table is ordered alphabetically, not ranked in order of features.

The Post Office Travel Money Card and Travelex card can load the most currencies, however, charges apply for some cash withdrawals at an ATM wth the Post Office deal.

Asda Money, Caxton, EasyFX, Sainsbury's and Travelex had similar offers with free ATM withdrawals. While most have £500 withdrawal limits Easy FX allows £1,000 (limited to £500 in a single transaction) and Nectar cardholders can get better exchange rates at Sainsbury's.

All the cards allow you to load money that is immediately converted to a foreign currency free of charge. However, more than half of the providers charge a fee of up to 2% for topping up your wallet with pounds to convert at a later date. So if you plan on doing this often you may be better off with one that doesn't charge.

Sterling prepaid cards offer the most flexible option for travellers and our analysis shows they can be as competitive as multi-currency deals.

We looked at the exchange rates offered, as well as the fees you'll pay and maximum balances.

*Rate could be higher depending on currency

These cards are convenient as they allow you to load as much currency as you want into your account, however, you'll need to download an app to use them.

The Revolut card uses the interbank rate and you will incur no fees on top of the rate if you convert money Monday to Friday - therefore it's worth loading up and exchanging before the weekend. You'll be charged a 2% fee if you withdraw more than £200 a month.

The Wise card also uses the interbank exchange rate but charges a 0.43% fee on top every day of the week. It offers two fee-free cash withdrawals of up to £200 each month in the UK or Europe.

HSBC-backed app Zing could also be a good option. It has a lower fee when converting currencies, and it uses a third party conversion rate which is typically lower than the interbank rate.

Get Which? Money magazine

Find the best deals, avoid scams and grow your money with our expert advice. £4.99 a month or £49 a year, cancel any time.

Prepaid card providers offer different exchange rates.

Some use the 'interbank rate' (the rate banks charge one another) and others may use Mastercard or Visa's exchange rates.

In some cases, a provider may pick one of these rates, then apply a percentage on top, usually between 1% and 2.5%.

When picking a prepaid travel card you should compare the exchange rates offered as well as the card's fees.

Fees and charges to watch out for

Prepaid cards designed for spending abroad are usually cheaper than spending on your everyday debit or credit card.

However, almost all prepaid cards currently on the market come with a variety of fees and charges. Common charges to watch out for include:

- Application fees - some providers apply a one-off charge to open the account ranging from £5 to £10, though most will offset this if you load a certain amount.

- Monthly fees - the worst prepaid cards will charge an ongoing fee just for holding the card. It can range from £2 to £5 a month, which can be hugely expensive over a year.

- Top-up fees - if you're using a credit card to top up your prepaid card you could be charged a fee by your prepaid card provider. Plus as it counts as a 'cash transaction' your credit card provider could charge you a fee and interest. So it's usually best to use a debit card to top-up your account.

- UK and foreign ATM withdrawal fees - some prepaid cards charge for using ATMs abroad, usually £1.50 to £2 per withdrawal. Some providers will waive the fee if you withdraw a certain amount. You can minimise the risk of being hit with fees by planning how much you want to spend before you travel and taking out cash in one lump sum.

- Cross border fees - if you use your prepaid card for a transaction that's not in your card's currency, you could be charged a fee of around 2.75%.

- Inactivity fees - if you don't use your card you could also face a penalty. Some providers will charge around £2 a month if you haven't spent on the card within 12 months.

- Replacement fees - prepaid cards, like credit and debit cards, come with an expiry date, which can range between one and five years after opening. You'll normally have to pay a renewal fee of around £5 if you want to continue to use the account.

- Redemption fees - some providers charge a fee to get any money you haven't used back. This can be up to £10 so it's wise to only load what you plan to spend and nothing more.

Prepaid cards also often come with limits on loading and transactions, which could leave you in a tricky situation if you aren't aware of them.

If you're considering getting a prepaid travel card, here are the pros and cons to weigh up.

Each card provider will have its own terms and conditions, so read them carefully before you sign up.

What are the pros of getting a prepaid card?

- Widely accepted around the world.

- Comes with chargeback protection.

- Can help you budget and avoid overspending.

- Could be cheaper for overseas spending and withdrawals.

What are the disadvantages of getting a prepaid card?

- Not accepted for pre-authorised transactions such as hiring a car.

- No Section 75 protection on purchases over £100.

- Low withdrawal limits and no way to borrow money in an emergency.

- Come with a variety of fees including charges for lack of use.

Prepaid cards offer a secure way to carry cash when abroad.

They come with the same security features as credit and debit cards, so you need a Pin to withdraw cash or use them in person. However, many are now contactless so you may not need a Pin for smaller purchases.

It's also worth bearing in mind that prepaid cards offer no protection for losses under Section 75 of the Consumer Credit Act . However, redress may be possible under the MasterCard or Visa chargeback scheme.

What if the prepaid card provider goes bust?

The Financial Services Compensation Scheme does not cover deposits onto prepaid cards.

Most prepaid providers will deposit customers' cash in a ring-fenced account held in a bank or building society. So, if the prepaid company goes bust, your money should be protected by the bank holding your cash.

However, if the bank or building society fails, your cash won't be protected. So you should never store lots of money on a prepaid card, just what you need to spend in the near future.

Prepaid cards are a safe way to carry cash overseas. But you won't be able to spend from your main current accounts or borrow money in an emergency.

A credit card with low fees on overseas spending can work out as the best option for purchases made abroad, as long as the bill is paid off in full each month. For a credit card with low overseas spending fees, check out the best travel credit cards .

Alternatively, many banks offer debit cards with fee-free overseas spending. We round up your options in our guide to the best debit cards to use abroad .

That said, applying for a credit card or current account for a debit card requires a credit check, whereas applying for a prepaid card doesn't. So if you have a poor or no credit history it will be easier for you to get a prepaid card.

Currensea has launched what it calls the 'first UK direct debit travel card'. This card is linked to your bank account which means you do not need to top up the card, as long as you have money in your account.

It provides a layer over your existing bank account that will allow you to spend in all 180 currencies without charges. It uses the interbank exchange rate for 16 major currencies and Mastercard rates for all other available currencies.

Currensea doesn't charge any non-sterling transaction fees or dormancy fees. For personal accounts, there is a 0.5% markup on the exchange rate. ATM withdrawals are free under a limit of £500 a month. After this, a 2% fee will be applied.

Your prepaid card questions answered

Grace, our prepaid card expert, answers the top questions people have about these types of deals.

Where can I use a prepaid travel card?

Prepaid cards are usually issued by major card networks like Visa or Mastercard, meaning they can be used in millions of places around the world, as well as online, just like a debit or credit card.

You should be able to use your card at most ATMs abroad, and at most retailers that accept card payments.

However, there are some notable exceptions to this, including car hire firms, hotels and petrol stations that require pre-authorisation.

Should I pay in pounds or in the local currency?

When abroad you will sometimes be asked if you want to pay or withdraw cash in sterling or the local currency. This is called dynamic currency conversion and is usually best avoided.

With a specialist prepaid card you'll get a better rate paying in the foreign currency rather than in sterling. In fact, you might be charged a fee for paying in sterling if you don't have a multi-currency card.

What happens if my prepaid card is lost or stolen?

Like travellers cheques , your money is safe and will be replaced if the prepaid card is lost or stolen.

However, you might be charged for calling the customer helpline and for emergency card replacement by courier.

As long as you contact the provider of your prepaid card and get it blocked, you shouldn't lose out on any money, though you may have to pay up to £10 for a replacement card.

Bear in mind that if your prepaid card is contactless it could be used for a series of small, fraudulent transactions, so always alert your card provider as soon as possible. It's also worth alerting local police or security services if there's been a theft - you may need an incident number to claim losses back on your travel insurance.

Why can't I use it for car hire or a hotel room?

Most prepaid cards don't allow you to make pre-authorised transactions. These are often required when you have to pay for something where the final cost hasn't been decided, or where you use the service before paying.

As such, you may not be able to use your prepaid car to pay for petrol at the pump, hire a car, or pay for a hotel room.

What if I have an emergency or run out of money overseas?

You'll be able to load more money onto your prepaid card after you've activated it, usually through the provider website or app.

Most cards have daily withdrawal limits, so make sure you can withdraw enough cash to cover your spending for the full day.

Keep in mind that prepaid cards don't have a borrowing facility, so you won't be able to rely on it for emergency funds. For this reason, it can be wise to bring a travel credit card overseas with you, in case you need to buy flights home or pay for out-of-pocket medical expenses.

Related articles.

- Share on Facebook

- Share by email

Latest News In Which? Money

Which? Money podcast: how will the base rate cut help mortgage holders?

23 Aug 2024

Which? Money podcast: how much do you really need to save for a stress-free retirement?

16 Aug 2024

Which? Money podcast: the golden rules of spending money abroad

09 Aug 2024

Which? Money podcast: 4 ways to diversify your investment portfolio

02 Aug 2024

Which? Money podcast: are we being short-changed by our banks?

29 Jul 2024

Which? Money podcast: is it worth paying £650 for a credit card?

19 Jul 2024

Which? Money podcast: what a fall in the base rate would mean for your mortgage

28 Jun 2024

Which? Money podcast: picking the best travel insurance for your next holiday

21 Jun 2024

Which? Money podcast: how new rules will protect you from financial greenwashing

14 Jun 2024

Which? Money podcast: 6 quick and easy ways to make more money

07 Jun 2024

Which? Shorts podcast: how to stop companies selling your data

05 Jun 2024

Which? Money podcast: Why now might be the best time to invest

31 May 2024

Which? Money podcast: how to avoid so-called recovery scammers

24 May 2024

Which? Money podcast: can you trust second-hand marketplace apps?

17 May 2024

Which? Shorts podcast: when is the right time to downsize your home?

15 May 2024

Which? Money podcast: are charity shops the answer to rising cost of clothes?

10 May 2024

Which? Money podcast: how would a base rate fall impact your savings?

03 May 2024

Which? Money podcast: how to make the most of your pension in 2024-25

19 Apr 2024

Which? Money podcast: can banking hubs save our access to cash in the UK?

05 Apr 2024

Which? Money podcast: can you cut your council tax?

29 Mar 2024

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

The savvy way to pay on holiday Travel Money Card

A safe-to-use, prepaid, reloadable, multi-currency card that’s not linked to your bank account

No charges when you spend abroad*

Make contactless, Apple Pay and Google Pay™ payments

Manage your account and top up or freeze your card easily with our Travel app

*No charges when you spend abroad using an available balance of a local currency supported by the card.

Why get a Travel Money Card?

Carry up to 22 currencies safely.

Take one secure, prepaid Mastercard® away with you that holds multiple currencies (see ‘common questions’ for which).

Accepted in over 36 million locations worldwide

Use it wherever you see the Mastercard Acceptance Mark – millions of shops, restaurants and bars in more than 200 countries.

Manage your card with our travel app

Top up, manage or freeze your card, transfer funds between currencies, view your PIN and more all in our free Travel app .

Safe and secure holiday spending

Manage your holiday funds on a Travel Money Card with our free travel app. Top it up, freeze it, swap currencies, view your PIN and more.

It’s simple to get started

No need to carry lots of cash abroad. Order a Travel Money Card today for smart, secure holiday spending.

Order your card

Order online, via the app or pick one up in branch and load it with any of the 22 currencies it holds.

Activate it

Cards ordered online and in-app should arrive within 2-3 working days. Activate it by following the instructions in your welcome letter.

It’s ready to use

Spend in 36 million locations worldwide, and top up and manage your card in the app or online.

What is Post Office Travel Money Card?

Discover how easy our Travel Money Card makes managing your spending aboard

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Order a Travel Money Card

Order your card online – or through the Post Office travel app – and we'll deliver it within 2-3 days. Just activate it and go.

Need it quick? Visit a branch

Pick up a Travel Money Card instantly at your local Post Office. Bring a valid passport, UK driving licence or valid EEA card as ID.

Need some help?

We’re here to help you make the most of your Travel Money Card – or put your mind at ease if it’s been lost or stolen

Lost or stolen card?

Please immediately call: 020 7937 0280

Available 24/7

To read our FAQs, manage your card or contact us about using it:

Visit our Travel Money Card support page

Common questions

How can i order my card.

There are three ways that you able to obtain a Travel Money Card, each very simple.

Please note, you must be a UK resident over the age of 18 to obtain a Travel Monday Card.

- Via our travel app: you can order and store up to three Travel Money Cards in our free travel app . Delivery will take 2-3 working days.

- Online: follow our application process to order your card online. Your card will take 2-3 working days to be delivered. Once it arrives you can link it to our Travel app to manage on the go.

- In branch: simply find a nearby Post Office branch and pop in to get your Travel Money Card there. Please remember to take a valid passport, UK driving licence or a valid EEA card in order to obtain your card, and you can take it away the same day.

Whichever way you choose to order your card, don't forget to activate it once it arrives. Full details of how to activate your card will be provided in your welcome letter, to which your card will be attached if it’s been sent in the post.

How do I use my card?

Travel Money Card is enabled with both chip & PIN and contactless, so you can make larger and lower-value value payments with it respectively. For convenience, you can also add it to Apple Pay and Google Wallet.

You can load it with between £50 and £5,000 (see more on load limits below). You can use it to pay wherever the Mastercard Acceptance Mark is displayed. And you can withdraw cash with it at over 2 million ATMs worldwide (charges and fees apply, see 'Are there top-up limits?' below).

Your Travel Money Card is completely separate from your bank account so it’s a safe and secure way to pay while you’re abroad.

How can I manage my card?

After you've activated your card, you can manage it using our travel app or via a web browser. You can check your recent transactions, view your PIN, transfer funds between different currency ‘wallets’, top up your card, freeze your card and more.

Our travel app brings together travel essentials including holiday money, travel insurance and more together in one place. As well as managing your Travel Money Card you can buy cover for your trip, access your policy documents on the move, book extras such as airport parking and hotels, and find your nearest ATM while overseas or Post Office branches here in the UK.

Which currencies can I use?

The Post Office Travel Money Card can be loaded with up to 22 currencies at any one time. You can top up funds on the card and transfer currencies between different ‘wallets’ for these currencies easily in our travel app or online.

Currencies available:

- EUR – euro

- USD – US dollar

- AUD – Australian dollar

- AED - UAE dirham

- CAD – Canadian dollar

- CHF – Swiss franc

- CNY – Chinese yuan

- CZK – Czech koruna

- DKK – Danish krone

- GBP – pound sterling

- HKD – Hong Kong dollar

- HUF – Hungarian forint

- JPY – Japanese yen

- NOK – Norwegian krone

- NZD – New Zealand dollar

- PLN – Polish zloty

- SAR – Saudi riyal

- SEK – Swedish Krona

- SGD – Singapore dollar

- THB – Thai baht

- TRY – Turkish lira

- ZAR – South African rand

What are the charges and fees?

Full details of our charges and fees can be found in our Travel Money Card terms and conditions .

The Post Office Travel Money Card is intended for use in the countries where the national currency is the same as the currencies on your card. If the currency falls outside of any of the 22 we offer on your card, you’ll be charged a cross-border fee. For example, using your card in Brazil will incur a cross-border fee because we do not offer the Brazilian real as a currency.

Cross border fees are set at 3% and are only applicable when you use your currency in a country other than the ones we offer.

For more information on cross border fees, please visit our cross border payment page.

There are no charges when using your card in retailers in the country of the currency on the card. This means that a €20 purchase in Spain would cost you €20 and will be deducted from your euro balance.

To avoid unnecessary charges to your card, wherever asked, you should always choose to pay for goods or withdraw cash in the currencies of your card. For example, if you are using the card in Spain you should always choose to pay in euro if offered a choice; choosing to pay in sterling (GBP) in this example would allow the merchant to exchange your transaction from euro to sterling. This would mean your transaction has gone through two exchange rate conversions, which will increase the total cost of your transaction.

For loads in Great British pounds, a load commission fee of 1.5% will apply (min £3, max £50). A monthly maintenance fee of £2 will be deducted from your balance 12 months after your card expires. Expiration dates can be found on your TMC; all cards are valid for up to 3 years.

A cash withdrawal fee will be charged when withdrawing cash from a UK Post Office branch or from any ATM globally that accepts Mastercard. Some ATM owners will charge their own fees for withdrawing cash, these are in addition to the fees that we charge.

We have listed all available currencies and their associated withdrawal limits and charges below:

EUR – euro Max daily cash withdrawal: 450 EUR Withdrawal charge: 2 EUR

USD – US dollar Max daily cash withdrawal: 500 USD Withdrawal charge: 2.5 USD

AED – UAE dirham Max daily cash withdrawal: 1,700 AED Withdrawal charge: 8.5 AED

AUD – Australian dollar Max daily cash withdrawal: 700 AUD Withdrawal charge: 3 AUD

CAD – Canadian dollar Max daily cash withdrawal: 600 CAD Withdrawal charge: 3 CAD

CHF – Swiss franc Max daily cash withdrawal: 500 CHF Withdrawal charge: 2.5 CHF

CNY – Chinese yuan Max daily cash withdrawal: 2,500 CNY Withdrawal charge: 15 CNY

CZK – Czech koruna Max daily cash withdrawal: 9,000 CZK Withdrawal charge: 50 CZK

DKK – Danish krone Max daily cash withdrawal: 2,500 DKK Withdrawal charge: 12.50 DKK

GBP – Great British pound Max daily cash withdrawal: 300 GBP Withdrawal charge: 1.5 GBP

HKD – Hong Kong dollar Max daily cash withdrawal: 3,000 HKD Withdrawal charge: 15 HKD

HUF – Hungarian forint Max daily cash withdrawal: 110,000 HUF Withdrawal charge: 600 HUF

JPY – Japanese yen Max daily cash withdrawal: 40,000 JPY Withdrawal charge: 200 JPY

NOK – Norwegian krone Max daily cash withdrawal: 3,250 NOK Withdrawal charge: 20 NOK

NZD – New Zealand dollar Max daily cash withdrawal: 750 NZD Withdrawal charge: 3.5 NZD

PLN – Polish zloty Max daily cash withdrawal: 1,700 PLN Withdrawal charge: 8.5 PLN

SAR – Saudi riyal Max daily cash withdrawal: 1,500 SAR Withdrawal charge: 7.50 SAR

SEK – Swedish Krona Max daily cash withdrawal: 3,500 SEK Withdrawal charge: 20 SEK

SGD – Singapore dollar Max daily cash withdrawal: 500 SGD Withdrawal charge: 3 SGD

THB – Thai baht Max daily cash withdrawal: 17,000 THB Withdrawal charge: 80 THB

TRY – Turkish lira Max daily cash withdrawal: 1,500 TRY Withdrawal charge: 7 TRY

ZAR – South African rand Max daily cash withdrawal: 6,500 ZAR Withdrawal charge: 30 ZAR

Are there top-up limits?

Yes, all currencies have top-up limits and balances. See full information below, which is applicable to all currencies available on the Travel Money Card.

- Top-up limit: minimum £50 – maximum £5,000

- Maximum balance: £10,000 at any time, with a maximum annual balance of £30,000

- Read more Travel Money Card FAQs

Other related services

Hoi An in Vietnam is still the best-value long haul destination for UK ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

One of the joys of summer are the many music festivals playing across the ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

Going on holiday is an exciting time for families. To make sure it stays fun, ...

We all look forward to our holidays. Unfortunately, though, more and more ...

Looking to enjoy the sunshine without breaking the bank? New research from Post ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

Eastern Europe leads the way for the best value city breaks this year. And ...

Our annual survey of European ski resorts compares local prices for adults and ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

From European hotspots to far-flung destinations, UK travellers are making ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Travelling abroad? These tips will help you get sorted with your foreign ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

Travel smarter with the Post Office travel app. Paired with a Travel Money ...

Find out more information by reading the Post Office Travel Money Card's terms and conditions .

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial Services Register No. 900412). Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Post Office and the Post Office logo are registered trademarks of Post Office Limited.

Post Office Limited is registered in England and Wales. Registered number 2154540. Registered office: 100 Wood Street, London, EC2V 7ER.

These details can be checked on the Financial Services Register by visiting the Financial Conduct Authority website and searching by Firm Reference Number (FRN).

- Lost or stolen cards

- Online Banking – Personal

- Online Banking – Business

- Corporate Online

- Westpac Share Trading

- View all online services

- International & Travel

Travel money card

- Activate and manage your card Activate and manage your card

Are you an existing customer?

A smart and safe way to pay in foreign currencies

Features and benefits

- Travel and shop worry-free Lock in your budget by converting your loaded AUD ahead of time and feel safe and secure from fraudulent transactions with Mastercard Zero Liability protection.¹

- Lounge access if your flight is delayed You and a companion can get access to over 1,000 lounges² if your flight is delayed for 120 minutes or more. Visit the Mastercard Flight Delay Pass website to pre-register your flight. T&Cs apply.

- Access unforgettable experiences and rewards Your Mastercard gives you access to Priceless ® Cities with unforgettable experiences in the cities where you live and travel.³ You can also get cashback when you shop overseas with your Worldwide Wallet, thanks to Mastercard Travel Rewards .⁴

How it works

Before you leave.

- Order a Worldwide Wallet online.

- Activate your cards in Online Banking

- Transfer AUD to your card and convert into your choice of up to 10 currencies to lock in your rates.

While you’re away

Pay for things using the local currency loaded on your card

Avoid ATM fees at Global ATM Alliance partners 5

Reload your card as you go using the Westpac App, with no load or reload fees.

When you get home

- Convert leftover currency back to AUD or another available currency, with no unload fees

- Remember , you can avoid foreign transaction fees while shopping online by paying with your Worldwide Wallet.

Save on fees

- Avoid ATM withdrawal fees Through our Global ATM Alliance and overseas partner ATMs which you can easily find using the ATM locator in the Westpac App

- No foreign transaction fees Avoid a 3% foreign transaction fee whenever you use your Worldwide Wallet to shop online or in person.

- No load or unload fees Reload your account on the go, whenever you need.

- No account keeping fees You won’t pay any inactivity or account keeping fees, so any funds left in your account will be there ready for your next trip or purchase.

Other fees may apply. Read the Product Disclosure Statement (PDF 231KB) for full list of fees.

Like to shop online?

Use your Worldwide Wallet for online purchases in foreign currencies and avoid a 3% foreign transaction fee.

You can also shop worry-free from fraudulent transactions with Mastercard Zero Liability protection. 1

Complete visibility and control

All in one view

See your account balance and transactions in the Westpac App or in Online Banking.

Move money easily

Transfer money to and from your Worldwide Wallet and convert AUD into foreign currencies while you’re on the go in the Westpac App.

More ways to pay

Add your Worldwide Wallet to Google Pay™ or Samsung Pay™, or use your card to tap and go.

A spare card for peace of mind

Both cards give you access to the same funds and can be locked and unlocked instantly at your convenience via Online Banking or the Westpac App. 6

Add up to 11 currencies

Lock in your rate head of time by converting currency in advance.

You'll still be able to spend in currencies not listed here and avoid Westpac's 3% foreign transaction fee.

To view our latest rates, see our currency converter .

A Westpac Worldwide Wallet is a prepaid travel money card that can help you save on foreign transaction fees and give you control over your spending. With the Westpac Worldwide Wallet, there are no load, reload or unload fees, or ATM withdrawal fees at Westpac Group or select Westpac Group partner ATMs in Australia and Global ATM Alliance partners. 5

Before you shop or travel, you can also choose to convert your loaded AUD into any of the following currencies: USD, EUR, GBP, CAD, JPY, THB, ZAR, SGD, NZD and HKD. By locking in your exchange rate in advance and knowing exactly how much of a foreign currency is loaded on your card, the Westpac Worldwide Wallet can make it easy for you to stay on top of your spending. When you sign up to a Westpac Worldwide Wallet, you’ll also get access to exciting Mastercard travel and shopping perks - Flight Delay Pass , Mastercard Travel Rewards and Priceless Cities.

With the Westpac Worldwide Wallet, you can avoid a 3% foreign transaction fee when you shop online in available currencies.

You can shop safely by loading only what you need into any of the following currencies: USD, EUR, GBP, CAD, JPY, THB, ZAR, SGD, NZD and HKD. By knowing exactly how much of a foreign currency is loaded on your card, you can stay on top of your spending.

You’ll also benefit from Mastercard Zero Liability protection, 1 so you can shop worry-free from fraudulent transactions.

To apply for a Westpac Worldwide Wallet, you must be aged 14 years or older and be an existing Westpac customer who is registered for Online Banking. If you haven’t registered for Online Banking, see this helpful guide to learn how to get started. If you’re new to Westpac and would like to apply for a Worldwide Wallet, you’ll need to become a customer first by opening a Westpac savings or transaction account and meeting our identification requirements. You can visit westpac.com.au/aml for more information on how we identify you.

If you have insufficient funds to complete a transaction in a currency loaded on your account, or the transaction is in a currency not loaded on your account, the transaction will be automatically processed by drawing down from another currency in your account (provided that there are sufficient funds available in one or more other currencies to complete the transaction). Funds will be withdrawn according to the drawdown sequence, and the applicable exchange rate will apply. See the Product Disclosure Statement (PDF 231KB) for the drawdown sequence.

Yes, you can withdraw money or check your balance at overseas ATMs using your Worldwide Wallet. The balance displayed will be in the currency of the country you are visiting. You won’t pay an ATM withdrawal fee when using a Global ATM Alliance ATM. 5 However, fees may apply if you use an ATM outside of the Global ATM Alliance network.

If you have insufficient funds to complete a transaction in a currency loaded on your account, or the transaction is in a currency not loaded on your account, the transaction will be automatically processed by drawing down from another currency in your account (provided that there are sufficient funds available in one or more other currencies to complete the transaction). Funds will be withdrawn according to the drawdown sequence, and the applicable exchange rate will apply. See the Product Disclosure Statement (PDF 231KB) for the drawdown sequence.

We recommend you download our app as we may send you important notifications about your Worldwide Wallet while you are travelling. Using the Westpac App makes it easy for you to get these notifications while you’re on the go. You can also use the app to:

- Instantly transfer AUD between your savings and transaction Westpac account/s and your travel money card

- Convert between your loaded AUD and up to 10 different foreign currencies at any time to lock in your exchange rate

- View your currency balances and transactions

- Access your Worldwide Wallet account’s BSB and account number as well as your eStatements

- Block your card/s if they have been lost or stolen

If you’re new to the Westpac App, learn more about how to get started .

See all FAQs

Order online

Your cards will be delivered within 5-8 business days

Worldwide Wallet 24/7 support in Australia

1300 797 470

Things you should know