Student Login

How To Network As A Travel Agent (Networking Tips and Tricks)

Mar 24, 2022 | Abundance , Grow a travel business , Marketing , Sales , Travel Business

Are you the kind of person who loves to network with people? Mingling at various 🥂 functions, calling people on the 📞 phone, getting involved in groups, setting up Zoom chats and what-not… Are these all the kinds of things that get you out of bed every morning? 🌅

Or are you a person who would rather do anything else, like getting a root canal or filling out your tax return? 🌧️

Networking can be a real benefit to a lot of travel agents, but if you’re not a natural social 🦋 butterfly, it can be hard to do. And if you’re just starting out as a travel agent, you may not even know where to begin!

I’ve compiled a few networking tips and tricks to help you get the ball rolling. With these tips in your back pocket, you’ll be ready to network in ways that build your client base and your travel agency, while not being too painful.

They’re all here in my latest 📽️ video, “ How To Network As A Travel Agent (Networking Tips and Tricks).”

If you find networking to be a chore or if you’ve never really given it much thought, you’re going to get a lot out of this video. And if you’re already a networking champ and have some tips of your own, pass them on! I’m always excited to learn.

If you’re looking to take your travel business to the next level in 2022, then the Careers on Vacation Mastermind may be just right for you! It’s the ultimate tool for travel professionals and travel agency owners.

Find out all about it by clicking the button below. You’re going to love it!

Yes! Tell Me More About Careers on Vacation!

Pin for later!

Explore by category

Travel business, masterclass: put your love of travel to work for you, read the latest posts.

Pros and Cons of Being an Independent Travel Agent

Are you thinking about embarking on the exciting journey of becoming a travel agent but unsure whether to go independent or work under an established host agency? Read on as we explore the pros and cons of being an independent travel agent, helping you decide if that...

Transforming Your Travel Agency: From Hobby Business to Full-Time Venture

Running a travel agency can be incredibly rewarding, but are you treating it like a full-time business or just a hobby? Discover the key signs of a hobby business and learn how to transform your travel agency into a thriving entrepreneurial venture. Originally posted...

3 Reasons to Become a Travel Agent

Have you ever dreamed of turning your passion for travel into a rewarding career? We've identified the top three reasons why becoming a travel agent might be the perfect path for you. Discover how your love for travel, commitment to self-investment, and...

Grab the free toolkit: Top 10 Tools for Travel Agents

So many travel agents struggle to grow their businesses because they don’t have the right tools in their toolbox. 🙁

That’s why we put together Cyndi’s Top 10 Tools for Travel Agents – to give you the tools you need to grow your client base and business!

Inside, you’ll find:

💰 Valuable marketing content 👀 Helpful YouTube videos 🎨 Design resources 🎧 Podcast episodes 💸 Discounts and coupons ⭐ …and SO much additional gold to help you grow your business!

You’re going to love it!

JOIN THE FREE MASTERCLASS

Wondering if becoming a travel agent is right for you .

Our travel agent trainings and certifications have helped thousands of people successfully transition into making travel their new way of life. Grab a spot in our masterclass and learn the simple systems our clients use to create wildly successful travel businesses in record time.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

Businessing Magazine

Strategizing Emily Mollown March 28, 2024 10 min read

How to Merge Travel with Networking for Unprecedented Business Growth

In the current global business arena, marked by widespread connectivity and the merging of markets, entrepreneurs and professionals across industries are tirelessly exploring creative avenues to drive expansion and broaden their reach. One often overlooked yet incredibly potent strategy is merging travel with networking.

This dynamic duo can catapult your business to new heights, offering opportunities for personal growth, market expansion, and invaluable global connections. Here’s how you can leverage travel networking to drive unprecedented business growth.

Embrace the Global Mindset

First and foremost, adopting a global mindset is crucial. This means viewing every travel opportunity, whether for leisure or business, as a golden ticket to understanding new cultures, markets, and business practices. Embracing a global mindset is akin to unlocking a door to diverse possibilities and untapped markets, essential for those aiming to elevate their business in today’s interconnected world.

This perspective encourages you to see beyond local boundaries and consider the vast tapestry of cultures, economies, and business practices that our world offers. It’s about recognizing that your next big opportunity might not be in your backyard, but on a different continent, requiring you to navigate new cultural nuances and market dynamics.

A global mindset empowers entrepreneurs to adapt their strategies and products to meet varied consumer needs and preferences, ultimately leading to innovative solutions that stand out in crowded markets. It fosters resilience and flexibility, qualities that are indispensable in facing the challenges of entering new territories. By understanding and appreciating the complexities of global markets, you can anticipate trends, seize opportunities, and mitigate risks more effectively.

Moreover, this mindset enhances your ability to build meaningful, cross-cultural relationships, laying the foundation for successful international collaborations and partnerships. It encourages continuous learning and curiosity, driving you to explore, ask questions, and engage deeply with different cultures and business environments. Adopting a global mindset is not just about expanding your business geographically; it’s about enriching your entrepreneurial journey with diverse experiences and perspectives, fostering growth on both a personal and professional level.

Plan Your Trips with a Networking Agenda

Strategic planning can transform any trip into a networking goldmine, including extended stays in Atlanta . Before embarking on your journey, research and identify key events, conferences, and meetups happening at your destination. Planning your trips with a networking agenda transforms mere travel into a strategic endeavor, maximizing every journey’s potential for business growth and development. Here’s how to effectively curate your trips to serve as powerful networking opportunities:

- Pre-Trip Research: Weeks before departure, delve into the local business scene of your destination. Identify key industry events, conferences, and networking gatherings that align with your business interests. Utilizing platforms like Eventbrite or Meetup can offer insight into local professional events.

- Set Clear Objectives: Define what you aim to achieve through your networking efforts. Whether it’s finding potential clients, partners, or gaining market insights, having clear goals helps tailor your networking efforts effectively.

- Engage on Social Media: Utilize LinkedIn and Twitter to announce your visit. Reach out to local professionals and industry leaders with a personalized message expressing your interest in connecting while you’re in town. This pre-engagement sets the groundwork for meaningful face-to-face interactions.

- Schedule Smartly: Balance is key. While you want to maximize your networking opportunities, overbooking yourself can lead to rushed meetings and burnout. Schedule with ample time for each interaction, allowing for genuine connection and conversation.

- Follow-Up Plan: Networking doesn’t end with the trip. Have a follow-up strategy for each contact made. Whether it’s a simple thank-you message, sharing a useful article, or proposing a collaboration, timely follow-up can cement the newly formed connections.

Adopting a structured approach to integrate networking into your travel plans not only enriches your business with valuable connections but also ensures that every trip contributes significantly to your professional growth and global footprint.

Leverage Social Media and Professional Platforms

Social media and professional networking platforms are invaluable tools for connecting with local professionals and industry leaders ahead of your travels. Leveraging social media and professional platforms is a powerful strategy to amplify your networking reach before, during, and after your travels. In today’s digital age, these platforms serve as virtual meeting grounds where professionals can connect, share insights, and explore collaborative opportunities beyond geographical constraints.

Before embarking on your journey, harness the potential of platforms like LinkedIn to announce your travel plans and intentions to network. This preemptive step not only alerts your existing connections about your visit but also piques the interest of potential new contacts in the destination area.

Engaging in relevant groups and forums related to your industry or destination can further enhance your visibility and introduce you to local professionals with aligned interests. Sharing valuable content, commenting on discussions, and asking insightful questions establishes your presence and expertise, making others more inclined to connect with you in person.

Twitter and Instagram also offer unique opportunities for real-time updates, allowing you to share moments from your travels and networking events. Using specific hashtags can attract attention from local professionals and event attendees, facilitating impromptu meet-ups or conversations.

After your travels, these platforms enable you to maintain and nurture the connections you’ve made. A personalized message thanking someone for their time or sharing a relevant article can keep the conversation going, laying the groundwork for a lasting professional relationship. By strategically utilizing social media and professional platforms, you turn every trip into a networking success story, continuously expanding your professional network and opening doors to new business opportunities.

Cultivate a Storytelling Approach

When networking, your ability to share your business journey compellingly can make a lasting impression. Cultivating a storytelling approach in networking can significantly enhance the impact of your interactions, making your business and personal brand more memorable and engaging. Here’s how to effectively harness the power of storytelling in your networking endeavors.

- Identify Your Key Narratives: Begin by reflecting on your business journey, identifying pivotal moments, challenges overcome, and milestones reached. These elements form the backbone of your narrative, offering relatable and inspiring tales for your audience.

- Emphasize Emotion and Relatability: Stories that evoke emotions or share common struggles and triumphs resonate more deeply. Highlight moments of uncertainty, learning, and success in a way that your listener can see themselves in your story, fostering a stronger connection.

- Incorporate Lessons Learned: Every good story has a moral or lesson. Share insights gained through your experiences, offering value to your listener. This not only positions you as a thoughtful leader but also makes your stories educational.

- Practice Brevity and Clarity: While detail is important, the ability to convey your story succinctly is crucial. Practice distilling your narratives into concise, impactful anecdotes that capture interest without losing the listener’s attention.

- Adapt to Your Audience: Tailor your stories to suit your audience, whether it’s a potential client, a fellow entrepreneur, or a mentor. Personalizing your narrative to align with their interests or industry can make your message more impactful.

By weaving compelling narratives into your networking strategy, you not only leave a lasting impression but also build meaningful connections rooted in shared experiences and values. Storytelling is not just a tool for engagement; it’s a pathway to deeper, more substantive relationships in the business world.

Foster Genuine Relationships

Networking should never be a mere exchange of business cards; it’s about building genuine relationships. Show genuine interest in the people you meet, listen actively, and seek ways to offer value. This could mean sharing insights, making introductions, or offering solutions to challenges they might be facing. Remember, strong relationships are the foundation of a successful business network.

Follow Up and Nurture Your Connections

The magic of networking often happens after the initial interaction. Make it a point to follow up with your new connections through personalized messages, expressing your appreciation for the meeting and reiterating how you might help each other. Regularly sharing relevant information, such as articles, reports, or event invitations, can keep the conversation going and deepen the relationship over time.

Reflect and Strategize Post-Travel

Upon returning from your travels , take time to reflect on your experiences and the connections you’ve made. Evaluate how these new insights and relationships can be integrated into your business strategy. Perhaps you’ve identified a new market to explore, discovered a potential partner, or gained a fresh perspective on an existing challenge. Strategically incorporating these learnings can drive your business forward in unexpected and rewarding ways.

Case Studies and Success Stories

Throughout the business world, there are numerous success stories of individuals who have mastered the art of merging travel with networking to catalyze growth. Exploring case studies and success stories unveils the tangible impacts of integrating travel with networking, providing real-world insights into this strategy’s effectiveness. One illustrative example involves a startup founder who, by attending an international tech conference, connected with a venture capitalist interested in emerging technologies.

This chance meeting led to a significant investment, catapulting the startup into new markets. Another story highlights a small business owner whose participation in a trade mission in Southeast Asia opened doors to lucrative export opportunities, significantly boosting annual revenues. These narratives not only serve as a testament to the power of strategic networking while traveling but also offer practical lessons and inspiration. They underscore the importance of being open to serendipitous encounters and the potential of every trip to foster pivotal connections that drive business forward.

The Road Ahead

Merging travel with networking is more than a strategy; it’s a mindset that views every journey as an opportunity to grow, learn, and connect. In an age where business is increasingly global, those who harness the power of travel networking are poised to achieve unprecedented growth. So, pack your bags, and your business cards, and embark on a journey where the world becomes your office, and every destination holds the promise of new connections and opportunities.

By weaving together the threads of travel and networking, you’re not just exploring new territories geographically but also charting a course for your business that’s rich in diversity, innovation, and boundless potential. The future of business growth is global, and it begins with the next step you take.

Emily Mollown

Emily Mollown is a marketing specialist, business writer, and entrepreneur. She helps clients grow their personal and professional brands in a fast-changing and demanding market environment.

Related Articles

Strategizing

Entrepreneuring

Official Supporters

BELONG TO A NETWORK OF LEADERS

Inspire your clients to travel, grow your agency’s business.

Travel Leaders Network is a passionate community of travel professionals focused on mutual success. Travel Leaders Network is one of the largest sellers of luxury travel, cruises and tours in the industry. Representing over 5,700 travel agency locations across the United States and Canada, our Network uses the power of our parent company, Internova, to assist millions of leisure and business travelers annually.

BE A LEADER

I am so appreciative of the Social Media images, tools and training provided by Travel Leaders Network. I'm often so busy crafting travel experiences for clients that I neglect my social media. Travel Leaders Network is such an asset and crucial partner to my business, because I can access and use the images and tools to engage with my audience on social media.

Angela Lindsey | Luxury Vacations and Travel, LLC

Being part of the Luxury Leaders Alliance gives me the opportunity to learn from other advisors that focus on luxury travel. Hearing their feedback about destinations, hotels and suppliers is priceless. Being able to have more intimate, smaller group trainings with more open dialogue has proven to be beneficial.

Diane Michael | Travel Leaders

The most valuable aspect of Engagement is the Agent-level marketing that ties my photo and profile to the online promotions and emails that go out our behalf. I recently heard from an old client who had not booked with me in years. She told me that she was so happy to see I was still in the business after seeing my photo on an email and the renewed relationship has already turned into two sales of more than $30,000 each.

Nora Blum | Market Square Travel

The Engagement program is AMAZING! I use the Engagement emails and mailers to keep in touch with my clients, reminding them that I am here when they need me and keeping them aware of travel trends and offers. Many of my clients tell me that they love getting the emails and mail so they can start dreaming about their next adventure!

Catherine Taucher | Destiny Travel & Group Tours

I can't do it without Engagement! This resource gives me a professional edge over other small travel agencies. I'm so excited each time a client contacts me to book a holiday based on the flyer they recently received in the mail. If you are not using this resource, you miss out on a great opportunity!

Brenda McCafferty | World Travel Destinations and Cruises, LLC.

The leads generated to me are incredible. I have booked Regent Seven Seas, Silversea and Paul Gauguin cruises from leads. I have booked Kensington Tours private safaris in Africa and high-end European private tours from leads generated from Agent Profiler. I have new clients that travel business class and stay in suite accommodation at Leading Hotels of the World that found me on Agent Profiler. They have told their friends about me and I have gained many more clients from their referrals. I love Agent Profiler. Thank you.

Julie Evans | Valente Travel

The IC program has really helped me step by step to get my program up and running without feeling overwhelmed. We are a small agency and have little experience with ICs. On Agent Universe I am able to quickly access documents needed to continue my knowledge of the program. This helped me get my orientation packet together for my ICs and I am able to answer questions that I have not thought of.

Anne Jasper, Owner | Travel Leaders / Destinations Unlimited | Cedar Rapids, Iowa

The Host Agency+ program has been invaluable for me this year. For someone who has just dabbled in IC’s in the past, it has given me many resources especially in the area of recruitment and implementation that have helped me finally have a handle and focus on where I want to go with my IC efforts.

Ann Waters, President | Conference & Travel | Fort Wayne, Indiana

Travel Leaders Network has been a longstanding partner for us in providing the tools and resources our independent agents need. Extensive education opportunities, cutting edge technology, robust marketing programs and dedicated support all enhance and strengthen our independent agent network. Engaging with our agent network, providing support and ongoing education has always been a core focus for our agency and Travel Leaders Network has been a great collaborator for us in meeting that goal.

Kimberly LaScala Detore, President | Prestige Travel Systems Tampa, FL

I’m a veteran in the travel industry with over 34 years of experience, but I was a real novice in respect to ICs and being a host agency. I am so thankful for the Travel Leaders’ Host Agency+ Program which laid out a one-year plan to get me up and running with all the tools available online and at my disposal to be a successful host agency.

Sue Tindell, CTC, Owner | Travel Designers Travel Leaders | Rice Lake, Wisconsin

There are offerings out there for the dabblers and the tinkerers, but the Host Agency+ Program isn’t one of them. This program, by design, is intended for those who have already embraced a serious commitment to growing their host agency program. You will find in this program virtually every requisite tool to compete effectively in this very challenging marketplace. From competitive insights, to market trends, to critical analysis, it is all there.

Terry Denton, Executive Vice President | Main Street Travel | Fort Worth, Texas

For nearly 20 years, we’ve enjoyed far more than just the products and services offered by Travel Leaders Network. We’ve enjoyed sincere relationships with dedicated partners that are truly here to support us. We can’t imagine having a better partner than Travel Leaders Network.

Chad Burt, Co-Owner | Cruises & Tours, Unlimited | Jacksonville FL

“Since joining Travel Leaders, our business has grown significantly due to the support and programs offered. The training offered has taken my staff to a new level. We fully anticipate continued growth as part of Travel Leaders Network.”

Christy Prescott a Travel Leaders Network Associate Member from San Antonio, Texas

"I never thought in a million years that we would feel so valued in an organization this size, but it has been incredible. There is help with whatever we need to be successful. The marketing and support we’ve received has saved us thousands of dollars."

Mimi Comfort, a Travel Leaders Network Affiliate from Kansas City, Missouri

Find your community: inspiring travel networks

Jul 31, 2018 • 6 min read

Rear view of friends sitting on building terrace. Males and females are looking at cityscape and sea. They are wearing casuals.

The internet is a vast resource when it comes to travel – there’s an abundance of websites and apps designed to aid those looking to explore. At Lonely Planet, we curate collections of our experts' best recommendations, but we also realise the value of community, of conversing with fellow travellers who have been where you want to go, and who can answer questions and share experiences in real time. Here, we’ve compiled a list of thriving communities that exist on (and off) the web to help you plug into the perfect travel network.

Thorntree and Lonely Planet Travellers Group

Lonely Planet has long been home to a vibrant community of travellers keen to share tips and tricks. We established the Th orntree forum in 1996 – it's one of the longest-running online travel communities and a fantastic place to find detailed information on itineraries, recommendations and logistics. The forum is helpfully organised by country and interest, so you won't have to scroll through tons of unrelated posts to find your topic.

If Facebook is more your speed, hop into the new LP Travellers Group , where members share a variety of images, videos and information to help and inspire others.

Girls Love Travel

Girls Love Travel (GLT) came onto the scene in 2015 and has become one of the biggest travel communities on the internet, amassing over 610,000 women or female-identifying members. Founder Haley Woods started the group after struggling with 'first-date friendships' during her own travels, creating a community who shared her passion for globetrotting and empowering more women to travel in the process.

The group contains a number of subgroups (GLT 35+, GLT Pride, GLT Moms, among others). Members can pay a monthly fee to be part of a new GiveBack subscription scheme, which gives them access to a smaller community and assistance with trip planning. The money goes toward purchasing passports for GLTers who don't have one. After six months, members of GiveBack receive either $50 toward branded merchandise or a GLT trip.

To Woods, the strength of GLT lies in the dedication and engagement of its members. 'Time and time again, members have asked a question, a local answered, and the member has ended up travelling and meeting the local. For us, it’s not just coming together online, but it's making sure we are building that offline relationship too. As all of us evolve more onto our devices, one thing that helps the travel community is knowing that there is someone else on the other side of the device.'

Digital Nomads Around the World

As companies continue to embrace the flexibility available with a remote working set-up and more people choose to leave the desk-bound life behind, record numbers of digital nomads are roaming the globe, taking their mobile offices with them. Digital Nomads Around the World is an online forum that connects full-time travelling professionals with others doing the same; members share tips on everything from useful on-the-road work hacks to workspace recommendations to restaurant advice.

Fat Girls Traveling

Annette Richmond kicked off her online presence with a blog about plus-sized fashion before transitioning into the world of travel; today, she blends the two in her community platform Fat Girls Traveling. The project started on Instagram – Richmond chose to feature editorial photos that highlight the beauty and success of plus-size travellers, and since then the account has grown into a fully fledged community, with 4,300 members on Facebook and 14,500 followers on Instagram. The Instagram account has become a beacon of plus-size representation in travel, and the Facebook group allows for members to discuss all things related to discovering new destinations.

'Our society has always shown fat people to be depressed or eager to lose weight, to be the class clown – to fall back on other things because they can’t offer anything of beauty. I want to rock the boat a little bit,' says Richmond. 'We want to see representation of ourselves. We want to see fat people thriving because there are plenty of us that are.'

Richmond will be hosting her first annual Fat Camp in North Carolina in August 2018, a fat-positive adult summer camp for plus-size women. 'For fat people, camp can trigger negative emotions – it’s a time where they wanted to hide, or they were sent to a weight loss camp. We aren’t focused on weight loss or counting calories. We’ll have delicious food, nostalgic summer activities, tubing, s’mores and campfires.' Interested members can sign up for the whole weekend or day passes.

Nomadness Travel Tribe

What started as a Facebook group with 100 members has now morphed into an international network of 20,000 members: Nomadness Travel Tribe . The community is geared towards millennial travellers of colour and the only prerequisite to join is a single stamp in your passport. 'The community is for people who organise their lives so they can maximise their time on their road,' says founder Evita Robinson. 'It’s an alternative universe of knowledge: a community that looks like you, that understands your perspective and your concerns, and can give the most real, authentic answers to your questions.'

Nomadness usually hosts three to four formally organised trips per year (though the community averages around 100 meet-ups around the world annually), and in late summer of 2018, it is throwing its first festival for travellers of colour: Audacity Fest in Oakland, California. The event’s schedule features a number of speakers (including Oneika Raymond, Gloria Atanmo, and Tiffany 'The Budgetnista' Aliche) giving talks on a variety of travel-related topics.

For Robinson, Nomadness represents a movement. 'When it comes to mass media, [travellers of colour] are completely underrepresented. We are just as transformational and we are bringing so much money into this industry. African-American travellers – we’re talking about people who historically have gone through so much. Historical reference is what we carry with us. I step in as 20,000 – it’s not just me. I take my tribe wherever I go.' Potential members can join via Nomadness’ website.

Outdoor Afro

Outdoor Afro is a US-based nonprofit network that operates in 30 states, working to inspire African Americans to connect with the country's public lands and support their mission statement of inspiring 'black leadership in nature'. Trained volunteers lead a number of outdoor activities including hiking, camping, environmental education and conservation excursions. At the heart of these activities, the organisation promotes equitable access to public spaces and increased representation of the African American community in conversations regarding the infrastructures of and narratives surrounding these open spaces. The group specifically partners with organisations dedicated to environmentally sustainable and culturally respectful travel.

Outdoor Afro hosts a number of location-specific groups on Facebook , so find the one nearest you and hit the trail. To see what members are doing nationwide, follow the organisation's Instagram.

Travel for All

Martin Heng, Lonely Planet’s Accessible Travel Manager, kicked off the Travel for All online community in 2015, and since then its membership has boomed to 30,000. The group consists of travellers with access needs, providing a platform to share their own experiences, crowdsource information, and find travel inspiration.

'Particularly for people living with disability, travel can be daunting. Hearing from people with similar conditions overcoming their fears can be a great motivator,' says Heng. 'Also, accessibility is not just about the built environment; the barrier is often more a case of insufficient information about accessibility in any given location.'

The community, one of the first to address accessible and inclusive travel online, also serves as a space for disabled travel bloggers to share their work and for members to collect relevant articles and other literature in a central location. 'Confident or not, when you have access issues you do need to plan ahead, which means access to accurate and trustworthy information,' Heng says. 'There’s no real alternative to eyes on the ground.'

Check out adventure tours for every traveller from our trusted partners.

Explore related stories

Destination Practicalities

Jul 17, 2024 • 6 min read

From car to train, find your way around Montana with our guide to transportation across the state.

Jul 8, 2024 • 10 min read

Jul 24, 2024 • 7 min read

Jul 24, 2024 • 8 min read

Jul 23, 2024 • 6 min read

Jul 24, 2024 • 3 min read

Jul 24, 2024 • 9 min read

Jul 24, 2024 • 6 min read

Top Ten Networking Strategies for Travel Agents to Enhance Industry Connections

As travel agents, networking is an integral part of our profession. We strive to connect with industry leaders and peers, enabling us to better serve our clients and grow our businesses. However, networking can sometimes seem like a daunting task. How do you make that integral exchange valuable and memorable? How can you coin the art of mingling and conversing into a pathway to securing a long-lasting business relationship? Gateway Travel is here to help. We've compiled a list of networking strategies to help travel agents like you boost your industry connections and engage effectively with industry leaders.

The Power of Networking in the Travel Industry

Before we jump into the strategies, it is important to grasp the significant role networking plays in our industry. Networking is a matter of creating professional relationships. For travel agents, these connections lead to productive partnerships , business growth, sharing of expertise, and engagement with industry leaders who can provide you with invaluable insight and guidance.

Whether you are attending a travel industry conference or meeting others in a more casual setting, powerful networking can work wonders. The following strategies, therefore, will help open doors to beneficial discussions, forge strong connections, and elevate your travel agency to new heights.

Strategy 1: Be Prepared

Preparation is key when it comes to networking. Do your homework before attending any event. Research who is going to be there and identify who you want to meet. Have informed topics of discussion ready. This will impress industry leaders and show that you take your role as a travel agent seriously.

Strategy 2: Actively Listen

Actively listening to others is a fundamental aspect of networking. It shows that you value what others have to say, inviting in a sense of mutual respect and understanding that is likely to be reciprocated.

Strategy 3: Always Follow-Up

Once you establish a connection, don’t let it grow cold. Follow up with emails or phone calls and keep the conversation going. This will help maintain and strengthen that budding connection.

Strategy 4: Create and Refine Your Elevator Pitch

Crafting a compelling elevator pitch is crucial. A concise, targeted message about you and your travel agency leaves a lasting impression. Update it often, reflecting your current status and goals.

Strategy 5: Use Social Media Wisely

In today's digital era, social media platforms have emerged as crucial networking tools. Use them wisely to identify significant industry leaders and connect with them. Be active, engaging, and authentic.

Strategy 6: Be a Source of Information

Stay updated about industry trends and share this knowledge with your connections. Being a source of information will make you a go-to person and enhance your standing among industry leaders.

Strategy 7: Volunteer for Industry Events

Volunteering offers a great opportunity to meet and mingle with leaders in the travel industry. It also helps establish goodwill and credibility in your network.

Strategy 8: Participate Actively in Industry Forums

Many travel professionals participate in online forums. This is an excellent avenue to network with peers and industry leaders, engage in informative discussions and foster meaningful connections.

Strategy 9: Follow the Norms of Professionalism

While networking, remain professional yet approachable. Avoid controversial topics and refrain from gossip. That will present you as a dependable, respectful industry professional.

Strategy 10: Be True to You

Authenticity is key to effective networking. Be yourself and let your passion for travel and your work shine through. More people will connect with you when you are genuine and sincere.

By following these networking strategies, travel agents can foster powerful connections with industry leaders. Remember, networking isn’t just about getting your name out there; it is about creating a solid reputation for your business, engaging effectively with industry leaders, learning from them, and sharing your insights and experiences with others. As you employ these tips and start increasing your network, remember that each connection brings unique opportunities for growth and success in the travel industry. Happy networking!

Recent Posts

Essential Post-Trip Strategies to Ensure Client Satisfaction

Discover Effective Techniques to Build a Referral System with Clients and Grow Your Business Relationships Organically

Unlocking the Secrets to Strategic Pricing for Travel Agents

Groups | Customized Experiences | Africa Specialists | Network Travel Edmonton

- Escorted Groups

- Destination Weddings

- Gift Certificates

- Retreats & Conferences

- "House Calls Are Back"

- Airport Parking

- Important Contacts

- Meet The Team

- Giving Back

- Join Our Network

Designing Lifestyle Travel Experiences from Alberta

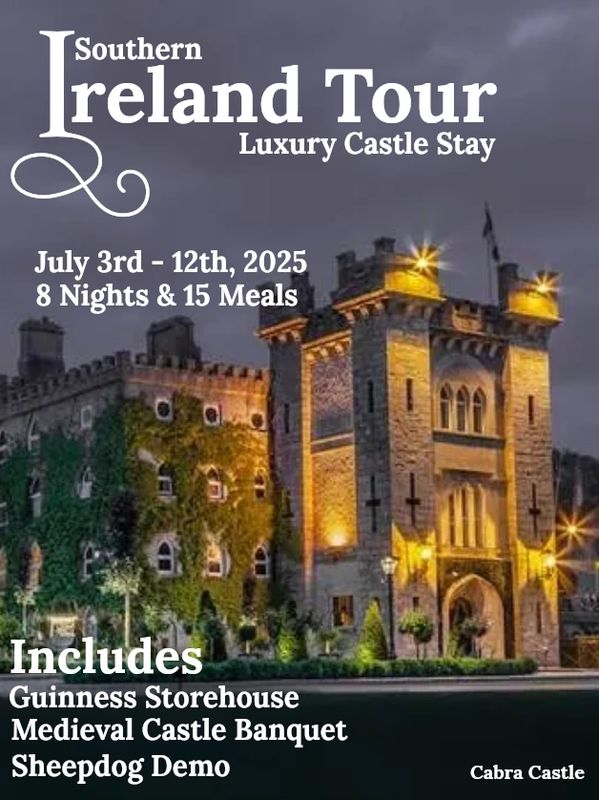

Cliffs of Moher, Ireland

Irish Summer Tour & Luxury Castle Stay

Private Tour: July 3rd - 12th, 2025

8 Nights / 10 Days - 15 Meals, Castles, Music, & Tours

$5588 CAD per person based on double

Single: $6488 Triple: $5488 (Including all taxes)

Return flight to Dublin approximately: $1500 per person

Tour Highlights

Live like royalty during overnight stays on the grounds of a castle. From history-filled Dublin to the rolling green hills and dramatic coast, experience Ireland’s charms on a journey through the Emerald Isle. Choose how you explore the city of Dublin. Kiss the Blarney Stone at historic Blarney Castle. See Killarney from an Irish jaunting car. Please pick from the best restaurants with our Diner’s Choice program. Experience the world-famous beauty of the Ring of Kerry. See border collies in action during a traditional sheepdog demonstration. Stand in awe at the top of the stunning 700-foot Cliffs of Moher. Experience the famous Guinness Storehouse and learn how to pour a perfect pint. A vibrant blend of captivating culture and breathtaking nature, this is the Ireland you’ve always imagined.

Pre-Departure Irish Pub Night

Hosted from Edmonton: Rick MacSwain - Network Travel

Detailed Itinerary Click HERE Please get in touch with me!

We manage all travel but Groups are our Specialty!

Group Travel, Our Expertise!

Join one of our customized experiences, or let us create a group for you!

At Network Travel we specialize in crafting unforgettable group travel experiences. Whether you are planning a family reunion, a friend's getaway, a destination wedding, or a corporate retreat, we are dedicated to making every journey seamless and enjoyable.

* Tailored Itineraries (to any destination)

We design custom travel plans, unique to your group's interest

* Expert Coordination

From transportation to accommodation, our team handles all logistics, ensuring a stress-free adventure

* Shared Memories

We create opportunities for bonding and shared experiences that you'll cherish for a lifetime

* Cost Efficiency

Benefit from group discounts and shared expenses, making your dream trip more affordable.

Travel together, laugh together, and explore together with Network Travel. Let us take care of the details so you can focus on creating memories.

Alaska from $786 CAD

Cruise Deals! (Canadian Dollars )

September 7, 2024

7-Day Voyage of the Glaciers with Glacier Bay

Sapphire Princess

Inside Stateroom: $786 p/p

Oceanview $1464 p/p

Balcony Stateroom: $2962 p/p

September 18, 2024, Grand Princess - 5 Ports

7-Day Roundtrip from Vancouver

Interior Cabin: $1471 per person based on double

Balcony Cabin: $3776 p/p

September 14th, 2024- Sapphire Princess

10-Day Inside Passage Roundtrip Vancouver

Interior Cabin $2159 per person based on double

Suite: $6749

We can arrange your flights and pre or post-stays

Note - Taxes and flights extra

Ask about other dates and cabin categories

Please contact me!

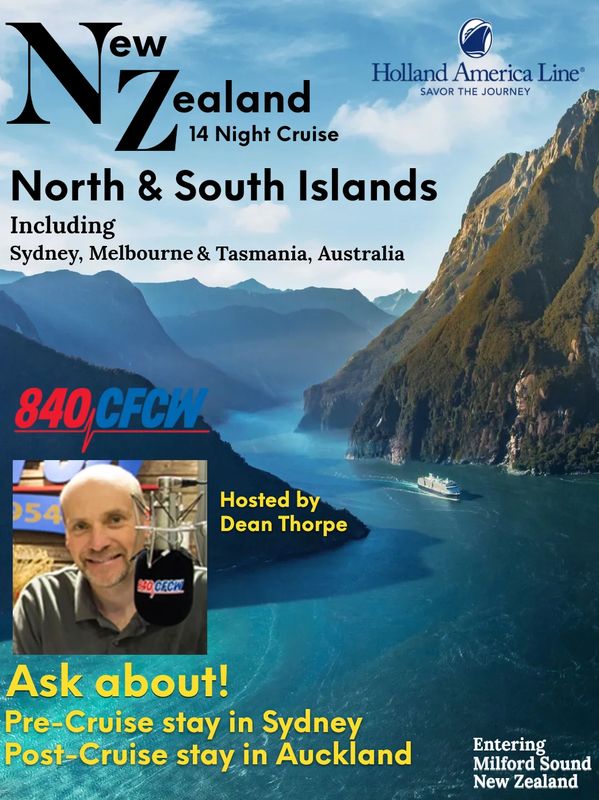

14-Night Cruise Group Escorted from Edmonton

March 2nd - 16th, 2025 ( 14 nights / 15 Days)

Holland America Cruise Line on the Westerdam

Outside Stateroom: From $5339 CAD p/p

Balcony Stateroom: From $6249 CAD p/p

Signature Suite: From $7719 CAD p/p (**Call for Single Rates)

Includes:

Drink package, gratuities, $200 USD Shore excursion credit,

2 nights specialty dining, Wifi, taxes, port charges, & transfers

Itinerary: CLICK HERE

Departs: Sydney, Australia to Melbourne & Tasmania

New Zealand -Milford Sound, Fiordland National Park, Port Chalmers (Dunedin), Timaru, Picton, Wellington, Napier, Tauranga, Disembark in Auckland

Highlights:

Departing Sydney Australia with a stop in Melbourne and then on to Tasmania known for its unique wildlife and World Heritage area.

New Zealand is one of the most unique destinations on Earth, where scenes of sweeping, verdant landscapes and pristine wilderness abound. New Zealand is also known for its rich culture, friendly people & excellent food & wine.

Hosts: CFCW's Dean Thorpe & Rick MacSwain Network Travel

Please contact me by email

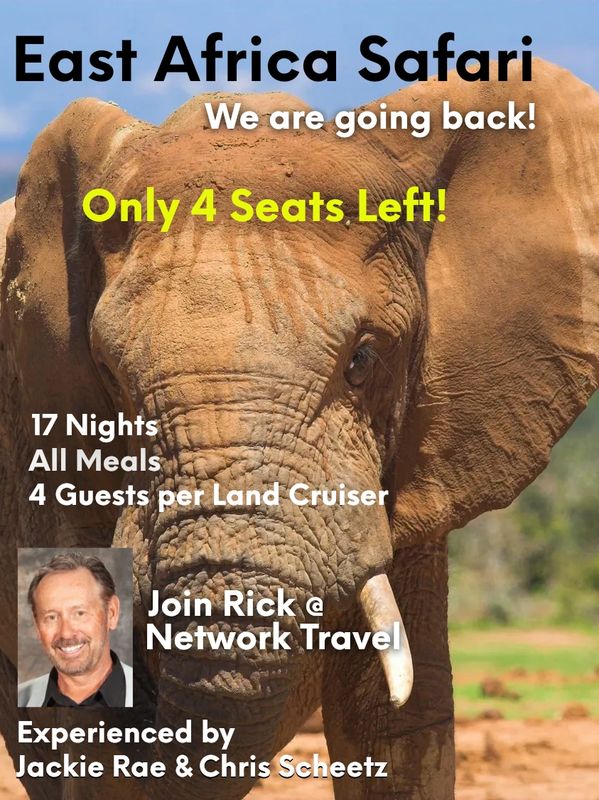

17 Nights in Kenya - Safari & Indian Ocean

Join Network Travel's Rick MacSwain as he escorts another group back to Kenya on safari.

Please NOTE: This is NOT an off-the-self, pre-packaged tour

Our unique safari is designed to provide the greatest opportunity to experience the Big 5 in comfort and safety.

January 10th - 27th, 2025 -- $12,399 CAD p/p based on double

Highlights (Limited to 24 Guests)

2 Nights to rest after a long flight, 2 Nights in Samburu, 2 Nights in the Ol Pejeta Conservancy, 1 Night Lake Nakuru, 3 Nights Masai Mara, 1 Night Lake Naivasha, 2 Nights Amboseli National Park with Mt. Kilimanjaro as the backdrop and 4 Nights post safari on the Indian Ocean at an all-inclusive beachfront resort.

• Luxury Lodges / Hotels (6 Nights in tented lodges)

• Private Land Cruisers with open hatch roofs, onboard fresh drinking water, binoculars & coolers

• Safety & Comfort - Only 4 guests per Land Cruiser with a private English-speaking driver guide

• Daily morning & afternoon game drives

• Visit the Sheldrick Elephant Orphanage and Giraffe Centre including lunch.

Detailed Itinerary Please contact me by email

This Fall - Canada & New England

10-Day Classic Canada & New England - 6 Ports

Quebec City to Boston on Emerald Princess

Includes: Saguenay, Charlottetown, Sydney, Halifax, Saint John (Bay of Fundy) Portland Maine & Boston Massachusetts

Inside Stateroom: $1387 p/p

Oceanview $2166 p/p

Balcony Stateroom: $2496 p/p

October 17, 2024, Emerald Princess - 6 Ports

14-Day Quebec City to Ft. Lauderdale, Florida

Quebec City, Halifax, Portland Maine, Boston, New York City, Norfolk, Charleston South Carolina, Ft. Lauderdale.

Interior Cabin: $1522 per person based on double

Oceanview $2427 p/p

Balcony Stateroom: $3912 p/p

Mini-Suite: $6188 p/p

Note - Taxes Included - Flights extra

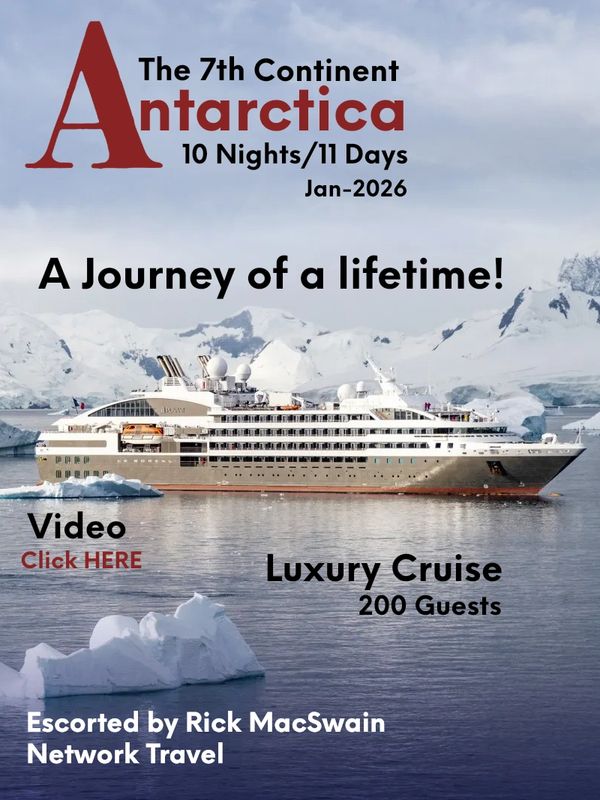

Antarctica Luxury Cruise

January 29th - February 8th, 2026

10 Nights Antarctica Ushuaia - Ushuaia

Superior Stateroom $12,635 USD p/p based on double

Ponant Cruise Line "Explore to Inspire"

The most common reaction upon reaching the 7th Continent is a sense of reverence and awe. The experience is beyond words since few places are as untouched and enduring as Antarctica. You will begin to appreciate why this region has long captivated the attention of explorers and travelers alike.

• All meals while on board the ship

• Standard Open Bar Package • Gratuities

• Port charges ($560 per person) • Airport charges

• Flight Package 1 Night in Buenos Aires + flight Buenos Aires/Ushuaia + visit + flight Ushuaia/Buenos Aires

• Captain’s welcome cocktail and gala dinner

• Unlimited Wi-Fi • Onboard credit ($100 per person)

• Evening entertainment and events

• Room service 24h (special selection)

• Highly qualified expedition team

• Zodiac landings and park entry fees into protected areas

• Complimentary boot rental & a Polar Parka to keep

Please contact me with more details!

Circle Japan & her Southern Islands

17-Day Cruise departing June 14th, 2025 on Diamond Princess

Roundtrip from Tokyo (Yokohama), Japan

9 Ports: Tokyo (Yokohama), Japan Nagasaki, Japan Busan, South Korea Sakaiminato, Japan Aomori, Japan Tokyo (Yokohama), Japan Taipei (Keelung)Hualien, Taiwan Ishigaki, Japan Okinawa, Japan Tokyo (Yokohama), Japan (Taxes included / Flights are extra)

Inside Stateroom: $2992 p/p - Oceanview $4072 - Balcony $4747 p/p

On this incredible journey, you will enjoy the most astonishing city on earth; the city of Tokyo. In Nagasaki visit: (Peace Memorial Park, Atomic Bomb Museum, Shimabara Castle & Village, Mt. Inasa)

Enjoy Busan, the second largest city in South Korea from modern high-rise towers to ancient Buddhist temples. You will visit the small fishing port of Sakaiminato in Japan, esteemed for centuries for its superb seafood. In Northern Japan, you will enjoy the city of Aomori, known for its beauty from apple orchards and cherry blossoms. In Taiwan, you will visit the bustling city of Taipei and other interesting areas surrounding on this fascinating island in the East China Sea.

Onboard the Diamond Princess

Dine on freshly prepared sashimi in Kai Sushi, watch street performers in the dazzling Atrium, or take in a lavish production show in our state-of-the-art theater. Please contact me!

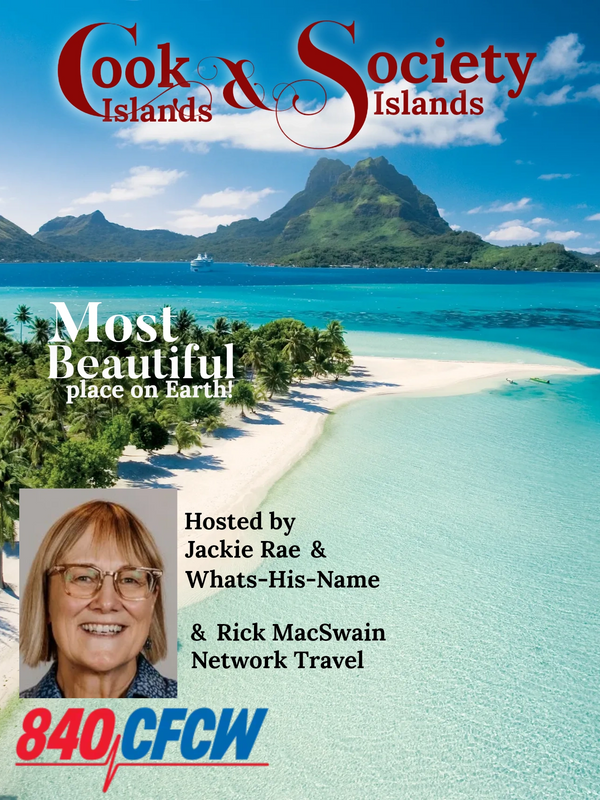

Nov 15th - 26th, 2025 Small Ship Experience!

11-Night / 12-Day Cruise Video Click HERE

From $5549 USD p/p based on double

Group Price: Save over $700 USD per person

November 15th - 26th, 2025

Small Ship Experience - 330 Guests & 217 Crew

Includes: luxury cruise, all-inclusive meals, alcoholic/non-alcoholic beverages, transfers, port charges, gratuities, taxes, and $150 USD Shipboard credit per person.

Flights not included - only 8.5 hours direct from Seattle

Why is a Paul Gauguin Cruise - SPECIAL?

The MS Paul Gauguin was specifically built to explore the islands of the South Pacific. It is one of a few ships able to access the shallow reef-protected lagoons, so you to get close up to the islands that larger ships cannot access. Every shade of blue is here. The Paul Gauguin's marina means you enjoy watersports right off the ship with kayaks and standup paddleboards. A team of locals (Gauguins and Gaugines) are on board to share their local culture.

Pre-cruise Options: New Zealand Tour or overwater bungalow experience! Full Itinerary - Click HERE

Click here to inquire by email

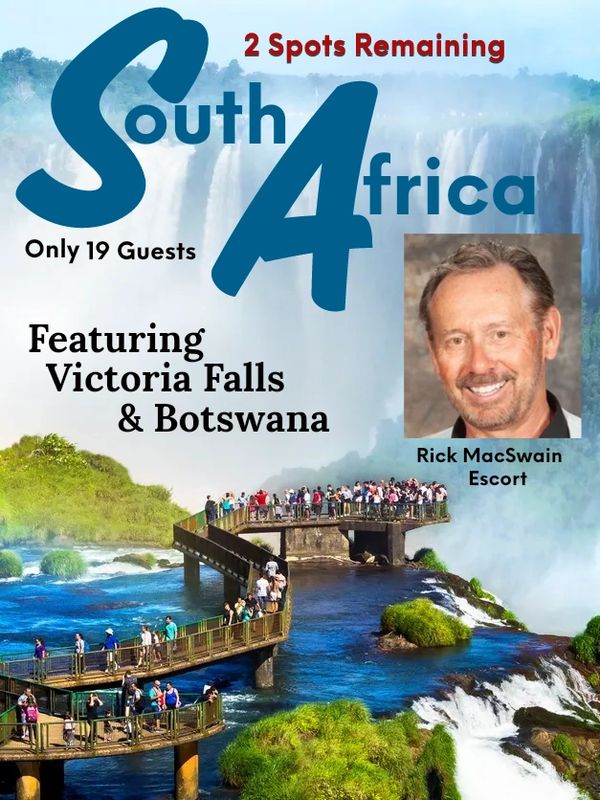

South Africa - Victoria Falls & Botswana

Depart Canada January 31st - Feb 14th, 2025

From $7999 CAD p/p double occupancy

Includes: Escorted from Edmonton

Park fees and domestic flights - Victoria Falls & Botswana

5 Star accommodations, 29 meals, vineyard tasting

Victoria Falls, Chobe National Park, Pilanesberg National Park, 8 game drives, Cape Winelands, Cape Town and Table Mountain. (International flights not included)

Get ready for an unparalleled journey through southern Africa's cultural diversity and abundant wildlife. Seek out the “Big 5” on 8 different safari game drives. Get a taste of South African culture at local wineries. Witness the natural beauty of Victoria Falls and learn about its people during a township visit and home-hosted lunch. Greet African elephants and spend time learning about them. Search for animals along the winding Chobe River. Epic scenery and winding coastlines come together in an incredible adventure.

Contact us for more details

Itinerary Details - Click HERE

Optional: 3 Night Pre-tour in Dubai

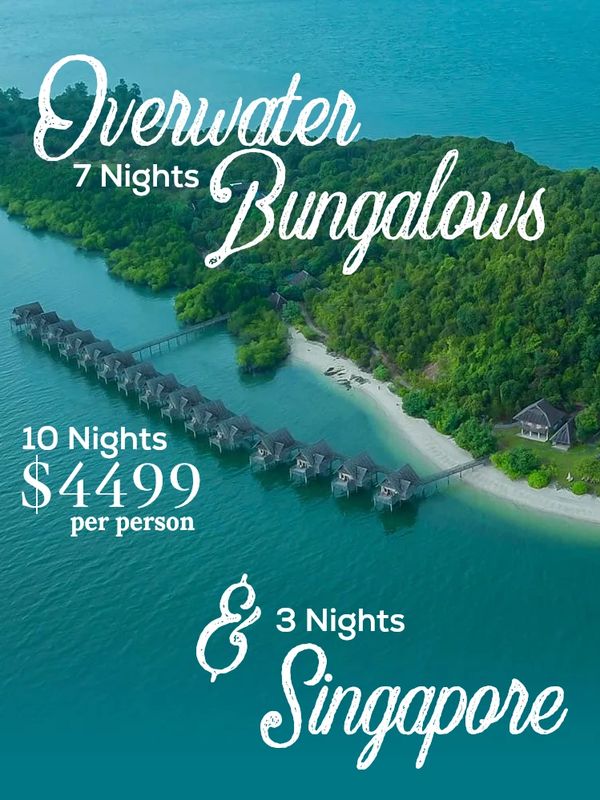

Private Island & Overwater Bungalows

10 Night Package

Customized - Only 15 Bungalows

February 9th - 20th, 2025 (10 Nights)

$4499 CAD per person based on double occupancy

International flights from Edmonton approx. $2000 extra

(Direct flight from Vancouver to Singapore)

7 Nights Overwater Bungalows - King Bedroom

3 Nights Singapore - Mondrian Singapore King Room

All Meals - Overwater Bungalow (7 Nights)

Daily Breakfast - Mondrian Singapore Duxton Hotel

60 Minute Massage - Overwater Bungalows

Transfers - Airport and Ferry to private island

Experience your own private island & 3 Nights in Singapore!

We designed this incredible Experience for guests seeking something unique and off the beaten track.

Ask about adding more days to your vacation!

Contact us by email

Make it SPECIAL!

A customized wedding is thoughtful, special, and full of pleasant surprises for your invited guests.

We will make your celebration SPECIAL!

May we suggest!

Start with the Wow Factor!

Guests arrive at the resort on a private yacht shuttle

A thank-you gift is thoughtfully placed in each guest suite

Your welcome reception is a sunset delight

Group Outing

Spa & wine tasting or golf & cocktails

Wedding Celebration

Private remote setting exclusive for you with warm tropical breezes and the scent of fresh flowers

Your reception is magically decorated with fine dining and music.

We welcome all weddings and coordinate guests arriving from around the world.

Email Us: [email protected]

Call: 780-454-4933 ext.: 101 TF: 866-604-8714 ext.: 101

Escorted Tours, Groups & Affordable Luxury

We all love travel deals and occasionally we discover offers that are simply out of this world. Sign up to receive our “Network Getaways” and we will ensure you are on the top of our VIP list. Note: We hate spam too! We respect your privacy and only send permission-based emails.

In the News

Copyright © 2024 Network Travel - All Rights Reserved.

Professional Lifestyle Service Provider

- Privacy Policy

- Terms and Conditions

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.

Start and scale your business with the travel host agency that makes it simple.

The smartest way to sell travel, imagine starting a travel business with the resources, supplier relationships, and tools you need from day one., build a foundation, business essentials.

Start selling and earning commission instantly with top-rated travel planning tools, industry memberships, and access to our list of trusted suppliers and vendors.

access more

Network perks.

Premier pricing and special offers to our network of preferred partners, including marketing content, design software, promotional items, and travel planning resources.

expand your brand

Agent resources.

Members-only tools and trainings to make your travel business a success from the very start. Access your exclusive resources any time in your Pickles Travel Network Portal.

Pickles Travel Network is proud to be a 5-star rated agency on Google and Host Agency Reviews!

“PTN is incredibly dependable and supportive. As a new TA, I honestly feel lucky that I found Pickles. They have connected me with ridiculously amazing resources/opportunities (i.e. VIRTUOSO!!, CLIA, and a top-level list of ….They are also very approachable and easy to communicate with. I love the supportive culture they are continually developing. Pickles is doing an amazing job equipping and empowering me to become the successful TA that I am striving to be.”

Jonathan H.

“Pickles Travel Network is the best! The entire staff is helpful and supportive; you can feel how much they want you to succeed. They have also created an incredibly encouraging community that feels like a family. I highly recommend them!”

“Pickles Travel Network offers AMAZING ongoing training, resources and support. As a new agent, the training offered to expand my knowledge and growth is priceless! If you’re looking for a host Pickles is definitely worth it! The best decision I have made as a travel agent was signing up with Pickles Travel Network. I am so grateful that I found the PTN community :)”

“The best decision I have made as a travel agent was signing up with Pickles Travel Network. Pickles Travel Network has the nicest, most supportive staff and members. They also offer the best resources in the industry that are necessary for success. I cannot say enough wonderful things about Pickles!”

“Pickles Travel Network has been such a huge help to me as a new travel advisor. They provide wonderful resources, the ability to choose your commission percentage, the ability to keep 100% of your planning fees, a wide variety of training options, and they are always available to help when I need it. PTN feels like a family, & I’m very thankful to be part of their agency!”

“The Pickles team has been a wonderful and attentive support system for agents at every level and at every turn. They’ve laid some amazing ground work that is there for you to take advantage of to learn and grow professionally. It’s been incredibly helpful to me as a new travel agent.”

“Pickles is a great host agency! They have amazing support and lots of good trainings! I love the fact that all their programs are easy and clear to understand and I’m glad I switched over to this host agency!”

“I began this process about 6 months ago, found PTN and scheduled a call with Stephanie. The fact that she took my call and answered all of my questions made me feel this was the best choice to help launch my career change to Travel Advisor from Educator. The support has been tremendous and I am so happy to be a part of PTN.”

“Working with PTN has been nothing but exceptional. Someone always gets back to me with questions or concerns and is attentive to the needs of everyone. The trainings are so valuable as well with a variety of topics discussed every month. If I can’t attend a live training, the replays are always available.”

“Pickles has made life simple with some tools that are amazing. They provide an easy to use booking system, a comprehensive travel agent portal, and a customer service team that is always available to help. They also offer a variety of marketing materials and resources… Pickles is the perfect host agency for any travel agent looking to make their business successful.”

let us guess...

You’re here because you love planning incredible vacations, but want the time and flexibility in your schedule to enjoy your own, too..

Get your agency up and running in no time at all! We provide you with everything you need to be your own boss.

A host agency is a foundation to support independent travel contractors. They provide low start-up costs, industry credentials, accreditation, suppliers, access to educational programs, tools, and agent support.

- They are sour & sweet, crunchy and taste great with ice cream!

- You have the ability to charge planning fees and keep a 100% of your fees**. Unlike other host agencies that require you to include them with your commission split.*

- Membership with Virtuoso, the leading global luxury travel network.

- Commission Tracking with Sion

- Membership to Travefy a platform for Itineraries, Proposals, Client Management & Marketing Tools

- Group coaching

- Supplier trainings

- You choose your commission rate* – 70%, 80%, or 90%, unlike other travel hosts that have you hit a min sales to get higher commission rates. Keep more of your profits from day one

- Ability to brand your own agency and be your own boss

- Access to FAM (Familiarization) trips and reduced travel rates

No, we welcome new and experienced agents. We have all the tools you need to be successful as a travel advisor new or experienced.

If you have a passion for travel and willingness to grow your own business, you’re a perfect fit for Pickles Travel Network!

We like to break things down into three areas. Business Essentials are the core systems and software you’ll need to get your agency up and running, and these are included at no extra cost with your PTN membership. Network Perks are the optional add-ons like marketing resources and extra training that you can purchase at a discount any time if you’re a PTN member. And our personal favorite, Agent Resources are the complete (and growing!) bank of educational and training resources that we provide to you to support you in growing your travel business. These include seminars led by our Pickles Vacations team, guest experts, and recorded Q+A calls for PTN members only. Learn more about what’s included with your membership here!

How does today sound? Apply right now online, and set up an appointment with a member of our team to get your questions answered. If it sounds like it’ll be a good fit between us, we’ll invite you to sign up and grant you access to the PTN portal right away! As you complete your enrollment steps, we’ll work on getting your accounts created with our partner platforms.

see all FAQs →

Our vendors + affiliates

Sometimes, it’s all about who you know..

The travel industry is all about relationships. That’s why we make the connections for you and partner with industry leaders to give you reliable, modern, and user-friendly resources to run your travel business easily. When you become an agent with Pickles Travel Network, you’ll get automatic access to Virtuoso’s membership network, Sion, Travefy, and more affiliates through your exclusive member portal. We can’t wait to see you in the network!

What's the dill?

Educational blog for travel advisors.

Understanding Travel Insurance: A Comprehensive Guide for Agents

Travel insurance is an essential tool for safeguarding travelers against unforeseen events.

How to Leverage Influencers and Bloggers for Travel Agency Marketing

Leveraging influencers and bloggers can significantly enhance your travel agency’s marketing efforts.

6 Travel Trends to Watch in the Next Decade

The future of travel is dynamic and filled with opportunities for those who can adapt to emerging trends.

10 Ways Travel Agents Can Adapt to Market Shifts and Industry Changes

Stay ahead of the curve with insights on embracing technology, diversifying offerings, and fostering a culture of innovation.

Successful Financial Management for Travel Agents: The Ultimate Guide

By budgeting meticulously, diversifying revenue streams, cutting costs, and planning strategically, you can maximize profitability and ensure sustainable growth in your travel business.

5 Ways to Maximize Travel Agent Efficiency with AI and Automation

AI and automation offer transformative potential for travel agents, enhancing efficiency, improving client service, and driving business growth.

*Not available for residents in Hawaii.

**Advisors are responsible for checking state laws before charging planning fees.

Hours of Operation

Mon - fri: 9am - 5pm ct.

©2022 Pickles Travel Network

4261 EAST UNIVERSITY DRIVE, SUITE 30-505 PROSPER, TX 75078

Seller of Travel: CA #2152037-50 | FL #ST43007 | WA #604-994-859

IATA | CLIA Membership

Ptn iatan code: 45769253, ptn clia number: 00032299.

When you enroll with suppliers, you must use PTN’s codes to receive a commission from us. Want to sign up for your own CLIA or IATA numbers for exclusive travel benefits? See below.

Get your own IATA/IATAN ID Card:

The IATA/IATAN ID Card is the industry-standard credential to identify bona fide travel professionals. Key benefits include access to concessionary incentives from industry suppliers. The IATA MemberPerks program provides cardholders with daily savings at over 300,000 merchants across North America.

To be eligible, you must register with IATAN under PTN’s IATA number 45769253, work a minimum of 20 hours per week, and earn a minimum of $5,000 per annum in commissions. You’ll need to send PTN a support ticket asking for approval. Once approved, we will send you a PRIN # to allow you to register with IATAN and ask for an ID card.

Get your own CLIA EMBARK ID:

Obtain a CLIA EMBARC ID for travel discounts and FAM (Familiarization) trips. Join CLIA as an Individual Agent Member under Pickles Travel Network CLIA #00032299.

To be eligible, you must work at least 20 hours per week and earn a minimum of $5,000 per annum in commissions. Once you’ve registered, submit a support ticket to let us know, and we will approve your registration.

Please select the option that best describes you for more information.

The Best Networking Tips for Travel Agents (Step-by-Step Guide For Growth)

- Published on March 23, 2023

With the rising use of new technologies and advanced tools to grow and market any business today, the value of an important traditional method to connect with industry peers is gradually being forgotten; this slowly fading yet effective way is called Networking .

Networking, in simple terms, means the exchange of information and ideas among people with a common profession or special interest, usually in an informal social setting.

It is especially important for a Travel Agent because connecting with the other travel industry members can help you hone your existing relationships as well as make new contacts, get new ideas, mentorship, opportunities and a potential set of customers.

It will make you an active, knowledgeable and known member in the market and definitely help you gain trust of new and existing customers.

It keeps you on your toes by exposing you to the necessary competition and support needed to grow in this fast-paced world of Tourism.

Whether you’re new to the industry or an old player, networking has proven to be a valuable tool regardless!

Ways of Networking for Travel Agents:

Networking is a crucial art for any entrepreneur. It is all about building mutually beneficial relationships where interacting face to face, staying in touch, explaining yours and understanding the other person’s needs is considered as the best form of communication.

Listed below are the top ways in which you can practice maximum networking as a Travel Agent:

1. Networking with Clients

Every travel agent, big or small, wants to have the maximum customer base but what makes an agent different is his skill to identify moments and turn them into business opportunities .

Talk about travel with the people you come in contact with, tell them about your agency, what you do and what you can do for them. This type of networking can simply start with a handshake at any informal get-together, party or even at the gym, school functions or grocery stores.

If you are new in business then this is the best form of networking for you!

2. Networking with Travel Agents

Agent to agent networking is considered to be the most beneficial and amazing form of networking.

Meeting your fellow agents, discussing new travel trends , destinations, challenges and ideas can help you learn and plan the future of your travel agency.

Attend as many agent to agent events as possible, interact actively, exchange contacts and explore the best business opportunities available from time to time.

3. Supplier events and FAM Trips

Attending supplier events and webinars whenever possible is a great way to build relationships across the industry.

Learning about new destinations, connecting with suppliers , letting them know what your needs are and what the end customers expect can help you expand your business further.

Attending events like tourism roadshows or SATTE , participating in supplier webinars and undertaking FAM trips can shape and widen your understanding of the business.

4. Social Media Networking

Go ahead and connect with agents, suppliers as well as clients on Social Media. Be active on the internet, market your business, share deals / posters , ask your customers to write testimonials, follow fellow agents and join tourism groups on facebook, whatsapp, etc.

This will help you reach out to a wider audience and make a market presence of your brand. Take your business online today and slowly build a brand that people connect with.

We hope these networking tips help you expand your business, plan its course and find more customers.

Keep working, keep networking and keep getting closer to making your business known!

We at TravClan have compiled for you the latest marketing content, interactive videos, world-class website, latest travel deals, and much more in a bundle just for you to use and upgrade your travel agency to the next level.

Related Articles

Subscribe to our Newsletter

Get latest updates about travel industry straight in your inbox.

.png?width=333&height=100&name=WORLDVIA%20TRAVEL%20QUEST%20NETWORK%20LOGO%20(1).png)

Everything your travel business needs in one place.

You are not alone.

As a travel professional, whether new to the industry or well-seasoned, you want a host agency that truly knows how to support you and your business.

WorldVia Travel Quest Network has been empowering entrepreneurs with industry-leading education, marketing, and technology for over twenty-five years, with a world-class Member Success team backing you up every step of the way.

How We Help You

Our integrated and AI-powered technologies work together to create efficiency in running your travel business, helping you attract more clients and boost your productivity.

Our multi-faceted approach to loyalty marketing keeps your good name in front of clients all year long and inspires them to rely on your services.

Events + Education

Discover new ways to grow through a wealth of in-person and online training and development opportunities, including detailed program tutorials to get you started.

Lead Generation

Our lead generation program connects you with the exact travelers looking for your services by promoting your distinct capabilities and personalities first and foremost and utilizing the latest SEO strategies.

Partnerships

Our supplier and destination partners provide our members with the most robust offers, incentives, and training in the industry, giving you every advantage you need to sell more and profit more.

Luxury Travel Solutions

As a member of our network, you can access programs, tools, marketing, and services that help advisors better serve affluent consumers.

Corporate Travel Solutions

Grow your corporate travel business by offering customized solutions backed by our tools and resources.

Product Programs

Reward your clients with exclusive experiences, pricing, and added amenities, enhancing your commissions and client loyalty.

Plus, connect with thousands of other agents who are growing their travel business.

What our members think.

"...The training resources are abundant as are the suppliers that Travel Quest Network has relationships with. The commission rates are top tier for all of them. Other agents have been so helpful with sharing information, making suggestions, and offering encouragement. As others have said, it really is like a family..."

"Wow, wow, wow. I can't say enough good things about TQN. I changed recently after a rough first year at a small host agency that was quite honestly a mess. I love not having to fight tooth and nail for my commissions. They pop up on time under "Commission Manager" and it's so easy to follow along. The times I've had to reach out to the team they've been SO nice and helped right away!"

"I cannot recommend them enough. I have learned so much through them, their Weekly Chat, Monthly All Call, their private FB page, and University. It's also they are connected with Travel Leaders, you have much better training and resources. I personally came from another Host, that specialized in one thing and not the thing I wanted to specialize in. Here I have found my home. OH and the CEO answers FB questions, how cool is that!!"

Hear Akua's Story

"To anyone considering Travel Quest Network, once you come across it, you won't regret the decision."

Get To Know WorldVia Travel Quest Network

Do you want to know more about the host agency designed for Travel Entrepreneurs—WorldVia Travel Quest Network?

If so, take a peek behind the curtain as our team shares what makes us the best platform for building a thriving travel business in America.

New to the Travel Industry?

WorldVia Travel Quest Network makes becoming an independent travel professional simple. As your host agency, we give you an edge, supplying you with everything you need to run a business successfully.

So even though you're business is entirely yours, you're never going at it alone.

Learn more about what a host agency does

Stay connected + Power Up Your Business

Let us send you tips, tools, and more to help you grow your travel business delivered straight to your inbox.

Agency of Excellence Award Logo 2024

4140 Parker Rd. Allentown, New Mexico 31134

Host Agency of the Year Award 2024 logo

Elite Award Logo 2024

Travel Leaders Agency of Excellence 2023

Travel Leaders Logo

To revisit this article, visit My Profile, then View saved stories .

- The Big Story

- Newsletters

- Steven Levy's Plaintext Column

- WIRED Classics from the Archive

- WIRED Insider

- WIRED Consulting

A Hacker ‘Ghost’ Network Is Quietly Spreading Malware on GitHub

A secretive network of around 3,000 “ghost” accounts on GitHub has quietly been manipulating pages on the code-hosting website to promote malware and phishing links, according to new research seen by WIRED.

Since at least June last year, according to researchers at cybersecurity company Check Point, a cybercriminal they dubbed “Stargazer Goblin” has been hosting malicious code repositories on the Microsoft-owned platform. GitHub is the world’s largest open-source code website, hosting millions of developers' work. As well as uploading malicious repositories, Stargazer Goblin has been boosting the pages by using GitHub’s own community tools.

Antonis Terefos, a malware reverse engineer at Check Point who discovered the nefarious behavior , says the persona behind the network uses their false accounts to “star,” “fork,” and “watch” the malicious pages. These actions—which are loosely similar to liking, sharing, and subscribing, respectively—help make the pages appear popular and genuine. The more stars, the more realistic a page looks. “The malicious repositories appeared really legitimate,” Terefos says.

“The way he has developed it is really smart, taking advantage of how GitHub operates,” Terefos says of the person behind the persona. While cybercriminals have been abusing GitHub for years, uploading malicious code and adapting legitimate repositories , Terefos says he has not previously seen a network of fake accounts operating in this way on the platform. The buying and selling of repositories and starring is coordinated on a cybercrime-linked Telegram channel and criminal marketplaces. WIRED previously reported on other GitHub black markets.

The Stargazers Ghost Network, which Check Point named after one of the first accounts they spotted, has been spreading malicious GitHub repositories that offer downloads of social media, gaming, and cryptocurrency tools. For instance, pages might be claiming to provide code to run a VPN or license a version of Adobe's Photoshop. These are mostly targeting Windows users, the research says, and aim to capitalize on people potentially searching for free software online.

The operator behind the network charges other hackers to use their services, which Check Point call “distribution as a service.” The harmful network has been spotted sharing various types of ransomware and info-stealer malware, Check Point says, including the Atlantida Stealer , Rhadamanthys , and the Lumma Stealer . Terefos says he discovered the network while researching instances of the Atlantida Stealer. The researcher says the network could be bigger than he expects, as he has also seen legitimate GitHub accounts being taken over using stolen login details.

“We disabled user accounts in accordance with GitHub’s Acceptable Use Policies , which prohibit posting content that directly supports unlawful active attack or malware campaigns that are causing technical harms,” says Alexis Wales, vice president of security operations at GitHub. “We have teams dedicated to detecting, analyzing, and removing content and accounts that violate these policies.”

GitHub has more than 100 million users who have contributed over 420 million repositories on the platform. Given the breadth of the platform, it’s unsurprising that cybercriminals and hackers are attempting to abuse it. In recent years, researchers have been mapping instances of fake stars , spotting dangerous code hidden in projects , facing growing supply-chain attacks against open source software , and seeing comments being used to spread malware .

The Stargazer Goblin threat actor identified by Check Point sells their services through ads on cybercrime forums and also through a Telegram account. A posts on a Russian-language cybercrime forum advertises 100 stars for $10 and 500 for $50 and says they can provide clones of existing repositories and trusted accounts. “For GitHub, the process looks organic,” one translated post says. The Check Point research says the network could have started operating as early as August 2022 and may have made as much as $100,000—from mid-May to mid-June this year, they estimate the operator made around $8,000.

Terefos says, in some instances, he has seen a legitimate code repository being changed by the threat actor, potentially using stolen credentials, and turned into a malicious one. If legitimate users fork a malicious repository, it has the potential to spread the code, Terefos says. The reverse malware engineer adds that he has automated the search for accounts linked to the network and is able to identify them based on common features, such as repositories using similar templates and tags. Some of the repositories seen by WIRED use variations on "instagram-follower" and "youtube-views" tags, with the names changed based on the software the page alleges to offer.

“Users of GitHub, and especially inexperienced users, can easily download malicious code, which can often be the result of fictitious reviews and starring,” says Jake Moore, global cybersecurity adviser at security firm Eset. “Telltale signs of malicious code on GitHub could also be unexpected or suspicious code changes, code that accesses external resources, and specific hard-coded credentials or API keys.”

Terefos says the activity of the network—staring and watching pages—is likely automated, as he saw repositories being acted upon in quick succession. “I don't think they're clicking, doing like manual work.” For GitHub, Terefos says, it may be difficult to identify this activity, as the behavior of the accounts is intended to look like a genuine GitHub user. Wales, from GitHub, says the company uses a combination of manual reviews and “at-scale detections” that use machine learning to identify suspicious activity

The Check Point engineer also says he identified one YouTube “ghost” account that was sharing malicious links via video, indicating that the network could be more encompassing. “I think this is not the whole picture,” Terefos says.

You Might Also Like …

J.D. Vance left his Venmo public. Here's what it shows

In your inbox: Get Plaintext —Steven Levy's long view on tech's global impact

How Apple, Nvidia, and Anthropic used thousands of swiped YouTube videos to train AI

It’s shockingly easy to buy off-brand Ozempic online , even if you don’t need it

The WIRED AI Elections Project : Tracking more than 60 global elections

Customize Your Experience

Looking for a Travel Agent?

Looking to Join MAST?

Login to My Account.

About MAST!

MAST works for you! We focus on your needs, your branding, and your growth.

Agent login, mast travel network offers you the benefits and advice you need, find a travel agent near you.

Search for a travel agency within

Why Choose a MAST Travel Advisor?

Saves you money.

MAST Travel Advisors have access to the myriad of airfares, hotel rates, package tours, and cruise vacations worldwide and are Internet savvy. Accompanied by strong working relationships with travel suppliers, often the best deal lies with the people who know where to look.

Relationships & Clout

Advisors know how to interact with suppliers and have the proper contacts to get things done. Advisors have more buying power. Advisors offer value and amenities by providing inclusions or extras at no cost.

Experience & Knowledge

Popular travel destinations.

Search here for an agency that truly fits your unique travel needs!

⋆ Highly Rated Cruises, Tours, & Hotels ⋆

Holland America Line

Explore the early days of the “New World” by walking the grounds of significant battles and touring fascinating sites you’ll remember from history books. Cruise to Nova Scotia on sailings from Boston, munch on fresh seafood and tap your toe along to a fiddler. A vacation in New England and Canada packs in a lifetime of memories.

Or Search by Travel Style:

Join MAST Travel Network

MAST works for you! We focus on your needs, your branding, your growth. We supply the tools to fulfill your marketing, networking, and training needs. Our emphasis is on growing your business and increasing your sales. As a MAST member agency, you share in our resources, our growth, and our supplier overrides go back to you!

Exceptional customer service requires skilled professionals. MAST offers a multi-faceted educational program from webinars to regional training to networking events. MAST makes it easy to stay informed and knowledgeable through the endless educational opportunities we offer our members.

Member Owned

MAST Travel Network is a member-owned and member-driven consortium composed of more than 200 travel agencies across the United States & Canada. Through exclusive agreements, partnerships, training, and support, MAST agencies have the tools to deliver an outstanding customer service experience every time.

MAST Preferred Suppliers