By Bastian Herre, Veronika Samborska and Max Roser

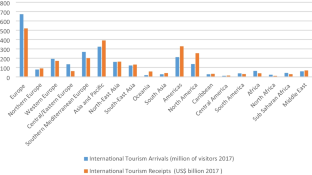

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000.

Tourism can be important for both the travelers and the people in the countries they visit.

For visitors, traveling can increase their understanding of and appreciation for people in other countries and their cultures.

And in many countries, many people rely on tourism for their income. In some, it is one of the largest industries.

But tourism also has externalities: it contributes to global carbon emissions and can encroach on local environments and cultures.

On this page, you can find data and visualizations on the history and current state of tourism across the world.

Interactive Charts on Tourism

Cite this work.

Our articles and data visualizations rely on work from many different people and organizations. When citing this topic page, please also cite the underlying data sources. This topic page can be cited as:

BibTeX citation

Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license . You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

U.S. Department of Commerce

- Fact Sheets

Was this page helpful?

Fact sheet: 2022 national travel and tourism strategy, office of public affairs.

The 2022 National Travel and Tourism Strategy was released on June 6, 2022, by U.S. Secretary of Commerce Gina M. Raimondo on behalf of the Tourism Policy Council (TPC). The new strategy focuses the full efforts of the federal government to promote the United States as a premier destination grounded in the breadth and diversity of our communities, and to foster a sector that drives economic growth, creates good jobs, and bolsters conservation and sustainability. Drawing on engagement and capabilities from across the federal government, the strategy aims to support broad-based economic growth in travel and tourism across the United States, its territories, and the District of Columbia.

The federal government will work to implement the strategy under the leadership of the TPC and in partnership with the private sector, aiming toward an ambitious five-year goal of increasing American jobs by attracting and welcoming 90 million international visitors, who we estimate will spend $279 billion, annually by 2027.

The new National Travel and Tourism Strategy supports growth and competitiveness for an industry that, prior to the COVID-19 pandemic, generated $1.9 trillion in economic output and supported 9.5 million American jobs. Also, in 2019, nearly 80 million international travelers visited the United States and contributed nearly $240 billion to the U.S. economy, making the United States the global leader in revenue from international travel and tourism. As the top services export for the United States that year, travel and tourism generated a $53.4 billion trade surplus and supported 1 million jobs in the United States.

The strategy follows a four-point approach:

- Promoting the United States as a Travel Destination Goal : Leverage existing programs and assets to promote the United States to international visitors and broaden marketing efforts to encourage visitation to underserved communities.

- Facilitating Travel to and Within the United States Goal : Reduce barriers to trade in travel services and make it safer and more efficient for visitors to enter and travel within the United States.

- Ensuring Diverse, Inclusive, and Accessible Tourism Experiences Goal : Extend the benefits of travel and tourism by supporting the development of diverse tourism products, focusing on under-served communities and populations. Address the financial and workplace needs of travel and tourism businesses, supporting destination communities as they grow their tourism economies. Deliver world-class experiences and customer service at federal lands and waters that showcase the nation’s assets while protecting them for future generations.

- Fostering Resilient and Sustainable Travel and Tourism Goal : Reduce travel and tourism’s contributions to climate change and build a travel and tourism sector that is resilient to natural disasters, public health threats, and the impacts of climate change. Build a sustainable sector that integrates protecting natural resources, supporting the tourism economy, and ensuring equitable development.

Travel and Tourism Fast Facts

- The travel and tourism industry supported 9.5 million American jobs through $1.9 trillion of economic activity in 2019. In fact, 1 in every 20 jobs in the United States was either directly or indirectly supported by travel and tourism. These jobs can be found in industries like lodging, food services, arts, entertainment, recreation, transportation, and education.

- Travel and tourism was the top services export for the United States in 2019, generating a $53.4 billion trade surplus.

- The travel and tourism industry was one of the U.S. business sectors hardest hit by the COVID-19 pandemic and subsequent health and travel restrictions, with travel exports decreasing nearly 65% from 2019 to 2020.

- The decline in travel and tourism contributed heavily to unemployment; leisure and hospitality lost 8.2 million jobs between February and April 2020 alone, accounting for 37% of the decline in overall nonfarm employment during that time.

- By 2021, the rollout of vaccines and lifting of international and domestic restrictions allowed travel and tourism to begin its recovery. International arrivals to the United States grew to 22.1 million in 2021, up from 19.2 million in 2020. Spending by international visitors also grew, reaching $81.0 billion, or 34 percent of 2019’s total.

More about the Tourism Policy Council and the 2022 National Travel and Tourism Strategy

Created by Congress and chaired by Secretary Raimondo, the Tourism Policy Council (TPC) is the interagency council charged with coordinating national policies and programs relating to travel and tourism. At the direction of Secretary Raimondo, the TPC created a new five-year strategy to focus U.S. government efforts in support of the travel and tourism sector which has been deeply and disproportionately affected by the COVID-19 pandemic.

Read the full strategy here

What next for travel and tourism? Here's what the experts say

In many countries, more than 80% of travel and tourism spending actually comes from the domestic market. Image: Unsplash/Surface

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Julie Masiga

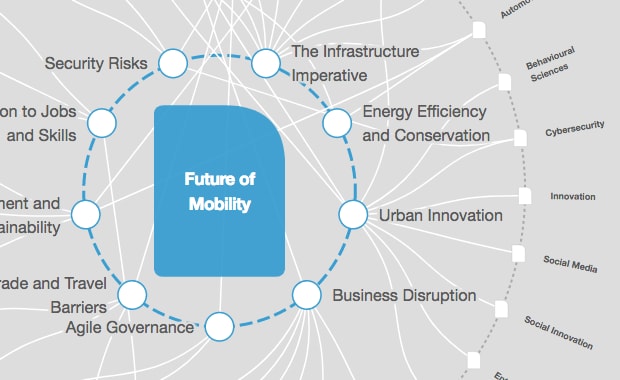

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} Mobility is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:.

- In 2020 alone, the travel and tourism sector lost $4.5 trillion and 62 million jobs globally.

- But as the world recovers from the impacts of the COVID-19 pandemic, travel and tourism can bounce back as an inclusive, sustainable, and resilient sector.

- Two experts highlight some of the key transformations in the sector going forward during the World Economic Forum's Our World in Transformation series.

The Travel & Tourism sector was one of the hardest hit by the COVID-19 pandemic, leaving not only companies but also tourism-driven economies severely affected by shutdowns, travel restrictions and the disappearance of international travel.

In 2020 alone, the sector lost $4.5 trillion and 62 million jobs, impacting the living standards and well-being of communities across the globe. Moreover, the halt in international travel gave both leisure and business travellers the chance to consider the impact of their choices on the climate and environment.

Amid shifting demand dynamics and future opportunities and risks, a more inclusive, sustainable and resilient travel and tourism sector can be - and needs to be - built.

The World Economic Forum's Travel & Tourism Development Index 2021 finds that embedding inclusivity, sustainability and resilience into the travel and tourism sector as it recovers, will ensure it can continue to be a driver of global connectivity, peace and economic and social progress.

We spoke to Sandra Carvao , Chief of Market Intelligence and Competitiveness at the United Nations World Tourism Organization (UNWTO), and Liz Ortiguera , CEO of the Pacific Asia Travel Association in Thailand (PATA), and asked them to highlight some of the key areas of risk and opportunity in the sector during an episode of the World Economic Forum's Our World in Transformation series.

Have you read?

Travel & tourism development index 2021: rebuilding for a sustainable and resilient future, towards resilience and sustainability: travel and tourism development recovery, how can we really achieve sustainability in the travel sector, what are some of the top global trends you're witnessing currently in the travel and tourism sector.

Liz Ortiguera: Given the extended lockdown that we had on travel with the pandemic, vacation for friends and relatives (VFR) is now a high priority for people who haven’t been in touch for a long time thanks to the pandemic. So, people are reconnecting. And that kind of links to the second trend, which is multi-purpose or blended travel. Never before, particularly now that we can connect digitally through Zoom, has the ability to work from anywhere enabled travellers to cover multiple purposes, like visits with friends and multiple business trips. So, we'll find that the duration of travel and the length of stay is longer. And third is the continued high focus on safety and wellness which is top of mind for travellers due to the pandemic. All travel is wellness-related now.

Sandra Carvao: I think there is a bigger concern with sustainability, which is very welcome in our industry. Consumers, particularly the younger generation, are much more aware of the impact they have, not only on the environment but also socially and on the communities they live in. We've also seen an increase in expenditure per trip, so I think people are very eager to go outside, and they're staying longer. And on the other side, I think there are some challenges: we’re seeing a rise in late bookings because restrictions can change at short notice and that’s having an impact on the decisions of travellers. This is putting pressure on the industry in terms of planning and anticipating fluctuations in demand.

Social media surveys have shown that travellers who have immersive experiences are more likely to post about them, which is good for the industry.

What is community-based tourism and why is it important?

Sandra Carvao: One of the positive impacts of the pandemic is that people are looking for local experiences and are spending more time with communities. So, the concept of community-based tourism is obviously one that puts the community at the core of every development, ensuring that it's engaged and empowered and that it benefits. At the UNWTO, we worked with the G20 and the Saudi presidency back in 2020 and produced a framework for tourism development in communities, which states that communities need to be part of the planning and management of tourism activities. We need to go beyond traditional definitions of community to a point where the industry leans on partnerships between the public and private sectors and communities.

Liz Ortiguera: In July 2022, PATA is hosting a destination-marketing forum and one of the key themes is community-based tourism. The purpose is really to put the community and authenticity-in-culture activities at the heart of the travel experience. There are benefits for all stakeholders. One is that travellers can have an authentic experience. They're not in overcrowded, touristic locations and they experience something new and unique within the community. These experiences are designed in partnership with communities who get the benefit of financial inclusion, and if activities are designed properly, the reinforcement of their cultural heritage. Governments also engage in economic development more broadly across countries. Another interesting trend is creative tourism, which means you create an experience for tourists to participate in, like a dance lesson, or a cooking lesson. Social media surveys have shown that travellers who have these kinds of immersive experiences are more likely to post about them online and that's good for the industry.

It is important to emphasize that virtual experiences, while they are a fun tool, can never replace visiting a destination.

How is technology and innovation helping to leverage cultural resources?

Sandra Carvao: One interesting trend we’re seeing is that more and more people are booking trips directly, so communities need to be supported to digitize their systems. Education and upskilling of communities are important so that they can leverage digital platforms to market themselves. From the tourists’ perspective, it is important to emphasize that virtual experiences, while they are a fun tool, can never replace visiting a destination.

Liz Ortiguera: People have been living virtually for more than two years. Amazing innovations have emerged, such as virtual reality and augmented reality, and all kinds of applications and tools. But the important thing is the experience. The destination. Real-world experiences need to remain front and centre. Technology tools should be viewed as enablers and not the core experience. And when it comes to staff, technology can really democratize education. There’s an opportunity to mobilize a mobile-first approach for those who are on the frontlines, or out in the field, and can’t easily access computers, but need to get real-time information.

How is the sector dealing with labour shortages and re-employment of the workforce?

Liz Ortiguera: Labour shortages are much more dynamic in North America and in Europe. But it’s having a knock-on effect on Asia. If, for example, their air carriers are limited by staff and they have to cancel flights, which we're very much seeing out of Europe, seating capacity then becomes a limiting factor in the recovery of Asia Pacific. That's the main constraint right now. And compounding that is the rising price of fuel. But people in the Asia Pacific are keen to get reemployed.

Sandra Carvao: Labour shortages are a priority for the sector in countries around the world. Many workers left the sector during the pandemic and the uncertainty that surrounded the measures taken to contain it left many people unsure of whether the sector would recover. It is time to address things like conditions, scheduling, and work/life balance, all things which have been top of mind for workers during the pandemic. As the sector recovers, we need time to bring new hires on board and to train them to take over where those who switched jobs left off.

Are we seeing a growing trend towards domestic tourism?

Sandra Carvao: We’re talking about 9 billion people travelling within their own countries. And in many countries, for example in Germany, more than 80% of the tourism spending actually comes from the domestic market, similarly in countries like Spain and even smaller economies. Whenever it's possible to travel again, domestic markets tend to be more resilient. They kick off first mostly due to perceptions of safety and security issues. As the world economy recovers from the pandemic, there is a good opportunity for nations to rethink their strategy, look at the domestic market in a different way, and leverage different products for domestic tourists.

When it comes to sustainable tourism, how quickly could we mainstream eco-friendly modes of transportation?

Sandra Carvao: Transport is one of the key contributors to energy impacts and tourism. But it's also important that we look at the whole value chain. The UNWTO together with the One Planet Sustainable Tourism Programme just launched the Glasgow Declaration, which includes green commitments from destinations and companies. We’re seeing a strong movement in the airline industry to reduce emissions. But I think, obviously, technological developments will be very important. But it's also very important to look at market shifts. And we can't forget small islands and developing states that rely on long-haul air travel. It’s important to make sure that we invest in making the problem much less impactful.

Liz Ortiguera: 'Travel and tourism' is such a broad encompassing term that it’s not fair to call it an industry: it is actually a sector of many industries. The pandemic taught us how broad the impact of the sector is in terms of sustainability. There's a big movement in terms of destination resilience, which is the foundation for achieving sustainability in the journey to net-zero. We now have standards to mitigate that impact including meetings-and-events (MIE) standards and standards for tour operators. There are multiple areas within our industry where progress is being made. And I'm really encouraged by the fact that there is such a focus not just within the sector but also among consumers.

This interview was first done at the World Economic Forum's studios in Geneva as part of 'Our World in Transformation' - a live interactive event series for our digital members. To watch all the episodes and join future sessions, please subscribe here .

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Industries in Depth .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

Robot rock stars, pocket forests, and the battle for chips - Forum podcasts you should hear this month

Robin Pomeroy and Linda Lacina

April 29, 2024

Agritech: Shaping Agriculture in Emerging Economies, Today and Tomorrow

Confused about AI? Here are the podcasts you need on artificial intelligence

Robin Pomeroy

April 25, 2024

Which technologies will enable a cleaner steel industry?

Daniel Boero Vargas and Mandy Chan

Industry government collaboration on agritech can empower global agriculture

Abhay Pareek and Drishti Kumar

April 23, 2024

Nearly 15% of the seafood we produce each year is wasted. Here’s what needs to happen

Charlotte Edmond

April 11, 2024

Reimagining the $9 trillion tourism economy—what will it take?

Tourism made up 10 percent of global GDP in 2019 and was worth almost $9 trillion, 1 See “Economic impact reports,” World Travel & Tourism Council (WTTC), wttc.org. making the sector nearly three times larger than agriculture. However, the tourism value chain of suppliers and intermediaries has always been fragmented, with limited coordination among the small and medium-size enterprises (SMEs) that make up a large portion of the sector. Governments have generally played a limited role in the industry, with partial oversight and light-touch management.

COVID-19 has caused an unprecedented crisis for the tourism industry. International tourist arrivals are projected to plunge by 60 to 80 percent in 2020, and tourism spending is not likely to return to precrisis levels until 2024. This puts as many as 120 million jobs at risk. 2 “International tourist numbers could fall 60-80% in 2020, UNWTO reports,” World Tourism Organization, May 7, 2020, unwto.org.

Reopening tourism-related businesses and managing their recovery in a way that is safe, attractive for tourists, and economically viable will require coordination at a level not seen before. The public sector may be best placed to oversee this process in the context of the fragmented SME ecosystem, large state-owned enterprises controlling entry points, and the increasing impact of health-related agencies. As borders start reopening and interest in leisure rebounds in some regions , governments could take the opportunity to rethink their role within tourism, thereby potentially both assisting in the sector’s recovery and strengthening it in the long term.

In this article, we suggest four ways in which governments can reimagine their role in the tourism sector in the context of COVID-19.

1. Streamlining public–private interfaces through a tourism nerve center

Before COVID-19, most tourism ministries and authorities focused on destination marketing, industry promotions, and research. Many are now dealing with a raft of new regulations, stimulus programs, and protocols. They are also dealing with uncertainty around demand forecasting, and the decisions they make around which assets—such as airports—to reopen will have a major impact on the safety of tourists and sector employees.

Coordination between the public and private sectors in tourism was already complex prior to COVID-19. In the United Kingdom, for example, tourism falls within the remit of two departments—the Department for Business, Energy, and Industrial Strategy (BEIS) and the Department for Digital, Culture, Media & Sport (DCMS)—which interact with other government agencies and the private sector at several points. Complex coordination structures often make clarity and consistency difficult. These issues are exacerbated by the degree of coordination that will be required by the tourism sector in the aftermath of the crisis, both across government agencies (for example, between the ministries responsible for transport, tourism, and health), and between the government and private-sector players (such as for implementing protocols, syncing financial aid, and reopening assets).

Concentrating crucial leadership into a central nerve center is a crisis management response many organizations have deployed in similar situations. Tourism nerve centers, which bring together public, private, and semi-private players into project teams to address five themes, could provide an active collaboration framework that is particularly suited to the diverse stakeholders within the tourism sector (Exhibit 1).

We analyzed stimulus packages across 24 economies, 3 Australia, Bahrain, Belgium, Canada, Egypt, Finland, France, Germany, Hong Kong, Indonesia, Israel, Italy, Kenya, Malaysia, New Zealand, Peru, Philippines, Singapore, South Africa, South Korea, Spain, Switzerland, Thailand, and the United Kingdom. which totaled nearly $100 billion in funds dedicated directly to the tourism sector, and close to $300 billion including cross-sector packages with a heavy tourism footprint. This stimulus was generally provided by multiple entities and government departments, and few countries had a single integrated view on beneficiaries and losers. We conducted surveys on how effective the public-sector response has been and found that two-thirds of tourism players were either unaware of the measures taken by government or felt they did not have sufficient impact. Given uncertainty about the timing and speed of the tourism recovery, obtaining quick feedback and redeploying funds will be critical to ensuring that stimulus packages have maximum impact.

2. Experimenting with new financing mechanisms

Most of the $100 billion stimulus that we analyzed was structured as grants, debt relief, and aid to SMEs and airlines. New Zealand has offered an NZ $15,000 (US $10,000) grant per SME to cover wages, for example, while Singapore has instituted an 8 percent cash grant on the gross monthly wages of local employees. Japan has waived the debt of small companies where income dropped more than 20 percent. In Germany, companies can use state-sponsored work-sharing schemes for up to six months, and the government provides an income replacement rate of 60 percent.

Our forecasts indicate that it will take four to seven years for tourism demand to return to 2019 levels, which means that overcapacity will be the new normal in the medium term. This prolonged period of low demand means that the way tourism is financed needs to change. The aforementioned types of policies are expensive and will be difficult for governments to sustain over multiple years. They also might not go far enough. A recent Organisation for Economic Co-operation and Development (OECD) survey of SMEs in the tourism sector suggested more than half would not survive the next few months, and the failure of businesses on anything like this scale would put the recovery far behind even the most conservative forecasts. 4 See Tourism policy responses to the coronavirus (COVID-19), OECD, June 2020, oecd.org. Governments and the private sector should be investigating new, innovative financing measures.

Revenue-pooling structures for hotels

One option would be the creation of revenue-pooling structures, which could help asset owners and operators, especially SMEs, to manage variable costs and losses moving forward. Hotels competing for the same segment in the same district, such as a beach strip, could have an incentive to pool revenues and losses while operating at reduced capacity. Instead of having all hotels operating at 20 to 40 percent occupancy, a subset of hotels could operate at a higher occupancy rate and share the revenue with the remainder. This would allow hotels to optimize variable costs and reduce the need for government stimulus. Non-operating hotels could channel stimulus funds into refurbishments or other investment, which would boost the destination’s attractiveness. Governments will need to be the intermediary between businesses through auditing or escrow accounts in this model.

Joint equity funds for small and medium-size enterprises

Government-backed equity funds could also be used to deploy private capital to help ensure that tourism-related SMEs survive the crisis (Exhibit 2). This principle underpins the European Commission’s temporary framework for recapitalization of state-aided enterprises, which provided an estimated €1.9 trillion in aid to the EU economy between March and May 2020. 5 See “State aid: Commission expands temporary framework to recapitalisation and subordinated debt measures to further support the economy in the context of the coronavirus outbreak,” European Commission, May 8, 2020, ec.europa.eu. Applying such a mechanism to SMEs would require creating an appropriate equity-holding structure, or securitizing equity stakes in multiple SMEs at once, reducing the overall risk profile for the investor. In addition, developing a standardized valuation methodology would avoid lengthy due diligence processes on each asset. Governments that do not have the resources to co-invest could limit their role to setting up those structures and opening them to potential private investors.

3. Ensuring transparent, consistent communication on protocols

The return of tourism demand requires that travelers and tourism-sector employees feel—and are—safe. Although international organizations such as the International Air Transport Association (IATA), and the World Travel & Tourism Council (WTTC) have developed a set of guidelines to serve as a baseline, local regulators are layering additional measures on top. This leads to low levels of harmonization regarding regulations imposed by local governments.

Our surveys of traveler confidence in the United States suggests anxiety remains high, and authorities and destination managers must work to ensure travelers know about, and feel reassured by, protocols put in place for their protection. Our latest survey of traveler sentiment in China suggests a significant gap between how confident travelers would like to feel and how confident they actually feel; actual confidence in safety is much lower than the expected level asked a month before.

One reason for this low level of confidence is confusion over the safety measures that are currently in place. Communication is therefore key to bolstering demand. Experience in Europe indicates that prompt, transparent, consistent communications from public agencies have had a similar impact on traveler demand as CEO announcements have on stock prices. Clear, credible announcements regarding the removal of travel restrictions have already led to increased air-travel searches and bookings. In the week that governments announced the removal of travel bans to a number of European summer destinations, for example, outbound air travel web search volumes recently exceeded precrisis levels by more than 20 percent in some countries.

The case of Greece helps illustrate the importance of clear and consistent communication. Greece was one of the first EU countries to announce the date of, and conditions and protocols for, border reopening. Since that announcement, Greece’s disease incidence has remained steady and there have been no changes to the announced protocols. The result: our joint research with trivago shows that Greece is now among the top five summer destinations for German travelers for the first time. In July and August, Greece will reach inbound airline ticketing levels that are approximately 50 percent of that achieved in the same period last year. This exceeds the rate in most other European summer destinations, including Croatia (35 percent), Portugal (around 30 percent), and Spain (around 40 percent). 6 Based on IATA Air Travel Pulse by McKinsey. In contrast, some destinations that have had inconsistent communications around the time frame of reopening have shown net cancellations of flights for June and July. Even for the high seasons toward the end of the year, inbound air travel ticketing barely reaches 30 percent of 2019 volumes.

Digital solutions can be an effective tool to bridge communication and to create consistency on protocols between governments and the private sector. In China, the health QR code system, which reflects past travel history and contact with infected people, is being widely used during the reopening stage. Travelers have to show their green, government-issued QR code before entering airports, hotels, and attractions. The code is also required for preflight check-in and, at certain destination airports, after landing.

4. Enabling a digital and analytics transformation within the tourism sector

Data sources and forecasts have shifted, and proliferated, in the crisis. Last year’s demand prediction models are no longer relevant, leaving many destinations struggling to understand how demand will evolve, and therefore how to manage supply. Uncertainty over the speed and shape of the recovery means that segmentation and marketing budgets, historically reassessed every few years, now need to be updated every few months. The tourism sector needs to undergo an analytics transformation to enable the coordination of marketing budgets, sector promotions, and calendars of events, and to ensure that products are marketed to the right population segment at the right time.

Governments have an opportunity to reimagine their roles in providing data infrastructure and capabilities to the tourism sector, and to investigate new and innovative operating models. This was already underway in some destinations before COVID-19. Singapore, for example, made heavy investments in its data and analytics stack over the past decade through the Singapore Tourism Analytics Network (STAN), which provided tourism players with visitor arrival statistics, passenger profiling, spending data, revenue data, and extensive customer-experience surveys. During the COVID-19 pandemic, real-time data on leading travel indicators and “nowcasts” (forecasts for the coming weeks and months) could be invaluable to inform the decisions of both public-sector and private-sector entities.

This analytics transformation will also help to address the digital gap that was evident in tourism even before the crisis. Digital services are vital for travelers: in 2019, more than 40 percent of US travelers used mobile devices to book their trips. 7 Global Digital Traveler Research 2019, Travelport, marketing.cloud.travelport.com; “Mobile travel trends 2019 in the words of industry experts,” blog entry by David MacHale, December 11, 2018, blog.digital.travelport.com. In Europe and the United States, as many as 60 percent of travel bookings are digital, and online travel agents can have a market share as high as 50 percent, particularly for smaller independent hotels. 8 Sean O’Neill, “Coronavirus upheaval prompts independent hotels to look at management company startups,” Skift, May 11, 2020, skift.com. COVID-19 is likely to accelerate the shift to digital as travelers look for flexibility and booking lead times shorten: more than 90 percent of recent trips in China were booked within seven days of the trip itself. Many tourism businesses have struggled to keep pace with changing consumer preferences around digital. In particular, many tourism SMEs have not been fully able to integrate new digital capabilities in the way that larger businesses have, with barriers including language issues, and low levels of digital fluency. The commission rates on existing platforms, which range from 10 percent for larger hotel brands to 25 percent for independent hotels, also make it difficult for SMEs to compete in the digital space.

Governments are well-positioned to overcome the digital gap within the sector and to level the playing field for SMEs. The Tourism Exchange Australia (TXA) platform, which was created by the Australian government, is an example of enabling at scale. It acts as a matchmaker, connecting suppliers with distributors and intermediaries to create packages attractive to a specific segment of tourists, then uses tourist engagement to provide further analytical insights to travel intermediaries (Exhibit 3). This mechanism allows online travel agents to diversify their offerings by providing more experiences away from the beaten track, which both adds to Australia’s destination attractiveness, and gives small suppliers better access to customers.

Governments that seize the opportunity to reimagine tourism operations and oversight will be well positioned to steer their national tourism industries safely into—and set them up to thrive within—the next normal.

Download the article in Arabic (513KB)

Margaux Constantin is an associate partner in McKinsey’s Dubai office, Steve Saxon is a partner in the Shanghai office, and Jackey Yu is an associate partner in the Hong Kong office.

The authors wish to thank Hugo Espirito Santo, Urs Binggeli, Jonathan Steinbach, Yassir Zouaoui, Rebecca Stone, and Ninan Chacko for their contributions to this article.

Explore a career with us

Related articles.

Make it better, not just safer: The opportunity to reinvent travel

Hospitality and COVID-19: How long until ‘no vacancy’ for US hotels?

A new approach in tracking travel demand

Travel, Tourism & Hospitality

Travel and tourism in the U.S. - statistics & facts

What are the most popular travel destinations in the u.s., u.s. travel trends, key insights.

Detailed statistics

Tourism contribution to GDP in the U.S. 2019-2022

Total travel expenditures in the U.S. 2019-2026

Number of domestic leisure and business trips in the U.S. 2019-2026

Editor’s Picks Current statistics on this topic

International travel spending in the U.S. 2019-2026

Leading city destinations in the U.S. 2019, by number of international arrivals

Further recommended statistics

Industry overview.

- Basic Statistic Tourism contribution to GDP in the U.S. 2019-2022

- Premium Statistic Total travel expenditures in the U.S. 2019-2026

- Premium Statistic Direct travel spending in the U.S. 2019-2022, by traveler type

- Basic Statistic Countries that visited the U.S. the most 2019-2022

- Basic Statistic Leading outbound travel markets in the U.S. 2019-2022, country

- Basic Statistic Contribution of travel and tourism to employment in the U.S. 2019-2022

- Premium Statistic Most visited states in the U.S. 2022

Total contribution of travel and tourism to the gross domestic product (GDP) in the United States in 2019 and 2022 (in trillion U.S. dollars)

Total travel spending in the United States from 2019 to 2022, with a forecast until 2026 (in trillion U.S. dollars)

Direct travel spending in the U.S. 2019-2022, by traveler type

Total direct travel spending in the United States from 2019 to 2022, by type of traveler (in billion U.S. dollars)

Countries that visited the U.S. the most 2019-2022

Distribution of international tourist arrivals in the United States in 2019 and 2022, by country

Leading outbound travel markets in the U.S. 2019-2022, country

Distribution of outbound tourist departures in the United States in 2019 and 2022, by country

Contribution of travel and tourism to employment in the U.S. 2019-2022

Contribution of travel and tourism to employment in the United States in 2019 and 2022 (in millions)

Most visited states in the U.S. 2022

Most visited states by adults in the United States as of September 2022

Key players

- Premium Statistic Leading holiday travel provider websites in the U.S. Q2 2023, by share of voice

- Premium Statistic Number of aggregated downloads of leading travel apps in the U.S. 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps in the U.S. 2023

- Basic Statistic American Customer Satisfaction Index for internet travel companies U.S. 2002-2024

- Premium Statistic American Customer Satisfaction Index for U.S. lodging companies 2008-2024, by company

Leading holiday travel provider websites in the U.S. Q2 2023, by share of voice

Leading travel brands in the United States in 2nd quarter 2023, by share of voice

Number of aggregated downloads of leading travel apps in the U.S. 2023

Number of aggregated downloads of selected leading travel apps in the United States in 2023 (in millions)

Number of aggregated downloads of leading online travel agency apps in the U.S. 2023

Number of aggregated downloads of selected leading online travel agency apps in the United States in 2023 (in millions)

American Customer Satisfaction Index for internet travel companies U.S. 2002-2024

American Customer Satisfaction Index Scores for internet travel companies in the United States from 2002 to 2024

American Customer Satisfaction Index for U.S. lodging companies 2008-2024, by company

American Customer Satisfaction Index scores for lodging companies in the United States from 2008 to 2024, by company

- Premium Statistic U.S. hotel and motel industry market size 2012-2022

- Premium Statistic Number of hotel jobs in the U.S. 2019-2022

- Premium Statistic ADR of hotels in the U.S. 2001-2022

- Premium Statistic Occupancy rate of the U.S. hotel industry 2001-2022

- Premium Statistic Revenue per available room of the U.S. hotel industry 2001-2022

- Premium Statistic Change in monthly number of hotel bookings in the U.S. 2020-2023

- Premium Statistic YoY monthly change in number of online hotel searches in the U.S. 2020-2023

U.S. hotel and motel industry market size 2012-2022

Market size of the hotel and motel sector in the United States from 2012 to 2022 (in billion U.S. dollars)

Number of hotel jobs in the U.S. 2019-2022

Number of hotel jobs in the United States from 2019 to 2022, with a forecast for 2023 (in millions)

ADR of hotels in the U.S. 2001-2022

Average daily rate of hotels in the United States from 2001 to 2022 (in U.S. dollars)

Occupancy rate of the U.S. hotel industry 2001-2022

Occupancy rate of the hotel industry in the United States from 2001 to 2022

Revenue per available room of the U.S. hotel industry 2001-2022

Revenue per available room (RevPAR) of hotel industry in the United States from 2001 to 2022 (in U.S. dollars)

Change in monthly number of hotel bookings in the U.S. 2020-2023

Year-over-year monthly change in number of hotel bookings in the United States from 2020 to 2023

YoY monthly change in number of online hotel searches in the U.S. 2020-2023

Year-over-year monthly change in number of online hotel searches in the United States from 2020 to 2023

Attractions

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Premium Statistic U.S. amusement park industry market size 2011-2022

- Premium Statistic Landmarks most recommended visitors in the U.S. 2022

Leading museums by highest attendance worldwide 2019-2022

Most visited museums worldwide from 2019 to 2022 (in millions)

Most visited amusement and theme parks worldwide 2019-2022

Leading amusement and theme parks worldwide from 2019 to 2022, by attendance (in millions)

U.S. amusement park industry market size 2011-2022

Market size of the amusement park sector in the United States from 2011 to 2022 (in billion U.S. dollars)

Landmarks most recommended visitors in the U.S. 2022

Most recommended landmarks by visitors in the United States as of September 2022

City tourism

- Basic Statistic City destinations with the highest direct travel and tourism GDP worldwide 2022

- Premium Statistic World's highest-priced business travel destinations Q4 2022

- Basic Statistic Selected cities with the highest hotel rates in the U.S. as of September 2023

- Basic Statistic Most affordable cities for backpacking in the U.S. 2024, by daily price

- Premium Statistic Average price per night of Airbnb listings in selected U.S. cities 2024

- Premium Statistic Number of Airbnb listings in selected U.S. cities 2024

City destinations with the highest direct travel and tourism GDP worldwide 2022

Leading city tourism destinations worldwide in 2022, ranked by direct contribution of travel and tourism to GDP (in billion U.S. dollars)

World's highest-priced business travel destinations Q4 2022

Most expensive cities for business tourism worldwide in 4th quarter 2022, by average daily costs (in U.S. dollars)

Selected cities with the highest hotel rates in the U.S. as of September 2023

Selected cities with the most expensive hotel rates in the United States as of September 2023 (in U.S. dollars)

Most affordable cities for backpacking in the U.S. 2024, by daily price

Most affordable cities for backpacking in the United States as of January 2024, by daily price (in U.S. dollars)

Average price per night of Airbnb listings in selected U.S. cities 2024

Average price per night of Airbnb listings in selected cities in the United States as of February 2024 (in U.S. dollars)

Number of Airbnb listings in selected U.S. cities 2024

Number of Airbnb listings in selected cities in the United States as of February 2024

Sustainable tourism

- Premium Statistic Travelers who find sustainable travel important in the U.S. 2022

- Premium Statistic Share of travelers that plan to make sustainable travel choices in the U.S. 2022

- Premium Statistic How much more travelers would pay to make a trip more sustainable in the U.S. 2022

- Premium Statistic U.S. consumers who have paid extra for sustainable travel in the past two years 2022

- Premium Statistic U.S. consumers willing to pay extra for a sustainable travel provider 2022

- Premium Statistic Share of U.S. travelers that feel guilty over non-eco-friendly past travel 2022

- Premium Statistic Reasons travelers were against staying in sustainable hotels in the U.S. 2022

Travelers who find sustainable travel important in the U.S. 2022

Share of travelers that think sustainable travel is important in the United States as of February 2022

Share of travelers that plan to make sustainable travel choices in the U.S. 2022

Share of travelers that intend to make more sustainable travel decisions in the United States as of March 2022

How much more travelers would pay to make a trip more sustainable in the U.S. 2022

Extra cost travelers would be willing to pay to make a trip more carbon friendly in the United States as of March 2022

U.S. consumers who have paid extra for sustainable travel in the past two years 2022

Share of consumers that have paid extra for sustainable travel in the past two years in the United States as of February 2022

U.S. consumers willing to pay extra for a sustainable travel provider 2022

Share of consumers willing to pay extra for a sustainable travel provider in the United States as of February 2022

Share of U.S. travelers that feel guilty over non-eco-friendly past travel 2022

Share of travelers that experience guilt over past trips not being sustainable in the United States as of August 2022

Reasons travelers were against staying in sustainable hotels in the U.S. 2022

Reasons travelers were against staying in a hotel with sustainable practices in the United States as of August 2022

- Premium Statistic Priorities when choosing a leisure travel destination in the U.S. 2023, by generation

- Premium Statistic Leading destinations travelers intend to visit in the next 12 months in the U.S. 2023

- Premium Statistic Trust in travel and hospitality brands in the U.S. 2023, by brand type

- Premium Statistic American Customer Satisfaction Index: travel and tourism industries in the U.S. 2024

Priorities when choosing a leisure travel destination in the U.S. 2023, by generation

Main factors for choosing a leisure travel destination among adults in the United States as of May 2023, by generation

Leading destinations travelers intend to visit in the next 12 months in the U.S. 2023

Leading leisure travel destinations travelers intend to go to in the next 12 months in the United States as of September 2023

Trust in travel and hospitality brands in the U.S. 2023, by brand type

Level of trust in travel and hospitality brands in the United States as of September 2023, by brand type

American Customer Satisfaction Index: travel and tourism industries in the U.S. 2024

American Customer Satisfaction Index for the travel and tourism sector in the United States in 2024, by industry

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

An official website of the United States government

- Special Topics

Travel and Tourism

Travel and tourism satellite account for 2018-2022.

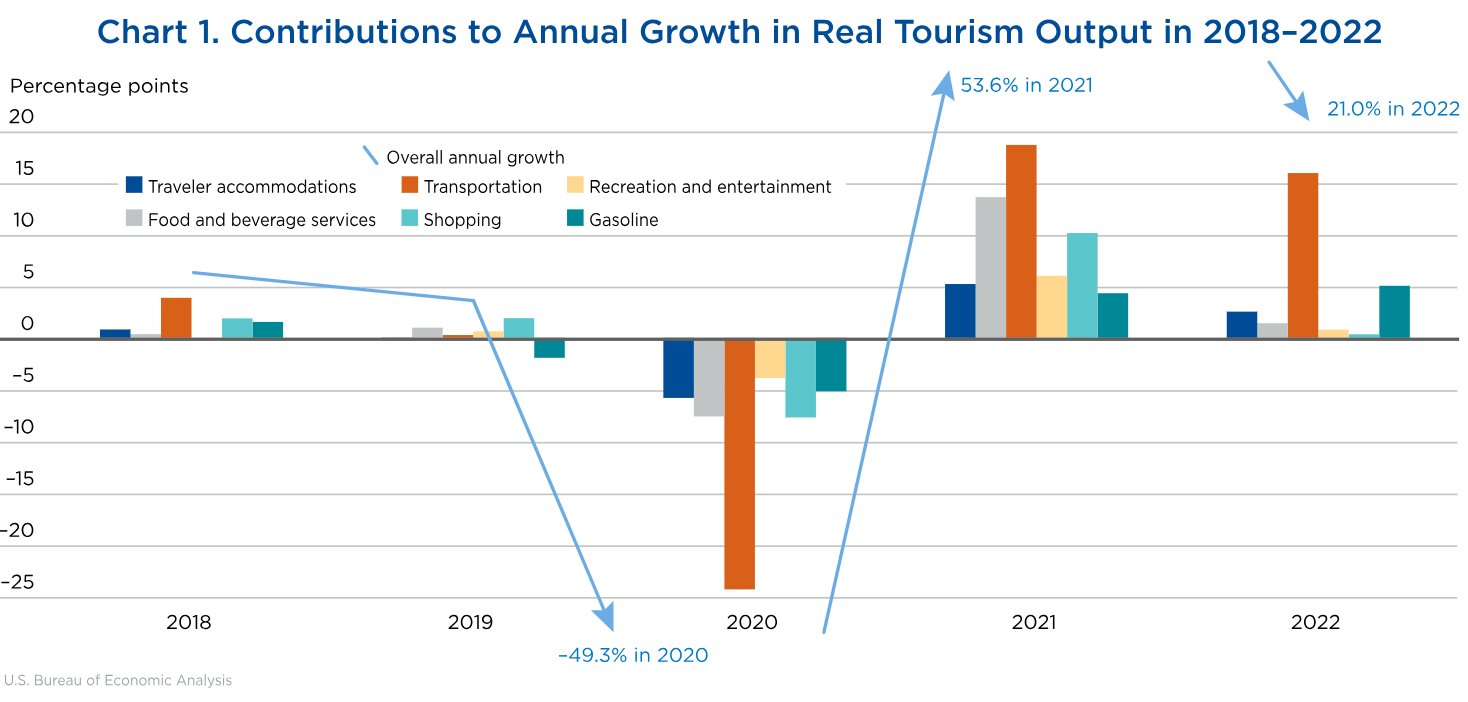

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2018–2022 By Hunter Arcand and Paul Kern - Survey of Current Business April 2024

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

Download WP Travel

Please enter your email to download WP Travel and also get amazing WP Travel offers and Newsletters.

Global Tourism Statistics 2024:Facts and Forecasts

Home » Blog » Global Tourism Statistics 2024:Facts and Forecasts

After the massive hit of the COVID-19 pandemic, global tourism’s future and trends tend to move towards an upward shift. This paradigm shift has a gigantic impact on tourism and related activities. So, we will delve more into Global Tourism Statistics 2024:Facts and Forecasts today.

There was a subsequent rise in GDP after the COVID-19 pandemic period . Statista predicted in 2022 that the tourism industry will get back on track as tourists tend to be inbound and outbound from place to place.

Table of contents

Global tourism analysis, global tourism statistics 2019, global tourism statistics 2020, global tourism statistics 2021, global tourism statistics 2022, global tourism statistics 2023, global tourism statistics 2024 | predictive analysis, international tourist arrivals in 2024.

- Global Tourism Contributions to GDP 2024

Global Tourism Growth Rate 2024

Global tourism revenue growth rate 2024.

The tourism industry and activities started to flourish after the pandemic. The number started to rise again. Global Tourism Statistics predicted that the travel and tourism business will experience 18% growth in 2024.

This is the highest point after the pandemic period. Hotel bookings, travel, and tourism businesses are expected to reach new heights. Experts suggest it’s the best time to start your own travel agency business.

- International tourist arrivals worldwide were around 95,000 at the beginning of 2019.

- The growth rate of tourist arrivals was slower.

- Nearly $1.9 trillion was spent by tourists in 2019.

- Travel receipts were around $9.3 billion in 2019.

Global Tourism was about $8.9 trillion in 2019 . Tourists love to explore beautiful countries. And popular destinations. France tends to hold the Number 1 position in 2019 as more than 90 million tourists visit the country.

(Top 5 visited countries 2019)

Moreover, 2019 tourism was slightly disturbed by covid 19 from July. However, there were many popular destinations loved by tourists worldwide.

In 2019, the total spending on world tourism reached a peak of $1.86 trillion, showing a growth of 1.81% compared to the previous year.

This indicates that people tend to spend more on travel and tourism activities, contributing to the overall tourism industry’s economic enhancement.

The increase in spending suggests a continued interest and investment in tourism experiences on a global scale.

There was a massive decline in the travel and tourism industry in 2020. The tourism industry declined by more than 67% compared to the previous year . This makes one of the greatest downward shifts in the tourism industry ever recorded after subsequent time.

Pacific island Fiji tends to face an economic crisis because of a decline in tourist and tourism activities. Countries relying totally on tourism were more affected this year.

From January to May 2020. International tourist arrivals declined by more than 56% similarly in April it was recorded with a decline of 97%.

(Decline in international tourist arrivals 2019 vs 2022))

The limited movement of people from place to place results in a massive loss for the aviation industry as well.

Air passenger was reduced by almost 60.2% compared to 2019 . This creates the worst conditions for the airline industry. Among many industries airline industry was one of the most impacted as there was a decline in tourist flow.

- GDP of tourism ( 2.9 of GDP) $624.7 billion was declined to $356.8 (1.7 of GDP) making it the greatest downfall of all time in tourism history.

- Total number of visitors in 2020 was comparatively low compared with the past 10 years of data.

- Tourism-dependent countries faced a major economic crisis.

Overall global tourism in 2020 didn’t grow that well the unpredictable circumstance has resulted in a massive decline in the GPD as well. There were approximately 1.5 billion tourist arrivals in 2019 and the number declined by more than 75% in 2020 the estimated tourist arrival in 2020 was around 381 million only. Compared with the 2019 tourist arrival the data fluctuation is very high.

The Tourism industry has gone through numerous uptrends and downtrends throughout the period. 2019 ended and 2020 was considered one of the most challenging years for the whole tourism industry. Regarding 2021 the tourism industry starts to rise at a minimal speed.

In 2021 tourism industry start to gain speed at a minimal rate according to the popular data analytical site Statista. Global tourism worldwide increased by 4% in 2021 compared to 2020.

Matter of fact the international tourist arrival was 79% down compared with the 2019 tourist inbound data.

Recovering from the mass decline of 2020 the tourism industry started to increase with several 64.4% in 2021. The travel and tourism increment number in 2020 was only 50.7%

(Decline in international tourist arrivals)

In 2021, the US had 22.1 million inbound arrivals, which is a 15% increase from 2020 and a 72% decrease from 2019.

- Overall increment in the tourism industry was recorded at more than 64.4 %

- Export revenues from international tourism dropped 59%.

- In 2021, the travel and tourism industry’s share of GDP increased from 1.54% in 2020 to 2.15% in 2021.

- Compared to 2019 the contribution of GDP was still down in 2021 ( 49.1% ) only.

- Recovering from the pandemic travel and tourism businesses tend to increase by more than 362 billion dollars.

Regarding 2021 tourism status it has shown a little increment in terms of number compared with the 2020 data. The industry recorded a substantial 64.4% growth , surpassing the incremental rate in 2020.

Export revenues dropped by 59%, while the industry’s share of GDP improved from 1.54% in 2020 to 2.15% in 2021 . Despite signs of recovery, the sector has not reached its growth level in 2020.

Comparing the tourism condition with the year 2021 the number and data start to shift toward an upward curve. Analyzing the data deeply in 2022 total international tourism receipt reached the threshold of $1 trillion which is massive compared to the 2022 number.

However, the total receipts were still not able to reach the number of pre-pandemic. In 2022 more than 900 million tourists travel internationally.

International tourist spending reached 64% of pre-pandemic levels. 2022 start to maintain sort of momentum to reach the peak point of travel and tourism activities.

(Travel and tourism contribution over GDP from 2019 to 2022 )

- The total earned export revenue was still below the line ( 34 % ) below pre pre-pandemic level.

- $7.7 trillion contribution to global GDP

- Significant growth in spending of international visitors ( about 20.4% increment )

- 2022 travel and tourism generated more than 22 million new jobs . Significantly high in number compared to 2021 data.

The travel and tourism sector ultimately makes a contribution of 7.7 trillion dollars to global gross domestic product ( GDP ). The number is shifting in an upward trend compared with other previous years.

The 2022 travel and tourism activities maintained a pace of recovery mode. The industry maintained to level up from the previous year. As it intends to create more jobs and contribute more to the global economy and GDP.

All the dimensions of the tourism industry in 2022 start to evolve and grow over time. Ultimately the revenue received from tourists hit a whopping $1 trillion and more than 900 million people travel globally.

The travel industry solely created millions of jobs and contributed to overall economic growth.

Popular website for travel and tourism data stated that more than 975 million tourists were traveling internationally in the year 2023. Compared with 2021 and 2022 this year seems to be beneficial for travel and tourism industries.

In the first quarter of 2023, there is a spike in the growth of tourist arrivals. International tourist arrival reached 80% of pre-pandemic level. This states that the year 2023 is a sort of recovery year for the tourism industry. After years the industry was able to reach this point.

The travel and tourism industry somehow was able to reach progress similar to the year 2019. Travel bookings were up r oughly 31% at the end of March 2023 compared to the same time in 2019.

The travel and tourism health progress up to 87% in the year 2023. The USA tends to be a prime actor as it was able to accumulate more than $190.39 billion U.S. dollars.

Followed by the supreme country China and Canada.

China accumulated around $154.02 billion U.S. dollars followed by Canada which is $16 billion U.S. dollars.

The total gap between Canada and the USA is around $174.39 billion U.S. dollars respectively. In terms of numbers, these countries seem to do well in the tourism industry.

(Top 5 Visited Countries 2023 )

- Over 975 million tourists traveled worldwide in 2023 ( Jan to Sep)

- The total projected contribution of travel and tourism was around $2.2 trillion U.S. dollars toward global GDP.

- The total international receipt projected in 2023 was around USD 1.4 trillion .

- Compared with other years in 2023, there were more than 171 nights spent compared to 2022.

- Rise in tourist traveling rate results into increment in increment in hotel occupancy rate up to 10% higher compared to the previous year.

Airline industries also tend to bounce back as revenues reach more than $803 billion , Comparatively it’s higher than 2022 as it reached around 9.7%.

Certain external factors do impact the travel business globally. The economic sanctions on Russia by different nations have resulted in delays in travel and tourism as well. Similarly, the zero COVID strategy promulgated by China has also affected the tourism industry overall.

The momentum of global tourism could potentially shift to an upward curve if all external factors don’t interrupt travel and tourism activities.

2024 is regarded as one of the important years for the travel and tourism sector. As the impact of COVID-19 started to overcome the travel and tourism business all across the world started to gain momentum throughout the time.

There are thorough predictions made for 2024 tourism. Multiple analyses tend to show potential opportunities for the tourism sector. From 2019 to 2023 the industry of tourism was scattered by COVID-19 after the interference of COVID-19 the cycle of 2024 tourism got into rollercoaster rides.

However, global tourism spending is predicted to reach $2 trillion in 2024 . After a long period, it’s predicted that international travel trips will exceed pre-pandemic levels in 2024, marking a 3% increase from 2019 .

The overall tourism market will get to a new level. The prediction is that the travel and tourism market will reach $927.30 billion in 2024 . Which is one of the big numbers compared to the previous year’s global tourism statistics.

After lot’s of ups and downs finally the travel and tourism industry is getting into momentum. It’s expected that tourist arrivals in 2024 will increase by 17.23% from the past year i.e. 2023. If the industry can meet the expectation there will be massive changes in the overall tourism business.

- The expected international tourists is about 1.53 billion which is significantly large compared to the previous year.

- the GDP contribution by tourism in 2024 will be 10.6%

- Year-to-year growth in 2024 will be increased by a large number as expectation of over 17.24 % is made.

- Ultimately the revenue will be around US 9.4 billion American dollars .

In 2024, the travel and tourism industry is on the rise after facing challenges. There’s a big anticipation of a 17.23% increase in tourist arrivals compared to 2023.

(International Tourist Arrival in 2024 )

If this expectation is met, it could bring significant positive changes to the overall tourism business.

The projected number of international tourists for 2024 is a substantial 1.53 billion, a noteworthy increase from the previous year.

The industry’s contribution to the global GDP in 2023 was 10.6%. Looking ahead, there’s an optimistic year-to-year growth forecast of over 17.24% in 2024.

In terms of revenue, the industry is expected to generate around US $9.4 billion . These promising figures indicate a strong recovery and growth for the travel and tourism sector in the coming year.

Global Tourism Contributions to GDP 2024

The travel and tourism industry is getting on track after facing challenges in recent years. For 2024, there is an optimistic growth outlook:

- Tourist arrivals are expected to increase by 17.23% from 2023 . If this matches the expectations, it could bring major positive impacts for the overall tourism business.

- International tourist projections sit at a substantial 1.53 billion for 2024, a significant jump from the previous year’s numbers.

- The industry contributed 10.6% to global GDP in 2023.

- For 2024, year-over-year growth forecasts are a promising 17.24%, indicating strong momentum.

- In terms of revenue generation, the travel sector could reach around USD 9.4 billion.

(2024 Global Tourism Contribution To GDP)

These numbers and projections point to a rapid recovery and expansion period for international and domestic travel over the coming year.

More people are expected to take vacations and business trips that could greatly benefit tour operators, hotels, airlines, and other travel entities after facing struggles not too long ago.

If the above expectations and forecasts are fulfilled, 2024 is shaping up to be a beneficial year for travel and tourism when looking at tourist arrivals, GDP contributions, growth percentages, and total revenue creation. There seems to be renewed optimism across the sector.

Overall ,the travel and tourism industry holds a positive growth approach in 2024 according to projections:

- Global tourism saw significant declines in 2020 and 2021 due to the COVID-19 pandemic. However, momentum picked back up in 2022.

- For 2023, the estimated growth rate in global tourism is between 30% to 35% as the industry rebounds.

- Looking ahead to 2024 , the global tourism growth rate is forecasted to be around 34.7%.

- This would represent a noticeable jump from the expected 30-35% growth in 2023 showing sustained positive momentum.

- If 2024 hits the projected 34.7% in tourism growth , it would take global travel significantly above 2019 volumes indicating a full industry comeback has been achieved.

- This global growth also implies strong performance in major tourism markets across different regions like Europe, Asia Pacific, the Americas, the Middle East, and Africa.

(Global Tourism Growth Rate 2024)

Ultimately, 2024 is setting up to be another very high growth year for travel globally with expectations of over one-third increase in tourism versus 2023 numbers.

So, we suggest that travel business owners be ready to create travel booking websites and generate revenue and growth substantially with huge scope.

All signals point to a sector that has recovered to pre-pandemic strength and managed to undo the large drops observed in 2020 and 2021.

International tourist arrivals are projected to reach 1.53 billion, representing a substantial recovery with an expected year-over-year growth of 17.24% from the 975 million arrivals in 2023.

After facing major challenges in 2020 and 2021, the tourism industry is all set for substantial revenue growth in 2024:

- Global tourism revenue saw a major decline of nearly 50% at the peak of the pandemic. This significantly impacted many travel businesses and destinations.

- A rebound is already underway in 2022 and is expected to continue accelerating through 2023 with an estimated 30-35% growth rate .

- For 2024, global tourism revenues are forecasted to grow around 34.7% year-over-year.

- Gaining a 34.7% revenue growth target would indicate tourism has fully recovered from the pandemic demand shock and is expanding rapidly again.

(Global Tourism Revenue Growth 2024)

If achieved, 2024 would likely represent the highest-ever revenues for the tourism industry globally surpassing pre-pandemic levels.

The projections for a nearly 35% boost in tourism revenues globally paint an extremely optimistic picture of what lies ahead for the sector in 2024 as demand swells.

This rapid growth trajectory beyond 2023 forecasts shows tourism maintaining great momentum as a key recovery success story among industries worldwide.

➤ Here is the complete list of tour operator software.

The overview for tourism in 2024 is highly positive across expected metrics. International tourist arrivals are forecasted to hit 1.5 billion, representing a rapid 17.23% increase from 2023’s estimates, elevating volumes well beyond pre-pandemic levels.

The sector’s contribution to global GDP, which recorded 10.6% in 2023, is also expected to rise considerably in 2024, reflecting its full rise in economic impact. Most notably, tourism revenues could grow up to 34.7% year-over-year, reaching around $9.4 billion globally .

This Global Tourism Statistics 2024:Facts and Forecasts would be the highest growth rate realized since before the COVID-19 downturn,, these projections point to 2024 being a standout year as the industry looks positively to completely negate pandemic losses and reach new historical highs across metrics like tourist arrivals, revenues, and GDP.

Yam Bahadur Chhetri is a content writer and vivid contributor to the WordPress community and a WordPress enthusiast with an experience of 7+ years in the relative field. He also loves to develop WordPress Themes, Plugins, and custom WordPress development for clients.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Get WP Travel Pro

Create Stunning , SEO friendly and Fully functional Travel website within minutes . No Coding Required !

Suitable for any

- Travel Agency

- Tour Booking Services

- Travel Bloggers

Drive more Sales and Revenues from today !

$ 99 99 USD per year

📢 Santa has sent the gift for Christmas and New Year sales on all WP Travel Pro plans. 🛍️ Use coupon code "XMAS_NEWYEAR2024" at checkout.

Related posts

Top 10 Awesome Travel Podcasts to Listen in 2024

How to add WordPress tax option to your travel site

10 Best WordPress Popup Plugins in 2024(Reviewed)

Wp travel modules.

Need more features to save your time and to boost your travel business? WP Travel Pro comes with more powerful modules . While our core travel plugin provides almost all the features that a travel and trekking websites generally needs, our add-ons boost it’s capacity further to make it the best travel engine on WordPress. Whether you want to add new payment method to your site or brush up your trekking listings with beautiful maps show casing your trips, we have all your imagination covered. See all our add ons below to boost your travel website’s features further.

Weather Forecast

Import Export

Partial Payment

Connect with wp travel to join the travel conversation, documentation →.

Explore More

Customer Support →

We are here to help.

Facebook Group →

User Community Forum

Follow On Twitter →

Connect with us on Twitter

Tourism and Economic Growth: Evidence from Cross-Country Data with Policy Insights

- Published: 08 May 2024

Cite this article

- Mohd Arshad Ansari ORCID: orcid.org/0000-0002-6291-4137 1

61 Accesses

Explore all metrics

This work analyzes whether tourism development affects the economic growth. Using yearly data of 1995–2017 for the sample of 35 countries, the empirical findings reveal that tourism arrivals and tourism receipts stimulate the economic growth. Similarly, renewable and non-renewable energy consumption enhance economic growth in the selected countries. Further, human capital positively affects economic growth in case of developed countries, African, and European regions. However, the coefficients of human capital are negative on economic growth in case of aggregate panel as well as for developing countries, Asian and Latin American regions. The pairwise causality test performed mixed results in case of direction of causality. Notwithstanding, the empirical outcomes vary across various subpanels. Thus, policy should focus on enhancing cognitive skills, knowledge, high-quality educational infrastructure, and increasing school enrolment which are key to achieve higher economic growth in developing countries, Asian and Latin American regions. Moreover, for sustainable economic growth, use of more renewable energy with protective environmental quality is a win-win position in the long run.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Artificial Intelligence and Economic Development: An Evolutionary Investigation and Systematic Review

The effect of health on economic growth: a meta-regression analysis

The relationship between CO2 emissions, economic growth, available energy, and employment in SEE countries

Data availability.

Data will be made available upon request.

See Table 1 for more details about tourism contribution to GDP and employment.

The readers should not get confused that there are 35 countries, we have first arranged these countries on the basis of income into subpanels namely developing and developed countries collected from the WDI ( 2018 ). Later we have arranged these 35 countries from same developing and developed nation into four other sub panels namely Latin American, European, African, and Asian based on their regional level (UNWTO, 2018 ). It is also to be noticed that while dividing them into regional blocks we have mentioned only 29 countries out of 35 countries. This is because other 4 countries (Australia and New Zealand comes under Oceania region; Canada and US are the part of North America) do not come under selected regions; therefore, we could not include them here.

Consequently, the prominent method is to consider the assumption and condition of each estimator. DFE technique is similar to PMG method in that it restricts the coefficient of the co-integrating vector to be equal across all panels across time. Furthermore, the DFE estimator requires that the short-term coefficient and the speed of the adjustment and be the same or equal, and panel-specific intercepts are permitted. MG technique was revealed by Pesaran and Smith ( 1995 ) including the distinct regressions for each nation, as well as the coefficients as the unweighted averages of the estimated coefficients for each country.

This is because the characteristic of all these three estimators is almost similar

The argument here is that the usage of non-renewable energy is very small that it may have no or very less impact on economic growth, for which developed countries should not be much worried about their environmental consequences. This is one case where environmental Kuznets curve can be valid for developed countries which depicts that better technology and renewable energy consumption could support green economy and at the same time reduction in carbon emission.

Except human capital which is found to be insignificant on economic growth in case of FMOLS model

Abdouli, M., & Omri, A. (2021). Exploring the nexus among FDI inflows, environmental quality, human capital, and economic growth in the Mediterranean region. Journal of the Knowledge Economy, 12 (2), 788–810.

Article Google Scholar

Affandi, Y., Anugrah, D. F., & Bary, P. (2019). Human capital and economic growth across regions: A case study in Indonesia. Eurasian Economic Review, 9 (3), 331–347.

Ahmed, E. M., & Krishnasamy, G. (2013). Human capital investment to achieve knowledge-based economy in ASEAN5: DEA applications. Journal of the Knowledge Economy, 4 (4), 331–342.

Akadiri, S. S., Bekun, F. V., Taheri, E., & Akadiri, A. C. (2019). Carbon emissions, energy consumption and economic growth: A causality evidence. International Journal of Energy Technology and Policy, 15 (2-3), 320–336.

Amin, S. B., Kabir, F. A., & Khan, F. (2020). Tourism and energy nexus in selected South Asian countries: A panel study. Current Issues in Tourism, 23 (16), 1963–1967.

Amna Intisar, R., Yaseen, M. R., Kousar, R., Usman, M., & Makhdum, M. S. A. (2020). Impact of trade openness and human capital on economic growth: A comparative investigation of Asian countries. Sustainability, 12 (7), 2930.

Ansari, M. A., Haider, S., & Masood, T. (2021). Do renewable energy and globalization enhance ecological footprint: An analysis of top renewable energy countries? Environmental Science and Pollution Research, 28 (6), 6719–6732.

Antonakakis, N., Dragouni, M., & Filis, G. (2015). How strong is the linkage between tourism and economic growth in Europe? Economic Modelling, 44 , 142–155.

Apergis, N., & Payne, J. E. (2010). Renewable energy consumption and growth in Eurasia. Energy Economics, 32 (6), 1392–1397.

Apergis, N., & Payne, J. E. (2011). The renewable energy consumption– Growth nexus in Central America. Applied Energy, 88 (1), 343–347.

Archer, E. (1984). Estimating the relationship between tourism and economic growth in Barbados. Journal of Travel Research, 22 (4), 8–12.

Arslanturk, Y., Balcilar, M., & Ozdemir, Z. A. (2011). Time-varying linkages between tourism receipts and economic growth in a small open economy. Economic Modelling, 28 (1-2), 664–671.

Awad, A. (2021). Which contributes more to economic growth in the MENA region: Health or education? An empirical investigation. Journal of the Knowledge Economy, 12 (3), 1119–1133.

Azam, M., & Abdullah, H. (2022). Dynamic links among tourism, energy consumption, and economic growth: Empirical evidences from top tourist destination countries in Asia. Journal of Public Affairs, 22 (4), e2629.