Credit Cards

- Best Rewards Credit Cards

- Best Credit Card Promotions

- Best Credit Cards for Dining

- Best Credit Cards for Shopping

- Best Cashback Credit Cards

- Best Miles Credit Cards for Travel

- Best No Annual Fee Credit Cards

- Best Credit Cards for Petrol

- Best Credit Cards for Businesses/SMEs

- Best Personal Loans

- Best Home Mortgage Loans

- Best Renovation Loans

- Best Car Loans

- Best Education Loans

- Best Debt Consolidation Loans

- Best Business/SME Loans

- Best Car Insurance

- Best Travel Insurance

- Best Home Insurance

- Best Mortgage Insurance

- Best Health Insurance

- Best Endowment Insurance

- Best Critical Illness Insurance

- Best Maid Insurance

- Best Whole Life Insurance

- Best Term Life Insurance

- Best Personal Accident Insurance

- Best Motorcycle Insurance

- Best Pet Insurance

Investments

- Best Online Brokerages

- Best Robo Advisors

- Best P2P/Crowdfunding Platforms

Bank Accounts

- Best Savings Accounts

- Best Fixed Deposit Accounts

- Best Debit Cards

- Best Hotel Booking Sites

- Best Wire Transfers

- Best Electrical Retailers

- Best Travel Deals

Personal Finance Guides

We'll help you make informed decisions on everything from choosing a job to saving on your family activities.

- Average Cost of Home Renovation

- Average Cost of Monthly SP Bills

- Average Cost of Domestic Help

- Average Cost of Moving Your Home

- Average Cost of Renting a Car

- Average Cost of a Wedding

- Average Cost of a Divorce

- Average Cost of a Funeral

- Average Cost of an Engagement Ring

- Research Reports

- Evaluation Methodology

MSIG Travel Insurance: What's the Deal?

- Travellers who need pre-existing condition coverage

- People seeking adventurous activity or golf coverage

- Lone senior travellers

- Families and groups

- Consumers who need trip inconvenience coverage due to their conditions

MSIG's Travel Pre-Ex plan stands out as being one of three travel insurance policies that offers coverage for pre-existing conditions and offers average coverage for competitive prices. Furthermore, because MSIG's Pre-Ex version offers most of the benefits of the standard TravelEasy plans, value-seeking consumers may find the plethora of miscellaneous benefits a bonus.

Table of Contents

- MSIG Travel Insurance: What You Need to Know

- MSIG TravelEasy Pre-Ex Travel Insurance: For COVID-19 Coverage

Sports Coverage

Notable exclusions, claims information.

- Summary of Coverage

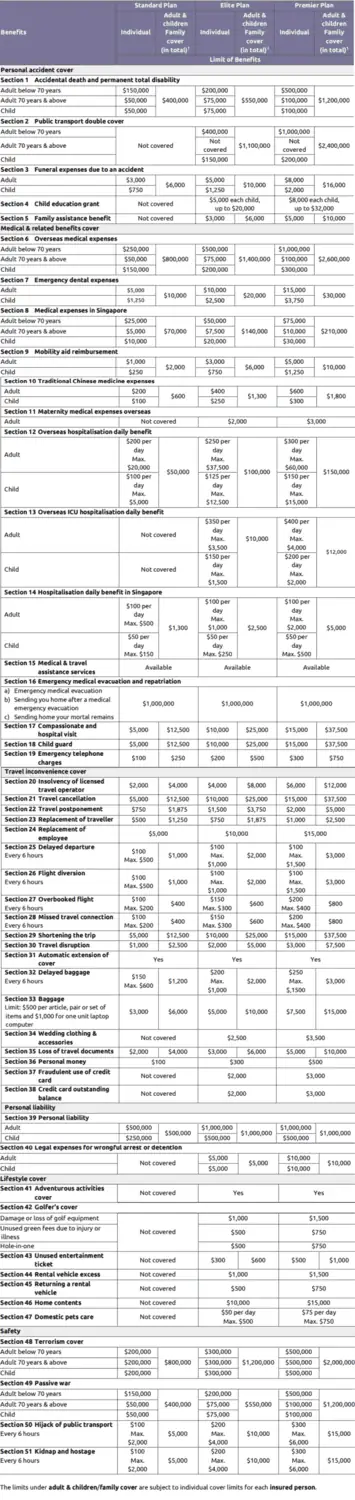

MSIG TravelEasy Pre-Ex Travel Insurance: What You Need to Know

MSIG is one of the three insurers in Singapore offering travel insurance plans that provide coverage for pre-existing conditions. MSIG's TravelEasy and its Pre-Ex add-on plan offer three plans to choose from: Standard, Elite and Premier. In most cases, MSIG's Pre-Ex plans are cheaper than other pre-existing plans on the market by 5-15%. Considering that pre-existing conditions can be expensive to manage, MSIG's pricing can be a welcome change for the financially-burdened traveller who is used to paying high premiums for their condition. This is in contrast to MSIG's base TravelEasy option, which, with the exception annual ASEAN plans, is not as competitively priced.

The TravelEasy Pre-Ex plan includes almost all of the benefits (except COVID-19 coverage) of the TravelEasy plan along with medical coverage for pre-existing conditions. Its medical coverage ranges from S$75,000 for the Standard plan to S$150,000 for the Premier plan, which is around the average compared to the market coverage for pre-existing medical conditions. Trip incovenience benefits are similarly around market average. However, MSIG's TravelEasy plans offer some notable perks in their coverage that are rarely seen all together in other plans. This includes golf and adventure sports coverage and peace of mind benefits like wedding items coverage, passive war medical coverage, terrorism cover, pet care coverage and FDW belongings coverage. However, most of these perks are offered only for the Premier and Elite plan, pricing out those who are looking for budget plans.

There are a couple of drawbacks of the Pre-Ex plans that consumers should be aware of. Firstly, for customers of the Pre-Ex plan, the maximum trip length you can take and still receive coverage is 30 days, so travellers with pre-existing conditions who take long-haul trips may not get enough coverage. Secondly, pre-existing conditions won't be covered if they worsen within 30 days of the departure date and the doctor prescribes further treatment, medication or surgery. Lastly, you will not be able to file a claim for trip inconvenience benefits, such as trip cancellations, due to pre-existing conditions. For consumers looking for trip inconvenience coverage that includes their pre-existing conditions can consider NTUC Income's Enhanced Pre-Ex Plan instead.

MSIG TravelEasy Travel Insurance: For COVID-19 Coverage

If you are looking for a travel insurance plan that is more focused on offering coverage for expenses related to COVID-19 rather than pre-existing conditions, MSIG's TravelEasy insurance plan might be a better option for you. Although MSIG's TravelEasy doesn't provide any coverage for pre-existing conditions, it has one of the most holistic coverage for COVID-19 related trip complications that might prove more useful to some people during the tail's end of this pandemic.

Do ensure that you've taken all of the necessary precautions to adhere to local and international governments' regulations related to COVID-19 and your travels.

You are covered for adventurous activity including bungee jumping, skydiving, paragliding, hot air ballooning, jet skiing, white water rafting, diving and general snow sports (skiing, snowboarding). There is also decent golf coverage for equipment, unused green fees, and hole-in-one. However, you will only get the adventure cover and golf cover for Elite and Premier plans.

MSIG has standard medical and trip/baggage related exclusions. You can't claim for terminal illnesses, mental disorders, pregnancy related expenses that aren't covered by the maternity illness benefit and you can't file any claims if you are travelling for medical purposes. Additionally you will not be covered if you are travelling to compete in professional sports, will do any kind of manual work or will be going on expeditions. You should always double check the policy wording to make sure you know exactly what events you will be covered for.

To submit a claim with MSIG, you can either submit the claim online or download and mail the claim form. For both options you need to have all the appropriate documentation. If you are claiming for loss or damaged items, you have to make a police report within 24 hours of the event and request a copy for your claim submission.

MSIG Travel Insurance Details

It is important to make sure that you are getting the right coverage for your next trip, and that you're not overpaying for coverage. Below, you'll find a summary of MSIG's benefits and premiums for its Pre-Ex plan, as well as how they compare to the industry average. If you would like to compare MSIG to other plans on the market, you can read our top picks of the best travel insurance policies in Singapore here .

All insurance product-related transactions via AMTD PolicyPal Group (including Value Champion) are arranged and administered by Baoxianbaobao Pte. Ltd., our insurance broker and exempt financial adviser licensed and regulated by the Monetary Authority of Singapore. This insurance purchase is powered by Baoxianbaobao Pte. Ltd.

Protected up to specified limits by SDIC. This is only product information provided. You may wish to seek advice from a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. Buying an insurance product that is not suitable for you may impact your ability to finance your future financial needs. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy.

- Best Travel Insurance in Singapore

- Average Costs and Benefits of Travel Insurance

- How to Pick the Best Travel Insurance

Our Top Travel Insurance

- Best Travel Insurance Promotions

- Best Annual Travel Insurance

- Best Travel Insurance for Sports

- Best Travel Insurance for Families & Groups

- Best Travel Insurance for Seniors

- Best Insurance Companies in Singapore

Keep up with our news and analysis.

Stay up to date.

Featured Travel Insurance Companies

- Allianz Travel Insurance

- FWD Travel Insurance

- Direct Asia Travel Insurance

- Etiqa Travel Insurance

- Aviva Travel Insurance

- HL Assurance Travel Insurance

- Wise Traveller Travel Insurance

Travel Insurance Basics

- What is Travel Insurance

- Why You Need Travel Insurance

- Average Cost and Benefits of Travel Insurance

- Average Cost of a Staycation

- Average Cost of a Vacation

- Who Should Get Annual Travel Insurance

- Airline Travel Insurance vs. Traditional Travel Insurance

- Travel Insurance and Terrorism Coverage

- Travel Insurance and Haze Coverage

- Travel Insurance and Zika Coverage

- Travel Insurance and Overbooked Flight Coverage

- Travel Insurance and Trip Cancellation Coverage

- How to Successfully File an Insurance Claim

Other Financial Products for Travellers

- Best Air Miles Credit Cards

- Best Credit Cards for Complimentary Lounge Access

- Best Credit Cards for Overseas Spending

Related Articles

- Best Year-End Travel Destinations to Beat the Crowd

- Travel Diaries: 5 Safest Travel Destinations in the World

- Travel Essentials Checklist For Your Family Vacation

- How To Survive and Thrive as a Solo Traveller

- How Travel Insurance Can Protect Your Refund Rights for Flight Cancellations and Delays

- Travel Essentials for Every Trip – From the Best Travel Insurance to Miles Credit Card

- Best Frequent Flyer Plans to Upgrade Your Travels in 2023

- Travel Insurance

- MSIG Travel Insurance: What's the Deal?

- Copyright © 2024 ValueChampion

Advertiser Disclosure: ValueChampion is a free source of information and tools for consumers. Our site may not feature every company or financial product available on the market. However, the guides and tools we create are based on objective and independent analysis so that they can help everyone make financial decisions with confidence. Some of the offers that appear on this website are from companies which ValueChampion receives compensation. This compensation may impact how and where offers appear on this site (including, for example, the order in which they appear). However, this does not affect our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services

We strive to have the most current information on our site, but consumers should inquire with the relevant financial institution if they have any questions, including eligibility to buy financial products. ValueChampion is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. The site does not review or include all companies or all available products.

- Entertainment

Travel insurance review: Is MSIG travel insurance worth it?

MSIG travel insurance is one of the most popular brands in Singapore and is second only to NTUC (impressive!). That’s probably because MSIG used to be the provider of DBS travel insurance .

DBS might have since changed their provider to Chubb, but that doesn’t mean that MSIG travel insurance isn’t solid. Let’s have a look at whether MSIG TravelEasy is worth your money.

MSIG travel insurance at a glance

Here’s a quick look at the three tiers of MSIG TravelEasy insurance plans , the Covid-19 extension as well as the TravelEasy Pre-Ex plans:

Here’s a summary of the Covid-19 extension that applies to single trip policies:

And here are the TravelEasy PreX travel insurance plans, which cover pre-existing medical conditions:

MSIG travel insurance promotions

Though the listed prices of MSIG travel insurance plans seem pretty hefty at first glance, there’s almost always a promotion to keep their prices competitive, like the current 40 per cent discount off single trip plans.

That means if you get an MSIG TravelEasy Standard plan for a week in Asean, it’d only set you back $34.20. That’s quite a steal.

To see what’s on, just click or tap on the “Promotions” tab on the MSIG travel insurance page .

As long as the 40 per cent promotion is on, I’d say it’s worth it to buy travel insurance from MSIG. The price is really competitive against the likes of NTUC Income, Aviva and FWD.

ALSO READ: What to look out for when buying travel insurance in Singapore (2022)

What does MSIG travel insurance cover?

Overall, MSIG’s travel insurance coverage is pretty adequate. The Standard plan has a slightly low coverage limit for emergency evacuation, and the payout for baggage delays is lower than standard, but those aren’t dealbreakers.

But the important thing to note is that the cheapest Standard plan is limited in coverage if you’re planning anything more than a normal sedate city getaway. It doesn’t cover most outdoor activities, even basic ones like skiing and scuba diving.

So you might want to opt for an Elite (or even Premier) plan for better and wider coverage. These higher tier plans cover a whole slew of outdoor activities, including the common ones listed here:

The Elite & Premier plans also cover loss of wedding-related items (so it’s good for wedding photoshoots or destination weddings) and entertainment/sports tickets (so get this if you plan to go to a festival or watch a major football match).

However, another drawback of MSIG’s travel insurance policies is the limited coverage of its Covid-19 extension. It’s payout of $65,000 for overseas medical fees due to Covid-19 falls short of other policies which offer $100,000 and upwards in claims. It also won’t do very much for you in the event of travel inconveniences caused by the pandemic.

MSIG travel insurance claim procedure

Emergency hotline: Call the MSIG emergency assistance hotline at +65 6323 8288

Phone claims: For non-emergency but urgent claim requests, call MSIG’s Claims Hotline at +65 6827 7660. A claims officer will be in touch with you to handle your case.

Online claims: Submit your claim and supporting documents through the online form (linked on MSIG’s travel insurance claims page ). Or you can download it and email MSIG at [email protected]

Hard copy claims: You can submit your claim in person or mail it to MSIG, 4 Shenton Way, #21-01 SGX Centre 2, Singapore 068807.

Things to note: Refer to MSIG’s travel insurance claims page for instructions and a useful checklist of required documents before you make a claim. There’s also a chatbot with whom you can check on your eligibility for certain claims.

MSIG prides itself on a good claims experience, with personalised, responsive claims specialists attending to your requests. They typically settle straightforward claims within two to three weeks. Expect some delays during peak travel periods like school holidays.

Conclusion: should you buy MSIG travel insurance?

If you just look at its cheapest Standard plan, MSIG travel insurance is extremely affordable after the generous promotional discounts.

The level of support and clarity MSIG provides is also reassuring. Terms & conditions are clearly stated on the site, not hidden away in some remote PDF, and the claims process appears to be pleasant. Basically, it looks like MSIG knows their stuff.

However, the drawback is that MSIG has made the Standard plan very limited in comparison to the Elite and Premier plans. Once you compare their coverage, you will definitely feel tempted to upgrade. It’s a bit like how budget airlines compel you to add a bundle on to your basic-ass air ticket. Another thing to have in mind is that their Covid-19 extension is not the most comprehensive in its coverage.

However, if you’re vaccinated and in the pink of health and are buying from MSIG, it is worthwhile to pay a bit more for Elite if you’re taking part in outdoor activities, a wedding shoot or catching some kind of music or sports event overseas. As a bonus, you get higher coverage limits too.

ALSO READ: Travel insurance: Promo codes for 2022 and 7 more ways to save on it

This article was first published in MoneySmart .

MSIG TravelEasy Travel Insurance Review

- Financially Reviewed by Edward Hee

- Published: 24 December, 2023

- Last Updated: 9 January, 2024

At Dollar Bureau, we’re committed to providing you with reliable, unbiased financial guidance. Our content is crafted by everyday Singaporeans who are trained in finance and insurance, ensuring relatable and practical guidance. We uphold strict editorial independence, regularly update our reviews, and value your feedback to keep our information accurate and relevant.

Discover more about our editorial guidelines here .

Table of Contents

When travelling abroad for business or leisure, we are ready to explore new places and enjoy new environments.

We never really think about the negatives of what would happen if something unexpected were to occur.

For this reason, travel insurance are an essential part of your travels.

And MSIG’s TravelEasy with (or without) COVID-19 Cover Travel Insurance could give you a piece of mind.

Here’s our review of MSIG’s Travel Insurance:

Key Features Of MSIG TravelEasy Travel Insurance

MSIG TravelEasy offers some tremendous key features, and when considering your options, it is always important to stay informed and know what you are buying.

- COVID-19 Coverage: If you are travelling and get affected by COVID-19, MSIG TravelEasy w/ COVID-19 Cover has your back. This includes situations like testing positive, being in close contact with a COVID-19 case, or if a family member is hospitalised due to COVID-19.

- Medical & Travel Assistance: If you face a medical emergency related to COVID-19 during your trip, MSIG Assist is there to help. Just remember to contact them immediately for any medical claims related to COVID-19.

- Automatic Extension of Cover: If you cannot complete your journey before your policy ends due to COVID-19-related hospitalisation or quarantine, your cover will automatically extend for up to 30 days without any extra premium.

- Overseas Quarantine Daily Benefit : If you test positive for COVID-19 and have to quarantine, MSIG TravelEasy will pay a daily benefit for each complete 24-hour period of quarantine or isolation.

- Travel Cancellation & Postponement: If you have to cancel or postpone your trip due to COVID-19, like testing positive or being denied boarding due to symptoms, MSIG TravelEasy will cover the costs under certain conditions.

- During Trip Benefits: MSIG TravelEasy extends medical and travel assistance for COVID-19-related issues during your trip.

Comparison Against Other Single-Trip Travel Insurance Policies

In this section, the insurers that we’re comparing MSIG TravelEasy Insurance against its competitors:

- AIG Travel Guard Direct

- AIA Around the World Plus (II)

- Allianz Travel Bronze

- Klook TravelCare

- Singlife Travel Insurance

- NTUC Income Travel Insurance

- Sompo Travel (COVID-19) Insurance

- Etiqa TIQ Travel Insurance (with COVID-19 cover)

- FWD Travel Insurance Plan

The basis for this comparison will be the coverage for an individual travelling to ASEAN for a week and the lowest-tiered plan across all insurers.

- Total Premium : MSIG TravelEasy Standard’s premium is $37.20, which is moderately priced compared to others. The cheapest is Klook TravelCare Lite at $27.65, while the most expensive is AIG Travel Guard Direct Basic at $83.00.

- Overseas Medical Expenses : MSIG offers $250,000, which is the highest, matching the coverage offered by NTUC Income and Singlife.

- Accidental Death and TPD : MSIG’s coverage of $150,000 is substantial, higher than most except for Sompo Travel , FWD, and TIQ, which offer $200,000.

- Overseas Travel Delay : MSIG provides $500 for every 6 hours of delay, which is average compared to others. AIA Around the World Plus (II) Classic and NTUC Income offer the highest at $1,000.

- Trip Cancellation : MSIG’s coverage of $5,000 is quite standard, similar to most other insurers.

- Baggage Delay : MSIG offers $600 for every 6 hours, which is higher than the standard $200 or $400 offered by others but lower than Sompo Travel’s $1,200.

- Baggage Loss/Damage : MSIG’s coverage of $3,000 is common among most plans.

- Cost-to-Benefit Ratio : MSIG’s ratio is 10997.31, which is lower compared to others, indicating a less favorable cost-to-benefit balance. The highest ratio is seen in Klook TravelCare Lite at 12,976.49, and the lowest in AIG Travel Guard Direct Basic at 671.08.

In summary, MSIG TravelEasy Standard offers competitive coverage in most categories, with particularly strong offerings in Accidental Death and TPD coverage.

Its total premium is reasonable, though not the cheapest, and its cost-to-benefit ratio suggests a less favorable balance compared to some other options.

Comparison Against Other Annual-Trip Travel Insurance Policies

Next up, let’s compare the insurers for annual trips. (We’ve removed Sompo Travel Insurance here because they do not offer travel insurance for annual trips).

The basis for this comparison will be the coverage for a single individual travelling to ASEAN for an annual trip and the lowest-tiered plan across all insurers.

Here’s what we found:

- Total Premium : MSIG TravelEasy Standard’s premium is $447.20, which is moderately priced. The cheapest is Etiqa TIQ Travel Insurance Entry at $369.00, and the most expensive is Allianz Travel Bronze at $570.60.

- Overseas Medical Expenses : MSIG offers $250,000, which is among the highest, matched by NTUC Income and Singlife but surpassed by FWD Travel Insurance Premium and Etiqa TIQ.

- Accidental Death and TPD : MSIG’s coverage of $150,000 is substantial, equal to AIA Around the World Plus (II) Classic.

- Overseas Travel Delay : MSIG provides $500 for every 6 hours of delay, which is average. The highest coverage is offered by AIA Around the World Plus (II) Classic and NTUC Income at $1,000.

- Baggage Delay : MSIG offers $600 for every 6 hours, which is higher than the standard $200 or $500 offered by others but lower than AIA Around the World Plus (II) Classic’s $1,000.

- Cost-to-Benefit Ratio : MSIG’s ratio is 914.80, which is relatively high, indicating a more favourable cost-to-benefit balance compared to some options like AIG Travel Guard Direct Basic (100.54) but lower than Etiqa TIQ (1104.34) and FWD (1008.59)

In summary, MSIG TravelEasy Standard offers competitive coverage in most categories, with particularly strong offerings in Overseas Medical Expenses and Accidental Death and TPD coverage. Its total premium is reasonable, and its cost-to-benefit ratio is relatively high, making it a favourable option among the annual travel insurance plans compared.

Who Is MSIG TravelEasy Travel Insurance Best Suited For

MSIG TravelEasy is particularly well-suited for a specific segment of travellers who prioritise comprehensive coverage in key areas over cost.

This plan is ideal for:

Frequent Travellers and Families: With high coverage limits for overseas medical expenses, accidental death, and total permanent disability (TPD), MSIG TravelEasy is a strong choice for frequent travellers and families who seek extensive protection. The high medical coverage is particularly beneficial for destinations where medical costs can be excessive.

Adventure Seekers: The plan covers a range of adventurous activities (under the Adventurous Activities Cover), making it a good option for those who engage in such activities during their travels.

Travellers Seeking Comprehensive Coverage: Individuals prioritising a wide range of protections, including high coverage for medical expenses and accidental death, will find this plan appealing. It’s also beneficial for those who want additional terrorism and passive war coverage.

Travellers to Remote or High-Risk Destinations: Given its extensive medical and evacuation coverage, this plan is well-suited for travel to remote or high-risk areas where medical facilities may be limited and evacuation might be necessary.

However, it’s less suited for

Budget Travellers: Those looking for the most cost-effective option might find the premium slightly higher compared to basic plans from other insurers.

Travellers Seeking Minimal Coverage: For those who travel light or do not require extensive coverage, especially in areas like baggage loss or delay, there might be more suitable, less comprehensive options.

My Review of the MSIG TravelEasy Travel Insurance

So, after extensive research and comparison with other travel insurance policies in Singapore, MSIG TravelEasy stands out as one of the best policies for frequent travellers and travellers going on adventurous journeys.

With MSIG TravelEasy, your premiums are manageable, so you get value for your money, and paying for premiums doesn’t break your bank account.

It offers a good balance between coverage and price – especially if you’re looking to overseas medical and accidental death & TPD coverage.

While MSIG TravelEasy is a well-rounded travel insurance policy, it’s always important to remember that there are other policies on the market that may be more suited to your needs.

What works for one might not be the best fit for another.

For example, if you’re looking for something really basic – then this isn’t for you. You’re better off saving some money on a policy that’s cheaper while covering you for what you need.

To ensure you’re making the most informed decision, take a moment to explore and compare various travel insurance options.

Dive into these comprehensive guides to get a clearer picture of what’s available:

- Best Annual Travel Insurance in Singapore

- Best Travel Insurance in Singapore

You can find the perfect travel insurance tailored to your needs and adventures by comparing different policies.

Criteria For MSIG TravelEasy Travel Insurance

To qualify for MSIG TravelEasy Travel Insurance, applicants typically need to meet the following requirements:

- Have a valid NRIC or FIN

- Be at least 16 years old at the time of purchase (only required if you’re the applicant)

- The insurance is designed for travellers on single or multiple trips throughout the year (annual plans). The duration of each trip under the annual plan is usually capped (e.g., 90 consecutive days per trip).

- Declare Health & Pre-existing Conditions

- The insurance is typically available for leisure or business travel. However, additional terms or exclusions may apply if the trip involves high-risk activities or destinations.

- The policy should be purchased before the commencement of the trip. The policy must be bought a specified number of days before the travel start date for certain benefits like trip cancellation.

- Applicants must agree to the policy’s terms and conditions, including any exclusions or limitations of coverage.

Benefits Summary

Individual & corporate policyholder summary of cover & limits.

Applicable to TravelEasy Single return trip or Annual plan cover.

Click to enlarge

The following is the COVID-19 Cover Benefits for individual policyholders:

The following is the COVID-19 Cover Benefits for corporate policyholders:

They are subject to the conditions and exclusions specified in the policy.

The limits specified are sub-limits of the limits specified in the main policy for the same sections.

Premium Rates (Single Trip)

Here are the prices for both single trip (7 days) & annual plans for ASEAN and Global coverage for a 25-year-old Singaporean.

Prices are before any discounts.

These benefits are specific to the COVID-19 Cover.

They are subject to the conditions and exclusions specified in the policy.

The limits specified are sub-limits of the limits specified in the main policy for the same sections.

All sums are in Singapore dollars.

Premiums Rates (Annual Plans)

Benefits explained for msig traveleasy travel insurance, section 1: accidental death & permanent total disability.

MSIG TravelEasy will pay the compensation for Death or Permanent Total Disability if an insured person suffers an injury during the journey, which, within 12 calendar months of its happening, is the only cause of death or disability.

What is Covered

- If you suffer an injury during your journey that leads to death within 12 months of the incident, MSIG TravelEasy will compensate you 100% of the limit for this section.

- In the case of Permanent & Total Disability, where you cannot engage in any business, profession, or occupation for life, you’ll receive 100% compensation. This cover is valid if the disability persists for 12 months from the injury date.

- If you lose sight completely in both eyes, you are entitled to 100% compensation.

- The loss of 2 or more limbs (permanent and total loss of use or complete physical severance) also qualifies for 100% compensation.

- If you lose sight in 1 eye and lose 1 limb, you’ll receive 100% compensation.

- Losing 1 limb entitles you to 50% compensation.

- Total and irrecoverable loss of sight in 1 eye qualifies for 50% compensation.

- “Loss of Limb(s)” means permanent and total loss of use or loss by complete and permanent physical severance of a hand at or above the wrist or a foot at or above the ankle.

- If the insured person suffers an injury resulting in more than 1 of the results described above, MSIG will pay the maximum of 100% of the limit in this section.

Coverage Structure

What is Not Covered

Specific exclusions for this section will be covered later on.

Section 2: Public Transport Double Cover

If you, as a fare-paying passenger, suffer an injury on public transport outside of Singapore during your journey and this injury is the sole cause of death within 12 months, MSIG TravelEasy offers double the death compensation limit of Section 1.

This double cover does not apply to the Standard Plan or any insured person aged 70 or above.

In case of a claim that falls under both Section 1 (Accidental Death & Permanent Total Disability) and this section, MSIG TravelEasy will compensate under either 1 of the sections, but not both.

Section 3: Funeral Expenses Due To Accidental Death

Suppose the insured person suffers an injury during the journey outside Singapore, which, within 12 calendar months of its happening, is the only cause of their death.

In that case, MSIG TravelEasy will reimburse the reasonable expenses for their funeral or burial.

The maximum MSIG TravelEasy will pay under this section is as follows:

What is Not covered

Please see the section on exclusions.

Section 4: Child Education Grant

This benefit applies if an adult insured person suffers an injury during the journey outside Singapore which, within 12 calendar months of its occurrence, is the sole cause of their death.

The policy will pay a specified amount to each of the deceased adult’s insured persons’ biological or legally adopted children.

The Standard Plan does not cover this benefit.

For exclusions, please refer to the policy’s exclusion section.

Section 5: Family Assistance Benefit

If you, as an insured person, unfortunately, pass away due to an injury sustained during your journey outside Singapore, MSIG TravelEasy provides a Family Assistance Benefit.

This applies if the death occurs within 12 months of the injury and is directly caused by it.

- The benefit does not apply if the death is not directly caused by the injury sustained during the journey.

- Specific exclusions will be detailed in the general exclusions section of the policy.

Section 6: Overseas Medical Expense

MSIG TravelEasy covers medical, surgical, nursing, or hospital charges incurred outside Singapore due to injury or illness during the journey, as deemed medically necessary by a doctor.

Costs for dental treatment, mobility aids, or prostheses are not covered.

- The policy has specific exclusions for certain illness or injury causes, which will be detailed in the general exclusions section.

- The maximum limit for sections 6 to 11, including extension under section 52 (Pre-Ex Critical Care), will not exceed the maximum limit under section 6.

- For claims under Pre-Ex Standard, Pre-Ex Elite, or Pre-Ex Premier plan due to pre-existing medical conditions, payments are based on the sub-limits stated under section 52.

Section 7: Emergency Dental Expenses

MSIG TravelEasy Emergency Dental Expenses coverage is designed to provide financial assistance for emergency dental treatments due to injuries sustained during your journey.

This includes treatments for restoring healthy and natural teeth or repairing a fractured jaw.

The coverage applies to treatments received outside and within Singapore (subject to conditions).

- Outside Singapore: If you require emergency dental treatment while abroad due to an injury, MSIG TravelEasy will cover the expenses.

- Upon Return to Singapore: If you didn’t receive dental treatment abroad, or if further treatment is needed after returning to Singapore, MSIG TravelEasy will cover the expenses up to 30 days after your return. However, you must seek the first dental treatment in Singapore within 72 hours of your return.

- MSIG TravelEasy does not cover treatment costs related to gum diseases, tooth decay, dentures, implants, crowns, bridges, or the use of precious metals.

- Routine dental care and non-emergency procedures are not included.

- The policy has specific exclusions for certain dental conditions and treatments, which will be detailed in the general exclusions section.

- The maximum limit for sections 6 to 11, including extension under section 52 (Pre-Ex Critical Care), will not exceed the maximum limit under section 6 – Overseas Medical Expenses.

Section 8: Medical Expenses In Singapore

MSIG TravelEasy provides coverage for medical expenses incurred in Singapore as a continuation of treatment for an injury or illness suffered during an overseas journey.

This coverage is applicable for up to 30 days after the insured person returns to Singapore.

- Continuation of Overseas Treatment: If you received medical treatment for an injury or illness during your journey, MSIG TravelEasy will cover the continued medical expenses upon your return to Singapore.

- Initial Treatment in Singapore: If you did not receive medical treatment outside Singapore, you must seek medical treatment in Singapore within 72 hours of your return. MSIG TravelEasy will cover further medical expenses up to 30 days after your return.

Coverage structure

- MSIG TravelEasy does not cover costs for dental treatment, mobility aids, or prostheses under this section.

- The policy has specific exclusions for certain medical conditions and treatments, which will be detailed in the general exclusions section.

Section 9: Mobility Aid Reimbursement

MSIG TravelEasy covers the necessary expenses incurred for purchasing mobility aids as prescribed by a doctor due to an injury suffered during an overseas journey.

Mobility aids include crutches, wheelchairs, or walkers but do not cover prostheses.

- MSIG TravelEasy does not cover the cost of prostheses under this section.

- The policy has specific exclusions for certain conditions and situations, which will be detailed in the general exclusions section.

Section 10: Traditional Chinese Medicine Expenses

MSIG TravelEasy offers coverage for the cost of traditional Chinese medical treatment (TCM) by a TCM practitioner, which is necessary for injuries and illnesses suffered during an overseas journey.

This coverage also extends to TCM treatments received in Singapore as a continuation of the overseas treatment, limited to 30 days after the insured person’s return to Singapore.

- Overseas Treatment: If you receive TCM treatment during your journey, MSIG TravelEasy will cover the expenses.

- Treatment in Singapore: If TCM treatment is not first received outside Singapore, you must seek TCM treatment in Singapore within 72 hours of your return.

MSIG TravelEasy will cover these expenses up to 30 days after your return.

- MSIG TravelEasy has specific exclusions for certain conditions and situations, which will be detailed in the general exclusions section of the policy.

Section 11: Maternity Medical Expenses Overseas

MSIG TravelEasy covers necessary medical expenses incurred outside Singapore for pregnancy-related illnesses the adult insured person suffers during an overseas journey.

- The first trimester of pregnancy (0 to 12 weeks).

- Ectopic pregnancy, childbirth, or stillbirth.

- Care and treatment for the newborn.

- Abortion or miscarriage unless due to an injury.

- Tests or treatments related to fertility, contraception, sterilisation, birth defects, or congenital disorders.

- Perinatal mental illnesses such as depression or anxiety disorders.

- Treatment for pregnancy is conceived through medical assistance.

- Medical expenses incurred in the country where the insured person is a citizen or permanent resident.

Section 12: Overseas Hospitalisation Daily Benefit

- This cover provides financial support for each complete 24-hour period an insured person spends in a hospital outside Singapore.

- This coverage is activated when the insured person requires hospitalisation due to an injury or illness incurred during their overseas journey.

- It’s important to note that this benefit applies to stays in a registered hospital where the insured person is admitted as an inpatient based on medical necessity and under a doctor’s recommendation.

- The coverage is specifically for stays in standard hospital wards.

- Additionally, while receiving benefits under this section, the insured person will not be eligible for benefits under section 13, which pertains to Overseas ICU Hospitalisation Daily Benefit.

- The benefit is only for stays in a regular hospital ward.

- No benefit will be paid under Section 13 – Overseas ICU Hospitalisation Daily Benefit during the period the insured person is paid under this section.

- Specific exclusions for certain conditions and situations will be detailed in the general exclusions section of the policy.

For detailed exclusions related to this section, it is advised to refer to the specific exclusions section of the policy document.

Section 13: Overseas ICU Hospitalisation Daily Benefit (MSIG TravelEasy)

MSIG TravelEasy provides a daily benefit for each complete 24-hour period of an insured person’s stay in an Intensive Care Unit (ICU) outside Singapore due to an injury or illness suffered during the overseas journey.

This coverage applies when the insured person is admitted as a registered inpatient in an ICU on the advice of a doctor.

- The benefit is only for stays in an ICU.

- No benefit will be paid under Section 12 – Overseas Hospitalisation Daily Benefit during the period the insured person is paid under this section.

Section 14: Hospitalisation Daily Benefit In Singapore (MSIG TravelEasy)

MSIG TravelEasy offers a daily benefit for each complete 24-hour period of hospital stay in Singapore if the insured person is hospitalised within 24 hours after returning to Singapore due to an injury or illness suffered during the overseas journey.

This coverage applies when the insured person is admitted as a registered inpatient in a hospital on the advice of a doctor.

Specific exclusions for certain conditions and situations will be detailed in the general exclusions

Section 15: Medical & Travel Assistance Services (MSIG TravelEasy)

MSIG TravelEasy offers various medical and travel assistance services through their appointed assistance company.

These services are accessible to insured persons, but it’s important to note that all costs and expenses, including telecommunication charges, are the insured’s responsibility.

Overview of Services

- The insured person is responsible for all costs and expenses for the services listed.

- General exclusions applicable to these services.

Section 16: Emergency Medical Evacuation & Repatriation (MSIG TravelEasy)

MSIG TravelEasy offers extensive support and coverage for situations requiring emergency medical evacuation and repatriation due to serious medical conditions encountered during overseas travel.

This section addresses emergencies where the insured needs immediate medical attention or repatriation.

Detailed Coverage Structure:

Emergency Medical Evacuation:

- Scope : In case of a severe injury or illness during the journey, MSIG TravelEasy organises and covers the cost of transportation (air, land, or sea) to the nearest hospital where appropriate medical care is available.

- Decision Making: MSIG TravelEasy, considering all known facts and circumstances, decides the evacuation destination and the transport method.

- Coverage Limit: Up to $1,000,000 per insured person.

Sending Home After Medical Evacuation:

- Scope : If deemed medically necessary, MSIG TravelEasy arranges and pays for the insured person’s return to Singapore following an emergency evacuation. This includes scheduled airline flights (economy class) or other suitable transportation methods.

- Ticket Utilisation: The insured person must surrender any unused portion of their original ticket to MSIG TravelEasy.

- Additional Costs : Covers extra transportation costs to and from the airport if the original ticket is invalid.

Sending Home Mortal Remains:

- Scope : In the unfortunate event of the insured person’s death overseas, MSIG TravelEasy makes all necessary arrangements (including meeting local formalities) for sending the body or ashes back to Singapore.

- Coverage Limit : Included within the overall limit of $1,000,000.

Maximum Coverage Limit:

- The total coverage for all services under sections 16 to 19 is capped at $1,000,000 per insured person for any journey, regardless of the number of events involved.

Sub-limits for Pre-Existing Conditions:

- For claims related to pre-existing medical conditions under the Pre-Ex Standard, Elite, or Premier plans, payments are based on the sub-limits specified in section 52 – Pre-Ex Critical Care.

- MSIG TravelEasy does not cover expenses for services not arranged or approved by them.

- Any costs exceeding the maximum limit of $1,000,000 per insured person per journey.

Section 17: Compassionate & Hospital Visit (MSIG TravelEasy)

MSIG TravelEasy offers coverage for one immediate family member’s travel and accommodation expenses.

This coverage starts when the insured person is hospitalised outside Singapore for more than five days without any adult family member present or in the event of the insured person’s death due to injury or illness during the journey.

The coverage includes reasonable expenses for economy air travel or first-class rail travel and accommodation.

It applies when no adult family member is accompanying the hospitalised insured person.

Maximum Coverage Limit:

The total coverage for all services under sections 16 to 19 is capped at $1,000,000 per insured person for any journey, irrespective of the number of events involved.

Expenses for services not arranged or approved by MSIG TravelEasy are excluded.

Specific exclusions applicable to this section will be detailed in the policy document.

For complete details, benefits, limits, and exclusions of Section 17, it’s essential to refer to the actual MSIG TravelEasy policy document.

The above information provides a summarised overview of the coverage offered under this section.

Section 18: Child Guard (MSIG TravelEasy)

MSIG TravelEasy’s Child Guard section provides coverage for the travel and accommodation expenses of a family member or relative.

This support is provided when an adult insured person is hospitalised outside Singapore due to injury or illness and cannot accompany their children, who are also on the journey.

The coverage includes reasonable costs for economy air travel or first-class rail travel and accommodation for the family member or relative who travels to accompany the children.

This ensures that the children are safely returned to Singapore in the absence of the hospitalised adult insured person.

The overall maximum coverage for all services under sections 16 to 19 is limited to $1,000,000 per insured person for any single journey.

This cap applies irrespective of the number of events involved.

MSIG TravelEasy specifies that expenses for services not arranged or approved by them are excluded from this coverage.

The policy document will also detail specific exclusions applicable to this section.

Section 19: Emergency Telephone Charges (MSIG TravelEasy)

Section 20: insolvency of licensed travel operator (msig traveleasy), section 21: travel cancellation (msig traveleasy), section 22: travel postponement (msig traveleasy).

MSIG TravelEasy provides coverage for reasonable additional travel expenses to reschedule the insured person’s journey if it is unexpectedly and unavoidably postponed due to specific covered reasons occurring within 30 days before the journey’s start but after purchasing the insurance.

Coverage is for additional travel expenses due to unexpected and unavoidable postponement of the journey.

Covered reasons include

- Death, serious injury, or illness of the insured person or their family member/travel companion.

- Being called as a witness in a Singapore court.

- Homes or businesses in Singapore are becoming uninhabitable or seriously damaged.

- Unexpected strikes, industrial action, riots, civil commotions, natural disasters, airport/airspace closures.

- Denial of boarding due to infectious disease symptoms.

Policy Termination:

- Policy ends for the insured person who postpones the trip after a claim is made under this section.

- The policy continues for other insured persons who continue with the trip.

Claim Limitation:

- Only 1 claim is payable under Sections 20, 21, 22, or 23 if they result from the same event.

MSIG TravelEasy specifies that expenses and losses not covered by this section will be detailed in the policy document’s exclusions section.

In a single return trip policy, once a claim is made for travel postponement under this section and the trip is postponed, the policy will immediately end for the insured person who postpones the trip.

The policy remains in force for other insured persons who continue with the trip.

Section 23: Replacement Of Traveller (MSIG TravelEasy)

Section 24: replacement of employee (msig traveleasy - corporate policyholders only).

MSIG TravelEasy’s Section 24 covers the insured person’s employer for replacement expenses to send a substitute employee.

This coverage is activated if the insured person either passes away during the trip, suffers an injury or illness leading to hospitalisation for more than seven days, or is confirmed by a doctor to be unable to perform work duties for more than seven days.

Coverage Details

- Replacement Expenses: Includes all reasonable and necessary expenses for sending a substitute employee. This includes economy return air tickets and accommodation expenses for the substitute employee to travel to the location where the original insured person was carrying out their work duties.

- Travel and Accommodation Class: The transportation and accommodation booked for the substitute employee must not be higher in class or category than that of the insured person.

- Itinerary Requirements: The itinerary of the substitute employee must be similar to and no longer than the original insured person’s duration.

Documentation :

Claims under this section must include supporting documents such as proof of payments made by the policyholder, letters of appointment, and employment contracts.

The policy document’s exclusions section will detail specific exclusions applicable to this section.

Section 25: Delayed Departure (MSIG TravelEasy)

MSIG TravelEasy provides coverage for delays in public transport departure due to reasons like strikes, industrial action, riots, civil commotion, poor weather conditions, natural disasters, mechanical breakdowns, or closure of airport or airspace.

Benefits Offered:

- Delay Benefit:

- MSIG TravelEasy will pay $100 to each insured person for every full 6 hours of continuous delay.

- The delay period is calculated from the scheduled departure time to the actual departure time of the replacement flight.

- Alternative Travel Arrangement:

- Suppose the insured person books alternative transportation to the same destination that departs earlier than the next available scheduled departure. MSIG TravelEasy will cover the additional administrative or travel expenses incurred in that case.

- The maximum reimbursement under this option will not exceed the amount payable under the Delay Benefit, less any refund recovered.

Claim Eligibility:

- To qualify for a claim, the insured person must have checked in as per the original itinerary and received written confirmation from the carrier or their handling agents stating the reason and length of the delay.

- If a claim under Section 25 or related sections (26 to 30, 50) results from the same event, MSIG TravelEasy will pay under only 1 of these sections.

Section 26: Flight Diversion (MSIG TravelEasy)

MSIG TravelEasy provides coverage if the insured person’s scheduled flight is diverted due to poor weather conditions, natural disasters, emergency medical treatment for a fellow passenger, or mechanical breakdown of the aircraft, resulting in a delay in reaching the planned destination.

Compensation Details:

- MSIG TravelEasy will pay $100 for every full 6 hours of continuous delay due to flight diversion.

- The delay period is calculated from the scheduled arrival time at the planned destination to the flight’s actual arrival time.

Documentation Requirement:

- The insured person must obtain written confirmation from the carrier, operator, or handling agent stating the reasons and length of the delay.

- If a claim under Section 26 or related sections (25, 27 to 30, 50) results from the same event, MSIG TravelEasy will pay under only one of these sections.

Section 27: Overbooked Flight (MSIG TravelEasy)

MSIG TravelEasy provides coverage if the insured person is denied boarding on a scheduled flight for which they have a confirmed reservation due to overbooking by the travel agent or airline.

- MSIG TravelEasy will pay the specified amount for every full 6 hours of continuous delay due to an overbooked flight.

- If a claim under Section 27 or related sections (25, 26, 28 to 30, 50) results from the same event, MSIG TravelEasy will only pay under one of these sections.

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 28: Missed Travel Connection (MSIG TravelEasy)

MSIG TravelEasy provides coverage if the insured person misses an onward scheduled public transport connection outside Singapore due to the late arrival of their incoming transport.

This coverage applies when the insured person has a confirmed reservation for the missed connection.

- MSIG TravelEasy will pay the specified amount for every full six hours of continuous delay due to a missed travel connection.

- The delay period is calculated from the actual arrival time of the incoming transport at the transfer point to the actual departure time of the replacement transport.

- If a claim under Section 28 or related sections (25, 26, 27, 29 to 30, 50) results from the same event, MSIG TravelEasy will only pay under one of these sections.

Section 29: Shortening The Trip (MSIG TravelEasy)

MSIG TravelEasy covers unused travel fare, accommodation charges, deposits, and reasonable additional travel expenses if the insured person needs to make a direct trip home due to specific covered reasons occurring during the journey.

Covered Reasons for Shortening the Trip:

- Death, serious injury, or severe illness of the insured person, their family member, or travel companion.

- The insured person or their travel companion is called a witness in a Singapore court.

- The insured person’s home or place of business in Singapore is becoming uninhabitable or seriously damaged.

- Unexpected strike, industrial action, riot, civil commotion, natural disasters, airport/airspace closure, hijacking, or denial of boarding due to infectious disease symptoms at the destination.

Notification Requirement:

- The insured person must immediately notify the tour, public transport, or accommodation provider that a change or cancellation is required.

- If a claim under Section 29 or related sections (25, 26, 27, 28, 30, 50) results from the same event, MSIG TravelEasy will pay under only one of these sections.

Section 30: Travel Disruption (MSIG TravelEasy)

MSIG TravelEasy provides coverage for additional travel expenses needed to continue the originally scheduled journey if the trip is disrupted due to specific covered reasons.

Covered Reasons for Travel Disruption:

- Unexpected strike, industrial action, riot, civil commotion, natural disasters, airport/airspace closure, hijacking, or fire at the accommodation at the destination.

- Denial of boarding of public transport due to infectious disease symptoms.

- The insured person must immediately notify the tour, public transport, or accommodation provider upon finding out that a change or cancellation is required.

- If a claim under Section 30 or related sections (25, 26, 27, 28, 29, 50) results from the same event, MSIG TravelEasy will pay under only one of these sections.

Section 31: Automatic Extension Of Cover (MSIG TravelEasy)

MSIG TravelEasy ensures that the policy coverage is automatically extended without any additional premium under certain circumstances if the insured person cannot complete their homeward journey before the policy’s end date.

The coverage extension is provided under 2 specific conditions:

- Public Transport Delay:

- If any public transport in which the insured person is travelling as a fare-paying passenger is delayed, the cover will be extended for up to 14 days.

- Injury or Illness Prevention:

- Suppose the insured person’s intended return journey is prevented due to their injury or illness arising from a cause covered under the policy. The cover will be extended for up to 30 days in that case.

Section 32: Delayed Baggage (MSIG TravelEasy)

MSIG TravelEasy provides coverage if the insured person’s checked-in baggage is temporarily lost or misdirected by the carrier and not returned within six hours after arrival at the baggage pick-up point of the scheduled overseas destination.

- MSIG TravelEasy will pay the specified amount for every total six hours of continuous delay in receiving the checked-in baggage.

- If the baggage is delayed on arrival in Singapore, the maximum sum payable is $200, provided a minimum period of six hours of delay has elapsed.

Claim Conditions:

- Only one baggage delay claim will be paid per insured person, regardless of the number of baggage pieces delayed or the number of insured persons sharing one piece of delayed baggage.

- Any payment will be deducted from the amount payable under Section 33 – Baggage if the baggage is later found to be permanently lost.

- The insured person must obtain written confirmation from the carrier, operator, or their handling agents stating the reason and length of the delay.

Section 33: Baggage (MSIG TravelEasy)

MSIG TravelEasy covers accidental loss or damage to personal baggage, including clothing, personal belongings, one laptop computer, and one mobile device owned or taken by an insured person during the journey outside Singapore.

Coverage Details:

- Jewellery, laptop computers, and mobile devices must be carried as hand luggage; loss or damage to these items in checked-in baggage is not covered.

- MSIG TravelEasy may opt to pay for or repair damaged items, considering wear and tear and market value.

- For electronic items bought within one year before the accident, market value loss may not be considered if original receipts are provided.

- If an item is beyond economical repair, it is treated as lost.

- The maximum payment for any single item, pair, or set of items is $500, but up to $1,000 for a laptop computer (one laptop and one mobile device per trip).

Claim Process:

- For loss or damage caused by public transport, accommodation, or service providers, claims must be made to them first. Proof of compensation denial is required when claiming from MSIG TravelEasy.

Items covered under Section 34 – Wedding Clothing and Accessories, Section 35 – Loss of Travel Documents, or Section 42 – Golfer’s Cover are excluded.

- The maximum payment under Sections 33 to 35 combined will not exceed the maximum limit under Section 33 – Baggage.

Section 34: Wedding Clothing & Accessories (MSIG TravelEasy)

MSIG TravelEasy covers accidental loss or damage to bridal and ceremonial clothing, wedding rings, jewellery, and wedding accessories owned, hired, or on loan to the adult insured person for their wedding.

- Includes bridal and ceremonial clothing, wedding rings, jewellery, and accessories to be used by the bride or groom for the wedding ceremony, reception, or overseas wedding photoshoot.

- These items must be transported as carry-on baggage during travel on public transport; loss or damage in checked-in baggage is not covered.

- The maximum payment for any single item, pair, or set of items is $750, or up to 40% of the limit for this section for wedding rings and jewellery.

- If a claim under Section 34 and Section 33 results from the same event, MSIG TravelEasy will pay under Section 34.

- This benefit does not apply to an insured child.

Section 35: Loss Of Travel Documents (MSIG TravelEasy)

MSIG TravelEasy covers the cost of obtaining replacement passports, travel tickets, and other relevant travel documents due to accidental loss or damage while overseas.

It also covers reasonable additional travel expenses needed to replace lost travel documents if the loss results from robbery, burglary, or theft during the journey outside Singapore.

Reporting Requirement:

- The loss must be reported to the local police at the place of the incident within 24 hours after it occurs.

- Claims must be accompanied by written documentation from the police.

Section 36: Personal Money (MSIG TravelEasy)

MSIG TravelEasy covers the loss of an insured person’s cash, banknotes, or traveller’s cheques for social and domestic purposes.

The loss must arise from robbery, burglary, or theft while the insured person is outside Singapore during the journey.

Reporting Requirement :

What is Not Covered:

Loss or theft of money while transported as checked-in baggage is not covered.

Section 37: Fraudulent Use Of Credit Card (MSIG TravelEasy)

MSIG TravelEasy covers financial loss resulting from the fraudulent use of the adult-insured person’s personal credit card.

This coverage applies to unauthorised charges made overseas following the loss of the card due to robbery, burglary, or theft while the adult insured person is outside Singapore during the journey.

- The loss of the credit card must be reported to the credit card issuer within six hours of the robbery, burglary, or theft.

- Failure to report within this timeframe will result in no benefit being paid under this section.

- A claim must be accompanied by a report from the credit card issuer showing the amount of loss and confirming the insured person’s liability for the loss.

Section 38: Credit Card Outstanding Balance (MSIG TravelEasy)

MSIG TravelEasy provides coverage for the outstanding balance on an adult insured person’s personal credit card account.

This coverage is applicable if the insured person suffers an injury during the journey outside Singapore, which, within 90 days of its occurrence, is the sole cause of their death.

- The policy will pay the outstanding balance on the insured person’s personal credit card account as of the date of the accident leading to their death.

Section 39: Personal Liability (MSIG TravelEasy)

MSIG TravelEasy provides coverage for legal liabilities incurred by the insured person for accidents during the journey outside Singapore, leading to death or injury of others or loss of or damage to others’ property.

- The policy covers legal costs and expenses awarded against or paid by the insured person with MSIG TravelEasy’s written permission.

- The coverage includes compensation for accidents resulting in death or injury to any person and loss of or damage to property belonging to others.

Maximum Payment:

- The maximum payment under this section for any 1 event or series of events from 1 original cause, and in total for all events in any one trip, is specified in the table above.

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section

Section 40: Legal Expenses For Wrongful Arrest Or Detention (MSIG TravelEasy)

MSIG TravelEasy provides coverage for legal costs and expenses that the insured person is legally obligated to pay due to wrongful arrest or detention by any government or local authority during their journey outside Singapore.

The policy covers legal costs and expenses, including those awarded against or paid by the insured person with MSIG TravelEasy’s written permission.

- The coverage applies to wrongful arrest or detention incidents during the journey.

Maximum Payment

Section 41: Adventurous Activities Cover (MSIG TravelEasy - Elite & Premier Plans Only)

MSIG TravelEasy covers accidental death or injury incurred while participating in or practising certain adventurous activities for leisure and non-competitive purposes.

The activities must be conducted with a licensed operator, and the insured person must adhere to all safety and health instructions, guidelines, or regulations.

Covered Activities:

- Aerial Activities: Zip-lining, zip-riding, bungee jumping, parasailing, tandem sky diving, tandem paragliding, tandem hang gliding.

- Aerial Sightseeing: Hot-air balloon, helicopter, airplane.

- Water Activities: Canoeing or white-water rafting up to Grade 3, jet skiing, helmet diving, scuba diving (up to the depth of certification, max 30 meters).

- Winter Sports: Ice skating, tobogganing, sledging, snow tube sliding, dog sledding, snow rafting, skiing, snowboarding, snowmobiling (excluding off-piste, ungroomed, unpatrolled areas).

- Hiking and Trekking: Up to 3,000m above sea level.

- Marathon Running: Up to 42.195km.

Section 42: Golfer’s Cover (MSIG TravelEasy)

MSIG TravelEasy covers golf-related incidents, including loss or damage to golfing equipment, non-refundable green fees due to injury or illness, and expenses for a celebratory round of drinks for scoring a hole-in-one.

- Golfing Equipment: Covers loss or damage to golf clubs and bags. Excludes loss or damage during play or practice.

- Green Fees: Reimburses non-refundable pre-booked green fees if unable to play due to injury or illness.

- Hole-in-One: Covers the cost of celebratory drinks for scoring a hole-in-one in an organised event at any 18-hole golf course outside Singapore.

- For golfing equipment, MSIG TravelEasy may opt to pay or repair items, considering wear and tear and market value.

- For hole-in-one claims, written evidence from the golf club official and original receipts for the cost of celebratory drinks are required.

- If a claim under Section 33 – Baggage and Section 42 – Golfer’s Cover results from the same event, MSIG TravelEasy will pay under Section 42.

Section 43: Unused Entertainment Ticket (MSIG TravelEasy)

MSIG TravelEasy covers the cost of any prepaid or unused portion of entertainment tickets meant for use overseas during the trip.

The coverage applies if the insured person is prevented from using the ticket due to specific reasons occurring within 30 days before or during the trip.

Covered Reasons

- Health Issues: Death, serious injury, or severe illness of the insured person, their family member, or travel companion.

- Civil Unrest: Unexpected strike, industrial action, riot, civil commotion at the destination.

- Natural Disasters: Occurrences at the destination prevent the journey’s start or continuation.

- Transport Issues: Closing of airport or airspace or denial of boarding due to infectious disease symptoms.

- The insured person must first seek a cancellation refund from relevant parties (e.g., tour operator, event organiser).

- Claims must be submitted with proof or denial of any compensation from these parties.

Section 44: Rental Vehicle Excess (MSIG TravelEasy)

MSIG TravelEasy covers the excess amount an adult insured person must pay under a rental agreement for accidental loss or damage to a rented car or campervan.

Coverage Conditions:

- Rental Requirements: The vehicle must be rented from a licensed rental agency, and the rental agreement includes an excess (or deductible) condition.

- Driver Eligibility: The adult insured person must be a named driver or co-driver of the rental vehicle and comply with all rental agreement requirements.

- Driving Conditions: The insured person must be licensed to drive the vehicle and not participate in speed/time trials or drive under the influence of alcohol or drugs.

- Insurance Requirement: Full motor insurance against loss or damage to the rental vehicle must be taken as part of the hiring arrangement.

Limitations:

- Coverage is limited to 1 adult insured person per rented vehicle, regardless of the number of insured persons registered to rent or authorised to drive the vehicle.

- The limit for 1 adult insured person applies for the entire trip, irrespective of the number of vehicles rented.

- Loss or damage due to wear and tear, gradual deterioration, insects/vermin, built-in faults, or non-obvious faults/damage.

- Damage to tyres and rims unless it occurs with damage to other parts of the vehicle in the same accident.

Section 45: Returning a Rental Vehicle (MSIG TravelEasy)

MSIG TravelEasy provides coverage for the costs associated with returning a rented car or campervan to the nearest hire depot if the adult insured person, due to injury or illness, is unable to return it personally.

- Rental Agreement: The insured person must be legally responsible for these costs under the rental agreement.

- Driver Eligibility: The insured person must be a named driver or co-driver of the rental vehicle.

- Compliance: All rental agreement requirements must be adhered to by the insured person.

Section 46: Home Contents (MSIG TravelEasy)

MSIG TravelEasy provides coverage for physical loss or damage to the contents of the insured person’s home in Singapore caused by fire or theft (with force and violence) while the home is vacant during the insured person’s trip.

Home Contents Definition:

- Includes household furniture, domestic appliances, audio and video equipment, clothing, and personal belongings owned by the insured person or their immediate family members living with them.

- Excludes deeds, bonds, bills of exchange, promissory notes, cheques, traveller’s cheques, securities, cash, documents, perishable goods, livestock, motor vehicles, bicycles, boats, and accessories.

Coverage Limitations:

- For Platinum, Gold, Silver, etc.: Maximum of $2,000.

- For Any 1 Item: Maximum of $1,000 for any 1 item, set, or pair of items.

- MSIG TravelEasy may opt to pay, reinstate, or repair damaged items, considering wear and tear and market value.

- For electronic items bought within 1 year before the accident, market value loss may not be considered if original receipts are provided.

Section 47: Domestic Pets Care (MSIG TravelEasy)

MSIG TravelEasy covers the additional costs incurred for the continued stay of the insured person’s pet dog or cat at a pet hotel, kennel, or cattery.

This coverage applies if the adult insured person is unable to return to Singapore on the scheduled date due to injury, illness, or delay of public transport.

- The insured person must provide written confirmation from the pet hotel, kennel, or cattery stating the period of stay, the collection date arranged before the journey, and the extended stay period.

- Proof of delay must be provided, either a medical report for medical reasons covered under Section 6 or written confirmation of transport delay.

- Coverage is limited to 1 insured person per policy, regardless of the number of pets they own.

Section 48: Terrorism Cover (MSIG TravelEasy)

MSIG TravelEasy extends coverage to include losses resulting from acts of terrorism.

This is an exception to the general exclusion regarding terrorism.

- Exclusions : No coverage is provided for acts of terrorism involving the use of biological weapons, chemical agents, or nuclear devices.

- Coverage Limits: The policy will pay based on the limits of all other sections.

Group Cover Limit

- For insured persons under group cover, the maximum payout is $5,000,000 for each event involving acts of terrorism, regardless of the transport used on the journey.

Policy Limitation:

- If the insured person is covered under more than 1 policy with MSIG TravelEasy that includes terrorism cover, the maximum payout will be limited to the policy with the highest limit on acts of terrorism.

Section 49: Passive War

As an exception to general exclusion 13(a), we will extend section 1:

Accidental Death & Permanent Total Disability of this policy to cover the insured person for death or bodily injury which may be suffered through war, riot, revolution or any similar event as long as no state of war exists in the country when the insured person travels there, and that country is not the home of the insured person.

The insured person must prove that, when suffering the loss, they were in no way directly or indirectly taking part in any of those activities, apart from steps which were reasonably necessary to protect themselves or their property.

They must also not have been involved in controlling, preventing, suppressing or in any other way dealing or attempting to deal with those events.

This cover will not apply 30 days after the outbreak of war or any of the events listed during the insured person’s visit to that country.

Suppose the insured person is insured under more than one policy with us covering passive war extension.

In that case, the most MSIG TravelEasy will pay for all claims arising directly or indirectly from this will be limited to one policy only (with the highest limit on passive war extension).

Section 50: Hijack Of Public Transport (MSIG TravelEasy)

MSIG TravelEasy provides coverage if the public transport the insured person is travelling is hijacked.

Compensation is provided every 6 hours if the insured is prevented from reaching their scheduled destination.

- Exclusions: No payment will be made for hijack if the intended destination of the public transport is to or by way of, a country in a state of war.

Additional Information:

If a claim under Section 50 and other specified sections (like Delayed Departure, Flight Diversion, etc.) results from the same event, MSIG TravelEasy will pay for the claim under only 1 of these sections.

Section 51: Kidnap And Hostage (MSIG TravelEasy)

MSIG TravelEasy provides coverage if the insured person is kidnapped or wrongly held, abducted, or restrained by a criminal during the journey outside Singapore.

- Exclusions: The kidnap cannot be committed by any insured person, their family member, travel companion, or close business associate, whether acting alone or with others.

- Reporting: The kidnap must be reported to the local police at the place of the event within 24 hours of the incident ending. Written documents from the police must accompany claims.

- The insured person must prove that they were not directly or indirectly taking part in any of the activities related to the kidnap, apart from steps reasonably necessary to protect themselves or their property.

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions.

Additional Bonus Features Of MSIG TravelEasy Travel Insurance

General Overview:

- MSIG TravelEasy arranges worldwide medical and travel assistance services through an appointed assistance company to aid insured persons during emergencies on their journey outside Singapore.

MSIG Assist 24-hour Hotline:

- Insured persons can access support by calling +65 6323 8288.

- Identification by full name and policy number is required for service.

Maximum Coverage:

- The maximum coverage for all services and benefits under sections 16 to 19 is capped at $1,000,000 per insured person for any one journey, irrespective of the number of events involved.

Service Availability:

- Services are provided globally, except in areas where offering them is impossible or impractical.

- MSIG TravelEasy and the assistance company are not responsible for service failures or delays caused by external factors like strikes, legal restrictions, or the inability of local medical providers to offer assistance.

Legal Proceedings:

- MSIG TravelEasy may initiate legal proceedings in the insured person’s name to recover compensation from 3rd parties responsible for any loss, injury, or illness. This action will not affect the benefits under sections 15 to 19.

Exclusions:

- Specific exclusions applicable to these sections will be detailed in the policy document.

Section Overview:

- Section 15: Likely covers initial emergency assistance services.

- Section 16: May include emergency medical evacuation and related services.

- Sections 17 to 19: Typically cover other travel assistance services like repatriation, travel advice, and support in case of lost documents or other travel-related issues.

For precise details, benefits, limits, and exclusions of Sections 15 to 19, it’s essential to refer to the actual MSIG TravelEasy policy document.

The above summary provides a general understanding based on typical travel insurance offerings.

Optional Add-Ons For MSIG TravelEasy Travel Insurance

Covid-19 cover (traveleasy) benefit, what is covered.

- Extends policy to cover claims related to COVID-19 under certain conditions.

- Includes coverage for hospitalisation, quarantine, and positive COVID-19 tests.

Conditions applicable to the COVID-19 cover benefit

The COVID-19 Cover endorsement under MSIG TravelEasy extends specific policy sections to cover claims related to COVID-19, adhering to certain conditions and exclusions.

Here’s a summary of the key conditions:

- Travel Advisory Compliance: The insured must not travel against advisories issued by the Singapore government.

- Adherence to COVID-19 Measures: Compliance with all COVID-19-related measures set by Singapore and relevant overseas authorities is required. This includes vaccination requirements, pre-departure and post-arrival COVID-19 testing, quarantine, isolation, and following a controlled itinerary.

- Avoidance of COVID-19 Exposure: During the trip, the insured should not knowingly stay with anyone suspected or confirmed to have COVID-19 or undergoing isolation or quarantine.

- Immediate Contact with MSIG Assist: For any medical claims related to COVID-19, the insured or their representative must promptly contact MSIG Assist.

- Specific Conditions for Travel Cancellation, Postponement, and Replacement of Traveller:

- If the policy is bought within 30 days before the trip’s scheduled departure, it must be purchased at least 3 days in advance.

- Neither should exhibit COVID-19 symptoms (fever, cough, shortness of breath, blocked or runny nose, sore throat, loss of smell).

- Neither should have tested positive for COVID-19.

- Neither should have been in close contact with anyone suspected or confirmed to have COVID-19.

- These conditions are crucial for the COVID-19 coverage to be valid and for claims related to COVID-19 to be considered under the policy.

Pre-trip Benefit

Section 21 – Travel cancellation