Stravl.org is solely used for administrative services. Stravl's user-facing website is available at

Stravl Data

Stravl is open-sourcing over 1,000,000 user travel preference data.

Gain access to Stravl's extensive travel preference data, the largest custom data set of its kind. You are free to use the data for any academic or commercial purposes. We're happy to help with questions, just reach out to [email protected] .

Stravl Data Repository

Download Stravl Data [317MB]

Optional Attribution:

Sursock, A. & Brooks, C. (2023). Stravl Travel Preference Data A. www.stravl.org/data.

Data Descriptions:

Stravl-Data is the world's largest, open-sourced data set of travel preferences. Through a user-facing website, Stravl gathered 80,301 travelers' vacation preferences. Users were asked to fill out a brief form on their ideal vacation preferences (such as expected experiences, scenery, and activity level) and logistical constraints (such as budget, traveler ages, and season). Thereafter, they were asked to "swipe" or "rate" ten destinations. Users have the option to respond with "Yes", "No", or "Maybe" in a Tinder-like rating framework. In total, over 1,000,000 user swipes were recorded. Lastly, users are shown 5 to 10 recommendations, which were selected using different ML-models. Those recommendations are recorded and users' feedback on them (through clicking a "smiley" or "frowny" face next to them) is stored. Personally-identifying information such as IP data, user names, or other metadata has been removed prior to the release of this dataset.

Stravl's extensive travel preference data is the largest custom data set of its kind. You are free to use the data for any academic or commercial purposes. We're happy to help with questions, just reach out to [email protected]. Below find a brief description of all columns in our data set.

Form Responses:

What age ranges are present in your travel group? [multiple selections possible]

What is your trip budget (per person, per night)?

2: $100-$249

What season are you planning to travel?

What are you looking to experience? Multiple selections encouraged.

1: Adventure

4: Nightlife

6: Shopping

What scenery are you seeking? Multiple selections encouraged.

3: Mountain

Activity Level

0: Chill & Relaxed

1: Balanced

Safety Conscious

0: Very Safety Conscious

2: Ready for Anything

Destination Popularity

0: Off the Beaten Path

1: Classic Spot

2: Mainstream & Trendy

Where do you want to go?

0: Anywhere

1: Specific Regions

Which specific regions? [If ‘Specific Regions’ is selected in FORM_R] [multiple selections allowed]

n: N. America

c: Caribbean

s: S. America

m: Mid. East

Swipe Responses:

Each of "yes_swipes", "no_swipes", and "maybe_swipes" includes a list of indices representing destinations a user swiped 'yes', 'no', or 'maybe' on. The indices can be transformed to its corresponding destination names through the "destination_ids" table.

Model, Recommendations, and Ratings:

Users were then recommended a set of 5 destinations (or 10 if a user wanted more). Different algorithms were used to recommend those destinations; the variables "model", "retrieval", and "dynaMatch" indicate which algorithms were used. Their implementations are not released, yet their selections are still shared for research purposes.

Each of the recommendation columns includes the names of recommended destinations in order of recommendation; if a column includes '-1' recommendations were not yet tracked at the time this user completed the form. Each rating column includes ant user ratings that were provided. If all ten columns are set to -1, ratings were not tracked at the time this user completed the form. If not, a rating of '-1' indicates a user's disapproval with the rating, and a rating of '1' indicates their approval of it. If the entry is empty, the user has not rated the corresponding destination.

For an updated version of Stravl Data, Star our GitHub repository here: https://github.com/Stravl/Stravl-Data

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Data Descriptor

- Open access

- Published: 23 September 2021

A database of travel-related behaviors and attitudes before, during, and after COVID-19 in the United States

- Rishabh Singh Chauhan ORCID: orcid.org/0000-0001-7188-557X 1 ,

- Matthew Wigginton Bhagat-Conway ORCID: orcid.org/0000-0002-1210-2982 2 ,

- Denise Capasso da Silva ORCID: orcid.org/0000-0003-1414-8439 3 ,

- Deborah Salon ORCID: orcid.org/0000-0002-2240-8408 2 ,

- Ali Shamshiripour 1 ,

- Ehsan Rahimi ORCID: orcid.org/0000-0002-8649-7542 1 ,

- Sara Khoeini 3 ,

- Abolfazl (Kouros) Mohammadian ORCID: orcid.org/0000-0003-3595-3664 1 ,

- Sybil Derrible ORCID: orcid.org/0000-0002-2939-6016 1 &

- Ram Pendyala 3

Scientific Data volume 8 , Article number: 245 ( 2021 ) Cite this article

8762 Accesses

14 Citations

2 Altmetric

Metrics details

- Interdisciplinary studies

- Research data

The COVID-19 pandemic has impacted billions of people around the world. To capture some of these impacts in the United States, we are conducting a nationwide longitudinal survey collecting information about activity and travel-related behaviors and attitudes before, during, and after the COVID-19 pandemic. The survey questions cover a wide range of topics including commuting, daily travel, air travel, working from home, online learning, shopping, and risk perception, along with attitudinal, socioeconomic, and demographic information. The survey is deployed over multiple waves to the same respondents to monitor how behaviors and attitudes evolve over time. Version 1.0 of the survey contains 8,723 responses that are publicly available. This article details the methodology adopted for the collection, cleaning, and processing of the data. In addition, the data are weighted to be representative of national and regional demographics. This survey dataset can aid researchers, policymakers, businesses, and government agencies in understanding both the extent of behavioral shifts and the likelihood that changes in behaviors will persist after COVID-19.

Machine-accessible metadata file describing the reported data: https://doi.org/10.6084/m9.figshare.15141945

Similar content being viewed by others

Effect of COVID-19 response policies on walking behavior in US cities

Mapping global variation in human mobility

Mobility networks in Greater Mexico City

Background & summary.

The COVID-19 pandemic has spread across the world, infecting tens of millions and killing over one million people 1 . By March 2021, the United States (U.S.) had recorded the highest number of confirmed COVID-19 cases and COVID-19 related deaths in the world 1 . Since social distancing is one of the most effective measures in containing the spread of the infection 2 , several U.S. states issued various restrictions including stay at home orders. Moreover, numerous restaurants and bars closed for dine-in services, various recreation facilities were shut down, many offices and schools switched from meeting in-person to meeting online, and travel restrictions were imposed. These measures had a profound impact on how people in the U.S. went about their daily lives.

To understand the current and future impacts of the pandemic, we conducted a nationwide online survey. The goal of the survey is to capture attitudes and shifts in travel-related choices of people across the nation both during the pandemic and once COVID-19 is no longer a threat. The data are shared publicly in order to help government agencies and businesses prepare for the future. We are conducting additional survey waves with the same respondents to monitor how people’s choices evolve over the course of the pandemic and beyond.

An early version of the survey took place from April to June 2020, when the stay at home orders were in place in most parts of the country 3 , 4 ; this portion of the data collection is referenced as Wave 1 A . A slightly-modified larger-scale survey, Wave 1B ,was deployed between late June and October 2020. Subsequent survey waves are being conducted as the situation evolves. The collected data are released as they become available and necessary procedures for cleaning, documenting, and weighting the data are completed. This procedures for data processing are detailed in this paper. The present article focuses on data from the first wave of the survey.

In the months following the beginning of the spread of COVID-19, several efforts have been made to collect data related to COVID-19. In fact, many datasets have been compiled, specifically on COVID-19 testing 5 , medical imaging of COVID-19 cases 6 , the timeline of government interventions 7 , policy announcements 8 , implementation and relaxation of public health and social measures 9 , epidemiological data 10 , mobility-related data 11 , and out-of-home activity information 12 , to name a few. Researchers also turned to social media platforms, like Twitter and Instagram, to gather COVID-19-related data 13 , 14 , 15 , 16 . Furthermore, several surveys have been conducted to measure the impacts of the pandemic 17 , 18 , 19 , some of which are now released for public use 20 , 21 .

Our survey data are different from most others in several ways. First, it is comprehensive insofar as it includes data about a wide range of topics including commuting, daily travel, air travel, working from home, online learning, shopping, attitudes, risk perception, and socioeconomic and demographic details. Second, it captures detailed information about behaviors before and during the COVID-19 pandemic, as well as the choices that people expect to make when the COVID-19 virus is no longer a threat. Third, it was collected from respondents across the U.S., covering diverse socio-economic backgrounds, professions, education levels, and ages. Fourth, the survey is a true longitudinal panel survey, collecting data in multiple waves from the same individuals at regular intervals. Finally, the data are made publicly available to promote data-driven analysis and research.

The next section describes the data collection methodology, the questions included in the survey, the survey deployment process, and the participant recruitment strategy. Next, the data records section describes the data file types and metadata. Subsequently, the technical validation section explains the procedure for the survey data cleaning and weighting. Lastly, the final section provides additional notes for data users.

Ethical compliance

Our study protocol was approved by both Arizona State University (ASU) and University of Illinois at Chicago (UIC) Institutional Review Board offices. Participants were informed that their participation is voluntary, and that their responses are shared anonymously. An online informed consent was obtained from everyone who responded to the survey.

Survey questions

The data were collected through an extensive online survey with over 120 questions. The survey questions can be broadly divided into three categories: (1) retrospective questions focusing on the period before COVID-19, (2) questions about the period during COVID-19, and (3) prospective questions on respondent expectations for a future period in which COVID-19 is no longer a threat. The questions cover a wide variety of subjects including commuting habits, discretionary travel choices, work-related questions, study-related questions, shopping, dining, and so on – all before, during, and expected after the pandemic.

The survey questions can be classified into eight categories based on question subject type, namely: demographics, work, study, shopping and dining, transportation, and general attitudes. Table 1 describes each of these categories.

Survey recruitment

From April to mid-June 2020, initial Wave 1A responses were collected from a convenience sample via mailing lists, social media outreach, and mainstream media articles. A total of 1,110 responses were collected during this phase.

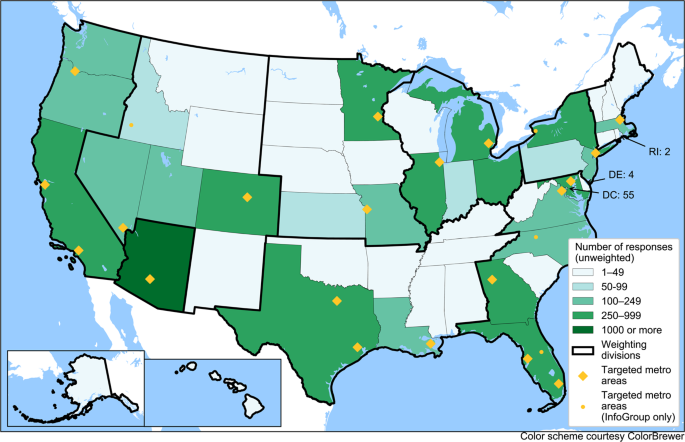

From late June onward, Wave 1B, the modified version of the survey, was deployed through survey invitations sent to a random email list purchased from a data marketing company. The list contained 350,000 email addresses belonging to people in 24 metropolitan areas across the U.S., as well as the state of Ohio (see Fig. 1 ). We purchased 100,000 additional email addresses of people randomly selected from across the country, including rural areas and excluding the areas covered by the first 350,000 emails. A total of 1,116 responses were received from the email list. Unfortunately, major email service providers quickly began marking our survey invitations as spam, while some smaller providers did not. While we took several steps to mitigate this issue, including changing the wording of the emails, changing the source of the emails (a uic.edu, asu.edu, or covidfuture.org email address), we were ultimately not able to fully solve this problem and saw a lower response rate from individuals with addresses from major email providers.

Distribution of survey respondents by the state of residence for survey dataset version 1.0. Alaska and Hawai’i are in the same weighting division as California, Oregon, and Washington.

Survey invitation emails were also sent to an additional list of approximately 39,000 email addresses from the Phoenix metropolitan area purchased for a previous survey effort 22 . This list yielded 782 responses. The survey invitation emails were sent using Amazon Web Services (AWS) and through the Qualtrics platform. Every 20 th respondent who was invited through the purchased email addresses received a $10 incentive as a gift card. Respondents also had the option to donate their survey incentive to a charity. Invitees received two reminders as part of efforts to maximize response rates.

An additional 5,250 responses to the Wave 1B survey were collected through a Qualtrics Online Panel. Qualtrics recruits these respondents from a variety of panels maintained by other firms and uses quota sampling to recruit respondents that are demographically representative of the nation. The Qualtrics quotas were set to collect information from 20 U.S. metropolitan areas, mostly consistent with the metropolitan areas sampled from the purchased email list, as well as the states of Ohio, Utah, North Carolina, upstate New York, and rural areas. In order to obtain samples that would represent the population in each of the selected geographies, quotas were imposed in the Qualtrics online panel subsample to guarantee representation based on income, age, race and ethnicity, and education. We requested all respondents to provide their email addresses in order to recontact them for subsequent survey waves. Since the Qualtrics respondents are professional survey takers, we designated most questions as mandatory, and we included attention check questions, which are shown to improve response quality 23 .

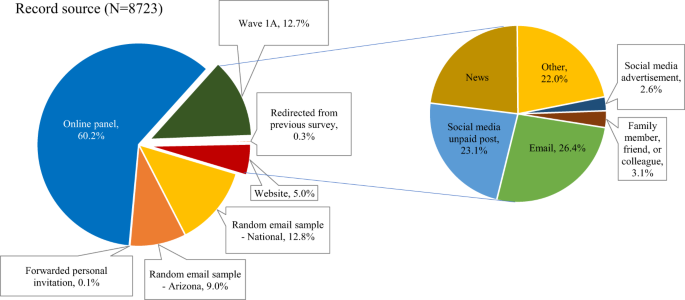

The distribution of responses by geography, as well as the targeted metropolitan areas, are shown in Fig. 1 . Figure 2 shows the distribution of responses by recruitment method, available in the “org” variable in the dataset. The geographical targets were chosen based on geographic and metropolitan area size diversity, as well as the state of the virus spread in May 2020.

Distribution of Record by Source (from the survey dataset version 1.0).

Figure 1 shows the distribution of survey respondents across the U.S. (50 states and the District of Columbia). Following our recruitment strategy, a greater number of responses come from larger and more urban states. Arizona is overrepresented due to the oversample of Arizona respondents in the email-based deployment. The respondents from the initial Wave 1A sample are also more likely to hail from Arizona as the Arizona State University survey team’s network is heavily Arizona-based. When the data are weighted, any geographic discrepancies at the census division level are controlled and overrepresentation of Arizona is controlled/corrected separately.

Additional survey waves

To monitor how people’s attitudes and behaviors evolve, survey respondents are contacted again with at least two shorter follow-up surveys, approximately four months apart in spring and fall 2021.

Data Records

The survey dataset 24 can be accessed from the ASU Dataverse at: https://doi.org/10.48349/ASU/QO7BTC . The dataset is available in CSV (comma-separated value) format. Since the data will be updated periodically, the data are versioned—in this article, results from the survey dataset version 1.0 are reported. The dataverse also contains the database codebook containing the metadata and explaining the variables. The codebook contains a changelog for each new version.

The respondents to Waves 1A and 1B received similar but not identical surveys. We have merged the responses to these two versions of the survey into the final dataset wherever possible. For some variables, the questions were identical, whereas for other variables, harmonization of similar responses was required. In the dataset, variables ending in ‘_harm’ are harmonized between the two datasets, variables ending in ‘_w1a’ are available only for Wave 1A respondents, variables ending in ‘_w1b’ are available only for respondents from our Qualtrics Online Panel, purchased email lists, and anyone who found the survey via the COVIDFuture web site or email lists after June 19, 2020 (start date of Wave 1B). Variables with no suffix were asked the same way between the two surveys, and no harmonization was necessary. We also provide a file containing only Wave 1B responses and variables, which simplifies analysis of the Wave 1B data.

Technical Validation

Data cleaning.

To monitor respondents’ attention to survey questions in the Qualtrics online panel, attention check questions were included. Respondents were allowed to miss one attention check and be given an opportunity to answer that section again. If they missed an attention check twice, or both attention checks once, their survey was terminated.

We additionally undertook several quality checks to help ensure that the collected data were valid. We removed any respondents who reported that they shop for groceries both in-store and online every day, or expect to after the pandemic, as these are likely to be invalid responses. We also removed respondents who reported strongly agreeing or strongly disagreeing with all COVID-related attitudes, as some of these were worded positively and some negatively. Several additional quality checks were undertaken in the Qualtrics Online Panel as part of Qualtrics’ data cleaning process, including a check for people finishing the survey too quickly.

Respondents that did not report a state of residence, reported living outside the 50 states and the District of Columbia, or did not provide answers to all of the control variables used in the data weighting process described in the next section were removed from the data. Due to this restriction, 558 records with missing control variable information, 59 records with missing home location, and one response from Puerto Rico were not included in the final dataset encompassing responses received through October 14, 2020. Further steps in data preparation will include imputation of missing data, which will allow for some of these omitted records to be recovered in the next version of the dataset. Among the respondents who were not included in the dataset due to missing control variable information, there are 34 respondents who declared their gender as Other; these respondents could not be included because the Census offers no control marginals to weight these records. Further data weighting procedures will attempt to incorporate non-binary gendered individuals on the dataset. Due to the data cleaning and filtering process applied to responses obtained through October 14, 2020, a total of 618 records were not included in the published dataset.

Data weighting

Because the raw data are not fully representative of the U.S. population, weights were calculated using the following control variables: age, education, gender, Hispanic status, household income, presence of children, and number of household vehicles. The weighting procedure accounts for the true population characteristics at the person level. Household-level variables (i.e., income, presence of children, and number of vehicles) were controlled at the person level as well. For example, the marginal distribution used for presence of children refers to the share of adults aged 18 years and older living in household with children, instead of the share of households that have children as it is usually represented. Those marginal distributions were computed using data from the Integrated Public Use Microdata Sample and the American Community Survey (ACS) 2018 1-year data 25 using the sample 18 and older in each of the weighting region boundaries. A noteworthy consequence of this approach is that adjusted household weights are necessary to evaluate household-level characteristics since individuals from larger households are more likely to be represented in the survey (given there are more individuals in these households), and thus have a higher probability of being selected. Weights for household-level analysis can be computed by dividing the person-level weight (provided in the data) by the number of adults in the household.

The national sample was divided into nine regions based on the reported home state (Table 2 ). Each region’s sample was then weighted to match the distributions observed in ACS 2018 1-year estimates 25 , meaning that the survey is demographically representative at the level of each region as well as the entire U.S. The unweighted and weighted survey results are shown in Table 3 ; the weighted results closely replicate population distributions, with inevitable minor deviations on variables that were not controlled in the weighting process.

Weights were calculated using iterative proportional fitting (IPF) procedures embedded within the synthetic population generator PopGen2.0 26 , 27 , 28 . Univariate marginal control distributions were derived from the Integrated Public Use Microdata Sample, American Community Survey (ACS) 2018 1-year data 25 .

Usage Notes

Since the survey will be followed by at least two follow-up survey waves, the database will be updated periodically after the data for each wave is collected, cleaned, and weighted. Each version of the data will be uploaded to the ASU Dataverse and assigned a new DOI number, and all previous versions will remain available to promote reproducibility.

The weights were developed to produce a sample that is representative of the U.S. population, as well as representative of nine divisions within the U.S.: eight census regions (with East and West South Central combined due to small samples in these regions), and a separate category for Arizona due to its large number of respondents. The weights are not guaranteed to produce a representative sample for other (smaller) geographies. When evaluating subsamples at a finer geography (e.g., state or metropolitan area), data users should compare marginal distributions of key demographic variables with the census, and re-weight the data if needed to be representative of the area being analyzed.

Some questions differ between Waves 1A and 1B. Therefore, we have weighted the dataset twice: once including all respondents (Waves 1A and 1B), and once excluding respondents to the Wave 1A sample. Data users should use the Wave 1B weights whenever using variables that are not present in the convenience sample. Since Wave 1A data deviates significantly in terms of population representativeness 4 , there are no weights for questions asked only of Wave 1A respondents. In the file with only Wave 1B responses, only Wave 1B weights are presented.

This unique dataset provides insights on attitudes and behaviors not just before and during pandemic, but also on what might be expected after the pandemic. Possible use cases include modeling of during-pandemic and longer-term changes in mode use, air travel, transit ridership, work from home, and traffic congestion (especially for peak period traffic planning). Published uses of this dataset are documented in Capasso da Silva et al . 29 , Chauhan et al . 30 , Mirtich et al . 31 , and Salon et al . 32 .

Code availability

No codes were developed for this research.

COVID-19 Map. Johns Hopkins Coronavirus Resource Center https://coronavirus.jhu.edu/map.html (2020).

CDC. Coronavirus Disease 2019 (COVID-19). Centers for Disease Control and Prevention https://www.cdc.gov/coronavirus/2019-ncov/prevent-getting-sick/social-distancing.html (2020).

Shamshiripour, A., Rahimi, E., Shabanpour, R. & Mohammadian, A. K. How is COVID-19 reshaping activity-travel behavior? Evidence from a comprehensive survey in Chicago. Transp. Res. Interdiscip. Perspect. 7 , 100216 (2020).

PubMed PubMed Central Google Scholar

Conway, M. W., Salon, D., da Silva, D. C. & Mirtich, L. How will the COVID-19 pandemic affect the future of urban life? Early evidence from highly-educated respondents in the United States. Urban Sci. 4 , 50 (2020).

Article Google Scholar

Hasell, J. et al . A cross-country database of COVID-19 testing. Sci. Data 7 , 1–7 (2020).

Kalkreuth, R. & Kaufmann, P. COVID-19: a survey on public medical imaging data resources. ArXiv Prepr. ArXiv200404569 (2020).

Desvars-Larrive, A. et al . A structured open dataset of government interventions in response to COVID-19. medRxiv (2020).

Cheng, C., Barceló, J., Hartnett, A. S., Kubinec, R. & Messerschmidt, L. Covid-19 government response event dataset (coronanet v. 1.0). Nat. Hum. Behav. 4 , 756–768 (2020).

Zheng, Q. et al . HIT-COVID, a global database tracking public health interventions to COVID-19. Sci. Data 7 , 1–8 (2020).

Xu, B. et al . Epidemiological data from the COVID-19 outbreak, real-time case information. Sci. Data 7 , 1–6 (2020).

Pepe, E. et al . COVID-19 outbreak response, a dataset to assess mobility changes in Italy following national lockdown. Sci. Data 7 , 1–7 (2020).

Killeen, B. D. et al . A County-level dataset for informing the United States’ response to COVID-19. ArXiv Prepr. ArXiv200400756 (2020).

Chen, E., Lerman, K. & Ferrara, E. Tracking social media discourse about the COVID-19 pandemic: Development of a public coronavirus Twitter data set. JMIR Public Health Surveill. 6 , e19273 (2020).

Zarei, K., Farahbakhsh, R., Crespi, N. & Tyson, G. A first Instagram dataset on COVID-19. ArXiv Prepr. ArXiv200412226 (2020).

Alqurashi, S., Alhindi, A. & Alanazi, E. Large arabic twitter dataset on covid-19. ArXiv Prepr. ArXiv200404315 (2020).

Lopez, C. E., Vasu, M. & Gallemore, C. Understanding the perception of COVID-19 policies by mining a multilanguage Twitter dataset. ArXiv Prepr. ArXiv200310359 (2020).

Gensler. US Work from home survey 2020. Gensler-US-Work-From-Home-Survey-2020-Briefing-1.pdf (2020).

Kleinberg, B., van der Vegt, I. & Mozes, M. Measuring emotions in the covid-19 real world worry dataset. ArXiv Prepr. ArXiv200404225 (2020).

Grashuis, J., Skevas, T. & Segovia, M. S. Grocery shopping preferences during the COVID-19 pandemic. Sustainability 12 , 5369 (2020).

Article CAS Google Scholar

Shuja, J., Alanazi, E., Alasmary, W. & Alashaikh, A. Covid-19 open source data sets: A comprehensive survey. Appl. Intell . 1–30 (2020).

Trung, T. et al . Dataset of Vietnamese student’s learning habits during COVID-19. Data Brief 105682 (2020).

Khoeini, S. et al . Attitudes Towards Emerging Mobility Options and Technologies – Phase 2: Pilot and Full Survey Deployment . https://tomnet-utc.engineering.asu.edu/wp-content/uploads/2020/11/TOMNET-Year-2-Project-Report-All-Universities_-Attitudes-Towards-Mobility-Options-Technologies.pdf (2019).

Shamon, H. & Berning, C. Attention check items and instructions in online surveys: Boon or bane for data quality? Surv. Res. Methods Forthcom . (2019).

Salon, D. et al . COVID Future Wave 1 Survey Data v1.0.0. ASU Library Research Data Repository https://doi.org/10.48349/ASU/QO7BTC (2020).

Ruggles, S. et al . IPUMS USA: Version 10.0 Minneapolis, MN: IPUMS https://doi.org/10.18128/D010.V10.0 (2020).

PopGen. MARG - Mobility Analytics Research Group https://www.mobilityanalytics.org/popgen.html (2020).

Ye, X., Konduri, K., Pendyala, R. M., Sana, B. & Waddell, P. A methodology to match distributions of both household and person attributes in the generation of synthetic populations. In 88th Annual Meeting of the Transportation Research Board, Washington, DC (2009).

Konduri, K. C., You, D., Garikapati, V. M. & Pendyala, R. M. Enhanced synthetic population generator that accommodates control variables at multiple geographic resolutions. Transp. Res. Rec. 2563 , 40–50 (2016).

Capasso da Silva, D. et al . How are attitudes toward COVID-19 associated with traveler behavior during the pandemic? Findings https://doi.org/10.32866/001c.24389 (2021).

Chauhan, R. S. et al . COVID-19 related attitudes and risk perceptions across urban, rural, and suburban areas in the United States. Findings https://doi.org/10.32866/001c.23714 (2021).

Mirtich, L. et al . How stable are transport-related attitudes over time? Findings https://doi.org/10.32866/001c.24556 (2021).

Salon, D. et al . The potential stickiness of pandemic-induced behavior changes in the United States. Proceedings of the National Academy of Sciences 118 (27), e2106499118, https://doi.org/10.1073/pnas.2106499118 (2021).

Download references

Acknowledgements

This research was supported in part by the National Science Foundation (NSF) RAPID program under grants no. 2030156 and 2029962 and by the Center for Teaching Old Models New Tricks (TOMNET), a University Transportation Center sponsored by the U.S. Department of Transportation through grant no. 69A3551747116, as well as by the Knowledge Exchange for Resilience at Arizona State University. This COVID-19 Working Group effort was also supported by the NSF-funded Social Science Extreme Events Research (SSEER) network and the CONVERGE facility at the Natural Hazards Center at the University of Colorado Boulder (NSF Award #1841338) and the NSF CAREER award under grant no. 155173. Any opinions, findings, and conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of the funders.

Author information

Authors and affiliations.

Department of Civil, Materials, and Environmental Engineering, University of Illinois at Chicago, Chicago, IL, USA

Rishabh Singh Chauhan, Ali Shamshiripour, Ehsan Rahimi, Abolfazl (Kouros) Mohammadian & Sybil Derrible

School of Geographical Sciences and Urban Planning, Arizona State University, Tempe, AZ, USA

Matthew Wigginton Bhagat-Conway & Deborah Salon

School of Sustainable Engineering and the Built Environment, Arizona State University, Tempe, AZ, USA

Denise Capasso da Silva, Sara Khoeini & Ram Pendyala

You can also search for this author in PubMed Google Scholar

Contributions

R.P., A.M., S.D., D.S. and S.K. planned the project. D.S., M.C., D.C.S., R.C., E.R. and A.M. prepared the survey questions. M.C., D.C.S. and D.S. designed the survey flow logic. R.C., D.C.S., M.C., D.S. and S.D. deployed the survey. M.C. and D.C.S. performed data cleaning and survey data analysis. D.C.S. weighted the dataset. M.C. and D.S. worked on sending out the incentives to the selected respondents. R.C. prepared the first draft. All the authors made significant contributions to manuscript editing and approving the final version of the manuscript.

Corresponding author

Correspondence to Rishabh Singh Chauhan .

Ethics declarations

Competing interests.

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/ .

The Creative Commons Public Domain Dedication waiver http://creativecommons.org/publicdomain/zero/1.0/ applies to the metadata files associated with this article.

Reprints and permissions

About this article

Cite this article.

Chauhan, R.S., Bhagat-Conway, M.W., Capasso da Silva, D. et al. A database of travel-related behaviors and attitudes before, during, and after COVID-19 in the United States. Sci Data 8 , 245 (2021). https://doi.org/10.1038/s41597-021-01020-8

Download citation

Received : 14 December 2020

Accepted : 29 July 2021

Published : 23 September 2021

DOI : https://doi.org/10.1038/s41597-021-01020-8

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

This article is cited by

Covid future panel survey: a unique public dataset documenting how u.s. residents’ travel-related choices changed during the covid-19 pandemic.

- R. S. Chauhan

- M. Bhagat-Conway

Transportation (2024)

Response willingness in consecutive travel surveys: an investigation based on the National Household Travel Survey using a sample selection model

- F. Atiyya Shaw

- Kari E. Watkins

Transportation (2023)

Tracking the state and behavior of people in response to COVID-19 through the fusion of multiple longitudinal data streams

- Mohamed Amine Bouzaghrane

- Hassan Obeid

- Joan Walker

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

Sign up for the Nature Briefing newsletter — what matters in science, free to your inbox daily.

By Bastian Herre, Veronika Samborska and Max Roser

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000.

Tourism can be important for both the travelers and the people in the countries they visit.

For visitors, traveling can increase their understanding of and appreciation for people in other countries and their cultures.

And in many countries, many people rely on tourism for their income. In some, it is one of the largest industries.

But tourism also has externalities: it contributes to global carbon emissions and can encroach on local environments and cultures.

On this page, you can find data and visualizations on the history and current state of tourism across the world.

Interactive Charts on Tourism

Cite this work.

Our articles and data visualizations rely on work from many different people and organizations. When citing this topic page, please also cite the underlying data sources. This topic page can be cited as:

BibTeX citation

Open Data in tourism

How Open Data can sustainably improve the cooperation in tourism sector

Rising demand for new services

Every year millions of people flock to holiday areas to relax at the beach, explore nature or go sightseeing. The tourism industry has been experiencing a sustained boom for years and is continuously generating increased revenues in the holiday regions. Since digitisation does not stop at tourism, innovative solutions come into focus here as well. Data-driven services like apps and online communities are increasingly in demand and are frequently used for travel planning. However, a prerequisite for these services is the availability of data.

Benefits of Open Data

Published in June 2018 on the European Data Portal , the article The benefits of Open Data re-use are gaining awareness in tourism sector elaborates that the use of Open Data in tourism is predicted to have great potential. The availability of data and the openness of platforms in tourism were also discussed during the 11 th Tourism Camp in cooperation with the network Tourismuszukunft and outdooractive , with a particular focus on active cooperation. The aim was to create more transparency about existing industry projects. A panel of experts discussed how an Open Data infrastructure in tourism, based on a Linked Open Data (LOD) approach , can be implemented in the future to achieve sustainable digital transformation in tourism. Initiatives and approaches to standardise real-time data flow in tourism already exist at the European level. A project of the Salzburger Land Tourism Association already provides tourist information as Linked Open Data and stringently pursues the goal of building up knowledge graphs for tourism in other regions as well. These enable interoperability between the technical systems as well as hierarchy levels and thus enables the compatibility of different systems and collaboration of different actors in the tourism sector.

The time is ripe

The dissemination of standardised data will become even more important in the future and the tourism sector can benefit from it. The accessibility of data related to tourism offers the provision of information regarding region and location descriptions, tours or sights that can be read and processed by interfaces, databases and machines. The large IT companies like Google, Amazon, Facebook and Apple, who have an extensive understanding of data, already offer communication solutions in almost all areas - including tourism. Google, for example, provides the app Google trips where the user benefits from the extensive database of the search engine giant. With the user's consent to access his or her personal data in combination with existing data obtained by Google, the app analyses the mail traffic and the Google calendar so that flight data and destinations are available and additional journeys and offers can be suggested. In order to stay competitive smaller actors in the tourism sector are now realising that they have to share their data to offer tourists seamless and value-added services.

First steps into the future of Open Data in tourism

Open Data plays a key part in promoting the tourism sector. The company outdooractive manages many tourist data with the open central database solution . These include events, current news, region and place descriptions, tours and activity trail networks, accommodation reviews, excursion destinations and sights, and stories, pictures or videos.

With its app , outdooractive offers the user the possibility to plan a complete tour from start to end. Users of the app can become part of the community by publishing their own planned and recorded tours on the app's platform. This is only possible because of the complete synchronisation between the website and application.

This example illustrates initiated plans for the use of Open Data in tourism. If the tourism industry succeeds in organising itself jointly and building a comprehensive, open and interoperable data infrastructure, this could promote competition and innovation, enable new business models and reduce dependencies. More and more people are able to travel and are interested in such services, which is why innovative ideas within the tourism industry are far from being exhausted. For this reason, the industry should now start to move closer together and make use of synergy effects.

Let the journey begin!

quality-assurance

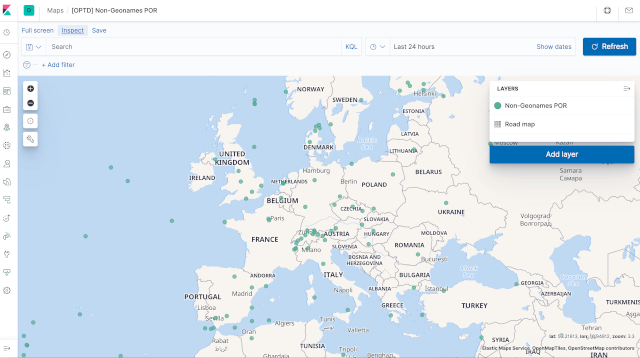

Quality Assurance (QA) for Open Travel Data (OPTD)

View the Project on GitHub opentraveldata/quality-assurance

- Quality Assurance (QA) for OpenTravelData (OPTD)

- Table of Content (ToC)

Ingest processors

Through a pre-built docker image, with a manually built docker image, through a local cloned git repository (without docker), pyenv and pipenv, launch the python checkers.

- Re-set the read-write property of indices

Simplified pipeline and index

Por full index and pipeline, optd consistency and geonames id, por having no geo-location in optd, city por not in optd, multi-city por in optd.

- OPTD vs IATA

State codes

Optd vs un/locode, airport bases / hubs, airline networks, airline appearing in schedules but not in optd, example - optd consistency and geonames.

Table of contents generated with markdown-toc

That repository features scripts to check the quality of the data files produced by the Open Travel Data (OPTD) project.

Though it is not well maintained, that project should produce a Quality Assurance (QA) dashboard, much like Geonames’ one . See the Geonames use case on the Data Quality reference page for more details.

For now, the results of the data quality checks are available on the Transport Search data QA page . For instance, for the 2 June 2021 snapshots:

- Results of the validation checks are published on: https://transport-search.org/data/optd/qa/2021-06-02/results/

- Corresponding reference data sets (which have been checked): https://transport-search.org/data/optd/qa/2021-06-02/to_be_checked/

The corresponding checkers are scripts, maintained in a dedicated checkers/ directory of this repository. Most of them are written in Python, but any other programmation language may be used.

And, hopefully, the QA dashboard will be powered by container images generated thanks to that repository as well.

Travis CI builds are partially covering the tests in https://travis-ci.com/opentraveldata/quality-assurance

Most of the scripts generate CSV data files, which can then be uploaded in databases (classical relational database systems (RDBMS) such as PostgreSQL or ElasticSearch (ES)), or served through standard Web applications. For historical reasons, some scripts may still generate JSON structures on the standard output. In the future, JSON should be used only for metadata, not for the data itself.

The CSV reports are published (thanks to Travis CI) to an OPTD-operated ElasticSearch (ES) cluster. The full details on how to setup that ES cluster, on Proxmox LXC containers, are given in a dedicated elasticsearch tutorial .

For convenience, most of the ES examples are demonstrated both on a local single-node installation ( e.g. , on a laptop) and on on the above-mentioned cluster.

- GitHub repository dedicated to Data Quality

- Transport Search data QA page

- Geonames use case on the Data Quality reference page

- Quality Assurance (QA) images on Docker Cloud

- Induction on monitoring with Elasticsearch

- How to set up a Python virtual environment

ElasticSearch (ES)

- EFK (ElasticSearch, Fluentd, Kibana

- Tutorial - Setup an ES cluster on Proxmox LXC containers )

- Elasticsearch geo-point

- Main: https://www.elastic.co/guide/en/elasticsearch/reference/current/ingest-processors.html

- Grok processor

- CSV processor

- Date processor

- Script processor

Quick starter

- Retrieve the Docker image: $ docker pull infrahelpers/optd-qa:latest

- Launch the Docker-powered scripts: $ docker run --rm -it infrahelpers/optd-qa:latest bash [ build@8ce25cc20a10 opentraveldata-qa ( master )] make checkers [ build@8ce25cc20a10 opentraveldata-qa ( master )] exit

Installation

- See the Dockerfile for more details

- Clone the OpenTravelData (OPTD) Quality Assurance (QA) Git repository : $ mkdir -p ~/dev/geo $ git clone https://github.com/opentraveldata/quality-assurance.git ~/dev/geo/opentraveldata-qa $ pushd ~/dev/geo/opentraveldata-qa $ ./mkLocalDir.sh $ popd

Points of Reference (POR)

- results/optd-qa-por-best-not-in-optd.csv , exhibiting the POR manually curated in the file of best known POR but not present in the generated OPTD public file

- results/optd-qa-por-cmp-geo-id.csv , reporting POR having a Geonames ID inconsistent among the curated file of best known POR and the generated OPTD public file

- Note that a CSV file has a single row, it is the header. So, it can be considered as empty. $ pushd ~/dev/geo/opentraveldata-qa $ pipenv run checkers/check-por-geo-id-in-optd.py $ wc -l results/optd-qa-por-best-not-in-optd.csv results/optd-qa-por-cmp-geo-id.csv 11 results/optd-qa-por-best-not-in-optd.csv 1 results/optd-qa-por-cmp-geo-id.csv $ ls -lFh results/optd-qa-por-best-not-in-optd.csv results/optd-qa-por-cmp-geo-id.csv -rw-r--r-- 1 user staff 400B Jan 10 15:54 results/optd-qa-por-best-not-in-optd.csv -rw-r--r-- 1 user staff 60B Jan 10 15:54 results/optd-qa-por-cmp-geo-id.csv $ popd

- results/optd-qa-por-optd-no-geocoord.csv , reporting the POR having no geo-location (geo-coordinates)

- Note that if a CSV file has a single row, it is the header. So, it can be considered as empty. $ pushd ~/dev/geo/opentraveldata-qa $ make results/optd-qa-por-optd-no-geocoord.csv pipenv run python checkers/check-por-optd-no-geocoord.py && \ wc -l results/optd-qa-por-optd-no-geocoord.csv && head -3 results/optd-qa-por-optd-no-geocoord.csv 1 results/optd-qa-por-optd-no-geocoord.csv iata_code^geo_id^loc_type $ popd

- results/optd-qa-por-city-not-in-optd.csv , reporting the POR in the curated file of best known POR with cities not referenced as a city in the generated OPTD public file

- Note that if a CSV file has a single row, it is the header. So, it can be considered as empty. $ pushd ~/dev/geo/opentraveldata-qa $ make results/optd-qa-por-city-not-in-optd.csv pipenv run python checkers/check-por-city-not-in-optd.py && \ wc -l results/optd-qa-por-city-not-in-optd.csv && head -3 results/optd-qa-por-city-not-in-optd.csv 1 results/optd-qa-por-city-not-in-optd.csv iata_code^optd_pk^loc_type^geo_id^city_code $ popd

- results/optd-qa-por-multi-city.csv , reporting POR with multiple cities

- results/optd-qa-por-multi-city-not-std.csv , reporting POR with multiple cities not following the sorting order of PageRank values

- Note that if a CSV file has a single row, it is the header. So, it can be considered as empty. ```bash $ pushd ~/dev/geo/opentraveldata-qa $ make results/optd-qa-por-multi-city.csv pipenv run python checkers/check-por-multiple-cities.py && wc -l results/optd-qa-por-multi-city.csv results/optd-qa-por-multi-city-not-std.csv && head -3 results/optd-qa-por-multi-city.csv results/optd-qa-por-multi-city-not-std.csv 111 results/optd-qa-por-multi-city.csv 30 results/optd-qa-por-multi-city-not-std.csv 141 total ==> results/optd-qa-por-multi-city.csv <== iata_code^optd_pk^loc_type^geo_id^city_code_list^page_rank ADJ^ADJ-A-250437^A^250437^AMM,ADJ^0.09819215728644931,0.0 AGY^AGY-R-10377026^R^10377026^MUC,AGY^0.35785165780444,0.0

==> results/optd-qa-por-multi-city-not-std.csv <== iata_code^optd_pk^loc_type^geo_id^city_code_list^page_rank BQC^BQC-B-11279243^B^11279243^BQC,YQB^0.006501240960634933,0.05835677851287664 BVV^BVV-A-8030061^A^8030061^BVV,ITU^0.0,0.006116247321847354 $ popd

The checker is the same as above ( checkers/check-por-cmp-optd-it.py )

- Check the number of POR having different state codes, broken down by country: $ awk -F '^' '{print $8}' results/optd-qa-state-optd-it-diff.csv|sort|uniq -c |sort -nr |head -5 342 CN 288 FR 185 DE 175 GB 138 RU $

- Check the number of POR having differrent state codes for a specific country: $ awk -F '^' '{if ($8 == "CN") {print $8 "^" $7 "^" $12}}' results/optd-qa-state-optd-it-diff.csv|sort|uniq -c |sort -nr |head -5 33 CN^^GD 24 CN^^NM 24 CN^^HB 19 CN^^ZJ 19 CN^^LN

- Add some exception rules in the optd_state_exceptions.csv CSV file : $ head -3 to_be_checked/optd_state_exceptions.csv pk^state_code^geo_id^source^env_id^date_from^date_to^wrong_state_code^comment AR-C^C^3433955^IR^^^^BA^State code in source does not reflect any of the known standards ( be it ISO 3166-2 or IATA codes ) , but seems to correspond to the phonetic initials. References: https://en.wikipedia.org/wiki/ISO_3166-2:AR, https://en.wikipedia.org/wiki/Provinces_of_Argentina AR-H^H^3861887^IR^^^^CH^State code in source does not reflect any of the known standards ( be it ISO 3166-2 or IATA codes ) , but seems to correspond to the first two letters of the state name. References: https://en.wikipedia.org/wiki/ISO_3166-2:AR, https://en.wikipedia.org/wiki/Provinces_of_Argentina

- results/optd-qa-por-optd-not-in-unlc.csv , exhibiting the POR referenced by OPTD but not by UN/LOCODE

- iresults/optd-qa-por-unlc-not-in-optd.csv , exhibiting the POR referenced by UN/LOCODE but not by OPTD

- Note that if a CSV file has a single row, it is the header. So, it can be considered as empty. $ pushd ~/dev/geo/opentraveldata-qa $ pipenv run checkers/check-por-cmp-optd-unlc.py $ wc -l results/optd-qa-por-unlc-not-in-optd.csv 10349 results/optd-qa-por-unlc-not-in-optd.csv $ ls -lFh results/optd-qa-por- * unlc * .csv -rw-r--r-- 1 user staff 4.7M Dec 13 18:22 results/optd-qa-por-optd-not-in-unlc.csv -rw-r--r-- 1 user staff 763K Dec 13 18:22 results/optd-qa-por-unlc-not-in-optd.csv $ popd

- In order to get the IATA-referenced POR out of UN/LOCODE-referenced ones: $ pushd ~/dev/geo/opentraveldata-qa $ awk -F '^' '{if ($2 != "") {print $0}}' results/optd-qa-por-unlc-not-in-optd.csv | wc -l 21 $ popd

That script checks, for every airline of the optd_airlines.csv file , that the airport bases/hubs are appearing in the optd_airline_por_rcld.csv file .

Note that both files ( optd_airlines.csv and optd_airline_por_rcld.csv ) will be downloaded from the OpenTravelData project and stored within the to_be_checked directory. If those files are too old, they should be removed (a newer version will then be automatically downloaded and stored again).

Note that a CSV file has a single row, it is the header. So, it can be considered as empty.

The following script displays all the missing airport bases/hubs:

If the script does not return anything, then the check (successfully) passes.

- That script performs, for every airline of the optd_airlines.csv file , some basic statistics on their network, modelled as graph (where POR are nodes and flight segments/legs are edges): $ pushd ~/dev/geo/opentraveldata-qa $ pipenv run checkers/check-airline-networks.py $ wc -l results/optd-qa-airline-network-far-nodes.csv 7 results/optd-qa-airline-network-far-nodes.csv $ ls -lFh results/optd-qa-airline- * .csv -rw-r--r-- 1 user staff 8.8K Dec 13 18:47 results/optd-qa-airline-network-far-nodes.csv -rw-r--r-- 1 user staff 34B Dec 13 18:47 results/optd-qa-airline-network-zero-distance.csv -rw-r--r-- 1 user staff 87B Dec 13 18:47 results/optd-qa-airline-network-zero-edges.csv -rw-r--r-- 1 user staff 70B Dec 13 18:47 results/optd-qa-airline-por-not-in-optd.csv -rw-r--r-- 1 user staff 136B Dec 13 18:47 results/optd-qa-airline-zero-coord-por-in-optd.csv $ cut -d '^' -f1 ,1 results/optd-qa-airline-network-far-nodes.csv | grep -v "^airline" 9W B5 KD NS P2 X3 $ cat results/optd-qa-airline-network-zero-edges.csv | grep -v "^airline" BY^MAN^MAN^1.0 MT^BHX^BHX^1.0 ZB^LBA^LBA^1.0 $ popd

- That script checks, for every airline appearing in the optd_airline_por_rcld.csv file , whether they are also referenced by OpenTravelData (OPTD) in the optd_airlines.csv file : $ pushd ~/dev/geo/opentraveldata-qa $ pipenv run check-airline-sched-in-optd.py $ wc -l results/optd-qa-airline-schd-not-in-optd.csv 28 results/optd-qa-airline-schd-not-in-optd.csv $ head -3 results/optd-qa-airline-schd-not-in-optd.csv airline_code 9Y AJA $ popd

Publishing to ElasticSearch (ES)

- Ingest the data: $ export TIMESTP = " $( date -u + '%Y-%m-%d %H:%M:%S' ) " $ tail -n +2 results/optd-qa-por-best-not-in-geo.csv | while IFS = ; read -r -a arr ; do curl -XPOST "http://localhost:9200/optd-qa-por-full-v1/_doc?pipeline=parse_optd_por_full_csv" -H "Content-Type: application/json" -d "{ \" tag \" : [ \" optd \" , \" qa \" , \" checker \" , \" por \" , \" geonames \" , \" check-por-geo-id-in-optd.py \" , \" optd-qa-por-best-not-in-geo.csv \" ], \" timestamp \" : \" ${ TIMESTP } \" , \" optd_qa_por_full \" : \" ${ arr [@] } \" }" ; done % Total % Received % Xferd Average Speed Time Time Time Current Dload Upload Total Spent Left Speed 100 660 100 186 100 474 1430 3646 -- : -- : -- -- : -- : -- -- : -- : -- 5076 % Total % Received % Xferd Average Speed Time Time Time Current Dload Upload Total Spent Left Speed 100 835 100 186 100 649 712 2486 -- : -- : -- -- : -- : -- -- : -- : -- 3199 { " _index " : " optd-qa-por-full-v1 " , " _type " : " _doc " , " _id " : " 8cSoKHEBu3P1TMMtzG4v " , " _version " : 1 , " result " : " created " , " _shards " : { " total " : 1 , " successful " : 1 , " failed " : 0 }, " _seq_no " : 1 , " _primary_term " : 1 } { " _index " : " optd-qa-por-full-v1 " , " _type " : " _doc " , " _id " : " 8sSoKHEBu3P1TMMtzG6f " , " _version " : 1 , " result " : " created " , " _shards " : { " total " : 1 , " successful " : 1 , " failed " : 0 }, " _seq_no " : 2 , " _primary_term " : 1 } $ export TIMESTP = " $( date -u + '%Y-%m-%d %H:%M:%S' ) " $ wc -l results/optd-qa-por-best-not-in-geo.csv 616 results/optd-qa-por-best-not-in-geo.csv $ ssh root@tiproxy8 -f -L9400 :10.30.2.191:9200 sleep 600 $ tail -n +2 results/optd-qa-por-best-not-in-geo.csv | while IFS = ; read -r -a arr ; do curl -XPOST "http://localhost:9400/optd-qa-por-full-v1/_doc?pipeline=parse_optd_por_full_csv" -H "Content-Type: application/json" -d "{ \" tag \" : [ \" optd \" , \" qa \" , \" checker \" , \" por \" , \" geonames \" , \" check-por-geo-id-in-optd.py \" , \" optd-qa-por-best-not-in-geo.csv \" ], \" timestamp \" : \" ${ TIMESTP } \" , \" optd_qa_por_full \" : \" ${ arr [@] } \" }" ; done % Total % Received % Xferd Average Speed Time Time Time Current Dload Upload Total Spent Left Speed 100 15053 100 8583 100 6470 128k 99538 -- :--:-- -- :--:-- -- :--:-- 226k { ... }

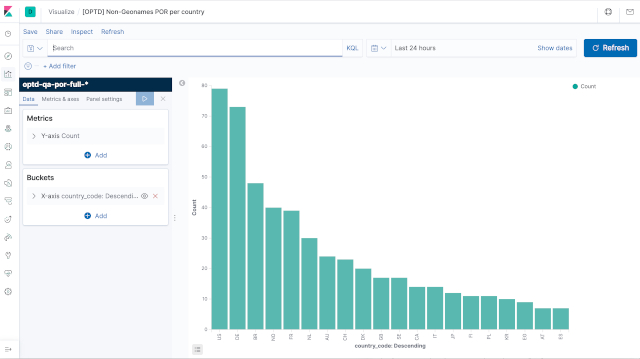

Querying ElasticSearch (ES) and Kibana

The ElasticSearch (ES) REST API is also the one to use for Kibana queries.

- Query: optd-qa-kibana-request-por-non-geo-hist-ctry.json query

- Response: optd-qa-kibana-response-por-non-geo-hist-ctry.json query

- Launch on the command-line the optd-qa-kibana-response-por-non-geo-map.json query : $ curl -XGET "http://localhost:9200/optd-qa-por-full-v1/_search" \ -H "Content-Type: application/json" \ --data "@elastic/optd-qa-kibana-request-por-non-geo-hist-ctry.json" | jq \ > elastic/optd-qa-kibana-response-por-non-geo-hist-ctry.json $ ssh root@tiproxy8 -f -L9400 :10.30.2.191:9200 sleep 5 ; \ curl -XGET "http://localhost:9400/optd-qa-por-full-v1/_search" \ -H "Content-Type: application/json" \ --data "@elastic/optd-qa-kibana-request-por-non-geo-hist-ctry.json" | jq \ > elastic/optd-qa-kibana-response-por-non-geo-hist-ctry.json

- It generates the optd-qa-kibana-response-por-non-geo-hist-ctry.json response

- Query: optd-qa-kibana-request-por-non-geo-map.json query

- Response: optd-qa-kibana-response-por-non-geo-map.json response

- Launch on the command-line the optd-qa-kibana-response-por-non-geo-map.json query : $ curl -XGET "http://localhost:9200/optd-qa-por-full-v1/_search" \ -H "Content-Type: application/json" \ --data "@elastic/optd-qa-kibana-request-por-non-geo.json" | jq \ > elastic/optd-qa-kibana-response-por-non-geo-map.json $ ssh root@tiproxy8 -f -L9400 :10.30.2.191:9200 sleep 5 ; \ curl -XGET "http://localhost:9400/optd-qa-por-full-v1/_search" \ -H "Content-Type: application/json" \ --data "@elastic/optd-qa-kibana-request-por-non-geo.json" | jq \ > elastic/optd-qa-kibana-response-por-non-geo-map.json

- It generates the optd-qa-kibana-response-por-non-geo-map.json response

Navigation Menu

Search code, repositories, users, issues, pull requests..., provide feedback.

We read every piece of feedback, and take your input very seriously.

Saved searches

Use saved searches to filter your results more quickly.

To see all available qualifiers, see our documentation .

- Notifications

Python wrapper around OpenTravelData (OPTD)

opentraveldata/python-opentraveldata

Folders and files, repository files navigation, opentraveldata (optd) data wrapper - python bindings.

Python wrapper around OpenTravelData (OPTD) data sets, for instance to be used by Python software needing to access OPTD data.

- PyPi artifacts: https://pypi.org/project/opentraveldata/

- Source code on GitHub: https://github.com/opentraveldata/opentraveldata

- Docker Cloud repository: https://cloud.docker.com/u/opentraveldata/repository/docker/opentraveldata/quality-assurance

- This Python-wrapper Git repository: https://github.com/opentraveldata/python-opentraveldata

- POR (Points of Reference)): https://www2.transport-search.org/data/optd/por/

- CI/CD deliveries: https://www2.transport-search.org/data/optd/cicd/

- Sourcce code on GitHub: https://github.com/opentraveldata/quality-assurance

- Quality Assurance (QA) reports: https://www2.transport-search.org/data/optd/qa/

- How-to install Python virtual environment with pyenv and pipenv

- How to package modules for Python

- PyPi Travis CI provider

- Launch a Python interpreter:

- Import the opentraveldata library:

- With the default local directory for the data files, that is /tmp/opentraveldata

- If you do not have access rights for writing into that directory, initialize the OpenTravelData object with a directory on which you have writing access rights:

- Display some information about the OpenTravelData object:

- For the main (IATA/ICAO) POR (points of reference) data file:

- For the UN/LOCODE POR (points of reference) data file:

- Download the latest data files (to be done once in a while; it takes a few seconds, depending on the network bandwidth):

- Trigger an exception if the data files have not been properly downloaded:

- Check that the data files have been properly downloaded, and that their sizes are as expected (40 to 50 MB for the IATA/ICAO data file and 4 to 5 MB for the UN/LOCODE data file):

- IATA/ICAO data file:

- UN/LOCODE data file:

- Display the first few lines (here, 3 lines) of the data files:

- Parse the data files and load their content into internal Python dictionaries:

- Retrieve the details for the IEV code:

Installation - configuration

Reference: How-to install Python virtual environment with pyenv and pipenv : https://github.com/machine-learning-helpers/induction-python/tree/master/installation/virtual-env

Install Pyenv, Python 3.9.6, pip and pipenv :

- Clone the Git repository and install the Python virtual environment (with pipenv ):

PyPi credentials for Travis deployment

- Encrypt the PyPi API token with the Travis command-line utility, which stores the encrypted secret token. As the project is managed by travis-ci.com , the --com option has to be added in the command-line:

Package and release the Python module

- Launch the setup.py script:

- Upload/release the Python packages onto the PyPi test repository :

- Upload/release the Python packages onto the PyPi repository :

Test the Python module

- Launch the test:

Contributors 4

- Python 96.4%

UN Tourism | Bringing the world closer

Statistics of tourism, tourism statistics database, share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

UN Tourism systematically collects tourism statistics from countries and territories around the world in an extensive database that provides the most comprehensive repository of statistical information available on the tourism sector. This database consists mainly of more than 145 tourism indicators that are updated regularly. You can explore the data available through the UN Tourism database below:

145 Key Tourism Statistics

Data on inbound, outbound and domestic tourism, international tourism flows, tourism industries, employment and other indicators.

Economic Contribution and the SDGs

Data on the economic contribution of tourism and the implementation of relevant standards, such as the Tourism Satellite Account (TSA) and the System of Environmental-Economic Accounting (SEEA).

- About data.world

- Terms & Privacy

- © 2024 data.world, inc

OFFENER TOURISTISCHER DATENSTANDARD

DAS DATENFORMAT FÜR HÖCHSTE DATENQUALITÄT

EIN FORMAT - EIN VEREIN

LEISTUNGSSTARK. OFFEN. KOSTENFREI

OTDS - DATENSTANDARD DER TOURISMUSBRANCHE

BEI DER MEHRZAHL DER VERANSTALTER IMPLEMENTIERT

A high performance data standard is transforming the travel industry: The Open Travel Data Standard OTDS facilitates travel offers performing on highest data quality levels into the travel sales channels. The modern XML standard accelerates and specifies the production of travel offers while at the same time delivering significantly more booking relevant details and number of data records. The travellers benefit from a comprehensive and meaningful travel offer matching their search terms which in addition can be narrowed down to their individual whishes via filters. Last but not least reliable pricings and availability declarations ease the way to booking conversion.

- The OTDS standard

The OTDS association

OTDS stands for the Open Travel Data Standard – a powerful data format developed from experts within the travel industry to serve the branch. All interested market player may use the format and its extensive documentation free of charge.

The XML-format OTDS contains all master data of the included travel components as well as all necessary product and pricing rules. Travel providers may use OTDS to distribute their offer into all sales channels, whether it be to travel agencies or to travel websites.

The Open Travel Data Standard OTDS is published by the OTDS association (OTDS e.V.) in Berlin, Germany. The members of the association represent almost every branch of the travel industry and join forces to continuously refine and extend the data format OTDS.

Via the committees of the association each member is actively involved in the decision-making process and into the development roadmap and realisation. The joint future development of OTDS and the communication between the members takes places within the exclusive internet-based member’s forum.

OTDS registration

Your Username *

Your Password * (min. 8 Characters)

Password repeat *

First name *

Last name *

Your eMail adress *

Hereby I accept the Privacy Policy

Privacy Policy

The OTDS association commits itself to compliance with the legal regulations for data security, which are regulated in particular in the Federal Data Protection Act (BDSG) and in the Telemedia Act (TMG).

In compliance with the laws BDSG and TMG the OTDS association collects and uses personal data of each user registering for downloading the OTDS standard.

The data entered by the user in this context are utilized by the OTDS association to create and maintain a user profile consisting of user name, a password chosen by the user which is being depicted only encrypted in our database, first and last name, e-mail address, and company. In addition date and time of the first registration and – for future logins – the date and time of the respectively last login is being archived.

By registering you declare your agreement with the OTDS association creating a personalized user profile within the scope of your registration for www.otds.de. You also declare your agreement with anonymized analyses of the entries within our database. Furthermore you declare your agreement with your e-mail address being used for sending you your login-confirmation and for contacting you in urgent matters concerning your OTDS-registration.

Link to external website

If you activate a link on www.otds.de leading to an external website, the external provider might obtain the information from your browser, which of our webpages was your origin before changing to his internet page. For the use of this data as well as for the content on those external websites exclusively the external provider is responsible.

Bitte lasse dieses Feld leer.

" style="background-color: #fff;border-color: #fff;color: #ea5c00;">

News & Events

freshcells joins the OTDS association

Since 2005, the software and consulting company freshcells systems engineering GmbH has been supporting many companies also in the travel industry in […]

Registrierung für den OTDS-Summit (6) geöffnet

Sorry, this entry is only available in Deutsch. Der OTDS-Verein freut sich sehr, die OTDS-Summit Reihe wieder aufzunehmen: In der 6. Auflage […]

OTDS honored for 10 years of DRV membership

At this year’s Annual General Assembly of Deutscher Reiseverband DRV in Berlin it became briefly ceremonial for the OTDS association: OTDS Chairman […]

THE OTDS STANDARD

What is the otds format capable of and what makes it so special, how does otds support tour operators and sales channels.

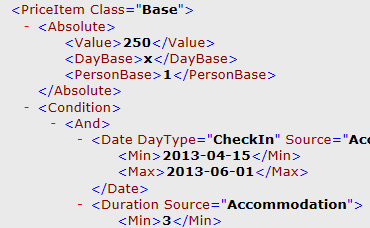

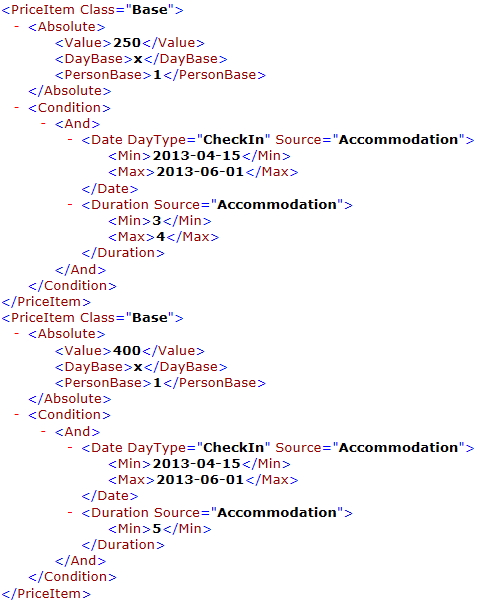

Strengths of OTDS - The data format OTDS is designed to improve the transmission of provider’s product data such as tour operators, airlines, rental car companies, or other supplier to the distribution systems that process those data for the use in travel search tools used in travel agencies or in travel website booking engines.

OTDS significantly minimizes the production time for data exports of tour operators or their Inventory Management Systems. Compared to the standards used to date such as INFX or KATI the production time is reduced by at least 75 percent. In addition incremental updates allow for deliveries of parts of the portfolio with the corresponding reduced file generation time.

Thanks to OTDS tour operators and other provider may decrease the volume of their data delivery to distribution systems significantly: In practice sizes for OTDS-files reach no more than 10% of the size for INFX-deliveries containng the same amount of offers. As with OTDS rather price- and product rules than complete offers are expressed, considerably more offers can be transferred in even smaller files. The effect on transfer- and loading times is correspondingly positive – while at the same time data quality is pushed to a higher level.

Due to the precise definition of price- and product rules by the tour operator in OTDS there is no scope for interpretation when processing the data. As a result the data quality increases – trips are displayed with reliably calculated prices and availabilities within the consulting tools of travel agencies and in the IBEs. Also total prices for families are feasible. In general with OTDS 95% of all prices are identical with those of the booking request. More that 90% of the trips are available and bookable.

Free of charge

OTDS as the open, nonproprietary standard is available free-of-charge and may be used by any tour operator- and distribution system – regardless of the technology deployed (e.g. central caches or local player). This ensures independence from proprietary data standards or -formats for tour operators and distribution systems.

OTDS already allows the transfer of all data for the most relevant travel components accommodation, flight, packaged travel as well as add-on services such as transfers, rental cars, insurances, activities, or parking lots. In addition OTDS contains all product- and price rules necessary for correct price calculation. All relevant information needed for product display, availability check, booking requests and the booking itself are also included.

OTDS is compatible for various systems: it is the powerful standard of choice for providing travel data to central cache systems as well as all filling players located in the sphere of the supplier. OTDS also supports different external attribution systems for describing the travel products such as Giata Facts and DRV GlobalTypes.

SEE THE OTDS STANDARD FOR YOURSELF

- The value of OTDS

- OTDS versions

The leading distribution systems in the German market already interpret and process OTDS. By doing so, the optimized data are available within their frontoffice tools for travel agencies as well as in their internet booking engines. The tour operator webpages also can be equipped with the enhanced OTDS-data, so that customers searching for travel offers in travel agencies or in the internet can rely on meaningful offers with reliable pricing and availability information and including add-on services. The OTDS format allows for significantly more details, options, room- and flight alternatives.

Families can rely on the total price of a trip when transmitted with OTDS from the very first display on. Price corrections resulting from booking requests are omitted thanks to reliable adult- and children prices and explicit rules for the price calculation in dynamically packaged travel offers.

„BEST TRAVEL TECHNOLOGY SOLUTION 2012“

The travel industry works with a large number of data formats. Those formats help to display the countless travel offers of tour operators and other provider that reach the consumer via various distribution channels. All information about a trip are being processed so that the IT systems within the distribution chain can depict those data. But the travel wishes of the consumer today are much more individual than ten years ago – the travel offers have to meet this change. And also tour operators and other supplier, online portals and travel agencies expect more from the technology they use. Legacy data formats today cannot fulfill those expectations anymore.

So far provider in the travel industry had to translate their travel offers into several data formats in order to supply the various distribution channels. In spite of the many formats the provider often did not succeed in highlighting their specific competitive advantages: the one format lacks a space for submitting taxi transfers, the other format cannot deal with child price reductions or specific child care offers.

So a new, common, open format was needed that delivers all relevant information regarding a travel offer into all distribution channels. This is precisely the intention of OTDS. At the same time it shall reflect the requirements of as many market player as possible and refine itself as an open data format. Thanks to the cost-free download at this website OTDS is freely accessible to all interested travel organisations and thus can establish itself as the future market standard.

OTDS versions - OTDS 1.0 was published by the OTDS association in April 2012. Within this first basic version the travel components accomodation, flight, packaged travel and add-on services such as transfer, rental car, parking, insurances etc. together with all the implicated product- and pricing rules already could be represented.

Version OTDS 1.9.3 provided comprehensive options for flight prioritisation and rules for rounding monetary amounts. Together with the multi-currency option and further diversified possibilities for rental cars and insurances those criteria meet the requirements of many tour operator regarding an efficient and extensive display of their travel products in the distribution systems.

With the main version 2.0, non-bookable content elements such as descriptive texts and media content as well as the ability for multilingualism were integrated. Thanks to the introduction of the Compare construct, product components can be combined much more flexibly under predefined conditions. The Accomodation-, Flight- and AddonWrapper allow the mapping of a sequence of flights and several hotels with rooms, meals and durations - an important basis for round trips in OTDS.

The current version OTDS 2.1 as new features among others offers a revision of the BookingNameSpace, introduces @Class to properties and extends the update option for tags.

OTDS in Use

A continuously rising number of provider from various areas of the travel industry use OTDS in order to fuel their travel offers to their customers quickly and reliably. Distribution channels and systems can feed on an extensive variety of travel offer data delivered in the up-to-date OTDS format for travel agency tools and Internet Booking Engines:

Schmetterling Technology

Schauinsland-Reisen

Bentour Reisen

Attika Reisen

Testimonials.

“OTDS: a flexible and living standard, that optimally displays the enormous product diversity of dozens of WBS-tour operators – without converter or third parties. Highest performance in terms of quality and quantity!”

“OTDS is just fun”

“OTDS offers unlimited possibilities for travel offers and overcomes the limitations of other formats.”

Hotel-only, Package travel and flight data in OTDS

Among others the following provider deliver their portfolio of offers in OTDS already or provide it via an OTDS-Player.

"Entire offering" includes the hotel-only, package- and X-offerings of a tour operator brand. The list does not claim to be complete.

- 5 vor Flug (live in Amadeus, Schmetterling and Traffics)

- Aldiana (live in Amadeus, Schmetterling and Traffics)

- Alltours (entire offering live in Amadeus, Schmetterling and Traffics)

- Anex (Hotel-only and packaged trips live in Amadeus, Schmetterling and Traffics)

- anixe (bedbank, Hotel-only data-delivery)

- Attika Reisen (Hotel-only and packaged trips live in Amadeus)

- Bentour Reisen (entire offering live in Amadeus, Schmetterling and Traffics)

- BigXtra (entire offering live in Amadeus, Schmetterling and Traffics, corporate website IBE with OTDS-data)

- Botros Tours (entire offering in the OTDS-Player)

- Bucher Reisen (entire offering live in Amadeus, Schmetterling and Traffics)

- byebye (entire offering live in Amadeus, Schmetterling and Traffics)

- Connected Destination (Hotel-only and packaged trips live in Traffics)

- Coral Travel (entire offering live in Amadeus, Schmetterling and Traffics)

- DERTOUR (entire offering live in Amadeus, Schmetterling and Traffics)

- dta Touristik (Hotel-only and packaged trips live in Amadeus)

- ETI (entire offering live in Amadeus, Schmetterling and Traffics)

- ECCO-Reisen (entire offering live in Amadeus)

- FTI Touristik (entire offering live in Amadeus, Schmetterling and Traffics as well as available in OTDS-Player)

- Gruber Reisen (entire offering in OTDS-Player, live in Amadeus)

- Helvetic Tours (Hotel-only and packaged trips live in Amadeus, Schmetterling and Traffics)

- ITS, ITS Billa und ITS Coop (entire offering live in Amadeus, Schmetterling and Traffics)

- Jahn (entire offering live in Amadeus, Schmetterling and Traffics)

- Kuoni (entire offering live in Amadeus, Schmetterling and Traffics)

- Luxair Tours (entire offering live in Amadeus)

- Meiers Weltreisen (entire offering live in Amadeus, Schmetterling and Traffics)

- Misir (entire offering in OTDS-Player)

- Neckermann Reisen (entire offering live in Amadeus, Schmetterling and Traffics)

- Öger Tours (entire offering live in Amadeus, Schmetterling and Traffics)

- Olimar (entire offering live in Amadeus, Schmetterling and Traffics, OTDS for website)

- Palma (Hotel-only and Packaged trips live in Traffics)

- Phoenix (Hotel-only and Packaged trips live in Amadeus)

- Schauinsland-Reisen (entire offering live in Amadeus, Schmetterling and Traffics, offering available in OTDS-Player)

- Sonnenklar-TV (Hotel-only and packaged trips live in Amadeus and Traffics)

- Travel Partner (Hotel-only also in combination with Addon-Services in various channels)

- TUI (TUI Germany/Switzerland, Airtours DE/CH, XTUI: entire offering live in Amadeus, Schmetterling and Traffics)

- TUI Cruises (offering available in OTDS-Player and on TUI Cruises website)

- Urlaubstouristik (entire offering live in Amadeus)

- vtours (VTOI live in Traffics)

- Windrose Finest Travel (Hotel-only and packaged trips live in Amadeus and Schmetterling)

Flight content in the OTDS format is provided by the travel technology solution providers of Bewotec via its Flex Flight Player (click here for Bewotec airline list ) and Ypsilon.net (click here for Ypsilon airline list ).

OTDS Association

The “Verein zur Förderung eines offenen touristischen Datenstandards e.V.” (Association to promote an Open Travel Data Standard, OTDS e.V. in Berlin, Germany) specifies and develops the data format OTDS for the travel industry. OTDS is based on open, nondiscriminatory, and standardized technologies. The data format is freely available and free-of-charge to everyone, especially to enterprises within the travel industry – regardless of a membership within the OTDS e.V.

OTDS – a modern data standard

It is the objective of the OTDS e.V. to establish its state-of-the-art data format OTDS as a market-wide standard for transmitting all product data relevant for distribution between provider/tour operators and distribution systems. The format is open and non-proprietary. OTDS is independent from any technology concepts and can be used with central caching systems as well as with decentralized player-hub solutions.

Constitution