Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Generali Global Assistance Travel Insurance Review — Is It Worth It?

Content Contributor

66 Published Articles

Countries Visited: 197 U.S. States Visited: 50

Editor & Content Contributor

153 Published Articles 761 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Stella Shon

News Managing Editor

90 Published Articles 639 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Table of Contents

Who can get generali global assistance travel insurance, what does generali global assistance travel insurance include, generali global assistance coverage types and benefits, coverage exclusions, comparison of generali global assistance plans, how much does generali global assistance travel insurance cost, how generali global assistance travel insurance compares to other options, tips for ensuring a smooth claim process, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

It’s not fun to think about, but part of trip planning includes considering the “what ifs.”

These include questions like: What if you have to go to the hospital during your trip? What if your flight home is canceled and you have unforeseen expenses as a result? What if you wreck the fancy convertible you rented to drive around the island or contract an illness that causes you to miss your flight home?

Generali Global Assistance is a U.S.-based travel insurance provider that offers 3 different plan levels (Standard, Preferred, and Premium) for trips of differing lengths and travel groups of various sizes. Its plans are available for both domestic and international travel and come as packages, rather than needing to purchase coverage elements independently.

Is Generali Global Assistance travel insurance right for you? Here’s what you should know.

Generali Global Assistance plans are available only to U.S. residents . And while plans are available for both domestic and international travel, not all destinations are covered .

Exclusions include Afghanistan, Belarus, Crimea and the Donetsk and Luhansk People’s regions, Cuba, Iran, Myanmar, North Korea, Russia, Syria, and Venezuela. Additionally, the Generali Global Assistance website says it has limited ability to help you if you’re visiting Ukraine.

Before diving into the coverage terms and benefit types, let’s consider what’s included for all customers, regardless of which plan is chosen.

All customers get a “free look period” of up to 30 days, depending on their state of residence. This period allows you to get a full refund if you decide your Generali Global Assistance plan isn’t the right travel insurance plan for you. However, you can’t receive a refund if you’ve started your trip or if you’ve submitted a claim.

You’re also covered for financial insolvency of your common carrier as part of your trip cancellation and trip interruption benefits. Finally, you’ll have access to telemedicine consultations with any plan type, helping you access a doctor in non-emergency cases.

COVID-19 Coverage

COVID-19 coverage applies under multiple policy benefits. If you meet the requirements , you can be reimbursed for 100% of your expenses and even have your policy extended until your quarantine period ends and you’re able to travel home.

This coverage applies to you, your traveling companions, and family members as long as you purchase your travel insurance plan before getting sick or visiting a doctor. Coverage applies also when you test positive, including at-home tests if they include video supervision.

Optional Add-ons

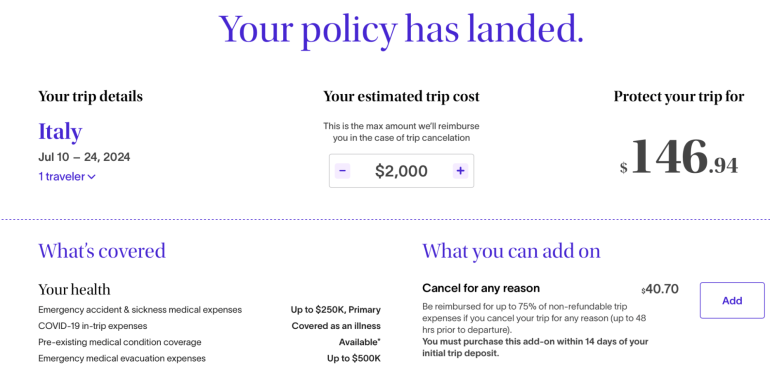

There are 2 optional add-ons that merit discussion, as well. Cancel for Any Reason (CFAR) coverage isn’t included with any Generali Global Assistance travel insurance plans . However, you can add it to your Premium plan as long as you do so within 24 hours of making the first payment or deposit toward your trip.

Another add-on with Premium plans is coverage for pre-existing medical conditions . To get this coverage, you must add it to your plan before or within 24 hours of your final trip payment. Pre-existing conditions coverage applies if you’re medically able to travel at the time you buy the plan and if all prepaid trip costs with cancellation fees are insured.

Ensure you add Cancel for Any Reason or pre-existing conditions coverage to your plan within 24 hours. Otherwise, you’ll lose these options.

When considering a travel insurance plan, you’re probably assuming that you get more coverage when you pay more. That’s largely true. Benefit coverage amounts will be higher on premium plans from the same provider. But that’s not necessarily true when comparing providers to each other.

In order to know what you’re looking for in a travel insurance policy, you should first understand what the types of coverage are:

- Cancel for Any Reason (CFAR) Coverage: This add-on policy covers up to 60% of your losses if you cancel for reasons not covered in other sections of your policy.

- Pre-existing Medical Conditions: Available only with the Premium plan, your current medical conditions may be covered if you buy a plan before or within 24 hours of making your final trip payment and are medically able to travel at the time of purchase.

- Trip Cancellation Insurance: You’ll receive reimbursement for prepaid, non-refundable costs if you cancel a trip for one of the covered reasons listed in your policy.

- Trip Interruption: Once you start your trip, this coverage goes into effect and can reimburse non-refundable costs from lost portions of your travel plan. It also can cover costs to catch up with your trip if there are delays for covered reasons.

- Trip Delay: You can be reimbursed for meals, parking, transportation, and other expenses incurred because of delays. This coverage goes into effect after a delay of 10 hours with the Standard plan, 8 hours with the Preferred plan, or 6 hours with the Premium plan.

- Baggage Loss or Damage: This coverage is secondary to homeowner’s or renter’s insurance and covers lost, damaged, or stolen baggage — including the items inside, with some exceptions. This coverage may even reimburse the cost of replacing a passport during your trip.

- Baggage Delay: If your luggage is delayed, you can be reimbursed for reasonable costs incurred while waiting for it to arrive, such as clothes and toiletries. Reimbursement only applies after delays of 24 hours with the Standard plan, 18 hours with Preferred, or 12 hours with a Premium plan.

- Sporting Equipment Loss or Damage: Similar to baggage coverage, this section specifically applies to sporting equipment you take on your trip.

- Sporting Equipment Delay: You’ll be reimbursed for costs incurred while waiting for delayed sporting equipment, such as needing to rent skis until yours arrive. Required delays are 18 hours with Preferred plans and 12 hours with Premium plans.

- Missed Connection: This coverage applies only to cruises and tours and covers your extra costs to catch up with your travel plans and/or lodging and meals during your delays. Coverage applies to flights that are canceled or delayed for at least 3 hours because of inclement weather.

- Medical and Dental: This protection covers illnesses and injuries during your trip and the resulting expenses. It also can cover deductibles or unpaid expenses from your health insurance provider.

- Emergency Assistance and Transportation: If you encounter an emergency or medical situation where adequate healthcare isn’t available nearby, you can be evacuated to an appropriate facility. This policy also covers returning your remains to the U.S. or local burial costs in the event of death.

- Accidental Death and Dismemberment — Air Flight Accident: This coverage provides payments if you lose life, limb, or sight during a flight. In case of death, the payout goes to your designated beneficiary.

- Accidental Death and Dismemberment — Travel Accident: Similar to the coverage above, this covers loss of life, limb, or sight during other types of travel (not flights).

- Rental Car Damage: You’re covered for collision damage, theft, vandalism, natural disasters, or damages for reasons beyond your control. Some types of vehicles are excluded, but coverage applies to all drivers listed on your rental agreement. Coverage is up to the cash value of the car or the cost of repairs and related costs — whichever is less. This coverage isn’t available to residents of Texas.

It’s also important to note that each section has rules and restrictions about which costs are covered, when coverage applies, and other terms you must follow.

Sometimes, understanding what’s not included may be more important than comparing prices between Generali Global Assistance plans and other companies selling travel insurance.

Why is that? Well, exclusions are built into every insurance benefit , and it’s important to know if your particular trip, destination, or activity is excluded from coverage. Having robust travel insurance won’t help if it doesn’t cover your specific situation.

For example, you aren’t covered if you sustain injuries while intoxicated or for medical emergencies related to pregnancy . You also aren’t covered when you’re the one flying a plane or you’re participating in extreme sports .

Coverage excludes war zones and certain destinations , as well. These include Belarus, Cuba, Iran, North Korea, Russia, Syria, and disputed regions of Ukraine.

Generali Global Travel Assistance Standard Plan

The Standard plan provides the most common coverage elements , reimbursing you for canceled, delayed, or interrupted trips if the reasons meet those outlined in your policy.

While you won’t be covered for sporting equipment problems or death/dismemberment anywhere outside a plane, you can be covered for medical problems and even missed connections. And if you use a credit card with rental car insurance , you may not be concerned about not having this coverage in your policy.

Generali Global Travel Assistance Preferred Plan

The Preferred plan includes everything in the Standard plan but with greater coverage amounts in nearly every category . Rental car coverage is still missing, but you’ll gain coverage for sporting equipment delays and damages/losses and coverage for death or dismemberment throughout your trip.

Generali Global Travel Assistance Premium Plan

This is the only plan that includes car rental damage and is the only plan allowing for add-on coverage related to pre-existing medical conditions or canceling for any reason. It has the greatest coverage limits of any plan . It even includes $1,000,000 in emergency assistance and transportation coverage.

If you want coverage for pre-existing medical conditions or Cancel for Any Reason coverage, those are only available as add-ons to a Premium plan.

If you want coverage for pre-existing medical conditions, you must add this option before or within 24 hours of your final trip payment and must be well enough to travel at the time you purchase the policy. Cancel for Any Reason coverage is an optional add-on here, as well, and it must be added within 24 hours of your first payment toward the trip.

Let’s look at some sample plans to see how much a policy costs. This will give you a better idea of whether these plans fit your budget.

Generali Global Assistance Travel Insurance vs. Competitors

Before buying a travel insurance policy from Generali, it’s worth understanding how its plans compare to popular competitors like Seven Corners and WorldTrips . We priced a 5-day trip to Mexico in November 2023 for a family of 4 (ages 40, 39, 10, and 8) with a trip cost of $3,000 using Squaremouth. The first trip deposit was made in the past 24 hours in this estimate.

WorldTrips’ plan is significantly cheaper , despite all 3 offering similar trip cancellation, COVID-19, and terrorism-related coverage. Generali has the highest trip interruption amount — a full 25% higher than the other 2 options.

All 3 plans have the same coverage for medical-related cancellations, CFAR, and trip interruptions. Only WorldTrips has coverage for work-related cancellations .

While all 3 have the same coverage for medical evacuation , the emergency medical benefits are vastly different . Seven Corners offers $500,000, Generali has $250,000, and WorldTrips has just $150,000.

Generali Global Assistance charges more than some competitors without providing higher benefit thresholds across the board. The real differentiator is in trip interruption and emergency medical benefits. If you don’t need higher coverage in these areas, other companies may have better price-per-benefit options for you.

Generali Global Assistance Travel Insurance vs. Credit Card Insurance

Before deciding to buy an insurance policy for an upcoming trip, understand that your credit card may provide some of the same coverage.

However, how you trigger that coverage can vary — such as whether you need to pay the full amount of the trip or just part of it with your card (or whether using points to pay qualifies). Here’s a look at how Generali’s Premium Travel Insurance Plan compares to coverage with The Platinum Card ® from American Express , Capital One Venture X Rewards Credit Card , Chase Sapphire Preferred ® Card , and the Chase Sapphire Reserve ® .

Always review and compare your options, whether that’s with another travel insurance company or travel insurance with a credit card .

You hope you never have to use your travel insurance. If you do, however, there are certain things you can do to improve the claims process.

First, save all receipts , especially if you buy new equipment or clothing for your trip. Insurance claims will use depreciation when evaluating how much lost/damaged items are worth. If your items are brand new, you’ll want to prove that they haven’t depreciated in value. You also want to save all receipts for your reimbursement claims. These include hospital visits, medications, meals during flight delays, etc.

Additionally, ensure you read the terms of your policy and that you understand them . This way, you’ll know what is and isn’t covered. This will help you avoid submitting claims for items that aren’t covered or purchasing items for which you won’t be reimbursed.

Finally, ensure you cover all costs associated with your trip . This is especially true for any parts of your trip with change or cancellation policies. When you must purchase your policy in relation to first payments and final payments changes depending on what coverage you want. Make sure you know this and get the right coverage at the right time to cover everything you need.

If you need to file a claim, you can do so in the online claims portal . You’ll start by putting in your policy number, which is included in your original confirmation email. From here, the site will guide you through the claims process. If you’ve lost the confirmation email and don’t know your policy number, you can call 800-541-3522 or email [email protected] .

Travel insurance is something you hope you never need. In an ideal world, your flights would all arrive on time and you’d never get hurt.

Unfortunately, however, things can and do go wrong. Generali Global Assistance offers 3 travel insurance plans with various coverage types and optional add-ons. Refer to this guide often to fully understand their similarities and differences to help you choose the right one for your next holiday.

For Capital One products listed on this page, some of the above benefits are provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

For the baggage insurance plan benefit of the Amex Platinum card, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the car rental loss and damage insurance benefit of the Amex Platinum card, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the premium global assist hotline benefit of the Amex Platinum card, eligibility and benefit level varies by Card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, card members may be responsible for the costs charged by third-party service providers.

For the trip delay insurance benefit of the Amex Platinum card, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip cancellation and interruption insurance benefit of the Amex Platinum card, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is generali global assistance good insurance.

Generali offers multiple, robust insurance plans. After more than 26,000 customer reviews, Generali Global Assistance has a 4.8/5 rating on its own site, 4.36/5 average on Squaremouth, and 3.5/5 on Trustpilot.

How big is Generali Global Assistance?

It’s part of Assicurazioni Generali Group, one of the 50 biggest companies in the world, and Generali Global Assistance is one of the largest insurance providers in the world. It’s available in 60 countries on 5 continents, employing more than 75,000 people worldwide.

Who owns Generali travel insurance?

Generali Global Assistance is part of Assicurazioni Generali Group, headquartered in Italy. However, the U.S. division was founded in 1935. It maintains staff and support centers in San Diego and Pembroke Pines, Florida.

How do I contact Generali Global Assistance?

For 24-hour emergency assistance, call 877-243-4135 or 240-330-1529 from outside the U.S. For customer service, call 800-874-2442. You can file a claim online or email [email protected] .

How do I file a claim with Generali Global Assistance?

You can file a claim online or email [email protected] . You also can call 24-hour customer service for help with your claim. The U.S. phone number is 800-874-2442.

Was this page helpful?

About Ryan Smith

Ryan completed his goal of visiting every country in the world in December of 2023 and now plans to let his wife choose their destinations. Over the years, he’s written about award travel for publications including AwardWallet, The Points Guy, USA Today Blueprint, CNBC Select, Tripadvisor, and Forbes Advisor.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Generali Global Assistance Travel Insurance Review (2024)

Planning a trip? Read our review of Generali travel insurance to see if its policies offer the coverage you need.

in under 2 minutes

If you’re planning an international or domestic vacation, consider protecting your trip with travel insurance. The Generali Group is one of the most popular U.S. travel insurance providers. It’s our travel insurance pick for emergency assistance. It has extra policy inclusions, such as rental car collision coverage and sporting equipment benefits. Let’s see if this insurance provider is the best option for your upcoming trip — and if it is worth the price.

Learn more about the benefits of Generali travel insurance, what you might pay for coverage and how to get a quote.

- Average Cost: $201

- BBB Rating: A+

- AM Best Score: A+

- Medical Expense Max: $250,000

- Emergency Evacuation Max: $1,000,000

Our Take on Generali Global Assistance Travel Insurance

We gave Generali Global Assistance 4.5 out of 5.0 stars , with top marks for its emergency assistance features. Its trip interruption and travel delay coverages are generous, with up to 175% coverage for trip interruptions. Generali’s policies also offer to cover sporting equipment and baggage loss and delay , which is beneficial if you bring expensive equipment with you. All of Generali’s plans also include 24/7 multi-lingual support — a lifesaver if there’s an international emergency.

Generali’s travel insurance could be less valuable for you if you’re shopping for the most affordable coverage . In our review, we found that two people are likely to pay almost $300 on average for an international policy, which is less than budget options like Faye or Trawick. Generali’s CFAR reimbursement option also only covers 60% of trip costs, which is disappointing compared to other insurers.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Pros and Cons of Generali

Generali travel insurance plans.

Generali’s travel insurance policies are significantly more inclusive compared to the specific inclusions found on competitors’ policies. Coverages are generous. For example, while providers like Trawick have trip interruption coverage of 100% of plan expenses, Generali’s plans cover more — up to 175% of costs. These policies also have standardized items like sporting equipment and rental car coverage, which are usually add-ons with other providers.

Let’s look at Generali’s three plans: Standard, Preferred and Premium.

Standard Plan

Generali Travel Insurance’s basic trip coverage option is its Standard Plan. It includes a range of policy inclusions despite its low price point . You’ll find these protections on the Standard Plan:

- 100% of trip cancellation costs

- 125% of trip interruption costs

- $50,000 worth of coverage for emergency medical and dental expenses

- $1,000 ($150 per day) to cover accommodations and other expenses caused by trip delays

- $250,000 for medical evacuation and repatriation

- $1,000 in baggage coverage

- $200 per person for baggage delay

- $50,000 worth of accidental death and dismemberment (AD&D) coverage (flights only)

All Generali plans carry 24/7 travel concierge services, which help you access local medical care and emergency services. This inclusion is a major benefit if you visit a country where you cannot speak the primary language. It includes telemedicine, no out-of-pocket medical expenses and identity theft coverage, even the lowest-tier policy.

In addition to the Standard Plan, Generali offers two higher coverage tiers, which have extra and extended benefits.

Preferred Plan

The Preferred Plan is Generali’s middle-tier coverage and is useful for sports travelers because of its standard equipment coverage. The Preferred Plan includes all the benefits from the Standard Plan, plus these extra items or extensions:

- 150% of trip interruption costs

- $150,000 worth of coverage for emergency medical and dental expenses

- $1,000 ($200 per day) to cover accommodations and other expenses caused by trip delays

- $1,500 in baggage coverage

- $1,500 coverage for sporting equipment

- $300 for sporting equipment delays

- $300 per person for baggage delays

- $750 for missed connections

- $500,000 for medical evacuation and repatriation

- $75,000 worth of AD&D coverage (flights only)

- $25,000 worth of standard non-flight AD&D coverage

- Coverage for financial insolvency of your tourism and travel vendors

Premium Plan

The Premium Plan is Generali’s most comprehensive travel insurance plan, promoting coverage for extended medical and baggage incidents. It includes all of the coverage ranges found on the Preferred Plan, plus the following extra benefits and extensions:

- 175% of trip interruption costs

- $250,000 worth of coverage for emergency medical and dental expenses

- $1,000 ($300 per day) to cover accommodations and other expenses caused by trip delays

- $2,000 in baggage coverage

- $2,000 coverage for sporting equipment

- $500 for sporting equipment delays

- $500 per person for baggage delay

- $1,000 for missed connections

- $1 million for medical evacuation and repatriation

- $100,000 worth of AD&D coverage (flights only)

- $50,000 worth of standard AD&D coverage

- $25,000 worth of rental car collision coverage

The premium plan is the only one of Generali’s travel insurance plans that covers pre-existing conditions and that allows you to add CFAR coverage.

Generali Add-On Options

Add-ons, also known as insurance riders, are optional benefits you can add to a travel insurance policy to increase your coverage. Generali Global Assistance has fewer travel plan add-ons than some other companies. You can add the following two coverages to your policy:

- Rental car damage: This add-on covers costs associated with rental car damages while traveling. You can add it to the Standard or Preferred plans, and it’s automatically included in the Premium Plan.

- CFAR coverage: Extends your trip cancellation benefits to cover situations outside your standard policy. Generali only allows you to add this coverage to its Premium policies.

Cost of Generali Travel Insurance

The coverage tier you select plays a major role in your cost. Higher tiers of travel insurance include more expensive coverages and a wider selection of reimbursements, which increases the insurer’s financial risk. So, higher levels of coverage are more costly than lower tiers.

In our travel insurance review, we found the average traveler can expect to pay between $70 and $751 for coverage. The price is a bit more expensive than competitors like Faye, which specializes in budget policies.

The overall cost of your trip also affects travel insurance costs. Browse our table to get a better idea of how different types of trips may affect cost.

Use the chart below to compare Generali's average cost to competitors:

Generali Domestic Travel Insurance

Generali also offers travel insurance coverage on U.S. domestic trips. Our table summarizes what a 30-year-old couple could expect to pay for each of Generali’s plans on a $5,000 trip to New York.

Read More: Travel Insurance For Parents Visiting The USA

Generali Travel Insurance Reviews

Generali travel insurance holds 3.5 out of 5 stars from almost 250 customer reviews on Trustpilot. Many satisfied customers report that the process of getting an insurance policy is simple and the coverage is comprehensive. Unsatisfied customers mentioned how the claims process is complicated and can take months to resolve. However, in a number of cases, customers who initially left negative reviews about a lack of communication following claims noted swift resolution after leaving a review.

Below are some examples of positive and negative company reviews on Trustpilot.

“Very competitive plans at decent prices. Hard to say for sure how good it is until I make a claim, but the purchase experience was smooth. One problem with travel insurance is it is not always easy to determine what will be covered. Recently, I have come to believe that the most important feature of any travel insurance is coverage for an enormous loss, such as medical evacuation from a remote location (like a cruise ship). Even the basic Generali plan offers very good coverage in that area.” — Joe B. via Trustpilot “I've used Generali in the past. If I had a claim it was fulfilled in a timely manner. Once my trip was canceled and though there was some confusion about my policy, [Generali] stuck with it and I was refunded my entire amount. [Generali is] good to work with.” — Dennis S. via Trustpilot “I travel up to three times a year and always use Generali. I usually do not submit a claim but have for a skiing accident. I submitted the claim over a month ago and upon checking in with a live agent over chat, was told that in those 33 days, nobody has picked up the claim and there is nothing she can do about escalating it … But immediate action was taken after I left this review. The check is in the mail.” — Anteres N. via Trustpilot "In December we visited a sick relative who subsequently passed away. At the same time, both me and my partner got sick and could not travel. Almost two months later, we have not received the claim money from the trip. It seems our claim has not yet been assigned a rep. I realize there have been some airline meltdowns and [Generali is] busy but the communication is terrible. We are so frustrated … the whole time we've dealt with it has been horrible and extremely stressful — what you don't need when traveling!” — Carol S. vis Trustpilot

How To File a Claim with Generali Travel Insurance

Generali offers a three-step process for filing a travel insurance claim:

- Visit Generali’s website and log into your eClaims portal to access the claims form. If you’re in an area where you can’t file a claim online, call 800-541-3522.

- Upload supporting documentation to your account or email it to a representative according to Generali’s requests. Examples of documents you might need include hospital reports and flight cancellation confirmations.

- After submitting your claims package, Generali will assign your case a number and a representative. You’ll hear from your representative, who will help guide you through the next steps.

Keep your documentation — in either digital or physical form — as you travel in case you need to use emergency assistance services.

Compare Generali to Other Travel Insurance Companies

Now that you understand what Generali’s plans cover let’s take a look at how it stacks up against top travel insurance competitors.

The countries you visit also play a role in travel insurance pricing. Here are a few examples of how your destination might impact your travel insurance premium.

What’s Not Covered by Generali Travel Insurance?

While Generali’s policies include generous trip coverage and medical insurance , they don’t cover everything. The following are a few exclusions you’ll find on Generali’s coverages — and where you can find these inclusions if they’re important to you.

- Business equipment: While Generali’s policies have options to cover sporting equipment, coverage does not extend to business equipment and technology. If you plan to travel with more expensive business luggage, consider a provider like Travelex that offers protection for these items.

- Extreme sports: Medical insurance for travel policies doesn’t usually extend to injuries sustained while participating in extreme sports. If you’re planning on hiking, scuba diving, mountain biking or performing other serious physical activities abroad, consider a provider like IMG Travel Insurance or Travelex. While Generali doesn’t allow you to extend medical coverage to include these circumstances, other insurers offer an extreme-sports add-on.

- Non-medical emergency evacuations: Generali’s travel insurance plans include coverage for medical evacuations only. If you believe you might need emergency political or environmental evacuation resources, consider a provider like AXA , which has this option.

Is Generali a Good Choice for Travel Insurance?

The choice of travel insurance provider usually comes down to your individual needs. If you’re traveling to an area where you can’t speak the primary language, Generali’s around-the-clock concierge emergency service could provide peace of mind. But if you’re looking for political evacuation assistance and reimbursements or more expansive CFAR coverage, Generali might not be the best choice.

Frequently Asked Questions About Generali Travel Insurance

How do i file a claim with generali travel insurance.

You can file a claim with Generali Global Assistance travel insurance online using its eClaims portal. Alternatively, you can call the Claims Department at 1-800-541-3522. You will need to provide disclosures about the circumstances of your claim, along with supporting documentation to prove your losses, such as a credit card statement.

Once submitted, Generali will assign your claim to a representative to manage from start to finish. Your refunded amount will depend on your travel insurance plan and related coverage limits. You can monitor the status of your claim on the eClaims portal.

What is the difference between trip cancellation and trip interruption coverage?

Trip cancellation coverage includes non-refundable expenses you made before traveling, such as airline tickets and lodging. Coverage kicks in if your trip is canceled for a covered reason, leaving you unable to travel. Trip interruption coverage begins after you leave and covers expenses if you need to cut your trip short or return home early.

Both forms of insurance are designed to safeguard against unforeseen events, such as the policyholder or a close family member suffering an injury, serious illness or accidental death. Unforeseen events can also include terrorism and natural disasters.

How much do Generali travel insurance premiums cost?

The price of Generali travel insurance depends on factors such as the cost of your trip, how long you are traveling and who is going. Based on sample quotes we pulled for a $5,000 trip to Cancun, Mexico, it would cost $168 to insure two New York residents in their 30s under the Standard Plan. Prices were higher for the Preferred and Premium plans, ranging from $195 to $228.

We recommend you request a free quote on the Generali website to check rates and compare options before you buy travel insurance. The company also offers a 10-day “free look” period in which you can decide if the policy is right for you. If you are unsatisfied or find a better policy elsewhere, you can cancel for a full refund.

How does Generali pay claims?

Generali’s team recommends that you elect to receive claims payouts using its e-payment partner Zelle. When you choose to receive payments through Zelle, you can receive payment in as little as a day. Otherwise, Generali will mail you a check with your payment, which will usually take between seven and 10 business days.

Does Generali have 24/7 travel assistance?

Yes, all of Generali’s travel insurance policies include access to a 24/7 travel insurance hotline that is offered around the clock to support customers in all time zones. To get in touch with Generali’s 24/7 customer service team, call (877) 243-4135 if you’re in the U.S. +1 (240) 330-1529 if you’re abroad.

Does Generali cover COVID-19?

Yes, Generali’s travel insurance policies include COVID-19-related expenses as standard medical coverage. In other words, the company treats COVID-19 the same as any other illness under your travel insurance reimbursement limits and specifications.

Other Travel Insurance Providers to Consider

- TravelSafe Travel Insurance Review

- Nationwide Travel Insurance Review

- World Nomads Travel Insurance Review

- Faye Travel Insurance Review

- Tin Leg Travel Insurance Review

- Travelers Travel Insurance Review

- Allianz Travel Insurance Review

- WorldTrips Travel Insurance Review

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

Joseph Reaney is an experienced writer for travel brands, including Lonely Planet, Fodor’s, DK Eyewitness and National Geographic. He is also the founder and editor-in-chief of the travel specialist content writing agency World Words . When he isn’t busy traveling or writing about it, you’ll find him at the local comedy club.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York's Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

If you have questions about this page, please reach out to our editors at [email protected] .

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- Travel Insurance

- Generali Travel Insurance Review

On This Page

- Key takeaways

Is Generali travel insurance any good?

- Bottom line Main highlights of Generali travel insurance

Generali travel insurance plans & coverage

Compare generali travel insurance coverage, cost of generali travel insurance plans, generali travel insurance reviews from customers, is generali travel insurance worth it, faq: generali travel insurance, related topics.

Generali Travel Insurance Review May 2024

- Generali Global Assistance offers three comprehensive travel insurance plans : Standard, Preferred and Premium.

- All plans include medical and medical evacuation coverage, as well as coverage for lost/damaged baggage and trip cancellations, delays and interruptions.

- You can purchase rental car coverage as an add-on for any of the three plans.

- Generali has excellent ratings of A+ from the Better Business Bureau and A from AM Best. Generali customers give the provider 4.34 stars out of 5!

- Customer reviews highlight an easy claims process, clear terms and helpful customer service .

- To easily view all travel insurance plans available, try using an online comparison tool .

With over three decades in the industry , Generali Global Assistance stands out as a reliable travel insurance provider.

The company offers three plans with various coverage options that cater to your specific travel needs.

In the Generali review, we’ll break down its offerings and give insight into customer experiences to help you decide if this provider is the right choice for your travel insurance.

- A+ from the Better Business Bureau

- High medical and medevac limits

- Every plan includes coverage for trip cancellation

- Higher cancellation limits

- Pre-existing conditions only covered in the premium plan

- Baggage delay coverage requires 12 hour delay (long)

Yes, Generali travel insurance is a good choice for a travel insurance provider.

Generali is one of the largest travel insurance brands in the world. The company has been in business for 32 years, and it’s also accredited by the Better Business Bureau.

Generali has an A+ BBB rating and an A (excellent) AM best financial rating, which means it has an excellent ability to meet its ongoing insurance obligations . In other words, the company isn’t likely to fail.

Unlike many travel insurance providers, Generali offers comprehensive plans at every level . Even the most basic plans include several types of insurance coverage. That’s why Generali Standard is one of the top five most popular travel insurance policies sold on our website.

Here’s a look at the main highlights and benefits of Generali travel insurance.

Bottom line: Main highlights of Generali travel insurance

Generali Global Assistance only offers three travel insurance plans, but each one is extremely comprehensive.

All three plans offered by Generali Global Assistance have high medical and medevac limits , giving you extra peace of mind for both domestic and international trips. This can be especially beneficial if you plan to travel to a remote area where you may need much higher medevac insurance limits.

In addition to medical and medical evacuation coverage , every plan includes coverage for trip cancellation , trip delays, trip interruptions and lost/damaged baggage. That’s not always the case with travel insurance. Generali Global Assistance travel insurance also has higher limits for these scenarios, which is a huge benefit because delays, cancellations and interruptions are so common.

Generali Global Assistance offers three travel insurance plans: Standard, Preferred and Premium.

Generali Global Assistance

Generali standard.

This insurance plan is great for travel within the United States, North America and the Caribbean. It comes with $50,000 in medical insurance per person, which is ideal for supplementing your existing U.S. health insurance plan. The Standard plan also includes $1,000 in coverage for lost or stolen baggage, $200 per person for baggage delays and up to $250,000 in emergency assistance and transportation benefits.

Generali Preferred

The middle-of-the-road insurance plan has high coverage limits for trips abroad or within the United States. In general, you’re paying for higher limits on all standard benefits, but the plan does come with a few extras. For example, the Preferred plan includes dental coverage, additional accidental death and dismemberment (AD&D) benefits and insurance for lost or damaged sports equipment.

Generali Premium

This insurance plan is best for premium coverage on international trips or trips to remote locations where you may need higher plan limits and payouts. It comes with $250,000 of medical coverage per person and $2,000 per person in baggage coverage. The Premium plan also includes rental car coverage as a standard benefit.

Optional rental car collision damage waiver

Generali Global Assistance also offers $25,000 in rental car damage protection. This is an optional benefit, so it doesn’t come standard with any of the three insurance plans described above. However, you can pay extra to opt in and get upgraded benefits.

If you add this type of insurance to your plan, you’ll be covered for losses due to vandalism, collision, inclement weather and theft.

The company will pay the lesser amount of the following:

- The cost to repair the vehicle and any rental fees charged while it’s out of service

- The cash value of the vehicle

This type of travel insurance doesn’t apply to vehicles that are more than 20 years old, vehicles used for commercial purposes or vehicles with a manufacturer’s retail price exceeding $75,000. There are some additional exclusions, so read your travel insurance policy carefully to ensure you understand what’s covered.

Things not covered by Generali Assistance USA Travel Insurance

Generali Global Assistance offers comprehensive travel insurance, but its plans don’t cover everything.

These items are excluded from the Standard, Preferred and Premium insurance plans:

- Financial defaults: In the insurance industry, financial default coverage protects you in the event that a travel supplier suspends its operations due to financial difficulties. Generali’s travel insurance plans don’t come with this type of coverage.

- Cancel for any reason: Cancel-for-any-reason travel insurance allows you to recoup your costs for any reason, even one that isn’t listed as a “covered reason” under your basic trip cancellation coverage. Generali offers this type of insurance as an add-on, but cancel-for-any-reason coverage isn’t included with the Standard, Preferred or Premium plans.

- Pre-existing conditions: When you’re looking at travel insurance, a pre-existing condition is any health problem that you had before you booked your trip. Unless you purchase an add-on, Generali doesn’t provide any coverage for these conditions . The company has a 180-day lookback period, which means your illness or injury must be stable for at least 6 months if you want a pre-existing condition waiver.

According to sales data from visitors to our website, the average cost of a Generali Global Assistance travel insurance plan is $282.95 for a 14-day trip.

Of course, many factors go into determining the cost of travel insurance, such as:

- The type of coverage

- The number of travelers

- The length of the trip

- Your destination

To give you a general idea of how much Generali travel insurance plans cost , we got various quotes for the Standard, Preferred and Premium plans. For all quotes, we used California as the state of residence.

Example Quotes from Generali Global Assistance

One of the best ways to get an idea of quality is to review what Generali customers are saying about it. To help you get a better idea of what Generali customers like (and don’t like), we’ve done the research and listed out the top recurring feedback from real customers on Squaremouth .

What customers like

Customers have mentioned the following as some of the major benefits of purchasing travel insurance from Generali:

- Easy claims process

- Clear terms of service

- Helpful customer service agents

Here are a few comments from satisfied reviewers:

Tatiana from California: “It gave me a peace of mind, and I will use it again in the future.”

Kathryn from New York: “The insurance company sent me a notification and asked if I needed their assistance. I refused because I had a courtesy well check from the hotel physician and was fine. I was extremely pleased with the company’s immediate follow up.”

What customers don’t like

Although this travel insurance provider has thousands of positive reviews, past customers have pointed out a few drawbacks to using Generali:

- Slow to reimburse

- Difficulty connecting with a live agent

- Cumbersome documentation requirements

These reviewers provided negative feedback:

AJ from Massachusetts: “I tried to file a claim; their online claims module failed miserably. It kept rejecting my UN and PW, even though I was logged in and using the same credentials, as required, for the claims site.”

Rinnea from Illinois: “They say claim is under review. It has been since August 18 when they received claim. It is now October 17 and nothing.”

Buying travel insurance from Generali is definitely worth it. It’s a well-established company with several plans to suit your unique needs.

The Standard plan was one of the best-selling plans on our website over the past year, indicating it was one of the most popular options with customers.

Generali is right for customers who need comprehensive travel insurance and don’t want to spend time picking from 10 or 12 plans. Although the company only offers three types of travel insurance, each plan includes valuable benefits.

The Standard plan is ideal for budget-conscious consumers who need travel insurance and don’t want to spend a lot of money. Generali’s standard benefits are well-suited for people taking trips within the United States, Canada, Mexico and the Caribbean.

Generali’s Preferred travel insurance is ideal if you’re traveling internationally or planning an expensive trip within the United States. It increases the limits on standard benefits and adds dental coverage, travel insurance for lost or damaged sports equipment and extra AD&D coverage.

Premium travel insurance is best for travelers who plan to travel overseas or spend time in remote locations, as it costs a lot more to get emergency care in a remote area than it does in a big city. The Premium plan comes with high coverage limits and adds rental car coverage as a standard benefit.

If you’re looking for a larger selection of plans, you may want to go with a different travel insurance provider.

Here are our top picks for the best alternative plans

AXA Assistance USA

Seven corners, are generali travel insurance plans good.

Yes. Although the company only offers three travel insurance plans, each one comes with solid coverage limits. Every plan also includes coverage for trip delays, trip interruptions, trip cancellations and lost/stolen baggage, which is unusual for such inexpensive travel insurance. Depending on which plan you purchase, Generali Global Assistance may reimburse you for anywhere from 125% to 175% of your trip cost for travel interruptions.

Does Generali cover COVID-19?

Yes. Each travel insurance policy covers COVID-19 as part of its standard benefits. For example, if you come down with COVID-19 after your trip begins, the company may reimburse you for all non-refundable expenses under the terms of your trip interruption coverage. You may also be able to use trip cancellation coverage, medical benefits, medical evacuation insurance or other travel insurance benefits to recoup your costs.

Does Generali include 24/7 travel assistance?

Yes. The company offers 24/7 travel assistance for customers who need help navigating international medical systems, finding emergency medical resources, using travel insurance benefits or returning home due to a medical emergency.

Does Generali travel insurance come with a money-back guarantee?

If you aren’t happy with the coverage you purchased from Generali Global Assistance, you have 10 days from the date of purchase to contact the company and cancel. As long as you haven’t started your trip or filed a claim, Generali will reimburse you for the full cost of your plan. Note that Indiana residents are eligible for a refund up to 30 days after the original purchase date.

Does Generali have an app for travel insurance claims?

Generali doesn’t have an app for submitting travel insurance claims. However, it does have an online portal. You can always use your smartphone or tablet browser to access the portal and start the claims process.

Does Generali travel insurance cover trip cancellations?

Yes. Unlike many insurance providers, Generali includes trip cancellation coverage as a standard benefit with all three of its plans. If you have to cancel your trip for a covered reason, the company will reimburse you for any prepaid, non-refundable expenses. For example, if you paid $1,500 for flights and can’t get a refund from the airline, you may be eligible for reimbursement from Generali.

Does Generali travel insurance work abroad?

Yes. All three of Generali’s insurance plans work abroad, but we recommend that you buy the Preferred plan or the Premium plan if you intend to do any international travel. These plans have higher limits than the Standard plan, so they’re more helpful if you have some type of emergency while you’re overseas.

Leigh Morgan is a seasoned personal finance contributor with over 15 years of experience writing on a diverse range of professional legal and financial topics. She specializes in subjects like navigating the complexities of insurance, savings, zero-based budgeting and emergency fund development.

In the last five years, she’s authored over 300 articles for credit unions, digital banks, and financial professionals. Morgan is also the author of “77 Tips for Preventing Elder Financial Abuse,” a book focused on helping caregivers protect the elderly from financial scams.

In addition to her writing skills, she brings real-world financial acumen thanks to her previous experience managing rental properties as part of a $34 million real estate portfolio.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

Best Travel Insurance Companies & Plans in 2024

Best Medical Evacuation Insurance Plans 2024

Best Travel Insurance for Seniors

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Guide to Traveling While Pregnant: Pregnancy Travel Insurance

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions May 2024

22 Places to Travel Without a Passport in 2024

Costa Rica Travel Insurance: Requirements, Tips & Safety Info

Best Spain Travel Insurance: Top Plans & Cost

Best Italy Travel Insurance: Plans, Cost, & Tips

Best Travel Insurance for your Vacation to Disney World

Chase Sapphire Travel Insurance Coverage: What To Know & How It Works

2024 Complete Guide to American Express Travel Insurance

Schengen Travel Insurance: Coverage for your Schengen Visa Application

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Plans for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Top Plans 2024

Best UK Travel Insurance: Coverage Tips & Plans May 2024

Best Travel Insurance for Trips to the Bahamas

Europe Travel Insurance: Your Essential Coverage Guide

Best Trip Cancellation Insurance Plans for 2024

What Countries Require Travel Insurance for Entry?

Philippines Travel Insurance: Coverage Requirements & Costs

Travel Insurance for the Dominican Republic: Requirements & Tips

Travel Insurance for Trips Cuba: Tips & Safety Info

AXA Travel Insurance Review May 2024

Best Travel Insurance for Thailand in 2024

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Travel Insurance for a Japan Vacation: Tips & Safety Info

Faye Travel Insurance Review May 2024

Travel Insurance for Brazil: Visitor Tips & Safety Info

Travel Insurance for Bali: US Visitor Requirements & Quotes

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

Travel Insurance for India: U.S. Visitor Requirements & Quotes

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for May 2024

Travel Insured International Review for 2024

Seven Corners Travel Insurance Review May 2024

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

Medjet Travel Insurance Review 2024: What You Need To Know

Antarctica Travel Insurance: Tips & Requirements for US Visitors

Travel Insurance for Kenya: Recommendations & Requirements

Travel Insurance for Botswana: Compare Your Coverage Options

Travel Insurance for Tanzania: Compare Your Coverage Options

Travel Insurance for an African Safari: Coverage Options & Costs

Nationwide Cruise Insurance Review 2024: Is It Worth It?

Travel Insurance for Hurricane Season: All You Need To Know

- Travel Insurance for Seniors

- Cheap Travel Insurance

- Cancel for Any Reason Travel Insurance

- Travel Health Insurance

- How Much is Travel Insurance?

- Is Flight Insurance Worth It?

- Anniversary Trip Ideas

- Travel Insurance for Pre-Existing Conditions

- Places to Travel Without a Passport

- Christmas In Mexico

- Europe Travel Insurance

- Compulsory Insurance Destinations

- Philippines Travel Insurance

- Dominican Republic Travel Insurance

- Cuba Travel Insurance

- AXA Travel Insurance Review

- Travel Insurance for Thailand

- Ireland Travel Insurance

- Japan Travel Insurance

- Faye Travel Insurance Review

- Brazil Travel Insurance

- Travel Insurance Bali

- Travel Insurance Turkey

- India Travel Insurance

- Australia Travel Insurance

- Travelex Travel Insurance Review

- Tin Leg Travel Insurance Review

- Travel Insured International Travel Insurance Review

- Seven Corners Travel Insurance Review

- HTH WorldWide Travel Insurance Review

- Medjet Travel Insurance Review

- Antarctica Travel Insurance

- Kenya Travel Insurance

- Botswana Travel Insurance

- Tanzania Travel Insurance

- Safari Travel Insurance

- Nationwide Cruise Insurance Review

- Hurricane Travel Insurance

Policy Details

LA Times Compare is committed to helping you compare products and services in a safe and helpful manner. It’s our goal to help you make sound financial decisions and choose financial products with confidence. Although we don’t feature all of the products and services available on the market, we are confident in our ability to sound advice and guidance.

We work to ensure that the information and advice we offer on our website is objective, unbiased, verifiable, easy to understand for all audiences, and free of charge to our users.

We are able to offer this and our services thanks to partners that compensate us. This may affect which products we write about as well as where and how product offers appear on our website – such as the order in which they appear. This does not affect our ability to offer unbiased reviews and information about these products and all partner offers are clearly marked. Given our collaboration with top providers, it’s important to note that our partners are not involved in deciding the order in which brands and products appear. We leave this to our editorial team who reviews and rates each product independently.

At LA Times Compare, our mission is to help our readers reach their financial goals by making smarter choices. As such, we follow stringent editorial guidelines to ensure we offer accurate, fact-checked and unbiased information that aligns with the needs of the Los Angeles Times audience. Learn how we are compensated by our partners.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Generali Global

Generali Global Assistance 2021 Review. Pros, cons, pricing, and more.

InsuranceRanked values your trust!

InsuranceRanked.com is a free online resource that provides valuable content and comparison features to visitors. To keep our resources 100% free for consumers, InsuranceRanked.com attempts to partner with some of the companies listed on this page, and may receive marketing compensation in exchange for clicks and calls from our site. Such compensation can impact the location and order in which such companies appear on this page. All such location, order and company ratings are subject to change based on editorial decisions.

Our Phone Insurance Partners

5Devices, AIG TravelGuard, Akko, Arizona State University, Faye, Generali Global, Hiscox, Liberty University, Lynn University, Next Insurance, Purdue Global, Simply Business, Southern New Hampshire University (SNHU), Squaremouth, Tivly, TravelInsurance.com, Upsie, VSP

HOME > TRAVEL INSURANCE > GENERALI GLOBAL

Generali Global 2024 Review

Award-Winning Writer, Digital Communications Leader

Generali Global Assistance Review

The owner of CSA Travel Protection and Trip Mate, Generali Global Assistance is one of the biggest names in the travel insurance world. Even if you don’t purchase your insurance directly from Generali, odds are certain assurance products — like language assistance, facility finding, or concierge services — are provided by this Italian insurance giant.

Should you purchase your travel insurance from Generali as well? In this review, we’ll dive into what plans Generali Global Assistance offers customers, and who would benefit most from their options.

What is Generali Global Assistance?

As an insurance company, Assicurazoni Generali traces their history back to Trieste, Italy. In 1831, Generali first opened for business as a property insurance company. Over the next 190 years, the company went through several transitions as Italy — and greater Europe — broke up and reformed several times. Today, the company is the largest insurer in Italy, and is the ninth largest insurance company worldwide by value of net premiums written. In Europe, Generali is only behind AXA and Allianz.

Although the company is well known for their variety of insurance products, their entry into the travel market came after the purchase of two well-known travel insurance companies: CSA Travel Protection and Europ Assistance. Pierre Desnos founded Europ Assistance in 1963, offering travelers translation and medical aid when traveling.

CSA Travel Insurance was formed in 1991 as one of the pioneers of the travel insurance industry. Their first product covered trip cancellation for tourists going abroad, allowing them to recover certain costs in the event a major life event forced them to stay home.

Generali purchased the assets of Europ Assistance in 2001, followed by CSA Travel Protection years later. By 2016, the Italian insurance giant began rebranding CSA and Europ Assistance USA as Generali Global Assistance, giving them a unified brand in the marketplace. Three years later, Generali would go on to acquire Trip Mate, further expanding their reach into the travel insurance market.

Generali Global Assistance Travel Insurance Options

Generali Global Assistance offers three levels of travel insurance policies for international travelers, ranging from Standard to Preferred. The best plan for your travels will depend on your destination, planned activities, and how much your trip costs.

Generali Standard Travel Insurance

Built for travelers on a budget, Generali’s Standard travel insurance plan covers all the basics. Trip cancellation, trip interruption, baggage loss and medical emergency coverage. This plan is designed for those taking a smaller trip, such as a cruise or a resort vacation.

Generali Preferred Travel insurance

Improving off the Standard plan, Generali Preferred travel insurance offers additional benefits for those taking a longer or more expensive trip. In addition to higher benefit maximums, the plan offers coverage for lost or delayed sporting equipment, operator financial insolvency, as well as accidental death and dismemberment aboard a common carrier.

Generali Premium Travel Insurance

For travelers who are taking an expensive trip abroad with a cruise line or tour company, Generali’s Premium travel insurance plan has the highest benefit maximums and most add-on options, including coverage for pre-existing conditions. Alongside up to $1 million in emergency assistance and transportation, travelers can also buy coverage for cancellation for any reason.

What’s Covered Under a Typical Company Plan

All three Generali Global Assistance travel insurance policies offer a base package of benefits to help travelers navigate the most common frustrations they may face. They include trip cancellation, trip interruption, baggage delay, and emergency assistance and transportation.

- Trip cancellation: If an emergency at home prevents you from going on vacation — such as a death in the family, or accident on the way to the airport — trip cancellation benefits can help you recover some non-refundable costs.

- Travel delay: Irregular operations and bad weather can stop planes and trains from leaving the station. Should a covered situation stop you from traveling, travel delay benefits can reimburse you for certain inconveniences, including meals and spare phone charges.