Buy Now, Pay Later at Journeys

Elevate Your Journeys Online Shopping

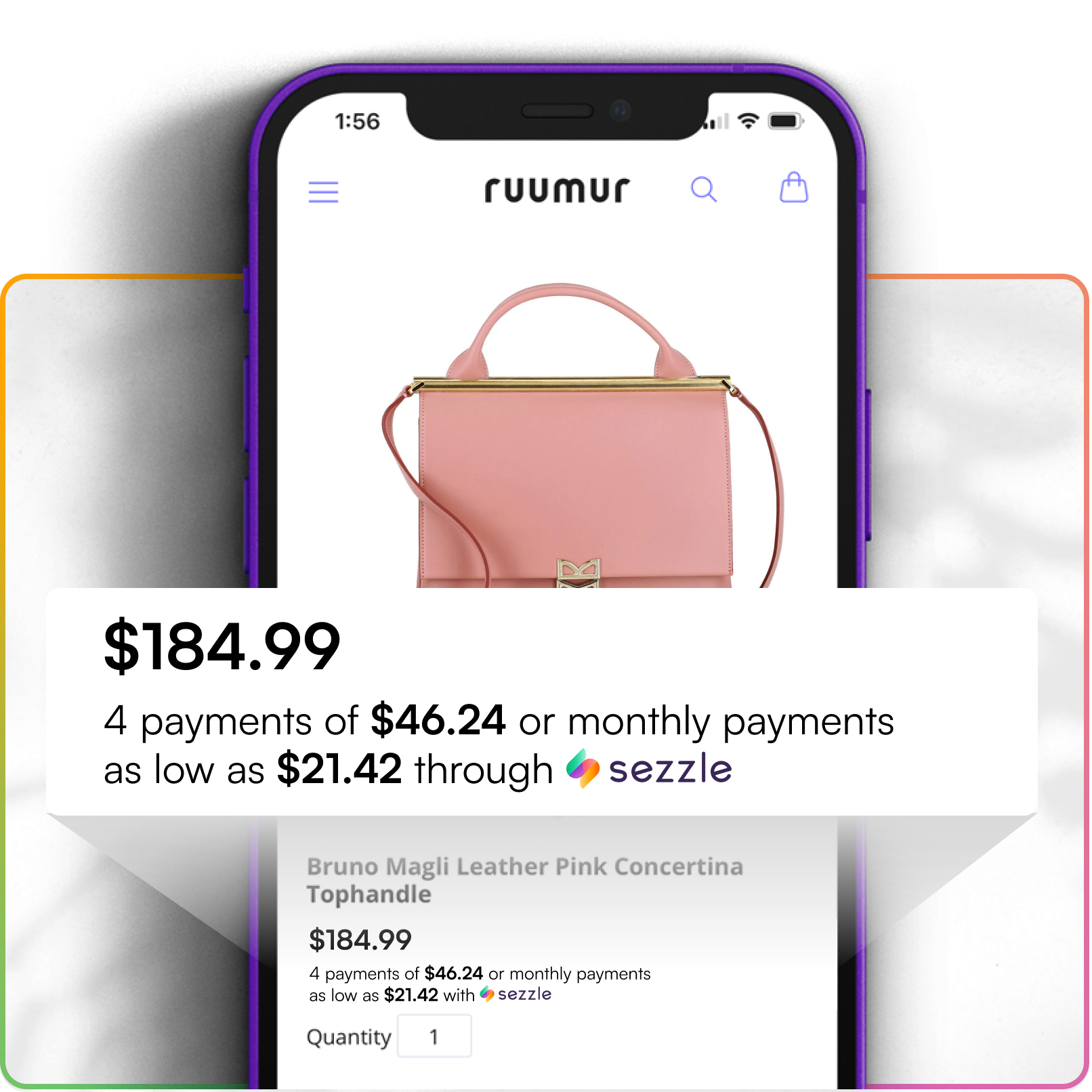

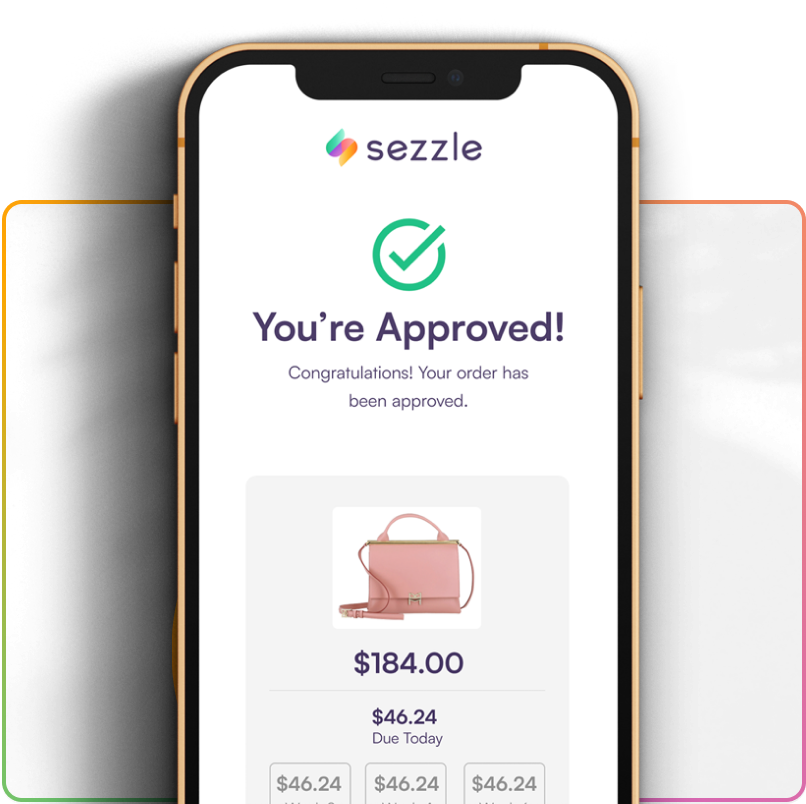

Enhance your shopping experience at Journeys with Sezzle’s flexible payment plan that breaks your purchase into 4 equal payments over 6 weeks.² Enjoy Journeys’s vast selection and the convenience of shopping with more flexible payment options on Sezzle’s BNPL platform. Begin today and discover the simplicity of paying with Sezzle installments at Journeys.

Flexible Financing

Pay for your purchases in 4 installments over 6 weeks with 0% interest or choose to pay monthly.² Learn How it Works

No Hard Credit Check³

Sign up for Sezzle today with no impact on your credit and get an approval decision within seconds! Sign Up

For Merchants

Offer a responsible way for customers to pay later, driving increased basket sizes and incremental conversions. Learn More

Sezzle and Journeys Help You Achieve Financial Freedom

Financial freedom is a right, not a privilege. Everyone deserves to be trusted, and by valuing, respecting, and supporting each individual, opportunities expand for everyone to achieve their potential. We’re here to help you achieve financial freedom and take control of your finances so you can build your future. Forget the high interest and strict payment schedules of traditional online credit shopping. Shop seamlessly at Journeys using Sezzle’s payment platform to become financially empowered through a user-friendly approach that fits your financial flow and ensures no surprises.

Sezzle: Your Shopping Routine, Upgraded

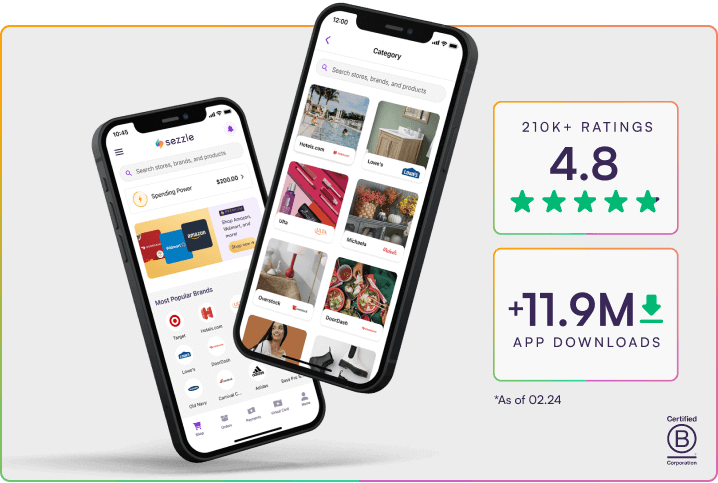

Sezzle adapts to your lifestyle, providing instant finance options at checkout, online or in-store. It’s easy: download the Sezzle app, sign up, receive an instant approval decision with no hard credit check³, and pay over time. This removes the financing hassle, making it a top choice for informed shoppers.

Shop Smart at Journeys with Sezzle’s BNPL App

Sezzle’s BNPL app enables personalized shopping decisions. It allows you to control your finances strategically to ensure your money works harder for you without sacrificing your desires. The flexibility to pay in installments lets you manage your budget effectively, ensuring each purchase is an investment in quality.

Shop Anywhere with the Sezzle Virtual Card⁴

With Sezzle Anywhere, Sezzle allows shoppers use the Virtual Card to establish installment payments anywhere Visa is accepted, providing you with additional choices and flexibility.

Some Benefits of Buy Now Pay Later

BNPL apps, like Sezzle, let you: • Take home high-value merchandise that might otherwise be unaffordable if full payment was required upfront. • Enjoy flexibility during the holidays and back-to-school seasons to ensure your family has what it needs without worrying about your cash flow. • Handle the high cost of emergency expenses. • Personalize your shopping experience, where financial planning becomes integral to the purchasing process.

Who Uses BNPL Installment Options

• Nearly 50% of Gen Z and Millennials use BNPL finance options. Consumers 18-34 years old are 3x more likely to use BNPL installment financing. • Men (63%) use BNPL options more than women (51%). • 42% of consumers who use the buy now pay later payment options to use it because of the clarity of fees and interest rates, with 39% saying they use it to monitor their spending.

Sezzle: A New Era of Finance at Journeys

Sezzle ushers in a new era of finance, merging convenience, flexibility, and financial control. Opting for "pay in 4" or installment payments means embracing a modern financial management approach tailored to today’s digital shopper’s needs.

How to #SezzleIt at Journeys

1. Download the Sezzle App. 2. Search for and click Journeys. 3. Click Pay with Sezzle. 4. Your Journeys purchase is split into 4 interest-free payments over 6 weeks.²

HELP CENTER

Shop now, pay later with klarna, apr 12, 2022 • knowledge, was this helpful.

1-855-472-0435

Customer Service Hours

Mon-Fri: 7am-8pm CT

Sat: 9am-6pm CT

Sun: 10am-7pm CT

Mon-Fri: 7am-6pm CT

Sat-Sun: Closed

Language

Customer Service

- order tracking

- Returns & Exchanges

- Shipping & Delivery

- Order Pickup Options

- Payment Options

- Site Feedback

- JOURNEYS ALL ACCESS

- Student Discount

- View Online Catalog

- Offers + Promotions

- Community Outreach

- Privacy Policy

- Terms of Use

- CA Statement

If you are using a screen reader and are having problems using this website, please call 1-855-472-0435 for assistance.

When you buy something using these coupons, we may earn a small affiliate commission. TIME is involved in the coupon selection process, working closely with Savings United to bring you the best deals and discounts. More information

Journeys Coupons

Journeys promo codes – last updated on april 2024, today's top journeys deal on the web, receive a 10% off journeys promo code with email sign-up.

Be the first to know about new arrivals, great deals, Promo Codes, special events and much more and knock 10% Off when you sign up with your email.

Receive a $5 off Journeys Coupon

Stay updated on special sales, Promo Codes, and more when you sign up for sms, and receive a $5 Off Coupon plus free shipping too!

Journeys Deals: get Converse for up to 40% Off

Grab 40% Off at Journeys this Holiday Season, shop for Converse Styles 40% Off, and save big on Chuck Taylor Hi Sneakers, Retro Sport, Bubbles, Electric Purple, and lots more

Journeys Sale: Adidas Sneakers under $40

Save big on a great selection of Adidas sneakers under $40 at Journeys, and get great low prices on Adidas Swift Run, Bravada 2.0, Ozelia, Nizza Trek, and many more styles on sale

Dr. Martens up to 40% Off at Journeys Clearance

Purchase Dr Martens Classic boots, Chelsea, Platform Styles, Casual shoes, Vegan Styles, and lots more with 40% Off at Journeys.

Kids Special: Adidas Sneakers for less than $30

Enjoy a great selection of kids' Adidas sneakers under $30, and save big on Adidas Swift Run, Grand Court, Lite Racer, and lots more

Create a Free Journeys Account for Free Delivery + Benefits

Create your free account now, receive exclusive perks, earn 10 points for every $1 you spend and get FREE shipping and save big at Journeys.

Grab a Journey Gift Card From $10

Stumped by what to give? Buy a gift card, and let them choose what to get. Our gift cards can be redeemed online or in-store, and best of all, there are no fees, and they never expire. Grab yours now from $10.

Journeys Student Coupon Code: Knock $10 Off

College students can benefit from $10 Off orders over $75 at Journeys. Simply verify your student status with UNiDAYS, and enjoy this deal!

Journeys: get Top Brands Pre Loved Apparel for 70% Off

Take 70% Off now on a great selection of pre-loved apparel, and discover top deals on jeans, casual dresses, denim jackets, jeggings and lots more. Buying (and wearing!) secondhand clothing reduces CO2 emissions by 25%.

Journeys: Buy Now Pay Later with Klarna

Shopping at Journeys is easier than ever with Klarna. Buy now and pay later in 4 interest-free installments when you choose Klarna.

Buy Men's & Women's Casual Shoes up to 50% Off at Journeys

Score 50% Off at Journeys, and grab amazing deals on Dr. Martens boots, Levi's casual shoes, Crocs clogs, Hey Dude slip ons, and lots more on sale.

Purchase Champion Footwear under $40 at Journeys

Discover amazing Champion deals under $40 deals at Journeys, and look yor best with a wide range of high-quality sporting modern sneakers with a retro heritage,

Crocs for 40% Off w/ Journeys Clearance

Enjoy 40% osavings now on a great selection of Crocs, and save big on classic, platform, sandals, fuzz lined, multicolor, and lots more, all under $40/each at Journeys.

Students Enjoy $10 Off $75+ and Free Shipping

College students enjoy a $10 Off Discount at Journeys plus free shipping. Simply join now and verify your student status with UNiDAYS.

Explore NEW Puma Styles at Journeys Now!

Grab top deals at Journeys, and elevate your footwear with Puma's latest styles: Suede Classic, Mayze platform, Biktop Rider, Caven 2.0, Palermo, and lots more.

Check Out NEW Styles from Adidas at Journeys Now!

Enjoy the latest Adidas new arrivals at Journeys, and grab great low prices on Adidas Run, Forum Boot, Gazelle, Original X Mickey Mouse, Samba, and many more new styles on sale

Save 45% Off on Sneakers Sale

Elevate your style and grab 45% Off on Converse, Fila, Puma, Champions, NB, and many more top brands on sale at Journeys.

PUMA Women Softride Sophia no $39.98

Grab 60% now and shop for style and comfort with the new Softride Sophia Luxe Athletic Shoe from PUMA. Get yours now for $39.98 at Journeys

April Sale Up to 50% Off Sale

Get up to 50% Off on a great selection of shoes, and shop for Converse, Puma, Vans, Ugg, and lots more.

Converse Spring Savings at Journeys

Save big at journeys, and choose your favorite Converse at great low prices: Chuck Taylor hi and low, retro styles, platform sneakers, and lots more

Birkenstock Clogs from $59.99

Add a water-friendly style to your warm-weather wardrobe with the new Boston EVA Clog. Get yours now for only $59.99

Hey Dude Shoes 50% Off Spring Sale

Enjoy unbeatable 50% off spring deals, and save big on Hey Dude shoes: slip-on casual, Peak hi, casual sneakers, and lots more at great low prices.

Converse Girls' Sneakers from $29.99

Grab amazing deals at Journeys, and shop for cute girl's styles on sale: butterflies, cherries and bees, pink flowers, and lots more on sale from $29.99/each.

Journeys Mother's Day Adidas 30% off Deals

Knock up to 30% off at Journeys, and get top deals on Adidas running sneakers, backpacks, Stan Smith styles, and lots more.

Popular Shops

- Saks Fifth Avenue

- Nordstrom Rack

- Michael Kors

- LUISAVIAROMA

- American Eagle Outfitters

- Foot Locker

- Finish Line

- PrettyLittleThing

- The Home Depot

- 1-800-Flowers.com

- Personalization Mall

- Bloomingdale's

- Ballard Designs

- Design Within Reach

- Global Industrial

- Vivid Seats

Similar Brands

- The Motley Fool

- H&R Block Tax

- Ulta Beauty

- Booking.com

- Free People

- Dick's Sporting Goods

- Victoria's Secret

What is the most popular Journeys Coupon for shoes?

{active_Coupons_count} Journeys Coupons are currently available: all are verified and up-to-date. The most popular deal right now is the Get $10 off $50 and free shipping one : to get it, you only need to Join Journeys All Access on the shop’s website.

Does journeys take expired Coupons?

Once a Journeys discount passes its expiration date, it is not possible to apply it anymore : make sure to use them before they expire. On Time.com, you should always find Promo Codes that are up-to-date, and all Coupons indicate the expiration date in their description for you to be aware.

What is the Journeys birthday discount?

Every new customer joining the Journeys Birthday Club receives a free anniversary gift during the first month after their subscription. This present, sent by email, generally consists of an exclusive Promo Code for you to use on your next order.

Does Journeys have discounts for students?

During the entire year, Journeys offers a $10 student discount on orders worth $75 and more : as for many other shops, you only need to register via your Unidays account for your status to be verified : once done, the promotion will be automatically applied.

Is there a Journeys military Promo Code?

Absolutely! Journeys offers a 10% off military discount on its entire store, however this deal only applies to in-store purchase. Active-duty and veterans can benefit from this offer, as long as they are able to provide a valid military ID.

Is there a Discount Code for Journeys employees?

Yes, Journeys applies a dedicated discount when employees purchase at one of their stores. The process is automated so that when you add an item to your cart and log in to your personal account, the employee status is verified and the reduction is applied directly.

Does Journeys Kidz also provide Coupons on shoes for kids?

Journeys also provides deals and promotions for its young customers : these Journeys Kidz offers are particularly valuable during back to school season in order to ensure that our little ones start the year in the best conditions.

How to use a Journeys Coupon

Once you choose the Coupon code that suits your needs, you can follow these steps :

- Copy the code displayed

- On the Journeys website, add the items you want to buy to your basket

- At the checkout, paste the code in the Promotion Code box, just below the “Order summary”

- Click on “Apply”

Can I use several Coupons at the same time at Journeys?

No, it is not possible to stack Coupons at Journeys : only one can be applied on each purchase. Luckily, Journeys has a large selection of Promo Codes and discounts for you to choose from : select the best offer from the list above and you will for sure make savings on your next favorite pair of sneakers.

Expired promo codes for Journeys

Journeys promo code: take an extra 20% off all sale.

Grab an additional 20% Off using this Coupon Code, and save now on Converse, UGG, Timberland, Vans, Dr. Martens, and lots more

Journeys Event: Kids Clearance 55% Off

Enjoy a great variety of kids shoes with 55% Off this Black Friday, and save big on Crocs, UGG, Converse, Adidas, and lots more

Toddlers Boots w/ up to 50% off

Explore amazing up to 50% Off deals at Journeys, and find great low prices on toddlers UGG, Dr. Martens, Timberland, Ralph Lauren, and many more boots on sale.

Get $10 Off $75+ orders w/ Journeys Promo Code

Knock this Coupon, grab $10 Off on orders $75+ at Journeys, and enjoy amazing low prices on Vans, Converse, UGG, Dr Martens, Crocs, and lots more.

Shop UGG Boots under $100 on Journeys February Sale

Grab amazing under $100 deals on a selection of UGG boots, and choose from Chukka boots, Classic Mini Logo, Slippers, Lug boots, Heritage sneakers, and lots more on sale at Journeys

Winter Discounts: up to 45% Off at Journeys

Get amazing up to 45% Off deals at Jorneyes, and save now on Adidas,Dr. Martens, UGG, Timberland, Vans, Converse, and many more footwear top brands on sale.

President's Day Savings $50 Off

Get amazing deals sitewide this President's Day, and save $50 Off on Converse, NB, Vans, Adidas and lots more on sale

Kids Sale Adidasfor up to 50% off at Journeys

Save big at Journeys, knock up to 50% off on Adidas Kids Sneakers, and choose from Grand Court, Lite Racer, Swift Run, Hoops Mid, and many more styles on sale.

It’s COLD out there! Shop Winter Boots Under $75 at Journeys Now!

Grab top deals under $75 on a selection of winter boots at journeys, and elevate your footwear with DR. Martens, UGG Classic, Timberland, Levi's, and many more great brands on sale.

Shop the Journeys GiftMas Sale in Progress Now!

Browse the best deals on our Giftmas Sale, and elevate your footwear with Dr. Martens, Champion, Adidas, Crocs, Converse, and lots more.

HELP CENTER

Buy online, pick up in store, feb 13, 2024 • knowledge, was this helpful.

1-855-852-4180

1-888-324-6356 (English)

Customer Service Hours

Mon-Fri: 7am-8pm CT

Sat: 9am-6pm CT

Sun: 10am-7pm CT

Ship To

Customer Service

- Order Tracking

- Returns & Exchanges

- Shipping & Delivery

- Order PickUp Options

- Payment Options

- Site Feedback

- JOURNEYS ALL ACCESS

- WAYS TO SAVE

- STUDENT DISCOUNT

- REQUEST A CATALOG

- VIEW ONLINE CATALOG

- Privacy Policy

- Terms of Use

- CA Statement

- Investor Relations

- Attitude That Cares

If you are using a screen reader and are having problems using this website, please call 1-888-324-6356 for assistance in English or 1-866-322-9099 for assistance in Spanish.

Buy now, pay later: Five business models to compete

Point-of-sale (POS) financing services in the United States have grown significantly over the past 24 months, especially since the onset of COVID-19. Trends fueling growth include digitization, rising merchant adoption, increasing repeat usage among younger consumers, and an expanding set of players targeting lending at point of sale, a service also known as “buy now, pay later.”

About the authors

Thus far, fintechs have taken the lead, to the point of diverting $8 billion to $10 billion in annual revenues away from banks, according to McKinsey’s Consumer Lending Pools data. In our view, only a few banks are responding fast enough and boldly enough to compete. Banks that underestimate the threat may see continued loss in share and could lose out on participating in a growing value pool and gaining share among younger and new-to-credit customers, as banks in Australia and China did when facing a similar situation. To avoid that outcome, US banks need to understand the landscape for POS financing and choose from among the emerging models.

This article seeks to give POS financing players as well as merchants the necessary insights to refine their strategies in the POS-financing arena. It provides an overview of the market, details key trends and factors influencing growth, and offers ideas for market entry for banks and partnerships for merchants. The insights are based on McKinsey research, including McKinsey Consumer Lending Pools (a proprietary database covering granular market size and growth trends), the McKinsey POS Financing Consumer Survey and POS Financing Merchant Survey, and our recent experience with banks and merchants.

POS financing’s expanding role in unsecured lending

Credit originated at point of sale is projected to continue its growth from 7 percent of US unsecured lending balances in 2019 to about 13 to 15 percent of balances by 2023, according to data from McKinsey’s Consumer Lending Pools (Exhibit 1). This is the only unsecured-lending asset class that has experienced high-double-digit growth through the COVID-19 crisis. The growth is underpinned by increased consumer and merchant awareness and adoption of point-of-sale financing solutions.

Our annual POS Financing Survey shows that US consumers are getting used to seeking merchant-subsidized credit at point of sale: about 60 percent of consumers say they are likely to use POS financing over the next six to 12 months. Additionally, merchants are seeing value in these solutions, as most enhance cart conversion, increase average order value, and attract new, younger consumers to the merchants’ platforms. However, the incremental impact of such solutions varies by merchant size and category.

About 60 percent of consumers say they are likely to use POS financing over the next six to 12 months.

Fintechs are capturing almost all the value being created in POS financing because banks have been slow to respond. Consequently, banks have lost about $8 billion to $10 billion in annual revenues to fintechs. Far worse for banks, they are losing access to an acquisition channel with potential to serve highly engaged younger consumers.

Adoption of POS financing isn’t limited to consumers with relatively low credit scores. Adoption across higher-credit customers is increasing as the credit mix is influenced by more premium merchants starting to offer financing at checkout. Around 65 percent of total receivables originated by point-of-sale lenders are with consumers having credit scores higher than 700. As an example, Affirm is originating upward of $1 billion in loans at the exercise equipment company Peloton annually, with the portfolio’s average credit score at about 740. In the lower-ticket “Pay in 4” model, which allows consumers to split payments into four interest-free installments (for example, Klarna, Afterpay), usage is driven by consumers with lower credit scores, but even here, the low scores result from thinner credit files, not poor credit usage.

Five distinct offerings with integration across the purchase journey

The growth in POS financing for consumers involves five distinct sets of providers and models, each with varying strategies and value propositions (Exhibit 2). 1 POS financing for small and medium-size enterprises is ripe for growth, but we do not cover the opportunity in this article. Understanding these models gives a sense of the segments they target, the merchant and consumer needs they address, and business models banks and traditional lenders are competing with.

Integrated shopping apps

The most prevalent misconception across banks and traditional players is that shopping apps offering “buy now, pay later” (BNPL) solutions are pure financing offerings. While that may be true for the smaller players, the leading Pay in 4 providers are building integrated shopping platforms that engage consumers through the entire purchase journey, from prepurchase to post-purchase.

The largest players are steadily building scale and engagement with an aspiration to become a “super app,” similar to large China-based players such as TMall or Ant Group, that offer shopping, payments, financing, and banking products in a single platform. These large providers already monetize consumer engagement through offerings other than financing (for example, affiliate marketing, cross-selling of credit cards and banking products). As long as traditional competitors fail to acknowledge this and unless they build solutions that drive engagement through the entire journey, they will find it tough to compete with these players (Exhibit 3).

The core Pay in 4 model still focuses on financing smaller-ticket purchases (typically less than $250) with installments that consumers pay down in six weeks. Providers like Klarna and Afterpay have seen exponential growth during the COVID-19 pandemic, amplified by rising merchant adoption and repeat consumer usage. Even the largest merchants that have shied away from these products, in part to limit cannibalization of their private-label credit card portfolios, are now integrating these offerings at checkout.

Roughly 80 to 90 percent of these transactions happen on debit cards, with average ticket sizes of between $100 and $110. 2 Jared Beilby, “6 need-to-know buy now, pay later statistics for small businesses,” Merchant Maverick, August 12, 2020, merchantmaverick.com. And a survey in July 2020 found that nearly 56 percent of American consumers have used a BNPL service—compared with 38 percent the year prior. 3 Maurie Backman, “Study: Buy now, pay later services continue to explode,” Ascent, March 22, 2021, fool.com. Unlike with other POS installment loans, consumers have a very high affinity and engagement, resulting in significant repeat usage. More mature consumer cohorts are using these financing products about 15 to 20 times a year and logging into these apps ten to 15 times a month to browse or shop. While the average credit score of consumers using these solutions is under 700, this has less to do with bad credit history and more to do with relatively thin credit files.

The already fast growth of Pay in 4 accelerated during the COVID-19 crisis, increasing at 300 to 400 percent in 2020 and accounting for about $15 billion in originations. McKinsey projects that Pay in 4 players are likely to originate about $90 billion annually by 2023 and to generate around $4 billion to $6 billion in revenues, not including revenues from other products they will cross-sell. Most of the originations are from higher-margin, discretionary-spend categories, such as apparel and footwear, fitness, accessories, and beauty. However, the largest players are also starting to integrate with newer categories, as in the cases of Klarna with Etsy.com and Afterpay with Houzz.com.

Given the shorter duration of financing in this model, receivables turn over about eight to ten times a year, resulting in return on assets (ROA) between 30 and 35 percent. Loss rates for more mature portfolios are comparable to those of credit cards (6 to 8 percent). 4 Review of company reporting.

Regulatory actions outside the United States

Regulators across geographies are looking at enhancing regulatory overview of some POS financing models like Pay in 4. With this in mind, industry players in some countries are trying to self-regulate to address potential regulatory concerns proactively. 1 Ranina Sanglap, “Australian buy-now-pay-later industry may need regulation to inspire confidence,” S&P Global Market Intelligence, March 9, 2021, spglobal.com.

Regulators outside of the United States, in markets including Australia and the United Kingdom, have raised concerns regarding the share of late fees charged by the Pay in 4 players. Another concern, referred to as “stacking” risks, involves consumers using too many Pay in 4 providers and getting overburdened by debt.

In Australia, the largest industry players have come together to self-regulate and issue a code of conduct intended to protect consumers. The industry leaders’ commitments include affordability checks, greater transparency on fees, and financial-hardship assistance.

In the United Kingdom, the Treasury announced that Pay in 4 players will come under the purview of the Financial Conduct Authority (FCA), which regulates financial-services firms. Pay in 4 players will be required to conduct affordability checks before lending to customers, and customers will be allowed to escalate complaints to the UK financial ombudsman.

In markets like Australia, POS financing is significantly more mature and widespread and Pay in 4 products have been around longer than in the United States; in Australia, roughly 30 percent of the adult population had an account with a Pay in 4 provider as of June 2019, 5 Buy now, pay later: An industry update - Report 672 , Australian Securities & Investments Commission, November 16, 2020, asic.gov.au. and the value of BNPL transactions grew by around 55 percent in 2020, 6 Chay Fisher, Cara Holland, and Tim West, “Developments in the buy now, pay later market,” Bulletin , Reserve Bank of Australia, March 18, 2021, rba.gov.au. in contrast to the continued decrease in credit cards in circulation. These markets are experiencing increased regulatory activity associated with POS financing (see sidebar “Regulatory actions outside the United States”). This model has a set of competitive advantages that are increasingly difficult for traditional banks and large incumbents to replicate. Key differentiators of the Pay in 4 model include the following:

- Solutions to engage throughout the purchase journey. The largest providers are transforming into shopping apps; consumers are starting their journeys within the Pay in 4 providers’ apps, not just using Pay in 4 at merchants’ checkouts. As an example, Afterpay reports that about 17 percent of their consumers initiated one or more transactions from within their shopping app in February 2021. 7 “Afterpay reports record sales of $10B in first half 2021,” PR Newswire, February 25, 2021, prnewswire.com. Shopping from within the app allows consumers to use the Pay in 4 feature even at merchants where these solutions are not integrated at checkout. For example, consumers shopping from within the Klarna app can use Klarna at Amazon, even though Klarna is not available at Amazon’s checkout.

Given the race to sign up the largest merchants over the next 18 to 24 months, Pay in 4 providers are competing heavily on price and on marketing support promised to retailers. However, they are offsetting this price compression by offering merchants affiliate marketing services: merchants pay 4 to 12 percent of the transacted amount if the customer landed at the merchant website from within the provider’s app or website. McKinsey’s semiannual POS Financing Merchant Survey of more than 200 large and midsize merchants has repeatedly shown that acquiring new consumers is more important for merchants than increased cart conversion and increased average order value across categories. This heavily influences merchants’ willingness to pay more for affiliate marketing than for financing.

As these players continue to acquire consumers at a low cost through merchant checkout (getting access to a large, low-cost feeder channel) and leverage their engagement through cross-selling, they are well positioned to become the financial-services provider of choice for new-to-banking consumers

- Advanced technological capabilities, including distinctive merchant underwriting and consumer-fraud models, deep integrations into shopping carts, and sophisticated consumer-service tools. Competing in the Pay in 4 installment market requires highly sophisticated fraud tools, because identifying the consumer’s intent to defraud at the time of the application is a lot more important than assessing ability to repay, especially given the six-week tenure of the loan. In that short time, the ability to repay is unlikely to change dramatically. Advanced underwriting requires integrations into merchants’ order management systems that enable lenders to access and leverage SKU-level data. Additionally, dispute mitigation is significant, given the high rate of returns in many of the target categories, including apparel and footwear. Managing billings in real time is crucial for mitigating disputes, because it materially reduces customer complaints for wrongful billing and payments.

- Brand and positioning. Pay in 4 players have invested heavily in building a brand image that appeals to the segments they target. Klarna leverages celebrities to further enhance its brand and distinguish itself from legacy banking providers. Merchants in fashion and similar categories value this strong brand positioning and see these providers as brand adjacent. This brand positioning has also changed the way merchants perceive these players relative to banks. Merchants look at banks as private-label credit card partners and hence will seek profit sharing from them, but the same merchants look at Pay in 4 players as partners in commerce enablement and co-marketing.

Banks and larger incumbents that are building solutions to compete with Pay in 4 players will need to address each of these differentiators to build a compelling and scalable business model. Most banks and traditional players are thinking about this only as a financing solution at checkout and have not considered how they need to cover the entire purchase journey. Additionally, banks are not effectively leveraging their existing scale to highlight their ability to drive incremental traffic to merchants. This is a missed opportunity. Integrations with shopping carts, an engaging consumer-facing app, and self-serve functionality to limit call volumes also are critical to win. The higher bar on regulation, credit reporting, and compliance also affects a bank’s ability to design seamless application experiences at checkout.

Despite these hurdles, banks will need to assess ways in which they can present themselves within purchase journeys and ideally at point of sale. The shift in volumes to credit originated at point of sale is accelerating. Neobanks that have built significant scale with a younger audience also have the potential to compete more directly in this model.

Off-card financing solutions

Typically, off-card financing solutions, such as Affirm and Uplift, offer financing on midsize purchases (between $250 and $3,000) and require payment in monthly installments. The average ticket sizes are close to $800, and the average tenure of the loans is about eight or nine months. Typical verticals include electronics, furniture and home goods, sports and home fitness equipment, and travel. Unlike Pay in 4 solutions, which are entirely merchant subsidized (0 percent annual percentage rate for consumers), off-card financing models also have originations where consumers are paying an APR—at times partially subsidized by the merchant—in the case of lower-margin verticals, such as travel.

Of the consumers who take these loans, about 80 percent already have a credit card with enough credit availability to fund the purchase. These consumers choose to take a financing product because it offers cheaper credit or easier payment terms.

Most merchants that integrate such solutions are in categories with higher-ticket, lower-frequency purchases where cart conversions are critical, given abandonment rates—which can be as high as 80 or 90 percent—and costs. According to results from McKinsey’s semiannual POS Financing Merchant Survey, the willingness to pay for POS financing is greater among merchant categories with higher costs of acquisition and higher gross margins (Exhibit 4).

Digital has been a primary driver of growth for these solutions, though in-store financing is starting to catch up: about 25 to 30 percent of originations in 2021 are expected to be in-store, using applications submitted through smart tablets. Additionally, increasing adoption across customers with higher credit scores—especially in higher-ticket financing categories—is further fueling growth. Roughly 65 percent of originated volume is prime or higher. As a result, this model has cannibalized volume from credit card issuers.

Consumers using these financing solutions tend to be less engaged with these solutions than are consumers using the integrated Pay in 4 shopping apps. Active consumers in mature cohorts, even best-in-class off-card financing players, have a repeat usage of two or three times a year, versus more than 20 times for integrated Pay in 4 shopping apps. This will be a critical metric for these players to address, given the risk of commoditization at point of sale.

Additionally, as credit-card-linked installments start becoming more readily available at point of sale, these models will see volumes move back to cards, especially in originations from higher-prime customers. Offering card-linked installments at point of sale will also enable the issuers to deliver a much more frictionless financing process and to match the 0 percent APR financing from the off-card financing providers.

Some off-card financing players are starting to make investments that can help offset this potential threat from card-linked installments by integrating across the shopping journey from prepurchase to returns (for example, Affirm’s acquisition of Returnly). Legacy financing providers are either modernizing their platforms or licensing the technology platforms from new software-as-a-service-based players to compete more effectively; an example is TD Bank with Amount at NordicTrack.

Virtual rent-to-own models

The virtual rent-to-own (VRTO) players, including AcceptanceNow and Progressive Leasing, are primarily targeting the subprime consumer base and have very high implied APRs. Most (95 percent) of the consumers have a credit score below 700; about 70 percent have a score below 600. A difference from most other models is that merchants are not heavily subsidizing APRs. On the contrary, larger merchants now receive rebates from VRTO providers on originated volumes.

Categories are typically limited to goods that can, in theory, be repossessed, but VRTO players are branching into other categories. More than three-quarters (78 percent) of all originations are across two categories: mattresses/furniture and electronics/appliances.

Most of these players are integrating digitally and in-store as second- or third-look financing providers; examples include Progressive Leasing at Best Buy and Katapult at Wayfair. For larger lenders and issuers, there is an opportunity to partner with one of these players to enhance the breadth of the credit box and make the proposition more compelling for merchants. Subprime issuers have an opportunity to address this need through their existing card solutions.

Card-linked installment offerings

Card-linked installments are the prevalent form of financing at point of sale across Asia and Latin America. In contrast, US card issuers have launched post-purchase installment functionality (for example, American Express Plan It and Citi Flex Pay), but the adoption rates have stayed low. In the United States, these post-purchase installments cannot compete with the 0 percent APR solutions offered at purchase.

However, card-linked at-purchase installments do have the potential to materially gain scale, as they can enable merchant-subsidized offers. Another highly underserved opportunity is in prepurchase journeys: before buying, issuers can enable consumers to select merchant transactions they want converted into installments. This can be done by using the existing offer portals that most issuers have—examples include Amex Offers for You, BankAmeriDeals, and Capital One’s Capital One Shopping asset. This is a significant opportunity to address merchant needs met by the integrated Pay in 4 shopping apps.

Currently, card-linked installments at purchase are offered in the United States through fintechs like SplitIt; network-offered solutions in pilot stages, like Visa Installments; or cobranded or narrowly targeted merchant partnerships, such as the ones Chase and Citi have with Amazon. Average ticket sizes are around $1,000, and adoption is greater in higher credit bands.

Card-linked installments will be a table-stakes capability in the coming years, but the players who can integrate this across the purchase journey and effectively monetize prepurchase offerings are likely to be able to differentiate.

Vertical-focused larger-ticket plays

A model very similar to the way sales financing has worked historically is vertical-focused larger-ticket plays. This model usually has category specialists; examples include CareCredit in healthcare and GreenSky in home improvement.

Average ticket sizes for healthcare can range between $2,000 and $10,000, with elective healthcare categories like dental, dermatology, and veterinary accounting for a majority of the originations. Nonelective healthcare is still underserved.

In home improvement, average ticket sizes can vary between $5,000 and $50,000, depending on subcategories. The larger categories are heating, ventilation, and air conditioning (HVAC); windows and doors; roofing and siding; and remodeling. Players tend to achieve scale through partnerships with original equipment manufacturers (OEMs). Solar financing, while growing, is a more complex vertical, given larger loan tenures and tax credit implications. Home improvement financing has been cannibalizing volumes for home equity lines of credit and personal loans, so traditional lenders need to assess how to compete in this model.

As this space gets increasingly competitive, there is growing margin pressure and a greater need for experience. Players trying to scale in this space will have to assess which subcategories to focus on, whether they want access to the end-consumer relationship, and which go-to-market approach to pursue. Banks can target this space to acquire high-credit customers and to cross-sell mortgage refinancing and other banking services.

How traditional players and other fintechs can compete

The traditional players should treat the variety and growth of POS financing as a signal to rethink the lending landscape. To achieve long-term growth, lenders of all kinds will need to address three core changes in consumer experience related to borrowing:

- Product-agnostic delivery of credit. The lines across traditional credit products are already blurring, as banks offer loans against open credit card lines and fintechs offer installment-based credit cards or debit cards with Pay in 4 features. Underwriting therefore needs to be agnostic of the product through which credit is being delivered—say, personal loans or credit cards. Banks that do this early and well while managing economics and risk will benefit significantly.

- Integration and engagement across the entire purchase journey. A big differentiator for banks will be integrating across the entire purchase journey, leveraging affiliate marketing to subsidize both credit and rewards costs, and delivering greater control and value to the end consumer. These integrations not only contribute to scale and engagement but also help banks get much better access to and visibility into younger consumers and their credit behavior. Integration at checkout alone will not be enough, as the providers not offering incremental value to the merchant in prepurchase journeys will get commoditized.

- Habituation to subsidized credit and enhanced value. As consumers get habituated to merchant-subsidized credit, banks need to rethink their risk and economic models and even the underlying value propositions. US banks might imitate Australian banks that have launched interest-free credit cards to address the expectations set by Pay in 4 providers across the younger consumer base that credit can be accessed at 0 percent APR. Merchant partnerships of some form will be critical to enable this, and merchant acquirers can play a big role in being the intermediaries to scale this model.

Traditional issuers and lenders, merchant acquirers, and neobanks each have a mix of assets that gives them a right to play in this space. But competing will require players to assess which is the right business model to focus on, which verticals to prioritize, and how to go to market. Players can choose from a mix of go-to-market models to access this space (Exhibit 5).

The go-to-market models vary in their expected return on assets, technology requirements, size of investment, and speed to market. In fact, these are just a few of the relevant considerations. Banks also need to make decisions across each step based on implications on required capabilities, compliance and risk, consumer experience, vertical focus, competitiveness of offering, and other factors.

Growth in point-of-sale financing is a secular trend, and regardless of whether the existing players survive, the underlying consumer needs addressed by POS financing will affect consumer choice over the long run. Moving fast to have a clear strategy and some path to enter and play in this market will be critical. While this evolution of POS financing may seem slow to scale for now, it is likely to accelerate. Starting to make investments to address this trend should be on every banking player’s strategic road map.

Puneet Dikshit is a partner in McKinsey’s New York office, where Diana Goldshtein is a knowledge expert, Udai Kaura is an associate partner, and Felicia Tan is a consultant; Blazej Karwowski is an associate partner in the London office.

Explore a career with us

Related articles.

US lending at point of sale: The next frontier of growth

Buy now, pay later credit reporting moves forward, but a long journey lies ahead

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Credit cards

- • Credit scores

- • Rewards credit cards

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Earlier this month, Apple became the first major provider of buy now, pay later loans to report all of its customers’ “pay-in-four” account histories to a credit bureau (Experian). While this is a notable milestone, I also see it as a sign of how far the industry still needs to go in order to make buy now, pay later (BNPL) a mainstream credit reporting component.

Apple and Experian should be commended for their leadership on this issue, but let’s face it: This is just one provider, providing data to just one of the three major credit bureaus. And while Apple is a huge, successful company overall, it’s one of the newest entrants to the BNPL market with much smaller BNPL market share than more established BNPL competitors such as Affirm , Afterpay and Klarna .

Affirm reports some of its longer-term loans to Experian, but across the industry, the vast majority of BNPL products remain unknown to credit bureaus. Especially the “pay-in-four” model which typically involves a 25 percent down payment and then additional 25 percent installments due in two, four and six weeks.

It’s important to note that while Apple Pay Later plans have started appearing on Experian credit reports for consumers’ self-edification, lenders will not be able to see these credit report notations for the foreseeable future. And it could be much longer before these plans are factored into credit scores , the crucial three-digit numbers that substantially impact whether or not applicants are approved for loans and lines of credit.

Why BNPL credit reporting is proving to be difficult

I hoped that lenders would be able to see BNPL information much sooner, although I realize that this lending model represents a square peg compared with the proverbial round hole of traditional credit reporting.

To be honest, it seems as if existing credit scoring models don’t know what to do with BNPL. This has been a pain point for years, and it’s one the Consumer Financial Protection Bureau has been looking into. The formal rulemaking process is still playing out, but in 2022, the agency noted that “consumer reporting companies should incorporate the BNPL data into core credit files as soon as possible.”

In early 2022, Equifax debuted a new “business industry code” for BNPL and encouraged providers to report consumers’ usage. But adoption has been slow across the industry, and there are several primary reasons.

First, by definition, BNPL plans are often very short-term loans (six weeks, in most cases). Credit scoring models don’t like it when consumers frequently open new accounts — it would be disastrous for your credit score if you opened a new credit card every six weeks, since this would be viewed as a sign of financial distress. In other words, why do you need so much new credit? But BNPL is designed to be a short-term funding source.

The other key issue pertains to credit utilization . On a credit card, this refers to credit you’re using compared to the credit available to you. It’s often recommended that you use no more than about 30 percent of your credit line, because maxing out a card can be an indicator of financial trouble. But how should BNPL utilization be measured? Is the customer effectively maxing out their available credit when they make the purchase and then paying it off within six weeks, if all goes according to plan?

BNPL plans don’t usually have a defined credit limit like credit cards do. Whereas a credit card issuer might give you a $5,000 credit line that you can use as you wish — charging purchases, paying them off over time and watching your available credit rise and fall along with your usage — BNPL loans are usually one-offs underwritten for a specific purchase.

How BNPL could be integrated into credit reports

One fix could be for the BNPL industry to treat its payment plans more like ongoing lines of credit, rather than a series of separate loans for individual purchases. But this would require fundamental adjustments to the way they do business.

An easier lift — and a potential short-term fix — would probably be to acknowledge that BNPL is different from credit cards. Therefore, credit scoring models could exclude BNPL from the average age of accounts and credit utilization calculations. My near-term suggestion is to incorporate BNPL into credit reports and credit scores, but to focus more on whether or not the consumer paid on time. It wouldn’t be a particularly comprehensive solution, but payment history is the most important factor in one’s credit score, so it would at least check that box.

Bankrate’s take: Plus, if lenders could see consumers' complete BNPL usage (including the number of plans, how recently they were opened and how much the customer owes), they might also be able to use this data to refine their own proprietary risk assessment algorithms.

Why BNPL credit reporting matters to lenders and consumers

I know this is a process, and it’s going to take more time for BNPL to become more embedded into the credit scoring system. But right now, it still feels as if there are too many blind spots for lenders — and it’s not great for some consumers, either.

Many shoppers are drawn to BNPL because these plans are generally easier to obtain than credit cards and other loans, meaning that people with lower incomes and lower credit scores are more likely to be approved. But using BNPL plans responsibly doesn’t usually help build credit, so this can be a self-fulfilling prophecy.

In other words, BNPL plans can hurt your credit if you fall so far behind that you’re sent to collections . But since most routine payments aren’t reported, using this financing responsibly usually won’t help you to improve your credit score over time, either. That’s unfortunate, because responsible BNPL usage could become a stepping stone to a better credit score — but only if this account history is reported.

Some other financial products, such as rent payments, utilities and streaming subscriptions, operate similarly. They’re mostly outside the traditional credit scoring system, but there are some ways to bring them into the light (for example, by signing up for services such as Experian Boost , eCredable Lift and RentTrack ).

Can better credit reporting boost BNPL customer satisfaction?

Apple Pay Later received a middle-of-the-pack rating in J.D. Power’s 2024 U.S. Buy Now Pay Later Satisfaction Study . Interestingly, the BNPL offerings from established credit card leaders American Express , Chase and Citi took the top three spots, while pure-play BNPL providers Sezzle , Afterpay and Affirm placed at the bottom of the ranking.

“The credit card brands’ customers tend to be financially healthier than the other providers’ customers and financially healthier customers tend to be more satisfied with BNPL providers. They are more likely to find BNPL terms reasonable than other consumers are. They are likely less concerned about missing a payment and therefore using BNPL to budget/spread out repayment.” — Miles Tullo Managing Director of banking and payment, J.D. Power

I wonder if Apple’s leadership on BNPL credit reporting will help it move up the ranks?

I asked Tullo, who replied, “Credit reporting is likely to affect satisfaction differently depending on the provider. Apple, for example, shouldn’t see a change in satisfaction or growth with Apple Pay Later now that they are reporting. Their customers are more likely to have higher credit scores. Providers that are not reporting today and are attracting a greater percentage of customers with low credit scores may be more likely to experience lower satisfaction scores if they begin reporting. That being said, reporting will only help further legitimize BNPL and improve the health of the industry long-term, which should benefit all providers.”

The bottom line

Buy now, pay later has become a mainstream payment method over the past few years. In fact, online usage of this method hit a record-high $16.6 billion during the 2023 holiday season, which was up 14 percent from 2022, according to Adobe . The BNPL industry has hit critical mass and it’s time — past time, really — for this popular lending product to be included in Americans’ credit reports.

Have a question about credit cards? E-mail me at [email protected] and I’d be happy to help.

Related Articles

Best credit cards with buy now, pay later options

Buy now, pay later statistics

How does ‘buy now, pay later’ affect your credit score?

‘Buy now, pay later’ is coming to credit scores—but key questions still must be answered

More From Forbes

Buy now, pay later: the “new” payments trend generating $100 billion in sales.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Buy now pay later Photographer: Brent Lewin/Bloomberg

OBSERVATIONS FROM THE FINTECH SNARK TANK

Buy Now, Pay Later (BNPL) providers like Affirm, AfterPay, and Klarna generated a lot of press over the past year as consumers looked for ways to make it easier to buy what they wanted without incurring more credit card debt. Recent developments include:

- Amazon and Affirm partnered. Amazon shoppers will be able to split purchases of $50 or more into smaller, monthly installments. Affirm said some loans will come with 0% APR, while others will bear interest.

- PayPal will stop charging late fees on BNPL payments. Since its launch, more than 7 million consumers have used PayPal’s BNPL service, purchasing more than $3.5 billion of products.

- Square acquired AfterPay. The deal will bring AfterPay’s merchant relationships into Square’s seller ecosystem and help to convert AfterPay’s existing customer base into Cash App users.

- Apple announced a BNPL offering. Apple Pay users will be able to make interest-free BNPL purchases, choose any credit card to make the payments, and avoid late and processing fees with certain plans.

Buy Now, Pay Later to Reach $100 Billion in 2021

The percentage of Gen Zers in the US using BNPL has grown six-fold from 6% in 2019 to 36% in 2021. Millennials’ use of BNPL has more than doubled since 2019 to 41%. Gen Xers’ adoption more than tripled, and even Boomers are getting into the act.

Buy now, pay later adoption by generation

Overall, consumers will make nearly $100 billion in retail purchases using BNPL programs in 2021—up from $24 billion in 2020, and $20 billion in 2019.

Buy now, pay later retail purchases in the US

How To Buy Cryptocurrency

Best cryptocurrencies to buy now, best cryptocurrency exchange, buy now, pay later changes the customer experience.

Observers on social media and blogosphere claim that “BNPL is here to stay.”

That’s an odd perspective because BNPL—also known as installment payments and point-of-sale financing (POSF)—has been around longer than some of the observers.

What’s different—and important—about today’s buy now, pay later service is its place in the customer journey.

Traditionally, installment payments, POSF, BNPL—whatever you call it—was an option at checkout (i.e, the end of the customer journey). Today, BNPL influences consumers’ choices of products and providers (i.e., earlier in the journey).

Payments: The 5th P of Marketing

Students of marketing learn about the 4 Ps of Marketing: product, place, price, and promotion. According to the 4 Ps creator Northwestern professor Philip Kotler:

“The marketing mix is the set of controllable variables that the firm can use to influence the buyer’s response. The four variables help a company develop a unique selling point as well as a brand image.”

Payments have become an important element of the selling proposition and should be considered the 5th P of marketing. For example, by varying payment terms—for example, spreading payments for a purchase over a period of time—marketers can influence consumers’ likelihood to buy.

As merchants experiment with surcharges on card-related payments, do they run the risk of decreasing sales or average transaction sizes? Do they risk losing sales to merchants who don’t surcharge on card transactions?

If the answer to these questions is yes (and BNPL providers claim it is), then BNPL (and payments overall) are an element of the marketing mix for marketers to leverage.

The Future of Buy Now, Pay Later

To succeed and differentiate, BNPL providers will:

- Become shopping destinations. Afterpay, for example, announced that it will enable its merchant partners to advertise on the BNPL firm's app to boost their promotions, products, and offers. Brands will be able to choose the products they want to promote via sponsored listing formats, and pay only when a shopper engages with the ad.

- Sharpen their sales attribution claims. BNPL providers claim that they help merchants make sales that wouldn’t have been made otherwise. Sound familiar? Visa and MasterCard made the same claims about credit cards they were launched. Today’s merchants will demand accurate attribution statistics.

- Specialize. BNPL providers will need to be masters of the customer journey. Few (if any) will be able to do that in more than just a couple of product categories resulting in specialization by product category. This is already happening with BNPL specialists like LoanStar Technologies in home improvement and Prima Health Credit in elective medical procedures.

Standalone BNPL Providers Won’t Last Long

Why does Square need Afterpay’s app to enable merchants to advertise when it has broader reach than Afterpay does? Answer: It doesn’t. Expect Afterpay’s app to be embedded into and absorbed by the Square app after the acquisition is complete.

As Afterpay gets absorbed into Square, its payments will increasingly come from within the Square network, not the traditional payment rails. Other BNPL providers will have to find similar paths in order to keep up with the margin improvements Afterpay will realize.

Same with Amazon and Affirm. The giant retailer is partnering with Affirm—instead of acquiring the company—in order to test the impact that BNPL can have on sales. If it’s positive, they’ll acquire Affirm or build their own BNPL capability.

This is not to say that with their lofty valuations, some BNPL providers—Klarna is a good example—won’t be acquirers themselves. Why? Because a BNPL offering—by itself—is only part of the value chain (or customer journey).

To maximize the value of buy now, pay later, it must be integrated with the other elements of the marketing mix—that is, become the 5th P of marketing.

The Downside of Buy Now Pay Later?

BNPL has its detractors, however. Consumer advocates criticize BNPL programs for encouraging consumers to take on debt they might not be able to afford:

“There is a risk that BNPL schemes may attract people who are already in financial difficulties and may be struggling to make their existing bills and payments.”

There is evidence of that. Among BNPL users, 31% consider their financial health to be “dire” or “struggling” (versus “managing” and “thriving”). In contrast, of consumers who don’t use BNPL services, just 20% rate their financial health as dire or struggling.

Other warning signs support the critics’ claims:

- Over the past two years, 43% of BNPL users made late payments. Two-thirds of them, however, said it was because they lost track of when the bill was due—just a third blamed it on not having the money to pay the bill.

- More than half of BNPL users had their credit card limits decreased in 2020. This likely led to some consumers using BNPL programs.

Detractors’ warnings won’t slow the growth of BNPL any more than their warnings against the dangers of using credit cards have had on the growth of that product.

Can Banks Battle Back?

For now, the majority of BNPL purchases are paid with either a debit or credit card. So, if banks don’t get their money upfront (i.e., at the time of transaction), they get their interchange fee when the BNPL players get paid.

That won’t last.

Merchants have two things in common: 1) They’ll do anything to make a sale, and 2) They hate (with a passion) interchange.

If merchants can reduce interchange fees by driving purchases from debit and credit cards to other forms of payments, they’ll do what they can to make that happen.

As Buy Now, Pay Later providers collect more data about consumers’ shopping and buying behaviors, they will become better partners to merchants than the banks and payment networks are.

The long-term impact on banks: Less interchange revenue and customer engagement.

The clue to what banks can do to fight back comes from the number of BNPL users who were late on a payment because they lost track of when the bill was due. Banks can fight back by helping consumers better manage their money.

That will be a tough challenge for banks that see themselves as product (e.g., checking account, savings account, loan ) providers and not service (i.e., advice, guidance, monitoring) providers.

My bet: Banks will fight back from a regulatory perspective focusing on the alleged downsides of BNPL and the “risks” it presents to consumers. I don’t think they’ll win that battle.

- Editorial Standards

- Reprints & Permissions

IMAGES

COMMENTS

Enter the credit or debit card of your choice for automatic payments every two weeks. No interest or added fees when you pay on time. How to checkout with Klarna. 1) Add item (s) to your cart and head to the checkout. 2) Select Klarna at the checkout to pay as you like for your purchase. 3) Manage your orders and payments in the Klarna app.

Find the Latest Promotions, Sales and Events at Journeys. Free Shipping On Orders Over $39.98. Find Out More! Journeys Journeys Kidz. Get $5 off $25 + Free Shipping - Join Journeys All Access. ... Buy Now, Pay Later Learn More. 365 Days To Decide Learn More. Free In Store Returns Find a Store. Ship To . Ship to ; Customer Service Contact Us ...

All existing accounts can opt-in to Journeys All Access through their profile on Journeys.com and will receive the welcome offer. Journeys All Access can only be linked to one account at a time. For questions about the account associated with your membership, please contact our Customer Service department at 1-888-324-6356 for assistance.

You're about to leave our site to Shop Journeys 2nd Hand on thredUP, where you can give new life to PreLoved styles and do a little good for the environment. Start Shopping If you are using a screen reader and are having problems using this website, please call 1-888-324-6356 for assistance in English or 1-866-322-9099 for assistance in Spanish.

Shipping is always free for Journeys All Access members! Journeys Journeys Kidz. Get $5 off $25 + Free Shipping - Join Journeys All Access. Buy now, pay later with Klarna. Buy Online, Pick Up in Store. Find Your Store [Skip to Content] Toggle navigation. Journeys Journeys Kidz; Brands . Adidas. Converse. New Balance.

Buy now, pay later with Klarna. Buy Online, Pick Up in Store. Find Your Store [Skip to Content] Toggle navigation. Journeys Journeys Kidz; Brands . Adidas. Converse. New Balance. ... Enter For Your Chance to Win Free Crocs For a Year Join Journeys All Access and Enter Today. Home. Stores.

Shop Journeys online or in-store and pay in 4 installments over 6 weeks with Zip, previously Quadpay. Zip is a buy now, pay later platform that can be used almost anywhere Visa is accepted.

You're about to leave our site to Shop Journeys 2nd Hand on thredUP, where you can give new life to PreLoved styles and do a little good for the environment. Start Shopping If you are using a screen reader and are having problems using this website, please call 1-888-324-6356 for assistance in English or 1-866-322-9099 for assistance in Spanish.

Download the Sezzle App. 2. Search for and click Journeys. 3. Click Pay with Sezzle. 4. Your Journeys purchase is split into 4 interest-free payments over 6 weeks.². Use Sezzle when you buy now and pay later at Journeys. Pay in easy budget-friendly payments.

Find the Journeys Store Closest to Your Location. Over 1,100 Stores in the United States From Which to Choose. ... Journeys Journeys Kidz. Get $5 off $25 + Free Shipping - Join Journeys All Access. Buy now, pay later with Klarna. Buy Online, Pick Up in Store. Find Your Store [Skip to Content] Toggle navigation. Journeys Journeys Kidz; Brands ...

Shop All Clothing including Shirts, Ponchos, Tanks, Pants and More at Journeys.com. Journeys carries the Hottest Brands and latest styles of shoes, clothes, and accessories. ... Journeys Journeys Kidz. Get $5 off $25 + Free Shipping - Join Journeys All Access. Buy now, pay later with Klarna. Buy Online, Pick Up in Store. Find Your Store [Skip ...

Buy Now, Pay Later at Journeys. Shopping at Journeys just got easier with Afterpay's BNPL (Buy Now, Pay Later) offering. Shoppers can enjoy the freedom to purchase their favorite items and 'pay over time' in manageable installments. Afterpay offers interest-free payment plans that allow shoppers to spread the cost of their purchases over ...

Enter the credit or debit card of your choice for automatic payments every two weeks. No interest or added fees when you pay on time. 1) Add item (s) to your cart and head to the checkout. 2) Select Klarna at the checkout to pay as you like for your purchase. *Minimum purchase of $10 (before tax).

Journeys: Buy Now Pay Later with Klarna ... Buy now and pay later in 4 interest-free installments when you choose Klarna. Valid until 12/31/2024. Show More See discount 50% ...

If you are using a screen reader and are having problems using this website, please call 1-888-324-6356 for assistance in English or 1-866-322-9099 for assistance in Spanish.

30% off Orders $39+, Capped at $25. New Users Only! As low as 0% APR. Free Shipping and Returns on any order. As low as 0% APR. New Customers Can Take an Extra 30% off Hardgoods. As low as 0% APR. Earn OneKeyCash for every dollar spent on eligible hotels, vacation rentals, flights, car rentals & more. With Affirm, you can pay over time at your ...

bnpl.shop/Journeys.com. Journeys is a leader in the teen specialty retail scene, with more than 800 stores in all 50 states, Puerto Rico and Canada. Journeys uses fashion savvy and merchandising science to keep in step with the fast-paced footwear and accessories market for 13 to 22-year-old guys and girls. Journeys offers a wide variety of ...

Buy Now Pay Later Customer Journey. Please complete the form below to view the presentation slides. Please provide more details on how Equifax can help you. Do not enter a SSN or unique identification number in this box. Buy now, pay later (BNPL) services are booming. In July 2020, 37% of consumers aged 18-24 had used a BNPL service.

Point-of-sale (POS) financing services in the United States have grown significantly over the past 24 months, especially since the onset of COVID-19. Trends fueling growth include digitization, rising merchant adoption, increasing repeat usage among younger consumers, and an expanding set of players targeting lending at point of sale, a service also known as "buy now, pay later."

The bottom line. Buy now, pay later has become a mainstream payment method over the past few years. In fact, online usage of this method hit a record-high $16.6 billion during the 2023 holiday ...

Here are four ways BNPL can enhance the customer journey, help merchants boost their sales and ultimately improve the customer experience: 1. Greater spending power. According to pymnts.com, 87% ...

Buy Now, Pay Later to Reach $100 Billion in 2021. The percentage of Gen Zers in the US using BNPL has grown six-fold from 6% in 2019 to 36% in 2021.

Buy Now, Pay Later at Vans. Shopping at Vans just got easier with Afterpay's BNPL (Buy Now, Pay Later) offering. ... Journeys. Nike. Steve Madden. PacSun. Under Armour. Urban Outfitters. adidas *You must be 18 or older, a resident of the U.S. and meet additional eligibility criteria to qualify. For access to in-store, additional verification ...

Alternative Airlines can help. With Alternative Airlines, you can book flights now on over 650 airlines such as United, British Airways and American Airlines and pay later with different payment plan options available. Check out with either Affirm, Klarna , Zip, Afterpay, Clearpay, Postpay, Laybuy, Tabby, or one of our other options, and pay ...

¹⁰ Retailers bid farewell to layaway, as shoppers embrace buy now, pay later options. CNBC, 2021. ¹¹ Retailers bid farewell to layaway, as shoppers embrace buy now, pay later options. CNBC, 2021.