Travel Expense Policy: Best Practices and Templates

Do you run a small business or non-profit organisation? Do you or your employees travel for business purposes?

If your answer to these questions is “yes”, then it’s a good idea to have a policy in place that governs your and your employees’ travelling expenses. Not yet thought about this? — Don’t Panic! — Read on for all the information you need.

What is a Small Business Travel Expense Policy?

A small business travel expense policy outlines rules for employee spending and reporting on work trips. It helps manage and control business travel costs, making sure they match your company's goals and financial limits.

Benefits of Travel Expense Policies

A business travel expense policy contributes to financial responsibility, operational efficiency and employee satisfaction within your organisation. It ensures consistency and transparency, as well as supporting your financial planning and budgeting.

What’s more, having a policy in place provides a level of legal protection for your organisation. It demonstrates that you have clear guidelines and processes in place, which can be useful in the event of any disputes or legal inquiries related to travel expenses.

Why Should Small Businesses Have a Travel Expense Policy?

Small businesses and non-profits need a travel expense policy as a guide for spending on business trips. It helps you manage your limited funds wisely, ensuring you're spending efficiently and within set limits. It also ensures fairness amongst your employees, reduces confusion about what's allowed and makes it easier for your staff to be reimbursed for their expenses.

All in all, it builds trust within your organisation, encourages responsible spending and ensures compliance with legal and tax regulations. Ultimately, a business travel expense policy contributes to the overall financial health, transparency and efficiency of your small business or non-profit organisation.

What Should You Include in Your Travel Expense Policy?

A comprehensive business travel expense policy should provide clear guidelines for employees and ensure effective management of expenses.

Think about all the possible spending scenarios your employees might face and make sure they know exactly what expenses are covered, how they should go about booking and paying for their trip, how they will be reimbursed for things they pay for themselves and any relevant restrictions they should bear in mind.

Here’s a sample of the different sections you might want to include in your small business travel expense policy.

Travel Expense Policy Template Checklist

Purpose and Scope : clearly state the policy’s purpose and specify its scope, including which types of expenses are covered.

Authorisation and Approval : outline the process for obtaining authorisation before making travel arrangements. Define the approval hierarchy and who is responsible for approving travel plans.

Transportation Expenses : detail guidelines for booking and reimbursing transportation expenses, including airfare, train tickets and rental cars. Specify any class or seat restrictions.

Accommodation Expenses : provide guidelines for selecting and reimbursing accommodation expenses, including acceptable options and daily room rate limits.

Meals and Incidentals : establish per diem or daily allowances for meals and incidental expenses. Clarify what types of expenses are considered incidental and eligible for reimbursement.

Ground Transportation : address expenses related to local transportation during the business trip, such as taxis, ride-share services or public transportation.

Communication Expenses : specify guidelines for reimbursing expenses related to communication, such as mobile phone charges or internet fees during travel.

Entertainment Expenses : guide entertainment expenses incurred during business travel, including any limitations or approval requirements.

Expense Documentation : clearly outline the documentation requirements for reimbursement, including receipts for accommodation, transportation, meals and other eligible expenses.

Reimbursement Procedures : detail the process for submitting and processing travel expense reimbursement claims. Specify the timeline for submission and the method of reimbursement.

Spending Limits : set limits on certain expenses to control costs, such as daily or per-meal limits.

International Travel : address specific considerations for international travel, including currency exchange, visa requirements and other cross-border considerations.

Policy Compliance : emphasise the importance of compliance with the travel expense policy. Communicate the consequences for non-compliance.

Updates and Communication : establish a process for updating the policy and communicating changes to employees. Ensure that employees are aware of and understand the policy.

Record Keeping : encourage employees to keep accurate records of their expenses for auditing and reporting purposes.

Legal Compliance : ensure that the policy aligns with relevant tax laws and other regulations to avoid legal issues.

Exceptions and Special Circumstances : define any circumstances under which exceptions to the policy may be considered. Outline the process for requesting and approving exceptions.

Employee Responsibilities : clearly define employees’ responsibilities in adhering to the policy, including timely submission of expense reports and accurate documentation.

FREENOW for Business Travel Expense Management

FREENOW’s Business Travel Service is a flexible tool that puts organising business travel in the hands of those who need it without adding any extra stress.

You or your employees can organise trips in a way that suits you while keeping synched in with a central management system. With our business travel solution, you get all of these benefits and more, depending on your service type:

Use your dedicated business dashboard to manage your employee profiles , set budget limits and track everyone’s expenses .

Your employees can easily request rides through the FREENOW App , ensuring problem-free, cashless transactions.

The platform provides detailed invoices that include details of each journey, simplifying your accounts processes.

Get detailed expense reports at the click of a button, centralise your payments and pay with one monthly invoice .

FREENOW's business travel services enhance your control, transparency and convenience, optimising your business travel expense management in a user-friendly and cost-effective manner. So, what are you waiting for? Jump on board and let FREENOW help you get your business travel expense policy up and running now.

Sign up for our business travel solution and alleviate your expensing here .

How Can You Reduce Your Company's Business Travel Carbon Footprint?

Road to the Future: How to Make Your Business Travel More Sustainable and Seamless

Mastering Business Travel Etiquette: the 3 R’s and 7 Tips

Harling House,

Great Suffolk Street,

London SE1 0BS

10 travel & expense policy samples, templates & resources

Published on January 14, 2023

)

So it's time to write your company's expense policy. And either you have no idea where to start, or you've done this before and you just want to make sure that you hit all the important points.

Either way, we've got you covered. We've pulled together a handful of useful templates that you can copy directly. And perhaps more useful are the seven real-world expense policies from companies and institutions you've heard of.

See how each approaches its travel and expense requirements differently, and what they each expect from employees. Then use these insights to write a successful policy that team members actually use .

Let’s begin with a collection of ready-to-copy templates to help you create your company expense policy.

Disclaimer : The real expense policy examples below were easily found online and not provided by the businesses themselves. They are to be used for the purposes of comparison and inspiration, and Spendesk will happily remove them from this post if requested.

hbspt.cta.load(2694209, '496b7000-1d9a-42cb-a345-7142cd1cef17', {"useNewLoader":"true","region":"na1"});

Real travel & expense policy samples.

We’ll share hands-on, ready-to-use policy templates shortly. But perhaps more valuable is to see the real travel and expense policies successful companies use .

We’ve pulled out the most noteworthy aspects of each below, and you can click the links to see them in full. Read through a few and decide which company’s approach best matches your own philosophy . It’s always nice to know that there are thriving, famous institutions that think the same way you do.

You don’t need a link to see the full Netflix expense policy - it only contains five words:

“ Act in Netflix’s best interests. ”

For obvious reasons, this has become famous. And it matches Netflix’s overall culture code, which includes a full section on Freedom and responsibility . It’s a fascinating document, including a few highlights:

Our vacation policy is “take vacation .” We don’t have any rules or forms around how many weeks per year. Our leaders make sure they set good examples by taking vacations, often coming back with fresh ideas, and encourage the rest of the team to do the same.

Our parental leave policy is: “ take care of your baby and yourself .” New parents generally take 4-8 months.

Each employee chooses each year how much of their compensation they want in salary versus stock options . You can choose all cash, all options, or whatever combination suits you.

If that sounds like the kind of company you’re building - and you’re willing to back it up - then perhaps the Netflix approach is right for you.

Basecamp’s expense policy is not quite as simple as Netflix’s, but displays a similar ethic. We don’t have the full policy itself, but rather a set of key benefits given to Basecamp employees. These were shared by CEO Jason Fried in a 2016 blog post.

The most important aspect shared is the company’s “no-red-tape business account.” Every employee gets their own American Express card. There’s no need to ask for approval for transactions - just be reasonable.

Which is clearly a highly trusting approach to managing spending. But if you plan to replicate this, you’ll still need to ensure you have a clear process for documenting transactions - otherwise your finance team will be forever in the dark.

Because this post is full of fascinating nuggets, we’d better share a few more:

Employees receive a $100/month massage allowance.

They also receive $100/month towards their gym, yoga studio, or fitness pursuit of choice.

Employees can work from anywhere in the world. “Move cities, keep your job.”

There’s plenty more to read in there. It may not be the exact expense policy that employees use when spending, but it’s fascinating just the same.

In a word: classic. The document is comprehensive and contains all the main expense categories and key pieces of information you’d expect to find. It’s a good example of a more prescriptive (but still easy to follow) policy .

Here are a few highlights:

The BBC has a written sustainable travel policy , and explicitly requires staff to use public transport where possible.

There are specific rules governing “ late night/early morning transport ” (LNEMT), which makes sense given the operating hours of its radio and television channels.

Employees may claim interest incurred on personal credit cards if reimbursement from the BBC was late and this was the reason for the interest.

There are a huge range of incredibly specific rules in this document. Which makes for a very interesting read.

Allowances for things like food, accommodation, and mileage follow HMRC’s recommendations, as you’d expect. Read our detailed explanation of HMRC’s travel expense rules .

Note : This is an older document - last updated in 2015. So it’s possible that it’s no longer 100% up to date. But nonetheless, it’s worth looking through it to see what inspiration you can draw.

As an enormous international company, it’s probably not surprising that FedEd’s policy reads like a legal document more than a set of guidelines . The company likely feels that can’t afford to be unclear about its rules, and has been quite exhaustive in stating what’s permitted.

It’s up to you whether this matches your own philosophy. At Spendesk, we prefer overarching guidelines to prescriptive rulebooks. This suits us better.

Here are some noteworthy sections of FedEx’s travel and expense policy:

The first page of the policy explicitly states that “termination” is a possibility if employees don’t follow the policy . Which makes sense, but isn't always spelled out in a simple policy document.

Expense reports should be submitted on a weekly or per-trip basis . The latter is quite standard, but submitting reports weekly can easily put a huge burden on both travelling employees and finance teams.

Team members are expected to keep all of their receipts for 12 months . This has likely been updated with more companies using e-receipts these days. If not, that’s quite a tall order.

Vice Presidents and above are permitted to travel first class , while other employees are expected to fly coach (economy). For flights longer than six hours, business class may be allowed.

Because this travel policy is so detailed, there’s plenty more of interest to explore.

Bank of England

Similar to FedEx’s, Bank of England’s policy and long and detailed. Similar to the BBC, Bank of England is a public entity and therefore takes fiscal responsibility seriously.

The policy begins by setting out two clear operating principles :

The value-for-money principle : because the bank is accountable to Parliament and the public, it needs to take good care of spending.

The integrity principle : “we should not be influenced by the prospect of personal advantage or gain. We must use the Bank’s resources responsibly for the public good, not to profit personally.”

While quite exhaustive, this policy does read as though written by those with the best interests of both employees and the institution at heart. The language is clear and easy to understand , and many of the ideas are based on what’s good for the individual.

For example, “wellbeing is also important. Travelling long distances and being away from family and friends has a cost. The Bank wants staff to be able to perform at their best when travelling for work.”

This shows that, even if long and quite technical, a good expense policy can also show the care with which a company treats its team .

Dartmouth College

Dartmouth’s travel and expense policy is one of the more legal and technical policies we’ll see. It’s written more like a piece of legislation than a “clear and simple” playbook . Whether that suits your business is your own call, but it probably makes it more difficult to follow for employees.

On the other hand, it’s very comprehensive . And we might imagine that Dartmouth employees are naturally more used to technical and academic writing than the average company employee.

Similar to others we’ve seen above, the document sets out a list of non-allowable expenses, which is important if you want your policy to be exhaustive. It also states clearly the likely penalties if the policy isn’t followed properly.

It’s also worth examining the procurement section near the beginning of the policy . If your business handles lots of high-value purchases, you may be interested in the rules set out by Dartmouth.

Victoria University of Wellington

We can compare Dartmouth’s policy with another academic institute: Victoria University. Similarly, this policy is formulated like a legal document, setting out very clearly what’s permitted and what isn’t.

Despite this, it’s fairly easy to understand and is only 9 real pages of text . Which compared with some others isn’t too daunting.

A few things worth noting:

All University travel should be economy class , with a few narrow exceptions. These exceptions are not related to job description.

For meals, mileage, parking fees, and other on-the-road travel expenses, the University doesn’t state a fixed amount covered . Instead, it will cover “all ordinary, necessary and reasonable expenses required for the individual to undertake approved University travel.”

The second page sets out the ethical framework upon which the whole document was written .

Expense policy templates

Putting an expense policy together is often a long, drawn out process. You need buy-in from different teams, managers, and executive leadership, to ensure you’ve covered all your bases.

And even then, there’s no guarantee that everyone will read and appreciate your hard work. Expense policies are regularly overlooked or ignored , and many employees prefer to do things their own way.

Which is frustrating, of course.

Given this, it doesn’t make sense to devote hours and hours to writing it from scratch. Instead, take one of these templates and tailor it to your own company’s needs .

This is a very clear and easy to understand expense policy , written in plain English (which is always important). It can be downloaded in DOC format, with spaces for you to fill in managers’ names, points-of-contact, and any other important information.

You know, a template.

And a very good one at that. If you simply want a plug-and-play expense policy that you can get live in a hurry, this is the perfect place to start.

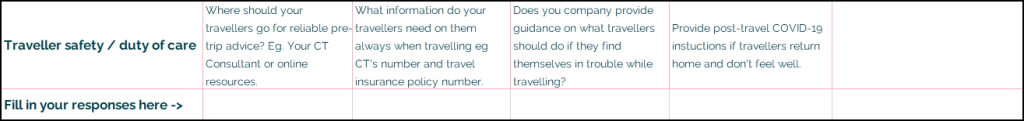

Corporate Traveller

This PDF from Corporate Traveller isn’t exactly a copy/paste template like the two above. But it includes the firm’s recommended top 10 elements to include in your own policy.

Some of these don’t feature in our other listed templates, but may be good ideas. For example, “traveller profile forms” which ask frequent travellers for information to the company which might help in an emergency. This isn’t rocket science, but it’s the sort of thing that you might easily forget.

This template is specifically for employee expense reimbursements . We always advise you avoid expense claims , but since most companies still rely on them on some form, it’s a good idea to make sure the rules are clearly stipulated.

Further resources

If all the above isn’t enough information and inspiration to draft a winning expense policy, here are two more excellent resources that give you principles and foundations to build upon.

Expense policy 101: understanding the basics

Company expense policy: a guide for modern businesses

Spend management guide for growing businesses

Create the perfect T&E policy with help from others

As we've seen, there's plenty of inspiration available for finance leaders and managers to craft a winning travel and expense policy. It doesn't have to be a chore.

And on top of the excellent examples we've shared, get help from the people around you. A good expense policy isn't simply a top-down affair. If other team members have input - not just your finance team - you can be confident that your policy will reflect what's best for the whole company.

In the end, it's about writing something that people will actually follow . More often than not, that means a simple, clear, and concise travel and expense policy.

And even better, it might mean a policy that's built into the tools your teams use every day. That's how it works here at Spendesk, and we'd love to help you achieve the same outcome:

More reads on Expense management

)

Expense reconciliation: how to reconcile spending faster

)

Enhanced reporting requirements 2024: key advice for Irish businesses

Get started with spendesk.

Close the books 4x faster , collect over 95% of receipts on time , and get 100% visibility over company spending.

Expenses Policy (Including Travel and Hospitality)

Try using genie's free ai legal assistant.

- You don't 'need' templates anymore - use our AI Contract Generator to create a new bespoke document from scratch

- Ask anything about the document to better understand the language

- Customise your document by asking the AI to make changes for you (in tracked changes)

- Import any document and use our AI Risk Review feature to highlight high, medium and low risk clauses

Open any document on Genie and our AI Legal Assistant will appear.

Sign up and try our Legal AI today

Note: When you sign up to the free plan (no card required) you get 1 Premium Document with 5 AI uses . Paid plans can be found here .

Create doc / use template

Chat to our AI Legal Assistant

Edit, collaborate & share

Export to .docx

Templates properties

expenses_policy_(including_travel_and_hospitality)_template.docx

England and Wales

Free to use

📑 Expenses policy

A expenses policy covers the rules and regulations regarding the reimbursement of employees for business expenses incurred. This includes specifying what expenses are eligible for reimbursement, how expenses should be documented, and the deadlines for submitting expense reports.

Create expenses policy

Easy-fill with questionnaire

Tweak with our online editor

Export to .docx format

Save, clone, print & share

Similar legal templates

Advisor agreement (payment via share options), consultancy agreement - company appointing an individual consultant (not using a personal service company), senior employment agreement (genie), website privacy policy, intellectual property assignment (for founders to assign ip to company), intern agreement letter, saas (software) subscription agreement (pro-supplier), one way nda uk, saas agreement (yc).

YCombinator

United States

Commercial Lease (for Mutuals & Cooperatives)

UK Government

Standard Notice By Tenant Indicating Preference To Deal Directly With The Other Landlord

Standard notice to complete by tenant (served on landlord), try the world's most advanced ai legal assistant, today.

Crafting an Effective Travel and Expenses Policy Template for UK Businesses

Disclaimer: This content is provided for informational purposes only and does not intend to substitute financial, educational, health, nutritional, medical, legal, etc advice provided by a professional.

Why Your Business Needs a Solid Expenses Policy

In today's fast-paced and global business environment, travel expenses are a common part of doing business. Whether it's attending conferences, meeting clients, or visiting remote offices, travel is often necessary to ensure the growth and success of your company. However, without a solid travel and expenses policy in place, managing these expenses can quickly become a complex and time-consuming task.

With a well-crafted travel and expenses policy template, you can set clear guidelines and processes for managing travel expenses, ensuring compliance with UK regulations, and streamlining expense management.

Navigating UK Expense Regulations: Compliance Essentials

When it comes to travel and expenses, UK businesses need to adhere to certain regulations and guidelines to ensure legal and financial compliance. Some of the compliance essentials include:

- Defining Expense Categories & Types

- Setting Clear Guidelines for Allowable & Non-Allowable Expenses

- Establishing a Clear Process for Expense Approval & Reimbursement

- Detailing the Requirements for Documentation & Receipt Management

By addressing these compliance essentials in your travel and expenses policy template, you can avoid potential legal and financial risks.

Crafting Your Travel and Expenses Policy: A Step-by-Step Guide

To help you create an effective travel and expenses policy template for your UK business, we've put together a step-by-step guide:

1. Define Expense Categories & Types

Start by identifying and categorizing the different types of expenses that employees may incur during business travel. This could include transportation, accommodation, meals, and other miscellaneous expenses. Clearly define what is considered an allowable expense and what is not.

2. Set Clear Guidelines for Allowable & Non-Allowable Expenses

Specify the limits and guidelines for each expense category. For example, you may set a maximum daily allowance for meals or a maximum amount for accommodation expenses. Clearly communicate the consequences of non-compliant expenses.

3. Establish a Clear Process for Expense Approval & Reimbursement

Outline the steps and procedures employees need to follow to get their travel expenses approved and reimbursed. This may include submitting expense reports, attaching receipts, and obtaining proper authorization.

4. Detail the Requirements for Documentation & Receipt Management

Specify the documentation and receipt management requirements. This may include guidelines on retaining receipts, acceptable formats for digital receipts, and the consequences of lost or missing receipts.

Free Travel and Expenses Policy Template

To help you get started, we've created a free travel and expenses policy template that you can download and customize for your UK business. This template covers the essential elements mentioned above and provides a framework for building a comprehensive policy that meets your specific needs.

Best Practices for Implementing a Travel and Expenses Policy

Creating a travel and expenses policy is just the first step. To ensure its effectiveness, here are some best practices to consider:

1. Educate Staff & Management About the Policy

Make sure all employees and management are aware of the policy and understand their roles and responsibilities. Conduct training sessions or provide resources to help them navigate the policy.

2. Align the Policy with Accounting Software & Systems

Integrate your travel and expenses policy with your accounting software and systems to streamline expense management and automate the approval and reimbursement processes.

3. Regularly Review & Update the Policy

Business needs and regulations can change over time, so it's important to review and update your travel and expenses policy regularly. This ensures that it remains relevant and effective.

Get Your Travel and Expenses Policy Template Started with ExpenseIn

ExpenseIn is a leading expense management platform that helps businesses streamline their travel and expense processes. With ExpenseIn, you can easily create, manage, and enforce your travel and expenses policy. Sign up today to get started!

A well-crafted travel and expenses policy template is essential for UK businesses to effectively manage travel expenses, ensure compliance with regulations, and streamline expense management. By following the step-by-step guide and best practices outlined in this blog post, you can create a comprehensive and effective policy that meets your specific business needs. Download our free template and start crafting your policy today!

Related Reads You’ll Enjoy

How to Fill Out a Receipt Book for Babys...

How to Fill Out a Receipt Book: A Compre...

How to Write a Receipt Book: A Step-by-S...

How to Fill Out a Rent Receipt Book: A S...

Mastering Expense Tracking with Excel: Y...

The Essential Guide to Travel Expense Re...

The Ultimate Guide to Using Templates fo...

Travel Reimbursement VA: A Comprehensive...

Streamline Processes with a Travel Policy Template

Do you shudder at the thought of building a business travel policy from scratch? Does the mere mention of "policy" have you running for the hills? If so, you’re not alone.

Building a comprehensive travel policy for your company can be a daunting task – especially if you’re starting from the ground up. But don’t worry, Corporate Traveller has got you covered.

From setting clear goals to prioritising traveller safety, we’ll cover everything you need to know to create a travel policy that works for you. So take a deep breath, grab a cup of coffee, and let's dive in.

Psst – Download the travel policy template at the bottom of this page to help you get started!

DOWNLOAD TRAVEL POLICY TEMPLATE

First things first – what are the goals of your travel policy?

Writing a corporate travel policy is kind of like playing a game of darts. You need to know what you’re aiming for in order to hit the bullseye.

So, before you start building or revamping your travel policy, take a moment to determine your top two or three goals for doing so. Do you want to reduce business travel costs so your organisation can splurge on fancy new desktops for the whole office? Or maybe you’re tired of sorting through piles of receipts and want to improve expense tracking.

Whatever your end game is, adding those goals to the top of your corporate travel policy template will help ensure that your policy is set up to meet your targets.

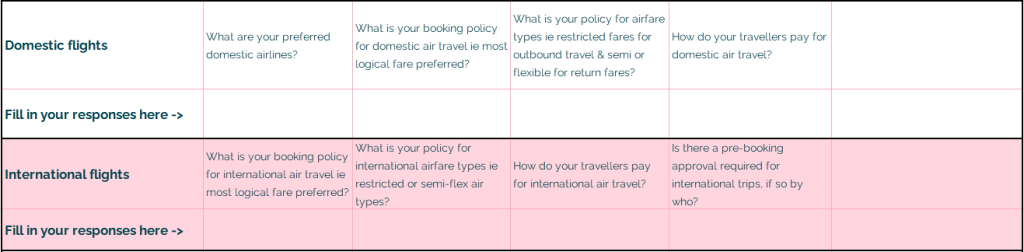

What to include in your travel policy

Now that you know what you want from your policy, let’s talk about what one should look like.

A well-planned travel policy answers all questions about company travel, including everything you want employees to know AND be accountable for. Without this framework (and great travel management software to support it), business travel can quickly spiral into a free-for-all mess.

A starter travel policy could include basic instructions on:

- Booking information

- Domestic flights

- International travel

- Car hire/transport

- Accommodation

- Internal communication

- Traveller safety and wellbeing

Capture your instructions for each of these expense categories in a document (like a business travel policy template) that can be shared and developed with a travel management company . It’s also a good idea to share this document internally and potentially with one or two regular travellers in your organisation to sense check.

1. Booking information

When it comes to creating a travel policy , it's important to outline the entire booking process – and yes, we mean the entire process. Your policy should cover everything from approved tech for booking and steps for change requests, to the importance of tracking and recording all travel bookings. And don’t forget the details!

Make sure your employees keep their information up to date, and know what information needs to be included with their profiles, such as their job number or department. This help with budgeting and cost control, but it also makes it simple to manage changes or cancellations.

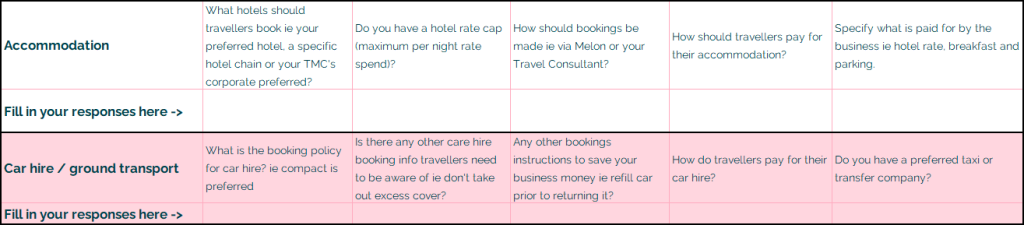

2. Transportation

Transportation expenses can include air travel, train or bus tickets, car hires, and taxi or ride-sharing services. A comprehensive travel and expense policy should be clear about which types of transportation are allowed and what limits are in place.

For example, team members may be allowed to rent a car for up to a certain cost per-day or only use a ride-sharing service for a business trip under a certain distance. Are your employees flying economy class or business class?

The policy should clearly state which class of flight bookings are applicable for expense reimbursement.

3. Accommodation

Do you have a policy on which hotels your employees are allowed to stay in and what the maximum per-night rate is? And if your employees don't book through an agent, are you driving them to your corporate travel booking software and defining capping amounts for hotel bookings? Be clear so you're not overpaying for hotel rooms or other accommodations.

You can also define what extra costs your organisation isn't willing to pay for. For example, does your budget include parking fees? What about room service and entertainment expenses? Define these business travel expenses now so you don’t have to dispute them later.

4. Traveller safety and wellbeing

As a travel manager, your duty of care is to prioritise the safety and well-being of your travellers. Putting people at the heart of your travel policy means taking strategies to ensure their safety and comfort. This includes using a traveller tracking function (find one in Melon!), providing emergency protocols and resources, and ensuring that liability and insurance considerations are covered.

But duty-of-care doesn’t just stop at general safety concerns. Building inclusive policies is essential to making all employees feel comfortable and welcome while traveling. When filling out your company travel policy template, make extra considerations for people who are more at risk for discrimination, such as people of color, LGBTQ+ individuals, and travellers with accessibility needs.

Remember: your goal should be to create a policy that naturally accommodates your employees' needs rather than one that requires them to need personal accommodations.

Read more about traveller safety & wellbeing:

- How to build a proactive travel risk management policy

- The 5 pillars of travel risk management software

5. Internal communication

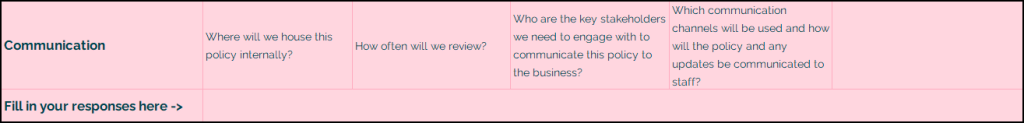

So, you've written your travel policy? Congrats! Now, how are you going to get your employees to care about it?

It's important to consider how you'll get the word out about your policy before it's finalised. Think about training sessions or a communication channel to keep everyone is aware of the policy and its contents.

You'll also make sure you communicate the policy to the business leaders in finance or human resources. Once your policy is in place, set up a timeline for review and revision (we recommend you check back at least annually). And when updates are made, be sure to communicate those changes clearly to your employees.

Build a foundation and review your policy as your company grows to make sure your programme runs efficiently and keeps on budget long term.

- Top 5 Corporate Travel Policy Best Practices

- Building A Better Travel & Expense Policy: Step by Step

- How to Improve Corporate Travel Policy Compliance

Ready to level up your business travel?

Download this template of travel questions to guide the first draft of your policy. Then connect with one of our travel specialists directly, to help you roll the policy out to your business.

Service unavailable in your location

Unfortunately Booking.com for Business is currently not offering its services in your location

Travel and Expense

Here’s the travel expense policy you need.

Setting clear guidelines is important in every aspect of business, particularly with your most valued audience – your employees. Managing business expense and travel is no exception. And, with an average of 10% of a company's business budget devoted to employee expense and business travel, this isn't a cost area you can afford to overlook.

A formal travel expense policy provides employees with knowledge of what they can and cannot submit as reimbursable, while providing management with critical real-time visibility into budgets. Having this protocol in writing will cut down on reimbursable expense report fraud, which is often unintentional, but can have big consequences. Oversight found that 37% of business travellers had at least one exception on their expense reports, and the typical company loses at least 5% of its annual revenue to fraud.

How to Create an Expenses Policy: Free Template and Guidance

Use this free template, based on best practice, as a starting point to create your own T&E policy today.

Where Do You Start When Creating an Employee Expense Reimbursement Policy?

Creating an employee expense reimbursement policy from scratch can be overwhelming but an expense policy template can help get you started. You can use our expense policy builder to create your own customisable expense policy template in just a few clicks.

Consider the following when you start working on (or revising) your policy.

1. Ditch the jargon: Write the policy to cover the basics, but don’t be afraid to revise it later. Make sure it’s easy to read and not bogged down by jargon. The easier a policy is to understand, the easier it is for your employees to follow on their next business trip.

2. Keep it fair and sensible: Write your policy to guide behaviour but be flexible enough to adapt to local and international travel requirements— such as higher air travel fares in more remote locations and hotel room costs in more expensive cities.

3. Invite participation: Before you implement your expense policy, ask team members to participate in the new expense reporting process. For example, if they help develop the policy, they’ll see why it’s necessary and will be more likely to adhere to the rules, encouraging others to do the same.

4. Make it easy to find and easy to use: Your expense policy won’t be followed unless people know about it. Make sure yours is visible and easy for company employees to find.

5. Emphasise the positives of a revised expense policy and lead by example: Hold a training session for employees, accounting, and human resources teams to explain your expense policy’s benefits and purpose. Familiarising managers who approve expenses with the content, the importance of compliance, and the reasons for implementing the policy can help them confidently enforce the rules.

6. Consider helpful software tools and leverage existing technology: An automated solution that automatically populates charges from suppliers, credit card companies, common expense categories and receipts such as business meal expenses, car rentals, dry cleaning, hotel rooms and airfare will save time and allow you to focus on your core business purpose. Choose an expense management solution that works with mobile devices and allows for the submission and approval of employee expenses via photographed receipts no matter where you or your employees are.

Ready to get started? Generate your custom expense policy template now with our expense policy builder or download our expense policy template .

How to Create a Travel and Expense Policy Template

A travel and expense policy template is a key part of budget management that benefits both the senior leadership team and employees.

But while the crisis may have dented business travel, that does not deter corporate payables from coming in. Employees continue to incur expenses that are necessary for them to perform their roles. The work-from-home arrangement has also opened new expense categories, such as the purchase of ergonomic chairs and office desks, with the aim of making this set-up as conducive to employees as possible.

Now, with countries like Singapore making great strides in inoculating their population, analysts are expecting a return, albeit gradual, of corporate travel. This, coupled with the anticipated adoption of a hybrid set-up, underscores the importance of a travel and expense policy (T&E policy). This set of guidelines is necessary not just to simplify the reimbursement process, but to centralize a company’s spending management system to save on costs and labour work.

What is a travel and expense policy?

A travel and expense policy is a set of guidelines detailing how employees should book business-related travels, what items can be reimbursed, and how reimbursement works. It lists the company’s do’s and don’ts on all approved business travels to keep potential cases of fraud at bay and bring costs down by creating wider visibility over the budget.

Having an expense policy is essential to streamlining organizational processes, making business expenses more predictable, and helping employees understand the spending limitations of an approved business trip. A travel and expense policy is often part of a wider corporate travel policy, which reflects a company’s culture and values when it comes to how an employee represents the business outside the office premises.

This policy is also key to creating an expense report used to track business spending. With corporate travel expenses accounting for about 10% of a company’s yearly revenue , an expense report is even more crucial to ensure that your business is operating in a cost-efficient manner. Without a travel and expense policy, a company runs the risk of irresponsible spending during a business trip, having misreported expenses, and encouraging fraudulent behaviour.

What should be included in a travel and expense policy template?

A solid travel and expense policy should anticipate all the potential queries of all the stakeholders. When can one upgrade from first class to economy class? Can one bring non-employees during a business trip? Are there different sets of protocols for domestic travel and international travel?

Failure to address questions like these could lead to overspending, abuses, and fraud, regardless of whether they are intentional or not. Representatives of a company’s finance and human resources department are often in charge of crafting a travel and expense policy. If a company has a dedicated manager for corporate travel, they can get in the mix, as well.

Since the guidelines should be clear and in detail, a travel and expense policy may often take several pages. In some cases, a company may also opt to produce a condensed one-page version summarizing all the key policies. Keep in mind that one of the key goals of a travel policy is to remove ambiguity for better enforcement. To create the guidelines, the following key components must be considered:

Introduction and Purpose

A travel policy should start with a purpose. You should explain to all stakeholders involved that the policy is not just a procedural step but a safeguard to ensure fairness, cut manual work, and improve the overall budget management. If your company has different policies depending on the seniority level or department, your introduction should also clearly explain who the guidelines are for.

The introduction part is also the best venue to mention the benefits (and consequences) of following the protocols, such as getting travel support, to encourage employees to follow them.

Travel booking process

In this section, you should discuss how to book airline tickets and accommodations, specifying the company’s approved booking tool or platform. If your company does not have these, including the contact details of the agent an employee needs to contact if they need to make a booking. The arrangement should likewise include the lead time per travel booking, meaning an airfare or a hotel room booking must be made before a specified number of days before the expected arrival.

This section should also explain the approval process of such bookings. In most cases, the process differs per seniority level. The travel policy needs to write out the names or positions of the approving officers for all types of travel.

Another component of a travel policy is the guideline for using loyalty programs. Expenses for a business trip are often made through a corporate credit card, which is known for offering lucrative perks. The company must specify whether the employee can use the loyalty points and other perks for personal expenses and if there are limitations to doing so. If a corporate card is issued, the expense policy needs to specify if there are certain purchases that should only be made via the said card and not out of an employee’s own pockets.

In some cases, the employee may choose to extend their stay for personal leisure. The T&E policy must detail the rules around such extensions, tackle differences in airfare and accommodation costs during the additional stay and provide a black-and-white guideline for what your company can cover under your travel policy. Other items that you can discuss under the booking process are the rules for bringing along non-employees during a business trip, as well as the per diem for every type of employee.

Expense categories

The next section is all about expense categories. This is one of the key parts of your expense policy template as it will determine how cost-efficient are your guidelines and whether they are aligned with the overall budget. Here are the common categories under expenses:

Travel expenses

This type of expense covers airfare, including the type of airline, approved booking tool, or preferred third-party vendor. The policy should address the nitty-gritty details of corporate travel, such as what type of travel class is allowable. Some companies allow employees to book a business class if a certain mileage is met, while in other cases, only an economy class is permitted for short-haul flights.

Accommodation

Under this section, your company should outline the policies on booking hotels, Airbnb, or apartments. This should cover the authorized booking tool or travel agency, nightly rate ceilings per city or country, the hotel’s star classification, and reimbursable hotel expenses like parking. You can also specify the hotel and negotiate rates whenever available.

Other travel expenses

Corporate travels incur other types of expenses that fall outside of airfares and hotel bookings. They can be:

- Taxi, ride-sharing, car rental, and other commuting fees

- Business meals

- Business-related telephone charges

- Asset repair costs during the business trip

Remember to be as specific as possible when listing down allowable reimbursements. For example, you can set an amount allowed per breakfast, lunch, and dinner meal. In some cases, companies opt for per diem or a daily maximum.

Non-reimbursable expenses

To remove ambiguities, the T&E policy should set out rules on what costs are excluded. This can be as specific as room service charges, room upgrades at an extra cost, and minibar purchases, additional cost and meal expenses of a non-employee joining the business trip, excess baggage, laundry or dry cleaning, parking fines, and entertainment expenses, among others.

When discussing non-reimbursable expenses, seek the opinion of finance leaders and stakeholders who frequently go on business trips to come up with a fair and justifiable list.

Reimbursement process and filing of expense report

In this section, the policy should identify the tool used to file an expense report, the person in charge of receiving the report, the deadline for submission, and the average processing time of reimbursements. But the most important component of this section is the list of items that an employee must include in expense reporting. Typically, these are original receipts that the employee can upload directly to the expense management tool.

Travel support

Other T&E policies dedicate a section to travel support to ensure employees that they are being taken care of during a business trip. This is where you need to specify other information on travel arrangements such as the name and details of the persons in charge in case of flight cancellations or other booking problems. You can also include information on the company’s travel insurance in this section as part of the expense policy template.

Manual vs automated travel expense filing

Corporate travel expenses easily accumulate especially among companies with frequent jet-setters, making them hard to track and adding to the monthly burden of the finance department. Technology draws the fine line that separates efficient business travel management from the opposite.

Traditional companies that use manual travel expense filing require employees to collect their paper receipts for a specified period and only then can they begin crafting the report. This cumbersome process not only leaves room for costly human errors, but it also extends the work of the HR department by going through piles of receipts, authenticating each, and separating allowable expenses from not. This results in delays to the reimbursement process, slow claim submissions, and loss of productivity.

Manual filing of expense reports also tends to prevent a company from gaining full visibility into the budget and spending trends, which could have been essential when crafting an effective travel policy.

On the other hand, an automated travel expense filing adopts a centralized and end-to-end expense management process covering claims submissions, authentication, approvals, and release of reimbursement. Under this process, an employee simply has to log the expenses online and directly upload the original receipts, which will then get picked up by the expense management software for it to analyze and extract details from.

Once submitted, the employee can generate the expense report within minutes, leaving a digital audit trail for all the stakeholders. This process is much more efficient as it offers black-and-white guidelines on what types of expenses are allowable or not while minimizing the possibility of committing fraud.

Read more on the types of allowable expenses

3 ways you can improve your T&E policy and process

1) go paperless.

Manual work is a daunting task, be it for verification of submitted claims or plain manual data entry. To unload this burden, companies must adopt a paperless policy through an expense management platform.

Spenmo , for example, requires four easy steps when processing corporate travel reimbursements: first, an employee will have to upload the photo of the original receipt to the Spenmo app; next, they will log a few key details such as expense category, and then send the form to the approving manager; third, the manager will approve or reject the reimbursement request; if approved, the payout will be released in an instant either via the Spenmo dashboard or company payroll.

2) Use Corporate Cards

Assigning a corporate credit card to employees helps fine-tune a company’s expense management by leaving a digital audit trail for all business purchases. The company can customize its account to block certain spends and merchants, giving it full control of and insights into an employee’s incurred costs during travels, as well as reducing the possibility of committing costly human errors.

Additionally, a corporate card prevents out-of-the-pocket expenses, which often lead to piles of physical receipts that are hard to sort and authenticate individually. It also helps segregate business and personal expenses since transactions made via a corporate card are easily seen and tracked by the finance or human resources department.

3) Keep it up-to-date

You should also revisit your expense policy regularly to ensure that it stays relevant and up-to-date with the existing protocols, be it company-wide or regulatory. The policy should also be readily available to employees to reduce the risk of disobedience. It should be accessible via your travel booking tool, on the company intranet, and on the cloud. The HR should also have a ready-made hard copy for additional access.

A travel expense policy is an essential part of budget management as it helps the company’s senior leadership gain insight into an efficient allocation of money through spending patterns and trends while allowing the employees to claim reimbursements in a fast and systematic manner. It helps reduce the risk of committing fraud by outlining the black-and-white details of what types of expenses are allowable and not, as well as the approved booking tools.

Companies must fully automate their expense management to remove time-consuming and inefficient manual work such as going through each receipt and authenticating them, a process deemed cumbersome among human resources professionals.

Having an automated expense management platform that supports your travel expense policy also helps centralize the system for all the stakeholders, creating a digital audit trail that anyone can refer back to when verifying a transaction. The expense policy must be relevant to company-wide and regulatory protocols, adopt the latest practices such as the use of corporate credit cards, and be readily available to anyone within the company

Similar posts

Should you get a business credit card 5 signs you need one.

It may or may not be necessary for your business to obtain a credit card. We tell you the tell-tale signs that you need to get one.

4 Strategies to Improve Your Company’s Spend Management Process

Managing business expenses can be tedious and time-consuming. Read this article to streamline your company’s spend management process.

8 Ways finance leaders can benefit from technology

Finance leaders benefit from technology since it improves productivity, corporate decision-making, operations, and practices in the finance...

Stay up to date with Spenmo

Sign up to get the latest news, updates, and special offers delivered directly to your mailbox

Travel expense report: template for download

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

When someone takes a trip, they mustn’t forget to complete their travel expense report once they get back. After returning from a business trip , the accounting department requires a detailed account of the costs that your trip incurred. This guarantees that you get the money that you spent back from your employer. You must pay attention to certain subtleties, otherwise you might not get any money at all, or possibly only after a long delay.

What is the purpose of a travel expense report?

If an employee goes on a business trip, i.e. has to travel to another location on behalf of the company – whether to a neighbouring city or to the other side of the world – costs are incurred: tickets, hotel accommodation, meals. Some of these costs are already paid for in advance by the company and therefore no longer play a role in travel expense accounting. Others are incurred by the employee – and paid out of their own pocket. The accounting department can see from the travel expense report and the submitted receipts (very important!) what has to be reimbursed.

But not only the accounting department is interested in the travel expense report. It is also important for the tax office . After all, travel expenses are business expenses and therefore have an influence on the profit a company makes. And for the employees themselves, the tax office plays an equally important role during a business trip: If the employer does not reimburse the travel expenses, the employee can include the costs in their tax return. Detailed and correct documentation is a must.

The self-employed also use travel expense report forms – on the one hand for tax returns, because costs for business trips are part of the operating expenses. On the other hand, they sometimes pass on their travel expenses to their clients, who also expect complete documentation of the costs incurred.

Components of the travel expense report – what the template should include

Four main sections are part of every travel expense report, therefore the template must contain them.

A detailed representation of all items in a travel expense report can be found in the text on travel expense reports .

- Travel expenses : Costs arise through using a company car, your own car, or from purchasing train, bus, or plane tickets. If you are travelling by company car, the employer usually insists that the employee keeps a mileage log. If you use your own vehicle, you’re often paid a flat-rate mileage charge for the sake of simplicity. Tickets for public transport must be kept in a safe place.

- Overnight expenses : When it comes to overnight expenses, you have the choice to either have the costs compensated by a flat rate or have them refunded via the receipts you submit. Ask for an itemised bill because minibar purchases and any movies you watch won’t be reimbursed by the employer.

- Additional costs for meals : When you are travelling, it is assumed that the costs are higher than when you eat at home. For trips abroad, different rates apply depending on the destination.

- Incidental travel expenses : Incidental expenses include parking fees or toll charges, for example. It’s best to keep evidence of these too, if possible.

These four sections cover all costs that can be reimbursed after a business trip. Of course, there are further details to be included in the travel expense report:

- Personnel number

- Start and end of trip with exact time of day

- Destination of the trip

- Travel purpose

- Means of transport used

- Signatures of claimant (employee) and supervisor

Travel expense report: template for your use

A travel expense report template facilitates the work for all parties involved and keeps the tax office happy. Both employees and the accounting department must be able to circumnavigate the document without any problems . Sections should therefore be uniquely named, which is the only way to avoid unnecessary mistakes. In addition, the sections should be created in an organised way. If the form isn’t designed in an easy-to-understand manner, a careless input can quickly mess up the whole layout.

Our travel expense report template is available as a free download in Word format. Employees can either print out the template and fill it out manually or complete the sections of the form directly on their PC.

Free Download

You can adapt the travel expense report template to your requirements as follows.

Our template is created in Word and is best customised using Microsoft software. To be able to access all the functions you need, you must first display the developer tools . If these are not already available in the menu, switch to the options via the “File” tab and activate the extended functions in the “Customize the Ribbon” area.

Control elements are available in the template, which make it interactive. Template users can choose from the list of options and input data themselves. In the travel expense report template, for example, we have used content controls for date selection. You can add additional controls or sections that you require for your accounting, or delete entries that you do not need.

We have also included a header in the template. You can customise this just as you would with Word or any other word processing software. Simply replace the sample entries with your company’s details. In addition, you are of course free to add other design elements such as your company logo to the template.

Employees simply need to open the travel expense report template, fill out the document, and then save it. This requires very little effort, but at the same time the accounting department can easily analyse the information contained. In addition, all parties involved can be sure that all necessary information is provided.

Please note the legal disclaimer relating to this article.

An Overview of Employee Expense Reimbursement Law in the UK

Home / An Overview of Employee Expense Reimbursement Law in the UK

Do you reimburse your employees for expenses incurred while working? Do you want to know the legal requirements when it comes to employee expense reimbursement law in the UK? If so, you’ve come to the right place.

We’ll outline what constitutes an employee expense reimbursement. We’ll also look at the legal framework governing expense reimbursement in the UK. Finally, we’ll provide you with our top recommendations so you can stay HMRC compliant and ensure a smooth reimbursement process.

What is e mployee e xpense r eimbursement?

Employee expense reimbursement is a process where you repay your employees for business-related expenses they have personally covered. These expenses can include travel costs, meals, accommodation, or any other out-of-pocket expenses they incur while performing their job duties.

The process typically involves employees submitting receipts or expense reports, which are then reviewed and approved by your finance team before reimbursement is issued. This method helps make sure that your staff aren’t financially burdened by work-related costs, allowing them to focus on contributing to your business’s success.

Common t ypes of r eimbursable e xpenses in the UK

Travel expenses.

- Commuting: includes transportation costs such as public transport fares, mileage, parking fees, and tolls.

- Accommodation: covers hotel stays or other lodging expenses during business trips.

- Meals: encompasses food and drink expenses incurred during travel or while entertaining clients.

Equipment and supplies

- Office supplies: items such as pens, paper, and other stationery.

- Equipment: larger items like laptops, printers, and office furniture.

Training and professional development

- Courses and workshops: fees for attending professional courses, workshops, or conferences.

- Certifications: costs associated with obtaining professional certifications relevant to the job.

Phone and internet bills

- Mobile phone bills: monthly charges for business-related phone usage.

- Internet costs: fees for home internet if used for remote working.

E mployee expense reimbursement law in the UK

The legal framework governing employee expense reimbursement in the UK is primarily based on common law principles and statutory provisions. While there isn’t a specific statute dedicated solely to expense reimbursement, various employment laws and tax regulations provide guidance on this matter.

Let’s look at some key legal considerations:

Employment Rights Act 1996

The Employment Rights Act 1996 outlines the basic rights of employees, including the right to be paid for work done and to receive wages that are not below the National Minimum Wage . While it doesn’t explicitly address expense reimbursement, it can still be relevant in certain contexts. For example, when employees incur costs related to their job duties, they may expect reimbursement. This expectation typically applies to reasonable expenses incurred while performing their responsibilities.

Tax legislation

UK tax laws, such as the Income Tax (Earnings and Pensions) Act 2003 , provide guidance on the tax treatment of employee expenses. Reimbursed expenses are generally exempt from income tax if they are incurred for business purposes .

Implied term of contract

I n many cases, there is an implied term in an employment contract that the employer will reimburse employees for reasonable business expenses incurred on their behalf.

HMRC g uidelines on r eimbursable e xpenses

HMRC ’s g uidelines on r eimbursable e xpenses provide detailed instructions on what constitutes allowable expenses (such as travel and subsistence . HMRC distinguishes between business expenses and personal expenses to ensure only legitimate business expenses are reimbursed without tax implications.

Reporting your employee expense reimbursements to HMRC

When handling employee expense reimbursements, you have two main options for reporting these expenses:

- Firstly, you can use a P11D form to report expenses and benefits to HMRC at the end of the tax year.

- Alternatively, you can opt for payrolling , where you include the value of the expenses and benefits in the employee’s pay. This method spreads the tax due across the year, which can be more manageable.

Record keeping

You should keep records of all itemised receipts, completed reimbursement forms, the purpose of expenses, amounts spent, and any relevant documentation outlined in your expense policy.

Common c hallenges betwee n you and your employees when it comes to reimbursements

Disputes over what constitutes a legitimate expense.

Disputes over what constitutes a legitimate expense can be a recurring issue between you and your employees. Often, the grey areas arise from differing interpretations of the expense policy . For instance, while you might consider a client lunch a justifiable business cost, an employee could see a casual coffee meeting the same way.

Delays in reimbursement

Delayed reimbursements can seriously affect your employees’ morale. When your team experiences repeated delays in getting reimbursed for their expenses, it creates financial strain and frustration.

This lack of timely compensation can decrease trust in your company, reduce job satisfaction, and lower motivation among your staff.

Expense reimbursement strategies to consider

Provide employee training .

For an expense to be reimbursable and non-taxable, it must be incurred wholly, exclusively, and necessarily for business purposes. Ensuring that your employees understand this is essential.

You should invest in training sessions that explain:

- What qualifies as a reimbursable expense.

- How to document expenses accurately.

- The importance of timely submissions.

Create a c lear and concise expense polic y

An expense policy template is the backbone of any reimbursement strategy.

Your policy should be:

- Clear : avoid ambiguity by laying out which expenses are eligible for reimbursement.

- Concise : make sure it’s easy to read and understand, avoiding overly technical language.

- Accessible : employees should have easy access to this document at all times.

Implement expense management software

Manual expense management can be time-consuming and error-prone. Automating this process with expense management software like Capture Expense offers numerous benefits:

- Efficiency : speeds up the submission and approval process.

- Accuracy : reduces human errors in data entry.

- Transparency : provides real-time tracking and reporting of expenses.

- Compliance : ensures adherence to company policies and tax regulations.

Meet Capture Expense

Simplify and automate how you manage your expense reimbursements using the intuitive Capture Expense app. Book a personalised demo today to see how we can help.

Empowering your organisation, one expense at a time.

Experience the power of our all-in-one platform and say farewell to spreadsheets! Save valuable time and money with effortless automation for reimbursements, vehicle mileage, and credit card reconciliation.

B o o k a D e m o

- Book a Demo

Contact Details

+44 (0) 191 478 7000

© 2024 Capture Expense

Terms & Conditions

Privacy Policy

Comments are closed.

- Receipt Scanning

- Reimbursements

- Card Reconciliation

- Vehicle Mileage

- Expense Reporting

- Spend Control

- Integrations

- Global Expenses

- ROI Calculator

- Field Engineers

- Construction

- Case Studies

- Product Tour

- Product Announcements

- Why Capture Expense?

- View Product Tour

- English (CA)

- English (UK)

- Deutsch (DE)

- Deutsch (CH)

Managing business travel expenses

Free business travel expense form templates.

?)

What is an expense form?

- Determine how much they need to reimburse an employee for business expenses that have some out of their own pocket

- Document business expenses in enough detail so they can write these off on their business tax returns

?)

Download your travel expense claim form

What should an expense claim form template include.

- Information about the employee submitting the report (department, position, contact info, etc.)

- Dates and currency amounts detailed for each expense,that matches the dates and amounts of the receipts submitted as evidence of that expense

- A short description of each expense

- Which account inside your company the expense will be billed to

- Subtotals for each expense type, which simplifies things for the person entering the data into the accounting system

- The amount of reimbursement being requested by the employee submitting the report

- Additional space to explain certain expenditures that don’t fit clearly into any category

- Removing fields related to expenses nobody uses anymore

- Clearly indicating which fields are required and which are optional or contingent (for example, you might only require detailed explanations for entertainment expenses)

- Preparing a clear and concise addendum for any fields on the expense claim form that might be confusing (for example, spelling out just what the employee needs to include in the explanation of entertainment expenses — who was present, the nature of the entertainment, the business purpose, and so on)

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

?)

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Careers Hiring

- User Reviews

- Integrations

- Trust Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

IMAGES

VIDEO

COMMENTS

Our company travel policy template for UK, US, or EU travelers includes the six key sections detailed here. We've formatted it to be easy to read and easy to customize. It can apply to domestic or international travel, air travel, rail transport, and more. An effective corporate travel policy is made up of six key sections: Introduction.

Travel Expense Policy Template Checklist Purpose and Scope : clearly state the policy's purpose and specify its scope, including which types of expenses are covered. Authorisation and Approval : outline the process for obtaining authorisation before making travel arrangements.

Click here to download our free expense policy template. Remember, the key to an effective expenses policy is clarity. Keep your language simple, your guidelines realistic, and ensure the policy is accessible to all employees. Tailor this template to your company's specific needs to maintain financial control and ensure compliance with UK ...

10 travel & expense policy samples, templates & resources. Patrick Whatman. Published on January 14, 2023. Expense management Spend management. 9min. So it's time to write your company's expense policy. And either you have no idea where to start, or you've done this before and you just want to make sure that you hit all the important points.

Building a better travel & expense policy: Step by step. A travel and expense policy (T&E) is a dynamic set of rules regulating how employees book travel. From setting budgets on flights and accommodations to standardising the process for expense reports, your T&E should answer any (and all) questions about company travel, so you don't have ...

Having a travel policy helps you: Control travel costs. Determine how reimbursement works. Compile a list of trusted and approved travel vendors. Manage an employee's travel experience and safety. Cut rogue bookings - and simplify approvals. Budget, report on travel expenses and activity and reconcile bookings.

This legal template, the "Expenses Policy (Including Travel and Hospitality) under UK law," is a comprehensive document that outlines the guidelines and regulations related to expenses, travel, and hospitality expenditure within a UK-based organization. The policy covers a wide range of areas and aims to provide clear instructions and standards ...

define a travel policy and approval workflow. in under 2 minutes Make sure you set out what the company will cover. For example, if an employee is having dinner on a work trip, it's a given that this should be covered as a travel expense. Now let's say this employee wants to treat a client or contact to dinner, because they think it would ...

Crafting Your Travel and Expenses Policy: A Step-by-Step Guide. To help you create an effective travel and expenses policy template for your UK business, we've put together a step-by-step guide: 1. Define Expense Categories & Types. Start by identifying and categorizing the different types of expenses that employees may incur during business ...

Capture your instructions for each of these expense categories in a document (like a business travel policy template) that can be shared and developed with a travel management company. It's also a good idea to share this document internally and potentially with one or two regular travellers in your organisation to sense check. 1.

A travel expense policy sets clear expectations for business travellers. Use our adaptable travel expense policy template to create your own. A travel expense policy sets reimbursement expectations, ensuring a company and its employees are on the same page, which is why a travel expense policy template is so crucial.

A travel expense policy in a small business is a set of clearly defined corporate rules, which outlines exactly what is expected of employees when it comes to booking and paying for work-related travel. Successful travel expense policies set boundaries on the amount an employee can spend on corporate travel, while also defining what is an ...

2. Keep it fair and sensible: Write your policy to guide behaviour but be flexible enough to adapt to local and international travel requirements— such as higher air travel fares in more remote locations and hotel room costs in more expensive cities. 3. Invite participation: Before you implement your expense policy, ask team members to ...

A travel and expense policy template is a key part of budget management that benefits both the senior leadership team and employees. The COVID-19 pandemic and the ensuing border restrictions have virtually halted air travel, making the industry for corporate trips one of the biggest casualties. In 2020, corporate travel expenses plummeted 52% ...

The company travel policy outlines provisions for business-related travel, detailing reimbursable expenses and guidelines. It covers transportation, accommodation, legal/medical expenses, and daily allowances. Employees are advised to exercise judgment and submit expenses timely for reimbursement. This company travel policy template is ready to ...

Employees see the policy rules as they book travel, and while on the road, they can easily access expense guidelines for meals, incidentals, and more in the mobile app. Learn more about how Navan can support your travel policy implementation at www.navan.com. Download our free travel policy template to streamline your business travel management.

and travel (e.g. by using advance booking and restricted travel times where appropriate for rail travel, see Appendix A). Claims must be supported by detailed receipts unless specified. For any expenditure, incurred on behalf of Monitor that does not fall within the normal definition of a business expense, Monitor's policy on procurement

An employee travel expense policy outlines the rules, procedures, and expectations for incurring, documenting, and reimbursing business expenses during work trips. This policy is integral to maintaining financial transparency, ensuring compliance with regulations, and promoting responsible spending within the organization. — By Andy Przystański, Mar 01, 2024

Expense reimbursement policy best practices. Expense reimbursements are when a company owes its employees money for out-of-pocket purchases that they made on behalf of the company. Establishing a formal expense reimbursement policy sets expectations about what types of expenses will be covered by the company and when the company will pay them back.

Staff Travel and Expenses Policy and Procedure Status: Final Date: 10/08/17 3 8. RECEIPTS All claims MUST be supported by a valid receipt or invoice, which in the case of expenses incurred in the UK means a VAT receipt/invoice. This is a receipt or invoice which details the goods or services purchased and gives the supplier's VAT number.

If the form isn't designed in an easy-to-understand manner, a careless input can quickly mess up the whole layout. Our travel expense report template is available as a free download in Word format. Employees can either print out the template and fill it out manually or complete the sections of the form directly on their PC.

Free excel expense form and expense report templates. Access these directly via google sheets. Also, with information on best practices for expenses. ... (UK) English (CA) Español. Français. Deutsch (DE) ... to advice on setting up a business travel policy, and managing your expenses. Our latest e-books. and . blog posts. have you covered ...

Create a c lear and concise expense polic y An expense policy template is the backbone of any reimbursement strategy. Your policy should be: Clear: avoid ambiguity by laying out which expenses are eligible for reimbursement. Concise: make sure it's easy to read and understand, avoiding overly technical language.

Document business expenses in enough detail so they can write these off on their business tax returns. Expense claim forms can be prepared using accounting software or apps**,** with templates generated in Microsoft Office via Word or Excel, or with PDFs as well as other programmes. Expense claim forms are filled out on a regular basis ...