Trip and Parking Generation

Click here to access information on Trip Generation

Parking Generation, 6th Edition - October 2023

Discover What's New in the 6th Edition

Users will experience a number of improvements in the ITEParkGen web app, making it easier to access the information you need, and there are new land use codes and subcategories.

ITEParkGen web app improvements:

- Single click access to individual land use text and data plots pdfs

- Calculate parking demand for: average rate; fitted curve; and 85th percentile

- Complete pdf version of the Parking Generation Manual, 5th edition in the Support Documents folder

New/Reconfigured Land Use Codes:

- Single Family Attached Housing

- Multifamily Housing

- Urgent Care Center

- Walk-in Clinic

- Shopping Center, Shopping Plaza, and Strip Retail Plaza

- Brewery Tap Room

New Land Use Subcategories for:

- Affordable Housing

- High Turn-Over (sit-down) Restaurant

- Medical-Dental Office Building

- Shopping Plaza

- Government Office Building

- Soccer Field

Please click here to access a complete list of Parking Generation Manual land use codes.

The information included in this resource is based on parking generation studies submitted voluntarily to ITE by public agencies, developers, consulting firms, student chapters and associations.

Note about the Transition from Parking Generation , 5th Edition to the 6th Edition

* *When you purchase the 6th Edition and use your new code to update from the 5 th Edition to the 6 th Edition, the ITEParkGen web app will enable data analysis, filter, and calculate functions for only the 6 th Edition database. You will still be able to access PDFs for the entire 5 th Edition contents through the Support Documents button within the ITEParkGen web app.

Purchasing Parking Generation, 6th Edition - Multiple Formats Available

Digital – A single ParkGen6 user license providing electronic access to all plots, descriptions and references and the ability to filter the data to match local conditions.

- $295 members | $495 non-members: Purchase a Single License

Hard Copy - A full-printed version of the 6th edition plots and descriptions.

- $295 members | $495 non-members (+ shipping and handling): Purchase a Hard Copy

All-in-one-Bundle - A single ParkGen6 User License and 6th Edition Hard Copy are available at a discounted price of $490 members | $790 non-members (+ shipping and handling): Purchase the All-in-one-Bundle

Parking Generation, 6th Edition - Significant Discounts for Multi-Users Additional ParkGen6 user license - $195 members | $295 non-members For members purchasing 3 or more single user licenses, it’s most cost effective to purchase the Five-pack or the Office Bundle

- Two (2) ParkGen6 single user licenses - $490 members | $790 non-members: Purchase two (2) single user license

- Five-pack (five (5) ParkGen6 user licenses) - $695 members | $1,295 non-members: Purchase the Five-Pack

- Office Bundle (five (5) ParkGen6 user licenses and one (1) hard copy) - $895 members | $1,495 non-members (+ shipping and handling): Purchase an Office Bundle

For every license purchased, you will receive a unique key code, to create one, single user account at www.iteparkgen.org . This is where you will go to access all ITEParkGen's web app data, plots, create plots of your own, and access reference documents.

Questions or interested in purchasing more than 5 licenses at a time? Contact Frances Bettis at 202-785-0060 x149 or [email protected] .

Submit Data for ITE’s Parking Generation Manual

Do you have parking generation data that you would like to see included in ITE's Parking Generation Manual? To submit data, go here Submit Parking Data . If you have any questions about submitting data, email [email protected] .

Other Parking Generation Resources

In addition to the ITE Trip Generation Manual , we also provide access to several other related resources such as articles and FAQ's as follows:

- Parking Generation FAQs

Trip Generation Manual, 11th Edition (TripGen11)

The ITE Trip Generation Manual presents a summary of the trip generation data that have been voluntarily collected and submitted to ITE. The trip generation database includes both vehicle and person trip generation for urban, suburban and rural settings. A Trip Generation web app—ITETripGen allows electronic access to the entire dataset with numerous filtering capabilities including site setting, geographic location, age of data, development size, and trip type. As additional data become available, they will be distributed through periodic updates to the Trip Generation Manual.

Submit Data for ITE's Trip Generation Manual

Do you have trip generation data that you would like to see included in ITE's Trip Generation Manual ? To submit data, go here https://www.itedatasubmission.org/index.html . If you have any questions about submitting data, email [email protected] . Hard copy submittals are also accepted using ITE’s standard trip generation data collection form .

Purchase the Trip Generation Manual, 11th Edition

This new edition of the Trip Generation Manual enhances the 10th edition’s modernized content, data set, and contemporary delivery - making it an invaluable resource.

The 11th edition features:

- All the latest multimodal trip generation data for urban, suburban and rural applications,

- Reclassified land uses to better meet user needs,

- Integrated digital copies of all land use definitions, plots and supporting materials,

- Full ability to filter the data to match local conditions (in digital versions only)

**When you purchase the 11th Edition and use your new code to update from the 10 th Edition to the 11 th Edition, the ITETripGen web app will enable data analysis, filter, and calculate functions for only the 11 th Edition database. You will still be able to access PDFs for the entire 10 th Edition and entire 10 th Edition Supplement contents through the Support Documents button within the ITE TripGen11 Web-based App.

For every license purchased, you will receive a unique key code, to create one, single user account at www.itetripgen.org This is where you will go to access all TripGen11’s data, plots, create plots of your own, and access reference documents. Everything you need is on www.itetripgen.org .

Available in Multiple Formats at the Same Price

- $895 members | $1,395 non-members: Purchase a Single License

- $895 members | $1,395 non-members (+ shipping and handling): Purchase a Hard Copy

All-in-one-Bundle - A single TripGen11 User License and 11 th Edition Hard Copy are available at a discounted price of $1,290 members | $1,890 non-members (+ shipping and handling): Purchase the All-in-one-Bundle

Significant Discounts for Multi-Users Additional TripGen11 user license - $395 members | $495 non-members For members purchasing 3 or more single user licenses, it’s most cost effective to purchase the Five-pack or the Office Bundle

- Two (2) TripGen11 single user licenses - $1,290 members | $1,890 non-members: Purchase two (2) single user license

- Five-pack (five (5) TripGen11 user licenses) - $1,675 members | $3,375 non-members: Purchase the Five-Pack

- Office Bundle (five (5) TripGen11 user licenses and one (1) hard copy) - $1,995 members | $3,695 non-members (+ shipping and handling): Purchase an Office Bundle

Questions or interest in purchasing more than 5 licenses? Email [email protected] .

Looking for Assistance with Traffic Impact Analysis Studies?

The following members of the ITE Consultants Council are available to perform traffic impact analysis studies. The below organizations operate independently of ITE and ITE does not take responsibility for their performance. Individuals should contact the below organizations directly.

- American Structurepoint

- CBB Transportation Engineers + Planners

- Crawford, Murphy & Tilly

- DCS Engineering

- DKS Associates

- Fehr & Peers

- Gannett Fleming

- Kimley Horn

- Kittelson & Associates, Ltd.

- Lambeth Engineering

- Lee Engineering

- Paradigm Transportation Solutions Ltd.

- Sam Schwartz

- Sanderson Stewart

- The Traffic Group, Inc.

- Urban Systems

Interested in adding your organization to this list? Contact Kathi Driggs to learn more about joining the ITE Consultants Council .

Next Evolution in Transportation Impact Analysis

Now Available! The TripGen11 API, developed by Transoft Solutions for ITE, allows for third-party transportation engineering software providers to link their products directly to the ITE TripGen 11 app and gives users to extract data needed for analysis.

ITE has initially partnered with PTV Group to offer integration through their software platform, PTV Vistro. The ITE TripGen11 API allows users to import ITE Trip Generation data for proposed project land uses directly within the software and apply the results in integrated transportation impact analysis workflows.

Through PTV’s Vistro software, users can select the land use characteristics, independent variable and time period. Then, choose to apply the average rate or fitted curve equation and view the results in Vistro’s trip generation table and on the ITE formatted data plot graphics.

Information about purchase the Trip Generation Manual, 11th Edition to gain access to TripGen11 App is below. To learn more about PTV’s Vistro, click here . If you are interested in partnering with ITE on API integration, contact Kevin Hooper .

Other Trip Generation Resources

In addition to the ITE Trip Generation Manual , we also provide access to several other related resources such as articles, related research and white papers as follows:

- High-Cube Warehouse Vehicle Trip Generation Analysis Prepared for South Coast Air Quality Management District and National Association of Industrial and Office Properties Prepared by Institute of Transportation Engineers

- Urban and Person Trip Generation White Paper

- Related Research

- Trip Generation Manual 11 th Edition, ITE Pass-by Rates

- Trip Generation Manual 11 th Edition ITE Trip Generation Hourly Distribution of Entering and Exiting Vehicle Trips

- Trip Generation Manual 11 th Edition ITE Trip Generation Hourly Distribution of Entering and Exiting Truck Trips

Featured Resources

- Coming Soon -

This updated manual follows the lead of the modernized, updated, and expanded Trip Generation Manual, 10th Edition. The analyses in more..

US Travel Header Utility Menu

- Future of Travel Mobility

- Travel Action Network

- Commission on Seamless & Secure Travel

- Travel Works

- Journey to Clean

Header Utility Social Links

- Follow us on FOLLOW US

- Follow us on Twitter

- Follow us on LinkedIn

- Follow us on Instagram

- Follow us on Facebook

User account menu

Travel price index.

MONTHLY INSIGHTS December 20, 2023

The Travel Price Index (TPI) measures the cost of travel away from home in the United States. It is based on the U.S. Department of Labor price data collected for the monthly Consumer Price Index (CPI). The TPI is released monthly and is directly comparable to the CPI.

Please see attached table for the latest data.

Member Price: $0

Non-Member Price: $0 Become a member to access.

An official website of the United States government Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means youâve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Site Notification

Interactive visualization requires JavaScript

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

How Much Is Travel Insurance in 2024?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Average cost of travel insurance by trip cost

Factors that affect travel insurance cost, more example costs of travel insurance, types of travel insurance, how to buy travel insurance, credit cards with travel insurance, cost of travel insurance recapped.

According to NerdWallet analysis, the short answer to “How much does travel insurance cost?” is that it’s typically 7% of your overall trip cost. For example, travel insurance will cost you an additional $70 (roughly) for a $1,000 trip.

However, depending on your provider, travel insurance costs can range from 4%-16% of your trip cost. That means for that $1,000 trip, you might find coverage for as little as $40 or up $160 on the high end.

Costs vary across providers, level of coverage and factors like your age and destination. Let’s take a look at the different types of travel insurance, what influences its cost and the average cost of travel insurance.

The Nerds dove deep into over 50 real world coverage price points to get a clearer sense of typical travel insurance costs in 2024.

On average, travelers should expect to pay 6.87% of their total trip cost for travel insurance. The minimum you might expect to pay is 4.15%, but it can go as high as 15.8%.

How did we determine these ballpark travel insurance prices?

We broke it down by looking at four individual providers' cheapest basic plan and most expensive basic plan for two traveler age demographics: a 30 year old and a 60 year old.

The Texas-based travelers are taking a 10 day trip to Florida in the summer. Included providers in our analysis were:

Allianz Global Assistance .

Travel Guard by AIG .

USI Affinity Travel Insurance Services .

Travel Insured International .

World Nomads .

Berkshire Hathaway Travel Protection .

Travelex Insurance Services .

Seven Corners .

AXA Assistance USA .

TravelSafe .

HTH Insurance .

According to the U.S. Travel Insurance Association, a national association of insurance carriers, the amount you can expect to pay for travel insurance will vary between 4% to 8% of your overall trip. This falls in the general range of our analysis, too.

If your vacation was $5,000, you’d be looking at somewhere between $200 and $400 for insurance. NerdWallet findings corroborate this range, with the average travel insurance cost for a trip at this price point being about $350.

Of course, as we describe below, the type of coverage you choose can greatly affect the cost of your insurance.

» Learn more: What does travel insurance cover?

So, how much is travel insurance? Several factors will influence the cost, like:

Type and extent of coverage.

The length of your trip.

Your destination.

The age of the policyholder.

Total trip cost.

Let’s say that you chose to purchase an insurance policy to cover any health care expenses you incur while traveling. This will reimburse you in the event you need to see a doctor, require hospitalization or have a variety of needs related to health care.

However, let’s say that you also chose to insure some of your trip costs; this means that, if need be, the policy will reimburse you for nonrefundable trip costs in case of a covered event. This will drive up the price of your policy overall.

Another factor that will affect the cost of your travel insurance is the coverage limits of your policy. These limits dictate how much you’ll be reimbursed in the event you need to use your insurance; the higher the amount, the more expensive your insurance.

» Learn more: The best travel insurance companies

Here are some sample costs of travel insurance for a seven-day trip in the United States for two travelers ages 34 and 36. Full trip costs are estimated to be $2,000, and trip bookings have yet to be paid in full.

Policies include trip interruption coverage, travel delay coverage (up to $500) and emergency medical coverage.

In addition to the cost of travel insurance, we also need to talk about the different types of travel insurance. This is because the price you’ll pay will depend on the insurance you choose. Some policies — like those that allow you to cancel for any reason — can be more expensive than other, more limited, policies.

Common types of travel insurance include:

Lost luggage insurance .

Trip interruption insurance .

Trip cancellation insurance .

Rental car insurance .

Cancel For Any Reason insurance .

Health insurance .

Accidental death insurance .

Emergency evacuation insurance .

Different types of insurance will cover various things. Trip cancellation insurance, for example, will allow you to recoup a portion of nonrefundable costs when you’re forced to cancel your trip for a covered reason.

It’s simple to purchase travel insurance; you’ve probably seen dozens of ads for insurance whenever booking a flight or rental car.

However, it’s a better idea to get multiple quotes for policies. Insurance policy aggregators, such as Squaremouth, allow you to search a variety of different providers at once. You can then compare the coverage and price of each policy before choosing one that suits your needs.

» Learn more: What to know before buying travel insurance

If you’re looking into purchasing travel insurance, you may want to check which credit card you’re using to book your trip. Many of today’s popular travel credit cards offer complimentary travel insurance.

Cards such as the Chase Sapphire Preferred® Card offer primary rental car insurance; this means that the card will pay for any covered damage so that it doesn’t pass on to your personal insurance policy.

The types of insurance and total coverage vary according to the card, so you’ll want to check your individual policies.

Common coverage includes trip delay insurance, lost luggage insurance, rental car insurance and emergency medical insurance.

Popular cards that provide these types of coverage include:

Chase Sapphire Preferred® Card .

Chase Sapphire Reserve® .

Capital One Venture X Rewards Credit Card . (Benefits may change over time.)

The Platinum Card® from American Express . Terms apply.

United℠ Explorer Card .

In order to qualify for coverage, you’ll want to use your card to pay for any trip costs, including your airfare, lodging and rental cars.

The amount you’ll be reimbursed varies widely depending on which card you hold. For instance, the Chase Sapphire Preferred® Card provides coverage for up to $10,000 per person and $20,000 per trip for prepaid, nonrefundable travel expenses for covered trip cancellations.

Chase Sapphire Preferred® Card

These include airfare, accommodations and even tours.

The United℠ Explorer Card , meanwhile, offers far less coverage at just $1,500 per person and $6,000 per trip.

United℠ Explorer Card

$0 intro for the first year, then $95

Of course, your trip will need to fall under covered circumstances, including sickness and severe weather.

» Learn more: Does my Chase credit card have travel insurance?

It can make sense to purchase travel insurance, especially if you’re unsure about your vacation or worried about incurring expenses you can’t afford. Before buying a policy, you’ll first want to decide what type of insurance you’re looking to buy; some types of coverage cost much more than others.

You’ll also want to check to see if your credit card already provides complimentary travel insurance. Many popular travel cards offer this feature, though the limits may be lower than you might prefer.

Finally, do your homework before buying a policy. Gather quotes from multiple companies before making a decision, and remember the average price of trip insurance ranges from 4% to 8% of your total vacation costs.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Browser not supported

This probably isn't the experience you were expecting. Internet Explorer isn't supported on Uber.com. Try switching to a different browser to view our site.

How much does a ride with Uber cost?

Plan your next trip with the price estimator.

How prices are estimated

In most cities, your cost is calculated up front, before you confirm your ride. In others, you will see an estimated price range (see applicable price terms in your city). Here are some fees and factors that can affect your price:

The base rate is determined by the time and distance of a trip.

Operating fee

In your city, a flat fee might be added to each trip. It helps support operational, regulatory, and safety costs.

Busy times and areas

When there are more riders than available drivers, prices may temporarily increase until the marketplace is rebalanced.

Ways to ride in the area

Making money by driving with the uber app, behind the wheel.

Drive using Uber when you want and make money on your schedule.

Find out what resources and promotions are in the app that can help you maximize your earnings.

Frequently asked questions

After you arrive at your destination and exit the vehicle, your final cost will be automatically calculated and charged to the payment method you’ve set.

Yes, you can request a ride to and from most major airports around the world. Go to our airports page to see the locations where Uber is available.

In most cities, Uber is designed to be a cashless experience. In cities where cash payments are available, this option must be selected before you request your ride.

Open the app and input your destination in the “Where to?” box. The price estimate for each ride option will appear; scroll to see what’s available in your area.

Do more in the app

Download the uber app.

Scan to download

Sign up to ride

- Our offerings

- How Uber works

- Diversity, equity, and inclusion

- Sustainability

- Investor relations

Sign up to drive & deliver

Create a rider account, order delivery with uber eats, sign up for uber for business, sign in to drive & deliver, sign in to ride, sign in to order delivery with uber eats, sign in to your uber for business account, drive & deliver, ride with uber, uber for business, manage account.

Protect Your Trip »

How much does a cruise cost in 2024.

Use this guide to learn more about cruise pricing and how to figure out the total cost of a cruise.

How Much Does a Cruise Cost?

Getty Images

With the rising cost of everything, cruise fares – some even as low as $27 per person per night based on double occupancy – seem like an incredible bargain. And they certainly can be, but the fares you see advertised online often don't include extras like taxes, fees, port expenses, gratuities, shore excursions, specialty dining, alcoholic beverages, specialty coffees, room service fees and more.

Cruise pricing can be confusing with so many variables. Unless you're sailing with a smaller luxury line that is all-inclusive , your bill on the day of disembarkation may be unexpected or even shocking. Small things like buying bottled water or renting noodles for floating in the ocean at a cruise line's private island can add up quickly. To help you plan better for a cruise vacation , U.S. News has broken down some of the costs and add-ons you need to take into consideration before booking your next getaway on the high seas.

Find your perfect cruise

How much does a one-week cruise cost?

A cruise can cost anywhere from about $109 per person in an interior cabin for a four-night Bahamas cruise up to $101,199 per person for an entry-level suite on a 168-night world cruise – and anywhere in between. Cruise fares vary based on itinerary, number of nights, cabin type, amenities and cruise line. Here are a few examples of base cruise cost ranges on larger cruise lines for various regions:

- A seven-night Caribbean cruise in November ranges from approximately $270 to $2,600 per person.

- A seven-night Alaska cruise in May ranges from approximately $250 to $1,700 per person.

- A seven-night Mediterranean cruise in June ranges from approximately $620 to $2,300 per person.

- A seven-night Mexico cruise on the Pacific Coast in January ranges from approximately $470 to $700 per person.

- A seven-night Canada and New England cruise in October ranges from approximately $490 to $1,100 per person.

What's included in the base fare with a larger cruise line?

Mass market cruise lines such as Royal Caribbean International , Norwegian Cruise Line , MSC Cruises and Carnival Cruise Line – and more upscale lines like Celebrity Cruises , Holland America Line , Cunard Line , Disney Cruise Line and Princess Cruises – advertise "starting from" base fares, which are for inside cabins. These are the least expensive staterooms on the ship, and they do not have windows. Staying in these accommodations still gives you access to all the complimentary dining venues and several types of nonalcoholic beverages (such as nonbottled water, iced tea, juices, hot coffee and tea), as well as the ship's pools, gym facilities, kids clubs and onboard entertainment.

If you want a room with a view – or a larger stateroom – consider booking an ocean view room with a window, or a cabin with a balcony or veranda. With these rooms, you'll have access to all the ship's included amenities and typically more spacious accommodations for the week. Of course, this option will come at a higher price point.

No matter which room category you choose, port expenses, taxes and fees are not included in the base fares, and they're automatically added to the cost of your cruise. The amount of these charges will depend on the length of your cruise and where you're sailing. Gratuities for the staff and crew are also additional.

Ready to plan a cruise? Find the best value sailings on GoToSea , a service of U.S. News.

What if you want more amenities and perks?

For more perks, you can splurge on a suite or a higher room category. With Celebrity's Concierge Class, for example, you'll be treated to amenities such as a welcome lunch, a complimentary bottle of sparkling wine, personalized concierge service, an exclusive destination seminar, pillow selection upon request, laundry service and more.

With Disney Cruise Line's Concierge Staterooms and Suites, guests have a dedicated concierge agent offering personalized assistance for pre-arrival planning for port adventures, dining reservations, other onboard activities and special requests. You'll also get priority check-in and boarding, a private welcome reception, free Basic Surf Wi-Fi, access to a private lounge with complimentary food and beverages (alcoholic and nonalcoholic) served throughout the day, and other perks.

You may opt to stay within an exclusive area of the ship, such as the MSC Yacht Club, The Haven by Norwegian or Celebrity's The Retreat. These high-end private retreats offer a mostly all-inclusive experience with additional features, while still including access to all the entertainment, dining venues and more on board. The accommodations can cost hundreds more dollars per day, but you'll have an experience similar to sailing on a small luxury vessel.

For example, the MSC Yacht Club offers an intimate all-inclusive space within its larger ships. The private area is accessible with a key card and features luxurious suites, a dedicated concierge, 24-hour butler service, a private restaurant and lounge, a secluded pool deck, priority reservations for specialty dining, VIP seating for entertainment, and other amenities. There are also additional dining and snack options throughout the day at the pool and lounge.

You'll find similar amenities in Norwegian's and Celebrity's private retreats, including priority boarding and disembarkation, exclusive sun deck areas, and priority access when boarding tenders for going ashore.

Guests of MSC's Yacht Club receive the line's Premium Extra Beverage Package, which covers premium liquors, fine wines and Champagne in the Yacht Club and at most other venues on the ship. Accommodations in The Retreat on Celebrity also include premium beverages throughout the ship. If you're staying in The Haven by Norwegian, a beverage package is not covered in the pricing, but Norwegian frequently advertises its "Free at Sea" package, which includes free unlimited bar, free specialty dining, complimentary Wi-Fi, discounts on excursions and other perks.

What factors determine pricing?

Base pricing and the additional components vary greatly among the cruise lines, so you'll need to determine what your budget is for the trip – and what you can and can't live without when it comes to accommodations and amenities. Travelers may also find that one cruise line has a deal or promotion with reduced pricing that covers airfare, specialty dining, a beverage package, free Wi-Fi or other perks in the advertised rate (such as the Norwegian package mentioned above), while another line isn't running any specials for a similar itinerary.

Voyages on older cruise ships tend to be less expensive, so if you're on a tight budget, consider a ship with fewer bells and whistles. If you're sailing on a short itinerary in the Bahamas and plan to lounge by the pool or on the beach all day, you may not be concerned about having high-tech onboard amenities, martini bars and several specialty restaurants.

Save the money to splurge on more expensive fares when you're planning to sail on longer voyages on larger and newer ships . You'll want several days at sea to enjoy the onboard amenities on some vessels, such as a three-level racetrack and a 10-story-tall slide on Norwegian Viva . It would take a full week (or more) to explore all the entertainment options aboard Royal Caribbean International's newest ship, Icon of the Seas – or all the new entertainment offerings and attractions on Princess Cruises' latest addition to its fleet: Sun Princess.

Another significant factor to consider is the time of year you want to travel. Better deals are available in the offseason, but the offseason varies depending on what part of the world you're traveling to. For example, May is a great time to find a deal in the Caribbean. The offseason – or shoulder season – in that market typically runs from May to November. However, keep in mind this period overlaps with hurricane season .

You also may be able to find last-minute deals in many other destinations if you're flexible. Working with a travel agent is an excellent way to learn of last-minute specials and cruise deals that offer add-ons like beverage packages, specialty dining inclusions, shore excursions and other perks. You can also check out the online specials that change frequently.

Solo travelers may pay more

If you're traveling alone, you may also need to factor in a single supplement, which can add up to as much as 100% of the cruise fare. To save money, bring a friend so you can access the lower double occupancy fare or consider lines that feature rooms for solo travelers; select Royal Caribbean, Norwegian and Celebrity ships offer solo staterooms, as do other cruise lines. Check out our guide to the best solo cruises with no supplement fare .

These smaller accommodations – typically ranging from around 100 to more than 200 square feet in size – are priced and designed for solo travelers. Key card access to Norwegian's Studio Lounge is included with the line's solo cabins and offers a place to relax and mix and mingle with other cruisers. Other lines that offer solo cabins include Holland America, MSC, Cunard and Virgin Voyages . While the price may not be as inexpensive as the double occupancy fare when traveling with someone else, these accommodations offer some savings over a typical solo fare.

Some lines often feature special deals on select sailings where the single supplement is waived or reduced. A knowledgeable travel agent specializing in cruises can assist in finding the best offers for solo travelers.

'Kids cruise free' promotions can help families save

If you're traveling with kids, many cruise lines – such as Holland America, MSC, Norwegian, Royal Caribbean, Disney and Princess – offer "kids sail free" promotions periodically throughout the year. You can also find discounted fares for children on select sailings.

Regent Seven Seas Cruises has fares as low as $999 for children 17 and younger on a variety of select voyages. Regent's regular fares typically start at around $3,600 per person for a seven-night cruise, so this is a significant savings. This fare also includes unlimited complimentary shore excursions and all the benefits and perks of sailing with an all-inclusive luxury cruise line. Regent even has a current promotion where kids sail free on a selection of seven- to 20-night itineraries in Europe and the U.K.

Food and beverages are another expense to consider

Once you determine your total cruise fare with the taxes, fees, port charges and gratuities, you'll need to budget for the additional expenses you'll have on the ship – and these extras can add up quickly. Meals at specialty dining venues, alcoholic drinks and other beverages may not be covered in the basic cruise fare. You'll also have to pay for room service on many ships.

You can purchase specialty dining, beverage and Wi-Fi packages before or during your cruise. These packages offer savings over purchasing everything individually – and it's best to buy them once you book your cruise, as they're typically cheaper to purchase before you board the ship.

For an example of the savings with a food package, Royal Caribbean offers up to a 40% discount with a dining package. This package includes reduced pricing for children ages 6 to 12, while kids 5 and younger eat for free. The cruise line's unlimited dining package also offers discounts on bottles of wine.

In addition to specialty dining venues that charge a flat fee – usually between $30 and $50 – there are also restaurants that charge as much as $135 or more for dinner, such as the adult venues on Disney Cruise Line's ships. Other restaurants feature a la carte menus with sushi, bar food and even steakhouses that price out individual courses. Some of these venues may not include gratuities, so that's another add-on. If you decide to dine at any of these spots – and they're not included in your package – you'll have to budget for them in the total cruise price.

Enticing dessert items in the gelato and ice cream shops on some ships also come with a price, including Coco's and Dolce Gelato on Norwegian or MSC's Venchi Gelati and Chocolate.

There are endless options when considering beverage packages, too, so you need choose what fits best with your interests and budget. Some of the package options are only for nonalcoholic drinks like fountain sodas, sparkling waters and coffees, while premium or deluxe beverage packages cover beer, wine and cocktails, so they are more expensive.

Depending on the cruise line, most premium packages will usually cover drinks up to $15, but many craft cocktails on cruise ships can be quite expensive, costing much more, especially if you request a specific brand for the liquor. If you have the premium package and want to splurge on the fancy beverage, you'll have to pay the difference.

It's important to know that there are a few select venues and bars on some ships that do not accept a beverage package, so you'll have to pay extra for drinks at those places. For example, MSC's ships have several signature venues that do not accept drink packages, such as Hola! Tacos & Cantina, Lavazza coffee shops and Venchi 1878.

Norwegian offers a package that covers top-shelf beverages and select bottles of wine and Champagne, Starbucks coffee, bottled water, soda, specialty drinks and other beverages. You'll need to budget around $138 per person per day for this option – and an additional 20% gratuity. This type of package can add up to quite a bit of money on a seven-day cruise or longer. For more information, consult our guide on the drink package options for major cruise lines .

Bundle pricing

For additional savings, look into bundle pricing that includes specialty dining, Wi-Fi, photos and more. Purchasing them together may be more cost-effective. For example, Holland America offers the "Have It All" package, which encompasses a $100 shore excursion credit, the Signature Beverage Package (including the service charge), one evening of specialty dining and the Surf Wi-Fi package for a six- to nine-day cruise. If you're sailing for 10 to 20 days or even longer, the benefits increase. The line estimates savings of 50% when you purchase this bundle.

While these packages may not always work out in your favor, you'll at least know what your dining, imbibing, excursions, Wi-Fi and even additional activities on the cruise will cost.

Tips on Trips and Expert Picks Newsletter

Travel tips, vacation ideas and more to make your next vacation stellar.

Sign up to receive the latest updates from U.S News & World Report and our trusted partners and sponsors. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy .

Additional costs on a cruise ship

Cruisers will also incur additional fees from excursions, fitness classes, spa treatments, access to thermal spa rooms, babysitting services, ship tours, wine tastings, cocktail demonstrations, cooking classes, laundry services, and some entertainment venues and activities on the ship. Examples include Norwegian's racetrack, Viva Speedway; high-tech attractions like the Robotron thrill ride and the XD cinema on MSC Seascape ; and Carnival's first roller coaster at sea, BOLT.

See some of the more popular added costs you'll want to consider below.

Wi-Fi access

If you need Wi-Fi during the cruise, that's another cost to factor into the total price. Here are two examples of pricing for internet plans for two cruise lines.

Carnival offers three options for Wi-Fi, using Starlink. The basic Social Wi-Fi Plan gives you access to certain social media channels like Facebook Messenger, Instagram, Twitter, WhatsApp and more, starting at about $15 per person per day. The cost increases to roughly $20 per person per day with the Value Wi-Fi Plan. This option gives you access to your email and to sites for weather, news, finance and more. It does not support Skype or music and video streaming services like Spotify and Netflix during your cruise.

The last option, Carnival's Premium Wi-Fi Plan, starts at around $19 per person per day and offers speeds up to three times faster than the Value plan. With this plan you can make Zoom calls and use Skype. For all three of these plans, you can save 15% off the total price if you book in advance of your trip.

Celebrity also uses Starlink. The line's "All Included" fare includes basic internet and a classic drink package, which the line says can save you potentially hundreds of dollars. If you don't book that fare, Wi-Fi plans range from around $20 per day for basic service to premium Wi-Fi at $35 per day.

- Shore excursions

If you're traveling to far-flung or new destinations, you'll want to book shore excursions. Cruise lines recommend that you book excursions directly with them rather than hiring an independent tour company or operator, but it can be more expensive to book tours through the cruise line.

However, if you experienced a delay on an independent tour and couldn't get back to the ship on time, there's a chance you could get left behind if you're not on a ship-sponsored tour. If you decide to go with a private tour guide, be sure to book an excursion that will allow you to arrive back at the ship with plenty of time to spare before the vessel departs for the next destination. Most tour operators in busy cruise ports work with the cruise ship schedules all the time, so you should be fine with a reputable independent guide.

Some trips last an entire day or are once-in-a-lifetime adventures like dog-sledding on a glacier in Alaska or taking a helicopter ride over the active volcanoes and waterfalls in Iceland. These types of excursions can be costly, ranging anywhere from hundreds to even thousands of dollars. If these types of experiences are not in your budget, look for historic walking or panoramic driving tours. These activities are shorter in duration and typically the least expensive tours available on the cruise. Many of these types of tours will cost less than $100. And, of course, there are always other options available that range between the lower and higher price range of excursions.

If your ship is docked directly in the town or city, then you'll be able to explore off the ship on your own for free. Some cruise lines also offer complimentary shuttle buses into town or a round-trip ride for a nominal fee if it's not within walking distance of the ship. That's another less expensive option for you to sightsee, shop or grab lunch in town.

Transportation

Transportation is another expense that's often overlooked in the total cost of a cruise. Consider if you'll be driving or flying to the cruise port. If you're driving, you'll have to pay for gas and parking at the port – and maybe a hotel the night before the cruise, depending on when you arrive and when your ship is scheduled to set sail. Don't forget the meals or beverages you'll purchase on the way.

If you're flying to the port, especially on a long-distance flight, it's best to come in a day early. In that case, you'll also have to pay for a hotel, transfers from the airport to the hotel and then a transfer (private hire, Uber or cab) to the ship's terminal. There will also be meals to budget for while you're in town before the cruise and a ride back to the airport after the cruise.

Souvenirs or forgotten items

Don't forget to account for purchases on the ship. Items that you forgot to bring from home will be more expensive on board. It's also easy to run up the bill when buying souvenirs for yourself or the kids. It's a good idea to periodically check your bill online or with guest services to see the current balance. You can keep a running tab of what you've billed to your stateroom – and also make sure that the charges are correct.

Cruise pricing checklist

To sum it up, here's a checklist of major items that will help you to compare costs across cruise lines and tally up the total cost of a cruise:

- Base cruise price

- Taxes, fees, gratuities and port expenses

- Specialty dining

- Food and beverage packages

- Optional activities (such as spa treatments or extra-fee entertainment on the ship)

- Miscellaneous expenses (such as meals and beverages ashore)

- Air or ground travel to the port

- Hotel prior to embarking

If you don't want to budget for all the individual expenses related to a cruise – and you don't need the over-the-top entertainment of a larger cruise ship – consider booking a mostly all-inclusive or fully all-inclusive cruise with a luxury cruise line . These cruise lines include almost everything in your cruise fare.

Mostly all-inclusive cruises

One option for a mostly all-inclusive cruise is Viking Ocean Cruises . The line's 12 all-veranda ocean-going vessels accommodate between 930 to 998 guests based on double occupancy – and all of Viking's ships feature the same categories of staterooms and suites, dining, lounges, and entertainment venues across the fleet. The ships offer an immersive cultural curriculum on board with regional dishes, destination performances and enrichment lectures.

Viking's fares include veranda accommodations, port taxes and fees, free Wi-Fi, access to the spa and fitness center, 24-hour room service, ground transportation (if you book airfare with Viking), and one complimentary excursion in each port. You'll also have alternative dining options at no extra charge, plus free beer, wine and soft drinks with lunch and dinner on board the ship. Specialty coffees, teas and bottled water are available 24 hours a day at no extra charge.

If you like to have an aperitif before your evening meal or an after-dinner cocktail, those beverages will be at an additional cost. You'll also need to budget for any optional shore excursions that are not included in the fare.

Keep in mind that Viking is an adults-only cruise line , so children younger than 18 are not permitted.

All-inclusive cruises

Regent Seven Seas, Silversea Cruises and Seabourn Cruise Line boast all-inclusive luxury experiences with shipwide amenities such as ocean-facing suites, butlers, premium spirits, fully stocked in-suite bars, no tipping and complimentary dining at world-class restaurants.

Additional perks with Regent Seven Seas include complimentary unlimited shore excursions, free two- or three-night land programs, a free one-night hotel stay before the cruise departure, transfers from the airport to the ship, and business class or economy airfare (depending on the destination).

Silversea offers door-to-door arrangements where everything is handled by the cruise line. You can also opt for a port-to-port all-inclusive rate if you prefer to make your own travel arrangements. If you're on one of the cruise line's expedition cruises, fares will include a pre- or post-cruise hotel stay. All door-to-door and port-to-port Silversea fares cover a selection of complimentary shore excursions in each port.

If you're interested in an even smaller ship – and are sailing to the Caribbean or Mediterranean – SeaDream Yacht Club features an intimate luxury experience on its two 56-stateroom yachts. The fares include top-notch cuisine, an open bar, gratuities, complimentary daily yoga, access to water sports and movies under the stars.

How much does a luxury cruise cost for two?

If you want to go on a mostly adults-only luxury ship, what can you expect to pay for two people? This will depend on the ship, where you want to sail and for how long – and what amenities are included in the fare.

For a seven-night cruise in the Caribbean in December 2024 round-trip from Miami with Regent Seven Seas, an all-inclusive cruise fare with suite accommodations starts at $7,398 ($3,699 per person). There are additional perks and savings available, depending on the level of accommodations you book and if you combine this cruise with another voyage. You can also check with a travel agent specializing in cruises to see if they have access to other promotions.

For a Silversea cruise in December 2025 that sails round-trip from Bridgetown, Barbados, the all-inclusive port-to-port cruise fare starts at $9,800 for two people ($4,900 per person) in suite accommodations. Contact a travel agent before booking to see if they can offer upgrades or additional amenities.

While the price tag may seem high, compare the total cost with the base fare on a larger cruise ship and then add in all the extras.

See the top cruises on GoToSea .

The bottom line

The average cost of a cruise is all over the map – and there are many variables to consider. Hiring a cruise specialist to navigate the rough waters may be your best option. Cruise specialists are also privy to special deals and incentives that you may not be able to access on your own. Travel agents can also advise you of promotions that may include free specialty dining, beverage packages, complimentary Wi-Fi, shore excursions, discounts on solo and family travel, and more. This approach will save you the hassle of searching online or calling the individual cruise companies to check on what specials are available.

If you'd rather have one price with everything included so there's little room for surprises at the end of the trip, consider a mostly or fully all-inclusive cruise fare. If you don't need waterslides for the kids, big Broadway shows and high-tech entertainment, a cruise on a small luxury line may suit you well.

When doing the math and comparing the costs, you might be surprised how similar in price cruising with a larger mass market cruise line and a smaller luxury line can be. In the end, your decision will come down to your personal preferences and what you value most for your cruise vacation.

Why Trust U.S. News Travel

Gwen Pratesi has been an avid cruiser since her early 20s. She has sailed to destinations around the globe on nearly every type of cruise ship built, including the newest megaships, luxury yachts, expedition vessels and traditional masted sailing ships. Cruising is one of her favorite ways to travel and she hopes to book an extended cruise to see the rest of the world someday soon. She covers the travel and culinary industries for major publications, including U.S. News & World Report.

You might also be interested in:

- Cruise Packing List: Essentials for Your Cruise

- How Much Does an Alaska Cruise Cost?

- Royal Caribbean vs. Carnival: Which Is Right for You?

- The Top Cruise Insurance Plans

- Is Travel Insurance Worth It?

Cheap Tropical Vacations

Tags: Travel , Cruises

World's Best Places To Visit

- # 1 South Island, New Zealand

- # 4 Bora Bora

If you make a purchase from our site, we may earn a commission. This does not affect the quality or independence of our editorial content.

You May Also Like

The best whale watching in cape cod.

Lyn Mettler April 24, 2024

Best Whale Watching Tours in Maine

Marisa Méndez April 23, 2024

The Best Wineries in Napa Valley

April 23, 2024

The Best East Coast Beaches

April 19, 2024

The Best Luggage Brands

Rachael Hood April 17, 2024

The Best Carry-on Luggage

Erin Evans , Rachael Hood , Catriona Kendall , Amanda Norcross and Leilani Osmundson April 17, 2024

The Best Hard-sided Luggage Picks

The Best Yellowstone National Park Tours

John Rodwan April 17, 2024

The Best Rome Colosseum Tours

Laura Itzkowitz April 17, 2024

Best Alaska Tours

Lyn Mettler April 16, 2024

- Forecasting

8 comments

Trip Generation Review: Multifamily Housing Land Use

By Mike Spack

May 1, 2018

By Max Moreland, PE

In the current 10 th edition of ITE’s Trip Generation Manual, the categorization for a number of land uses has changed from previous editions. One of those changes is for multi-family housing. I thought I would take a closer look at the new ITE multi-family housing land uses to see how it compares to local data we have collected.

In previous versions of ITE’s Trip Generation manual, apartments and condominiums/townhomes were separate from one another and the classification is further broken into various classifications such as height, rental versus owner and luxury versus standard. In the 10 th edition, apartments and condominiums/townhomes have been combined under the same umbrella of multifamily housing.

Multifamily housing in the ITE Trip Generation Manual is now broken up into:

- #220 – Multifamily Housing (Low-Rise) – containing one or two floors

- #221 – Multifamily Housing (Mid-Rise) – containing three to ten floors

- #222 – Multifamily Housing (High-Rise) – containing more than ten floors

At TripGeneration.org, we also collected data at multifamily housing locations for the last few years. Our data has been categorized as either Townhomes or Apartments. All the townhomes we collected data at have either one or two floors and all the apartments we have collected data at have between three and ten floors.

Comparing the data we collected locally in the Minneapolis, Minnesota region for TripGeneration.org against the ITE data, our Townhome data fits neatly in the Multifamily Housing (Low-Rise) category and our Apartment data fits neatly in the Multifamily Housing (Mid-Rise) category.

The following charts compare our local Townhome and Apartment data against the three new ITE Multifamily categories.

As shown in the charts, our local rates for Townhomes are in line with Multifamily Housing (Low-Rise) in the a.m. and p.m. peak hours, but the local rates are lower for the daily trips. For Apartments, our local data is in line with Multifamily Housing (Mid-Rise) in the p.m. peak hour, but the local rates are lower for the a.m. peak hour and daily trips.

[Download Free Trip Generation Data – TripGeneration.org]

While the locally collected data does not line up 100% with the ITE data, the trend is still the same between the two: as the buildings get taller, the trips per unit get smaller. The reasons behind this are multiple and varied and would take another blog post to get into, so rather than get into that, I will repeat myself because it is fun to rhyme:

As the buildings get taller, the trips per unit get smaller.

Of course, there are many factors that impact trip generation data for each of the new land uses, which is why we encourage everyone to collect trip generation for there region when preparing traffic studies.

What’s your experience? How does your regional data compare to the numbers in ITE’s Trip Generation Manual? Add your thoughts in the comments below.

Free Trip Generation Data at TripGeneration.org

At Spack Consulting , we collect local data on many, if not most, of our traffic studies. And we make this professionally collected data for free. Our document includes over 13,500 hours of data and allows you to see the full 24-hour data collected. Go to TripGeneration.org to download the raw data we’ve collected. Check out our free parking generation data as well!

I would be interested in your opinion regarding the new ITE category of high-rise residential with ground floor commercial. As an initial observation, it appears that in this new category, the inclusion of commercial does not result in a higher number of trips (or at least not significantly higher) compared to a similar high-rise without commercial.

I am also interested in the inclusion of this in the ITE manual as it is something that is becoming more and more common here in Minnesota. Comparing the data, you are correct that at the high-rise buildings the addition of ground floor commercial does not appear to have much impact on vehicle trips. However, there does seem to be more of an increase on vehicle trips for the mid-rise buildings. For both mid-rise and high-rise buildings, the addition of ground floor commercial causes an increase in person trips.

Definitely something that could use more looking into.

In the locations where you collected local counts, what do you expect the percentage of non-vehicle modes accessing those sites? Are they in areas that are well connected to transit, bike routes, etc.?

We have a large range of areas in the dataset, so there is a range of non-vehicle trips being made at the sites.

Gents- Do you have any data on trip generation for short term vacation rentals STVR)? Interested in seeing how single family or multi-family low-rise would compare to STVR and what the best way to compare would be by bedroom or unit?

Sorry – we don’t have data on short term rentals such as AirBNB. My hunch is that it can vary wildly based on context (heavy rental car area or no rental car area). Mike

Are your trips one way or round trip? Please include units in your work.

A trip by definition one way. Round trip equals two trips.

My mission is to help traffic engineers, transportation planners, and other transportation professionals improve our world.

Get these blog posts sent to your email! Sign up below.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

Get our information in your Inbox!

Sign up below to stay informed

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

City Pair Program (CPP)

The OMB-designated Best-in-Class City Pair Program procures and manages discounted air passenger transportation services for federal government travelers. At its inception in 1980 this service covered only 11 markets, and now covers over 13,000 markets. Today, CPP offers four different contract fares.

Fare finder

- Search for contract fares

Note: All fares are listed one-way and are valid in either direction. Disclaimer - taxes and fees may apply to the final price

Taxes and fees may apply to the final price

Your agency’s authorized travel management system will show the final price, excluding baggage fees. Commercial baggage fees can be found on the Airline information page.

Domestic fares include all existing Federal, State, and local taxes, as well as airport maintenance fees and other administrative fees. Domestic fares do not include fees such as passenger facility charges, segment fees, and passenger security service fees.

International

International fares do not include taxes and fees, but include fuel surcharge fees.

Note for international fares: City codes, such as Washington (WAS), are used for international routes.

Federal travelers should use their authorized travel management system when booking airfare.

- E-Gov Travel Service for civilian agencies.

- Defense Travel System for the Department of Defense.

If these services are not fully implemented, travelers should use these links:

- Travel Management Center for civilian agencies.

- Defense Travel Management Office for the Department of Defense.

Contract Awards CSV

Download the FY24 City Pair Contract Awards [CSV - 1 MB] to have them available offline. The file updates after 11:59 pm Eastern Time on standard business days. Previous fiscal year contract awards can be found on the Fiscal documents and information page . To read more about the contract award highlights, please see our Award highlights .

Instructions for the FY24 CSV file

All fares are listed one-way and are valid in either direction. In the CSV file, Origin and Destination are in alphabetical order regardless of travel direction. The Origin is the airport code (domestic travel) or city code (international travel) that comes first alphabetically and the Destination is the airport or city code that comes second alphabetically.

For example, you are traveling from Washington, DC to London, England. You know the city codes are WAS and LON respectively. The city code LON comes first alphabetically and WAS comes second alphabetically. To find the contract fares, you filter:

City Pair Program benefits and info

CPP offers government travelers extra features and flexibility when planning official travel, in addition to maintaining deep program discounts. These include:

- Fully refundable tickets.

- No advance purchase required.

- No change fees or cancelation penalties.

- Stable prices which enables accurate travel budgeting.

- No blackout dates.

- Fares priced on one-way routes, permitting agencies to plan multiple destinations.

CPP is a mandatory use, government-wide program, designated as a Best-In-Class procurement by OMB. The program delivers best value airfares, and ensures federal agencies effectively and efficiently meet their mission.

CPP saves the federal government time and money by maintaining one government-wide air program. At the acquisition level CPP delivers data analysis, compliance, and uses strategic sourcing to optimize its service.

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

Travel could be a good deal this summer. Here's when plane ticket prices will peak.

Spring is springing, and according to Hopper, it’s time to start thinking about your summer vacation plans.

New data from the online booking site shows some favorable trends for travelers in the next few months, including slightly lower airfares compared with 2023 and hotel and car rental prices that are more or less flat year-over-year.

Here’s what you need to know as you prepare to book, whether you’re looking for a domestic getaway or go on an overseas adventure. It’s also not too late to take advantage of deals on some last-minute trips.

How much are spring and summer plane tickets?

According to Hopper, the best deals right now are on domestic airline tickets. Round-trip flights within the U.S. are averaging $290 in April, but prices are expected to rise in the months ahead.

Hopper’s data shows prices for domestic flights will peak between May and June at $315 on average, then will gradually fall through the summer, reaching a low of $264 on average in September.

On a call with investors discussing first-quarter earnings Wednesday, Delta Air Lines CEO Ed Bastian said summer travel demand has been pushed forward in recent years in part because schools, especially in the South, are finishing their summer breaks earlier in the year.

Is airport Wi-Fi safe to use? How to keep your information safe while traveling.

Short vs. long cruises: Which one is right for you? Here's how they compare.

This summer also will be a good time to travel internationally; Hopper data shows fares to most destinations abroad are down compared with last year.

“Airfare to international destinations continues to improve following two years of bloated prices due to quickly recovering demand, high fuel prices and supply constraints. Airfare to most major regions of the world has dropped compared to last year with the exception of trips to Canada,” Hayley Berg, Hopper’s chief economist, said in the report. “International fares remain higher than pre-pandemic levels to most regions, as higher fuel prices persist and airlines continue to rebuild capacity to many regions.”

How much will a hotel room for the spring and summer cost?

Hotel prices remain mostly flat compared with the same time last year. Rooms in the U.S. are averaging $206 a night; better deals are available in some trending international destinations like Osaka, Japan, and Istanbul, Turkey.

According to Hopper, Las Vegas, New York and Chicago remain popular destinations in the U.S.

Will car rental prices rise this summer?

Car rental prices also haven’t increased much since last year and average $42 a day, according to Hopper.

The report shows most travelers rent a car for about four days, and warm-weather destinations like Orlando and Los Angeles remain popular pickup points.

Zach Wichter is a travel reporter for USA TODAY based in New York. You can reach him at [email protected].

An official website of the United States government Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

2023 Annual Average Domestic Air Fares Decreases from 2022

BTS 18-24

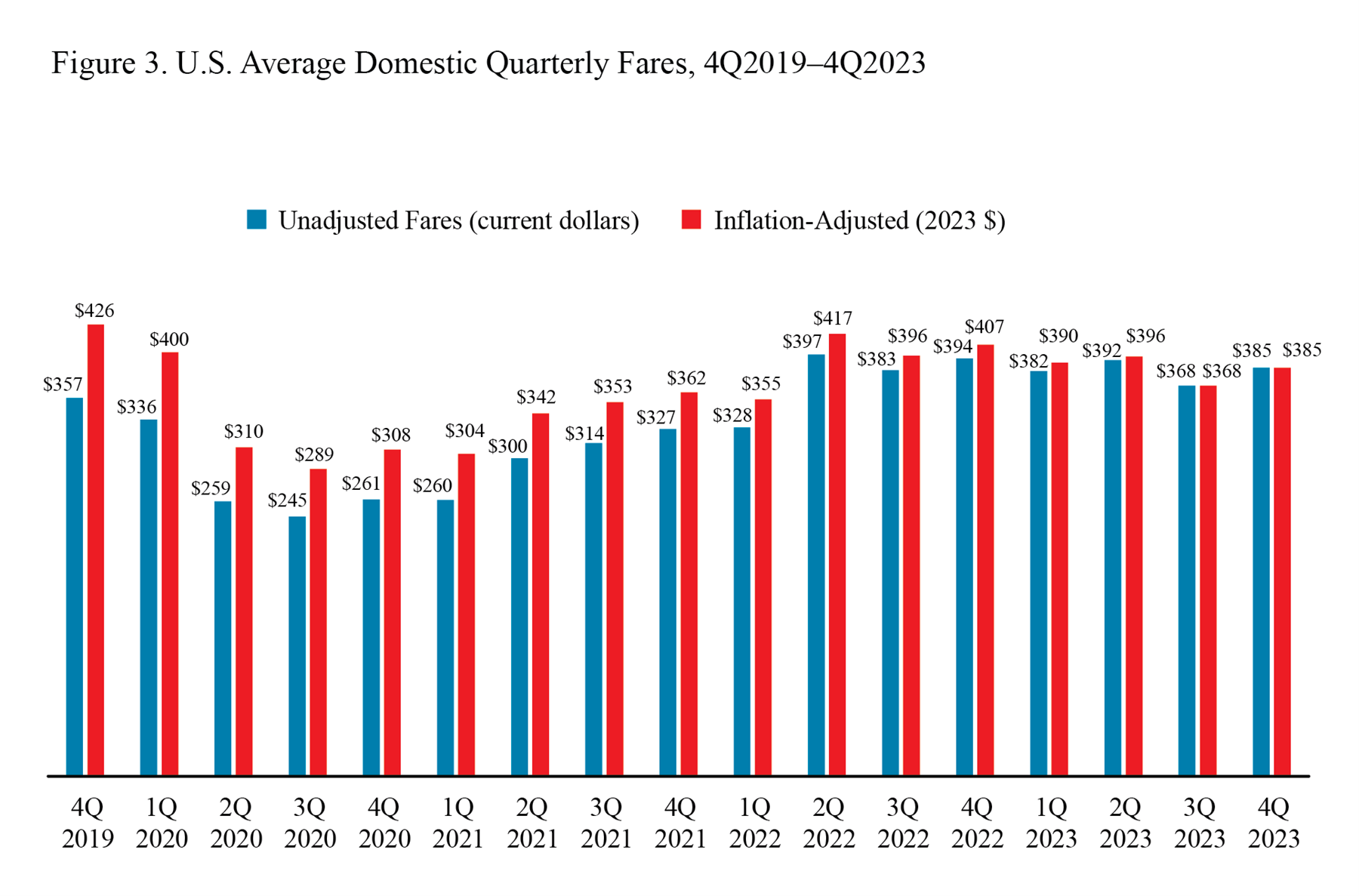

Fourth Quarter 2023 Fares Increase 4.6%, Adjusted for Inflation, from Previous Quarter

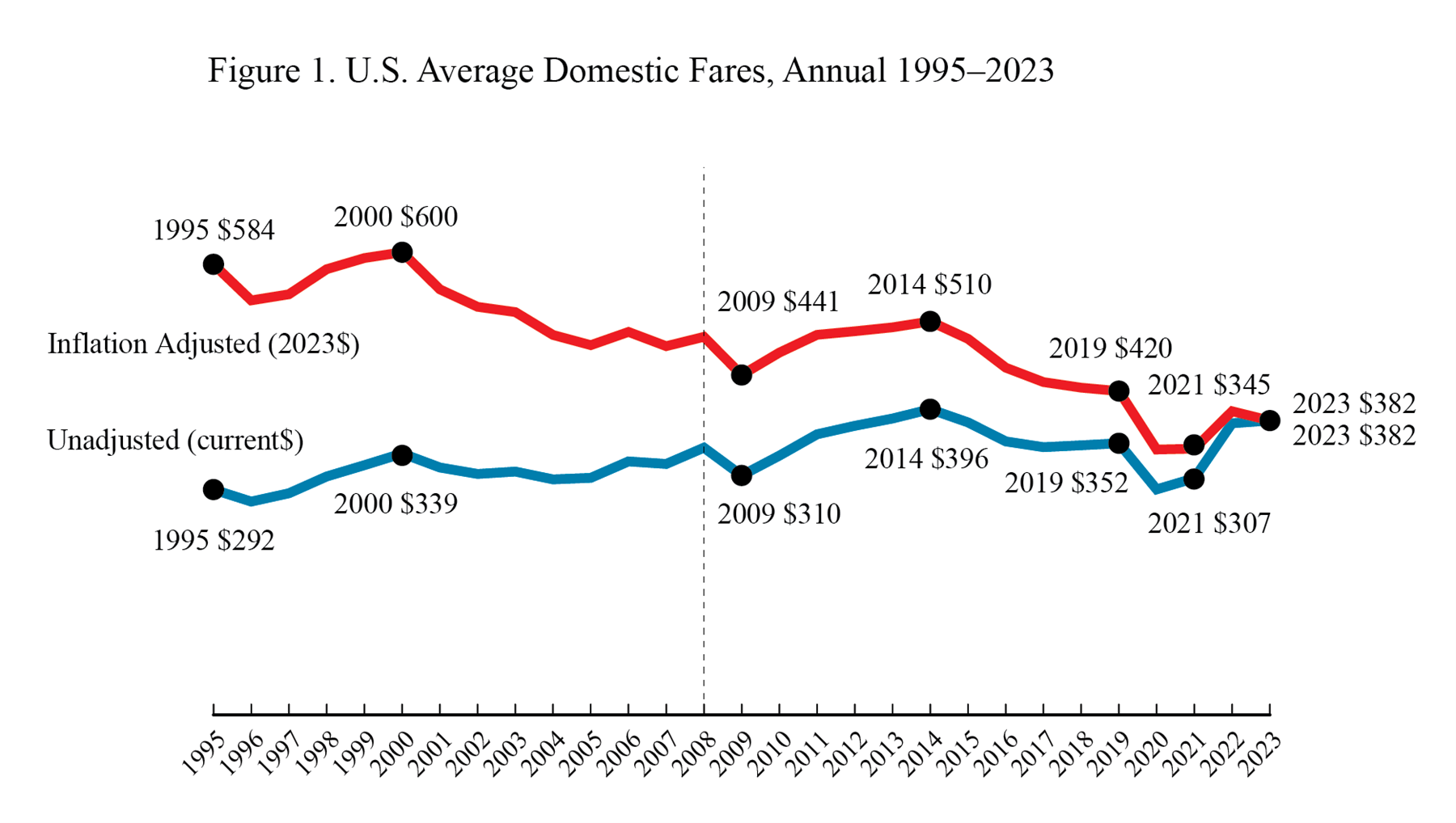

The 2023 annual average domestic itinerary air fare of $382 decreased 3.1% from the 2022 inflation-adjusted annual fare of $394.

Annual Air Fares

Inflation-adjusted Annual 2023 fare: $382 All years: Down 36.4% from the highest fare for any year, $600 in 2000 Start of BTS records in 1995: Down 34.7% from 1995 ($584) Recent high: Down 10.1% from 2018 ($424)

Unadjusted Annual 2023 fare: $382 From previous year: Up 0.9% from 2022 ($378) All years: Down 3.8% from the highest fare for any year, $396 in 2014 Start of BTS records in 1995: Up 30.6% ($292) (compared to 99.9% consumer price index increase) Recent low: Up 30.54% from 2020 ($292)

Fare calculations by BTS Itinerary Fares: Round-trips but include one-ways if no return is purchased. Breakout of trip types: one-way, 39% ($274); round-trip: 61%, ($466).

Based on a random sample of 10% of tickets. Total ticket value: The price charged by airlines at time of ticket purchase. Included: All fees and charges levied by an air carrier required for the passenger to board the aircraft. Also, additional taxes and fees levied by an outside entity at time of ticket purchase. Not included: Fees for optional services, such as baggage fees.

Fourth Quarter 2022 Air Fares

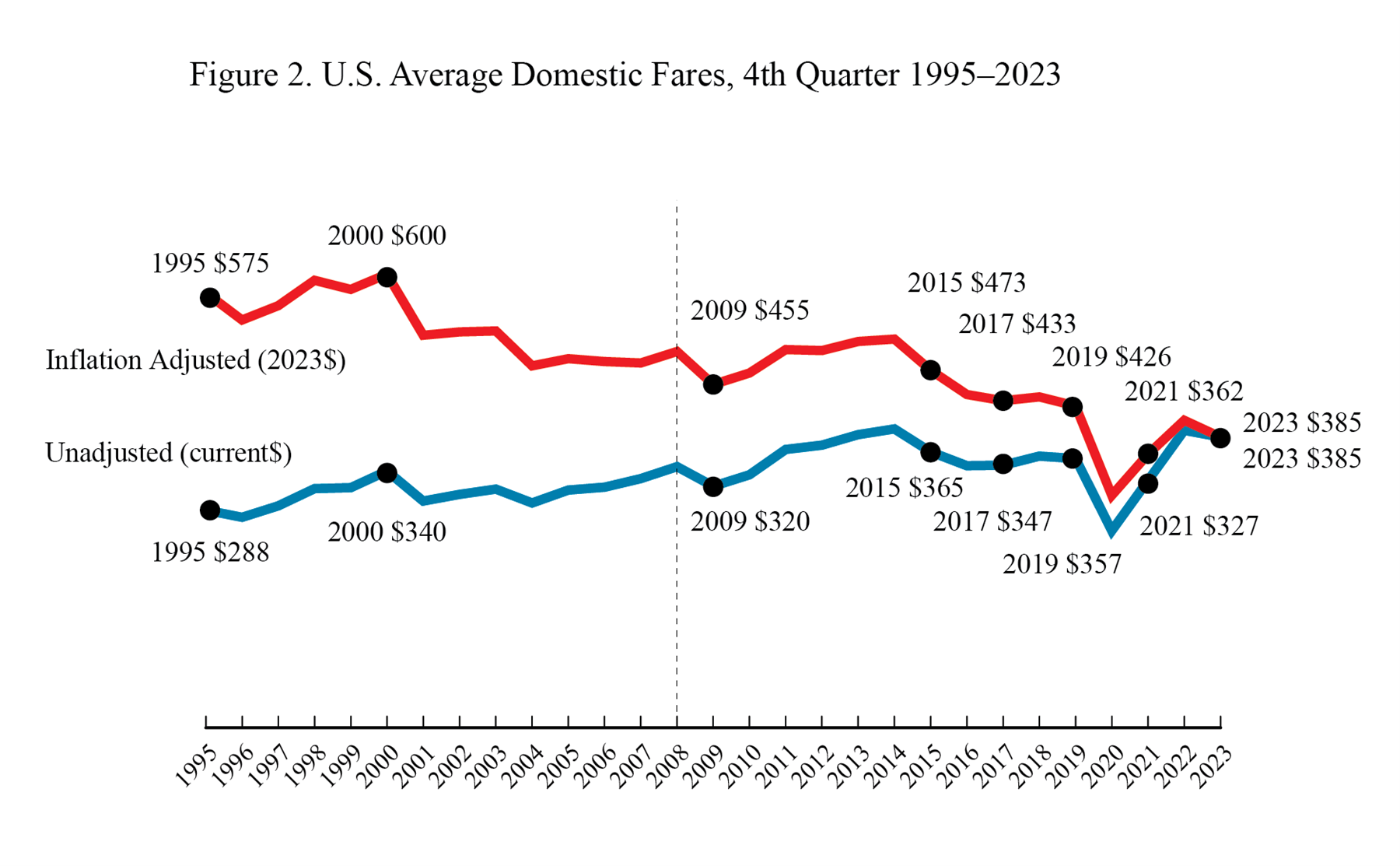

The average U.S. domestic air fare in the fourth quarter of 2023 was $385, increasing 4.6% from an inflation-adjusted third quarter 2023 fare of $368. Adjusted for inflation (constant 2023 dollars) the average 4Q 2023 air fare was:

- Up 6.4% from 4Q 2021 ($361)

- Up 4.6% from 3Q 2023 ($368)

- Down 9.6% from 4Q 2019 ($426)

Itinerary Fares: Round-trips, but includes one-way tickets if no return is purchased. Breakout of trip types: one-way, 39% ($274); round-trip, 61% ($468).

Inflation-Adjusted Average Air Fares Fourth Quarter 2023 fare: $385 Compared to all fourth quarters: Down 35.9% from the highest 4Q fare, $600 in 2000. Compared to all quarters: Down 37.8% from the highest fare for any quarter, $619 in 1Q 1999. Start of BTS records in 1Q 1995: Down 36.3% ($604). Recent high: Down 1.1% from 2Q 2019 ($428) Recent low: Up 33.0% from 3Q 2020 ($289). All-time low: Up 33.0% from the previous low 3Q 2020 ($289). All-time fourth-quarter low: Up 25.1% from the previous low 4Q 2020 ($307).

Unadjusted Average Air Fares Fourth Quarter 2023 fare: $385 Trend: Up 4.6% from 3Q 2023 ($368) Compared to all fourth quarters: Down 2.7% from the highest 4Q fare, $395 in 2014 Compared to all quarters: Down 4.3% from the highest fare for any quarter, $402 in 2Q 2014 Start of BTS records in 1Q 1995: Up 29.6% ($297) (compared to 100.0% consumer price index increase) Recent low: Up 57.2% from 3Q 2020 ($245) Recent high: Down 3.1% from 2Q 2022 ($397) All-time low: Up 57.2% from 3Q 2020 ($245) All-time fourth-quarter low: Up 47.6% from 4Q 2020 ($261).

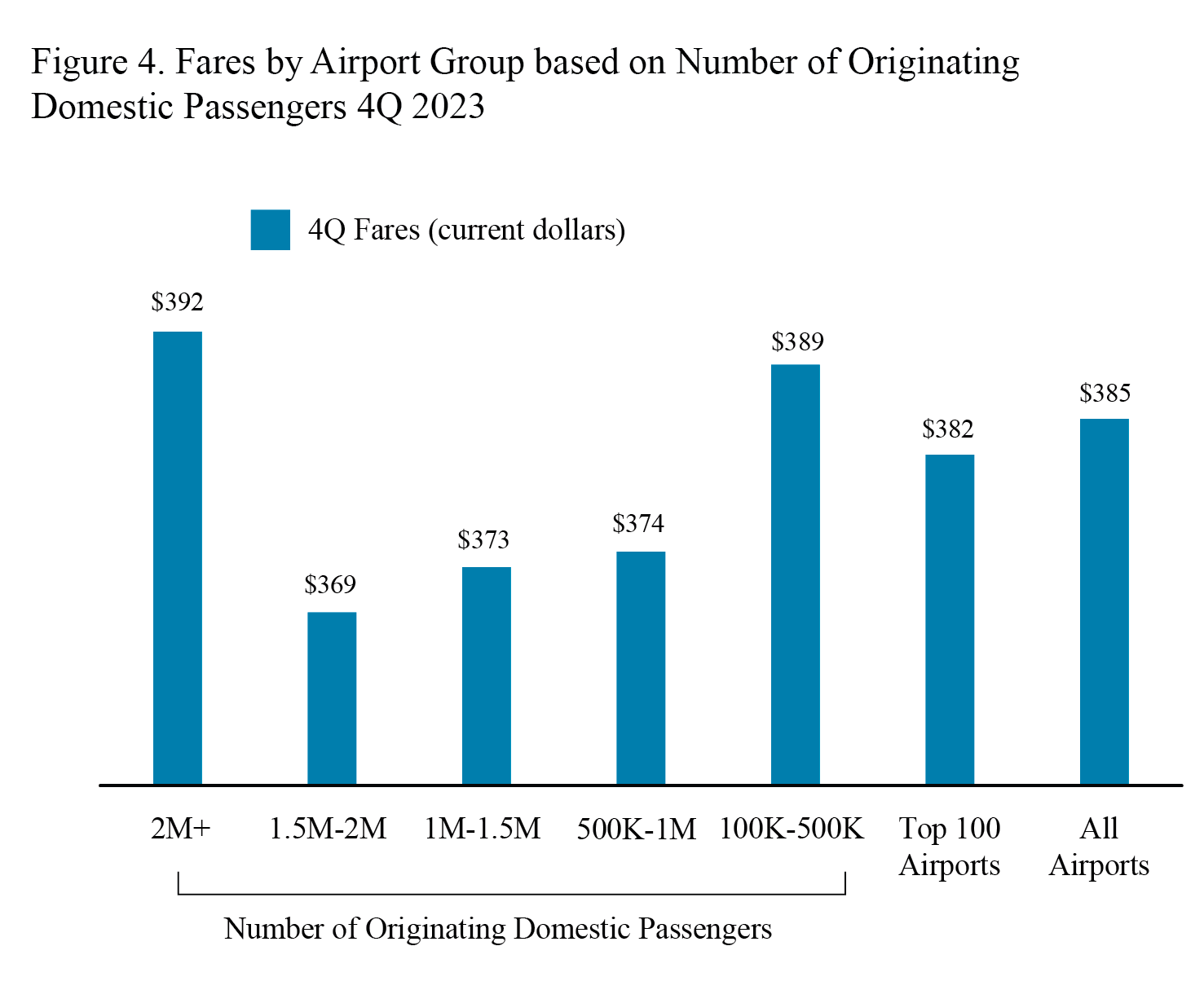

Fares by Airport Group

Fares by airport group:

Highest: 11 airports with 2.0+ million originating passengers ($392). Lowest: 4 airports with 1.5-1.99 million originating passengers ($369).

Additional data: see Top 100 Airports or All Airports . First Quarter 2024 average fare data will be released July 16.

What is the average interest rate for savings accounts?

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate banking products to write unbiased product reviews.

The average savings account in the US has an interest rate of 0.46% APY. But the type of savings account you have has a big impact on your interest rate. Switching your savings from a traditional savings account to a high-yield savings account could help your money grow much quicker.

How we calculate the average national savings interest rate

We use data from the Federal Deposit Insurance Corporation, or FDIC . The FDIC is a government agency that insures money deposited at banks. This way, if your bank unexpectedly shuts down, you won't lose your money.

The FDIC tracks average interest rates paid on savings accounts nationwide and updates its data monthly. The FDIC considers rates paid by credit unions in its data, not just banks.

Savings account interest rates at national banks

Many banks offer savings accounts, but these traditional savings accounts earn fairly low interest rates.

Here are some of the savings account interest rates offered on all balance tiers for the most basic accounts at major banks:

With these low interest rates, it's hard to make money grow, whether it's 0.01% APY (Annual Percentage Yield) or 0.05% APY. But, you don't have to settle for such low interest rates.

Interest rates for linked checking and savings accounts

Some banks will pay you a higher rate on your savings account if you link it to a certain checking account. Here are some examples:

Keep in mind, sometimes there are additional criteria to earn the relationship savings rate. For example, with Chase, you also have to make five transactions per month from the linked checking account. Most relationship rates still aren't competitive with what you'll earn through an online high-yield savings account. But they could be useful if you know you prefer in-person banking.

Savings account interest rates at online banks

A high-yield savings account could help you grow your money quicker and make your money work harder, without any cost or inconvenience to you. The following are all high-yield savings accounts:

High-yield savings accounts earn multiple times more than a traditional savings account. We're not talking investment returns, here — more like 3.40% APY to 4.25% APY. That's along the lines of the rates you'd see with some CDs , but with the flexibility to access your money when you need it. And, it's still significantly higher than the 0.46% APY average.

Online banks don't have the overhead that brick-and-mortar banks do, allowing them to pass on more money in interest. Based on the account interest rates above, it's easy to tell just how wide the gap is between the interest offered by a traditional savings account and an online, high-yield savings account.

Savings account interest rates at credit unions

Many credit unions pay high interest rates on accounts. In some cases, they pay competitive rates on checking accounts, money market accounts, or CDs, but not on savings accounts. You usually have to open a basic savings account to become a member of a credit union, and those don't always pay impressive rates.