The 5 best cruise travel insurance plans

While smooth sailing will always be the aim, cruising today is often about expecting the unexpected. You can prepare yourself by taking out an insurance policy that can compensate you when your vacation at sea does not go as planned.

Need to cancel your trip last minute due to an accident or illness? Did your bags get delayed or lost? Do you need to exit the sailing early to take care of an emergency back home? Was there a mechanical issue with the ship that required a change of itinerary, causing you to miss your flight home?

For cruise news, reviews and tips, sign up for TPG's cruise newsletter .

All of these contingencies and more can be covered; it's just a matter of finding the best insurance policy for you. Here's how to evaluate which plan is the right choice for you, as well as five of the best cruise travel insurance plans available.

The best cruise travel insurance plan will always be a 3rd-party option

No plan will meet the needs of all cruise travelers, so there is little benefit to booking the one insurance option recommended by your cruise line during the booking process other than convenience.

You'll often find more affordable rates, comprehensive coverage and favorable terms utilizing third-party insurance companies. You'll have a wide choice of plans, so you can pick the one that works the best for your situation.

If you're wondering where the best place is to purchase third-party insurance, "No one comparison site is getting preferential deals," says Stan Sandberg, co-founder of TravelInsurance.com . "Insurance carriers' rates are the same anywhere." However, these insurance comparison sites can help you directly compare the pricing and coverage of multiple policies by a range of preferred providers.

Look for the following coverage options and compare coverage amounts to determine which third-party plan is the best cruise insurance option for your upcoming trip.

Related: Cruise travel insurance: What it covers and why you need it

Trip cancellation

You'll want to be reimbursed if an unexpected event forces you to cancel your cruise. Be sure to read the fine print of your policy, detailing which specific reasons for canceling your trip are covered and not covered.

Trip interruption and travel delays

You'll also want to be covered if issues occur after travel begins. It's important to find "a plan that offers trip interruption if something does happen during your trip, along with a plan that offers emergency medical evacuation, coverage for travel delays and missed connection benefits," adds insurance expert Meghan Walch from InsureMyTrip .

Related: What happens if you miss your cruise

COVID-19 contingencies

Walch advises all travelers booking a cruise to consider a plan that includes cancellation coverage for COVID-19. Note that you'll need more than a home test to file a claim. According to Walch, "You'll need a doctor saying that you have been diagnosed with COVID and specify that you are unable to travel."

In addition, look for coverage if you get sick and need to isolate away from home. "Some plans offer additional trip delay coverage, put in place as a result of needing additional or higher limits for instances that might include if the policyholder gets quarantined in a location," Sandberg adds.

Cancel for any reason

A cancel-for-any-reason optional upgrade offers the most flexibility. You can get a refund of up to 75% if you cancel your voyage for reasons not usually covered by travel insurance. However, it adds about 40% to your premium and can only be purchased within a limited window of time after your cruise purchase.

Related: What happens if my cruise line changes my itinerary or ship?

Lost or delayed baggage

Baggage loss insurance covers your luggage if it is lost, damaged or stolen during your trip. In the case that you make it on the cruise and your bags do not, the insurance agency can assist with locating and redirecting the bags to your next port, reimbursing you for items you may need to purchase to get you through your travels while you are without your belongings and covering your losses in the case that the bag is actually gone for good.

Note that certain high-cost items such as electronics, luxury watches and fine jewelry are not always covered by baggage loss insurance. Consider purchasing additional coverage for such items or — better yet — keep those items with you at all times.

Health coverage

Medical coverage is another consideration. "Most domestic health coverage [including Medicare] does not cover travel abroad, so it is important to look at a travel insurance policy that offers medical coverage during your trip, just in case anything happens," says Walch. "If you fall ill or are injured during the trip, it can be pretty expensive – even when going to the ship's onboard medical facility."

Related: How to avoid getting sick on a cruise

Hurricane coverage

Extreme weather and hurricanes are typically not covered if the cruise commences as scheduled, though you might be eligible for trip interruption coverage if weather cancels the cruise or cuts the itinerary short. There are also insurance plans that offer trip reimbursement if a destination on your itinerary is under a National Oceanic and Atmospheric Administration-issued hurricane alert or warning.

How much will cruise travel insurance cost?

Insurance pricing is dependent on the trip cost and the age of the insured travelers. Sandberg estimates that "travelers in their 30s or 40s can ballpark insurance coverage somewhere around 5% to 7% of the trip costs, with rates that can get lower depending on the extent of coverage."

Insurance is a tiered product that gets more expensive as you age. "As you get older, that range can expand to 10% of trip costs," notes Sandberg. "Adding bells and whistles, like 'cancel for any reason' [coverage], rates can rise to 11% to 12% of the cost of your trip."

Related: How cruising newbies waste money on their 1st cruise

5 best cruise travel insurance plans

Following extensive research scouring the fine print, we've selected five of the best cruise insurance plans that will appeal to a variety of seagoing travelers.

All five plans provide coverage for COVID-19-related trip cancellation and interruption.

For the leisure cruiser: TravelSafe Classic Plan

TravelSafe's Classic Plan is the best value all-around for the average cruiser, with superior coverage limits at a fair rate.

This plan's coverage includes an impressive $1 million per person for medical evacuation and a high $2,500 coverage limit for bag loss. You have extra time – 21 days – from your initial deposit to add a cancel-for-any-reason upgrade to your plan. The accident and sickness medical coverage is primary, with coverage up to $100,000.

The policy's $750-maximum trip delay coverage begins after a six-hour delay and includes kennel fees for up to $100 per day, along with coverage for additional meal and accommodation expenses.

For the budget conscious: AXA's Silver Plan

AXA's Silver Plan is the company's entry-level offering, with more value added than most budget insurance options — most notably the company's concierge service. Coverage under this plan includes robust trip cancellation and interruption coverage, both at 100% of the costs, along with $100,000 for emergency medical evacuation.

The plan also offers identity theft assistance in case your wallet or passport gets stolen while traveling, assisting with filing and obtaining police and credit reports, taking inventory of lost or stolen items, and even wiring emergency funds to you when you're really in a bind.

You won't have the option to purchase a cancel-for-any-reason add-on or opt in for a collision damage waiver on this lowest-tier plan.

For the luxury cruise traveler: John Hancock's Gold Plan

John Hancock's Gold Plan offers robust medical evacuation and repatriation coverage up to $1 million per person, ideal for those luxury cruises that rove to the farthest reaches of the globe. The plan has excellent baggage loss coverage at up to $2,500 per person, along with a low three-hour minimum travel delay ($1,000 per person, $200 daily limit) benefit.

Preexisting medical conditions are covered by this policy, though you must purchase your policy within 14 days of your trip deposit.

For increased medical coverage: Seven Corners' RoundTrip Choice Plan

Seven Corners' RoundTrip Choice Plan offers primary medical coverage for emergency accident and sickness medical expenses up to $500,000, while many other plans only offer secondary coverage. The plan's medical evacuation coverage is high at $1 million, and preexisting conditions are covered with a few conditions that apply, namely that you purchase the policy within 20 days of your initial trip payment.

The policy also offers detailed, robust COVID-19 coverage, including reimbursement for medical care if you contract COVID-19 while traveling. Its coverage also includes meals, local transportation and lodging if you're delayed six or more consecutive hours due to quarantining with COVID-19.

Coverage options on the plan may vary slightly depending on which U.S. state you claim as your residence.

For the adventurous cruiser: World Nomads' Explorer Plan

World Nomads is one of the few insurance companies that will cover more than 200 adventure activities on your travels, including scuba diving, skydiving and bungee jumping. The coverage for the long list of activities includes emergency medical expenses while outside the U.S., medical evacuation and repatriation, along with trip interruption.

World Nomads' Explorer Plan also offers $25,000 in coverage for nonmedical emergency evacuation for covered events, such as a natural disaster or political or security situations.

Travelers 70 and older are required to add a "Silver Nomads" policy, offered through TripAssure.

Bottom line

Cruising isn't always a blissful week spent relaxing on the pool deck or snorkeling among multicolored reefs. Mishaps occur, whether it's losing luggage, missing a flight or falling ill.

The best cruise insurance policies are the ones that won't let you sail without a safety net, charging a fraction of your trip expenses in exchange for the peace of mind that there's a plan in place should something go wrong. With a range of pricing and coverage options available, you can feel confident that you can find a policy to suit your travel needs.

Planning a cruise? Start with these stories:

- The 5 most desirable cabin locations on any cruise ship

- A beginners guide to picking a cruise line

- The 8 worst cabin locations on any cruise ship

- The ultimate guide to what to pack for a cruise

- A quick guide to the most popular cruise lines

- 21 tips and tricks that will make your cruise go smoothly

- 15 ways cruisers waste money

- The ultimate guide to choosing a cruise ship cabin

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Best Cruise Insurance in May 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What to look for in cruise insurance

Factors we considered when picking the best cruise insurance companies, an overview of the best cruise insurance, best cruise insurance options, more resources for cruise travel insurance shoppers.

Cruising is back, but many travelers are still reluctant to board ships alongside thousands of other travelers. Cruise insurance has you covered if:

You need to be reimbursed for canceling your trip.

Your flight to the port gets delayed.

You need to pay for medical care if you get sick on board.

You need to fly home in case of an emergency.

Of course, there's much more than just this list that cruise insurance can cover.

No matter the reason you might be looking for coverage, here are some of the best cruise insurance companies available to help bring you peace of mind on your next experience at sea:

World Nomads .

Berkshire Hathaway .

Travelex Insurance Services .

Travel Guard by AIG .

When shopping for cruise insurance, make sure to look for coverage that offers the following:

Trip delay and cancellation.

Medical expenses, including emergency evacuation.

The option to cancel for any reason (including COVID-19).

Adventure activities if you’re planning certain onshore excursions.

Cruise insurance isn’t much different than traditional travel insurance. Any good travel insurance should cover cruises in addition to travel by air or car.

After our analysis, we've determined these are some of the best cruise insurance options available.

» Learn more: The best travel credit cards right now

We used the following factors to choose top insurance providers to highlight:

Specifics of coverage: Including what coverage plans include and whether they offer useful coverage and benefits for cruises specifically.

Amount of coverage: Including the maximum payouts for trip cancellation and trip interruption claims.

Cost: We compared prices to determine average costs across basic plans.

Customizability: We checked to see if policies allow users to customize options to suit their specific needs.

» Learn more: The guide to cruise travel insurance

We searched for quotes from several companies for a seven-day trip in February 2023 from the U.S. to Mexico. The traveler was 35 years old, from Georgia, and planned to spend $2,500 total on the whole trip, including airfare.

The average price of each company’s most basic coverage plan was $124. These policies didn't include optional add-ons, such as Cancel for Any Reason coverage or coverage for pre-existing medical conditions .

» Learn more: Should you insure your cruise?

Here’s a closer look at our five recommendations for cruise insurance and what makes them unique.

Allianz Global Assistance

What makes allianz global assistance a top choice for cruise insurance:.

Multiple policies are available for international and domestic travel.

Plans offer trip cancellation and interruption coverage for COVID-19.

Offers emergency medical and transportation.

For our test trip, Allianz Global Assistance’s basic plan cost $106, slightly below average.

World Nomads

What makes world nomads a top choice for cruise insurance:.

Adventure activities like mountain biking and scuba diving are covered, perfect for land-based experienced (though which sports are covered varies from plan to plan).

Offers comprehensive travel insurance plans for domestic and international travel.

Larger-than-average coverage for baggage loss and delays.

For our test trip, World Nomad’s basic plan cost $63, well below average. But the actual trip cost isn’t taken into consideration for trip cancellation and interruption coverage.

Berkshire Hathaway Travel Protection

What makes berkshire hathaway travel protection a top choice for cruise insurance:.

A wide range of comprehensive plans cover cancellation, emergency medical and transportation coverage, and emergency travel assistance.

A cruise-specific plan includes some compensation for cruise disablement and the most emergency medical and evacuation coverage of any of these plans.

There are many plans available, including plans that cover adventure activities.

A Berkshire Hathaway WaveCare cruise-specific plan was $202, quite a bit more than average, but with the most medical evacuation coverage.

Travelex Insurance Services

What makes travelex insurance services a top choice for cruise insurance:.

Three comprehensive plans are available.

Kids-included pricing is available with the Travel Select plan.

There's an option to add accidental death and dismemberment coverage to the basic plan.

The Travel Basic plan from Travelex Insurance Services cost $116 for our sample trip; just below the average for plans listed here.

Travel Guard by AIG

What makes travel guard by aig a top choice for cruise insurance:.

Cancel For Any Reason coverage is available as an optional upgrade on two plans.

A pre-existing condition waiver is also available as an add-on.

Travel Guard by AIG offers a basic Essential plan for $133, just a little higher than average, but adding coverage may raise that price.

Bookmark these resources to help you make smart money moves as you shop for cruise travel insurance.

The best travel insurance companies.

The best credit cards for cruises .

What is travel insurance?

Is travel insurance worth getting?

10 credit cards that provide travel insurance .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Cruise and Hotels

- Disney Cruise

- Insuring Your Disney Cruise Adventure: Discover the Best Travel Insurance Options for a Memorable Journey

Embarking on a Disney Cruise Adventure is an exciting and magical experience that promises unforgettable memories. However, it is essential to consider the importance of travel insurance to protect yourself and your loved ones during the journey. While Disney Cruise Line offers its own insurance options, exploring alternatives can provide you with better coverage and peace of mind. In this guide, we will delve into the best travel insurance options for insuring your Disney Cruise Adventure, ensuring your trip is not only memorable but also worry-free.

The Importance of Travel Insurance for a Disney Cruise Adventure

Before diving into the best travel insurance options for your Disney Cruise Adventure, let’s understand why having coverage is crucial. Travel insurance provides financial protection against unforeseen events that may disrupt or cancel your trip, such as medical emergencies, trip interruptions, lost baggage, or flight delays. With the right insurance, you can enjoy your vacation with confidence, knowing that you are protected.

When it comes to insuring your Disney Cruise Adventure, it’s essential to explore different options to find the best coverage that suits your needs. Let’s dive into the details of the best travel insurance options available, ensuring your journey is not only memorable but also protected every step of the way.

Sources: Travel + Leisure , Forbes , InsureMyTrip

What is the percentage of insurance for Disney Cruise?

When planning your Disney Cruise adventure, it is crucial to consider travel insurance to protect yourself and your investment. The percentage of insurance for Disney Cruise can vary depending on factors such as the duration of your trip, the type of coverage you choose, and the age of the insured individuals. On average, travel insurance for a Disney Cruise can range from 5% to 10% of the total trip cost. It is advisable to explore different insurance options and compare their benefits and coverage limits to ensure a memorable and stress-free journey. To learn more about the best travel insurance options for your Disney Cruise adventure, visit reputable sources like InsureMyTrip.com or TravelInsurance.com.

Does Disney travel insurance cover pre-existing conditions?

When planning a Disney cruise adventure, it is essential to consider travel insurance that covers pre-existing conditions. Disney travel insurance does offer coverage for pre-existing conditions, provided certain conditions are met. It is important to carefully review the policy details to understand the specific terms and limitations. Disney Cruise Line recommends guests to consult with a licensed insurance provider for more information and to ensure that their pre-existing conditions are covered. For a comprehensive guide on the best travel insurance options for a memorable journey, check out Insuring Your Disney Cruise Adventure: Discover the Best Travel Insurance Options for a Memorable Journey.

Can I add Disney cruise insurance later?

Adding Disney cruise insurance later is possible, but it is recommended to purchase it at the time of booking to ensure maximum coverage. Disney Cruise Line offers its own insurance, the Vacation Protection Plan, which provides benefits such as trip cancellation/interruption coverage, medical expenses coverage, and baggage protection. However, it is worth considering third-party insurance options as well, as they may offer more comprehensive coverage and flexibility. When selecting travel insurance, it is important to compare different plans, consider the specific needs of your Disney cruise adventure, and choose the one that best suits your requirements and budget. It is advisable to read the terms and conditions of the policy carefully to understand the coverage limits, exclusions, and claim procedures. For more information on the best travel insurance options for a memorable Disney cruise journey, visit reputable travel insurance websites like InsureMyTrip and Squaremouth.

Can you book travel insurance after booking a cruise?

Booking travel insurance after booking a Disney cruise is indeed possible and highly recommended. While it is ideal to purchase insurance at the time of booking to ensure maximum coverage, it is not too late to protect your investment and secure peace of mind. Many travel insurance providers offer a “post-departure” option that allows you to purchase coverage even after you have booked your cruise. However, it is important to note that certain benefits, such as pre-existing medical conditions coverage, may have restrictions if you wait until after booking. It is crucial to thoroughly review the policy details and consult with a reputable travel insurance provider to understand the available options and limitations. Remember, travel insurance can safeguard you against unforeseen circumstances, such as trip cancellations, medical emergencies, and lost baggage, so don’t overlook the importance of insuring your Disney cruise adventure.

Disney cruise line vacation protection plan worth it

When embarking on a Disney cruise adventure, it is essential to consider the benefits of the Disney Cruise Line Vacation Protection Plan. This comprehensive travel insurance option offers peace of mind and financial protection, ensuring a memorable journey for all. With coverage for trip cancellation, trip interruption, medical emergencies, and more, this plan safeguards against unforeseen circumstances that could disrupt your vacation. Additionally, the plan includes coverage for pre-existing medical conditions, making it a valuable option for individuals with specific health concerns. To learn more about the Disney Cruise Line Vacation Protection Plan and how it can enhance your travel experience, visit the official Disney Cruise Line website [https://disneycruise.disney.go.com/faq/plan/vacation-protection-plan/].

In conclusion, it is essential to consider travel insurance when embarking on a Disney Cruise adventure. The unpredictable nature of travel, coupled with the unique experiences offered by a Disney Cruise, makes it crucial to have adequate coverage in case of unforeseen circumstances.

By understanding the various aspects of travel insurance, such as trip cancellation, trip interruption, medical coverage, and baggage protection, you can make an informed decision that best suits your needs and budget. It is advisable to carefully assess the coverage options provided by different insurance providers, comparing their benefits, exclusions, and limitations.

When selecting a travel insurance policy for your Disney Cruise, it is important to consider reputable insurance companies that specialize in cruise insurance. These companies understand the specific needs and risks associated with cruise vacations, ensuring that you receive the most comprehensive coverage available.

Some trusted sources for researching and purchasing travel insurance include:

1. Travel Insurance Review (https://www.travelinsurancereview.net/): This website provides comprehensive reviews and comparisons of various travel insurance providers. It offers a detailed analysis of policy features, benefits, and prices, helping you make an informed decision.

2. InsureMyTrip (https://www.insuremytrip.com/): InsureMyTrip is a leading online travel insurance comparison site. It allows you to compare policies from different providers, ensuring that you find the most suitable coverage for your Disney Cruise adventure.

3. Squaremouth (https://www.squaremouth.com/): Squaremouth is an online platform that enables you to compare travel insurance policies from different providers. It offers a user-friendly interface and provides transparent information about policy coverage and pricing.

Remember to carefully review the policy terms and conditions, as well as any exclusions or limitations that may apply. It is crucial to understand what is covered and what is not, ensuring that you have the necessary protection in case of emergencies or unexpected events.

Lastly, it is essential to purchase travel insurance as soon as you book your Disney Cruise. Many insurance policies have time-sensitive benefits, such as pre-existing medical condition coverage or cancel for any reason coverage, which may only be available if you purchase the policy within a certain timeframe.

By taking the time to research and select the best travel insurance options for your Disney Cruise adventure, you can have peace of mind knowing that you are protected in case of any unforeseen circumstances. Whether it’s trip cancellation, medical emergencies, or lost luggage, having the right coverage ensures that your journey is memorable for all the right reasons.

So, before you set sail on your Disney Cruise, take the necessary steps to insure your adventure and make the most of your magical journey!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Is Disney travel insurance worth the cost?

- Published: Jun. 05, 2022, 10:10 a.m.

People visit Magic Kingdom Park at Walt Disney World Resort in Lake Buena Vista, Florida, on Friday, April 22, 2022. (AP Photo/Ted Shaffrey) AP

- NerdWallet | special to cleveland.com

A Disney vacation can be a trip of a lifetime. It can also be the most expensive trip of your lifetime.

For many, buying travel insurance should be just as essential as buying a churro as you cruise down Main Street. After all, we’re still in the midst of a pandemic. But that’s not the only reason you might cancel. Maybe you booked a vacation but later lost your job; you might want to delay until you regain a stable income stream. Maybe your kid breaks his leg and you want to rebook when it’s healed.

Trip insurance can be purchased from a dedicated travel insurance company , or you might already have it by holding certain credit cards. Otherwise, you might buy it directly from Disney, which offers insurance as an add-on for vacation packages at its U.S. theme parks.

Is Disney travel insurance worth it, or are there better deals out there?

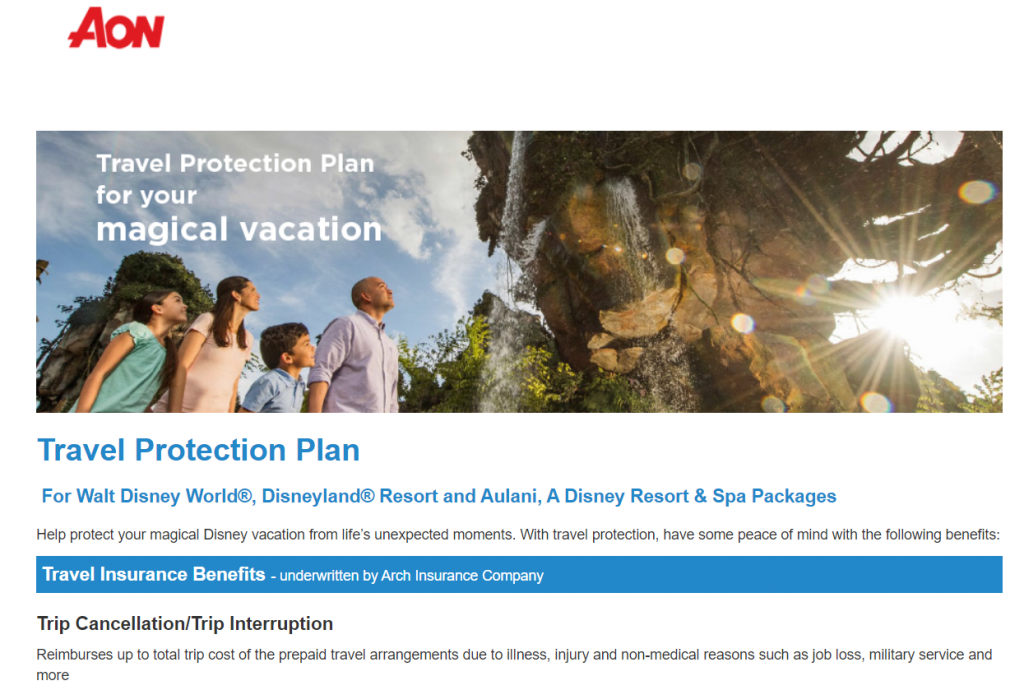

What Disney travel insurance covers

If you’re heading to Walt Disney World in Florida or Disneyland in California and you’ve booked a vacation package (meaning a hotel and theme park tickets), you’re eligible to purchase Disney’s Travel Protection Plan. Underwritten by Arch Insurance Company, it’s available for purchase by U.S. residents and U.S. citizens living abroad who book through Disney’s website.

Exact coverage and benefit availability varies based on where you live, but it typically includes:

- Trip cancellation or interruption: Reimburses prepaid travel up to your total trip cost for covered reasons including illness, injury, job loss or military service.

- Trip delay: Reimburses eligible expenses of up to $200 per day ($600 per trip).

- Baggage loss: Reimburses up to $2,000 for lost, stolen or damaged luggage.

- Bag delay: Reimburses purchases of necessary items if your bags are delayed 12 or more hours.

- Emergency medical expenses: Provides up to $25,000 of coverage if you get ill or injured while traveling.

- Rental car damage: Reimburses repair costs up to $25,000 in the event of collision, theft, damage or vandalism.

How much is Disney travel insurance?

While Disney doesn’t outright state its prices, a NerdWallet analysis of several travel packages found that it costs a flat rate of $82.50 per adult and $6 per child.

Flat-rate travel insurance can be good for ultra-expensive trips, but a bad deal for budget trips.

Take a seven-night stay during the week of Christmas 2022 for a family of four (two adults and two children) at Disney’s opulent Grand Floridian Resort & Spa. Book it alongside six-day theme park tickets with all the add-ons — like water park admission — and you’d pay about $12,000. Adding on travel insurance would cost $177, which is 1.4% of your overall cost.

But say you instead planned a trip at the end of September when the kids are back at school. Two adults could stay at Disney’s All-Star Movies Resort with basic, two-day tickets for just $850. Adding Disney’s insurance would increase your package cost to over $1,000, which is an overall price increase of nearly 20%.

Travel insurance that nets out to just 1.4% of your overall trip cost is a deal, but 20% is far from it. After all, most travel insurance costs between 4% to 8% of the total trip, according to the U.S. Travel Insurance Association.

Reasons to get Disney travel insurance

Flat-rate travel insurance, as Disney offers, is pretty rare. Most policies are priced based on factors including the length of your trip, your destination and the age of the policyholder.

Here’s why it might make a good deal:

Flat-rate pricing is better for more expensive trips: If a costly trip is going to result in equally costly travel insurance, opting for flat-rate pricing is smart. And it’s not just a fancy hotel and Disney theme park tickets with all the add-ons like front-of-the–line passes. Factor in other nonrefundable trip elements, such as airfare and pre-paid rental cars. If you’re flying first class, or you’re a victim to rising rental car prices , then flat rate insurance is especially appealing.

You’re an older adult: Travel insurance costs are based on risk, and insurance is more expensive for older travelers, who are more likely to experience health problems, according to Allianz Travel Insurance.

Because Disney’s only age differentiator is child versus adult, its plan might be cheaper for older adults versus going with an independent insurer.

Many other policies won’t cover theme park tickets: Ever since the COVID-19 pandemic, Disney has required travelers to make advance reservations to enter its U.S. theme parks. The days of buying tickets first thing in the morning are gone. For popular days, you’ll often have to reserve your tickets months in advance. But while most policies cover cruises, airfare, lodging and tours, it’s tough to find policies that cover theme park tickets.

Because of the high cost of Disney tickets (and the fact that most Disney tickets are nontransferable and nonrefundable), you likely want to be covered for those too.

Reasons to skip Disney travel insurance

But most people would be better off skipping Disney insurance. Here are a few reasons why:

Maximum coverage is relatively low: Disney’s insurance will pay out a maximum of $25,000 in the event of accidental death and dismemberment, while it’s common to find coverage of up to $500,000 elsewhere.

Similarly, Disney’s policy covers up to $2,000 for lost baggage. That might be insufficient if you’ve packed a fancy camera. With other insurance policies, coverage of at least $3,000 is common.

And Disney’s rental car coverage only reimburses repair costs of up to $25,000. Especially given rising car prices, that might not be enough for serious accidents.

Coverage is limited: Actually getting reimbursed with your Disney travel insurance can be tricky. Covered events are restricted to narrow situations, including injury, a family member’s death or jury duty. Plus, you must provide proof, like a court order or death certificate. Disney’s insurance also won’t cover pre-existing conditions.

You don’t want to book a Disney hotel: Disney’s insurance is only available to travelers staying at one of Disney’s own (expensive) resorts. If you’re going to Disney World on the cheap , staying off-property is almost always cheaper. Don’t let eligibility to purchase Disney insurance persuade you to book a Disney resort that’s outside of your ideal budget.

Better alternatives to Disney travel insurance

Before your Disney trip, compare travel insurance quotes from multiple providers. And don’t overlook these other types of travel insurance:

Cancel For Any Reason coverage

Perhaps an uptick in COVID-19 cases has you considering travel. Or maybe an injury is preventing you from travel, but you don’t have a doctor’s note to prove it. Given the limited number of reasons that qualify for coverage, you might be better off with “Cancel For Any Reason” coverage, which covers you no matter why you cancel.

Look to your credit card

Some credit cards offer travel insurance as a benefit, as long as you purchased the trip on that card. Given the high cost of travel insurance, this benefit alone can often be worth the often-high annual fees these cards charge.

Check with your bank to see what’s covered. For example, the insurance offered via many Chase credit cards explicitly won’t cover theme park tickets.

When is Disney travel insurance worth it?

Given the uncertainty of travel these days, even a quick weekend getaway should have some degree of insurance. But you might not need to pay for Disney’s travel insurance.

As long as you’re OK with your theme park tickets not being insured, the travel insurance offered through many credit cards is likely a better bet, and might not cost you anything once you hold the card. If you really want to ensure coverage, paying for a Cancel For Any Reason might be even better.

More From NerdWallet

- 6 Common Myths About Travel Insurance and What It Covers

- For New Meat-Free Meal Options, 1 U.S. Airline Hits the Spot

- 2022 Is the Year of All-Inclusive Travel, and Here’s Why

Sally French writes for NerdWallet. Email: [email protected] . Twitter: @SAFmedia.

The article Is Disney Travel Insurance Worth the Cost? originally appeared on NerdWallet.

If you purchase a product or register for an account through a link on our site, we may receive compensation. By using this site, you consent to our User Agreement and agree that your clicks, interactions, and personal information may be collected, recorded, and/or stored by us and social media and other third-party partners in accordance with our Privacy Policy.

Travel Insurance

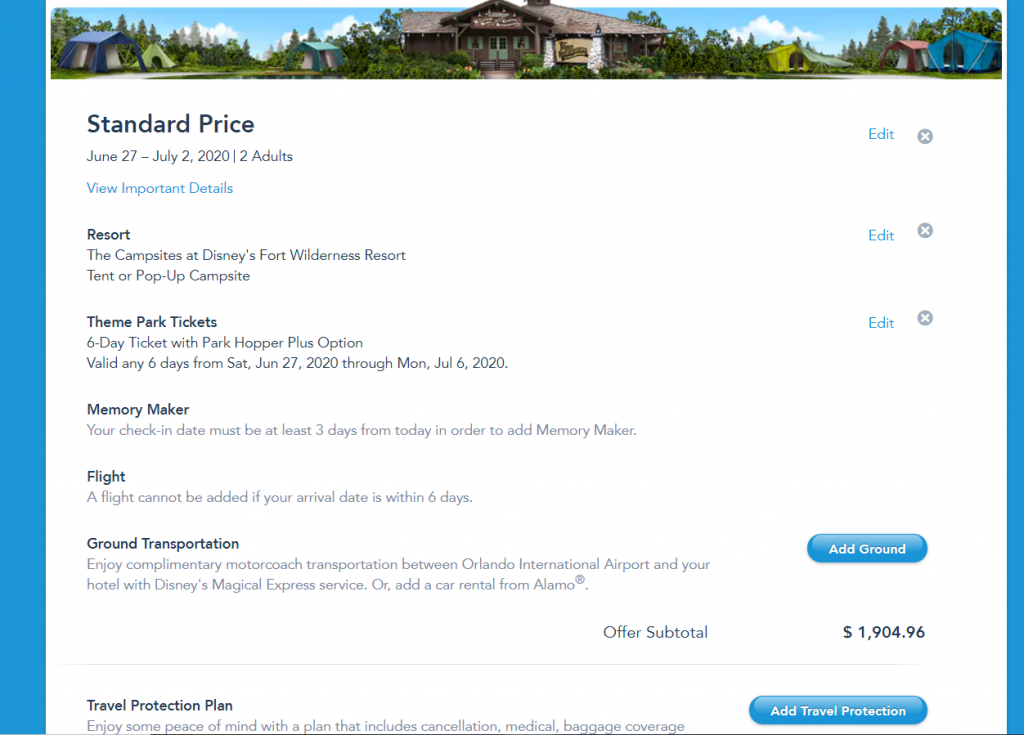

Learn more about how to purchase a travel protection plan for your next disney world resort vacation..

- Go to the bottom of any page of Disneyworld.com and select “My Plans”.

- Select “Change Reservation” next to your package reservation.

- Scroll down to see if your trip is eligible for a Travel Protection Plan—if it is, “Add” will be available; if it is not, “Add” will be unavailable.

- Select “Add” and follow the prompts.

You may also add the Travel Protection Plan to your reservation by calling Walt Disney World Resort at (407) 939-5277. However, due to a high volume of calls, you might experience delays. Guests under 18 years of age must have parent or guardian permission to call.

The Travel Protection Plan is designed for and is available to US residents. Please view your state’s specific terms, conditions and exclusions at www.affinitytravelcert.com/docs/DSP01 .

Travel insurance benefits are underwritten by Arch Insurance Company, with administrative offices in Jersey City, NJ (NAIC #11150), under Policy Form series LTP 2013 and applicable amendatory endorsements. This is a brief overview of the coverages, subject to terms, conditions and exclusions. Coverages may vary in certain states and not all benefits are available in all jurisdictions. Please refer to your certificate of benefits or policy of insurance for detailed terms, conditions and exclusions that apply.

Additional Information - Opens Dialog

Guest Services

- Travel Services

Use CoBrowse to Share Your Screen?

Even as the Disney Cast Member guides you around our site, they will be unable to access or view any files or information on your device or anything you type.

To stop the session, click the X in the screen-sharing window at any time. You can remain on the phone with the Cast Member.

Enter the code provided by the Cast Member and Accept to get started.

Invalid code. Please reenter

Not on the Phone with a Cast Member?

Help Center

How can we help you.

Travel Insurance – Frequently Asked Questions

What are the benefits of the Travel Protection Plan?

The Travel Protection Plan helps protect you and your family for unexpected covered losses from the moment that you step out of your front door until the moment you safely arrive back home. The Travel Protection Plan provides coverage if you cancel or interrupt your Walt Disney World, Disneyland or Aulani, a Disney Resort and Spa package for covered reasons described in the plan such as illness or injury. If you cancel due to a covered reason, the Travel Protection Plan will provide a refund of the prepaid, nonrefundable travel package, including the cost of airfare that is scheduled for travel within 7 days of the travel packages.

The Travel Protection Plan also provides coverage for covered losses while traveling, such as trip interruption, trip and baggage delays, baggage protection and medical expenses protection (including emergency medical transportation). In addition, the Travel Protection Plan contains non-insurance services for 24-hour worldwide emergency assistance (provided by LiveTravel).

To view the terms, conditions and exclusions, visit: www.affinitytravelcert.com/docs/DSP01 .

If you have questions, please call (844) 203-3123 to speak with a representative from Aon Affinity, the program administrator.

To purchase Travel Protection, please select the "Add Travel Protection" option when booking your vacation package . Travel Protection may also be added to your reservation by calling the Disneyland Resort at (714) 520-5050. Guests under 18 years of age must have parent or guardian permission to call.

Travel Protection Plan can be purchased any time prior to final payment for your trip.

Aon Affinity is the brand name for the brokerage and program administration of Affinity Insurance Services, Inc. (TX 13695); (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services; in CA, Aon Affinity Insurance Services, Inc. (CA 0G94493), Aon Direct Insurance Administrators and Berkely Insurance Agency and in NY, AIS Affinity Insurance Agency. Affinity Insurance Services is acting as a Managing General Agent as that term is defined in section 626.015(14) of the Florida Insurance Code. Aon Affinity Contact Information: 900 Stewart Ave #400, Garden City, NY 11530; 800-842-4084; [email protected] . As an MGA we are acting on behalf of our carrier partner, Arch Insurance Company (NAIC #11150). Arch Insurance Contact Information: 844-289-3443.

Travel insurance benefits are underwritten by Arch Insurance Company, with administrative offices in Jersey City, NJ (NAIC #11150) under Policy Form series LTP2013 and applicable amendatory endorsements. Assistance services are provided by the designated travel assistance company listed in your Travel Protection Plan. This is a brief overview of the coverages. Subject to terms, conditions and exclusions. This is a general overview of insurance benefits available. Coverages may vary in certain states and not all benefits are available in all jurisdictions. Please refer to your certificate of benefits or policy of insurance for detailed terms, conditions and exclusions that may apply.

DSP_101619A

Did you find this answer helpful?

Related Questions

Do I need to buy travel protection?

- Search forums

- Disney Cruise Line

- Disney Cruise Line Forum

How much is travel insurance?

- Thread starter DisneyDad1736

- Start date Jan 1, 2024

DisneyDad1736

Mouseketeer.

- Jan 1, 2024

Cruising in a few weeks for 7 days and wondering how much the cost ranges for travel insurance through Disney? Is it really expensive? Thanks

KrzyKtty101

DisneyDad1736 said: Cruising in a few weeks for 7 days and wondering how much the cost ranges for travel insurance through Disney? Is it really expensive? Thanks Click to expand...

The insurance through DCL tends to be “expensive” compared to insurance obtained via a third-party vendor. Look at the coverage levels, door-to-door aspect, if you need pre-existing conditions waiver, etc. The expense of travel insurance is worth it unless you’d be ok losing the amount you paid for the cruise, or worse incurring significant expense of medical bills and travel accommodations in a foreign country.

DIS Veteran

I would buy 3rd party insurance. Disney only covers what you bought with Disney. Other trip insurance can cover flights, and any non refundable parts of your trip. I look for a high medical evacuation coverage as that is a huge expense if you need it. We've been paying under $400 for a family of 4 for $12,000 in trip expenses. I think we used Nationwide the last couple trips. We have not needed to submit any claims so I have no knowledge of that.

Party at Mickey's

I paid $100 for a family of 4 for $6500 via 3rd party

Question anything the facts don't support.

lanejudy said: The expense of travel insurance is worth it unless you’d be ok losing the amount you paid for the cruise, or worse incurring significant expense of medical bills and travel accommodations in a foreign country. Click to expand...

allaboutthemouse

We always get third party through our travel agent . These numbers are fresh on my mind cause I just paid them…coverage for $3000 for a 3-day wish cruise, two adults, covering day before embarking and transfers…$174. I questioned that number because I always remember it being like $50/person, but it’s also age dependent and I am older now lol and like everything I think it has gone up in price….mine was $102 and my son was $72 of that. I believe under 18 is free. Covers up to $100,000 accident, up to $1 million med evac, that is important. We always get insurance for cruises, have had to put in claims on two trips out of like 15 for just a visit to the health center on the ship, each medical visit ended up costing more than the insurance, I would say count on a couple hundred dollars to be seen and treated. You pay upfront, then put in claim and they reimburse. Last claim was last years cruise, and it did take awhile (months) to get reimbursement. But was all easy submitting pictures of the docs online…just remember if you have to go to medical, get as much of a detailed invoice as you can printed out for easy submitting of docs when you get home. We don’t get the insurance for the possible health center visits, though. We get it for that chance of getting hurt off the ship in another country or med evac.

We always get the insurance from DCL , I know it’s expensive but just easier for us. We booked the treasure for 2025, a little over 5800.00 and the insurance cost was $468.16. So I think for DCL they are charging around 8%. My son in law didn’t buy the DCL insurance and thinks he can get it for less than $200.00 by shopping around.

A guy can love Disney and still keep his man card!

Asking and giving out premiums for travel insurance is like asking how much is your homeowners or auto insurance. There are a lot of variables that go into how much travel insurance costs. How much are your coverages? Does it cover for any reason cancelation? How much is your trip? What are the ages of the travelers? These are only a few. Shop around and compare apples to apples. Don't compare to price alone. Circling back to the original question. I couldn't answer for the DCL insurance cost. I don't use DCL to cover my trip. I need coverage that is going to cover my hotel, airfare, and other expenses that are not included in my Disney Cruise booking and what Disney's insurance will not cover.

Prices on 3rd party insurance also depends on your age. If you are older you may find DCL Insurance at 8% is actually cheaper.

I stopped using DCL insurance because they only covered flights booked through DCL and they don't book SW. I have been able to get better coverage cheaper than DCL. I use sites to shop around for the policy. Insuremytrip is my go to for shopping. Forbes also has some great articles. I am very paranoid about needing to be evacuated off an island/ship (It happened to a friend and they had to put down a credit card to pay for it and fight with the their insurance company later). We had to use our cruise insurance in 2017 and it was so easy and the reimbursement was quick. It saved our trip.

Disneyland_emily

- Jan 2, 2024

We live in Orlando area and don’t need a lot of what’s covered for travel insurance so only buy “catastrophic” insurance for basically medical evac level stuff. It’s typically about $100 for a week cruise.

It all depends on what you want covered. I live in FL and drive to the port. I always get 3rd party travel insurance because I think what Disney offers is too little and costs too much. I can usually get coverage I want for a little more. I have never seen 7 day coverage as low as $100 as others have said and it is just my husband and I BUT I also get high limited on evacuation and medical and we are also in the 50+ age range. I personally feel people under estimate the cost of getting evacuated. Look at recent Youtube Vlogs... Man had a heart attack on a ship, was sent to a hospital in Mexico. He was basically held hostage for $60K++ in medical costs plus over $25k to evacuate. Family and friends had to max out credit cards to get him home, then he still had to have more surgery etc. Age does have a lot to do with it. On our most recent cruise MIL went as well in her own room. The 7 day cruise was 4500 per room. DH and I got coverage for mid $300's. MIL is in her 80s and same coverage with the same company would have cost her almost $1000. She opted for Disney coverage because they don't care about age, they base is on the cost of the cruise - but again what they cover is a lot less for medical and evacuation. Think about what you want covered and then go from there. I get my quotes, compare coverages and when I find ones I am interested in look at their ratings and stick with the A+ and A++ companies.

Share this page

Dis news & updates.

- Have You Seen Disney Fairy Tale Weddings' Villains Bridal Gowns?

- New Teaser Trailer for LEGO 'Star Wars: Rebuild the Galaxy'

- Traveling on Disney Cruise Line With a Toddler

- Ube Tiramisu & Zesty Chamoyada Now at Vivoli Disney Springs

- Let's Talk About the New Rides in Fantasy Springs at Tokyo Disney

New DISboards Threads

- 6 minutes ago

- Disneyland (California)

- BeachMouse1

- 17 minutes ago

- Disney Restaurants

- gottalovepluto

- Today at 7:15 PM

- Transportation

- KGmomoftwins

- Today at 7:04 PM

- Theme Parks Attractions and Strategies

- Sparrow'sLady

- Today at 6:35 PM

- Today at 6:25 PM

- Walt Disney World News

- Walt Disney World Articles

- Disney Cruise Line News

- Disneyland News

- General Disney News

GET UP TO A $1000 SHIPBOARD CREDIT AND AN EXCLUSIVE GIFT!

Latest posts

- Latest: jimmymc

- A moment ago

- Latest: atthebeachclub

- Latest: DWillowBay

- Latest: mmmears

- Latest: leebee

- 1 minute ago

Disney World Travel Insurance: Is it Worth It?

Nothing dampens a Disney trip idea more than having to cancel it because of a last-minute emergency, and what’s more, with a penalty! However, Disney World travel insurance can save you the trouble of worrying about such scenarios.

Travel insurance is one of those things you buy but may never use. However, for peace of mind, it is well worth it.

Walt Disney World may be the Most Magical Place on Earth , but even there you can run into problems. The idea isn’t to be pessimistic but to think ahead.

Pre-planning for a troublesome situation will not only save you lots of bucks, it also provide an immediate solution.

So, let’s talk about Disney World travel insurance in detail .

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. Which means if you click on certain links, I may receive a small commission at no additional charge to you.

Disney World Travel Insurance

The Disney World fandom is aware of the hurricane season (also hurricane policy ), and the past pandemic that 2020 has brought us.

Even though the magical world has been closed for the longest time in history, once it opens, we all will need to take special measures as a precaution against the slimmest chance of any mishap.

In short, with the global crisis, travel insurance has become imperative for any near-future Disney trips.

How do you go about your Walt Disney World travel insurance?

Here’s a brief idea.

If you’re buying a vacation package , you will get the option to buy the Disney Travel Protection Plan (DTPP) as an add-on. If you are going with a room- or ticket-only purchase, then you will need to look for insurance outside of Disney.

Read on to get into the details.

Do I Need Disney World Travel Insurance?

After all, what could go wrong at the most magical place? This is a common question that pops up in everyone’s mind, even mine when thinking of getting insured for any major trip.

Most likely, you’ve already traveled to a lot of places without getting into insurance, then what’s the big deal now?

At the time when the article is being published, the answer could be pandemic. But, what about later? Will you still need insurance once this lethal smoke screen fades away for good?

The answer is mostly yes.

Travel insurance is optional and might even seem like yet another expense, but there are several reasons why it could be a good idea to buy it. Some of them include:

- Cancellation of your flight

- Hurricanes at Disney World

- Last-minute need to cancel the Disney reservations

- Loss of baggage

- Sickness or injury on the trip

Disney is indeed known to show compassion towards the last-minute cancellation emergencies. They make bookings flexible and re-adjustable. But there is no guarantee that this is what will happen for you.

That’s when the insurance will come to the rescue.

So, before you ignore the idea of getting insured, ask yourself, if you:

- are traveling during Hurricane Season i.e. June-November

- going during Peak Hurricane Season i.e. August-September

- or anyone you’re traveling with suffers from pre-existing health issues

- know that your flight tickets are refundable

- will lose a large sum of money on canceling Disney reservations

- are flying during weather that causes flight cancellation

- need to cut short the trip and return home early

In case by answering these questions, you figure you need the insurance, here is detailed information about your two best options – Disney Travel Protection Plan or a third-party insurance.

All About Disney World Travel Protection Plan

As mentioned before, it is Disney’s (Aon Affinity-contracted) insurance plan that is exclusively for guests who purchase Walt Disney World vacation packages.

It has many benefits ranging from reimbursements to medical protection. Most importantly, it is affordable.

Much like auto insurance, Disney Travel Protection Plan cost is quoted based on age. It costs around $82.50 per adult and $6.00 per child cost.

The insurance provides the best price-value for those aged 70 or above. If you are an adult traveling with a minor, the minor gets covered under insurance automatically.

Another good thing about this Disney trip insurance is that it is easy to purchase since it pops up as an option when you book a vacation.

A big caution is to wait until you’ve reach the final payment window before adding the insurance or any type of Disney feature. Just in case the website becomes buggy and messes up your order.

Note that the Disney Travel Insurance Plan will generally not cover extra components like the party tickets.

In short, if you are booking your rooms separately from the tickets, you might have to skip this option. Also, if you are not buying a vacation package, then you are typically not eligible either.

So, let’s discover and talk about the next best option – third-party insurance.

Is Third-Party Disney World Insurance Worth It?

The biggest difference between Disney Travel Protection Plan and third-party insurance is that Disney will only cover you inside its own premises.

This means if you are planning to tour more than just Disney World, then the rest of your trip goes uncovered .

Depending on which travel company you choose to approach, you might even get away with more insurance coverage at a lesser price compared to DTPP.

But, if you are thinking which is the best travel insurance for Disney World, I do not have a cast-iron answer for it. Speaking with experience, my recommended company for Disney travel insurance would be Travel Guard®.

Say for instance, you decide to visit Orlando during the hurricane season and you plan on visiting more than just Walt Disney World. While you’re most likely iffy about getting insurance, it may be best to go for it.

Traveling to Walt Disney World is not the cheapest thing in the world, so to give yourself peace of mind, it would be great to add on a third-party company to help you with your Orlando trip.

The only frustrating part of getting insured through a third-party company is that you might need to contact an agent. It is also not as effortless as checking a box.

However, most sites make it easy to go through to find what you need quickly. You can also use your Authorized Disney Vacation Planner to help you with this addition.

Have a DIFFERENT kind of Orlando vacation with a Resort home next to Disney World. Find Your Disney Resort Vacation Rental here!

Considerations to Think About When Buying Disney World Trip Insurance

Now that you know your options, let’s talk about some things to consider when buying the insurance.

Disney Trip Insurance Cost

Considering the price of insurance is particularly essential because you are buying something you are not actually hoping to use. We already know the price of Disney Travel Protection Plan – $82.50 per adult and $6.00 per minor.

What does Disney Travel Insurance cover?

- Trip Cancellation/Trip Interruption: Reimburses up to total trip cost of the prepaid travel arrangements due to illness, injury and non-medical reasons such as job loss, military service and more

- Trip Delay: Reimburses related expenses, up to $600 ($200 per day)

- Baggage Loss: Reimburses up to $2,000 for lost, stolen, or damaged luggage and personal effects

- Bag Delay: Reimburses the purchase of necessary personal items if your bags are delayed 12+ hours

- Emergency Medical Protection: Provides up to $25,000 of coverage if you get ill or injured on your trip

- Emergency Evacuation/Repatriation: Arranges and prepays for emergency medical transportation and other covered expenses

- Travel Accident: Provides up to $25,000 in the event of accidental death or dismemberment

- Rental Car Damage: Reimburses repair costs up to $25,000 in the event of collision, theft, damage or vandalism to rented vehicles

Resource: Arch Insurance Company

Third-Party Insurance

The prices of third-party insurances are also easy to get such as Travel Guard. When booking it from a third party source, make sure you get the best coverage for things mentioned above, from bag delay/loss, car rental damage to booking cancellation.

What does Travel Guard insurance cover?

- Trip Cancellation

- Medical Evacuations/Illness

- Travel Assistance Service

- Flight Guard

- Baggage Coverage

- Adventure Package (upgrade)

- Children Covered at No Additional Cost

Affordable Deductible

When it comes to Disney travel insurance, you will find several extremely cheap options. Here is a catch to look out for. Most cheap policies have high deductible prices.

For example, if you were to lose your baggage and claim for $1400 through a policy with $500 excess, you will pay the $500 while the insurance covers the remaining $900.

So, before you go for an extremely cheap insurance policy, learn what your possible deductible could be and see if you can afford it.

Travel Destinations

You’re traveling to Disney World , I get it, but is there any place else you’d like to explore while in Florida? The question seems pretty simple and impromptu plans are always a possibility.

So, if you are not getting DTPP, then make sure to get all expected destinations covered under one the top third-party Disney trip insurance plans.

Get a Medical Report

Whether it is hypertension, diabetes, asthma, or even chronic pain, it is important that you get a medical report for it.

Most insurance policies won’t cover a lower-risk ailment unless you declare it or, in some cases, you may pay extra. However, remember to be honest with your travel insurance providers.

If you’ve been seeing a physician or chiropractor, let them know about it.

Underlying or a chronic health condition can show up anytime during the trip. You don’t want the vacation to get spoiled because of it.

Extra Cover for Certain Elements

Areas inside as well as surrounding Disney World are teeming with things to do. They include a variety of adventures that might need extra insurance cover.

If on your trip, you are planning to go horse riding, surfing, or biking, be sure to check that the policy you choose covers you.

Hipster Power Tip: Use websites like Insuremytrip.com to compare trip insurance rates.

Equipment Cover

Crime in Disney is almost non-existent, but if you are anything like me, you’d want to keep an eye on your belongings. Especially if you’re traveling alone.

Secondly, you never know if you may end up losing your mobile device or expensive camera while on your Disney vacation.

To avoid the financial headaches that may occur as a result of this, be sure that you store you money in a safe place. You’ll also make a list of all equipment and other expensive belongings, and that you give this information to the travel insurance provider.

This will help you see what is covered and what is not. Plus, due to a surge in mobile-recoup claims, many insurers have begun to offer coverage for them.

Hipster Power Tip: Check with your credit card company to see if they offer travel insurance. They may not cover your full trip, but the options may be enough coverage for you without the additional fee.

Frequently Asked Questions

Now that we have the basics covered, let’s go through some of the most common questions when it comes to getting some type of Disney World travel insurance.

Can I add Disney Travel Protection Plan after making the reservations?

If you have not made the final payment, you should be able to get travel protection added to your vacation package by called on WDW Resort at (407) 939-1936.

However, you should either be at least 18 or have a parent/guardian permission to make the call.

Is the price of the Disney Protection Plan refundable?

The insurance comes with a 14-day trial period. If you cancel it within that period, Disney states that it will refund the entire amount of the insurance.

What is Disney’s cancelation policy for room-only reservations?

You can cancel your reservation penalty-free up until 5 days before the check-in. A cancellation done during the last 5 days will cost you a penalty equal to the first night’s room rate.

What are the common exclusions from travel insurance?

For most travel insurance companies, any claim made for illness or injury from an unstated sport or activity will not be covered. This also applies to unstated equipment loss/damage, medical condition, and personal financial loss.

Will my travel insurance cover if I can’t go?

Yes, most insurances cover cancellations.

What if my visa gets rejected and I already have travel insurance?

In this case, you will want to cancel the travel insurance policy itself because you did not take the trip. It should also be possible.

To apply for the cancellation of the policy altogether, you will need to submit the policy, copy of passport, and a cover letter explaining the trip was canceled due to denial of visa.

Ready to start planning your next Disney World vacation? Listen to the latest podcast episode on Apple or on your non-Apple device now!

Let’s Wrap It Up

Traveling to the Most Magical Place on Earth should be a worry-free business. No pandemic, medical problem, financial hiccups, or mishaps should be able to dampen your goal of having unlimited fun.

Disney World travel insurance ensures this happens.

Imagine it like a (paid) guardian angel that protects you throughout the trip. Just keep in mind that policies and prices do change constantly, so you’ll want to keep an eye on the agency that you choose to go with in case anything changes.

Since many of us wonder if it is necessary, super expensive, or effort-taking, we hope this guide was able to answer all your pressing questions.

Overall, ALWAYS CHECK YOUR PLAN THOROUGHLY!

After all, the only screaming or fear at the Walt Disney World should be on the hair-raising rides.

Until next time, Happy Park Hopping Hipsters!

UP NEXT: Ultimate 3-Day Disney World Itinerary Template

Share this article!

41 Spectacular Things to Do in Orlando for Adults

6 easy steps to save money for disney in 6 months, leave a comment cancel reply.

Help Center

How can we help you.

Hotel Reservations – Frequently Asked Questions

What are the benefits of the Travel Protection Plan?

The Travel Protection Plan helps protect you and your family for unexpected covered losses from the moment that you step out of your front door until the moment you safely arrive back home. The Travel Protection Plan provides coverage if you cancel or interrupt your Walt Disney World, Disneyland or Aulani, a Disney Resort and Spa package for covered reasons described in the plan such as illness or injury. If you cancel due to a covered reason, the Travel Protection Plan will provide a refund for the prepaid, nonrefundable travel package, including the cost of airfare that is scheduled for travel within 7 days of the travel package.

The Travel Protection Plan also provides coverage for covered losses while traveling, such as trip interruption, trip and baggage delays, baggage protection and medical expense protection (including emergency medical transportation). In addition, the Travel Protection Plan contains non-insurance services for 24-hour worldwide emergency assistance (provided by LiveTravel).

To view the terms, conditions and exclusions, visit: www.affinitytravelcert.com/docs/DSP01

If you have questions, please call (844) 203-3123 to speak with a representative from Aon Affinity, the program administrator.

You can purchase a Travel Protection Plan for eligible trips any time prior to final payment. To purchase the Travel Protection Plan when making a new reservation, select “Add Travel Protection” at the time of booking. To add the plan to an existing reservation:

- Go to the bottom of any page of Disneyworld.com and select “My Plans.”

- Select “Change Reservation” next to your package reservation.

- Scroll down to see if your trip is eligible for a Travel Protection Plan—if it is, “Add” will be available; if it is not, “Add” will be unavailable.

- Select “Add” and follow the prompts.

You may also add the Travel Protection Plan to your reservation by calling Walt Disney World Resort at (407) 939-5277. However, due to a high volume of calls, you might experience delays. Guests under 18 years of age must have parent or guardian permission to call.

Aon Affinity is the brand name for the brokerage and program administration of Affinity Insurance Services, Inc. (TX 13695); (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services; in CA, Aon Affinity Insurance Services, Inc. (CA 0G94493), Aon Direct Insurance Administrators and Berkely Insurance Agency and in NY, AIS Affinity Insurance Agency. Affinity Insurance Services is acting as a Managing General Agent as that term is defined in section 626.015(14) of the Florida Insurance Code. Aon Affinity Contact Information: 900 Stewart Ave #400, Garden City, NY 11530; 800-842-4084; [email protected]. As an MGA we are acting on behalf of our carrier partner, Arch Insurance Company (NAIC #11150). Arch Insurance Contact Information: 844-289-3443.

Travel insurance benefits are underwritten by Arch Insurance Company, with administrative offices in Jersey City, NJ (NAIC #11150), under Policy Form series LTP 2013 and applicable amendatory endorsements. Assistance services are provided by the designated travel assistance company listed in your Travel Protection Plan. This is a brief overview of the coverages. Subject to terms, conditions and exclusions. This is a general overview of insurance benefits available. Coverages may vary in certain states and not all benefits are available in all jurisdictions. Please refer to your certificate of benefits or policy of insurance for detailed terms, conditions and exclusions that apply.

Did you find this answer helpful?

Related Questions

Will I be responsible for any cancellation or change fees or other amounts if a hurricane warning is issued within 7 days of my arrival date?

Do I need to buy travel protection?

What does it mean for my vacation plans if a hurricane warning is issued within 7 days of my arrival date?

How Much Does A Disney Cruise Cost? - 2024

I ’ve been on twelve Disney cruises, so I obviously think that the Disney Cruise line is worth the money. But when you are booking your family cruise, you may look at other family-friendly cruise lines as well. Disney Cruise Line cruises can often be more expensive, and without really knowing about the experience, it can be hard to justify the extra expense.

If you are considering taking a Disney cruise for your next family vacation, you’re probably wondering, “How much does a Disney Cruise cost” ? It’s important to understand, whether you are evaluating different cruise options or budgeting for a future trip. You’ll probably also wonder what’s included and whether it’s worth the cost.

The price of a Disney cruise depends on many factors. Here’s an overview of Disney Cruise prices as well as what’s included and what factors influence the price.

Disclosure I’ve been on one complimentary media preview cruise and two cruises as part of Disney Social Media Moms. The remainder of my trips have been at full cost. All opinions are my own.

This post contains affiliate links. A purchase through one of these links may result in a commission paid to us at no additional cost to you.

If you want to take a cruise on the Disney Cruise Line, consider booking with Get Away Today. When you mention Family Travel Magazine, you get an extra $25 onboard credit! Give their agents a call at 877-510-2929.

How Much Is A Disney Cruise? Is It Worth the Cost?

Factors that affect the price of a disney cruise.

When looking at the price of a Disney cruise, many factors affect the price. The time of year of the cruise can often influence the price. Like other travel products like airfare and hotels, demand significantly influences the price.

With a limited supply of staterooms and only four ships (with more on the way), the price is impacted by the current demand for staterooms.

You’ll often find that Disney Cruises that take place during peak times of year (like school vacations) will be more expensive than other weeks. You’ll want to book those early to get the most stateroom options and the best Disney Cruise prices.

If you are thinking of doing a Caribbean cruise, January can be a great option and is often the cheapest month. Typically all four ships (the Disney Magic , Disney Fantasy , Disney Dream , and Disney Wonder ) are sailing in the Caribbean, so there are lots of sailings to choose from, with many Caribbean itineraries.

In addition, because the Caribbean can sometimes be chilly in January, it’s not as busy. I’ve been on several January cruises, and while sometimes the weather has been a little cool, we’ve also been very lucky with perfect weather.

Of course, most schools are in session for most of January, so it can be more difficult to sail than if your kids are in school. Martin Luther King weekend typically is more expensive than the rest of the month.

As you’d expect, the duration of the cruise also affects the prices. A longer cruise is more expensive than a shorter cruise. I usually recommend that travelers start with a 3 or 4-day cruise to see if it’s something they enjoy before committing to a longer cruise.

Some families like to do a Disney Land and Sea vacation where they combine their cruise with some time at Walt Disney World. That can be a great way to take your first cruise and make sure it’s something your family enjoys.

Unlike hotels, where you’ll pay per room, on the Disney Cruise Line, the cost increases per person in a stateroom. This is because the cost of a Disney cruise includes all of your meals in the regular dining rooms as well as activities.

Of course, the incremental amount of an additional person in the room is lower. When I travel with my friends on the Disney Cruise Line, we like to have two to three people in the room. We don’t usually spend too much time in the room, and it never feels crowded, even though it is a small room.

The type of stateroom you book is also a factor in the cost. We typically book a deluxe family stateroom with a verandah, although you can save money by getting a room without the verandah. Interior rooms are less expensive.

Think about how much time you plan to spend in the room, and whether or not you’ll use the verandah. I love sitting outside sipping coffee in the morning, and I find the verandah is worth the extra cost. But that may not be the case for everyone.

Special cruises, like the Very Merrytime Cruises and the Marvel Day at Sea, may also cost a bit more than a standard cruise. Often discounts (like the discount for booking onboard) aren’t available on these cruises.

Getting a Disney Cruise Line Discount

The best way for a return guest to get a discount on the Disney Cruise Line is to book while you are already on a sailing. You’ll have two options.

You can book the dates that you want to sail and can choose your exact dates and room. For this, you’ll need to make a deposit.

Alternatively, you can book a placeholder for a $250 fee. This can be applied to a cruise booked within the next two years. I typically book a placeholder, even if I don’t have another cruise planned because it’s valid for a while.

Depending on the sailing, you’ll get a discount as well as stateroom credit. To make an onboard booking, you’ll want to visit the desk on the ship as soon as possible. It can be very busy by the end of your sailing and there is typically a line to talk to a cast member.

Other discounts can sometimes be available for Canadian residents, Florida residents, and members of the military. The Disney Cruise Line special offers page has more specific information on this. They aren’t always available so you’ll have to check for details and eligible sailings.

What’s Included in a Disney Cruise?

When assessing the cost of a Disney cruise, you’ll also want to know what’s included and what isn’t included in the price of the cruise. It’s important to calculate the total cost that you’ll expect to spend.

Things included in your Disney Cruise cost include Disney character interactions, shows on the Disney cruise ships, the kids’ clubs, meals in the main dining rooms, unlimited ice cream, many snacks, most room service, soda, standard coffee, and iced tea.

While many cruise lines do include these items (soda is typically not included with most cruise brands, however), it’s important to look at how your family will use these inclusions.

My kids love the kids’ clubs and the shows, so we usually do that daily. It’s completely worth it for us. On the other hand, we don’t drink soda, so we don’t care if it’s included.

What’s Not Included in a Disney Cruise

As you do your price comparisons and start to budget for your trip, you’ll also need to know what’s not included in a Disney Cruise.

Once you arrive at the airport, you’ll need to get to the port. Depending on the port you are leaving from (for instance, Port Canaveral ), Disney transportation may be offered. However, this is an extra cost and isn’t included in your cruise.

If you are leaving from Port Canaveral, Florida, you may want to start (or end with) a Walt Disney World vacation as part of a Disney land and sea adventure. In that case, transportation is offered from the parks to the port, but again, that is an extra fee that you’ll need to include in your budget.

Where available, I find it convenient to take Disney transportation because they will tell you exactly where you need to go. It’s worth the extra peace of mind for me to pay for it rather than worry about transportation on my own. But, rental cars, ride-sharing, and private transportation are also an option. Compare rental car prices here .

Shore excursions are another cost that is separate from the standard cruise cost. These are something that you’ll want to research before committing to your cruise because they can be expensive.

This is especially the case in Europe and Alaska, where you may pay around $700+ per person for a single excursion. That can add up, especially for longer cruises when you’ll want to take multiple excursions!

Sometimes you’ll find that excursions booked outside the cruise line might be a little less expensive. Just keep in mind that there is a risk associated with this. These excursions and companies may not be vetted by the cruise line.

You will also be responsible for making sure you get back on board with plenty of time. If for some reason, the cruise doesn’t dock at a specific port, you probably won’t get a refund. This can sometimes happen because of weather or other unpredictable reasons.