All products are independently selected by our editors. If you buy something, we may earn an affiliate commission.

Travel insurance with Covid cancellation cover: the right policies

By Sophie Butler

Purchasing travel insurance during the time of Covid can be overwhelming – will you be covered in case of cancellation, or do policies that offer medical assistance for Covid exist? Here, we break down the policies that offer Covid cover, plus what to look for in a travel insurance policy and whether your insurance is invalidated if the government advises not to travel.

What is the best travel insurance with Covid cancellation cover?

Yes, here goes... Note though, all policies currently have restrictions on claims relating to Covid-19 and be aware that the situation is changing fast, so double-check the latest cover before you buy.

All Clear Travel Insurance ( allcleartravel.co.uk ): cover is available to people of all ages but particularly suitable for travellers with pre-existing medical conditions that other insurers are reluctant to cover.

Axa ( axa.co.uk ): this long-established, French-owned company is one of the largest insurers, providing a wide range of different policies geared to a variety of travel types.

Battleface ( battleface.com ): geared to individuals and groups with an emphasis on adventurous activities abroad and travel to remote destinations.

Campbell Irvine Direct ( campbellirvinedirect.com ): this insurer was established more than 45 years ago, and policies offer cover for travel to challenging and adventurous locations, including conservation and volunteer projects.

CoverForYou ( coverforyou.com ): competitively priced policies include winter sports and backpacker cover with enhanced silver, gold and platinum options.

Holidaysafe ( holidaysafe.co.uk ): catch-all travel specialist with a portfolio of ‘niche’ policies covering specific sporting activities including triathlon, sailing and cycling .

LV Travel Insurance ( lv.com ): one of the UK’s largest and longest-standing insurers, founded in 1843, offering single and multi-trip cover.

PJ Hayman ( pjhayman.com ): strong on customer care, with cover for medical conditions and hazardous activities plus round-the-world and gap-year travel.

Puffin Insurance ( puffininsurance.com ): annual or single-trip policies for customers aged 18-74, covering more than 75 different activities with numerous optional add-ons.

Trailfinders ( trailfinders.com ): policy automatically includes children up to 21 years, free of charge (note those aged 19-21 must be in full-time education).

Can I get travel insurance during Covid?

In a word, yes. Some companies (see list above) say they will still sell you insurance – including the crucial medical-expenses cover – provided the UK's Foreign, Commonwealth and Development Office (FCDO) doesn’t advise against all or all but essential travel. Check the current FCDO list for the latest advice. Some insurers will also offer cover for destinations on the red list , but in the current climate of uncertainty, rules governing travel to individual countries can change fast. Travel-insurance specialist Battleface has a useful country travel restrictions tool on its website to help people check the latest developments based on a variety of factors including destination and departure dates.

Why is travel insurance important?

If you have a trip booked and don’t yet have insurance, it’s important to buy a policy as soon as possible. That way, if anything changes – FCDO advice for example – you will already have cover in place. The problem with choosing the best policy is that everyone has different requirements – it may depend on your destination, the type of trip (are you doing lots of adventurous activities , for example?) and quite detailed, nerdy stuff such as ‘travel disruption cover’, which is particularly useful at the moment if you are travelling independently. There is no shortcut to checking through the key provisions of any insurance you are considering.

What should I look for in a travel insurance policy during the pandemic?

This is the key problem. Insurers are obviously jumpy about how exposed they are to claims both for cancellations because of Covid-19 and for medical treatment as a result of catching it while you are abroad. So all have added restrictions and exclusions into their policies. You need to check exactly what those are and make sure you understand the limitations of the cover.

Does travel insurance cover Covid cancellations?

If you already have travel insurance it will normally cover your cancellation costs if you, or one of your travelling companions, falls ill before departure and can’t travel – though you will need a medical report from your doctor to confirm this. Some policies – though not many – cover losses incurred if you have booked independently and have to cancel because of FCDO advice. Look for ‘travel disruption cover’ or ‘journey disruption cover’ in the policy details, which may or may not include disruption due to epidemics (see below for more information). If you are forced to quarantine in a hotel after visiting a red list country, this is unlikely to be covered by any insurance companies. If you are simply nervous of travelling and want to cancel – which is known as ‘disinclination to travel’ in the insurance industry – no policy will cover you.

So what use is travel insurance during the Covid pandemic?

The key value of travel insurance is the medical cover it offers while you are travelling. This will underwrite the cost of treatment and if necessary a hospital stay if you fall ill on holiday. But whether or not you are covered for accommodation costs if you are diagnosed with Covid-19 and have to enter self-isolation or quarantine while you are abroad varies by policy. Some insurers, however, will pay up if you need a new flight home in these circumstances. In short – it varies, so be sure to read the small print.

Is my travel insurance invalidated if the FCDO advises not to travel?

In normal times, travel insurers won’t provide cover to countries or regions where the FCDO advises against all but essential travel. Traditionally, these areas might include destinations such as Afghanistan, Iraq or Yemen, but in recent times it has included much of Europe too, with countries being regularly added to and taken off the UK's quarantine list. However, some insurers now offer affordable policies that are designed for travellers heading to these European destinations, which may be of use once the lockdowns start to ease. As ever, it’s important to read the small print. For example, policies are invalidated during a government-imposed regional or national lockdown in the UK.

Can I get insurance cover if I catch Covid abroad?

Some insurers will cover against coronavirus if the FCDO has listed your destination as safe to visit before you head off. Some offer cancellation cover if you’re diagnosed with Covid-19 within a fortnight of departure, including emergency Covid-related medical expenses while abroad and repatriation, as well as cover in the event of a travelling companion contracting the disease. And you can find insurers that offer cover for medical expenses resulting from Covid-19 for all destinations including countries under FCDO and government essential and non-essential travel advisories.

So what happens if my holiday is cancelled?

If you have booked a package with a tour operator and the FCDO advises against all but essential travel to your destination, your tour operator is obliged to cancel the holiday and offer you a full refund. They might also offer you an alternative holiday, or suggest you postpone travelling dates, but you are entitled to get your cash back. If you can afford to, consider postponing your trip rather than cancelling it completely, should your health or updated government advice mean that you can’t go away as planned. There are a lot of people out there relying on us to keep spending on travel, with around 10 per cent of the world's population earning an income that is linked to tourism. To learn more about how important this is, see our guide to why you shouldn't cancel your holiday .

What if I booked my trip independently?

Travellers who have booked, say, a flight and accommodation separately, normally have no right to a refund if they cancel unilaterally, even if the FCDO has since advised against travel. In practice, however, most airlines are cancelling flights and refunding passengers in this situation. A hotel or villa company doesn’t have to give you your money back – though it is obviously worth talking to them; they may allow you to postpone your stay.

Will my insurance cover me if my airline collapses?

It’s vital to make sure you pay for flights with a credit card (if you are booking a flight directly with the airline and it costs more than £100 you can claim your money back from the credit card company), and check that any tour operator you book with has up-to-date Atol protection – or can show that it has an alternative bonding arrangement in place.

Which websites should I check for the best travel insurance information and advice?

A good website that gives the latest figures for every country reporting cases of Covid-19 is worldometers.info . For the latest formal FCDO advice on every country in the world see gov.uk and search for travel advice. The best health advice is at nhs.uk .

Adam Turner

CNT Editors

Rachel Everett

Am I still covered by the EHIC scheme in Europe?

Yes and no. As of Thursday 31 December 2020, Britain left the EU, but anyone holding a valid EHIC (European Health Insurance Card) will be covered for state-supplied medical care while holidaying in Europe until it runs out. And while the EHIC card has been scrapped for anyone who doesn't currently hold one, it has been replaced by the very similar GHIC (Global Health Insurance Card).

Anything else I need to worry about?

Insurers have become very jumpy about pre-existing medical conditions in recent years because they add to the risk of expensive medical claims and cancellations. It is absolutely critical that you declare any conditions you may have when you buy a policy, otherwise – if you do need treatment while you are travelling – you may find your claim is refused.

How do you choose travel insurance that covers COVID-19?

Oct 26, 2021 • 5 min read

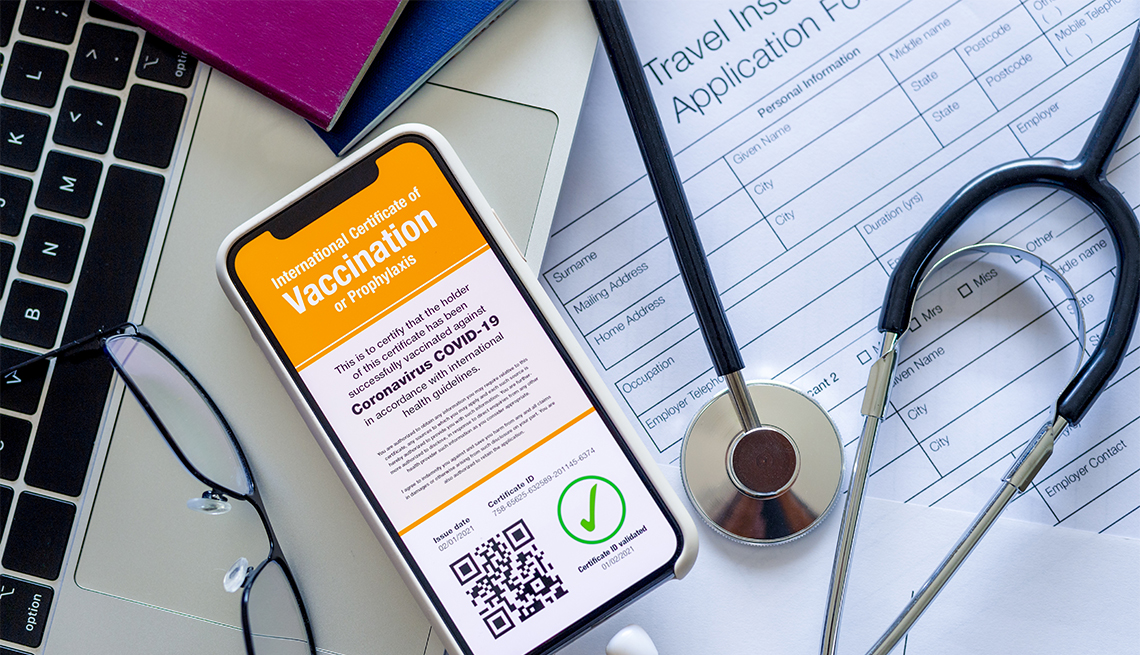

COVID-19 has made it more important to check the health coverage on your travel insurance © Maskot/Getty Images

After 18 months of pandemic-related travel restrictions, you may be itching to act on your pent-up wanderlust—but the situation and the rules are still continuously evolving. So before you go anywhere, it’s best to have a travel insurance plan that protects the investment you’ve made in a long-awaited trip.

A robust travel insurance plan will reimburse pre-paid trip costs and non-refundable deposits if you have to cancel or interrupt your trip, encounter trip delays, experience baggage loss or require medical expense and medical evacuation. Your policy will also reimburse “covered reasons” in your plan, such as death, illness or injury, serious family emergencies, unplanned jury duty, military deployment, acts of terrorism, or your travel supplier going out of business.

But COVID-19 has added an additional checklist to your usual insurance needs—it’s now important to check to ensure your travel insurance plan includes coverage for COVID-19 medical expenses, and losses related to illness. Your policy should also cover quarantine costs if you need to self-isolate after testing positive for the virus.

What do I look for in COVID-19 insurance coverage?

When you’re shopping for a travel insurance plan that covers COVID-19, you need to do your research and read the fine print of your plan.

Look for a travel insurance product that will protect your non-refundable, prepaid expenses if you have to cancel your trip due to illness caused by COVID-19. Your policy should also cover emergency medical treatment and emergency medical transportation. With regard to COVID-19 coverage, be sure your policy covers medical care, medicine, hospitalization and quarantine expenses.

“The type of coverage you should look for depends on you, your needs, travel dates, and the type of trip you’re taking,” says Sasha Gainullin, CEO of battleface , a travel insurance carrier. He says some travel insurance companies have now excluded COVID-19 coverage because it has been labeled a “known/foreseeable event”, while others may exclude pandemics altogether.

“It’s important to search for plans that include medical and quarantine expenses as well—this will be critical in the event you become ill and need to receive treatment while traveling,” continues Gainullin.

One additional tip is to confirm there are no exclusions based on the destinations you’re traveling to—this can happen with countries under government-issued travel warnings, Gainullin says.

“If a traveler feels uncertain, I recommend speaking with the travel insurance company directly. They can review the policy details with you, answer all of your questions, and confirm all of your required coverage options are included,” he adds.

Is getting coverage dependent on vaccination?

While it’s a good idea to be fully vaccinated before traveling, vaccination is not required to purchase a travel insurance policy, says Daniel Durazo, spokesperson with Allianz Partners USA.

What are the medical costs that are covered by travel insurance?

Travel insurance can cover the cost of both medical treatment and emergency medical transportation. A US health insurance plan, as well as Medicare, generally will not cover overseas medical expenses, so it’s best to check with your personal health insurance provider if any global coverage is available.

“While losing the cost of a trip due to an unexpected cancellation would be painful, paying for expensive emergency medical treatment or emergency medical transportation can be financially devastating,” Durazo says.

Under a travel insurance plan, medical costs could range doctor visits, pharmacy expenses, imaging costs and covering a hospital stay if required. Other expenses that can be covered are transportation to medical care and medicine.

Read more: Will my health insurance cover getting COVID-19 while traveling in the US—or abroad?

What about covering an unexpected quarantine due to COVID-19?

Many international destinations are now requiring that visitors purchase travel insurance coverage for an unexpected quarantine. Allianz Travel Insurance has added coverage to many of its products that includes reimbursement for quarantine-related accommodations if you or a traveling companion is individually-ordered to quarantine while on their trip, says Durazo.

This coverage typically covers the cost of additional food, lodging and transportation while quarantined. In addition, trip interruption and travel delay benefits on certain Allianz plans also provide coverage if you or your travel companion is denied boarding by your travel carrier due to suspicion of illness.

The benefits for quarantine coverage vary from carrier to carrier. For example, on select Trawick International plans, they offer $2,000 in quarantine benefits and for an additional charge, and you can increase it up to $7,000.

What about pre-flight COVID-19 testing?

Your plan may provide coverage for flights if you are turned away at a border for not passing a health inspection. Foster says Trawick’s travel insurance plans that cover COVID-19 would cover the expenses if you could not pass your pre-health inspection. Also, the plan would cover the costs of the failure of your PCR test to return to the United States, such as having to quarantine abroad.

It’s important to note that the actual cost of the PCR test is not covered by your policy, just the loss associated with the negative test.

Read more: PCR tests for travel: everything you need to know

Some destinations require COVID-specific insurance coverage—how do I comply with those restrictions?

Before any international travel, you should check the country where you are headed to make sure you comply with insurance coverage requirements. Countries like Spain, Turks and Caicos and Thailand are among the nations that mandate COVID-19 insurance coverage.

“You first must check the countries’ specific COVID regulations for entry into the country. Some countries require travelers to provide proof of travel insurance that covers COVID-19 related expenses purchased from a third party,” explains Foster. Providing proof coverage is key; so travelers need to ensure they receive documentation from their insurance provider that their policy covers COVID-19 related expenses to show customs officials, she says.

Should you arrive in a country that requires proof of insurance to cover COVID-19 medical expenses and quarantine costs, and you don’t hold a policy, you will not be granted entry.

For more information on COVID-19 and travel, check out Lonely Planet's Health Hub .

You may also like: What happens if I'm denied entry to a country on arrival? What is a vaccine passport and do I need one to travel? What is the IATA Travel Pass and do I need it to travel?

Explore related stories

Destination Practicalities

Mar 28, 2023 • 3 min read

Here’s all you need to know about getting a traveler visa to visit China now that “zero COVID” has come and gone.

Sep 12, 2022 • 4 min read

May 1, 2024 • 9 min read

May 1, 2024 • 6 min read

May 1, 2024 • 7 min read

May 1, 2024 • 12 min read

Apr 30, 2024 • 6 min read

Apr 30, 2024 • 7 min read

How COVID-19 Travel Insurance Works

From weekend getaways to extended vacations, specialized covid-19 travel insurance can provide security if the virus affects your travel plans..

)

3+ years writing about auto, home, and life insurance

7+ years in personal finance and technology

Amy specializes in insurance and technology writing and has a talent for transforming complex topics into easy-to-understand stories.

Read Editorial Guidelines

Featured in

)

Licensed auto and home insurance agent

4+ years in content creation and marketing

As Insurify’s home and pet insurance editor, Danny also specializes in auto insurance. His goal is to help consumers navigate the complex world of insurance buying.

Updated September 18, 2023

Reading time: 4 minutes

)

Table of contents

- Pandemic insurance

- What’s covered

- Is it worth it?

- Secure a policy

Travel lets you see new places, meet new people, and experience different cultures. But the lurking shadow of COVID-19 can make traveling uncertain. Almost half of canceled trips in 2020 were due to the virus, according to the U.S. Travel Insurance Association (UStiA). [1]

Travel insurance can help if something goes wrong before or during your trip, but not all policies cover COVID-19 issues. Let’s explore how COVID-19 travel insurance works and how it might — or might not — shield you on your next journey.

How pandemic travel insurance works

Most travel insurance policies include protections for trip cancellations, delays, or other trip interruption coverage. However, many policies don’t cover disruptions due to pandemics. [2] That’s where COVID travel insurance comes into play.

COVID travel insurance is a specialized policy that can refund your money if the virus throws a wrench into your plans. It typically has three coverage levels: coverage for a trip delay, canceling for any reason, and medical care if you get sick.

Travel delay coverage

Illness, injury, jury duty, and other circumstances beyond your control can delay your travel plans. Travel delay insurance covers flight issues, bad weather, sudden breakdowns, and unexpected illnesses or injuries that happen before reaching your destination. It can pay you back for non-refundable expenses and cover extra costs, too — like food, hotel rooms, or cab rides.

Cancel for any reason

Travel insurance policies typically have strict rules, but a cancel-for-any-reason (CFAR) option offers more leeway, allowing you to cancel for reasons not covered in the original policy.

But with CFAR benefits, you might only get a partial refund amount. Reimbursements usually range from 50% to 75% of the total price. [2]

Medical coverage for COVID-19

If your health insurance is only valid in a specific area and doesn’t cover international travel, travel insurance with medical expenses coverage can fill the gap.

If medical insurance is included in your trip policy, it can help pay for medical attention and treatment costs if you, a family member, or another traveling companion becomes ill from COVID-19 before or during your trip.

Will travel insurance cover you if you need to quarantine?

Some travel protection plans cover quarantine or self-isolation due to COVID-19 concerns. It can reimburse you for lost prepaid expenses and cover additional lodging and meal costs. However, it depends on your policy and the conditions leading to the cancellation, delay, or disruption.

Protection often hinges on two factors:

Not all travel insurance plans include a pandemic as a covered reason. If COVID-19 was a significant public concern when you purchased the policy, insurers may not provide coverage because it’s a “foreseeable” threat. But some plans let you add COVID-19 coverage as an endorsement.

Even if you set out to buy COVID-19 travel insurance, it may not be available for your plan or location. Review your benefits and endorsement options to look for “pandemic” or “epidemic-related” language to see if COVID-19 is a covered event.

Is travel insurance worth it?

The Centers for Disease Control and Prevention (CDC) declared the COVID-19 public health emergency over in May 2023, but there’s still a risk of infection, according to the World Health Organization (WHO). [3] [4]

Your credit card’s travel protections are worth considering, but you may not want to rely on that alone. Credit cards often limit travel coverage, and most companies don’t include trip cancellation coverage. [5]

Travel delay benefits can fill the gap — especially benefits with COVID-19 coverage. Compare the policy cost against the potential loss if you have to cancel or delay your trip to determine if it’s worth it. The up-front payment for travel insurance is typically a fraction of what you might spend out of pocket if plans go south.

The CDC reports that medical bills in the first six months of a COVID-19 diagnosis average nearly $8,400. [6] Factor in non-refundable trip costs, accommodation charges, and other miscellaneous expenses, and the expenses can skyrocket.

How to find the best travel insurance

If you’re concerned about the pandemic and the potential effects on your travels, here are some tips to help you secure a policy with the best travel insurance plan:

Research coverage and services

Compare multiple companies and policies and read reviews to see others’ experiences.

Check for pandemic coverage

Not all policies cover travel disruptions from COVID-19. Review your coverage to make sure it specifically addresses pandemic reasons.

Buy medical coverage

Travel policies don’t automatically include medical emergencies. Consider adding medical travel insurance, and ask about emergency assistance coverage and medical evacuation in case of a natural disaster.

Consider a cancel-for-any-reason insurance policy

CFAR policies can be beneficial, especially with unpredictable pandemic-related concerns and travel restrictions.

Understand refund policies

Read the fine print and policy information to verify how the insurer handles refunds. Some policies might offer partial refunds.

COVID travel insurance FAQs

The COVID-19 virus has made travel plans tricky. Whether you’re planning a weekend getaway or a month-long vacation, here’s what you need to know about COVID-19 travel insurance.

Will travel insurance cover COVID cancellations?

It depends. Standard travel insurance policies don’t cover COVID-19 or other pandemic-related reasons, but some travel insurance companies offer specialty COVID-19 coverage against the virus’ potential interference. If you cancel your trip due to the virus, a COVID travel insurance policy may provide refunds or reimbursements for your expenses.

Do you get your travel insurance premium refunded if you cancel your trip?

Travel insurance offers varying refund policies depending on the travel insurance company, but it doesn’t refund your premium. Instead, coverage can reimburse you for prepaid trip costs, meals, hotel rooms, or cab rides because of the interruption.

Will travel insurance cover quarantine outside the U.S.?

It’s possible. Travel insurance policies may cover quarantine or self-isolation expenses outside the United States due to COVID-19 concerns. However, coverage depends on your specific policy and the circumstances leading to the quarantine. It’s crucial to review the specific details and look for “pandemic” or “epidemic-related” language to ensure coverage.

How does COVID travel insurance differ from regular travel insurance?

Regular travel insurance often covers typical trip cancellations, interruptions, or delays. However, many don’t address pandemic-related disruptions. COVID travel insurance provides specialized coverage for travel hiccups related to the virus, ensuring you’re shielded financially if COVID-19 affects your journey.

Related articles

- Tesla Battery Replacement Cost

- What to Know About Illinois Emissions Testing

- What Is the Difference Between a Real ID and a Driver’s License?

- How Much Will Insurance Pay for My Totaled Car? (Full Guide)

- Can You Legally Drive with an Expired License?

- How Many Cars Can You Have in Your Name?

- Best and Worst Roadside Assistance and Service Plans

Popular articles

- How Long Does an Accident Affect Your Car Insurance Rates?

- 6 Best Pay-as-You-Go Car Insurance Companies

- The 10 Best Car Insurance Companies

- Cheap Auto Insurance in Birmingham, Alabama

- Cost of Tesla Model Y Car Insurance

- Cheapest Auto Insurance in Las Vegas, Nevada

- Cheapest Auto Insurance in Georgia

- US Travel Insurance Association . " Consumers Spend $1.72B on Travel Protection in 2020, According to New UStiA Study ."

- National Association of Insurance Commissioners . " Travel Insurance ."

- Centers for Disease Control and Prevention . " End of the Federal COVID-19 Public Health Emergency (PHE) Declaration ."

- World Health Organization . " Coronavirus disease (COVID-19) pandemic ."

- US Travel Insurance Association . " Will Your Credit Card Protect Your Travels? ."

- Centers for Disease Control and Prevention . " Direct Medical Costs Associated With Post–COVID-19 Conditions Among Privately Insured Children and Adults ."

)

Amy is a personal finance and technology writer. With a background in the legal field and a bachelor's degree from Ferris State University, she has a talent for transforming complex topics into content that’s easy to understand. Connect with Amy on LinkedIn .

Latest Articles

)

How to Get a Texas Driver’s License: A Step-by-Step Guide

To become a licensed driver in Texas, you must pass a three-part test. You might also need to take driver’s ed courses depending on your age.

)

How to Get Cheap Car Insurance

Don’t assume you already have the best car insurance deal for you. Strategies beyond bundling can result in cheap rates. Learn more.

)

17 Factors That Affect Car Insurance Rates

Curious what factors affect your car insurance rates? Learn more about how insurers determine your premiums here.

)

Tickets vs. Citations: What’s the Difference?

A citation is the same thing as a ticket. Using the word “ticket” instead of “citation” is much like saying “pink slip” instead of “termination notice.”

)

What Is a Car Insurance Premium?

A car insurance premium is the amount you pay to keep your coverage. Learn more about what factors influence your premium in our guide.

)

What Are the Best Cars for Senior Drivers?

Toyota Camry, Acura Integra, and Honda CR-V are among the best cars for senior drivers. Learn more about safe and affordable vehicle options.

Advertisement

Supported by

Omicron and Travel: So, Now Do I Need Trip Insurance?

In light of the new variant, is extra protection warranted for things like flight and lodging cancellations and quarantine hotels? It depends. Here’s what you need to know.

- Share full article

By Elaine Glusac

While the pandemic has depressed travel, it may have encouraged travel insurance, say those in the industry.

“The biggest question we get from customers is: ‘What happens if I get Covid during travel and what if I have to quarantine?’” said Jeremy Murchland, the president of Seven Corners , a travel insurance management company. “Covid has created a much broader awareness of travel insurance.”

But will it help you in light of the new Omicron variant, which has already led to new travel restrictions and requirements? In the early days of the pandemic, travel insurance largely failed to protect travelers who wanted or needed to cancel as the world shut down. The following are answers to common questions about travel insurance now.

Does travel insurance cover Covid-19, including the new Omicron variant?

For the most part, yes, travel insurance policies now treat Covid-19 in all its variants — including Omicron — like any other medical emergency.

“Consumers should know that most travel insurance plans with medical benefits now treat Covid like any other illness that you could contract while traveling or that could prohibit you from going on your trip,” said Carol Mueller, a vice president of Berkshire Hathaway Travel Protection . “If you become ill before your trip, you’ll need a doctor’s note confirming your illness and that you are unable to travel in order to be eligible for benefits. The benefits are the same regardless of whether you contract Omicron, another variant of Covid or any illness for that matter.”

Buyers should read the policies carefully and look out for those that exclude pandemics, Covid-19 and its variants. To make a claim, you must have had travel insurance before becoming ill.

“We always say, you can’t buy auto insurance after you’ve already had an accident,” said Meghan Walch, the product manager of InsureMyTrip , an insurance sales site. “It is designed for unforeseen issues. You have to purchase it before an event.”

I am traveling internationally. If borders close because of Omicron, am I covered through travel insurance?

No, most policies do not cover you if your foreign destination closes its borders to visitors, as Israel did recently. With a few exceptions, that also goes for a government-issued travel warning to a destination, which is generally not a covered reason to make a claim.

Given the added uncertainties of Omicron, should I consider a ‘Cancel for Any Reason’ policy?

Cancel for Any Reason, or C.F.A.R., provisions would allow you to claim some of your nonrefundable costs if you decide not to go on a trip for any reason, including border closures or fear of contracting Covid. The rub is that this form of insurance — in addition to being more expensive — must generally be purchased within a few weeks of booking the trip and will only return 50 to 75 percent of nonrefundable trip costs.

“Most travel insurance policies do not cover you for wanting to cancel out of fear of Covid. We say this 10 times a week,” said Sarah Groen, the owner of the agency Bell and Bly Travel . She counsels clients to consider their worst fears — illness, for example, or quarantine — in troubleshooting travel insurance. “We’ve become like therapists,” she said.

What about quarantine and medical expenses?

Make sure the policy you choose covers these. In the case of medical coverage, check with your regular health insurer; many policies will not cover you abroad, which is an additional reason to consider coverage if you are traveling internationally.

“What travel insurance can do is cover additional hotel stays if you are able to self-quarantine and additional airfare when you’re able to come home,” said Megan Moncrief, the chief marketing officer for Squaremouth , a travel insurance sales site. She added that most policies will extend to seven days past your originally scheduled return date, effectively covering only about seven days in case of quarantine.

Do some destinations require travel insurance?

Yes, primarily to cover medical care or quarantine accommodations in the event that a traveler tests positive for Covid-19. For example, Singapore requires medical insurance with a minimum coverage of 30,000 Singapore dollars, or about $22,000. Fiji requires travel insurance to cover potential treatment for Covid-19, and makes it available from about $30. Some destinations, such as Anguilla , recommend rather than require travel insurance. InsureMyTrip.com has a page devoted to countries that require travel insurance.

It bears thinking about what it would take to get home for treatment should you contract Covid-19 abroad. Thailand, for example, requires travelers to have medical insurance with the minimum coverage of $50,000. “Evacuation out of Thailand would be higher,” said Sasha Gainullin, the chief executive of Battleface , a travel insurance start-up that unbundles benefits. In the case of a Thailand trip, he advised taking medical coverage up to $100,000 for treatment locally and $500,000 for medical evacuation and repatriation.

Do I need insurance if I have bookings with flexible cancellation policies?

Probably not, if you have hotel reservations that allow free cancellation 24 to 48 hours in advance. The same with flights; if your flight is changeable and will provide a voucher or refund in case of cancellation, you’re covered.

I have rented a house with restrictive cancellation penalties. Can I insure against those?

Yes. Vacation home rentals from Airbnb and the like can be treated just like other accommodations that do not offer refunds. In this case, you would want to get a policy in the amount you would forfeit if you had to cancel for a covered reason like illness. Again, fear of travel is not a covered reason; for that, you would need C.F.A.R.

Elaine Glusac is the Frugal Traveler columnist. Follow her on Instagram: @eglusac .

Follow New York Times Travel on Instagram , Twitter and Facebook . And sign up for our weekly Travel Dispatch newsletter to receive expert tips on traveling smarter and inspiration for your next vacation.

An earlier version of this article misstated the timeframe within which it is recommended that Cancel for Any Reason travel insurance be purchased. It is generally within about two to three weeks of booking the trip, not one or two days.

How we handle corrections

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best COVID-19 Travel Insurance in May 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Factors we considered when picking travel insurance that covers COVID

An overview of the best travel insurance for covid , top travel insurance for covid options , additional resources for covid-19 travel insurance shoppers.

No matter how well you prepare, travel plans don’t always go as expected. Some travelers buy travel insurance to protect their investment in prepaid travel costs. Amid the ongoing pandemic, exploring travel insurance with COVID-19 coverage is recommended. With the right policy, you can protect yourself if you need to cancel your trip or end it early due to illness. Many insurers offer travel insurance policies with this kind of coverage.

This is the shortlist of the best travel insurance for COVID options:

Berkshire Hathaway Travel Protection .

John Hancock Insurance Agency, Inc.

Seven Corners .

Travelex Insurance Services .

Travel Insured International .

WorldTrips .

We used the following factors to choose insurance providers to highlight in our best travel insurance for COVID list:

Range of coverage: We looked at how many plans each company offered with COVID-19 coverage, plus the range of available plans.

Depth of coverage: We compared the maximum caps for trip cancellation and trip interruption claims between carriers and plans.

Medical benefits: We examined whether plans included emergency medical benefits for COVID-19 reasons and whether plans included medical evacuation and repatriation benefits.

Cost: We determined an average cost for shoppers to benchmark plan prices by looking at the basic coverage costs for plans with COVID-19 benefits across multiple companies.

We looked at quotes from various companies for a six-night trip in May 2023 to Croatia. The traveler was 30 years old, from Texas and planned to spend $1,500 on the trip, including airfare.

On average, the price of each company’s most basic coverage plan with COVID-19 coverage was $47.22. The prices listed below are for the most basic COVID-19 travel insurance coverage. All insurers offer multiple COVID-19 policies with greater coverage coming at a higher cost.

Let's take a closer look at our eight recommendations for travel insurance with COVID coverage:

Berkshire Hathaway Travel Protection

What makes Berkshire Hathaway Travel Protection great:

Several plans allow policyholders to cancel for COVID-19 sickness as part of trip cancellation and trip interruption insurance benefits.

Several plans include COVID-19 medical coverage benefits.

Medical evacuation benefits are included in these plans.

Plans include limited sports and activities coverage and sports equipment loss benefits.

Basic Berkshire Hathaway Travel Protection will run you $50 for an ExactCare Value policy, the company’s most basic COVID-19 travel insurance coverage option.

What makes IMG great:

Many plans include COVID-19 cancellation benefits.

Most of these plans also include COVID-19 medical benefits (the Travel Essentials plan doesn’t include this).

Medical evacuation coverage is available on select plans.

Coverage for adventure travel is available for an extra cost.

IMG is a good option for the budget-minded: Its Travel Essential plans cost more than $10 less than average based on our comparison.

John Hancock Insurance Agency, Inc.

What makes John Hancock Insurance Agency great:

Multiple plans offer COVID-19 cancellation benefits as part of the included trip interruption and trip cancellation coverage.

These plans offer COVID-19 medical benefits.

Medical evacuation coverage is included in all COVID-19 coverage plans.

The John Hancock Insurance Agency, Inc. basic plan (Bronze) costs $56.

Seven Corners

What makes Seven Corners great:

Multiple plans offer COVID-19 cancellation benefits as part of the included trip interruption and trip cancelation coverage.

These plans include COVID-19 medical benefits and evacuation and repatriation benefits.

There is no medical deductible.

Seven Corners’ basic coverage plan (RoundTrip Basic) for our trip to Croatia costs $44.

Travelex Insurance Services

What makes Travelex Insurance Services great:

Multiple plans include Covid-19 sickness coverage, which reimburses prepaid and nonrefundable trip payments if a trip is canceled or interrupted due to a traveler contracting the virus.

These plans also include COVID-19 medical benefits.

Medical evacuation and repatriation benefits are included.

Basic coverage (Travel Basic) from Travelex Insurance Services costs $44 for our sample trip, which is slightly cheaper than average.

Travel Insured International

What makes Travel Insured International great:

Multiple plans cover COVID-19 cancellation benefits as part of the included trip interruption and trip cancelation coverage.

These plans also include COVID-19 medical benefits, including medical evacuation.

Limited sports and activities coverage is included in plans with COVID-19 coverage.

Travel Insured International's basic coverage (Worldwide Trip Protector Edge) begins at $55 — only a few dollars more than the average basic policy price.

What makes Tin Leg great:

A wide range of plans offer COVID-19 cancellation benefits as part of the included trip interruption and trip cancelation coverage.

All of these plans also include COVID-19 medical benefits.

All of these include medical evacuation benefits.

An adventure travel policy is available.

Another plus: Tin Leg’s basic coverage plan (Basic) for our trip to Croatia costs $48.85 — making it right around the average price for the policies we covered.

WorldTrips

What makes WorldTrips great:

Several plans include medical coverage for COVID-19.

Sports and activities and sports equipment loss are included.

Coverage can be extended for up to thirty days, including for medical quarantine purposes.

WorldTrips’ most affordable plan with COVID-19 coverage (Atlas Journey Economy) starts at $44, making it a low-cost option.

Do you want to learn more about travel insurance before you spend money on a policy? Take a look at these resources:

What is travel insurance?

What does travel insurance cover?

The best travel insurance companies

How to find the right travel insurance for you

10 credit cards that provide travel insurance

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

AARP's Brain Health Resource Center offers tips, tools and explainers on brain health.

AARP daily Crossword Puzzle

Hotels with AARP discounts

Life Insurance

AARP Dental Insurance Plans

AARP MEMBERSHIP — $12 FOR YOUR FIRST YEAR WHEN YOU SIGN UP FOR AUTOMATIC RENEWAL

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

- right_container

Work & Jobs

Social Security

AARP en Español

- Membership & Benefits

- AARP Rewards

- AARP Rewards %{points}%

Conditions & Treatments

Drugs & Supplements

Health Care & Coverage

Health Benefits

Staying Fit

Your Personalized Guide to Fitness

AARP Hearing Center

Ways To Improve Your Hearing

Brain Health Resources

Tools and Explainers on Brain Health

A Retreat For Those Struggling

Scams & Fraud

Personal Finance

Money Benefits

View and Report Scams in Your Area

AARP Foundation Tax-Aide

Free Tax Preparation Assistance

AARP Money Map

Get Your Finances Back on Track

How to Protect What You Collect

Small Business

Age Discrimination

Flexible Work

Freelance Jobs You Can Do From Home

AARP Skills Builder

Online Courses to Boost Your Career

31 Great Ways to Boost Your Career

ON-DEMAND WEBINARS

Tips to Enhance Your Job Search

Get More out of Your Benefits

When to Start Taking Social Security

10 Top Social Security FAQs

Social Security Benefits Calculator

Medicare Made Easy

Original vs. Medicare Advantage

Enrollment Guide

Step-by-Step Tool for First-Timers

Prescription Drugs

9 Biggest Changes Under New Rx Law

Medicare FAQs

Quick Answers to Your Top Questions

Care at Home

Financial & Legal

Life Balance

LONG-TERM CARE

Understanding Basics of LTC Insurance

State Guides

Assistance and Services in Your Area

Prepare to Care Guides

How to Develop a Caregiving Plan

End of Life

How to Cope With Grief, Loss

Recently Played

Word & Trivia

Atari® & Retro

Members Only

Staying Sharp

Mobile Apps

More About Games

Right Again! Trivia

Right Again! Trivia – Sports

Atari® Video Games

Throwback Thursday Crossword

Travel Tips

Vacation Ideas

Destinations

Travel Benefits

Beach vacation ideas

Vacations for Sun and Fun

Plan Ahead for Tourist Taxes

AARP City Guide

Discover Seattle

25 Ways to Save on Your Vacation

Entertainment & Style

Family & Relationships

Personal Tech

Home & Living

Celebrities

Beauty & Style

TV for Grownups

Best Reality TV Shows for Grownups

Robert De Niro Reflects on His Life

Looking Back

50 World Changers Turning 50

Sex & Dating

Spice Up Your Love Life

Navigate All Kinds of Connections

Life & Home

Couple Creates Their Forever Home

Store Medical Records on Your Phone?

Maximize the Life of Your Phone Battery

Virtual Community Center

Join Free Tech Help Events

Create a Hygge Haven

Soups to Comfort Your Soul

Your Ultimate Guide to Mulching

Driver Safety

Maintenance & Safety

Trends & Technology

AARP Smart Guide

How to Keep Your Car Running

We Need To Talk

Assess Your Loved One's Driving Skills

AARP Smart Driver Course

Building Resilience in Difficult Times

Tips for Finding Your Calm

Weight Loss After 50 Challenge

Cautionary Tales of Today's Biggest Scams

7 Top Podcasts for Armchair Travelers

Jean Chatzky: ‘Closing the Savings Gap’

Quick Digest of Today's Top News

AARP Top Tips for Navigating Life

Get Moving With Our Workout Series

You are now leaving AARP.org and going to a website that is not operated by AARP. A different privacy policy and terms of service will apply.

Go to Series Main Page

Do You Need Special Health Insurance to Travel Internationally?

Some countries are requiring proof of medical coverage in the covid-19 era.

Before your next international trip , you may have to add an item to your packing list: proof of health insurance.

As the world begins to reopen to tourism, Americans are finding that some countries, including many Caribbean nations, now require arriving passengers to document that they have medical coverage. And a few, such as Costa Rica , are even demanding special policies that cover up to $2,000 for the expense of quarantining in a hotel if a visitor tests positive for COVID-19, as well as at least $50,000 of expenses relating to coronavirus care.

"We're seeing this more and more,” says Brook Wilkinson, an editor at travel-advice website WendyPerrin. “If someone wants an easy-breezy trip 2019-style, that's going to be tricky."

AARP Membership — $12 for your first year when you sign up for Automatic Renewal

You may already be covered by a health insurance plan in the U.S. A health insurance policy for international travel may be necessary if you don't have your own health plan, if your plan doesn't cover medical care outside of the U.S. or if your destination requires a special country-specific plan.

Here are questions to ask when considering whether you need to purchase travel health insurance.

Does the country you're visiting require travel health insurance?

Before COVID-19, some countries already required visitors to prove they had health insurance coverage, and now a growing number are requiring a special country-specific policy related to the pandemic.

While Western European countries haven't adopted the requirement, countries that have include Cambodia, which requires visitors to buy COVID-19 insurance from a local company ($90 for 20 days); Aruba; the Bahamas; the British Virgin Islands; Dubai; Egypt; Grenada; Jordan; Mauritius; Namibia; Rwanda; Saba; St. Martin/Sint Maarten; the Seychelles; Sri Lanka; and Thailand.

ARTICLE CONTINUES AFTER ADVERTISEMENT

Entry requirements are changing frequently. Ask your travel agent or search online for the latest updates. The best source of information is usually the country's tourism office and the U.S. State Department . Other helpful resources include CanITravel.net and WendyPerrin.com , which maintains a comprehensive list. The sites also have the latest traveler requirements for COVID-19 vaccination, testing and quarantining. Note that the Centers for Disease Control and Prevention (CDC) advises delaying international trips until you are fully vaccinated.

If a country requires special health insurance, you must bring written proof, sometimes specifically mentioning coverage for COVID-19, which the insurer can provide. Without it, airlines may not let you board and some countries may not admit you.

AARP® Dental Insurance Plan administered by Delta Dental Insurance Company

Dental insurance plans for members and their families

Travel Insurance Terms

Travel health insurance covers medical issues that arise while you're traveling. You may need it if you don't have another form of health insurance , your health insurance doesn't fully cover you outside the U.S. or your destination requires visitors to purchase a particular plan.

Medical evacuation insurance covers transportation to a medical facility if there isn't one in your immediate destination. It may be included in a travel health insurance policy or bought separately.

Trip cancellation or disruption insurance allows you to recoup the nonrefundable portion of a trip canceled for a covered reason. Sometimes it covers cancellation in case of illness, but it doesn't cover medical care. It may or may not cover cancellation due to disease outbreaks (such as COVID-19 ) in your destination.

Does your current health insurance policy cover medical care outside the United States?

Even if you have health insurance and special coverage isn't required for entry to your destination country, you may still need a travel health policy. Many traditional health insurance policies, including basic Medicare plans , do not provide coverage outside the U.S. And while some Medicare supplement polices include overseas coverage, it may be limited.

"A lot of U.S. travelers really aren't aware of how much medical coverage they have when they're traveling internationally,” says Stan Sandberg, cofounder of TravelInsurance.com. “They're assuming that health insurance travels with them, but in many cases it doesn't."

If you don't have health insurance (travel or otherwise) that covers you in your destination, you could face bills running many thousands of dollars if a health emergency arises.

Will you be particularly vulnerable during your travels because of a health condition or high-risk activities?

The CDC recommends travel health insurance for international travel, particularly for those who “have an existing health condition, are traveling for more than six months, or doing adventure activities such as scuba diving or hang gliding.”

You can find travel health insurance plans that cover preexisting conditions , but you often need to purchase one shortly after paying for your trip (usually within two or three weeks). And some plans won't cover medical care for injuries resulting from activities that are generally considered high risk. So be sure your plan does if you want to be adventurous and, say, skydive.

Do you need emergency evacuation coverage?

Even if your health insurance includes medical transportation, it may just cover the cost of getting you to the nearest appropriate medical facility. For example, if you sustained a serious injury on a safari in South Africa, your carrier may pay for transportation to a hospital in Johannesburg but not the cost to fly you back home.

Some travel health insurance policies include emergency evacuation home, and other companies, such as Medjet (MedJetAssist.com) and GlobalRescue.com, sell stand-alone plans that provide the coverage.

Choosing a travel health insurance plan

Travel health insurance generally isn't super expensive. A policy for a 65-year-old going to Europe for two weeks could cost less than $35 for $50,000 in coverage, Sandberg says. Paying just a bit more can bring higher policy limits and extras like lost-baggage coverage. (By contrast, trip cancellation insurance is pricier, costing up to 10 percent of the price of your trip. And coverage that lets you cancel for any reason runs even more.)

Shop around. Sandberg's company offers quotes from multiple plans, as do platforms such as InsureMyTrip.com. These companies also sell travel cancellation insurance, but you can narrow your search for travel health insurance policies by entering $0 as your total trip cost.

And, as noted above, you may want to consider whether a policy covers medical care for preexisting conditions or for COVID-19 and whether it includes emergency evacuation.

More on travel

A Guide to Hawaii's Evolving COVID-19 Rules

Do's and Don't's of (Almost) Post-Pandemic Travel

Like Cruising? These People Are Totally Wild About It

Or Call: 1-800-675-4318

Enter a valid from location

Enter a valid to location

Enter a valid departing date

Enter a valid returning date

Age of children:

Child under 2 must either sit in laps or in seats:

+ Add Another Flight

Enter a valid destination location

Enter a valid checking in date

Enter a valid checking out date

Occupants of Room

Occupants of Room 1:

Occupants of Room 2:

Occupants of Room 3:

Occupants of Room 4:

Occupants of Room 5:

Occupants of Room 6:

Occupants of Room 7:

Occupants of Room 8:

Enter a valid date

You didn't specify child's age

There are children in room 1 without an adult

You didn't specify child's age for room 1

There are children in room 2 without an adult

You didn't specify child's age in room 2

There are children in room 3 without an adult

You didn't specify child's age in room 3

There are children in room 4 without an adult

You didn't specify child's age in room 4

There are children in room 5 without an adult

You didn't specify child's age in room 5

You have more than 6 people total

Please select a trip duration less than 28 days

There must be at least 1 traveler (age 12+) for each infant in a lap

Enter a valid From location

Enter a valid start date

Enter a valid drop location

Enter a valid drop off date

Select a valid to location

Select a month

Enter a valid going to location

Enter a valid from date

Enter a valid to date

AARP VALUE &

MEMBER BENEFITS

Denny's

15% off dine-in and pickup orders

AARP Travel Center Powered by Expedia: Vacation Packages

$50 gift card of your choice when booking any flight package

$20 off a Walmart+ annual membership

AARP® Staying Sharp®

Activities, recipes, challenges and more with full access to AARP Staying Sharp®

SAVE MONEY WITH THESE LIMITED-TIME OFFERS

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

UPDATED APRIL 6, 2022

The information in this FAQ is current as of the time of publication but is subject to change . Please see our Coverage Alert for the latest coverage information. The information in this FAQ is intended to provide general information only and is not a coverage determination in any respect on any claim. All claims are evaluated under the terms, conditions, and exclusions of the plan purchased based on the particular facts and circumstance of that claim. The below FAQ responses address only losses incurred on or after the publication date of these FAQs . If a loss was incurred prior to that date, these responses may not apply to you or may vary. Please contact us at the number listed on your plan with any questions about coverage or to file a claim.

For customers purchasing a new travel protection plan, some of our plans now include an Epidemic Coverage Endorsement, which adds epidemic-related covered reasons for certain benefits. Benefits vary by plan and by state of residence, and are not available in all jurisdictions.

Please read your plan documents to see if the Epidemic Coverage Endorsement is included in your plan. We are also offering certain temporary accommodations as described in our COVID-19 coverage alert .

For frequently asked questions regarding details of the Epidemic Coverage Endorsement, see below section on “Epidemic Coverage Endorsement.”

General COVID-19

+ - i am worried about covid-19 impacting a trip i have scheduled or plan to schedule. should i buy an allianz travel protection plan to cover me in case covid-19 impacts my trip.

COVID-19 is a known and evolving epidemic that is impacting travel worldwide, with continued spread and impacts expected. Our travel protection plans do not generally cover losses directly or indirectly related to known, foreseeable, or expected events, epidemics, government prohibitions, warnings, or travel advisories, or fear of travel.

However, we are pleased to announce the introduction of our Epidemic Coverage Endorsement to certain plans purchased on or after March 6, 2021. This endorsement adds certain new covered reasons related to epidemics (including COVID-19) to some of our most popular insurance plans. Please see the below FAQ section on “Epidemic Coverage Endorsement” for more information. Note, the Epidemic Coverage Endorsement may not be available for all plans or in all jurisdictions. To see if your plan includes this endorsement, please look for “Epidemic Coverage Endorsement” on your Declarations of Coverage or Letter of Confirmation.

Additionally, in response to the ongoing public health and travel crisis, we are temporarily extending certain claims accommodations as follows*:

1. For plans that do not include the Epidemic Coverage Endorsement, we are temporarily accommodating claims for the following:

- Emergency medical care for an insured who becomes ill with COVID-19 while on their trip (if your plan includes the Emergency Medical Care benefit)

- Trip cancellation and trip interruption if an insured, or that insured’s traveling companion or family member, becomes ill with COVID-19 either before or during the insured’s trip (if your plan includes Trip Cancellation or Trip Interruption benefits, as applicable)

2. If an insured or their traveling companion become ill with COVID-19 while on their trip, that insured will not be subject to the Trip Interruption benefit’s five-day maximum limit for additional accommodation and transportation expenses (however, the maximum daily limit for such expenses and the maximum Trip Interruption benefit limit still apply).

These temporary accommodations are strictly applicable to COVID-19 and are only available to customers whose plan includes the applicable benefit. These accommodations apply to plans currently in effect but may not apply to plans purchased in the future, so please refer to our Coverage Alert for the most up to date information before purchasing.

+ - Am I covered if I want to cancel my travel plans because I’m afraid to travel due to COVID-19?

No, canceling a trip because you’re afraid to travel due to COVID-19 is generally not covered by our travel protection plans.

However, if you’re concerned about traveling during this time, many airlines and other travel suppliers are allowing their customers to change the dates of their travel without change fees. If you change your trip’s dates, we are happy to allow you to move your plan coverage dates to cover a new or rescheduled trip, so long as that trip is scheduled to be completed within 770 days from the plan’s original purchase date.* For terms and details, please see the below FAQ on changing your travel protection plan’s effective dates .

This temporary accommodation is strictly applicable to COVID-19. This accommodation applies to plans currently in effect but may not apply to plans purchased in the future, so please refer to our Coverage Alert for the most up to date information before purchasing.

+ - Am I covered if I cancel or interrupt my trip due to COVID-19?

Claims due to known, foreseeable, or expected events, epidemics, government prohibitions, warnings, or travel advisories or fear of travel are generally not covered. As such, our travel insurance plans do not generally cover trip cancellations or interruptions directly or indirectly related to COVID-19.

However, we are pleased to announce the introduction of our Epidemic Coverage Endorsement to certain plans purchased on or after March 6, 2021. This endorsement adds certain new covered reasons related to epidemics (including COVID-19) to some of our most popular insurance plans. Please see the below FAQ section on “Epidemic Coverage Endorsement” for more information. Note, the Epidemic Coverage Endorsement may not be available for all plans or in all jurisdictions. To see if your plan includes this endorsement, please look for “Epidemic Coverage Endorsement” on your Declarations of Coverage or Letter of Confirmation.

+ - What if my travel supplier (e.g. airline, cruise line, tour operator, etc.) cancels a portion or all of my trip due to COVID-19?

Travel supplier cancellations due to COVID-19 are generally not covered under our travel protection plans. However, if your supplier cancels your trip, you may be eligible for a refund directly from your supplier, and we encourage you to contact them for assistance.

If you have rescheduled your trip or rebooked a new trip, we are happy to allow you to move your plan coverage dates to cover a new or rescheduled trip, so long as that trip is scheduled to be completed within 770 days from the plan’s original purchase date.* For terms and details, please see the below FAQ on changing your travel protection plan’s effective dates .

Alternatively, if your travel supplier has canceled your trip due to COVID-19, you may be eligible for a refund of the cost of your travel protection plan.* For terms and details, please see the below FAQ on canceling your plan .

These temporary accommodations are strictly applicable to COVID-19. These accommodations apply to plans currently in effect but may not apply to plans purchased in the future, so please refer to our Coverage Alert for the most up to date information before purchasing.

+ - Am I covered if I cancel my travel plans because of a travel ban or other government-imposed restriction on travel related to COVID-19?

No, canceling a trip because of a travel ban or other government-imposed restriction on travel directly or indirectly related to COVID-19 is generally not covered by our travel protection plans.

Please note, many airlines and other travel suppliers are allowing their customers to change the dates of their travel without change fees. If you change your trip’s dates, we are happy to allow you to move your plan coverage dates to cover a new or rescheduled trip, so long as that trip is scheduled to be completed within 770 days from the plan’s original purchase date.* For terms and details, please see the below FAQ on changing your travel protection plan’s effective dates .

Alternatively, if your travel supplier has canceled your trip due to COVID-19, you may be eligible for a refund of the cost of your travel protection plan.* For terms and details, please see the below FAQ on canceling your plan .

+ - How do I know if COVID-19 testing and/or vaccination is required for my destination?

Check our interactive map for the latest information on travel requirements and entry restrictions for international destinations, including COVID-19 testing, vaccination policies, necessary travel documents and quarantine periods. (Content is provided by Sherpa, an affiliated third party).

Please keep in mind that travel restrictions change often, so you should check the travel requirements again before you leave for your trip.

+ - What should I do if my destination requires proof of travel insurance that covers COVID-19?

If your destination requires proof of travel insurance, we're happy to provide a summary letter that describes your travel insurance plan benefits, also called Proof of Insurance. Click here to request Proof of Insurance (please allow approximately 48 hours for a response).

If you’re not sure whether the information provided in the Proof of Insurance satisfies the requirements of your destination country, we recommend that you or your travel advisor contact the nearest embassy or consulate of that country to confirm.

+ - Can travel insurance cover trip cancellation or interruption if I don't meet the COVID-19 entry requirements for my destination?

Failing to meet a country’s entry requirements, whether for COVID-19 or any other reason, is not a covered reason for trip cancellation or interruption. It’s the responsibility of the traveler to check international entry requirements before booking a trip.

Before you book, and before you travel, use our interactive map to see current information on travel requirements and entry restrictions for international destinations, including COVID-19 testing, vaccination policies, necessary travel documents and quarantine periods. (Content is provided by Sherpa, an affiliated third party).

+ - I have an upcoming trip to an area with reported cases of COVID-19. Will I be covered if I cancel my trip?

No, canceling a trip because of an area being affected by COVID-19 is generally not covered by our travel protection plans.

+ - Am I covered if I cancel or interrupt my trip because the government has issued a travel advisory or warning for my destination due to COVID-19?

Our plans do not generally cover losses directly or indirectly resulting from government-issued travel advisories or warnings related to COVID-19, including those issued by the U.S. Centers for Disease Control and Prevention (CDC) and U.S. Department of State.

However, as a temporary accommodation, please note that the accommodations and other coverage for which you are otherwise eligible under your plan continue to apply regardless of any U.S. Centers for Disease Control and Prevention and U.S. Department of State travel alerts regarding COVID-19 that exist on the effective date of our COVID-19 Coverage Alert . For the latest information and updates, please see our COVID-19 Coverage Alert .

+ - Can I cancel my travel protection plan and get the cost of my travel protection plan refunded?

You may be eligible to cancel your plan and receive a refund of your plan cost in the following situations:

- You generally have 15 days (or more, depending on your plan and state of residence) from the date your plan was purchased to request a refund of the cost of your plan, provided you have not started your trip or initiated a claim. Please note, plan refund rules vary by state and plan purchased, so please see your plan for details.

- Additionally, for a temporary period, we are offering refunds for the cost of your single-trip travel protection plan if your travel supplier cancels your trip due to COVID-19, as long as no payable claim has been filed under the plan. (This is not available for annual travel insurance plans, which may be canceled any time for a refund of unearned premium.) Refunds must be requested within 770 days of the original plan purchase date.*

To cancel your plan for one of these situations, please call us at the number listed on your plan.

Unless earlier canceled or otherwise ended in accordance with its terms or the accommodations stated here, plans end 770 days after the original plan purchase date. Plans do not provide any coverage or accommodation for any loss incurred after the plan ends.

+ - If I rebook my trip to a later date, can I change my travel protection plan’s effective dates to cover the rebooked trip?

Yes, you may change your travel protection plan’s effective dates to cover a new or rescheduled trip, as long as that trip is scheduled to be completed within 770 days from the plan’s original purchase date. Changes can be made at www.allianztravelinsurance.com or by calling the phone number on your plan.

Please note, if you wish to move your plan’s covered trip dates to cover a new or rescheduled trip, you must update your trip dates prior to the departure date of that new or rescheduled trip and prior to any loss for which you seek coverage.* Additionally, if your trip costs for your new or rescheduled trip are different than the cost of your original trip, you will need to update your plan’s coverage limits accordingly. Any change in trip cost insured for the new or rescheduled trip may result in a change in premium. If you update your plan’s trip dates to cover a new or rescheduled trip but do not adjust your limits, the original plan limits will apply to the new or rescheduled trip.

+ - What are your temporary accommodations for COVID-19?

To learn more about the temporary, specific accommodations we are currently offering, please read our Coverage Alert . These accommodations apply to plans currently in effect but may not apply to plans purchased in the future, so please refer to our Coverage Alert for the most up to date information before purchasing.

+ - Am I covered for trip cancellation due to COVID-19 if I have a Cancel Anytime plan?

Our Cancel Anytime plans provide up to 100% reimbursement of non-refundable, pre-paid trip costs when a trip is canceled for a covered reason, and up to 80% of those costs for most other unforeseen reasons for cancellation. However, our plans do not provide “Cancel For Any Reason” coverage, and coverage under these plans is subject to terms, conditions, and exclusions. Specifically, Cancel Anytime plans generally exclude coverage for losses directly or indirectly resulting from any of the following: known, foreseeable, or expected events, epidemics, and government prohibitions, and certain other causes of loss. As such, losses directly or indirectly resulting from COVID-19 are not generally covered under our Cancel Anytime plans.

However, we are pleased to announce the introduction of our Epidemic Coverage Endorsement to certain plans purchased on or after March 6, 2021. This endorsement adds certain new covered reasons related to epidemics (including COVID-19) to some of our most popular insurance plans. Please see the below FAQ section on “Epidemic Coverage Endorsement” for more information. Note, the Epidemic Coverage Endorsement may not be available for all plans or in all jurisdictions. To see if your plan includes this endorsement, please look for “Epidemic Coverage Endorsement” on your Declarations of Coverage or Letter of Confirmation.

+ - Am I covered if I need emergency medical care because I become ill with COVID-19 while on my trip?

Claims due to known, foreseeable, or expected events, epidemics, government prohibitions, warnings, or travel advisories or fear of travel are generally not covered. As such, our travel insurance plans do not generally cover medical claims directly or indirectly related to COVID-19.

However, we are pleased to announce the introduction of our Epidemic Coverage Endorsement to certain plans purchased on or after March 6, 2021. This endorsement adds certain new covered reasons related to epidemics (including COVID-19), including related to emergency medical care if you or a traveling companion become ill with COVID-19 while on your trip, to some of our most popular insurance plans. Please see the below FAQ section on “Epidemic Coverage Endorsement” for more information. Note, the Epidemic Coverage Endorsement may not be available for all plans or in all jurisdictions. To see if your plan includes this endorsement, please look for “Epidemic Coverage Endorsement” on your Declarations of Coverage or Letter of Confirmation.

Please note, the above applies to emergency medical care for insured individuals who become ill with COVID-19 while traveling. For the elimination of doubt, we do not provide coverage or reimbursement for the cost of COVID-19 testing required for travel, the cost of COVID-19 vaccination, or any other such expenses.

We urge any customer who has a medical issue while traveling or needs help to call us. We are assisting customers 24/7/365 who wish to change their travel plans, need travel assistance, or would like to file a claim. Our assistance team is ready to help all of our customers who need help while traveling, such as locating medical facilities or rebooking transportation. You can also use our self-service options on this website. We review every claim based on its unique facts and circumstances and are happy to answer any questions you may have.

+ - Is a “long-haul” or an ongoing or active case of COVID-19 considered a pre-existing medical condition?

Our plans generally define a pre-existing medical condition as an injury, illness, or medical condition that, within the 120 days prior to and including the purchase date of your travel protection plan:

- Caused a person to seek medical examination, diagnosis, care, or treatment by a doctor;

- Presented symptoms; or

- Required a person to take medication prescribed by a doctor (unless the condition or symptoms are controlled by that prescription, and the prescription has not changed).

The illness, injury, or medical condition does not need to be formally diagnosed in order to be considered a pre-existing medical condition.

If your medical documentation indicates that COVID-19 symptoms/treatment were present within the 120 day look-back period prior to your insurance purchase, the condition could fall under the definition of a pre-existing medical condition.

Please note: Many plans include a Pre-Existing Medical Condition Exclusion Waiver. If your travel insurance plan includes this Waiver, and you meet the conditions of the Waiver, then this exclusion will not apply to your plan. One of the conditions to qualify for this Waiver is that you must be medically able to travel on the day you purchased your plan. As such, if you are not medically able to travel on the day you purchase your plan as a result of “long-haul” or an ongoing or active case of COVID-19, you may not be eligible for this Waiver. Please see your plan documents for details, and learn more about pre-existing medical conditions here .

Epidemic Coverage Endorsement

+ - if i was exposed to someone with covid-19, would trip cancellation benefits apply.

Exposure to someone with COVID-19 is not by itself a covered reason under the Trip Cancellation benefit. However, the Trip Cancellation benefit would apply if you or a traveling companion test positive for COVID-19 or you are diagnosed with COVID-19 by your physician.

The Trip Cancellation benefit would also apply if you or your traveling companion are individually-ordered to quarantine as a result of your exposure. Benefits may not cover the full cost of your quarantine and are subject to applicable benefit limits. For information on what qualifies as an “individually-ordered quarantine,” see the FAQ above on what is meant by individually-ordered quarantine .

For more information, please refer to the Epidemic Coverage Endorsement within your plan details.

Please note, this answer is specific to products that include the Epidemic Coverage Endorsement and applicable benefit(s) and covered reason(s) described. To see if your plan includes this endorsement, please look for “Epidemic Coverage Endorsement” on your Declarations of Coverage or Letter of Confirmation.