- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to AmEx Car Rental Insurance

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Does AmEx cover rental car insurance?

Amex cards that provide rental car insurance, what does amex rental car insurance cover, who is covered, how to file a claim with amex rental car insurance, amex car rental insurance, recapped.

Do you have an American Express card? Many AmEx cards include travel insurance, which can cover you in the event that an incident occurs. Among other benefits, AmEx provides complimentary rental car insurance on its cards, though the coverage level can vary depending on the card you hold.

Here's a look at AmEx car rental insurance, which cards have it and how it works.

Many AmEx cards include rental car insurance as a benefit. This applies to its most premium options, such as The Platinum Card® from American Express , as well as no-fee cards such as the Hilton Honors American Express Card . Terms apply.

Here are some of the AmEx cards that provide rental car insurance :

American Express® Gold Card .

Amex EveryDay® Credit Card .

Delta SkyMiles® Platinum American Express Card .

Hilton Honors American Express Surpass® Card .

Marriott Bonvoy Brilliant® American Express® Card .

The Blue Business® Plus Credit Card from American Express .

Marriott Bonvoy Bevy™ American Express® Card .

Terms apply.

on American Express' website

» Learn more: The best travel credit cards right now

Coverage levels differ depending on which card you hold. If you have The Platinum Card® from American Express , for example, AmEx will reimburse up to $75,000 for damage or theft after a qualifying incident. Meanwhile, if you have the Delta SkyMiles® Blue American Express Card , you’ll receive $50,000 in coverage after an incident. Terms apply.

Note that AmEx car rental insurance is secondary, which means it’ll reimburse you only after all other insurance has paid out. This includes any personal insurance that you have. However, secondary insurance becomes primary if you don’t hold any other car insurance, even within the U.S.

» Learn more: Best credit cards for rental cars

Complimentary credit card rental insurance does a pretty good job when it comes to coverage, but keep in mind that what's covered depends on the card you hold.

Here’s what American Express rental car insurance generally covers for premium cards, such as the Delta SkyMiles® Reserve American Express Card and the Hilton Honors American Express Aspire Card :

Theft of a covered rental car.

Physical damage to the vehicle.

Accidental death or dismemberment.

Accidental injury.

Car rental personal property coverage.

Loss-of-use charges as incurred by the agency.

Appraisal fees.

Reasonable towing charges.

Coverage for other cards is less comprehensive and includes:

Theft of the rental car.

Loss-of-use fees.

You’ll find this type of insurance on cards such as the American Express® Gold Card and the Delta SkyMiles® Platinum American Express Card . Terms apply.

To receive coverage for your rental vehicle, you’ll need to:

Pay for the full rental using your eligible AmEx card.

Decline the optional insurance coverages offered by the rental company — for higher-end cards, this means you’ll also need to decline insurance such as personal property coverage and personal accident insurance. Other cardholders simply need to decline the full collision damage waiver.

Note that you can still receive insurance if you’ve used your American Express Membership Rewards to pay for the car, but not if you used any other reward programs.

Rental car insurance is valid for rentals of up to 30 consecutive days only. Terms apply.

» Learn more: What your credit card rental car coverage doesn’t include

AmEx’s rental car insurance protects more than the cardholder. As defined in the guide to benefits, an eligible renter for collision insurance is a card member with an eligible card, their spouse or partner and any authorized drivers. For other types of insurance, such as accidental injury insurance, passengers of the vehicle are also covered. Terms apply.

There are two different ways to file a claim for an incident. The first is to head to AmEx’s online site and start your claim.

If you prefer talking to someone, report your claim by calling 800-338-1670. If you’re out of the country, call 303-273-6497 collect. You’ll want to report the incident within 30 days of the loss or as soon as reasonably possible.

Then, you'll need to submit proof of loss within 60 days. Expect to provide a variety of documentation, including:

An itemized repair estimate and itemized bill.

A copy of the rental agreement.

A copy of the charge slip for the vehicle.

A copy of your personal insurance or a notarized letter stating that you don’t have any.

Police report (if there is one).

A copy of your driver’s license.

Once AmEx has all your information and has processed your claim, they’ll pay out your benefits within 30 days. Terms apply.

Most AmEx cards come with some form of rental car insurance. This is true of both premium cards with high annual fees and lower-fee cards alike. However, the type of insurance and the level of coverage that you’ll receive varies based on your card. Terms apply.

To determine how the AmEx rental car benefits for your card work, you’ll want to check out its guide to benefits, where you’ll find information such as coverage limits and who is eligible for coverage.

To receive complimentary rental car insurance, you’ll need to pay for the full rental with your eligible card. You’ll also need to decline any insurance offered by the rental agency. Once that’s done, insurance is automatic and you can drive away knowing that you’re covered.

Insurance Benefit: Car Rental Loss & Damage Insurance

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

IHG One Rewards Premier Credit Card

Earn 5 free nights at an IHG property after $4k in spend (each night valued at up to 60k points).

/member/login'">Member Login

Home > Rental Car Benefits > American Express

Extra benefits.

Exclusively for American Express ® Platinum Card Members enrolled in Hertz Gold Plus Rewards ® .

*Available at select U.S. locations † Taxes and fees excluded. Terms apply.

Everything you need to know about Amex Travel

The American Express Travel portal allows you to redeem Membership Rewards points directly for travel reservations and activities rather than transfer your rewards to airline or hotel partners like Delta Air Lines SkyMiles and Marriott Bonvoy .

You also can book discounted premium tickets, use benefits like a 35% points rebate on certain bookings and even book premium hotels with additional perks through Amex Travel.

Let's explore this booking portal to uncover all its benefits and potential disadvantages.

What is the American Express Travel portal?

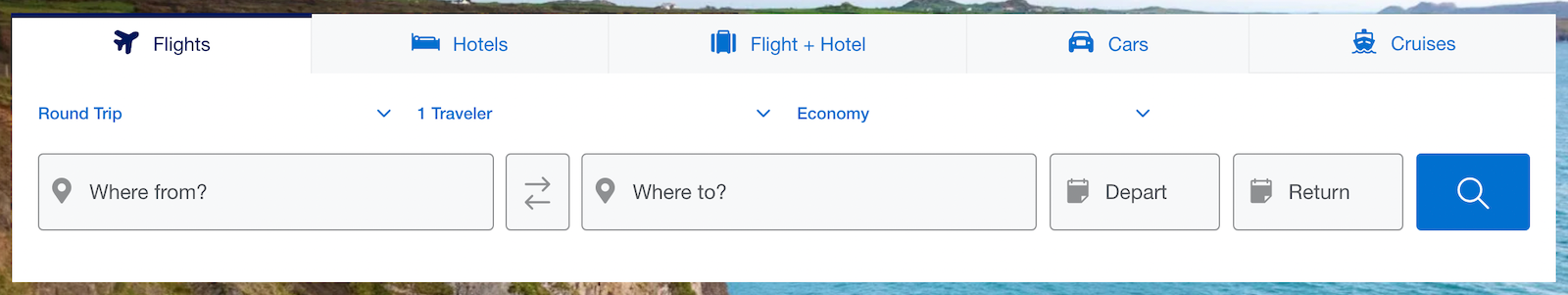

Amex Travel is the booking portal for most American Express cards . You can book flights, hotels, rental cars and cruises through the site, and you can pay with points, cash or a combination of the two.

How to book flights on the Amex Travel portal

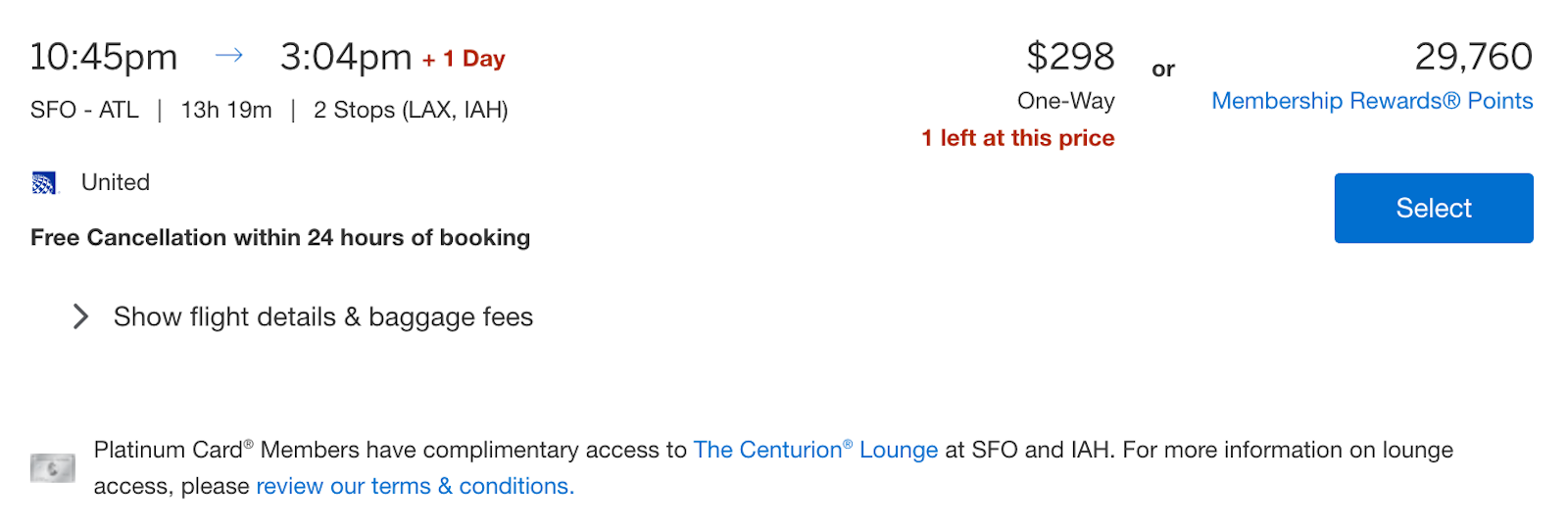

To find flights on American Express Travel, visit this webpage . The flight booking process on the Amex Travel portal is similar to other popular sites like Kayak and Orbitz. You'll find a search box where you can enter your departure and destination cities.

If you're flexible with your departure airport, you can choose an entire city, such as New York, which has multiple airports. Additionally, you can customize your booking by selecting your preferred class and the number of travelers, and choosing between one-way and round-trip flights.

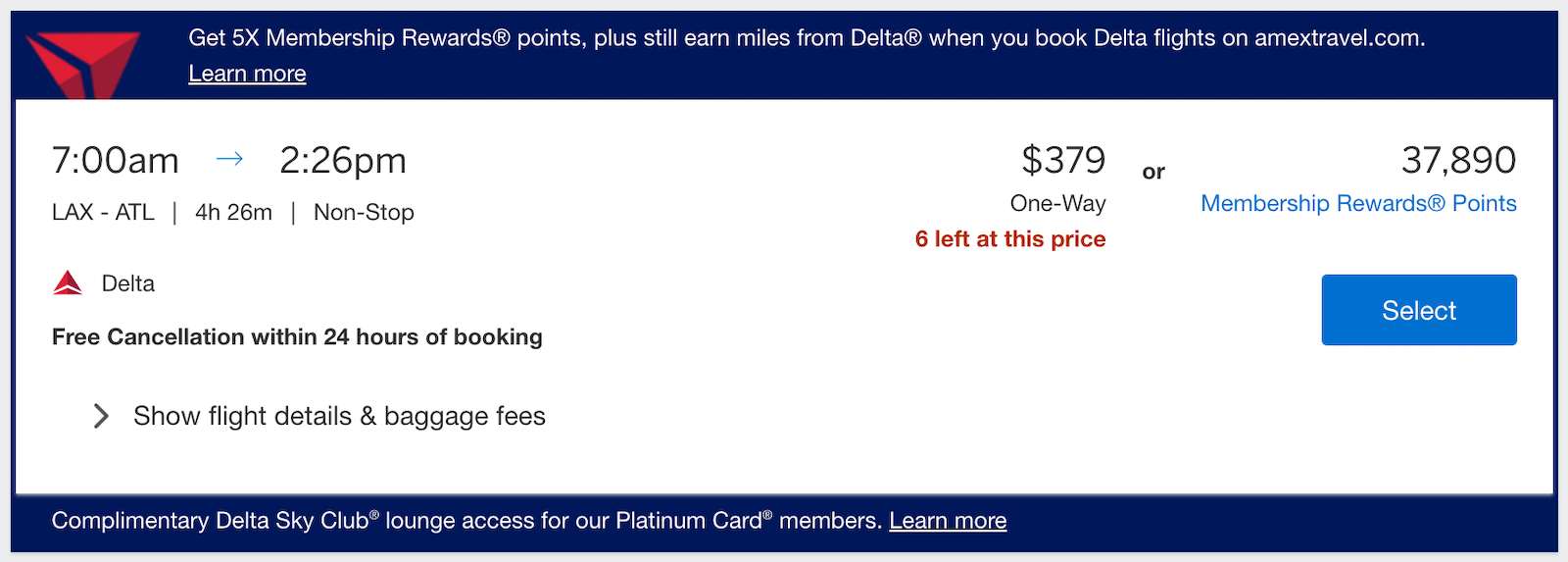

You'll see the price listed in dollars and the number of Amex Membership Rewards points during the booking process.

You can also use the options on the left-hand side to filter flights by number of stops, departure and arrival times, flight duration and airline.

Delta Air Lines is a featured airline in the Amex Travel portal. Sometimes, Delta flights appear at the top of your results, listed as "recommended," but this doesn't mean those flights are always the cheapest.

Additionally, if you have The Platinum Card® from American Express or The Business Platinum Card® from American Express and are flying from an airport with a Centurion Lounge , you'll see an indicator that a lounge is available.

Points vs. cash

When paying for your flights on Amex Travel, several American Express cards offer elevated earning rates:

You can also pay with Amex Membership Rewards points to cover the cost of your flight.

You'll see the number of points required next to the cash price of a flight. You can expect a value of 1 cent per point when using Pay with Points . However, TPG values Membership Rewards points at 2 cents apiece when you maximize Amex's transfer partners.

Related: How to redeem American Express Membership Rewards for maximum value

It's important to compare the number of points required for bookings on Amex Travel with the points you'd need to transfer to an airline program . If you can't book a flight through transfer partners and prefer to use your points, Amex Travel remains an option.

There's an additional benefit for Amex Business Platinum cardmembers: You can get 35% of your points back when paying with points on Amex Travel. This applies to first- and business-class flights on any airline plus tickets in any class on your preferred airline (the same one used for your airline incidental credits ; enrollment is required in advance). This 35% points rebate can provide a value of 1.54 cents per point, which may influence your decision to pay with cash or points.

Similarly, the Business Centurion® Card from American Express offers a 50% Pay with Points rebate on eligible flights. Note that Centurion cards are available by invitation only.

The information for the Business Centurion Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

More details about flights through Amex Travel

During the payment process, you can use points, your credit card or a combination of both. The minimum number of points you can use is 5,000, and each point is valued at 1 cent.

You can upgrade your flights using cash or points in the Amex Travel portal. This generally gives you a return of 1 cent each, and you can book using your Amex card, points or a combination of both.

During your flight search, you might come across "Insider Fares" that offer a discounted price. But to benefit from the discount, you must redeem points to cover the full fare amount.

Amex Platinum and Amex Business Platinum cardmembers have another benefit: discounted premium tickets through Amex Travel's International Airline Program . This program offers discounts on first-class, business-class and premium economy tickets from over 20 participating airlines.

To book a premium ticket using the IAP, go to the Amex Travel portal and pay with cash or points, including the Business Platinum card's 35% airline rebate. Keep in mind that not all flights are eligible and there are restrictions:

- The cardmember must travel on the itinerary.

- A maximum of eight tickets can be booked per itinerary; travel must begin and end in the U.S. or Canadian international airports.

- Tickets are nonrefundable unless stated otherwise.

- Name changes for passengers are not allowed.

Finally, note that flights booked through Amex Travel are typically treated as normal paid tickets, meaning you're eligible to earn points or miles with participating airline loyalty programs.

Related: Why I love the Amex Business Platinum's Pay with Points perk

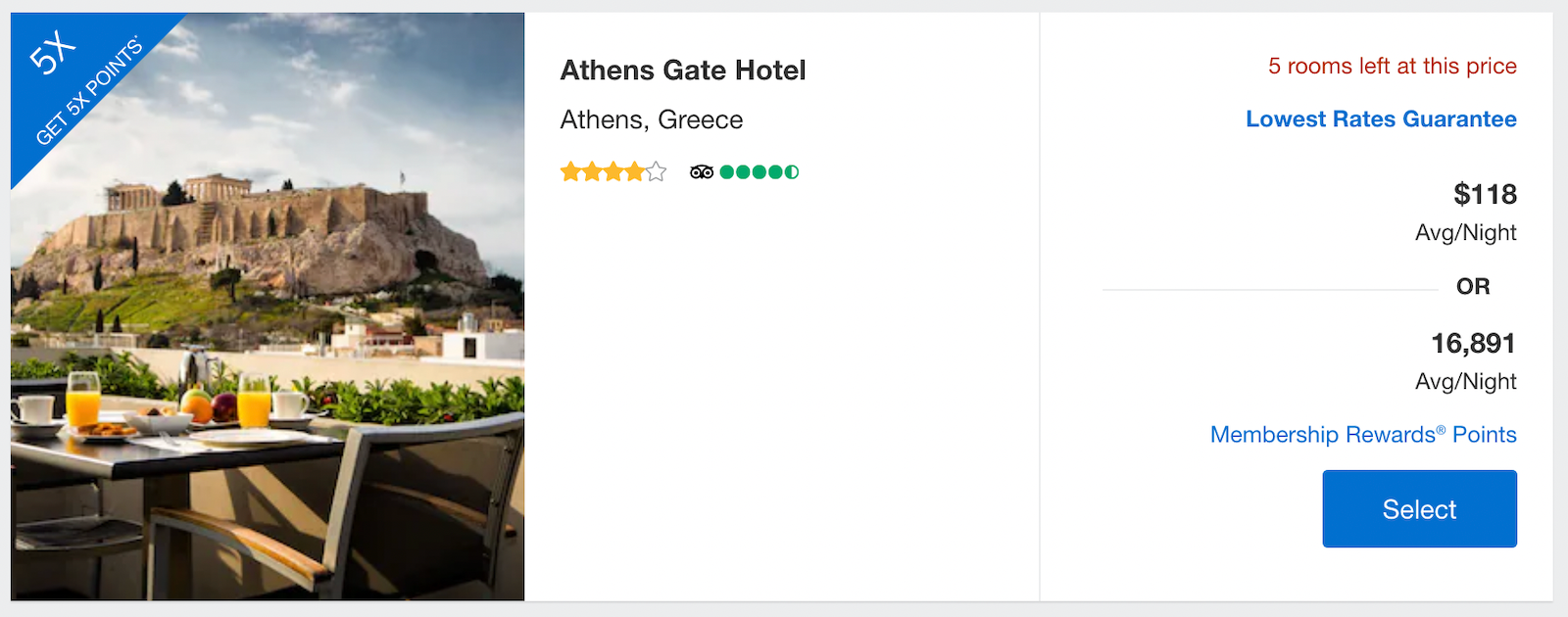

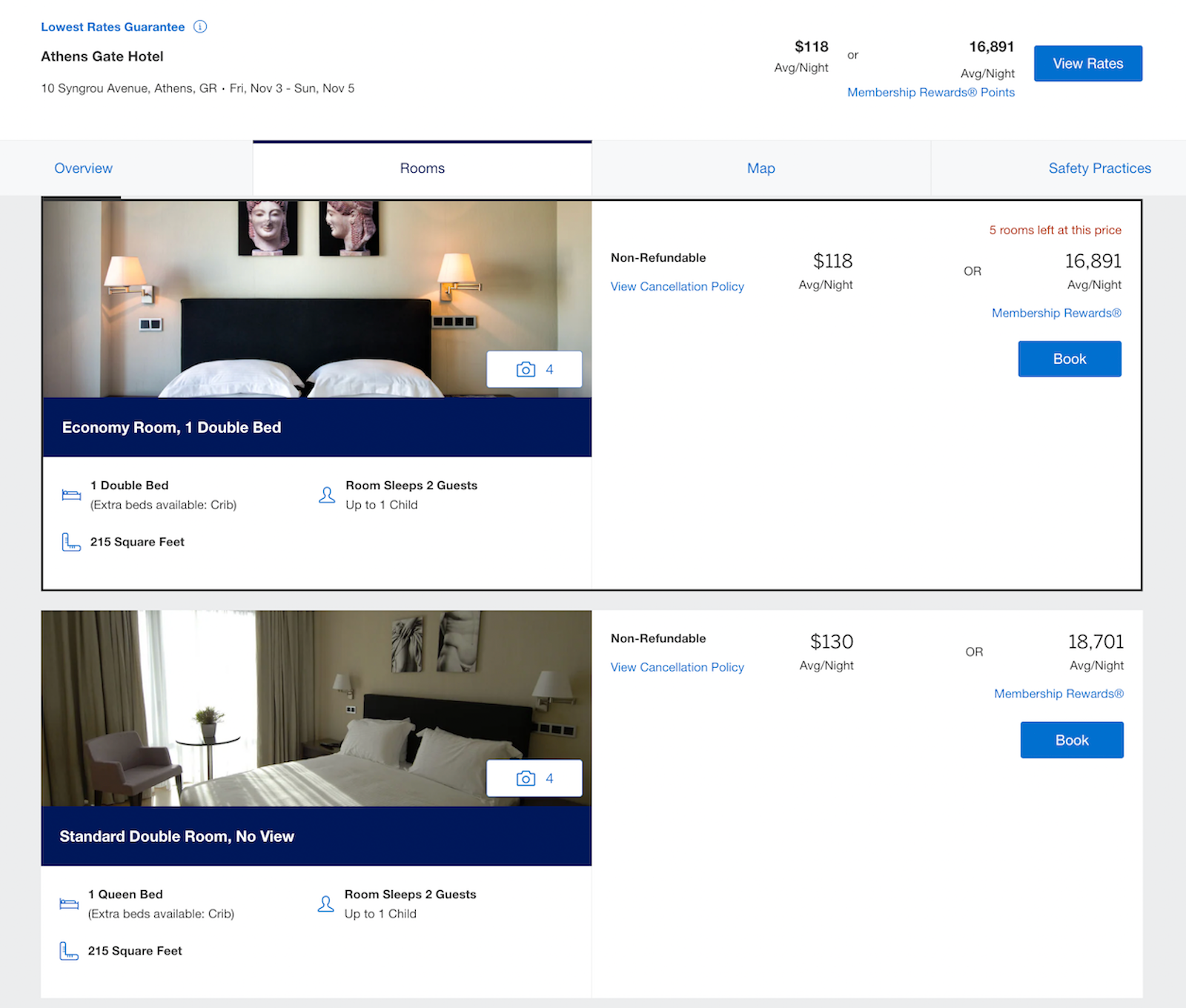

How to book hotels on the Amex Travel portal

You can book hotels through American Express Travel with a Gold, Platinum or Centurion card. As with other travel portals, you can input your destination, dates, number of rooms and number of guests (with separate input fields for adults and children).

Platinum and Business Platinum cardmembers earn 5 points per dollar on prepaid hotel reservations.

After selecting your hotel, you'll choose your preferred room and pay with points or cash. If you pay with points, you'll only get a value of 0.7 cents per point (compared to 1 cent when you book flights).

Note that these are considered third-party bookings, so you likely won't earn hotel points or elite credits for your stay . While there are reports of people receiving stay credits with Marriott Bonvoy or Hilton Honors on rooms booked through Amex Travel, the hotel is not guaranteed to recognize your elite status in these programs or provide status-qualifying stay credits.

Related: 9 things to consider when choosing to book via a portal vs. booking directly

Amex Fine Hotels + Resorts

Platinum and Centurion cardholders also have access to the Fine Hotels + Resorts program through Amex Travel. This can add some great benefits to your hotel stays — and may not cost much more than booking directly with the hotel.

Here are the perks you'll receive with every FHR booking, regardless of the length of your stay:

- Room upgrade upon arrival (when available): Some room types may be excluded, but you could receive an upgrade to preferred rooms with better views or a better location in the hotel.

- Daily breakfast for two people: The provided breakfast must be, at a minimum, a continental breakfast.

- Guaranteed 4 p.m. late checkout

- Noon check-in when available

- Complimentary Wi-Fi

- Unique property amenity: The amenity varies by hotel but should be valued at $100 or more and usually consists of a property credit, dining credit, spa credit, private airport transfer or similar amenity.

You'll need to book these stays through Amex Travel, but note that FHR is considered a separate program from Amex Travel.

In addition, if you have the personal Amex Platinum , you can also get up to $200 in statement credits every year for prepaid reservations through Fine Hotels + Resorts or The Hotel Collection — which we'll discuss next. Enrollment is required.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

The Hotel Collection

A lesser-known American Express benefit is The Hotel Collection , which allows you to book in cash or with points. Those with Amex Gold, Platinum and Centurion cards have access to this program, which offers the following benefits:

- A room upgrade at check-in (if available)

- $100 on-property credit for qualifying dining, spa and resort activities

Note that The Hotel Collection bookings require a minimum stay of two nights, though they too are eligible for the $200 hotel credit on the Amex Platinum.

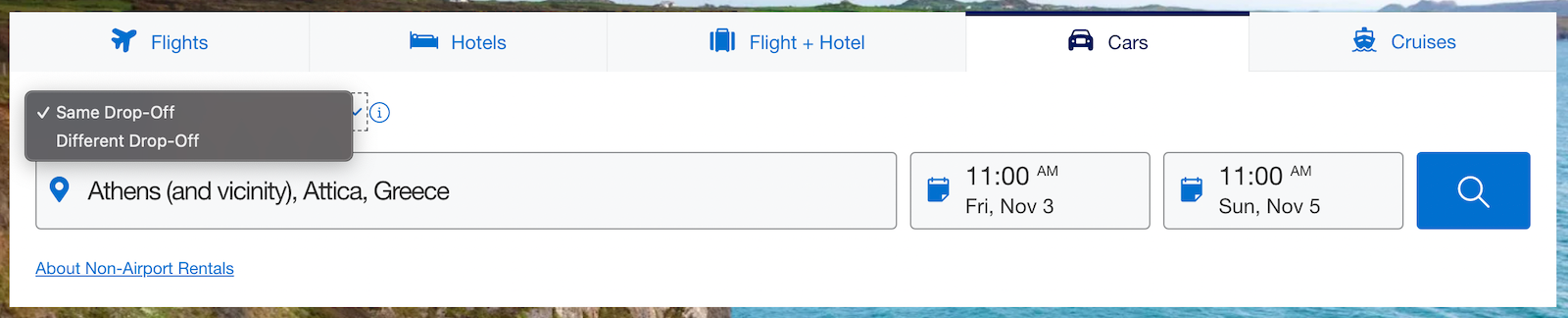

How to book rental cars and cruises on the Amex Travel portal

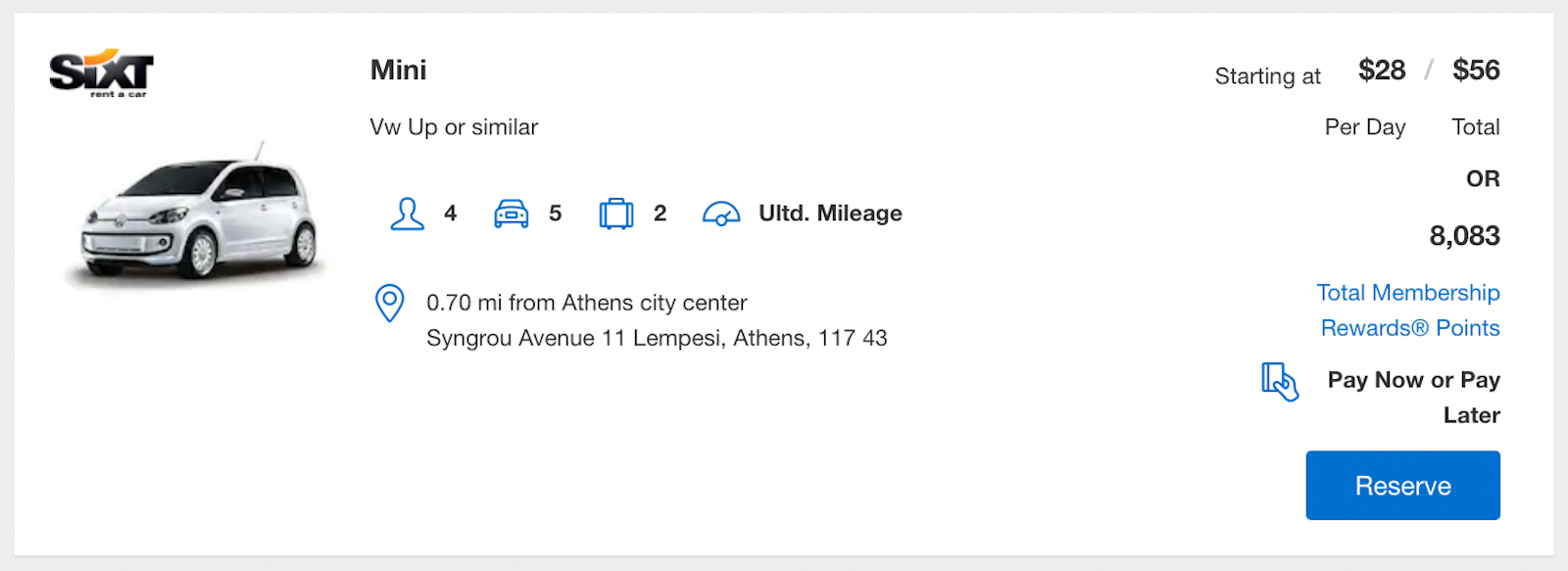

Reserving a car in the Amex portal is relatively simple. You'll input your pickup and drop-off times and location.

You'll see rental car prices listed in cash and points. When using Pay with Points , your points are worth 0.7 cents — just over a third of TPG's valuation of Amex Membership Rewards points.

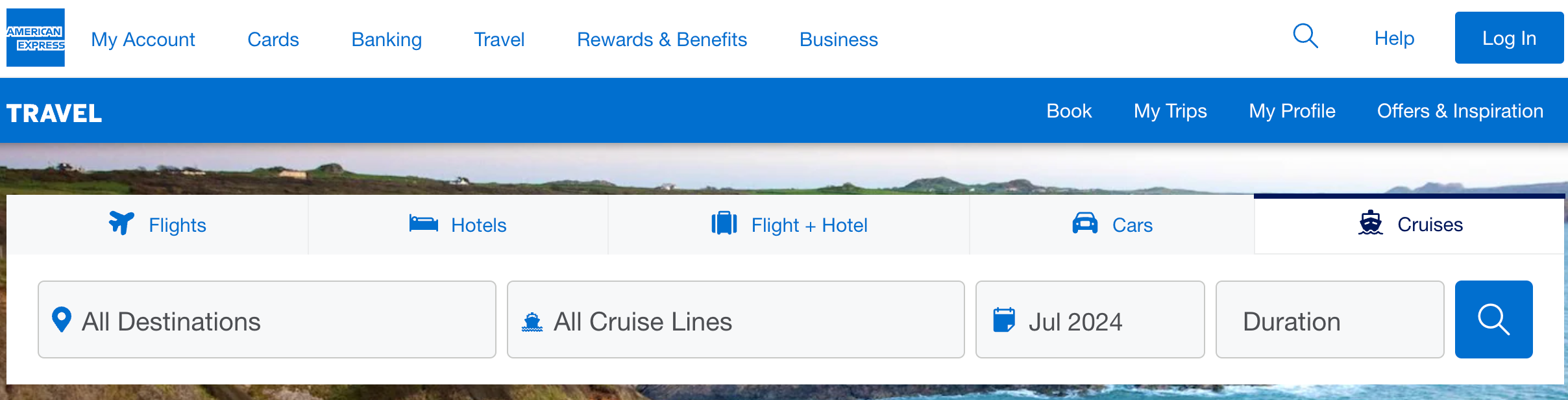

Although the format differs, you can also search for cruises on Amex Travel.

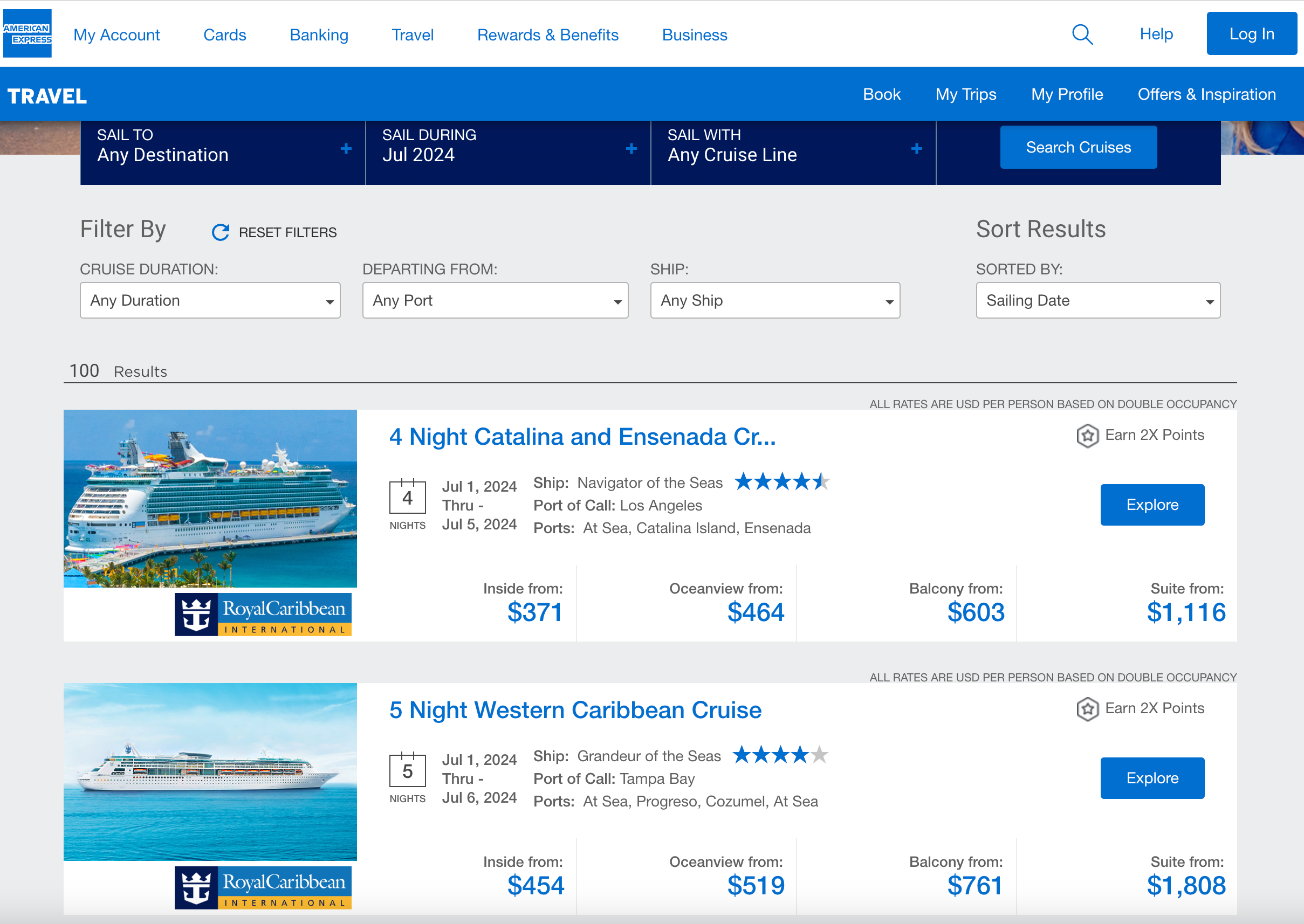

Rather than typing specific dates and numbers of passengers, you'll see four drop-down menus. These allow you to choose a destination (by region), filter by cruise lines and choose a month for travel — though not specific dates — on this first page. You can also select your desired cruise duration.

From here, you can filter by cruise duration, departure port and ship. You can sort your results by sailing date, value, price or ship rating.

On the final payment page, you can use your card or redeem points, ranging from 1 point to enough to cover the entire cost. Using points for a cruise will result in a low valuation of 0.7 cents per point, but it can be a money-saving option if you prefer not to spend cash.

There's another benefit available if you're a Platinum or Centurion cardholder (including personal and business versions of these cards): the Cruise Privileges Program .

This is available on cruises of five nights or more with select cruise lines, and it offers the following perks:

- $100-$500 in onboard ship credit (note that this cannot be used for casino or gratuity charges)

- Additional onboard amenities vary by line, such as spa vouchers, a bottle of Champagne, shore excursion credits or a private ship tour

Note that the Platinum cardmember must be one of the travelers on the cruise to enjoy these benefits.

Related: How to book a cruise using points and miles

Further things to consider about Amex Travel

When booking through the Amex Travel portal, there are a few factors to consider.

First, using Amex Membership Rewards points on Amex Travel may not provide the best value compared to transferring points to airline or hotel loyalty programs. The Pay with Points feature typically values points at 0.7 to 1 cent per point, which is far lower than our 2-cent valuation .

Additionally, the prices on Amex Travel may not always be the most competitive, so we recommend checking other platforms like Google Flights before booking your travel. Also, booking directly with hotels is advised for those seeking to utilize elite status benefits.

When you need to change your upcoming trips booked through Amex Travel, it can get complicated. You may encounter change and cancellation fees, often around $75, and making a change requires a phone call. Flight credit vouchers from cancellations can only be used for rebooking through Amex Travel via phone.

On the positive side, Amex Travel allows a 24-hour cancellation window for most reservations, and booking flights through the site generally still qualifies for earning miles and status with airline loyalty programs.

Related: Redeeming American Express Membership Rewards for maximum value

Bottom line

American Express Travel offers an array of booking options, including the ability to earn bonus Membership Rewards points on select purchases. Although you can use your points to book hotels, flights, rental cars and cruises through Amex Travel, you can get more from your points when you transfer them to Amex's airline and hotel partners .

However, there are exceptions, such as when there is no award availability for last-minute travel. In addition, Amex Travel offers perks like discounted premium flights, added benefits with Amex Fine Hotels + Resorts and a user-friendly interface. And with a simple redemption scheme that doesn't involve complicated loyalty programs and transfer partners, many Amex cardholders prefer it when planning their trips.

Additional reporting by Ryan Patterson and Kyle Olsen.

Select your Country

Car Rental in Saint Petersburg

Travel information, top 4 cities near saint petersburg.

- Moscow 670 km / 416.3 miles away

- Krasnodar 1,750.8 km / 1,087.9 miles away

- Sochi 1,941.9 km / 1,206.6 miles away

- Vladivostok 6,518.3 km / 4,050.3 miles away

Top 4 locations near Saint Petersburg

- Saint Petersburg Pulkovo Airport 17.7 km / 11 miles away

- Moscow Sheremetyevo Airport 601.9 km / 374 miles away

- Moscow Vnukovo Airport 629.1 km / 390.9 miles away

- Moscow Airport Domodedovo 670 km / 416.3 miles away

Map of Car Rental Locations

Car rental information, our customers' reviews.

Because we want to make sure each review listed here is left by a real customer, we don’t have the option to post a review here. Instead, we ask each and every customer to leave a review after they return their rental car. This way, you know that all reviews are authentic.

Top supplier in Saint Petersburg in 2024

Highly recommended by our customers

- Saint Petersburg

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Book Your Next Group Getaway with Select Homes + Retreats™

You’ll want to stay a while when you book these curated short-term rental properties available to platinum card® members..

By American Express Travel®

August 30, 2024

Link copied!

Imagine waking up to the Florida sunshine in your townhouse with a private pool or hitting the Utah slopes, then gathering to roast s’mores at your fire pit. Whether you’re reconnecting with family and friends, working remotely, or doing a bit of both, American Express Select Homes + Retreats* properties can feel like your home away from home.

This curated portfolio of vacation rentals is available to eligible Platinum Card® Members through AmexTravel.com . The homes can offer inviting indoor-outdoor spaces with room for everyone in your group and easy access to skiing, golf, beaches, theme parks, or other attractions. Currently, the Select Homes + Retreats portfolio is focused on select U.S. destinations, with more properties to be added in the coming months.

When you book Select Homes + Retreats through AmexTravel.com , you earn 5X Membership Rewards points* for your booking. You can also choose to use Membership Rewards® Pay with Points* for all or part of your booking. In addition, you have the flexibility to cancel for free within 48 hours after booking, if you booked at least 10 days in advance of your stay.

You can also rest easy knowing that your hosts are professional vacation rental management companies, and Card Members have around-the-clock phone support from American Express Travel when needed.

Here’s a closer look at some Select Homes + Retreats short-term rental properties in popular U.S. destinations.

Charleston, South Carolina Area

Where the Ashley and Cooper Rivers flow out into the Atlantic, Charleston grew up as a thriving harbor town. It’s rich in historic sights, from Fort Sumter (where the Civil War began) to Charleston City Market and the pastel Georgian houses of Rainbow Row. Head to Upper King Street for hip local boutiques and some of the most buzzed about restaurants. There’s plenty of nature to be enjoyed in the area as well—take a stroll along the Battery seawall, or wander the beaches of Sullivan’s Island.

Rental Spotlight: Palmer House , Charleston, SC

Host : StayDuvet

Embrace the charms of southern living at this restored Victorian in the Cannonborough Elliotborough neighborhood; you can while away a summer afternoon on the porch or stay up late around the fireplace in winter. With eight bedrooms, seven bathrooms, two kitchens, and bright, open-plan living spaces, this home is ideal for family reunions and other big groups. The room with double bunk beds will delight kids with the possibilities of sleepover-style fun.

Perfect for: Fans of architecture and antiques, history buffs

Breckenridge, Colorado Area

The former mining town of Breckenridge is a world-renowned destination for skiers and snowboarders that sits 9,600 feet above sea level. Chase powder at Breckenridge Ski Resort’s five peaks and 2,908 skiable acres. Après-ski, head to historic Main Street to toast the day at your pick of restaurants and craft distilleries. In the warmer months, try hiking, paddleboarding on Maggie Pond, or fly-fishing on the shores of the Blue River.

Rental Spotlight: Restoration on the River , Breckenridge, CO

Host: Moving Mountains

Ease into the high-altitude setting in the comfort of this four-bedroom duplex that embraces modern mountain style. The home is open and airy, with views of the Blue River, a gourmet kitchen, hardwood floors, and a natural color palette. Curl up by the fireplace, or head outside for the firepit, hot tub, and grilling area. The Village at Breckenridge is a three-minute drive away for access to Peak 9 Quicksilver SuperChair and a few minutes’ walk to the free shuttle stop on River Park Drive.

Perfect for: Anyone who can’t wait to shred powder

Big Island, Hawaii Area

Famed for its paniolo, or Hawaiian cowboys, Waimea is a historic area in the northwest of the island of Hawai‘i full of rolling grassy hills, working ranches, and incredible regional cuisine. The town of Waimea has a thriving culinary and theater scene, and the farmer’s market is right next to the Paniolo Heritage Center and Nā Wahine Holo Lio Paʻu Museum. Nearby Kauna‘o and Puako Bays are home to soft-sand beaches and glittering waters for kayaking, surfing, and boat tours.

Rental Spotlight : Hapuna Beach Residence B15 at Mauna Kea Resort , Waimea, HI

Host : Hosted by Mauna Kea Residences by East West Hospitality

There’s nothing between you and the beach but your private pool at this recently-constructed island haven. Each of the four bedrooms is outfitted in crisp modern style, and some open out onto lanai for a decadent lounging experience. After you’ve hit the beach, wash off in the bathroom with a rainfall shower or soaking tub.

Perfect for: Would-be cowboys, foodies, and beach bums

Florida Panhandle Area

This stretch of coastline beckons with powdery fine sand, sparkling Gulf Coast water, and quaint beach communities connected by State Road 30A. You might start with a stroll along the boardwalks of Inlet Beach, soaking up the views of scrub oaks and Florida palms, and then take a dip in the ocean. You can also try your luck on a fishing expedition or on the links. Detour over to Camp Helen State Park for the hiking trails and a rare coastal dune lake.

Rental Spotlight: 30A Beach House - 33 Sunset , Inlet Beach, FL

Host: Panhandle Getaways

Savor beach living at this sunny four-bedroom within The Ivy at Inlet Beach, a private community with a pool. This contemporary house is decorated in serene blues and white. Gather in the open-plan kitchen and dining area, or head to the patio to simply relax.

Perfect for: Beach lovers who also want to hit the links

San Diego, California Area

No wonder there’s an easygoing vibe in San Diego when you can bask in ample sunshine and temperatures that hold steady in the 60s and 70s. Surfing, biking, and hiking are among the outdoor pastimes, and Torres Pines State Natural Reserve is popular for its scenic trails and beaches. Get your culture fix at the museums of Balboa Park – also home to the world-famous San Diego Zoo – and explore the restaurants, bars and shops of the Gaslamp Quarter, a walkable downtown neighborhood.

Rental Spotlight: B5407 Beachfront Modern , San Diego, CA

Host: Bluewater Vacation Homes

The activity of Pacific Beach – surfers shredding waves, kids playing, couples strolling – unfolds in front of this home’s living room, which has huge glass sliding doors. There’s also a wrap-around courtyard and terrace featuring lounge chairs, a shaded communal table, and a ping pong table. With one king and three queen beds, this home easily accommodates extended family or a friends’ getaway. A dedicated desk area is handy for combining business with pleasure.

Perfect for: Enjoying the beach at your doorstep and the SoCal good life

Cape Cod, Massachusetts Area

A quintessential American summer getaway, the curved arm of Cape Cod is dotted by lighthouses and an eclectic mix of towns and villages. Explore the beaches, dunes, and salt marshes of the Cape Cod National Seashore, and cycle along the Cape Cod Rail Trail. Indulging in fresh seafood here is a must, whatever the season.

Rental Spotlight: Cape Castle , Mashpee, MA

Host: Vacasa, LLC

This home in Mashpee encourages friendly competition and bonding – just head to the basement where a foosball table, a 10-player poker table, a Ping Pong table, and a karaoke machine await. Outside, there’s an asphalt court for pickleball or badminton, plus swings and a sandbox. When you’re ready to slow down the pace, lounge by the outdoor gazebo and pool, or retreat to the living area with a gas fireplace.

Perfect for: Experiencing seaside fun with New England charm

Orlando, Florida Area

Orlando brings to mind theme parks, which are big draws for the young and young-at-heart. But there’s much more to explore, starting with a lively downtown and natural attractions like Wekiwa Springs State Park and the Hilochee and Lake Marion Creek Wildlife Management Areas. Bring the whole family to see the home team play a minor league baseball game or take an airboat tour to spot alligators. The interactive and educational Kennedy Space Center is an hour’s drive away at Cape Canaveral.

Rental Spotlight: W403J - Boho-Chic Estate with Themed Bedrooms at Reunion , Kissimmee, FL

Host: Jeeves Florida Rentals

Situated within the luxurious Reunion Resort, this house has the chic living spaces you’d expect, plus less-expected playful features that surprise and delight. The themed children’s bedrooms are a riot of colorful and playable décor (slides, bunk beds with a climbing wall) while the game room and theater room will keep everyone up making memories.

Perfect for: Theme park enthusiasts who want to keep the fun and games going at home

Vail + Beaver Creek, Colorado Area

If you’re dreaming of fresh powder, you can find it in Vail and Beaver Creek. These world-class Colorado ski resorts are known for deep snow, thousands of acres of skiable terrain, and stunning natural beauty. During warmer months, opt for white-water rafting along the Eagle River or play a round of golf at a championship course. Hiking Vail Mountain is a must for spotting wildlife.

Rental Spotlight: Buckhorn Townhome 80 - Rustic- Chic four bedroom , Avon, CO

Host: East West Hospitality BC

This cozy and rugged stay is less than 300 yards from the slopes, with stunning mountain and valley views and space for you and 13 favorite travel companions. There’s a great room with a gas fireplace, three guest suites (each with an attached bath), plus a bunk room, and a dedicated ski room with boot warmers. Wind down the day in the media room – outfitted with a popcorn machine, wet bar, and pool and game tables.

Perfect for: Being so close to the mountains that you can ski in, ski out

Park City, Utah Area

Park City is an all-seasons outdoor playground and a true skier’s paradise, nestled between Park City Mountain, the largest ski area in the U.S., and Deer Valley Resort. The small town also has an outsized cultural scene, with annual film and music festivals. In the summer months, you can trade the slopes for 450 miles of mountain biking trails and try rafting, kayaking, or tubing along the Provo River.

Rental Spotlight: 4202 Modern Vibe at Fairway Springs, Park City, Utah

Host: SkyRun Park City

This stylish three-bedroom townhome is on a golf course in the Canyons Resort area of Park City and within walking distance to Frostwood Gondola. It’s decorated in a soothing, neutral color palette and outfitted with a hot tub, outdoor fire pit, and two private decks.

Perfect for: Outdoor adventurers who want golf at their doorstep

Explore All Select Homes + Retreats™ in the U.S.

Get more out of your getaway with american express.

Recommended Flights offers Platinum Card® Members access to lower fares on select routes with Delta.* Plus, Platinum Card Members earn 5X Membership Rewards® points on up to $500,000 per calendar year on flights booked through American Express Travel® or flights purchased directly from airlines.*

Refuel in comfort at Los Angeles International Airport (LAX) thanks to the American Express Global Lounge Collection ®. It enables Platinum Card Members to enjoy complimentary access to more than 1,400 airport lounges in over 500 airports around the world, including flagship locations through The Centurion® Network. Terms apply.

Platinum Card® Members are eligible to enjoy complimentary premium status for car rental programs as well as additional benefits and discounts. Each status program has a set of benefits for Platinum Card and ways to claim them. Log into your Platinum Card account to view your specific Car Rental Privileges . Enrollment required. Terms and limitations apply.

Global Dining Access by Resy gives you special access to sought-after restaurants across the globe when you add your eligible Card to your Resy profile. Access to exclusive reservations, premium dining experiences, Priority Notify, and more, all from the Resy app. Terms apply.

When you Shop Small ®, you’re not just supporting neighborhood favorites – you’re investing in the community. Whether you’re a local or visiting, explore our map to find small businesses near you.

Fine Hotels + Resorts Program: Fine Hotels + Resorts® (FHR) program benefits are available for new bookings made through American Express Travel with participating properties and are valid only for eligible U.S. Consumer, Business, and Corporate Platinum Card® Members, and Centurion® Members. Additional Platinum Card Members on Consumer and Business Platinum and Centurion Card Accounts are also eligible for FHR program benefits. Companion Card Members on Consumer Platinum and Centurion Card Accounts, Additional Business Gold and Additional Business Expense Card Members on Business Platinum and Centurion Card Accounts, and Delta SkyMiles® Platinum Card Members are not eligible for FHR program benefits. Bookings must be made using an eligible Card and must be paid using that Card, or another American Express® Card, in the eligible Card Member's name, and that Card Member must be traveling on the itinerary booked. The average total value of the program benefits is based on prior-year bookings for stays of two nights; the actual value varies. Noon check-in and room upgrade are subject to availability and are provided at check-in; certain room categories are not eligible for upgrade. The type of $100 credit and additional amenity (if applicable) varies by property; the credit will be applied to eligible charges up to the amount of the credit. To receive the credit, the eligible spend must be charged to your hotel room. The credit will be applied at check-out. Advance reservations are recommended for certain credits. The type and value of the daily breakfast (for two) varies by property; breakfast will be valued at a minimum of US$60 per room per day. To receive the breakfast credit, the breakfast bill must be charged to your hotel room. The breakfast credit will be applied at check-out. If the cost of Wi-Fi is included in a mandatory property fee, a daily credit of that amount will be applied at check-out. Benefits are applied per room, per stay (with a three-room limit per stay). Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members traveling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional FHR benefits (“Prohibited Action”). American Express and the Property reserve the right to modify or revoke FHR benefits at any time without notice if we or they determine, in our or their sole discretion, that you may have engaged in a Prohibited Action, or have engaged in abuse, misuse, or gaming in connection with your FHR benefits. Benefit restrictions vary by property. Benefits cannot be redeemed for cash and are not combinable with other offers unless indicated. Benefits must be used during the stay booked. Any credits applicable are applied at check-out in USD or the local currency equivalent. Benefits, participating properties, and availability and amenities at those properties are subject to change. To be eligible for FHR program benefits, your eligible Card Account must not be cancelled. For additional information, call the number on the back of your Card.

Fine Hotels + Resorts Special Offers: Special offer and Fine Hotels + Resorts® (FHR) program benefits are available for new bookings made through American Express Travel® with participating properties and are valid only for eligible U.S. Consumer, Business, Corporate Platinum Card® Members and Centurion® Members. Additional Platinum Card Members on Consumer and Business Platinum and Centurion Card Accounts are also eligible for FHR program benefits. Companion Card Members on Consumer Platinum and Centurion Card Accounts, Additional Business Gold and Additional Business Expense Card Members on Business Platinum and Centurion Card Accounts, and Delta SkyMiles® Platinum Card Members are not eligible for FHR program benefits or related special offers. Special offers are not combinable with other offers unless indicated, including, without limitation, lower rate offers.

Special offer book by and travel by dates apply and vary by property. The availability and related terms of this special offer applies at the point of booking. The special offer is subject to change at the discretion of the property and you may see a different offer if you navigate away and return later. A minimum number of consecutive nights of stay are required and blackout dates may apply, please refer to the offer terms associated with a given property for details. Any complimentary nights will be reflected at the time of booking; applicable taxes and fees for the complimentary nights will be removed at check-out.

Bookings must be made using an eligible Card and must be paid using that Card, or another American Express® Card, in the eligible Card Member's name, and that Card Member must be traveling on the itinerary booked. The average total value of the program benefits is based on prior-year bookings for stays of two nights; the actual value varies. Noon check-in and room upgrade are subject to availability and are provided at check-in; certain room categories are not eligible for upgrade. The type of $100 credit and additional amenity (if applicable) varies by property; the credit will be applied to eligible charges up to the amount of the credit. To receive the credit, the eligible spend must be charged to your hotel room. The credit will be applied at check-out. Advance reservations are recommended for certain credits. The type and value of the daily breakfast (for two) varies by property; breakfast will be valued at a minimum of US$60 per room per day. To receive the breakfast credit, the breakfast bill must be charged to your hotel room. The breakfast credit will be applied at check-out. If the cost of Wi-Fi is included in a mandatory property fee, a daily credit of that amount will be applied at check-out. Benefits are applied per room, per stay (with a three-room limit per stay). Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members traveling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional FHR benefits (“Prohibited Action”). American Express and the Property reserve the right to modify or revoke FHR benefits at any time without notice if we or they determine, in our or their sole discretion, that you may have engaged in a Prohibited Action, or have engaged in abuse, misuse, or gaming in connection with your FHR benefits. Benefit restrictions vary by property. Benefits cannot be redeemed for cash and are not combinable with other offers unless indicated. Benefits must be used during the stay booked. Any credits applicable are applied at check-out in USD or the local currency equivalent. Benefits, participating properties, and availability and amenities at those properties are subject to change. To be eligible for FHR program benefits, your eligible Card Account must not be cancelled. For additional information, call the number on the back of your Card.

The Hotel Collection Program: The Hotel Collection (THC) benefits are available for new bookings of two consecutive nights or more made through American Express Travel with participating properties and are valid only for eligible U.S. Consumer and Business Gold Card, Platinum Card® Members, and Centurion® Members. Additional Card Members on Consumer and Business Platinum Card Accounts, and Additional Card Members on Consumer and Business Centurion Accounts are also eligible for THC program benefits. Delta SkyMiles® Gold and Platinum Card Members are not eligible. Bookings must be made using an eligible Card and must be paid using that Card, or another American Express® Card, in the eligible Card Member's name, and that Card Member must be traveling on the itinerary booked. Noon check-in, late check-out and the room upgrade are subject to availability; certain room categories are not eligible for upgrade. The type of $100 credit and additional amenity (if applicable) varies by property; the $100 credit will be applied to eligible charges up to $100. To receive the $100 credit, the eligible spend must be charged to your hotel room. The $100 credit will be applied at check-out. Advance reservations are recommended for certain credits. Benefit restrictions vary by property. Benefits are applied per room, per stay (with a three-room limit per stay). Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members traveling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional THC benefits (“Prohibited Action”). American Express and the Property reserve the right to modify or revoke the THC benefits at any time without notice if we or they determine, in our or their sole discretion, that you have engaged in a Prohibited Action, or have engaged in abuse, misuse, or gaming in connection with your THC benefits. Benefits cannot be redeemed for cash and are not combinable with other offers unless indicated. Benefits must be used during the stay booked. Any credits applicable are applied at check-out in USD or the local currency equivalent. Benefits, participating properties, and availability and amenities at those properties are subject to change. To be eligible for THC program benefits, your eligible Card Account must not be cancelled. For additional information, call the number on the back of your Card.

The Hotel Collection Special Offers: Special offer and The Hotel Collection (THC) benefits are available for new bookings of two consecutive nights or more made through American Express Travel® with participating properties and are valid only for eligible U.S. Consumer and Business Gold Card, Platinum Card®, and Centurion® Members. Additional Card Members on Consumer and Business Platinum Card Accounts, and Additional Card Members on Consumer and Business Centurion Accounts are also eligible for THC program benefits. Delta SkyMiles® Gold and Platinum Card Members are not eligible. Special offers are not combinable with other offers unless indicated, including, without limitation, lower rate offers.

Special offer book by and travel by dates apply and vary by property. The availability and related terms of this special offer applies at the point of booking. The special offer is subject to change at the discretion of the property and you may see a different offer if you navigate away and return later. A minimum number of consecutive nights of stay are required and blackout dates may apply, please refer to the offer terms associated with a given property for details. Any complimentary nights will be reflected at the time of booking; applicable taxes and fees for the complimentary nights will be removed at check-out.

Bookings must be made using an eligible Card and must be paid using that Card, or another American Express® Card, in the eligible Card Member's name, and that Card Member must be traveling on the itinerary booked. Noon check-in, late check-out and the room upgrade are subject to availability; certain room categories are not eligible for upgrade. The type of $100 credit and additional amenity (if applicable) varies by property; the $100 credit will be applied to eligible charges up to $100. To receive the $100 credit, the eligible spend must be charged to your hotel room. The $100 credit will be applied at check-out. Advance reservations are recommended for certain credits. Benefit restrictions vary by property. Benefits are applied per room, per stay (with a three-room limit per stay). Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members traveling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional THC benefits (“Prohibited Action”). American Express and the Property reserve the right to modify or revoke the THC benefits at any time without notice if we or they determine, in our or their sole discretion, that you have engaged in a Prohibited Action, or have engaged in abuse, misuse, or gaming in connection with your THC benefits. Benefits cannot be redeemed for cash and are not combinable with other offers unless indicated. Benefits must be used during the stay booked. Any credits applicable are applied at check-out in USD or the local currency equivalent. Benefits, participating properties, and availability and amenities at those properties are subject to change. To be eligible for THC program benefits, your eligible Card Account must not be cancelled. For additional information, call the number on the back of your Card.

Select Homes + Retreats™: Select Homes + Retreats™ (SHR) program bookings must be made through AmexTravel.com with participating vacation rental management companies (also referred to as “Hosts”) and their participating properties. Bookings are valid only for eligible American Express® U.S. Consumer and Business Platinum Card® Members and Centurion® Members. Additional Card Members on U.S. Consumer and Business Platinum and Centurion Card Accounts are also eligible for SHR. Companion Card Members on U.S. Consumer Platinum and Centurion Card Accounts, Additional Business Gold and Additional Business Expense Card Members on U.S. Business Platinum and Centurion Card Accounts, and Delta SkyMiles® Platinum Card Members are not eligible for SHR. Bookings must be made by an eligible Card Member using an American Express® Card, in the eligible Card Member's name, and that Card Member must be staying at the property booked. Properties may have minimum age requirements to book. Bookings require prepayment and may require advance security deposit, as/if specified in the property listing. Bookings must be made at least 10 days prior to the date of check-in. Other than if specified in a property listing, the minimum length of stay is 2 consecutive nights and the maximum length of stay is 28 consecutive nights. Bookings are cancellable without penalty within 48 hours of being made if your booking is made at least 10 days before your scheduled check-in date; thereafter, bookings are subject to the Host’s applicable cancellation and other policies. Any booking cancelled within 48 hours after the initial booking will result in a voided billing transaction. Voided billing transactions do not result in a charge or refund and will not appear on your monthly Card statement. Dates of a booking cannot be modified once made. Card Members must cancel their booking and make a new booking through AmexTravel.com; in which case, the new booking will be subject to availability, any cancellation policies and fees, any increase in the nightly rates or other fees, and any other applicable policies or fees of the Host. After cancellation, the property previously booked may not be available for subsequent booking for up to 24 hours or more. Hosts may require Card Members to complete additional steps after booking, such as signing a rental agreement, completing identity and/or age verification, or other steps described in a property listing; if such steps are not completed promptly, your Host may cancel your booking, subject to the Host’s policies. Card Members must use the property for lawful purposes and the purposes for which the rental of a vacation home is provided, including, without limitation, abiding by all applicable rules, laws, and regulations and not gathering more people than the maximum occupancy of the home without the prior written approval of the Host. Participating Hosts and their participating properties are subject to change. American Express is not liable for the acts or omissions of Hosts, their properties (including homeowners), or third parties acting for or on behalf of Hosts or homeowners. American Express is not the provider of the properties offered for rental and does not collect taxes or remit taxes to applicable tax authorities. Tax amounts displayed include an estimated amount that Hosts are to bill for applicable government-imposed taxes and fees. Hosts are responsible for providing a final receipt to Card Members upon request and remitting the government-imposed taxes and fees to relevant tax authorities.

2X Membership Rewards Points – Basic Card Members with a Membership Rewards-enrolled Card get at least 1 Membership Rewards® point for every eligible dollar spent on their Membership Rewards program-enrolled American Express Card or Additional Card on their Account and will also get at least 1 additional point (for a total of 2 points) for each dollar charged for eligible Select Homes + Retreats purchases on any Card on the Account, minus cancellations and credits.

3X Membership Rewards Points – Green Card: Basic Card Members, when paying with their eligible Green Card or Additional Card on their Account, can earn 2 additional points (for a total of 3 points) for each dollar charged for eligible Select Homes + Retreats purchases on any Card on the Account, minus cancellations and credits.

5X Membership Rewards Points – Platinum Card: Basic Card Members, when paying with their eligible Platinum Card or Additional Card on their Account, can earn 4 additional points (for a total of 5 points) for each dollar charged for eligible Select Homes + Retreats purchases on any Card on the Platinum Card Account, minus cancellations and credits. Additional points will be credited to the Membership Rewards account 10-12 weeks after final payment is made.

$200 Hotel Credit: Basic Card Members on U.S. Consumer Platinum Card Account are eligible to receive up to $200 in statement credits per calendar year when they or Additional Platinum Card Members use their Cards to pay for eligible prepaid Fine Hotels + Resorts® and The Hotel Collection bookings made through American Express Travel (meaning through amextravel.com, the Amex® App, or by calling the phone number on the back of your eligible Card) or when Companion Platinum Card Members on such Platinum Card Accounts pay for eligible prepaid bookings for The Hotel Collection made through American Express Travel (meaning through amextravel.com, the Amex® App, or by calling the phone number on the back of your eligible Card). Purchases by both the Basic Card Member and any Additional Card Members on the Card Account are eligible for statement credits. However, the total amount of statement credits for eligible purchases will not exceed $200 per calendar year, per Card Account. Fine Hotels + Resorts® program bookings may be made only by eligible U.S. Consumer Basic Platinum and Additional Platinum Card Members. The Hotel Collection bookings may be made by eligible U.S. Consumer Basic and Additional Platinum Card Members and Companion Platinum Card Members on the Platinum Card Account. Delta SkyMiles® Platinum Card Members are not eligible for the benefit. To receive the statement credits, an eligible Card Member must make a new booking using their eligible Card through American Express Travel on or after July 1st, 2021, that is prepaid (referred to as "Pay Now" on amextravel.com and the Amex App), for a qualifying stay at an available, participating Fine Hotels + Resorts or The Hotel Collection property. Bookings of The Hotel Collection require a minimum stay of two consecutive nights. Eligible bookings must be processed before December 31st, 11:59PM Central Time, each calendar year to be eligible for statement credits within that year. Eligible bookings do not include interest charges, cancellation fees, property fees or other similar fees, or any charges by a property to you (whether for your booking, your stay or otherwise).

Statement credits are typically received within a few days, however it may take 90 days after an eligible prepaid hotel booking is charged to the Card Account. American Express relies on the merchant’s processing of transactions to determine the transaction date. The transaction date may differ from the date you made the purchase if, for example, there is a delay in the merchant submitting the transaction to us or if the merchant uses another date as the transaction date. This means that in some cases your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. For example, if an eligible purchase is made on December 31st but the merchant processes the transaction such that it is identified to us as occurring on January 1st, then the statement credit available in the next calendar year will be applied. Statement credits may not be received or may be reversed if the booking is cancelled or modified. If the Card Account is canceled or past due, it may not qualify to receive a statement credit. If American Express does not receive information that identifies your transaction as eligible, you will not receive the statement credits. For example, your transaction will not be eligible if it is a booking: (i) made with a property not included in the Fine Hotels + Resorts or The Hotel Collection programs, (ii) not made through American Express Travel, or (iii) not made with an eligible Card. Participating properties and their availability are subject to change. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide and may reverse any statement credits provided to you. If a charge for an eligible purchase is included in a Pay Over Time balance on your Card Account, the statement credit associated with that charge may not be applied to that Pay Over Time balance. Instead, the statement credit may be applied to your Pay In Full balance. Please refer to AmericanExpress.com/FHR and AmericanExpress.com/HC for more information about Fine Hotels + Resorts and The Hotel Collection, respectively.

5X Membership Rewards® Points Platinum Card: Basic Card Members will get 1 Membership Rewards® point for each dollar charged for eligible purchases on their Platinum Card® or an Additional Card on their Account and 4 additional points (for a total of 5 points) for each dollar charged for eligible travel purchases on any Card on the Account (“Additional Points”), minus cancellations and credits. Eligible travel purchases are limited to: (i) purchases of air tickets on scheduled flights, of up to $500,000 in charges per calendar year, booked directly with passenger airlines or through American Express Travel (by calling 1-800-525-3355 or through AmexTravel.com); (ii) purchases of prepaid hotel reservations booked through American Express Travel; and (iii) purchases of prepaid flight+hotel packages booked through AmexTravel.com. Eligible travel purchases do not include: charter flights, private jet flights, flights that are part of tours, cruises, or travel packages (other than prepaid flight+hotel packages booked through AmexTravel.com), ticketing or similar service fees, ticket cancellation or change fees, property fees or similar fees, hotel group reservations or events, interest charges, or purchases of cash equivalents. Eligible prepaid hotel bookings or prepaid flight+hotel bookings that are modified directly with the hotel will not be eligible for Additional Points.

Bonuses that may be received with your Card on other purchase categories or in connection with promotions or offers from American Express cannot be combined with this benefit. Any portion of a charge that the Basic Card Member elects to cover through redemption of Membership Rewards points is not eligible to receive points. Additional terms and restrictions apply.

Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for Additional Points. A purchase with a merchant will not earn Additional Points if the merchant’s code is not included in an Additional Points category. Basic Card Members may not receive Additional Points if we receive inaccurate information or are otherwise unable to identify your purchase as eligible for an Additional Points category. For example, you may not receive Additional Points when: a merchant uses a third-party to sell their products or services, a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers), or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

To be eligible for this benefit, the Card Account must not be cancelled. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit in any way American Express may remove access to this benefit from the Account. For additional information, call the number on the back of your Card or visit americanexpress.com/rewards-info for more information about rewards.

5X Membership Rewards Points Business Platinum Card: You will get one point for each dollar charged for an eligible purchase on your Business Platinum Card® from American Express. You will get 4 additional points (for a total of 5 points) for each dollar spent on eligible travel purchases. Eligible travel purchases include scheduled flights and prepaid flight and hotel packages made online at AmexTravel.com, minus returns and other credits. Additionally, eligible travel purchases include prepaid hotel purchases made through American Express Travel, over the phone with our Travel Consultants or made online at AmexTravel.com, minus returns and other credits. Eligible travel purchases do NOT include non-prepaid hotel bookings, scheduled flights and prepaid flight and hotel packages over the phone, vacation packages, car rentals, cruise, hotel group reservations or events, ticketing service, cancellation or other fees, interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents. To be eligible for the 5x Membership Rewards® points, you must both reserve and charge the travel purchase with the same eligible Business Platinum Card®. To modify a reservation you must cancel and rebook your reservation. You can cancel and rebook your reservation on AmexTravel.com or by calling a representative of AmexTravel.com at 1-800-297-2977. Cancellations are subject to hotel cancellation penalty policies. If hotel reservations are made or modified directly with the hotel provider, the reservation will not be eligible for this 5X Membership Rewards® point benefit. To be eligible to receive extra points, Card account(s) must not be cancelled or past due at the time of extra points fulfillment. If booking is cancelled, the extra points will be deducted from the Membership Rewards account. Extra points will be credited to the Membership Rewards account approximately 6-10 weeks after eligible purchases appear on the billing statement. Additional point bonuses you may receive with your Card on other purchase categories from American Express may not be combined with this benefit (e.g., 1.5X and 2X bonuses for Business Platinum Card Members, etc.). Purchases eligible for multiple additional point bonuses will only receive the highest eligible bonus. The benefits associated with the Additional Card(s) you choose may be different than the benefits associated with your basic Card. To learn about the benefits associated with Additional Card(s) you choose, please call the number on the back of your Card.

Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for additional points. A purchase with a merchant will not earn additional points if the merchant’s code is not included in an additional points category. You may not receive additional points if we receive inaccurate information or are otherwise unable to identify your purchase as eligible for an additional points category. For example, you may not receive additional points when: a merchant uses a third-party to sell their products or services; or a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

Please visit americanexpress.com/rewards-info for more information about rewards.

Pay with Points: To use Pay with Points, you must charge your eligible purchase through American Express Travel to a Membership Rewards® program-enrolled American Express® Card. Eligible purchases through American Express Travel exclude non-prepaid car rentals and non-prepaid hotels. Points will be debited from your Membership Rewards account, and credit for corresponding dollar amount will be issued to the American Express Card account used. If points redeemed do not cover entire amount, the balance of purchase price will remain on the American Express Card account. Minimum redemption 5,000 points.

See membershiprewards.com/terms for the Membership Rewards program terms and conditions.

If a charge for a purchase is included in a Pay Over Time balance on your Linked Account the statement credit associated with that charge may not be applied to that Pay Over Time balance. Instead the statement credit may be applied to your Pay in Full balance. If you believe this has occurred, please contact us by calling the number on the back of your Card. Corporate Card Members are not eligible for Pay Over Time.

International Airline Program: International Airline Program benefits are valid only for eligible U.S. Consumer, Business, and Corporate Platinum Card® and Centurion® Members (Delta SkyMiles® Platinum Card Members are not eligible), on international tickets booked through American Express Travel for select first class, business class, and premium economy tickets with participating airlines, subject to availability. Additional Platinum Cards on U.S. Consumer and Business Platinum Card Accounts and Additional Centurion and Additional Platinum Cards on U.S. Consumer and Business Centurion Accounts are also eligible to receive program benefits. Companion Card Members on Consumer Platinum and Centurion Card Accounts, Additional Business Gold and Business Expense Card Members on Business Platinum and Centurion Card Accounts are not eligible. Most tickets will originate in and return to U.S. gateway (may exclude certain overseas territories) and select Canadian gateways. One-way travel is permitted on some airlines. An eligible Card Member can book for himself/herself and up to seven passengers traveling on the same itinerary as that Card Member. Bookings must be made using an eligible Card in the Card Member’s name. Discounts are applied to the base airfare. Discounts are not combinable with other offers unless indicated and may not apply to codeshare partners. Airline fare rules and restrictions apply and are subject to change at the discretion of the airline. American Express and the airline reserve the right to modify or revoke airline discount benefits at any time without notice if we or they determine, in our or their sole discretion, that you may have engaged in abuse, misuse, or gaming in connection with your airline discount benefits. Tickets are non-refundable unless otherwise indicated. Tickets are non-transferable; name changes are not permitted. Benefits, participating airlines, and ticket availability are subject to change.

Recommended Flights: Special offer fares are valid only for eligible U.S. Consumer and Business Platinum Card® and Centurion® Members (Delta SkyMiles® Platinum Card Members are not eligible) on participating airlines for select domestic routes (routes may vary by airline); routes and participating airlines are subject to change during the offer term. The eligible Card Member must be one of the travelers on the booking. Discounts are applied to the base airfare. Discounts are not combinable with other offers unless otherwise specified. Tickets are subject to applicable government-imposed taxes/fees and airline-imposed fees; if baggage, seat-selection or similar items were not included with the tickets, additional fees may apply. Airline fare rules and restrictions and ticket terms and conditions apply and are subject to change at the discretion of the airline. Tickets are non-refundable unless otherwise indicated. Tickets are non-transferable. Applicable fares will display in search results on AmexTravel.com only if the eligible Card Member is logged into his/her account. Changes to tickets (if permitted) may incur an airline-imposed change fee, and/or any difference in fare. Cancellations of tickets (if permitted) may incur an airline-imposed cancellation fee. Special offer is valid for eligible bookings made through American Express Travel from today’s date through 9/30/2024.

Hilton Honors Gold Status Enrollment: Enrollment through American Express is required to receive the benefit. Platinum Card Members and Additional Platinum Card Members on the Platinum Card Account can enroll in complimentary Hilton Honors Gold status in the Benefits section of their americanexpress.com online account or by calling the number on the back of their Card. If a Card Member already has a Hilton Honors Number, they may enter it on the benefit page prior to enrollment. Benefit available only to Platinum Card Members and is not transferable. Once the Card Member requests enrollment in the Hilton Honors program, American Express will share their enrollment information with Hilton. Hilton may use this information in accordance with its privacy policy available at hilton.com/en/p/global-privacy-statement/. Enrolled Card Members will maintain Hilton Honors Gold Status without meeting otherwise required Hilton Honors criteria as long as the Card Member remains an eligible American Express Card Member or until American Express notifies the Card Member that the benefit is terminated. If your Platinum Card is cancelled for any reason, your complimentary Hilton Honors Gold status provided with the Card will be cancelled. American Express reserves the right to change, modify or revoke complimentary Gold status at any time. If your complimentary Gold status is cancelled, you may be able to maintain your Gold status by qualifying under the Hilton Honors Program terms. Gold status benefits are subject to availability and vary by hotel; see Hiltonhonors.com/MemberBenefits and Hilton.com/en/hilton-honors/benefit-terms/ for additional details. The Hilton Honors Program, including the benefits of Hilton Honors membership, are subject to Hilton Honors Terms and Conditions; see hiltonhonors.com/terms.

To be eligible for this benefit, Card Account(s) must not be cancelled. If your Card has been replaced, please check the Benefits section of your americanexpress.com account, mobile app or call the number on the back of your Card to confirm your continued enrollment in the benefit. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit in any way, American Express may remove access to this benefit from the Account. For additional information, call the number on the back of your Card.

2X Membership Rewards® Points: Membership Rewards-enrolled Card Members get at least 1 Membership Rewards® point for every eligible dollar spent on their Membership Rewards program-enrolled American Express® Card. Those same Card Members will also get at least 1 additional point for each dollar of eligible travel purchases made on amextravel.com on their Membership Rewards program-enrolled American Express Card. Corporate Card Members are not eligible for the additional point. Eligible travel purchases include all travel purchases made with your Membership Rewards program-enrolled American Express® Card on amextravel.com, including air, prepaid hotels, prepaid short-term rentals, prepaid car rentals, vacation packages (flight + hotel packages) or cruise reservations, minus returns and other credits. Platinum and Business Platinum Card Members are only eligible for 1 additional point on cruise reservations. Eligible travel purchases do NOT include non-prepaid car rentals, non-prepaid hotels, ticketing service or other fees, or interest charges. Additional point bonuses you may receive with your Card on other purchase categories from American Express may not be combined with this offer (e.g., 5X bonuses for Platinum and Business Platinum Card Members, 3X bonuses for Business Gold Card Members, or 1.5X bonuses for Business Centurion and Business Platinum Card Members, etc.). Any portion of a charge that you elect to cover through redemption of Membership Rewards points is not eligible to receive points. Additional points will be credited to the Membership Rewards account 10-12 weeks after final payment is made.

3X Membership Rewards Points Business Gold Card: Basic American Express® Business Gold Card Members will get at least one Membership Rewards® point for each dollar of eligible travel purchases on their Card and on any Employee Cards on their Card Account. Basic Card Members will get 2 additional points (for a total of 3 points) for each dollar spent on eligible travel purchases on their Business Gold Card Account from American Express. Eligible travel purchases include scheduled flights and prepaid flight+hotel packages made online at AmexTravel.com, minus returns and other credits. Additionally, eligible travel purchases include prepaid hotel purchases made through American Express Travel over the phone with our Travel Consultants or made online at AmexTravel.com, minus returns and other credits. Eligible travel purchases do NOT include non-prepaid hotel bookings, scheduled flights and prepaid flight+hotel packages booked over the phone, vacation packages, car rentals, cruise, hotel group reservations or events, ticketing service, cancellation or other fees, interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents. To be eligible for the 3X Membership Rewards® points, the booking must be both reserved and charged on the Basic or Additional/Employee Card on the Card Account. To modify a reservation, you can cancel and rebook your reservation on AmexTravel.com or by calling a representative of AmexTravel.com at 1-800-297-2977. To be eligible for the 3X Membership Rewards® points, any changes to an existing reservation must be made through the same method as your original booking. Cancellations are subject to hotel cancellation penalty policies. If hotel reservations are made or modified directly with the hotel provider, the reservation will not be eligible for this 3X Membership Rewards® point benefit. To be eligible to receive extra points, Card Account(s) must not be cancelled or past due at the time of extra points fulfillment. If a booking is cancelled, the extra points will be deducted from the Membership Rewards account. Extra points will be credited to the Membership Rewards account approximately 6-10 weeks after eligible purchases appear on the billing statement. Bonuses you may receive with your Card on other purchase categories or in connection with promotions or offers from American Express may not be combined with this benefit.

Please visit americanexpress.com/rewards-info for more information about rewards.

Global Dining Access by Resy: The Global Dining Access program (“GDA”) is a benefit available to eligible Card Members. “Eligible Card Members” are account holders of Platinum Card® or Centurion® Card from American Express, Business Platinum Card®, Business Centurion® Card from American Express, Corporate Platinum Card® or Corporate Centurion® Card from American Express, Delta SkyMiles® Reserve American Express Card, Delta SkyMiles® Reserve Business American Express Card, Hilton Honors American Express Aspire Card, The Platinum Card® from American Express Exclusively for Morgan Stanley, The Platinum Card® from American Express Exclusively for Charles Schwab, The Platinum Card® from American Express for Goldman Sachs, and The Centurion® Card from American Express for Goldman Sachs (and any Additional Card Member(s) on their accounts). GDA may not be available for Cards issued from some countries. GDA provides eligible Card Members with (a) access to exclusive reservations, (b) Priority Notify, which allows GDA members to set notifications to be in the first group notified when tables become available before they are made available to other Resy users, and (c) access to exclusive events. GDA reservations are accessible through the Resy iOS App and Website (“Resy Sites”) and Concierge. Some features of GDA, like Priority Notify, may not be available through Concierge. To access this benefit through the Resy iOS App, you must download the Resy App; or if you already have the Resy iOS App, ensure the latest update is downloaded. When using the Resy Sites, create a Resy account or log into your existing Resy account and add your eligible Card to your Resy account. If you are assigned a new Card number, you must update the Card number in your Resy account. When you use GDA, a badge will be placed on your Resy profile, letting restaurants know that you are a member of the GDA program. Reservations are based on a first-come, first-served basis. In the event of a reservation cancellation, you will be subject to the restaurant’s cancellation policy. Generally, same-day reservations that are not booked by GDA members are released back to restaurants at certain times of day that vary across restaurant policies. American Express and Resy make no representations or warranties regarding the availability of reservations, events, and/or experiences, which shall at all times be subject to availability and the discretion of the applicable restaurant. American Express and Resy are not responsible for informing the restaurants of any dietary restrictions or for a restaurant being able to accommodate such restrictions. There is no cost to you for booking services through GDA, although you are responsible for any purchases or fees you authorize to be charged to your Card account. GDA reservations and events are intended for personal use only and cannot be resold or used for commercial purposes. By participating in the GDA program, you are accepting these GDA terms and conditions, which are in addition to and do not replace the Resy Sites’ Terms of Service. To be eligible for this benefit, your Card account must not be cancelled.